XAI Octagon Floating Rate &

Alternative Income Term Trust | Notes to Financial Statements |

September 30, 2017

1. ORGANIZATION

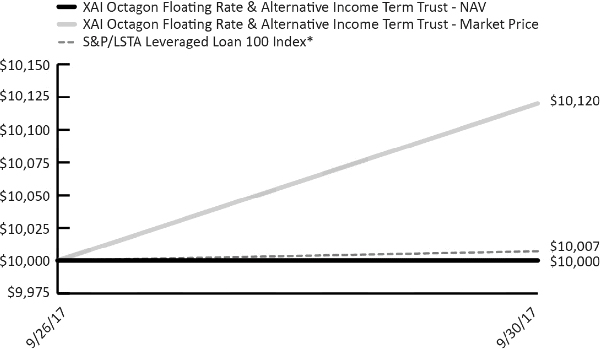

XAI Octagon Floating Rate & Alternative Income Term Trust (the “Trust”) is a newly‐organized, diversified, closed‐end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust commenced operations on September 27, 2017.

The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets (as defined in this Prospectus) in floating rate credit instruments and other structured credit investments.

2. SIGNIFICANT ACCOUNTING POLICIES

Organizational Expenses: XA Investments LLC (“The Adviser”), has agreed to pay all of the Trust’s organizational expenses. As a result, any organizational expenses of the Trust are not reflected in the Trust’s financial statements.

Offering Costs: Offering costs are incurred by the Trust. The Adviser has agreed to pay the amount, by which the Trust’s offering costs (other than the sales load) exceed $0.02 per share (0.20% of the offering price).

Use of Estimates: The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the period reported. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Trust ultimately realizes upon sale of the securities. The Trust is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on September 29, 2017.

Portfolio Valuation: The net asset value per common share of the Trust is determined daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Trust’s net asset value per common share is calculated by dividing the value of the Trust’s total assets, less its liabilities by the number of shares outstanding.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex‐dividend date. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the identified cost basis method for financial reporting purposes.

Concentration of Credit Risk: The Trust places its cash with a banking institution, which is insured by Federal Deposit Insurance Corporation (FDIC). The FDIC limit is $250,000. At various times throughout the year, the amount on deposit may exceed the FDIC limit and subject the Trust to a credit risk. The Trust does not believe that such deposits are subject to any unusual risk associated with investment activities.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

XA Investments LLC serves as the investment adviser to the Trust and is responsible for overseeing the Trust’s overall investment strategy and its implementation. Octagon Credit Investors, LLC (“Octagon” or the “Sub‐Adviser”) serves as the investment sub‐adviser of the Trust and is responsible for investing the Trust’s assets. The Trust pays an advisory fee to the Adviser. The Adviser pays to the Sub‐Adviser a sub‐advisory fee out of the advisory fee received by the Adviser.

Pursuant to an investment advisory agreement between the Trust and the Adviser, the Trust pays the Adviser a fee, payable monthly in arrears, in an annual amount equal to 1.70% of the Trust’s average daily Managed Assets. “Managed Assets” means the total assets of the Trust, including assets attributable to the Trust’s use of leverage, minus the sum of its accrued liabilities (other than liabilities incurred for the purpose of creating leverage). For the period ended September 30, 2017 the Trust accrued $13,227 in advisory fees.

The sub‐advisory fee, payable monthly in arrears to the sub‐adviser, is calculated as a specified percentage of the advisory fee payable by the Trust to the Adviser (before giving effect to any fees waived or expenses reimbursed by the Adviser). The specified percentage is equal to the blended percentage computed by applying the following percentages to the aggregate average daily Managed Assets of all registered investment companies in the XAI fund complex for which the Sub‐Adviser (or an affiliate of the Sub‐Adviser) serves as investment sub‐adviser, including the Trust (“Eligible Funds”):

| Annual Report | September 30, 2017 | 7 |

XAI Octagon Floating Rate &

Alternative Income Term Trust | Notes to Financial Statements |

September 30, 2017

Aggregate Eligible Funds

Average Daily Managed Assets | Percentage of Advisory Fee |

| First $500 million | 60% |

| Over $500 million | 50% |

The Trust is currently the only Eligible Fund. Therefore, the sub‐advisory fee would equal 60% of the advisory fee payable to the Adviser.

The Trust pays all costs and expenses of its operations in addition to the advisory fee and investor support services and secondary market support services fee paid to the adviser. The Adviser has contractually agreed to waive a portion of the advisory fee and/or reimburse the Trust for certain operating expenses so that the annual expenses of the Trust do not exceed 0.30% of the Trust’s Managed Assets (exclusive of investment advisory fees, investor support and secondary market services fees, taxes, expenses incurred directly or indirectly by the Trust as a result of an investment in a permitted investment (including, without limitation, acquired fund fees and expenses), expenses associated with the acquisition or disposition of portfolio investments (including, without limitation, brokerage commissions and other trading or transaction expenses), leverage expenses (including, without limitation, costs associated with the issuance or incurrence of leverage, commitment fees, interest expense or dividends on preferred shares), expenses incurred in connection with issuances and sales of shares of the Trust (including, without limitation, fees, commissions and offering costs), dividends on short sales, if any, securities lending costs, if any, expenses of holding, and soliciting proxies for, meetings of shareholders of the Trust (except to the extent relating to routine items such as the election of trustees), expenses of a reorganization, restructuring, redomiciling or merger of the Trust or the acquisition of all or substantially all of the assets of another fund, or any extraordinary expenses not incurred in the ordinary course of the Trust’s business (including, without limitation, expenses related to litigation, derivative actions, demands related to litigation, regulatory or other government investigations and proceeding)). The Adviser may recoup waived or reimbursed amounts for three years following the date of such waiver or reimbursement, provided total expenses, including such recoupment, do not exceed the lesser of the annual expense limit at the time such expenses were waived or reimbursed or the annual expense limit at the time of recoupment. During the period ended September 30, 2017, the adviser waived fees and/or reimbursed expenses totaling $21,797. As of September 30, 2017, the amount of recoverable by the Adviser was $21,797 which is available to be recouped by the Adviser until September 30, 2020.

The Trust has also retained the Adviser to provide investor support services and secondary market support services in connection with the ongoing operation of the Trust. Such services include providing ongoing contact with respect to the Trust with financial intermediaries, communicating with the NYSE specialist for the Shares, and with the closed‐end fund analyst community regarding the Trust on a regular basis, and hosting and maintaining a website for the Trust. The Trust will pay the Adviser a service fee, payable monthly in arrears, in an annual amount equal to 0.20% of the Trust’s average daily Managed Assets.

ALPS Fund Services, Inc. (“ALPS”) serves as the Trust’s Administrator and Accounting Agent (the “Administrator”) and receives customary fees from the Trust for such services.

ALPS provides services that assist the Trust’s chief compliance officer in monitoring and testing the policies and procedures of the Trust in conjunction with requirements under Rule 38a‐1 under the 1940 Act and receives an annual base fee. ALPS is reimbursed for certain out‐of‐pocket expenses by the Trust. Compliance service fees paid by the Trust for the period ended September 30, 2017 are disclosed in the Statement of Operations.

DST Systems Inc., an affiliate of ALPS, serves as transfer, dividend paying and shareholder servicing agent for the Trust (“Transfer Agent”).

4. DISTRIBUTIONS

The Trust intends to pay substantially all of its net investment income, if any, to common shareholders through monthly distributions. The Trust intends to distribute any net long‐term capital gains to common shareholders at least annually. The Trust expects to declare initial distributions approximately 45 to 60 days after completion of the common share offering and to pay such initial distributions approximately 60 to 90 days after the completion of the common share offering, depending upon market conditions. There is no assurance the Trust will make its initial monthly distribution or continue to pay regular monthly distributions or that it will do so at a particular rate. Distributions may be paid by the Trust from any permitted source and, from time to time, all or a portion of a distribution may be a return of capital. No distributions were paid in the period ended September 30, 2017.

XAI Octagon Floating Rate &

Alternative Income Term Trust | Notes to Financial Statements |

September 30, 20175. CAPITAL TRANSACTIONS

Pursuant to the Declaration of Trust, the Trust is authorized to issue an unlimited number of Common Shares of beneficial interest, par value $0.01 per share (“Common Shares”). Each Common Share has one vote and, when issued and paid for in accordance with the terms of this offering, will be fully paid and non‐assessable. All Common Shares are equal as to dividends, assets and voting privileges and have no conversion, preemptive or other subscription rights. The Trust will send annual and semi‐annual reports, including financial statements, to all holders of its shares.

Any additional offerings of Common Shares will require approval by the Board of Trustees. Any additional offering of Common Shares will be subject to the requirements of the 1940 Act, which provides that shares may not be issued at a price below the then current net asset value, exclusive of sales load, except in connection with an offering to existing Common Shareholders or with the consent of a majority of the Trust’s outstanding voting securities.

The Trust issued 7,250,000 Common Shares in its initial public offering on September 27, 2017. These Common Shares were issued at $10.00 per share before the underwriting discount of $0.20 per share. Offering costs of $145,000 (representing $0.02 per Common Share) were offset against the net proceeds of the offering and have been charged to paid‐in capital of the Common Shares. The Adviser agreed to pay those offering costs of the Trust (other than the sales load) that exceeded $0.02 per Common Share. These offering costs paid by the Adviser are not subject to recoupment from the Trust.

6. TAXES

Classification of Distributions: Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Trust. The Trust did not pay distributions for the period ended September 30, 2017.

Components of Earnings: Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under accounting principles generally accepted in the United States. Accordingly, for the period ended September 30, 2017, there were no differences reclassified.

Tax Basis of Distributable Earnings: Tax components of distributable earnings are determined in accordance with income tax regulations which may differ from composition of net assets reported under GAAP.

| Undistributed ordinary income | | $ | – | |

| Other cumulative effect of timing differences | | | (17,117 | ) |

| Total | | $ | (17,117 | ) |

The Trust elects to defer to the period ending September 30, 2018, late year ordinary losses in the amount of $17,117.

Federal Income Tax Status: For federal income tax purposes, the Trust currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its investment company taxable net income and realized gain, not offset by capital loss carryforwards, if any, to its shareholders. No provision for federal income taxes has been made.

As of and during the period ended September 30, 2017, the Trust did not have a liability for any unrecognized tax benefits. The Trust files U.S. federal, state, and local tax returns as required. The Trust’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return. Since the Trust commenced operations on September 27, 2017 no tax returns have been filed for the Trust as of the date of this report.

| Annual Report | September 30, 2017 | 9 |

XAI Octagon Floating Rate &

Alternative Income Term Trust | Notes to Financial Statements |

September 30, 2017

7. SUBSEQUENT EVENTS

On October 6, 2017, the Trust entered into a Credit Agreement with Societe Generale (the “Lender”) that established a revolving credit facility (the “Facility”) of up to $40,000,000. The Trust borrowed $32,000,000 under the Facility on October 6, 2017 and an additional $4,465,000 and $2,400,000, under the Facility on November 1, 2017 and November 17, 2017, respectively.

In connection with its initial public offering, the Trust granted to the underwriters of that offering an option, exercisable for 45 days from September 27, 2017, to purchase up to an additional 1,087,500 Common Shares to cover over‐allotments, if any, at the initial offering price. The Trust issued 500,000 Common Shares on October 13, 2017 and 587,500 Common Shares on November 10, 2017 pursuant to this option.

XAI Octagon Floating Rate &

Alternative Income Term Trust | Report of Independent Registered

Public Accounting Firm |

To the Board of Trustees and Shareholders of XAI Octagon Floating Rate & Alternative Income Term Trust:

We have audited the accompanying statement of assets and liabilities of XAI Octagon Floating Rate & Alternative Income Term Trust (the “Trust”) as of September 30, 2017, and the related statements of operations and changes in net assets and the financial highlights for the period September 27, 2017 (commencement of operations) to September 30, 2017. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of cash held with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Trust as of September 30, 2017, and the results of its operations, changes in its net assets, and the financial highlights for the period September 27, 2017 (commencement of operations) to September 30, 2017, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Chicago, Illinois

November 22, 2017

| Annual Report | September 30, 2017 | 11 |

XAI Octagon Floating Rate &

Alternative Income Term Trust | Additional Information |

September 30, 2017 (Unaudited)

DIVIDEND REINVESTMENT PLAN

Under the Trust’s Dividend Reinvestment Plan, a Common Shareholder whose Common Shares are registered in his or her own name will have all distributions reinvested automatically by DST Systems, Inc., which is agent under the Plan (the “Plan Agent”), unless the Common Shareholder elects to receive cash.

Distributions with respect to Common Shares registered in the name of a broker‐dealer or other nominee (that is, in “street name”) will be reinvested in additional Common Shares under the Plan, unless the broker or nominee does not participate in the Plan or the Common Shareholder elects to receive distributions in cash. Investors who own Common Shares registered in street name should consult their broker‐dealers for details regarding reinvestment. All distributions to investors who do not participate in the Plan will be paid by check mailed directly to the record holder by DST Systems, Inc., as dividend disbursing agent. A participant in the Plan who wishes to opt out of the Plan and elect to receive distributions in cash should contact DST Systems, Inc. in writing at the address specified below or by calling the telephone number specified below.

Under the Plan, whenever the market price of the Common Shares is equal to or exceeds net asset value at the time Common Shares are valued for purposes of determining the number of Common Shares equivalent to the cash dividend or capital gains distribution, participants in the Plan are issued new Common Shares from the Trust, valued at the greater of (i) the net asset value as most recently determined or (ii) 95% of the then‐current market price of the Common Shares. The valuation date is the dividend or distribution payment date or, if that date is not a NYSE trading day, the next preceding trading day. If the net asset value of the Common Shares at the time of valuation exceeds the market price of the Common Shares, the Plan Agent will buy the Common Shares for the Plan in the open market, on the NYSE or elsewhere, for the participants’ accounts, except that the Plan Agent will endeavor to terminate purchases in the open market and cause the Trust to issue Common Shares at the greater of net asset value or 95% of market value if, following the commencement of such purchases, the market value of the Common Shares exceeds net asset value. If the Trust should declare a distribution or capital gains distribution payable only in cash, the Plan Agent will buy the Common Shares for the Plan in the open market, on the NYSE or elsewhere, for the participants’ accounts. There is no charge from the Trust for reinvestment of dividends or distributions in Common Shares pursuant to the Plan and no brokerage charges will be incurred with respect to Common Shares issued directly by the Trust pursuant to the Plan; however, all participants will pay a pro rata share of brokerage commissions incurred by the Plan Agent when it makes open‐market purchases.

The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in the account, including information needed by shareholders for personal and tax records. Common Shares in the account of each Plan participant will be held by the Plan Agent in non‐certificated form in the name of the participant.

In the case of shareholders such as banks, brokers or nominees, which hold Common Shares for others who are the beneficial owners, and participate in the Plan, the Plan Agent will administer the Plan on the basis of the number of Common Shares certified from time to time by the Common Shareholder as representing the total amount registered in the shareholder’s name and held for the account of beneficial owners who participate in the Plan.

Participants that request a sale of shares through the Plan Agent will incur brokerage charges in connection with such sales.

The automatic reinvestment of dividends and other distributions will not relieve participants of any income tax that may be payable or required to be withheld on such dividends or distributions.

Experience under the Plan may indicate that changes are desirable. Accordingly, the Trust reserves the right to amend or terminate its Plan as applied to any voluntary cash payments made and any dividend or distribution paid subsequent to written notice of the change sent to the members of such Plan at least 90 days before the record date for such dividend or distribution. The Plan also may be amended or terminated by the Plan Agent on at least 90 days’ prior written notice to the participants in such Plan. All correspondence concerning the Plan should be directed to the Plan Agent, DST Systems, Inc., 430 W. 7th Street, Kansas City, Missouri 64105‐1594.

LEVERAGE

The Trust uses leverage to seek to enhance total return and income. The Trust may use leverage through (i) the issuance of senior securities representing indebtedness, including through borrowing from financial institutions or issuance of debt securities, including notes or commercial paper (collectively, “Indebtedness”), (ii) the issuance of preferred shares (“Preferred Shares”) and/or (iii) reverse repurchase agreements, securities lending, short sales or derivatives, such as swaps, futures or forward contracts, that have the effect of leverage (“portfolio leverage”).The Trust currently intends to use leverage through Indebtedness and may use Indebtedness to the maximum extent permitted under the Investment Company Act of 1940 (the “1940 Act”). Under the 1940 Act the Trust may utilize Indebtedness up to 33 1/3% of its Managed Assets (specifically, the Trust may not incur Indebtedness if, immediately after incurring such Indebtedness, the Trust would have asset coverage (as defined in the 1940 Act) of less than 300%). The Trust will not utilize leverage, either through Indebtedness, Preferred Shares or portfolio leverage, in an aggregate amount in excess of 40% of the Trust’s Managed Assets (including the proceeds of leverage).

XAI Octagon Floating Rate &

Alternative Income Term Trust | Additional Information |

September 30, 2017 (Unaudited)

On October 6, 2017, the Trust entered into a Credit Agreement with Societe Generale (the “Lender”) that established a revolving credit facility (the “Facility”) of up to $40,000,000. Interest on the amount borrowed is based on three‐month LIBOR plus 1.20%. The Trust’s borrowings are secured by eligible securities held in its portfolio of investments. The Credit Agreement includes usual and customary covenants. Among other things, these covenants place limitations or restrictions on the Trust’s ability to (i) incur other indebtedness, (ii) change certain investment policies, (iii) pledge or create liens upon the assets of the Trust. In addition, the Trust is required to deliver financial information to the Lender, maintain an asset coverage ratio of not less than 300% and maintain its registration as a closed‐end management investment company.

In light of the cost of leverage and prevailing market conditions and investment opportunities in the structured credit and corporate credit markets, the Trust borrowed $32,000,000 under the Facility on October 6, 2017 and an additional $4,465,000 and $2,400,000, under the Facility on November 1, 2017 and November 17, 2017, respectively. As of November 20, 2017, outstanding borrowings under the Facility were $38,865,000, which represented approximately 32.4% of the Trust’s Managed Assets as of such date.

The use of leverage is a speculative technique that involves special risks. The Trust currently anticipates utilizing leverage to seek to enhance total return and income. There can be no assurance that the Advisor’s and the Sub‐Adviser’s expectations will be realized or that a leveraging strategy will be successful in any particular time period. Use of leverage creates an opportunity for increased income and capital appreciation but, at the same time, creates special risks. Leverage is a speculative technique that exposes the Trust to greater risk and increased costs than if it were not implemented. The more leverage that is utilized by the Trust, the more exposed the Trust will be to the risks of leverage. The use of leverage by the Trust causes the net asset value of the common shares to fluctuate significantly in response to changes in interest rates and other economic indicators. As a result, the net asset value, market price and dividend rate of the common shares is likely to be more volatile than those of a fund that is not exposed to leverage. Leverage increases operating costs, which may reduce total return. The Trust pays interest on its borrowings, which may reduce the Trust’s return. Increases in interest rates that the Trust must pay on its borrowings will increase the cost of leverage and may reduce the return to common shareholders. The risk of increases in interest rates may be greater in the current market environment because interest rates are near historically low levels. During the time in which the Trust is utilizing leverage, the amount of the investment advisory fee paid by the Trust will be higher than if the Trust did not utilize leverage because the fees paid will be calculated based on the Trust’s Managed Assets, including proceeds of leverage. Common shareholders bear the portion of the management fee attributable to assets purchased with the proceeds of leverage, which means that common shareholders effectively bear the entire management fee.

BOARD CONSIDERATION OF INVESTMENT ADVISORY AGREEMENT AND INVESTMENT SUB‐ADVISORY AGREEMENT

The Board, including the Independent Trustees, evaluated the terms of the investment management agreement between the Trust and XA Investments LLC (the “Advisory Agreement”) and the investment management agreement among the Trust, XA Investments LLC and Octagon Credit Investors, LLC (the “Sub‐Advisory Agreement” and together with the Advisory Agreement, the “Investment Management Agreements”) and reviewed the duties and responsibilities of the Trustees in evaluating and approving such agreements.

In considering whether to approve the Investment Management Agreements, the Board, including the Independent Trustees, reviewed the materials provided by XA Investments LLC (the “Adviser”) and Octagon Credit Investors, LLC (the “Sub‐Adviser”) and other information from counsel and from the Adviser and Sub‐Adviser, including: (i) a copy of the form of Investment Management Agreements; (ii) information describing the nature, quality and extent of the services that the Adviser and Sub‐Adviser will provide to the Trust and the fees the Adviser and Sub‐Adviser will charge to the Trust; (iii) information concerning the Adviser’s and Sub‐Adviser’s financial condition, business, operations, portfolio management personnel and compliance programs; (iv) information describing the Trust’s anticipated advisory fee and operating expenses; (v) a copy of the Sub‐Adviser’s current Form ADV; and (vi) a memorandum from counsel on the responsibilities of trustees in considering investment advisory arrangements under the Investment Company Act of 1940. The Board also considered presentations made by, and discussions held with, representatives of the Adviser and Sub‐Adviser. The Board also received information comparing the proposed advisory fee and expenses of the Trust to those of investment companies that were defined as competitors. The Board determined that the responses provided by the Adviser and Sub‐Adviser were sufficiently responsive to permit it to evaluate the Investment Advisory Agreements.

During its review of this information, the Board focused on and analyzed the factors that the Board deemed relevant, including: the nature, extent and quality of the services to be provided to Trust by the Adviser and Sub‐Adviser; the personnel and operations of the Adviser and Sub‐Adviser; the Trust’s anticipated expenses; the anticipated profitability to the Adviser and Sub‐Adviser under the Investment Management Agreements based on certain assumptions; any “fall‐out” benefits to the Adviser and the Sub‐Adviser; and the effect of asset growth on the Trust’s expenses.

| Annual Report | September 30, 2017 | 13 |

XAI Octagon Floating Rate &

Alternative Income Term Trust | Additional Information |

September 30, 2017 (Unaudited)

The Board, including the Independent Trustees, considered the following in respect of the Trust:

The nature, extent and quality of services to be provided by the Adviser and Sub‐Adviser. The Board reviewed the services that the Adviser and Sub‐Adviser would provide to Trust. In connection with the investment advisory services to be provided by the Adviser, the Board noted the responsibilities that the Adviser would have as the Trust’s investment adviser, including: the overall supervisory responsibility for the general management and investment of the Trust’s securities portfolio; providing oversight of the investment performance and processes and compliance with the Trust’s investment objective, policies and limitations; oversight of the implementation of the investment management program of the Trust; the oversight of the day‐to‐day investment and reinvestment of the assets of the Trust; the oversight of executing portfolio security trades for the Trust; quarterly reporting to the Board; the review of brokerage matters; the oversight of general portfolio compliance with relevant law; and the implementation of and compliance with Board directives as they relate to the Trust.

In connection with the investment advisory services to be provided by the Sub‐Adviser, the Board noted the responsibilities that the Sub‐Adviser would have as the Trust’s investment adviser, including: the responsibility for the management and investment of the Trust’s securities portfolio; management of the investment performance and processes and compliance with the Trust’s investment objective, policies and limitations; the implementation of the investment management program of the Trust; responsibility for the day‐to‐day investment and reinvestment of the assets of the Trust; executing portfolio security trades for the Trust; quarterly reporting to the Board; oversight of brokerage matters; ensuring general portfolio compliance with relevant law; and implementation of and compliance with Board directives as they relate to the Trust.

The Board recognized that the Adviser had limited experience managing a registered investment company, however, the Board noted that the Adviser’s personnel appeared to possess the necessary experience to effectively manage the Trust and the related oversight of the Sub‐Adviser.

Based on its consideration and review of the foregoing information, the Board determined that the nature, quality and extent of these services were sufficient and appropriate for the Trust.

Investment performance of the Trust, the Adviser and the Sub‐Adviser. Because the Trust and the Adviser are newly formed and had not yet commenced operations, the Board did not consider the investment performance of the Trust in approving the initial contracts with the Adviser and Sub‐Adviser. The Board reviewed the Sub‐Adviser’s investment track record with comparable investment strategies, and recognizing that past performance is not indicative of future returns, and taking into account the differences the investment strategies, the Board determined to consider the performance as one factor in its considerations.

Comparison of the costs of services to be rendered and fees to be paid to those under other investment advisory contracts, and the cost of the services to be provided and profits to be realized by the Adviser from the relationship with the Trust; “fall‐out” benefits. The Board then compared both the services to be rendered and the proposed fees to be paid under other contracts of the Adviser and the Sub‐Adviser, and under contracts of other investment advisers with respect to similar investment companies as determined by an independent third party consultant. In particular, the Board compared the Trust’s proposed advisory fees and projected expense ratio to other investment companies considered to be in the Trust’s peer group by the consultant. The Board also received and considered information about the fee rates charged to other accounts and clients that are managed by the Sub‐Adviser, including information about the differences in services provided to the non‐registered investment company clients. The Board also discussed the anticipated costs and projected profitability of the Adviser and Sub‐Adviser in connection with its serving as investment adviser or sub‐adviser, respectively, to the Trust, including operational costs. These considerations involved various factual scenarios. After comparing the Trust’s proposed fees with those of other trusts in the Trust’s peer group, and asking additional questions of the Adviser regarding peer group selection, and a consideration of the nature, extent and quality of services proposed to be provided by the Adviser and the costs expected to be incurred by the Adviser in rendering those services, the Board concluded that the level of fees proposed to be paid to the Adviser with respect to the Trust was fair and reasonable.

The Board also considered whether the Adviser or Sub‐Adviser may experience any additional “fall‐out” benefits based on their work on behalf of the Trust, and noted that, given the start‐up nature of the Trust, any such benefits were speculative at present.

The extent to which economies of scale would be realized as the Trust grows and whether fee levels would reflect such economies of scale. The Board next discussed potential economies of scale. Since the Trust is newly formed, the Trust had not commenced operations, and the eventual aggregate amount of assets was uncertain, the Adviser and Sub‐Adviser indicated that, given the nature of the Trust and initial profitability analyses, they did not expect to have economies of scale at any time in the foreseeable future.

Conclusion. Based on the foregoing and such other matters as were deemed relevant, the Board concluded in its reasonable business judgment that the proposed advisory fee rate and projected total expense ratio are reasonable in relation to the services to be provided by the Adviser and Sub‐Adviser to the Trust, as well as the costs to be incurred and benefits to be gained by the Adviser and Sub‐Adviser in providing such services. The Board also found the proposed advisory fees and sub‐advisory fees to be reasonable in comparison to the fees charged by advisers to other comparable trusts of similar actual or anticipated size. As a result, the Board concluded that the initial approval of the Investment Management Agreements was in the best interests of the Trust and approved the Investment Management Agreements. No single factor was determinative to the decision of the Board.

XAI Octagon Floating Rate &

Alternative Income Term Trust | Additional Information |

September 30, 2017 (Unaudited)

PROXY VOTING

Information on how the Trust voted proxies relating to portfolio securities during the most recent twelve‐month period ended June 30 will be available without charge, upon request, by calling (312) 262‐6930. This information is also available on the SEC’s website at www.sec.gov.

PRIVACY PRINCIPLES OF THE TRUST

The Trust is committed to maintaining the privacy of its shareholders and to safeguarding their non‐public personal information. The following information is provided to help you understand what personal information the Trust collects, how the Trust protects that information and why, in certain cases, the Trust may share information with select other parties.

Generally, the Trust does not receive any non‐public personal information relating to its shareholders, although certain non‐public personal information of its shareholders may become available to the Trust. The Trust does not disclose any non‐public personal information about its shareholders or former shareholders to anyone, except as permitted by law or as is necessary in order to service shareholder accounts (for example, to a transfer agent or third party administrator).

The Trust restricts access to non‐public personal information about its shareholders to employees of the Adviser and its delegates and affiliates with a legitimate business need for the information. The Trust maintains physical, electronic and procedural safeguards designed to protect the non‐public personal information of its shareholders.

TRANSFER AGENT AND CUSTODIAN

DST Systems, Inc., 430 W. 7th Street, Kansas City, Missouri 64105, serves as the Trust’s transfer agent and registrar.

U.S. Bank N.A., 1555 N. River Center Drive, Milwaukee, Wisconsin 53212, serves as the custodian of the Trust.

LEGAL COUNSEL

Skadden, Arps, Slate Meagher & Flom LLP, 155 North Wacker Drive, Chicago, Illinois 60606, serves as legal counsel to the Trust.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP, 200 E. Randolph Drive, Chicago, IL 60601, is the independent registered public accounting firm of the Trust.

| Annual Report | September 30, 2017 | 15 |