UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-23262 |

Nuveen Emerging Markets Debt 2022 Target Term Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 December

2021

Nuveen Closed-End Funds

| | |

| JHAA | | Nuveen Corporate Income 2023 Target Term Fund |

| JEMD | | Nuveen Emerging Markets Debt 2022 Target Term Fund |

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will not be sent to you by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences”. Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Annual Report

Life is Complex

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial professional or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table of Contents

3

Chair’s Letter to Shareholders

Dear Shareholders,

We have seen a nearly full recovery in the economy and began to approach more normalcy in our daily lives, enabled by unprecedented help from governments and central banks and the development of effective COVID-19 vaccines and therapies.

As crisis-related monetary and fiscal supports are phasing out, global economic growth is expected to moderate from post-pandemic peak growth toward a more sustainable pace of expansion. In the U.S., the rapid rebound in the economy has pushed consumer prices higher, and ongoing supply chain disruptions have kept the inflation rate elevated for longer than expected. With the economy and employment on strong footing, the Federal Reserve is ending its pandemic bond buying program and will begin raising short-term interest rates in 2022 to help keep inflation in check. The Fed now faces the challenge of counteracting inflation pressures without stifling economic growth, which the markets will be watching closely. On the fiscal side, government spending will be lower from here, but the U.S. will begin funding projects with the $1.2 trillion Infrastructure Investment and Jobs Act enacted on November 15, 2021, and Europe, Japan and China are also expected to roll out fiscal support in 2022.

Inflation levels, the timing of monetary policy normalization and the global economy’s response to tighter financial conditions will be a key focus in the markets. We anticipate periodic volatility as markets digest incoming data on these impacts, as well as COVID-19 headlines, as there is still uncertainty about the course of the pandemic. Short-term market fluctuations can provide your Fund opportunities to invest in new ideas as well as upgrade existing positioning while providing long-term value for shareholders. For more than 120 years, the careful consideration of risk and reward has guided Nuveen’s focus on delivering long-term results to our shareholders.

To learn more about how your portfolio can take advantage of new opportunities arising from the normalizing global economy, we encourage you to review your time horizon, risk tolerance and investment goals with your financial professional.

On behalf of the other members of the Nuveen Fund Board, I look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

February 22, 2022

4

Portfolio Managers’ Comments

Nuveen Corporate Income 2023 Target Term Fund (JHAA)

Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD)

Nuveen Corporate Income 2023 Target Term Fund (JHAA) features portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. The Fund’s portfolio managers are Kevin Lorenz, CFA, Jacob J. Fitzpatrick, CFA, and Christopher Williams. Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD) features portfolio management by Teachers Advisors, LLC, an affiliate of Nuveen Fund Advisors, LLC, the Fund’s investment adviser. The Fund’s portfolio managers are Anupam Damani, CFA, and Katherine Renfrew.

Here the Funds’ portfolio management teams review economic and financial market conditions, key investment strategies and the performance of the Funds for the twelve-month reporting period ended December 31, 2021. For more information on the Funds’ investment objectives and policies, please refer to the Shareholder Update section at the end of the report.

What factors affected the economy and financial markets during the twelve-month reporting period ended December 31, 2021?

The U.S. economic recovery remained on course over the twelve-month reporting period, despite setbacks from the COVID-19 virus and higher-than-expected inflation readings. Since the pandemic reached the U.S. in early 2020, the federal government has enacted $5.3 trillion in crisis-related aid and the U.S. Federal Reserve (Fed) has kept borrowing rates low for businesses and individuals and kept the credit system stable. These measures, along with increasing vaccinations and improved treatments, helped the economy to reopen and activity to rebound during 2021, despite additional COVID-19 surges caused by new, more contagious variants. U.S. gross domestic product (GDP) rose at an annualized 6.9% in the fourth quarter of 2021, accelerating from 2.3% in the third quarter when the delta variant weighed on economic activity, according to the Bureau of Economic Analysis “advance” estimate. Also according to the “advance” estimate, in 2021 overall, GDP grew 5.7%, rebounding from the contraction of -3.4% in 2020.

The return of consumer demand to the economy put upward pressure on inflation in 2021. However, as supply chains remained under stress and labor shortages continued, in part because of resurgences of the virus around the world, inflation appeared to be more durable than initially expected. The Fed responded by reducing its pandemic-era support programs and signaled that rate increases were likely in 2022. Financial markets grew more concerned about the timing and size of these monetary policy shifts and their implications for the broader economic outlook, which led to short-term volatility in interest rates and stock prices. However, strong corporate earnings and a lessening economic impact from each subsequent wave of the virus supported a more optimistic view that ultimately drove stock prices and interest rates higher over 2021.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

Emerging markets debt faced headwinds during the reporting period. The macroeconomic environment proved challenging, with rising inflation, interest rate volatility, expectations for monetary tightening in the U.S. and a stronger U.S. dollar. China contributed to negative sentiment with an unexpected regulatory crackdown across several industries, a debt crisis in its property sector, power outages and uncertainty about fiscal and monetary policy amid moderating economic growth. Other country-specific concerns ranged from elections across several Latin American countries, a return to unorthodox policymaking in Turkey and ongoing negotiations with the International Monetary Fund (IMF) in Ukraine, Argentina, Lebanon and other nations. Investors also kept an eye on geopolitical dynamics. Tensions were elevated between Russia and Europe over natural gas supply, exacerbated by Russia amassing troops at the Ukraine border. The management team continues to monitor this situation.

Nuveen Corporate Income 2023 Target Term Fund (JHAA)

What key strategies were used to manage the Fund during the twelve-month reporting period ended December 31, 2021?

The Fund seeks to provide a high level of current income and to return the original $9.875 net asset value (NAV) per common share on or about December 1, 2023. The Fund invests in a portfolio of primarily corporate debt securities, including bonds and senior loans. The Fund may invest in other types of securities including convertible securities and other types of debt instruments and derivatives that provide comparable economic exposure to the corporate debt market. In seeking to return the original NAV on or about December 1, 2023, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains, and limiting the longest maturity of any holding to no later than June 1, 2024. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage Section of this report.

The Fund’s objective to return original NAV at term is not a guarantee and is dependent on a number of factors including the extent of market recovery and the cumulative level of income retained in relation to cumulative portfolio gains net of losses.

How did the Fund perform during the twelve-month reporting period ended December 31, 2021?

For the twelve-month reporting period ended December 31, 2021, the Fund underperformed the Bloomberg U.S. Corporate High Yield 1-5 Year Cash Pay 2% Issuer Capped Bond Index. For purposes of this Performance Commentary, references to relative performance are in comparison to the Bloomberg U.S. Corporate High Yield 1-5 Year Cash Pay 2% Issuer Capped Bond Index.

The Fund’s underweight to securities rated CCC and below detracted from performance during the reporting period as those segments outperformed the broader U.S. Corporate High Yield 1-5 Year market. Spreads in the lower rating categories rallied during the reporting period led by an improved fundamental outlook, economic reopenings and an increase in consumer spending. The portfolio management team continued to position the portfolio with a higher quality bias as the Fund approaches its termination date.

Security selection in the energy sector was also a source of underperformance. In particular, an underweight in issues from oil field services companies detracted from relative performance as certain benchmark issuers within this industry significantly outperformed the broader benchmark. Also, within independent energy producers, the Fund’s higher quality tilt and underweight to lower quality issuers hindered performance. Securities from lower quality issuers outperformed as these companies benefited more from an improving commodity price environment. In general, the Fund was not able to invest in many commodity-related credits because of the length of their term structures, since June 2024 is the maximum maturity that is allowed to be held in the Fund. Over the past few years, many energy-related issuers have focused their efforts on liability management and optimizing their capital stacks by reducing debt and terming debt further out the curve.

Partially offsetting the underperformance was the Fund’s underweight position in the wireless sector, which underperformed during the reporting period. Security selection in the building materials area of the capital goods sector also

6

contributed to relative performance. The Fund benefited from overweight exposure to the senior secured loan of building products company DiversiTech Holdings. The company manufactures and supplies parts and accessories for heating, ventilation and air conditioning (HVAC) building products. At the end of the reporting period, DiversiTech was no longer held as the loan position was refinanced and its maturity extended.

Nuveen Emerging Markets Debt 2022 Target Term Fund (JEMD)

What key strategies were used to manage the Fund during this twelve-month reporting period ended December 31, 2021?

The Fund seeks to provide a high level of current income and return the original $9.85 net asset value (NAV) per common share on or about December 1, 2022. The Fund generally invests in a portfolio of below investment grade emerging markets debt securities. In seeking to return the original NAV on or about December 1, 2022, the Fund intends to utilize various portfolio and cash flow management techniques, including setting aside a portion of its net investment income, possibly retaining gains and limiting the longest effective maturity on any holding to no later than June 1, 2023. The Fund uses leverage. Leverage is discussed in more detail later in the Fund Leverage Section of this report.

Based on market conditions as of the date of this report, management anticipates that the Fund’s objective of returning the original $9.85 NAV on December 1, 2022 will not be met.

How did the Fund perform during the twelve-month reporting period ended December 31, 2021?

For the twelve-month reporting period ended December 31, 2021, the Fund outperformed the JP Morgan EMBI Global Diversified Index. For purposes of this Performance Commentary, references to relative performance are in comparison to the JP Morgan EMBI Global Diversified Index.

One of the main factors that contributed to benchmark-relative performance was the Fund’s significantly shorter duration, which is consistent with the Fund’s target term mandate as it approaches its termination date in late 2022. The shorter duration positioning helped protect the portfolio from rising interest rates during the reporting period. In addition, the Fund’s lower quality tilt relative to the benchmark contributed to relative performance as the high yield segments of corporates and sovereigns outperformed their investment grade counterparts.

Within the Fund’s sovereign allocation, holdings in Zambia were the top contributor to relative performance. The Fund’s Zambia holdings led gains despite defaulting on its Eurobond debt during the fourth quarter of 2020. The default came as fiscal/external imbalances and public arrears continued to build while reforms and policy responses were lacking amid continued talks with the International Monetary Fund (IMF). In 2021, a strong macro picture for copper, a robust maize harvest and policy tools utilized by the IMF all served to boost foreign exchange reserves and provide additional resources to help smooth the country’s macro adjustment. While uncertainty remains, discussions continue with the IMF about a comprehensive debt restructuring plan. In addition, the electoral landslide victory for opposition leader Hakainde Hichilema in August 2021 as well as the strong copper market provided a supportive backdrop for debtholders. The Fund continues to maintain its exposure to Zambia. Among individual securities, the leading contributor to the Fund’s relative performance was its position in Petra Diamonds as its restructured debt rallied. The Fund continues to hold Petra Diamonds given the overall improved outlook for diamond sales.

Partially offsetting the outperformance was the Fund’s holdings in Chinese property names China Evergrande Group and Shimao Group Holdings. Following a rapid deterioration in funding channels and an overall slowdown in the real estate market within China, China Evergrande officially defaulted in December 2021 and while expected to proceed with a reorganization effort, the Fund has sold its exposure. While Shimao is of higher quality than China Evergrande and has yet to default, difficult market dynamics following Chinese government regulations led to large declines in bond prices as expectations for a restructuring rose. The Fund continues to maintain its exposure to Shimao Group based on the portfolio management team’s view that the selling pressure was overdone.

7

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through the use of bank borrowings for JHAA as well as the use of reverse repurchase agreements for JEMD. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when short-term rates that the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio securities that it has bought with the proceeds of that leverage. This has been particularly true in the recent market environment where short-term rates have been low by historical standards.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value. All this will make the shares’ total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent quarters, fund leverage expenses have generally tracked the overall movement of short-term tax-exempt interest rates. While fund leverage expenses are somewhat higher than their recent lows, leverage nevertheless continues to provide the opportunity for incremental common share income, particularly over longer-term periods.

The use of leverage for JHAA and JEMD had a positive impact on the total return performance of the Funds over the reporting period.

As of December 31, 2021, the Funds’ percentages of leverage are shown in the accompanying table.

| | | | | | | | |

| | | JHAA | | | JEMD | |

Effective Leverage* | | | 23.86 | % | | | 22.77 | % |

Regulatory Leverage* | | | 23.86 | % | | | 0.00 | % |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

8

THE FUNDS’ LEVERAGE

Bank Borrowings

As noted previously, JHAA employs leverage through the use of bank borrowings. The Fund’s bank borrowing activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | Outstanding

Balance as of

January 1, 2021 | | | Draws | | | Paydowns | | | Outstanding

Balance as of

December 31, 2021 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | Outstanding

Balance as of

February 25, 2022 | |

JHAA | | $ | 24,525,000 | | | $ | — | | | $ | — | | | $ | 24,525,000 | | | $ | 24,525,000 | | | | | | | $ | — | | | $ | — | | | $ | 24,525,000 | |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage, for further details.

Reverse Repurchase Agreements

As noted previously, JEMD used reverse repurchase agreements, in which the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date.

The Fund’s transactions in reverse repurchase agreements are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | Outstanding

Balance as of January 1, 2021 | | | Sales | | | Purchases | | | Outstanding

Balance as of December 31, 2021 | | | Average Balance

Outstanding | | | | | | Sales | | | Purchases | | | Outstanding

Balance as of

February 25, 2022 | |

JEMD | | $ | 32,854,811 | | | $ | — | | | $ | — | | | $ | 32,854,811 | | | $ | 32,854,811 | | | | | | | $ | — | | | $ | — | | | $ | 32,854,811 | |

Refer to Notes to Financial Statements, Note 8 – Fund Leverage, for further details.

9

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of December 31, 2021. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, the Funds’ distributions to common shareholders were as shown in the accompanying table.

| | | | | | | | |

| Monthly Distributions (Ex-Dividend Date) | | JHAA | | | JEMD | |

January 2021 | | $ | 0.0395 | | | $ | 0.0335 | |

February | | | 0.0395 | | | | 0.0335 | |

March | | | 0.0395 | | | | 0.0305 | |

April | | | 0.0395 | | | | 0.0305 | |

May | | | 0.0395 | | | | 0.0305 | |

June | | | 0.0315 | | | | 0.0305 | |

July | | | 0.0315 | | | | 0.0305 | |

August | | | 0.0315 | | | | 0.0305 | |

September | | | 0.0315 | | | | 0.0305 | |

October | | | 0.0315 | | | | 0.0305 | |

November | | | 0.0315 | | | | 0.0305 | |

December 2021 | | | 0.0315 | | | | 0.0305 | |

Total Distributions from Net Investment Income | | $ | 0.4180 | | | $ | 0.3720 | |

| | |

Current Distribution Rate* | | | 3.79 | % | | | 4.83 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the Fund’s distributions, a return of capital for tax purposes. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product

10

updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

COMMON SHARE REPURCHASES

During August 2021, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of December 31, 2021, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | | |

| | | JHAA | | | JEMD | |

Common shares cumulatively repurchased and retired | | | 0 | | | | 0 | |

Common shares authorized for repurchase | | | 780,000 | | | | 1,420,000 | |

During the current reporting period, the Funds did not repurchase any of their outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of December 31, 2021, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

| | | | | | | | |

| | | JHAA | | | JEMD | |

Common share NAV | | $ | 10.00 | | | $ | 7.82 | |

Common share price | | $ | 9.98 | | | $ | 7.57 | |

Premium/(Discount) to NAV | | | (0.20 | )% | | | (3.20 | )% |

Average premium/(discount) to NAV | | | (1.05 | )% | | | (1.46 | )% |

JHAA and JEMD each have an investment objective to return $9.875 and $9.85, respectively (the original net asset value following each Fund’s initial public offering (the “Original NAV”)) to shareholders on or about the end of the Fund’s term. There can be no assurance that the Funds will be able to return the Original NAV to shareholders, and such return is not backed or otherwise guaranteed by the Funds’ investment adviser, Nuveen Fund Advisors, LLC (the “Adviser”), or any other entity.

In connection with the objective of returning Original NAV, each Fund currently intends to set aside and retain in its net assets a portion of its net investment income and possibly all or a portion of its gains. This will reduce the amounts otherwise available for distribution prior to the liquidation of each Fund, and the Fund may incur taxes on such retained amount, which will reduce the overall amounts that the Fund would have otherwise been able to distribute. Such retained income or gains, net of any taxes, would constitute a portion of the liquidating distribution returned to investors at the end of each Fund’s term. In addition, each Fund’s investment in shorter term and lower yielding securities, especially as the Fund nears the end of its term, may reduce investment income and, therefore, the monthly dividends during the period prior to termination. Investors that purchase shares in the secondary market (particularly if their purchase price differs meaningfully from the Original NAV) may receive more or less than their original investment.

Each Fund’s ability to return Original NAV to common shareholders on or about the termination date will depend on market conditions and the success of various portfolio and cash flow management techniques. Based on market conditions as of the date of this report, management anticipates that JEMD’s objective of returning the original $9.85 NAV on December 1, 2022 will not be met. JHAA’s objective is not a guarantee and is dependent on a number of factors including market conditions and the cumulative level of income retained in relation to cumulative portfolio gains net of losses.

11

| | |

| JHAA | | Nuveen Corporate Income 2023 Target Term Fund Performance Overview and Holding Summaries as of December 31, 2021 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

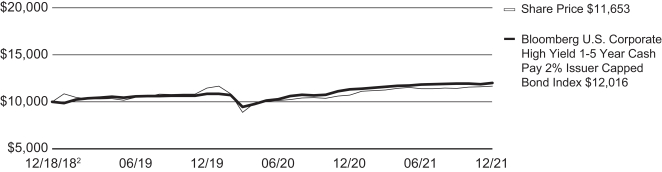

Average Annual Total Returns as of December 31, 2021

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

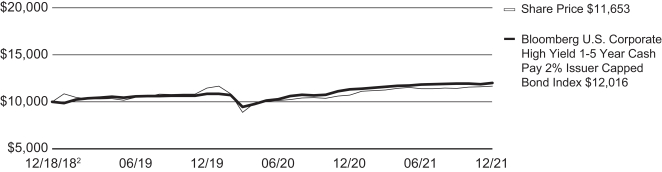

| JHAA at Common Share NAV | | | 3.92% | | | | 5.63% | |

| JHAA at Common Share Price | | | 8.63% | | | | 5.19% | |

| Bloomberg U.S. Corporate High Yield 1-5 Year Cash Pay 2% Issuer Capped Bond Index1 | | | 6.07% | | | | 6.24% | |

Since inception returns are from 12/18/18. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

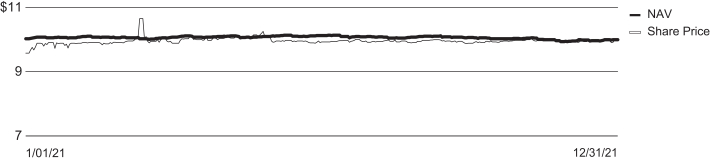

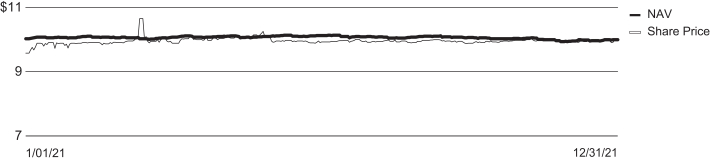

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of December 31, 2021 — Common Share Price

| 1 | For purposes of Fund performance, relative results are measured against this benchmark/index. |

| 2 | Value on 12/18/18 is $9.88, which represents the Fund’s public offering price less sales load. |

12

This data relates to the securities held in the Funds’ portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Corporate Bonds | | | 89.2% | |

| Variable Rate Senior Loan Interests | | | 30.3% | |

| Convertible Bonds | | | 4.8% | |

| Repurchase Agreements | | | 7.9% | |

| Other Assets Less Liabilities | | | (0.9)% | |

Net Assets Plus Borrowings | | | 131.3% | |

| Borrowings | | | (31.3)% | |

Net Assets | | | 100% | |

Country Allocation1

(% of total investments)

| | | | |

| United States | | | 86.5% | |

| Israel | | | 3.6% | |

| Australia | | | 2.4% | |

| Canada | | | 2.0% | |

| Zambia | | | 1.2% | |

| Ireland | | | 1.1% | |

| Mexico | | | 1.0% | |

| Luxembourg | | | 1.0% | |

| Ukraine | | | 0.9% | |

| South Africa | | | 0.3% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Oil, Gas & Consumable Fuels | | | 14.4% | |

| Media | | | 8.4% | |

| Hotels, Restaurants & Leisure | | | 6.2% | |

| Chemicals | | | 5.6% | |

| Metals & Mining | | | 5.3% | |

| Automobiles | | | 4.6% | |

| Commercial Services & Supplies | | | 4.5% | |

| Health Care Technology | | | 3.9% | |

| Consumer Finance | | | 3.7% | |

| Household Durables | | | 3.4% | |

| Professional Services | | | 3.2% | |

| Textiles, Apparel & Luxury Goods | | | 2.9% | |

| Electric Utilities | | | 2.5% | |

| Health Care Providers & Services | | | 2.4% | |

| Food & Staples Retailing | | | 2.2% | |

| Wireless Telecommunication Services | | | 2.2% | |

| Other2 | | | 18.6% | |

| Repurchase Agreements | | | 6.0% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term investments)

| | | | |

| BBB | | | 18.8% | |

| BB or Lower | | | 79.9% | |

| N/R | | | 1.3% | |

Total | | | 100% | |

Top Five Issuers

(% of total long-term investments)

| | | | |

| Ford Motor Credit Co LLC | | | 4.9% | |

| Nielsen Finance LLC, Term Loan B4 | | | 3.4% | |

| Hanesbrands Inc | | | 3.1% | |

| Prime Security Services Borrower LLC / Prime Finance Inc | | | 3.0% | |

| MGM Resorts International | | | 2.7% | |

| 1 | Includes 4.4% (as a percentage of total investments) in emerging markets countries. |

| 2 | See the Portfolio of Investments for the remaining industries and or sectors comprising “Other” and not listed in the Portfolio Composition above. |

13

| | |

| JEMD | | Nuveen Emerging Markets Debt 2022 Target Term Fund Performance Overview and Holding Summaries as of December 31, 2021 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

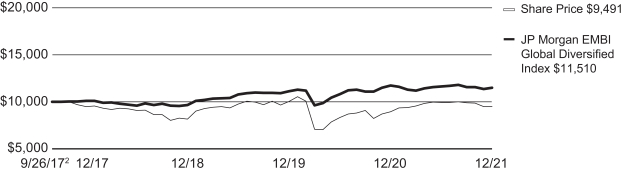

Average Annual Total Returns as of December 31, 2021

| | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | Since

Inception | |

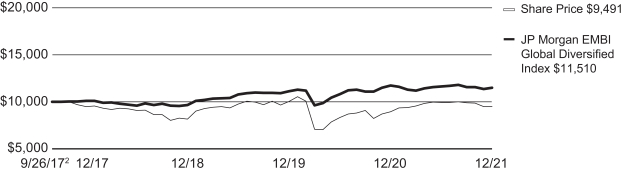

| JEMD at Common Share NAV | | | 3.53% | | | | (0.28)% | |

| JEMD at Common Share Price | | | 6.04% | | | | (1.22)% | |

| JP Morgan EMBI Global Diversified Index1 | | | (1.80)% | | | | 3.35% | |

Since inception returns are from 9/26/17. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

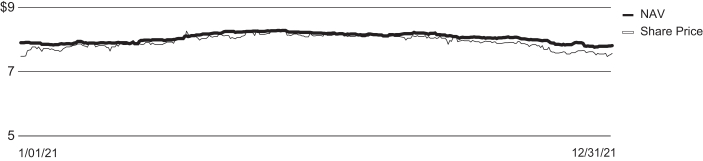

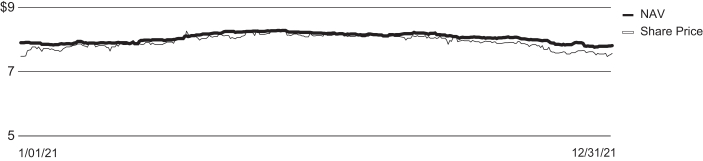

Daily Common Share NAV and Share Price

Growth of an Assumed $10,000 Investment as of December 31, 2021 — Common Share Price

| 1 | For purposes of Fund performance, relative results are measured against this benchmark/index. |

| 2 | Value on 9/26/17 is $9.85, which represents the Fund’s public offering price less sales load. |

14

This data relates to the securities held in the Funds’ portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Emerging Markets Debt | | | 72.1% | |

| Corporate Bonds | | | 54.3% | |

| Common Stocks | | | 0.7% | |

| Convertible Bonds | | | 0.5% | |

| U.S. Government and Agency Obligations | | | 0.6% | |

| Other Assets Less Liabilities | | | 1.4% | |

Net Assets Plus Reverse Repurchase Agreements | | | 129.6% | |

| Reverse Repurchase Agreements | | | (29.6)% | |

Net Assets | | | 100% | |

Country Allocation1

(% of total investments)

| | | | |

| Turkey | | | 10.4% | |

| South Africa | | | 9.8% | |

| Mexico | | | 7.7% | |

| Ukraine | | | 7.7% | |

| Iraq | | | 6.7% | |

| Barbados | | | 4.6% | |

| Egypt | | | 4.6% | |

| Nigeria | | | 4.6% | |

| Brazil | | | 4.1% | |

| El Salvador | | | 3.6% | |

| Costa Rica | | | 3.6% | |

| Ecuador | | | 3.6% | |

| Israel | | | 3.5% | |

| China | | | 3.4% | |

| Mongolia | | | 3.3% | |

| Other3 | | | 18.8% | |

Total | | | 100% | |

Portfolio Composition

(% of total investments)

| | | | |

| Emerging Markets Debt | | | 56.2% | |

| Oil, Gas & Consumable Fuels | | | 12.4% | |

| Banks | | | 8.3% | |

| Road & Rail | | | 5.2% | |

| Other2 | | | 17.4% | |

| U.S. Government and Agency Obligations | | | 0.5% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total investments)

| | | | |

| AAA | | | 0.5% | |

| BBB | | | 13.5% | |

| BB or Lower | | | 85.4% | |

| N/A | | | 0.6% | |

Total | | | 100% | |

Top Five Issuers

(% of total investments)

| | | | |

| Petroleos Mexicanos | | | 7.7% | |

| Iraq International Bond | | | 6.7% | |

| Ukraine Government International Bond | | | 5.7% | |

| Transnet SOC Ltd | | | 5.2% | |

| Barbados Government International Bond | | | 4.6% | |

| 1 | Includes 96.0% (as a percentage of total investments) in emerging markets countries. |

| 2 | See the Portfolio of Investments for the remaining industries and or sectors comprising “Other” and not listed in the Portfolio Composition above. |

| 3 | “Other” countries include twelve countries that individually constitute less than 3.3% as a percentage of total investments. |

15

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees

Nuveen Corporate Income 2023 Target Term Fund

Nuveen Emerging Markets Debt 2022 Target Term Fund:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Nuveen Corporate Income 2023 Target Term Fund and Nuveen Emerging Markets Debt 2022 Target Term Fund (the Funds), including the portfolios of investments, as of December 31, 2021, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the financial statements) and the financial highlights for each of the years in the three-year period then ended and the period from December 18, 2018 (commencement of operations) to December 31, 2018 for Nuveen Corporate Income 2023 Target Term Fund and four-year period then ended and the period from September 26, 2017 (commencement of operations) to December 31, 2017 for Nuveen Emerging Markets Debt 2022 Target Term Fund. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of December 31, 2021, the results of their operations and cash flows for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the three-year period then ended and the period from December 18, 2018 to December 31, 2018 for Nuveen Corporate Income 2023 Target Term Fund and four-year period then ended and the period from September 26, 2017 to December 31, 2017 for Nuveen Emerging Markets Debt 2022 Target Term Fund, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of December 31, 2021, by correspondence with custodians and brokers or other appropriate auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

As discussed in Note 1 to the financial statements, the Nuveen Emerging Markets Debt 2022 Target Term Fund has a termination date of December 1, 2022. Our opinion is not modified with respect to this matter.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, Illinois

February 28, 2022

16

| | |

| JHAA | | Nuveen Corporate Income 2023

Target Term Fund Portfolio of Investments December 31, 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| |

| | | | LONG-TERM INVESTMENTS – 124.3% (94.0% of Total Investments) | |

| |

| | | | CORPORATE BONDS – 89.2% (67.5% of Total Investments) | |

| |

| | | | Airlines – 1.3% | |

| | | | | |

| $ | 1,000 | | | United Airlines Holdings Inc | | | 5.000% | | | | 2/01/24 | | | | Ba3 | | | $ | 1,035,000 | |

| | | | | |

| | | | Auto Components – 1.3% | | | | | | | | | | | | |

| | | | | |

| | 975 | | | Icahn Enterprises LP / Icahn Enterprises Finance Corp | | | 6.750% | | | | 2/01/24 | | | | BB | | | | 977,438 | |

| | | | | |

| | | | Automobiles – 6.1% | | | | | | | | | | | | |

| | | | | |

| | 2,000 | | | Ford Motor Credit Co LLC | | | 3.370% | | | | 11/17/23 | | | | BB+ | | | | 2,062,740 | |

| | 2,550 | | | Ford Motor Credit Co LLC | | | 5.584% | | | | 3/18/24 | | | | BB+ | | | | 2,747,625 | |

| | 4,550 | | | Total Automobiles | | | | | | | | | | | | | | | 4,810,365 | |

| | | | | |

| | | | Chemicals – 2.7% | | | | | | | | | | | | |

| | | | | |

| | 2,025 | | | NOVA Chemicals Corp, 144A | | | 4.875% | | | | 6/01/24 | | | | BB– | | | | 2,090,812 | |

| | | | | |

| | | | Commercial Services & Supplies – 5.7% | | | | | | | | | | | | |

| | | | | |

| | 1,475 | | | ADT Security Corp | | | 4.125% | | | | 6/15/23 | | | | BB– | | | | 1,532,001 | |

| | 2,750 | | | Prime Security Services Borrower LLC / Prime Finance Inc, 144A | | | 5.250% | | | | 4/15/24 | | | | BB– | | | | 2,926,399 | |

| | 4,225 | | | Total Commercial Services & Supplies | | | | | | | | | | | | | | | 4,458,400 | |

| | | | | |

| | | | Consumer Finance – 4.9% | | | | | | | | | | | | |

| | | | | |

| | 500 | | | Navient Corp | | | 5.500% | | | | 1/25/23 | | | | Ba3 | | | | 520,750 | |

| | 780 | | | Navient Corp | | | 7.250% | | | | 9/25/23 | | | | Ba3 | | | | 840,934 | |

| | 500 | | | Navient Corp | | | 6.125% | | | | 3/25/24 | | | | Ba3 | | | | 533,125 | |

| | 1,300 | | | OneMain Finance Corp | | | 8.250% | | | | 10/01/23 | | | | Ba2 | | | | 1,431,625 | |

| | 500 | | | OneMain Finance Corp | | | 6.125% | | | | 3/15/24 | | | | Ba2 | | | | 530,115 | |

| | 3,580 | | | Total Consumer Finance | | | | | | | | | | | | | | | 3,856,549 | |

| | | | | |

| | | | Containers & Packaging – 2.8% | | | | | | | | | | | | |

| | | | | |

| | 750 | | | Ball Corp | | | 4.000% | | | | 11/15/23 | | | | BB+ | | | | 782,813 | |

| | 1,350 | | | Sealed Air Corp, 144A | | | 5.250% | | | | 4/01/23 | | | | BB+ | | | | 1,398,937 | |

| | 2,100 | | | Total Containers & Packaging | | | | | | | | | | | | | | | 2,181,750 | |

| | | | | |

| | | | Diversified Financial Services – 0.9% | | | | | | | | | | | | |

| | | | | |

| | 300 | | | Park Aerospace Holdings Ltd, 144A | | | 4.500% | | | | 3/15/23 | | | | BBB– | | | | 309,600 | |

| | 350 | | | Park Aerospace Holdings Ltd, 144A | | | 5.500% | | | | 2/15/24 | | | | BBB– | | | | 375,314 | |

| | 650 | | | Total Diversified Financial Services | | | | | | | | | | | | | | | 684,914 | |

| | | | | |

| | | | Diversified Telecommunication Services – 2.1% | | | | | | | | | | | | |

| | | | | |

| | 1,500 | | | Lumen Technologies Inc | | | 6.750% | | | | 12/01/23 | | | | BB | | | | 1,620,000 | |

| | | | | |

| | | | Electric Utilities – 3.4% | | | | | | | | | | | | |

| | | | | |

| | 1,500 | | | Pacific Gas and Electric Co | | | 1.750% | | | | 6/16/22 | | | | BBB– | | | | 1,500,005 | |

| | 1,100 | | | TerraForm Power Operating LLC, 144A | | | 4.250% | | | | 1/31/23 | | | | BB– | | | | 1,124,750 | |

| | 2,600 | | | Total Electric Utilities | | | | | | | | | | | | | | | 2,624,755 | |

| | | | | |

| | | | Equity Real Estate Investment Trust – 2.0% | | | | | | | | | | | | |

| | | | | |

| | 750 | | | GLP Capital LP / GLP Financing II Inc | | | 5.375% | | | | 11/01/23 | | | | BBB– | | | | 795,900 | |

| | 750 | | | Starwood Property Trust Inc, 144A | | | 5.500% | | | | 11/01/23 | | | | BB+ | | | | 776,250 | |

| | 1,500 | | | Total Equity Real Estate Investment Trust | | | | | | | | | | | | | | | 1,572,150 | |

| | | | | |

| | | | Food & Staples Retailing – 2.9% | | | | | | | | | | | | |

| | | | | |

| | 2,250 | | | Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC, 144A | | | 3.500% | | | | 2/15/23 | | | | BB | | | | 2,289,375 | |

17

| | |

| |

| JHAA | | Nuveen Corporate Income 2023 Target Term Fund (continued) |

| | Portfolio of Investments December 31, 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | Gas Utilities – 1.2% | | | | | | | | | | | | |

| | | | | |

| $ | 900 | | | AmeriGas Partners LP / AmeriGas Finance Corp | | | 5.625% | | | | 5/20/24 | | | | BB | | | $ | 973,053 | |

| | | | | |

| | | | Health Care Providers & Services – 2.0% | | | | | | | | | | | | |

| | | | | |

| | 118 | | | Encompass Health Corp | | | 5.125% | | | | 3/15/23 | | | | B+ | | | | 118,000 | |

| | 500 | | | HCA Inc | | | 5.875% | | | | 5/01/23 | | | | Baa3 | | | | 529,375 | |

| | 850 | | | Tenet Healthcare Corp | | | 6.750% | | | | 6/15/23 | | | | B | | | | 908,438 | |

| | 1,468 | | | Total Health Care Providers & Services | | | | | | | | | | | | | | | 1,555,813 | |

| | | | | |

| | | | Hotels, Restaurants & Leisure – 3.3% | | | | | | | | | | | | |

| | | | | |

| | 2,500 | | | MGM Resorts International | | | 6.000% | | | | 3/15/23 | | | | Ba3 | | | | 2,612,500 | |

| | | | | |

| | | | Household Durables – 4.5% | | | | | | | | | | | | |

| | | | | |

| | 1,250 | | | KB Home | | | 7.625% | | | | 5/15/23 | | | | BB | | | | 1,314,062 | |

| | 2,035 | | | Taylor Morrison Communities Inc / Taylor Morrison Holdings II Inc, 144A | | | 5.625% | | | | 3/01/24 | | | | BB | | | | 2,167,275 | |

| | 3,285 | | | Total Household Durables | | | | | | | | | | | | | | | 3,481,337 | |

| | | | | |

| | | | Media – 5.0% | | | | | | | | | | | | |

| | | | | |

| | 340 | | | AMC Networks Inc | | | 5.000% | | | | 4/01/24 | | | | BB | | | | 342,550 | |

| | 375 | | | CCO Holdings LLC / CCO Holdings Capital Corp, 144A | | | 4.000% | | | | 3/01/23 | | | | BB+ | | | | 375,015 | |

| | 2,350 | | | CSC Holdings LLC | | | 5.250% | | | | 6/01/24 | | | | B+ | | | | 2,444,000 | |

| | 750 | | | DISH DBS Corp | | | 5.000% | | | | 3/15/23 | | | | B– | | | | 768,750 | |

| | 3,815 | | | Total Media | | | | | | | | | | | | | | | 3,930,315 | |

| | | | | |

| | | | Metals & Mining – 6.9% | | | | | | | | | | | | |

| | | | | |

| | 1,100 | | | Commercial Metals Co | | | 4.875% | | | | 5/15/23 | | | | BB+ | | | | 1,133,000 | |

| | 1,250 | | | First Quantum Minerals Ltd, 144A | | | 6.500% | | | | 3/01/24 | | | | B | | | | 1,265,625 | |

| | 2,375 | | | FMG Resources August 2006 Pty Ltd, 144A | | | 5.125% | | | | 5/15/24 | | | | BB+ | | | | 2,517,500 | |

| | 500 | | | Freeport-McMoRan Inc | | | 3.875% | | | | 3/15/23 | | | | Baa3 | | | | 516,935 | |

| | 5,225 | | | Total Metals & Mining | | | | | | | | | | | | | | | 5,433,060 | |

| | | | | |

| | | | Oil, Gas & Consumable Fuels – 19.0% | | | | | | | | | | | | |

| | | | | |

| | 550 | | | Buckeye Partners LP | | | 4.150% | | | | 7/01/23 | | | | BB | | | | 563,750 | |

| | 500 | | | Calumet Specialty Products Partners LP / Calumet Finance Corp | | | 7.750% | | | | 4/15/23 | | | | B– | | | | 498,125 | |

| | 225 | | | Continental Resources Inc | | | 4.500% | | | | 4/15/23 | | | | BBB | | | | 231,856 | |

| | 1,000 | | | Continental Resources Inc | | | 3.800% | | | | 6/01/24 | | | | BBB | | | | 1,043,465 | |

| | 794 | | | Energean Israel Finance Ltd, 144A, Reg S | | | 4.500% | | | | 3/30/24 | | | | BB– | | | | 799,561 | |

| | 250 | | | Energy Transfer LP | | | 5.875% | | | | 1/15/24 | | | | BBB– | | | | 269,068 | |

| | 500 | | | EnLink Midstream Partners LP | | | 4.400% | | | | 4/01/24 | | | | BB+ | | | | 522,500 | |

| | 750 | | | EQM Midstream Partners LP | | | 4.750% | | | | 7/15/23 | | | | BB | | | | 780,004 | |

| | 1,500 | | | Leviathan Bond Ltd, 144A, Reg S | | | 5.750% | | | | 6/30/23 | | | | BB | | | | 1,543,327 | |

| | 1,000 | | | NAK Naftogaz Ukraine via Kondor Finance PLC, Reg S | | | 7.375% | | | | 7/19/22 | | | | B | | | | 977,500 | |

| | 2,250 | | | Occidental Petroleum Corp | | | 2.700% | | | | 2/15/23 | | | | BB+ | | | | 2,278,969 | |

| | 1,000 | | | Petroleos Mexicanos | | | 4.875% | | | | 1/18/24 | | | | BBB | | | | 1,035,000 | |

| | 1,000 | | | Range Resources Corp | | | 5.000% | | | | 3/15/23 | | | | B1 | | | | 1,022,500 | |

| | 300 | | | Sasol Financing International Ltd | | | 4.500% | | | | 11/14/22 | | | | BB | | | | 303,276 | |

| | 1,000 | | | SM Energy Co | | | 5.000% | | | | 1/15/24 | | | | B | | | | 992,500 | |

| | 270 | | | Western Midstream Operating LP | | | 4.000% | | | | 7/01/22 | | | | BB+ | | | | 270,675 | |

| | 1,750 | | | Western Midstream Operating LP, (3-Month LIBOR reference rate + 1.850% spread), (3) | | | 1.972% | | | | 1/13/23 | | | | BB+ | | | | 1,747,427 | |

| | 14,639 | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | | | | | 14,879,503 | |

| | | | | |

| | | | Pharmaceuticals – 1.7% | | | | | | | | | | | | |

| | | | | |

| | 1,300 | | | Teva Pharmaceutical Finance Netherlands III BV | | | 6.000% | | | | 4/15/24 | | | | Ba2 | | | | 1,362,244 | |

| | | | | |

| | | | Real Estate Management & Development – 1.1% | | | | | | | | | | | | |

| | | | | |

| | 850 | | | Realogy Group LLC / Realogy Co-Issuer Corp, 144A | | | 4.875% | | | | 6/01/23 | | | | B+ | | | | 872,313 | |

18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | | | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | Technology Hardware, Storage & Peripherals – 0.6% | | | | | | | | | | | | | |

| | | | | |

| $ | 500 | | | Diebold Nixdorf Inc | | | | 8.500% | | | | 4/15/24 | | | | Caa1 | | | $ | 500,000 | |

| | | | | |

| | | | Textiles, Apparel & Luxury Goods – 3.8% | | | | | | | | | | | | | |

| | | | | |

| | 2,825 | | | Hanesbrands Inc, 144A | | | | 4.625% | | | | 5/15/24 | | | | BB | | | | 2,958,170 | |

| | | | | |

| | | | Trading Companies & Distributors – 1.1% | | | | | | | | | | | | | |

| | | | | |

| | 400 | | | AerCap Ireland Capital DAC / AerCap Global Aviation Trust | | | | 4.500% | | | | 9/15/23 | | | | BBB | | | | 419,569 | |

| | 400 | | | Aircastle Ltd | | | | 4.400% | | | | 9/25/23 | | | | BBB | | | | 419,111 | |

| | 800 | | | Total Trading Companies & Distributors | | | | | | | | | | | | | | | | 838,680 | |

| | | | | |

| | | | Wireless Telecommunication Services – 2.9% | | | | | | | | | | | | | |

| | | | | |

| | 2,025 | | | Sprint Corp | | | | 7.875% | | | | 9/15/23 | | | | BB+ | | | | 2,230,031 | |

| $ | 67,087 | | | Total Corporate Bonds (cost $68,028,233) | | | | | | | | | | | | | | | | 69,828,527 | |

| | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon (4) | | | Reference

Rate (4) | | | Spread (4) | | | Maturity (5) | | | Ratings (2) | | | Value | |

| | |

| | | | VARIABLE RATE SENIOR LOAN INTERESTS – 30.3% (22.9% of Total Investments) (4) | | | | | |

| |

| | | | Beverages – 0.7% | |

| | | | | | | |

| $ | 620 | | | Arctic Glacier U.S.A., Inc., Term Loan B | | | 4.500% | | | | 3-Month LIBOR | | | | 3.500% | | | | 3/20/24 | | | | CCC+ | | | $ | 586,786 | |

| |

| | | | Capital Markets – 0.6% | |

| | | | | | | |

| | 453 | | | Lions Gate Capital Holdings LLC, Term Loan B | | | 1.854% | | | | 1-Month LIBOR | | | | 1.750% | | | | 3/22/23 | | | | Ba2 | | | | 451,214 | |

| |

| | | | Chemicals – 4.8% | |

| | | | | | | |

| | 1,240 | | | Axalta Coating Systems US Holdings Inc., Term Loan B3 | | | 1.974% | | | | 3-Month LIBOR | | | | 1.750% | | | | 6/01/24 | | | | BBB– | | | | 1,240,438 | |

| | 987 | | | Ineos US Finance LLC, Term Loan B | | | 2.104% | | | | 1-Month LIBOR | | | | 2.000% | | | | 3/31/24 | | | | BBB– | | | | 983,298 | |

| | 1,500 | | | Minerals Technologies Inc., Term Loan B | | | 3.000% | | | | 1-Month LIBOR | | | | 2.250% | | | | 2/14/24 | | | | BB+ | | | | 1,503,750 | |

| | 3,727 | | | Total Chemicals | | | | | | | | | | | | | | | | | | | | 3,727,486 | |

| |

| | | | Commercial Services & Supplies – 0.2% | |

| | | | | | | |

| | 177 | | | R.R. Donnelley & Sons Company, Term Loan B | | | 5.104% | | | | 1-Month LIBOR | | | | 5.000% | | | | 1/15/24 | | | | B+ | | | | 176,918 | |

| |

| | | | Health Care Providers & Services – 1.2% | |

| | | | | | | |

| | 969 | | | Team Health Holdings, Inc., Term Loan, First Lien | | | 3.750% | | | | 1-Month LIBOR | | | | 2.750% | | | | 2/06/24 | | | | B | | | | 929,717 | |

| |

| | | | Health Care Technology – 5.2% | |

| | | | | | | |

| | 1,097 | | | Change Healthcare Holdings LLC, Term Loan B | | | 3.500% | | | | 1-Month LIBOR | | | | 2.500% | | | | 3/01/24 | | | | B+ | | | | 1,096,875 | |

| | 2,952 | | | IQVIA Inc., Term Loan B3 | | | 1.854% | | | | 1-Month LIBOR | | | | 1.750% | | | | 3/07/24 | | | | BBB– | | | | 2,953,289 | |

| | 4,049 | | | Total Health Care Technology | | | | | | | | | | | | | | | | | | | | 4,050,164 | |

| |

| | | | Hotels, Restaurants & Leisure – 4.9% | |

| | | | | | | |

| | 1,941 | | | Boyd Gaming Corporation, Term Loan B3 | | | 2.354% | | | | 1-Month LIBOR | | | | 2.250% | | | | 9/15/23 | | | | BB | | | | 1,942,456 | |

| | 94 | | | CDS U.S. Intermediate Holdings, Inc., Term Loan, Second Lien | | | 7.000% | | | | 3-Month LIBOR | | | | 6.000% | | | | 11/24/25 | | | | B | | | | 94,693 | |

| | 90 | | | CDS U.S. Intermediate Holdings, Inc., Term Loan, Second Lien | | | 4.500% | | | | 3-Month LIBOR | | | | 7.000% | | | | 11/24/27 | | | | CCC | | | | 89,674 | |

| | 250 | | | Cedar Fair, L.P., Term Loan B | | | 1.854% | | | | 1-Month LIBOR | | | | 1.750% | | | | 4/13/24 | | | | Ba2 | | | | 245,860 | |

19

| | |

| |

| JHAA | | Nuveen Corporate Income 2023 Target Term Fund (continued) |

| | Portfolio of Investments December 31, 2021 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon (4) | | | Reference

Rate (4) | | | Spread (4) | | | Maturity (5) | | | Ratings (2) | | | Value | |

| |

| | | | Hotels, Restaurants & Leisure (continued) | |

| | | | | | | |

| $ | 458 | | | Golden Nugget, Inc., Term Loan B | | | 3.250% | | | | 3-Month LIBOR | | | | 2.500% | | | | 10/04/23 | | | | B | | | $ | 455,155 | |

| | 534 | | | Golden Nugget, Inc., Term Loan B | | | 3.250% | | | | 2-Month LIBOR | | | | 2.500% | | | | 10/04/23 | | | | B | | | | 531,854 | |

| | 485 | | | Travel Leaders Group, LLC, Term Loan B | | | 4.104% | | | | 1-Month LIBOR | | | | 4.000% | | | | 1/25/24 | | | | CCC | | | | 444,870 | |

| | 3,852 | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | | | | | | | | | | 3,804,562 | |

| |

| | | | Insurance – 1.7% | |

| | | | | | | |

| | 216 | | | Asurion LLC, Term Loan B8 | | | 3.229% | | | | 1-Month LIBOR | | | | 3.125% | | | | 11/03/23 | | | | Ba3 | | | | 215,753 | |

| | 1,128 | | | USI, Inc., Repriced Term Loan | | | 3.224% | | | | 3-Month LIBOR | | | | 3.000% | | | | 5/16/24 | | | | B | | | | 1,120,309 | |

| | 1,344 | | | Total Insurance | | | | | | | | | | | | | | | | | | | | 1,336,062 | |

| |

| | | | IT Services – 1.0% | |

| | | | | | | |

| | 743 | | | Syniverse Holdings, Inc., Term Loan, First Lien | | | 6.000% | | | | 3-Month LIBOR | | | | 5.000% | | | | 3/09/23 | | | | CCC+ | | | | 739,679 | |

| | 72 | | | Tempo Acquisition LLC, Extended Term Loan | | | 2.854% | | | | 1-Month LIBOR | | | | 2.750% | | | | 5/01/24 | | | | BB– | | | | 72,109 | |

| | 815 | | | Total IT Services | | | | | | | | | | | | | | | | | | | | 811,788 | |

| |

| | | | Media – 4.5% | |

| | | | | | | |

| | 1,000 | | | Gray Television, Inc., Term Loan B | | | 2.349% | | | | 3-Month LIBOR | | | | 2.250% | | | | 2/07/24 | | | | BB+ | | | | 998,940 | |

| | 1,646 | | | Nexstar Broadcasting, Inc., Term Loan B3, (DD1) | | | 2.354% | | | | 1-Month LIBOR | | | | 2.250% | | | | 1/17/24 | | | | BBB– | | | | 1,645,202 | |

| | 842 | | | Univision Communications Inc., Term Loan C5 | | | 4.000% | | | | 1-Month LIBOR | | | | 3.250% | | | | 3/24/26 | | | | B2 | | | | 845,195 | |

| | 3,488 | | | Total Media | | | | | | | | | | | | | | | | | | | | 3,489,337 | |

| |

| | | | Professional Services – 4.2% | |

| | | | | | | |

| | 3,266 | | | Nielsen Finance LLC, Term Loan B4, (DD1) | | | 2.102% | | | | 1-Month LIBOR | | | | 2.000% | | | | 10/04/23 | | | | BBB– | | | | 3,268,058 | |

| |

| | | | Semiconductors & Semiconductor Equipment – 0.1% | |

| | | | | | | |

| | 107 | | | MACOM Technology Solutions Holdings, Inc., Term Loan | | | 2.354% | | | | 1-Month LIBOR | | | | 2.250% | | | | 5/19/24 | | | | BB | | | | 106,725 | |

| |

| | | | Technology Hardware, Storage & Peripherals – 1.2% | |

| | | | | | | |

| | 988 | | | Diebold, Incorporated, Term Loan B | | | 2.875% | | | | 1-Month LIBOR | | | | 2.750% | | | | 11/06/23 | | | | B2 | | | | 982,933 | |

| $ | 23,855 | | | Total Variable Rate Senior Loan Interests (cost $23,670,058) | | | | | | | | | | | | 23,721,750 | |

| | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | | | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| |

| | | | CONVERTIBLE BONDS – 4.8% (3.6% of Total Investments) | |

| | | | | | |

| | | | Media – 1.6% | | | | | | | | | | | | | | | | |

| | | | | | | |

| $ | 1,275 | | | DISH Network Corp | | | | | | | | | | | 2.375% | | | | 3/15/24 | | | | B2 | | | $ | 1,220,812 | |

| | | | | |

| | | | Mortgage Real Estate Investment Trust – 2.3% | | | | | | | | | | | | | |

| | | | | |

| | 1,250 | | | Blackstone Mortgage Trust Inc | | | | 4.750% | | | | 3/15/23 | | | | N/R | | | | 1,275,750 | |

| | 500 | | | Starwood Property Trust Inc | | | | 4.375% | | | | 4/01/23 | | | | BB+ | | | | 523,450 | |

| | 1,750 | | | Total Mortgage Real Estate Investment Trust | | | | | | | | | | | | | | | | 1,799,200 | |

| |

| | | | Technology Hardware, Storage & Peripherals – 0.9% | |

| | | | | | | |

| | 700 | | | Western Digital Corp | | | | | | | | | | | 1.500% | | | | 2/01/24 | | | | Baa3 | | | | 706,563 | |

| $ | 3,725 | | | Total Convertible Bonds (cost $3,636,961) | | | | | | | | | | | | | | | | | | | | 3,726,575 | |

| | | | Total Long-Term Investments (cost $95,335,252) | | | | | | | | | | | | 97,276,852 | |

20

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | | | | Coupon | | | Maturity | | | | | | Value | |

| |

| | | | SHORT-TERM INVESTMENTS – 7.9% (6.0% of Total Investments) | |

| |

| | | | REPURCHASE AGREEMENTS – 7.9% (6.0% of Total Investments) | |

| | | | | | |

| $ | 6,199 | | | Repurchase Agreement with Fixed Income Clearing Corporation, dated 12/31/21, repurchase price $6,198,915, collateralized by $5,475,500, U.S. Treasury Inflation Index Notes, 0.125%, due 4/15/22, value $6,322,997 | | | | | | | 0.000% | | | | 1/03/22 | | | | | | | $ | 6,198,915 | |

| | | | Total Short-Term Investments (cost $6,198,915) | | | | | | | | | | | | | | | | 6,198,915 | |

| | | | Total Investments (cost $101,534,167) – 132.2% | | | | | | | | | | | | | | | | 103,475,767 | |

| | | | Borrowings – (31.3)% (6), (7) | | | | | | | | | | | | | | | | (24,525,000 | ) |

| | | | Other Assets Less Liabilities – (0.9)% | | | | | | | | | | | | | | | | (680,282 | ) |

| | | | Net Assets Applicable to Common Shares – 100% | | | | | | | | | | | | | | | $ | 78,270,485 | |

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. |

| (3) | Variable rate security. The rate shown is the coupon as of the end of the reporting period. |

| (4) | Senior loans generally pay interest at rates which are periodically adjusted by reference to a base short-term, floating lending rate (Reference Rate) plus an assigned fixed rate (Spread). These floating lending rates are generally (i) the lending rate referenced by the London Inter-Bank Offered Rate (“LIBOR”), or (ii) the prime rate offered by one or more major United States banks. Senior loans may be considered restricted in that the Fund ordinarily is contractually obligated to receive approval from the agent bank and/or borrower prior to the disposition of a senior loan. The rate shown is the coupon as of the end of the reporting period. |

| (5) | Senior Loans generally are subject to mandatory and/or optional prepayment. Because of these mandatory prepayment conditions and because there may be significant economic incentives for a borrower to prepay, prepayments of senior loans may occur. As a result, the actual remaining maturity of senior loans held may be substantially less than the stated maturities shown. |

| (6) | Borrowings as a percentage of Total Investments is 23.7%. |

| (7) | The Fund may pledge up to 100% of its eligible investments (excluding any investments separately pledged as collateral for specific investments in derivatives, when applicable) in the Portfolio of Investments as collateral for borrowings. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| DD1 | Portion of investment purchased on a delayed delivery basis. |

| LIBOR | London Inter-Bank Offered Rate |

| Reg S | Regulation S allows U.S. companies to sell securities to persons or entities located outside of the United States without registering those securities with the Securities and Exchange Commission. Specifically, Regulation S provides a safe harbor from the registration requirements of the Securities Act for the offers and sales of securities by both foreign and domestic issuers that are made outside the United States. |

See accompanying notes to financial statements.

21

| | |

| JEMD | | Nuveen Emerging Markets Debt 2022

Target Term Fund Portfolio of Investments December 31, 2021

|

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | |

| | | | LONG-TERM INVESTMENTS – 127.6% (99.5% of Total Investments) | | | | | | | |

| | |

| | | | EMERGING MARKETS DEBT – 72.1% (56.2% of Total Investments) | | | | | |

| | |

| | | | Argentina – 3.1% | | | | |

| | | | | |

| $ | 8,214 | | | Provincia de Buenos Aires/Government Bonds, 144A | | | 3.900% | | | | 9/01/37 | | | | CCC+ | | | $ | 3,491,003 | |

| | |

| | | | Bahrain – 2.7% | | | | |

| | | | | |

| | 2,950 | | | Bahrain Government International Bond, 144A, (3) | | | 6.125% | | | | 7/05/22 | | | | B+ | | | | 3,011,714 | |

| | |

| | | | Barbados – 5.9% | | | | |

| | | | | |

| | 6,640 | | | Barbados Government International Bond, 144A | | | 6.500% | | | | 10/01/29 | | | | B– | | | | 6,622,901 | |

| | |

| | | | Costa Rica – 4.6% | | | | |

| | | | | |

| | 5,000 | | | Costa Rica Government International Bond, 144A, (3) | | | 4.250% | | | | 1/26/23 | | | | B | | | | 5,068,750 | |

| | |

| | | | Ecuador – 4.6% | | | | |

| | | | | |

| | 2,205 | | | Ecuador Government International Bond, 144A | | | 5.000% | | | | 7/31/30 | | | | B– | | | | 1,827,394 | |

| | 625 | | | Ecuador Government International Bond, 144A | | | 0.000% | | | | 7/31/30 | | | | B– | | | | 351,794 | |

| | 3,640 | | | Ecuador Government International Bond, 144A | | | 1.000% | | | | 7/31/35 | | | | B– | | | | 2,389,048 | |

| | 853 | | | Ecuador Government International Bond, 144A | | | 0.500% | | | | 7/31/40 | | | | B– | | | | 498,771 | |

| | 7,323 | | | Total Ecuador | | | | | | | | | | | | | | | 5,067,007 | |

| | |

| | | | Egypt – 5.9% | | | | |

| | | | | |

| | 3,775 | | | Egypt Government International Bond, 144A | | | 6.125% | | | | 1/31/22 | | | | B+ | | | | 3,790,100 | |

| | 2,725 | | | Egypt Government International Bond, 144A | | | 5.577% | | | | 2/21/23 | | | | B+ | | | | 2,820,048 | |

| | 6,500 | | | Total Egypt | | | | | | | | | | | | | | | 6,610,148 | |

| | |

| | | | El Salvador – 4.6% | | | | |

| | | | | |

| | 6,375 | | | El Salvador Government International Bond, 144A, (3) | | | 7.750% | | | | 1/24/23 | | | | B– | | | | 5,100,064 | |

| | |

| | | | Ghana – 1.1% | | | | |

| | | | | |

| | 1,250 | | | Ghana Government International Bond, 144A | | | 9.250% | | | | 9/15/22 | | | | B | | | | 1,255,975 | |

| | |

| | | | Iraq – 8.6% | | | | |

| | | | | |

| | 9,500 | | | Iraq International Bond, 144A, (3) | | | 6.752% | | | | 3/09/23 | | | | B– | | | | 9,595,665 | |

| | |

| | | | Lebanon – 0.8% | | | | |

| | | | | |

| | 5,000 | | | Lebanon Government International Bond, Reg S (4) | | | 6.000% | | | | 1/27/23 | | | | D | | | | 515,400 | |

| | 4,000 | | | Lebanon Government International Bond, (4) | | | 6.400% | | | | 5/26/23 | | | | D | | | | 420,000 | |

| | 9,000 | | | Total Lebanon | | | | | | | | | | | | | | | 935,400 | |

| | |

| | | | Mongolia – 4.3% | | | | |

| | | | | |

| | 3,000 | | | Mongolia Government International Bond, 144A | | | 5.125% | | | | 12/05/22 | | | | B | | | | 3,067,501 | |

| | 1,650 | | | Mongolia Government International Bond, 144A | | | 5.625% | | | | 5/01/23 | | | | B | | | | 1,697,481 | |

| | 4,650 | | | Total Mongolia | | | | | | | | | | | | | | | 4,764,982 | |

| | |

| | | | Nigeria – 3.1% | | | | |

| | | | | |

| | 3,425 | | | Nigeria Government International Bond, (3) | | | 5.625% | | | | 6/27/22 | | | | B2 | | | | 3,459,044 | |

| | |

| | | | Oman – 2.7% | | | | |

| | | | | |

| | 3,000 | | | Oman Government International Bond, 144A | | | 4.125% | | | | 1/17/23 | | | | Ba3 | | | | 3,048,750 | |

| | |

| | | | Pakistan – 3.2% | | | | |

| | | | | |

| | 3,450 | | | Third Pakistan International Sukuk Co Ltd, 144A | | | 5.625% | | | | 12/05/22 | | | | B– | | | | 3,510,720 | |

| | |

| | | | Sri Lanka – 1.5% | | | | |

| | | | | |

| | 3,000 | | | Sri Lanka Government International Bond, 144A | | | 5.750% | | | | 4/18/23 | | | | CCC+ | | | | 1,671,060 | |

22

| | | | | | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | |

| | | | Turkey – 4.4% | | | | |

| | | | | |

| $ | 4,000 | | | Turkey Government International Bond | | | 3.250% | | | | 3/23/23 | | | | BB– | | | $ | 3,884,136 | |

| | 1,000 | | | Turkiye Ihracat Kredi Bankasi AS, 144A | | | 4.250% | | | | 9/18/22 | | | | B+ | | | | 990,180 | |

| | 5,000 | | | Total Turkey | | | | | | | | | | | | | | | 4,874,316 | |

| | |

| | | | Ukraine – 7.3% | | | | |

| | | | | |

| | 8,225 | | | Ukraine Government International Bond, 144A, (3) | | | 7.750% | | | | 9/01/22 | | | | B | | | | 8,138,802 | |

| | |

| | | | Zambia – 3.7% | | | | |

| | | | | |

| | 5,500 | | | Zambia Government International Bond, 144A | | | 5.375% | | | | 9/20/22 | | | | D | | | | 4,105,288 | |

| $ | 99,002 | | | Total Emerging Markets Debt (cost $92,442,329) | | | | | | | | | | | | | | | 80,331,589 | |

| | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Ratings (2) | | | Value | |

| | | | | |

| | | | CORPORATE BONDS – 54.3% (42.3% of Total Investments) | | | | | | | | | | | | | | | | |

| | | | | |

| | | | Aerospace & Defense – 2.7% | | | | | | | | | | | | |

| | | | | |

| $ | 3,000 | | | Embraer SA | | | 5.150% | | | | 6/15/22 | | | | BB+ | | | $ | 3,040,530 | |

| | |

| | | | Banks – 10.7% | | | | |

| | | | | |

| | 2,000 | | | TC Ziraat Bankasi AS, 144A | | | 5.125% | | | | 5/03/22 | | | | B+ | | | | 1,993,688 | |

| | 3,200 | | | Turkiye Is Bankasi AS, 144A | | | 6.000% | | | | 10/24/22 | | | | B– | | | | 3,170,912 | |

| | 2,704 | | | Turkiye Vakiflar Bankasi TAO, 144A | | | 6.000% | | | | 11/01/22 | | | | B– | | | | 2,656,680 | |

| | 700 | | | Turkiye Vakiflar Bankasi TAO, 144A | | | 5.750% | | | | 1/30/23 | | | | B+ | | | | 690,856 | |

| | 358 | | | Ukreximbank Via Biz Finance PLC, 144A | | | 9.625% | | | | 4/27/22 | | | | B | | | | 358,674 | |

| | 3,000 | | | United Bank for Africa PLC, 144A, (3) | | | 7.750% | | | | 6/08/22 | | | | B | | | | 3,033,900 | |

| | 11,962 | | | Total Banks | | | | | | | | | | | | | | | 11,904,710 | |

| | |

| | | | Beverages – 1.4% | | | | |

| | | | | |

| | 1,500 | | | Anadolu Efes Biracilik Ve Malt Sanayii AS, 144A | | | 3.375% | | | | 11/01/22 | | | | BBB– | | | | 1,503,435 | |

| | |

| | | | Capital Markets – 1.8% | | | | |

| | | | | |

| | 2,000 | | | Grupo Aval Ltd, 144A, (3) | | | 4.750% | | | | 9/26/22 | | | | BB+ | | | | 2,036,000 | |

| | |

| | | | Food Products – 2.6% | | | | |

| | | | | |

| | 2,800 | | | BRF SA, 144A | | | 3.950% | | | | 5/22/23 | | | | Ba2 | | | | 2,845,528 | |

| | |

| | | | Hotels, Restaurants & Leisure – 0.9% | | | | |

| | | | | |

| | 1,000 | | | Fortune Star BVI Ltd, Reg S | | | 5.250% | | | | 3/23/22 | | | | BB | | | | 1,000,340 | |

| | |

| | | | Metals & Mining – 3.7% | | | | |

| | | | | |

| | 1,569 | | | Petra Diamonds US Treasury PLC, 144A, (cash 10.500%, PIK 10.500%) | | | 10.500% | | | | 3/08/26 | | | | B– | | | | 1,616,070 | |

| | 2,500 | | | Volcan Cia Minera SAA, 144A | | | 5.375% | | | | 2/02/22 | | | | BB | | | | 2,487,500 | |

| | 4,069 | | | Total Metals & Mining | | | | | | | | | | | | | | | 4,103,570 | |

| | |