- VICI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

VICI Properties (VICI) DEF 14ADefinitive proxy

Filed: 18 Mar 19, 8:28am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

| Preliminary Proxy Statement

| |

☐

| Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2))

| |

☒

| Definitive Proxy Statement

| |

☐

| Definitive Additional Materials

| |

☐

| Soliciting Material Under Rule14a-12

|

VICI PROPERTIES INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||||

| (1) | Title of each class of securities to which transaction applies: | |||||

| ||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||

| ||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

| ||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||

| ||||||

| (5) | Total fee paid: | |||||

| ||||||

| ☐ | Fee paid previously with preliminary materials. | |||||

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

| (1) | Amount Previously Paid: | |||||

| ||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||

| ||||||

| (3) | Filing Party: | |||||

| ||||||

| (4) | Date Filed: | |||||

| ||||||

A LETTER TO OUR STOCKHOLDERS FROM THE CEO

March 18, 2019

430 Park Avenue, 8th Floor • New York, New York 10022 • Telephone (646)949-4631

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of VICI Properties Inc. on Tuesday, April 30, 2019, at 10:00 a.m., Eastern Time, at the InterContinental New York Barclay Hotel, 111 East 48th Street, New York, NY 10017.

Your Board of Directors is unanimously recommending a highly qualified, experienced, diverse and actively engaged slate of nominees for election to the Board of Directors at the Annual Meeting. Your Board’s nominees are James R. Abrahamson, Diana F. Cantor, Eric L. Hausler, Elizabeth I. Holland, Craig Macnab, Edward B. Pitoniak and Michael D. Rumbolz. Your Board brings executive and financial leadership, a wide range of complementary skills and backgrounds relevant to the company’s industry, strategy and commitment to stockholder value and diversity.

At the Annual Meeting, you will be asked to:

| • | elect the seven members named in the accompanying proxy statement to serve on our Board of Directors; |

| • | ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; |

| • | approve (on anon-binding, advisory basis) the compensation of our named executive officers; and |

| • | transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |

The accompanying proxy statement provides a detailed description of these proposals and instructions on how to vote your shares.

Your vote is very important. Whether or not you plan to attend the meeting, please vote as soon as possible. Instructions on how to vote are contained in the proxy statement.

On behalf of the Board of Directors and our employees, we thank you for your continued interest in and support of our company. We look forward to seeing you at the meeting.

Sincerely,

Edward B. Pitoniak

Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TUESDAY, APRIL 30, 2019

10:00 A.M., EASTERN TIME

INTERCONTINENTAL NEW YORK BARCLAY HOTEL 111 East 48th Street New York, NY 10017 | PROXY VOTING

Your vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares now as instructed in the proxy statement. If you attend the Annual Meeting, you may revoke your proxy and vote in person. Your proxy is revocable in accordance with the procedures set forth in this proxy statement. |

To Our Stockholders:

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of VICI Properties Inc., at which stockholders will vote on the following proposals:

Items of Business

| ||

1. |

To elect the seven director nominees named in the accompanying proxy statement to serve on our board of directors until the next annual meeting of stockholders or until their successors are elected and qualified.

| |

2. |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

| |

3. |

To approve (on anon-binding, advisory basis) the compensation of our named executive officers.

| |

4. |

To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

| |

Record Date

|

Stockholders of record as of the close of business on March 1, 2019 are entitled to notice of and to vote at the Annual Meeting and at any postponements or adjournments thereof.

|

This Notice of Annual Meeting and the accompanying proxy statement are first being made available to our stockholders on or about March 18, 2019.

By Order of the Board of Directors,

Samantha Sacks Gallagher

Executive Vice President, General Counsel

and Secretary

New York, New York

March 18, 2019

|

VOTING CAN BE COMPLETED IN ONE OF FOUR WAYS:

| VIA THE INTERNET

Go to the website address shown on your Proxy Card and related instructions | |

| BY TELEPHONE

Use the toll-free number shown on your Proxy Card or Voting Instruction Form and follow the recorded instructions | |

| BY MAIL

Mark, sign, date and return the enclosed Proxy Card and related instructions in the postage-paid envelope

| |

| IN PERSON

Vote at the Annual Meeting in New York, NY (if you are a record holder) |

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 30, 2019. The accompanying proxy statement and our 2018 Annual Report are available athttp://investors.viciproperties.com/investors/Annual-Meeting. In addition, our stockholders may access this information, as well as submit their voting instructions, atwww.proxyvote.com by having their proxy card and related instructions in hand.

|

|

|

i

|

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

2019 Annual Meeting of Stockholders

DATE AND TIME

Tuesday, April 30, 2019 10:00 a.m., Eastern Time |

PLACE

InterContinental New York Barclay Hotel 111 East 48th Street New York, NY 10017

|

RECORD DATE

March 1, 2019

|

Annual Meeting Proposals

Proposal | Board Vote Recommendation |

Page Reference | ||

1 — Election of Directors

| FOR each nominee

| 8

| ||

2 — Ratification of Appointment of Independent Registered Public Accounting Firm

| FOR

| 13

| ||

3 — Advisory Vote on Named Executive Officer Compensation | FOR

| 51

|

General

VICI Properties Inc. (“VICI,” the “Company,” “we,” “us” and “our”) is using the Securities and Exchange Commission (the “SEC”) rule that allows companies to furnish their proxy materials over the Internet. As a result, we mailed to our stockholders a Notice Regarding the Availability of Proxy Materials (the “Notice of Availability”) instead of a paper copy of the proxy materials (including the proxy card (the “Proxy Card”), this proxy statement (the “Proxy Statement”) and our 2018 Annual Report) on or about March 18, 2019. We also provided access to our proxy materials over the Internet beginning on that date. The Notice of Availability contained instructions on how to access this Proxy Statement and the 2018 Annual Report and how to vote online or by toll-free number. Subsequent to receiving the Notice of Availability, all stockholders have the ability to access the proxy materials over the Internet and request to receive a paper copy of the proxy materials by mail. Additionally, stockholders can access a copy of the proxy materials atwww.proxyvote.com.

Our board of directors (the “Board of Directors” or “Board”) is soliciting proxies to be voted at the 2019 Annual Meeting of Stockholders (the “Annual Meeting”). The Proxy Statement provides the information stockholders need to know to vote by proxy or in person at the Annual Meeting. Stockholders do not need to attend the Annual Meeting in person in order to vote. If, at the close of business on March 1, 2019, you were a stockholder of record or held shares through a broker, bank or other nominee, you may vote your shares by proxy via the Internet, by telephone or by mail. For shares held through a broker, bank or other nominee, you may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions.

|

1

|

PROXY STATEMENT SUMMARY |

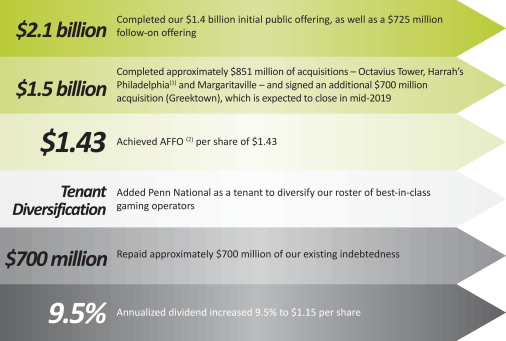

2018 Business Highlights

2018 was a transformative year for us, with our leadership team successfully delivering on our clearly articulated strategic goals. In February 2018, we completed our $1.4 billion initial public offering, the proceeds of which we used to consummate approximately $851 million in accretive acquisitions and to repay approximately $600 million of our existing indebtedness and further reduce our leverage. In June 2018, we entered into a definitive agreement to acquire Margaritaville Resort Casino (“Margaritaville”), partnering with Penn National Gaming, Inc. (“Penn National”) as our tenant, which partnership represented the first step in our strategy to diversify our roster ofbest-in-class gaming operators (the acquisition subsequently closed on January 2, 2019). In July 2018, we completed the acquisition of Octavius Tower at Caesars Palace, and entered into definitive agreements to acquire Harrah’s Philadelphia from an affiliate of Caesars Entertainment Corporation (“Caesars”), as well as to make certain modifications to our existing leases with Caesars in connection with these acquisitions, with both landlord and tenant trading future uncertainty for future certainty around lease payments among other key modifications designed to better align the strategic interests of landlord and tenant. We subsequently closed on the acquisition of Harrah’s Philadelphia and the modification of our existing leases with Caesars in December 2018. In November 2018, we entered into definitive agreements to acquire Greektown Casino-Hotel (“Greektown”), again partnering with Penn National as we continue to grow our portfolio of market-leading gaming, hospitality and entertainment destinations. The acquisition of Greektown is subject to regulatory approvals and customary closing conditions and is expected to close inmid-2019. In connection with the announcement of the Greektown transaction, in November 2018 we also closed on a $725 millionfollow-on equity offering, the largest-ever first follow-on offering of primary shares by a REIT. Indeed, no other American REIT raised as much primary equity in 2018 as VICI did, with our two equity raises totaling $2.1 billion of gross proceeds, or approximately 21% of the $10 billion of REIT primary equity raised in the year.

In just our first full year since ourspin-off from Caesars Entertainment Operating Company, Inc. (“CEOC”), we have acquired one of the largest and best portfolios of gaming, hospitality and entertainment destinations in the REIT sector, and will continue to focus on carrying out a strategy whereby we will finance growth with prudent leverage, while maintaining sufficient liquidity for long-term growth.

For more information on our 2018 results and other related financial measures, see our 2018 Annual Report.

We look forward to continuing to execute on all facets of our exciting business strategy and, in doing so, believe we will continue to be successful in delivering long-term value and strong total returns to our stockholders. |

$2.1 billion

Completed our $1.4 billion initial

| |||||

$1.5 billion

Completed approximately $851 million of acquisitions – Octavius Tower, Harrah’s Philadelphia(1) and Margaritaville – and signed an additional $700 million acquisition (Greektown), which is expected to close inmid-2019

| ||||||

$1.43

Achieved adjusted funds from

| ||||||

Tenant Diversification

Added Penn National as a

| ||||||

$700 million

Repaid approximately $700 million

| ||||||

9.5%

Annualized dividend increased

| ||||||

(1) Purchase price for Harrah’s Philadelphia ($241.5 million) was reduced by $159.0 million to reflect the aggregate net present value of the lease modifications, resulting in a net cash consideration of $82.5 million, which is the amount used in the total dollar value of acquisition set forth above.

(2) AFFO is anon-GAAP financial measure. “GAAP” means the generally accepted accounting principles in the U.S. For a definition and reconciliation of thisnon-GAAP financial measure to the most directly comparable GAAP measures, see the section entitled “Reconciliation ofNon-GAAP Measures” in our 2018 Annual Report.

| ||||||

2

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

PROXY STATEMENT SUMMARY |

Board of Directors Nominees and Committees

Committee Membership

| ||||||||||||

Name

| Age

| Independent

| Audit & Finance

| Compensation

|

Nominating and Governance

| # of Other Public Company Boards

| ||||||

James R. Abrahamson(1)

|

63

|

✓

|

†

|

†

|

†

|

2

| ||||||

Diana F. Cantor*

|

61

|

✓

|

•

|

•

|

2

| |||||||

Eric L. Hausler*

|

49

|

✓

|

•

| •

|

0

| |||||||

Elizabeth I. Holland*

|

53

|

✓

|

•

|

•

|

1

| |||||||

Craig Macnab

|

63

|

✓

| •

|

•

|

1

| |||||||

Edward B. Pitoniak

|

63

|

1(2)

| ||||||||||

Michael D. Rumbolz

|

64

|

✓

|

•

|

•

|

2

| |||||||

| (1) | Mr. Abrahamson serves as our independent chairman of the Board of Directors. |

| (2) | As disclosed on February 28, 2019, Mr. Pitoniak notified Ritchie Bros. Auctioneers Inc. of his decision to retire from service on its Board of Directors following completion of his current term and will not stand for re-election at its annual meeting on May 7, 2019. |

| † | Mr. Abrahamson also serves as an ex officio member of all committees of the Board. Whenever possible, he actively participates, but does not vote, in the meetings of such committees. |

| * | Audit committee financial expert. |

Eugene I. Davis has decided not to stand for re-election at the Annual Meeting. In connection with the foregoing, our Board of Directors will be reduced from eight directors to seven directors at the Annual Meeting, and, therefore, at the Annual Meeting, only seven directors will be nominated to serve until the 2020 annual meeting of stockholders or until their successors are elected and qualified.

Snapshot of Board, Governance & Compensation Information

Below presents a snapshot of the expected composition of our Board of Directors immediately following the Annual Meeting, as well as certain key governance and compensation policies.

SNAPSHOT

| ||||||||||||

|

GENDER

|

|

AGE

|

|

TENURE

|

| ||||||

YES

|

• Separate Chairman and Chief Executive Officer | |

• Independent Chairman | ||

• Annual Election of All Directors | ||

• Majority Voting for Directors | ||

• Regular Executive Sessions of Independent Directors | ||

• Annual Board and Committee Self-Evaluations | ||

• Stock Ownership Requirements for Directors and Officers | ||

• Robust Anti-Hedging, Anti-Short Sale and Anti-Pledging Policies | ||

• Clawback Policy | ||

• “Double-Trigger” for Change in Control Severance Payments | ||

• One-Year Minimum Vesting Period on Equity Grants

| ||

NO

|

• Excise TaxGross-Up Provisions | |

• Repricing of Underwater Options or Share Appreciation Rights | ||

• Excess Perquisites

|

| 3

|

PROXY STATEMENT SUMMARY |

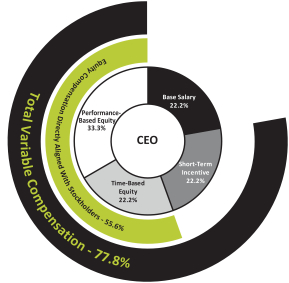

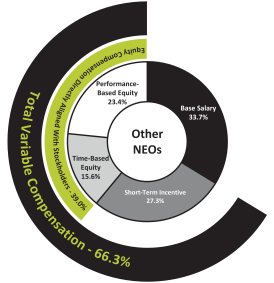

Executive Compensation Highlights

The following is an overview of the highlights of our compensation structure, and the fundamental compensation policies and practices we do and do not use.

WHAT WE DO

|

WHAT WE DON’T DO

| |||||

|

Align the interests of our executives and stockholders through the use of performance-based annual cash incentive compensation and service and performance-based long-term equity incentive compensation.

|

|

No excise taxgross-ups upon a change in control. | |||

|

Double-Trigger Severance Payments – a change in control by itself is not sufficient to trigger severance payments, it must also be accompanied by a qualifying termination.

|

|

No pledging, hedging or short sale activities by our executives and directors. | |||

|

We have a clawback policy regarding the recoupment of incentive compensation if an executive officer willfully committed an illegal act, fraud, intentional misconduct or gross recklessness that caused a mandatory restatement of our financials.

|

|

We do not maintain any defined benefit or supplemental retirement plans.

| |||

|

No perquisites or other personal benefits to executive officers that are not available to all employees. | |||||

|

Maintain meaningful director and executive officer stock ownership guidelines, including requirement that our CEO accumulate a holding of 5x his base salary.

|

|

We do not pay dividends on unvested equity awardsuntil, and only to the extent, those awards vest. | |||

|

Engage an independent compensation consultant to review and provide recommendations regarding our executive compensation program.

|

|

We do not allow for repricing or buyouts of underwater options or stock appreciation rights without stockholder approval. | |||

|

We require aone-year minimum vesting period on equity grants, subject to a 5% carve out.

|

|

No plan design features that encourage excessive or imprudent risk taking. |

4

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

ABOUT THE MEETING: QUESTIONS & ANSWERS

|

WHY AM I RECEIVING THIS PROXY STATEMENT?

This Proxy Statement is furnished in connection with the solicitation of proxies for use at the Annual Meeting to be held for the purposes stated in the accompanying Notice of Annual Meeting of Stockholders. This solicitation is made by VICI on behalf of our Board of Directors. This Proxy Statement, the enclosed Proxy Card and our 2018 Annual Report are first being mailed to stockholders beginning on or about March 18, 2019.

WHAT AM I BEING ASKED TO VOTE ON, AND WHAT ARE THE BOARD OF DIRECTORS’ VOTING RECOMMENDATIONS?

Proposal 1: Election of Directors |

The election of seven directors to our Board of Directors, each for a term expiring at the 2020 annual meeting of stockholders or until their successors are elected and qualified |

| “FOR” |

Proposal 2: Ratification of Appointment of Deloitte & Touche LLP |

| The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019 |

| “FOR” |

Proposal 3: Advisory Vote on Executive Compensation |

| The approval (on anon-binding, advisory basis) of the compensation of our named executive officers |

| “FOR” |

WILL ANY OTHER MATTERS BE VOTED ON?

The proposals set forth in this Proxy Statement constitute the only business that the Board of Directors intends to present at the Annual Meeting. The proxy does, however, confer discretionary authority upon the persons designated as proxy holders on the Proxy Card, or their substitutes, to vote on any other business that may properly come before the meeting.

WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING?

Only holders of record of our common stock, or their duly appointed proxies, as of the close of business on March 1, 2019, the record date for the Annual Meeting, are entitled to receive notice of and to vote at the Annual Meeting and all postponements or adjournments thereof. Our common stock constitutes the only class of securities entitled to vote at the meeting.

WHAT ARE THE VOTING RIGHTS OF STOCKHOLDERS?

Each share of common stock outstanding on the record date entitles its holder to cast one vote on each matter to be voted on at the Annual Meeting.

WHO CAN ATTEND THE ANNUAL MEETING?

All holders of our common stock at the close of business on March 1, 2019, the record date for the Annual Meeting, or their duly appointed proxies, are authorized to attend the Annual Meeting. Admission to the meeting will be on a first-come, first-served basis. If you attend the meeting, you may be asked to present valid photo identification, such as a driver’s license or passport, before being admitted. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

Please also note that if you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), you will need to bring a copy of the brokerage statement reflecting your share ownership as of March 1, 2019.

|

5

|

ABOUT THE MEETING: QUESTIONS & ANSWERS |

WHAT WILL CONSTITUTE A QUORUM AT THE ANNUAL MEETING?

The presence in person or by proxy of a majority of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting as of March 1, 2019 will constitute a quorum, permitting the stockholders to conduct business at the Annual Meeting. As of the March 1, 2019 record date, there were 405,174,748 shares of common stock outstanding. If you have returned valid proxy instructions or if you hold your shares of common stock in your own name as a holder of record and attend the Annual Meeting in person, your shares will be counted for the purpose of determining whether there is a quorum. We will include abstentions and “brokernon-votes” in the calculation of the number of shares of common stock considered to be present at the meeting for purposes of determining the presence of a quorum at the meeting. If a quorum is not present, the Annual Meeting may be adjourned from time to time to a date not more than 120 days after March 1, 2019, by the vote of a majority of the shares of common stock represented at the Annual Meeting in person or by proxy until a quorum has been obtained.

HOW DO I VOTE?

Voting in Person at the Annual Meeting. If you are a stockholder of record and attend the Annual Meeting, you may vote in person at the meeting. If you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), and you wish to vote in person at the Annual Meeting, you will need to bring a copy of the brokerage statement reflecting your share ownership as of March 1, 2019 and obtain a “legal proxy” from the bank, broker or other nominee that holds your common shares of record.

Voting by Proxy for Shares Registered Directly in the Name of the Stockholder. If you are a stockholder of record, you may instruct the proxy holders named in the Proxy Card how to vote your shares of common stock in one of the following ways:

| • | Vote by Internet.In order to vote on the Internet, you must go to www.proxyvote.com, have your Notice of Availability, Proxy Card or voting instruction form in hand and follow the instructions.If you vote via the Internet, you do not need to return your Proxy Card. |

| • | Vote by Phone.In order to vote by telephone, you must call the toll-free number listed on your Notice of Availability and/or Proxy Card, have your Notice of Availability, Proxy Card or voting instruction form in hand and follow the instructions.If you vote by telephone, you do not need to return your Proxy Card. |

| • | Vote by Mail.To vote by mail, if you have not already received one, you may request a Proxy Card from us as instructed in the Notice of Availability and sign, date and mail the Proxy Card in the postage-paid envelope provided. Properly signed and returned proxies will be voted in accordance with the instructions contained therein. |

Voting by Proxy for Shares Held in Street Name. If you are the beneficial owner of shares of common stock held in “street name” (that is, through a bank, broker or other nominee), then you should follow the instructions provided to you by your broker, bank or other nominee.

WHAT ARE BROKERNON-VOTES?

Brokernon-votes occur when nominees, such as banks and brokers holding shares in “street name” on behalf of beneficial owners, do not receive voting instructions from the beneficial owners at least ten days before the Annual Meeting. If that happens, the nominees may vote those shares of common stock only on matters deemed “routine” by the New York Stock Exchange (the “NYSE”), the exchange on which our shares of common stock are listed. Onnon-routine matters, nominees holding shares for a beneficial owner cannot vote without instructions from the beneficial owner, resulting in aso-called “brokernon-vote”.

Proposal 2 (Ratification of Appointment of Deloitte & Touche LLP (“Deloitte”)) is the only proposal that is considered “routine” under the NYSE rules. Accordingly, no brokernon-votes will arise in the context of voting for the ratification of the appointment of Deloitte as our independent registered public accounting firm for our year ending December 31, 2019, and the broker is permitted to vote your shares on such ratification even if the broker does not receive voting instructions from you.

However, brokernon-votes may arise in the context of Proposals 1 and 3 (Election of Directors and Advisory Vote on Executive Compensation, respectively) because such proposals are considerednon-routine matters under the NYSE rules. Consequently, if you do not give your broker specific voting instructions, your broker will not be able to vote on any of these proposals.

HOW ARE THE PROXY CARD VOTES COUNTED?

If the accompanying Proxy Card is properly completed, signed and returned to us, and not subsequently revoked, it will be voted as directed by you. If the Proxy Card is submitted, but voting instructions are not provided, the proxy will be voted (i)“FOR” each of the director nominees, (ii)“FOR” the ratification of the appointment of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019, (iii)“FOR” approval, on anon-binding advisory basis, of the compensation of the Company’s named executive officers, and (iv) as recommended by our Board of Directors with regard to any other matters that may properly come before the Annual Meeting, or, if no such recommendation is given, in the discretion of the proxy holders.

6

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

ABOUT THE MEETING: QUESTIONS & ANSWERS |

MAY I CHANGE MY VOTE AFTER I SUBMIT MY PROXY CARD?

Yes. You may revoke a previously granted proxy at any time before it is exercised by any of the following actions:

| • | notifying our Secretary in writing that you would like to revoke your proxy; |

| • | completing a Proxy Card on the Internet, by telephone or by mail with a later date at or before our Annual Meeting; or |

| • | attending our Annual Meeting and voting in person. |

If your shares of common stock are held on your behalf by a broker, bank or other nominee, you must contact them to receive instructions as to how you may revoke your proxy instructions.

WHO PAYS THE COSTS OF SOLICITING PROXIES?

We will pay the cost of solicitation of proxies. In addition to the solicitation of proxies through the Internet or by mail, our directors, officers and employees may also solicit proxies in person, by telephone, electronically, by mail or other means, but they will not be specifically compensated for these services. We will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to, and obtain proxies from, such beneficial owners.

WHAT SHOULD I DO IF I RECEIVED MORE THAN ONE NOTICE OF AVAILABILITY?

There are circumstances under which you may receive more than one Notice of Availability. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each such brokerage account. In addition, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Notice of Availability. Please authorize your proxy in accordance with the instructions of each Notice of Availability separately, since each one represents different shares that you own.

You should rely only on the information provided in this Proxy Statement. No person is authorized to give any information or to make any representation not contained in this Proxy Statement and, if given or made, you should not rely on that information or representation as having been authorized by us. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

|

7

|

PROPOSAL 1: ELECTION OF DIRECTORS

|

Introduction

Our Board of Directors currently consists of eight members, all of whom have terms expiring at the Annual Meeting or until his or her earlier death, resignation, removal or a determination by the Board of Directors that such director no longer has the qualifications that were required by the Company’s charter or bylaws. As previously disclosed, Eugene I. Davis has decided not to stand for re-election at the Annual Meeting. In connection with the foregoing, our Board of Directors will be reduced from eight directors to seven directors at the Annual Meeting, and, therefore, at the Annual Meeting, only seven directors will be nominated to serve until the 2020 annual meeting of stockholders or until their successors are elected and qualified.

At the Annual Meeting, stockholders will be asked to elect each of the director nominees to serve until the 2020 annual meeting of stockholders or until their successors are duly elected and qualified. Our Board of Directors, upon the recommendation of our Nominating and Governance Committee, has nominated James R. Abrahamson, Diana F. Cantor, Eric L. Hausler, Elizabeth I. Holland, Craig Macnab, Edward B. Pitoniak and Michael D. Rumbolz to serve as directors. Each of the nominated persons currently serves as a member of the Board of Directors and has consented to being named in this Proxy Statement and to serve as a director, if elected. If any nominee is unavailable for election or service, the Board of Directors may designate a substitute nominee and the persons designated as proxy holders on the Proxy Card will vote for the substitute nominee recommended by the Board of Directors.

We believe that each of our director nominees has the specific experience, qualifications, attributes, and skills necessary to serve as an effective director on our Board of Directors. A description of our process for identifying and evaluating director nominees, as well as our criteria for membership on our Board of Directors, is set forth under the heading “Corporate Governance Matters—Director Candidate Qualification and Selection Process”.

Vote Required

Under our bylaws, to be elected in an uncontested election, director nominees must receive the affirmative vote of a majority of the votes cast, which means that the number of shares of common stock voted for a nominee must exceed the number of shares of common stock voted against that nominee. For purposes of the election of directors, abstentions and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

If an incumbent director fails to bere-elected by a majority of votes cast, that director is required under our bylaws to tender his or her resignation to the Board of Directors. Any such resignation will take effect immediately upon its receipt. The Nominating and Governance Committee will consider promptly whether to fill the office of the nominee who has tendered a resignation and make a recommendation to the Board of Directors about filling the vacancy. The Board of Directors is required to act on the Nominating and Governance Committee’s recommendation and publicly disclose its decision and its rationale within 90 days after the election results are certified.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH DIRECTOR NOMINEE SET FORTH BELOW.

|

8

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

PROPOSAL 1: ELECTION OF DIRECTORS |

Below is the biographical information about the director nominees, including the specific experience, qualifications, attributes and skills that led to our Board of Directors and Nominating and Governance Committee to conclude that each should be nominated to serve as a director.

|

JAMES R. ABRAHAMSON

Chairman of the Board, VICI Properties Inc. Chairman of Interstate Hotels & Resorts

Age: 63 Director Since: October 2017 |

BIOGRAPHICAL INFORMATION

Mr. Abrahamsonis Chairman of Interstate Hotels & Resorts (“Interstate”), the leading U.S.-based global hotel management company comprising over 500 hotels. He previously served as Interstate’s Chief Executive Officer from 2011 to March 2017; he was named to the additional position of Chairman in October 2016. Mr. Abrahamson served as an independent director at La Quinta Holdings, Inc. (NYSE: LQ) from November 2015 to May 2018, and has served as a director of CorePoint Lodging Inc. (NYSE: CPLG), a REIT comprised of over 300 hotels, since it was spun out of La Quinta Holdings, Inc. at the end of May 2018. Mr. Abrahamson is also an independent director at BrightView Holdings Inc. (NYSE: BV), the largest provider of commercial landscaping services in the United States. Prior to joining Interstate in 2011, Mr. Abrahamson also held senior leadership positions with InterContinental Hotels Group (NYSE: IHG), Hyatt Corporation, Marcus Corporation and Hilton Worldwide. At IHG, where he served from 2009 to 2011, he served as President of the Americas division and, from 2010 to 2011, as executive director. At Hyatt, which he joined in 2004, he was Head of Development for the Americas division. At Marcus, where he served from 2000 to 2004, Mr. Abrahamson was President of the Baymont Inn and Suites and Woodfield Suites hotels division consisting of approximately 200 properties, both owned and franchised. At Hilton, where he served from 1988 to 2000, Mr. Abrahamson oversaw the Americas region franchise division for all Hilton brands and launched the Hilton Garden Inn brand. Mr. Abrahamson has served as president of the Marriott International National Association owners’ organization in 2017 and 2018, as national board chair of the American Hotel and Lodging Association in 2015 and 2016 and as national board chair of the U.S. Travel Association in 2013 and 2014. He holds a degree in Business Administration from the University of Minnesota.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS: Mr. Abrahamson’s vast experience in, and knowledge of, the hospitality industry provides our Board of Directors with valuable insight into the industry. Skills gained from extensive previous and current board service in public and private companies are also valuable for our Company and our Board of Directors.

|

|

DIANA F. CANTOR

Partner, Alternative Investment Management, LLC

Age: 61 Director Since: May 2018 |

BIOGRAPHICAL INFORMATION

Ms. Cantor is currently a partner with Alternative Investment Management, LLC, an independent, privately-held investment firm with a focus on private equity and hedge funds – a position she has held since January 2010. She is the Vice Chairman of the Virginia Retirement System, where she also serves on the Audit and Compliance Committee. Ms. Cantor was a Managing Director with New York Private Bank and Trust from January 2008 through the end of 2009. Ms. Cantor served as founding Executive Director of the Virginia College Savings Plan, the state’s 529 college savings program, from 1996 to January 2008. Ms. Cantor served seven years as Vice President of Richmond Resources, Ltd. from 1990 through 1996, and as Vice President of Goldman, Sachs & Co. from 1985 to 1990. Ms. Cantor is a Certified Public Accountant. Ms. Cantor has served on the Board of Directors of Domino’s Pizza, Inc. (NYSE: DPZ) since October 2005 and the Board of Directors of Universal Corporation (NYSE: UVV) since 2012, and continues to serve on both. She previously served on the Boards of Directors of Media General Inc., Revlon, Inc., Vistage International, Inc., Knowledge Universe Education LLC, Edelman Financial Services, LLC (previously The Edelman Financial Group Inc. (NASDAQ: EF)), and Service King Body and Paint LLC. Ms. Cantor earned a Juris Doctor degree from New York University School of Law, a Master of Business Administration degree from the University of Miami and a Bachelor of Science degree in Accounting from the University of Florida.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS Ms. Cantor possesses extensive financial skills and brings to the Board of Directors an important financial perspective. Ms. Cantor also provides valuable consumer product and marketing knowledge, as well as significant public company directorship experience, making her qualified for service as a director of the Company.

|

|

9

|

PROPOSAL 1: ELECTION OF DIRECTORS |

|

ERIC L. HAUSLER

Former Chief Executive Officer, Isle of Capri Casinos, Inc.

Age: 49 Director Since: October 2017

|

BIOGRAPHICAL INFORMATION:

Mr. Hausler currently serves on the board of directors of Alter Trading Corporation, a privately held scrap metal recycling company. Mr. Hauslerheld the position of Chief Executive Officer of Isle of Capri Casinos, Inc. (NYSE: ISLE), a developer, owner and operator of branded gaming facilities and related dining, lodging and entertainment facilities in regional markets in the United States, from April 2016 to May 2017. Prior to that, Mr. Hausler served as ISLE’s Chief Financial Officer from 2014 to 2016, as its Chief Strategic Officer from 2011 to 2014, and as its Senior Vice President, Strategic Initiatives from 2009 to 2011. Mr. Hausler retired from ISLE in May 2017 immediately following the company’s merger with Eldorado Resorts. From 2006 to 2009, Mr. Hausler served as Senior Vice President of Development for Trump Entertainment Resorts, Inc., which filed for Chapter 11 bankruptcy in February 2009. From 2005 to 2006, Mr. Hausler served as Managing Director in Fixed Income Research, covering the gaming, lodging and leisure industries for Bear Stearns & Co. Inc. From 2003 to 2005, Mr. Hausler was a Senior Equity Analyst for Susquehanna Financial Group covering the gaming industry. Mr. Hausler also held positions in equity research covering the gaming, lodging and leisure industries at Bear Stearns & Co. Inc. and Deutsche Bank Securities Inc. from 1999 to 2003. Prior to working in securities research, from 1996 to 1999, Mr. Hausler worked for the New Jersey Casino Control Commission. Mr. Hausler holds a Bachelor’s degree from Binghamton University and a Master’s degree from the New Jersey Institute of Technology.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS: Mr. Hausler’s extensive expertise leading companies in the gaming, entertainment and real estate industries, as well as his experience in the capital markets, regulatory, and acquisitions and divestiture fields in these industries are valuable to the achievement of the Company’s business strategy.

|

|

ELIZABETH I. HOLLAND

Chief Executive Officer, Abbell Credit Corporation and Abbell Associates, LLC

Age: 53 Director Since: January 2018

|

BIOGRAPHICAL INFORMATION:

Ms. Holland is the Chief Executive Officer of Abbell Credit Corporation and Abbell Associates, LLC, a77-year-old privately held real estate acquisition, development and management company with a portfolio of shopping center, office and enclosed mall properties. She has held these roles since 1997. Ms. Holland is also the Chief Executive Officer of Consortial Technologies, LLC, a privately held company. Prior to joining Abbell Associates, Ms. Holland was a senior staff attorney on the National Bankruptcy Review where she was a member of a Congressional commission charged with making recommendations to Congress for bankruptcy code reform. Prior to that, she was a restructuring and business reorganization attorney at Skadden, Arps, Slate, Meagher & Flom LLP in New York City. Ms. Holland was also a fixed income portfolio manager. Ms. Holland is an independent trustee of Federal Realty Investment Trust, a leading shopping center REIT. She is an active member of the International Council of Shopping Centers (“ICSC”), serving as the organization’s Chairman from 2016 to 2017, Vice Chairman from 2015 to 2016, and currently serves on the Executive Board and the Board of Trustees. She is also a member of the Real Estate Roundtable and the Urban Land Institute and its CRC Blue Flight Council. Ms. Holland earned a Juris Doctor degree from Brooklyn Law School and a Bachelor of Arts degree from Hamilton College.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS: Ms. Holland’s retail real estate expertise and experience as Chairman of ICSC provide valuable and complimentary skill sets to our Board of Directors.

|

10

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

PROPOSAL 1: ELECTION OF DIRECTORS |

|

CRAIG MACNAB

Former Chairman and Chief Executive Officer, National Retail Properties, Inc.

Age: 63 Director Since: October 2017 |

BIOGRAPHICAL INFORMATION

Mr. Macnab held the position of Chairman and Chief Executive Officer of National Retail Properties, Inc. (NYSE: NNN), a real estate investment trust that acquires, owns, invests in and develops properties that are leased primarily to retail tenants, since 2008 (with his service as Chief Executive Officer beginning in 2004). Mr. Macnab retired from NNN in April 2017. Mr. Macnab is an independent director of Cadillac Fairview Corporation (a private company), since 2011 and of American Tower Corporation (NYSE: AMT), since 2014 and served as a director of Forest City Realty Trust (NYSE:FCEA) from 2017 to 2018, Eclipsys Corporation from 2008 to 2014, and DDR Corp. (NYSE: DDR) from 2003 to 2015. Previously, Mr. Macnab was the chief executive officer and president of JDN Realty, a publicly traded real estate investment trust, from 2000 to 2003. Mr. Macnab holds a Bachelor’s degree in Economics and Accounting from the University of the Witwatersrand and a Master of Business Administration from Drexel University.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS: Mr. Macnab brings to our Company and Board of Directors extensive experience leading a publicly held REIT, as well as skills gained from vast public and private board experience.

|

|

EDWARD B. PITONIAK

Chief Executive Officer, VICI Properties Inc.

Age: 63 Director Since: October 2017

|

BIOGRAPHICAL INFORMATION

Mr. Pitoniak was appointed as our chief executive officer on October 6, 2017 (the “Formation Date”). Prior to this, Mr. Pitoniak served as Vice Chairman of Realterm, a private equity real estate manager based in Annapolis, Maryland, that invests in logistics real estate, from January 2015 to July 2017. Mr. Pitoniak has served as an independent director on the board of directors of Ritchie Bros. Auctioneers Incorporated, a NYSE-listed global asset management and disposition company from July 2006 to the present. Mr. Pitoniak served as Managing Director, Acting Chief Executive Officer and Trustee of InnVest, a publicly listed REIT, from April 2014 to February 2015, where he was responsible for recapitalizing the REIT and transitioning its management function from an external, third-party management model, to an internal management model. He then served as Chairman and Trustee of InnVest from February 2015 to August 2016, when the REIT was sold and taken private. He also served as a director of Regal Lifestyle Communities (TSE: RLC), a Canadian senior housing real estate owner and operator, from 2012 until its sale in 2015. Mr. Pitoniak retired in 2009 from the position of President and Chief Executive Officer and Director of bcIMC Hospitality Group, a hotel property and brand ownership entity (formerly a public income trust called Canadian Hotel Income Properties Real Estate Investment Trust (“CHIP”)), where he was employed from 2004 to 2009. As Chief Executive Officer of CHIP, he led the company to four consecutive years of total return leadership among Canadian hotel REITs, and then to a sale in 2007. Mr. Pitoniak was also a member of CHIP’s Board of Trustees before it went private. Prior to joining CHIP, Mr. Pitoniak was a Senior Vice President at Intrawest Corporation, a ski and golf resort operator and developer, for nearly eight years. Before Intrawest, Mr. Pitoniak spent nine years with Times Mirror Magazines, where he served aseditor-in-chief and associate publisher with Ski Magazine. Mr. Pitoniak has a Bachelor of Arts degree from Amherst College.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS Mr. Pitoniak provides our Board of Directors with valuable experience in the hospitality, entertainment and real estate industries and, in particular, with respect to publicly held REITs. Our Company and our Board of Directors also benefit from Mr. Pitoniak’s extensive previous and current board service. In addition, Mr. Pitoniak’s position as our Chief Executive Officer allows him to advise our Board of Directors on management’s perspective over a full range of issues affecting the Company.

|

|

11

|

PROPOSAL 1: ELECTION OF DIRECTORS |

|

MICHAEL D. RUMBOLZ

Director, President and Chief Executive Officer, Everi Holdings Inc.

Age: 64 Director Since: October 2017

|

BIOGRAPHICAL INFORMATION:

Mr. Rumbolz is Director, President and Chief Executive Officer of Everi Holdings Inc. (NYSE: EVRI), a developer of gaming products and services, Chairman of the Board of Directors of Employers Holding, Inc. (NYSE: EIG), and an independent director of Seminole Hard Rock Entertainment, LLC. Mr. Rumbolz served as Chairman and Chief Executive Officer of Cash Systems, Inc., a provider of cash access services to the gaming industry, from 2005 until 2008 when Cash Systems, Inc. was acquired by Everi. Mr. Rumbolz also has from time to time provided consulting services and held a number of public and private sector employment positions in the gaming industry, including serving as Member and Chairman of the Nevada Gaming Control Board from 1985 through 1988. Mr. Rumbolz was also the former Vice Chairman of the Board of Casino Data Systems until it was sold in 2001, was the President and CEO of Anchor Gaming from 1995 to 2000, was the director of Development for Circus Enterprises (later Mandalay Bay Group) from 1992 to 1995, and was the President of Casino Windsor at the time of its opening in Windsor, Ontario in 1995. In addition, Mr. Rumbolz is the former Chief Deputy Attorney General of the State of Nevada. Mr. Rumbolz earned a Bachelor of Arts degree in political science from the University of Nevada – Las Vegas and a Juris Doctor degree from the University of Southern California.

EXPERIENCE, QUALIFICATIONS, ATTRIBUTESAND SKILLS: Mr. Rumbolz’s experience in the highly regulated gaming industry, both as an operator and as a regulator, are of value to our Company and our Board of Directors. Our Company and our Board of Directors also benefit from Mr. Rumbolz’s extensive previous and current public and private board service.

|

There are no family relationships among any of our directors or executive officers.

12

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

Our Audit & Finance Committee has appointed the accounting firm of Deloitte to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Action by stockholders is not required by law, the NYSE or our organizational documents in the appointment of an independent registered public accounting firm, but this appointment is submitted by our Board of Directors for ratification as a matter of good corporate governance in order to give our stockholders a voice in the designation of auditors. If the appointment is not ratified by our stockholders, our Board of Directors will further consider its choice of Deloitte as our independent registered public accounting firm and may, but will not be required to, appoint a different independent registered public accounting firm. Deloitte has served as our independent registered public accounting firm since the Formation Date and is considered by our management to be well-qualified. Deloitte has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in our Company or any of our subsidiaries in any capacity.

For additional information regarding our independent registered public accounting firm, see “Principal Accountant Fees and Services” below.

A representative of Deloitte will be present at the Annual Meeting. The representative will have an opportunity to make a statement if he or she desires and will be available to respond to appropriate questions.

Vote Required

The affirmative vote of a majority of the votes cast is required for approval of the ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2019, which is considered a routine matter. For purposes of the vote on this proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.

|

|

13

|

|

We have structured our corporate governance in a manner that we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure include the following:

WHAT WE DO | WHAT WE DON’T DO | |||||

|

86% Independent Directors. Six of our seven directors standing for election have been determined by us to be “independent” as defined by the NYSE listing standards.

|

|

No Classified Board.Our directors are elected annually for one-year terms. | |||

|

Independent Chairman.Our Chairman of the Board is an independent director, which strengthens the role of our independent directors and encourages independent Board leadership.

|

|

No Poison Pill.We do not have a “poison pill” or stockholder rights plan, and we shall seek stockholder approval prior to, or in certain circumstances within twelve months following, the adoption by our Board of Directors of a stockholder rights plan.

| |||

|

Majority Voting for Directors.Directors are elected in uncontested elections by the affirmative vote of a majority of the votes cast.

|

|

Opted Out of Maryland Anti-Takeover Statutes.We have elected not to be subject to the Maryland Business Combination Statute and the Maryland Control Share Acquisition Statute, and any change to such elections must be approved by our stockholders.

| |||

|

Entirely Independent Committees.All of the members of our Audit & Finance, Compensation, and Nominating and Governance Committees are independent.

|

|

No Significant Related Party Transactions.We do not currently have any significant related party transactions. | |||

|

Audit Committee Financial Experts.All members of our Audit & Finance Committee qualify as an “audit committee financial expert” as defined by the SEC.

|

|

No Hedging of Our Securities. Our anti-hedging policy prohibits our directors and officers from engaging in any hedging or monetization transactions involving our securities.

| |||

|

Stock Ownership Guidelines for Directors.Our stock ownership guidelines require that each of our directors, over a reasonable period of time, accumulate a holding of shares having a value of three-times the value of the annual Board of Directors stock retainer amount.

|

|

No Pledging of Our Securities. None of our executive officers or directors are permitted to pledge our securities for margin or other loans. | |||

|

Stock Ownership Guidelines for Executives.Our stock ownership guidelines require our CEO to accumulate a holding of shares equal to 5x his annual base salary, and our other executives to accumulate a holding of shares equal to 3x their respective annual base salaries.

|

|

No Affiliation with Tenants.None of our directors or our officers are compensated by or otherwise affiliated with or owe any fiduciary duty to any of our tenants. | |||

14

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

CORPORATE GOVERNANCE MATTERS |

CORPORATE GOVERNANCE GUIDELINES |

Our Board of Directors has adopted Corporate Governance Guidelines, which set forth a flexible framework within which the Board of Directors, assisted by its committees, directs the affairs of the Company. The Corporate Governance Guidelines reflect the Board of Directors’ commitment to monitoring the effectiveness of decision-making at the Board of Directors and management level and ensuring adherence to good corporate governance principles. The Corporate Governance Guidelines address, among other things:

• the responsibilities and qualifications of directors, including director independence, and the selection process for new director candidates;

• the responsibilities, composition and functioning of committees of the Board of Directors;

• director access to officers and employees, as well as to outside advisors;

• the principles of director compensation;

• director orientation and continuing education;

• Board of Director interaction with stockholders and interested parties;

• management succession, development and review; and

• annual performance evaluation of the Board of Directors and its committees.

Our Corporate Governance Guidelines are subject to periodic review by the Nominating and Governance Committee and were amended in February 2019 to, among other things, adopt executive stock ownership guidelines.

| |

CODE OF BUSINESS CONDUCT |

Our Board of Directors has established a Code of Business Conduct that applies to our directors, officers (including our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer) and other employees. Among other matters, our Code of Business Conduct is designed to deter wrongdoing and to promote:

• honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

• full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications;

• compliance with applicable governmental laws, rules and regulations;

• fair dealing with our competitors, tenants, managers of our properties, suppliers and employees;

• prompt internal reporting of violations of the Code of Business Conduct to appropriate persons identified in the Code of Business Conduct; and

• accountability for adherence to the Code of Business Conduct.

Only our Board of Directors, or a committee designated by the Board of Directors, will be able to approve any waiver of the Code of Business Conduct for our executive officers or directors, and any such waiver shall be promptly disclosed as required by law, stock exchange regulation or the requirements of the SEC. Any substantive amendments to or waivers from any provision of the Code of Business Conduct applicable to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer will be posted on our website at www.viciproperties.com under the section “Investors — Governance”.

| |

WHISTLEBLOWER POLICY & HOTLINE |

Our Board of Directors has adopted a Whistleblower Policy, which establishes procedures for (i) the receipt, retention and treatment of complaints regarding improper or questionable accounting internal controls or auditing matters or practices, and (ii) the confidential, anonymous submission of such complaints. In order to facilitate the submission of such complaints, we have implemented a secure whistleblower hotline and website. The whistleblower hotline and website are operated by an independent service provider and are available for the anonymous submission of complaints.

|

|

15

|

CORPORATE GOVERNANCE MATTERS |

Availability of Corporate Governance Materials

You are encouraged to visit our website atwww.viciproperties.com to view or obtain copies of our Corporate Governance Guidelines, committee charters, Code of Business Conduct and Whistleblower Policy. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this Proxy Statement or any other report or document we file with or furnish to the SEC. You may also obtain, free of charge, a copy of our Corporate Governance Guidelines, committee charters, and Code of Business Conduct by directing your request in writing to Secretary, VICI Properties Inc., 430 Park Avenue, 8th Floor, New York, New York 10022. Additional information relating to the corporate governance of our Company is also set forth below and included in other sections of this Proxy Statement.

Background. Our Corporate Governance Guidelines provide that a majority of our directors serving on our Board of Directors must be independent as required by the listing standards of the NYSE.

Independence Determinations Made by our Board of Directors. We define “independent director” by reference to the rules, regulations and listing qualifications of the NYSE. In general, a director is deemed independent if the director has no relationship to us that may interfere with the exercise of the director’s independence from management and our Company. Our Board of Directors, after broadly considering all relevant facts and circumstances regarding the past and current relationships, if any, of each director with the Company, has affirmatively determined that all of the Company’snon-employee directors, Messrs. Abrahamson, Davis, Hausler, Macnab and Rumbolz and Mses. Cantor and Holland are independent directors. In making this determination, the Board of Directors reviewed thenon-employee directors’ relationships, if any, with us, and determined that there are no material relationships that would interfere with the exercise of such directors’ independence from management and our Company.

Director Candidate Qualification and Selection Process

Director Selection Process. Our Nominating and Governance Committee is responsible for recommending director candidates and nominees to the full Board of Directors, in collaboration with the Chairman of the Board of Directors.

The Nominating and Governance Committee seeks to identify candidates based on input provided by a number of sources, including (i) other members of the Board of Directors, (ii) officers and employees of the Company and (iii) stockholders of the Company. As part of the candidate identification process, the Nominating and Governance Committee evaluates the skills, experience and diversity possessed by the current Board of Directors, and whether there are additional skills, experience or diversity that should be added to complement the composition of the existing Board of Directors. The Nominating and Governance Committee also will take into account whether existing directors have indicated a willingness to continue to serve as directors ifre-nominated.The Nominating and Governance Committee will also seek ongoing input from the incumbent directors and the Chief Executive Officer, with the goal of identifying and informally approaching possible director candidates in advance of actual need. The Board shall itself determine in each case the manner by which an invitation to join the Board of the Directors shall be extended to director nominees, other than those nominated directly by the Company’s stockholders.

Once director candidates have been identified, the Nominating and Governance Committee will then evaluate each candidate in light of his or her qualifications and credentials, and any additional factors that the Nominating and Governance Committee deems necessary or appropriate. Existing directors who are being considered forre-nomination will bere-evaluated as part of the Nominating and Governance Committee’s process of recommending director candidates.

Director Qualifications. Our Corporate Governance Guidelines contain the membership criteria for our Board of Directors. Directors should have (i) integrity, strength of character, vision, imagination and loyalty to the Company and its stockholders, (ii) practical and mature judgment, with ability to evaluate and appraise objectively the Company’s strategies and financial position and possess the necessary governance experience and relevant skills to fulfill the role of fiduciary oversight, (iii) substantial business experience and strong financial acumen, with practical application to the Company’s needs, (iv) the willingness and ability to make a significant commitment of time and attention to the Board of Director’s processes and affairs, including meetings and preparation, (v) the ability to work with fellow directors as members of a collegial group, without necessarily always agreeing with them, and the ability to provide guidance, relevant insights and support to the Company’s Chief Executive Officer and senior management team, (vi) an absence of conflicts of interest that would interfere with Board of Director service, (vii) the ability to secure relevant licenses required and (viii) a commitment to having a meaningful, long-term equity ownership stake in the Company in compliance with any director stock ownership guidelines adopted by the Board of Directors.

We endeavor to have a Board of Directors that represents diverse backgrounds, experiences, expertise, skills and contacts, and a range of tenures that are appropriate given the Company’s current and anticipated circumstances and that, collectively, enable the Board of Directors to perform its oversight function effectively.

16

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

CORPORATE GOVERNANCE MATTERS |

Directors are expected to prepare for, attend regularly and participate actively and constructively at meetings of the Board of Directors and its committees. Directors are expected to review the material that is distributed in advance of any Board of Directors or Committee meeting. The Board of Directors will consider other commitments, including board service, in assessing each director’s and potential candidate’s ability to serve on the Board of Directors and fulfill his or her responsibilities. Each director is expected to notify the Board of Directors chair and the chair of the Nominating and Governance Committee in advance of accepting an invitation to serve as a member of another public company board of directors.

Other Considerations. The Nominating and Governance Committee will consider the optimal size and composition of the Board of Directors and identify and screen candidates qualified to serve on the Board of Directors, consistent with the criteria approved by the Board of Directors, including considering suggestions for Board of Directors membership submitted by stockholders in accordance with the notice provisions and procedures set forth in the Company’s bylaws.

After completing the identification and evaluation process described above, the Nominating and Governance Committee will recommend to the Board of Directors the nomination of a number of candidates equal to the number of director vacancies that will exist at the annual meeting of stockholders. The Board of Directors will then select the Board’s director nominees for stockholders to consider and vote upon at the annual meeting of stockholders.

Stockholder Recommendations for Board Nominations.Our Nominating and Governance Committee considers properly submitted stockholder recommendations for candidates for membership on our Board of Directors complying with procedural requirements that may be communicated to stockholders from time to time. The recommendation should be addressed to the Secretary, VICI Properties Inc., 430 Park Avenue, 8th Floor, New York, New York 10022.

Leadership Structure of our Board of Directors

At the present time, the Board of Directors believes that a structure that separates the roles of chair and Chief Executive Officer is appropriate and that the chair should serve in anon-executive role. However, the Board of Directors does not believe that mandating any single structure regarding the separation of the roles of chair of the Board of Directors and Chief Executive Officer is necessary or appropriate. The Board of Directors reserves the right to determine the appropriate leadership structure for the Board of Directors on acase-by-case basis, taking into account at any particular time the Board of Directors’ assessment of its and the Company’s needs, as well as the people and situation involved. As a result of the current separation between the roles of chair of the Board of Directors and Chief Executive Officer (where the current chair is an independent director), the Board of Directors has determined that no lead independent director is necessary at this time.

|

17

|

CORPORATE GOVERNANCE MATTERS |

The Board of Directors’ Role in Risk Oversight

THE BOARD

The Board of Directors has overall responsibility for risk oversight, including, as part of regular Board and committee meetings, general oversight of executives’ management of risks relevant to the Company. In this regard, the Board of Directors seeks to identify, understand, analyze and oversee critical business risks. While the full Board of Directors has primary responsibility for risk oversight, it utilizes its committees, as appropriate, to monitor and address risks that may be within the scope of a particular committee’s expertise or charter. Our Board of Directors uses its committees to assist in its risk oversight function as follows: | ||||

• • • • • | • • • • • | • • • • • |

AUDIT & FINANCE COMMITTEE

|

COMPENSATION COMMITTEE

|

NOMINATING AND GOVERNANCE COMMITTEE

| ||||||||||||||||||

The Audit & Finance Committee’s responsibilities include, among others, oversight relating to the integrity of our financial statements and financial reporting process; compliance with legal and regulatory requirements; the performance of our internal audit function; our primary financial policies and programs, including those relating to leverage ratio, debt coverage, dividend policy and major financial risk exposures; policies and transactions related to corporate finance and capital markets activities; and the evaluation of our annual and long term strategic plans and transactions related to capital allocation and major strategic initiatives, including potential acquisitions, divestitures, restructurings of business units, and formation of new businesses.

| The Compensation Committee’s responsibilities include, among others, oversight of risks related to our compensation practices and plans to ensure that such practices and plans are designed with an appropriate balance of risk and reward in relation to our overall business strategy and do not encourage excessive or unnecessary risk-taking behavior. | The Nominating and Governance Committee’s responsibilities include, among others, oversight of (i) the general operations of the Board; (ii) the Company’s compliance with our Corporate Governance Guidelines and applicable laws and regulations, including applicable rules of the NYSE; and (iii) corporate governance-related risk. |

While the Board of Directors oversees risk management as part of anon-going process, the Company’s management is charged with managing risk. Management periodically reports to the Board of Directors and its committees, as appropriate, on the material risks to the Company, including any major strategic, operational, regulatory and external risks inherent in the Company’s business and the policies and procedures with respect to such risks.

18

| VICI PROPERTIES INC. — 2019 PROXY STATEMENT

|

CORPORATE GOVERNANCE MATTERS |

Our Board of Directors has three standing committees: the Audit & Finance Committee; the Compensation Committee; and the Nominating and Governance Committee. Our committees are composed entirely of independent directors as defined under the rules, regulations and listing qualifications of the NYSE. From time to time, our Board of Directors may also create additional committees for such purposes as our Board of Directors may determine.

The table below provides membership information for each of the Board committees as of the date of this Proxy Statement:

Director

| Audit & Finance Committee | Compensation Committee | Nominating and Governance Committee | |||

James R. Abrahamson(1)

|

Ex Officio Member

|

Ex Officio Member

|

Ex Officio Member

| |||

Diana F. Cantor*

|

Member

|

Member

| ||||

Eugene I. Davis*

|

Chair

|

Member

| ||||

Eric L. Hausler*

|

Member

|

Chair

| ||||

Elizabeth I. Holland*

|

Member

|

Member

| ||||

Craig Macnab

|

Chair

|

Member

| ||||

Michael D. Rumbolz

|

Member

|

Member

| ||||

| (1) | Mr. Abrahamson serves as our independent Chairman of the Board of Directors. Whenever possible, he actively participates, but does not vote, in meetings of the committees of the Board. |

| * | Audit committee financial expert |

AUDIT & FINANCE COMMITTEE

The Audit & Finance Committee monitors the integrity of (i) our financial statements and financial reporting processes, (ii) our compliance with legal and regulatory requirements, (iii) our continued qualification as a REIT, (iv) the performance of our internal audit function as well as of our independent auditors, (v) the qualifications and independence of our independent auditor, (vi) our primary financial policies and programs, including those relating to leverage ratio, debt coverage, dividend policy and major financial risk policies, and (vii) our policies and transactions related to corporate finance, capital markets activities, capital allocation and major strategic initiatives, including potential acquisitions, divestitures, restructurings of business units, and formation of new businesses. The Audit & Finance Committee selects, assists and meets with the independent auditor, oversees each annual audit and quarterly review, establishes and maintains our internal audit controls and prepares the report that Federal securities laws require be included in our annual proxy statement. In addition, the Audit & Finance Committee is responsible for reviewing and assessing our policies and procedures related to our compliance with applicable gaming regulations. The duties and responsibilities of our Audit & Finance Committee are more fully described in our Audit & Finance Committee Charter, which is available under the “Investors” tab of the Company’s website atwww.viciproperties.com, under the heading “Governance—Governance Documents”.

Our Board of Directors has determined that all members of our Audit & Finance Committee qualify as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC RegulationS-K, and that each of them is “independent” as such term is defined by the applicable rules of the SEC and NYSE.

COMPENSATION COMMITTEE

The Compensation Committee reviews and approves the compensation and benefits of our executive officers and directors, administers and makes recommendations to our Board of Directors regarding our compensation and stock incentive plans, produces an annual report on executive compensation for inclusion in our annual report or proxy statement and publishes an annual committee report for our stockholders. The duties and responsibilities of our Compensation Committee are more fully described in our Compensation Committee Charter, which is available under the “Investors” tab of the Company’s website atwww.viciproperties.com, under the heading “Governance—Governance Documents”.

The Compensation Committee may obtain advice from external or internal compensation consultants, legal, accounting or other advisors. The Compensation Committee has the sole authority and appropriate funding from the Company to select, approve, retain, terminate and oversee outside consultants, experts and legal, accounting and other advisors as it deems appropriate to assist it in the performance of its responsibilities. The Compensation Committee also has the sole authority to determine the terms of the engagement and the compensation of any such advisors. The Compensation Committee considers the independence of any compensation consultant or advisor retained or to be retained by it, including any independence factors it is required to consider by the NYSE, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the rules and regulations promulgated by the SEC thereunder, or other applicable laws and regulations.

Our Board has determined that each of the members of the Compensation Committee is independent as defined by our Corporate Governance Guidelines and the NYSE listing standards applicable to boards of directors generally and compensation committees in particular.

|

19

|

CORPORATE GOVERNANCE MATTERS |

NOMINATINGAND GOVERNANCE COMMITTEE

The Nominating and Governance Committee (i) establishes criteria for prospective members of our Board of Directors, conducts candidate searches and interviews, and formally proposes the slate of directors to be elected at each annual meeting of our stockholders, (ii) develops and recommends to our Board of Directors adoption of our Corporate Governance Guidelines, our Code of Business Conduct and our policies with respect to conflicts of interest, (iii) makes recommendations to the Board of Directors as to the membership of committees of the Board of Directors, including a chair for each committee, (iv) oversees and evaluates our Board of Directors and management, (v) evaluates from time to time the appropriate size and composition of our Board of Directors and recommends, as appropriate, increases, decreases and changes in the composition of our Board of Directors and (vi) monitors our compliance with the corporate governance requirements of state and Federal law. The duties and responsibilities of our Nominating and Governance Committee are more fully described in our Nominating and Governance Committee Charter, which is available under the “Investors” tab of the Company’s website atwww.viciproperties.com, under the heading “Governance—Governance Documents”.

Our Board has determined that each of the members of the Nominating and Governance Committee is independent as defined by our Corporate Governance Guidelines and the NYSE listing standards.

Executive Sessions ofNon-Management Directors