UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23247

(Investment Company Act File Number)

XAI Octagon Floating Rate & Alternative Income Term Trust

(Exact Name of Registrant as Specified in Charter)

321 North Clark Street, Suite 2430

Chicago, IL 60654

(Address of Principal Executive Offices)

Benjamin McCulloch, Esq.

XA Investments LLC

321 North Clark Street, Suite 2430

Chicago, IL 60654

(Name and Address of Agent for Service)

(312) 374-6930

(Registrant’s Telephone Number)

Date of Fiscal Year End:September 30

Date of Reporting Period:September 30, 2019

| Item 1. | Reports to Stockholders. |

TABLE OF CONTENTS

| Shareholder Letter | 1 |

| Questions & Answers | 2 |

| Trust Portfolio Information | 8 |

| Schedule of Investments | 10 |

| Statement of Assets and Liabilities | 17 |

| Statement of Operations | 18 |

| Statements of Changes In Net Assets | 19 |

| Statement of Cash Flows | 20 |

| Financial Highlights | 21 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered Public Accounting Firm | 32 |

| Additional Information | 33 |

| Trustees and Officers | 35 |

Beginning on January 1, 2021, as permitted by regulations adopted by the SEC, paper copies of XAI Octagon Floating Rate & Alternative Income Term Trust’s (the “Trust”) annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Trust or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (www.xainvestments.com/XFLT), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically from the Trust by contacting your financial intermediary, such as a broker-dealer or bank.

You may elect to receive all future reports in paper free of charge. If you own these shares through a financial intermediary, such as a broker-dealer or bank, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you can inform the Trust that you wish to continue receiving paper copies of your shareholder reports by calling (888) 903-3358. Your election to receive reports in paper will apply to all funds held with the fund complex if you invest directly with the Trust or to all funds held in your account if you invest through your financial intermediary.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Shareholder Letter |

September 30, 2019 (Unaudited)

Dear Shareholder:

We thank you for your investment in XAI Octagon Floating Rate & Alternative Income Term Trust (the “Trust”). This annual report covers the twelve-month period ended September 30, 2019.

XA Investments LLC (“XAI”) serves as the investment adviser to the Trust. Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s investment sub-adviser and is responsible for the management of the Trust’s portfolio of investments. The investment objective of the Trust is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating-rate credit instruments and other structured credit investments. There can be no assurance that the Trust will achieve its investment objective.

For the twelve months ended September 30, 2019, the Trust experienced a decline in net assets from operations of approximately $4.4 million, or -$0.43 per average common share (inclusive of unrealized losses). This represents an annualized net asset value return on the Trust’s common equity of approximately -4.55% since September 30, 2018.

For the twelve months ended September 30, 2019, the S&P 500 Index, the Bloomberg Barclays U.S. High Yield 1% Issuer Capped Index and the Trust’s benchmark, the S&P/LSTA Leveraged Loan 100 Index, generated returns of 4.25%, 6.20%, and 3.44%,1 respectively. For the nine months ending September 30, 2019, the S&P 500 Index, the Bloomberg Barclays U.S. High Yield 1% Issuer Capped Index and the Trust’s benchmark, the S&P/LSTA Leveraged Loan 100 Index, generated returns of 20.55%, 11.34%, and 8.21%, respectively.1

From October 1, 2018 through September 30, 2019, the Trust’s net asset value (“NAV”) decreased by 13.47% from $9.50 per common share to $8.22 per common share largely reflecting unrealized losses due to valuation changes for the Trust’s investments in collateralized loan obligation (“CLO”) debt, CLO equity, and opportunistic loan segments. As described below, during the last twelve months, the Trust had aggregate distributions totaling $0.848 per common share with respect to distributions declared. The distribution declared September 3, 2019 represents an annualized distribution rate of 9.79% based on the Trust’s closing market price of $8.95 per common share on September 30, 2019.

The closing price per share of the Trust’s common shares was $8.95 on September 30, 2019, representing an 8.88% premium to NAV per common share as of such date. From the Trust’s IPO on September 27, 2017 through September 30, 2019, the Trust’s common shares have traded on average at a 0.53% premium to NAV. As of the date of this letter, November 21, 2019, the closing price per common share was $8.43 representing a 9.48% premium to NAV per common share.

The Trust has sold 1,799,427 common shares, which resulted in $16,305,512 of net proceeds, through the At-the-Market issuance between May 1, 2019 and October 30, 2019. The At-the-Market program originally authorized the issuance of up to 2,250,000 common shares. The Trust sold an additional 1,098,500 common shares through an overnight offering of common shares that settled on November 19, 2019. The overnight offering resulted in proceeds of $9,183,460 (before deduction of the sales load and offering expenses).

The last twelve months were characterized by market turbulence as retail loan fund outflows accelerated in the fourth quarter of 2018 and continued into 2019, reflecting investor concerns over the U.S. Federal Reserve’s (the “Fed”) more dovish stance on interest rates. Loan and CLO prices have since improved, despite periodic bouts of market volatility over the course of 2019. Notably, credit fundamentals are still supported by positive (albeit slow) U.S. GDP growth and continued healthy interest coverage for many borrowers. Although we have observed more weakness within certain sectors than we did a year ago, we do not yet see the signs of a broad recession in the U.S. U.S. economic growth, however, is decelerating—but remains positive—and the U.S. consumer remains strong despite global softening. Corporate earnings growth continues, but with greater performance dispersion among issuers and more ratings downgrades resulting from lower profitability of certain companies versus original expectations, and tariffs and other headwinds negatively impacting global growth. We believe that strong fundamental credit analysis and active portfolio management will be key to outperformance in a weaker growth environment. Broader market volatility and increasing risk aversion are underscoring the later stage of the credit cycle; nevertheless, we expect continued institutional demand for floating-rate assets given attractive relative yields compared to other fixed income asset classes without the attendant interest rate duration risk.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Trust’s website at www.xainvestments.com/XFLT.

Sincerely,

Kimberly Flynn

Managing Director

XA Investments LLC

November 21, 2019

| Annual Report | September 30, 2019 | 1 |

XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

Lauren M. Basmadjian, Senior Portfolio Manager at Octagon Credit Investors, LLC (“Octagon”) and a member of Octagon’s Investment Committee, serves as lead portfolio manager of XAI Octagon Floating Rate & Alternative Income Term Trust (the “Trust”). Ms. Basmadjian is supported by a team of Octagon investment professionals in the day-to-day management of the Trust’s portfolio, including the following additional members of Octagon’s Investment Committee: Andrew D. Gordon (Octagon’s co-founder, Chief Executive Officer and Co-Chief Investment Officer), Michael B. Nechamkin (Co-Chief Investment Officer and Senior Portfolio Manager), Gretchen M. Lam (Senior Portfolio Manager) and Lauren B. Law (Portfolio Manager). Herein, Ms. Basmadjian discusses the market environment and the Trust’s performance for the twelve-month period ended September 30, 2019.

What is the Trust’s investment objective and how is it pursued?

The Trust’s investment objective is to seek attractive total return with an emphasis on income generation across multiple stages of the credit cycle. The Trust seeks to achieve its investment objective by investing in a dynamically managed portfolio of opportunities primarily within the private credit markets. Under normal market conditions, the Trust will invest at least 80% of its Managed Assets in floating-rate credit instruments and other structured credit investments.

The Trust’s investments include (i) structured credit investments, including collateralized loan obligation (“CLO”) debt and subordinated (i.e., residual or equity) securities; (ii) traditional corporate credit investments, including leveraged loans and high yield bonds; (iii) opportunistic credit investments, including stressed and distressed credit situations and long/short credit investments; and (iv) other credit-related instruments.

Leveraged loans are debt obligations (also commonly referred to as “senior loans” or “floating-rate loans”) issued by a bank to a corporation that generally holds legal claim to the borrower’s assets above all other debt obligations. Leveraged loans have floating rates that typically fluctuate according to LIBOR. LIBOR stands for London Interbank Offered Rate and is the benchmark rate that most of the world’s leading banks charge each other for short-term loans.

CLOs are a type of structured credit vehicle that typically invest in a diverse portfolio of broadly syndicated leveraged loans. CLOs finance this pool of loans with a capital structure that consists of debt and equity. CLO debt includes senior and mezzanine debt (collectively, “liabilities”) of a CLO structure with tranches rated from AAA down to BB or B. Interest earned from the underlying loan collateral pool of a CLO is used to pay the coupon interest on the CLO liabilities. CLO debt investors earn returns based on spreads above 3-month LIBOR. CLO equity represents a residual stake in the CLO structure and is the first loss position in the event of defaults and credit losses. CLO equity investors receive the excess spread between the CLO assets and liabilities and expenses. CLO equity is junior in priority of payment and is subject to certain payment restrictions generally set forth in an indenture governing the notes.

The Trust pursues its investment objective by investing primarily in below investment grade credit instruments that are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and to repay principal. The Trust may invest without limitation in credit instruments that are illiquid.

The Trust uses leverage to seek to enhance total return and income. Although leverage may create an opportunity for increased return and income for shareholders, it also results in additional risks and can magnify the effect of any losses. There is no assurance that the leverage strategy will be successful. If income and gains on securities purchased with leverage proceeds are greater than the cost of the leverage, common shareholders’ return will be greater than if leverage had not been used. Conversely, if the income or gains from the securities purchased with the proceeds of leverage are less than the cost of leverage, common shareholders’ return will be less than if leverage had not been used.

Describe the current market conditions for the leveraged loan market and Octagon’s outlook.

Following a turbulent fourth quarter of 2018 driven by technical disruptions, leveraged loans have returned 6.79% year-to-date as of September 30, 20191, driven by market value gains among higher quality (BB) and more liquid loans (which experienced the largest price declines during the fourth quarter of 2018). The loan market has bifurcated significantly over 2019 as economic risk has increased and corporate earnings growth have softened. High quality credits have generally performed well; however, a growing number of borrowers have reported weaker results, and their loans have suffered in turn. Companies experiencing operating weakness or facing increased downgrade risk have seen their loan prices fall sharply, and discount margins have widened. While spreads for high quality assets should remain stable, spreads for lower quality loans will likely widen, with more borrowers moving into the latter category. We expect this dispersion in operating performance and loan price movement will continue in the context of a loan market with few incremental buyers of risk.

Increased performance dispersion among issuers has been driven in certain instances by negative impacts of trade policy/tariffs and weaker global (non-U.S.) economic growth on certain sectors. Credit fundamentals are still supported by positive (albeit slowing) U.S. GDP growth and continued healthy interest coverage for many borrowers. While we have observed more weakness within certain sectors than we did a year ago, we do not yet see the signs of a broad recession in the U.S. In our view, the near-to-medium term economic outlook for below investment grade corporate credit is relatively benign, though less so than last year due to slower GDP and earnings growth, more ratings downgrades, higher leverage levels, and weaker credit agreements. On the other hand, borrower interest coverage ratios remain high, and higher purchase price multiples for LBOs and sponsor equity contributions imply positive growth trends among private equity-backed businesses. The trailing twelve-month loan default rate stands at 1.29% as of September 30, still low relative to the long-term average of 3.1%,2 though we expect defaults to modestly increase, as credit conditions among borrowers are showing some signs of deterioration. While we believe that loan issuers in Octagon’s investments are largely well-positioned, we expect the flight-to-quality trend will dominate loan market dynamics through the remainder of the year.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

Shifting interest rate outlooks and broader market volatility have impacted loan market technicals over the past twelve months. Retail loan fund redemptions have continued over the course of 2019, though at a more modest pace as the year has progressed. The expectation for further rate cuts implies the likelihood of additional retail fund redemptions, though the contracting size of the retail fund complex (which currently represents approximately 12% of the loan market) should diminish the impact of future outflows. Meanwhile, CLOs continue to represent the lion’s share of loan demand. New CLO formation totaled $90 billion year-to-date as of September 303 and is on track to meet full-year projections of $110-$125 billion of new deals.4 With respect to loan supply, year-to-date institutional new issue volume of $237 billion as of September 30 remains subdued compared to prior years (down 35% versus the same period in 2018)5, with significantly less refinancing and repricing activity than in prior quarters due to spread widening.

We retain a cautious outlook as 2019 comes to a close, and anticipate periodic bouts of market turbulence given slowing economic growth, corporate earnings volatility, various geopolitical risks (both domestic and foreign), and investors’ ongoing aversion to risk. In a potential weaker growth environment, strong bottom-up fundamental credit research, proactive risk and portfolio management and prudent relative value focus will be paramount to loss avoidance. We will continue to focus on credits with strong underlying fundamentals and attractive terms, and will seek to proactively manage the Trust’s risk profile to withstand heightened volatility. Despite potential headwinds, we believe the loan market will continue to offer attractive risk/return opportunities for fundamental credit pickers like Octagon. At current levels, loans offer high current income compared to other fixed income asset classes. At 6.62% as of September 30, the average current loan yield remains elevated despite lower LIBOR levels or rates.1 Moreover, we believe loans’ senior priority and secured nature can help portfolios withstand challenging market conditions.

Describe the current market conditions for the CLO market and Octagon’s outlook.

The pace of new CLO issuance has been steady year-to-date; at $90 billion as of September 30, year-to-date new CLO issuance represents the third highest reading of any comparable period.3 CLO reset/refinancing activity remains muted compared to prior years due to wider CLO tranche spreads; only $35.3 billion of deals have been refinanced or reset year-to-date, compared to $124.6 billion over the same timeframe in 2018 (a 72% year-over-year decline).3 Meanwhile, secondary CLO trading levels have been elevated throughout 2019, with year-to-date Bids Wanted In Competition supply already surpassing full-year 2018 supply.6 Despite the challenging arbitrage, we believe new CLO issuance will remain healthy through the remainder of the year, driven by a large deal pipeline, new/debut managers with large internal equity commitments continuing to enter the market, and continued AAA demand from both foreign and domestic investors.

CLO liability spreads ended 2018 meaningfully wider on the year, as spread widening intensified in the fourth quarter in tandem with the loan market sell-off. Primary CLO debt spreads have continued to widen over much of 2019, though we saw some spread tightening midway through the second quarter as new CLO issuance increased. Of note, as overseas AAA buyers reduced purchase activity in the second quarter due to regulatory scrutiny, domestic buyers stepped in and the average AAA spread for top-tier managers tightened to approximately 130 basis points (“bps”) in the second quarter compared to 138 bps in the first quarter, helping to alleviate some pressure on the arbitrage.7 Mezzanine debt spreads (BB and B rated) widened modestly over the first half of 2019, driven by elevated secondary supply and investor focus away from floating-rate assets. In the third quarter, new issue CLO spreads widened slightly across the capital stack. We believe CLO debt spreads will remain relatively rangebound, with a bias towards modest widening. Deals with less subordination or underperforming/riskier collateral portfolios should continue to trade wider, reflecting investors’ focus on collateral managers’ ability to manage tail risk in underlying portfolios.10 As the year has progressed, we have observed ongoing tiering among collateral managers, particularly at the bottom of the capital stack.8 Tiering occurs in the CLO market as investors’ views towards collateral managers are reflected in pricing and trading levels—more established, seasoned managers generally considered “top-tier” will see their deals price and trade tighter to those of a smaller, less experienced manager. In the context of increasing idiosyncratic credit issues and loan downgrades, we expect further tiering and disparity in CLO manager performance.

In our view, the current market environment is reasonably supportive for CLO investors. There is healthy investor demand for CLO debt tranches, and loan market conditions are supportive for collateral managers. Fewer loans are trading above par,9 which allows managers to ramp collateral portfolios efficiently via the secondary market. Both CLO debt and equity investors should continue to benefit from CLO managers who are able to successfully minimize credit losses and increase coupon through buying loans in the primary market. As of September 30, 65.9% of loans were trading below par in the secondary market, which suggests that there are opportunities to buy assets in the secondary market to offset credit losses. The median annualized equity distribution for reinvesting U.S. CLOs is currently 14.7%.6 Wider loan spreads and relatively favorable CLO liability spreads combined with lower loan prices should significantly benefit CLO equity investors over the long-term. Potential bouts of market turbulence may also benefit CLO equity. When credit spreads widen, loan prepayments and amortizations are typically recycled into discounted/higher yielding assets during periods of market volatility, while CLO liability spreads are fixed, resulting in higher CLO equity distributions. We therefore believe CLO equity continues to offer compelling risk-adjusted returns to long-term investors seeking income strategies, especially in more volatile loan markets.

| Annual Report | September 30, 2019 | 3 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

How did the Trust perform for the twelve months ended September 30, 2019?

For the twelve-month period ended September 30, 2019, the Trust provided a total return on market price of 0.75% and a total return based on net asset value (“NAV”) of -4.55%. NAV return includes the deduction of management fees, operating expenses, and all other Trust expenses. All Trust returns cited – whether based on NAV or market price – assume the reinvestment of all distributions. As of September 30, 2019, the Trust’s market price of $8.95 represented a premium of 8.88% to its NAV of $8.22. The market value of the Trust’s shares fluctuates from time-to-time and may be higher or lower than the Trust’s NAV. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

What were the distributions over the period?

From October 1, 2018 through May 1, 2019, the Trust paid a monthly distribution of $0.069 per share. For the remainder of the twelve-month period ended September 30, 2019, the Trust increased the monthly distribution to $0.073 per share, beginning with the distribution paid on June 3, 2019. The distribution declared September 3, 2019 represents an annualized distribution rate of 9.79% based on the Trust’s closing market price of $8.95 per common share on September 30, 2019. The Trust’s distribution rate is not constant, and the amount of distributions, when declared by the Trust’s Board of Trustees, is subject to change based on the performance of the Trust. Please see Note 4 on page 25 for more information on distributions for the period.11

What influenced the Trust’s performance for the twelve months ended September 30, 2019?

Pronounced volatility towards year-end 2018 was reflected in lower valuations across most assets in the Trust’s portfolio, which negatively impacted the Trust’s performance for the fourth quarter of 2018. While the Trust generated strong returns in the first and second quarters of 2019 as asset prices rebounded, performance in the third quarter was weighed down by outsized unrealized losses among the Trust’s CLO equity positions. During the twelve-month period, the Trust’s portfolio generated a net gain in its senior loan segment (first lien and second lien loans) driven by interest income, but experienced net investment losses in all other asset class segments (CLO equity, CLO debt, high yield bonds, and opportunistic loans). The Trust’s CLO equity segment experienced a net loss at approximately ($0.12) per share for the period; the Trust’s CLO equity positions collected quarterly distribution payments totaling $7,571,109, or $0.88 per share, during the twelve-month period, which were offset by market value losses of $8,634,120, or ($1.00) per share. The majority of the Trust’s largest performance detractors during the period were CLO equity positions, reflecting lower CLO equity NAVs owing to lower underlying loan prices. It bears noting that recent market volatility may help boost quarterly CLO equity payments, to the benefit of the Trust.

Relevant indices for the markets in which the Trust invests include the Trust’s benchmark, the S&P/LSTA Leveraged Loan 100 Index, which returned 3.44% for the twelve-month period, the Bloomberg Barclays U.S. High Yield 1% Issuer Capped Index, which returned 6.20% for the twelve-month period, and the JP Morgan BB/B CLO Debt Index, which returned 2.69% for the twelve-month period.11 There is no representative benchmark index for CLO equity in the marketplace.

How is the Trust positioned for the remainder of 2019?

Looking ahead, we believe that the Trust is well-positioned across its primary investment segments to meet its investment objective. As of September 30, 2019, the Trust is invested predominantly in floating-rate assets, comprising first and second lien loans (48.7% of the total portfolio on a market value basis as of September 30, 2019), CLO equity (32.1%) and CLO debt securities (14.0%). We believe the Trust’s loan positions are appropriately diversified across industry sectors, with software, health care providers and services, and commercial services and supplies representing the largest exposures as of September 30, 2019. We generally expect to maintain the Trust’s current allocations to CLO equity and CLO debt, which have benefited from the Trust’s at-the-market share issuance (“ATM”) program during the period, in that proceeds from the ATM program have helped fund the Trust’s purchases of more accretive CLO equity and debt positions. The Trust’s CLO debt investments remain predominantly comprised of BB-rated tranches versus single-B tranches. We maintain a generally constructive view of CLO equity over the longer term. Lastly, we expect to maintain the Trust’s low exposure to high yield bonds, as we continue to prefer loans that offer comparable all-in yields with lower duration risk, seniority, collateral, and floating-rate coupons.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

Discuss the Trust’s secondary market performance and the ATM program.

On March 12, 2019, the Trust established a shelf registration to issue shares into the secondary market. On March 28, 2019, the Trust entered into a Distribution Agreement with Foreside Fund Services, LLC (the “Distributor”), pursuant to which the Trust may offer and sell up to 2,250,000 Common Shares, from time to time, through the Distributor, in transactions that are deemed to be “at-the-market.” The Trust began to issue common shares through its ATM program on May 15, 2019. For the twelve months ended September 30, 2019, the Trust issued 1,221,261 common shares pursuant to the ATM program.

The ATM program is a form of continuous follow-on offering of the Trust’s common shares. The goal of the Trust’s ATM program is to enhance secondary market liquidity for shareholders by growing the size of the Trust over time and reducing operating expenses per share. In an ATM offering, newly issued shares are sold incrementally into the secondary trading market through a placement agent at prevailing market prices. The placement agent sells the common shares in the open market and the Trust receives cash proceeds from the transaction to be invested pursuant to the Trust’s investment objectives. Octagon has been able to deploy the investment proceeds from the Trust’s ATM program in what it believes are attractive investment opportunities in CLO debt and CLO equity, which have been accretive to the Trust.

ATM sales are possible for closed end funds if the fund is trading at a sufficient premium to NAV to cover the issuance costs. From May 15, 2019 to September 30, 2019, when the Trust was active with the ATM program, the Trust traded at an average 6.44% premium to its NAV and has had average daily trading volumes of 57,264 common shares. For the twelve-month period ended September 30, 2019, the Trust traded at an average 0.22% premium to its NAV and has had average daily trading volumes of 37,685 common shares. ATM daily issuance totals depend on the Trust’s average daily trading volumes.

How is the Trust positioned to perform in the current interest rate environment?

The Trust is positioned conservatively in terms of duration, with predominantly all of the Trust’s investments in floating-rate or adjustable securities based on changes in LIBOR. While three-month LIBOR has decreased from 240 bps as of September 30, 2018 to 209 bps as of September 30, 2019, we believe the loan market currently offers high yields and select convexity opportunities. Credit spreads currently remain attractive relative to post-crisis levels, and all-in current loan yields have increased to 6.62% for the S&P/LSTA Leveraged Loan Index.1 Accommodative global central bank policy should continue to be supportive of risk assets and overall economic growth. At present, we think many asset prices and new issue deals are attractive, and we continue to believe it is still a good time to buy loans. Nevertheless, credit fundamentals have become more mixed, underscoring the importance of research-driven credit analysis and relative value-focused asset selection. Lower LIBOR should also limit any sustained tightening in CLO debt tranches, and result in lower all-in yields.

Discuss the Trust’s use of leverage.

The Trust uses leverage as part of its investment strategy to finance the purchase of additional securities that may provide increased income and greater appreciation potential to common shareholders than could be achieved from a portfolio that is unlevered. With the low cost of borrowing and relatively low default rates generally among U.S. companies, the amount of leverage used by the Trust is highly accretive to income generation. The Trust currently employs leverage through a bank borrowing. As of September 30, 2019, the amount of leverage was approximately 33.11% of the Trust’s Managed Assets (including proceeds of leverage). While leverage increases the income of the Trust in yield terms, it also amplifies the effects of changing market prices in the portfolio and can cause the Trust’s NAV to change to a greater degree than the market as a whole. This change in NAV can create volatility in Trust pricing but should not affect the Trust’s ability to pay distributions under normal circumstances.

Index Definitions

The Trust does not seek to track any index. Index returns are stated for illustrative purposes only, do not reflect the deduction of fees and expenses, and do not represent the performance of the Trust. It is not possible to invest directly in an index.

Bloomberg Barclays U.S. High Yield 1% Issuer Capped Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond markets. Securities are classified as high yield if the middle rating of the Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. Issuers are capped at 1% of the index.

J.P. Morgan CLO Debt Index represents the post-crisis J.P. Morgan Collateralized Loan Obligation Index (“CLOIE”). The CLOIE is an index that tracks the market for U.S. dollar-denominated broadly syndicated, arbitrage CLOs. The CLOIE is divided by origination (pre- versus post-crisis) and is broken out further into six original rating classes (AAA, AA, A, BBB, BB, B). The sub-index we reference here tracks BB-rated CLO debt.

S&P/LSTA U.S. Leveraged Loan 100 Index is a market value-weighted index designed to measure the performance of the U.S. leveraged loan market. In conjunction with Standard & Poor's/LCD, the Leveraged Syndications & Trading Association (“LSTA”) developed the S&P/LSTA U.S. Leveraged Loan 100 Index. The S&P/LSTA U.S. Leveraged Loan 100 Index is designed to reflect the 100 largest loan facilities in the leveraged loan market. It mirrors the market-value-weighted performance of the 100 largest institutional leveraged loans based upon actual market weightings, spreads and interest payments. The S&P/LSTA U.S. Leveraged Loan 100 Index utilizes LSTA/LPC Mark-to-Market Pricing, which is based on bid/ask quotes gathered from dealers and is not based upon derived pricing models. The index uses the average bid for its market value calculation. Each loan facility’s total return is calculated by aggregating the interest return (reflecting the return due to interest paid and accrued interest) and price return (reflecting the gains or losses due to changes in the end of day prices and principal repayments). The return of each loan facility is weighted in the index based upon its market value outstanding, which reflects both the prior period’s prices as well as accrued interest. The overall index return is the aggregate of each component loan facility’s return multiplied by the market value outstanding from the prior time period.

| Annual Report | September 30, 2019 | 5 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

Risks and Other Considerations

Investing involves risk, including the possible loss of principal and fluctuation in value.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are expressed for informational purposes only and are subject to change at any time, based on market and other conditions, and may not come to pass. These views should not be construed as research, investment advice or a recommendation of any kind regarding the Trust or any issuer or security, do not constitute a solicitation to buy or sell any security, and should not be considered specific legal, investment or tax advice. The information provided does not take into account the specific objectives, financial situation, or particular needs of any specific investor.

The views expressed in this report may also include forward-looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass. Actual results or events may differ materially from those projected, estimated, assumed, or anticipated in any such forward looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include general economic conditions such as inflation, recession, and interest rates. Neither XAI nor Octagon has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.

There can be no assurance that the Trust will achieve its investment objective or that any investment strategies or techniques discussed herein will be effective. The value of the Trust will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value.

Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

Please see www.xainvestments.com/XFLT for a detailed discussion of the Trust’s risks and considerations. The Trust regularly updates performance and certain other data and publishes material information as necessary from time to time on its website. Investors and others are advised to check the website for updated performance information and the release of other material information about the Trust. References herein to the Trust’s website are intended to allow investors public access to information regarding the Trust and do not, and are not intended to, incorporate the Trust’s website in this report.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be, and should not be construed as, legal or tax advice and/or legal opinion. Always consult a financial, tax, and/or legal professional regarding your specific situation.

| 1 | Source: S&P Capital IQ/SNL Financial Leveraged Commentary & Data. Represents metrics for the S&P/LSTA Leveraged Loan Index (September 30, 2019). |

| 2 | Source: S&P Capital/SNL Financial LCD News, “Leveraged loans gain 0.47% in September amid busy market” (October 1, 2019). Represents lagging 12-month default rate for the S&P/LSTA Leveraged Loan Index by principal amount as of September 30, 2019. Default rate is calculated as the amount defaulted over the last 12 months divided by the amount outstanding at the beginning of the 12-month period. Represents all loans including loans not included in the LSTA/LPC mark-to-market service. Source: LCD News (September 30, 2019). Long-term average loan default rate is calculated as the straight average of the monthly LTM loan default rate for the 20-year period through September 2019. Past defaults are not an indication of future default rates. |

| 3 | Source: S&P Capital IQ/SNL Financial LCD Research, Global CLO Databank (October 1, 2019). |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Questions & Answers |

September 30, 2019 (Unaudited)

| 4 | Wells Fargo Securities CLO and Commercial ABS Research team projects $110B in full-year 2019 (“FY”) new CLO issuance (Source: CLO Monthly Market Overview, July 2, 2019). JPMorgan CLO Research team projects $115-125B for FY new CLO issuance (Source: JPMorgan CLO Research, April 1, 2019). |

| 5 | Source: LCD Quarterly Review, Third Quarter 2019 (September 30, 2019). |

| 6 | Source: Wells Fargo Securities Structured Products Research, The U.S. CLO Manager Style Guide, October 25, 2019. Past performance has been achieved during a period of relative economic stability, and is not necessarily indicative of future results. |

| 7 | Source: S&P Global Market Intelligence LCD Quarterly Review – Second Quarter 2019 (July 2, 2019). |

| 8 | The capital stack refers to the various debt and equity issuances and their priority to recoup assets from an issuer in the case of default. |

| 9 | As of September 30, 2019. Source: J.P. Morgan Research, “JPM High-Yield and Leveraged Loan Morning Intelligence” (October 1, 2019). |

| 10 | Tail risk is the possibility of a loss that might occur as per a prediction of probability distribution due to a rare event. A short-term movement of three times the standard deviation is considered to represent a tail risk. |

| Annual Report | September 30, 2019 | 7 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Trust Portfolio Information |

September 30, 2019 (Unaudited)

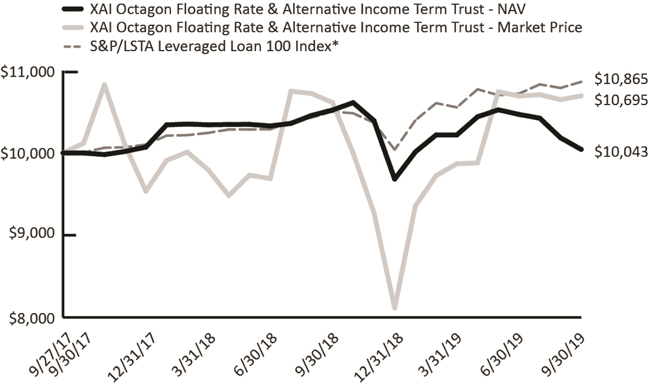

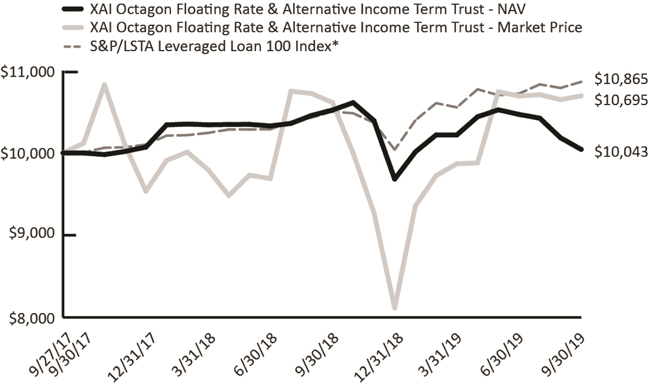

Growth of a $10,000 Investment(as of September 30, 2019)

The chart above represents historical performance of a hypothetical investment of $10,000 in the Trust since inception.Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Trust distributions or the redemption of Trust shares. The chart assumes that distributions from the Trust are reinvested.

Summary Performance(as of September 30, 2019)

| | 1 Month | 3 Months | 6 Months | 1 Year | Since the Trust’s Inception (September 27, 2017)^ |

| XAI Octagon Floating Rate & AlternativeIncome Term Trust - NAV | -1.39% | -4.06% | -1.72% | -4.55% | 0.22% |

| XAI Octagon Floating Rate & AlternativeIncome Term Trust – Market Price | 0.44% | 0.02% | 8.37% | 0.75% | 3.40% |

| S&P/LSTA Leveraged Loan 100 Index* | 0.68% | 1.33% | 2.93% | 3.44% | 4.21% |

| * | The S&P/LSTA (Loan Syndications and Trading Association) U.S. Leveraged Loan 100 Index was the first to track the investable senior loan market. This rules-based index consists of the 100 largest loan facilities in the benchmark S&P/LSTA Leveraged Loan Index (LLI). |

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than performance data quoted.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Trust Portfolio Information |

September 30, 2019 (Unaudited)

Top Ten Portfolio Holdings(as a % of Total Investments)*

| Name | | Type | | |

| Anchorage Capital CLO 1-R, Ltd. 2018-1RA | | CLO Equity | | | 2.70% |

| Madison Park Funding XVIII, Ltd. 2015-18A | | CLO Equity | | | 2.32% |

| CIFC Funding 2018-I, Ltd. | | CLO Equity | | | 2.22% |

| Apidos CLO XXVIII 2017-28A | | CLO Equity | | | 2.20% |

| THL Credit Wind River 2018-3 CLO, Ltd. | | CLO Equity | | | 2.15% |

| THL Credit Wind River 2016-1 CLO, Ltd. | | CLO Equity | | | 1.99% |

| Anchorage Capital CLO 4-R, Ltd. 2018-4RA | | CLO Equity | | | 1.94% |

| CIFC Funding 2017-V, Ltd. | | CLO Equity | | | 1.78% |

| THL Credit Wind River 2018-2 CLO, Ltd. | | CLO Equity | | | 1.66% |

| OHA Credit Partners XI, Ltd. 2015-11A | | CLO Equity | | | 1.60% |

| Total | | | | | 20.56% |

| * | Holdings are subject to change |

Asset Allocation(as a % of Total Investments)

| Senior Secured First Lien Loans | | | 42.05% |

| CLO Equity | | | 32.14% |

| CLO Debt | | | 14.02% |

| Secured Second Lien Loans | | | 6.48% |

| Corporate Bonds | | | 0.14% |

| Money Market Mutual Funds | | | 5.17% |

| Annual Report | September 30, 2019 | 9 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| CORPORATE BONDS - 0.22%* (0.14% of Total Investments) | | | | | | | | |

| Energy Equipment & Services - 0.22% (0.14% of Total Investments) | | | | | | | | |

| McDermott Technology Americas, Inc. / McDermott Technology US, Inc., Senior Unsecured(b) | | 10.63% | | N/A | | 05/01/2024 | | $ | 750,000 | | | $ | 174,375 | |

| | | | | | | | | | | | | | | |

| Total Corporate Bonds (Cost $700,077) | | | | | | | | $ | 750,000 | | | $ | 174,375 | |

| | | | | | | | | | | | | | | |

| SECURED SECOND LIEN LOANS(c)- 10.16%*(6.48% of Total Investments) | | | | | | | | |

| Commercial Services & Supplies - 0.97% (0.62% of Total Investments) | | | | | | | | |

| AVSC Holding Corp., Initial | | 9.50% | | 3M US L + 7.25% | | 09/01/2025 | | | 805,556 | | | | 765,278 | |

| | | | | | | | | | | | | | | |

| Communications Equipment - 0.42% (0.27% of Total Investments) | | | | | | | | |

| Global Tel*Link Corp. | | 10.29% | | 1M US L + 8.25% | | 11/29/2026 | | | 347,222 | | | | 327,910 | |

| | | | | | | | | | | | | | | |

| Diversified Financial Services - 0.63% (0.40% of Total Investments) | | | | | | | | |

| Edelman Financial Center LLC, Initial(d) | | N/A | | L + 6.75% | | 07/20/2026 | | | 500,000 | | | | 498,750 | |

| | | | | | | | | | | | | | | |

| Health Care Providers & Services - 0.16% (0.10% of Total Investments) | | | | | | | | |

| Albany Molecular Research, Inc., Initial | | 9.04% | | 1M US L + 7.00% | | 08/30/2025 | | | 126,466 | | | | 125,201 | |

| | | | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure - 0.41% (0.26% of Total Investments) | | | | | | | | |

| Affinity Gaming, Initial | | 10.29% | | 1M US L + 8.25% | | 01/31/2025 | | | 340,006 | | | | 324,025 | |

| | | | | | | | | | | | | | | |

| Insurance - 2.19% (1.40% of Total Investments) | | | | | | | | |

| Asurion LLC, Replacement B-2 | | 8.54% | | 1M US L + 6.50% | | 08/04/2025 | | | 1,700,000 | | | | 1,726,350 | |

| | | | | | | | | | | | | | | |

| Real Estate Investment Trusts (REITs) - 0.79% (0.50% of Total Investments) | | | | | | | | |

| Capital Automotive LP, Initial Tranche B | | 8.04% | | 1M US L + 6.00% | | 03/24/2025 | | | 620,378 | | | | 621,544 | |

| | | | | | | | | | | | | | | |

| Software - 3.76% (2.40% of Total Investments) | | | | | | | | |

| EagleView Technology Corp. | | 9.55% | | 1M US L + 7.50% | | 08/14/2026 | | | 442,623 | | | | 420,492 | |

| McAfee LLC, Initial | | 10.54% | | 1M US L + 8.50% | | 09/29/2025 | | | 875,000 | | | | 882,114 | |

| MH Sub I LLC, Amendment No. 2 Initial | | 9.54% | | 1M US L + 7.50% | | 09/15/2025 | | | 750,000 | | | | 751,875 | |

| Misys, Ltd., Dollar Term Loan | | 9.45% | | 6M US L + 7.25% | | 06/13/2025 | | | 950,000 | | | | 905,473 | |

| Total Software | | | | | | | | | 3,017,623 | | | | 2,959,954 | |

| | | | | | | | | | | | | | | |

| Transportation Infrastructure - 0.83% (0.53% of Total Investments) | | | | | | | | |

| Drive Chassis Holdco LLC, B | | 10.59% | | 3M US L + 8.25% | | 04/10/2026 | | | 687,838 | | | | 650,007 | |

| | | | | | | | | | | | | | | |

| Total Secured Second Lien Loans (Cost $8,177,497) | | | | | | | | $ | 8,145,089 | | | $ | 7,999,019 | |

| | | | | | | | | | | | | | | |

| SENIOR SECURED FIRST LIEN LOANS(c)- 65.93%* (42.05% of Total Investments) | | | | | | | | |

| Aerospace & Defense - 0.56% (0.36% of Total Investments) | | | | | | | | |

| Constellis Holdings LLC, B | | 7.26% | | 3M US L + 5.00% | | 04/21/2024 | | | 756,707 | | | | 439,972 | |

| | | | | | | | | | | | | | | |

| Airlines - 0.67% (0.43% of Total Investments) | | | | | | | | |

| Allegiant Travel Company, Class B | | 6.71% | | 3M US L + 4.50% | | 02/05/2024 | | | 390,794 | | | | 393,725 | |

| LifeMiles Finance, LLC / LifeMiles, Ltd., Initial Term Loan | | 7.54% | | 1M US L + 5.50% | | 08/18/2022 | | | 139,136 | | | | 132,875 | |

| Total Airlines | | | | | | | | | 529,930 | | | | 526,600 | |

See Notes to Financial Statements.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| SENIOR SECURED FIRST LIEN LOANS(c)(continued) | | | | | | | | |

| Automobiles - 0.49% (0.31% of Total Investments) | | | | | | | | |

| Truck Hero, Inc., Initial | | 5.79% | | 1M US L + 3.75% | | 04/22/2024 | | $ | 412,160 | | | $ | 384,854 | |

| | | | | | | | | | | | | | | |

| Chemicals - 1.81% (1.16% of Total Investments) | | | | | | | | |

| Ascend Performance Materials Operations LLC, Initial | | 7.35% | | 1M US L + 5.25% | | 08/27/2026 | | | 763,577 | | | | 764,058 | |

| INEOS Enterprises Holdings US Finco LLC, Initial Tranche B Dollar | | 6.12% | | 3M US L + 4.00% | | 08/28/2026 | | | 267,539 | | | | 268,208 | |

| Innovative Water Care Global Corp., Initial | | 7.10% | | 3M US L + 5.00% | | 02/27/2026 | | | 434,537 | | | | 395,429 | |

| Total Chemicals | | | | | | | | | 1,465,653 | | | | 1,427,695 | |

| | | | | | | | | | | | | | | |

| Commercial Services & Supplies - 3.65% (2.33% of Total Investments) | | | | | | | | |

| Allied Universal Holdco LLC, Initial(e) | | 6.51% | | 3M US L + 4.25% | | 07/10/2026 | | | 795,122 | | | | 795,496 | |

| Belfor Holdings, Inc., Initial | | 6.04% | | 1M US L + 4.00% | | 04/06/2026 | | | 651,488 | | | | 653,117 | |

| Dun & Bradstreet Corp., Initial Borrowing | | 7.05% | | 1M US L + 5.00% | | 02/06/2026 | | | 961,744 | | | | 967,409 | |

| Harland Clarke Holdings Corp., Initial | | 6.85% | | 3M US L + 4.75% | | 11/03/2023 | | | 591,270 | | | | 459,712 | |

| Total Commercial Services & Supplies | | | | | | | | | 2,999,624 | | | | 2,875,734 | |

| | | | | | | | | | | | | | | |

| Communications Equipment - 1.84% (1.18% of Total Investments) | | | | | | | | |

| Global Tel*Link Corp. | | 6.29% | | 1M US L + 4.25% | | 11/29/2025 | | | 460,600 | | | | 440,794 | |

| Intelsat Jackson Holdings S.A., Term B-4 Loan | | 6.55% | | 1M US L + 4.50% | | 01/02/2024 | | | 1,000,000 | | | | 1,010,830 | |

| Total Communications Equipment | | | | | | | | | 1,460,600 | | | | 1,451,624 | |

| | | | | | | | | | | | | | | |

| Construction Materials - 0.28% (0.18% of Total Investments) | | | | | | | | |

| Tailwind Smith Cooper Intermediate Corp., Initial | | 7.05% | | 1M US L + 5.00% | | 05/28/2026 | | | 238,532 | | | | 223,027 | |

| | | | | | | | | | | | | | | |

| Containers & Packaging - 0.30% (0.19% of Total Investments) | | | | | | | | |

| Pregis TopCo LLC, Initial | | 6.25% | | 3M US L + 4.00% | | 07/31/2026 | | | 238,650 | | | | 237,755 | |

| | | | | | | | | | | | | | | |

| Distributors - 1.59% (1.01% of Total Investments) | | | | | | | | |

| BCPE Empire Holdings, Inc., Initial(e) | | 6.04% | | 1M US L + 4.00% | | 06/11/2026 | | | 428,850 | | | | 422,687 | |

| United Natural Foods, Inc., Initial | | 6.29% | | 1M US L + 4.25% | | 10/22/2025 | | | 995,000 | | | | 829,044 | |

| Total Distributors | | | | | | | | | 1,423,850 | | | | 1,251,731 | |

| | | | | | | | | | | | | | | |

| Diversified Consumer Services - 3.82% (2.43% of Total Investments) | | | | | | | | |

| Cast & Crew Payroll LLC, Initial | | 6.05% | | 1M US L + 4.00% | | 02/09/2026 | | | 497,500 | | | | 500,764 | |

| Sotheby's Holdings, Inc., B(d) | | N/A | | L + 5.50% | | 01/22/2027 | | | 504,883 | | | | 498,890 | |

| Staples, Inc., 2019 Refinancing New B-1 | | 7.12% | | 3M US L + 5.00% | | 04/16/2026 | | | 995,235 | | | | 980,515 | |

| Travelport Finance S.à r.l., Initial | | 7.10% | | 3M US L + 5.00% | | 05/29/2026 | | | 1,136,897 | | | | 1,024,833 | |

| Total Diversified Consumer Services | | | | | | | | | 3,134,515 | | | | 3,005,002 | |

| | | | | | | | | | | | | | | |

| Diversified Financial Services - 1.12% (0.72% of Total Investments) | | | | | | | | |

| Refinitiv US Holdings, Inc., Initial Dollar | | 5.79% | | 1M US L + 3.75% | | 10/01/2025 | | | 880,128 | | | | 884,528 | |

| | | | | | | | | | | | | | | |

| Diversified Telecommunication Services - 2.60% (1.66% of Total Investments) | | | | | | | | |

| Altice France S.A., USD TLB-13 Incremental | | 6.03% | | 1M US L + 4.00% | | 08/14/2026 | | | 812,046 | | | | 809,341 | |

| Sorenson Communications LLC, Initial | | 8.60% | | 3M US L + 6.50% | | 04/29/2024 | | | 207,725 | | | | 207,466 | |

| Syniverse Holdings, Inc., Tranche C | | 7.03% | | 1M US L + 5.00% | | 03/09/2023 | | | 618,634 | | | | 581,226 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2019 | 11 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| SENIOR SECURED FIRST LIEN LOANS(c)(continued) | | | | | | | | |

| Diversified Telecommunication Services (continued) | | | | | | | | |

| WideOpenWest Finance LLC, Eighth Amendment B | | 5.29% | | 1M US L + 3.25% | | 08/18/2023 | | $ | 461,769 | | | $ | 445,030 | |

| Total Diversified Telecommunication Services | | | | | | | | | 2,100,174 | | | | 2,043,063 | |

| | | | | | | | | | | | | | | |

| Electronic Equipment, Instruments & Components - 1.76% (1.12% of Total Investments) | | | | |

| ConvergeOne Holdings, Corp., Initial | | 7.04% | | 1M US L + 5.00% | | 01/04/2026 | | | 435,403 | | | | 389,250 | |

| Mavenir Systems, Inc., Initial | | 8.34% | | 3M US L + 6.00% | | 05/08/2025 | | | 740,006 | | | | 727,056 | |

| Triton Solar US Acquisition Co., Initial | | 8.04% | | 1M US L + 6.00% | | 10/29/2024 | | | 289,679 | | | | 269,947 | |

| Total Electronic Equipment, Instruments & Components | | | | | | | | | 1,465,088 | | | | 1,386,253 | |

| | | | | | | | | | | | | | | |

| Energy Equipment & Services - 1.38% (0.88% of Total Investments) | | | | | | | | |

| McDermott International, Inc. | | 7.10% | | 3M US L + 5.00% | | 05/09/2025 | | | 651,023 | | | | 409,331 | |

| WaterBridge Midstream Operating LLC, Initial | | 7.83% | | 6M US L + 5.75% | | 06/22/2026 | | | 702,586 | | | | 677,117 | |

| Total Energy Equipment & Services | | | | | | | | | 1,353,609 | | | | 1,086,448 | |

| | | | | | | | | | | | | | | |

| Food Products - 1.53% (0.98% of Total Investments) | | | | | | | | |

| 8th Avenue Food & Provisions, Inc. | | 5.79% | | 1M US L + 3.75% | | 10/01/2025 | | | 497,494 | | | | 498,325 | |

| Give & Go Prepared Foods Corp., 2017 | | 6.29% | | 1M US L + 4.25% | | 07/29/2023 | | | 257,460 | | | | 240,511 | |

| Sage Borrowco LLC, B | | 7.13% | | 3M US L + 4.75% | | 06/20/2026 | | | 464,397 | | | | 465,850 | |

| Total Food Products | | | | | | | | | 1,219,351 | | | | 1,204,686 | |

| | | | | | | | | | | | | | | |

| Health Care Equipment & Supplies - 2.26% (1.44% of Total Investments) | | | | | | | | |

| Aldevron LLC, B(d) | | N/A | | L + 4.25% | | 09/18/2026 | | | 458,674 | | | | 459,821 | |

| Curium BidCo S.à r.l., Facility B | | 6.10% | | 3M US L + 4.00% | | 07/09/2026 | | | 379,315 | | | | 379,789 | |

| Femur Buyer, Inc., Initial | | 6.38% | | 3M US L + 4.25% | | 03/05/2026 | | | 934,977 | | | | 934,977 | |

| Total Health Care Equipment & Supplies | | | | | | | | | 1,772,966 | | | | 1,774,587 | |

| | | | | | | | | | | | | | | |

| Health Care Providers & Services - 8.82% (5.63% of Total Investments) | | | | | | | | |

| Air Medical Group Holdings, Inc., 2018 New | | 6.29% | | 1M US L + 4.25% | | 03/14/2025 | | | 496,215 | | | | 463,753 | |

| BW NHHC Holdco, Inc., Initial | | 7.05% | | 1M US L + 5.00% | | 05/15/2025 | | | 773,622 | | | | 642,107 | |

| Envision Healthcare Corp., Initial | | 5.79% | | 1M US L + 3.75% | | 10/10/2025 | | | 316,390 | | | | 257,164 | |

| Gentiva Health Services, Inc., Closing Date Initial | | 5.81% | | 1M US L + 3.75% | | 07/02/2025 | | | 834,982 | | | | 839,157 | |

| Phoenix Guarantor, Inc., Initial | | 6.57% | | 1M US L + 4.50% | | 03/05/2026 | | | 664,390 | | | | 665,081 | |

| Radiology Partners, Inc., B | | 7.19% | | 3M US L + 4.75% | | 07/09/2025 | | | 974,142 | | | | 958,663 | |

| Regionalcare Hospital Partners Holdings, Inc., B | | 6.55% | | 1M US L + 4.50% | | 11/16/2025 | | | 1,021,322 | | | | 1,021,486 | |

| Verscend Holding Corp., B | | 6.54% | | 1M US L + 4.50% | | 08/27/2025 | | | 1,085,230 | | | | 1,087,943 | |

| WP CityMD Bidco LLC, Initial | | 6.60% | | 3M US L + 4.50% | | 08/13/2026 | | | 1,019,951 | | | | 1,008,160 | |

| Total Health Care Providers & Services | | | | | | | | | 7,186,244 | | | | 6,943,514 | |

| | | | | | | | | | | | | | | |

| Health Care Technology - 2.69% (1.72% of Total Investments) | | | | | | | | |

| athenahealth, Inc., B | | 6.68% | | 3M US L + 4.50% | | 02/11/2026 | | | 1,241,972 | | | | 1,237,314 | |

| Zelis Healthcare Corp., B(d) | | N/A | | L + 4.75% | | 09/10/2026 | | | 889,472 | | | | 881,689 | |

| Total Health Care Technology | | | | | | | | | 2,131,444 | | �� | | 2,119,003 | |

| | | | | | | | | | | | | | | |

| Hotels, Restaurants & Leisure - 4.01% (2.55% of Total Investments) | | | | | | | | |

| Bulldog Purchaser, Inc., Initial(e) | | 5.79% | | 1M US L + 3.75% | | 09/05/2025 | | | 84,516 | | | | 83,390 | |

| Casablanca US Holdings, Inc., Amendment No. 2 Initial | | 6.26% | | 3M US L + 4.00% | | 03/29/2024 | | | 833,528 | | | | 803,938 | |

| CEC Entertainment, Inc., B | | 8.54% | | 1M US L + 6.50% | | 08/30/2026 | | | 986,012 | | | | 963,826 | |

See Notes to Financial Statements.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| SENIOR SECURED FIRST LIEN LOANS(c)(continued) | | | | | | | | |

| Hotels, Restaurants & Leisure (continued) | | | | | | | | |

| NPC International, Inc., Initial | | 5.54% | | 1M US L + 3.50% | | 04/19/2024 | | $ | 378,840 | | | $ | 234,070 | |

| Red Lobster Management LLC, Initial | | 7.29% | | 1M US L + 5.25% | | 07/28/2021 | | | 743,503 | | | | 736,068 | |

| United PF Holdings LLC(e) | | 6.54% | | 1M US L + 4.50% | | 06/10/2026 | | | 332,794 | | | | 331,130 | |

| Total Hotels, Restaurants & Leisure | | | | | | | | | 3,359,193 | | | | 3,152,422 | |

| | | | | | | | | | | | | | | |

| Household Products - 1.50% (0.96% of Total Investments) | | | | | | | | |

| Sunshine Luxembourg VII SARL, Facility B1(d) | | N/A | | L + 4.25% | | 09/23/2026 | | | 1,173,747 | | | | 1,178,642 | |

| | | | | | | | | | | | | | | |

| Industrial Conglomerates - 0.56% (0.35% of Total Investments) | | | | | | | | |

| J2 Acquisition, Ltd., B(d) | | N/A | | L + 2.50% | | 09/25/2026 | | | 187,365 | | | | 187,833 | |

| Sundyne US Purchaser, Inc., Initial | | 6.04% | | 1M US L + 4.00% | | 05/15/2026 | | | 250,567 | | | | 250,254 | |

| Total Industrial Conglomerates | | | | | | | | | 437,932 | | | | 438,087 | |

| | | | | | | | | | | | | | | |

| Insurance - 0.34% (0.22% of Total Investments) | | | | | | | | |

| Sedgwick Claims Management Services, Inc., 2019 | | 6.04% | | 1M US L + 4.00% | | 09/03/2026 | | | 266,712 | | | | 266,912 | |

| | | | | | | | | | | | | | | |

| Internet Software & Services - 2.53% (1.61% of Total Investments) | | | | | | | | |

| EIG Investors Corp., 2018 Refinancing | | 5.88% | | 3M US L + 3.75% | | 02/09/2023 | | | 321,209 | | | | 314,094 | |

| Ellie Mae, Inc. | | 6.04% | | 1M US L + 4.00% | | 04/17/2026 | | | 1,022,088 | | | | 1,022,517 | |

| Imperva, Inc. | | 6.30% | | 3M US L + 4.00% | | 01/12/2026 | | | 498,750 | | | | 483,788 | |

| Veritas US, Inc., New Dollar B | | 6.55% | | 1M US L + 4.50% | | 01/27/2023 | | | 176,968 | | | | 166,847 | |

| Total Internet Software & Services | | | | | | | | | 2,019,015 | | | | 1,987,246 | |

| | | | | | | | | | | | | | | |

| IT Services - 1.99% (1.27% of Total Investments) | | | | | | | | |

| Merrill Communications LLC, B(d) | | N/A | | L + 5.00% | | 09/25/2026 | | | 350,554 | | | | 347,925 | |

| Rackspace Hosting, Inc., B | | 5.29% | | 3M US L + 3.00% | | 11/03/2023 | | | 498,728 | | | | 456,879 | |

| ThoughtWorks, Inc., Replacement | | 6.04% | | 1M US L + 4.00% | | 10/11/2024 | | | 211,266 | | | | 211,266 | |

| West Corp., Initial B | | 6.06% | | 1M US L + 4.00% | | 10/10/2024 | | | 613,764 | | | | 547,226 | |

| Total IT Services | | | | | | | | | 1,674,312 | | | | 1,563,296 | |

| | | | | | | | | | | | | | | |

| Media - 3.12% (1.99% of Total Investments) | | | | | | | | |

| Ancestry.com Operations, Inc., Extended(d) | | N/A | | L + 4.25% | | 08/27/2026 | | | 748,125 | | | | 730,357 | |

| Clear Channel Outdoor Holdings, Inc., B | | 5.54% | | 1M US L + 3.50% | | 08/21/2026 | | | 117,513 | | | | 117,765 | |

| Cumulus Media New Holdings, Inc., Initial(d) | | N/A | | L + 3.75% | | 03/31/2026 | | | 324,423 | | | | 324,828 | |

| Diamond Sports Group LLC | | 5.30% | | 1M US L + 3.25% | | 08/24/2026 | | | 550,120 | | | | 552,871 | |

| MediArena Acquisition B.V., Dollar B | | 8.07% | | 3M US L + 5.75% | | 08/13/2021 | | | 739,004 | | | | 728,318 | |

| Total Media | | | | | | | | | 2,479,185 | | | | 2,454,139 | |

| | | | | | | | | | | | | | | |

| Oil, Gas & Consumable Fuels - 0.36% (0.23% of Total Investments) | | | | | | | | |

| ARGUS MEDIA LIMITED(d) | | N/A | | L + 3.25% | | 09/24/2026 | | | 70,028 | | | | 70,290 | |

| Permian Production Partners LLC, Initial Advances | | 8.05% | | 1M US L + 6.00% | | 05/20/2024 | | | 433,088 | | | | 216,544 | |

| Total Oil, Gas & Consumable Fuels | | | | | | | | | 503,116 | | | | 286,834 | |

| | | | | | | | | | | | | | | |

| Pharmaceuticals - 0.27% (0.17% of Total Investments) | | | | | | | | |

| Amneal Pharmaceuticals, LLC, Initial Term Loan | | 5.56% | | 1M US L + 3.50% | | 05/04/2025 | | | 249,151 | | | | 211,778 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2019 | 13 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| SENIOR SECURED FIRST LIEN LOANS(c)(continued) | | | | | | | | |

| Professional Services - 1.01% (0.64% of Total Investments) | | | | | | | | |

| AQ Carver Buyer, INC.(d) | | N/A | | L + 5.00% | | 09/23/2025 | | $ | 467,890 | | | $ | 463,211 | |

| National Intergovernmental Purchasing Alliance Company AKA Omnia Partners, Initial Term Loans | | 5.85% | | 3M US L + 3.75% | | 05/23/2025 | | | 336,507 | | | | 331,460 | |

| Total Professional Services | | | | | | | | | 804,397 | | | | 794,671 | |

| | | | | | | | | | | | | | | |

| Real Estate Management & Development - 0.58% (0.37% of Total Investments) | | | | | | | | |

| Forest City Enterprises LP, Initial | | 6.04% | | 1M US L + 4.00% | | 12/08/2025 | | | 456,089 | | | | 458,939 | |

| | | | | | | | | | | | | | | |

| Software - 8.85% (5.64% of Total Investments) | | | | | | | | |

| Carbonite, Inc., Initial | | 6.01% | | 1M US L + 3.75% | | 03/26/2026 | | | 489,899 | | | | 489,693 | |

| Datto, Inc., Cov-Lite TLB | | 6.29% | | 1M US L + 4.25% | | 04/02/2026 | | | 142,878 | | | | 143,950 | |

| DigiCert Holdings, Inc., B(d) | | N/A | | L + 4.00% | | 08/07/2026 | | | 796,742 | | | | 793,754 | |

| DiscoverOrg LLC, Initial | | 6.54% | | 1M US L + 4.50% | | 02/02/2026 | | | 988,060 | | | | 983,426 | |

| LegalZoom.com, Inc., 2018 | | 6.54% | | 1M US L + 4.50% | | 11/21/2024 | | | 557,766 | | | | 559,160 | |

| McAfee LLC, B USD | | 5.79% | | 1M US L + 3.75% | | 09/30/2024 | | | 834,605 | | | | 836,124 | |

| Perforce Software, Inc., B | | 6.54% | | 1M US L + 4.50% | | 07/01/2026 | | | 783,683 | | | | 782,703 | |

| Project Alpha Intermediate Holding, Inc., 2019 | | | | | | | | | | | | | | |

| Incremental | | 6.56% | | 3M US L + 4.25% | | 04/26/2024 | | | 596,587 | | | | 595,842 | |

| TIBCO Software, Inc., B-2 | | 6.07% | | 1M US L + 4.00% | | 06/30/2026 | | | 952,097 | | | | 952,497 | |

| Upland Software, Inc., Initial | | 5.79% | | 1M US L + 3.75% | | 08/06/2026 | | | 825,846 | | | | 826,879 | |

| Total Software | | | | | | | | | 6,968,163 | | | | 6,964,028 | |

| | | | | | | | | | | | | | | |

| Specialty Retail - 1.54% (0.98% of Total Investments) | | | | | | | | |

| Bass Pro Group LLC, Initial | | 7.04% | | 1M US L + 5.00% | | 09/25/2024 | | | 758,425 | | | | 729,226 | |

| Payless, Inc. | | | | | | | | | | | | | | |

| Tranche A-1(f) | | 14.25% | | 1M US L + 7.00% | | 02/09/2022 | | | 359,832 | | | | 251,882 | |

| Tranche A-2(f) | | 15.25% | | 3M US L + 8.00% | | 08/09/2022 | | | 643,500 | | | | 231,660 | |

| Total Specialty Retail | | | | | | | | | 1,761,757 | | | | 1,212,768 | |

| | | | | | | | | | | | | | | |

| Textiles, Apparel & Luxury Goods - 1.45% (0.92% of Total Investments) | | | | | | | | |

| Champ Acquisition Corp., Initial | | 7.60% | | 3M US L + 5.50% | | 12/19/2025 | | | 544,572 | | | | 542,873 | |

| Elevate Textiles, Inc., Initial | | 7.03% | | 1M US L + 5.00% | | 05/01/2024 | | | 708,227 | | | | 594,910 | |

| Total Textiles, Apparel & Luxury Goods | | | | | | | | | 1,252,799 | | | | 1,137,783 | |

| | | | | | | | | | | | | | | |

| Wireless Telecommunication Services - 0.65% (0.42% of Total Investments) | | | | | | | | |

| Digicel International Finance, Ltd., Initial B | | 5.34% | | 3M US L + 3.25% | | 05/27/2024 | | | 596,214 | | | | 515,230 | |

| | | | | | | | | | | | | | | |

| Total Senior Secured First Lien Loans (Cost $54,199,182) | | | | | | | | $ | 54,771,007 | | | $ | 51,888,851 | |

| | | | | | | | | | | | | | | |

| CLO DEBT(c)(g)- 21.98%* (14.02% of Total Investments) | | | | | | | | |

| Anchorage Capital CLO 2018-10, Ltd., Series 2018-10A(b) | | 8.05% | | 3M US L + 5.75% | | 10/15/2031 | | | 500,000 | | | | 452,658 | |

| Apidos CLO XXVIII, Series 2017-28A(b) | | 7.78% | | 3M US L + 5.50% | | 01/20/2031 | | | 1,000,000 | | | | 921,441 | |

| Atrium XIV LLC, Series 2018-14A(b) | | 7.97% | | 3M US L + 5.65% | | 08/23/2030 | | | 500,000 | | | | 461,352 | |

| CIFC Funding 2015-I, Ltd., Series 2015-1A(b) | | 8.28% | | 3M US L + 6.00% | | 01/22/2031 | | | 500,000 | | | | 461,865 | |

| CIFC Funding 2017-II, Ltd., Series 2017-2A(b) | | 8.23% | | 3M US L + 5.95% | | 04/20/2030 | | | 500,000 | | | | 465,302 | |

| CIFC Funding 2017-V, Ltd., Series 2017-5A(b) | | 8.40% | | 3M US L + 6.10% | | 11/16/2030 | | | 1,000,000 | | | | 945,687 | |

| Dryden 64 CLO, Ltd., Series 2018-64A(b) | | 7.90% | | 3M US L + 5.60% | | 04/18/2031 | | | 500,000 | | | | 449,023 | |

See Notes to Financial Statements.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| CLO DEBT(c)(g) (continued) | | | | | | | | | | | | | | |

| GoldenTree Loan Management US CLO 1, Ltd., Series 2017-1A(b) | | 7.88% | | 3M US L + 5.60% | | 04/20/2029 | | $ | 1,000,000 | | | $ | 813,850 | |

| GoldenTree Loan Opportunities XI, Ltd., Series 2015- 11A(b) | | 7.70% | | 3M US L + 5.40% | | 01/18/2031 | | | 750,000 | | | | 654,494 | |

| Halcyon Loan Advisors Funding 2018-2, Ltd., Series 2018- 2A(b) | | 9.18% | | 3M US L + 6.90% | | 01/22/2031 | | | 500,000 | | | | 483,584 | |

| HPS Loan Management 11-2017, Ltd., Series 2017-11A(b) | | 10.09% | | 3M US L + 7.85% | | 05/06/2030 | | | 1,000,000 | | | | 875,271 | |

| Madison Park Funding XVII, Ltd., Series 2015-17A(b) | | 9.76% | | 3M US L + 7.48% | | 07/21/2030 | | | 1,000,000 | | | | 834,141 | |

| Madison Park Funding XXIV, Ltd., Series 2019-24A(b) | | 9.38% | | 3M US L + 7.20% | | 10/20/2029 | | | 250,000 | | | | 245,014 | |

| Marble Point CLO XI, Ltd., Series 2017-2A E(b) | | 7.90% | | 3M US L + 5.60% | | 12/18/2030 | | | 1,000,000 | | | | 843,160 | |

| Neuberger Berman CLO XIV, Ltd., Series 2013-14A(b) | | 8.71% | | 3M US L + 6.45% | | 01/28/2030 | | | 1,000,000 | | | | 923,363 | |

| OZLM Funding, Ltd., Series 2012-1A(b) | | 8.95% | | 3M US L + 6.67% | | 07/23/2029 | | | 1,000,000 | | | | 986,459 | |

| OZLM XXII, Ltd., Series 2018-22A(b) | | 7.60% | | 3M US L + 5.30% | | 01/17/2031 | | | 500,000 | | | | 434,474 | |

| Sound Point CLO II, Ltd., Series 2013-1A(b) | | 7.77% | | 3M US L + 5.50% | | 01/26/2031 | | | 250,000 | | | | 211,843 | |

| Sound Point CLO XVIII, Ltd., Series 2017-4A(b) | | 7.78% | | 3M US L + 5.50% | | 01/20/2031 | | | 500,000 | | | | 428,673 | |

| Symphony CLO XVIII, Ltd., Series 2016-18A(b) | | 8.61% | | 3M US L + 6.35% | | 01/23/2028 | | | 1,500,000 | | | | 1,428,785 | |

| Symphony CLO XXI, Ltd., Series 2019-21A(b) | | 9.11% | | 3M US L + 6.75% | | 07/15/2032 | | | 1,000,000 | | | | 974,682 | |

| THL Credit Wind River 2017-4 CLO, Ltd., Series 2017-4A(b) | | 7.94% | | 3M US L + 5.80% | | 11/20/2030 | | | 500,000 | | | | 463,918 | |

| THL Credit Wind River 2019-1 CLO, Ltd., Series 2019-1A(b) | | 9.31% | | 3M US L + 6.72% | | 04/20/2031 | | | 750,000 | | | | 728,942 | |

| Voya CLO 2013-1, Ltd., Series 2013-1A(b) | | 8.78% | | 3M US L + 6.48% | | 10/15/2030 | | | 1,000,000 | | | | 921,060 | |

| Voya CLO 2013-2, Ltd., Series 2013-2A(b) | | 7.88% | | 3M US L + 5.60% | | 04/25/2031 | | | 1,000,000 | | | | 893,529 | |

| Total CLO Debt (Cost $18,864,987) | | | | | | | | $ | 19,000,000 | | | $ | 17,302,570 | |

| | | | | | | | | | | | | | | |

| CLO EQUITY(g)(h)- 50.40%* (32.14% of Total Investments) | | | | | | | | |

| ALM V, Ltd., Series 2012-5A(b) | | N/A | | Estimated yield of 11.77% | | 10/18/2027 | | | 2,000,000 | | | | 790,422 | |

| Anchorage Capital CLO 1-R, Ltd., Series 2018-1RA(b) | | N/A | | Estimated yield of 17.38% | | 04/13/2031 | | | 4,150,000 | | | | 3,334,301 | |

| Anchorage Capital CLO 3-R, Ltd., Series 2014-3RA(b) | | N/A | | Estimated yield of 16.30% | | 01/28/2031 | | | 1,400,000 | | | | 1,120,629 | |

| Anchorage Capital CLO 4-R, Ltd., Series 2018-4RA(b) | | N/A | | Estimated yield of 16.94% | | 01/28/2031 | | | 3,000,000 | | | | 2,402,097 | |

| Anchorage Capital CLO 9, Ltd., Series 2016-9A(b) | | N/A | | Estimated yield of 17.96% | | 07/15/2032 | | | 2,500,000 | | | | 1,196,685 | |

| Apidos CLO XXVII, Series 2017-27A(b) | | N/A | | Estimated yield of 16.21% | | 07/17/2030 | | | 1,300,000 | | | | 791,094 | |

| Apidos CLO XXVIII, Series 2017-28A(b) | | N/A | | Estimated yield of 11.42% | | 01/20/2031 | | | 3,500,000 | | | | 2,714,418 | |

| Carlyle Global Market Strategies CLO 2013-1, Ltd., Series 2013-1A(b) | | N/A | | Estimated yield of 13.90% | | 08/14/2030 | | | 3,500,000 | | | | 1,868,926 | |

| Carlyle Global Market Strategies CLO 2016-1, Ltd., Series 2016-1A(b) | | N/A | | Estimated yield of 10.35% | | 04/20/2027 | | | 598,000 | | | | 433,569 | |

| Carlyle US CLO 2018-2, Ltd., Series 2018-2A(b) | | N/A | | Estimated yield of 13.60% | | 10/15/2031 | | | 933,000 | | | | 722,890 | |

| Catamaran CLO 2015-1, Ltd., Series 2015-1A(b) | | N/A | | Estimated yield of 23.10% | | 04/22/2027 | | | 750,000 | | | | 286,129 | |

| CIFC Funding 2017-III, Ltd., Series 2017-3A(b) | | N/A | | Estimated yield of 16.99% | | 07/30/2030 | | | 1,400,000 | | | | 1,108,463 | |

| CIFC Funding 2017-V, Ltd., Series 2017-5A(b) | | N/A | | Estimated yield of 13.27% | | 11/16/2030 | | | 3,000,000 | | | | 2,195,577 | |

| CIFC Funding 2018-I, Ltd., Series 2018-1A(b) | | N/A | | Estimated yield of 15.04% | | 04/18/2031 | | | 3,250,000 | | | | 2,746,126 | |

| CIFC Funding 2019-III, Ltd., Series 2019-3A(b) | | N/A | | Estimated yield of 13.21% | | 07/16/2032 | | | 750,000 | | | | 623,918 | |

| Dryden 34 Senior Loan Fund, Series 2014-34A(b) | | N/A | | Estimated yield of 0.00% | | 10/15/2026 | | | 5,000,000 | | | | 29,000 | |

| Madison Park Funding XVIII, Ltd., Series 2015-18A(b) | | N/A | | Estimated yield of 6.80% | | 10/21/2030 | | | 4,000,000 | | | | 2,871,452 | |

| Oak Hill Credit Partners X-R, Ltd., Series 2014-10RA(b) | | N/A | | Estimated yield of 17.21% | | 12/20/2030 | | | 4,800,000 | | | | 1,911,432 | |

| OHA Credit Partners XI, Ltd., Series 2015-11A(b) | | N/A | | Estimated yield of 17.43% | | 01/20/2032 | | | 2,750,000 | | | | 1,972,960 | |

| Sound Point CLO III, Ltd., Series 2017-3A(b) | | N/A | | Estimated yield of 18.25% | | 10/20/2030 | | | 1,500,000 | | | | 1,108,953 | |

| Sound Point CLO III-R, Ltd., Series 2013-2RA(b) | | N/A | | Estimated yield of 17.34% | | 04/15/2029 | | | 1,000,000 | | | | 379,271 | |

| Sound Point CLO VI-R, Ltd., Series 2014-2RA(b) | | N/A | | Estimated yield of 19.05% | | 10/20/2031 | | | 2,000,000 | | | | 703,986 | |

| Thacher Park CLO, Ltd., Series 2014-1A(b) | | N/A | | Estimated yield of 0.00% | | 10/20/2026 | | | 6,000,000 | | | | 1,197,240 | |

See Notes to Financial Statements.

| Annual Report | September 30, 2019 | 15 |

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Schedule of Investments |

September 30, 2019

| | | Coupon(a) | | Reference Rate & Spread | | Maturity Date | | Principal Amount | | | Value | |

| CLO EQUITY(g)(h) (continued) | | | | | | | | | | | | | | |

| THL Credit Wind River 2016-1 CLO, Ltd., Series 2016-1A(b) | | N/A | | Estimated yield of 21.92% | | 07/15/2028 | | $ | 4,000,000 | | | $ | 2,454,752 | |

| THL Credit Wind River 2018-2 CLO, Ltd., Series 2018-2A(b) | | N/A | | Estimated yield of 14.76% | | 07/15/2030 | | | 2,500,000 | | | | 2,050,370 | |

| THL Credit Wind River 2018-3 CLO, Ltd., Series 2018-3A(b) | | N/A | | Estimated yield of 16.24% | | 01/20/2031 | | | 3,000,000 | | | | 2,652,084 | |

| Total CLO Equity (Cost $45,660,130) | | | | | | | | $ | 68,581,000 | | | $ | 39,666,744 | |

| | | Shares | | | | |

| MONEY MARKET MUTUAL FUNDS - 8.10%*(5.17% of Total Investments) | | | | | | | | |

| Invesco Short Term Investments Trust Treasury Portfolio, Institutional Class | | | | | | | | |

| (1.779% 7-Day Yield) | | | 6,377,104 | | | | 6,377,104 | |

| Total Money Market Mutual Funds (Cost $6,377,104) | | $ | 6,377,104 | | | $ | 6,377,104 | |

| | | | | | | | | |

| Total Investments - 156.79% (Cost $133,978,977) | | | | | | $ | 123,408,663 | |

| Liabilities in Excess of Other Assets - (7.32)% | | | | | | | (5,761,035 | ) |

| Leverage Facility (Net of $24,570 Deferred Leverage Costs) - (49.47)% | | | | | | | (38,940,430 | ) |

| Net Assets - 100.00% | | | | | | $ | 78,707,198 | |

| * | Amounts above are shown as a percentage of net assets as of September 30, 2019. |

| (a) | The rate shown is the coupon as of the end of the reporting period. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Total market value of Rule 144A securities amounts to $57,143,689, which represents approximately 72.60% of net assets as of September 30, 2019. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. |

| (c) | Variable rate investment. Interest rates reset periodically. Interest rate shown reflects the rate in effect at September 30, 2019. For securities based on a published reference rate and spread, the reference rate and spread are indicated in the description above. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| (d) | All or a portion of this position has not settled as of the period end. The interest rate shown represents the stated spread over the London Interbank Offered Rate ("LIBOR" or "L") or the applicable LIBOR floor; the Trust will not accrue interest until the settlement date, at which point LIBOR will be established. The total cost of securities purchased on a when issued or delivery delayed basis was $6,425,887 as of September 30, 2019. |

| (e) | This investment has an unfunded commitment as of September 30, 2019. For further details, see Note 8. |

| (f) | Issuer was in default and is non-income producing. Partial or no payments were paid on the last payment date. The aggregate value of these securities represented 0.61% of the Trust’s net assets. |

| (g) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. See also Note 2 to the Financial Statements for additional information. |

| (h) | CLO subordinated notes are considered CLO equity positions. CLO equity positions are entitled to recurring distributions which are generally equal to the remaining cash flow of payments made by underlying securities less contractual payments to debt holders and fund expenses. The effective yield is estimated based upon the current projection of the amount and timing of these recurring distributions in addition to the estimated amount of terminal principal payment. Effective yields for the CLO equity positions are updated generally once a quarter or on a transaction such as an add-on purchase, refinancing or reset. The estimated yield and investment cost may ultimately not be realized. |

All securities held as of September 30, 2019 are pledged as collateral for the leverage facility.

See Notes to Financial Statements.

| XAI Octagon Floating Rate & | |

| Alternative Income Term Trust | Statement of Assets and Liabilities |

September 30, 2019

| ASSETS: | | | |

| Investments, at value (Cost $133,978,977) | | $ | 123,408,663 | |

| Cash | | | 459,879 | |

| Receivable for investment securities sold | | | 6,323,963 | |

| Interest receivable | | | 648,428 | |

| Receivable for fund shares sold | | | 121,736 | |

| Deferred offering costs, net (Note 5) | | | 137,024 | |

| Prepaid expenses and other assets | | | 4,095 | |

| Total Assets | | | 131,103,788 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for professional fees | | | 115,647 | |

| Payable to transfer agent | | | 7,730 | |

| Payable for investor support services fees (Note 3) | | | 19,450 | |

| Payable for printing | | | 5,315 | |

| Payable for custodian fees | | | 5,405 | |

| Payable for investment securities purchased | | | 12,293,798 | |

| Leverage facility (Net of $24,570 deferred leverage costs) (Note 6) | | | 38,940,430 | |

| Interest due on leverage facility (Note 6) | | | 102,339 | |