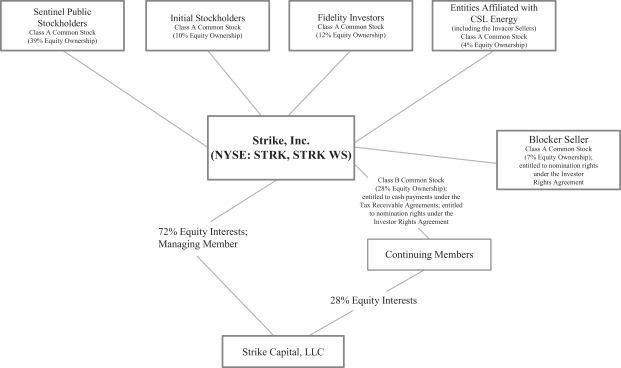

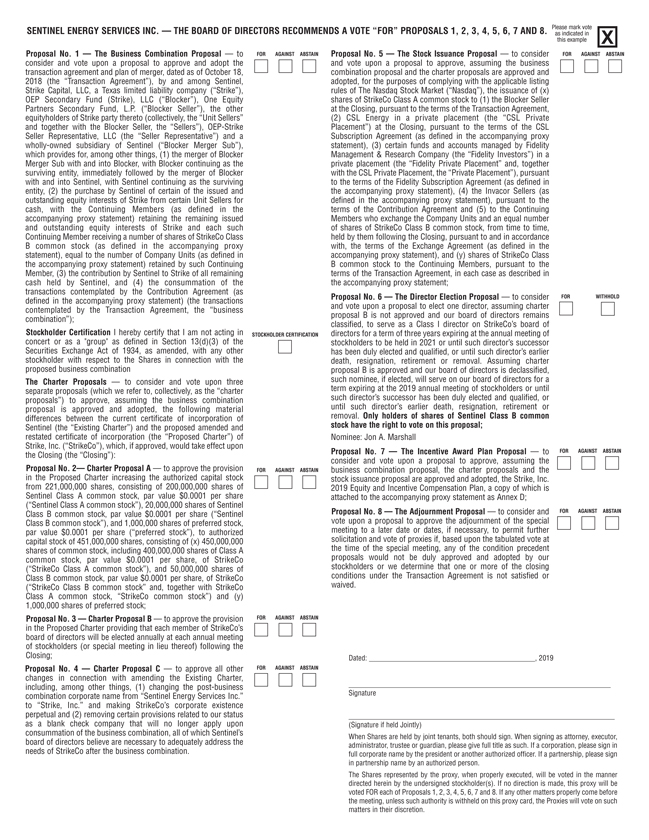

SENTINEL ENERGY SERVICES INC. THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4, 5, 6, 7 AND 8. Please mark vote as indicated in this example Proposal No. 1 The Business Combination Proposal to consider and vote upon a proposal to approve and adopt the transaction agreement and plan of merger, dated as of October 18, 2018 (the “Transaction Agreement”), by and among Sentinel, Strike Capital, LLC, a Texas limited liability company (“Strike”), OEP Secondary Fund (Strike), LLC (“Blocker”), One Equity Partners Secondary Fund, L.P. (“Blocker Seller”), the other equityholders of Strike party thereto (collectively, the “Unit Sellers” and together with the Blocker Seller, the “Sellers”), OEP-Strike Seller Representative, LLC (the “Seller Representative”) and a wholly-owned subsidiary of Sentinel (“Blocker Merger Sub”), which provides for, among other things, (1) the merger of Blocker Merger Sub with and into Blocker, with Blocker continuing as the surviving entity, immediately followed by the merger of Blocker with and into Sentinel, with Sentinel continuing as the surviving entity, (2) the purchase by Sentinel of certain of the issued and outstanding equity interests of Strike from certain Unit Sellers for cash, with the Continuing Members (as defined in the accompanying proxy statement) retaining the remaining issued and outstanding equity interests of Strike and each such Continuing Member receiving a number of shares of StrikeCo Class B common stock (as defined in the accompanying proxy statement), equal to the number of Company Units (as defined in the accompanying proxy statement) retained by such Continuing Member, (3) the contribution by Sentinel to Strike of all remaining cash held by Sentinel, and (4) the consummation of the transactions contemplated by the Contribution Agreement (as defined in the accompanying proxy statement) (the transactions contemplated by the Transaction Agreement, the “business combination”); Stockholder Certification I hereby certify that I am not acting in concert or as a “group” as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, with any other stockholder with respect to the Shares in connection with the proposed business combination The Charter Proposals to consider and vote upon three separate proposals (which we refer to, collectively, as the “charter proposals”) to approve, assuming the business combination proposal is approved and adopted, the following material differences between the current certificate of incorporation of Sentinel (the “Existing Charter”) and the proposed amended and restated certificate of incorporation (the “Proposed Charter”) of Strike, Inc. (“StrikeCo”), which, if approved, would take effect upon the Closing (the “Closing”): Proposal No. 2 Charter Proposal A to approve the provision in the Proposed Charter increasing the authorized capital stock from 221,000,000 shares, consisting of 200,000,000 shares of Sentinel Class A common stock, par value $0.0001 per share (“Sentinel Class A common stock”), 20,000,000 shares of Sentinel Class B common stock, par value $0.0001 per share (“Sentinel Class B common stock”), and 1,000,000 shares of preferred stock, par value $0.0001 per share (“preferred stock”), to authorized capital stock of 451,000,000 shares, consisting of (x) 450,000,000 shares of common stock, including 400,000,000 shares of Class A common stock, par value $0.0001 per share, of StrikeCo (“StrikeCo Class A common stock”), and 50,000,000 shares of Class B common stock, par value $0.0001 per share, of StrikeCo (“StrikeCo Class B common stock” and, together with StrikeCo Class A common stock, “StrikeCo common stock”) and (y) 1,000,000 shares of preferred stock; Proposal No. 3 Charter Proposal B to approve the provision in the Proposed Charter providing that each member of StrikeCo’s board of directors will be elected annually at each annual meeting of stockholders (or special meeting in lieu thereof) following the Closing; Proposal No. 4 Charter Proposal C to approve all other changes in connection with amending the Existing Charter, including, among other things, (1) changing the post-business combination corporate name from “Sentinel Energy Services Inc.” to “Strike, Inc.” and making StrikeCo’s corporate existence perpetual and (2) removing certain provisions related to our status as a blank check company that will no longer apply upon consummation of the business combination, all of which Sentinel’s board of directors believe are necessary to adequately address the needs of StrikeCo after the business combination. FOR AGAINST ABSTAIN STOCKHOLDER CERTIFICATION FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN Proposal No. 5 The Stock Issuance Proposal to consider and vote upon a proposal to approve, assuming the business combination proposal and the charter proposals are approved and adopted, for the purposes of complying with the applicable listing rules of The Nasdaq Stock Market (“Nasdaq”), the issuance of (x) shares of StrikeCo Class A common stock to (1) the Blocker Seller at the Closing, pursuant to the terms of the Transaction Agreement, (2) CSL Energy in a private placement (the “CSL Private Placement”) at the Closing, pursuant to the terms of the CSL Subscription Agreement (as defined in the accompanying proxy statement), (3) certain funds and accounts managed by Fidelity Management & Research Company (the “Fidelity Investors”) in a private placement (the “Fidelity Private Placement” and, together with the CSL Private Placement, the “Private Placement”), pursuant to the terms of the Fidelity Subscription Agreement (as defined in the accompanying proxy statement), (4) the Invacor Sellers (as defined in the accompanying proxy statement), pursuant to the terms of the Contribution Agreement and (5) to the Continuing Members who exchange the Company Units and an equal number of shares of StrikeCo Class B common stock, from time to time, held by them following the Closing, pursuant to and in accordance with, the terms of the Exchange Agreement (as defined in the accompanying proxy statement), and (y) shares of StrikeCo Class B common stock to the Continuing Members, pursuant to the terms of the Transaction Agreement, in each case as described in the accompanying proxy statement; Proposal No. 6 The Director Election Proposal to consider and vote upon a proposal to elect one director, assuming charter proposal B is not approved and our board of directors remains classified, to serve as a Class I director on StrikeCo’s board of directors for a term of three years expiring at the annual meeting of stockholders to be held in 2021 or until such director’s successor has been duly elected and qualified, or until such director’s earlier death, resignation, retirement or removal. Assuming charter proposal B is approved and our board of directors is declassified, such nominee, if elected, will serve on our board of directors for a term expiring at the 2019 annual meeting of stockholders or until such director’s successor has been duly elected and qualified, or until such director’s earlier death, resignation, retirement or removal. Only holders of shares of Sentinel Class B common stock have the right to vote on this proposal; Nominee: Jon A. Marshall Proposal No. 7 The Incentive Award Plan Proposal to consider and vote upon a proposal to approve, assuming the business combination proposal, the charter proposals and the stock issuance proposal are approved and adopted, the Strike, Inc. 2019 Equity and Incentive Compensation Plan, a copy of which is attached to the accompanying proxy statement as Annex D; Proposal No. 8 The Adjournment Proposal to consider and vote upon a proposal to approve the adjournment of the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the special meeting, any of the condition precedent proposals would not be duly approved and adopted by our stockholders or we determine that one or more of the closing conditions under the Transaction Agreement is not satisfied or waived. FOR AGAINST ABSTAIN FOR WITHHOLD FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN Dated: , 2019 Signature (Signature if held Jointly) When Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder(s). If no direction is made, this proxy will be voted FOR each of Proposals 1, 2, 3, 4, 5, 6, 7 and 8. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion.