- BY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Byline Bancorp (BY) DEF 14ADefinitive proxy

Filed: 26 Apr 21, 4:19pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Byline Bancorp, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

2021 Notice of

Annual Meeting

and Proxy Statement

Alberto J. Paracchini | | April 26, 2021 Dear Stockholder: You are cordially invited to attend the 2021 Annual Meeting of Stockholders of Byline Bancorp, Inc. The Annual Meeting will be held virtually through a live webcast on June 8, 2021 at 8:30 a.m. Central Daylight Time. The attached Notice of Meeting and Proxy Statement describe the formal business to be conducted at the Annual Meeting. Members of our Board of Directors and executive officers will be present virtually at the Annual Meeting to respond to any questions that our stockholders may have. Your vote is important. Whether or not you plan to attend the Annual Meeting virtually, please vote as soon as possible to ensure that your shares are represented and voted at the meeting. Our Board of Directors has determined that the proposals to be considered at the Annual Meeting as described in the attached Notice of Meeting and Proxy Statement are in the best interests of Byline Bancorp and its stockholders. For the reasons set forth in the Proxy Statement, the Board of Directors unanimously recommends a vote "FOR" each proposal to be considered. On behalf of the Board of Directors and the officers and employees of Byline Bancorp, we would like to take this opportunity to thank our stockholders for their continued support. Sincerely, | ||

| | | |||

| | Roberto R. Herencia Executive Chairman of the Board and Chief Executive Officer | | Alberto J. Paracchini President | |

Notice of Annual Meeting of Stockholders of Byline Bancorp, Inc.

![]()

Date and Time

June 8, 2021, at 8:30 a.m. CDT

![]()

Place

Virtually at

www.virtualshareholdermeeting.com/BY2021

![]()

Record Date

April 14, 2021

Only those stockholders of record as of the close of business on that date will be entitled to vote at the Annual Meeting. If there is an insufficient number of shares represented for a quorum, the meeting may be adjourned to permit further solicitation of proxies by the Company.

| Items of Business | ||||

To elect the eight director nominees named in the accompanying proxy statement to the Board of Directors of the Company, each to serve until the 2022 Annual Meeting of Stockholders or until their successors are duly elected and qualified; | ||||

To ratify the appointment of Moss Adams LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2021; and | ||||

To consider such other business that may properly come before the Annual Meeting, or any adjournment thereof, by or at the direction of the Board of Directors. | ||||

| | | | | |

| Every Vote is Important | ||||

Internet Visit the website noted on your proxy card to vote online. | Telephone Use the toll-free telephone number on your proxy card to vote by telephone. | Vote by Mail Sign, date, and return your proxy card in the enclosed envelope to vote by mail. | ||||

A list of stockholders entitled to vote at the meeting will be available for inspection at the Company's main office located at 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601 for a period of ten days prior to the Annual Meeting and will also be made available virtually at the Annual Meeting itself for examination by any stockholder upon request. We are taking advantage of the Securities and Exchange Commission's rules that allow companies to furnish proxy materials to stockholders via the Internet. We sent a Notice of Internet Availability of Proxy Materials to holders of our common stock as of the record date on or about April 26, 2021. The Notice describes how you can access our proxy materials, including this proxy statement, beginning on April 26, 2021. | ||||||

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SUBMIT YOUR PROXY WITH VOTING INSTRUCTIONS. YOU MAY VOTE BY TELEPHONE, VIA THE INTERNET OR BY MAIL.

| | BY ORDER OF THE BOARD OF DIRECTORS, | |||

| By | | ||

Chicago, Illinois April 26, 2021 | | Roberto Herencia Executive Chairman of the Board and Chief Executive Officer | ||

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

About the Meeting | 2 | |||

Stock Ownership | 5 | |||

Delinquent Section 16(a) Reports | 6 | |||

Proposal 1: Election of Directors | 7 | |||

Corporate Governance | 12 | |||

Human Capital and Social Responsibility | 19 | |||

Director Compensation | 22 | |||

Proposal 2: Ratification of Independent Registered Public Accounting Firm | 25 | |||

Report of the Audit Committee | 27 | |||

Executive Officers | 28 | |||

Executive Compensation | 29 | |||

Certain Relationships and Related Transactions | 39 | |||

Stockholder Proposals | 40 | |||

Delivery of Documents to Stockholders Sharing an Address | 41 | |||

Other Matters | 41 | |||

![]()

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 8, 2021

The enclosed proxy is solicited on behalf of the board of directors (the "Board of Directors" or the "Board") of Byline Bancorp, Inc., a Delaware corporation (the "Company"), which is a registered bank holding company that owns and operates Byline Bank (the "Bank"), for use at the 2021 Annual Meeting of Stockholders (the "Annual Meeting") to be held virtually on June 8, 2021 at 8:30 a.m. Central Daylight Time. This proxy statement (this "Proxy Statement"), together with the Notice of Annual Meeting and proxy card, is first being made available to stockholders on or about April 26, 2021.

Unless we state otherwise or the context otherwise requires, references in this Proxy Statement to "Byline," "we," "our," "us," "ourselves," "the company" and "the Company" refer to Byline Bancorp, Inc., and its consolidated subsidiaries.

Important Notice Regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on June 8, 2021

Pursuant to rules of the Securities and Exchange Commission (the "SEC"), we have elected to provide access to our proxy materials via the Internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders. The Notice provides stockholders with instructions on how to access and review this Proxy Statement and our 2020 Annual Report online, as well as vote online. We, like many public companies, have determined that providing proxy materials electronically significantly reduces our printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

Stockholders who receive the Notice will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials via the Internet or to request printed copies may be found within the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

YOUR VOTE IS IMPORTANT

Please vote via the Internet, Telephone or Mail.

Internet: www.proxyvote.com

Phone: 1-800-690-6903 and follow the instructions

If you are voting by mailing your proxy card, please mark, sign and date the proxy card when received and return it promptly in the self-addressed, stamped envelope that we have provided.

About the Meeting

What is the date, time and place of the Annual Meeting?

Our 2021 Annual Meeting of Stockholders will be held on Tuesday, June 8, 2021, beginning at 8:30 a.m., Central Daylight Time, virtually at www.virtualshareholdermeeting.com/BY2021

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters outlined in the Notice of Meeting on the cover page of this Proxy Statement, consisting of:

Why did I receive a notice in the mail regarding the availability of proxy materials on the Internet instead of a full set of proxy materials?

Pursuant to rules of the SEC, we have elected to provide access to our proxy materials via the Internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders. The Notice provides stockholders with instructions on how to access and review this Proxy Statement and our 2020 Annual Report online, as well as vote online. We, like many public companies, have determined that providing proxy materials electronically significantly reduces our printing and mailing costs associated with the distribution of printed copies of our proxy materials to our stockholders.

Stockholders who receive a Notice will not receive a printed copy of the proxy materials by mail unless you request one. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials via the Internet or to request printed copies may be found within the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Who is entitled to vote at the Annual Meeting?

Only our stockholders of record at the close of business on April 14, 2021, the record date for the meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponement(s) or adjournment(s) of the meeting. As of the record date, there were 38,632,697 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting. As of the record date, there were 39,106,222 shares of common stock issued.

A list of stockholders will be available at our offices at 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601 for a period of ten days prior to the Annual Meeting and will also be made available virtually at the Annual Meeting itself for examination by any stockholder.

What are the voting rights of the holders of our common stock?

Holders of our common stock are entitled to one vote per share on each matter that is submitted to stockholders for approval. Stockholders do not have cumulative voting rights.

2 Byline Bancorp, Inc. 2021 Proxy Statement

| About the Meeting |

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may virtually attend the Annual Meeting.

What constitutes a quorum?

The presence at the meeting, in person (virtually) or by proxy, of the holders of common stock representing a majority of the combined voting power of the outstanding shares of common stock on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, there were 38,632,697 shares of common stock outstanding, all of which are entitled to be voted at the Annual Meeting.

What vote is required to approve each item?

The votes required to approve the matters to be presented at the Annual Meeting as listed in the Notice of the Annual Meeting are as follows:

For purposes of Proposal 2, proxies received but marked as abstentions will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum. Pursuant to our By-laws, broker non-votes will not be counted as shares entitled to vote at the meeting, but votes cast "for" or "against" and abstentions with respect to all matters will be counted as shares entitled to vote. A "broker non-vote" will occur when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power with respect to that proposal and has not received instructions from the beneficial owner. On matters other than the election of directors, abstentions will be treated as a vote "against". If less than a majority of the combined voting power of the outstanding shares of common stock is represented at the Annual Meeting, either the Chairperson of the meeting or a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice.

The inspector of election for the Annual Meeting will determine the number of shares of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and votes and determine the results thereof.

Please note that if you hold your shares in "street name," your bank, broker or other nominee will not be permitted to vote your shares on Proposal 1 (election of directors) absent specific instructions from you. Therefore, it is important that you follow the voting instructions on the form that you receive from your bank, broker or other nominee.

What are the Board's recommendations?

Our Board of Directors recommends a vote FOR the election of all of the respective nominees for director named in this Proxy Statement and FOR the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021.

Unless contrary instructions are indicated on your proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted (1) FOR the election of each of the respective nominees for director named in this Proxy Statement; (2) the ratification of the appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021; and (3) in accordance with the recommendation of our Board of Directors, FOR or AGAINST all other matters as may properly come before the Annual Meeting. In the event a stockholder

Byline Bancorp, Inc. 2021 Proxy Statement 3

About the Meeting |

specifies a different choice by means of the proxy, such shares will be voted in accordance with the specification made.

How do I vote?

If you are a holder of record (that is, if your shares are registered in your own name with our transfer agent), you may vote using the proxy card contained in the proxy materials. Voting instructions are provided on the proxy card. The Notice also includes information about how to vote via the Internet (at www.proxyvote.com) or via telephone (1-800-690-6903 and follow the instructions).

If you are a street name holder (that is, if you hold your shares through a bank, broker or other holder of record), you must provide your voting instructions in accordance with the voting instruction form provided by your bank, broker or other holder of record, who will then vote your shares on your behalf. The availability of telephone or Internet voting will depend upon your bank's, broker's, or other holder of record's voting process.

If you virtually attend the Annual Meeting, you can vote your shares at that time.

Can I change my vote?

Yes. The giving of a proxy does not eliminate the right to vote at the Annual Meeting should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by (1) voting at the Annual Meeting, or (2) by filing a written revocation or duly executed proxy bearing a later date with our Secretary.

Who pays for costs relating to the proxy materials and Annual Meeting?

The costs of preparing, assembling, providing access to and mailing this Proxy Statement, the Notice of Annual Meeting of Stockholders and the Annual Report and proxy card, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers and employees may solicit proxies personally and by telephone, email and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy materials to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing, if applicable.

4 Byline Bancorp, Inc. 2021 Proxy Statement

Stock Ownership

Security Ownership of Certain Beneficial Owners and Management

The following table shows information regarding the beneficial ownership of our common stock for the following:

Beneficial ownership is shown as of April 14, 2021, and is based on 38,632,697 shares of our common stock outstanding as of April 14, 2021. Beneficial ownership is determined in accordance with the rules of the SEC, which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to such securities. A security holder also is deemed to be, as of any date, the beneficial owner of all securities that such security holder has the right to acquire within 60 days after such date, such as through the exercise of options or warrants or the conversion of a security. Except as otherwise indicated, all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them. Except as otherwise indicated, the address for each stockholder listed below is c/o Byline Bancorp, Inc., 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601.

| Beneficial Ownership | ||||||||||

| | | | | | | | | | | |

Name of Beneficial Owners | Number | Percentage | ||||||||

| | | | | | | | | | | |

Greater than 5% Stockholders: | ||||||||||

MBG Investors I, L.P.(1) | 11,467,123 | 29.68 | % | |||||||

ECR Holdings, S.A. de C.V.(2) | | 2,038,691 | | 5.28 | % | | ||||

Directors: | ||||||||||

Roberto R. Herencia(3) | 662,355 | 1.70 | % | |||||||

Phillip R. Cabrera | | 12,801 | | * | | |||||

Antonio del Valle Perochena(1) | 11,467,123 | 29.68 | % | |||||||

Mary Jo S. Herseth | | 7,825 | | * | | |||||

Steven P. Kent | 77,500 | * | ||||||||

William G. Kistner | | 5,000 | | * | | |||||

Steven M. Rull(4) | 185,400 | * | ||||||||

Named Executive Officers: | ||||||||||

Alberto J. Paracchini**(5) | 518,808 | 1.33 | % | |||||||

Thomas Abraham(6) | | 47,360 | | * | | |||||

Lindsay Corby(7) | 138,979 | * | ||||||||

Brogan Ptacin(8) | | 120,420 | | * | | |||||

| | | | | | | | | | | |

All directors and executive officers as a group (18 persons) | 13,504,747 | 34.96 | % | |||||||

| | | | | | | | | | | |

Byline Bancorp, Inc. 2021 Proxy Statement 5

Stock Ownership |

of such shares. The address for ECR Holdings, S.A. de C.V. is Vasconcelos 220, San Pedro Garza Garcia, Nuevo Leon, Mexico.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our directors and executive officers, and persons owning more than 10% of a registered class of our equity securities, to file with the SEC reports of ownership and changes in ownership of the Company's equity securities. These same persons are also required to furnish us with copies of all such forms. Based solely on a review of the copies of the forms furnished to us, or written representations that no Form 5 filings were required, we believe that, with respect to the 2020 fiscal year, all required Section 16(a) filings were timely made.

6 Byline Bancorp, Inc. 2021 Proxy Statement

| Proposal 1 Election of Directors The Governance and Nominating Committee of the Board of Directors is responsible for making recommendations to our Board of Directors regarding candidates for directorships and the size and composition of our Board of Directors. Each of our nominees currently serves as a Byline director, has consented to being named in this Proxy Statement and has agreed to serve if elected. If any nominee becomes unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute nominees as the Board of Directors may recommend. At this time, the Board of Directors knows of no reason why any nominee might be unavailable or unwilling to serve. |  |

The table below sets forth information regarding each nominee for director. Currently, each of our directors is elected annually to serve a one-year term.

| Name | Age | Position | Director Since | |||

|---|---|---|---|---|---|---|

| | | | | | | |

| Roberto R. Herencia | 61 | Executive Chairman and Chief Executive Officer | 2013 | |||

| Phillip R. Cabrera | 68 | Director | 2013 | |||

| Antonio del Valle Perochena | 52 | Director | 2013 | |||

| Mary Jo Herseth | 62 | Director | 2019 | |||

| Steven P. Kent | 70 | Director | 2019 | |||

| William G. Kistner | 70 | Director | 2018 | |||

| Alberto J. Paracchini | 50 | President and Director | 2013 | |||

| Steven M. Rull | 71 | Director | 2016 | |||

| | | | | | | |

Information Regarding Nominees for Election

| Roberto R. Herencia | ||||

| | | | | |

Age: 61 Director Since: 2013 Board Committees: | Background Roberto R. Herencia has served as Chairman of our Board of Directors since June 2013, and as Executive Chairman and Chief Executive Officer since February 12, 2021. He serves as a member of the risk committee. Mr. Herencia also serves as Executive Chairman of the board of directors of Byline Bank, and serves as a member of the risk, executive credit, trust, and Asset-Liability Committee ("ALCO") committees of Byline Bank. Mr. Herencia led the Recapitalization of our predecessor, Metropolitan Bank Group, Inc., as President and Chief Executive Officer of BXM Holdings, Inc., a position he has held since November 2010. Prior to BXM Holdings, Inc., Mr. Herencia served as President and Chief Executive Officer of Midwest Banc Holdings, Inc. and spent 17 years with Popular Inc. as its Executive Vice President and as President of Popular Inc.'s subsidiary, Banco Popular North America. Mr. Herencia has also served as an independent director of Banner Corporation and its subsidiary, Banner Bank, since March 2016, and as Chairman of the board of directors of First BanCorp, and its subsidiary, FirstBank Puerto Rico since October 2011. Mr. Herencia previously served as an independent director of privately held SKBHC Holdings LLC, and its two subsidiary banks, American West Bank and First National Bank of Starbuck, from December 2010 to September 2015. Appointed by President Obama in 2011, Mr. Herencia serves on the Overseas Private Investment Corporation's board of directors. Mr. Herencia holds a bachelor's degree in finance from Georgetown University and an M.B.A. from the Kellogg School of Management at Northwestern University. Mr. Herencia's qualifications include over 33 years of experience in the banking industry, having held senior roles in corporate, commercial, small business, problem asset restructuring and retail banking, as well as extensive experience with complex and distressed turnaround efforts, having executed over 15 mergers and acquisitions in his career. | |||

| | | | | |

Byline Bancorp, Inc. 2021 Proxy Statement 7

Proposal 1: Election of Directors |

| Phillip R. Cabrera | ||||

| | | | | |

Director Since: 2013 Board Committees: | Background Phillip R. Cabrera has served on our Board of Directors since June 2013, and serves as member of the audit, compensation, and governance and nominating committees. Mr. Cabrera also serves on the board of directors of Byline Bank, serves as a member of the audit, compensation, governance and nominating, executive credit, trust, and ALCO committees of Byline Bank. Since retiring from the McDonald's Corporation in 2015, Mr. Cabrera has served as an advisor and consultant to Air Products and INDURA, Santiago, Chile, assisting management in identifying and remedying gaps in audit, treasury, governance and controls. Mr. Cabrera retired as Vice President and International Treasurer of McDonald's Corporation in October 2015, where for 21 years he held varied executive roles. Prior to his tenure at McDonald's, Mr. Cabrera was a Managing Director and Senior Partner in the Latin America Group of Continental Bank and served as President of Continental International Finance Corporation, a holding company for Continental Bank's international equity investments, from 1993 to 1994. Mr. Cabrera also served on the board of directors of Institutional Cash Distributors, an internet broker of money funds, until it was sold to private equity in 2018. Mr. Cabrera currently serves as an Industry Advisor to McNally Capital. Mr. Cabrera previously served on the advisory board of Unibanco, Banco do Investimento do Brazil from 1982 to 1986. Mr. Cabrera holds a bachelor's degree in business administration from Bradley University and a master's degree in international management with a finance concentration from the Thunderbird School of Global Management and served in the U.S. Army. Mr. Cabrera's qualifications include over 30 years of experience in corporate finance, corporate treasury and banking. | |||

| | | | | |

Antonio del Valle Perochena | ||||

| | | | | |

Director Since: 2013 Board Committees: | Background Antonio del Valle Perochena has served on our Board of Directors since June 2013 and was appointed Lead Director in February 2021. He serves as the chair of the compensation committee, and as the chair of the governance and nominating committee. Mr. del Valle Perochena also serves on the board of directors of Byline Bank, and serves as the chair of the compensation committee, and as the chair of the governance and nominating committee of Byline Bank. Mr. del Valle Perochena has been the Chairman of the board of directors of Kaluz, S.A., which is the holding company for Mexichem, S.A.B. and Elementia, S.A., since September 2013 and has been the Chairman of the board of directors of Grupo Financiero Ve por Más, S.A. (BX+) since 2006. Prior to incorporating Kaluz and BX+, which are financial, industrial and construction enterprises, in 2003, Mr. del Valle Perochena worked at ING Group as Executive Vice President of Insurance and Pensions in Mexico from 1996 to 1999, and later as Director of New Projects of the direct banking business of the group, ING Direct, in Madrid, Spain from 1999 to 2001. Mr. del Valle Perochena has served as a director of Pochteca Group and Grupo Empresarial Kaluz since 2003 and as a director of Afianzadora Sofimex since 2004. Mr. del Valle Perochena holds a business administration degree and Masters in Management from Universidad Anáhuac. He also holds a Senior Management graduate degree at IPADE and a specialization in literature at the Iberoamericana University. Mr. del Valle Perochena's qualifications include over 20 years of experience in the financial and business sectors. | |||

| | | | | |

8 Byline Bancorp, Inc. 2021 Proxy Statement

| Proposal 1: Election of Directors |

| Mary Jo S. Herseth | ||||

| | | | | |

Director Since: 2019 Board Committees: | Background Mary Jo S. Herseth has served on our Board of Directors since April 2019. She serves as a member of the risk committee. Ms. Herseth also serves on the board of directors of Byline Bank and serves as the chair of the executive credit committee, and as a member of the risk, trust, and ALCO committees of Byline Bank. Ms. Herseth has more than 36 years of banking experience and brings significant credit approval and policy expertise to the Board. Ms. Herseth retired as Senior Vice President and National Head of Banking of BMO Private Bank- U.S. in 2017, where she was responsible for BMO's private banking line of business at a national level. Prior to BMO, Ms. Herseth was Market Executive for Illinois and Michigan for US Trust, a part of Bank of America. She spent the majority of her career at LaSalle Bank where she was Executive Vice President and Head of Wealth Management in addition to other senior roles in Wealth Management and Commercial Banking. Currently, Ms. Herseth serves as a Board member of Ride Illinois, a Board member and member of various board committees of Thresholds, Inc., and as a Trustee and member of various board committees of Dominican University. Ms. Herseth received her Bachelor's degree in Finance from Northern Illinois University, and her Master of Business Administration degree from Northwestern University's J.L. Kellogg Graduate School of Management. Ms. Herseth is a recipient of the National Association of Women Business Owners (NAWBO) corporate woman of achievement for 2011. | |||

| | | | | |

| Steven P. Kent | ||||

| | | | | |

Director Since: 2019 Board Committees: | Background Steven P. Kent has served on our Board of Directors since June 2019, and serves as the chair of the risk committee, and as a member of the compensation, and governance and nominating committees. Mr. Kent also serves on the board of directors of Byline Bank, and serves as the chair of the risk committee, and as a member of the executive credit, compensation, and governance and nominating committees of Byline Bank. Mr. Kent served as Vice Chairman and a managing director of the Financial Services Group at Piper Sandler Companies (formerly Piper Jaffray Companies) until January 2021, where he focused on merger and acquisition advisory and capital market transactions for financial services companies. Prior to joining Piper Sandler in October 2015, Mr. Kent co-founded and served as President of River Branch Capital from March 2011 through its sale to Piper Jaffray in September 2015. At River Branch, Mr. Kent advised client banking companies on capital management, equity recapitalizations, merger & acquisition transactions and private equity executions where, in select instances, affiliates of River Branch acted as an investing principal. From August 1998 through March 2011, Mr. Kent was a managing director and co-head of the Chicago office of Keefe, Bruyette & Woods ("KBW"), a boutique investment bank and broker-dealer that specializes in the financial services sector. Prior to joining KBW, Mr. Kent was an executive officer with Robert W. Baird and Co. ("Baird") for 16 years, where he led strategic planning, fixed income capital markets and structured finance, and headed the firm's Financial Services Investment Banking practice. From 1973 to 1982, Mr. Kent was an executive officer at two Midwestern multibank holding companies focusing on strategic planning, bank and trust investment portfolio management, asset and liability management, and commercial and government guaranteed credit origination. From 2012 to 2018, Mr. Kent served as a director and member of the finance and nominating committees of IFF, a Midwest-focused Community Development Financial Institution ("CDFI") certified by the U.S. Department of the Treasury, which serves as a mission-driven lender, real estate consultant and developer that helps communities thrive by creating opportunities for low-income communities and people with disabilities. In January 2019, Mr. Kent was elected to join the board of the Community Reinvestment Fund, USA ("CRF"), a CDFI with a mission-driven strategy headquartered in Minneapolis. In 2020, Mr. Kent was elected to be a founding director of Ignify Technologies, a Public Benefit Corporation formed by CRF to commercialize its Spark Technology Platform to integrate and digitize the small business lending ecosystem. | |||

| | | | | |

Byline Bancorp, Inc. 2021 Proxy Statement 9

Proposal 1: Election of Directors |

| William G. Kistner | ||||

| | | | | |

Director Since: 2018 Board Committees: | Background William G. Kistner has served on our Board of Directors since April 2018, and serves as the chair of the audit committee, and as a member of the risk committee. Mr. Kistner also serves on the board of directors of Byline Bank, and serves as the chair of the audit committee, and as a member of the risk committee of Byline Bank. Mr. Kistner retired from Northwestern Memorial HealthCare (NMHC) in 2018. He joined NMHC in 2004 and in 2006 was appointed Vice President of Internal Audit where he rebuilt the Internal Audit function, developed a coordinated risk assessment methodology and audit work plans based upon organizational needs. He coordinated Audit Committee meetings and reported results of audits and projects to management, the Audit Committee, and the Board. Prior to joining NMHC in 2004, Mr. Kistner worked at Ernst & Young, LLP for 31 years. He was a Tax Partner for 19 years in the Chicago office where he served a variety of clients. Currently Mr. Kistner serves on the Board of Trustees of Loyola University Chicago. He is Chair of the Audit Committee and serves on the Finance and Executive Committees. Also, he is a member of the Board of Directors and Treasurer of Erie Family Health Centers. He is Chair of the Finance Committee and serves on the Executive Committee. Mr. Kistner received his Bachelor of Business Administration degree in accounting from Loyola University Chicago, his Master of Management degree in finance from the Kellogg Graduate School of Management and is a registered Certified Public Accountant. | |||

| | | | | |

Alberto J. Paracchini | ||||

| | | | | |

Age: 50 Director Since: 2013 Board Committees: | Background Alberto J. Paracchini has served as President and Director of Byline Bancorp, Inc. and as Chief Executive Officer, President and Director of Byline Bank since June 2013. Mr. Paracchini also serves as a member of the executive credit and ALCO committees of Byline Bank. Prior to joining Byline, Mr. Paracchini served as Principal for BXM Holdings, Inc., an investment fund specializing in community bank investments, from October 2010 to June 2013 and spent 16 years at Popular, Inc., where he held numerous leadership positions in both its banking and mortgage subsidiaries. From January 2010 through May 2010, Mr. Paracchini was Executive Vice President at Midwest Bank & Trust. From 2006 through 2008, Mr. Paracchini served as President and Chief Financial Officer of Popular Financial Holdings and Chief Financial Officer of E-Loan, an internet banking and mortgage company. Prior to 2006, Mr. Paracchini spent 13 years at Banco Popular North America, where he held several senior leadership roles including Chief Financial Officer, Treasurer and the head of all operations and technology functions. Mr. Paracchini is a member of the Cook County Council of Economic Advisors and Economic Club of Chicago, and a member of the Board of Junior Achievement. Mr. Paracchini holds a bachelor's degree from Marquette University and an M.B.A. from the University of Chicago Booth School of Business. Mr. Paracchini's qualifications to serve as a member of our Board of Directors include his extensive experience in the financial services industry and his demonstrated leadership skills. | |||

| | | | | |

10 Byline Bancorp, Inc. 2021 Proxy Statement

| Proposal 1: Election of Directors |

| Steven M. Rull | ||||

| | | | | |

Director Since: 2016 Board Committees: | Background Steven M. Rull has served on our Board of Directors since October 2016 and serves as member of the audit and risk committees. Mr. Rull also serves on the board of directors of Byline Bank, as the chair of the Trust committee, as the chair of the ALCO committee, and as a member of the audit and risk committees of Byline Bank. From 2007 to 2016, Mr. Rull served as lead director of the board of Ridgestone Financial Services, Inc. and its subsidiary, Ridgestone Bank, which we acquired in 2016. Mr. Rull co-founded Manchester Holdings and its wholly owned subsidiaries, Detalus Advisors, a retail and institutional asset manager, and Detalus Securities, a financial technology and financial advisory firm, in 2001. Mr. Rull co-founded Manchester Partners, an investment and consulting firm where he serves as Managing Director, in 1997. Mr. Rull served as Chairman and Chief Executive Officer of Bunker Hill Bancorp and its subsidiary, Boulevard Bank, from 2003 until its sale in 2013. He also held positions as Chairman of Atlanta Bancorporation and director of its subsidiary, Bank of Atlanta, from 2005 until its sale in 2014. Mr. Rull was the co-head of the capital markets division of Mark Twain Bank from 1994 to 1997. Prior to this role, he held positions as Chief Investment Officer and Chief Financial Officer of United Postal Bancorp from 1987 to 1994 and as President of the Mortgage Division of Mercantile Bank, which acquired United Postal Bancorp in 1994. Mr. Rull holds a bachelor's degree in accounting from Southern Illinois University Edwardsville and was a Certified Public Accountant in the state of Missouri from 1973 to 1996. Mr. Rull's qualifications include over 40 years of management and advisory experience in the financial services industry. | |||

| | | | | |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH NOMINEE FOR DIRECTOR UNDER PROPOSAL 1

Retirement of Robert R. Yohanan from Byline's and Byline Bank's Board of Directors

On May 30, 2018, the Board of Directors appointed Robert R. Yohanan, who at that time was the Chief Executive Officer of First Evanston Bancorp, Inc. and First Bank & Trust (collectively, "First Evanston"), to the Board of Directors of Byline, to be effective upon completion of the merger of First Evanston with Byline. The appointment of Mr. Yohanan was contemplated by and made in accordance with the merger agreement.

Also in connection with the execution of the merger agreement, we entered into a services and covenant agreement (the "services agreement") with Mr. Yohanan, which superseded his then existing employment agreement and change in control agreement with First Evanston upon the effective time of the merger. The agreement provided that Mr. Yohanan's employment with First Evanston terminated upon the effective time of the merger and, for the period from the effective time of the merger until the third anniversary thereof, Mr. Yohanan was to provide general advisory services and be available to consult on specific projects with respect to Byline's business and the integration of Byline and First Evanston as requested by the Chief Executive Officer of Byline.

In addition, pursuant to the services agreement, during such three-year period, Mr. Yohanan served three one-year terms (or until our 2021 Annual Meeting) as a member of the boards of directors of Byline and Byline Bank. Mr. Yohanan will retire from his positions on the Board and Committees of Byline Bank effective upon the expiration of his current term as a director at the Annual Meeting on June 8, 2021.

Byline Bancorp, Inc. 2021 Proxy Statement 11

Corporate Governance

Composition of Our Board of Directors

Our Board of Directors currently has eight members. Under our Amended and Restated Certificate of Incorporation and By-Laws, the number of directors constituting our Board of Directors is fixed from time to time by resolution of the Board of Directors. The Board met 14 times during 2020. There are no family relationships among any of our directors and executive officers.

Board Leadership Structure and Qualifications

We believe that our directors should have the highest professional and personal ethics and values, consistent with our longstanding values and standards. They should have broad experience at the policy making level in business, government, or banking. They should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Each director must represent the interests of all stockholders.

When considering potential director candidates, our Board of Directors considers the candidate's character, judgment, diversity, skills, including financial literacy, and experience in the context of our needs and those of the Board of Directors. Our Board also considers the candidate's service on boards of other companies and whether such service would impair the candidate's ability to perform responsibly all director duties for Byline.

Our Board of Directors does not have a formal policy requiring the separation of the roles of Chief Executive Officer and Chairman of the Board. It is the Board of Directors' view that rather than having a rigid policy, the Board of Directors, with the advice and assistance of the Governance and Nominating Committee, and upon consideration of all relevant factors and circumstances, will determine, as and when appropriate, whether the two offices should be separate. Currently, Mr. Herencia holds the combined positions of Executive Chairman of the Board and Chief Executive Officer, while Mr. Paracchini is President of the Company, as well President and Chief Executive Officer of Byline Bank. Also, Mr. del Valle Perochena was appointed Lead Director of the Company in February 2021 upon the assumption by Mr. Herencia of the Executive Chairman and Chief Executive Officer roles. We believe this current structure provides the appropriate level of oversight and management, as well as intends to accelerate and support the execution of the Company's strategic plan, specifically its growth strategy, as a leading commercial bank in the Chicago MSA.

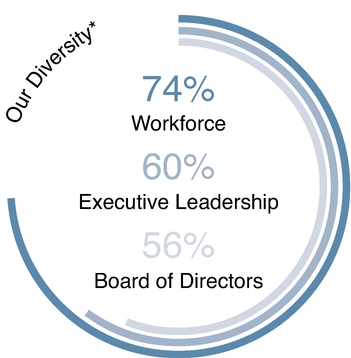

Diversity

Our Board believes that a range of experience, knowledge, and judgement, as well as a diversity of perspectives, geographic regions, gender, race, and national origin on the Board, enhances the overall effectiveness of the Board. At present, 56% of our Board is diverse from a gender, race, or ethnic perspective. During 2020, the Company focused its Diversity, Equity, and Inclusion (DEI) initiatives to ensure we are doing the work necessary to make the Company a safe and welcoming place for all of our employees and customers. With the support of the Board, the Company appointed a DEI Council as the foundation and catalyst for honoring our employees, engaging our customers and community, creating a great place to work, and ultimately driving business success.

Director Independence

Under the rules of the New York Stock Exchange ("NYSE"), independent directors must comprise a majority of our Board of Directors. The rules of the NYSE, as well as those of the SEC, impose several requirements with respect to the independence of our directors. Our Board of Directors has undertaken a review of the independence of each director in accordance with these rules. Based on information provided by each director concerning his or her background, employment and affiliations, our Board of Directors has determined that each of Phillip R. Cabrera, Antonio del Valle Perochena, Mary Jo S. Herseth, Steven P. Kent, William G. Kistner, and Steven M. Rull and do not have relationships that would interfere with the exercise of their independent judgment in carrying out the responsibilities of a director and that each of these directors is "independent" as that term is defined under the applicable rules. Our Board of Directors has determined that Messrs. del Valle Perochena, Cabrera and Kent also satisfy the heightened independence requirements for compensation committee members, and that Messrs. Rull,

12 Byline Bancorp, Inc. 2021 Proxy Statement

| Corporate Governance |

Kistner and Cabrera also qualify as independent directors under the heightened independence requirements of Rule 10A-3 of the Exchange Act for members of the audit committee. In making these determinations, our Board of Directors considered the current and prior relationships that each non-employee director has with our company and certain other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Committees of Our Board of Directors

The standing committees of our Board of Directors consist of an Audit Committee, a Compensation Committee, a Governance and Nominating Committee and a Risk Committee. The responsibilities of these committees are described below. Our Board of Directors may also establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents. The following table summarizes the current membership of each of the committees of the Board of Directors.

| Byline Committees | ||||||||

| | | | | | | | | |

| Audit | Compensation | Governance and Nominating | Risk | |||||

| | | | | | | | | |

Roberto R. Herencia | | | | · | ||||

| | | | | | | | | |

Phillip R. Cabrera | · | · | · | | ||||

| | | | | | | | | |

Antonio del Valle Perochena | | o | o | | ||||

| | | | | | | | | |

Mary Jo Herseth | | | | · | ||||

| | | | | | | | | |

Steven P. Kent | | · | · | o | ||||

| | | | | | | | | |

William G. Kistner | o | | | · | ||||

| | | | | | | | | |

Steven M. Rull | · | | | · | ||||

| | | | | | | | | |

· Member o Chair

Byline Bancorp, Inc. 2021 Proxy Statement 13

Corporate Governance |

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent auditors' qualifications and independence, the performance of our internal audit function and independent auditors and risk assessment and risk management.

| | | |

| Members William G. Kistner (Chair) Phillip R. Cabrera Steven M. Rull Meetings in 2020 | The Audit Committee's duties and responsibilities include the following: • Appoints, evaluates and determines the compensation of our independent auditors. • Reviews and approves the scope of the annual audit and quarterly reviews, the audit and quarterly review fees, any additional services provided by the independent auditors and the related fees, the financial statements, significant accounting policy changes, material weaknesses identified by outside auditors or the internal audit function and risk management issues. • Prepares the Audit Committee report for inclusion in our proxy statement for our annual meeting, and reviews regulatory reports before they are filed with the SEC. • Reviews disclosure controls and procedures, internal controls, internal audit function and corporate policies with respect to financial information. • Assists the Board of Directors in monitoring our compliance with applicable legal and regulatory requirements. • Oversees investigations into complaints concerning financial matters, if any. • Reviews other risks that may have a significant impact on our financial statements. • Annually reviews the Audit Committee charter and the committee's performance. |

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from, and receive appropriate funding to engage outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties. The Audit Committee has adopted a written charter that among other things, specifies the scope of its rights and responsibilities. A copy of the committee's charter is available on our website at www.bylinebancorp.com under the "Governance Documents" tab.

The Audit Committee is composed solely of members who satisfy the applicable independence, financial literacy and other requirements of the NYSE for audit committees, and at least one of its members is an "audit committee financial expert" as defined by the rules of the SEC, which is Mr. Kistner. Messrs. Rull, Kistner and Cabrera also meet the heightened independence requirements of Rule 10A-3 of the Exchange Act.

14 Byline Bancorp, Inc. 2021 Proxy Statement

| Corporate Governance |

Compensation Committee

The Compensation Committee sets and administers the policies that govern our executive compensation programs and is responsible for discharging the Board's responsibilities relating to compensation of our executive officers and directors.

| | | |

| Members Antonio del Valle Perochena (Chair) Phillip R. Cabrera Steven P. Kent Meetings in 2020 | The Compensation Committee's duties and responsibilities include the following: • Reviews and approves the Company's executive compensation structure, including salary, bonus, incentive and equity compensation. • Reviews and approves objectives relevant to the compensation of the Chief Executive Officer and other executive officers. • Evaluates performance against the objectives established for the Chief Executive Officer and determines and approves, or recommends to the Board for approval, the compensation of the Chief Executive Officer based on its evaluation. • Makes recommendations to the Board with respect to the Company's compensation plans that are subject to Board approval, discharges any responsibilities imposed on the Committee by any of these plans, and approves and recommends to the Board any new equity compensation plan or any material change to an existing equity compensation plan. • Reviews, approves and makes recommendations to the Board concerning the compensation of the non-employee directors of the Company. • Oversees and reviews periodically, as it deems appropriate, the administration of the Company's employee benefits plans and any material amendments to such plans. • Review and monitor matters related to human capital management, including Company culture, talent development, and diversity, equity and inclusion programs and initiatives • Evaluates performance in relation to the Compensation Committee charter. |

Under the Compensation Committee's charter, the Compensation Committee may, at its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee. In addition, it may delegate authority to the Chief Executive Officer to approve compensation applicable to non-executive level Company employees, provided that the Compensation Committee reviews and approves the Company's compensation structures applicable to non-executive level employees on an annual basis.

In 2020, the Compensation Committee retained Pearl Meyer & Partners, LLC ("Pearl Meyer") primarily to assist the Compensation Committee in determining and structuring executive compensation and to assess the market competitiveness of the Company's executive compensation program. The Compensation Committee has annually engaged Pearl Meyer for these and related services since 2014. With respect to any advice provided to the Committee by Pearl Meyer, the Compensation Committee received a letter from Pearl Meyer addressing factors relevant to SEC and NYSE rules regarding independence and conflicts of interest. After considering the information provided by Pearl Meyer and other factors, no conflicts of interest with respect to Pearl Meyer were identified by the Compensation Committee, and the Compensation Committee concluded that Pearl Meyer was an independent consultant.

The Compensation Committee has adopted a written charter that among other things, specifies the scope of its rights and responsibilities. A copy of the committee's charter is available on our website at www.bylinebancorp.com under the "Governance Documents" tab. The Compensation Committee is composed solely of members who satisfy the applicable independence requirements of the NYSE as they apply to members of compensation committees.

Byline Bancorp, Inc. 2021 Proxy Statement 15

Corporate Governance |

Governance and Nominating Committee

The Governance and Nominating Committee is responsible for making recommendations to our Board of Directors regarding candidates for directorships and the size and composition of our Board of Directors. In addition, the Governance and Nominating Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to our Board of Directors concerning governance matters.

| | | |

| Members Antonio del Valle Perochena (Chair) Phillip R. Cabrera Steven P. Kent Meetings in 2020 | The Governance and Nominating Committee's duties and responsibilities include the following: • Identifies individuals qualified to be directors consistent with the criteria approved by the Board of Directors, subject to any waivers granted by the Board, and recommends director nominees to the full Board of Directors. • Ensures that the Audit and Compensation Committees have the benefit of qualified "independent" directors. • Oversees management continuity planning. • Leads the Board of Directors in its annual performance review. • Takes a leadership role in shaping the corporate governance of our organization. |

The Governance and Nominating Committee has adopted a written charter that among other things, specifies the scope of its rights and responsibilities. A copy of the Committee's charter, as well as a copy of the corporate governance guidelines is available on our website at www.bylinebancorp.com under the "Governance Documents" tab. The Governance and Nominating Committee is composed solely of members who satisfy the applicable independence requirements of the NYSE for governance and nominating committees.

Risk Committee

The Risk Committee is responsible for overseeing our enterprise risk management policies, commensurate with our capital structure, risk profile, complexity, size and other risk related factors.

| | | |

| Members Steven P. Kent (Chair) Roberto R. Herencia Mary Jo Herseth William G. Kistner Steven M. Rull Meetings in 2020 | The Risk Committee's duties and responsibilities include the following: • Monitor management's assessment of the Company's aggregate enterprise-wide risk profile. • Review and recommend to the Board the articulation and establishment of the Company's risk tolerance and risk appetite. • Oversee risk management infrastructure, profile, and critical risk management policies, including the charter of the Risk Management Committee. • Evaluate management's activities with respect to capital planning, including stress testing and compliance with risk-based capital standards. • Provide input regarding the Chief Risk Officer's performance and the adequacy of the Bank's risks management functions. |

The Risk Committee has adopted a written charter that specifies among other things, the scope of its rights and responsibilities. A copy of the committee's charter is available on our website at www.bylinebancorp.com under "Goverrnance Documents" tab.

In addition to the committees described above, the Board of Directors of Byline Bank also has an Executive Credit Committee, a Trust Committee and an ALCO Committee. The Executive Credit Committee provides oversight of our credit risk management function. This committee oversees the risk appetite, the development of policies, practices

16 Byline Bancorp, Inc. 2021 Proxy Statement

| Corporate Governance |

and systems for measuring credit risk and monitors the performance and quality of our credit portfolio. Ms. Herseth is Chairman of the Executive Credit Committee, and the committee's other members include Messrs. Herencia, Paracchini, Kent and Ms. Cabrera. The Trust Committee provides oversight in implementing policies for the Bank's Wealth Management and Trust department, as well as practices and controls sufficient to promote high quality fiduciary administration. Mr. Rull is Chairman of the Trust Committee, and the committee's other members include Messrs. Cabrera, Herencia and Ms. Herseth. The ALCO Committee provides oversight of the Asset and Liability Management function. Mr. Rull is the Chairman of the ALCO Committee, and the committee's other members include Messrs. Herencia, Kent, Cabrera, Paracchini and Ms. Herseth.

Board Oversight of Risk Management

Our Board of Directors believes that effective risk management and control processes are critical to our safety and soundness, our ability to predict and manage the challenges that we face and, ultimately, our long-term corporate success. Our Board of Directors, both directly and through its committees, including the Risk Committee, is responsible for overseeing our risk management processes, with each of the committees of our Board of Directors assuming a different and important role in overseeing the management of the risks we face.

The Risk Committee of our Board of Directors oversees our enterprise-wide risk management framework, which establishes our overall risk appetite and risk management strategy and enables our management to understand, manage and report on the risks we face. Our Risk Committee also reviews and oversees policies and practices established by management to identify, assess, measure and manage key risks we face, including the risk appetite metrics developed by management and approved by our Board of Directors. The Audit Committee of our Board of Directors is responsible for overseeing risks associated with financial matters (particularly financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting) and engaging as appropriate with our Risk Committee to assess our enterprise-wide risk framework. The Compensation Committee of our Board of Directors has primary responsibility for risks and exposures associated with our compensation policies, plans and practices, regarding both executive compensation and the general compensation structure. In particular, our Compensation Committee, in conjunction with our Chief Executive Officer, President, Chief Human Resources Officer and other members of our management as appropriate, reviews our incentive compensation arrangements to ensure these programs are consistent with applicable laws and regulations, including safety and soundness requirements, and do not encourage imprudent or excessive risk taking by our employees. The Governance and Nominating Committee of our Board of Directors oversees risks associated with the independence of our Board of Directors and potential conflicts of interest.

Our senior management is responsible for implementing and reporting to our Board of Directors regarding our risk management processes, including by assessing and managing the risks we face, including strategic, operational, regulatory, investment and execution risks, on a day to day basis. Our senior management is also responsible for creating and recommending to our Board of Directors for approval appropriate risk appetite metrics reflecting the aggregate levels and types of risk we are willing to accept in connection with the operation of our business and pursuit of our business objectives.

The role of our Board of Directors in our risk oversight is consistent with our leadership structure, with our Chief Executive Officer, President, Chief Financial Officer and the other members of senior management having responsibility for assessing and managing our risk exposure, and our Board of Directors and its committees providing oversight in connection with those efforts. We believe this division of risk management responsibilities presents a consistent, systemic and effective approach for identifying, managing and mitigating risks throughout our operations.

Stockholder Engagement and Communicating with Our Board

We believe in proactive and transparent communication and engagement with our stockholders to promote an understanding of the values we maintain, our governance framework, the decisions we make and how me make them, our business strategy and our financial performance, and we welcome receiving communications from our stockholders regarding these matters. Generally, the Board relies on the Executive Chairman of the Board and Chief Executive Officer, and other executive officers to speak for the Company, and management is generally responsible for managing our corporate communications and investor relations activities. Throughout the year, our Executive

Byline Bancorp, Inc. 2021 Proxy Statement 17

Corporate Governance |

Chairman and Chief Executive Officer, President and Chief Financial Officer regularly interact with significant stockholders regarding our performance, business strategy and other corporate matters. From time to time, it may be appropriate for one or more of our non-executive directors to speak or meet with stockholders. Any such communication would occur under the direction and oversight of the Executive Chairman and Chief Executive Officer.

Stockholders may contact the Board or any committee of the Board about matters specific to the Board's and/or its committees' oversight responsibilities. Written correspondence may be directed to the Board of Directors at Byline Bancorp, Inc., Attention: Corporate Secretary, 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601. Inquiries from stockholders directed to the Board will be received and processed by the Corporate Secretary before being forwarded to the Board, the appropriate Committee or a particular director as designated in the communication.

Director Attendance at Our Annual Meeting and Board Meetings

While we do not have a formal policy regarding our directors' attendance at the Company's annual and special meetings, our Board expects each director to attend, either in person or remotely via conference call, the Company's Annual Meeting of Stockholders each year, absent extenuating circumstances. All of our directors serving on the Board in 2020 at that time attended our 2020 annual meeting. We currently anticipate that all our directors will attend the Annual Meeting. During 2020, each of our directors attended at least 75% of the meetings of the Board and Board committees on which they served.

Nominee Recommendations by Stockholders

Stockholders wishing to recommend persons for consideration by the Governance and Nominating Committee as nominees for election to the Board of Directors can do so by writing to the Governance and Nominating Committee at Byline Bancorp, Inc., Attention: Corporate Secretary, 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601. Recommendations must include the proposed nominee's name, biographical data and qualifications as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. If all necessary information is provided, the Governance and Nominating Committee will then consider the candidate and the candidate's qualifications in the same manner as prospective nominees that are identified by the committee. The Governance and Nominating Committee may contact the stockholder making the nomination to discuss the qualifications of the candidate and the reasons for making the nomination.

Any stockholder seeking to nominate persons for election to our Board of Directors must comply with our procedures for stockholder nominations described under the heading "Stockholder Proposals."

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is currently or was previously an officer or employee of Byline or Byline Bank. In addition, none of our executive officers serves or has served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any company or other entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Code of Business Conduct and Ethics

Our Board of Directors has adopted a code of business conduct and ethics (the "Code of Ethics") that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer and persons performing similar functions. Our Board has also adopted a Code of Ethics for Financial Officers. A copy of each code is available upon written request to Corporate Secretary, Byline Bancorp, Inc., 180 North LaSalle Street, Suite 300, Chicago, Illinois 60601 and on our website at www.bylinebancorp.com under the "Governance Documents" tab. If we amend or grant any waiver from a provision of our Code of Ethics that applies to our executive officers, we will publicly disclose such amendment or waiver on our website and as required by applicable law, including by filing a Current Report on Form 8-K.

18 Byline Bancorp, Inc. 2021 Proxy Statement

Human Capital and Social Responsibility

We believe in being the bank our customers deserve, which, as embodied in our name, means taking ownership, initiative, action, and responsibility for what we do.

In order to achieve our vision to be the bank our customers deserve, we focus on:

To do this, we've outlined the Things That Matter (TTM) at Byline—values that guide our business, mission, and team culture:

Human Capital

Attracting, developing, and retaining the best people is crucial to our long-term strategy. Our business is about people—our customers and our employees. We seek to help our customers build, make, and do—none of which would be possible without our employees.

Byline Bancorp, Inc. 2021 Proxy Statement 19

Human Capital and Social Responsibility |

Employee Profile and Diversity

We embrace diversity within our teams and define diversity by both gender and people of color. Our key human capital diversity metrics are as follows:

* Diversity is defined by gender and people of color, as disclosed. Data as of December 31, 2020

Talent Attraction, Development and Retention

To facilitate talent attraction, development and retention across our franchise, we strive to make Byline a diverse, inclusive, safe and healthy workplace, with opportunities for our employees to grow and develop in their careers, supported by strong compensation, benefits, health and welfare programs. We believe the management and development of our employees is key to our strategic growth plan and longer-term succession planning. We seek to encourage and empower our team members to take initiative, make decisions, own their careers and build customers relationships through our programs and employee-led efforts and initiatives throughout Byline Bank.

We have developed initiatives that support physical, emotional, financial, and social wellbeing, including:

We provide development opportunities to our employees. We recognize the critical importance of providing career development and advancement opportunities for all employees. Accordingly, we provide a variety of formal and informal development opportunities to help employees grow in their current roles and build new skills.

We encourage our team members to pursue educational opportunities that will help improve job performance and professional development. To further this goal, we reimburse tuition and certain fees for satisfactory completion of approved educational courses and certain certifications. In addition, we equip leaders with the tools to act as mentors and to give open and honest feedback and support, and we provide employees the resources and support to create and execute personalized developmental plans. Our Board of Directors oversees the succession planning for executive management on an annual basis.

20 Byline Bancorp, Inc. 2021 Proxy Statement

| Human Capital and Social Responsibility |

Employee recognition and engagement is important for us. Some of the tools we have developed to achieve such a crucial objective are:

Diversity, Equity and Inclusion

At Byline, racism and discrimination in any form is not tolerated and we believe in supporting a culture of respect and inclusion. We commit to DEI as the foundation and catalyst for honoring our employees, engaging our customers and community, creating a great place to work, and ultimately driving business success.

We pledge to create an environment where every employee can bring their authentic self to work and know that their unique background, ethnicity, experiences, perspective, and contributions serve to strengthen us and where growth opportunities exist at all levels.

For our customers and community, we strive that you see through our actions that we value each of you and know we are better together. We move forward challenging ourselves to live this vision every day.

Our Board is fully committed to this purpose and in 2020 supported management in developing a comprehensive DEI Initiative. Lead by members of the executive team, a DEI Council was created with focus in four key areas:

Workforce — Promoting representation at all levels and in all areas and business lines of the bank, with attention on recruiting and developing diverse talent and focusing on engagement and employee recognition.

Workplace — Creating a culture where everyone brings their authentic self to work and knows that their unique background, ethnicity, experiences, perspective, and contribution serve to strengthen the bank and our culture.

Community — Building meaningful, productive relationships in the communities we work.

Marketplace — Providing our customers with products and services that meet their diverse needs, including support through digital strategies that align to the market.

Community Impact

We are proud to be a community bank. By supporting local businesses and working with families to protect and grow their money, we make our neighborhoods even stronger. That's what being in the community means to us. We are committed to helping the local communities in which we live and work to grow and thrive, today and into the future. One way we do this is by providing employees paid time off to participate in community-based volunteer programs. Throughout the year, employees make a positive impact in their local communities and have found a

Byline Bancorp, Inc. 2021 Proxy Statement 21

Human Capital and Social Responsibility |

multitude of special ways to continue volunteering during the pandemic. During 2020, Byline made and/or supported:

Director Compensation

The following table lists the individuals who served on our Board of Directors in 2020 and the compensation received in 2020 for their service as directors, other than with respect to Mr. Paracchini, our President, who during 2020 held the positions of President and Chief Executive Officer, whose compensation as an officer of the Company is detailed in the Summary Compensation Table in the "Executive Compensation" section of this Proxy Statement. All compensation paid to directors is for their service on both the Byline Board of Directors and the Byline Bank Board of Directors.

| Name | Fees Earned or Paid in Cash(1) | All Other Compensation(2) | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Roberto R. Herencia | $ | 800,000 | $ | 15,571 | $ | 815,571 | ||||

Phillip R. Cabrera | | 120,000 | | — | | 120,000 | ||||

Antonio del Valle Perochena | 108,750 | — | 108,750 | |||||||

Mary Jo S. Herseth | | 80,000 | | — | | 80,000 | ||||

Steven P. Kent | 76,250 | — | 76,250 | |||||||

William G. Kistner | | 85,000 | | — | | 85,000 | ||||

Jaime Ruiz Sacristán(3) | 36,667 | — | 36,667 | |||||||

Steven M. Rull | | 80,000 | | — | | 80,000 | ||||

Robert R. Yohanan(4) | 900,000 | — | 900,000 | |||||||

| | | | | | | | | | | |

22 Byline Bancorp, Inc. 2021 Proxy Statement

| Director Compensation |

Byline Bancorp, Inc. Director Compensation Program

Our director compensation program provides the following compensation for non-employee members of our Board of Directors:

We also reimburse all directors for reasonable and substantiated out-of-pocket expenses incurred in connection with the performance of their duties as directors. Additionally, the Chairman of the Board is entitled to reimbursement of cell phone services and certain medical and health insurance expenses.

Directors agree, in connection with their service as directors, that they will not, without the prior consent of Byline, directly or indirectly, provide any material services to any other banking entity which competes in any material respect with Byline and its subsidiaries as long as they serve as a director of Byline (other than services disclosed in writing).

Notwithstanding the above, any director who is an officer of Byline will not receive any separate compensation for serving as a director of the Company or the Bank.

Compensation Paid to Mr. Herencia in 2020

Mr. Herencia is a founder of Byline, and his leadership was instrumental in the organization and recapitalization of our business in 2013. During that time, he organized the investor group, recruited the management team, and provided significant expertise resulting in the Company's financial and regulatory turnaround.

As Chairman of the Board from 2013 until February 2021, Mr. Herencia has been involved heavily with Board matters and overseeing management's execution of the Board's guidance. He actively interacted with the CEO and other members of management to provide his perspective on important issues facing our company and played an active role in the retention and recruiting of executive talent. It is the Board's position that his leadership is critical and his contributions in dealing with the effects of the COVID-19 pandemic will have long-term impact on the financial well-being of Byline.

Mr. Herencia's compensation for 2020 reflects his specialized expertise and the significant investment of time he spent with the Board and executive leadership, especially in light of the unprecedented challenges our business and our customers faced as a result of the COVID-19 pandemic. As such, he received an aggregate annual cash retainer of $400,000, which included the annual board retainer and all committee membership and committee chair retainers that the Chairman would otherwise be entitled to receive. Additionally, Mr. Herencia received a payment of $400,000, paid in two equal installments in March and September of 2020 subject to continued service through such dates.

New Agreement with Mr. Herencia

In January of 2021, the Board conducted a deeper evaluation of Mr. Herencia's significant ongoing involvement with management and his ability to have a substantial and positive impact on the execution of the Company's strategy. We announced the appointment of Mr. Herencia as Executive Chairman and Chief Executive Officer of the Byline, effective as of February 12, 2021, and entered into an employment agreement with Mr. Herencia in connection with the assumption of his expanded role (the "Employment Agreement").

Byline Bancorp, Inc. 2021 Proxy Statement 23

Director Compensation |

The Employment Agreement is for an initial term of three years and includes an automatic one-year extension at the end of each term following the initial term unless notice of termination is provided not less than 120 days prior to the end of such term. In addition, the Employment Agreement will terminate on the termination of Mr. Herencia's employment. Upon the occurrence of a Change in Control (as such term is defined in the Employment Agreement), the term of the Employment Agreement will renew for the period expiring on the second anniversary of such Change in Control and will automatically renew for one year on each subsequent anniversary of such date thereafter, unless at any time not less than 120 days prior to the end of such term either Byline or Mr. Herencia notifies the other in writing of the intention not to further extend the term.