UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

HIGHLAND FLOATING RATE OPPORTUNITIES FUND

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

October 11, 2017

Your action is required. Please vote today.

Dear Shareholder:

We are asking you to vote to authorize the Fund’s board of trustees (the “Board”) to amend the Agreement and Declaration of Trust of Highland Floating Rate Opportunities Fund (the “Fund”) to convert the Fund from anopen-end fund to aclosed-end fund (the “Proposal”). If shareholders approve the Proposal and the Fund converts to aclosed-end fund structure, shareholders of the Fund would no longer have the right to cause the Fund to directly redeem their shares; instead, the Fund will seek to list its shares for trading on the New York Stock Exchange (“NYSE”) or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards. If the Fund is not approved for listing, the Board will not implement the Proposal.

| | • | | On behalf of the Fund, Highland Capital Management, L.P. and its affiliates (collectively, “Highland” or “we”) vigorously pursued and obtained a $279 million judgment against Credit Suisse Group AG. |

| | • | | We believe this judgment is unprecedented in the history of registered investment fund management. The magnitude of the judgment relative to the Fund’s net asset value (“NAV”) and the upcoming appellate hearing have attracted interest from what we believe to be short-term speculators and litigation funders. The Fund expects such interest to continue until the Fund is able to reflect the value of such judgment as an asset on its books in accordance with generally accepted accounting principles in the United States. |

| | • | | While no assurance can be given as to the amount, if any, the Fund will ultimately collect, we believe this judgment will be upheld at the appellate level. To protect the interests of long-term shareholders and to prevent unnatural flows and unintended consequences described below, we propose converting the Fund into a listedclosed-end fund in the next 45 days. This requires shareholder approval.YOUR VOTE IN FAVOR OF THE PROPOSAL IS CRITICAL. |

| | • | | If approved, this proposal: |

| | • | | will protect shareholders’ interest in the judgment from being diluted by new subscriptions after conversion, while also protecting shareholders from a surge of investment or redemptions following the appellate decision. |

| | • | | will also eliminate the “liquidity mismatch” that would otherwise occur between the date that the judgment is included as an asset under accounting principles generally accepted in the United States and the actual receipt of cash or liquid securities from Credit Suisse. |

| | • | | While there is no guarantee that the Fund will trade at a premium, we believe the potential benefit of this settlement could cause the Fund to trade at a premium to NAV. To further support the Fund after conversion, the Fund will, subject to certain regulatory conditions and the availability of liquid assets after allowing for anticipated Fund expenses and contingencies, repurchase up to $20 million of shares, provided such shares are trading at a discount to NAV, and Highland will purchase at least $20 million in the secondary market, as discussed in the Proxy Statement, and generally expects that its purchases will occur when such shares are trading at a discount. |

| | • | | Shareholders that do not wish to hold shares of aclosed-end fund may redeem their shares prior to conversion. Shareholders that remain in the Fund after the conversion to aclosed-end fund may exit the Fund by selling their shares on the exchange. |

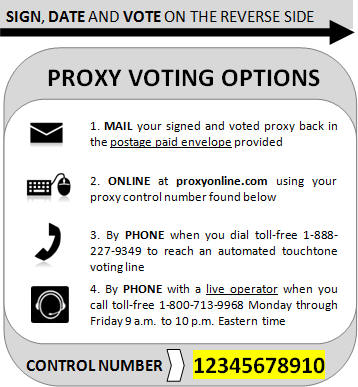

The Fund cannot convert to aclosed-end fund structure without shareholder approval, so a special shareholder meeting has been scheduled to take place on November 3, 2017, at 200 Crescent Court, Crescent Club, Gold Room, Dallas, Texas 75201, at 8:00 A.M. Central Time. Representatives of Highland Capital Management Fund

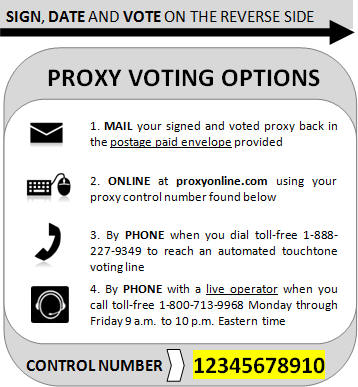

Advisors, L.P. will be available to answer questions. While you are welcome to attend the meeting in person,voting today will save the Fund the cost of future mailings to solicit shareholder votes. You have multiple options available to cast your proxy vote:

Online: proxyonline.com

Phone:Call (888)227-9349

Mail: Complete the enclosed proxy card and return it in the postage-paid envelope.

We encourage you to read the enclosed proxy statement for more information, and we thank you for voting today.

Sincerely,

J. Bradley Ross

President

Highland Capital Management Fund Advisors, L.P.

Highland Floating Rate Opportunities Fund

PROXY STATEMENT

October 11, 2017

This is a brief overview of the matters on which Highland Floating Rate Opportunities Fund (the “Fund”) shareholders will be asked to vote at the shareholder meeting to be held on November 3, 2017 (the “Meeting”).

Q: Why are you sending me this information?

You are being asked to vote to approve authorizing the board of trustees of the Fund (the “Board”) to convert the Fund from anopen-end structure to aclosed-end structure, which requires the approval of shareholders under the Investment Company Act of 1940, as amended (the “1940 Act”). Converting the Fund’s structure involves an amendment to Fund’s Agreement and Declaration of Trust (the “Declaration of Trust”), which, under the terms of the Declaration of Trust, also requires the approval of shareholders.

Q: Is my vote important?

Absolutely! While the Board has reviewed the proposed amendment to the Declaration of Trust (the “Proposal”) and recommends that you authorize them to implement it, the Proposal cannot go forward without the approval of the shareholders of the Fund. The Fund expects to continue to contact shareholders asking them to vote until it is certain that a quorum will be reached, and the Fund may continue to contact shareholders thereafter.

Q: What is the proposal?

Shareholders are being asked to authorize the Board to amend the Declaration of Trust to convert the Fund’s structure from anopen-end fund to aclosed-end fund. If shareholders approve the Proposal and the Fund converts to aclosed-end fund structure, shareholders of the Fund would no longer have the right to cause the Fund to directly redeem their shares; instead, the Fund will seek to list its shares for trading on the New York Stock Exchange (“NYSE”) or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards, which would give shareholders the ability to sell their shares of the Fund on the exchange. The Fund will apply for listing on the NYSE or another national securities exchange as soon as practicable, with such listing to be effective upon the approval of the Proposal and the amendment by the Board of the Declaration of Trust. If the Fund is not approved for listing, the Board will not implement the Proposal. Subject to shareholder approval of the Proposal, the Fund will seek to be listed on the NYSE or another national securities exchange before the exhaustion of appeals of the judgment.

Highland Capital Management Fund Advisors, L.P. (the “Adviser,” or “we”) encourage you to read the full text of the enclosed Proxy Statement to obtain a more detailed understanding of the issues relating to the Proposal.

Q: What is the difference between anopen-end fund and aclosed-end fund?

Generally, shareholders of anopen-end fund can request that the fund redeem their shares at net asset value (“NAV”) on any business day, whereas shareholders of aclosed-end fund do not have the ability to redeem shares at NAV. Shares of aclosed-end fund may trade at a premium or discount to NAV, and shares of manyclosed-end funds, particularly smallerclosed-end funds, trade at a discount to NAV.Open-end funds are subject to liquidity requirements to help ensure that they can meet such shareholder redemptions. Because anopen-end fund must hold cash reserves and liquid securities in order to meet liquidity requirements and redemption

i

requests, the fund may not be able to pursue certain investment opportunities within its investment objective and investment strategy, especially in investments that may be deemed illiquid. Aclosed-end fund does not provide shareholders with a right to cause theclosed-end fund to redeem their shares, and so is not subject to the liquidity requirements applicable toopen-end funds.

While the Fund would not be required to redeem shares each business day upon conversion to aclosed-end structure, the Fund will seek to list its shares for trading on the NYSE or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards, which would give shareholders the ability to sell their shares of the Fund on the exchange. The Fund will apply for listing on the NYSE or another national securities exchange as soon as practicable, with such listing to be effective upon the approval of the Proposal and the amendment by the Board of the Declaration of Trust. If the Fund is not approved for listing, the Board will not implement the Proposal. Subject to shareholder approval of the Proposal, the Fund will seek to be listed on the NYSE or another national securities exchange before the exhaustion of appeals of the judgment.

In addition to differences in redemption rights,closed-end funds also differ fromopen-end funds in thatclosed-end funds are permitted to issue preferred shares. While the Fund does not currently intend to issue preferred shares, if the Fund were to do so in the future, holders of such preferred shares would be entitled to preferential payment of dividends and would have different voting rights than common shareholders.

Q: Why is the conversion being proposed?

We believe that converting the Fund to aclosed-end fund with the same investment objective and strategy would serve to protect the interests of shareholders in the event that the Fund’s previously-disclosed judgment against Credit Suisse Group AG (“Credit Suisse”) is upheld on appeal and is recorded as an asset of the Fund. Confirmation of the judgment could result in the recognition of up to $279 million, or approximately 32% of the Fund’s net assets as of August 31, 2017, which will be reduced by attorneys’ fees and other litigation-related expenses. We believe a judgment of this size is highly unusual, if not unprecedented, in the mutual fund industry, and the award would represent a significant victory for the Fund’s shareholders. There can be no assurance that the judgment will be confirmed upon appeal or as to the amount, if any, that the Fund will ultimately receive in connection with the judgment. However, confirmation of the judgment could give rise to two issues that we believe are best mitigated by converting the Fund to aclosed-end fund.

First, there is a risk that current shareholders could be diluted by third parties who invest in the Fund solely to speculate on the outcome of the judgment. This risk may become particularly acute if the judgment is confirmed on appeal, as we believe significant dilutive speculation would occur thereafter. We believe that the judgment, if confirmed, should benefit long-term shareholders rather than speculators seeking to profit from the Fund’s successful litigation. By converting the Fund to aclosed-end structure and listing the Fund on an exchange in advance of the appellate decision, the ability of speculators to make dilutive investments in the Fund following a favorable appellate decision would be mitigated. Speculators would only be able to invest in the Fund by purchasing shares from existing shareholders at a price determined by the market, rather than at NAV. Once the Fund converts to aclosed-end fund, shares outstanding will not increase and therefore a shareholder will not be subject to a reduction in overall ownership percentage as a result of secondary market trading. Because the judgment has been publicly disclosed, Highland believes that the market price should reflect the expected value of the judgment, even if accounting principles generally accepted in the United States (“GAAP”) does not permit the Fund to reflect that value in its NAV. In order to limit the negative impact on existing shareholders of redemptions that occur prior to the conversion and to increase the potential benefits that may result from a larger fund, the Fund intends to reserve the right to accept additional purchases into the Fund prior to the conversion. However, the Fund may halt or limit purchases at any time and for any length of time. While purchases prior to the conversion have the potential to dilute existing shareholders, the Adviser also believes there are benefits to maintaining and even increasing the size of the Fund. If the Fund increases in size prior to the conversion, the largerclosed-end Fund would have the potential to reduce overall net expenses for

ii

shareholders. Larger funds also typically trade more frequently on the secondary market, potentially allowing investors access to and exit opportunities at more favorable prices, and reduce the likelihood of trading at a discount to NAV because shares of manyclosed-end funds, particularly smallerclosed-end funds, trade at a discount to NAV.

Second, recognition by the Fund of a substantial award could cause a “liquidity mismatch” for the period of time, if any, between the date that the judgment is included as an asset under GAAP and the date that the Fund actually receives cash or liquid securities from Credit Suisse. Under GAAP, the Fund would include the judgment as an asset of the Fund once the asset is no longer contingent, which we expect to occur upon the exhaustion of the appeals process. Even if the judgment is upheld and the appeals process is exhausted, Highland believes there is likely to be some delay in receipt by the Fund of cash or other assets from Credit Suisse in satisfaction of the judgment. Such delay may be caused by, for example, the process of involuntary collection of liquid assets from Credit Suisse, including, but not limited to, collection from outside the United States. Therefore, Highland cannot provide any assurances as to the length of such delay. By converting the Fund to aclosed-end structure, the Fund would not be required to redeem shares immediately following the recording of the award as an asset of the Fund, when the Fund may not be able to readily convert the award into cash. Therefore, the Proposal may prevent the Fund from being required to liquidate otherwise advantageous positions in order to meet a high volume of shareholder redemption requests in a short amount of time.

Irrespective of the potential award, we believe the Proposal will benefit shareholders by eliminating the need for the Fund to hold cash reserves and liquid securities in order to meet daily shareholder redemptions and liquidity requirements applicable to anopen-end fund. The Proposal will allow the Fund to pursue its existing investment objective and investment strategy through a structure that better positions the Fund to capitalize on its universe of investment opportunities, which may include investments in long-term illiquid positions.

Q: Did the Board consider options other than converting the Fund to aclosed-end structure?

Yes. The decision to convert the Fund to aclosed-end structure was made after extensive discussions with the Board, Board counsel and the Fund’s auditor. After reviewing numerous options, the Board, upon recommendation from the Fund’s investment adviser, determined that the best way to protect the interests of the Fund and its shareholders is to convert the Fund to aclosed-end structure. As discussed above, we believe this best mitigates the issues that may arise upon the exhaustion of appeals with respect to the Credit Suisse award.

Q: What can you tell me about the judgment against Credit Suisse?

Highland Capital Management, L.P. (“Highland”) commenced litigation against Credit Suisse on behalf of the Fund and other accounts advised by Highland and its affiliates in July 2013. The litigation relates to Credit Suisse’s fraudulent valuation of properties in which the Fund and other accounts advised by Highland and its affiliates invested.

The case, Claymore Holdings LLC v. Credit Suisse AG,13-07858, was heard in the Dallas County District Court before a jury in December 2014, and then before a judge in March 2015. In September 2015, a Texas district court judge ordered Credit Suisse to pay $287.5 million to the Fund and an affiliated fund. Post-judgment interest continues to accrue at 9% per annum on a principal of $212 million and the Fund seeks an additional $77.5 million inpre-judgment interest. Highland expects that approximately $279 million of the judgment would be allocated to the Fund, which will be reduced by attorneys’ fees and other litigation-related expenses.

The judgment is currently being appealed by Credit Suisse, on which the Texas Fifth Court of Appeals will hold oral arguments in October 2017. There is no deadline after the October 2017 hearing for the Court of Appeals to issue its ruling.

iii

On appeal, Credit Suisse has asserted that it is excused from liability pursuant to express disclaimers contained in the relevant loan agreement, and that the Fund’s damages are limited to the jury’s award of $40 million on the fraudulent inducement claim. The Fund believes it should prevail for the following reasons: First, the loan agreement disclaims Credit Suisse’s duties “except those expressly set forth herein.” The loan agreement expressly states that Credit Suisse was obligated to “review and approve” the “form and substance” of the appraisal in “its reasonable judgment.” Second, even if the loan agreement had disclaimed this express obligation, a general disclaimer cannot, as a matter of law, nullify an expressly assumed contractual obligation. Third, disclaimers, even those made to sophisticated parties, would not excuse Credit Suisse’s fraudulent misrepresentations and omissions to the Funds. Fourth, we believe the Fund and its affiliated Fund are entitled to the full judgment amount of $287.5 million because the jury award of $40 million was only related to legal damages for fraudulent inducement, but the trial court award of $287.5 million related to a larger set of claims, specifically breach of contract and other torts, as well as equitable relief for fraudulent inducement.

In the event the Court of Appeals affirms the Dallas County District Court ruling, we expect Credit Suisse to appeal to the Supreme Court of Texas. Barring further action, if the Texas Supreme Court refuses to hear the case, the judgment will be deemed final. Although litigation is inherently uncertain and no particular outcome is guaranteed, the Fund is confident in its legal position and believes it should prevail on appeal. It is, however, possible that the Court of Appeals may rule in favor of Credit Suisse or may reduce the amount of the judgment due to the Fund. No assurance can be given as to whether the judgment will be confirmed upon appeal, whether the decision by the Court of Appeals will generate further appeals by the Fund or Credit Suisse, the amount, if any, that the Fund will ultimately receive in connection with the judgment, or the timing of receipt of any proceeds thereof.

In accordance with GAAP, the Fund has not recorded the award as an asset because the award remains subject to appeal; however, the Fund expects to record the value of the award upon successful, final confirmation of the judgment. If the conversion is approved and Credit Suisse is successful in reducing or overturning the judgment, the market price of the Fund’s shares may fall, even if the value of the judgment had not been reflected in the Fund’s NAV. During the period between the final disposition of the litigation and receipt by the Fund of cash in satisfaction of the award, the award would likely be considered an illiquid asset representing (if the current judgment amount is upheld) approximately 32% of the Fund’s net assets as of August 31, 2017.

Q: Which shareholders will benefit from the award?

If the Fund remains anopen-end fund, it is expected that only shareholders of the Fund on the date that the award is recorded as an asset of the Fund for purposes of GAAP will benefit from the award. On that date, the Fund will record the asset on its books and shareholders in the Fund will experience accretion to the net asset value of their shares. If the Fund converts to aclosed-end fund and its shares are listed on the NYSE or another national securities exchange, its shares will trade a prices determined by the market, and it is possible that market participants may assign a value to the judgment at a different time than the Fund records the judgment as an asset under GAAP and/or may assign a different value to the judgment. As a result, if the Fund converts to aclosed-end fund, it is possible that shareholders who sell their shares before the award is recorded as an asset of the Fund may, but will not necessarily, benefit from the award.

Q: Who is eligible to vote?

Fund shareholders of record on October 6, 2017, are entitled to attend and vote at the Meeting or any adjourned session thereof. Each whole share of the Fund is entitled to one vote and each fractional share is entitled to a proportionate fractional vote. Shares represented by properly executed proxies, unless revoked before or at the Meeting, will be voted according to shareholders’ instructions. If you sign a proxy but do not fill in a vote, your shares will be voted in favor of the Proposal. If any other business comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

iv

Q: Will there be any changes to the options or services associated with my account as a result of the conversion?

If the Proposal is approved, some of the features and services that are available to you today as a Fund shareholder will not be available to you after the conversion to aclosed-end fund structure. For example, the converted Fund would not offer its shareholders the opportunity to redeem their shares at net asset value on a daily basis. Furthermore, the Fund will seek to list its shares for trading on the NYSE or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards. It is expected that American Stock Transfer & Trust Company, LLC will serve as the Fund’s transfer agent.

The other material features and services that will not be available to you following the conversion relate to this difference in the Fund’s redemption policies. After conversion to aclosed-end fund, we expect the Fund to have an “opt out” distribution reinvestment program such that when the Fund declares a dividend or other distribution, stockholders’ cash distributions will be reinvested automatically in additional shares of the Fund, unless they specifically “opt out” of the dividend reinvestment plan, in which case they will receive such dividends or other distributions in cash.

Shareholders can also get more information on the shareholder services to be offered to the converted Fund by calling AST Fund Solutions at (800)713-9968.

Q: Will there be any changes to Fund fees and expenses as a result of the conversion?

Total annual fund operating expenses borne by all shareholders are expected to decrease upon the Fund’s conversion to aclosed-end fund structure. By lowering transfer agency fees and eliminating distribution and service fees with respect to Class A and Class C shares, we expect Fund savings to be, in the aggregate, approximately $3.4 million per year, based on current Fund assets.

Q: Do I have appraisal or dissenters’ rights?

No. If you are not in favor of the Proposal, then you may redeem your shares at any time before the conversion closes.See “Can I still redeem my shares of the Fund” below.

Q: Are there costs or tax consequences of the conversion?

You will not pay any sales charges in connection with the conversion, although shares subject to a contingent deferred sales charge that are redeemed prior to the conversion will be subject to such contingent deferred sales charges. Legal and other costs associated with the Proposal will be borne by the Fund. To limit the impact of the direct costs associated with the conversion, the Adviser will pay such expenses to the extent such expenses exceed 0.1% of the Fund’s net assets.

The conversion is expected to betax-free for U.S. federal income tax purposes. Accordingly, it is expected that Fund shareholders will not and the Fund generally will not recognize gain or loss as a direct result of the conversion.

Q: Will the Fund trade at a premium or a discount after the conversion?

While we believe the potential benefit of the Credit Suisse judgment could cause shares of the Fund to trade at a premium to NAV, shares may still trade at a discount to NAV. To help mitigate this risk, the Adviser intends to implement a repurchase program under which the Fund will, subject to certain regulatory conditions and the availability of liquid assets after allowing for anticipated Fund expenses and contingencies, purchase and retire up to $20 million of Fund shares in open-market transactions, provided such shares are trading at a discount to

v

NAV. Any such repurchases would be subject to the availability to the Fund of cash for such purchases, after consideration of reserves necessary for anticipated Fund expenses and contingencies, and the Fund may sell portfolio securities in order to generate cash for repurchases. Any such repurchases would be made pursuant to Rule10b-18 under the Exchange Act of 1934, as amended, and only to the extent the Adviser, in its sole discretion, deems consistent with applicable law.

Additionally, the Adviser and its affiliates intend to purchase at least $20 million of Fund shares in open-market transactions over the three-year period following the conversion.

Q: If approved, when will the conversion happen?

The conversion will take place following shareholder approval of the Proposal, and is expected to close in 2017. However, in the event a quorum is not present at the Meeting, or if a quorum is present but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments or postponements of the Meeting to permit further solicitation of proxies. This may delay the close of the conversion and there is no guarantee that the conversion will take place.

Q: Can I purchase more shares of the Fund prior to the conversion?

Yes, however the Fund reserves the right to halt or limit purchases at any time and for any length of time prior to the conversion. After conversion, you may purchase additional shares of the Fund on the exchange.

Q: Can I still redeem my shares of the Fund?

Yes. If you do not want to remain a shareholder of the Fund upon conversion to aclosed-end structure, you may redeem your shares at any time before the conversion closes. If you choose to redeem your shares prior to the conversion, however, you will not receive the benefit, if any, that will accrue to shareholders holding shares at the time the Fund is able to reflect the value of the award as an asset on its books. Shares subject to a contingent deferred sales charge that are redeemed prior to the conversion will be subject to such contingent deferred sales charges. Such a redemption of shares would be taxable to you in the same manner as other redemptions of shares. Assuming shares are held as capital assets, any gain or loss on such redemptions would be capital in nature and would belong-term or short term depending on your holding period in the shares redeemed.

Q: How does the Board recommend that I vote?

After careful consideration, the Board recommends that you vote FOR the conversion of the Fund.

Q: How can I vote?

You can vote in one of four ways:

| | • | | By telephone (call the toll free number listed on your proxy card) |

| | • | | By internet (log on to the internet site listed on your proxy card) |

| | • | | By mail (using the enclosed postage prepaid envelope) |

| | • | | In person at the shareholder meeting scheduled to occur at 8:00 A.M. Central Time, November 3, 2017 |

The deadline for voting by telephone or internet is 11:59 P.M. E.T. on November 2, 2017. We encourage you to vote as soon as possible to avoid the cost of additional solicitation efforts. Please refer to the enclosed proxy card for instructions for voting by telephone, internet or mail.

vi

Q: Will I be notified of the results of the vote?

The final voting results for each proposal also will be included in the Fund’s next report to shareholders following the Meeting.

Q: Whom should I call if I have questions?

If you have questions about any of the proposals described in the Proxy Statement or about voting procedures, please call the Fund’s proxy solicitor, AST Fund Solutions, LLC, toll free at (800)713-9968.

vii

Highland Floating Rate Opportunities Fund

(the “Fund”)

200 Crescent Court

Dallas, Texas 75201

Notice of Special Meeting of Shareholders

Scheduled for November 3, 2017

This is the formal agenda for the Fund’s shareholder meeting. It explains what matters will be voted on and the time and place of the meeting, should you choose to attend in person.

To the shareholders of the Fund:

A meeting (the “Meeting”) of the shareholders of the Fund will be held at the offices of Highland Capital Management Fund Advisors, L.P., located at 200 Crescent Court, Crescent Club, Gold Room, Dallas, Texas 75201, on November 3, 2017, at 8:00 A.M. Central Time to consider:

| | • | | A proposal to authorize the Fund’s Board of Trustees (the “Board”) to amend the Fund’s Agreement and Declaration of Trust to convert the Fund’s structure from anopen-end fund to aclosed-end fund (the “Proposal”); and |

| | • | | Approval of the adjournment of the Meeting to permit further solicitation of proxies, if there are not sufficient votes at the time of the Meeting to approve the Proposal. |

In addition, shareholders will be asked to transact such other business as may properly come before the Meeting or any adjournments or postponements of the Meeting.

Approval of the Proposal requires the affirmative vote of (i) 67% or more of the shares present at the Meeting if the holders of 50% or more of the outstanding voting securities of the Fund are present or represented by proxy or (ii) more than 50% of the outstanding voting securities, whichever is less. Abstentions and “brokernon-votes” (i.e., shares held in “street name” by brokers that indicate on their proxies that they do not have discretionary authority to vote such shares as to the approval of the Proposal) are counted as present at the Meeting but, assuming the presence of a quorum, will have the effect of a vote against the Proposal.

Please carefully read the enclosed proxy statement, as it discusses the Proposal in more detail. If you were a shareholder of the Fund as of the close of business on October 6, 2017, you may vote at the Meeting or at any adjournment or postponement of the Meeting. You are welcome to attend the Meeting in person. If you cannot attend in person, please vote by mail, telephone or internet. Just follow the instructions on the enclosed proxy card. If you have questions, please call the Fund’s proxy solicitor toll free at (800)713-9968. It is important that you vote.The Board recommends that you vote FOR the Proposal.

By order of the Board,

Dustin Norris

Assistant Secretary

October 11, 2017

Whether or not you expect to attend the Meeting, please complete and return the enclosed proxy card(s). If shareholders do not return their proxies in sufficient numbers, the Fund may incur the expense of additional shareholder solicitation efforts.

PROXY STATEMENT OF

HIGHLAND FLOATING RATE OPPORTUNITIES FUND (THE “FUND”)

The address of the Fund is 200 Crescent Court, Suite 700, Dallas, Texas 75201.

* * * * * *

This proxy statement contains the information shareholders should know before voting on the proposed amendment to the Fund’s Agreement and Declaration of Trust (the “Declaration of Trust”). Please read it carefully and retain it for future reference.

Amendment to Declaration of Trust

Shareholders of the Fund are being asked to authorize the Fund’s Board of Trustees to amend the Declaration of Trust to convert the Fund’s structure from anopen-end fund to aclosed-end fund (the “Proposal”).

Rationale for the Proposal

Highland Capital Management Fund Advisors, L.P. (the “Adviser,” or “we”) believes that converting the Fund to aclosed-end fund with the same investment objective and strategy would serve to protect the interests of shareholders in the event that the Fund’s previously-disclosed judgment against Credit Suisse Group AG (“Credit Suisse”) is upheld on appeal and is recorded as an asset of the Fund. Confirmation of the judgment could result in the recognition of up to $279 million, or approximately 32% of the Fund’s net assets as of August 31, 2017, which will be reduced by attorneys’ fees and other litigation-related expenses. We believe a judgment of this size is highly unusual, if not unprecedented, in the mutual fund industry, and the award would represent a significant victory for the Fund’s shareholders. There can be no assurance that the judgment will be confirmed upon appeal or as to the amount, if any, that the Fund will ultimately receive in connection with the judgment. However, confirmation of the judgment could give rise to two issues that we believe are best mitigated by converting the Fund to aclosed-end fund.

First, there is a risk that current shareholders could be diluted by third parties who invest in the Fund solely to speculate on the outcome of the judgment. This risk may become particularly acute if the judgment is confirmed on appeal, as we believe significant dilutive speculation would occur thereafter. We believe that the judgment, if confirmed, should benefit long-term shareholders rather than speculators seeking to profit from the Fund’s successful litigation. By converting the Fund to aclosed-end structure and listing the Fund on an exchange in advance of the appellate decision, the ability of speculators to make dilutive investments in the Fund following a favorable appellate decision would be mitigated. Speculators would only be able to invest in the Fund by purchasing shares from existing shareholders at a price determined by the market, rather than at NAV. Once the Fund converts to aclosed-end fund, shares outstanding will not increase and therefore a shareholder will not be subject to a reduction in overall ownership percentage as a result of secondary market trading. Because the judgment has been publicly disclosed, Highland believes that the market price should reflect the expected value of the judgment, even if accounting principles generally accepted in the United States (“GAAP”) does not permit the Fund to reflect that value in its NAV. In order to limit the negative impact on existing shareholders of redemptions that occur prior to the conversion and to increase the potential benefits that may result from a larger fund, the Fund intends to reserve the right to accept additional purchases into the Fund prior to the conversion. However, the Fund may halt or limit purchases at any time and for any length of time. While purchases prior to the conversion have the potential to dilute existing shareholders, the Adviser also believes there are benefits to maintaining and even increasing the size of the Fund. If the Fund increases in size prior to the conversion, the largerclosed-end Fund would have the potential to reduce overall net expenses for shareholders. Larger funds also typically trade more frequently on the secondary market, potentially allowing investors access to and exit

1

opportunities at more favorable prices, and reduce the likelihood of trading at a discount to net asset value (“NAV”) because shares of manyclosed-end funds, particularly smallerclosed-end funds, trade at a discount to NAV.

Second, recognition by the Fund of a substantial award could cause a “liquidity mismatch” for the period of time, if any, between the date that the judgment is included as an asset under GAAP and the date that the Fund actually receives cash or liquid securities from Credit Suisse. Under GAAP, the Fund would include the judgment as an asset of the Fund once the asset is no longer contingent, which we expect to occur upon the exhaustion of the appeals process. Even if the judgment is upheld and the appeals process is exhausted, Highland believes there is likely to be some delay in receipt by the Fund of cash or other assets from Credit Suisse in satisfaction of the judgment. Such delay may be caused by, for example, the process of involuntary collection of liquid assets from Credit Suisse, including, but not limited to, collection from outside the United States. Therefore, Highland cannot provide any assurances as to the length of such delay. By converting the Fund to aclosed-end structure, the Fund would not be required to redeem shares immediately following the recording of the award as an asset of the Fund, when the Fund may not be able to readily convert the award into cash. Therefore, the Proposal may prevent the Fund from being required to liquidate otherwise advantageous positions in order to meet a high volume of shareholder redemption requests in a short amount of time.

Irrespective of the potential award, we believe the Proposal will benefit shareholders by eliminating the need for the Fund to hold cash reserves and liquid securities in order to meet daily shareholder redemptions and liquidity requirements applicable to anopen-end fund. The Proposal will allow the Fund to pursue its existing investment objective and investment strategy through a structure that better positions the Fund to capitalize on its universe of investment opportunities, which may include investments in long-term illiquid positions.

If shareholders approve the Proposal and the Fund converts to aclosed-end fund structure, shareholders of the Fund would no longer have the right to cause the Fund to directly redeem their shares; instead, the Fund will seek to list its shares for trading on the New York Stock Exchange or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards.

Total annual fund operating expenses borne by all shareholders are expected to decrease upon the Fund’s conversion to aclosed-end fund structure.

To ask questions about this proxy statement, call our toll-free telephone number: (800)713-9968.

The date of this proxy statement is October 11, 2017.

INTRODUCTION

This proxy statement is being used by the Board of Trustees (the “Board”) of Highland Floating Rate Opportunities Fund (the “Fund”) to solicit proxies to be voted at a special meeting of the Fund’s shareholders (the “Meeting”). This Meeting will be held on November 3, 2017 at 200 Crescent Court, Crescent Club, Gold Room, Dallas, Texas 75201, at 8:00 A.M. Central Time. The purpose of the Meeting is to consider a proposal to authorize the Board to amend the Fund’s Agreement and Declaration of Trust (the “Declaration of Trust”), to convert the Fund’s structure from anopen-end fund to aclosed-end fund (the “Proposal”). Representatives of Highland Capital Management Fund Advisors, L.P. (the “Adviser,” or “we”) will be available to answer any shareholder questions. This proxy statement is being mailed to eligible shareholders on or about October 11, 2017.

Who is eligible to vote?

Fund shareholders of record on October 6, 2017, are entitled to attend and vote at the Meeting or any adjourned meeting. Each whole share of the Fund is entitled to one vote and each fractional share is entitled to a proportionate

2

fractional vote. Shares represented by properly executed proxies, unless revoked before or at the Meeting, will be voted according to shareholders’ instructions. If you sign a proxy but do not fill in a vote, your shares will be voted in favor of the Proposal. If any other business comes before the Meeting, your shares will be voted at the discretion of the persons named as proxies.

PROPOSAL — AUTHORIZATION OF AMENDMENT TO DECLARATION OF TRUST

INTRODUCTION

Shareholders of the Fund are being asked to authorize the Board to amend the Declaration of Trust, dated August 17, 2017. The Board is proposing the amendment in order to protect the interests of shareholders in the event that the Fund’s previously-disclosed judgment against Credit Suisse Group AG (“Credit Suisse”) is upheld on appeal. In addition, the Board believes the Proposal will give the Fund the opportunity to pursue its existing investment objective and investment strategy through a structure that better positions the Fund to capitalize on its universe of investment opportunities, which may include greater use of illiquid securities. The Board also believes the Proposal will eliminate the need for the Fund to hold the cash reserves and liquid securities that are required for anopen-end fund and that are used to accommodate daily shareholder redemptions.

If shareholders approve the Proposal and the Fund converts to aclosed-end fund structure, shareholders of the Fund would no longer have the right to cause the Fund to directly redeem their shares. Instead, the Fund would offer to repurchase shares at its discretion, subject to applicable regulatory requirements. Any such repurchases would be subject to the availability to the Fund of cash for such purchases, after consideration of reserves necessary for anticipated Fund expenses and contingencies, and will only be made when the Fund’s shares are trading at a discount to NAV. Accordingly, no assurance can be given as to the number of shares, if any, that will ultimately be repurchased by the Fund. Following the conversion to aclosed-end fund structure, the Fund will seek to list its shares for trading on the New York Stock Exchange (“NYSE”) or another national securities exchange, subject to the approval of such exchange and satisfaction of such exchange’s listing standards.

Total annual fund operating expenses borne by all shareholders are expected to decrease upon the Fund’s conversion to aclosed-end fund structure.

No material changes to the Fund’s investment objective or fundamental investment policies are planned in connection with the proposed conversion. Upon conversion, the Fund will, as aclosed-end fund, have the same principal investment strategies andnon-fundamental investment restrictions that it had before the conversion, except that its investments in illiquid securities will not be limited to 15% of its net assets at the time of investment. To the extent that the Fund invests more of its assets in illiquid securities, it will be subject to the risks associated with investments in such securities to a greater extent. As noted in the Fund’s prospectus, illiquid investments may be difficult to resell at approximately the price they are valued. When investments cannot be sold readily at the desired time or price, the Fund may have to accept a much lower price, may not be able to sell the investment at all or may be forced to forego other investment opportunities, all of which may adversely impact the Fund’s returns. Illiquid investments also may be subject to valuation risk.

BACKGROUND AND RATIONALE

The Board believes that this conversion will benefit shareholders as the Proposal would serve to protect the interests of shareholders in the event that the Fund’s previously-disclosed judgment against Credit Suisse is upheld on appeal.

Highland Capital Management, L.P. (“Highland”) commenced litigation against Credit Suisse on behalf of the Fund and other accounts advised by Highland and its affiliates in July 2013. The litigation relates to Credit Suisse’s fraudulent valuation of properties in which the Fund and other accounts advised by Highland and its affiliates invested.

3

The case, Claymore Holdings LLC v. Credit Suisse AG,13-07858, was heard in the Dallas County District Court before a jury in December 2014, and then before a judge in March 2015. In September 2015, a Texas district court judge ordered Credit Suisse to pay $287.5 million to the Fund and an affiliated fund. Post-judgment interest continues to accrue at 9% per annum on a principal of $212 million and the Fund seeks an additional $77.5 million inpre-judgment interest. Highland expects that approximately $279 million of the judgment would be allocated to the Fund, which will be reduced by attorneys’ fees and other litigation-related expenses.

The judgment is currently being appealed by Credit Suisse, on which the Texas Fifth Court of Appeals will hold oral arguments in October 2017. There is no deadline after the October 2017 hearing for the Court of Appeals to issue its ruling.

On appeal, Credit Suisse has asserted that it is excused from liability pursuant to express disclaimers contained in the relevant loan agreement, and that the Fund’s damages are limited to the jury’s award of $40 million on the fraudulent inducement claim. The Fund believes it should prevail for the following reasons: First, the loan agreement disclaims Credit Suisse’s duties “except those expressly set forth herein.” The loan agreement expressly states that Credit Suisse was obligated to “review and approve” the “form and substance” of the appraisal in “its reasonable judgment.” Second, even if the loan agreement had disclaimed this express obligation, a general disclaimer cannot, as a matter of law, nullify an expressly assumed contractual obligation. Third, disclaimers, even those made to sophisticated parties, would not excuse Credit Suisse’s fraudulent misrepresentations and omissions to the Funds. Fourth, we believe the Fund and its affiliated Fund are entitled to the full judgment amount of $287.5 million because the jury award of $40 million was only related to legal damages for fraudulent inducement, but the trial court award of $287.5 million related to a larger set of claims, specifically breach of contract and other torts, as well as equitable relief for fraudulent inducement.

In the event the Court of Appeals affirms the Dallas County District Court ruling, we expect Credit Suisse to appeal to the Supreme Court of Texas. Barring further action, if the Texas Supreme Court refuses to hear the case, the judgment will be deemed final. It is, however, possible that the Court of Appeals may rule in favor of Credit Suisse or may reduce the amount of the judgment due to the Fund. No assurance can be given as to whether the judgment will be confirmed upon appeal, whether the decision by the Court of Appeals will generate further appeals by the Fund or Credit Suisse, the amount, if any, that the Fund will ultimately receive in connection with the judgment, or the timing of receipt of any proceeds thereof. In accordance with accounting principles generally accepted in the United States (“GAAP”), the Fund has not recorded the award as an asset because the award remains subject to appeal; however, the Fund expects to record the value of the award upon successful, final confirmation of the judgment. If the conversion is approved and Credit Suisse is successful in reducing or overturning the judgment, the market price of the Fund’s shares may fall, even if the value of the judgment had not been reflected in the Fund’s NAV. However, receipt of the award by the Fund could cause two issues that we believe are best mitigated by converting the Fund into aclosed-end fund.

First, there is a risk that current shareholders could be diluted by third parties who invest in the Fund solely to speculate on the outcome of the judgment. This risk may become particularly acute if the judgment is confirmed on appeal, as we believe significant dilutive speculation would occur thereafter. The Board believes that the judgment, if confirmed, should benefit long-term shareholders rather than speculators seeking to profit from the Fund’s successful litigation. By converting the Fund to aclosed-end structure and listing the Fund on an exchange in advance of the appellate decision, the ability of speculators to make dilutive investments in the Fund following a favorable appellate decision would be mitigated. Speculators would only be able to invest in the Fund by purchasing shares from existing shareholders at a price determined by the market, rather than at NAV. Once the Fund converts to aclosed-end fund, shares outstanding will not increase and therefore a shareholder will not be subject to a reduction in overall ownership percentage as a result of secondary market trading. Because the judgment has been publicly disclosed, Highland believes that the market price should reflect the expected value of the judgment, even if GAAP does not permit the Fund to reflect that value in its NAV. In order to limit the negative impact on existing shareholders of redemptions that occur prior to the conversion and to increase the potential benefits that may result from a larger fund, the Fund intends to reserve the right to accept

4

additional purchases into the Fund prior to the conversion. However, the Fund may halt or limit purchases at any time and for any length of time. While purchases prior to the conversion have the potential to dilute existing shareholders, the Adviser also believes there are benefits to maintaining and even increasing the size of the Fund. If the Fund increases in size prior to the conversion, the largerclosed-end Fund would have the potential to reduce overall net expenses for shareholders. Larger funds also typically trade more frequently on the secondary market, potentially allowing investors access to and exit opportunities at more favorable prices, and reduce the likelihood of trading at a discount to NAV because shares of manyclosed-end funds, particularly smallerclosed-end funds, trade at a discount to NAV.

Second, recognition by the Fund of a substantial award could cause a “liquidity mismatch” for the period of time, if any, between the date that the judgment is included as an asset under GAAP and the date that the Fund actually receives cash or liquid securities from Credit Suisse. Under GAAP, the Fund would include the judgment as an asset of the Fund once the asset is no longer contingent, which we expect to occur upon the exhaustion of the appeals process. Even if the judgment is upheld and the appeals process is exhausted, Highland believes there is likely to be some delay in receipt by the Fund of cash or other assets from Credit Suisse in satisfaction of the judgment. Such delay may be caused by, for example, the process of involuntary collection of liquid assets from Credit Suisse, including, but not limited to, collection from outside the United States. Therefore, Highland cannot provide any assurances as to the length of such delay. By converting the Fund to aclosed-end structure, the Fund would not be required to redeem shares immediately following the recording of the award as an asset of the Fund, when the Fund may not be able to readily convert the award into cash. The Proposal may prevent the Fund from being required to liquidate otherwise advantageous positions in order to meet a high volume of shareholder redemption requests in a short amount of time.

Irrespective of the potential award, the Board believes the Proposal will benefit shareholders by eliminating the need for the Fund to hold cash reserves and liquid securities in order to meet liquidity requirements applicable to anopen-end fund and daily shareholder redemptions. The Proposal will allow the Fund to pursue its existing investment objective and investment strategy through a structure that better positions the Fund to capitalize on its universe of investment opportunities, which may include investments in long-term illiquid positions.

If the Fund’s shareholders approve the Proposal, the Board will take action to combine the outstanding classes of shares into a single class of common shares and list the common shares on a national securities exchange, expected to be the NYSE. Total annual fund operating expenses borne by all shareholders are expected to decrease upon the Fund’s conversion to aclosed-end fund structure. Class A and Class C shares of the Fund are currently subject to distribution and/or service(12b-1) fees at an annual rate of 0.35% and 0.85% of net assets, respectively. Common shares of the Fund, once transitioned to aclosed-end fund structure, will not be subject to distribution and/or service(12b-1) fees and current Class A and Class C shareholders will no longer pay such fees following the conversion. In addition, shares that were subject to a contingent deferred sales charge prior to conversion will not be subject to such contingent deferred sales charges thereafter. Finally, transfer agency fees are expected to be reduced from an annual rate of 0.09% to 0.02% for all shareholders.

Some of the features and services that are available to you today as a Fund shareholder will not be available to you after the conversion to a closed end fund structure. Upon listing on a securities exchange, the Fund’s shares would trade in the open market at a price that would be a function of factors relating to the Fund, such as: market supply and demand, dividend levels (which will in turn be affected by Fund expenses, including the costs any forms of leverage used by the Fund, levels of dividend and interest payments by the Fund’s portfolio holdings, levels of appreciation/depreciation of the Fund’s portfolio holdings, regulation affecting the timing and character of the Fund’s distributions and other factors), portfolio credit quality, potential recoveries from the litigation discussed above, call protection and similar factors relating to the Fund’s portfolio holdings. The market price of the Fund’s common shares may also be affected by general market or economic conditions, including market trends affecting the value of securities generally or values ofclosed-end fund shares more specifically. Shares of aclosed-end investment company may frequently trade at prices lower than NAV, but may also trade at prices

5

higher than NAV. While there is no guarantee the Fund will trade at a premium, the Board believes the potential benefit of the Credit Suisse settlement could cause the Fund to trade at a premium to NAV.

If shares of the Fund trade at a discount during the6-month period following the conversion, we intend to implement a repurchase program under which the Fund will, subject to certain regulatory conditions and the availability of liquid assets after allowing for anticipated Fund expenses and contingencies, purchase and retire up to $20 million of Fund shares in open-market transactions, provided such shares are trading at a discount to NAV. Any such repurchases would be subject to the availability to the Fund of cash for such purchases, after consideration of reserves necessary for anticipated Fund expenses and contingencies, and the Fund may sell portfolio securities in order to generate cash for repurchases. Any such repurchases would be made pursuant to Rule10b-18 under the Exchange Act of 1934, as amended, and only to the extent the Adviser, in its sole discretion, deems consistent with applicable law. Additionally, Highland and its affiliates intend to purchase at least $20 million of Fund shares in open-market transactions over the three-year period following the conversion.

After conversion to aclosed-end fund, we expect the Fund to have an “opt out” distribution reinvestment program such that when the Fund declares a dividend or other distribution, shareholders’ cash distributions will be reinvested automatically in additional shares of the Fund, unless they specifically “opt out” of the dividend reinvestment plan, so as to receive cash dividends or other distributions.

Article VI, Section 2 of the Declaration of Trust currently requires the Fund to purchase at the next-determined net asset value, less any applicable sales charge, shares that are properly tendered by any shareholder for redemption on any business day. The Proposal would modify Article VI, Section 2 to remove the obligation of the Fund to purchase its shares, thereby converting the Fund to aclosed-end fund.

Article VI, Section 2 – As Currently in Effect

The Trust shall purchase such Shares as are offered by any Shareholder for redemption, upon the presentation of a proper instrument of transfer together with a request directed to the Trust or a person designated by the Trust that the Trust purchase such Shares or in accordance with such other procedures for redemption as the Trustees may from time to time authorize; and the Trust will pay therefor the net asset value thereof, as determined in accordance with the Bylaws, less any redemption charge fixed by the Trustees. Payment for said Shares shall be made by the Trust to the Shareholder within seven days after the date on which the request is made. The obligation set forth in this Section 2 is subject to the provision that in the event that any time the New York Stock Exchange is closed for other than weekends or holidays, or if permitted by the rules of the Securities and Exchange Commission, during periods when trading on the Exchange is restricted or during any emergency which makes it impractical for the Trust to dispose of the investments of the applicable series or to determine fairly the value of the net assets belonging to such series or attributable to any class thereof or during any other period permitted by order of the Securities and Exchange Commission for the protection of investors, such obligations may be suspended or postponed by the Trustees. The Trust may also purchase or repurchase Shares at a price not exceeding the net asset value of such Shares in effect when the purchase or repurchase or any contract to purchase or repurchase is made.

The redemption price may in any case or cases be paid wholly or partly in kind, except to the extent prohibited by the laws of any jurisdiction in which Shares are registered for sale, if the Trustees determine that such payment is advisable in the interest of the remaining Shareholders of the series the Shares of which are being redeemed. The fair value, selection and quantity of any securities or other property so paid or delivered as all or part of the redemption price may be determined by or under authority of the Trustees. In no event shall the Trust be liable for any delay of any corporation or other person in transferring securities or other property selected for delivery as all or part of any payment in kind.

6

Article VI, Section 2 – As Proposed to be Amended

The Trust may, but is not required to, purchase or otherwise acquire Shares, including in accordance with Rule23c-3 under the 1940 Act or as otherwise permitted under the 1940 Act and other applicable law.

BOARD OF TRUSTEES RECOMMENDATION

The Board has concluded that the Proposal is in the best interests of the Fund and its shareholders.The Board unanimously recommends that shareholders of the Fund approve the Proposal.

VOTING RIGHTS AND REQUIRED VOTE

Voting. Approval of the Proposal requires the affirmative vote of (i) 67% or more of the shares present at the Meeting if the holders of 50% or more of the outstanding voting securities of the Fund are present or represented by proxy or (ii) more than 50% of the outstanding voting securities, whichever is less. Abstentions and “brokernon-votes” (i.e., shares held in “street name” by brokers that indicate on their proxies that they do not have discretionary authority to vote such shares as to the approval of the Proposal) are counted as present at the Meeting but, assuming the presence of a quorum, will have the effect of a vote against the Proposal. Shareholders of record of the Fund on October 6, 2017 (the “Record Date”) are entitled to vote at the Meeting. Each full share of the Fund is entitled to one vote and each fractional share is entitled to a vote equal to its fraction of a full share. All share classes of the Fund will vote together as one class.

The total number of shares of each class of the Fund outstanding as of the close of business on the Record Date, and the total number of votes to which shareholders of such class are entitled at the Meeting, are set forth below.

| | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class Z | |

Shares Outstanding | | | 38,718,335.77 | | | | 35,031,698.37 | | | | 75,487,800.49 | |

Total Votes to which Entitled | | | 38,718,335.77 | | | | 35,031,698.37 | | | | 75,487,800.49 | |

Quorum and Methods of Tabulation. A quorum is required for shareholders of the Fund to take action at the Meeting. Thirty percent of the outstanding shares of the Fund, present at the Meeting in person or by proxy, constitutes a quorum.

All shares represented at the Meeting in person or by proxy will be counted for purposes of establishing a quorum. Shares represented by properly executed proxies with respect to which (i) a vote is withheld, (ii) the shareholder abstains or (iii) a broker does not vote (i.e., “brokernon-votes”) will be treated as shares that are present and entitled to vote for purposes of determining a quorum. Assuming the presence of a quorum, abstentions and “brokernon-votes” will have the effect of a vote against the Proposal.

We urge you to return the proxy as soon as possible with your vote in favor of the Proposal. As this matter is not routine, your broker may not be able to vote on your behalf unless specifically instructed. If your shares are held in an IRA account, you have the right to provide voting instructions to your IRA custodian with respect to those shares. If you do not provide voting instructions with respect to your shares, your IRA custodian may or may not, depending upon the terms of your IRA agreement, vote shares for which it has not received your voting instructions. Please consult your IRA agreement and/or financial advisor for more information.

Shareholder Proxies. Shares represented by proxies, unless previously revoked, will be voted at the Meeting in accordance with the instructions of the shareholders. If no instructions are given, the proxies will be voted in favor of the Proposal. To revoke a proxy, the shareholder giving such proxy must either (1) submit to the Fund a subsequently-dated proxy, (2) deliver to the Fund a written notice of revocation, or (3) otherwise give notice of revocation in open meeting, in all cases prior to the exercise of the authority granted in the proxy.

7

If you intend to vote in person at the Meeting, please call (800) 713-9968 to obtain important information regarding your attendance at the Meeting, including directions.

It is important that proxies be returned promptly. Therefore, whether or not you expect to attend the Meeting in person, you are urged to complete, sign and return the proxy in the enclosed stamped, self-addressed envelope.

Delivery Requirements.The U.S. Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement or Notice of Internet Availability of Proxy Materials (“Notice”) addressed to those shareholders or by sending separate Notices for each household account in a single envelope. This process, which is commonly referred to as “householding,” potentially provides extra convenience for shareholders and cost savings for companies. The Fund and some brokers household proxy materials or Notices, delivering a single proxy statement or Notice to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once a shareholder has received notice from a broker or the Fund that they will be householding materials to the shareholder’s address, householding will continue until the shareholder is notified otherwise or until the shareholder revokes consent.

We will deliver promptly, upon request, a separate copy of any of these documents to shareholders at a shared address to which a single copy of such document(s) was delivered. Shareholders who wish to receive a separate copy of any of these documents, or to receive a single copy of such documents if multiple copies were delivered, now or in the future, should submit their request by writing to the Fund c/o Highland Capital Management Fund Advisors, L.P., 300 Crescent Court, Suite 700, Dallas, Texas 75201 or calling the Fund at (800) 713-9968.

Communications with Trustees. Shareholders of the Fund who wish to communicate with the Fund’s trustees (the “Trustees”) (or to the Trustees who are not interested persons of the Fund, as a group) should send communications to the attention of the Secretary of the Fund, c/o Highland Capital Management Fund Advisors, L.P., 300 Crescent Court, Suite 700, Dallas, Texas 75201, and all communications will be directed to the Trustee or Trustees indicated in the communication or, if no Trustee or Trustees are indicated, to all Trustees.

Solicitation of Proxies. In addition to soliciting proxies by mail, the Fund’s officers and employees of Highland may solicit proxies by web, by telephone or in person. Copies of the notice for the Meeting, this Proxy Statement and the form of proxy are available athighlandfunds.com. The Fund has engaged AST Fund Solutions, LLC at 48 Wall Street New York, NY 10005 for inquiries, to provide shareholder meeting services, including the distribution of this Proxy Statement and related materials to shareholders as well as assisting the Fund in soliciting proxies for the Meeting at an approximate cost of $130,000. The costs of proxy solicitation and expenses incurred in connection with preparing this Proxy Statement and its enclosures will be paid by the Fund; however, the Adviser has undertaken to pay expenses associated with the Proposal to the extent such expenses exceed 0.1% of the Fund’s net assets.

Dissenters’ Right of Appraisal. Shareholders of the Fund have no appraisal or dissenters’ rights.

Other Business. The Board is not aware of any matters to be presented at the Meeting other than the Proposal. If other business should properly come before the Meeting, the persons named as proxies will vote thereon in their discretion.

Adjournment. If a quorum is not present at the Meeting, or if a quorum is present but sufficient votes to approve the Proposal are not received, the persons named as proxies may propose one or more adjournments or postponements of the Meeting to permit further solicitation of proxies. Any adjournment or postponement will require the affirmative vote of a majority of those shares that are represented at the Meeting in person or by proxy, whether or not a quorum is present.

8

The costs of any additional solicitation and of any adjourned Meeting will be borne in the same manner as the other expenses associated with the Proposal. Any proposal for which sufficient favorable votes have been received may be acted upon and considered final regardless of whether the Meeting is adjourned to permit additional solicitation with respect to any other proposal.

Shareholder Proposals at Future Meetings. The Fund is not required to hold an annual meeting of shareholders in any year in which the election of Trustees is not required to be acted upon under the 1940 Act. However, if the Proposal is approved and the Fund converts to aclosed-end fund structure and the Fund’s shares are listed on a national securities exchange, it is expected that the rules of such securities exchange will require that the Fund hold annual meetings of shareholders to elect Trustees. Shareholder proposals to be presented at any future meeting of shareholders of the Fund must be received by the Fund in writing a reasonable amount of time before the Fund solicits proxies for that meeting in order to be considered for inclusion in the proxy materials for that meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON NOVEMBER 3, 2017

Copies of these proxy materials and the form of proxy are available to you on the Internet at www.proxyonline.com/docs/highlandfloatingrateoppfund2017.pdf. Copies of the proxy materials are available upon request, without charge, by writing to AST Fund Solutions, LLC at AST Fund Solutions, ATTN: Highland Floating Rate Opportunities Fund #12090 Fulfillment, 55 Challenger Road, Suite 201, Ridgefield Park, NJ 07660, by calling800-713-9968, or by sending ane-mail to corporateservices@astfundsolutions.com, using subject line: Highland Floating Rate Opportunities Fund #12090 Fulfillment.

9

SHARE OWNERSHIP

5% Beneficial Ownership as of the Record Date

The following chart sets forth the names, addresses, and percentage ownership of those shareholders known by the Fund to own beneficially or of record 5% or more of the outstanding shares of a class of the Fund as of September 30, 2017:

| | | | | | | | | | |

(1) Title of

Class | | (2) Name and Address of Beneficial Owner | | (3) Amount and

Nature of

Beneficial

Ownership | | | (4) Percent of Class | |

Class A | | MORGAN STANLEY SMITH BARNEY, LLC 1 NEW YORK PLZ, FL 12 NEW YORK, NY 10004-1901 | | | 5,280,902.43 | | | | 14.99 | % |

| | PERSHING LLC 1 PERSHING PLZ JERSEY CITY, NJ 07399-0002 | | | 2,766,660.45 | | | | 7.85 | % |

| | RBC CAPITAL MARKETS LLC OMNIBUS CUSTOMER ACCOUNT ATTN: MUTUAL FUND OPS MANAGER 60 S 6TH STREET #P08 MINNEAPOLIS, MN 55402-4413 | | | 3,069,270.08 | | | | 8.71 | % |

| | WELLS FARGO CLEARING SERVICES LLC SPECIAL CUSTODY ACCT FOR THE EXCLUSIVE BENEFIT OF CUSTOMER 2801 MARKET STREET ST LOUIS, MO 63103-2523 | | | 4,078,351.29 | | | | 11.57 | % |

| | MERRILL LYNCH PIERCE FENNER & SMITH FOR THE SOLE BENEFIT OF ITS CUSTOMERS ATTN: FUND ADMINISTRATION #97425 4800 DEER LAKE DR E FL 2 JACKSONVILLE, FL 32246-6484 | | | 2,182,607.08 | | | | 6.19 | % |

| | CHARLES SCHWAB & CO INC CUST ATTN: MUTUAL FUNDS DEPT 101 MONTGOMERY ST SAN FRANCISCO, CA 94104-4151 | | | 1,930,943.07 | | | | 5.48 | % |

| | NATIONAL FINANCIAL SERVICES LLC FOR EXCLUSIVE BENEFIT OF OUR CUSTOMERS ATTN: MUTUAL FUNDS DEPT 4TH FLR 499 WASHINGTON BLVD JERSEY CITY, NJ 07310-2010 | | | 7,750,288.25 | | | | 22.00 | % |

10

| | | | | | | | | | |

(1) Title of

Class | | (2) Name and Address of Beneficial Owner | | (3) Amount and

Nature of

Beneficial

Ownership | | | (4) Percent of Class | |

Class C | | MORGAN STANLEY SMITH BARNEY, LLC 1 NEW YORK PLZ, FL 12 NEW YORK, NY 10004-1901 | | | 8,117,074.23 | | | | 25.00 | % |

| | PERSHING LLC 1 PERSHING PLZ JERSEY CITY, NJ 07399-0001 | | | 2,939,607.14 | | | | 9.05 | % |

| | CHARLES SCHWAB & CO INC CUST ATTN: MUTUAL FUNDS 101 MONTGOMERY STREET SAN FRANCISCO, CA 94104-4151 | | | 3,452,615.31 | | | | 10.63 | % |

| | LPL FINANCIAL OMNIBUS CUSTOMER ACCOUNT ATTN: MUTUAL FUND OPS MANAGER 4707 EXECUTIVE DRIVE SAN DIEGO, CA 92121-3091 | | | 1,678,971.76 | | | | 5.17 | % |

| | WELLS FARGO CLEARING SERVICES LLC SPECIAL CUSTODY ACCT FOR THE EXCLUSIVE BENEFIT OF CUSTOMER 2801 MARKET STREET ST LOUIS, MO 63103-2523 | | | 6,095,886.26 | | | | 18.78 | % |

| | NATIONAL FINANCIAL SERVICES LLC FOR EXCLUSIVE BENEFIT OF OUR CUSTOMERS ATTN: MUTUAL FUNDS DEPT 4TH FLR 499 WASHINGTON BLVD JERSEY CITY, NJ 07310-2010 | | | 1,714,941.25 | | | | 5.28 | % |

11

| | | | | | | | | | |

(1) Title of

Class | | (2) Name and Address of Beneficial Owner | | (3) Amount and

Nature of

Beneficial

Ownership | | | (4) Percent of Class | |

Class Z | | MORGAN STANLEY SMITH BARNEY, LLC 1 NEW YORK PLZ, FL 12 NEW YORK, NY 10004-1901 | | | 23,414,519.34 | | | | 34.21 | % |

| | NATIONAL FINANCIAL SERVICES LLC FOR EXCLUSIVE BENEFIT OF OUR CUSTOMERS ATTN: MUTUAL FUNDS DEPT 4TH FLR 499 WASHINGTON BLVD JERSEY CITY, NJ 07310-2010 | | | 5,132,405.94 | | | | 7.50 | % |

| | PERSHING LLC 1 PERSHING PLZ JERSEY CITY, NJ 07399-0001 | | | 3,749,476.07 | | | | 5.48 | % |

| | RBC CAPITAL MARKETS LLC OMNIBUS CUSTOMER ACCOUNT ATTN: MUTUAL FUND OPS MANAGER 60 S 6TH STREET #P08 MINNEAPOLIS, MN 55402-4413 | | | 3,486,147.04 | | | | 5.09 | % |

| | WELLS FARGO CLEARING SERVICES LLC SPECIAL CUSTODY ACCT FOR THE EXCLUSIVE BENEFIT OF CUSTOMER 2801 MARKET STREET ST LOUIS, MO 63103-2523 | | | 10,239,352.95 | | | | 14.96 | % |

| | CHARLES SCHWAB & CO INC CUST ATTN: MUTUAL FUNDS 101 MONTGOMERY STREET SAN FRANCISCO, CA 94104-4151 | | | 4,559,735.32 | | | | 6.66 | % |

| | BUFORD CAPITAL LLC 292 MADISON AVENUE, FLOOR 14 NEW YORK, NY 10017-6348 | | | 4,139,042.88 | | | | 6.05 | % |

Interests of Officers and Trustees

As of June 30, 2017, the Fund’s Trustees and officers as a group owned less than 1% of the outstanding shares of each class of the Fund.

Conflicts of Interest

To the extent that Highland and its affiliates hold interests in the Fund, such persons may have a conflict of interest in voting on the Proposal, as fee revenues from aclosed-end fund may be more predictable, and therefore more attractive to the investment adviser than those from anopen-end fund.

12

ADDITIONAL INFORMATION ABOUT THE FUND

Current Service Providers

Highland Capital Management Fund Advisors, L.P., located at 300 Crescent Court, Dallas, Texas 75201, serves as the investment adviser and administrator of the Fund. The Fund’s principal underwriter is Highland Capital Funds Distributor, Inc., whose address is also 200 Crescent Court, Dallas, Texas 75201.

Payments to Financial Intermediaries

The Adviser intends to pay broker-dealers and financial intermediaries at a rate of 0.25% (25 basis points) of the total value of Fund shares held by customers of such broker-dealers and financial intermediaries as of the conversion and maintained thereafter. Such payment will be paid each year for a period of 5 years following the conversion to compensate them for services they provide to their clients that have invested in the Fund and that continue to hold such investments through the conversion of the Fund to aclosed-end fund structure. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend retention of Fund shares over another investment.

The Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and files its prospectus, statement of additional information, shareholder reports, proxy statements, and other information with the SEC. These documents filed by the Fund can be inspected and copied (for a duplication fee) at the public reference facilities of the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Copies of these materials can also be obtained by mail from the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549, at prescribed rates. In addition, copies of these documents may be viewed online or downloaded from the SEC’s website at www.sec.gov. If you would like a hard copy of the Fund’s prospectus, statement of additional information or shareholder reports (when available), the Fund will furnish such copies without charge upon request via first-class mail within three business days of such request. You can access these materials at https://www.highlandfunds.com/floating-rate-opportunities-fund/. Please direct requests for hard copies of the reports to (877)665-1287, info@highlandfunds.com, or the following address:

| | |

Standard Mail: Highland Funds PO Box 8656 Boston, Massachusetts 02266-8656 | | Overnight Mail: Highland Funds 30 Dan Road, Suite 8656 Canton, MA 02021-2809 |

A copy of the Declaration of Trust of the Trust is on file with the Secretary of State of The Commonwealth of Massachusetts.

13

EXHIBIT A — AMENDMENT TO AGREEMENT AND DECLARATION OF TRUST

HIGHLAND FLOATING RATE OPPORTUNITIES FUND

Amendment to the Agreement and Declaration of Trust

WHEREAS, shareholders representing a majority of the outstanding shares of Highland Floating Rate Opportunities Fund (the “Trust”) have authorized the Trust’s Board of Trustees to amend the Trust’s Second Amended and Restated Agreement and Declaration of Trust dated September 25, 2017 (the “Declaration of Trust”) as indicated below,