- VICI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

VICI Properties (VICI) DEF 14ADefinitive proxy

Filed: 21 Jun 18, 8:22am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

VICI PROPERTIES INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

PROXY STATEMENT AND

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| 430 Park Avenue, 8th Floor New York, New York 10022 Telephone (646)949-4631 |

June 21, 2018

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of VICI Properties Inc. on Tuesday, July 31, 2018, at 10:00 a.m., Eastern Time, at the InterContinental New York Barclay Hotel, 111 East 48th Street, New York, NY 10017.

Your Board of Directors is unanimously recommending a highly qualified, experienced, diverse and actively engaged slate of nominees for election to the Board of Directors at the Annual Meeting. Your Board’s nominees are James R. Abrahamson, Diana F. Cantor, Eugene I. Davis, Eric L. Hausler, Elizabeth I. Holland, Craig Macnab, Edward B. Pitoniak and Michael D. Rumbolz. Your Board brings executive and financial leadership, a wide range of complementary skills and backgrounds relevant to the company’s industry, strategy and commitment to stockholder value and diversity.

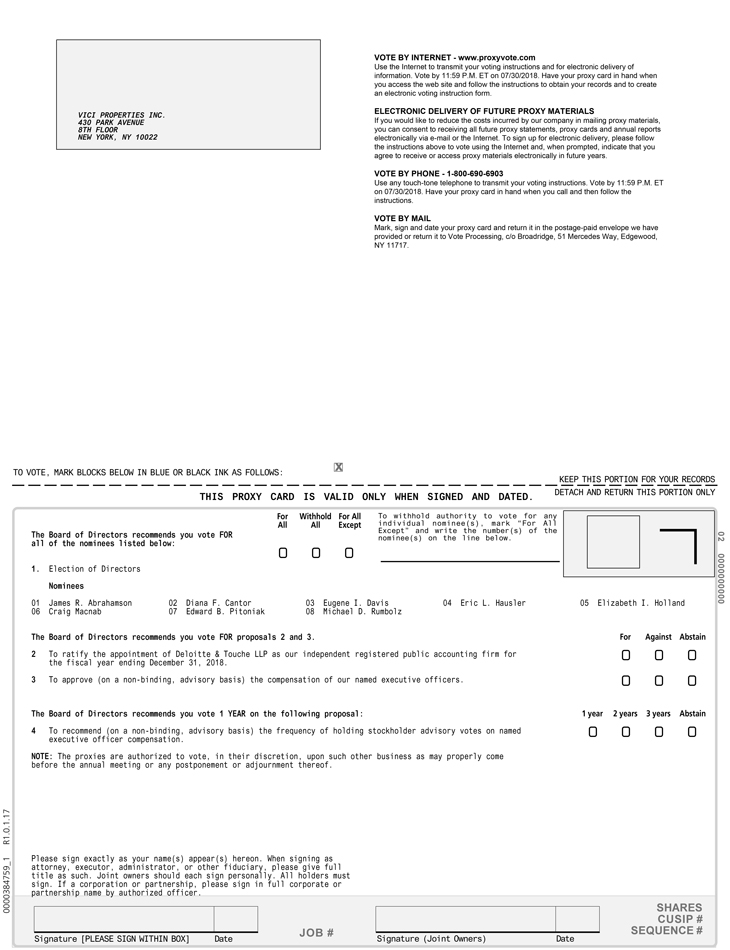

At the Annual Meeting, you will be asked to: (i) elect the eight members named in the accompanying proxy statement to serve on our Board of Directors; (ii) ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; (iii) approve (on anon-binding, advisory basis) the compensation of our named executive officers; (iv) recommend (on anon-binding, advisory basis) the frequency of holding stockholder advisory votes on named executive officer compensation; and (v) transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. The accompanying proxy statement provides a detailed description of these proposals and instructions on how to vote your shares.

Your vote is very important. Whether or not you plan to attend the meeting, please vote as soon as possible. Instructions on how to vote are contained in the proxy statement.

On behalf of the Board of Directors and our employees, we thank you for your continued interest in and support of our company. We look forward to seeing you at the meeting.

Sincerely,

Edward B. Pitoniak

Chief Executive Officer

| 430 Park Avenue, 8th Floor New York, New York 10022 Telephone (646)949-4631 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 31, 2018

To Our Stockholders:

You are cordially invited to attend the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of VICI Properties Inc., which will be held as follows:

| Date: | Tuesday, July 31, 2018 | |

| Time: | 10:00 a.m., Eastern Time | |

| Place: | InterContinental New York Barclay Hotel, 111 East 48th Street, New York, NY 10017 | |

| Items of Business: | 1. To elect the eight director nominees named in the accompanying proxy statement to serve on our board of directors until the next annual meeting of stockholders or until their successors are elected and qualified.

2. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018.

3. To approve (on anon-binding, advisory basis) the compensation of our named executive officers.

4. To recommend (on anon-binding, advisory basis) the frequency of holding stockholder advisory votes on named executive officer compensation.

5. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. | |

| Record Date: | Stockholders of record as of the close of business on June 1, 2018 are entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof. | |

| Proxy Voting: | Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares now as instructed in the proxy statement. If you attend the Annual Meeting, you may revoke your proxy and vote in person. Your proxy is revocable in accordance with the procedures set forth in this proxy statement. | |

This Notice of Annual Meeting and the accompanying proxy statement are first being made available to our stockholders on or about June 21, 2018.

By Order of the Board of Directors,

Samantha Sacks Gallagher

Executive Vice President, General Counsel

and Secretary

New York, New York

June 21, 2018

VOTING CAN BE COMPLETED IN ONE OF FOUR WAYS: | ||||||

| VIA THE INTERNET Go to the website address shown on your Proxy Card or Voting Instruction Form |  | BY MAIL Mark, sign, date and return the enclosed Proxy Card or Voting Instruction Form in the postage-paid envelope | |||

| BY TELEPHONE Use the toll-free number shown on your Proxy Card or Voting Instruction Form and follow the recorded instructions

|  | IN PERSON Vote at the annual meeting in New York, NY (if you are a record holder) | |||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON July 31, 2018. The accompanying proxy statementand our 2017 Annual Report are available athttp://investors.viciproperties.com/investors/Annual-Meeting.In addition, our stockholders may access this information, as well as submit their voting instructions, atwww.proxyvote.comby having their proxy card and related instructions in hand.

| Page | ||||

| 1 | ||||

| 6 | ||||

| 10 | ||||

| 10 | ||||

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 15 | |||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 22 | ||||

Director Attendance at Meetings of the Board and its Committees and Annual Meetings of Stockholders | 22 | |||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 27 | ||||

| 28 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 29 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

Employment and Post-Termination Arrangements of Executive Officers | 33 | |||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| 37 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

PROPOSAL 3:NON-BINDING, ADVISORY VOTE TO APPROVE THE COMPENSATION OF NAMED EXECUTIVE OFFICERS | 45 | |||

| 46 | ||||

| 47 | ||||

| 48 | ||||

Pre-Approval Policies and Procedures of our Audit & Finance Committee | 48 | |||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

i

VICI PROPERTIES INC.

430 Park Avenue, 8th Floor

New York, New York 10022

PROXY STATEMENT

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

GENERAL

VICI Properties Inc. (“VICI,” the “Company,” “we,” “us” and “our”) is using the Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish their proxy materials over the Internet. As a result, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials (the “Notice of Availability”) instead of a paper copy of the proxy materials (including the proxy card (the “Proxy Card”), this proxy statement (the “Proxy Statement”) and our 2017 Annual Report on or about June 21, 2018. We also provided access to our proxy materials over the Internet beginning on that date. The Notice of Availability contained instructions on how to access this Proxy Statement and the 2017 Annual Report and how to vote online or by toll-free number. Subsequent to receiving the Notice of Availability, all stockholders have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy materials by mail. Additionally, stockholders can access a copy of the proxy materials atwww.proxyvote.com.

Our Board of Directors (the “Board”) is soliciting proxies to be voted at the 2018 Annual Meeting of Stockholders (the “Annual Meeting”). The Proxy Statement provides the information stockholders need to know to vote by proxy or in person at the annual meeting. Stockholders do not need to attend the annual meeting in person in order to vote. If, at the close of business on June 1, 2018, you were a stockholder of record or held shares through a broker, bank or other nominee, you may vote your shares by proxy via the Internet, by telephone or by mail. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions.

ANNUAL MEETING OF STOCKHOLDERS

Meeting Date: | Tuesday, July 31, 2018 | |

Meeting Time: | 10:00 a.m. (ET) | |

Meeting Location: | InterContinental New York Barclay Hotel 111 East 48th Street, New York, NY 10017 | |

Record Date: | June 1, 2018 | |

Number of Shares of Common Stock Outstanding and Eligible to Vote at the Annual Meeting as of the Record Date: | 370,149,856 shares of common stock |

1

VOTING MATTERS

| Voting Matter | Board Vote Recommendation | Page Reference For More Information | ||||||

Item 1 — Election of Directors | FOR each nominee | 10 | ||||||

Item 2 — Ratification of Independent Registered Public Accounting Firm | FOR | 15 | ||||||

Item 3 — Advisory Vote on Named Executive Officer Compensation | FOR | 45 | ||||||

Item 4 — Advisory Vote on Frequency of Holding Advisory Votes on Named Executive Officer Compensation (“Say-on-Frequency”) | Every one (1) year | 46 | ||||||

BUSINESS HIGHLIGHTS

2017 was an exciting beginning for VICI. On October 6, 2017, in connection with the bankruptcy and related restructuring of Caesars Entertainment Operating Company, Inc. (“CEOC”) and its subsidiaries, we completed ourspin-off and emerged from CEOC to become one of the largest REIT owners of gaming, hospitality and entertainment destinations. Throughout the fourth quarter of 2017, we went to work and undertook several transformative transactions designed to improve our leverage, reduce our interest expense and to expand our portfolio of leading gaming assets and strengthen our relationship with our tenant in Caesars Entertainment Corporation (“Caesars”). We successfully raised $2.6 billion in debt financing at an interest rate of LIBOR + 225 and, with the help of our foundational investors, we executed a $1.0 billion equity private placement, the collective proceeds of which we used to refinance $1.6 billion of first lien term loan debt, to repurchase $300 million of first priority notes and to redeem $400 million of mezzanine debt. In addition, we consummated the $1.1 billion acquisition of Harrah’s Las Vegas from an affiliate of Caesars and, in connection with this acquisition, sold certain adjacent undeveloped land to an affiliate of Caesars for $73.6 million and the right to acquire ato-be-developed convention center in the future.

For more information on our 2017 results and other related financial measures, see our 2017 Annual Report.

ACCOMPLISHMENTS SINCE OUR FORMATION IN 2017

| DEBT CAPITAL | EQUITY CAPITAL | GROWTH | ||

REFINANCED SUBSTANTIAL PORTION OF OUR DEBT, GREATLY REDUCING INTEREST EXPENSE

LEVERAGE REDUCED DRAMATICALLY TO 4.6X, BRINGING ITIN-LINE WITH PEERS | COMPLETED $1.0 BILLION EQUITY PRIVATE PLACEMENT, WITH PROCEEDS USED TO FUND A LARGE, ACCRETIVE ACQUISITION

COMPLETED $1.4 BILLION UPSIZED IPO WITH OVER- ALLOTMENT EXERCISE | ACQUIRED HARRAH’S LAS VEGAS FOR $1.14 BILLION AT A CAP RATE OF 7.7%

RECEIVEDPUT-CALL OPTION ON CONVENTION CENTER AND CENTAUR REAL ESTATE ROFR

ENTERED INTO AN LOI ON OCTAVIUS TOWER AND HARRAH’S PHILADELPHIA AT A NET CAP RATE OF 9.5% | ||

2018 has been a highly successful year thus far. In February 2018, we completed our $1.4 billion initial public offering, the proceeds of which we used to repay over $600 million of our existing indebtedness and further reduce our leverage, while retaining the balance of the proceeds as cash on hand, which we intend to use to continue to pursue accretive acquisitions. In connection with the initial public offering, the interest rate on our December 2017 debt financing stepped down to LIBOR + 200. In May 2018, we announced our intention to purchase from an affiliate of Caesars the Octavius Tower at Caesars Palace and Harrah’s Philadelphia, as well as to make certain modifications to our existing leases in connection with these acquisitions, trading uncertainty for

2

certainty. In addition, we paid apro-rated quarterly cash dividend of $0.16 per share of common stock for the period from February 5, 2018 to March 31, 2018, and on June 14, 2018, we declared a quarterly cash dividend of $0.2625 per share of common stock for the second quarter of 2018 payable on July 13, 2018 to stockholders of record as of the close of business on June 28, 2018.

We look forward to continuing to execute on all facets of our exciting business strategy and, in doing so, believe we will continue to be successful in delivering long-term value and strong total returns to our stockholders.

BOARD OF DIRECTORS NOMINEES AND COMMITTEES

| Name | Independent | Committee Membership | Other Public Company Boards | |||

Edward B. Pitoniak | No | — | 1 | |||

James R. Abrahamson | Yes | Chairman of the Board of Directors | 1 | |||

Diana F. Cantor | Yes | Audit & Finance Committee, Nominating and Governance Committee | 2 | |||

Eugene I. Davis | Yes | Audit & Finance Committee (Chair), Compensation Committee | 2(1) | |||

Eric L. Hausler | Yes | Nominating and Governance Committee (Chair), Audit & Finance Committee | 0 | |||

Elizabeth I. Holland | Yes | Audit & Finance Committee, Compensation Committee | 1 | |||

Craig Macnab | Yes | Compensation Committee (Chair), Nominating and Governance Committee | 1 | |||

Michael D. Rumbolz | Yes | Compensation Committee, Nominating and Governance Committee | 2 |

(1) Mr. Davis currently serves on the boards of directors of two public companies listed on the New York Stock Exchange (the “NYSE”), Verso Corporation and Titan Energy, LLC. Mr. Davis also currently serves on the board of directors of one public company listed on the Australian Securities Exchange, Atlas Iron Limited. Atlas Iron Limited has executed definitive documentation to be acquired by Mineral Resources. Mr. Davis does not intend to serve on the board of Atlas Iron Limited after the consummation of the acquisition by Mineral Resources.

3

SNAPSHOT OF BOARD, GOVERNANCE & COMPENSATION INFORMATION

Number of Independent Directors Standing for Election | 7 | |||

Total Number of Directors Nominees | 8 | |||

Average Age of Directors Standing for Election | 59 | |||

Separate Chairman and Chief Executive Officer | Yes | |||

Independent Chairman | Yes | |||

Annual Election of All Directors | Yes | |||

Majority Voting for Directors | Yes | |||

Regular Executive Sessions of Independent Directors | Yes | |||

Annual Board and Committee Self-Evaluations | Yes | |||

Stock Ownership Requirements for Directors | Yes | |||

Stock Holding Requirements for CEO and Other Executives | Yes | |||

Anti-Hedging, Anti-Short Sale and Anti-Pledging Policies | Yes | |||

Clawback Policy | Yes | |||

“Double-Trigger” forChange-in-Control Severance Payments | Yes | |||

Excise TaxGross-Up Provisions | No | |||

Repricing of Underwater Options or Share Appreciation Rights | No | |||

Excess Perquisites | No | |||

Undue Restrictions on Stockholder Right to Amend Bylaws | No |

4

EXECUTIVE COMPENSATION HIGHLIGHTS

The following is an overview of the highlights of our compensation structure, and the fundamental compensation policies and practices we do and do not use.

| WHAT WE DO | WHAT WE DON’T DO | |

✓ Align the interests of our executives and stockholders through the use of performance-based annual cash incentive compensation and service and performance-based long-term equity incentive compensation. | ✗ No excise taxgross-ups upon a change in control. | |

✓ Double-Trigger Severance Payments – a “change in control” by itself is not sufficient to trigger severance payments, it must also be accompanied by a qualifying termination. | ✗ No pledging or hedging activities by our executives and directors. | |

✓ We have a clawback policy regarding the recoupment of incentive compensation if an executive officer willfully committed an illegal act, fraud, intentional misconduct or gross recklessness that caused a mandatory restatement of our financials. | ✗ We do not maintain any defined benefit or supplemental retirement plans.

✗ No perquisites or other personal benefits to executive officers that are not available to all employees. | |

✓ Maintain director stock ownership policy. | ✗ We do not pay dividends on unvested equity awardsuntil, and only to the extent, those awards vest. | |

✓ Provide for meaningful stock ownership for executive officers through a combination of vesting and/or post-vesting transfer restrictions on equity grants. | ✗ We do not allow for repricing or buyouts of underwater options or stock appreciation rights. | |

✓ Engage an independent compensation consultant to review and provide recommendations regarding our executive compensation program. | ✗ No plan design features that encourage excessive or imprudent risk taking. | |

5

Why am I receiving this Proxy Statement?

This Proxy Statement is furnished in connection with the solicitation of proxies for use at the Annual Meeting to be held for the purposes stated in the accompanying Notice of Annual Meeting of Stockholders. This solicitation is made by VICI on behalf of our board of directors (the “Board of Directors”). This Proxy Statement, the enclosed Proxy Card and our 2017 Annual Report are first being mailed to stockholders beginning on or about June 21, 2018.

What am I being asked to vote on, and what are the Board of Directors’ voting recommendations?

| Proposal | Proposal Description | Board of Directors’ Voting Recommendation | ||

Proposal 1: Election of Directors | The election of eight directors to our Board of Directors, each for a term expiring at the 2019 annual meeting of stockholders or until their successors are elected and qualified | “FOR” | ||

Proposal 2: Ratification of Appointment of Deloitte & Touche LLP | The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 | “FOR” | ||

Proposal 3: Advisory Vote on Executive Compensation | The approval (on anon-binding, advisory basis) of the compensation of our named executive officers | “FOR” | ||

Proposal 4: Advisory Vote on Frequency of Holding Advisory Votes on Executive Compensation | The recommendation (on anon-binding, advisory basis) of the frequency of holding advisory votes on named executive officer compensation | “EVERY YEAR” |

Will any other matters be voted on?

The proposals set forth in this Proxy Statement constitute the only business that the Board of Directors intends to present at the Annual Meeting. The proxy does, however, confer discretionary authority upon the persons designated as proxy holders on the Proxy Card, or their substitutes, to vote on any other business that may properly come before the meeting.

Who is entitled to vote at the Annual Meeting?

Only holders of record of our common stock, or their duly appointed proxies, as of the close of business on June 1, 2018, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting and all adjournments or postponements thereof. Our common stock constitutes the only class of securities entitled to vote at the meeting.

What are the voting rights of stockholders?

Each share of common stock outstanding on the record date entitles its holder to cast one vote on each matter to be voted on at the Annual Meeting.

Who can attend the Annual Meeting?

All holders of our common stock at the close of business on June 1, 2018, the record date for the Annual Meeting, or their duly appointed proxies, are authorized to attend the Annual Meeting. Admission to the meeting will be on a first-come, first-served basis. If you attend the meeting, you may be asked to present valid photo

6

identification, such as a driver’s license or passport, before being admitted. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Please also note that if you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), you will need to bring a copy of the brokerage statement reflecting your share ownership as of June 1, 2018.

What will constitute a quorum at the Annual Meeting?

The presence in person or by proxy of a majority of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting as of June 1, 2018 will constitute a quorum, permitting the stockholders to conduct business at the Annual Meeting. As of the June 1, 2018 record date, there were 370,149,856 shares of common stock outstanding. If you have returned valid proxy instructions or if you hold your shares of common stock in your own name as a holder of record and attend the Annual Meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. We will include abstentions and brokernon-votes in the calculation of the number of shares of common stock considered to be present at the meeting for purposes of determining the presence of a quorum at the meeting. If a quorum is not present, the Annual Meeting may be adjourned from time to time to a date not more than 120 days after June 1, 2018, by the vote of a majority of the shares of common stock represented at the Annual Meeting in person or by proxy until a quorum has been obtained.

How do I vote?

Voting in Person at the Annual Meeting. If you are a stockholder of record and attend the Annual Meeting, you may vote in person at the meeting. If you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), and you wish to vote in person at the Annual Meeting, you will need to bring a copy of the brokerage statement reflecting your share ownership as of June 1, 2018 and obtain a “legal proxy” from the bank, broker or other nominee that holds your common shares of record.

Voting by Proxy for Shares Registered Directly in the Name of the Stockholder. If you are a stockholder of record, you may instruct the proxy holders named in the Proxy Card how to vote your shares of common stock in one of the following ways:

| ● | Vote by Internet.In order to vote on the Internet, you must go to www.proxyvote.com, have your Notice of Availability, Proxy Card or voting instruction form in hand and follow the instructions.If you vote via the Internet, you do not need to return your Proxy Card. |

| ● | Vote by Phone.In order to vote by telephone, you must call the toll-free number listed on your Notice of Availability and/or Proxy Card, have your Notice of Availability, Proxy Card or voting instruction form in hand and follow the instructions.If you vote by telephone, you do not need to return your Proxy Card. |

| ● | Vote by Mail.To vote by mail, if you have not already received one, you may request a Proxy Card from us as instructed in the Notice of Availability and sign, date and mail the Proxy Card in the postage-paid envelope provided. Properly signed and returned proxies will be voted in accordance with the instructions contained therein. |

Voting by Proxy for Shares Held in Street Name. If you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), then you should follow the instructions provided to you by your broker, bank or other nominee.

How many votes are required for the proposals to be approved?

Proposal 1(Election of Directors). Under our bylaws, to be elected in an uncontested election, director nominees must receive the affirmative vote of a majority of the votes cast, which means that the number of

7

shares of common stock voted for a nominee must exceed the number of shares of common stock voted against that nominee. For purposes of the election of directors, abstentions and brokernon-votes (described below) will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

If an incumbent director fails to bere-elected by a majority of votes cast, that director is required under our bylaws to tender his or her resignation to the Board of Directors. Any such resignation will take effect immediately upon its receipt. The Nominating and Governance Committee will consider promptly whether to fill the office of the nominee who has tendered a resignation and make a recommendation to the Board of Directors about filling the vacancy. The Board of Directors is required to act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and its rationale within 90 days after the election results are certified.

Proposal 2 (Ratification of Appointment of Deloitte & Touche LLP). The affirmative vote of a majority of the votes cast is required for approval of the ratification of the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the year ending December 31, 2018, which is considered a routine matter (as discussed below). For purposes of the vote on this proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Proposal 3 (Advisory Vote on Executive Compensation). The affirmative vote of a majority of the votes cast is required for approval (on anon-binding advisory basis) of named executive officer compensation, commonly referred to as“Say-on-Pay.” For purposes of the vote on this proposal, abstentions and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Proposal 4 (Advisory Vote on Frequency of Holding Advisory Votes on Executive Compensation). The affirmative vote of a majority of the votes cast is required for approval (on anon-binding advisory basis) of the frequency of holding a“Say-on-Pay” vote in the future. Since stockholders have several voting choices for this proposal, it is possible that no single choice will receive a majority of the votes cast. The option (every year, two years or three years) that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected, on anon-binding advisory basis, by the stockholders. For purposes of the vote on this proposal, abstentions and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

What are brokernon-votes?

Brokernon-votes occur when nominees, such as banks and brokers holding shares in “street” name on behalf of beneficial owners, do not receive voting instructions from the beneficial owners at least ten days before the Annual Meeting. If that happens, the nominees may vote those shares of common stock only on matters deemed “routine” by the NYSE, the exchange on which our shares of common stock are listed. Onnon-routine matters, nominees holding shares for a beneficial owner cannot vote without instructions from the beneficial owner, resulting in aso-called “brokernon-vote.”

Proposal 2 (Ratification of Appointment of Deloitte) is the only proposal that is considered “routine” under the NYSE rules. Accordingly, no brokernon-votes will arise in the context of voting for the ratification of the appointment of Deloitte as our independent registered public accounting firm for our fiscal year ending December 31, 2018, and the broker is permitted to vote your shares on such ratification even if the broker does not receive voting instructions from you.

However, brokernon-votes may arise in the context of Proposals 1, 3 and 4 (Election of Directors, Advisory Vote on Executive Compensation and Advisory Vote on Frequency of Holding Advisory Votes on Executive Compensation, respectively) because such proposals are considerednon-routine matters under the

8

NYSE rules. Consequently, if you do not give your broker specific voting instructions, your broker will not be able to vote on any of these proposals.

How are the Proxy Card votes counted?

If the accompanying Proxy Card is properly completed, signed and returned to us, and not subsequently revoked, it will be voted as directed by you. If the Proxy Card is submitted, but voting instructions are not provided, the proxy will be voted (i)“FOR” each of the director nominees, (ii)“FOR” the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the year ending December 31, 2018, (iii)“FOR” approval, on anon-binding advisory basis, of the compensation of the Company’s named executive officers, (iv)“EVERY YEAR”for the advisory vote on the frequency of holding stockholder advisory votes on named executive officer compensation, and (v) as recommended by our Board of Directors with regard to any other matters that may properly come before the Annual Meeting, or, if no such recommendation is given, in the discretion of the proxy holders.

May I change my vote after I submit my Proxy Card?

Yes. You may revoke a previously granted proxy at any time before it is exercised by any of the following actions:

| ● | notifying our Secretary in writing that you would like to revoke your proxy; |

| ● | completing a Proxy Card on the Internet, by telephone or by mail with a later date at or before our Annual Meeting; or |

| ● | attending our Annual Meeting and voting in person. |

If your shares of common stock are held on your behalf by a broker, bank or other nominee, you must contact them to receive instructions as to how you may revoke your proxy instructions.

Who pays the costs of soliciting proxies?

We will pay the cost of solicitation of proxies. In addition to the solicitation of proxies through the Internet or by mail, our directors, officers and employees may also solicit proxies in person, by telephone, electronically, by mail or other means, but they will not be specifically compensated for these services. We will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to, and obtain proxies from, such beneficial owners.

We have retained D.F. King & Co., Inc. to provide services as proxy solicitor in connection with this Proxy Statement. We expect that such services, including fees and expenses, will be in the aggregate amount of approximately $11,500.

What should I do if I received more than one Notice of Availability?

There are circumstances under which you may receive more than one Notice of Availability. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each such brokerage account. In addition, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Notice of Availability. Please authorize your proxy in accordance with the instructions of each Notice of Availability separately, since each one represents different shares that you own.

You should rely only on the information provided in this Proxy Statement. No person is authorized to give any information or to make any representation not contained in this Proxy Statement and, if given or made, you should not rely on that information or representation as having been authorized by us. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

9

Our Board of Directors currently consists of eight members, all of whom have terms expiring at the Annual Meeting or until his or her earlier death, resignation, removal or a determination by the Board of Directors that such director no longer has the qualifications that were required by the Company’s charter or bylaws.

At the Annual Meeting, stockholders will be asked to elect each of the director nominees to serve until the 2019 annual meeting of stockholders or until their successors are duly elected and qualified. Our Board of Directors, upon the recommendation of our Nominating and Governance Committee, has nominated James R. Abrahamson, Diana F. Cantor, Eugene I. Davis, Eric L. Hausler, Elizabeth I. Holland, Craig Macnab, Edward B. Pitoniak and Michael D. Rumbolz to serve as directors. Each of the nominated persons currently serves as a member of the Board of Directors and has consented to being named in this Proxy Statement and to serve as a director, if elected. Each of Messrs. Abrahamson, Davis, Hausler, Macnab and Pitoniak have served as directors since October 6, 2017, the effective date of the Third Amended Joint Plan of Reorganization of Caesars Entertainment Operating Company, Inc., et al. (the “Plan of Reorganization”) and the formation date of the Company (the “Formation Date”). If any nominee is unavailable for election or service, the Board of Directors may designate a substitute nominee and the persons designated as proxy holders on the Proxy Card will vote for the substitute nominee recommended by the Board of Directors.

We believe that each of our director nominees has the specific experience, qualifications, attributes, and skills necessary to serve as an effective director on our Board of Directors. A description of our process for identifying and evaluating director nominees, as well as our criteria for membership on our Board of Directors, is set forth under the heading “Corporate Governance and Board of Directors Matters—Consideration of Director Candidates.”

Nominees for Election as Directors

The following table and biographical descriptions set forth certain information with respect to each nominee for election as a director at the Annual Meeting. The biographical information includes the specific experience, qualifications, attributes and skills that led to the conclusion by our Board of Directors that such person should serve as a director.

| Name | Age | Position | Committee | |||||

James R. Abrahamson | 62 | Chair of the Board of Directors and Independent Director | — | |||||

Diana F. Cantor | 60 | Independent Director | Audit & Finance Committee Nominating and Governance Committee | |||||

Eugene I. Davis | 63 | Independent Director | Audit & Finance Committee (Chair) Compensation Committee | |||||

Eric L. Hausler | 48 | Independent Director | Nominating and Governance Committee (Chair) Audit & Finance Committee | |||||

Elizabeth I. Holland | 52 | Independent Director | Audit & Finance Committee Compensation Committee | |||||

Craig Macnab | 62 | Independent Director | Compensation Committee (Chair) Nominating and Governance Committee | |||||

Edward B. Pitoniak | 62 | Chief Executive Officer and Director | — | |||||

Michael D. Rumbolz | 64 | Independent Director | Compensation Committee Nominating and Governance Committee | |||||

10

James R. Abrahamson, Age 62 Director Since: Formation Date; Chairman of the Board of Directors Experience, Qualifications, Attributes and Skills: Mr. Abrahamson’s vast experience in, and knowledge of, the hospitality industry provides our Board of Directors with valuable insight into the industry. Skills gained from extensive previous and current board service in public and private companies are also valuable for our Company and our Board of Directors. |

Mr. Abrahamsonis Chairman of Interstate Hotels & Resorts (“Interstate”), the leading U.S.-based global hotel management company comprising over 500 hotels. He previously served as Interstate’s Chief Executive Officer from 2011 to March 2017; he was named to the additional position of Chairman in October 2016. Mr. Abrahamson served as an independent director at La Quinta Holdings, Inc. (NYSE: LQ) from November 2015 to May 2018, and has served as a director of CorePoint Lodging (NYSE:CPLG), a REIT comprised of over 300 hotels, since it was spun out of La Quinta Holdings, Inc. at the end of May 2018. Mr. Abrahamson is also an independent director at BrightView Corporation (a private company). Prior to joining Interstate in 2011, Mr. Abrahamson also held senior leadership positions with InterContinental Hotels Group (NYSE: IHG), Hyatt Corporation, Marcus Corporation and Hilton Worldwide. At IHG, where he served from 2009 to 2011, he served as President of the Americas division and, from 2010 to 2011, as executive director. At Hyatt, which he joined in 2004, he was Head of Development for the Americas division. At Marcus, where he served from 2000 to 2004, Mr. Abrahamson was President of the Baymont Inn and Suites and Woodfield Suites hotels division consisting of approximately 200 properties, both owned and franchised. At Hilton, where he served from 1988 to 2000, Mr. Abrahamson oversaw the Americas region franchise division for all Hilton brands and launched the Hilton Garden Inn brand. Mr. Abrahamson currently serves as president of the Marriott International National Association owners’ organization and has served as national board chair of the American Hotel and Lodging Association in 2015 and 2016 and as national board chair of the U.S. Travel Association in 2013 and 2014. He holds a degree in Business Administration from the University of Minnesota.

Diana F. Cantor, Age 60 Director Since: May 2018 Experience, Qualifications, Attributes and Skills: Ms. Cantor possesses extensive financial skills and brings to the Board of Directors an important financial perspective. Ms. Cantor also provides valuable consumer product and marketing knowledge, as well as significant public company directorship experience, making her qualified for service as a director of the Company. |

Ms. Cantor has served as a member of our Board of Directors since May 2018. Ms. Cantor is currently a partner with Alternative Investment Management, LLC, an independent, privately-held investment firm with a focus on private equity and hedge funds – a position she has held since January 2010. She is the Vice Chairman of the Virginia Retirement System, where she also serves on the Audit and Compliance Committee. Ms. Cantor was a Managing Director with New York Private Bank and Trust from January 2008 through the end of 2009. Ms. Cantor served as founding Executive Director of the Virginia College Savings Plan, the state’s 529 college savings program, from 1996 to January 2008. Ms. Cantor served seven years as Vice President of Richmond Resources, Ltd. from 1990 through 1996, and as Vice President of Goldman, Sachs & Co. from 1985 to 1990. Ms. Cantor is a Certified Public Accountant. Ms. Cantor has served on the Board of Directors of Domino’s Pizza, Inc. (NYSE: DPZ) since October 2005 and the Board of Directors of Universal Corporation (NYSE: UVV) since 2012, and continues to serve on both. She previously served on the Boards of Directors of Media General Inc., Revlon, Inc., Vistage International, Inc., Knowledge Universe Education LLC, Edelman Financial Services, LLC (previously The Edelman Financial Group Inc. (NASDAQ: EF)), and Service King Body and Paint LLC. Ms. Cantor earned a Juris Doctor degree from New York University School of Law, a Master of Business Administration degree from the University of Miami and a Bachelor of Science degree in Accounting from the University of Florida.

11

Eugene I. Davis, Age 63 Director Since: Formation Date Experience, Qualifications, Attributes and Skills: Mr. Davis’ deep knowledge of the management and operation of public companies and extensive service in public and private company boards in many industries, including in the casino, entertainment and real estate industries, and in particular with respect to companies emerging from bankruptcy, are valuable to our Board of Directors, specifically providing it with insight into the operation of a company following restructuring. |

Mr. Davis currently serves as the Chairman and Chief Executive Officer of PIRINATE Consulting Group, LLC, a privately held consulting firm specializing in turnaround management, merger and acquisition consulting, hostile and friendly takeovers, proxy contests and strategic planning advisory services for domestic and international public and private business entities. Since forming PIRINATE in 1997, Mr. Davis has advised, managed, sold, liquidated and served as a chief executive officer, chief restructuring officer, director, chairman or committee chairman of a number of businesses operating in diverse sectors. Mr. Davis currently serves as Chairman of the Board of Atlas Iron Limited, which has executed definitive documentation to be acquired by Mineral Resources, however, Mr. Davis does not intend to serve on the board of Atlas Iron Limited after the consummation of the acquisition by Mineral Resources. Mr. Davis also serves as aCo-Chairman of the Board of Verso Corporation and a director of Titan Energy, LLC, as well as certain private,non-SEC reporting companies. He was the President, Vice Chairman and a director of Emerson Radio Corporation, a consumer electronics company, from 1990 to 1997 and was the Chief Executive Officer and Vice Chairman of Sport Supply Group, Inc., a direct-mail marketer of sports equipment, from 1996 to 1997. Mr. Davis began his career in 1980 as an attorney and international negotiator with Exxon Corporation and Standard Oil Company (Indiana) and was in private practice from 1984 to 1998. During the past five years, Mr. Davis has been a director of the following public or formerly public companies: ALST Casino Holdco, LLC; Atlas Air Worldwide Holdings, Inc.; The Cash Store Financial Services, Inc.; Dex One Corp.; Genco Shipping & Trading Limited, Global Power Equipment Group, Inc.; Goodrich Petroleum Corp.; Great Elm Capital Corp.; GSI Group, Inc.; Hercules Offshore, Inc.; HRG Group, Inc.; Knology, Inc.; SeraCare Life Sciences, Inc.; Spansion, Inc.; Spectrum Brands Holdings, Inc.; U.S. Concrete, Inc. and WMIH Corp. Mr. Davis earned a Juris Doctor degree from Columbia University’s School of Law, a Master of International Affairs from Columbia University’s School of International and Public Affairs and a Bachelor of Arts from Columbia University.

Eric L. Hausler, Age 48 Director Since: Formation Date Experience, Qualifications, Attributes and Skills: Mr. Hausler’s extensive expertise leading companies in the gaming, entertainment and real estate industries, as well as his experience in the capital markets, regulatory and acquisitions and divestiture fields in these industries are valuable to the achievement of the Company’s business strategy. |

Mr. Hausler currently serves on the board of directors of The Alter Companies. Mr. Hauslerheld the position of Chief Executive Officer of Isle of Capri Casinos, Inc. (NYSE: ISLE), a developer, owner and operator of branded gaming facilities and related dining, lodging and entertainment facilities in regional markets in the United States, from April 2016 to May 2017. Prior to that, Mr. Hausler served as ISLE’s Chief Financial Officer from 2014 to 2016, as its Chief Strategic Officer from 2011 to 2014, and as its Senior Vice President, Strategic Initiatives from 2009 to 2011. Mr. Hausler retired from ISLE in May 2017 immediately following the company’s merger with Eldorado Resorts. From 2006 to 2009, Mr. Hausler served as Senior Vice President of Development for Trump Entertainment Resorts, Inc., which filed for Chapter 11 bankruptcy in February 2009. From 2005 to 2006, Mr. Hausler served as Managing Director in Fixed Income Research, covering the gaming, lodging and leisure industries for Bear Stearns & Co. Inc. From 2003 to 2005, Mr. Hausler was a Senior Equity Analyst for Susquehanna Financial Group covering the gaming industry. Mr. Hausler also held positions in equity research covering the gaming, lodging and leisure industries at Bear Stearns & Co. Inc. and Deutsche Bank Securities Inc. from 1999 to 2003. Prior to working in securities research, from 1996 to 1999, Mr. Hausler worked for the New Jersey Casino Control Commission. Mr. Hausler holds a Bachelor’s degree from Binghamton University and a Master’s degree from the New Jersey Institute of Technology.

12

Elizabeth I. Holland, Age 52 Director Since: January 2018 Experience, Qualifications, Attributes and Skills: Ms. Holland’s retail real estate expertise and experience as Chairman of ICSC provide valuable and complimentary skill sets to our Board of Directors. |

Ms. Holland is the Chief Executive Officer of Abbell Credit Corporation and Abbell Associates, LLC, a77-year-old private real estate acquisition, development and management company with a portfolio of shopping center, office and enclosed mall properties. She has held these roles since 1997. Prior to joining Abbell Associates, Ms. Holland was a senior staff attorney on the National Bankruptcy Review where she was a member of a Congressional commission charged with making recommendations to Congress for bankruptcy code reform. Prior to that, she was a restructuring and business reorganization attorney at Skadden, Arps, Slate, Meagher & Flom LLP in New York City. Ms. Holland was also a fixed income portfolio manager. Ms. Holland is an independent trustee of Federal Realty Investment Trust, a leading shopping center REIT. She is an active member of the International Council of Shopping Centers (“ICSC”) serving as the organization’s Chairman from 2016 to 2017, Vice Chairman from 2015 to 2016, and currently serves on the Executive Board and the Board of Trustees. She is also a member of the Real Estate Roundtable and the Urban Land Institute and its CRC Blue Flight Council. Ms. Holland earned a Juris Doctor degree from Brooklyn Law School and a Bachelor of Arts degree from Hamilton College.

Craig Macnab, Age 62 Director Since: Formation Date Experience, Qualifications, Attributes and Skills: Mr. Macnab brings to our Company and Board of Directors extensive experience leading a publicly held REIT, as well as skills gained from vast public and private board experience. |

Mr. Macnab held the position of Chairman and Chief Executive Officer of National Retail Properties, Inc. (NYSE: NNN), a real estate investment trust that acquires, owns, invests in and develops properties that are leased primarily to retail tenants, since 2008 (with his service as Chief Executive Officer beginning in 2004). Mr. Macnab retired from NNN in April 2017. Mr. Macnab is an independent director of Cadillac Fairview Corporation (a private company), since 2011 and of American Tower Corporation (NYSE: AMT), since 2014 and served as a director of Eclipsys Corporation from 2008 to 2014. Mr. Macnab also served as a director of DDR Corp. (NYSE: DDR), a real estate investment trust, from 2003 to 2015. Mr. Macnab holds a Bachelor’s degree in Economics and Accounting from the University of the Witwatersrand and a Master of Business Administration from Drexel University.

Edward B. Pitoniak, Age 62 Director Since: Formation Date Experience, Qualifications, Attributes and Skills: Mr. Pitoniak provides our Board of Directors with valuable experience in the hospitality, entertainment and real estate industries and, in particular, with respect to publicly held REITs. Our Company and our Board of Directors also benefit from Mr. Pitoniak’s extensive previous and current board service. In addition, Mr. Pitoniak’s position as our Chief Executive Officer allows him to advise our Board of Directors on management’s perspective over a full range of issues affecting the Company. |

Mr. Pitoniak was appointed as our chief executive officer on the Formation Date. Mr. Pitoniak served as Vice Chairman of Realterm, a private equity real estate manager based in Annapolis, Maryland, that invests in logistics real estate, from January 2015 to July 2017. Mr. Pitoniak has served as an independent director on the board of directors of Ritchie Bros. Auctioneers Incorporated, a NYSE-listed global asset management and disposition company from July 2006 to the present. Mr. Pitoniak served as Managing Director, Acting Chief Executive Officer and Trustee of InnVest, a publicly listed REIT, from April 2014 to February 2015, where he was responsible for recapitalizing the REIT and transitioning its management function from an external, third-party management model, to an internal management model. He then served as Chairman and Trustee of InnVest from February 2015 to August 2016, when the REIT was sold and taken private. He also served as a director of Regal Lifestyle Communities (TSE: RLC), a Canadian seniors housing real estate owner and operator, from 2012

13

until its sale in 2015. Mr. Pitoniak retired in 2009 from the position of President and Chief Executive Officer and Director of bcIMC Hospitality Group, a hotel property and brand ownership entity (formerly a public income trust called Canadian Hotel Income Properties Real Estate Investment Trust (“CHIP”)), where he was employed from 2004 to 2009. As Chief Executive Officer of CHIP, he led the company to four consecutive years of total return leadership among Canadian hotel REITs, and then to a sale in 2007. Mr. Pitoniak was also a member of CHIP’s Board of Trustees before it went private. Prior to joining CHIP, Mr. Pitoniak was a Senior Vice-President at Intrawest Corporation, a ski and golf resort operator and developer, for nearly eight years. Before Intrawest, Mr. Pitoniak spent nine years with Times Mirror Magazines, where he served aseditor-in-chief and associate publisher with Ski Magazine. Mr. Pitoniak has a Bachelor of Arts degree from Amherst College.

Michael D. Rumbolz, Age 64 Director Since: Formation Date Experience, Qualifications, Attributes and Skills: Mr. Rumbolz’s experience in the highly regulated gaming industry, both as an operator and as a regulator, are of value to our Company and our Board of Directors. Our Company and our Board of Directors also benefit from Mr. Rumbolz’s extensive previous and current public and private board service. |

Mr. Rumbolz is Director, President and Chief Executive Officer of Everi Holdings Inc. (NYSE: EVRI), a developer of gaming products and services, Chairman of the Board of Directors of Employers Holding, Inc. (NYSE: EIG), and an independent director of Seminole Hard Rock Entertainment, LLC. Mr. Rumbolz served as Chairman and Chief Executive Officer of Cash Systems, Inc., a provider of cash access services to the gaming industry, from 2005 until 2008 when Cash Systems, Inc. was acquired by Everi. Mr. Rumbolz also has from time to time provided consulting services and held a number of public and private sector employment positions in the gaming industry, including serving as Member and Chairman of the Nevada Gaming Control Board from 1985 through 1988. Mr. Rumbolz was also the former Vice Chairman of the Board of Casino Data Systems until it was sold in 2001, was the President and CEO of Anchor Gaming from 1995 to 2000, was the director of Development for Circus Circus Enterprises (later Mandalay Bay Group) from 1992 to 1995, and was the President of Casino Windsor at the time of its opening in Windsor, Ontario in 1995. In addition, Mr. Rumbolz is the former Chief Deputy Attorney General of the State of Nevada. Mr. Rumbolz earned a Bachelor of Arts degree in political science from the University of Nevada – Las Vegas and a Juris Doctor degree from the University of Southern California.

There are no family relationships among any of our directors or executive officers.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH DIRECTOR NOMINEE SET FORTH ABOVE.

|

14

Our Audit & Finance Committee has appointed the accounting firm of Deloitte to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2018. Action by stockholders is not required by law, the NYSE or our organizational documents in the appointment of an independent registered public accounting firm, but this appointment is submitted by our Board of Directors for ratification as a matter of good corporate governance in order to give our stockholders a voice in the designation of auditors. If the appointment is not ratified by our stockholders, our Board of Directors will further consider its choice of Deloitte as our independent registered public accounting firm and may, but will not be required to, appoint a different independent registered public accounting firm. Deloitte has served as our independent registered public accounting firm since the Formation Date and is considered by our management to be well-qualified. Deloitte has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in our Company or any of our subsidiaries in any capacity.

For additional information regarding our independent registered public accounting firm, see “Principal Accountant Fees and Services” below.

A representative of Deloitte will be present at the Annual Meeting. The representative will have an opportunity to make a statement if he or she desires and will be available to respond to appropriate questions.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018.

|

15

We have structured our corporate governance in a manner that we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

| WHAT WE DO | WHAT WE DON’T DO | |

✓ 87.5% Independent Directors. Seven of our eight directors standing for election have been determined by us to be “independent” as defined by the NYSE listing standards. | ✗ No Classified Board.Our directors are elected annually forone-year terms. | |

✓ Independent Chairman.Our Chairman of the Board is an independent director, which strengthens the role of our independent directors and encourages independent Board leadership. | ✗ No Poison Pill.We do not have a “poison pill” or stockholder rights plan, and we shall seek stockholder approval prior to, or in certain circumstances within twelve months following, the adoption by our Board of Directors of a stockholder rights plan. | |

✓ Majority Voting for Directors.Directors are elected in uncontested elections by the affirmative vote of a majority of the votes cast. | ✗ Opted Out of Maryland Anti-Takeover Statutes.We have elected not to be subject to the Maryland Business Combination Statute and the Maryland Control Share Acquisition Statute, and any change to such elections must be approved by our stockholders. | |

✓ Entirely Independent Committees.All of the members of our Audit & Finance, Compensation and Nominating and Governance Committees are independent. | ✗ No Significant Related Party Transactions.We do not currently have any significant related party transactions. | |

✓ Audit Committee Financial Experts.All members of our Audit & Finance Committee qualify as an “audit committee financial expert” as defined by the SEC. | ✗ No Hedging of Our Securities. Our anti-hedging policy prohibits our directors and officers from engaging in any hedging or monetization transactions involving our securities. | |

✓ Stock Ownership Guidelines.Our stock ownership guidelines require that each of our directors, over a reasonable period of time, accumulate a holding of shares having a value of three-times the value of the annual Board of Directors stock retainer amount. | ✗ No Pledging of Our Securities. None of our executive officers or directors are permitted to pledge our securities for margin or other loans without ourpre-approval (and none of our executive officers or directors currently pledge our securities). | |

✓ Stock Holding Requirements for CEO and Other Executives.Encourage meaningful stock ownership for executive officers through a combination of vesting and/or post-vesting transfer restrictions on equity grants. | ✗ No Undue Restrictions on Stockholder Right to Amend Bylaws.Our bylaws allow stockholders to amend the bylaws by a majority vote of the outstanding shares entitled to be cast on the matter. (1) | |

(1) In addition, our bylaws provide that certain stockholder protections included in the bylaws require a supermajority vote to be amended in order to protect the stockholders, namely the Company’s decision toopt-out of the Maryland Control Share Acquisition Act and amendments to the amendment provision of the bylaws. Further, no bylaw adopted or amended by shareholders can be repealed by the Board of Directors.

16

Our directors will stay informed about our business by attending meetings of our Board of Directors and its committees and through supplemental reports and communications. Our independent directors will meet regularly in executive sessions without the presence of our corporate officers ornon-independent directors.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines, which set forth a flexible framework within which the Board of Directors, assisted by its committees, directs the affairs of the Company. The Corporate Governance Guidelines reflect the Board of Directors’ commitment to monitoring the effectiveness of decision-making at the Board of Directors and management level and ensuring adherence to good corporate governance principles. The Corporate Governance Guidelines address, among other things:

| ● | the responsibilities and qualifications of directors, including director independence, and the selection process for new director candidates; |

| ● | the responsibilities, composition and functioning of committees of the Board of Directors; |

| ● | director access to officers and employees, as well as to outside advisors; |

| ● | the principles of director compensation; |

| ● | director orientation and continuing education; |

| ● | Board of Director interaction with stockholders and interested parties; |

| ● | management succession, development and review; and |

| ● | annual performance evaluation of the Board of Directors and its committees. |

Our Corporate Governance Guidelines are subject to periodic review by the Nominating and Governance Committee.

Our Board of Directors has established a Code of Business Conduct that applies to our directors, officers (including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) and other employees. Among other matters, our Code of Business Conduct is designed to deter wrongdoing and to promote:

| ● | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| ● | full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; |

| ● | compliance with applicable governmental laws, rules and regulations; |

| ● | fair dealing with our competitors, tenants, managers of our properties, suppliers and employees; |

| ● | prompt internal reporting of violations of the Code of Business Conduct to appropriate persons identified in the Code of Business Conduct; and |

| ● | accountability for adherence to the Code of Business Conduct. |

17

Only our Board of Directors, or a committee designated by the Board of Directors, will be able to approve any waiver of the Code of Business Conduct for our executive officers or directors, and any such waiver shall be promptly disclosed as required by law, stock exchange regulation or the requirements of the SEC. We intend to satisfy the disclosure requirement under Item 5.05 ofForm 8-K relating to amendments to or waivers from any provision of the Code of Business Conduct applicable to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer by posting such information on our website atwww.viciproperties.com under the section “Investors — Governance.” Information on or accessible through our website is not and should not be considered a part of this Proxy Statement.

Availability of Corporate Governance Materials

You are encouraged to visit our website atwww.viciproperties.com to view or obtain copies of our Corporate Governance Guidelines, committee charters, and Code of Business Conduct. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with or furnish to the SEC. You may also obtain, free of charge, a copy of our Corporate Governance Guidelines, committee charters, and Code of Business Conduct by directing your request in writing to Secretary, VICI Properties Inc., 430 Park Avenue, 8th Floor, New York, New York 10022. Additional information relating to the corporate governance of our Company is also set forth below and included in other sections of this Proxy Statement.

Background. Our Corporate Governance Guidelines provide that a majority of our directors serving on our Board of Directors must be independent as required by the listing standards of the NYSE.

Independence Determinations Made by our Board of Directors. We define “independent director” by reference to the rules, regulations and listing qualifications of the NYSE. In general, a director is deemed independent if the director has no relationship to us that may interfere with the exercise of the director’s independence from management and our Company. Our Board of Directors, after broadly considering all relevant facts and circumstances regarding the past and current relationships, if any, of each director with the Company, has affirmatively determined that all of the Company’snon-employee directors, Messrs. Abrahamson, Davis, Hausler, Macnab and Rumbolz and Mses. Cantor and Holland are independent directors. In making this determination, the Board of Directors reviewed thenon-employee directors’ relationships, if any, with us, and determined that there are no relationships that would interfere with the exercise of such directors’ independence from management and our Company.

Director Candidate Qualification and Selection Process

Director Selection Process. Our Nominating and Governance Committee is responsible for recommending director candidates and nominees to the full Board of Directors, in collaboration with the Chairman of the Board of Directors.

The Nominating and Governance Committee seeks to identify candidates based on input provided by a number of sources, including (i) other members of the Board of Directors, (ii) officers and employees of the Company and (iii) stockholders of the Company. As part of the candidate identification process, the Nominating and Governance Committee evaluates the skills, experience and diversity possessed by the current Board of Directors, and whether there are additional skills, experience or diversity that should be added to complement the composition of the existing Board of Directors. The Nominating and Governance Committee also will take into account whether existing directors have indicated a willingness to continue to serve as directors ifre-nominated.The Nominating and Governance Committee will also seek ongoing input from the incumbent directors and the Chief Executive Officer, with the goal of identifying and informally approaching possible director candidates in advance of actual need. The Board shall itself determine in each case the manner by which an invitation to join the Board of the Directors shall be extended to director nominees, other than those nominated directly by the Company’s stockholders.

18

Once director candidates have been identified, the Nominating and Governance Committee will then evaluate each candidate in light of his or her qualifications and credentials, and any additional factors that the Nominating and Governance Committee deems necessary or appropriate. Existing directors who are being considered forre-nomination will bere-evaluated as part of the Nominating and Governance Committee’s process of recommending director candidates.

Director Qualifications. Our Corporate Governance Guidelines contain the membership criteria for our Board of Directors. Directors should have (i) integrity, strength of character, vision, imagination and loyalty to the Company and its stockholders, (ii) practical and mature judgment, with ability to evaluate and appraise objectively the Company’s strategies and financial position and possess the necessary governance experience and relevant skills to fulfill the role of fiduciary oversight, (iii) substantial business experience and strong financial acumen, with practical application to the Company’s needs, (iv) the willingness and ability to make a significant commitment of time and attention to the Board of Director’s processes and affairs, including meetings and preparation, (v) the ability to work with fellow directors as members of a collegial group, without necessarily always agreeing with them, and the ability to provide guidance, relevant insights and support to the Company’s Chief Executive Officer and senior management team, (vi) an absence of conflicts of interest that would interfere with Board of Director service, (vii) the ability to secure relevant licenses required and (viii) a commitment to having a meaningful, long-term equity ownership stake in the Company in compliance with any director stock ownership guidelines adopted by the Board of Directors.

We endeavor to have a Board of Directors that represents diverse backgrounds, experiences, expertise, skills and contacts, and a range of tenures that are appropriate given the Company’s current and anticipated circumstances and that, collectively, enable the Board of Directors to perform its oversight function effectively.

Directors are expected to prepare for, attend regularly and participate actively and constructively at meetings of the Board of Directors and its committees. Directors are expected to review the material that is distributed in advance of any Board of Directors or Committee meeting. The Board of Directors will consider other commitments, including board service, in assessing each director’s and potential candidate’s ability to serve on the Board of Directors and fulfill his or her responsibilities. Each director is expected to notify the Board of Directors chair and the chair of the Nominating and Governance Committee in advance of accepting an invitation to serve as a member of another public company board of directors.

Other Considerations. The Nominating and Governance Committee will identify and screen candidates qualified to serve on the Board of Directors, consistent with the criteria approved by the Board of Directors, including considering suggestions for Board of Directors membership submitted by stockholders in accordance with the notice provisions and procedures set forth in the Company’s bylaws.

After completing the identification and evaluation process described above, the Nominating and Governance Committee will recommend to the Board of Directors the nomination of a number of candidates equal to the number of director vacancies that will exist at the annual meeting of stockholders. The Board of Directors will then select the Board’s director nominees for stockholders to consider and vote upon at the annual meeting of stockholders.

Stockholder Recommendations for Board Nominations.Our Nominating and Governance Committee considers properly submitted stockholder recommendations for candidates for membership on our Board of Directors complying with procedural requirements that may be communicated to stockholders from time to time. The recommendation should be addressed to the Secretary, VICI Properties Inc., 430 Park Avenue, 8th Floor, New York, New York 10022.

Leadership Structure of our Board of Directors

At the present time, the Board of Directors believes that a structure that separates the roles of chair and Chief Executive Officer is appropriate and that the chair should serve in anon-executive role. However, the

19

Board of Directors does not believe that mandating any single structure regarding the separation of the roles of chair of the Board of Directors and Chief Executive Officer is necessary or appropriate. The Board of Directors reserves the right to determine the appropriate leadership structure for the Board of Directors on acase-by-case basis, taking into account at any particular time the Board of Directors’ assessment of its and the Company’s needs, as well as the people and situation involved. As a result of the current separation between the roles of chair of the Board of Directors and Chief Executive Officer (where the current chair is an independent director), the Board of Directors has determined that no lead independent director is necessary at this time.

The Board of Directors’ Role in Risk Oversight

The Board of Directors has overall responsibility for risk oversight, including, as part of regular Board and committee meetings, general oversight of executives’ management of risks relevant to the Company. In this regard, the Board of Directors seeks to identify, understand, analyze and oversee critical business risks. While the full Board of Directors has primary responsibility for risk oversight, it utilizes its committees, as appropriate, to monitor and address risks that may be within the scope of a particular committee’s expertise or charter. Our Board of Directors uses its committees to assist in its risk oversight function as follows:

| ● | Audit & Finance Committee—the Audit & Finance Committee’s responsibilities include, among others, oversight relating to the integrity of our financial statements and financial reporting process; compliance with legal and regulatory requirements; the performance of our internal audit function; our primary financial policies and programs, including those relating to leverage ratio, debt coverage, dividend policy and major financial risk exposures; policies and transactions related to corporate finance and capital markets activities; and the evaluation of our strategic planning process; |

| ● | Compensation Committee—the Compensation Committee’s responsibilities include, among others, oversight of risks related to our compensation practices and plans to ensure that such practices and plans (i) are designed with an appropriate balance of risk and reward in relation to our overall business strategy and (ii) do not encourage excessive or unnecessary risk-taking behavior; and |

| ● | Nominating and Governance Committee—the Nominating and Corporate Governance Committee’s responsibilities include, among others, oversight of the general operations of the Board; the Company’s compliance with our Corporate Governance Guidelines and applicable laws and regulations, including applicable rules of the NYSE; and corporate governance-related risk. |

While the Board of Directors oversees risk management as part of anon-going process, the Company’s management is charged with managing risk. Management periodically reports to the Board of Directors and its committees, as appropriate, on the material risks to the Company, including any major strategic, operational, regulatory and external risks inherent in the Company’s business and the policies and procedures with respect to such risks.

Our Board of Directors has three standing committees: the Audit & Finance Committee; the Compensation Committee; and the Nominating and Governance Committee. Our committees are composed entirely of independent directors as defined under the rules, regulations and listing qualifications of the NYSE. From time to time, our Board of Directors may also create additional committees for such purposes as our Board of Directors may determine.

20

The table below provides membership information for each of the Board committees as of the date of this Proxy Statement:

| Director | Audit & Finance Committee | Compensation Committee | Nominating and Governance Committee | |||

Diana F. Cantor* |  |  | ||||

Eugene I. Davis* |  |  | ||||

Eric L. Hausler* |  |  | ||||

Elizabeth I. Holland* |  |  | ||||

Craig Macnab |  |  | ||||

Michael D. Rumbolz |  |  | ||||

Number of Meetings Held During 2017 Since our Formation in October 2017 | 5 | 1 | — |

| * | Audit committee financial expert |

| Chair of the Committee |

The Compensation Committee and the Nominating and Governance Committee took certain actions by unanimous written consent following the Formation Date relating to matters approved in connection with our formation and emergence from bankruptcy. In addition, the directors serving on both the Compensation Committee and the Nominating and Governance Committee met periodically on an informal basis during the approximate three-month period from our formation in October 2017 through the end of 2017.

Audit & Finance Committee

The Audit & Finance Committee monitors the integrity of (i) our financial statements and financial reporting processes, (ii) our compliance with legal and regulatory requirements, (iii) our continued qualification as a REIT, (iv) the performance of our internal audit function as well as of our independent auditors, (v) the qualifications and independence of our independent auditor, (vi) our primary financial policies and programs, including those relating to leverage ratio, debt coverage, dividend policy and major financial risk policies, and (vii) our policies and transactions related to corporate finance, capital markets activities, capital allocation and major strategic initiatives. The Audit & Finance Committee selects, assists and meets with the independent auditor, oversees each annual audit and quarterly review, establishes and maintains our internal audit controls and prepares the report that Federal securities laws require be included in our annual proxy statement. In addition, the Audit & Finance Committee is responsible for reviewing and assessing our policies and procedures related to our compliance with applicable gaming regulations. The duties and responsibilities of our Audit & Finance Committee are more fully described in our Audit & Finance Committee Charter, which is available under the “Investors” tab of the Company’s website atwww.viciproperties.com, under the heading “Governance—Governance Documents.”

Our Board of Directors has determined that all members of our Audit & Finance Committee qualify as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC RegulationS-K, and that each of them is “independent” as such term is defined by the applicable rules of the SEC and NYSE.

Compensation Committee