Lender Presentation March 12th, 2019 Exhibit 99.1

Disclaimer This presentation (the “Presentation”) has been prepared by ADT Inc. (the “Company”) on behalf of Prime Security Services Borrower, LLC (the “Borrower”), a wholly owned subsidiary of the Company, in connection with the amendment of the 1st Lien Senior Secured Credit Facilities (the “Facilities”), solely for informational purposes. The information contained in this Presentation has been prepared to assist prospective lenders in conducting their own evaluation of the Company and the Facilities and does not purport to be complete or to contain all of the information that a prospective lender may require. Prospective lenders should conduct their own investigation and analysis of the Company and of the information set forth in this Presentation. The Company makes no representation or warranty as to the accuracy, reliability, reasonableness or completeness of this information and shall not have any liability for any representations regarding information contained in, or for any omission from, this Presentation or any other written or oral communications transmitted to the recipient in the course of its evaluation of the Company and the Facilities. The Company and its affiliates, representatives and advisors expressly disclaim any and all liability based, in whole or in part, on the information contained in this Presentation (which only speak as of the date identified on the cover page of this Presentation), errors therein or omissions therefrom. Neither the Company nor any of its affiliates, representatives or advisors intends to update or otherwise revise the information contained herein to reflect circumstances existing after the date identified on the cover page of this Presentation or to reflect the occurrence of future events even if any or all of the assumptions, judgments and estimates on which the information contained herein is based are shown to be in error. The Presentation does not constitute an offering of any securities. The offerings of securities discussed herein relate to prospective transactions that the Company is considering to reduce interest expense and extend maturities, especially associated with its 9.25% Second-Priority Senior Secured Notes due 2023, which become callable in May 2019. Any such offering of securities would be made pursuant to an offering memorandum, prospectus or similar document and not the Presentation. Should an offering of securities be made, you should refer only to the offering memorandum, prospectus or similar document distributed in connection with such offering and not to the Presentation.

Forward Looking Statements & Non-GAAP Measures The Company has made statements in this Presentation and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. All statements, other than statements of historical fact, included in this document are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, use of proceeds of the Facilities and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. The Company cautions that these statements are subject to risks and uncertainties, many of which are outside of the Company’s control, and could cause future events or results to be materially different from those stated or implied in this document, including among others, risk factors that are described in the Company’s Annual Report on Form 10-K and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein. Forward Looking Statements

Call Participants Brad Aston Managing Director, Barclays Deepika Yelamanchi Vice President & Treasurer, ADT Jim DeVries Chief Executive Officer, ADT Jeff Likosar Chief Financial Officer, ADT

Transaction Overview

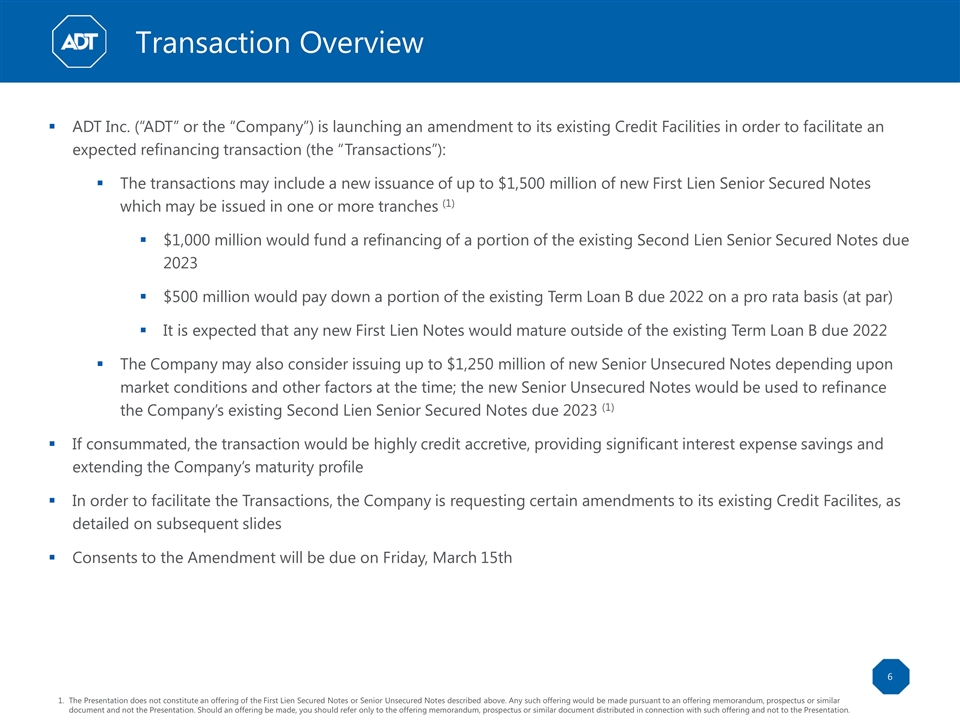

Transaction Overview ADT Inc. (“ADT” or the “Company”) is launching an amendment to its existing Credit Facilities in order to facilitate an expected refinancing transaction (the “Transactions”): The transactions may include a new issuance of up to $1,500 million of new First Lien Senior Secured Notes which may be issued in one or more tranches (1) $1,000 million would fund a refinancing of a portion of the existing Second Lien Senior Secured Notes due 2023 $500 million would pay down a portion of the existing Term Loan B due 2022 on a pro rata basis (at par) It is expected that any new First Lien Notes would mature outside of the existing Term Loan B due 2022 The Company may also consider issuing up to $1,250 million of new Senior Unsecured Notes depending upon market conditions and other factors at the time; the new Senior Unsecured Notes would be used to refinance the Company’s existing Second Lien Senior Secured Notes due 2023 (1) If consummated, the transaction would be highly credit accretive, providing significant interest expense savings and extending the Company’s maturity profile In order to facilitate the Transactions, the Company is requesting certain amendments to its existing Credit Facilites, as detailed on subsequent slides Consents to the Amendment will be due on Friday, March 15th The Presentation does not constitute an offering of the First Lien Secured Notes or Senior Unsecured Notes described above. Any such offering would be made pursuant to an offering memorandum, prospectus or similar document and not the Presentation. Should an offering be made, you should refer only to the offering memorandum, prospectus or similar document distributed in connection with such offering and not to the Presentation.

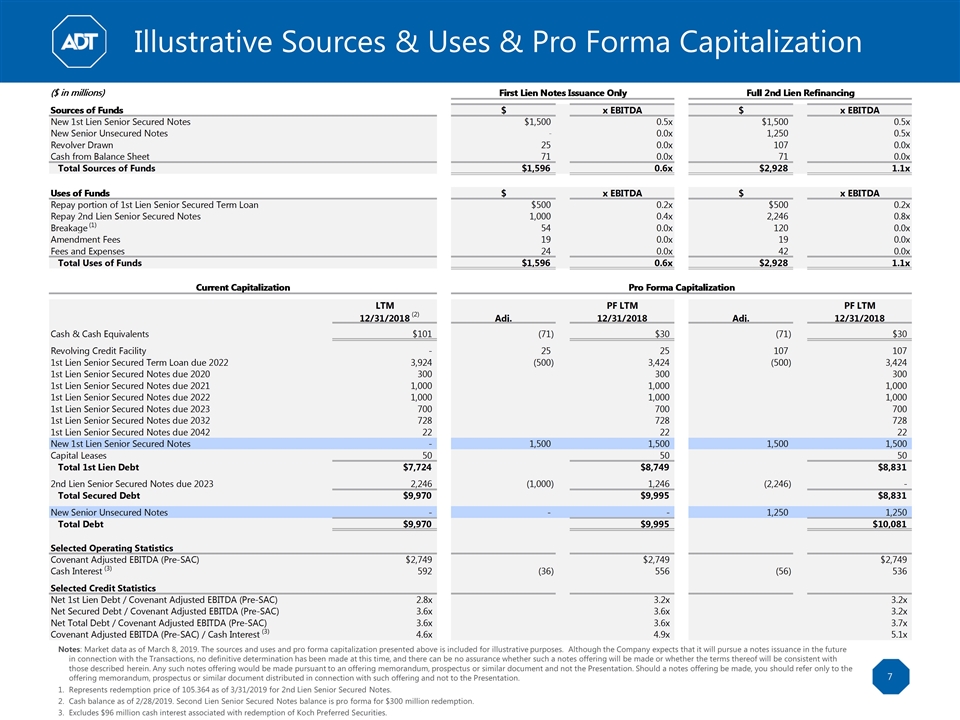

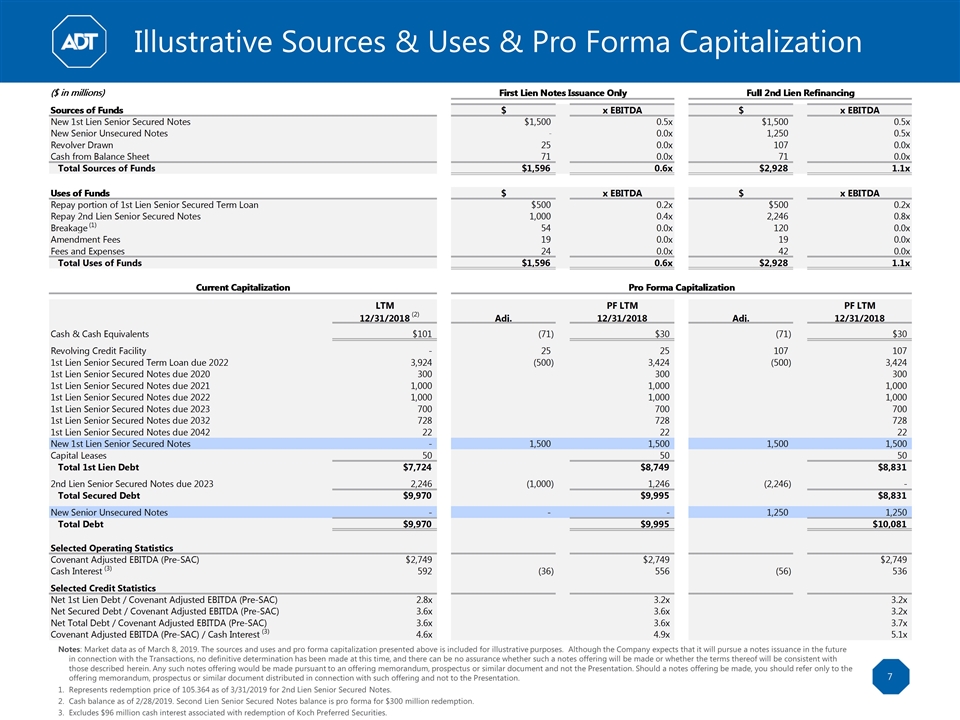

Illustrative Sources & Uses & Pro Forma Capitalization Notes: Market data as of March 8, 2019. The sources and uses and pro forma capitalization presented above is included for illustrative purposes. Although the Company expects that it will pursue a notes issuance in the future in connection with the Transactions, no definitive determination has been made at this time, and there can be no assurance whether such a notes offering will be made or whether the terms thereof will be consistent with those described herein. Any such notes offering would be made pursuant to an offering memorandum, prospectus or similar document and not the Presentation. Should a notes offering be made, you should refer only to the offering memorandum, prospectus or similar document distributed in connection with such offering and not to the Presentation. Represents redemption price of 105.364 as of 3/31/2019 for 2nd Lien Senior Secured Notes. Cash balance as of 2/28/2019. Second Lien Senior Secured Notes balance is pro forma for $300 million redemption. Excludes $96 million cash interest associated with redemption of Koch Preferred Securities. (2) (1) (3) (3)

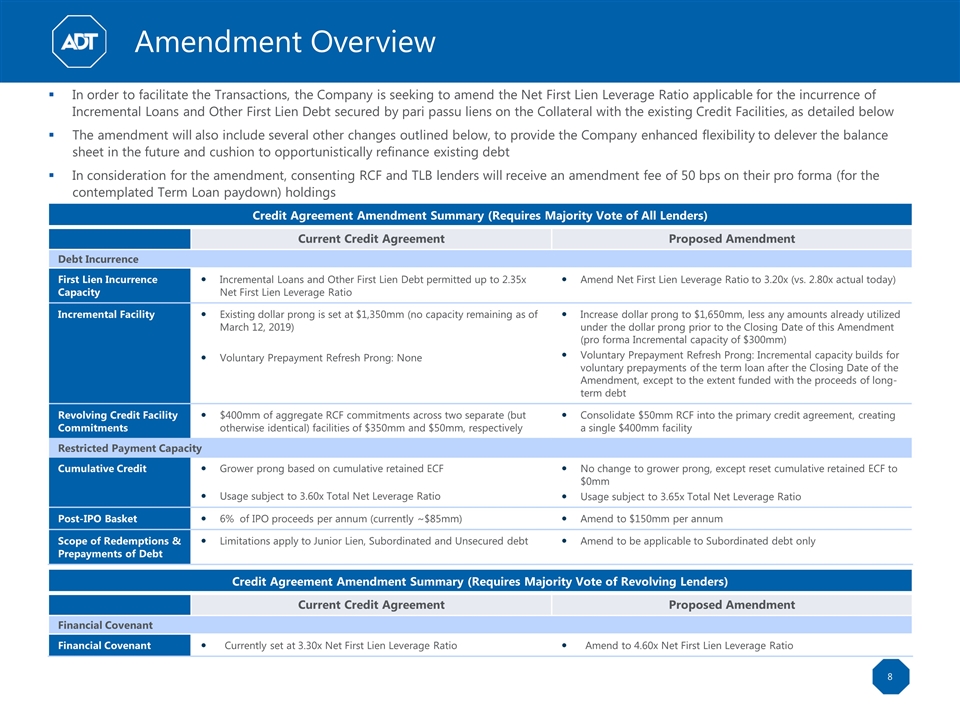

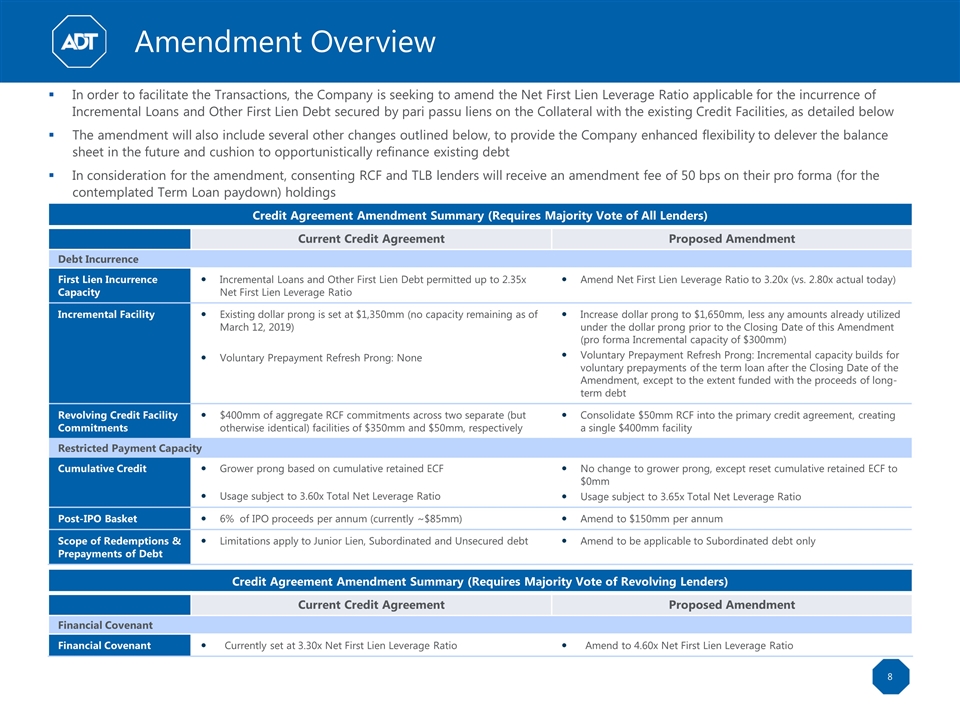

Amendment Overview In order to facilitate the Transactions, the Company is seeking to amend the Net First Lien Leverage Ratio applicable for the incurrence of Incremental Loans and Other First Lien Debt secured by pari passu liens on the Collateral with the existing Credit Facilities, as detailed below The amendment will also include several other changes outlined below, to provide the Company enhanced flexibility to delever the balance sheet in the future and cushion to opportunistically refinance existing debt In consideration for the amendment, consenting RCF and TLB lenders will receive an amendment fee of 50 bps on their pro forma (for the contemplated Term Loan paydown) holdings Credit Agreement Amendment Summary (Requires Majority Vote of All Lenders) Current Credit Agreement Proposed Amendment Debt Incurrence First Lien Incurrence Capacity Incremental Loans and Other First Lien Debt permitted up to 2.35x Net First Lien Leverage Ratio Amend Net First Lien Leverage Ratio to 3.20x (vs. 2.80x actual today) Incremental Facility Existing dollar prong is set at $1,350mm (no capacity remaining as of March 12, 2019) Voluntary Prepayment Refresh Prong: None Increase dollar prong to $1,650mm, less any amounts already utilized under the dollar prong prior to the Closing Date of this Amendment (pro forma Incremental capacity of $300mm) Voluntary Prepayment Refresh Prong: Incremental capacity builds for voluntary prepayments of the term loan after the Closing Date of the Amendment, except to the extent funded with the proceeds of long-term debt Revolving Credit Facility Commitments $400mm of aggregate RCF commitments across two separate (but otherwise identical) facilities of $350mm and $50mm, respectively Consolidate $50mm RCF into the primary credit agreement, creating a single $400mm facility Restricted Payment Capacity Cumulative Credit Grower prong based on cumulative retained ECF Usage subject to 3.60x Total Net Leverage Ratio No change to grower prong, except reset cumulative retained ECF to $0mm Usage subject to 3.65x Total Net Leverage Ratio Post-IPO Basket 6% of IPO proceeds per annum (currently ~$85mm) Amend to $150mm per annum Scope of Redemptions & Prepayments of Debt Limitations apply to Junior Lien, Subordinated and Unsecured debt Amend to be applicable to Subordinated debt only Credit Agreement Amendment Summary (Requires Majority Vote of Revolving Lenders) Current Credit Agreement Proposed Amendment Financial Covenant Financial Covenant Currently set at 3.30x Net First Lien Leverage Ratio Amend to 4.60x Net First Lien Leverage Ratio

April 2019 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Execution Timeline Date Event March 11th Announce Term Loan Amendment ADT FY 2018 Earnings Release March 12th Lender Call March 15th Consents Due at 12:00 PM ET Close Amendment March 2019 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Market Holiday Key Transaction Date

Q&A