Exhibit 99.2 SUPPLEMENTAL FINANCIAL & OPERATING DATA F I R S T Q U A R T E R E N D E D M A R C H 3 1 , 2019

Disclaimers Forward Looking Statements Certain statements in this presentation and that may be made in meetings are forward‐looking statements. Forward‐looking statements are based on VICI Properties Inc.’s (“VICI or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate to strictly historical and current facts and by the use of the words such as "expects", "plans", "opportunities" and similar words and variations thereof. Although the Company believes that the expectations reflected in such forward‐looking statements are based on reasonable assumptions, its results, performance and achievements could differ materially from those expressed in or by the forward‐looking statements and may be affected by a variety of risks and other factors including, among others: risks that our pending acquisitions of the Greektown Casino-Hotel (“Greektown”) and/or the JACK Cincinnati Casino (“JACK Cincinnati”) may not be consummated on the terms or timeframe described herein, or at all; the ability of the parties to satisfy the conditions set forth in the definitive transaction documents for our pending acquisitions, including the ability to receive, or delays in obtaining, the regulatory and other approvals and/or consents required to consummate the transaction; the terms on which the Company finances the pending transaction, including the source of funds used to finance such transactions; disruptions to the real property and operations of Greektown and/or JACK Cincinnati during the pendency of the closing; risks that the Company may not achieve the benefits contemplated by our pending and recently completed acquisitions of real estate assets (including any expected accretion or the amount of any future rent payments); risks that not all potential risks and liabilities have been identified in the due diligence for our pending and recently completed transactions; the Company's dependence on subsidiaries of Caesars Entertainment Corporation ("Caesars") and Penn National Gaming Inc. (“Penn”) as tenants of all of its properties, and Caesars and Penn or their subsidiaries as guarantors of the relevant lease payments, and the consequences that any material adverse effect on their respective businesses could have on the Company; the Company's dependence on the gaming industry; the Company's ability to pursue its business and growth strategies may be limited by its substantial debt service requirements and by the requirement that the Company distribute 90% of its real estate investment trust ("REIT") taxable income in order to qualify for taxation as a REIT and that the Company distribute 100% of its REIT taxable income in order to avoid current entity level U.S. Federal income taxes; the impact of extensive regulation from gaming and other regulatory authorities; the ability of the Company's tenants to obtain and maintain regulatory approvals in connection with the operation of the Company's properties; the possibility that the Company’s tenants may choose not to renew their lease agreements with the Company following the initial or subsequent terms of the leases; restrictions on the Company's ability to sell its properties subject to the lease agreements; the Company's indebtedness and ability to service and refinance such indebtedness; the Company's historical and pro forma financial information that may not be reliable indicators of its future results of operations and financial condition; limits on the Company's operational and financial flexibility imposed by its debt agreements; and the possibility the Company's separation from Caesars Entertainment Operating Company, Inc. (“CEOC”) fails to qualify as a tax‐free spin‐off, which could subject the Company to significant tax liabilities. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10‐K for the year ended December 31, 2018, Quarterly Reports on Form 10‐Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Caesars and Penn Information The Company makes no representation as to the accuracy or completeness of the information regarding Caesars and/or Penn included in this presentation. Caesars, the parent and guarantor of CEOC LLC, the Company’s significant lessee, is a publicly traded company that is subject to the informational filing requirements of the Securities Exchange Act of 1934, as amended, and is required to file periodic reports on Form 10-K and Form 10-Q and current reports on Form 8-K with the Securities and Exchange Commission. Caesars’ SEC filings are available to the public from the SEC’s web site at www.sec.gov. We make no representations as to the accuracy or completeness of the information regarding Caesars that is available through the SEC’s web site or otherwise made available by Caesars or any third party, and none of such information is incorporated by reference herein. Certain financial and other information for Caesars, CEOC and Penn included in this presentation have been derived from Caesars’ and Penn’s public filings, as applicable, and other publicly available presentations and press releases. Market and Industry Data This presentation contains estimates and information concerning the Company's industry, including market position, rent growth and rent coverage of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”), AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non‐GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share, and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of March 31, 2019 unless otherwise noted. Published May 1, 2019. VICI Q1 2019 Supplemental Financial & Operating Data 2

Corporate Overview About VICI Properties (NYSE: VICI) VICI Properties Inc. (“VICI Properties” or the “Company”) is an experiential real estate investment trust that owns one of the largest portfolios of market‐leading gaming, hospitality and entertainment destinations, including the world‐renowned Caesars Palace. VICI Properties’ national, geographically diverse portfolio consists of 22 gaming facilities comprising approximately 39 million square feet and features approximately 14,800 hotel rooms and more than 150 restaurants, bars and nightclubs. The Company’s properties are leased to subsidiaries of Caesars Entertainment Corporation and Penn National Gaming, Inc., two leading gaming and hospitality companies. VICI Properties also owns four championship golf courses and 34 acres of undeveloped land adjacent to the Las Vegas Strip. VICI Properties’ strategy is to create the nation’s highest quality and most productive experiential real estate portfolio. For additional information, please visit www.viciproperties.com. Senior Management Board of Directors Titles Independent Edward Pitoniak Chief Executive Officer & Director James Abrahamson Director, Chairman of the Board ✓ John Payne President & Chief Operating Officer Diana Cantor Director, Chair of the Audit Committee ✓ David Kieske EVP, Chief Financial Officer Eric Hausler Director, Chair of the Nominating & Governance Committee ✓ Samantha Gallagher EVP, General Counsel & Secretary Elizabeth Holland Director ✓ Gabriel Wasserman Chief Accounting Officer Craig Macnab Director, Chair of the Compensation Committee ✓ Edward Pitoniak Chief Executive Officer & Director Michael Rumbolz Director ✓ Covering Equity Analysts Contact Information Firm Analyst Phone Email Barclays Felicia Hendrix (212) 526‐5562 Felicia.Hendrix@barclays.com Corporate Headquarters Transfer Agent VICI Properties Inc. BofA Merrill Lynch Shaun Kelley (646) 855‐1005 Shaun.Kelley@baml.com Computershare 430 Park Ave., 8th Fl. Citi Smedes Rose (212) 816-6243 Smedes.Rose@citi.com 2335 Alaska Avenue New York, NY 10022 Credit Suisse Ben Combes (212) 538-2383 Ben.Combes@credit-Suisse.com El Segundo, CA 90245 (646) 949‐4631 Deutsche Bank Carlo Santarelli (212) 250‐5815 Carlo.Santarelli@db.com (800) 962‐4284 Evercore ISI Rich Hightower (212) 752-0886 Rich.Hightower@evercoreisi.com www.computershare.com Goldman Sachs Stephen Grambling (212) 902‐7832 Stephen.Grambling@gs.com Investor Relations Public Markets Detail Jefferies David Katz (212) 323-3355 Dkatz@jefferies.com investors@viciproperties.com Ticker: VICI Ladenburg Thalmann & Co. John Massocca (212) 409-2543 Jmassoca@ladenburg.com Exchange: NYSE Morgan Stanley Thomas Allen (212) 761‐3356 Thomas.Allen@morganstanley.com Public Relations Nomura l Instinet Daniel Adam (212) 310-5407 Daniel.Adam@instinet.com pr@viciproperties.com Robert W. Baird RJ Milligan (813) 273-8252 Rjmilligan@rwbaird.com Stifel Nicolaus Simon Yarmak (443) 224‐1345 Yarmaks@stifel.com Sun Trust Robinson Humphrey Barry Jonas (212) 590-0998 Barry.Jonas@suntrust.com Union Gaming John DeCree (702) 691‐3213 John.Decree@uniongaming.com Wells Fargo Securities Jeff Donnelly (617) 603‐4262 Jeff.Donnelly@wellsfargo.com Covering High Yield Analysts Corporate Credit Ratings Firm Analyst Phone Email Firm Rating BofA Merrill Lynch James Kayler (646) 855‐9223 James.F.Kayler@baml.com Moody's Ba3 Deutsche Bank Andrew Zarnett (212) 250-7995 Andrew.Zarnett@db.com Standard & Poor's BB Goldman Sachs Komal Patel (212) 357‐9774 Komal.Patel@gs.com J.P. Morgan Michael Pace (212) 270‐6530 Michael.Pace@jpmorgan.com VICI Q1 2019 Supplemental Financial & Operating Data 3

Table of Contents Portfolio & Financial Overview 5 Consolidated Balance Sheets 6-7 Consolidated Statements of Operations 8-9 Revenue Breakdown 10-11 Non‐GAAP Financial Measures 12-13 2019 Guidance 14 Capitalization 15 Property Overview 16 Properties Breakdown 17 Summary of Current Lease Terms 18 Recent Activity 19 Call Option Properties 20 Right of First Refusal / Put-Call Assets 21 VICI Q1 2019 Supplemental Financial & Operating Data 4

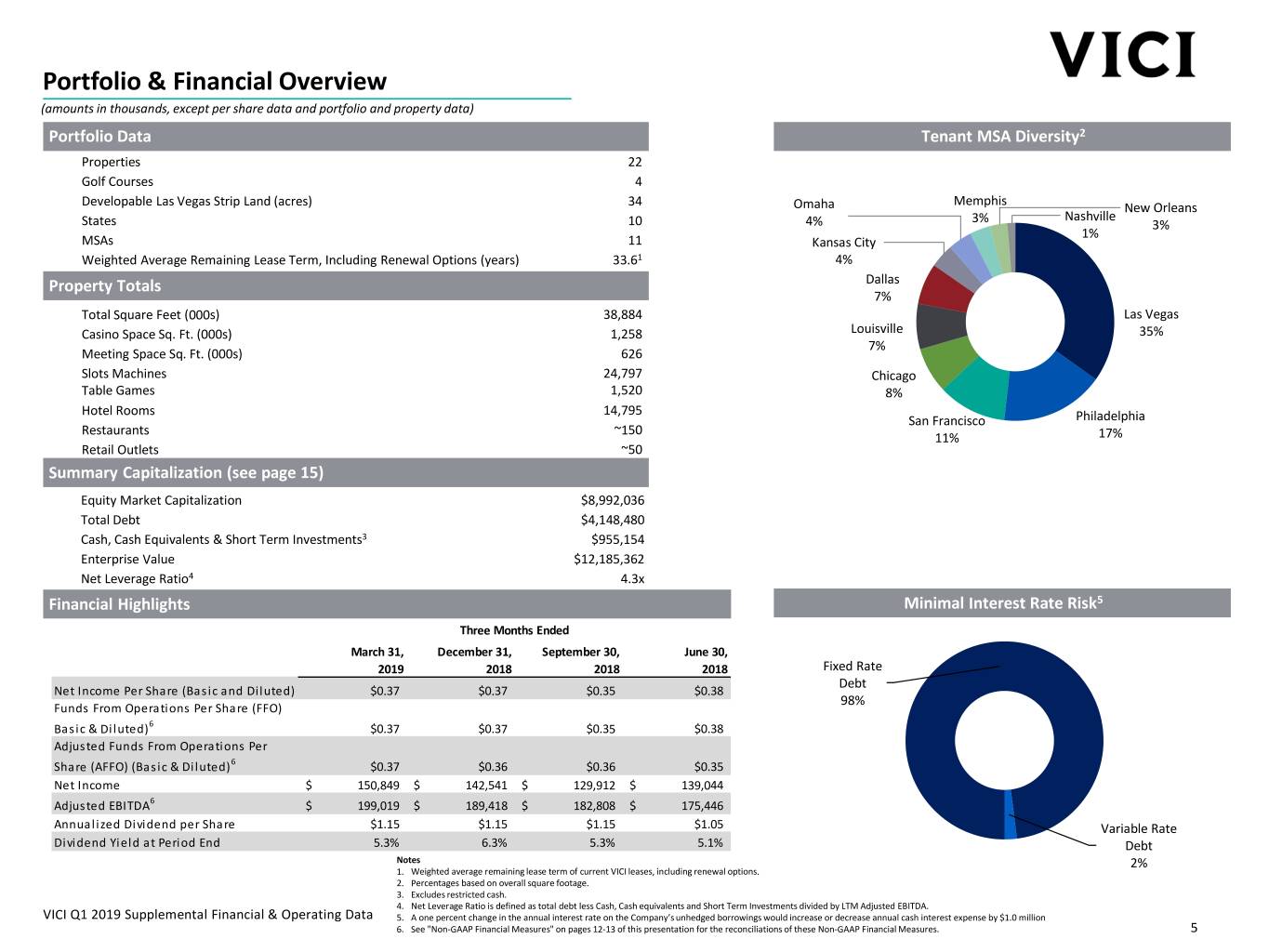

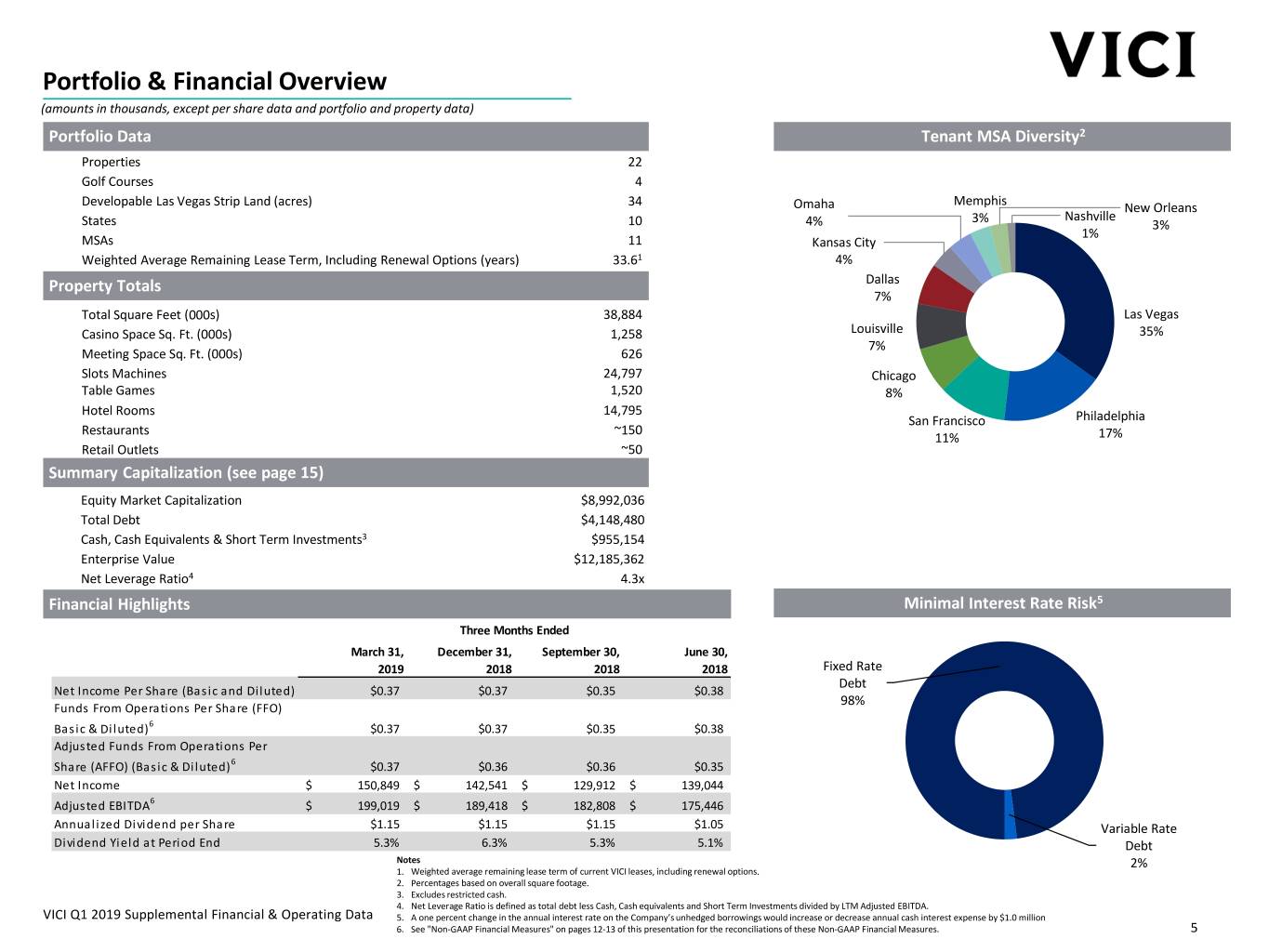

Portfolio & Financial Overview (amounts in thousands, except per share data and portfolio and property data) Portfolio Data Tenant MSA Diversity2 Properties 22 Golf Courses 4 Memphis Developable Las Vegas Strip Land (acres) 34 Omaha New Orleans 3% Nashville States 10 4% 3% 1% MSAs 11 Kansas City Weighted Average Remaining Lease Term, Including Renewal Options (years) 33.61 4% Property Totals Dallas 7% Total Square Feet (000s) 38,884 Las Vegas Casino Space Sq. Ft. (000s) 1,258 Louisville 35% 7% Meeting Space Sq. Ft. (000s) 626 Slots Machines 24,797 Chicago Table Games 1,520 8% Hotel Rooms 14,795 San Francisco Philadelphia Restaurants ~150 11% 17% Retail Outlets ~50 Summary Capitalization (see page 15) Equity Market Capitalization $8,992,036 Total Debt $4,148,480 Cash, Cash Equivalents & Short Term Investments3 $955,154 Enterprise Value $12,185,362 Net Leverage Ratio4 4.3x Financial Highlights Minimal Interest Rate Risk5 Three Months Ended March 31, December 31, September 30, June 30, 2019 2018 2018 2018 Fixed Rate Debt Net Income Per Share (Basic and Diluted) $0.37 $0.37 $0.35 $0.38 98% Funds From Operations Per Share (FFO) Basic & Diluted)6 $0.37 $0.37 $0.35 $0.38 Adjusted Funds From Operations Per Share (AFFO) (Basic & Diluted)6 $0.37 $0.36 $0.36 $0.35 Net Income $ 150,849 $ 142,541 $ 129,912 $ 139,044 Adjusted EBITDA6 $ 199,019 $ 189,418 $ 182,808 $ 175,446 Annualized Dividend per Share $1.15 $1.15 $1.15 $1.05 Variable Rate Dividend Yield at Period End 5.3% 6.3% 5.3% 5.1% Debt Notes 2% 1. Weighted average remaining lease term of current VICI leases, including renewal options. 2. Percentages based on overall square footage. 3. Excludes restricted cash. 4. Net Leverage Ratio is defined as total debt less Cash, Cash equivalents and Short Term Investments divided by LTM Adjusted EBITDA. VICI Q1 2019 Supplemental Financial & Operating Data 5. A one percent change in the annual interest rate on the Company’s unhedged borrowings would increase or decrease annual cash interest expense by $1.0 million 6. See "Non‐GAAP Financial Measures" on pages 12-13 of this presentation for the reconciliations of these Non‐GAAP Financial Measures. 5

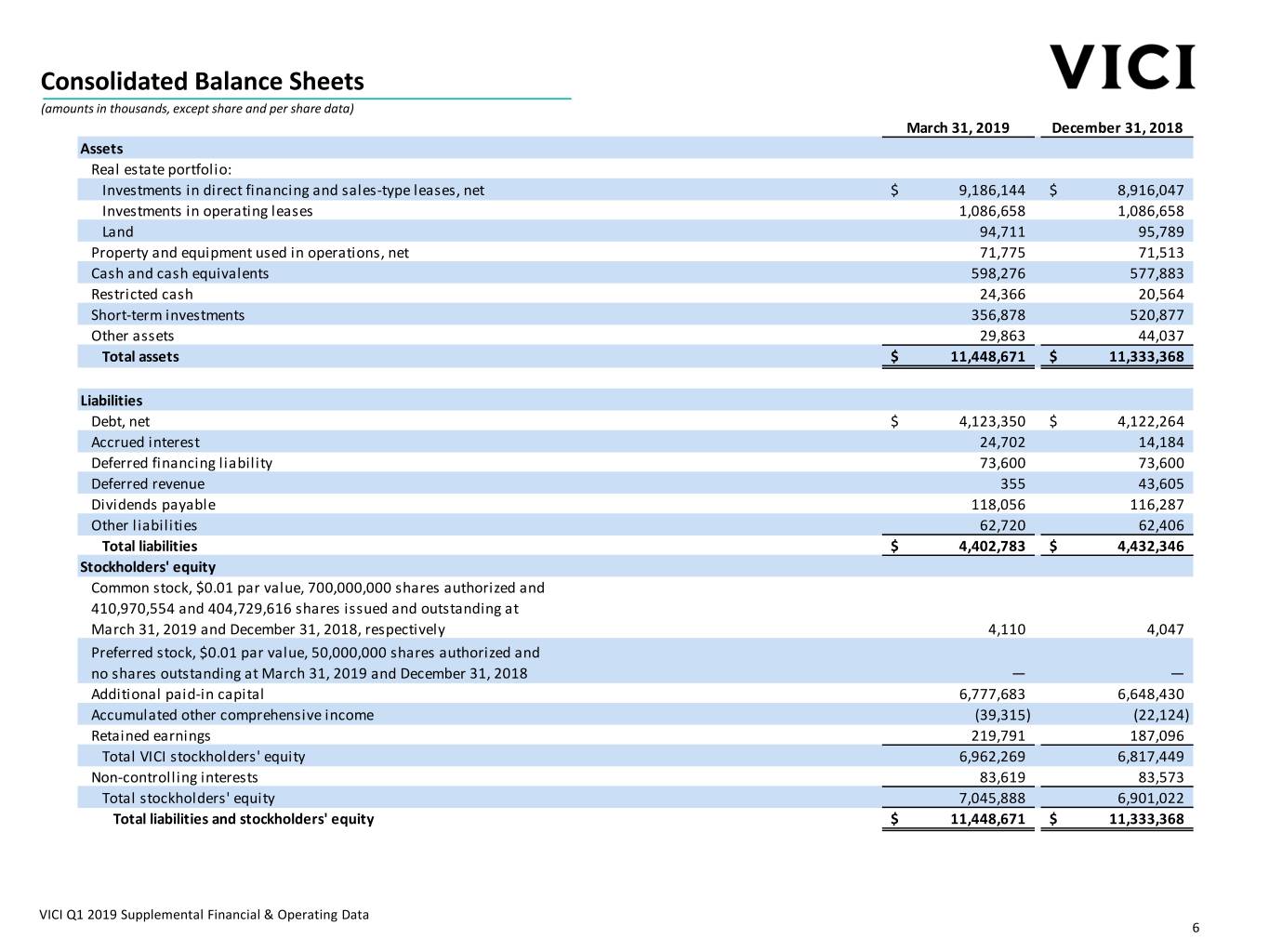

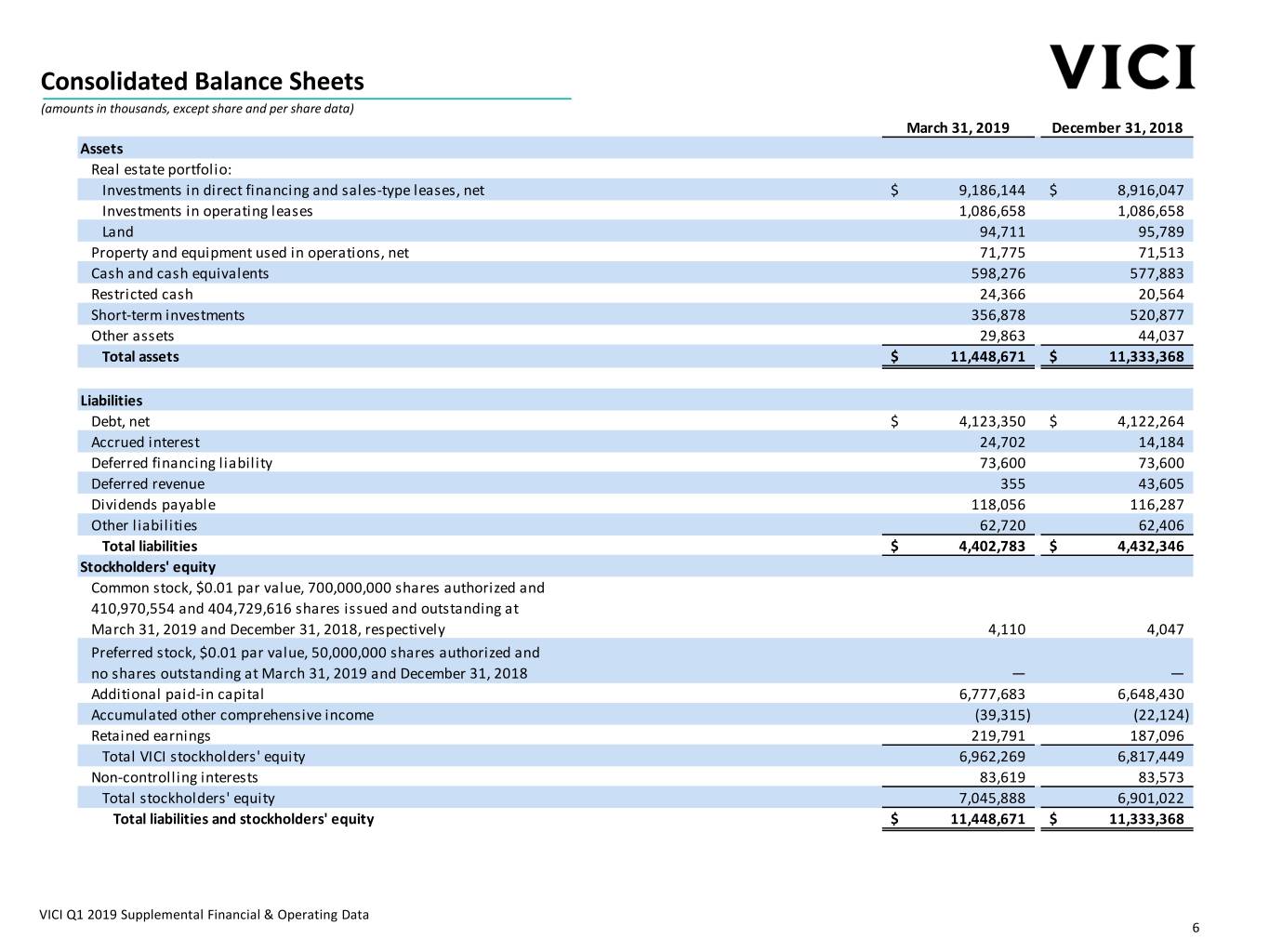

Consolidated Balance Sheets (amounts in thousands, except share and per share data) March 31, 2019 December 31, 2018 Assets Real estate portfolio: Investments in direct financing and sales-type leases, net $ 9,186,144 $ 8,916,047 Investments in operating leases 1,086,658 1,086,658 Land 94,711 95,789 Property and equipment used in operations, net 71,775 71,513 Cash and cash equivalents 598,276 577,883 Restricted cash 24,366 20,564 Short-term investments 356,878 520,877 Other assets 29,863 44,037 Total assets $ 11,448,671 $ 11,333,368 Liabilities Debt, net $ 4,123,350 $ 4,122,264 Accrued interest 24,702 14,184 Deferred financing liability 73,600 73,600 Deferred revenue 355 43,605 Dividends payable 118,056 116,287 Other liabilities 62,720 62,406 Total liabilities $ 4,402,783 $ 4,432,346 Stockholders' equity Common stock, $0.01 par value, 700,000,000 shares authorized and 410,970,554 and 404,729,616 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively 4,110 4,047 Preferred stock, $0.01 par value, 50,000,000 shares authorized and no shares outstanding at March 31, 2019 and December 31, 2018 — — Additional paid-in capital 6,777,683 6,648,430 Accumulated other comprehensive income (39,315) (22,124) Retained earnings 219,791 187,096 Total VICI stockholders' equity 6,962,269 6,817,449 Non-controlling interests 83,619 83,573 Total stockholders' equity 7,045,888 6,901,022 Total liabilities and stockholders' equity $ 11,448,671 $ 11,333,368 VICI Q1 2019 Supplemental Financial & Operating Data 6

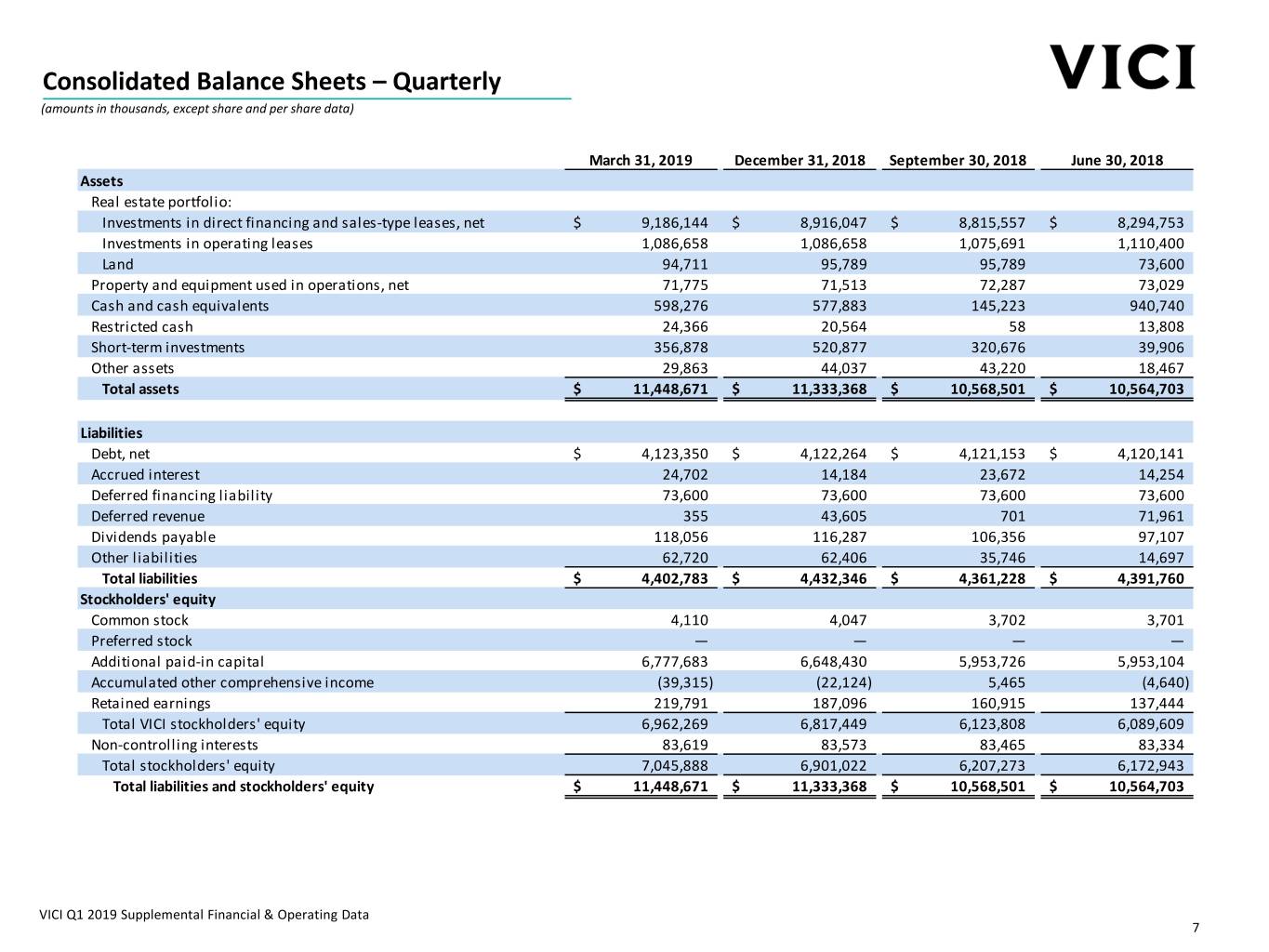

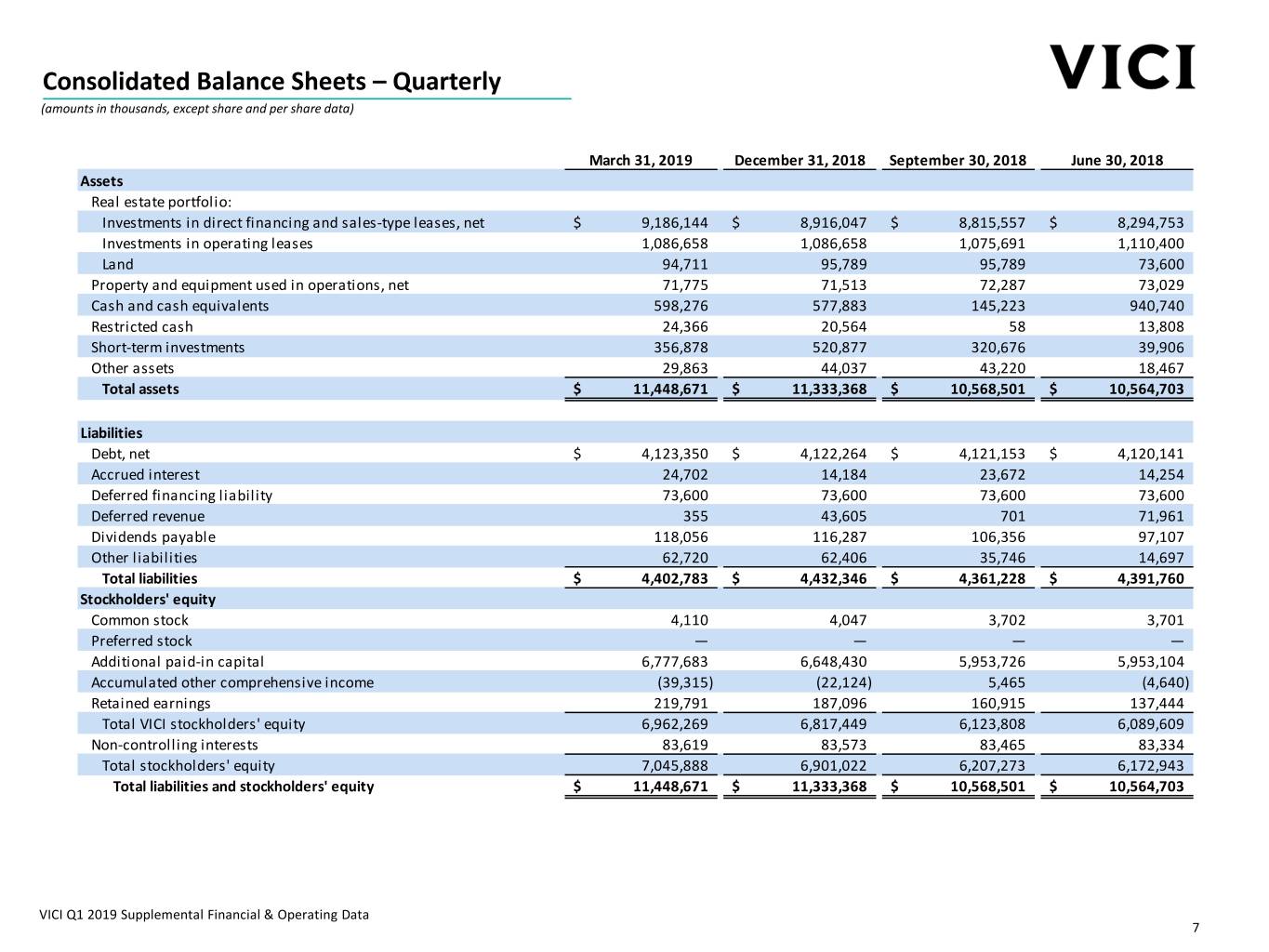

Consolidated Balance Sheets – Quarterly (amounts in thousands, except share and per share data) March 31, 2019 December 31, 2018 September 30, 2018 June 30, 2018 Assets Real estate portfolio: Investments in direct financing and sales-type leases, net $ 9,186,144 $ 8,916,047 $ 8,815,557 $ 8,294,753 Investments in operating leases 1,086,658 1,086,658 1,075,691 1,110,400 Land 94,711 95,789 95,789 73,600 Property and equipment used in operations, net 71,775 71,513 72,287 73,029 Cash and cash equivalents 598,276 577,883 145,223 940,740 Restricted cash 24,366 20,564 58 13,808 Short-term investments 356,878 520,877 320,676 39,906 Other assets 29,863 44,037 43,220 18,467 Total assets $ 11,448,671 $ 11,333,368 $ 10,568,501 $ 10,564,703 Liabilities Debt, net $ 4,123,350 $ 4,122,264 $ 4,121,153 $ 4,120,141 Accrued interest 24,702 14,184 23,672 14,254 Deferred financing liability 73,600 73,600 73,600 73,600 Deferred revenue 355 43,605 701 71,961 Dividends payable 118,056 116,287 106,356 97,107 Other liabilities 62,720 62,406 35,746 14,697 Total liabilities $ 4,402,783 $ 4,432,346 $ 4,361,228 $ 4,391,760 Stockholders' equity Common stock 4,110 4,047 3,702 3,701 Preferred stock — — — — Additional paid-in capital 6,777,683 6,648,430 5,953,726 5,953,104 Accumulated other comprehensive income (39,315) (22,124) 5,465 (4,640) Retained earnings 219,791 187,096 160,915 137,444 Total VICI stockholders' equity 6,962,269 6,817,449 6,123,808 6,089,609 Non-controlling interests 83,619 83,573 83,465 83,334 Total stockholders' equity 7,045,888 6,901,022 6,207,273 6,172,943 Total liabilities and stockholders' equity $ 11,448,671 $ 11,333,368 $ 10,568,501 $ 10,564,703 VICI Q1 2019 Supplemental Financial & Operating Data 7

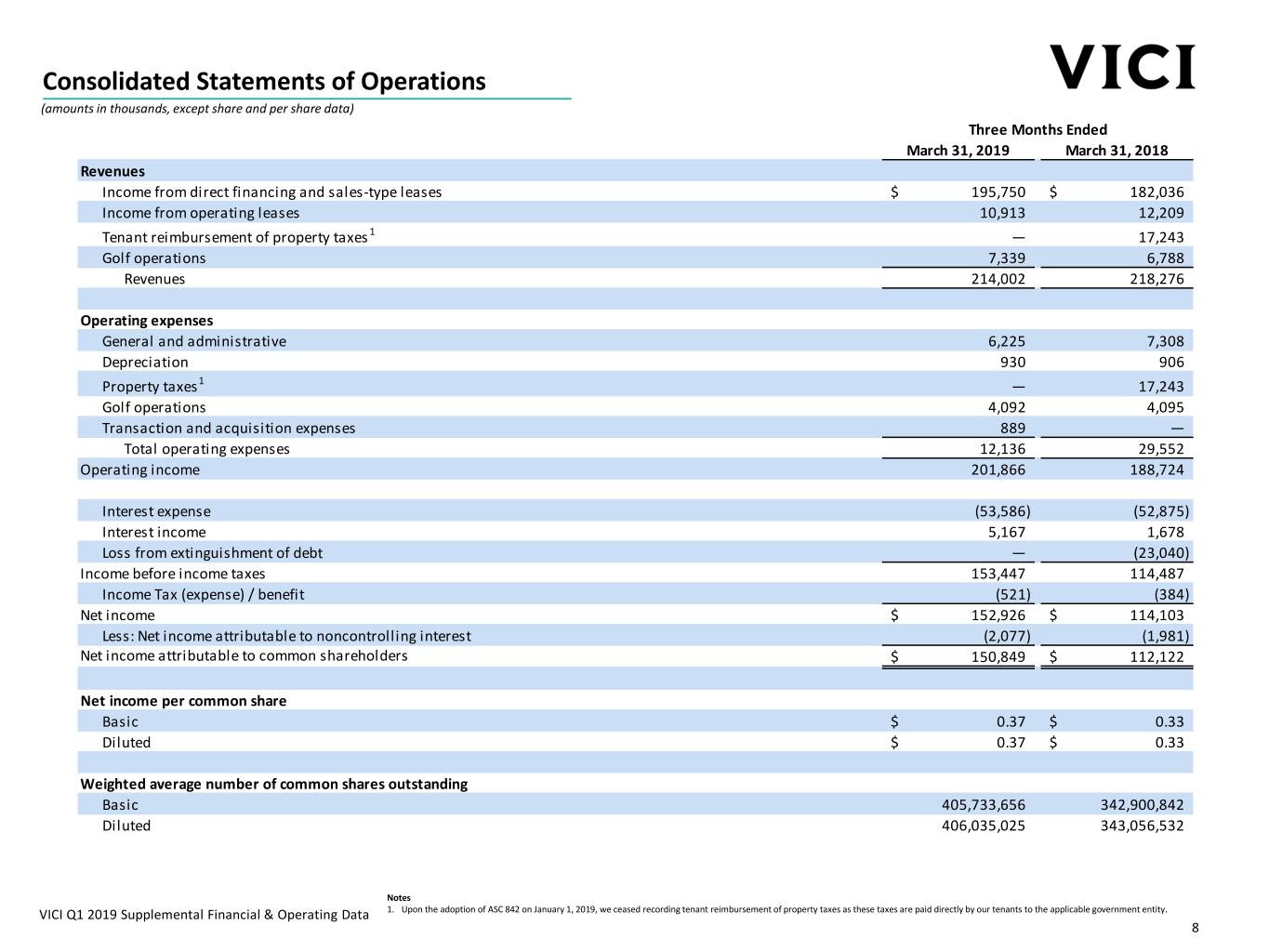

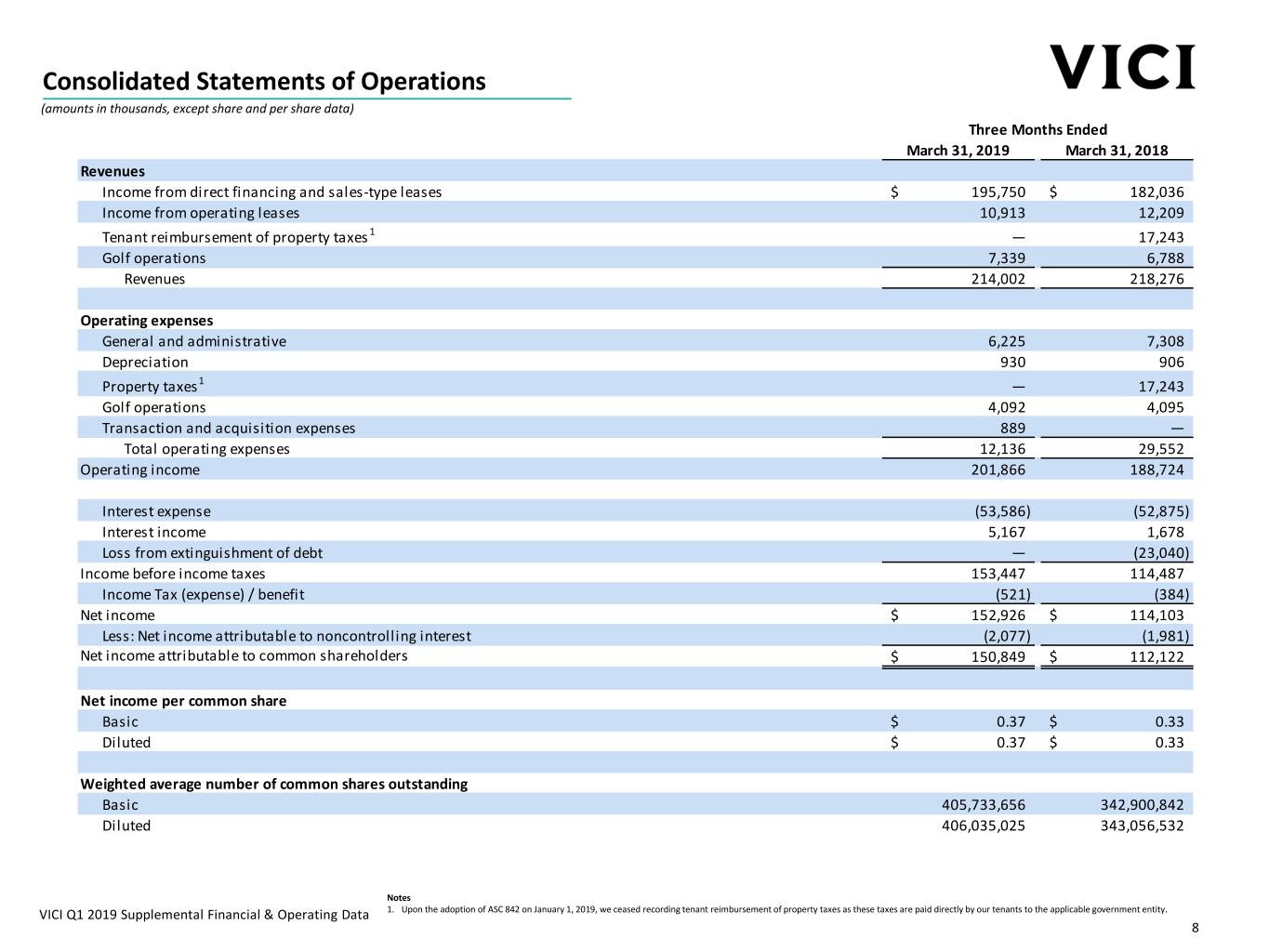

Consolidated Statements of Operations (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 March 31, 2018 Revenues Income from direct financing and sales-type leases $ 195,750 $ 182,036 Income from operating leases 10,913 12,209 Tenant reimbursement of property taxes 1 — 17,243 Golf operations 7,339 6,788 Revenues 214,002 218,276 Operating expenses General and administrative 6,225 7,308 Depreciation 930 906 Property taxes1 — 17,243 Golf operations 4,092 4,095 Transaction and acquisition expenses 889 — Total operating expenses 12,136 29,552 Operating income 201,866 188,724 Interest expense (53,586) (52,875) Interest income 5,167 1,678 Loss from extinguishment of debt — (23,040) Income before income taxes 153,447 114,487 Income Tax (expense) / benefit (521) (384) Net income $ 152,926 $ 114,103 Less: Net income attributable to noncontrolling interest (2,077) (1,981) Net income attributable to common shareholders $ 150,849 $ 112,122 Net income per common share Basic $ 0.37 $ 0.33 Diluted $ 0.37 $ 0.33 Weighted average number of common shares outstanding Basic 405,733,656 342,900,842 Diluted 406,035,025 343,056,532 Notes VICI Q1 2019 Supplemental Financial & Operating Data 1. Upon the adoption of ASC 842 on January 1, 2019, we ceased recording tenant reimbursement of property taxes as these taxes are paid directly by our tenants to the applicable government entity. 8

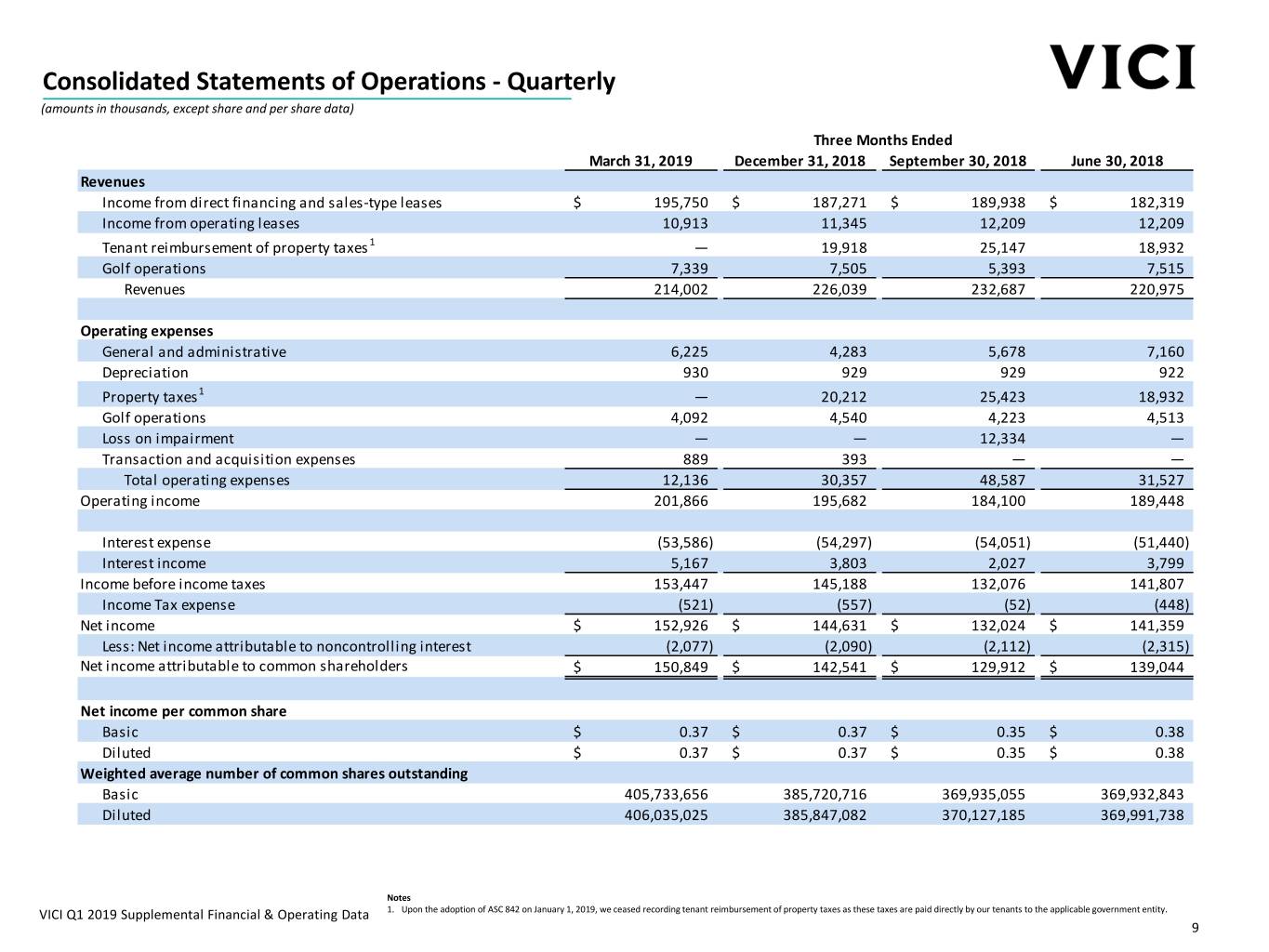

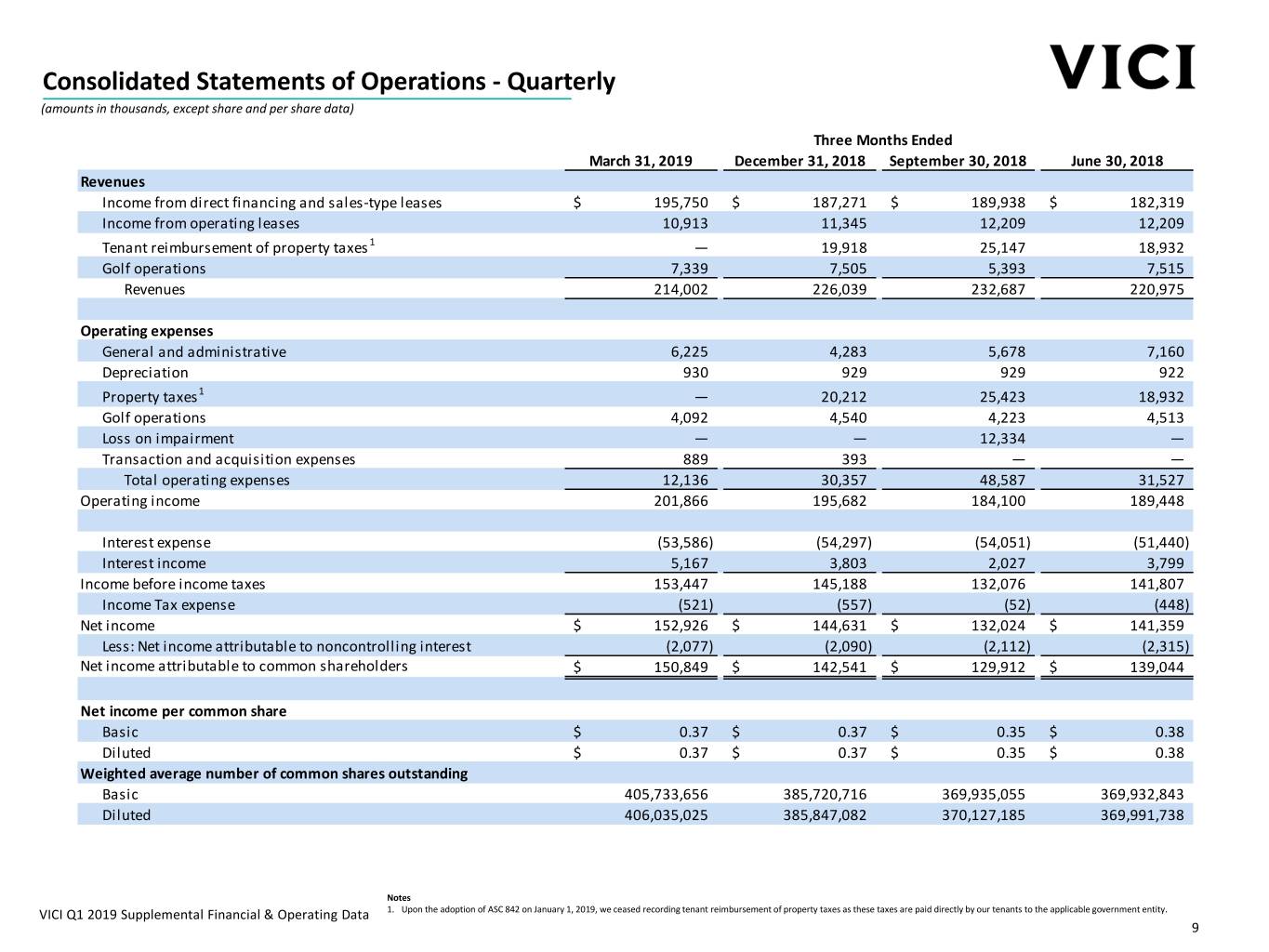

Consolidated Statements of Operations - Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 December 31, 2018 September 30, 2018 June 30, 2018 Revenues Income from direct financing and sales-type leases $ 195,750 $ 187,271 $ 189,938 $ 182,319 Income from operating leases 10,913 11,345 12,209 12,209 Tenant reimbursement of property taxes 1 — 19,918 25,147 18,932 Golf operations 7,339 7,505 5,393 7,515 Revenues 214,002 226,039 232,687 220,975 Operating expenses General and administrative 6,225 4,283 5,678 7,160 Depreciation 930 929 929 922 Property taxes1 — 20,212 25,423 18,932 Golf operations 4,092 4,540 4,223 4,513 Loss on impairment — — 12,334 — Transaction and acquisition expenses 889 393 — — Total operating expenses 12,136 30,357 48,587 31,527 Operating income 201,866 195,682 184,100 189,448 Interest expense (53,586) (54,297) (54,051) (51,440) Interest income 5,167 3,803 2,027 3,799 Income before income taxes 153,447 145,188 132,076 141,807 Income Tax expense (521) (557) (52) (448) Net income $ 152,926 $ 144,631 $ 132,024 $ 141,359 Less: Net income attributable to noncontrolling interest (2,077) (2,090) (2,112) (2,315) Net income attributable to common shareholders $ 150,849 $ 142,541 $ 129,912 $ 139,044 Net income per common share Basic $ 0.37 $ 0.37 $ 0.35 $ 0.38 Diluted $ 0.37 $ 0.37 $ 0.35 $ 0.38 Weighted average number of common shares outstanding Basic 405,733,656 385,720,716 369,935,055 369,932,843 Diluted 406,035,025 385,847,082 370,127,185 369,991,738 Notes VICI Q1 2019 Supplemental Financial & Operating Data 1. Upon the adoption of ASC 842 on January 1, 2019, we ceased recording tenant reimbursement of property taxes as these taxes are paid directly by our tenants to the applicable government entity. 9

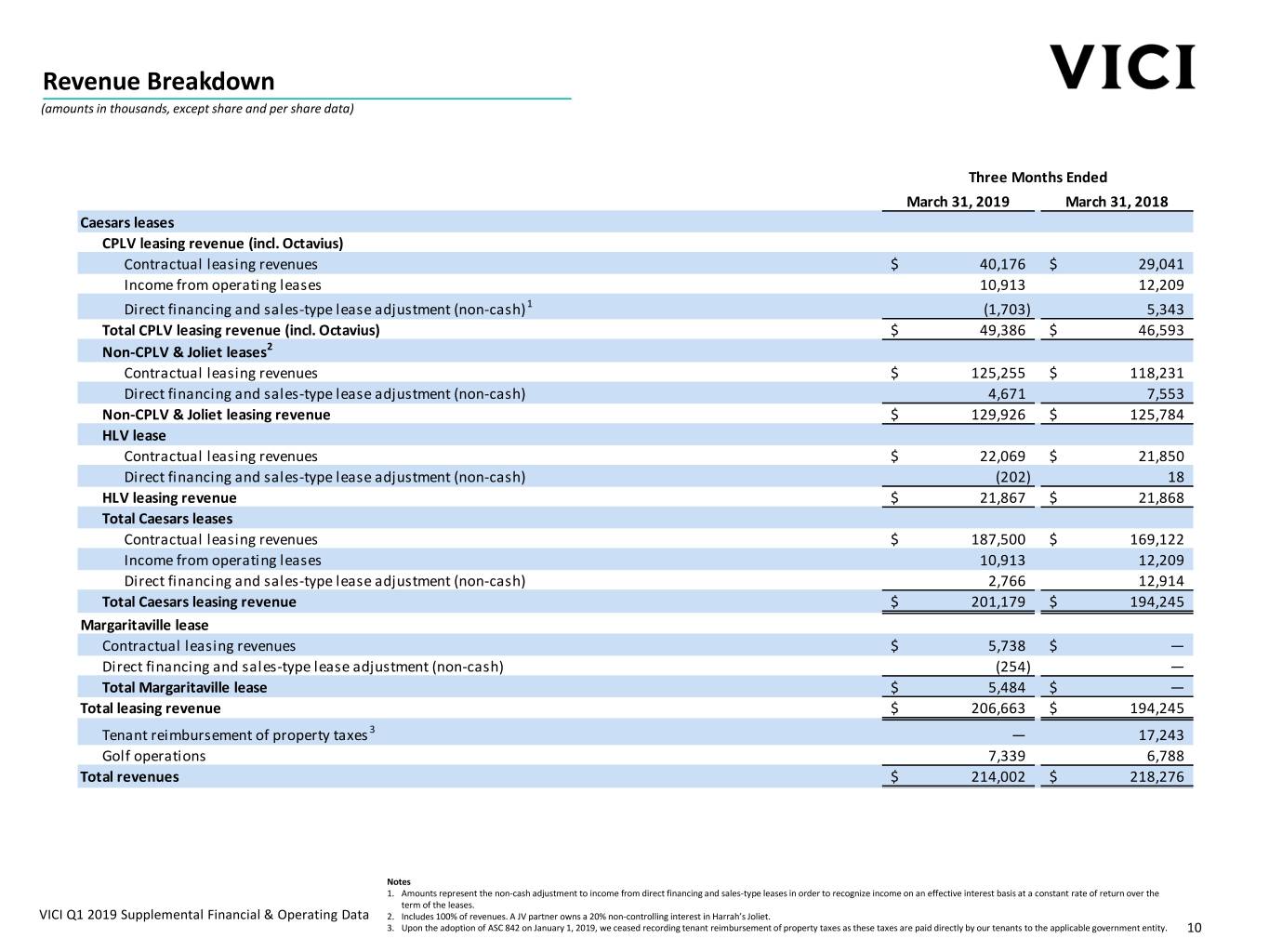

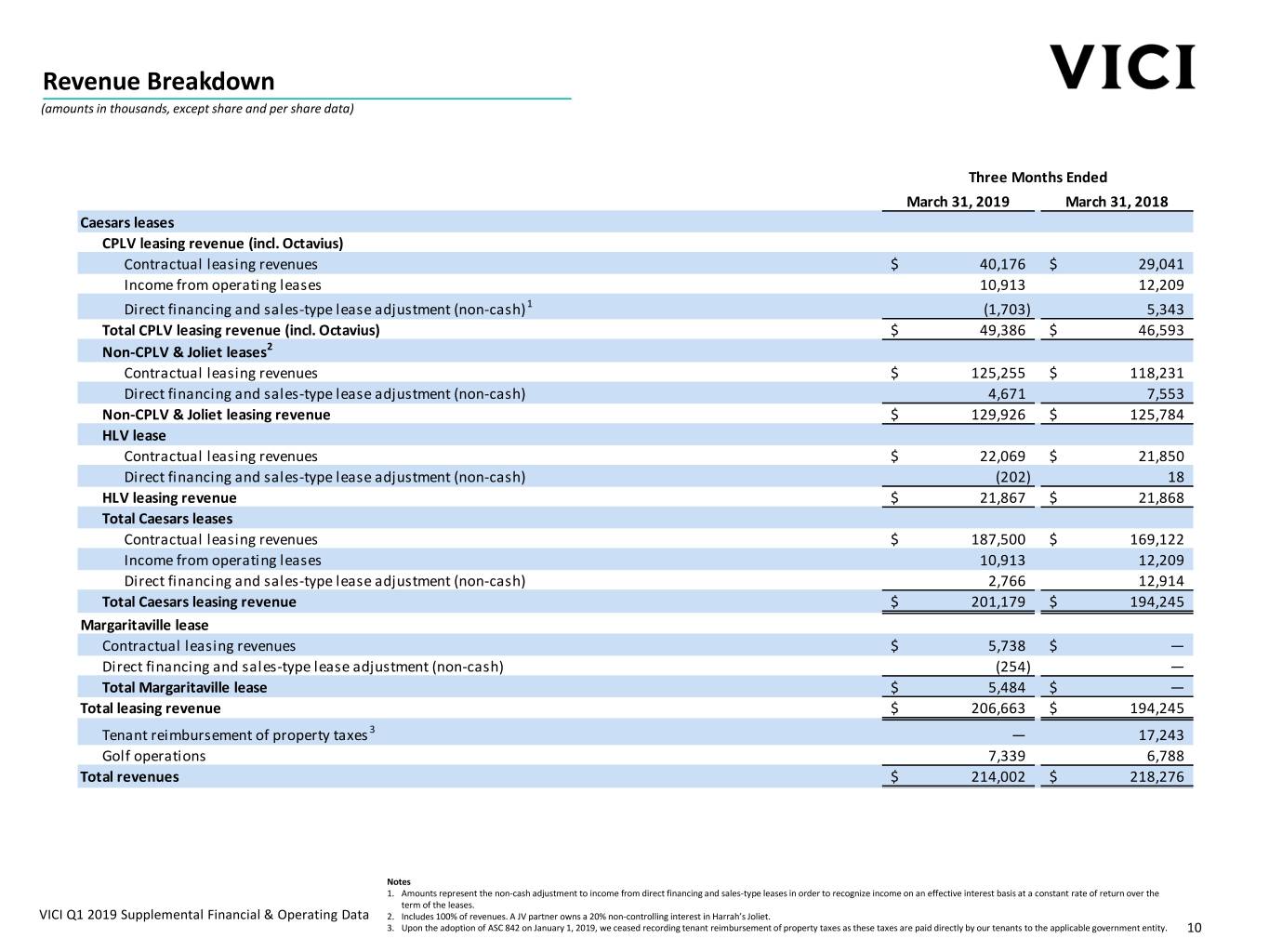

Revenue Breakdown (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 March 31, 2018 Caesars leases CPLV leasing revenue (incl. Octavius) Contractual leasing revenues $ 40,176 $ 29,041 Income from operating leases 10,913 12,209 Direct financing and sales-type lease adjustment (non-cash)1 (1,703) 5,343 Total CPLV leasing revenue (incl. Octavius) $ 49,386 $ 46,593 Non-CPLV & Joliet leases2 Contractual leasing revenues $ 125,255 $ 118,231 Direct financing and sales-type lease adjustment (non-cash) 4,671 7,553 Non-CPLV & Joliet leasing revenue $ 129,926 $ 125,784 HLV lease Contractual leasing revenues $ 22,069 $ 21,850 Direct financing and sales-type lease adjustment (non-cash) (202) 18 HLV leasing revenue $ 21,867 $ 21,868 Total Caesars leases Contractual leasing revenues $ 187,500 $ 169,122 Income from operating leases 10,913 12,209 Direct financing and sales-type lease adjustment (non-cash) 2,766 12,914 Total Caesars leasing revenue $ 201,179 $ 194,245 Margaritaville lease Contractual leasing revenues $ 5,738 $ — Direct financing and sales-type lease adjustment (non-cash) (254) — Total Margaritaville lease $ 5,484 $ — Total leasing revenue $ 206,663 $ 194,245 Tenant reimbursement of property taxes 3 — 17,243 Golf operations 7,339 6,788 Total revenues $ 214,002 $ 218,276 Notes 1. Amounts represent the non-cash adjustment to income from direct financing and sales-type leases in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. VICI Q1 2019 Supplemental Financial & Operating Data 2. Includes 100% of revenues. A JV partner owns a 20% non-controlling interest in Harrah’s Joliet. 3. Upon the adoption of ASC 842 on January 1, 2019, we ceased recording tenant reimbursement of property taxes as these taxes are paid directly by our tenants to the applicable government entity. 10

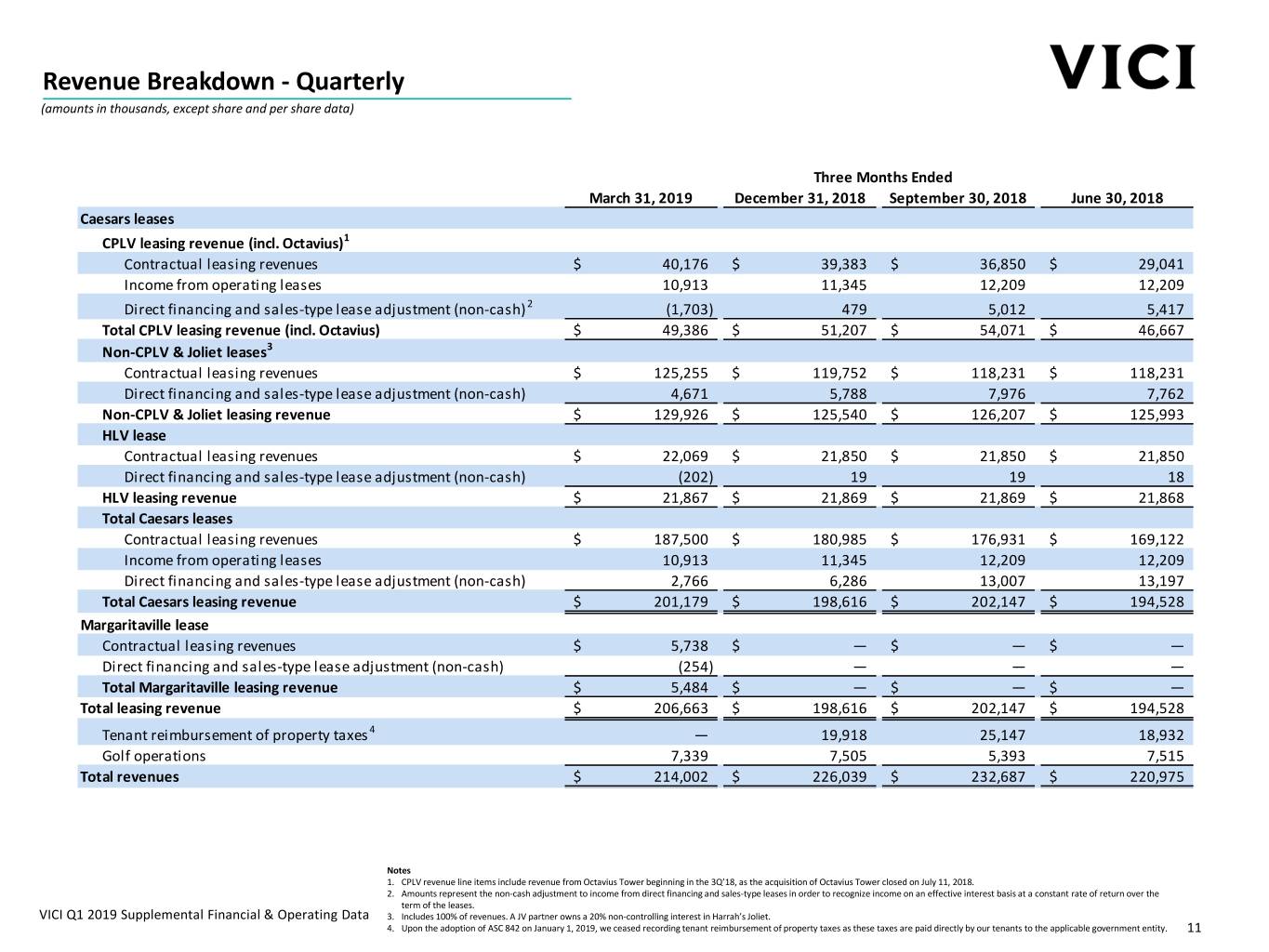

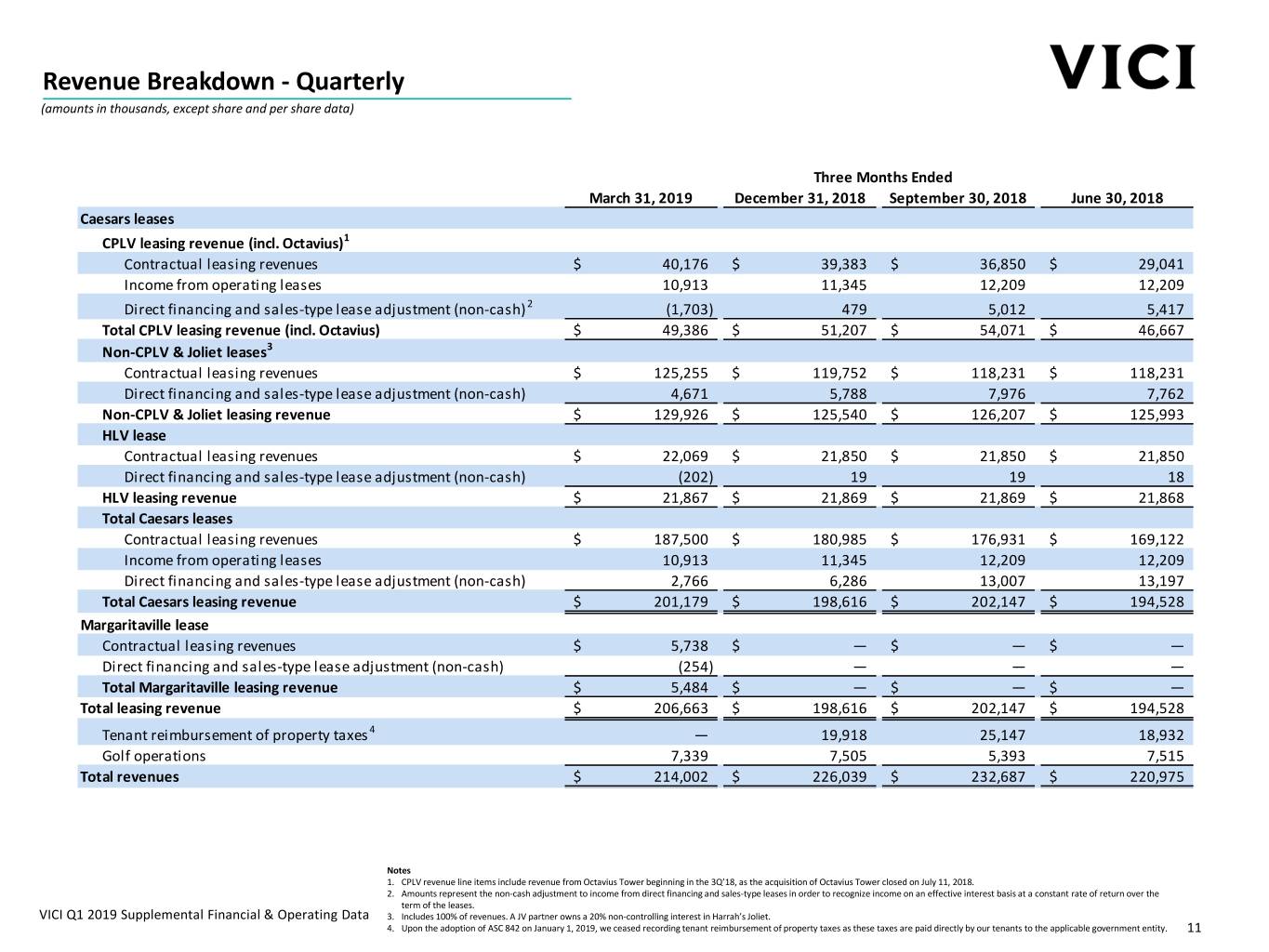

Revenue Breakdown - Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 December 31, 2018 September 30, 2018 June 30, 2018 Caesars leases CPLV leasing revenue (incl. Octavius)1 Contractual leasing revenues $ 40,176 $ 39,383 $ 36,850 $ 29,041 Income from operating leases 10,913 11,345 12,209 12,209 Direct financing and sales-type lease adjustment (non-cash)2 (1,703) 479 5,012 5,417 Total CPLV leasing revenue (incl. Octavius) $ 49,386 $ 51,207 $ 54,071 $ 46,667 Non-CPLV & Joliet leases3 Contractual leasing revenues $ 125,255 $ 119,752 $ 118,231 $ 118,231 Direct financing and sales-type lease adjustment (non-cash) 4,671 5,788 7,976 7,762 Non-CPLV & Joliet leasing revenue $ 129,926 $ 125,540 $ 126,207 $ 125,993 HLV lease Contractual leasing revenues $ 22,069 $ 21,850 $ 21,850 $ 21,850 Direct financing and sales-type lease adjustment (non-cash) (202) 19 19 18 HLV leasing revenue $ 21,867 $ 21,869 $ 21,869 $ 21,868 Total Caesars leases Contractual leasing revenues $ 187,500 $ 180,985 $ 176,931 $ 169,122 Income from operating leases 10,913 11,345 12,209 12,209 Direct financing and sales-type lease adjustment (non-cash) 2,766 6,286 13,007 13,197 Total Caesars leasing revenue $ 201,179 $ 198,616 $ 202,147 $ 194,528 Margaritaville lease Contractual leasing revenues $ 5,738 $ — $ — $ — Direct financing and sales-type lease adjustment (non-cash) (254) — — — Total Margaritaville leasing revenue $ 5,484 $ — $ — $ — Total leasing revenue $ 206,663 $ 198,616 $ 202,147 $ 194,528 Tenant reimbursement of property taxes 4 — 19,918 25,147 18,932 Golf operations 7,339 7,505 5,393 7,515 Total revenues $ 214,002 $ 226,039 $ 232,687 $ 220,975 Notes 1. CPLV revenue line items include revenue from Octavius Tower beginning in the 3Q’18, as the acquisition of Octavius Tower closed on July 11, 2018. 2. Amounts represent the non-cash adjustment to income from direct financing and sales-type leases in order to recognize income on an effective interest basis at a constant rate of return over the term of the leases. VICI Q1 2019 Supplemental Financial & Operating Data 3. Includes 100% of revenues. A JV partner owns a 20% non-controlling interest in Harrah’s Joliet. 4. Upon the adoption of ASC 842 on January 1, 2019, we ceased recording tenant reimbursement of property taxes as these taxes are paid directly by our tenants to the applicable government entity. 11

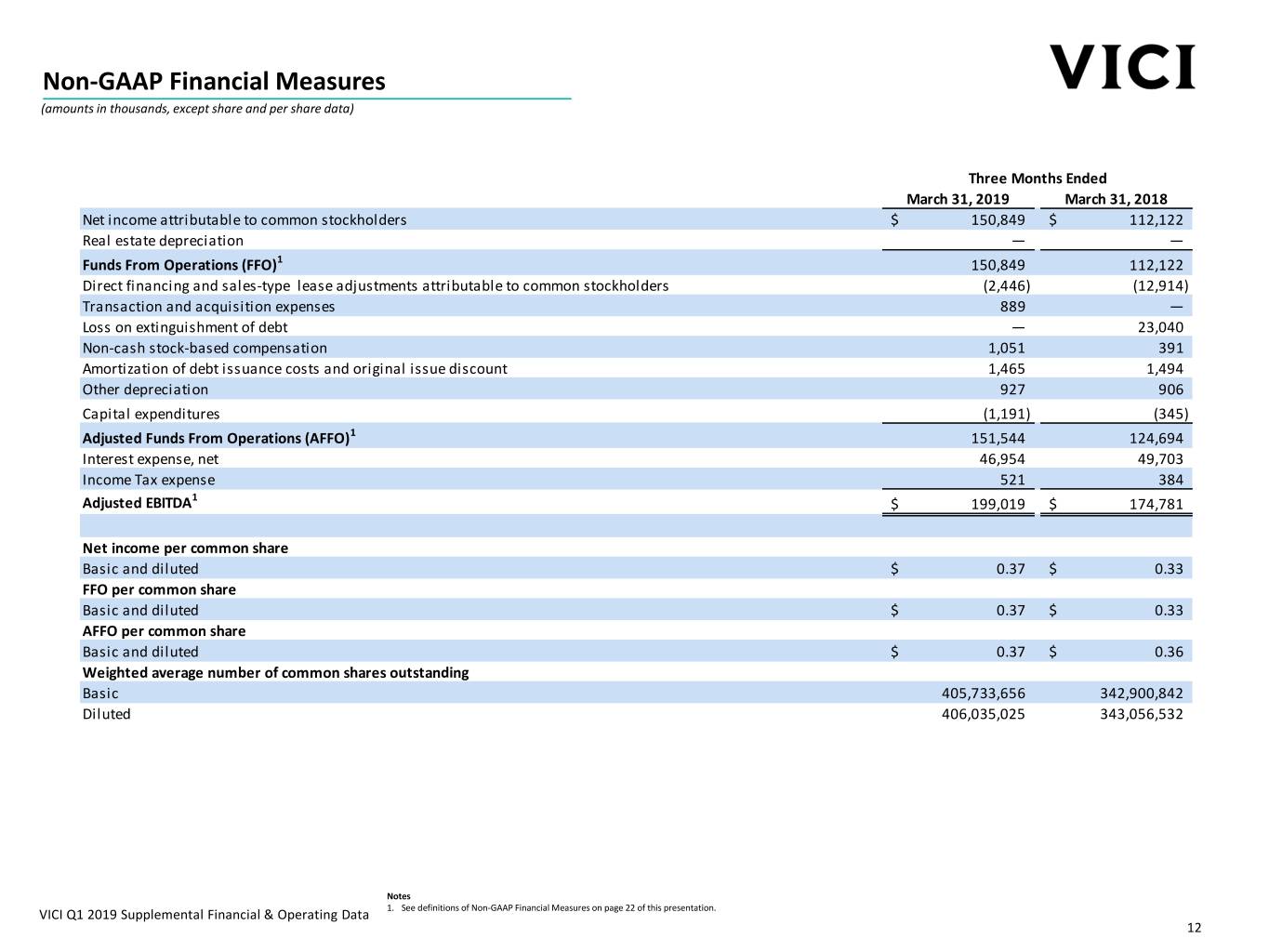

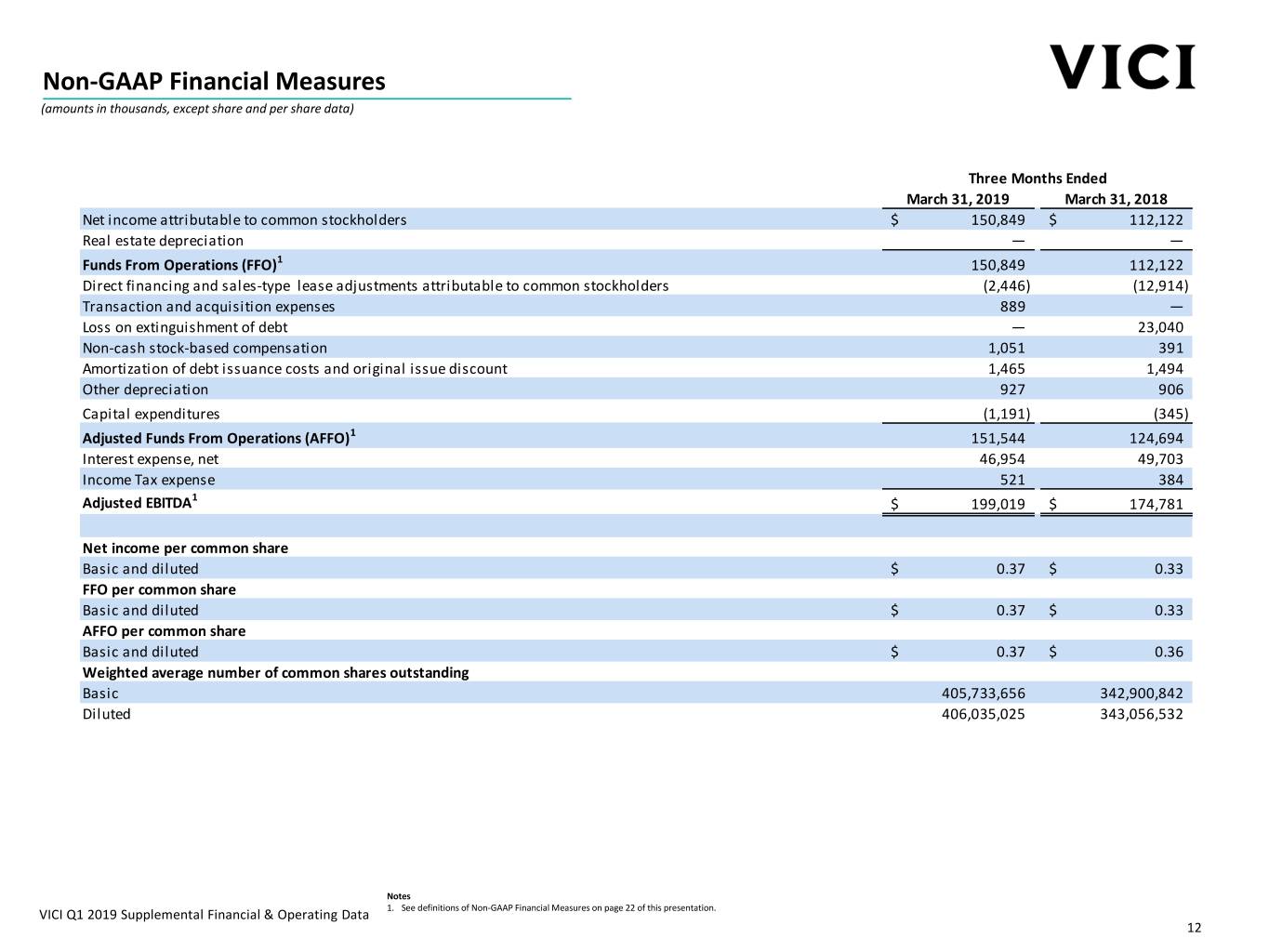

Non‐GAAP Financial Measures (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 March 31, 2018 Net income attributable to common stockholders $ 150,849 $ 112,122 Real estate depreciation — — Funds From Operations (FFO)1 150,849 112,122 Direct financing and sales-type lease adjustments attributable to common stockholders (2,446) (12,914) Transaction and acquisition expenses 889 — Loss on extinguishment of debt — 23,040 Non-cash stock-based compensation 1,051 391 Amortization of debt issuance costs and original issue discount 1,465 1,494 Other depreciation 927 906 Capital expenditures (1,191) (345) Adjusted Funds From Operations (AFFO)1 151,544 124,694 Interest expense, net 46,954 49,703 Income Tax expense 521 384 Adjusted EBITDA1 $ 199,019 $ 174,781 Net income per common share Basic and diluted $ 0.37 $ 0.33 FFO per common share Basic and diluted $ 0.37 $ 0.33 AFFO per common share Basic and diluted $ 0.37 $ 0.36 Weighted average number of common shares outstanding Basic 405,733,656 342,900,842 Diluted 406,035,025 343,056,532 Notes VICI Q1 2019 Supplemental Financial & Operating Data 1. See definitions of Non-GAAP Financial Measures on page 22 of this presentation. 12

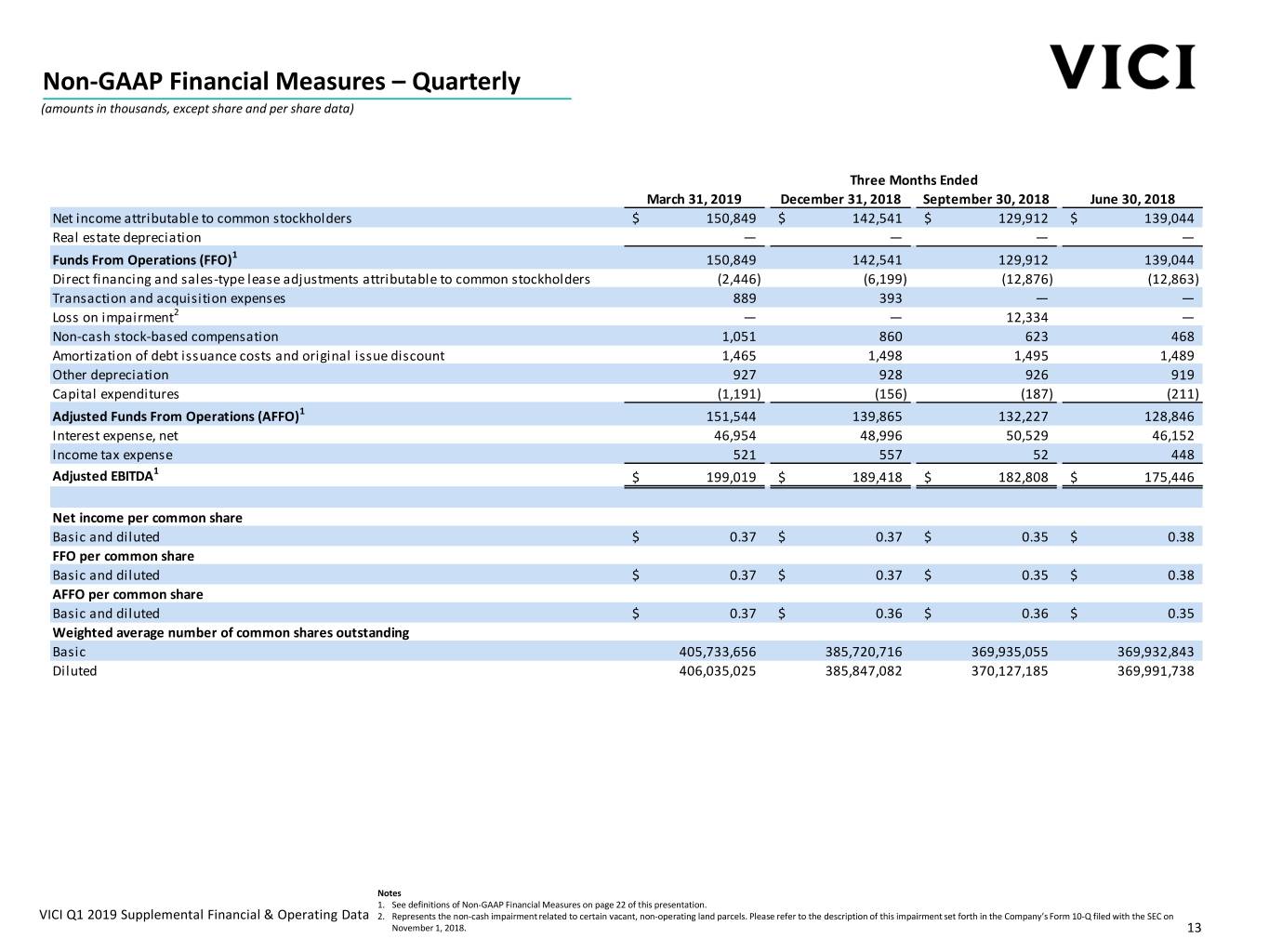

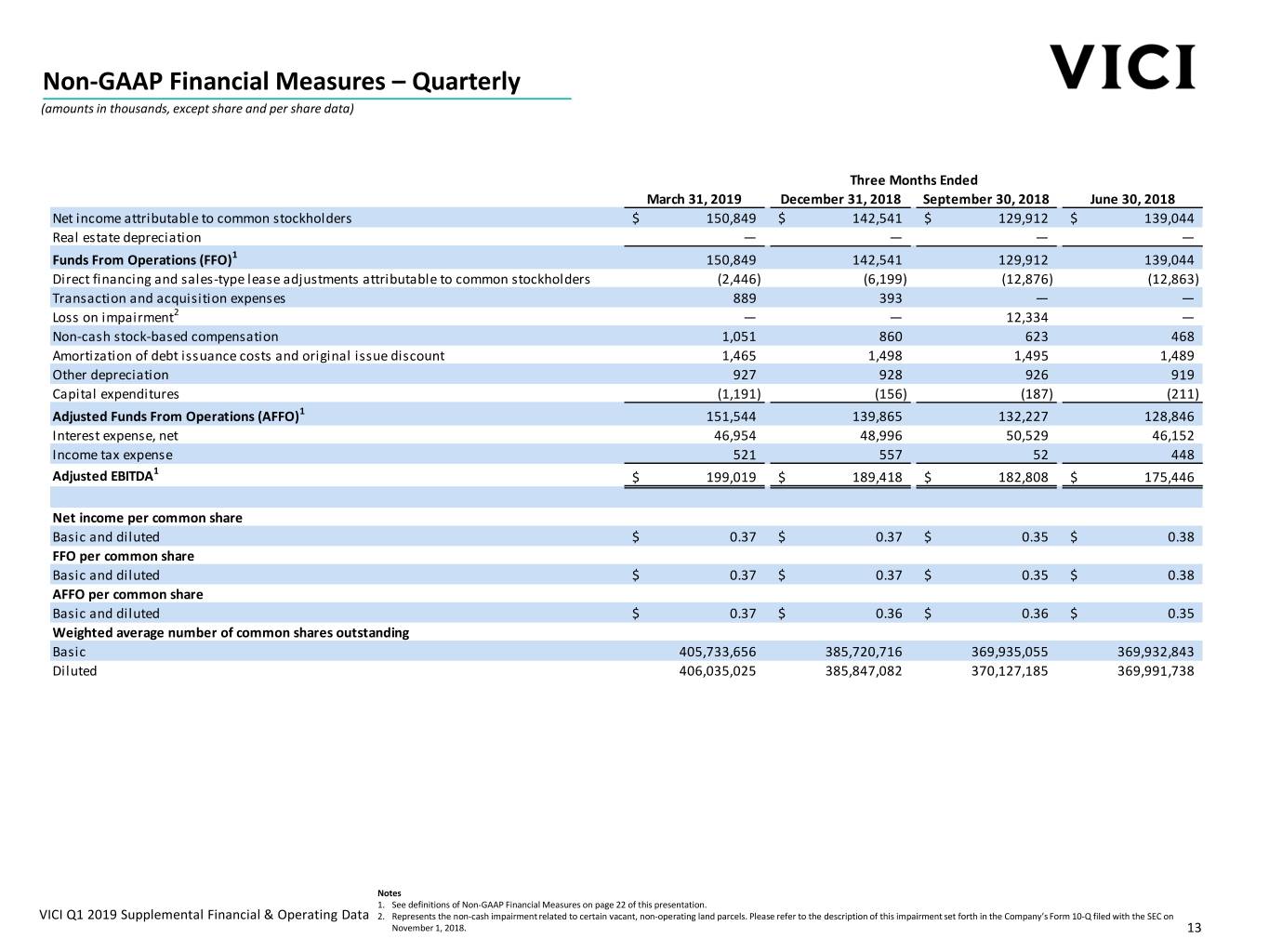

Non‐GAAP Financial Measures – Quarterly (amounts in thousands, except share and per share data) Three Months Ended March 31, 2019 December 31, 2018 September 30, 2018 June 30, 2018 Net income attributable to common stockholders $ 150,849 $ 142,541 $ 129,912 $ 139,044 Real estate depreciation — — — — Funds From Operations (FFO)1 150,849 142,541 129,912 139,044 Direct financing and sales-type lease adjustments attributable to common stockholders (2,446) (6,199) (12,876) (12,863) Transaction and acquisition expenses 889 393 — — Loss on impairment2 — — 12,334 — Non-cash stock-based compensation 1,051 860 623 468 Amortization of debt issuance costs and original issue discount 1,465 1,498 1,495 1,489 Other depreciation 927 928 926 919 Capital expenditures (1,191) (156) (187) (211) Adjusted Funds From Operations (AFFO)1 151,544 139,865 132,227 128,846 Interest expense, net 46,954 48,996 50,529 46,152 Income tax expense 521 557 52 448 Adjusted EBITDA1 $ 199,019 $ 189,418 $ 182,808 $ 175,446 Net income per common share Basic and diluted $ 0.37 $ 0.37 $ 0.35 $ 0.38 FFO per common share Basic and diluted $ 0.37 $ 0.37 $ 0.35 $ 0.38 AFFO per common share Basic and diluted $ 0.37 $ 0.36 $ 0.36 $ 0.35 Weighted average number of common shares outstanding Basic 405,733,656 385,720,716 369,935,055 369,932,843 Diluted 406,035,025 385,847,082 370,127,185 369,991,738 Notes 1. See definitions of Non-GAAP Financial Measures on page 22 of this presentation. VICI Q1 2019 Supplemental Financial & Operating Data 2. Represents the non-cash impairment related to certain vacant, non-operating land parcels. Please refer to the description of this impairment set forth in the Company’s Form 10-Q filed with the SEC on November 1, 2018. 13

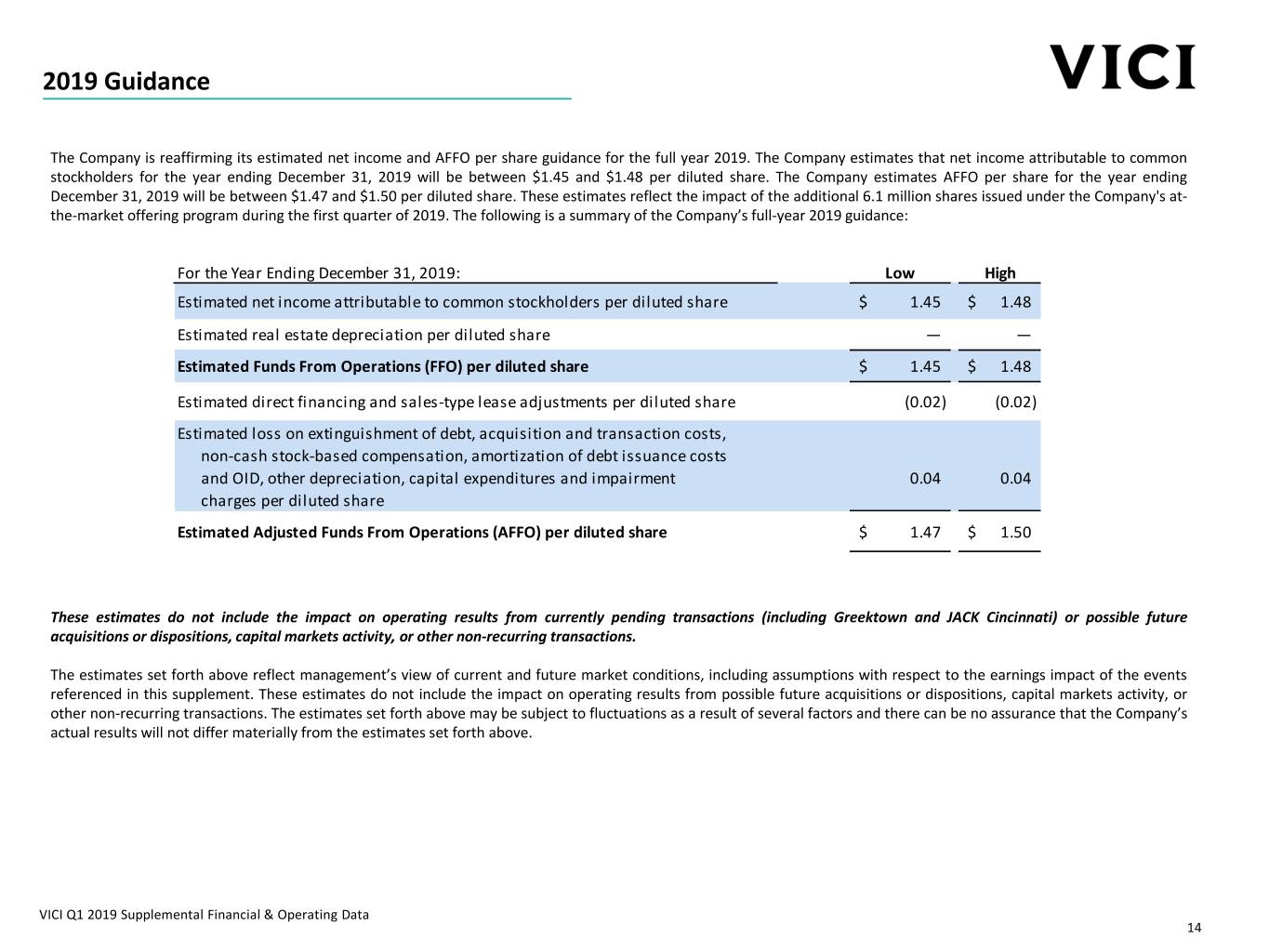

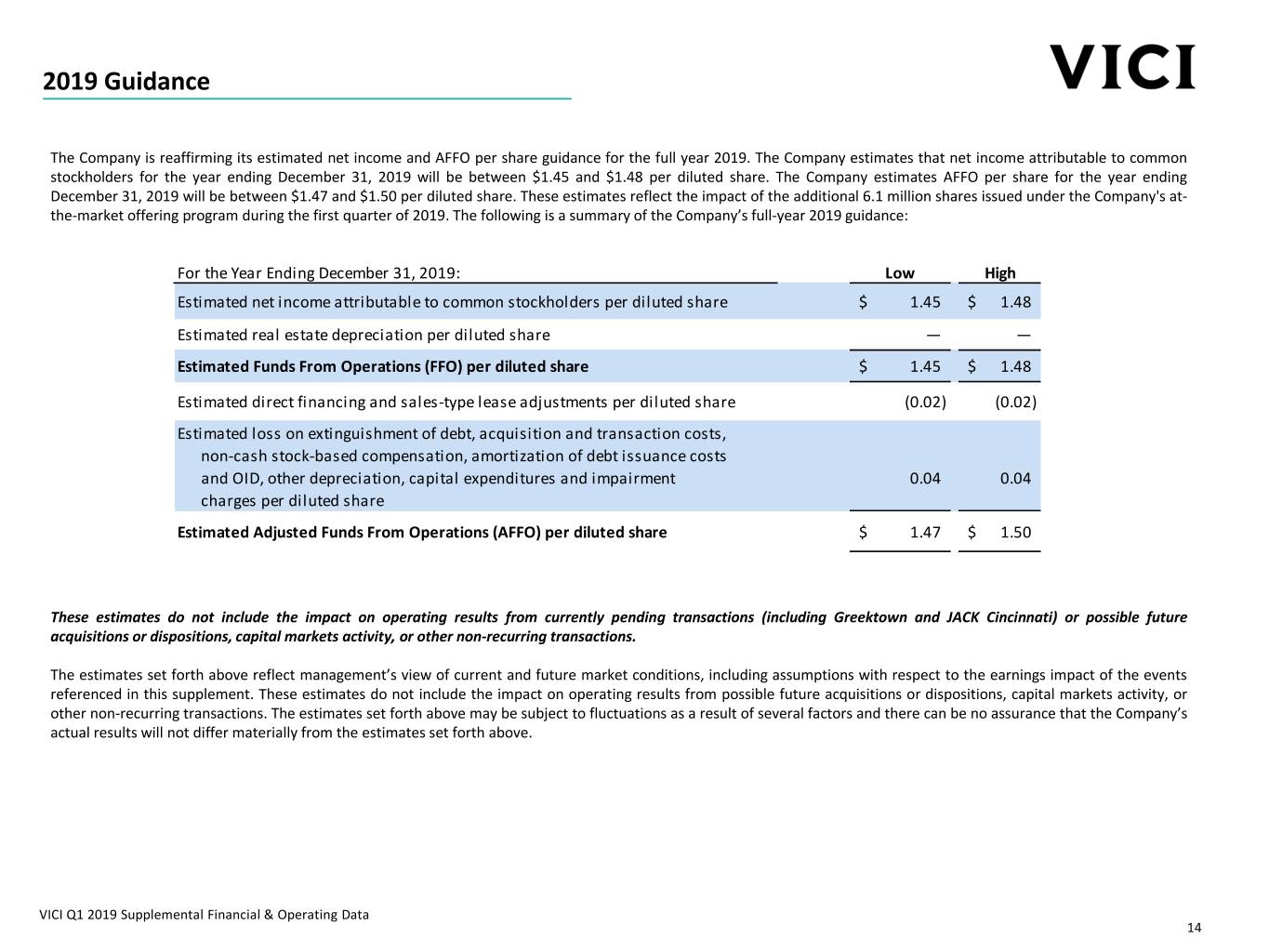

2019 Guidance The Company is reaffirming its estimated net income and AFFO per share guidance for the full year 2019. The Company estimates that net income attributable to common stockholders for the year ending December 31, 2019 will be between $1.45 and $1.48 per diluted share. The Company estimates AFFO per share for the year ending December 31, 2019 will be between $1.47 and $1.50 per diluted share. These estimates reflect the impact of the additional 6.1 million shares issued under the Company's at- the-market offering program during the first quarter of 2019. The following is a summary of the Company’s full-year 2019 guidance: For the Year Ending December 31, 2019: Low High Estimated net income attributable to common stockholders per diluted share $ 1.45 $ 1.48 Estimated real estate depreciation per diluted share — — Estimated Funds From Operations (FFO) per diluted share $ 1.45 $ 1.48 Estimated direct financing and sales-type lease adjustments per diluted share (0.02) (0.02) Estimated loss on extinguishment of debt, acquisition and transaction costs, non-cash stock-based compensation, amortization of debt issuance costs and OID, other depreciation, capital expenditures and impairment 0.04 0.04 charges per diluted share Estimated Adjusted Funds From Operations (AFFO) per diluted share $ 1.47 $ 1.50 These estimates do not include the impact on operating results from currently pending transactions (including Greektown and JACK Cincinnati) or possible future acquisitions or dispositions, capital markets activity, or other non-recurring transactions. The estimates set forth above reflect management’s view of current and future market conditions, including assumptions with respect to the earnings impact of the events referenced in this supplement. These estimates do not include the impact on operating results from possible future acquisitions or dispositions, capital markets activity, or other non-recurring transactions. The estimates set forth above may be subject to fluctuations as a result of several factors and there can be no assurance that the Company’s actual results will not differ materially from the estimates set forth above. VICI Q1 2019 Supplemental Financial & Operating Data 14

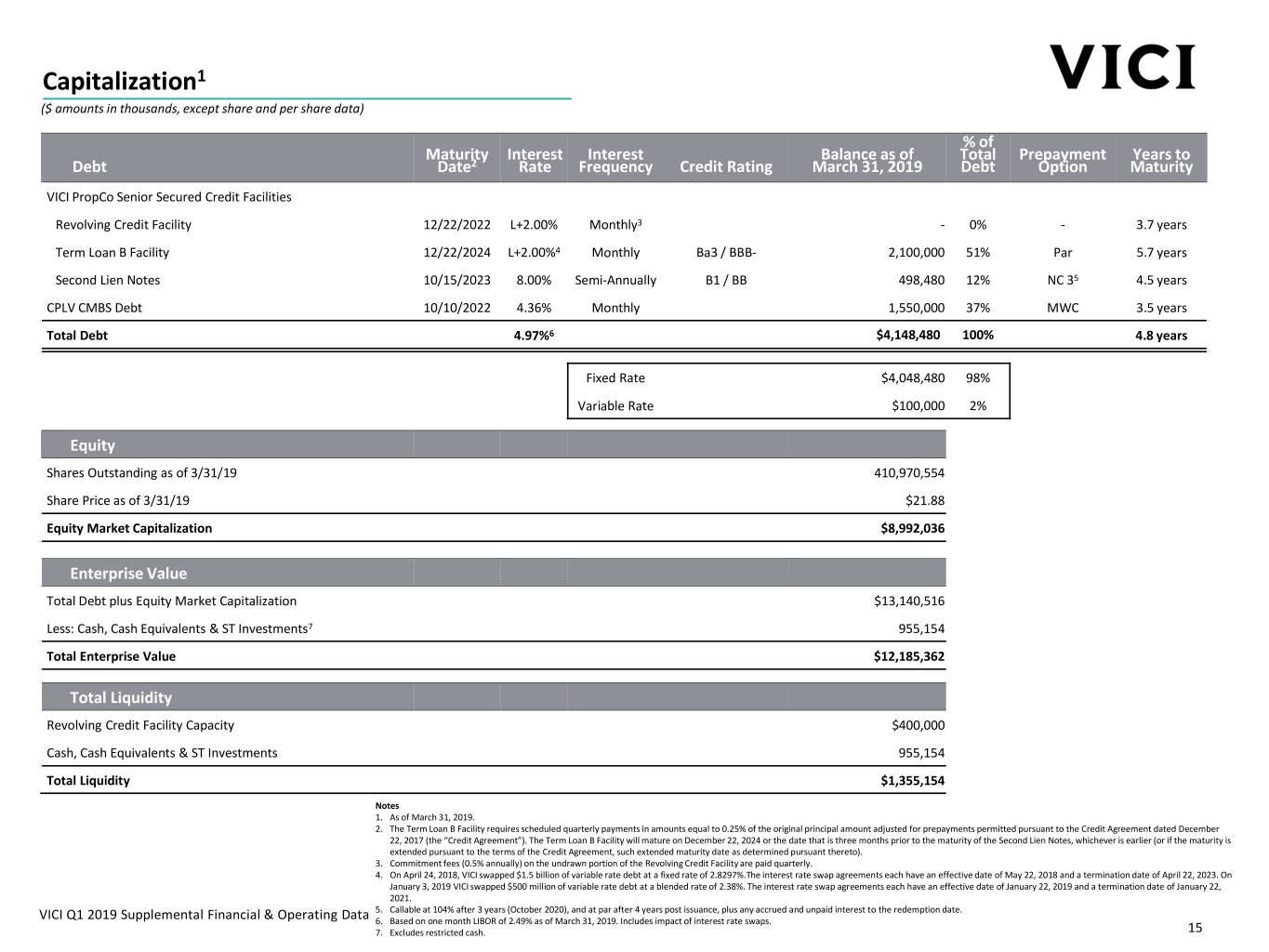

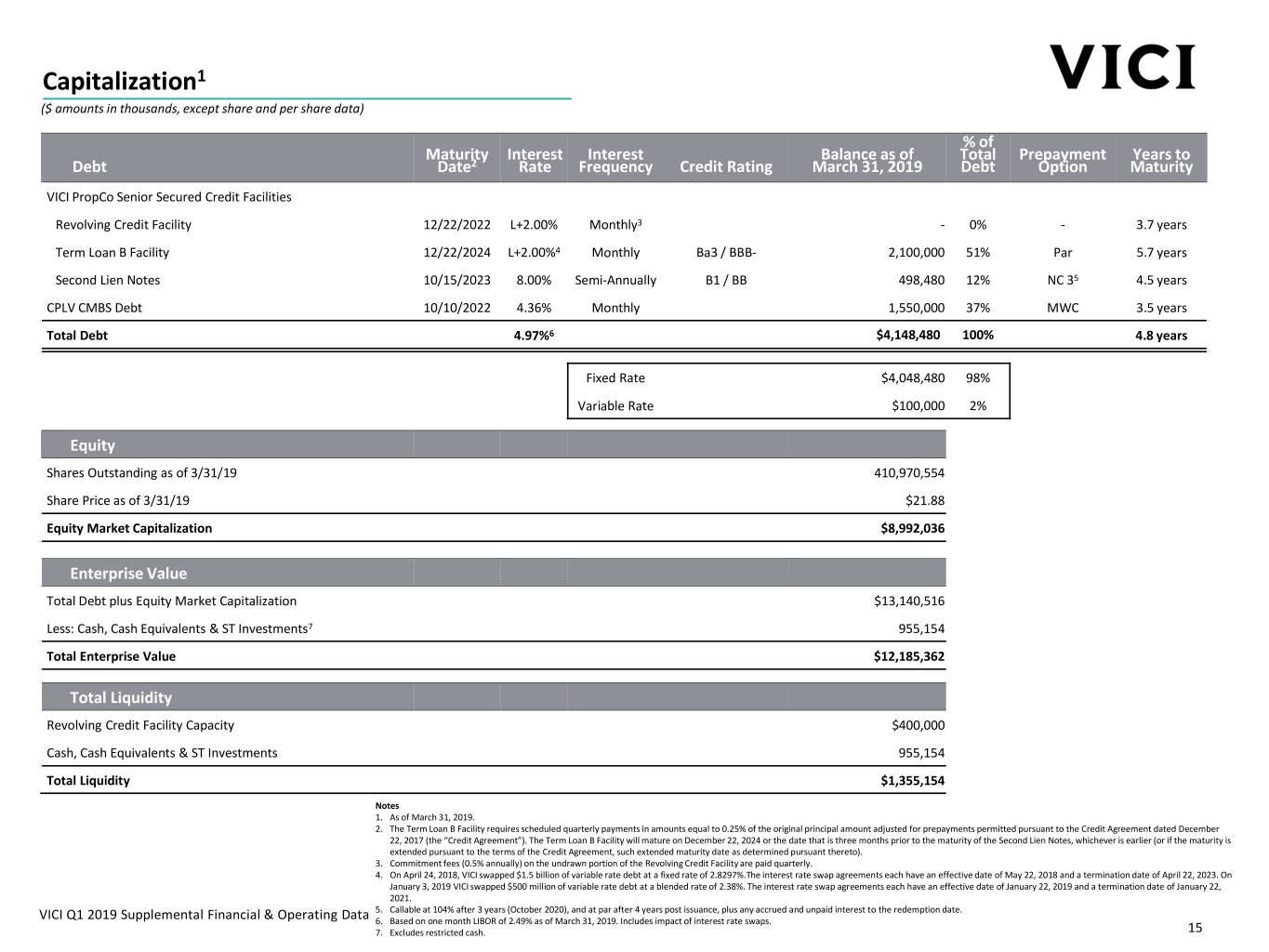

Capitalization1 ($ amounts in thousands, except share and per share data) % of Maturity Interest Interest Balance as of Total Prepayment Years to Debt Date2 Rate Frequency Credit Rating March 31, 2019 Debt Option Maturity VICI PropCo Senior Secured Credit Facilities Revolving Credit Facility 12/22/2022 L+2.00% Monthly3 - 0% ‐ 3.7 years Term Loan B Facility 12/22/2024 L+2.00%4 Monthly Ba3 / BBB- 2,100,000 51% Par 5.7 years Second Lien Notes 10/15/2023 8.00% Semi‐Annually B1 / BB 498,480 12% NC 35 4.5 years CPLV CMBS Debt 10/10/2022 4.36% Monthly 1,550,000 37% MWC 3.5 years Total Debt 4.97%6 $4,148,480 100% 4.8 years Fixed Rate $4,048,480 98% Variable Rate $100,000 2% Equity Shares Outstanding as of 3/31/19 410,970,554 Share Price as of 3/31/19 $21.88 Equity Market Capitalization $8,992,036 Enterprise Value Total Debt plus Equity Market Capitalization $13,140,516 Less: Cash, Cash Equivalents & ST Investments7 955,154 Total Enterprise Value $12,185,362 Total Liquidity Revolving Credit Facility Capacity $400,000 Cash, Cash Equivalents & ST Investments 955,154 Total Liquidity $1,355,154 Notes 1. As of March 31, 2019. 2. The Term Loan B Facility requires scheduled quarterly payments in amounts equal to 0.25% of the original principal amount adjusted for prepayments permitted pursuant to the Credit Agreement dated December 22, 2017 (the “Credit Agreement”). The Term Loan B Facility will mature on December 22, 2024 or the date that is three months prior to the maturity of the Second Lien Notes, whichever is earlier (or if the maturity is extended pursuant to the terms of the Credit Agreement, such extended maturity date as determined pursuant thereto). 3. Commitment fees (0.5% annually) on the undrawn portion of the Revolving Credit Facility are paid quarterly. 4. On April 24, 2018, VICI swapped $1.5 billion of variable rate debt at a fixed rate of 2.8297%.The interest rate swap agreements each have an effective date of May 22, 2018 and a termination date of April 22, 2023. On January 3, 2019 VICI swapped $500 million of variable rate debt at a blended rate of 2.38%. The interest rate swap agreements each have an effective date of January 22, 2019 and a termination date of January 22, 2021. 5. Callable at 104% after 3 years (October 2020), and at par after 4 years post issuance, plus any accrued and unpaid interest to the redemption date. VICI Q1 2019 Supplemental Financial & Operating Data 6. Based on one month LIBOR of 2.49% as of March 31, 2019. Includes impact of interest rate swaps. 7. Excludes restricted cash. 15

Property Overview COUNCIL BLUFFS METROPOLIS CINCINNATI DETROIT JOLIET / HAMMOND Harrah’s 2 Harrah’s Horseshoe JACK Greektown Harrah’s Horseshoe Metropolis Cincinnati1 Council Council Joliet Hammond Bluffs Bluffs N. KANSAS CITY PHILADELPHIA Harrah’s Harrah’s N. Kansas Philadelphia City LAKE TAHOE / RENO ATLANTIC CITY Harrah’s Detroit Reno Bally’s Lake Tahoe / Reno Joliet / Hammond Atlantic City Council Bluffs Philadelphia Harvey’s Cincinnati Atlantic City Caesars Lake Tahoe Las Vegas North Kansas City Louisville Atlantic City Harrah’s Metropolis Lake Tahoe Laughlin LOUISVILLE Tunica Resorts / Robinsonville Horseshoe Southern LAS VEGAS Bossier City Indiana Harrah’s Biloxi Las Vegas New Orleans PADUCAH Caesars Bluegrass Palace Downs Las Vegas BOSSIER CITY TUNICA RESORTS / ROBINSONVILLE BILOXI Octavius Margaritaville Louisiana Horseshoe Horseshoe Tunica Harrah’s Tower Bossier City3 Downs Bossier Tunica Roadhouse Gulf Coast City Hotel CURRENT PORTFOLIO ANNOUNCED ACQUISITIONS CALL OPTION PROPERTIES DESIGNATED ROFR (CENTAUR) / PUT-CALL OWNED GOLF COURSES Greektown Casino-Hotel Harrah’s New Orleans (CONVENTION CENTER) PROPERTIES Cascata, Boulder City, NV JACK Cincinnati Harrah’s Laughlin Indiana Grand, Centaur Rio Secco, Henderson, NV Harrah’s Atlantic City Hoosier Park, Centaur Grand Bear, Harrison County, MS Caesars Forum Convention Center, Vegas Chariot Run, Laconia, IN Notes 1. On April 5, 2019, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with JACK Cincinnati. The acquisition is pending completion, subject to customary closing conditions and regulatory approvals. 2. On November 14, 2018, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with Greektown. The VICI Q1 2019 Supplemental Financial & Operating Data acquisition is pending completion, subject to customary closing conditions and regulatory approvals. 3. VICI completed the acquisition of Margaritaville Bossier City on January 2, 2019. 16

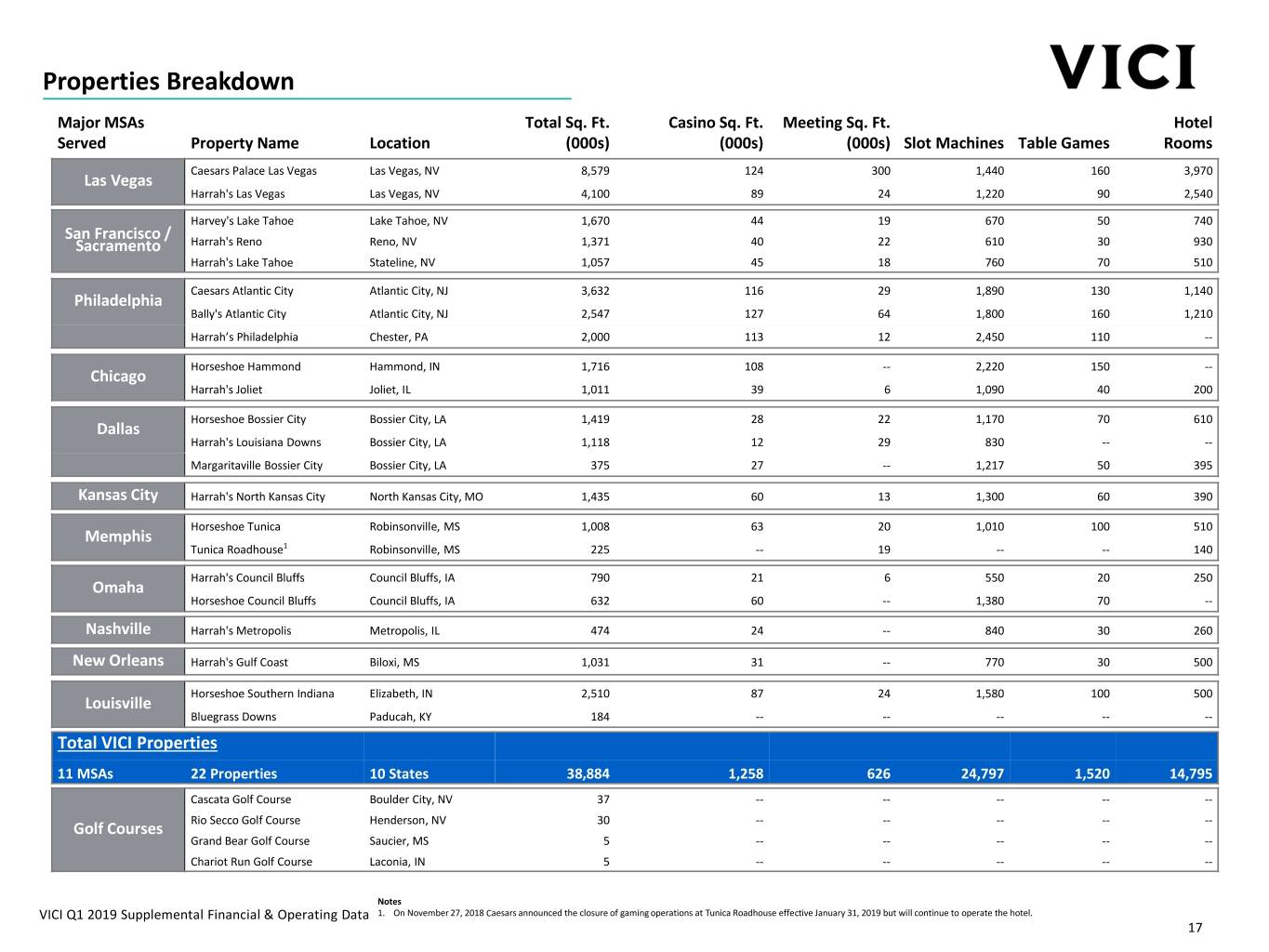

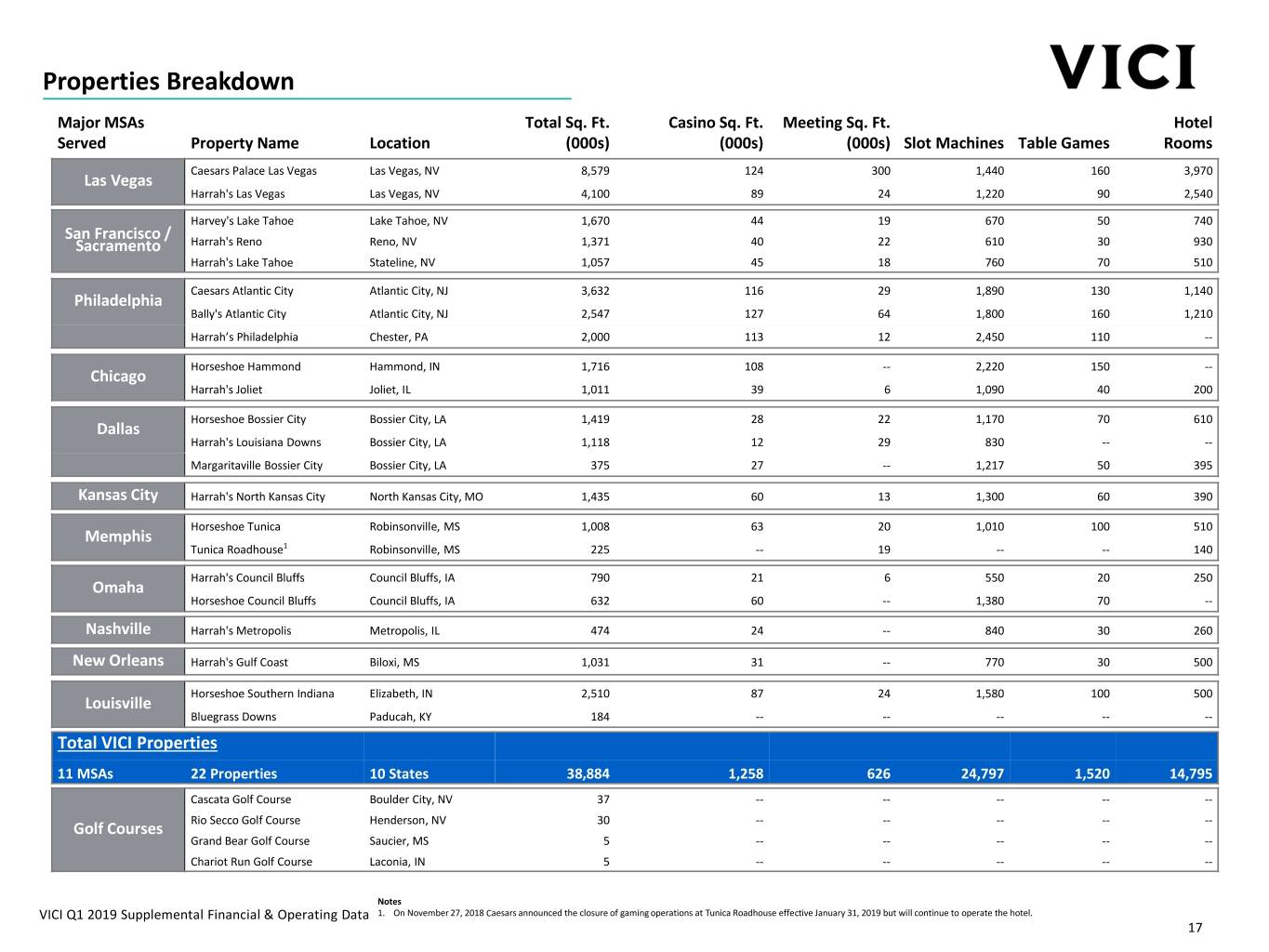

Properties Breakdown Major MSAs Total Sq. Ft. Casino Sq. Ft. Meeting Sq. Ft. Hotel Served Property Name Location (000s) (000s) (000s) Slot Machines Table Games Rooms Caesars Palace Las Vegas Las Vegas, NV 8,579 124 300 1,440 160 3,970 Las Vegas Harrah's Las Vegas Las Vegas, NV 4,100 89 24 1,220 90 2,540 Harvey's Lake Tahoe Lake Tahoe, NV 1,670 44 19 670 50 740 San Francisco / Sacramento Harrah's Reno Reno, NV 1,371 40 22 610 30 930 Harrah's Lake Tahoe Stateline, NV 1,057 45 18 760 70 510 Caesars Atlantic City Atlantic City, NJ 3,632 116 29 1,890 130 1,140 Philadelphia Bally's Atlantic City Atlantic City, NJ 2,547 127 64 1,800 160 1,210 Harrah’s Philadelphia Chester, PA 2,000 113 12 2,450 110 -- Horseshoe Hammond Hammond, IN 1,716 108 -- 2,220 150 -- Chicago Harrah's Joliet Joliet, IL 1,011 39 6 1,090 40 200 Horseshoe Bossier City Bossier City, LA 1,419 28 22 1,170 70 610 Dallas Harrah's Louisiana Downs Bossier City, LA 1,118 12 29 830 -- -- Margaritaville Bossier City Bossier City, LA 375 27 -- 1,217 50 395 Kansas City Harrah's North Kansas City North Kansas City, MO 1,435 60 13 1,300 60 390 Horseshoe Tunica Robinsonville, MS 1,008 63 20 1,010 100 510 Memphis Tunica Roadhouse1 Robinsonville, MS 225 -- 19 -- -- 140 Harrah's Council Bluffs Council Bluffs, IA 790 21 6 550 20 250 Omaha Horseshoe Council Bluffs Council Bluffs, IA 632 60 -- 1,380 70 -- Nashville Harrah's Metropolis Metropolis, IL 474 24 -- 840 30 260 New Orleans Harrah's Gulf Coast Biloxi, MS 1,031 31 -- 770 30 500 Horseshoe Southern Indiana Elizabeth, IN 2,510 87 24 1,580 100 500 Louisville Bluegrass Downs Paducah, KY 184 -- -- -- -- -- Total VICI Properties 11 MSAs 22 Properties 10 States 38,884 1,258 626 24,797 1,520 14,795 Cascata Golf Course Boulder City, NV 37 -- -- -- -- -- Rio Secco Golf Course Henderson, NV 30 -- -- -- -- -- Golf Courses Grand Bear Golf Course Saucier, MS 5 -- -- -- -- -- Chariot Run Golf Course Laconia, IN 5 -- -- -- -- -- Notes VICI Q1 2019 Supplemental Financial & Operating Data 1. On November 27, 2018 Caesars announced the closure of gaming operations at Tunica Roadhouse effective January 31, 2019 but will continue to operate the hotel. 17

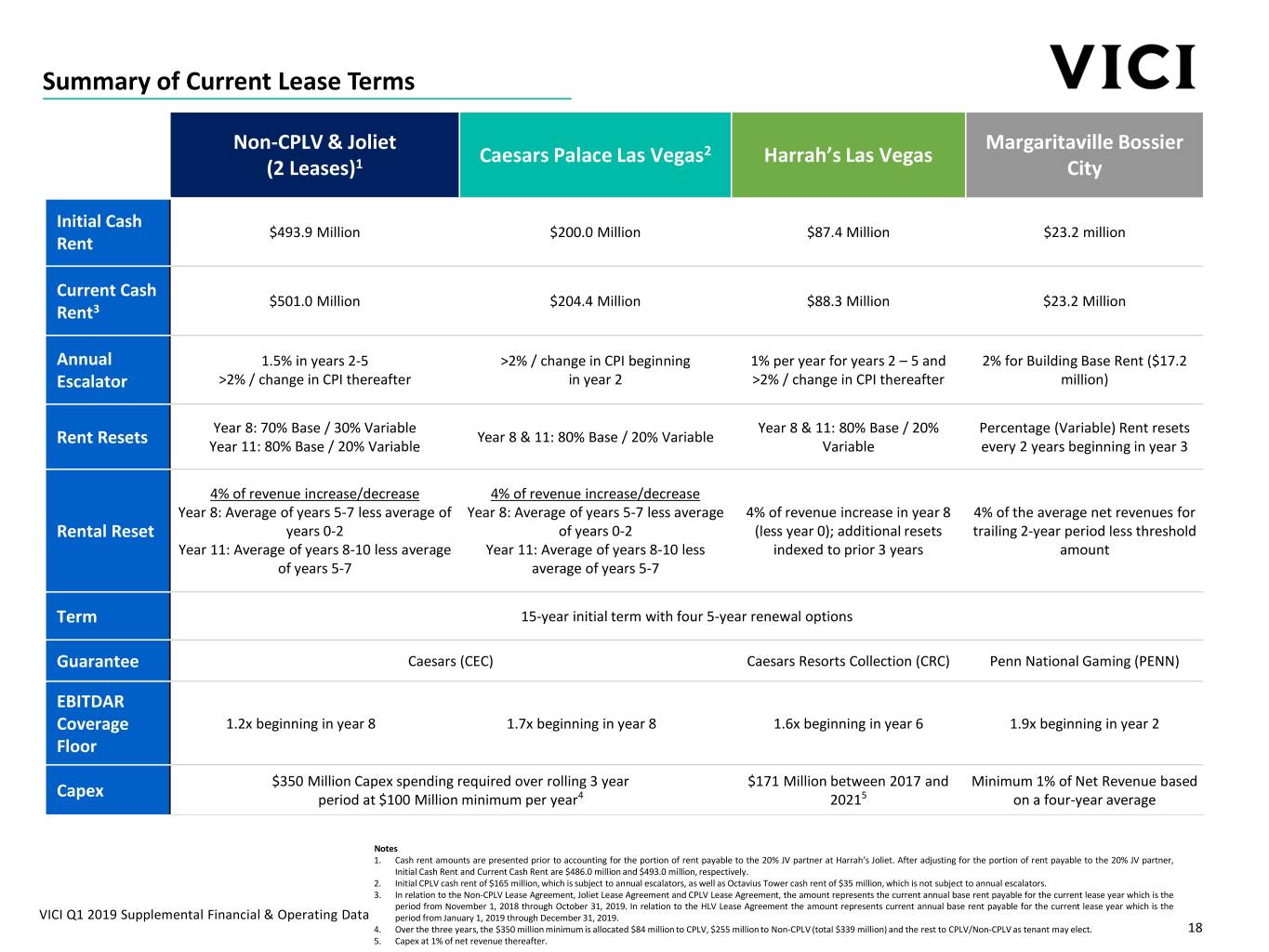

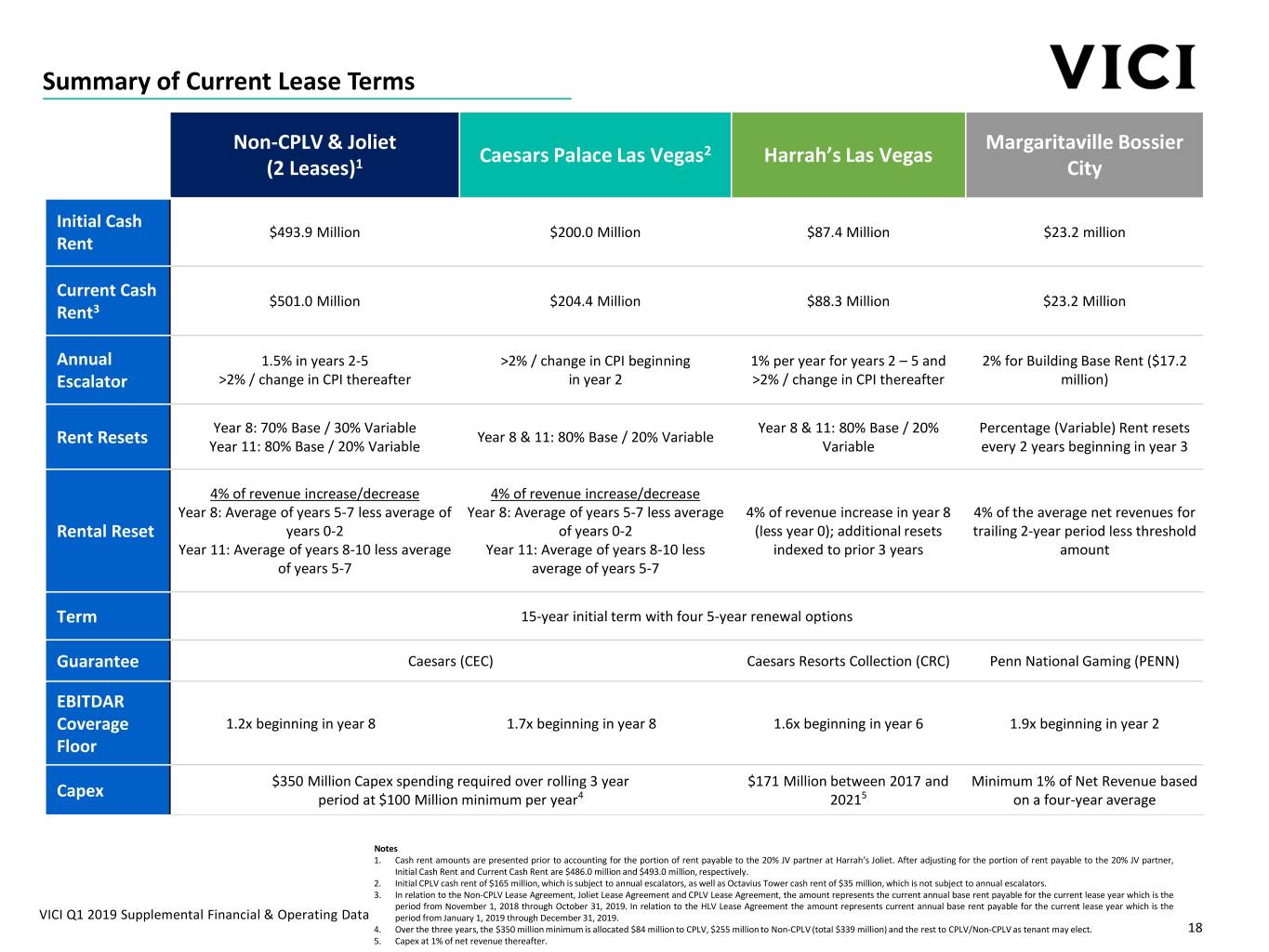

Summary of Current Lease Terms Non-CPLV & Joliet Margaritaville Bossier Caesars Palace Las Vegas2 Harrah’s Las Vegas (2 Leases)1 City Initial Cash $493.9 Million $200.0 Million $87.4 Million $23.2 million Rent Current Cash $501.0 Million $204.4 Million $88.3 Million $23.2 Million Rent3 Annual 1.5% in years 2-5 >2% / change in CPI beginning 1% per year for years 2 – 5 and 2% for Building Base Rent ($17.2 Escalator >2% / change in CPI thereafter in year 2 >2% / change in CPI thereafter million) Year 8: 70% Base / 30% Variable Year 8 & 11: 80% Base / 20% Percentage (Variable) Rent resets Year 8 & 11: 80% Base / 20% Variable Rent Resets Year 11: 80% Base / 20% Variable Variable every 2 years beginning in year 3 4% of revenue increase/decrease 4% of revenue increase/decrease Year 8: Average of years 5-7 less average of Year 8: Average of years 5-7 less average 4% of revenue increase in year 8 4% of the average net revenues for Rental Reset years 0-2 of years 0-2 (less year 0); additional resets trailing 2-year period less threshold Year 11: Average of years 8-10 less average Year 11: Average of years 8-10 less indexed to prior 3 years amount of years 5-7 average of years 5-7 Term 15-year initial term with four 5-year renewal options Guarantee Caesars (CEC) Caesars Resorts Collection (CRC) Penn National Gaming (PENN) EBITDAR Coverage 1.2x beginning in year 8 1.7x beginning in year 8 1.6x beginning in year 6 1.9x beginning in year 2 Floor $350 Million Capex spending required over rolling 3 year $171 Million between 2017 and Minimum 1% of Net Revenue based Capex period at $100 Million minimum per year4 20215 on a four-year average Notes 1. Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, Initial Cash Rent and Current Cash Rent are $486.0 million and $493.0 million, respectively. 2. Initial CPLV cash rent of $165 million, which is subject to annual escalators, as well as Octavius Tower cash rent of $35 million, which is not subject to annual escalators. 3. In relation to the Non-CPLV Lease Agreement, Joliet Lease Agreement and CPLV Lease Agreement, the amount represents the current annual base rent payable for the current lease year which is the period from November 1, 2018 through October 31, 2019. In relation to the HLV Lease Agreement the amount represents current annual base rent payable for the current lease year which is the VICI Q1 2019 Supplemental Financial & Operating Data period from January 1, 2019 through December 31, 2019. 4. Over the three years, the $350 million minimum is allocated $84 million to CPLV, $255 million to Non‐CPLV (total $339 million) and the rest to CPLV/Non‐CPLV as tenant may elect. 18 5. Capex at 1% of net revenue thereafter.

Recent Activity $mm; (unaudited) Pending Transactions Announcement Multiple / Property Status Rent Value Tenant Property Details Property Images Date Cap Rate JACK Cincinnati April 5, 2019 Expected $42.8 13.05x / 7.7% $558.3 Hard Rock ~100K Sq. Ft. of Casino Space (Cincinnati, OH)1 Close Int’l 1,800 Slots, 100 Table Games Late ’191 22 Acres ~100K Sq. Ft. of Casino Space Greektown Casino- November 14, Expected $55.6 12.6x / 7.9% $700.0 Penn 2,705 Slots, 75 Table Games Hotel 2018 Close National 400 Hotel Rooms (Detroit, MI)2 Q2’192 Gaming $134mm Cumulative Capital Invested since 2014 Completed Transactions Margaritaville June 19, 2018 Closed $23.2 11.3x / 8.9% $261.1 Penn 26.5K Sq. Ft. of Casino Space Resort Casino (January 2, National 1,217 Slots, 50 Table Games (Bossier City, LA) 2019) Gaming 395 Hotel Rooms (36 Luxury Suites) $25mm Cumulative Capital Invested since 2013 Octavius Tower May 9, 2018 Closed $35.0 14.5x / 6.9% $507.5 Caesars 1.2mm Sq. Ft. (Las Vegas, NV) (July 11, 23 Stories 2018) 668 Guestrooms, 40 Suites, 26 Premium Villas Harrah’s May 9, 2018 Closed $21.0 11.5x / 8.7% $241.5 Caesars 112.6K Sq. Ft. Philadelphia (December 2,450 Slots, 118 Table Games 26, 2018) 2,600 Space Covered Garage $750mm Capex Investment Lease May 9, 2018 Closed -- -- ($159.0) -- Modifies Leases to align VICI’s and Modifications (December Caesars’ incentives 26, 2018) Annual Rent Escalators for Non-CPLV of 1.5% retroactive to Nov.’18 Total Octavius Tower, Harrah’s Philadelphia & $56.0 10.5x / 9.5% $590.0 Lease Modifications Financing Activities Term Loan B - $500MM Swap Entered on January 3, 2019 at a blended rate of 2.38% Up to $750MM At-the-Market (“ATM”) Equity Program Issued 6.1 million shares in Q1’19, raising net proceeds of $128.1 million Notes 1. On April 5, 2019, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with JACK Cincinnati. Acquisition is pending completion, subject to customary closing conditions and regulatory approval. 2. On November 14, 2018, the Company announced that it entered into definitive agreements pursuant to which VICI will acquire the land and real estate assets associated with Greektown. Acquisition is pending completion, subject to customary closing conditions and regulatory approval. VICI Q1 2019 Supplemental Financial & Operating Data 19

Call Option Properties 5‐year Call Option Until October 2022 to Acquire Three Properties at a 10% Cap Rate1 with $130mm of Total Rent as of June 20162 Harrah's Atlantic City Harrah's Laughlin Harrah's New Orleans • Integrated hotel and resort located in the Marina • Integrated hotel and resort located on the banks of • Strategically-located, Mardi Gras themed resort and district of Atlantic City with leading service, including the Colorado River in Laughlin, NV casino operating as the only land-based casino in high-limit gaming, major F&B, and nightlife outlets Louisiana • Consists of a 55K sq.ft. casino including over 910 slot • Consists of a 156K sq.ft. casino, including over 2,270 and table-gaming units and a 1,500 room hotel • Consists of a 125K sq.ft. casino including over 1,620 slot and table-gaming units slot and table-gaming units and a 450 room hotel • Offering unique amenities such as a hotel beach, • 2,590 room hotel along with 28.6K sq.ft. of access to water sports, and golf courses • Property features nine restaurants as well as convention space nightlife offerings • Recently invested $125.8mm in a Water Front • 50% of Harrah’s New Orleans' business is national Conference Center offering +100,000 sq. ft. of and competes against major gaming destinations versatile meeting space Notes 1. Under the call right agreements, rent equates to 60% of the trailing property EBITDAR at the time of exercise. The purchase price is set at 10.0x rent. 2. Source: Caesars Entertainment Operating Company Disclosure Statement for the Debtors’ Second Amended Joint Plan of Reorganization filed in the United States Bankruptcy Court, Northern District of Illinois, Eastern Division on June 28, 2016. In conjunction with the Plan of Reorganization, the Debtors’ investment banker performed a valuation analysis. Such valuation assumed annual rent associated VICI Q1 2019 Supplemental Financial & Operating Data with the option properties of $130.0 million. These estimates were prepared by the Debtors. There can be no assurance that the Company will acquire any or all of the option properties, and the acquisition of the option properties is subject to various risks and uncertainties, including business, regulatory and others. 20

Right of First Refusal / Put‐Call Assets As part of the acquisition of Harrah's Las Vegas, VICI sold undeveloped land to Caesars and acquired a ROFR on the Centaur Gaming Real Estate Centaur Real Estate Caesars Forum Convention Center • On July 16, 2018 Caesars completed the acquisition of Centaur Holdings for • Caesars is building a $375mm center with ~300K sq.ft. convention space $1.7bn (12.1x LTM EBITDA1) on land acquired in the Harrah’s Las Vegas transaction; scheduled to open by 2020 • Centaur Holdings owns and operates two gaming assets • Put‐Call Agreement – Put Right: Once the Caesars Forum Convention Center (FCC) is complete, Caesars has a 1‐year put option beginning in 2024 Indiana Grand is a casino and Hoosier Park is a casino and horse track with ~80K sq.ft. of horse track with ~170K sq.ft. – HLV Repurchase Right: If Caesars exercises the Put Right but if VICI gaming space located 23 of gaming space located 35 does not purchase the FCC real estate, Caesars has the option to buy miles from Indianapolis miles from Indianapolis HLV for 13.0x rent – Call Right: If Caesars doesn’t exercise the put option on HLV, VICI has a 1‐year call option on the FCC beginning in 2027 • Rent associated with the FCC will be 7.7%2 of purchase price included in HLV lease and escalate at 1% per annum3 Mutual ROFR on any domestic properties acquired by Caesars Outside of Clark County, Nevada Notes 1. Source: Caesars Investor / Lender Call Presentation form 8‐K filed with the SEC December 1, 2017. VICI Q1 2019 Supplemental Financial & Operating Data 2. Implied cap rate on 13.0x purchase multiple. 3. Rent expected to be $35.4 million subject to a 1.75x LTM combined HLV and FCC rent coverage floor. 21

Definitions of Non-GAAP Financial Measures FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by The National Association of Real Estate Investment Trusts (“NAREIT”), we define FFO as net income (or loss) (computed in accordance with GAAP) excluding gains (or losses) from sales of property plus real estate depreciation. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate AFFO by adding or subtracting from FFO direct financing and sales-type lease adjustments, transaction costs incurred in connection with the acquisition of real estate investments, non-cash stock-based compensation expense, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges and gains (or losses) on debt extinguishment. We calculate Adjusted EBITDA by adding or subtracting from AFFO interest expense, net and income tax expense. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP. VICI Q1 2019 Supplemental Financial & Operating Data 22

VICI Q1 2019 Supplemental Financial & Operating Data VICI Q4 2018 Supplemental Financial & Operating Data