SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☒ | | Soliciting Material Pursuant to Sec. 240.14a-12 |

Highland Income Fund

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

F I NA NC I A L P R O F E S S I O N A L U S E O N L Y A copy of the preliminary proxy statement is available free of charge on the SEC’s website at www.sec.gov. The preliminary proxy statement is not complete and is subject to review by the SEC staff and other changes. HFRO expects to file a definitive proxy statement which will then be available free of charge at www.hfroconversion.com or at the SEC website, www.sec.gov. Shareholders should read the preliminary proxy statement and the definitive proxy statement, when it becomes available, carefully because they both contain or will contain important information. Shareholders should make no decision about the Conversion Proposal until reviewing the definitive proxy statement sent to them. H F R O C O N V E R S I O N P R O P O S A L HFRO and its trustees and officers, Highland Capital Management Fund Advisors, L.P.’s and its affiliates’ respective members, O v e r v i e w o f p r o p o s a l t o c o n v e r t H F R O trustees, directors, shareholders, officers and employees, Di i n t o a D i v e r s i f i e d H o l d i n g C o m p a n y Costa Partners LLC and other persons may be deemed to be participants in the solicitation of proxies with respect to the Conversion Proposal. Shareholders may obtain more detailed information regarding the direct and indirect interests of the foregoing persons by reading the preliminary proxy statement filed with the SEC, and the definitive proxy statement to be filed W W W . H F R O C O N V E R S I O N . C O M with the SEC, regarding the Conversion Proposal. H I G H L A N D I N C O M E F U N D ( N S Y E : H F R O ) | J U N E 2 0 2 1

The following discussion is subject to change until the proxy is definitive. The proposed conversion of HFRO to a diversified holding company is contingent upon an affirmative shareholder vote, regulatory approval, and the ability to reconfigure HFRO’s portfolio such that it is no longer an investment company for purposes of the Investment Company Act of 1940 (the “1940 Act”). The conversion process could take approximately 24 months; and there can be no assurance that conversion of HFRO to a diversified holding company will be completed, improve HFRO’s performance or reduce the common share discount to net asset value (“NAV”). In addition, actions taken in connection with the proposed conversion may adversely affect the financial condition, yield on investment, results of operations, cash flow, per share trading price of our securities, ability to satisfy debt service obligations, if any, and to make cash distributions to shareholders. Whether HFRO remains a registered investment company or converts to a diversified holding company, an investment in HFRO’s securities, like an investment in any other public company, is subject to investment risk, including the possible loss of investment. For a discussion of certain other risks relating to our conversion to a holding company, see “Implementation of the Business Change Proposal and Related Risks” and “Appendix B: Risks Associated with the Business Change Proposal” in the proxy statement. This presentation document contains forward-looking statements. These statements reflect the current views of management with respect to future events and financial performance. Forward-looking statements can be identified by words such as “anticipate”, “expect”, “could,” “may”, “potential”, “will”, “ability,” “targets,” “believe,” “likely,” “assumes,” “ensuring,” “available,” “optionality,” “viability,” “maintain,” “consistent,” “pace,” “should,” “emerging,” “driving,” “looking to,” and similar statements of a future or forward-looking nature. Forward-looking statements address matters that involve risks and uncertainties. Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance in difference economic and market cycles. There can be no assurance that similar performance will be experienced. Additional risks and disclosures can be found on Slides 41-43 of this presentation. Access the latest information on the conversion on the proposal website at: W W W . H F R OC ONV ER S I ON . C OM

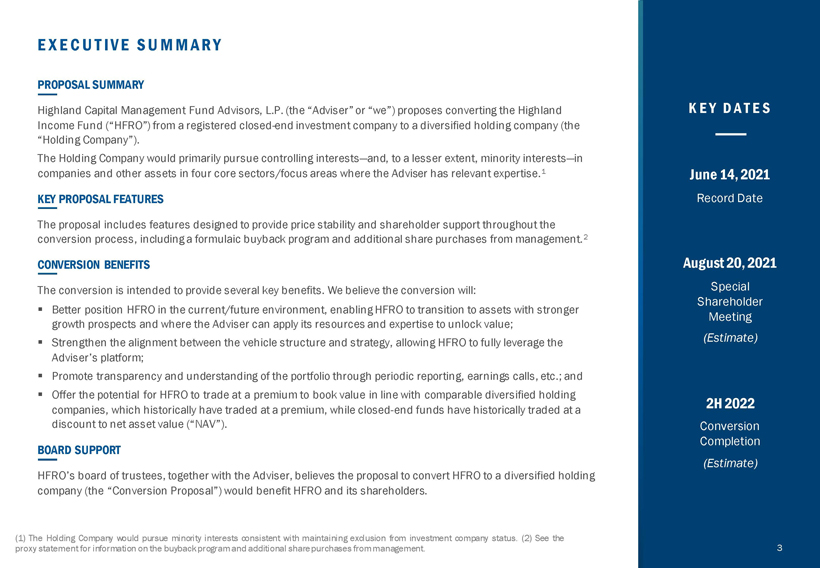

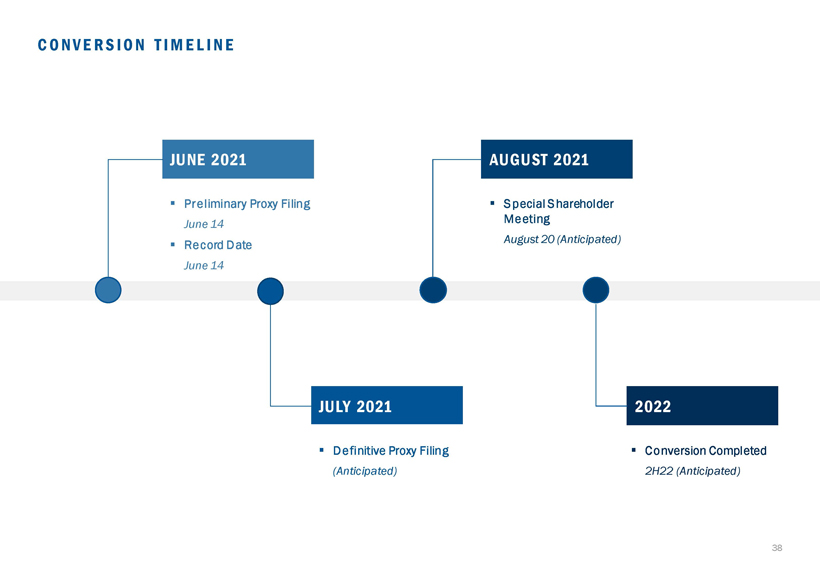

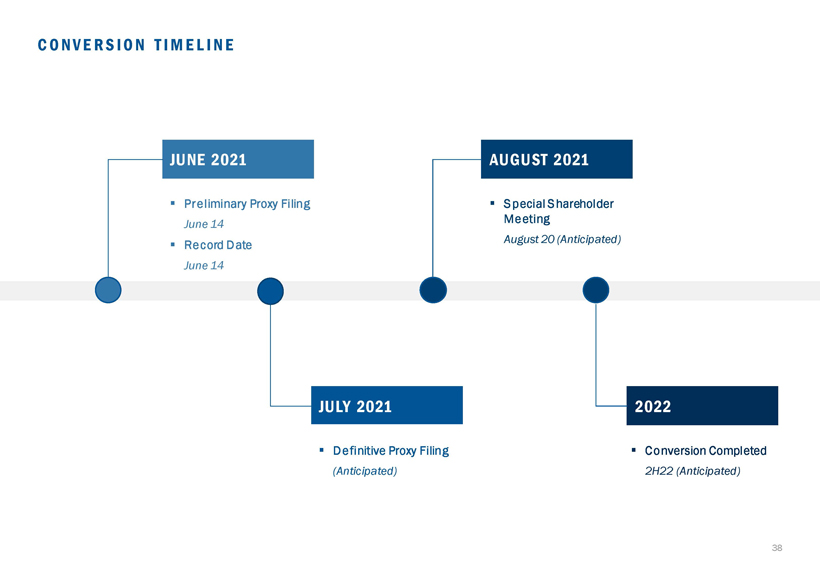

EXEC U T I V E S U M M A R Y PROPOSAL SUMMARY Highland Capital Management Fund Advisors, L.P. (the “Adviser” or “we”) proposes converting the Highland K EY D A T E S Income Fund (“HFRO”) from a registered closed-end investment company to a diversified holding company (the “Holding Company”). The Holding Company would primarily pursue controlling interests—and, to a lesser extent, minority interests—in companies and other assets in four core sectors/focus areas where the Adviser has relevant expertise.1 June 14, 2021 KEY PROPOSAL FEATURES Record Date The proposal includes features designed to provide price stability and shareholder support throughout the conversion process, including a formulaic buyback program and additional share purchases from management.2 CONVERSION BENEFITS August 20, 2021 The conversion is intended to provide several key benefits. We believe the conversion will: Special Shareholder ï,§ Better position HFRO in the current/future environment, enabling HFRO to transition to assets with stronger Meeting growth prospects and where the Adviser can apply its resources and expertise to unlock value; ï,§ Strengthen the alignment between the vehicle structure and strategy, allowing HFRO to fully leverage the (Estimate) Adviser’s platform; ï,§ Promote transparency and understanding of the portfolio through periodic reporting, earnings calls, etc.; andï,§ Offer the potential for HFRO to trade at a premium to book value in line with comparable diversified holding companies, which historically have traded at a premium, while closed-end funds have historically traded at a 2H 2022 discount to net asset value (“NAV”). Conversion Completion BOARD SUPPORT (Estimate) HFRO’s board of trustees, together with the Adviser, believes the proposal to convert HFRO to a diversified holding company (the “Conversion Proposal”) would benefit HFRO and its shareholders. The Holding Company would pursue minority interests consistent with maintaining exclusion from investment company status. (2) See the statement for information on the buyback program and additional share purchases from management. 3

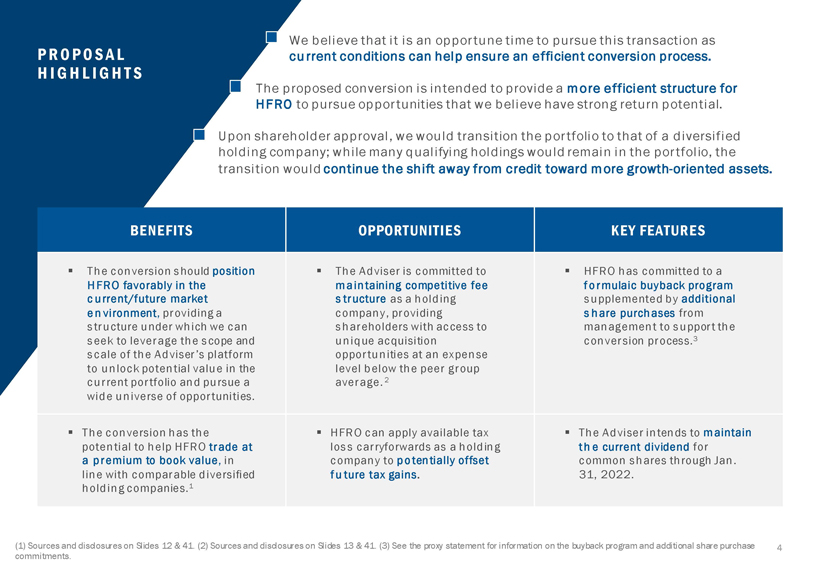

We believe that it is an opportune time to pursue this transaction as PR O PO SAL cu rrent conditions can help ensure an efficient conversion process. H I G H L I G H T S The proposed conversion is intended to provide a more efficient structure for HFRO to pursue opportunities that we believe have strong return potential. Upon shareholder approval, we would transition the portfolio to that of a diversified holding company; while many qualifying holdings would remain in the portfolio, the transition would continue the shift away from credit toward more growth-oriented assets. BENEFITS OPPORTUNITIES KEY FEATURES ï,§ The conversion should position ï,§ The Adviser is committed to ï,§ HFRO has committed to a H FRO favorably in the maintaining competitive fee f ormula ic buyback program c urrent/future market s tructure as a holding supplemented by additional en vironment, providing a company, providing s hare purchases from structure under which we can shareholders with access to management to support the seek to leverage the scope and unique acquisition conversion process.3 scale of the Adviser’s platform opportunities at an expense to unlock potential value in the level below the peer group current portfolio and pursue a average.2 wide universe of opportunities. ï,§ The conversion has the ï,§ HFRO can apply available tax ï,§ The Adviser intends to maintain potential to help HFRO trade at loss carryforwards as a holding th e current dividend for a premium to book value, in company to potentially offset common shares through Jan. line with comparable diversified f u ture tax gains. 31, 2022. holding companies.1 (1) Sources and disclosures on Slides 12 & 41. (2) Sources and disclosures on Slides 13 & 41. (3) See the proxy statement for information on the buyback program and additional share purchase 4 commitments.

CONTENTS

5

I. B E N E F I T S & O P P O R T U N I T I E S B e n e f i t s o f t h e D i v er si f ie d H o ld i ng C o m p any S t ruc t ure a nd O p p o r t unit i es f o r H F RO

DI V E R S I F I E D H O L D I N G C O M P A N Y B E N E F I T S A N D O P P O R T U N I T I E S F O R H F R O Operating HFRO as a diversified holding company provides several advantages that can benefit shareholders. MARKET OUTLOOK & OPPORTUNITY PERFORMANCE & PEER GROUP EXPENSES & TAX EFFICIENCIES Transitions to more favorable assetsAligns structure and strategyProvides access to diversified Supports ongoing transition away from credit The holding company structure is well suited holding company at expense level (where high-yield spreads are at an all-time for the business strategy, removing limitations significantly below peer group low) into companies we believe have strong and inefficiencies that can exist under the growth potential—and thus better potential for 1940 Act structure in order to unlock average shareholder returns potential growth and maximize value Proposal includes first-year expense cap of 1.15% 2; offers SG&A expenses significantly Expands universe of opportunities Provides to trade at a below public competitors and seeks to  potential maintain competitive expense level over long Allows HFRO to capture a wider net of premium to book value terrm3 opportunities, including those created by Diversified holding companies with similar inefficiencies in the public and private capital markets business models have historically traded at a Offers effective applications of tax premium to book value (while CEFs have loss carryforwardsBridges public/private markets historically traded at a discount to NAV)1 Un-expiring capital loss carryforwards can be Positions HFRO favorably between public and used to offset capital gains, if any, generated Promotes transparency by Holding Company private markets, facilitating equity investments in private companies—an area Diversified holding company management that has demonstrated strong performance teams typically host quarterly earnings calls over the long term—while also providing and publish detailed financial results flexibility to navigate areas of public and private market convergence No assurance can be given that the Holding Company will achieve its objectives. (1) Sources and disclosures on Slides 12 & 41. (2) The Adviser has agreed to a total expense cap of 1.15% of total Deregistration assets of the Order Fund . (3)on SG&A management expensesfees, refer administrative to Selling, General and shared & Administrative services fees expenses, and other which corporate include operating corporate expenses operating for the expenses, 12-month service period fees, following and management the Company’s compensation receipt of the. 7 Information on companies included as public competitors on Slide41.

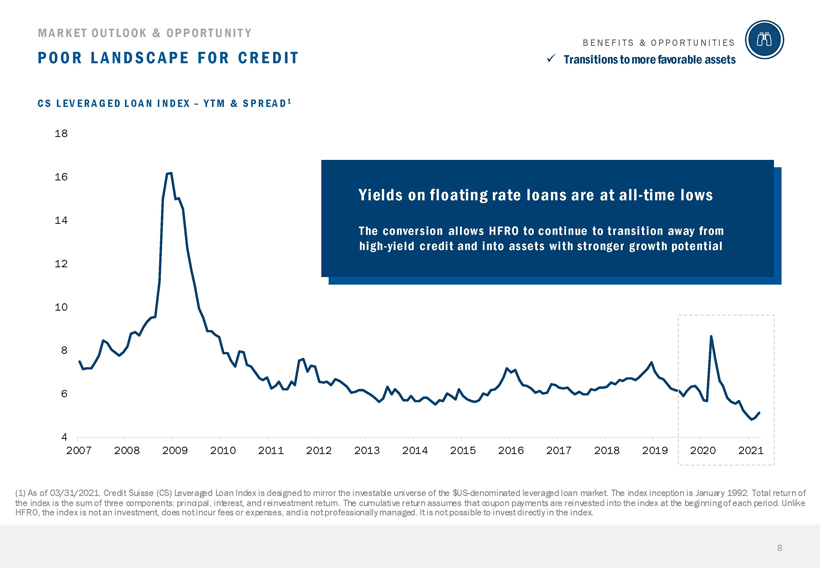

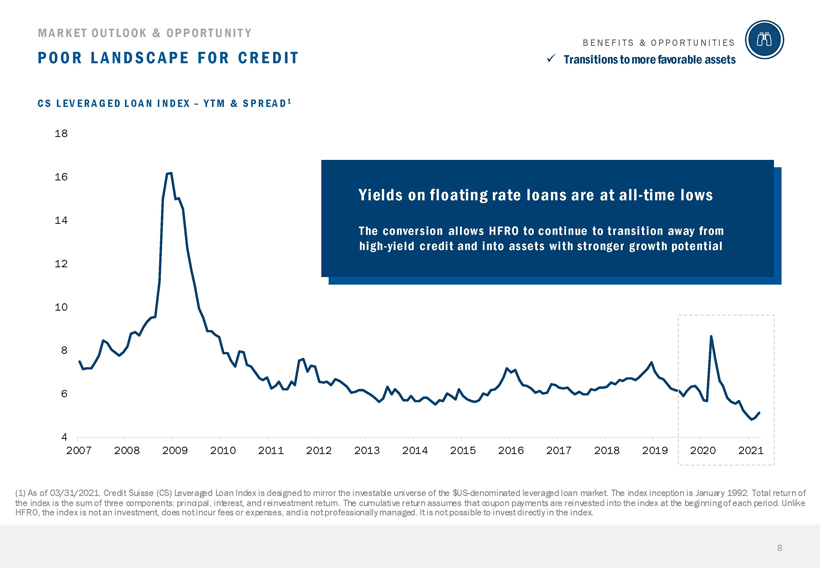

M A R K E T OU T LOOK & OP P OR T U NI T Y B E N E F I T S & O P P O R T U N I T I E S P OOR L A N D S C A P E F O R C R E D I T Transitions to more favorable assets C S L E V E R A G E D L O A N I N D E X – Y T M & S P R E A D 1 18 16 Yields on floating rate loans are at all-time lows 14 The conversion allows HFRO to continue to transition away from high-yield credit and into assets with stronger growth potential 12 10 8 6 4 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 (1) As of 03/31/2021. Credit Suisse (CS) Leveraged Loan Index is designed to mirror the investable universe of the $US-denominated leveraged loan market. The index inception is January 1992. Total return of HFRO, the index theis index the sum is not ofan three investment, components: does principal, not incurinterest, fees or expenses, and reinvestment andis not return. professionally The cumulative managed. return It is assumes not possible that coupon to invest payments directly in are the reinvested index. into the index at the beginning of each period. Unlike

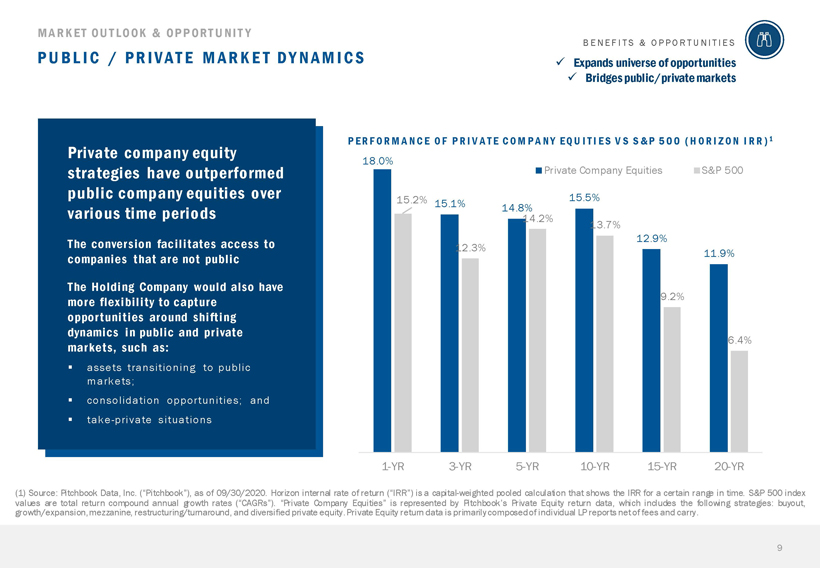

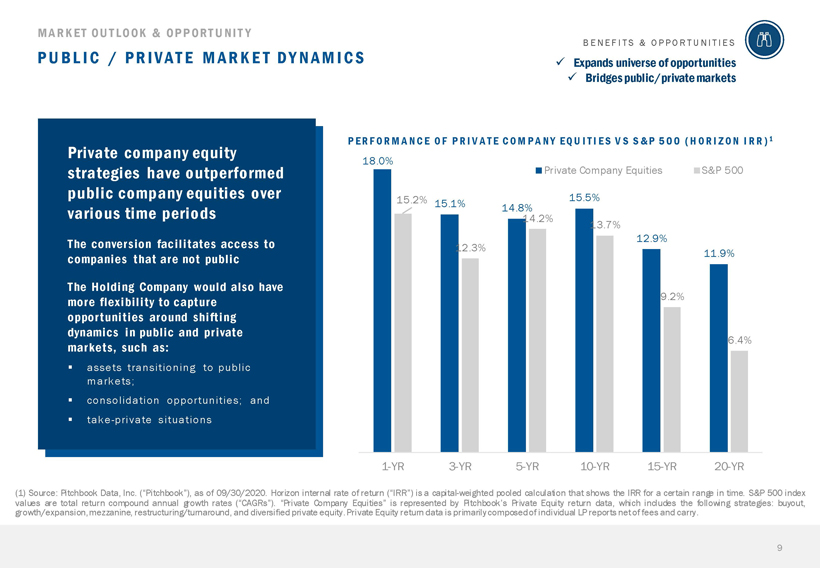

M A R K E T OU T LOOK & OP P OR T U NI T Y B E N E F I T S & O P P O R T U N I T I E S PU B L I C / P R I V A T E M A R K E T D Y N A M I C S Expands universe of opportunities Bridges public/private markets Private company equity PE R F O R M AN C E O F P R I V A T E C O M P A N Y E Q U I T I E S V S S & P 5 0 0 ( H O R I Z O N I R R ) 1 18.0% strategies have outperformed Private Company Equities S&P 500 public company equities over 15.2% 15.5% various time periods 15.1% 14.8% 14.2% 13.7% The conversion facilitates access to 12.9% 12.3% companies that are not public 11.9% The Holding Company would also have more flexibility to capture 9.2% opportunities around shifting dynamics in public and private 6.4% markets, such as: ï,§ assets transitioning to public markets;ï,§ consolidation opportunities; andï,§ take-private situations 1-YR 3-YR 5-YR 10-YR 15-YR 20-YR (1) Source: Pitchbook Data, Inc. (“Pitchbook”), as of 09/30/2020. Horizon internal rate of return (“IRR”) is a capital-weighted pooled calculation that shows the IRR for a certain range in time. S&P 500 index growth/expansion,mezzanine, values are total return compound restructuring/turnaround, annual growth rates and (“CAGRs”) diversified . “Private private Company equity.Private Equities” Equity is return represented data isby primarily Pitchbook’s composedof Privateindividual Equity return LP reports data, net which of fees includes and carry. the following strategies: buyout, 9

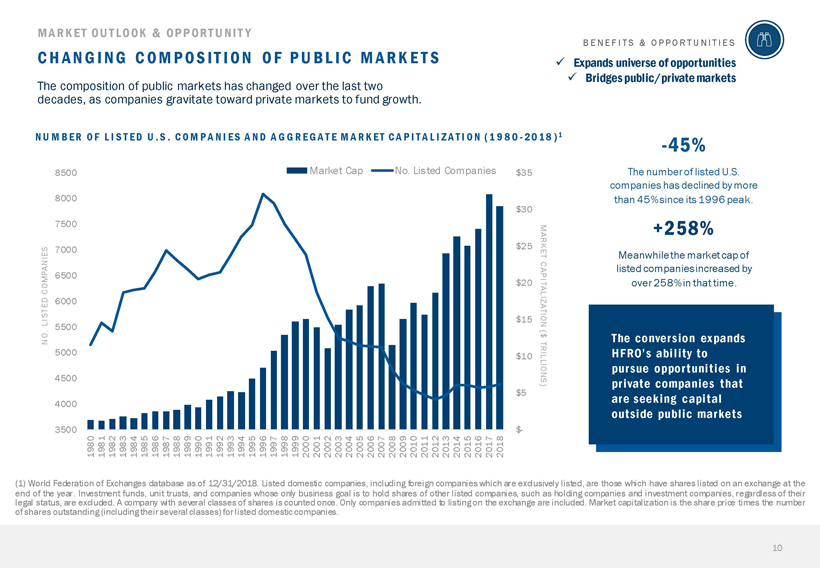

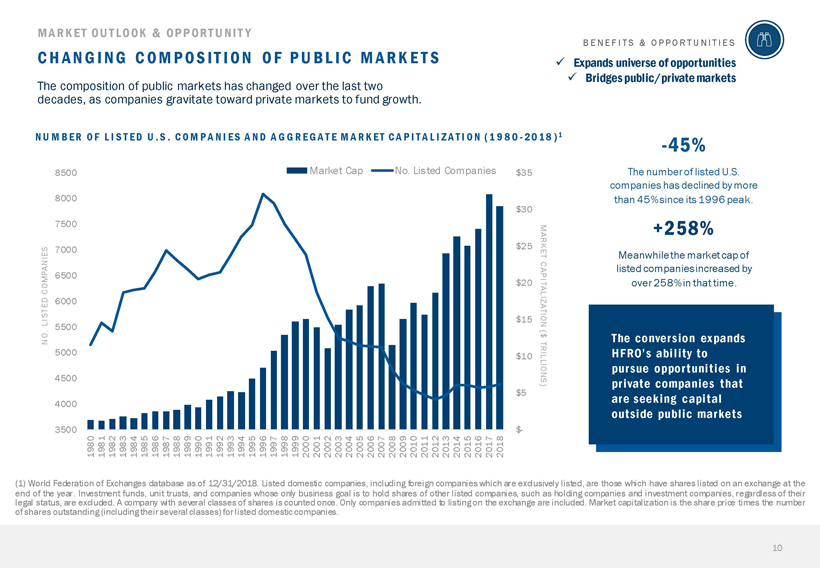

M A R K E T OU T LOOK & OP P OR T U NI T Y B E N E F I T S & O P P O R T U N I T I E S C H A NG I NG C O M P O S I T I O N O F P U B L I C M A R K E T S Expands universe of opportunities  Bridges public/private markets The composition of public markets has changed over the last two decades, as companies gravitate toward private markets to fund growth. N U M B E R O F L I S T E D U . S . C O M P A N I E S A N D A G G R E G A T E M A R K E T C A P I T A L I Z A T I O N ( 1 9 8 0 - 20 18 ) 1 -45% 8500 Market Cap No. Listed Companies $35 The number of listed U.S. companies has declined by more 8000 than 45% since its 1996 peak. $30 7500 +258% 7000 $25 MARKET IES Meanwhile the market cap of CAP listed companies increased by 6500 I COMPAN $20 over 258% in that time. STED 6000 $15 LI TALIZATION . 5500 ( O N TRILLIONS$ The conversion expands 5000 $10 HFRO’s ability to 4500 pursue opportunities in ) private companies that $5 are seeking capital 4000 outside public markets 3500 $-1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 (1) World Federation of Exchanges database as of 12/31/2018. Listed domestic companies, including foreign companies which are exclusively listed, are those which have shares listed on an exchange at the legal end of status, the year. are excluded. Investment Afunds, company unit with trusts, several andclasses companies of shares whoseisonly counted business once.goal Only iscompanies to hold shares admitted of other to listing listedon companies, the exchange such are asincluded. holding companies Market capitalization and investment is thecompanies, share priceregardless times the number of their of shares outstanding (including theirseveral classes) forlisted domestic companies.

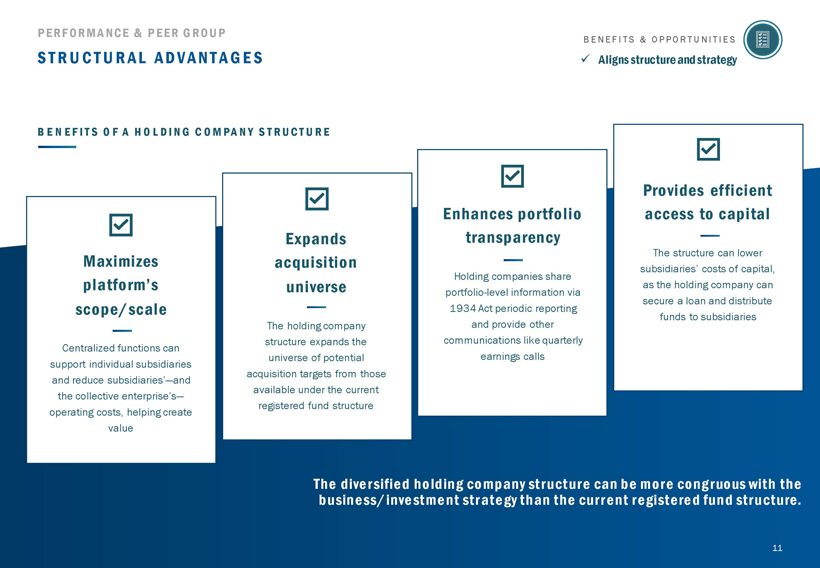

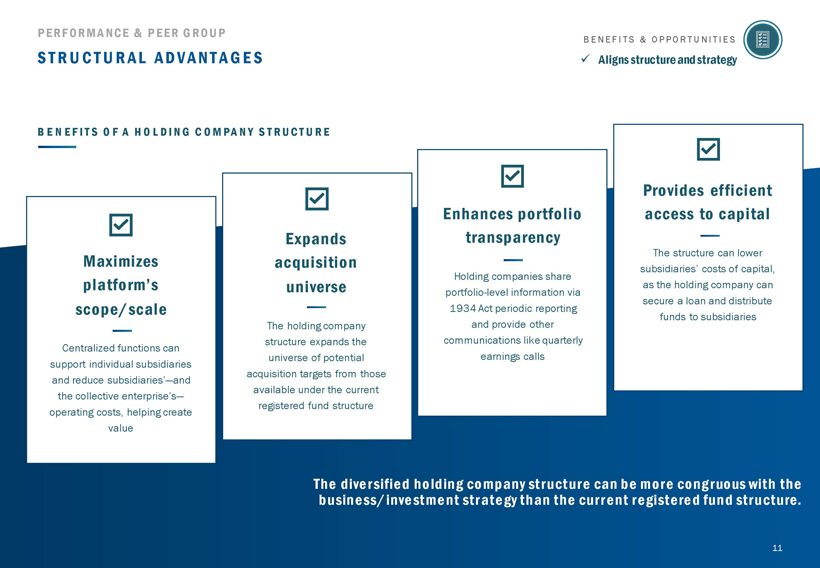

P E RF ORM A NCE & P E E R G R OU P B E N E F I T S & O P P O R T U N I T I E S ST R U C T U R AL A D V A N T A G E S Aligns structure and strategy B E N E F I T S O F A H O L D I N G C O M P A N Y S T R U C T U R E Provides efficient Enhances portfolio access to capital Expands transparency Maximizes acquisition The structure can lower subsidiaries’ costs of capital, Holding companies share platform’s universe as the holding company can portfolio-level information via secure a loan and distribute scope/scale 1934 Act periodic reporting funds to subsidiaries The holding company and provide other structure expands the communications like quarterly Centralized functions can universe of potential earnings calls support individual subsidiaries acquisition targets from those and reduce subsidiaries’—and available under the current the collective enterprise’sregistered fund structure operating costs, helping create value The diversified holding company structure can be more congruous with the business/investment strategy than the current registered fund structure. 11

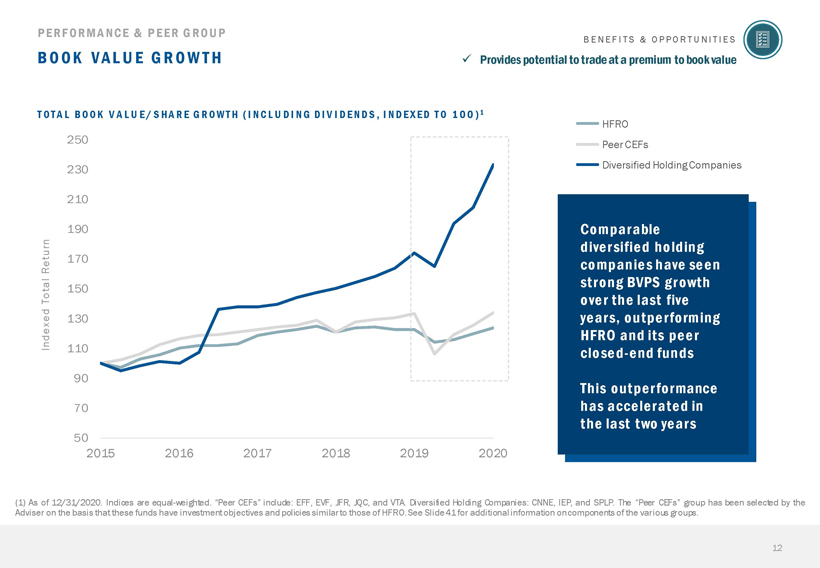

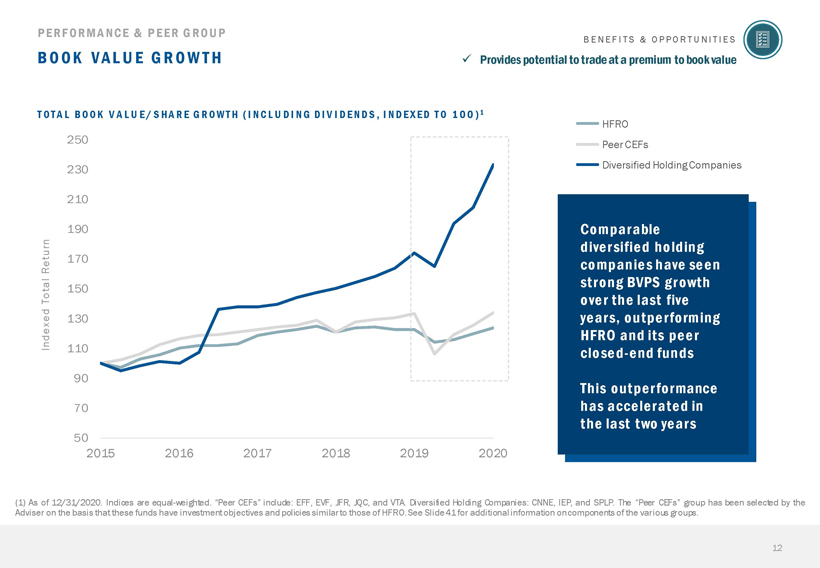

P E RF ORM A NCE & P E E R G R OU P B E N E F I T S & O P P O R T U N I T I E S BOOK V A L U E G R O W T H Provides potential to trade at a premium to book value T OT A L B O O K V A L U E / S HA R E G R O W T H ( I N C L U D I N G D I V I D E N D S , I N D E X E D T O 1 0 0 ) 1 HFRO 250 Peer CEFs 230 Diversified Holding Companies 210 190 Comparable 170 diversified holding Return companies have seen strong BVPS growth Total 150 over the last five 130 years, outperforming Indexed HFRO and its peer 110 closed-end funds 90 This outperformance 70 has accelerated in the last two years 50 2015 2016 2017 2018 2019 2020 (1) As of 12/31/2020. Indices are equal-weighted. “Peer CEFs” include: EFF, EVF, JFR, JQC, and VTA. Diversified Holding Companies: CNNE, IEP, and SPLP. The “Peer CEFs” group has been selected by the Adviser on the basis that these funds have investment objectives and policies similarto those of HFRO.See Slide41 for additional information oncomponents of the various groups.

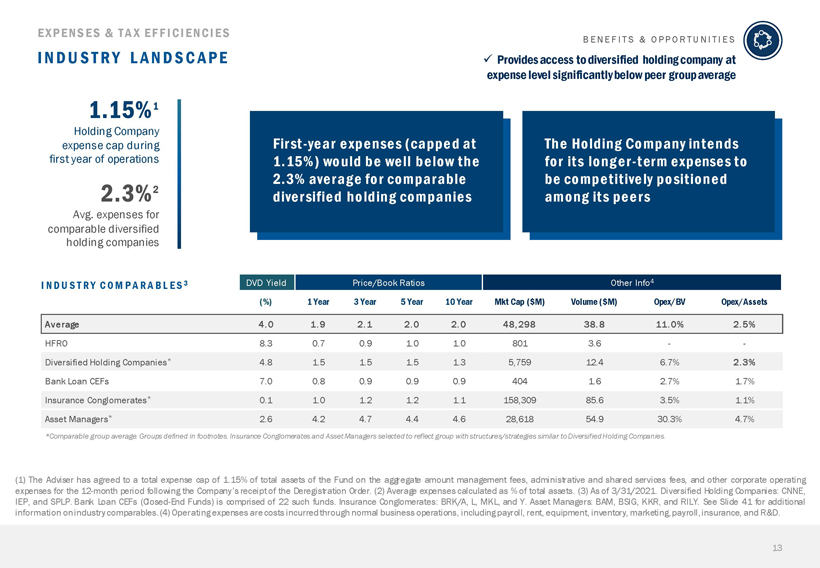

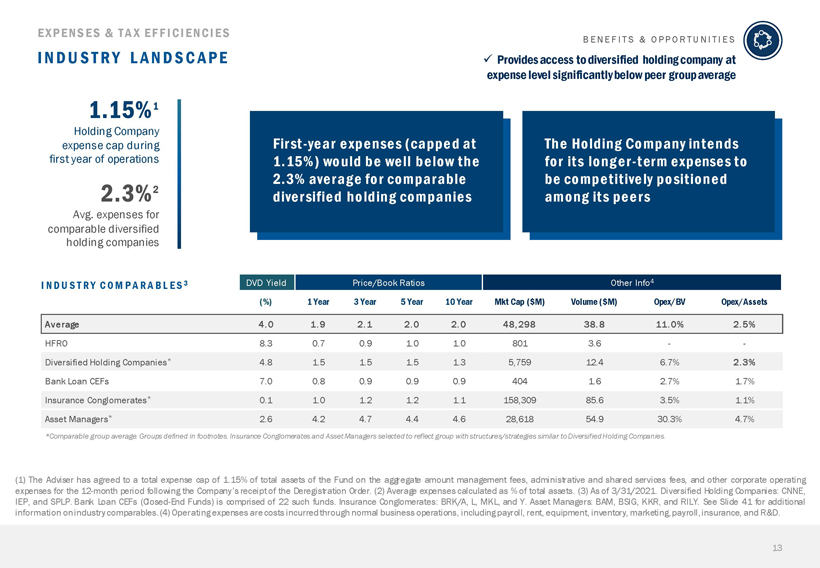

E X P E NS E S & T A X E F F I C I E NC I E S B E N E F I T S & O P P O R T U N I T I E S I N D U ST R Y L A N D S C A P E  Provides access to diversified holding company at expense level significantly below peer group average 1.15%1 Holding Company expense cap during First-year expenses (capped at The Holding Company intends first year of operations 1.15%) would be well below the for its longer-term expenses to 2.3% average for comparable be competitively positioned 2.3%2 diversified holding companies among its peers Avg. expenses for comparable diversified holding companies I NDU S T R Y C O M P A R A B L E S 3 DVD Yield Price/Book Ratios Other Info4 (%) 1 Year 3 Year 5 Year 10 Year Mkt Cap ($M) Volume ($M) Opex/BV Opex/Assets Average 4.0 1.9 2.1 2.0 2.0 48,298 38.8 11.0% 2.5% HFRO 8.3 0.7 0.9 1.0 1.0 801 3.6 - -Diversified Holding Companies* 4.8 1.5 1.5 1.5 1.3 5,759 12.4 6.7% 2.3% Bank Loan CEFs 7.0 0.8 0.9 0.9 0.9 404 1.6 2.7% 1.7% Insurance Conglomerates* 0.1 1.0 1.2 1.2 1.1 158,309 85.6 3.5% 1.1% Asset Managers* 2.6 4.2 4.7 4.4 4.6 28,618 54.9 30.3% 4.7% *Comparable group average. Groups defined in footnotes. Insurance Conglomerates and Asset Managers selected to reflect group with structures/strategies similar to Diversified Holding Companies. (1) The Adviser has agreed to a total expense cap of 1.15% of total assets of the Fund on the aggregate amount management fees, administrative and shared services fees, and other corporate operating expenses for the 12-month period following the Company’s receipt of the Deregistration Order. (2) Average expenses calculated as % of total assets. (3) As of 3/31/2021. Diversified Holding Companies: CNNE, IEP, and SPLP. Bank Loan CEFs (Closed-End Funds) is comprised of 22 such funds. Insurance Conglomerates: BRK/A, L, MKL, and Y. Asset Managers: BAM, BSIG, KKR, and RILY. See Slide 41 for additional information onindustry comparables.(4) Operating expenses arecosts incurredthrough normal business operations, including payroll, rent, equipment, inventory, marketing,payroll,insurance, and R&D. 13

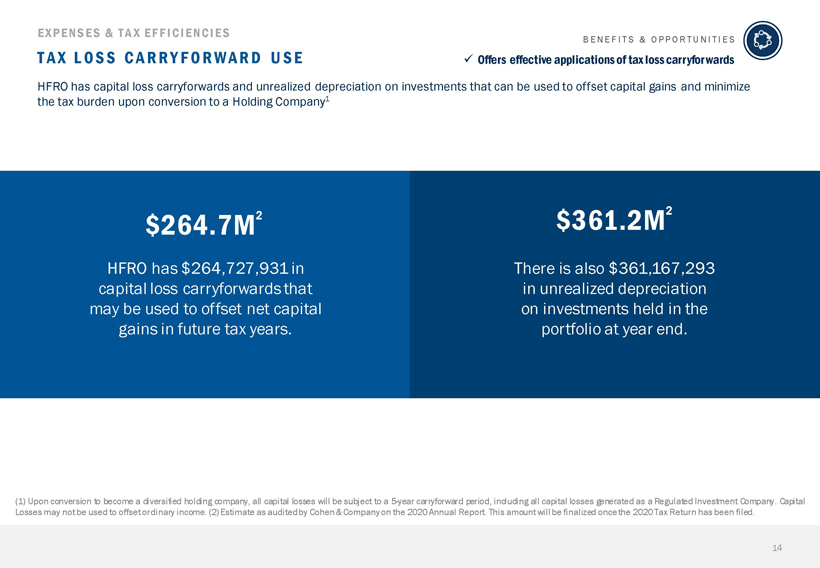

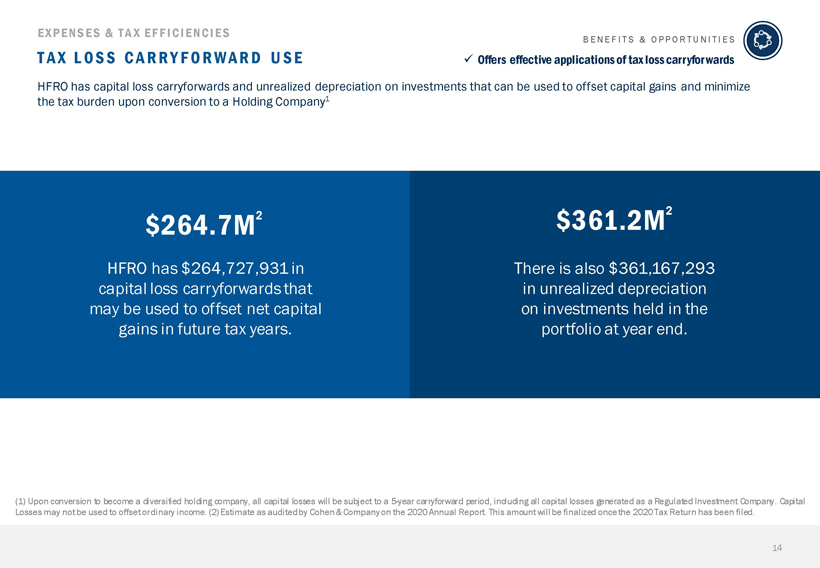

EXP ENS ES & T A X E F F I C I E NC I E S B E N E F I T S & O P P O R T U N I T I E S T AX L O S S C A R R Y F O R W A R D U S E Offers effective applications of tax loss carryforwards HFRO has capital loss carryforwards and unrealized depreciation on investments that can be used to offset capital gains and minimize the tax burden upon conversion to a Holding Company1 $264.7M2 $361.2M2 HFRO has $264,727,931 in There is also $361,167,293 capital loss carryforwards that in unrealized depreciation may be used to offset net capital on investments held in the gains in future tax years. portfolio at year end. (1) Upon conversion to become a diversified holding company, all capital losses will be subject to a 5-year carryforward period, including all capital losses generated as a Regulated Investment Company. Capital Losses may not be used to offset ordinary income. (2) Estimate as auditedby Cohen& Company on the 2020 Annual Report. This amount will be finalized oncethe 2020 Tax Return has been filed. 14

I I . P R O P O S A L B A C K G R O U N D & K E Y F E A T U R E S B a c k ground o n t h e P r o p os ed T r a nsa c t io n a nd I n f orm a t io n o n K e y P r o p os a l F e a t ur es 15

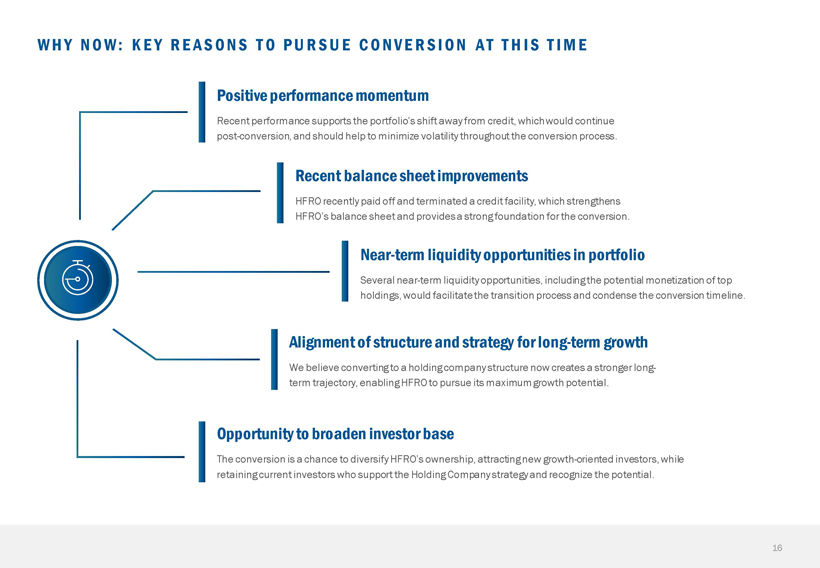

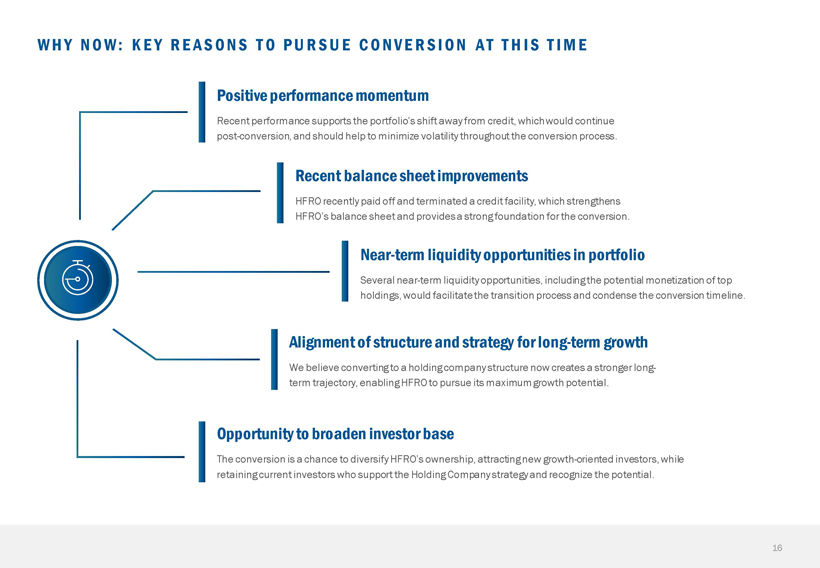

W H Y N O W : K E Y R E A S O N S T O P U R S U E C O N V E R S I O N A T T H I S T I M E Positive performance momentum Recent performance supports the portfolio’s shift away from credit, which would continue post-conversion, and should help to minimize volatility throughout the conversion process. Recent balance sheet improvements HFRO recently paid off and terminated a credit facility, which strengthens HFRO’s balance sheet and provides a strong foundation for the conversion. Near-term liquidity opportunities in portfolio Several near-term liquidity opportunities, including the potential monetization of top holdings, would facilitate the transition process and condense the conversion timeline. Alignment of structure and strategy for long-term growth We believe converting to a holding company structure now creates a stronger long-term trajectory, enabling HFRO to pursue its maximum growth potential. Opportunity to broaden investor base The conversion is a chance to diversify HFRO’s ownership, attracting new growth-oriented investors, while retaining current investors who support the Holding Company strategy and recognize the potential. 16

W H Y NOW C U R R E NT C O N D I T I O N S Current conditions—created by HFRO’s recent performance and improvements to the balance sheet—provide a favorable setup for the conversion. PE RFORMANCE MOME NTU M BAL ANCE SH E E T IMPROVE ME NTS HFRO’s recent performance: HFRO’s balance sheet improvements: Provides strong starting Offer flexibility and stability point for conversion With the repayment of the major credit facility, the current balance sheet provides flexibility to support the portfolio Performance momentum puts HFRO in a better position transition and overall conversion process. going into the conversion and may help limit volatility during the transition. Strengthens issuer profile Supports shift away from credit This significant reduction in leverage also improves the Fund’s risk adjusted asset coverage. Positive performance follows shift away from credit into assets where the Adviser sees more growth potential—this shift would continue via the conversion, allowing HFRO to pursue a wider universe of growth-oriented opportunities. Past performance is no guarantee of future results. The rate of return will vary, and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original investment costreturn . current does performance not reflectmay broker be lower sales or charges higheror than commissions the performance . All performance data quoted information . Returns are is for historical common and shares include of change the Trust in . share See the price proxy and statement reinvestment and of financial all distributions statements . Total for 17 more information before investing.

W H Y NOW NE A R - T E R M L I Q U I D I T Y O P P O R T U N I T I E S ï,§ The conversion involves transitioning the portfolio to M ONE T I Z A T I ON E V E NT S & that of a diversified holding company. LI QU I DI T Y OP P OR T U NI T I E Sï,§ HFRO has several potential liquidity opportunities—both at the portfolio level and within individual Potential near-term monetization events include: holdings—that can facilitate the transition and accelerate the conversion timeline. C R E E K P I N E R E C A P I TA LI ZA TI ON 1 ,2 In June 2020, key amendments were made to a wood supply agreement that are expected to: BE NE FITS OF MONE TIZATION ï,§ increase cash flows from timber sales at market-based prices E VE NTS/ L IQU IDIT Y OPPORTU NITIE S based on customary pricing mechanisms; ï,§ improve the value and marketability of the property for the long-term; and HFRO’s near-term liquidity opportunities: ï,§ significantly enhance the ability to make opportunistic timberland Facilitate portfolio transition process sales as well as recapitalize the investment. Potential near-term liquidity opportunities would simplify this M G M A C Q U I S I TI O N1 transition process and could accelerate the conversion timeline. On May 26, 2021, Metro Goldwyn Mayer (“MGM”) announced that it Begin to execute business strategy had entered into a definitive merger agreement with Amazon under which Amazon will acquire MGM for a purchase price of $8.45bn.3 In addition to facilitating the conversion process, such liquidity opportunities would provide capital to deploy toward the O TH E R L I Q U I D I TY O P P O R TU N ITI ES Holding Company business strategy. In addition to potential monetization events in individual holdings, the overall portfolio allocation includes other viable liquidity opportunities that can be drawn on to advance the (1) See Slides 30-36 for information on HFRO’s top holdings and potential monetization events. (2) No final transition and ensure an efficient conversion process. given decision as to has whether been made the anticipated as to whether terms HFRO of the will disposition exit in its will position change in Creek between Pine date andhereof no assurance and the date can be of disposition. (3) Completion of this transaction is subject to regulatory approvals and other customary closing terms conditions. or at all. Accordingly, there can be no assurance that the transaction will be consummated on the proposed 18

W H Y NOW G RO W T H T R A J E C T O R Y We believe the conversion will provide a more efficient structure for HFRO to pursue its full growth potential. ADVI S ER’ S OUTLOOK: VE H ICL E OPTIMIZATION CURRENT/FUTURE INVESTMENT ENVIRONMENT A diversified holding company vehicle: Facilitates the management of private market assets ï,§ Rates are at historic lows, and inflation expectations are We believe a diversified holding company is a more efficient vehicle to rising in response to the stimulus and central bank manage the assets and carry out the strategy that the Adviser believes have accommodations that stemmed from the COVID-19 better return potential. pandemic. We believe investments in floating-rate and fixed-rate securities driven by the short end of the curve will Provides optimal way to access private markets remain unattractive. The holding company vehicle provides an efficient way for shareholders to gain exposure to private market assets. ï,§ The ability to deliver excess returns within standard equity and credit markets is limited; meanwhile, opportunities with the most compelling return potential can be challenging to manage within the current fund structure. ï,§ The conversion would provide valuable realignment, creating POTE NTIAL TO BROADE N INVE STOR BASE a structure that is more supportive of a strategy that we believe has greater potential to generate outsized returns. A diversified holding company structure: ï,§ We continue to see outsized return potential in private Expands investor universe markets, where we can draw on our relationships, research Ownership of diversified holding companies spans a wide range of and due diligence, structuring, execution, and operational investors, and the potential for index inclusion further expands the expertise over a longer-term horizon to capitalize on investor universe. The conversion provides an opportunity to broaden inefficiencies and unlock value. HFRO’s investor base in a way that can promote liquidity and may help the Holding Company to trade at a premium to book value. 19 No assurance can be given that the Holding Company will achieve its objectives.

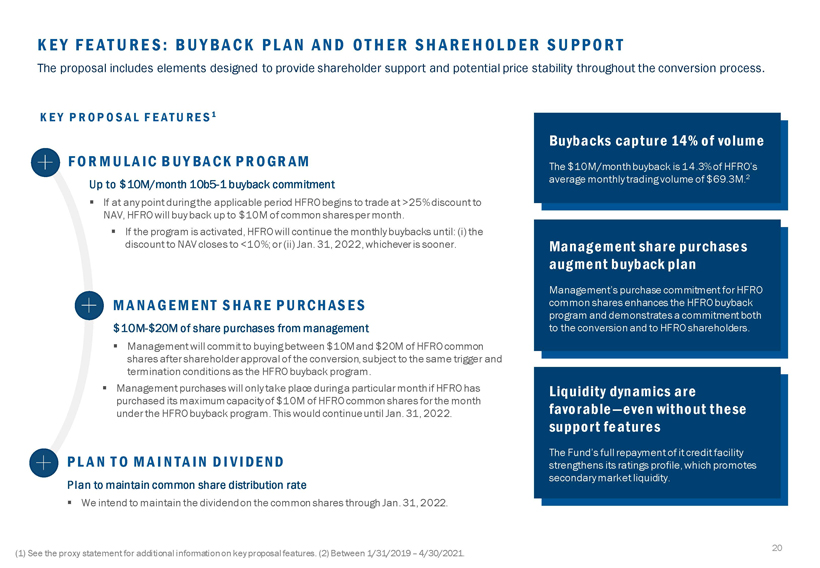

K E Y F E A T U R E S : B U Y B A C K P L A N A N D O T H E R S H A R E H O L D E R S U P P O R T The proposal includes elements designed to provide shareholder support and potential price stability throughout the conversion process. K EY P R O P O S A L F E A T U R E S 1 Buybacks capture 14% of volume F O R M U L A I C B U Y BA C K P R O GR AM The $10M/month buyback is 14.3% of HFRO’s average monthly trading volume of $69.3M.2 Up to $10M/month 10b5-1 buyback commitment ï,§ If at any point during the applicable period HFRO begins to trade at >25% discount to NAV, HFRO will buy back up to $10M of common shares per month. ï,§ If the program is activated, HFRO will continue the monthly buybacks until: (i) the discount to NAV closes to <10%; or (ii) Jan. 31, 2022, whichever is sooner. Management share purchases augment buyback plan Management’s purchase commitment for HFRO M A N A G E M E NT S H A R E P U R C H AS E S common shares enhances the HFRO buyback program and demonstrates a commitment both $10M-$20M of share purchases from management to the conversion and to HFRO shareholders. ï,§ Management will commit to buying between $10M and $20M of HFRO common shares after shareholder approval of the conversion, subject to the same trigger and termination conditions as the HFRO buyback program. ï,§ Management purchases will only take place during a particular month if HFRO has Liquidity dynamics are purchased its maximum capacity of $10M of HFRO common shares for the month favorable—even without these under the HFRO buyback program. This would continue until Jan. 31, 2022. support features The Fund’s full repayment of it credit facility P L A N T O M A I N TA I N D I V I DE ND strengthens its ratings profile, which promotes secondary market liquidity. Plan to maintain common share distribution rate ï,§ We intend to maintain the dividend on the common shares through Jan. 31, 2022. 20 (1) See the proxy statement for additional informationon key proposal features. (2) Between 1/31/2019 – 4/30/2021.

III. H O L D I N G C O M P A N Y S T R A T E G Y H i g h l igh t s o f t h e H o l d ing C o m p a ny ’ s P l a nne d B u si nes s S t ra te gy 21

H OL DI NG C O M P A N Y F O C U S A R E A S C O R E S E C T O R S / S T R A T E G Y 1 V E R T I C A L S 2 FINANCIAL SERVICES REAL ESTATE EQUITY OF PRIVATE COMPANIES Banking Multifamily Focus on control investments within core sectors Insurance/ Reinsurance Single-family rental Investment Management Storage Distribution Mortgage NEGOTIATED INVESTMENTS Broker/Dealer Hospitality Pursue various structures/strategies Life Settlements Office/industrial including equity/preferred/debt and pipe/SPAC-like investments in core sectors CO-INVESTMENTS HEALTHCARE OPPORTUNISTIC Focus on opportunities that offer Pharma/Biotech Technology control investments in core sectors Diagnostics Industrial/Cyclical Distributors Media ACTIVISM Pursue opportunities/apply strategy with focus on situations within core sectors and/or where Adviser has relevant expertise/resources commit No assurance an estimated can be 25% givenof that its the assets Holding to each Company of thewill financial achieve services, its objectives. real estate, (1) The andHolding healthcare Company sectors, willwith aiman to additional and operations 25% reserved in any given for opportunistic sector may represent acquisitions more across or less thethan economic 25% of spectrum; assets, depending however, this onis the not availability a fixed target and may attractiveness also expand of acquisition into otheropportunities, industries over general time in market orderconditions, to pursues and new other acquisition relevantopportunities. factors. The Holding (2) TheCompany Holding Company’s management core and strategy operations would that focus maximize on acquiring value and control promote positions growth; in businesses however, itand mayseeking participate to drive in other profitactivities through outside its core strategy. 22

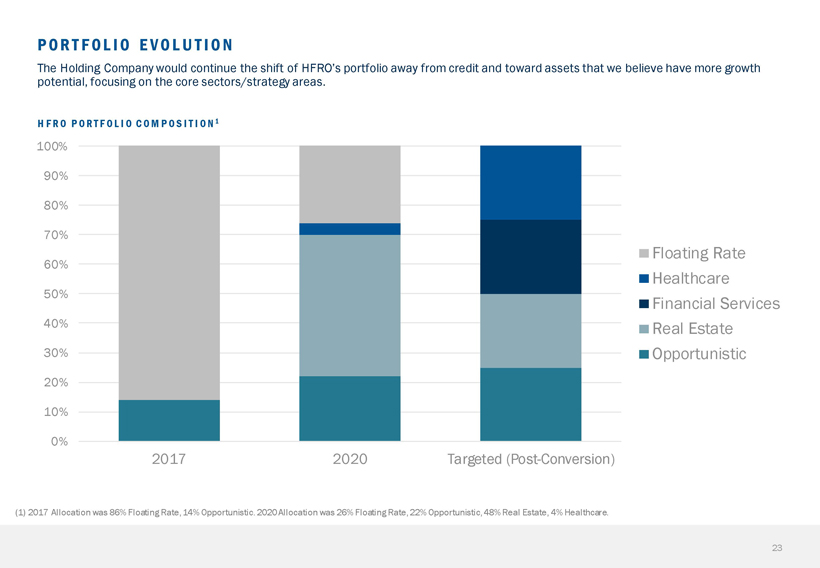

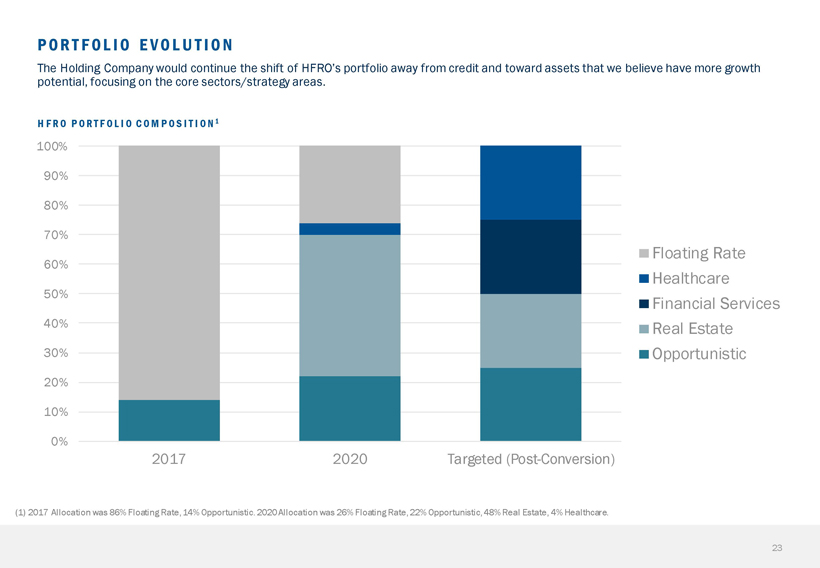

P OR T F OL I O E V O L U T I O N The Holding Company would continue the shift of HFRO’s portfolio away from credit and toward assets that we believe have more growth potential, focusing on the core sectors/strategy areas. H F R O P O R T F O L I O C O M P O S I T I O N 1 100% 90% 80% 70% Floating Rate 60% Healthcare 50% Financial Services 40% Real Estate 30% Opportunistic 20% 10% 0% 2017 2020 Targeted (Post-Conversion) (1) 2017 Allocation was 86% Floating Rate,14% Opportunistic.2020 Allocation was 26% Floating Rate,22% Opportunistic,48% Real Estate, 4% Healthcare. 23

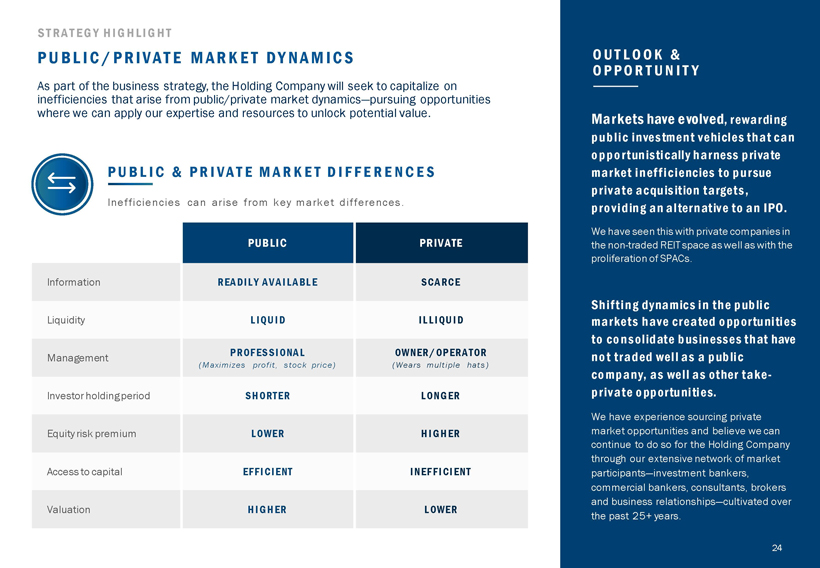

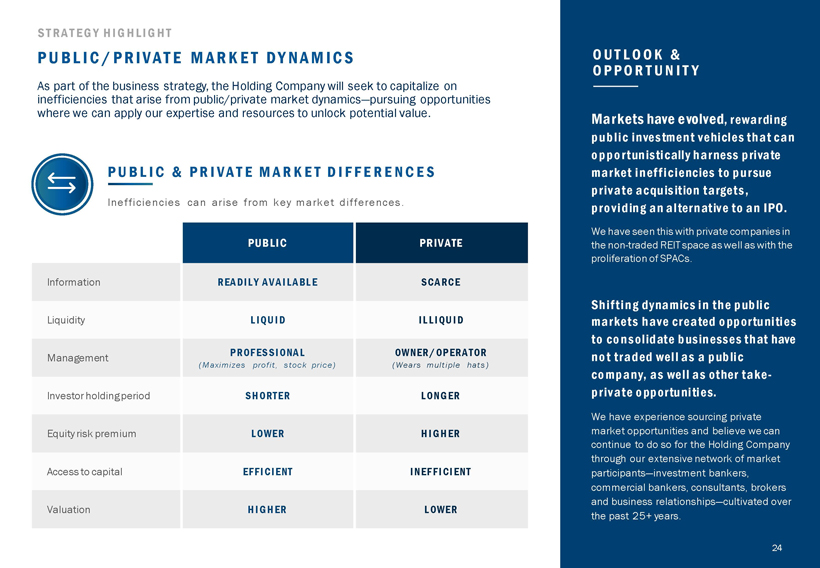

S T R A T E G Y H I G H LI G H T PU B L I C / PR I V AT E M A R K E T D Y N A M I C S OU T L OOK & O P P O R T U N I T Y As part of the business strategy, the Holding Company will seek to capitalize on inefficiencies that arise from public/private market dynamics—pursuing opportunities where we can apply our expertise and resources to unlock potential value. Markets have evolved, rewarding public investment vehicles that can opportunistically harness private P U B L I C & P R I V A T E M A R K E T D I F F E R E N C E S market inefficiencies to pursue private acquisition targets, Inefficiencies can arise from key market differences. providing an alternative to an IPO. PUBLIC PRIVATE We have seen this with private companies in the non-traded REIT space as well as with the proliferation of SPACs. Information READILY AV AILABLE SCARCE Shifting dynamics in the public Liquidity LIQUID ILLIQUID markets have created opportunities to consolidate businesses that have PROFESSIONAL OWNER/OPERATOR not traded well as a public Management (Maximizes profit, s toc k pric e) (Wears multiple hats ) company, as well as other take- Investor holding period SHORTER LONGER private opportunities. We have experience sourcing private Equity risk premium LOWER HIGHER market opportunities and believe we can continue to do so for the Holding Company through our extensive network of market Access to capital EFFICIENT INEFFICIENT participants—investment bankers, commercial bankers, consultants, brokers and business relationships—cultivated over Valuation HIGHER LOWER the past 25+ years. 24

V . C A P A B I L I T I E S & E X P E R I E N C E a p a b il it i es & E x p er ie nce R e l eva nt t o t h e H o l d ing C o m p a ny S t ra t egy 25

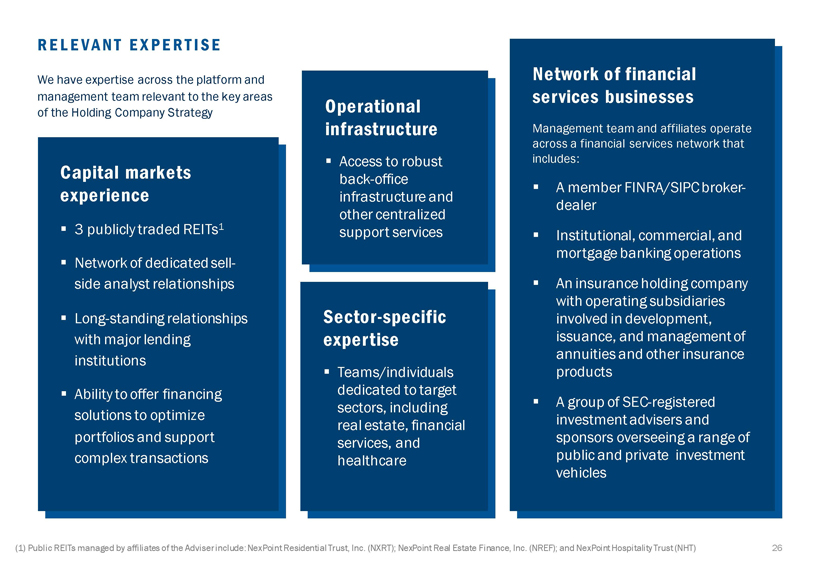

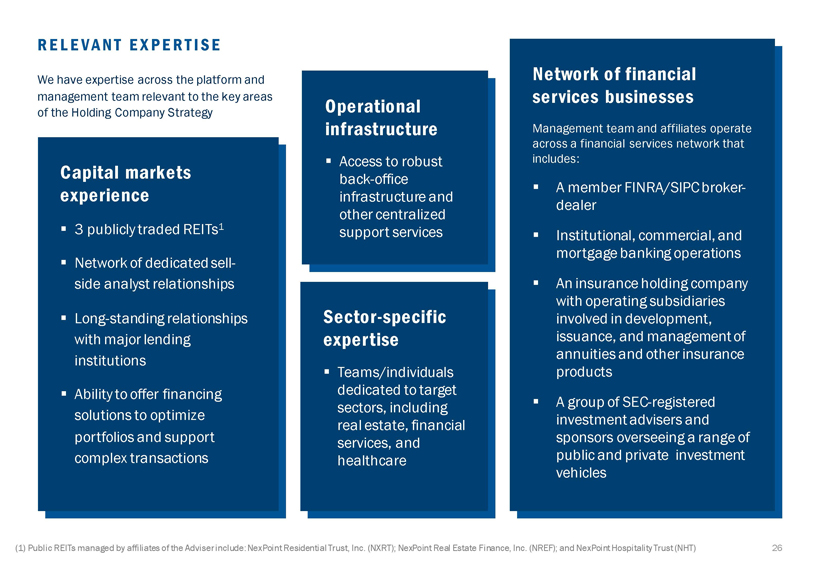

R EL EV A N T E X P E R T I S E We have expertise across the platform and Network of financial management team relevant to the key areas Operational services businesses of the Holding Company Strategy infrastructure Management team and affiliates operate across a financial services network that ï,§ Access to robust includes: Capital markets back-office experienceï,§ A member FINRA/SIPC broker-infrastructure and dealer other centralized ï,§ 3 publicly traded REITs1 support servicesï,§ Institutional, commercial, and mortgage banking operationsï,§ Network of dedicated sell-side analyst relationshipsï,§ An insurance holding company with operating subsidiaries ï,§ Long-standing relationships Sector-specific involved in development, with major lending expertise issuance, and management of institutions annuities and other insurance ï,§ Teams/individuals productsï,§ Ability to offer financing dedicated to target sectors, including ï,§ A group of SEC-registered solutions to optimize investment advisers and real estate, financial portfolios and support services, and sponsors overseeing a range of complex transactions healthcare public and private investment vehicles (1) Public REITs managed by affiliates of the Adviser include: NexPoint Residential Trust, Inc. (NXRT); NexPoint Real Estate Finance, Inc. (NREF); and NexPoint Hospitality Trust (NHT) 26

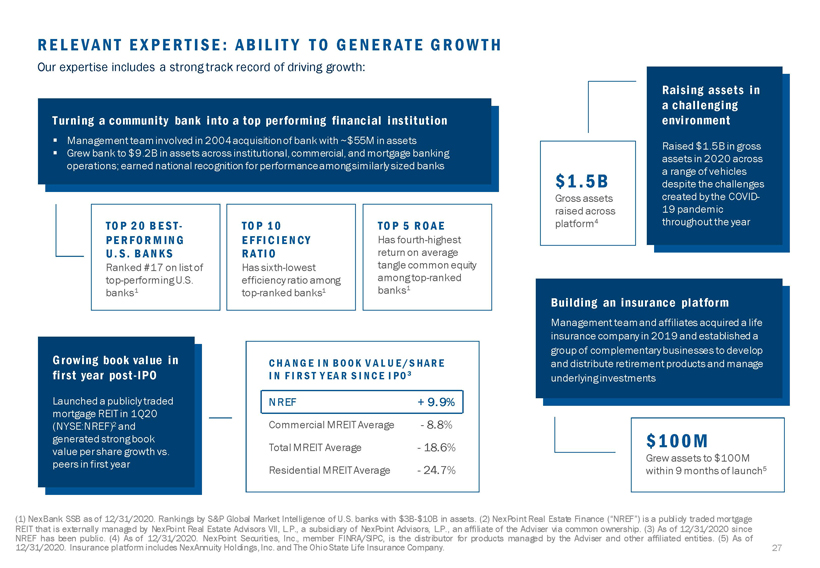

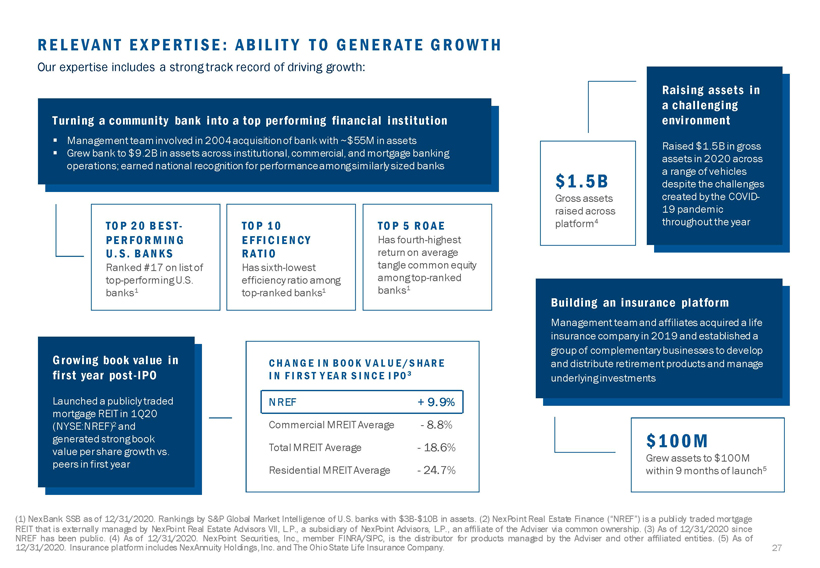

R EL EV A N T E X P E R T I S E : A B I L I T Y T O G E N E R A T E G R O W T H Our expertise includes a strong track record of driving growth: Raising assets in a challenging Turning a community bank into a top performing financial institution environment ï,§ Management team involved in 2004 acquisition of bank with ~$55M in assets Raised $1.5B in gross ï,§ Grew bank to $9.2B in assets across institutional, commercial, and mortgage banking assets in 2020 across operations; earned national recognition for performance among similarly sized banks $1.5B a range of vehicles despite the challenges Gross assets created by the COVID-raised across 19 pandemic TO P 2 0 B E S T- TO P 1 0 TO P 5 R O A E platform4 throughout the year P E R F O R M IN G E F F I C I E N CY Has fourth-highest U . S . B A N KS R A TI O return on average Ranked #17 on list of Has sixth-lowest tangle common equity top-performing U.S. efficiency ratio among among top-ranked banks1 top-ranked banks1 banks1 Building an insurance platform Management team and affiliates acquired a life insurance company in 2019 and established a group of complementary businesses to develop Growing book value in C H A NG E I N B O O K V A L U E /S HAR E and distribute retirement products and manage first year post-IPO I N F I R S T Y E A R S I N C E I PO 3 underlying investments Launched a publicly traded NREF + 9.9% mortgage REIT in 1Q20 (NYSE:NREF)2 and Commercial MREIT Average - 8.8% generated strong book $100M value per share growth vs. Total MREIT Average - 18.6% Grew assets to $100M peers in first year Residential MREIT Average - 24.7% within 9 months of launch5 (1) NexBank SSB as of 12/31/2020. Rankings by S&P Global Market Intelligence of U.S. banks with $3B-$10B in assets. (2) NexPoint Real Estate Finance (“NREF”) is a publicly traded mortgage NREF REIT that hasisbeen externally public. managed (4) As of by12/31/2020. NexPoint RealNexPoint Estate Advisors Securities, VII, L. Inc. P.,, a member subsidiary FINRA/SIPC, of NexPoint is Advisors, the distributor L.P., an for affiliate products of the managed Adviserby via the common Adviserownership. and other(3) affiliated As of 12/31/2020 entities. (5) since As of 12/31/2020. Insurance platform includes NexAnnuity Holdings,Inc. and The OhioState Life Insurance Company. 27

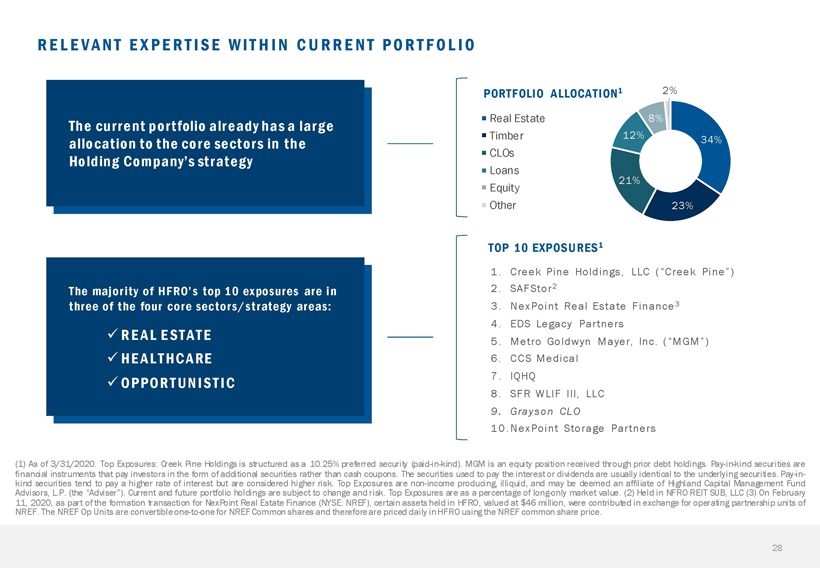

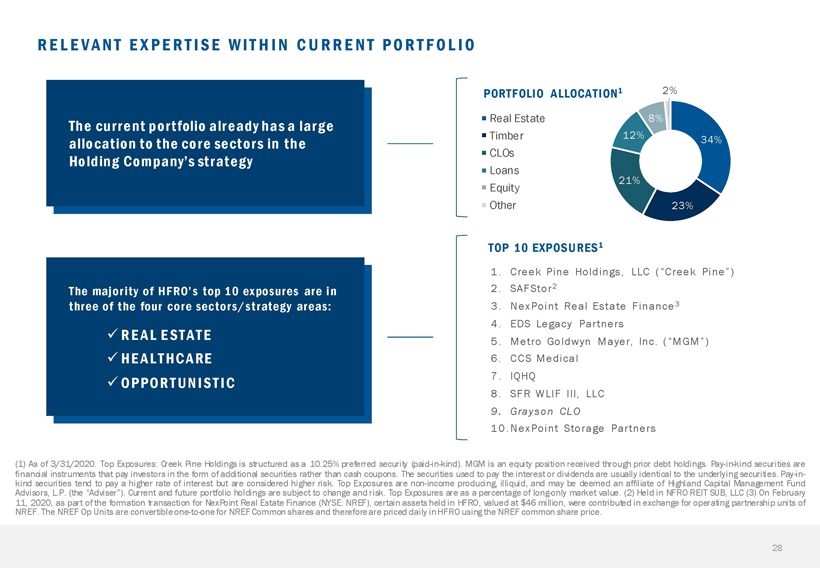

R EL EV A N T E X P E R T I S E W I T H I N C U R R E N T P O R T F O L I O PORTFOLIO ALLOCATION1 2% The current portfolio already has a large Real Estate 8% allocation to the core sectors in the Timber 12% 34% CLOs Holding Company’s strategy Loans 21% Equity Other 23% TOP 10 EXPOSURES1 1. Creek Pine Holdings, LLC (“Creek Pine”) The majority of HFRO’s top 10 exposures are in 2. SAFStor2 three of the four core sectors/strategy areas: 3. NexPoint Real Estate Finance3 4. EDS Legacy Partners R E AL E STATE 5. Metro Goldwyn Mayer, Inc. (“MGM”)HE AL THC ARE 6. CCS Medical OPPOR TUNI STI C 7. IQHQ 8. SFR WLIF III, LLC 9. Grayson CLO 10. NexPoint Storage Partners (1) As of 3/31/2020. Top Exposures: Creek Pine Holdings is structured as a 10.25% preferred security (paid-in-kind). MGM is an equity position received through prior debt holdings. Pay-in-kind securities are financial kind securities instruments tend to that pay pay a higher investors rate inof the interest form of but additional are considered securities higher rather risk. than Top cash Exposures coupons. are The non-income securities used producing, to pay illiquid, the interest and or may dividends be deemed are usually an affiliate identical of Highland to the underlying Capital Management securities. Pay-in- Fund Advisors, L.P. (the “Adviser”). Current and future portfolio holdings are subject to change and risk. Top Exposures are as a percentage of long-only market value. (2) Held in NFRO REIT SUB, LLC (3) On February 11, NREF. 2020, Theas NREF partOp ofUnits the formation are convertibleone-to-onefor transaction for NexPoint NREF Real Common Estate Finance shares and (NYSE: thereforeare NREF), certain priced assets daily held inHFRO in HFRO, using valued the NREF at $ common 46 million, share were price. contributed in exchange for operating partnership units of 28

V . A P P E N D I X S u p p l em e nt al I n fo rm at i on o n H F R O’ s C u r re nt P o r t fo li o, t h e H o l d in g C o m p a ny C o r p o ra te P r o f i l e, a n d t h e C o n ver si on P r o c es s 29

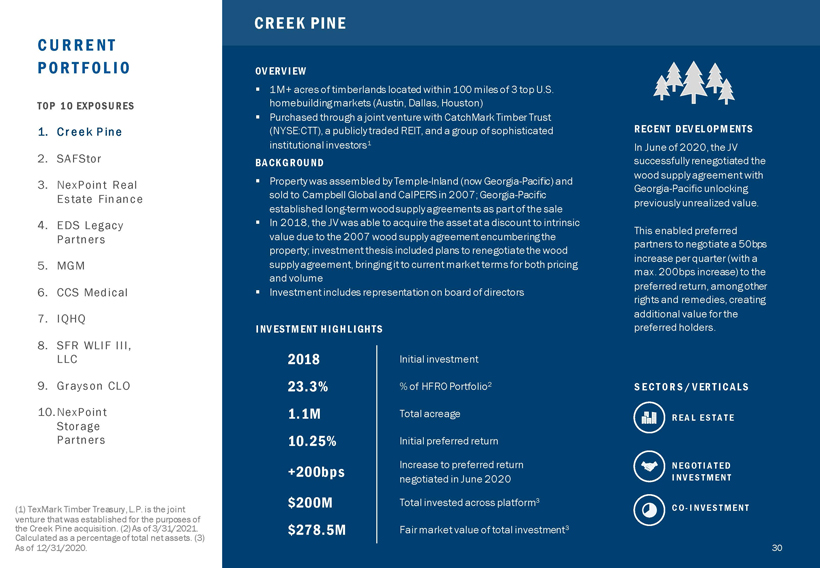

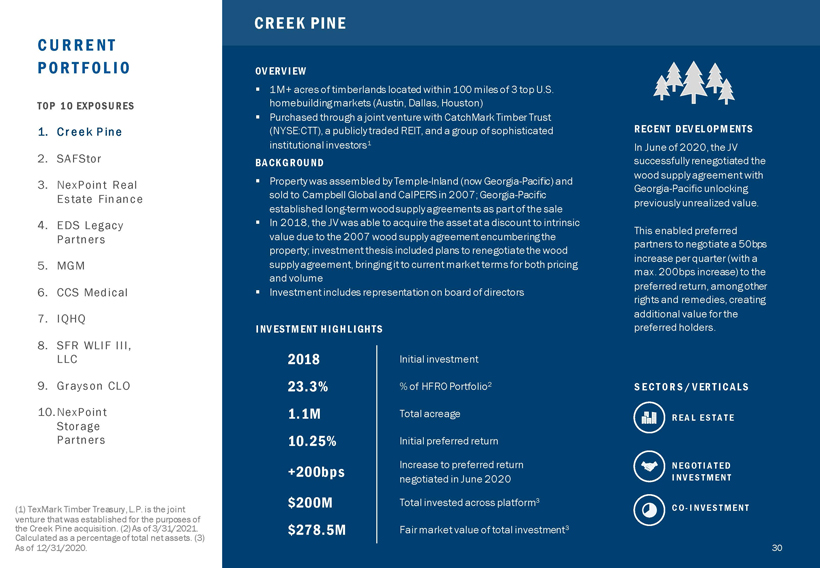

CRE E K PINE CU RRE N T P O R T F O L I O OV ERV IEW ï,§ 1M+ acres of timberlands located within 100 miles of 3 top U.S. TOP 10 EXPOSURES homebuilding markets (Austin, Dallas, Houston)ï,§ Purchased through a joint venture with CatchMark Timber Trust 1. C r eek P ine (NYSE:CTT), a publicly traded REIT, and a group of sophisticated RECENT DEV ELOPMENTS institutional investors1 In June of 2020, the JV 2. SAFStor BACKGROUND successfully renegotiated the wood supply agreement with 3. NexPoint Real ï,§ Property was assembled by Temple-Inland (now Georgia-Pacific) and Georgia-Pacific unlocking Estate Finance sold to Campbell Global and CalPERS in 2007; Georgia-Pacific previously unrealized value. established long-term wood supply agreements as part of the sale 4. EDS Legacy ï,§ In 2018, the JV was able to acquire the asset at a discount to intrinsic This enabled preferred Partners value due to the 2007 wood supply agreement encumbering the partners to negotiate a 50bps property; investment thesis included plans to renegotiate the wood increase per quarter (with a 5. MGM supply agreement, bringing it to current market terms for both pricing max. 200bps increase) to the and volume preferred return, among other 6. CCS Medicalï,§ Investment includes representation on board of directors rights and remedies, creating 7. IQHQ additional value for the INV ESTMENT HIGHLIGHTS preferred holders. 8. SFR WLIF III, LLC 2018 Initial investment 9. Grayson CLO 23.3% % of HFRO Portfolio2 S E CT O RS / V ERT ICALS 10.NexPoint 1.1M Total acreage R EA L E S T A T E Storage Partners 10.25% Initial preferred return +200bps Increase to preferred return N E G O T I A T E D negotiated in June 2020 I N V E S T M E N T $200M Total invested across platform3 (1) TexMark Timber Treasury, L.P. is the joint C O - I N V E S T M E N T venture that was established for the purposes of the Creek Pine acquisition. (2) As of 3/31/2021. $278.5M Fair market value of total investment3 Calculated as a percentage of total net assets. (3) As of 12/31/2020. 30

SAFSTOR CU RRE N T P O R T F O L I O BACKGROUND ï,§ HFRO has invested in 19 individual SAFStor storage properties (as of TOP 10 EXPOSURES 12/31/2020); stabilized cap rates for similar properties average S E CT O RS / V ERT ICALS approximately 5.5%, reflecting the potential for SAFStor properties to 1. Creek Pine see significant increases in value once stabilized 2. S A F Stor R EA L E S T A T E ï,§ We also expect appreciation of the storage portfolio once development is complete 3. NexPoint Real Estate Finance OV ERV IEW SECTOR OUTLOOK 4. EDS Legacy ï,§ Vertically-integrated self-ï,§ 2020 reinforced the view of the self-storage sector as a safe haven, as Partners storage company that owns, self-storage was among the top performing real estate asset classes develops, and redevelops amid the volatility that arose from the COVID-19 pandemic 5. MGM single- and multi-story self-ï,§ We believe self-storage will continue to be viewed as recession resistant storage properties in the due to strong relative performance in previous periods of economic 6. CCS Medical eastern U.S. weakness and volatilityï,§ Company focuses on 7. IQHQ currently undersupplied markets with greater barriers INV ESTMENT HIGHLIGHTS 8. SFR WLIF III, to entry; looks for markets LLC with low delinquency rates, 2019 Initial investment high traffic count, high 9. Grayson CLO % of HFRO Portfolio1 population growth, and 11.5% above average household 10.NexPoint $163M Total invested across platform2 income Storage ï,§ Property management is Partners Weighted average yield on cost for all performed by reputable 8.6% SAFStor properties2 operators such as Extra Space Storage and 5.5% Stabilized cap rates for similar properties2 CubeSmart; prior capital partners include top PE firms 5,100+ Rentable units2 and sovereign wealth and pension funds (1) As of 3/31/2021. Calculated as a percentage of total net assets. (2) As of 12/31/2020. 31

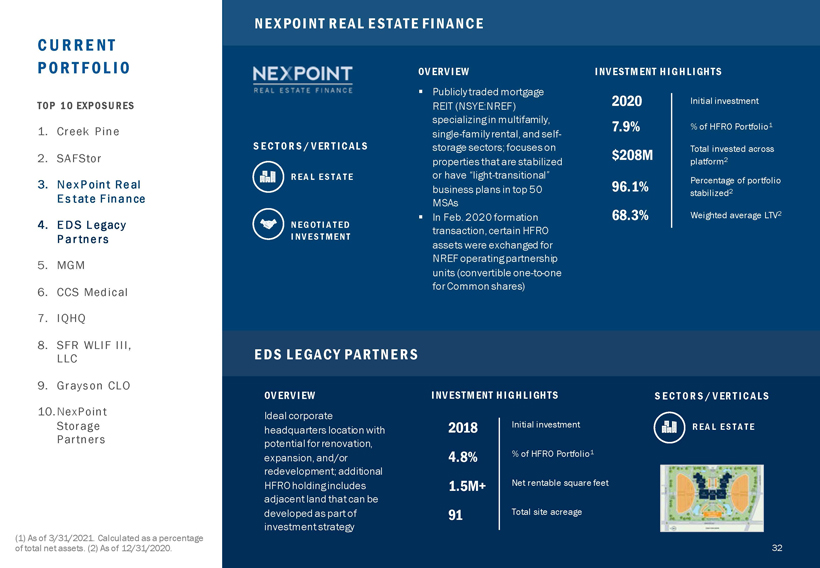

NE X POI NT R E AL E STATE FI NANC E CU RRE N T P O R T F O L I O OV ERV IEW INV ESTMENT HIGHLIGHTS ï,§ Publicly traded mortgage Initial investment TOP 10 EXPOSURES REIT (NSYE:NREF) 2020 specializing in multifamily, 7.9% % of HFRO Portfolio1 1. Creek Pine single-family rental, and self- S E CT O RS / V ERT ICALS storage sectors; focuses on Total invested across 2. SAFStor $208M 2 properties that are stabilized platform R EA L E S T A T E or have “light-transitional” 3. N ex P oint Real 96.1% Percentage of portfolio business plans in top 50 stabilized2 E s tate F inance MSAs ï,§ In Feb. 2020 formation 68.3% Weighted average LTV2 4. E D S L egacy N E G O T I A T E D transaction, certain HFRO P ar tners I N V E S T M E N T assets were exchanged for NREF operating partnership 5. MGM units (convertible one-to-one for Common shares) 6. CCS Medical 7. IQHQ 8. SFR WLIF III, LLC E DS L E GAC Y PAR TNE R S 9. Grayson CLO OV ERV IEW INV ESTMENT HIGHLIGHTS S E CT O RS / V ERT ICALS 10.NexPoint Ideal corporate Storage headquarters location with 2018 Initial investment R EA L E S T A T E Partners potential for renovation, expansion, and/or 4.8% % of HFRO Portfolio1 redevelopment; additional HFRO holding includes 1.5M+ Net rentable square feet adjacent land that can be developed as part of 91 Total site acreage investment strategy (1) As of 3/31/2021. Calculated as a percentage of total net assets. (2) As of 12/31/2020. 32

MG M CU RRE N T P O R T F O L I O OV ERV IEW S E CT O RS / V ERT ICALS TOP 10 EXPOSURESï,§ A leading entertainment company focused on the production and global distribution OP P OR T U NI S T I C 1. Creek Pine of film and television content across all platforms 2. SAFStorï,§ Owns one of the world’s deepest libraries of premium film and television content 3. NexPoint Real Estate Financeï,§ Company has investments in several other television channels, digital platforms, and 4. EDS Legacy interactive ventures Partners BACKGROUND 5. MG Mï,§ Initial investment in debt; received reorg INV ESTMENT HIGHLIGHTS 6. CCS Medical equity when company emerged from bankruptcy in 2010 7. IQHQï,§ Investment includes representation on 2010 Initial investment board of directors 8. SFR WLIF III, 4.8% % of HFRO Portfolio1 LLC RECENT DEV ELOPMENTS 9. Grayson CLO 17,000 Episodes of programming in ï,§ On May 26, 2021, Metro Goldwyn Mayer company’s television content library 10.NexPoint (“MGM”) announced that it had entered Storage into a definitive merger agreement with 4,000 Titles in company’s film content Partners Amazon under which Amazon will acquire library MGM for a purchase price of $8.45 billion Completion of this transaction is subject Value per share at time of initial ï,§ $23.75 to regulatory approvals and other investment customary closing conditions. Accordingly, there can be no assurance that the ~$152 Estimated value per share with $8.45B acquisition2 transaction will be consummated on the (1) As of 3/31/2021. Calculated as a percentage proposed terms or at all. of acquisition total net assets announcement . (2) As of. 5/26/2021 33

CCS ME DICAL CU RRE N T P O R T F O L I O OV ERV IEW S E CT O RS / V ERT ICALS ï,§ Leading national distributor of home TOP 10 EXPOSURES medical equipment and supplies for HE A L T HC A R E patients with chronic conditions, with a 1. Creek Pine focus on diabetes management; well positioned to compete in the rapidly INV ESTMENT HIGHLIGHTS 2. SAFStor growing distribution market for continuous glucose monitoring(CGM) diabetes supplies 2010 Initial investment 3. NexPoint Real and to capitalize on broader trend of Estate Finance healthcare moving to the home 3.9% % of HFRO Portfolio1ï,§ Expansive, diversified payor network covering majority of U.S. lives Patient install base (recurring revenue, cross- 4. EDS Legacy 70,000+ selling opportunities) ï,§ Investment includes representation on Partners board of directors 60% Total U.S. population covered by payor network 5. MGM 6. C C S Medical IQH Q 7. I Q H Q 8. SFR WLIF III, S E CT O RS / OV ERV IEW INV ESTMENT HIGHLIGHTS1 LLC V E R T I C ALS ï,§ Private REIT focused on the 9. Grayson CLO development and management 2019 Initial investment of the growing life science real 10.NexPoint estate sector 3.6% % of HFRO Portfolio1 Storage R EA L E S T A T E ï,§ Targets top life science clusters Partners (markets include Boston, San $100M Total invested Francisco, San Diego, Cambridge across platform2 / London) exhibiting strong rent growth, deep talent pool, and $2.4B Total capital raised2 significant demand with limited available supply ï,§ Investment includes $16.78 NAV per share (initial investment at $15/share)2 representation on board of (1) As of 3/31/2021. Calculated as a percentage directors of total net assets. (2) As of 12/31/2020. 34

SFR WL IF III CU RRE N T P O R T F O L I O OV ERV IEW TOP 10 EXPOSURES Loan originated by Freddie Mac and purchased by HFRO and affiliates; borrower is experienced owner/operator of single- 1. Creek Pine family rental (SFR) homes S E CT O RS / V ERT ICALS 2. SAFStor R EA L E S T A T E 3. NexPoint Real INV ESTMENT BACKGROUND Seller financing on the investment equal to approximately 85% Estate Finance of the loan’s unpaid principal balance; financing provided by Freddie Mac at favorable rates INV ESTMENT HIGHLIGHTS 4. EDS Legacy Partners SECTOR OUTLOOK 5. MGM 2019 Initial investment ï,§ As homeownership has become less attainable for low- to 6. CCS Medical middle-income wage earners, rental homes have become more desirable—especially for families who prefer the 7. IQHQ amenities of a single-family home to those of a multifamily 2.2% % of HFRO Portfolio1 property 8. S F R WLIF III, ï,§ The SFR space is a relatively new asset class, which only L L C Total number of began to get institutional interest in the wake of the global cash-flowing, financial crisis 4,111 stabilized SFR 9. Grayson CLO homes backing loan ï,§ SFR investors have traditionally been “mom and pop” landlords; out of the 16 million SFR households, only 2% of 10.NexPoint homes are owned by institutional investors, creating Storage consolidation opportunities for experienced operators who Partners can achieve scaleï,§ We believe SFR not only has significant growth potential, but we also view it as a sector that can exhibit resiliency, evidenced by its performance during the volatility in markets during 2020 (1) As of 3/31/2021. Calculated as a percentage of total net assets. 35

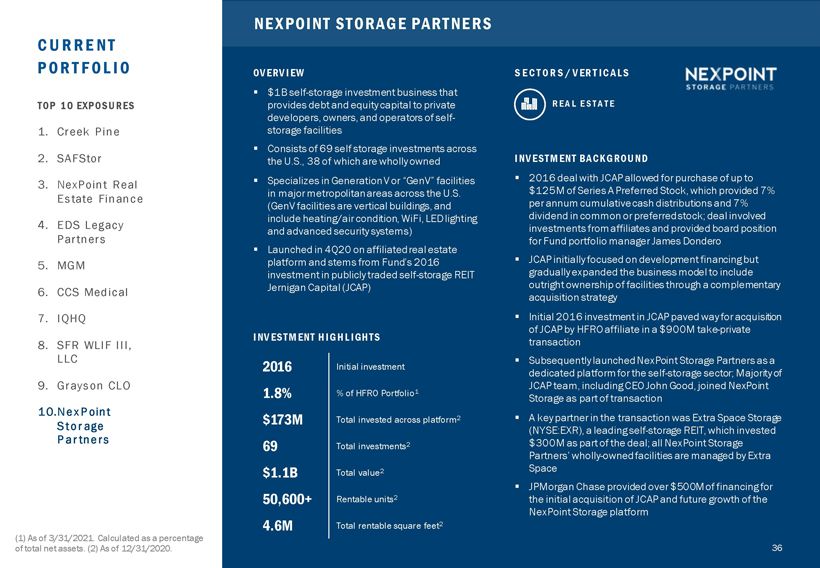

NE X POINT STORAG E PARTNE RS CU RRE N T P O R T F O L I O OV ERV IEW S E CT O RS / V ERT ICALS ï,§ $1B self-storage investment business that TOP 10 EXPOSURES provides debt and equity capital to private R EA L E S T A T E developers, owners, and operators of self- 1. Creek Pine storage facilities ï,§ Consists of 69 self storage investments across 2. SAFStor the U.S., 38 of which are wholly owned INV ESTMENT BACKGROUND ï,§ Specializes in Generation V or “GenV” facilities ï,§ 2016 deal with JCAP allowed for purchase of up to 3. NexPoint Real in major metropolitan areas across the U.S. $125M of Series A Preferred Stock, which provided 7% Estate Finance per annum cumulative cash distributions and 7% (GenV facilities are vertical buildings, and include heating/air condition, WiFi, LED lighting dividend in common or preferred stock; deal involved 4. EDS Legacy investments from affiliates and provided board position and advanced security systems) Partners ï,§ Launched in 4Q20 on affiliated real estate for Fund portfolio manager James Dondero platform and stems from Fund’s 2016 ï,§ JCAP initially focused on development financing but 5. MGM investment in publicly traded self-storage REIT gradually expanded the business model to include Jernigan Capital (JCAP) outright ownership of facilities through a complementary 6. CCS Medical acquisition strategy 7. IQHQï,§ Initial 2016 investment in JCAP paved way for acquisition of JCAP by HFRO affiliate in a $900M take-private INV ESTMENT HIGHLIGHTS transaction 8. SFR WLIF III, LLC ï,§ Subsequently launched NexPoint Storage Partners as a 2016 Initial investment dedicated platform for the self-storage sector; Majority of 9. Grayson CLO JCAP team, including CEO John Good, joined NexPoint 1.8% % of HFRO Portfolio1 Storage as part of transaction 1 0.N ex P oint $173M Total invested across platform2ï,§ A key partner in the transaction was Extra Space Storage S tor age (NYSE:EXR), a leading self-storage REIT, which invested P ar tners $300M as part of the deal; all NexPoint Storage 69 Total investments2 Partners’ wholly-owned facilities are managed by Extra $1.1B Total value2 Space ï,§ JPMorgan Chase provided over $500M of financing for 50,600+ Rentable units2 the initial acquisition of JCAP and future growth of the NexPoint Storage platform 4.6M Total rentable square feet2 (1) As of 3/31/2021. Calculated as a percentage of total net assets. (2) As of 12/31/2020. 36

H OL DI NG C O M P A N Y M A N A G E M E N T T E A M Management team has 25 years average market experience, with significant expertise investing, operating, and profitably exiting control- and minority-investments in private companies JIM DONDERO JOSEPH SOWIN JP SEVILLA FRANK WATERHOUSE President & CEO Co-Chief Investment Officer Co-Chief Investment Officer Chief Financial Officer ï,§ HFRO co-portfolio managerï,§ HFRO co-portfolio managerï,§ Oversees private equity holdings ï,§ Oversees back-office teams ï,§ Oversees platform; serves as across platform across platform including finance,ï,§ Oversees publicly equities across portfolio manager for various platformï,§ Serves as Chairman of the Board accounting, tax, and operations funds and accounts Manages daily operations of Directors of CCS Medical and ï,§ Experience managing back-office ï,§ ï,§ Formed numerous integrated including trading, risk Lake Las Vegas and is a Director operations across the investment businesses over 30+ years to management, and external of Terrestar Corporation. Mr. management industry, covering a own and manage assets across relationships with prime brokers Sevilla was Chairman of range of asset classes (credit, credit, real estate, private equity, and key service providers Cornerstone Healthcare Group equities, alternatives) and other areas until March 2021 and previously ï,§ Serves on the executive and served as a Director of Structural ï,§ Has worked across a range of ï,§ Serves as officer and director for compensation committees and & Steel Products, Inc. public and private fund/vehicle several publicly traded REITs on various investment committees structures, with extensive public NexPoint investment platform across asset classesï,§ Previously practiced law in New company experience board York at Cravath, Swaine & Moore ï,§ Holds positions atï,§ Nonprofit board member for LLP and Shearman & Sterling companies in financial services, Capital For Kids LLP, focusing on mergers & healthcare, real estate, including: acquisitions and leveraged chairman of NexBank Capital, finance transactions for sponsor Inc.; director at NexBank, and strategic clients Texmark Timber Treasury, MGM Holdings, Inc. 37

C ONV E R S I O N T I M E L I N E JUNE 2021 AUGUST 2021 ï,§ Preliminary Proxy Filing ï,§ Special Shareholder June 14 Meeting Record Date August 20 (Anticipated) ï,§ June 14 JULY 2021 2022 ï,§ Definitive Proxy Filing ï,§ Conversion Completed (Anticipated) 2H22 (Anticipated) 38

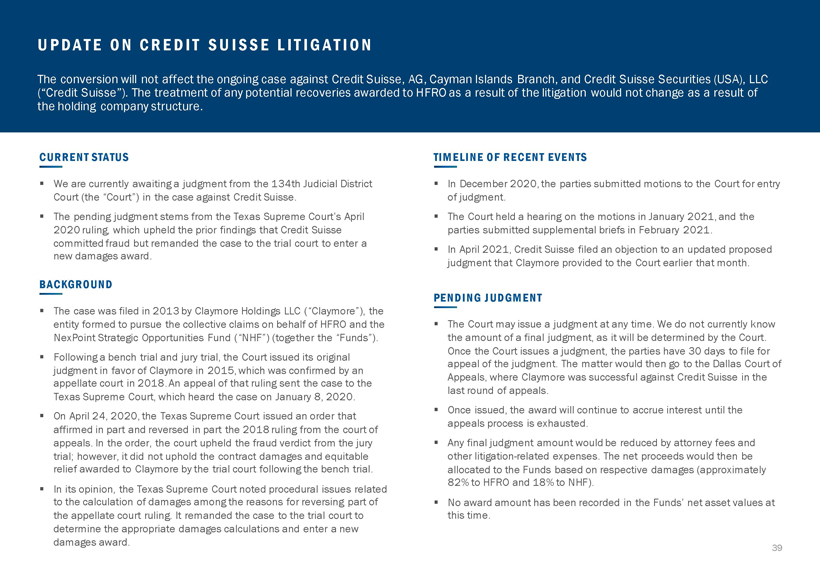

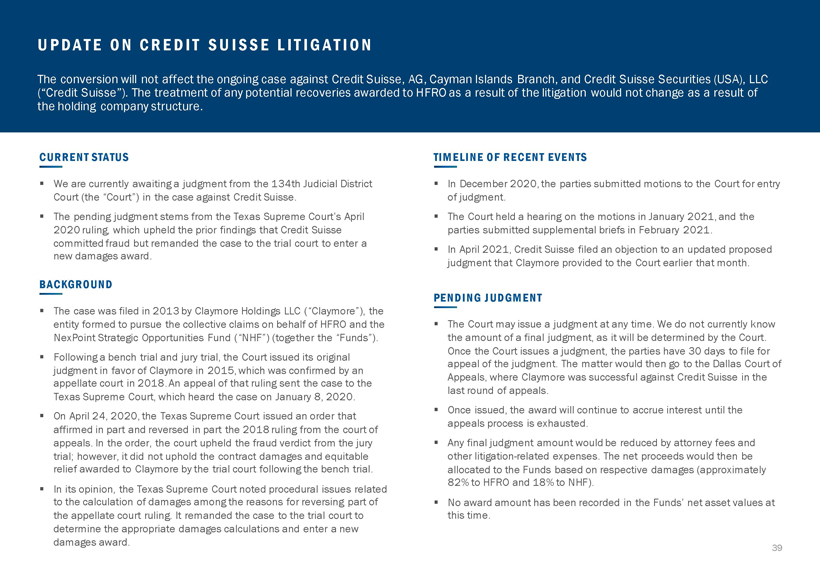

U P D A T E O N C R E D I T S U I S S E L I T I G A T I O N The conversion will not affect the ongoing case against Credit Suisse, AG, Cayman Islands Branch, and Credit Suisse Securities (USA), LLC (“Credit Suisse”). The treatment of any potential recoveries awarded to HFRO as a result of the litigation would not change as a result of the holding company structure. CURRENT STATUS TIMELINE OF RECENT EVENTS ï,§ We are currently awaiting a judgment from the 134th Judicial District ï,§ In December 2020, the parties submitted motions to the Court for entry Court (the “Court”) in the case against Credit Suisse. of judgment. ï,§ The pending judgment stems from the Texas Supreme Court’s April ï,§ The Court held a hearing on the motions in January 2021, and the 2020 ruling, which upheld the prior findings that Credit Suisse parties submitted supplemental briefs in February 2021. committed fraud but remanded the case to the trial court to enter a ï,§ In April 2021, Credit Suisse filed an objection to an updated proposed new damages award. judgment that Claymore provided to the Court earlier that month. BACKGROUND PENDING JUDGMENT ï,§ The case was filed in 2013 by Claymore Holdings LLC (“Claymore”), the entity formed to pursue the collective claims on behalf of HFRO and the ï,§ The Court may issue a judgment at any time. We do not currently know NexPoint Strategic Opportunities Fund (“NHF”) (together the “Funds”). the amount of a final judgment, as it will be determined by the Court. Once the Court issues a judgment, the parties have 30 days to file for ï,§ Following a bench trial and jury trial, the Court issued its original appeal of the judgment. The matter would then go to the Dallas Court of judgment in favor of Claymore in 2015, which was confirmed by an Appeals, where Claymore was successful against Credit Suisse in the appellate court in 2018. An appeal of that ruling sent the case to the last round of appeals. Texas Supreme Court, which heard the case on January 8, 2020. ï,§ Once issued, the award will continue to accrue interest until the ï,§ On April 24, 2020, the Texas Supreme Court issued an order that appeals process is exhausted. affirmed in part and reversed in part the 2018 ruling from the court of appeals. In the order, the court upheld the fraud verdict from the jury ï,§ Any final judgment amount would be reduced by attorney fees and trial; however, it did not uphold the contract damages and equitable other litigation-related expenses. The net proceeds would then be relief awarded to Claymore by the trial court following the bench trial. allocated to the Funds based on respective damages (approximately 82% to HFRO and 18% to NHF). ï,§ In its opinion, the Texas Supreme Court noted procedural issues related to the calculation of damages among the reasons for reversing part of ï,§ No award amount has been recorded in the Funds’ net asset values at the appellate court ruling. It remanded the case to the trial court to this time. determine the appropriate damages calculations and enter a new damages award. 39

V I . R I S K S , D I S C L O S U R E S , A N D N O T E S

RISKS & DISCLOSURES (CONTINUED) Registered investment companies like HFRO are subject to certain risks. Senior Loans Risk. The risk that the issuer of a senior may fail to pay interest or principal when due, and changes in market interest rates may reduce the value of the senior loan or reduce HFRO’s returns. The risks associated with senior loans are similar to the risks of high yield debt securities. Senior loans and other debt securities are also subject to the risk of price declines and to increases in interest rates, particularly long-term rates. Senior loans are also subject to the risk that, as interest rates rise, the cost of borrowing increases, which may increase the risk of default. In addition, the interest rates of floating rate loans typically only adjust to changes in short-term interest rates; long-term interest rates can vary dramatically from short-term interest rates. Therefore, senior loans may not mitigate price declines in a long-term interest rate environment. HFRO’s investments in senior loans are typically below investment grade and are considered speculative because of the credit risk of their issuers. Industry Concentration Risk. HFRO must invest at least 25% of the value of its total assets at the time of purchase in securities of issuers conducting their principal business activities in the real estate industry. HFRO may be subject to greater market fluctuations than a fund that does not concentrate its investments in a particular industry. Financial, economic, business, and other developments affecting issuers in the real estate industry will have a greater effect on HFRO, and if securities of the real estate industry fall out of favor, HFRO could underperform, or its NAV may be more volatile than, funds that have greater industry diversification. Interest Rate Risk. The risk that debt securities, and HFRO’s net assets, may decline in value because of changes in interest rates. Generally, debt securities will decrease in value when interest rates rise and increase in value when interest rates decline. Credit Risk. The risk that HFRO could lose money if the issuer or guarantor of a fixed income security, or the counterparty of a derivatives contract or repurchase agreement, is unable or unwilling (or is perceived to be unable or unwilling) to make a timely payment of principal and/or interest, or to otherwise honor its obligations. Leverage Risk. Leverage may increase the risk of loss, cause fluctuations in the market value of HFRO’s portfolio to have disproportionately large effects or cause our NAV to decline faster than it would otherwise. Real Estate Market Risk. HFRO is exposed to economic, market and regulatory changes that impact the real estate market generally and through its investment in NFRO REIT Sub, LLC (the “REIT Subsidiary”), which may cause HFRO’s operating results to suffer. A number of factors may prevent the REIT Subsidiary’s properties and other real estate-related investments from generating sufficient net cash flow or may adversely affect their value, or both, resulting in less cash available for distribution, or a loss, to us. These factors include: national, regional and local economic conditions; changing demographics; the ability of property managers to provide capable management and adequate maintenance; the quality of a property’s construction and design; increases in costs of maintenance, insurance, and operations (including energy costs and real estate taxes); potential environmental and other legal liabilities; the level of financing used by the REIT Subsidiary and the availability and cost of refinancing; potential instability, default or bankruptcy of tenants in the properties owned by the REIT Subsidiary; the relative illiquidity of real estate investments in general, which may make it difficult to sell a property at an attractive price or within a reasonable time frame. The full extent of the impact and effects of the recent outbreak of COVID-19 on the future financial performance of HFRO, and specifically, on its investments and tenants to properties held by its REIT Subsidiary, are uncertain at this time. The outbreak could have a continued adverse impact on economic and market conditions and trigger a period of global economic slowdown. Pandemics and Associated Economic Disruption. An outbreak of respiratory disease caused by a novel coronavirus was first detected in China in December 2019 and subsequently spread internationally. This coronavirus has resulted in the closing of borders, enhanced health screenings, healthcare service preparation and delivery, quarantines, cancellations, disruptions to supply chains and customer activity, as well as general anxiety and economic uncertainty. It is not known how long any negative impacts, or any future impacts of other significant events such as a substantial economic downturn, will last.

Health crises caused by outbreaks of disease, such as the coronavirus, may exacerbate other preexisting political, social and economic risks. This outbreak, and other epidemics and pandemics that may arise in the future, could negatively affect the global economy, as well as the economies of individual countries, individual companies and the market in general in significant and unforeseen ways. For example, a widespread health crisis such as a global pandemic could cause substantial market volatility, exchange trading suspensions and closures, which could adversely affect HFRO’s performance, the performance of the securities in which HFRO invests, lines of credit available to HFRO and may lead to losses on your investment in HFRO. In addition, the increasing interconnectedness of markets around the world may result in many markets being affected by events or conditions in a single country or region or events affecting a single or small number of issuers. In addition, we will be exposed to certain risks related to the implementation of the Conversion Proposal and the deregistration process. HFRO will remain subject to certain contractual limitations on leverage, asset coverage requirements and other restrictions similar to those imposed by the 1940 Act until the terms of HFRO’s outstanding preferred shares are amended or the preferred shares are redeemed, which may not occur until September 30, 2024. 42

RISKS & DISCLOSURES (CONTINUED) Portfolio Transition Risk. During the conversion period, we will be required to transition a material portion of our assets to ensure a non-investment company portfolio. Delays in the Deregistration Process. Any delay in receiving the Deregistration Order may delay our ability to operate like a typical diversified holding company not subject to the 1940 Act. In addition to the foregoing, we will be exposed to additional risks as a diversified holding company if the Conversion Proposal is implemented. Concentration and Illiquidity Risk. Our investments in our subsidiaries and future acquisition opportunities may be concentrated in a limited number of companies and may have limited liquidity. Management and Key Personnel Risk. Our future success is dependent on our management team and the management teams of our subsidiaries, the loss of any of whom could materially adversely affect our financial condition, business and results of operations. Acquisition Risk. Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect HFRO’s profitability. Future Opportunities Risk. We may not be able to successfully fund future acquisitions of new businesses due to the lack of availability of debt or equity financing at the HFRO level on acceptable terms, which could impede the implementation of our acquisition strategy and materially adversely impact our financial condition, business and results of operations. Sector Risks. To the extent that we and our subsidiaries operate in the financial services, real estate and healthcare industries, we and our subsidiaries will be exposed to certain risks unique to each of those sectors and risks associate with any other sectors in which we or our subsidiaries may operate. Capital Loss Carryforwards Risk. There can be no assurances that we will be able to use our accumulated capital loss carryforwards. Investment Securities Risks. We may continue to hold a portion of our assets in investment securities, which would expose HFRO to all of the risk traditionally associated with such investments, including total loss of investment. Conflicts of Interest. Substantial conflicts of interest may arise from our current and historical relationships with the Adviser and its affiliates. 43