GAAP to Non-GAAP Reconciliations March 2019 Exhibit 99.2

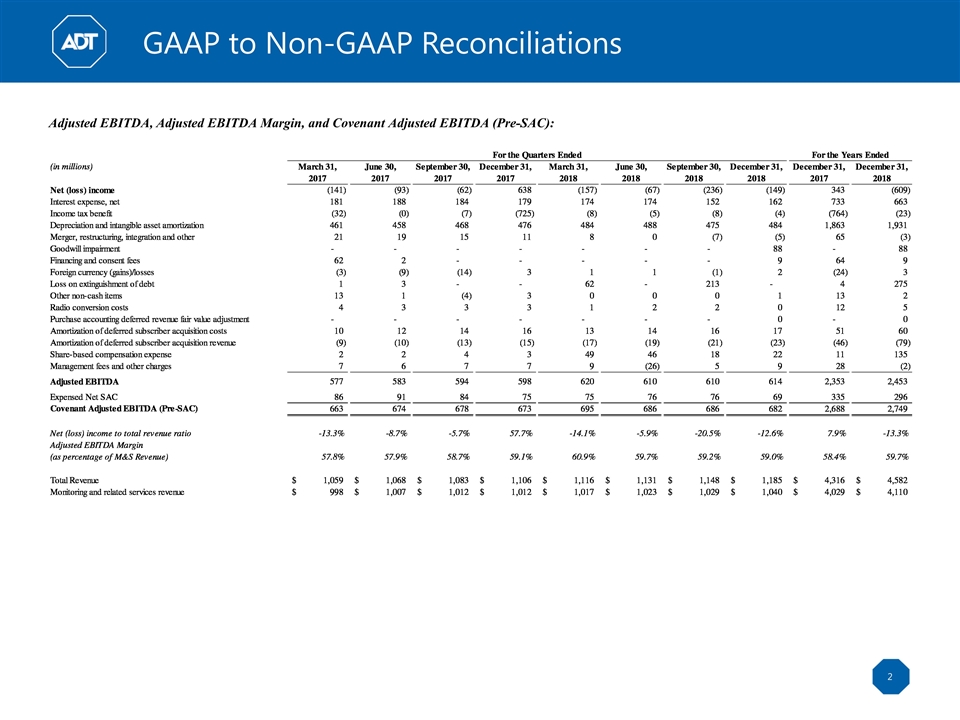

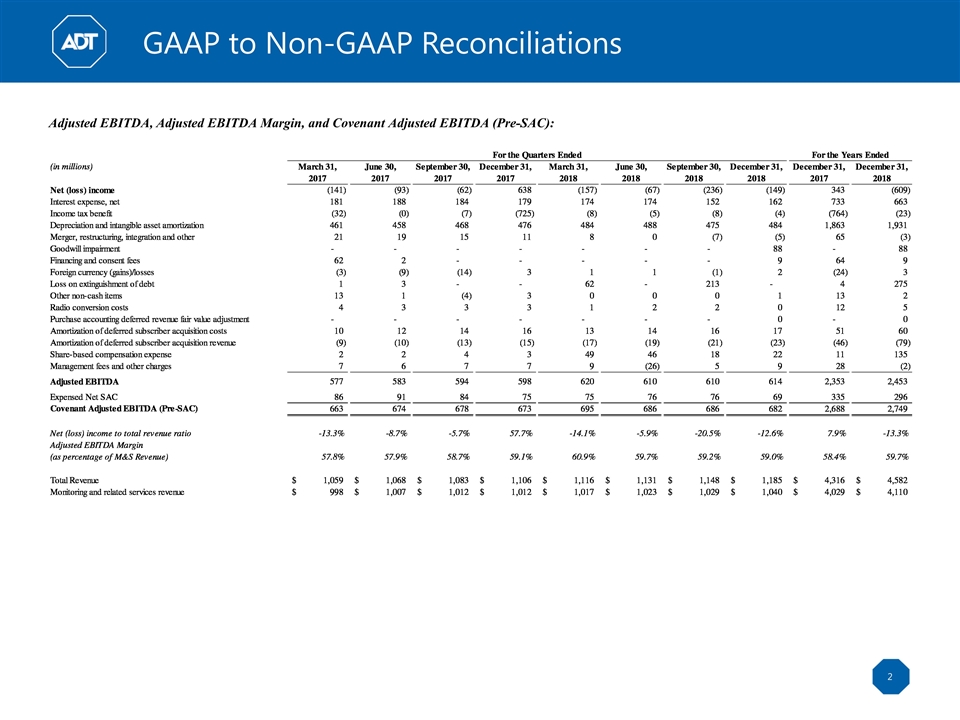

GAAP to Non-GAAP Reconciliations Adjusted EBITDA, Adjusted EBITDA Margin, and Covenant Adjusted EBITDA (Pre-SAC):

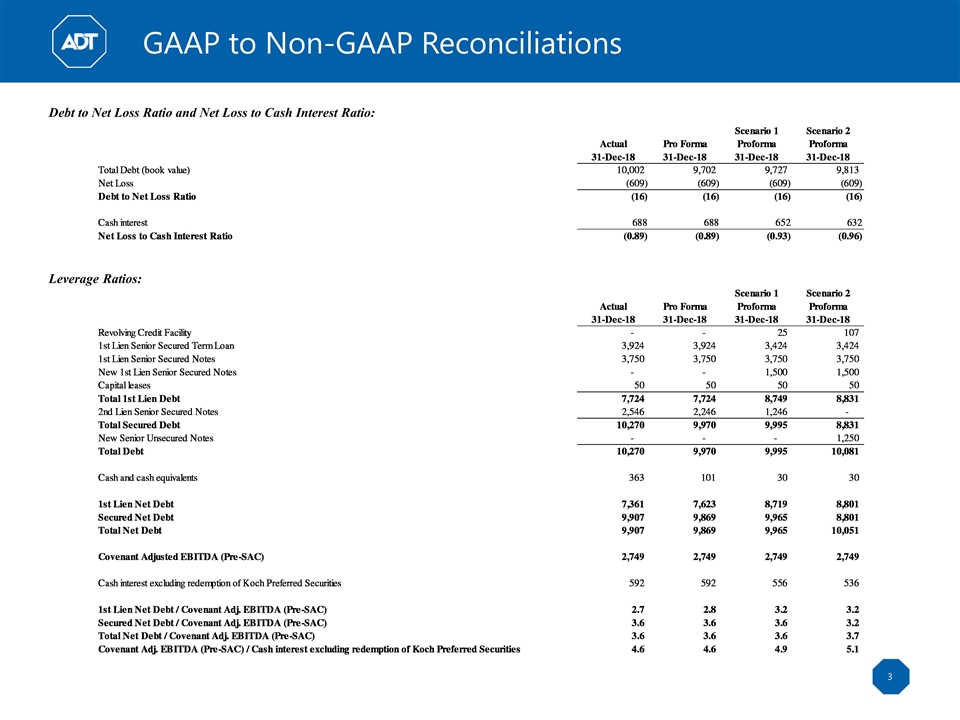

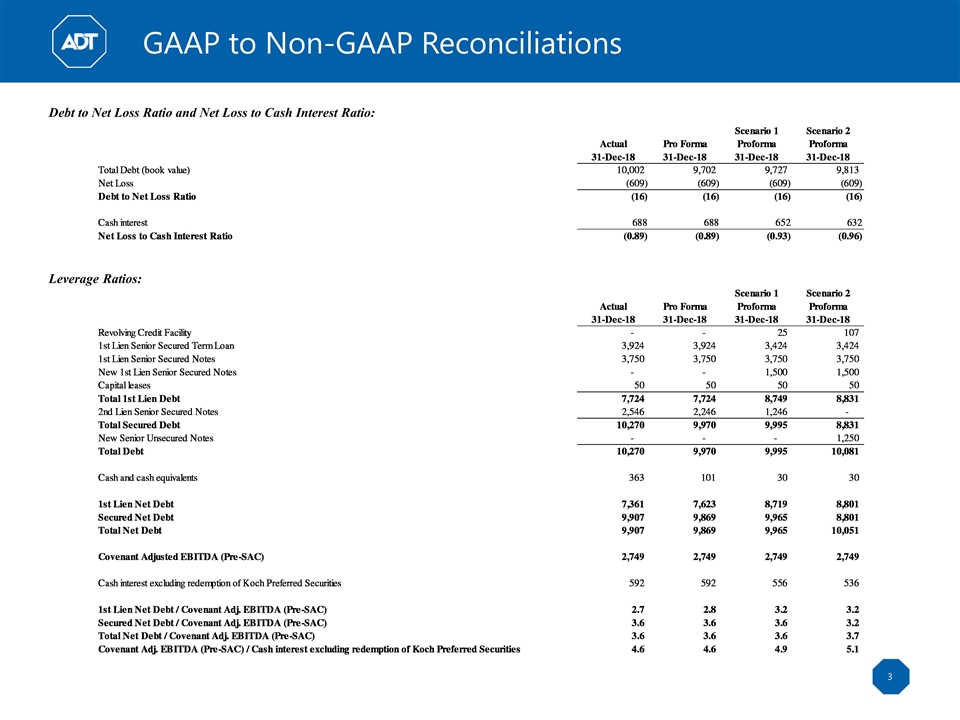

GAAP to Non-GAAP Reconciliations Debt to Net Loss Ratio and Net Loss to Cash Interest Ratio: Leverage Ratios:

Non-GAAP Measures To provide investors with additional information in connection with our results as determined by generally accepted accounting principles in the United States (“GAAP”), we disclose Adjusted EBITDA, Adjusted EBITDA margin, Covenant Adjusted EBITDA (Pre-SAC), and various leverage ratios as non-GAAP measures. These measures are not financial measures calculated in accordance with GAAP, and should not be considered as a substitute for net income, operating income, cash flows, or any other measure calculated in accordance with GAAP, and may not be comparable to similarly titled measures reported by other companies. Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) We believe that the presentation of Adjusted EBITDA is appropriate to provide additional information to investors about certain non-cash items and about unusual items that we do not expect to continue at the same level in the future, as well as other items. Further, we believe Adjusted EBITDA provides a meaningful measure of operating profitability because we use it for evaluating our business performance, making budgeting decisions, and comparing our performance against that of other peer companies using similar measures. We use Covenant Adjusted EBITDA (Pre-SAC) as a supplemental measure of our performance and ability to service debt and incur additional debt. Covenant Adjusted EBTIDA (Pre-SAC) is also important in measuring certain other restriction imposed on Borrower and its subsidiaries such as their ability to make investments, distribute dividends, and pledge some or all of their assets. We define Adjusted EBITDA as net income or loss adjusted for (i) interest, (ii) taxes, (iii) depreciation and amortization, including depreciation of subscriber system assets and other fixed assets and amortization of dealer and other intangible assets, (iv) amortization of deferred costs and deferred revenue associated with subscriber acquisitions, (v) share-based compensation expense, (vi) purchase accounting adjustments under GAAP, (vii) merger, restructuring, integration, and other, (viii) goodwill impairment losses (ix) financing and consent fees, (x) foreign currency gains/losses, (xi) losses on extinguishment of debt, (xii) radio conversion costs, (xiii) management fees and other charges, and (xiv) other non-cash items. Covenant Adjusted EBITDA (Pre-SAC) also is adjusted for costs in our statement of operations associated with the acquisition of customers, net of revenue associated with the sale of equipment (Expensed Net SAC). There are material limitations to using Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC). Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) do not take into account certain significant items, including depreciation and amortization, interest, taxes, and other adjustments which directly affect our net income or loss. These limitations are best addressed by considering the economic effects of the excluded items independently, and by considering Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) in conjunction with net income or loss as calculated in accordance with GAAP. The Adjusted EBITDA discussion above is also applicable to its margin measure, which is calculated as Adjusted EBITDA as a percentage of monitoring and related services revenue. Leverage Ratios Leverage ratios include first lien net debt, secured net debt, and total net debt all as compared to Covenant Adjusted EBITDA (Pre-SAC). First lien net debt, secured net debt, and total net debt are calculated as first lien debt, secured debt, and total debt, respectively, less cash and cash equivalents. The Company also presents Covenant Adjusted EBITDA (Pre-SAC) to cash interest excluding the redemption of the Koch Preferred Securities. Cash interest excluding the redemption of the Koch Preferred Securities excludes amounts associated with the redemption of the Koch Preferred Securities on July 2, 2018. Leverage ratios are useful measures of the Company’s credit position and progress towards leverage targets. Refer to discussion on Adjusted EBITDA and Covenant Adjusted EBITDA (Pre-SAC) for a description of the differences between the most comparable GAAP measure. The calculation is limited in that the Company may not always be able to use cash to repay debt on a dollar-for-dollar basis. Finally, the leverage ratios discussed herein may be presented on a pro forma basis.