Exhibit 99.2 JACK CINCINNATI CASINO TRANSACTION OVERVIEW APRIL 5, 2019

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 DISCLAIMERS 112 173 71 Forward-Looking Statements 72 73 79 This presentation contains forward-looking statements within the meaning of the federal securities laws. You can identify these statements by our use of the words “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,” and similar expressions that do not relate to historical matters. All statements other than statements of historical fact are forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors which are, in some 162 35 45 cases, beyond the control of VICI Properties Inc. and its subsidiaries (collectively, the “Company” or “VICI”) and could materially affect actual results, performance, or achievements. Among those risks, uncertainties and other factors are risks that the acquisition of the JACK Cincinnati Casino may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to 244 242 241 satisfy the conditions set forth in the definitive transaction documents, including the ability to receive, or delays in obtaining, the regulatory approvals required to consummate the transaction; the terms on which the Company finances the transaction, including the source of funds used to finance such transaction; disruptions to the real property and operations of the JACK Cincinnati Casino 194 209 216 during the pendency of the closing; risks that the Company may not achieve the benefits contemplated by the acquisition of the real estate assets (including any expected accretion or the amount of any future rent payments); and risks that not all potential risks and liabilities have been identified in the due diligence. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Market and Industry Data This presentation contains estimates and information concerning the Company's industry and certain relevant markets, including macroeconomic data and gross gaming revenue, that are based on industry publications, reports and public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described above under “Forward-Looking Statements.” Non‐GAAP Financial Measures This presentation includes reference to Adjusted Funds From Operations (“AFFO”), and Adjusted EBITDARM, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non‐GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe AFFO provides a meaningful perspective of the underlying operating performance of our business. We use Adjusted EBITDARM to evaluate the capacity of the tenant under the lease agreement for the JACK Cincinnati Casino to meet its obligations thereunder. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that Adjusted EBIDTARM, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP. 2

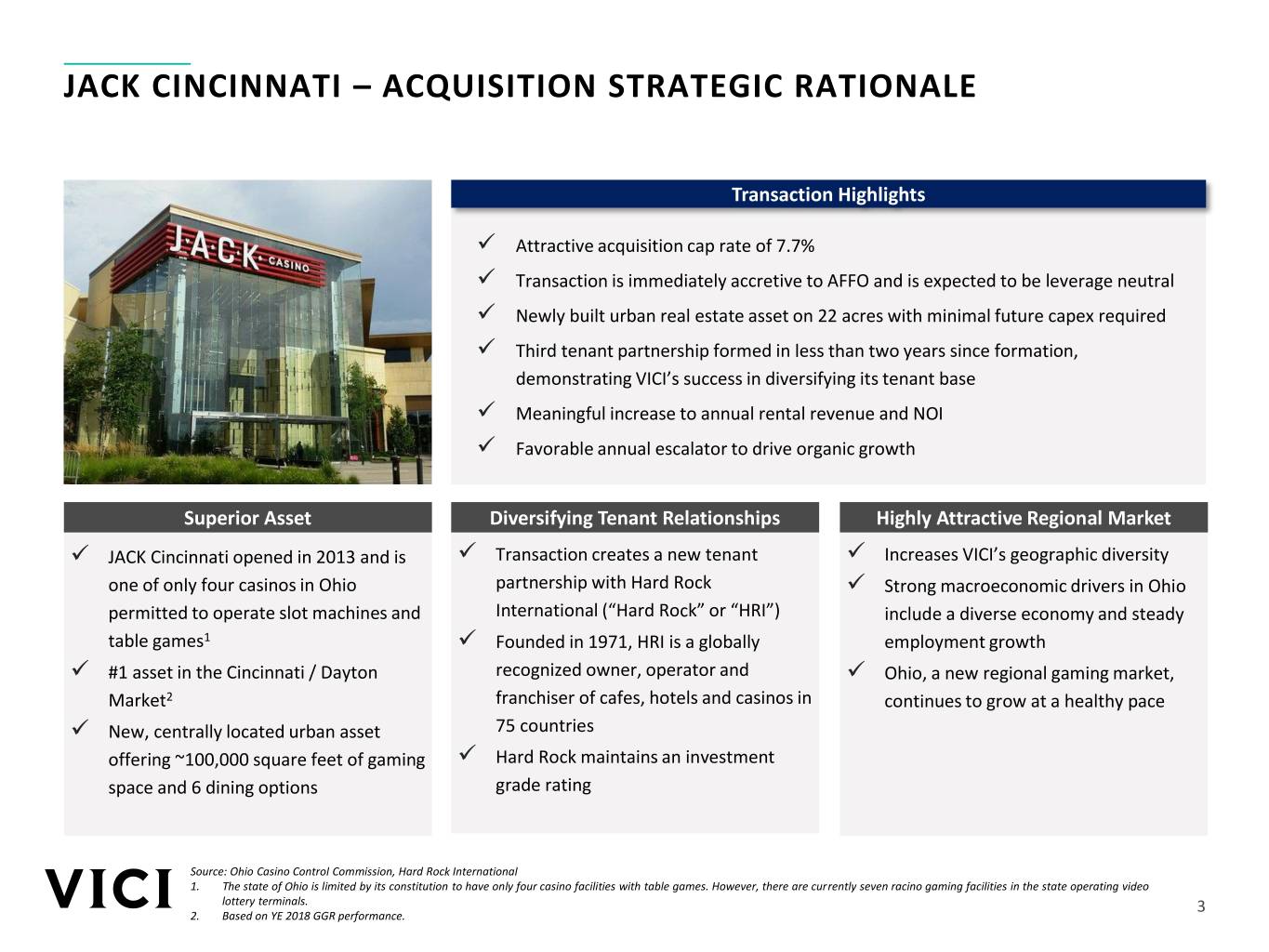

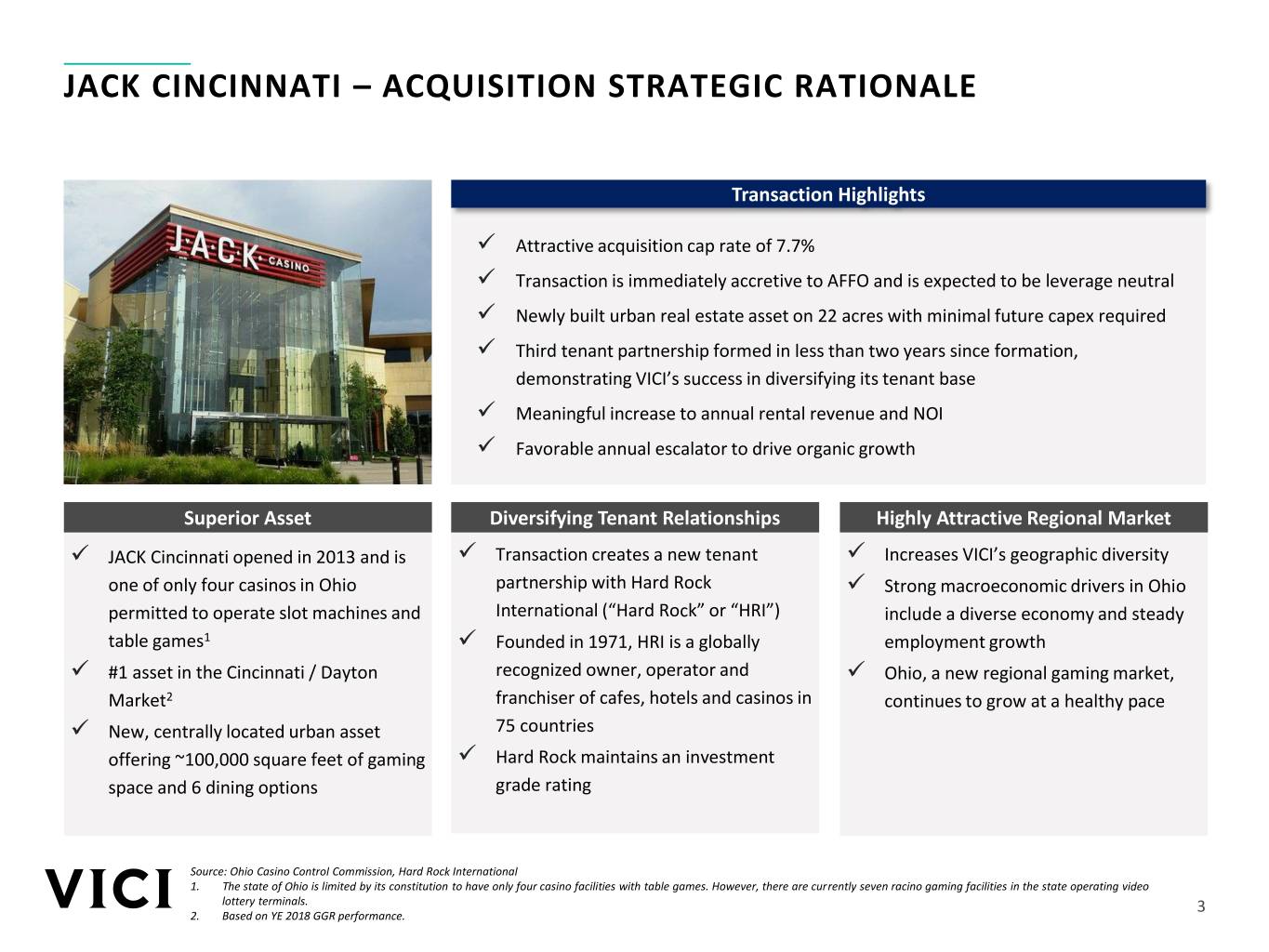

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 JACK CINCINNATI – ACQUISITION STRATEGIC RATIONALE 112 173 71 72 73 79 162 35 45 Transaction Highlights 244 242 241 Attractive acquisition cap rate of 7.7% 194 209 216 Transaction is immediately accretive to AFFO and is expected to be leverage neutral Newly built urban real estate asset on 22 acres with minimal future capex required Third tenant partnership formed in less than two years since formation, demonstrating VICI’s success in diversifying its tenant base Meaningful increase to annual rental revenue and NOI Favorable annual escalator to drive organic growth Superior Asset Diversifying Tenant Relationships Highly Attractive Regional Market JACK Cincinnati opened in 2013 and is Transaction creates a new tenant Increases VICI’s geographic diversity one of only four casinos in Ohio partnership with Hard Rock Strong macroeconomic drivers in Ohio permitted to operate slot machines and International (“Hard Rock” or “HRI”) include a diverse economy and steady table games1 Founded in 1971, HRI is a globally employment growth #1 asset in the Cincinnati / Dayton recognized owner, operator and Ohio, a new regional gaming market, Market2 franchiser of cafes, hotels and casinos in continues to grow at a healthy pace New, centrally located urban asset 75 countries offering ~100,000 square feet of gaming Hard Rock maintains an investment space and 6 dining options grade rating Source: Ohio Casino Control Commission, Hard Rock International 1. The state of Ohio is limited by its constitution to have only four casino facilities with table games. However, there are currently seven racino gaming facilities in the state operating video lottery terminals. 3 2. Based on YE 2018 GGR performance.

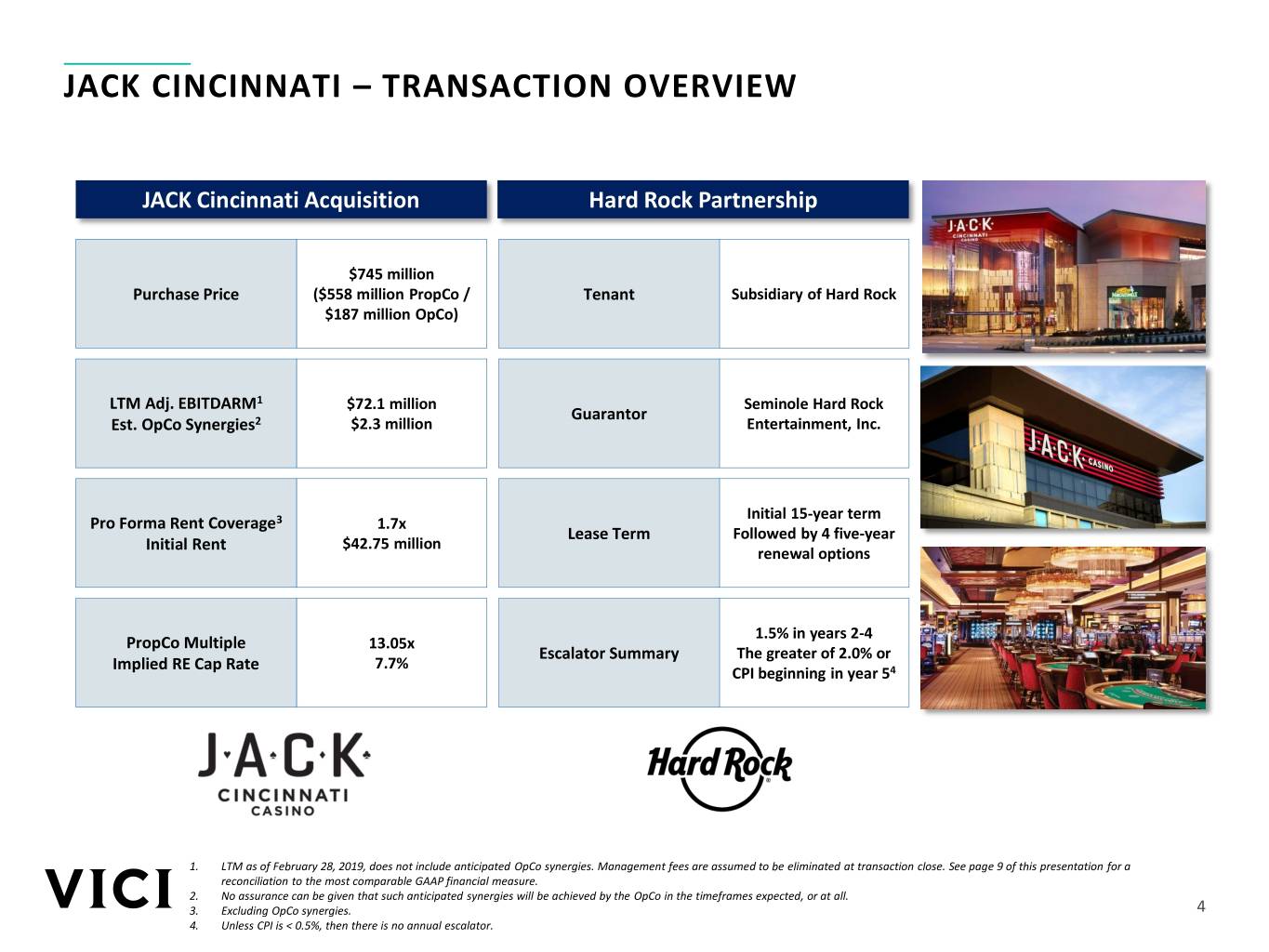

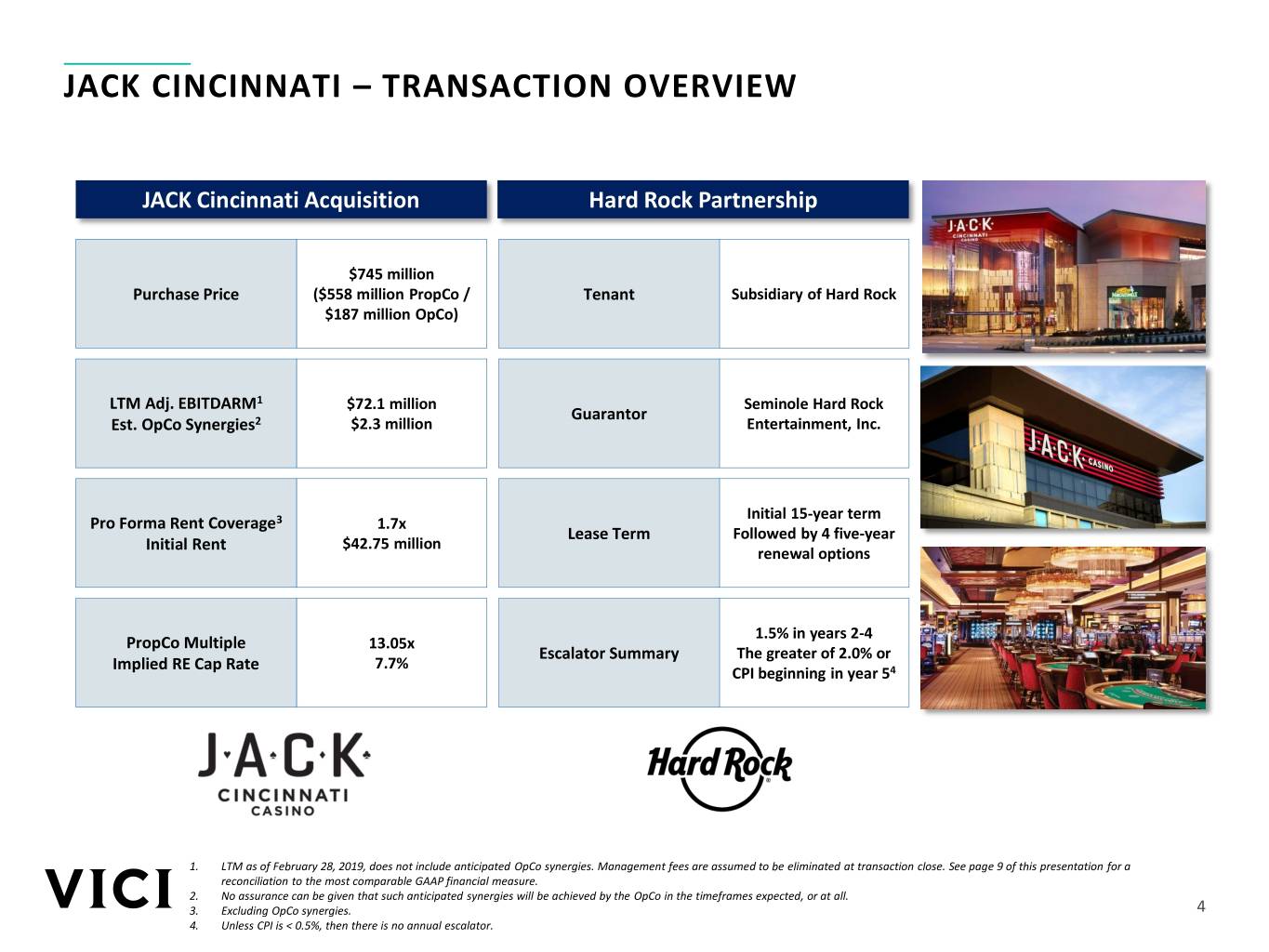

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 JACK CINCINNATI – TRANSACTION OVERVIEW 112 173 71 72 73 79 162 35 45 JACK Cincinnati Acquisition Hard Rock Partnership 244 242 241 $745 million 194 209 216 Purchase Price ($558 million PropCo / Tenant Subsidiary of Hard Rock $187 million OpCo) LTM Adj. EBITDARM1 $72.1 million Seminole Hard Rock Guarantor Est. OpCo Synergies2 $2.3 million Entertainment, Inc. Initial 15-year term Pro Forma Rent Coverage3 1.7x Lease Term Followed by 4 five-year Initial Rent $42.75 million renewal options 1.5% in years 2-4 PropCo Multiple 13.05x Escalator Summary The greater of 2.0% or Implied RE Cap Rate 7.7% CPI beginning in year 54 1. LTM as of February 28, 2019, does not include anticipated OpCo synergies. Management fees are assumed to be eliminated at transaction close. See page 9 of this presentation for a reconciliation to the most comparable GAAP financial measure. 2. No assurance can be given that such anticipated synergies will be achieved by the OpCo in the timeframes expected, or at all. 3. Excluding OpCo synergies. 4 4. Unless CPI is < 0.5%, then there is no annual escalator.

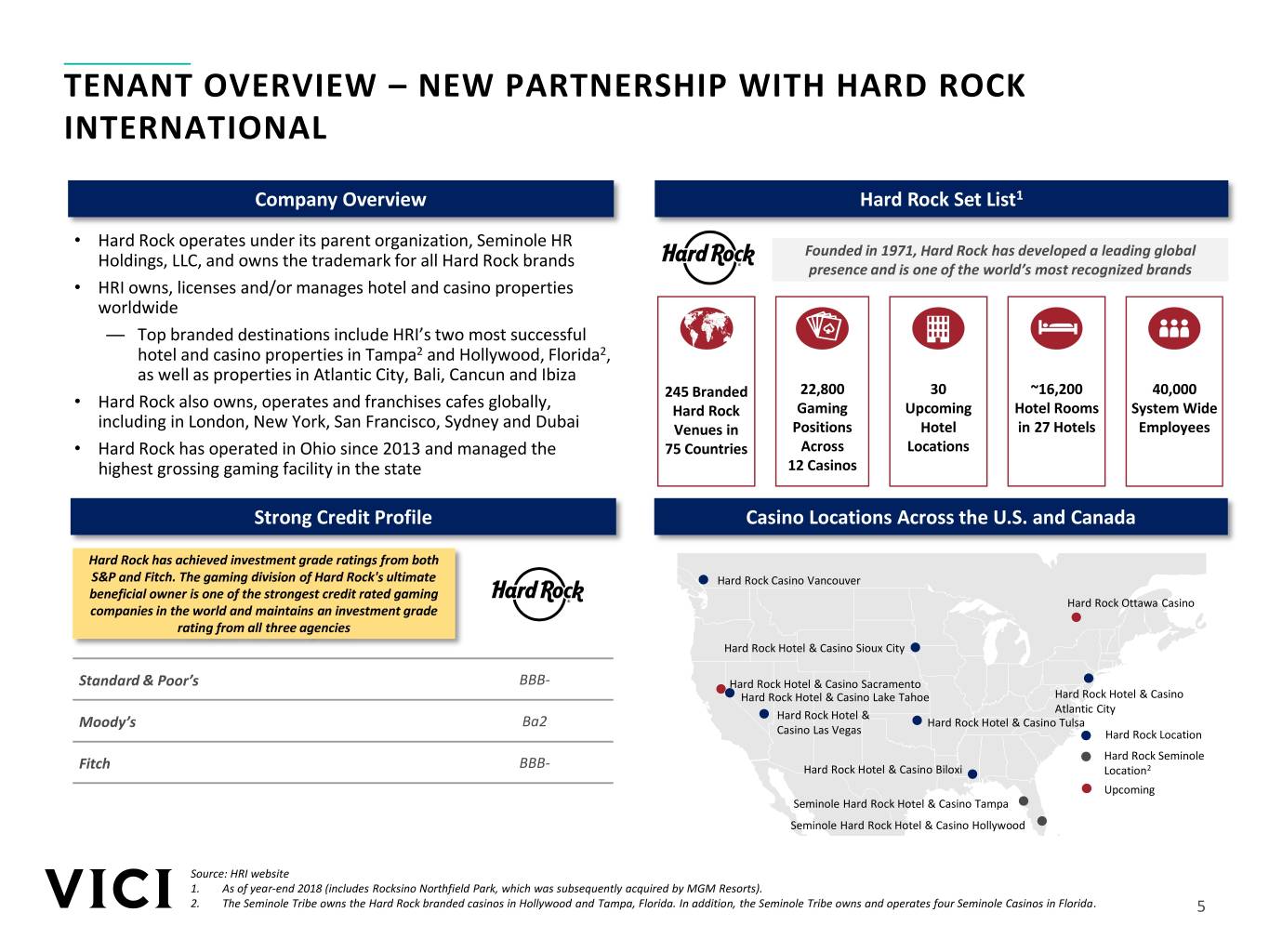

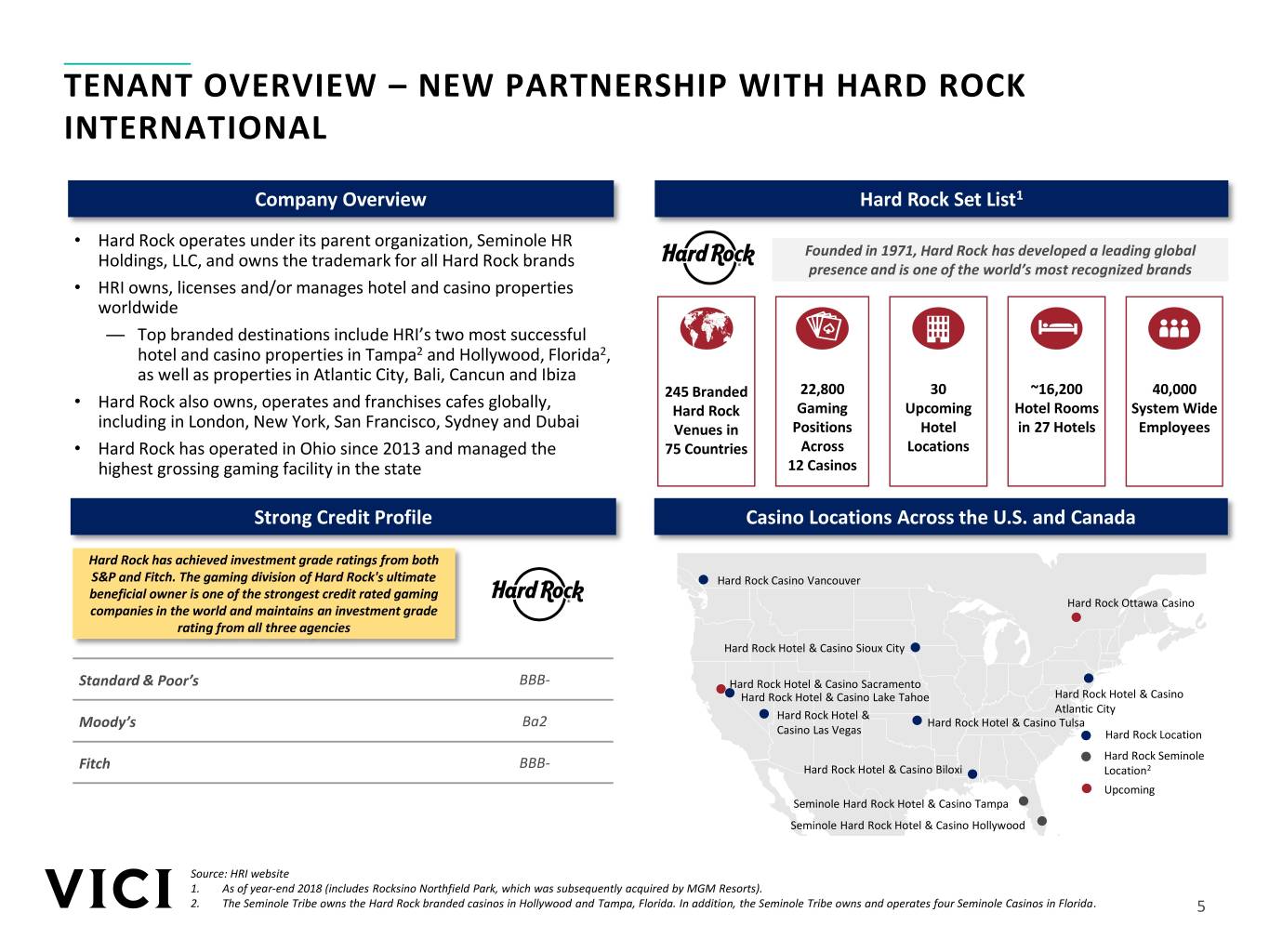

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 TENANT OVERVIEW – NEW PARTNERSHIP WITH HARD ROCK 112 173 71 INTERNATIONAL 72 73 79 162 35 45 Company Overview Hard Rock Set List1 • Hard Rock operates under its parent organization, Seminole HR 244 242 241 Founded in 1971, Hard Rock has developed a leading global Holdings, LLC, and owns the trademark for all Hard Rock brands presence and is one of the world’s most recognized brands 194 209 216 • HRI owns, licenses and/or manages hotel and casino properties worldwide — Top branded destinations include HRI’s two most successful hotel and casino properties in Tampa2 and Hollywood, Florida2, as well as properties in Atlantic City, Bali, Cancun and Ibiza 22,800 30 ~16,200 40,000 • 245 Branded Hard Rock also owns, operates and franchises cafes globally, Hard Rock Gaming Upcoming Hotel Rooms System Wide including in London, New York, San Francisco, Sydney and Dubai Venues in Positions Hotel in 27 Hotels Employees • Hard Rock has operated in Ohio since 2013 and managed the 75 Countries Across Locations highest grossing gaming facility in the state 12 Casinos Strong Credit Profile Casino Locations Across the U.S. and Canada Hard Rock Atlantic City Seminole Hard Rock Hollywood Hard Rock has achieved investment grade ratings from both S&P and Fitch. The gaming division of Hard Rock's ultimate Hard Rock Casino Vancouver beneficial owner is one of the strongest credit rated gaming Hard Rock Ottawa Casino companies in the world and maintains an investment grade rating from all three agencies Hard Rock Hotel & Casino Sioux City Hard Rock Lake Tahoe Seminole Hard Rock Tampa Standard & Poor’s BBB- Hard Rock Hotel & Casino Sacramento Hard Rock Hotel & Casino Lake Tahoe Hard Rock Hotel & Casino Atlantic City Hard Rock Hotel & Moody’s Ba2 Hard Rock Hotel & Casino Tulsa Casino Las Vegas Hard Rock Location Hard Rock Seminole Fitch BBB- Hard Rock Hotel & Casino Biloxi Location2 Upcoming Seminole Hard Rock Hotel & Casino Tampa Seminole Hard Rock Hotel & Casino Hollywood Source: HRI website 1. As of year-end 2018 (includes Rocksino Northfield Park, which was subsequently acquired by MGM Resorts). 2. The Seminole Tribe owns the Hard Rock branded casinos in Hollywood and Tampa, Florida. In addition, the Seminole Tribe owns and operates four Seminole Casinos in Florida. 5

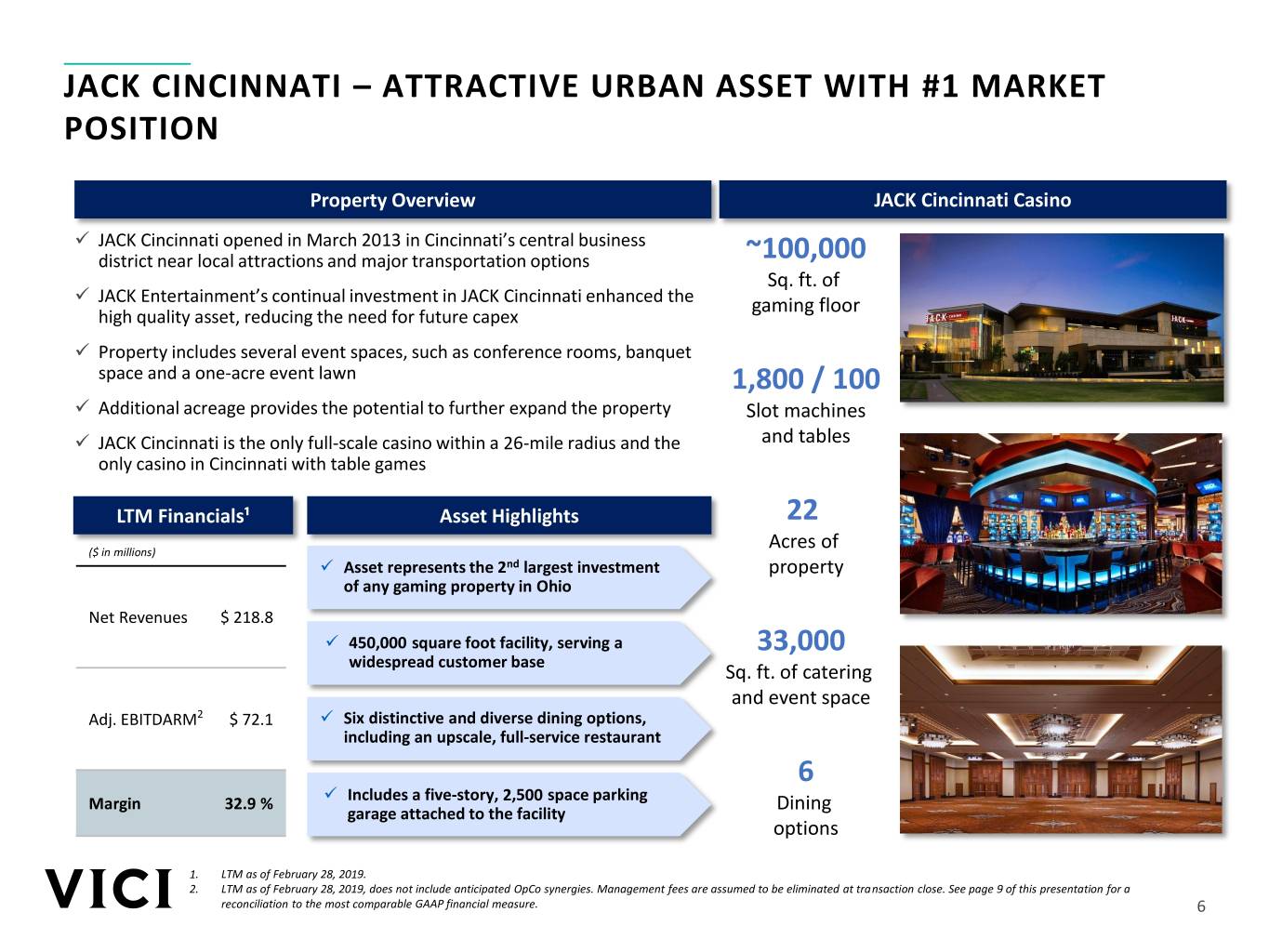

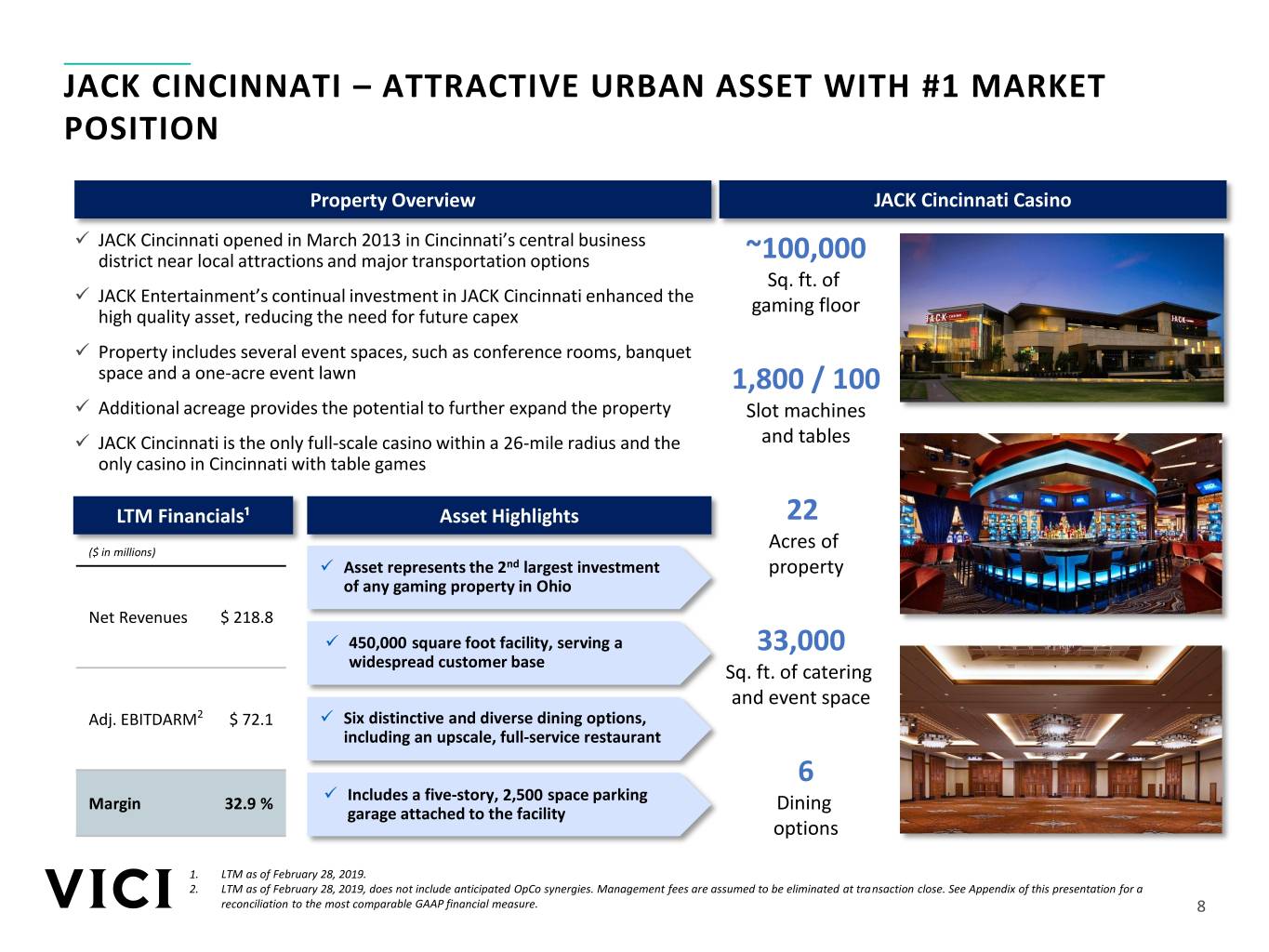

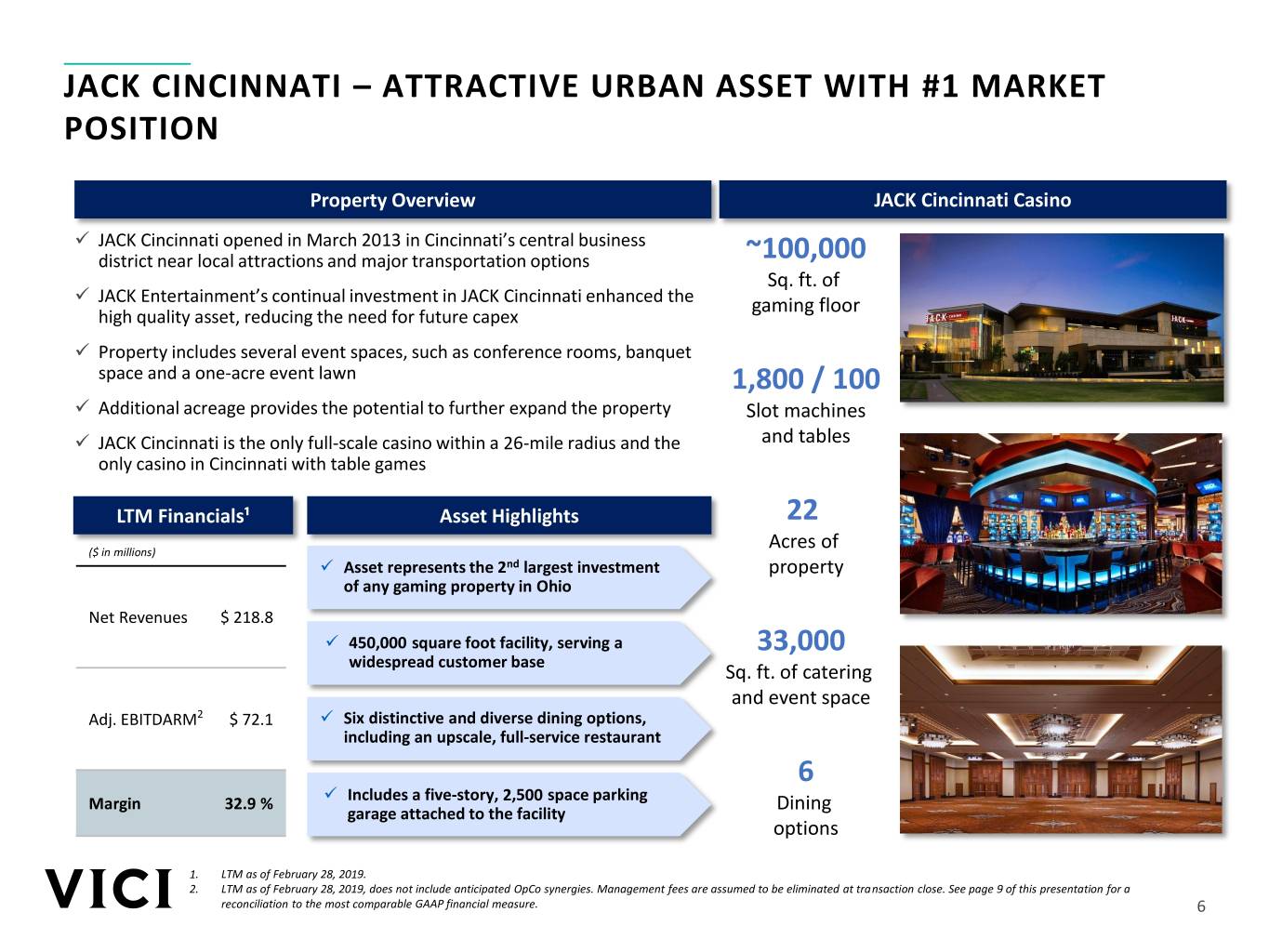

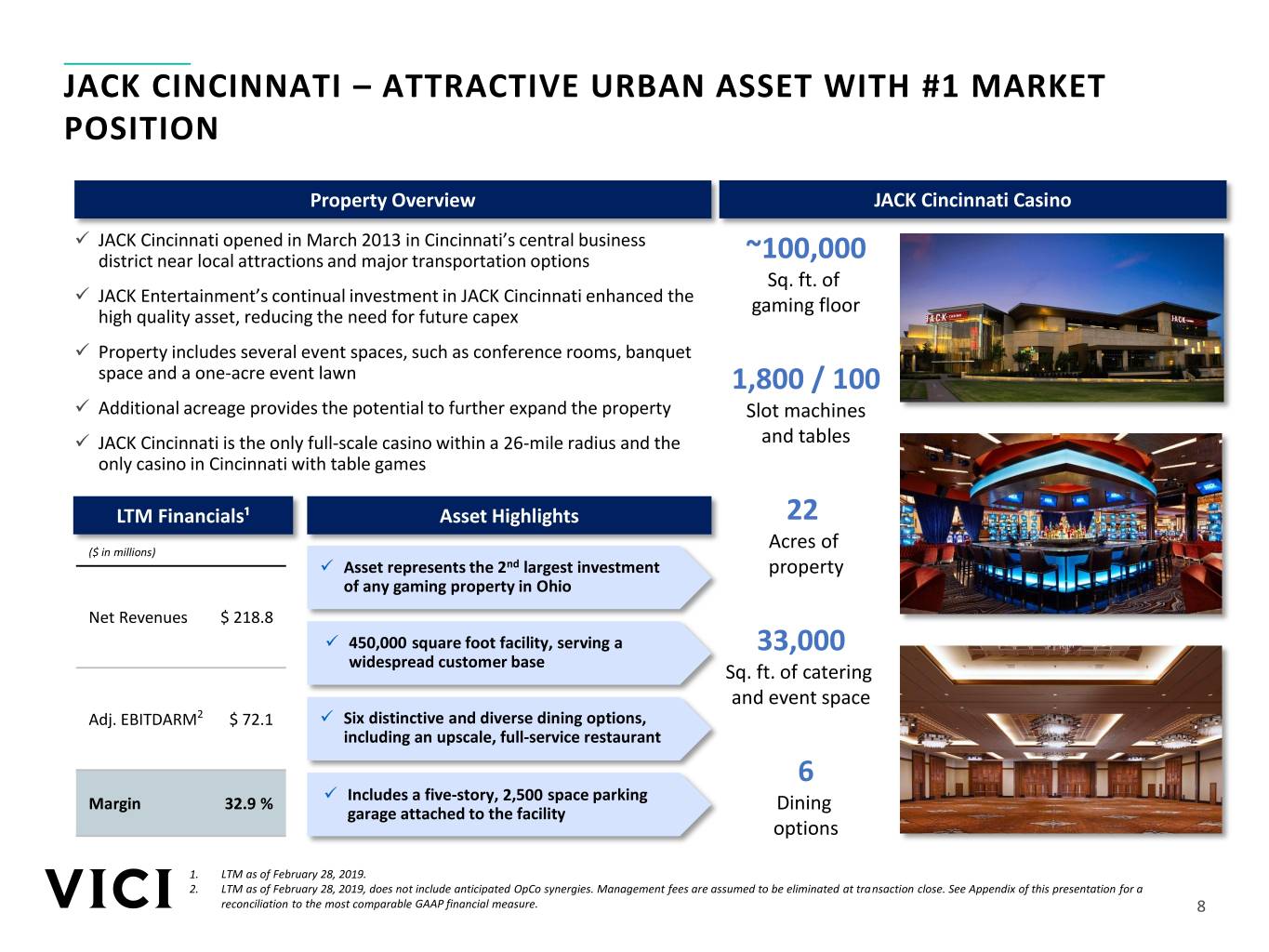

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 JACK CINCINNATI – ATTRACTIVE URBAN ASSET WITH #1 MARKET JACK Entertainment’s $437 initial investment in 112 173 71 JACK Cincinnati created $24 POSITION a high quality asset with 72 73 79 little need for capital spend. Furthermore, the asset has been enhanced 162 35 45 Property Overview JACK Cincinnati Casino with $24 million of additional investments 244 242 241 JACK Cincinnati opened in March 2013 in Cincinnati’s central business $413 ~100,000 Initial Investment district near local attractions and major transportation options Spend Since 194 209 216 Sq. ft. of Initial Investment JACK Entertainment’s continual investment in JACK Cincinnati enhanced the gaming floor high quality asset, reducing the need for future capex Property includes several event spaces, such as conference rooms, banquet space and a one-acre event lawn 1,800 / 100 CapEx Additional acreage provides the potential to further expand the property Slot machines Initial investment JACK Cincinnati is the only full-scale casino within a 26-mile radius and the and tables Spend since only casino in Cincinnati with table games initial investment $ 628 LTM Financials¹ Asset Highlights 22 ($ in millions) Acres of Asset represents the 2nd largest investment property of any gaming property in Ohio $ 387 Net Revenues $ 218.8 $ 581 450,000 square foot facility, serving a 33,000 widespread customer base Sq. ft. of catering $ 363 $ 166 and event space Adj. EBITDARM2 $ 72.1 Six distinctive and diverse dining options, $ 70 including an upscale, full-service restaurant $ 95 $ 47 $ 24 6 Includes a five-story, 2,500 space parking JACK JACK JACK Margin 32.9 % Dining garage attached to the facility Cleveland Cincinnati Thistledown options 1. LTM as of February 28, 2019. 2. LTM as of February 28, 2019, does not include anticipated OpCo synergies. Management fees are assumed to be eliminated at transaction close. See page 9 of this presentation for a reconciliation to the most comparable GAAP financial measure. 6

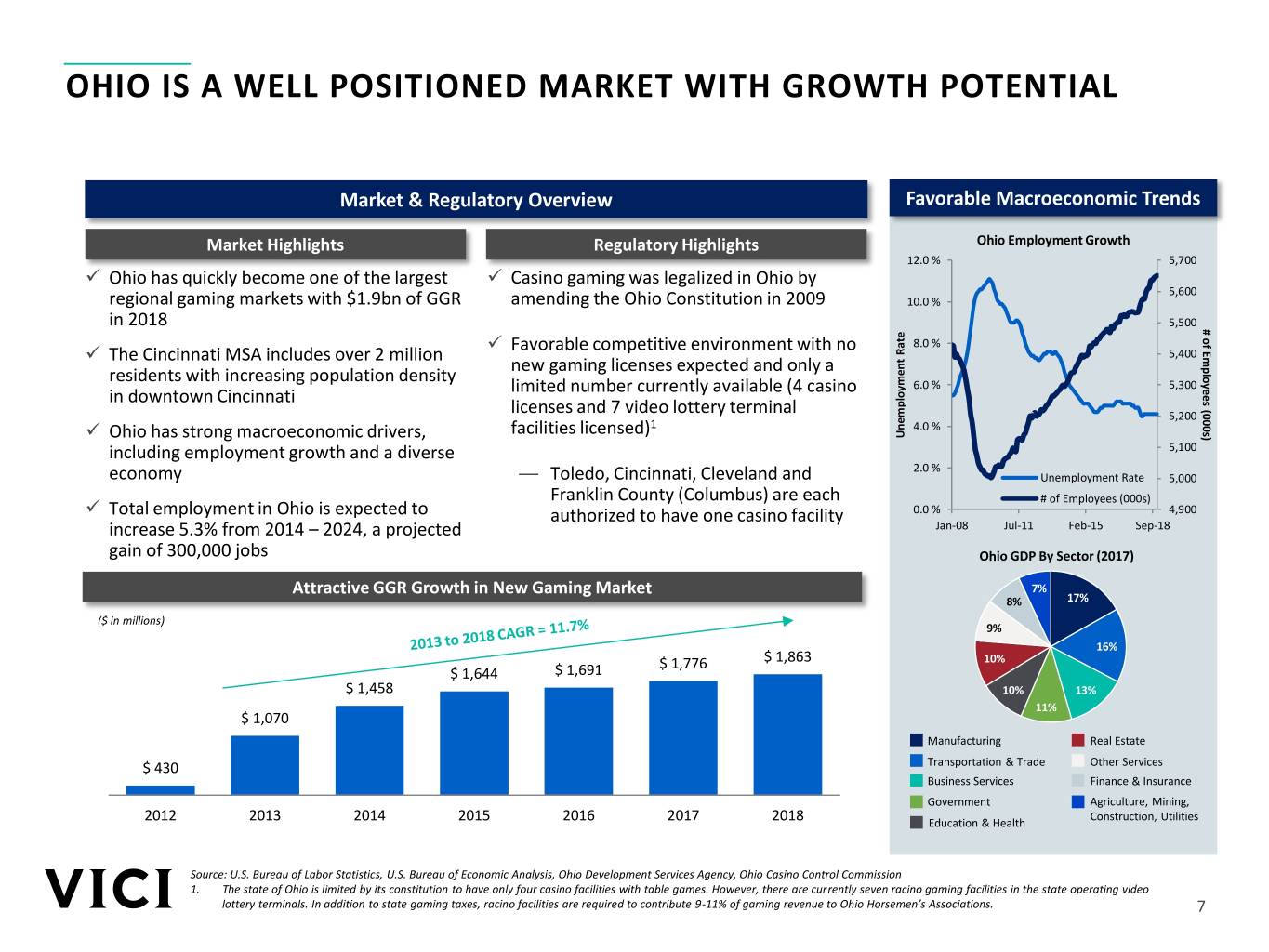

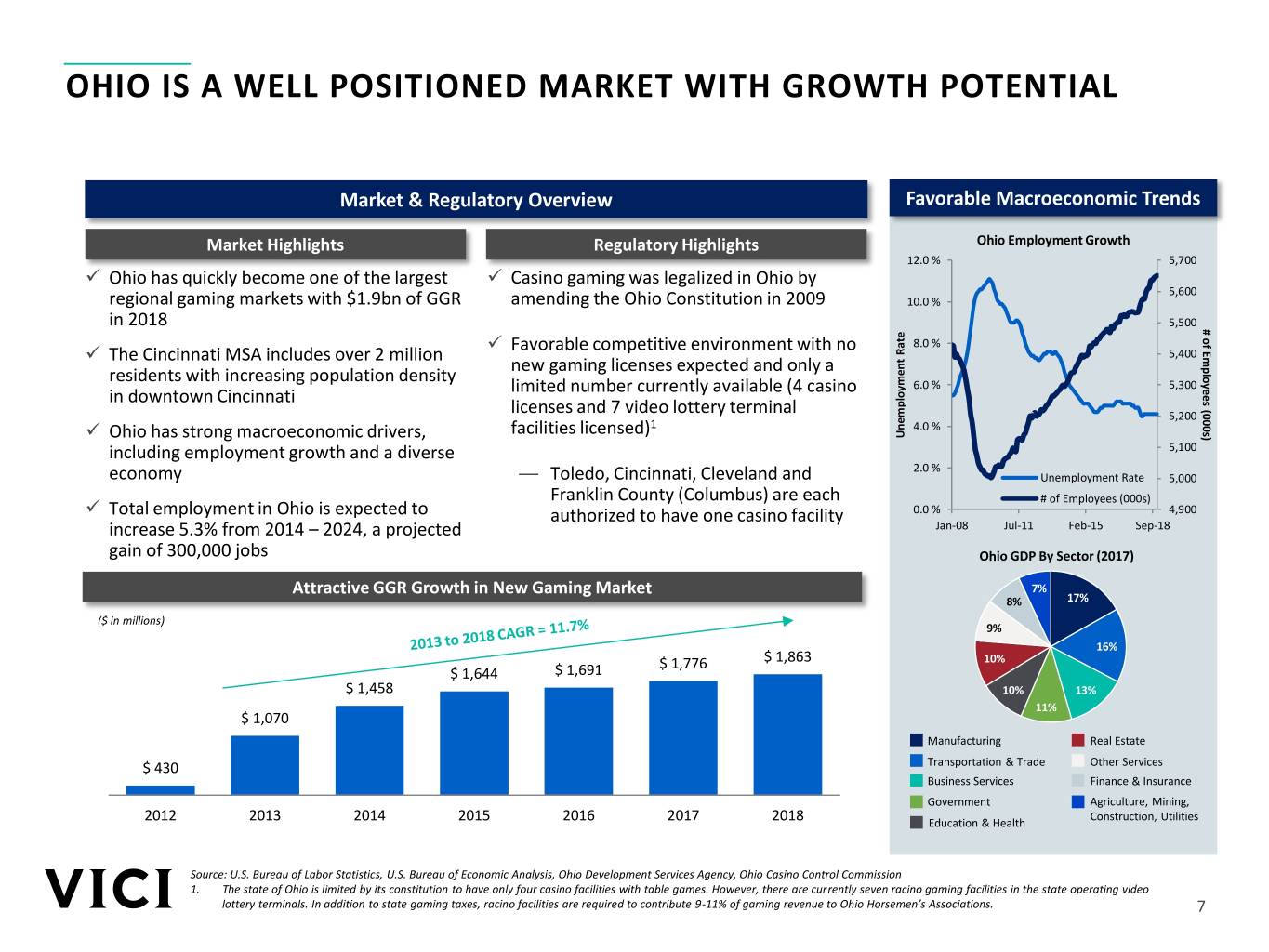

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 OHIO IS A WELL POSITIONED MARKET WITH GROWTH POTENTIAL 112 173 71 72 73 79 162 35 45 Market & Regulatory Overview Favorable Macroeconomic Trends Ohio Employment Growth 244 242 241 Market Highlights Regulatory Highlights 12.0 % 5,700 Ohio has quickly become one of the largest Casino gaming was legalized in Ohio by 194 209 216 5,600 regional gaming markets with $1.9bn of GGR amending the Ohio Constitution in 2009 10.0 % in 2018 5,500 (000s) Employeesof # Favorable competitive environment with no 8.0 % The Cincinnati MSA includes over 2 million 5,400 new gaming licenses expected and only a residents with increasing population density limited number currently available (4 casino 6.0 % 5,300 in downtown Cincinnati licenses and 7 video lottery terminal 5,200 1 4.0 % facilities licensed) Unemployment Rate Ohio has strong macroeconomic drivers, including employment growth and a diverse 5,100 2.0 % economy — Toledo, Cincinnati, Cleveland and Unemployment Rate 5,000 Franklin County (Columbus) are each # of Employees (000s) Total employment in Ohio is expected to authorized to have one casino facility 0.0 % 4,900 increase 5.3% from 2014 – 2024, a projected Jan-08 Jul-11 Feb-15 Sep-18 gain of 300,000 jobs Ohio GDP By Sector (2017) Attractive GGR Growth in New Gaming Market 7% 8% 17% ($ in millions) 9% 16% $ 1,776 $ 1,863 10% $ 1,644 $ 1,691 $ 1,458 10% 13% 11% $ 1,070 Manufacturing Real Estate $ 430 Transportation & Trade Other Services Business Services Finance & Insurance Government Agriculture, Mining, Construction, Utilities 2012 2013 2014 2015 2016 2017 2018 Education & Health Source: U.S. Bureau of Labor Statistics, U.S. Bureau of Economic Analysis, Ohio Development Services Agency, Ohio Casino Control Commission 1. The state of Ohio is limited by its constitution to have only four casino facilities with table games. However, there are currently seven racino gaming facilities in the state operating video lottery terminals. In addition to state gaming taxes, racino facilities are required to contribute 9-11% of gaming revenue to Ohio Horsemen’s Associations. 7

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 JACK CINCINNATI – ATTRACTIVE URBAN ASSET WITH #1 MARKET JACK Entertainment’s $437 initial investment in 112 173 71 JACK Cincinnati created $24 POSITION a high quality asset with 72 73 79 little need for capital spend. Furthermore, the asset has been enhanced 162 35 45 Property Overview JACK Cincinnati Casino with $24 million of additional investments 244 242 241 JACK Cincinnati opened in March 2013 in Cincinnati’s central business $413 ~100,000 Initial Investment district near local attractions and major transportation options Spend Since 194 209 216 Sq. ft. of Initial Investment JACK Entertainment’s continual investment in JACK Cincinnati enhanced the gaming floor high quality asset, reducing the need for future capex Property includes several event spaces, such as conference rooms, banquet space and a one-acre event lawn 1,800 / 100 CapEx Additional acreage provides the potential to further expand the property Slot machines Initial investment JACK Cincinnati is the only full-scale casino within a 26-mile radius and the and tables Spend since only casino in Cincinnati with table games initial investment $ 628 LTM Financials¹ Asset Highlights 22 ($ in millions) Acres of Asset represents the 2nd largest investment property of any gaming property in Ohio $ 387 Net Revenues $ 218.8 $ 581 450,000 square foot facility, serving a 33,000 widespread customer base Sq. ft. of catering $ 363 $ 166 and event space Adj. EBITDARM2 $ 72.1 Six distinctive and diverse dining options, $ 70 including an upscale, full-service restaurant $ 95 $ 47 $ 24 6 Includes a five-story, 2,500 space parking JACK JACK JACK Margin 32.9 % Dining garage attached to the facility Cleveland Cincinnati Thistledown options 1. LTM as of February 28, 2019. 2. LTM as of February 28, 2019, does not include anticipated OpCo synergies. Management fees are assumed to be eliminated at transaction close. See Appendix of this presentation for a reconciliation to the most comparable GAAP financial measure. 8

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 LEASE AGREEMENT OVERVIEW 112 173 71 JACK Cincinnati 72 73 79 162 35 45 Initial Cash Rent $42.75 million 244 242 241 194 209 216 1.5% in years 2-4 Annual Escalator > of 2.0% or CPI beginning in year 5, unless CPI is < 0.5%, then no annual escalator Rent Resets Year 8: 80% Base / 20% Variable 4% of net revenue increase / decrease Rental Reset Year 8: Average of years 5-7 less average of years 1-3 Term 15-year initial term with four 5-year renewal options Guarantee Seminole Hard Rock Entertainment, Inc. Capex Minimum 1.0% of net revenues 9

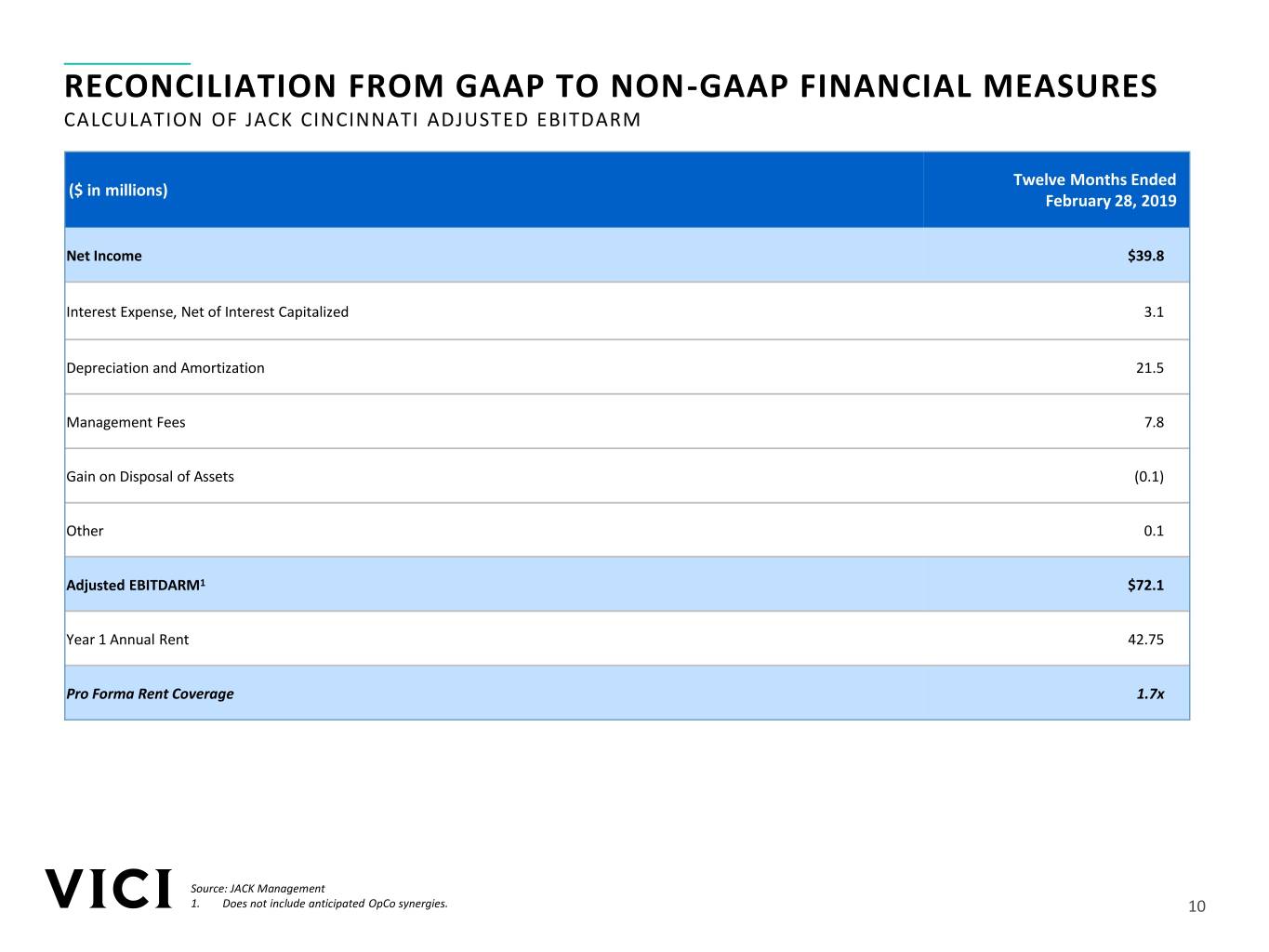

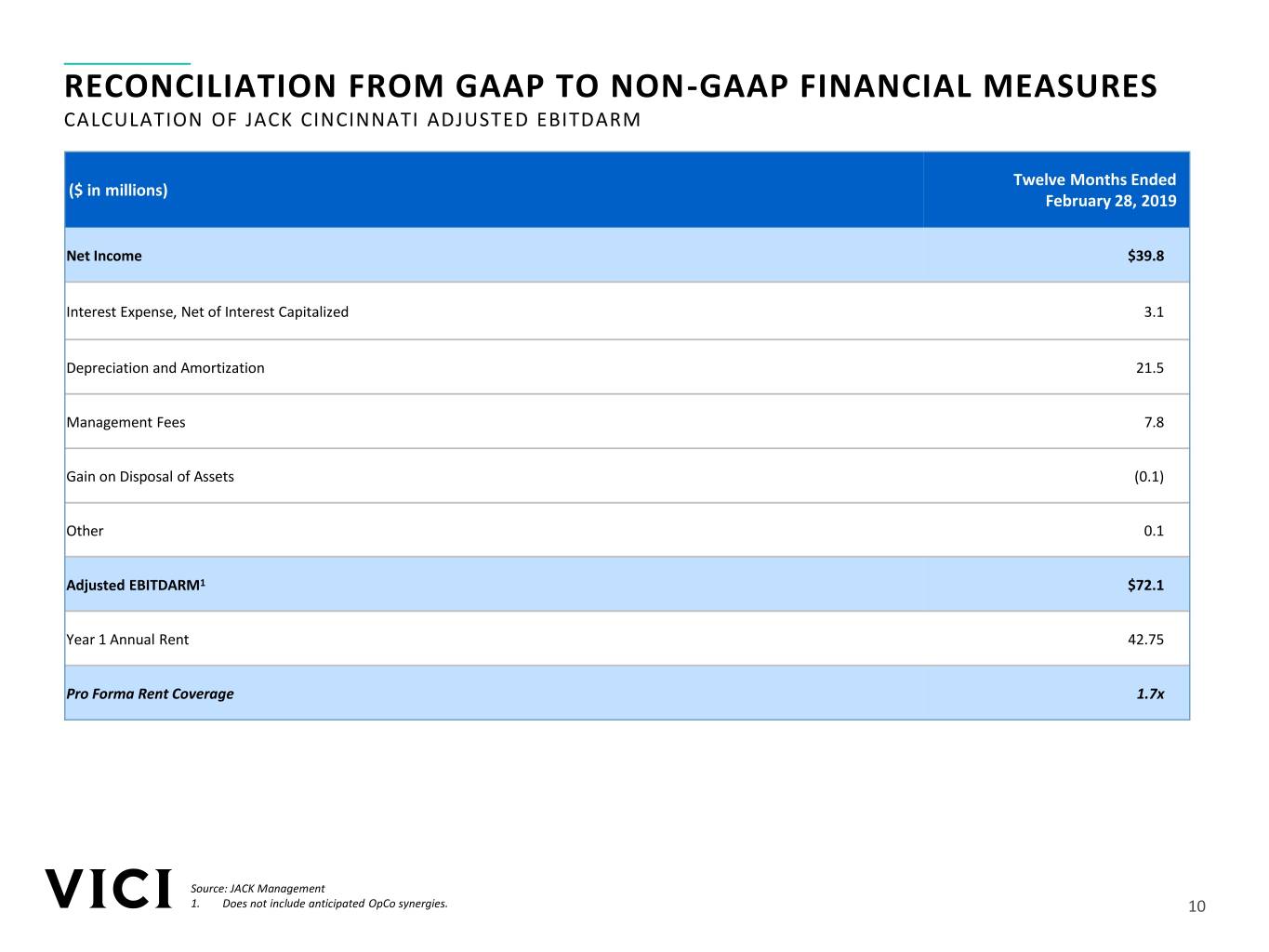

IBDROOT\PROJECTS\IBD-NY\VIGILS2017\608254_1\Docs\44. Jack - Project Gordie\2019-03-07 Investor Presentation\Transaction Overview JACK Cincinnati Casino Presentation_v13.pptx 0 32 96 0 96 199 0 187 167 RECONCILIATION FROM GAAP TO NON-GAAP FINANCIAL MEASURES 112 173 71 CALCULATION OF JACK CINCINNATI ADJUSTED EBITDARM 72 73 79 Twelve Months Ended ($ in millions) 162 35 45 February 28, 2019 244 242 241 Net Income $39.8 194 209 216 Interest Expense, Net of Interest Capitalized 3.1 Depreciation and Amortization 21.5 Management Fees 7.8 Gain on Disposal of Assets (0.1) Other 0.1 Adjusted EBITDARM1 $72.1 Year 1 Annual Rent 42.75 Pro Forma Rent Coverage 1.7x Source: JACK Management 1. Does not include anticipated OpCo synergies. 10