UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☒ | | Preliminary Proxy Statement. |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☐ | | Definitive Proxy Statement. |

| ☐ | | Definitive Additional Materials. |

| ☐ | | Soliciting Material Pursuant to §240.14a-12. |

TCG BDC II, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

PRELIMINARY PROXY MATERIALS – SUBJECT TO COMPLETION, DATED OCTOBER 13, 2021

TCG BDC II, Inc.

One Vanderbilt Avenue, Suite 3400

New York, NY 10017

[ ] [ ], 2021

To Our Stockholders:

We are pleased to invite you to attend the Special Meeting of Stockholders (the “Meeting”) of TCG BDC II, Inc. (“we,” “us,” “our,” “TCG BDC II,” or the “Company”) to be held virtually at [ ] on [ ] [ ], 2021, at [ ], Eastern Time.

The following pages include a formal notice of the Meeting and our proxy statement. The Notice of Internet Availability of Proxy Materials you received in the mail and our proxy statement describe the matters on the agenda for the Meeting. Please read these materials so that you will know what we intend to act on at the Meeting.

At the Meeting, you will be asked to consider and vote upon the proposals listed below, the effect of which—should each proposal be approved—would convert TCG BDC II into a permanent, private investment vehicle offering regular tenders to stockholders. The specific proposals include:

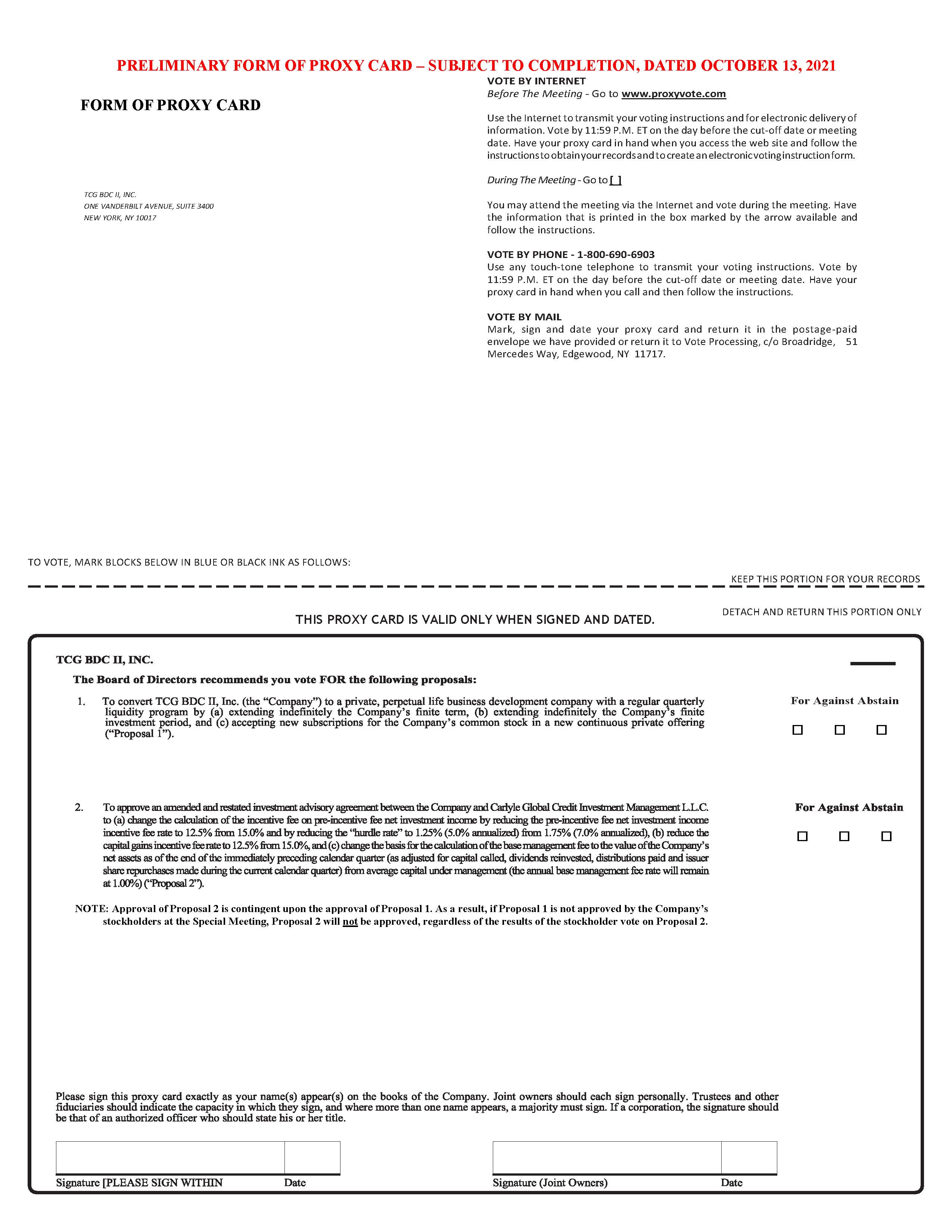

1.To convert the Company from a finite life, private business development company (“BDC”) with no interim liquidity to a private BDC with a perpetual life and a regular quarterly liquidity program by (a) extending indefinitely the Company’s finite term, which is currently scheduled to end at the close of business on November 9, 2025 (subject to extension by the Company’s Board of Directors for up to two successive one-year periods), (b) extending indefinitely the Company’s finite investment period, which is currently scheduled to end at the close of business on September 11, 2022, and (c) accepting new subscriptions for the Company’s common stock in a new continuous private offering (collectively, the “Extension Proposal”); and

2.To approve an amended and restated investment advisory agreement (the “Amended and Restated Investment Advisory Agreement”) between the Company and Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”) to (a) change the calculation of the incentive fee on pre-incentive fee net investment income payable by the Company to the Investment Adviser by reducing the pre-incentive fee net investment income incentive fee rate to 12.5% from 15.0% and by reducing the “hurdle rate” to 1.25% (5.0% annualized) from 1.75% (7.0% annualized) (such changes to the pre-incentive fee net investment income incentive fee to be effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement), (b) reduce the capital gains incentive fee rate payable by the Company to the Investment Adviser to 12.5% from 15.0%, and (c) change the basis for the calculation of the base management fee payable by the Company to the Investment Adviser to the value of the Company’s net assets as of the end of the immediately preceding calendar quarter (as adjusted for capital called, dividends reinvested, distributions paid and issuer share repurchases made during the current calendar quarter) from average capital under management (the annual base management fee rate will remain at 1.00%) (the “Advisory Agreement Amendment Proposal” and together with the Extension Proposal, the “Proposals”).

If the Extension Proposal is approved by the Company’s stockholders, the Company intends, subject to market and other conditions, to thereafter conduct recurring quarterly tender offers for the Company’s common stock, beginning in the second calendar quarter of 2022, in order to offer regular liquidity to stockholders. Initially, the Company expects to offer to repurchase through the quarterly tender offers at least 3.5% of the number of shares of its common stock outstanding as of the end of the calendar quarter immediately prior to the quarter in which the quarterly tender offer is conducted, at a specific per share price based on the Company’s net asset value as of the last date of the quarter in which the quarterly tender offer is conducted. In addition, assuming stockholder approval of the Extension Proposal, the Company expects that its stockholders will be provided with additional liquidity through

a special, one-time tender offer for its common stock commenced during the first calendar quarter of 2022, which is expected to be for up to $100 million in aggregate amount of the then-outstanding shares at a price per share equal to the Company’s net asset value per share, as determined by it on its then-most recently completed valuation date (the “Special Tender Offer”). Any Special Tender Offer will be funded by the Company, one of the Company’s affiliates, or a third party with the Company’s support. We expect these actions to create meaningfully improved initial and ongoing liquidity for stockholders in the coming years, as compared to a “no action” case. Please see the accompanying proxy statement for more information.

The terms of the Amended and Restated Investment Advisory Agreement will become effective promptly following receipt of the requisite stockholder approval of the Extension Proposal and the Advisory Agreement Amendment Proposal; provided however, that the proposed changes to the calculation of the pre-incentive fee net investment income incentive fee will become effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement.

Approval of the Advisory Agreement Amendment Proposal is contingent upon the approval of the Extension Proposal. As a result, if the Extension Proposal is not approved by the Company’s stockholders at the Meeting, the Advisory Agreement Amendment Proposal will not be approved, regardless of the results of the stockholder vote on the Advisory Agreement Amendment Proposal.

Approval of the Extension Proposal is not contingent on stockholder approval of the Advisory Agreement Amendment Proposal.

If the Proposals are approved by the Company’s stockholders, TCG BDC II’s investment strategy, approach to use of leverage and target returns will be unchanged, and there remains no intention of conducting a public listing of TCG BDC II’s shares of common stock in the near or long-term.

Capitalized terms used herein but not defined shall have the meanings ascribed to them in the Company’s proxy statement.

After careful consideration, our Board of Directors, including our directors who are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended, of the Company (the “Independent Directors”), has determined that the Proposals to be considered and voted on at the Meeting are in the best interests of the Company and its stockholders. Our Board of Directors, including each of the Independent Directors, unanimously recommends that you vote “FOR” each of the Proposals.

It is important that your shares be represented at the Meeting, regardless of whether you plan to participate in the virtual Meeting. Please vote your shares as soon as possible through any of the voting options available to you as described in our proxy statement.

On behalf of management and our Board of Directors, we thank you for your continued support of TCG BDC II, Inc.

| | |

| Sincerely, |

|

|

| Linda Pace |

| Chief Executive Officer, President and Chair |

New York, NY

[ ], [ ], 2021

TCG BDC II, Inc.

One Vanderbilt Avenue, Suite 3400

New York, NY 10017

Notice of the Special Meeting of Stockholders

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders (the “Meeting”) of TCG BDC II, Inc. (“we,” “us,” “our,” “TCG BDC II” or the “Company”) will be held virtually at [ ] on [ ] [ ], 2021, at [ ], Eastern Time.

At the Meeting, holders of our common stock will be asked to consider and vote on the following proposals:

1.To convert the Company from a finite life, private business development company (“BDC”) with no interim liquidity to a private BDC with a perpetual life and a regular quarterly liquidity program by:

(a)extending indefinitely the Company’s finite Term (as defined in “Proposal I – The Extension Proposal”), which is currently scheduled to end at the close of business on November 9, 2025 (subject to extension by the Company’s Board of Directors for up to two successive one-year periods);

(b)extending indefinitely the Company’s finite Investment Period (as defined in “Proposal I – The Extension Proposal”), which is currently scheduled to end at the close of business on September 11, 2022; and

(c)accepting new subscriptions for the Company’s common stock in a new continuous private offering (collectively, the “Extension Proposal”); and

2.To approve an amended and restated investment advisory agreement (the “Amended and Restated Investment Advisory Agreement”) between the Company and Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”) to (a) change the calculation of the incentive fee on pre-incentive fee net investment income payable by the Company to the Investment Adviser by reducing the pre-incentive fee net investment income incentive fee rate to 12.5% from 15.0% and by reducing the “hurdle rate” to 1.25% (5.0% annualized) from 1.75% (7.0% annualized) (such changes to the pre-incentive fee net investment income incentive fee to be effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement), (b) reduce the capital gains incentive fee rate payable by the Company to the Investment Adviser to 12.5% from 15.0%, and (c) change the basis for the calculation of the base management fee payable by the Company to the Investment Adviser to the value of the Company’s net assets as of the end of the immediately preceding calendar quarter (as adjusted for capital called, dividends reinvested, distributions paid and issuer share repurchases made during the current calendar quarter) from average capital under management (the annual base management fee rate will remain at 1.00%) (the “Advisory Agreement Amendment Proposal” and together with the Extension Proposal, the “Proposals”).

If the Extension Proposal is approved by the Company’s stockholders, the Company intends, subject to market and other conditions, to thereafter conduct recurring quarterly tender offers for the Company’s common stock, beginning in the second calendar quarter of 2022, in order to offer regular liquidity to stockholders. Initially, the Company expects to offer to repurchase through the quarterly tender offers at least 3.5% of the number of shares of its common stock outstanding as of the end of the calendar quarter immediately prior to the quarter in which the quarterly tender offer is conducted, at a specific per share price based on the Company’s net asset value as of the last date of the quarter in which the quarterly tender offer is conducted. In addition, assuming stockholder approval of the Extension Proposal, the Company expects that its stockholders will be provided with additional liquidity through a special, one-time tender offer for its common stock commenced during the first calendar quarter of 2022, which is expected to be for up to $100 million in aggregate amount of the then-outstanding shares at a price per share equal to

the Company’s net asset value per share, as determined by the Company on its then-most recently completed valuation date (the “Special Tender Offer”). Any Special Tender Offer will be funded by the Company, one of the Company’s affiliates, or a third party with the Company’s support. We expect these actions to create meaningfully improved initial and ongoing liquidity for stockholders in the coming years, as compared to a “no action” case. Please see the accompanying proxy statement for more information.

The terms of the Amended and Restated Investment Advisory Agreement will become effective promptly following receipt of the requisite stockholder approval of the Extension Proposal and the Advisory Agreement Amendment Proposal; provided however, that the proposed changes to the calculation of the pre-incentive fee net investment income incentive fee will become effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement.

Approval of the Advisory Agreement Amendment Proposal is contingent upon the approval of the Extension Proposal. As a result, if the Extension Proposal is not approved by the Company’s stockholders at the Meeting, the Advisory Agreement Amendment Proposal will not be approved, regardless of the results of the stockholder vote on the Advisory Agreement Amendment Proposal.

Approval of the Extension Proposal is not contingent on stockholder approval of the Advisory Agreement Amendment Proposal.

Only stockholders of record at the close of business on [ ] [ ], 2021 are entitled to notice of and to vote at the Meeting or at any postponement or adjournment thereof. We intend to mail these materials on or about [ ], 2021, to all stockholders of record entitled to vote at the Meeting. Capitalized terms used herein but not defined shall have the meanings ascribed to them in the accompanying proxy statement.

Each Company stockholder is invited to attend the Meeting virtually. You or your proxyholder will be able to attend the Meeting online, vote and submit questions by visiting [ ] and using a control number assigned by Broadridge Financial Solutions, Inc. Please see “How to Participate in the Meeting” in the accompanying proxy statement for more information.

We are furnishing the accompanying proxy statement and proxy card to our stockholders on the internet, rather than mailing printed copies of those materials to each stockholder. Since you received a Notice of Internet Availability of Proxy Materials, you will not receive printed copies of the proxy statement and proxy card unless you request them by following the instructions in the Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy statement and vote your proxy. If you have not received a copy of the Notice of Internet Availability of Proxy Materials, please contact us by mail sent to the attention of Allison Rudary, Investor Relations, at our principal executive offices located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017 or you can call us by dialing (212) 813-4756.

If you are unable to participate in the virtual Meeting, we encourage you to vote your proxy by following the instructions provided in the Notice of Internet Availability of Proxy Materials or the proxy card. Stockholders may also request from us free of charge printed copies of the proxy statement and proxy card by following the instructions in the Notice of Internet Availability of Proxy Materials. In the event there are not sufficient votes for a quorum at the time of the Meeting, the Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

Our Board of Directors, including each of our directors who are not “interested persons,” as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended, of the Company, unanimously recommends that you vote “FOR” each of the Proposals.

The enclosed proxy statement provides a detailed description of the Meeting, each of the Proposals and other related matters. We urge you to read the proxy statement carefully and in its entirety.

By Order of the Board of Directors,

_________________

Erik Barrios

Secretary

New York, NY

[ ] [ ], 2021

The proxy statement and a form of proxy card are available online at www.proxyvote.com. If you plan on participating in the virtual Meeting, whether or not you intend to vote your shares at the Meeting, you will need the 16-digit control number included on your proxy card, your voting instruction form, or the Notice of Internet Availability of Proxy Materials previously mailed or made available to stockholders entitled to vote at the Meeting. If your shares are held for your account by a broker, bank or other institution or nominee, you should follow the instructions provided by your institution or nominee to be able to participate in the Meeting. Please allow time to complete online check-in procedures prior to the start of the Meeting.

Stockholders are requested to execute and return promptly the accompanying proxy card, which is being solicited by the Board of Directors of the Company. You may execute the proxy card using the methods described in the proxy card. Executing and returning the proxy card is important to ensure a quorum at the Meeting. Stockholders also have the option to authorize their proxies by telephone or Internet by following the instructions printed on the proxy card. Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised, subject to the voting deadlines that are described in the accompanying proxy statement. Any such notice of revocation should be provided by the stockholder in the same manner as the proxy being revoked.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to Be Held on [ ], 2021:

Our notice of the Meeting and proxy statement are available on the internet at www.proxyvote.com.

The following information applicable to the Meeting may be found in the notice of Meeting, proxy statement and accompanying proxy card:

•The date, time and location of the Meeting;

•A list of the matters intended to be acted on and our Board of Directors' recommendations regarding those matters;

•Any control/identification numbers that you need to access your proxy card; and

•Information on how to obtain directions to attend the Meeting electronically via the live webcast.

TCG BDC II, Inc.

One Vanderbilt Avenue, Suite 3400

New York, NY 10017

PROXY STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

The accompanying proxy is solicited on behalf of the Board of Directors (the “Board,” the “Board of Directors” or the “Directors”) of TCG BDC II, Inc., which is sometimes referred to in this proxy statement as “TCG BDC II,” “we,” “us,” “our” or the “Company,” for use at the Company’s Special Meeting of Stockholders (the “Meeting”) to be held virtually at [ ] on [ ] [ ], 2021, at [ ], Eastern Time. Only holders of record of our common stock at the close of business on [ ] [ ], 2021 (the “Record Date”) will be entitled to notice of and to vote at the Meeting. At the close of business on the Record Date, the Company had [ ] shares of common stock outstanding and entitled to vote at the Meeting.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide our stockholders access to our proxy materials on the Internet, including the proxy statement and the accompanying form of proxy (collectively, the “Proxy Statement”). Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) was first distributed on or about [ ], 2021 to our stockholders of record as of the close of business on the Record Date. Stockholders are able to: (1) access the proxy materials on a website referred to in the Notice or (2) request that a printed set of the proxy materials be sent, at no cost to them, by following the instructions in the Notice. You will need your 16-digit control number that is included with the Notice to authorize your proxy for your shares through the Internet. If you are a stockholder of record and have not received a copy of the Notice, please contact us by mail sent to the attention of the Secretary of the Company, Erik Barrios, at our principal executive offices located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017 or you can call Allison Rudary, Investor Relations, by dialing (212) 813-4756.

We encourage you to access the Meeting prior to the start time. The live webcast will begin promptly at [ ], Eastern Time, on [ ], 2021. Participants should ensure that they have a strong WiFi connection if they intend to participate in the Meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear audio prior to the start of the Meeting. Please see “How to Participate in the Meeting” below for additional details.

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if the accompanying proxy is executed and returned (and not revoked) prior to the Meeting, the shares of TCG BDC II’s common stock represented by the proxy will be voted (1) FOR the Extension Proposal (as defined below), and (2) FOR the Advisory Agreement Amendment Proposal (as defined below).

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the Record Date. If your shares are held for your account by a broker, bank or other institution or nominee, your institution or nominee will not vote your shares unless you provide instructions to your institution or nominee on how to vote your shares. You should instruct your institution or nominee how to vote your shares by following the voting instructions provided by your institution or nominee.

At the Meeting, holders of our common stock will be asked to consider and vote on the following proposals:

1.to convert the Company from a finite life, private business development company (“BDC”) with no interim liquidity to a private BDC with a perpetual life and a regular quarterly liquidity program by:

(a)extending indefinitely the Company’s finite Term (as defined in “Proposal I – The Extension Proposal”), which is currently scheduled to end at the close of business on November 9, 2025 (subject to extension by the Board for up to two successive one-year periods);

(b)extending indefinitely the Company’s finite Investment Period (as defined in “Proposal I – The Extension Proposal”), which is currently scheduled to end at the close of business on September 11, 2022; and

(c)accepting new subscriptions for the Company’s common stock in a new continuous private offering (collectively, the “Extension Proposal”); and

2.to approve an amended and restated investment advisory agreement (the “Amended and Restated Investment Advisory Agreement”) between the Company and Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”) to (a) change the calculation of the incentive fee on pre-incentive fee net investment income payable by the Company to the Investment Adviser by reducing the pre-incentive fee net investment income incentive fee rate to 12.5% from 15.0% and by reducing the “hurdle rate” to 1.25% (5.0% annualized) from 1.75% (7.0% annualized) (such changes to the pre-incentive fee net investment income incentive fee to be effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement), (b) reduce the capital gains incentive fee rate payable by the Company to the Investment Adviser to 12.5% from 15.0%, and (c) change the basis for the calculation of the base management fee payable by the Company to the Investment Adviser to the value of the Company’s net assets as of the end of the immediately preceding calendar quarter (as adjusted for capital called, dividends reinvested, distributions paid and issuer share repurchases made during the current calendar quarter) from average capital under management (the annual base management fee rate will remain at 1.00%) (the “Advisory Agreement Amendment Proposal” and together with the Extension Proposal, the “Proposals”).

Quorum, Effect of Abstentions and Broker Non-Votes, and Vote Required to Approve the Proposals

A majority of the outstanding shares of common stock must be present in person or represented by proxy at the Meeting in order to have a quorum. If you have properly voted by proxy online or via mail and did not subsequently revoke your proxy, you will be considered part of the quorum. We will count “abstain” votes as present for the purpose of establishing a quorum for the transaction of business at the Meeting. A broker non-vote occurs when a broker holding shares for a beneficial owner votes on some matters on the proxy card, but not on others, because the broker does not have instructions from the beneficial owner or discretionary authority (or declines to exercise discretionary authority) with respect to those other matters. We do not expect any broker non-votes at the Meeting because there are no routine proposals to be voted on at the Meeting. For this reason, it is imperative that stockholders vote or provide instructions to their broker as to how to vote. Stockholders do not have cumulative voting rights or rights of appraisal.

The Company is seeking approval of the Extension Proposal by the affirmative vote of holders of shares of the Company’s common stock entitled to cast a majority of all the votes entitled to be cast on the Extension Proposal at the Meeting. Abstentions and broker non-votes will have the same effect as votes “against” this proposal. Approval of the Extension Proposal is not contingent on stockholder approval of the Advisory Agreement Amendment Proposal.

Approval of the Advisory Agreement Amendment Proposal requires the affirmative vote of a “majority of the outstanding voting securities” of the Company entitled to vote at the Meeting. For purposes of the Advisory Agreement Amendment Proposal, the Investment Company Act of 1940, as amended (the “1940 Act”), defines a “majority of the outstanding voting securities” of the Company as the lesser of (a) 67% or more of the voting securities present at the Meeting if the holders of more than 50% of the outstanding voting securities of the Company are present or represented by proxy; or (b) more than 50% of the outstanding voting securities of the Company (such threshold referred to herein as a “1940 Act Majority”). Abstentions and broker non-votes will have the same effect as votes “against” this proposal. The terms of the Amended and Restated Investment Advisory

Agreement will become effective promptly following receipt of the requisite stockholder approval of the Extension Proposal and the Advisory Agreement Amendment Proposal; provided however, that the proposed changes to the calculation of the pre-incentive fee net investment income incentive fee will become effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement.

Approval of the Advisory Agreement Amendment Proposal is contingent upon the approval of the Extension Proposal. As a result, if the Extension Proposal is not approved by the Company’s stockholders at the Meeting, the Advisory Agreement Amendment Proposal will not be approved, regardless of the results of the stockholder vote on the Advisory Agreement Amendment Proposal.

Adjournment of Meeting

In the event that a quorum is not achieved at the Meeting, either in person or represented by proxy, the chair of the Meeting shall have the power to adjourn the Meeting without any future date designated for resumption or from time to time to a date not more than 120 days after the original Record Date without notice other than the announcement at the Meeting to permit further solicitation of proxies. If the Meeting is adjourned and a quorum is present at such adjournment, any business may be transacted which might have been transacted at the Meeting as originally notified.

The stockholders present either in person or by proxy at a meeting which has been duly called and at which a quorum has been established may continue to transact business until adjournment (that is, the adjourned meeting), notwithstanding the withdrawal from the meeting of enough stockholders to leave fewer than would be required to establish a quorum.

Proxies for the Meeting

The named proxies for the Meeting are Erik Barrios and Peter Gaunt (or their duly authorized designees), who will follow submitted proxy voting instructions. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR each of the Proposals.

How to Participate in the Meeting

The Meeting will be conducted virtually, on [ ], [ ], 2021 at [ ], Eastern Time, via live webcast.

Stockholders of record can participate in the Meeting virtually by logging in to [ ] and following the instructions provided. We will have technicians ready to assist you with any technical difficulties you may have accessing the live webcast. Technical support will be available at (844) 986-0822 (US) or (303) 562-9302 (international) starting at approximately [ ], Eastern Time, and will remain available until the Meeting has finished. We recommend that you log in at least ten minutes before the Meeting to ensure you are logged in when the meeting starts. Only registered stockholders as of [ ] 2021, the record date for the Meeting, may submit questions and vote at the Meeting. You may still virtually participate in the Meeting if you vote by proxy in advance of the Meeting.

Please note that if you hold your shares through a bank, broker or other nominee (i.e., in street name), you may be able to authorize your proxy by telephone or the Internet, as well as by mail. You should follow the instructions you receive from your bank, broker or other nominee to vote these shares. Also, if you hold your shares in street name, you must obtain a proxy executed in your favor from your bank, broker or nominee to be able to participate in and vote via the Meeting webcast.

Expenses of Soliciting Proxies

The Company will bear the expenses of the solicitation of proxies for the Meeting, including the cost of preparing, printing and distributing the Notice and, if requested, this Proxy Statement, the accompanying Notice of Special Meeting of Stockholders and the proxy card. Upon request, the Company will reimburse brokers, dealers, banks and

trustees, or their nominees, for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of the Company’s common stock.

In addition to the solicitation of proxies by mail or e-mail, proxies may be solicited in person and by telephone or facsimile transmission by Directors and officers of the Company, or certain employees of and affiliates of the Investment Adviser, in each case without special compensation therefor.

The Company has also retained Broadridge Financial Solutions, Inc. (“Broadridge”) to assist in the distribution of the Company’s proxy materials and the solicitation and tabulation of proxies. The cost of Broadridge’s services with respect to the Company is estimated to be approximately $30,000.

Address of the Investment Adviser and Administrator

The principal executive offices of our Investment Adviser, Carlyle Global Credit Investment Management L.L.C., and our administrator, Carlyle Global Credit Administration L.L.C. (the “Administrator”), are located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017.

Householding of Proxy Materials

Under rules adopted by the SEC, companies and intermediaries (e.g., brokers) may satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement and annual report addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. The rules also apply to the delivery of the Notice.

The Company’s bylaws (the “Bylaws”) allow us to give a single notice to all stockholders who share an address, unless such stockholder objects to receiving such single notice or revokes a prior consent to receiving such single notice. A single copy of the Notice or, if applicable, our Proxy Statement, will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. If you have received notice from your broker that it will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. We will promptly deliver a separate copy of these documents to you upon written request to the attention of the Secretary of the Company, Erik Barrios, at our principal executive offices located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017 or upon request by telephone to Allison Rudary, Investor Relations, at (212) 813-4756. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Proxy Statement, please notify your broker. Stockholders who currently receive multiple copies of the Proxy Statement at their addresses and would like to request “householding” of their communications should contact their brokers.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by: (1) delivering a written revocation notice prior to the Meeting to the Company, Attention: Secretary, One Vanderbilt Avenue, Suite 3400, New York, NY 10017; (2) submitting a later-dated proxy card, a later-dated electronic vote via the website stated on the proxy card, or a later-dated vote using the toll-free telephone number stated on the proxy card; or (3) voting at the virtual Meeting. If a stockholder holds shares of our common stock through a broker, bank or other nominee, the stockholder must follow the instructions received from the broker, bank or other nominee in order to revoke the voting instructions. Participating in the Meeting does not revoke a proxy unless the stockholder also votes at the Meeting.

Contact Information for Proxy Solicitation

You can contact us by mail sent to the attention of the Secretary of the Company, Erik Barrios, at our principal executive offices located at One Vanderbilt Avenue, Suite 3400, New York, NY 10017. You can call us by dialing (212) 813-4756. You can access our proxy materials online at www.proxyvote.com using the control number found on your Notice or in the box at the right of your Proxy Card.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Beneficial ownership is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The following table sets forth, as of the Record Date, the beneficial ownership as indicated in the Company’s books and records of each Director, including each Director that is not an “interested person,” as defined in the 1940 Act, of the Company (such Director, an “Independent Director”), each executive officer of the Company, the executive officers and Directors as a group, and each person known to us to beneficially own 5% or more of the outstanding shares of our common stock. Ownership information for those persons who beneficially own 5% or more of the outstanding shares of our common stock is based on Schedule 13G or other filings by such persons with the SEC and other information obtained from such persons. There is no common stock subject to options or warrants that are currently exercisable or exercisable within 60 days of the Record Date.

The percentage ownership is based on [53,895,009] shares of common stock outstanding as of the Record Date. To our knowledge, except as indicated in the footnotes to the table, each of the stockholders listed below has sole voting and/or investment power with respect to shares beneficially owned by such stockholder. Unless otherwise indicated by footnote, the address for each listed individual is One Vanderbilt Avenue, Suite 3400, New York, NY 10017.

| | | | | | | | | | | | | | | | | | | | |

| Name of Individual or Identity of Group | | Number of Shares of Common Stock Beneficially Owned(1) | | Percent of Common Stock Beneficially Owned(1) | | Dollar Range of Equity Securities Beneficially Owned(2) |

| Directors and Executive Officers: | | | | | | |

| Interested Directors | | | | | | |

| Linda Pace | | — | | — | | — |

Mark Jenkins(3) | | 8,826 | | * | | Over $100,000 |

| Independent Directors | | | | | | |

| Nigel D.T. Andrews | | — | | — | | — |

| Leslie E. Bradford | | — | | — | | — |

| John G. Nestor | | — | | — | | — |

| William H. Wright II | | — | | — | | — |

| Aren C. LeeKong | | — | | — | | — |

| Executive Officers Who Are Not Directors | | | | | | |

Thomas M. Hennigan(4) | | 4,413 | | * | | $50,001 - $100,000 |

| Peter Gaunt | | — | | — | | — |

| Erik Barrios | | — | | — | | — |

| Taylor Boswell | | — | | — | | — |

| All Directors and Executive Officers as a Group (eleven persons) | | 13,239 | | * | | |

| Five-Percent Stockholders: | | | | | | |

The National Commercial Bank(5) | | 9,315,562 | | 17.3% | | Over $100,000 |

Fresno County Employees’ Retirement Association(6) | | 6,618,997 | | 12.3% | | Over $100,000 |

Moneda Carlyle XI Fondo de Inversion(7) | | 4,759,316 | | 8.8% | | Over $100,000 |

| | | | | | | | |

| * | Represents less than one tenth of one percent. |

| (1) | | For purposes of this table, a person or group is deemed to have “beneficial ownership” of any shares of common stock as of a given date which such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days after such date. For purposes of computing the percentage of outstanding shares of common stock held by each person or group of persons named above on a given date, any security which such person or persons has the right to acquire within 60 days after such date is deemed to be outstanding for the purpose of determining the percentage of shares beneficially owned for such person, but is not deemed to be outstanding for the purpose of computing the percentage of beneficial ownership of any other person (except in the case of Directors and executive officers as a group). Except as otherwise noted, each beneficial owner of more than five percent of our common stock and each Director and executive officer has sole voting and/or investment power over the shares reported. |

| (2) | | Beneficial ownership in this column has been determined in accordance with Rule 16a-1(a)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The dollar range of equity securities beneficially owned is based on the Company’s net asset value per share of $20.21 as of June 30, 2021. The dollar ranges are as follows: None, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000. |

| (3) | | Consists of 8,826 shares of common stock directly owned by Mr. Jenkins. |

| (4) | | Consists of 4,413 shares of common stock directly owned by Mr. Hennigan. |

| (5) | | Consists of 2,606,087 shares of common stock directly owned and 3,174,643 shares of common stock owned by a subsidiary and an investment vehicle for which that subsidiary serves as general partner. The address of The National Commercial Bank is King Abdul Aziz Street, P.O. Box 3555, Jeddah 21481, Saudi Arabia. |

| (6) | | Consists of 6,618,997 shares of common stock directly owned. The address of Fresno County Employees’ Retirement Association is 1111 H. Street, Fresno, CA 93721. |

| (7) | | Consists of 4,759,316 shares of common stock directly and beneficially owned by Moneda Carlyle XI Fondo de Inversion (“Moneda”). The address of Moneda is Isidora Goyenechea 3621, Las Condes, Santiago F3 7550110, Chile. Moneda has contractually agreed with the Company that, for so long as it owns more than 3% of the total outstanding shares of the Company’s common stock, it will vote such shares in the same proportion as the vote of all other stockholders of the Company. |

PROPOSAL I

THE EXTENSION PROPOSAL

Background

The Company is seeking stockholder approval to convert the Company from a finite life, private BDC with no interim liquidity to a private BDC with a perpetual life and a regular quarterly liquidity program by: (a) extending indefinitely the Company’s finite Term (as defined below), which is currently scheduled to end at the close of business on November 9, 2025 (subject to extension by the Board for up to two successive one-year periods); (b) extending indefinitely the Company’s finite Investment Period, which is currently scheduled to end at the close of business on September 11, 2022; and (c) accepting new subscriptions for the Company’s common stock in a new continuous private offering.

If the Extension Proposal is approved by the Company’s stockholders, the Company intends, subject to market and other conditions, to thereafter conduct recurring quarterly tender offers for the Company’s common stock, beginning in the second calendar quarter of 2022, in order to offer regular liquidity to stockholders, as discussed further below. In addition, assuming stockholder approval of the Extension Proposal, the Company expects that its stockholders will be provided with additional liquidity through a special, one-time tender offer for its common stock, which is expected to be for up to $100 million in aggregate amount of the then-outstanding shares at a price per share equal to the Company’s net asset value per share, as determined by the Company on its then-most recently completed valuation date (the “Special Tender Offer”). We expect that the Special Tender Offer will be commenced during the first calendar quarter of 2022, assuming stockholder approval of the Extension Proposal. Any Special Tender Offer will be funded by the Company, one of the Company’s affiliates, or a third party with the Company’s support. We expect these actions to create meaningfully improved initial and ongoing liquidity for stockholders in the coming years, as compared to a “no action” case.

The Company is an externally managed specialty finance company whose investment objective is to generate attractive risk adjusted returns and current income primarily by investing in senior secured term loans to U.S. middle market companies in which private equity sponsors hold, directly or indirectly, a financial interest in the form of debt and/or equity. The Company is managed by the Investment Adviser, a wholly owned subsidiary of The Carlyle Group Inc., and has elected to be regulated as a BDC under the 1940 Act. In addition, the Company has elected to be treated, and intends to continue to comply with the requirements to qualify annually, as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). The Company is a private BDC and has no intention of conducting a public listing of its shares of common stock in the near or long-term.

The Company was formed on February 10, 2017 as a Maryland corporation with the name Carlyle Private Credit, Inc., and its name was changed to TCG BDC II, Inc. on March 3, 2017. The Company conducted a private offering (the “Private Offering”) of its shares of common stock to investors in reliance on exemptions from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). On September 11, 2017, the first date on which the Company accepted subscriptions for shares of its common stock to be issued in the Private Offering (the “Initial Closing Date”), the Company completed its initial closing of capital commitments of $185.8 million. The Company has held additional closings subsequent to the Initial Closing Date. The last date on which the Company was authorized to accept subscriptions for shares of its common stock issued in the Private Offering was required to occur no later than 12 months following the Initial Closing Date, which is referred to as the “Final Closing Date,” provided that the Board could extend the Final Closing Date by up to an additional six-month period in its sole discretion (the end of such six-month period is referred to as the “Outside Date”). On August 6, 2018, the Board approved an extension of the Final Closing Date. The Company’s Outside Date occurred on November 9, 2018.

Certain Existing Terms of the Company

Existing Term

The term of the Company is currently seven years from the Outside Date, subject to the Board’s right to liquidate the Company at any time and to extend the term of the Company for up to two successive one-year periods (the seven-year period and successive extensions, the “Term”). Upon the request of the Board and the approval of holders of a majority of the outstanding shares of the Company’s common stock, the Term of the Company may be further extended. Therefore, the Term is currently scheduled to end on November 9, 2025, the seven-year anniversary of the Outside Date, which may be extended by the Board until November 9, 2027. Subject to the outcome of the vote on the Proposals, Company will be dissolved (i) upon the expiration of the Term (as such Term may be extended pursuant to the above) or (ii) at any time upon a decision of the Board, subject to any necessary stockholder approvals and applicable requirements of the 1940 Act.

Existing Investment Period

The Company’s investment period commenced on the Initial Closing Date and was originally scheduled to continue until the third anniversary of the Final Closing Date, regardless of whether the Final Closing Date has been extended to the Outside Date; provided, however, that it may be extended by the Board, in its discretion, for one additional one-year period, and, such end date may be further extended thereafter with the approval of holders of a majority of the shares of the Company’s common stock (such period, including any extensions, the “Investment Period”). On January 11, 2021, the Board extended the Investment Period for one additional one-year period. Therefore, the Investment Period is currently scheduled to expire September 11, 2022, subject to the right of the Board to terminate the Investment Period at any time in its discretion.

Existing Limitations on Redemption and Interim Liquidity

Shares of the Company’s common stock have no redemption rights and the Company does not currently offer, and has no obligation to offer, any interim liquidity to stockholders prior to the end of the Term. The Company’s stockholders may not sell, assign, transfer or otherwise dispose of (in each case, a “Transfer”) any common stock unless (i) the Company gives prior written consent and (ii) the Transfer is made in accordance with applicable securities laws. No Transfer will be effectuated except by registration of the Transfer on the Company’s books. Therefore, the Company’s stockholders currently have limited or no ability to dispose of their investments in the Company until the Term expires.

Proposed Changes in Connection with the Extension Proposal Subject to Stockholder Approval

Proposed Indefinite Extension of the Company’s Term and Investment Period and Conversion to a Perpetual BDC

If the Extension Proposal is approved by the Company’s stockholders, the Company’s finite Term and finite Investment Period will each be extended indefinitely, and the Company will be converted to a perpetual private BDC with an indefinite investment horizon. The proposal does not contemplate a public listing of the shares of the Company’s common stock.

Proposed Termination of Unused Capital Commitments

The Company intends, subject to market and other conditions, to conduct additional capital drawdowns under its current subscription agreements until the date of the first closing on subscription agreements in the Continuous Offering (as defined below), which the Company expects to occur in the second calendar quarter of 2022 (the “Continuous Offering First Closing”). If the Extension Proposal is approved by the Company’s stockholders, the Company intends to cease drawing on all stockholders’ unused capital commitments for shares of the Company’s

common stock (“Unused Capital Commitments”) then remaining under the terms of their respective subscription agreements after the Continuous Offering First Closing. If a stockholder would like to continue to acquire additional shares of the Company’s common stock through the Company’s private offering after the Continuous Offering First Closing, and assuming that the Extension Proposal is approved by stockholders, such stockholder will be required to execute and deliver a new subscription agreement to the Company for the desired capital commitment following the Meeting. See “Proposed New Subscriptions” below for more information.

Proposed New Subscriptions

If the Extension Proposal is approved by the Company’s stockholders, the Company will accept new subscriptions for shares of its common stock to be issued in a new continuous private offering to existing stockholders and new investors in reliance on Regulation D or another exemption from the registration requirements of the Securities Act (the “Continuous Offering”). If the Continuous Offering is commenced, the Company expects the Continuous Offering First Closing to occur in the second calendar quarter of 2022 and for additional closings to occur thereafter not more frequently than once per calendar month, subject to change at the discretion of the Company based on market and other conditions.

There will be no limit on the number of shares issued or the amount of capital raised in connection with the Continuous Offering. Each investor in the Continuous Offering will make a capital commitment to purchase shares of the Company’s common stock pursuant to a subscription agreement entered into with the Company. As mentioned above, the Company intends to cease drawing Unused Capital Commitments remaining under the terms of stockholders’ respective subscription agreements after the Continuous Offering First Closing. If a stockholder would like to continue to acquire additional shares of the Company’s common stock through the Company’s private offering after the Continuous Offering First Closing, and assuming that the Extension Proposal is approved by the Company’s stockholders, such stockholder will be required to execute and deliver a new subscription agreement to the Company for the desired capital commitment in connection with the Continuous Offering following the Meeting.

Stockholders whose subscription agreements are accepted by the Company in the Continuous Offering will be required to fund drawdowns to purchase shares of our common stock up to the amount of their respective capital commitments each time we deliver a drawdown notice, which will be issued based on our anticipated investment activities and capital needs and at least eight business days prior to funding.

Neither this Proxy Statement, the accompanying Notice of Special Meeting of Stockholders nor the proxy card constitutes an offer to sell, or a solicitation of an offer to buy, any securities and they should not be interpreted or construed as such. Any offers, solicitations or offers to buy, or any sales of securities will be made by the Company in accordance with the registration requirements of the Securities Act or an exemption therefrom.

Liquidity Changes in Connection with the Extension Proposal

Ongoing Liquidity

Pending the results of the stockholder votes at the Meeting, the Company’s stockholders are expected to be provided with a meaningful degree of liquidity through the Special Tender Offer and Quarterly Tender Offers (as defined below), each as discussed below, rather than being required to wait for the wind-down of the Company to liquidate their investment in the Company. In particular, the Special Tender Offer and Quarterly Tender Offers will provide the Company’s stockholders with the opportunity to have their shares repurchased at net asset value.

Special One-Time Tender Offer

If the Extension Proposal is approved by our stockholders, we expect that our stockholders will be provided with additional liquidity through the Special Tender Offer, which we expect to be for up to $100 million in aggregate

amount of the then-outstanding shares of our common stock at a price per share equal to our net asset value per share, as determined by us on our then-most recently completed valuation date. We expect that the Special Tender Offer will be commenced during the first calendar quarter of 2022, assuming stockholder approval of the Extension Proposal.

Any Special Tender Offer will be funded by the Company, one of the Company’s affiliates, or a third party with the Company’s support. On the commencement date of any Special Tender Offer, the offeror will file with the SEC a tender offer statement on Schedule TO, including an offer to purchase, letter of transmittal and related materials. The Special Tender Offer will be made only pursuant to the offer to purchase, the related letter of transmittal and other related materials filed as part of the Schedule TO with the SEC upon commencement of the tender offer. Stockholders should read those filings carefully if and when they become available as they will contain important information about the Special Tender Offer. Those documents may be obtained without charge at the SEC’s website at www.sec.gov if and when they become available.

Although the Company expects that the Special Tender Offer will be commenced during the first calendar quarter of 2022, assuming stockholder approval of the Extension Proposal, unforeseen liquidity or other constraints may result in a delay or reduction in size of the Special Tender Offer.

The Company is not seeking, and is not required to seek, stockholder approval of the Special Tender Offer under the Extension Proposal.

Recurring Quarterly Tender Offers

If the Extension Proposal is approved by the Company’s stockholders, the Board is expected to adopt an ongoing regular quarterly liquidity program pursuant to which the Company is expected to conduct quarterly tender offers (each, a “Quarterly Tender Offer”) as determined by the Board beginning in the second calendar quarter of 2022. At the Board’s discretion and in accordance with the requirements of Rule 13e-4 under the Exchange Act and the 1940 Act and subject to compliance with applicable covenants and restrictions under our financing arrangements, at each Quarterly Tender Offer, each stockholder will be given the opportunity to tender shares at a specific per share price based on the Company’s net asset value as of the last date of the quarter in which the Quarterly Tender Offer is conducted. The Company currently expects to conduct each Quarterly Tender Offer to repurchase at least 3.5% of the number of shares of its common stock outstanding as of the end of the calendar quarter immediately prior to the quarter in which the Quarterly Tender Offer is conducted. The number of shares to be repurchased at each Quarterly Tender Offer is subject to change, which may either increase or decrease, at the discretion of the Company. The Company is not seeking, and is not required to seek, stockholder approval of the Quarterly Tender Offers under the Extension Proposal.

All shares purchased by us pursuant to the terms of each Quarterly Tender Offer will be retired and thereafter will be authorized and unissued shares. The exact mechanics and specific terms of the Quarterly Tender Offers will be set forth in the repurchase documents to be distributed to stockholders upon the commencement thereof. The repurchase documents will also contain other information that stockholders should consider in deciding whether to tender their shares to the Company in connection with a Quarterly Tender Offer.

Under our quarterly liquidity program, to the extent we offer to repurchase shares in a Quarterly Tender Offer in any particular quarter, we expect to repurchase such shares at a purchase price equal to the net asset value per share as of the last calendar day of the applicable quarter; provided that, shares that have not been outstanding for at least one year may be subject to an early repurchase fee of up to 2% of such shares’ net asset value.

If during any consecutive 24-month period, the Company does not engage in a Quarterly Tender Offer in which the Company accepts 100% of properly tendered shares (a “Qualifying Tender”), the Company will not make commitments for new portfolio investments (excluding short-term cash management investments under 30 days in duration) and will reserve available assets to satisfy future tender requests until a Qualifying Tender occurs; provided, however, that the Company will continue to use available funds and liquidity (a) to pay, and/or establish reserves for, our actual or anticipated expenses, including management and incentive fees, any amounts that may

become due under any borrowings or other financings or similar obligations and any other liabilities, contingent or otherwise, whether incurred before, during or after the end of the relevant 24-month period, (b) to fulfill investment commitments made or approved by our Investment Adviser’s investment committee prior to the expiration of the relevant 24-month period, (c) to fund follow-on investments made in existing portfolio companies (including transactions to hedge interest rate relating to such additional investment) and amounts to protect the value of existing investments (for example, without limitation, follow-on debt or equity investments made to protect existing investments) as necessary, (d) to engage in hedging transactions, (e) to fund obligations under any guarantee or indemnity made by us prior to the end of the relevant 24-month period, (f) to fulfill obligations with respect to any purchase price due from an investor on a drawdown date that such investor fails to pay or (g) as necessary for us to comply with applicable laws and regulations, including the 1940 Act and the Code.

No Changes to the Company’s Investment Strategy

There will be no changes to the Company’s investment strategy, including its approach to use of leverage and target returns, in connection with the Extension Proposal, regardless of whether it is approved by the Company’s stockholders. In addition, the Company does not intend to become a publicly traded BDC listed on a national securities exchange, regardless of whether the Extension Proposal is approved by the Company’s stockholders.

Risks of Investing in the Company

The current risks of investing in the Company are disclosed in the Company’s most recent annual report on Form 10-K and other filings with the SEC, available at www.sec.gov.

If the Extension Proposal is approved, the Company intends, but is not obligated to, conduct the Quarterly Tender Offers, and, as discussed above, there is a risk that the Special Tender Offer may be delayed or reduced in size, even if the Extension Proposal is approved.

In any given quarter, the Investment Adviser may or may not recommend to the Board that the Company conduct a Quarterly Tender Offer. For example, if adverse market conditions occur, the Company does not have available cash on hand or other available capital resources necessary to conduct a Quarterly Tender Offer, or the Board otherwise believes that conducting a Quarterly Tender Offer would impose an undue burden on the Company and its stockholders then the Board, in its discretion, may determine to not conduct a Quarterly Tender Offer or otherwise alter or suspend the Company’s liquidity program. Accordingly, there may be periods during which no Quarterly Tender Offer is made.

If the Special Tender Offer or a Quarterly Tender Offer is not made, stockholders may not be able to sell their shares or, if they are able to sell their shares, may be able to sell such shares only at substantial discounts from net asset value. If the Company does conduct Quarterly Tender Offers or the Special Tender Offer, it may be required to sell portfolio securities it would otherwise hold to purchase shares that are tendered, which may result in losses and may increase Company expenses as a percentage of net assets. In addition, although the Company is permitted to borrow money to finance the repurchase of shares pursuant to the Quarterly Tender Offers or the Special Tender Offer, there can be no assurance that the Company will be able to obtain such financing at the time of any particular tender offer or that capacity will be available under any financing the Company has arranged to fund such tender offer. Because stockholders will be able to participate in the Special Tender Offer and/or in one or more Quarterly Tender Offers only up to their pro rata share of the number of Shares tendered if the applicable tender offer is oversubscribed, stockholders may not be able to exit the Company or sell their desired amount of Shares in the Special Tender Offer or through one or more Quarterly Tender Offers.

Board’s Consideration of the Extension Proposal

On October 12, 2021, the Board held a meeting to consider the Proposals. The Board received information and analyses regarding the Extension Proposal and the Investment Adviser presented its rationale for the Extension Proposal. The Independent Directors asked questions and discussed the information provided. The Independent Directors were represented by their independent legal counsel at the meeting and throughout the process of evaluating the Extension Proposal, and met separately with their independent legal counsel and the Company’s counsel before voting on the Extension Proposal. In particular, the Board considered the following in connection with the Extension Proposal:

•Liquidity Mechanisms: The Board considered the availability of potential liquidity options for stockholders if the Extension Proposal is approved and the fact that there may be stockholders who do not wish for the Term and Investment Period to be extended. In connection with these considerations, the Board noted that the Company and the Investment Adviser have arranged to provide a meaningful degree of liquidity to the Company’s stockholders who do not wish to remain invested in the Company or in a potentially perpetual life vehicle by allowing them, if the Extension Proposal is approved, to tender their shares for purchase through (1) the Special Tender Offer and (2) the Quarterly Tender Offers. The Board considered the fact that, if the Extension Proposal is approved by the Company’s stockholders, there is no guarantee that stockholders will be able to exit the Company in any single tender offer or series of tender offers if they are oversubscribed, and the risk that the Company or another party may not be able to purchase shares in the applicable tender offer or provide the liquidity to stockholders as contemplated by the Extension Proposal. The Board also noted that the Company, under its current Term, is not expected to liquidate until November 9, 2025 (subject to extension by the Board for up to two successive one-year periods), and stockholders who wish to exit the Company on the originally contemplated timeline could be expected to have the opportunity to participate in numerous tender offers prior to that time, which, based on an analysis conducted by the Investment Adviser, would allow for an earlier return in full of any such stockholder’s capital.

•Performance: The Board considered, among other things, the Company’s performance to date and the future income-earning potential that the Extension Proposal would make possible and that the risks of investing in the Company have been disclosed to stockholders in the Company’s stockholder reports and other SEC filings.

•Additional Capital Raises: The Board noted that, if the Extension Proposal is approved, and subject to market and other conditions, the Company intends, subject to appropriate Board oversight and approval, to seek to raise additional capital through the Continuous Offering. The Board considered the Investment Adviser’s view that additional capital will benefit the Company and its stockholders, including (i) through the ability to take advantage of attractive investment opportunities without the need to liquidate existing assets or (ii) through improvement of the Company’s liquidity and financing position. The Board also noted that the commencement of the Continuous Offering is an important element for the Company to be able to provide the Quarterly Tender Offers, and potentially the Special Tender Offer, to stockholders.

The Board’s evaluation took into account that the Company is approaching being fully invested and the Investment Adviser’s belief that the Company is appropriately leveraged at this time. The Board also considered that raising additional capital would result in a larger asset base over which to spread the Company’s fixed expenses, which may result in decreased expenses for stockholders. When determining to recommend approval of the Extension Proposal the Board also took into consideration the Investment Adviser’s conflict of interest with respect to the Extension Proposal and the potential additional capital-raising activities, namely that the Investment Adviser would receive additional fees over the perpetual life of the Company.

•Potential Changes to the Current Investment Advisory Agreement: The Board considered the fact that, if the Extension Proposal is approved, the Amended and Restated Investment Advisory Agreement may become effective, subject to stockholder approval of the Advisory Agreement Amendment Proposal, which

would (a) change the calculation of the incentive fee on pre-incentive fee net investment income payable by the Company to the Investment Adviser by reducing the pre-incentive fee net investment income incentive fee rate to 12.5% from 15.0% and by reducing the “hurdle rate” to 1.25% (5.0% annualized) from 1.75% (7.0% annualized) (such changes to the pre-incentive fee net investment income incentive fee to be effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement), (b) reduce the capital gains incentive fee rate payable by the Company to the Investment Adviser to 12.5% from 15.0%, and (c) change the basis for the calculation of the base management fee payable by the Company to the Investment Adviser to the value of the Company’s net assets as of the end of the immediately preceding calendar quarter (as adjusted for capital called, dividends reinvested, distributions paid and issuer share repurchases made during the current calendar quarter) from average capital under management (the annual base management fee rate will remain at 1.00%). The Board noted that these changes, in the aggregate, may lead to the payment of higher or lower fees to the Investment Adviser for its management of the Company depending upon the Company’s performance as detailed below in “Proposal II – The Advisory Agreement Amendment Proposal.” In addition, the Board considered the Investment Adviser’s willingness to reduce investment advisory fees payable by the Company to the Investment Adviser. The Board also considered the Investment Adviser’s belief that it is fair and reasonable to ask the Company to pay the costs associated with the Extension Proposal given the expected benefits for stockholders as a result of the Extension Proposal.

Based, among other things, on the information provided in connection with the meetings of the Board and related discussions, the Board, including each of the Independent Directors, determined that the Extension Proposal was in the best interests of the Company and its stockholders. The Board’s evaluation also took into account information received since the Company’s inception and reflected the knowledge and familiarity gained as members of the Board with respect to the operations of the Company. The Board then voted to approve the Extension Proposal, submit it for approval by the Company’s stockholders, and to recommend approval of the Extension Proposal at the Meeting.

Required Vote

Stockholders may vote “FOR” or “AGAINST,” or they may “ABSTAIN” from voting on, the Extension Proposal. The Company is seeking approval of the Extension Proposal by the affirmative vote of holders of shares of the Company’s common stock entitled to cast a majority of all the votes entitled to be cast on the Extension Proposal at the Meeting. Abstentions and broker non-votes will have the same effect as votes “against” this proposal. Proxies received will be voted “FOR” the approval of the Extension Proposal unless the relevant stockholder designates otherwise.

Approval of the Extension Proposal is not contingent on stockholder approval of the Advisory Agreement Amendment Proposal.

THE BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE FOR THE EXTENSION PROPOSAL.

PROPOSAL II

THE ADVISORY AGREEMENT AMENDMENT PROPOSAL

Background

The Company is seeking stockholder approval of an Amended and Restated Investment Advisory Agreement in connection with the Advisory Agreement Amendment Proposal, which would (a) change the calculation of the incentive fee on pre-incentive fee net investment income payable by the Company to the Investment Adviser by reducing the pre-incentive fee net investment income incentive fee rate to 12.5% from 15.0% and by reducing the “hurdle rate” to 1.25% (5.0% annualized) from 1.75% (7.0% annualized), (b) reduce the capital gains incentive fee rate payable by the Company to the Investment Adviser to 12.5% from 15.0%, and (c) change the basis for the calculation of the base management fee payable by the Company to the Investment Adviser to the value of the Company’s net assets as of the end of the immediately preceding calendar quarter (as adjusted for capital called, dividends reinvested, distributions paid and issuer share repurchases made during the current calendar quarter) from average capital under management (the annual base management fee rate will remain at 1.00%). These changes, in the aggregate, may lead to the payment of higher or lower fees to the Investment Adviser for its management of the Company depending upon the Company’s performance as detailed below.

The terms of the Amended and Restated Investment Advisory Agreement will become effective promptly following receipt of the requisite stockholder approval of the Extension Proposal and the Advisory Agreement Amendment Proposal; provided however, that the proposed changes to the calculation of the pre-incentive fee net investment income incentive fee will become effective for the first full calendar quarter commencing on or after the date of effectiveness of the Amended and Restated Investment Advisory Agreement.

Approval of the Advisory Agreement Amendment Proposal is contingent upon the approval of the Extension Proposal. As a result, if the Extension Proposal is not approved by the Company’s stockholders at the Meeting, the Advisory Agreement Amendment Proposal will not be approved, regardless of the results of the stockholder vote on the Advisory Agreement Amendment Proposal.

A copy of the Amended and Restated Investment Advisory Agreement is attached as Annex A to this Proxy Statement and is marked to show the changes against the Current Investment Advisory Agreement between the Company and the Investment Adviser dated as of June 26, 2017 (as amended, the “Current Investment Advisory Agreement”).

Overview of the Current Investment Advisory Agreement

On June 26, 2017, the Company entered into the Current Investment Advisory Agreement with the Investment Adviser. Unless terminated earlier, the Current Investment Advisory Agreement renews automatically for successive annual periods, provided that such continuance is specifically approved at least annually by the vote of the Board and by the vote of a majority of the Independent Directors. On May 26, 2021, the Board, including a majority of the Independent Directors, approved the continuance of the Current Investment Advisory Agreement with the Investment Adviser for an additional one-year term. The Current Investment Advisory Agreement will automatically terminate in the event of an assignment and may be terminated by either party without penalty upon at least 60 days’ written notice to the other party.

See Exhibit A to this Proxy Statement for a listing of the names, addresses, and principal occupations of the principal executive officers of the Investment Adviser and a listing of the names, addresses, and principal occupations of the officers and directors of the Company who are also officers, employees, or members of the Investment Adviser. The Investment Adviser is managed by its managing member, Carlyle Investment Management L.L.C.

Advisory Services

The Investment Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and serves as the Company’s investment adviser pursuant to the Current Advisory Agreement in accordance with the 1940 Act. Subject to the overall supervision of the Board of Directors, the Investment Adviser oversees the Company’s day-to-day operations and provides the Company with investment advisory services. Under the terms of the Current Advisory Agreement, the Investment Adviser, among other things: (i) determines the composition of the portfolio of the Company, the nature and timing of the changes therein and the manner of implementing such changes; (ii) identifies, evaluates and negotiates the structure of the investments made by the Company; (iii) monitors the Company’s investments; (iv) determines the securities and other assets that the Company will purchase, retain, or sell; (v) performs due diligence on prospective portfolio companies; (vi) assists the Board of Directors with its valuation of the Company’s assets; (vii) directs investment professionals of the Investment Adviser to provide managerial assistance to portfolio companies of the Company as requested by the Company, from time to time; and (viii) provides the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its funds. The Investment Adviser’s services under the Current Advisory Agreement are not exclusive and it is free to furnish similar services to other entities so long as its services to the Company are not impaired.

Advisory Fees

Pursuant to the Current Investment Advisory Agreement, the Investment Adviser is entitled to receive fees from the Company consisting of two components—a base management fee and an incentive fee.

The base management fee is calculated and payable quarterly in arrears at an annual rate of 1.00% of the Company’s average Capital Under Management (as defined below) at the end of the then-current quarter and the prior calendar quarter. Prior to September 12, 2021, the base management fee was calculated and payable quarterly in arrears at an annual rate of 1.25% of the Company’s average Capital Under Management at the end of the then-current quarter and the prior calendar quarter.

“Capital Under Management” means cumulative capital called, less cumulative distributions categorized as Returned Capital.1 For the avoidance of doubt, Capital Under Management does not include capital acquired through the use of leverage, and Returned Capital does not include distributions of the Company’s investment income (i.e., proceeds received in respect of interest payments, dividends or fees, net of expenses) or net realized capital gains to the investors.

The incentive fee consists of two parts as described below.

Incentive Fee on Pre-Incentive Fee Net Investment Income

Pre-incentive fee net investment income means consolidated interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s consolidated operating expenses accrued for the quarter (including the base management fee, expenses payable under the Company’s administration agreement with the Administrator, and any interest expense or fees on any credit facilities or outstanding debt and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee).