Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under§240.14a-12 | |

KRYSTAL BIOTECH, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

April 15, 2019

Dear Fellow Stockholders:

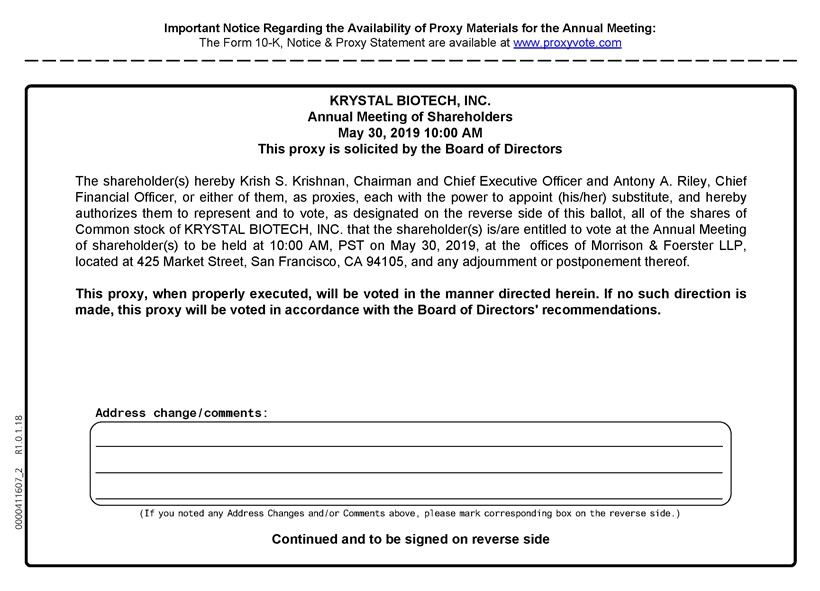

You are cordially invited to attend the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Krystal Biotech, Inc., which will be held at the offices of Morrison & Foerster LLP, located at 425 Market Street, San Francisco, California 94105, on May 30, 2019, at 10:00 a.m. Pacific Time.

The matters expected to be acted upon at the meeting are described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

In accordance with U.S. Securities and Exchange Commission rules, we are using the Internet as our primary means of furnishing proxy materials to our stockholders. Because we are using the Internet, most stockholders will not receive paper copies of our proxy materials. We will instead send our stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. This notice also provides information on how our stockholders may obtain paper copies of our proxy materials if they so choose. We believe the use of the Internet makes the proxy distribution process more efficient and less costly, and helps in conserving natural resources.

The Proxy Statement, the accompanying form of proxy card, the Notice of Annual Meeting of Stockholders and our Annual Report on Form10-K for the fiscal year ended December 31, 2018 are available at http://www.proxyvote.com and may also be accessed through our website atwww.krystalbio.com under the “SEC Filings” section of the “Investors” page. If you would like to receive a paper ore-mail copy of these documents, you must request one. There is no charge to you for requesting a copy.

Your vote is important. Please cast your vote as soon as possible over the Internet, by telephone, or by completing and returning the proxy card to ensure that your shares are represented. Your vote by written proxy will ensure your representation at the Annual Meeting regardless of whether or not you attend in person. Returning the proxy does not deprive you of your right to attend the Annual Meeting and to vote your shares in person.

On behalf of our Board of Directors and our employees, we thank you for your continued interest in and support of our company. We look forward to seeing you on May 30, 2019.

Sincerely,

Krish S. Krishnan

Chairman and Chief Executive Officer

Table of Contents

KRYSTAL BIOTECH, INC.

2100 Wharton Street, Suite 701

Pittsburgh, Pennsylvania 15203

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 30, 2019

NOTICE IS HEREBY GIVEN that the 2019 Annual Meeting of Stockholders (the “Annual Meeting”) of Krystal Biotech, Inc. (the “Company”) will be held at the offices of Morrison & Foerster LLP, located at 425 Market Street, San Francisco, California 94105, on May 30, 2019, at 10:00 a.m. Pacific Time, for the following purposes:

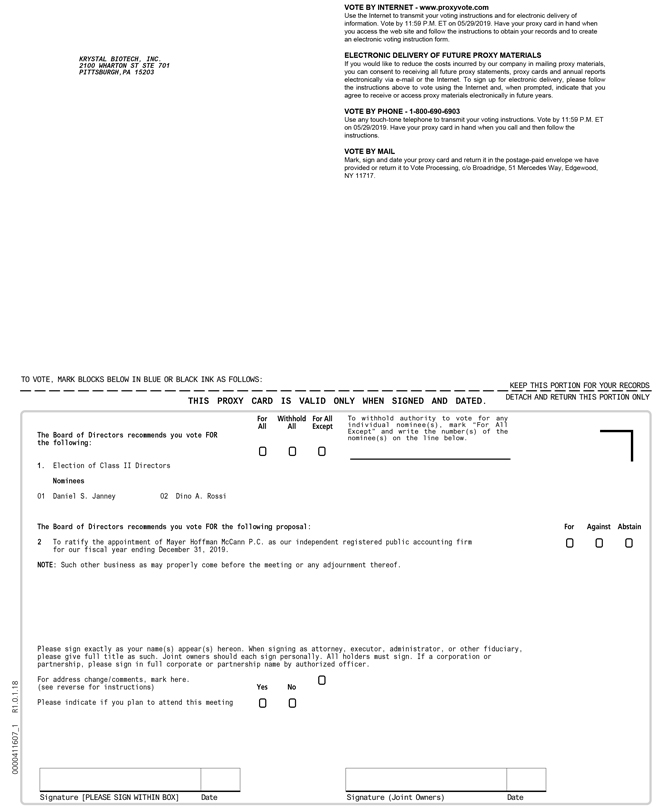

(1) to elect the two Class II director nominees named in the Proxy Statement;

(2) to ratify the appointment of Mayer Hoffman McCann P.C. as our independent registered public accounting firm for our fiscal year ending December 31, 2019; and

(3) to transact such other business as may properly come before the Annual Meeting or any adjournment(s) or postponement(s) of the Annual Meeting.

The Proxy Statement accompanying this notice describes each of these items of business in detail. The Board of Directors has fixed the close of business on April 2, 2019 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting. Accordingly, only stockholders of record at the close of business on April 2, 2019 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the Annual Meeting.

Your vote is important. Whether or not you expect to attend the meeting, please vote via the Internet, by telephone, or complete, date, sign and promptly return the proxy card so that your shares may be represented at the meeting.

By Order of the Board of Directors,

Krish S. Krishnan

Chairman and Chief Executive Officer

Pittsburgh, Pennsylvania

April 15, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 30, 2019.

This Notice of Annual Meeting of Stockholders, the Proxy Statement, accompanying form of proxy card and our Annual Report on Form10-K for the fiscal year ended December 31, 2018 are available at www.proxyvote.com.

Table of Contents

| Page | ||||

| 1 | ||||

| 6 | ||||

| 6 | ||||

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | 9 | |||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

Outstanding Equity Awards at FiscalYear-End December 31, 2018 | 19 | |||

| 19 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

Stockholders Proposals and Nominations for the 2018 Annual Meeting | 25 | |||

| 25 | ||||

Table of Contents

KRYSTAL BIOTECH, INC.

2100 Wharton Street, Suite 701

Pittsburgh, Pennsylvania 15203

PROXY STATEMENT

Why am I receiving this Proxy Statement?

This Proxy Statement (this “Proxy Statement”) contains information related to the solicitation of proxies for use at our 2019 Annual Meeting of Stockholders (the “Annual Meeting”), to be held at the offices of Morrison & Foerster LLP, located at 425 Market Street, San Francisco, California 94105, on May 30, 2019, at 10:00 a.m. Pacific Time, for the purposes stated in the accompanying Notice of Annual Meeting of Stockholders. This solicitation is made by Krystal Biotech, Inc. on behalf of our Board of Directors (also referred to as the “Board” in this Proxy Statement). “We,” “our,” “us,” “Krystal,” and the “Company” refer to Krystal Biotech, Inc.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending to our stockholders of record as of the close of business on April 2, 2019, the record date for the Annual Meeting (the “Record Date”), a Notice of Internet Availability of Proxy Materials (the “Notice”) relating to our Annual Meeting of Stockholders. All stockholders of record will have the ability to access the proxy materials on the website referred to in the Notice or to request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. On or about April 15, 2019, we intend to make this Proxy Statement and accompanying form of proxy card available on the Internet and to mail the Notice to all stockholders entitled to vote at the Annual Meeting. We intend to mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials, within three business days of such request.

The Notice, this Proxy Statement, accompanying form of proxy card and our Annual Report on Form10-K for the fiscal year ended December 31, 2018 are available at http://www.proxyvote.com. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

What am I being asked to vote on?

You are being asked to vote on the following proposals:

| • | Proposal 1 (Election of Class II Directors): The election of the two Class II director nominees named in this Proxy Statement, each for a three-year term expiring at the 2022 annual meeting of stockholders (the “2022 Annual Meeting”); |

| • | Proposal 2 (Ratification of Mayer Hoffman McCann P.C.): The ratification of Mayer Hoffman McCann P.C. (“Mayer Hoffman”) as our independent registered public accounting firm for our fiscal year ending December 31, 2019; and |

| • | To transact any other business that may properly come before the Annual Meeting or any adjournment(s) or postponements of the Annual Meeting. |

What are the Board’s voting recommendations?

The Board recommends that you vote as follows:

| • | Proposal 1 (Election of Class II Directors): “FOR” each of the Board nominees for election as directors; and |

| • | Proposal 2 (Ratification of Mayer Hoffman McCann P.C.): “FOR” the ratification of Mayer Hoffman as our independent registered public accounting firm for our fiscal year ending December 31, 2019. |

1

Table of Contents

Who is entitled to vote at the Annual Meeting?

Only holders of record of our common stock, par value $0.00001 per share (our “Common Stock”), at the close of business on April 2, 2019, which is the Record Date, are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting. Our Common Stock constitutes the only class of securities entitled to vote at the Annual Meeting.

What are the voting rights of stockholders?

Each share of our Common Stock outstanding on the Record Date entitles its holder to cast one vote on each matter to be voted on.

Who can attend the Annual Meeting?

All holders of our Common Stock as of the Record Date (the close of business on April 2, 2019), or their duly appointed proxies, are authorized to attend the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

| • | Stockholder of record. If your shares are registered directly in your name with our transfer agent, Computershare, you are considered the stockholder of record of those shares and the Notice is being sent directly to you by us. |

| • | Beneficial owner of shares held in street name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice is being forwarded to you by your broker or nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker how to vote your shares and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the organization that holds your shares. |

What will constitute a quorum at the Annual Meeting?

The presence at the meeting, in person or by proxy, of the holders of a majority of our Common Stock outstanding on the Record Date (the close of business on April 2, 2019) will constitute a quorum, permitting our stockholders to conduct business at the meeting. We will include abstentions and brokernon-votes in the calculation of the number of shares considered to be present at the meeting for purposes of determining the presence of a quorum at the meeting. As of the Record Date, there were 14,443,569 shares of our Common Stock outstanding.

If a quorum is not present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit solicitation of additional proxies. The chairperson of the Annual Meeting shall have the power to adjourn the Annual Meeting.

What are brokernon-votes?

Brokernon-votes occur when nominees, such as banks and brokers holding shares on behalf of beneficial owners, do not receive voting instructions from the beneficial owners at least ten days before the Annual Meeting. If that happens, the nominees may vote those shares only on matters deemed “routine” by the New York Stock Exchange (the “NYSE”). Onnon-routine matters, nominees cannot vote without instructions from the beneficial owner, resulting in aso-called “brokernon-vote.”

2

Table of Contents

Proposal 2 (ratification of Mayer Hoffman) is the only proposal that is considered “routine” under the NYSE rules. If you are a beneficial owner and your shares are held in the name of a broker or other nominee, the broker or other nominee is permitted to vote your shares on the ratification of the appointment of Mayer Hoffman as our independent registered public accounting firm for our fiscal year ending December 31, 2019, even if the broker or other nominee does not receive voting instructions from you.

Under Nasdaq rules, Proposal 1 (Election of Class II Directors) is considered a“non-routine” proposal. Consequently, if you do not give your broker or other nominee voting instructions, your broker or other nominee will not be able to vote on this proposal, and brokernon-votes may exist with respect to the election of directors.

How many votes are needed for the proposals to pass?

The proposals to be voted on at the Annual Meeting have the following voting requirements:

| • | Proposal 1 (Election of Class II Directors): Directors are elected by plurality vote. There is no cumulative voting in the election of directors. Therefore, the two director nominees receiving the highest number of “FOR” votes will be elected. For purposes of the election of directors, abstentions and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. |

| • | Proposal 2 (Ratification of Mayer Hoffman): The affirmative vote of a majority of the votes cast once a quorum has been established is required to ratify the appointment of Mayer Hoffman as our independent registered public accounting firm for our fiscal year ending December 31, 2019. For purposes of the vote on the ratification of Mayer Hoffman as our independent registered public accounting firm, abstentions will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. |

Will any other matters be voted on?

As of the date of this Proxy Statement, we are not aware of any matters that will come before the Annual Meeting other than those disclosed in this Proxy Statement. If any other matters are properly brought before the Annual Meeting, the persons named in the accompanying proxy card will vote the shares represented by the proxies on the other matters in the manner recommended by the Board, or, if no such recommendation is given, in the discretion of the proxy holders.

How do I vote?

If you are a registered stockholder as of the Record Date, you may submit your proxy by U.S. mail, Internet or telephone by following the instructions in the Notice. If you requested a paper copy of the proxy materials, you also may submit your completed proxy card by mail by following the instructions included with your proxy card. The deadline for submitting your vote by Internet or telephone is 11:59 a.m. Eastern Time on the day before the date of the Annual Meeting. The designated proxy holders named in the proxy card will vote according to your instructions. You may also attend the Annual Meeting and vote in person.

If you are a street name or beneficial stockholder because your shares are held in a brokerage account or by a bank or other nominee, your broker or nominee firm will provide you with the Notice. Follow the instructions on the Notice to access our proxy materials and vote by Internet or to request a paper or email copy of our proxy materials. If you receive these materials in paper form, the materials include a voting instruction card so that you can instruct your broker or nominee how to vote your shares.

If you sign and submit your proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Board’s recommendations specified above under “What are the Board’s voting recommendations?” and in accordance with the discretion of the proxy holders with respect to any other matters that may be voted upon at the Annual Meeting.

3

Table of Contents

If I plan to attend the Annual Meeting, should I still vote by proxy?

Yes. Voting in advance does not affect your right to attend the Annual Meeting. If you send in your proxy card and also attend the Annual Meeting, you do not need to vote again at the Annual Meeting unless you want to change your vote. Written ballots will be available at the meeting for stockholders of record. Beneficial owners of shares held in street name who wish to vote in person at the Annual Meeting must request a legal proxy from the organization that holds their shares and bring that legal proxy to the Annual Meeting.

How are proxy card votes counted?

If the proxy card is properly signed and returned to us, and not subsequently revoked, it will be voted as directed by you. Unless contrary instructions are given, the persons designated as proxy holders on the proxy card will vote: “FOR” the election of all nominees for the Board named in this Proxy Statement; “FOR” the ratification of the appointment of Mayer Hoffman as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and as recommended by the Board with regard to any other matters that may properly come before the Annual Meeting, or, if no such recommendation is given, in their own discretion.

May I revoke my vote after I return my proxy card?

Yes. You may revoke a previously granted proxy and change your vote at any time before the taking of the vote at the Annual Meeting by (i) filing with our Secretary a written notice of revocation or a duly executed proxy bearing a later date or (ii) attending the Annual Meeting and voting in person.

Who pays the costs of soliciting proxies?

We will pay the costs of soliciting proxies, including preparation and mailing of the Notice, preparation and assembly of this Proxy Statement, the proxy card and the Annual Report to Stockholders/Form10-K for the fiscal year ended December 31, 2018, coordination of the Internet and telephone voting process, and any additional information furnished to you by the Company. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our Common Stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of shares of our Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by Internet and mail may be supplemented by telephone, facsimile, or personal solicitation by our directors, officers or other regular employees.

What are the implications of being an “emerging growth company”?

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act, enacted on April 5, 2012 (the “JOBS Act”). For as long as we are an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding stockholder advisory“say-on-pay” votes on executive compensation and stockholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

| • | the last day of the fiscal year during which we have total annual gross revenues of $1.07 billion or more; |

| • | the last day of the fiscal year following the fifth anniversary of our initial public offering; |

| • | the date on which we have, during the previous three-year period, issued more than $1 billion innon-convertible debt; and |

4

Table of Contents

| • | the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter). |

You should rely only on the information provided in this Proxy Statement. We have not authorized anyone to provide you with different or additional information. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

5

Table of Contents

PROPOSAL 1: ELECTION OF CLASS II DIRECTORS

Our Board of Directors is divided into three classes of directors, each serving staggered three-year terms. The Board is currently comprised of seven directors, two of whom have terms expiring at the Annual Meeting. The nominees, each of whom is currently serving as a Class II director, have been recommended by the Board forre-election to serve as directors for three-year terms until the 2022 Annual Meeting and until their successors are duly elected and qualify.

The Board knows of no reason why either nominee would be unable to serve as a director. If either nominee is unavailable for election or service, the Board may designate a substitute nominee and the persons designated as proxy holders on the proxy card will vote for the substitute nominee recommended by the Board. Under these circumstances, the Board may also, as permitted by our bylaws, decrease the size of the Board.

Nominees for Election for a Three-Year Term Expiring at the 2022 Annual Meeting

The following table sets forth the name and age of each nominee for director, indicating all positions and offices with us currently held by the director.

Name | Age(1) | Title | Director Since | |||

Daniel S. Janney | 53 | Independent Director | 2017 | |||

Dino A. Rossi | 64 | Independent Director | 2017 |

| (1) | Age as of April 15, 2019. |

Set forth below are descriptions of the backgrounds and principal occupations of each of Mr. Janney and Mr. Rossi, and the period during which she or he has served as a director.

Daniel S. Janney. Daniel S. Janney has served as a member of our board of directors since November 2016, and is chairman of the Compensation Committee and a member of the Audit Committee. Mr. Janney is a Managing Director at Alta Partners, a life sciences venture capital firm, which he joined in 1996. Prior to joining Alta, from 1993 to 1996, he was a Vice President in Montgomery Securities’ healthcare and biotechnology investment banking group, focusing on life sciences companies. Mr. Janney is a director of a number of companies including Esperion Therapeutics (Nasdaq:ESPR), Prolacta Bioscience, Inc., Sutro Biopharma and Viveve Medical, Inc. (Nasdaq:VIVE). He holds a Bachelor of Arts in History from Georgetown University and an M.B.A. from the Anderson School of Management at the University of California, Los Angeles. We believe Mr. Janney’s experience working with and serving on the boards of directors of life sciences companies and his experience working in the venture capital industry with a focus on the life sciences industry qualifies him to serve as a member of our Board.

Dino A. Rossi. Dino A. Rossi has served as a member of our board of directors since June 2017, and is a member of the Audit Committee, Compensation Committee and Chairman of our Nominating and Corporate Governance Committee. Mr. Rossi was previously employed by Balchem Corporation (Nasdaq: BCPC), where he served as Chief Executive Officer and President from October 1997 to April 2015, Chief Financial Officer from April 1996 to January 2004 and Treasurer from June 1996 to June 2003, as well as Executive Chairman from September 2015 to December 2016. He has also previously served as Vice President, Finance & Administration of Norit Americas Inc., a wholly owned subsidiary of Norit N.V. and Vice President, finance and Administration of Oakite Products Inc. Mr. Rossi is currently on the board of directors of Chroma Color Concentrates. He also previously served on the boards of Elite Comfort Solutions from January 2017 to January 2019 and of Scientific Learning Corp from February 2010 to December 2011. Mr. Rossi holds a BS in Accounting from West Virginia University. We believe that Mr. Rossi’s extensive leadership experience as an executive officer of a publicly traded company, as well as his financial expertise, qualifies him to serve as a member of our Board.

6

Table of Contents

Vote Required and Recommendation

Directors are elected by plurality vote. For purposes of the vote on this proposal, abstentions and brokernon-votes will not be counted as votes cast and will have no effect on the result of the vote.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NOMINEES SET FORTH ABOVE.

Continuing Directors

Class III Directors with Terms Expiring at the 2020 Annual Meeting of Stockholders

Krish S. Krishnan. Krish S. Krishnan has served as our President and Chief Executive Officer and Chairman of our board of directors since our inception. Mr. Krishnan previously served as Chief Operating Officer of Intrexon Corporation (NYSE: XON) from 2011 to 2016, and as Chief Executive Officer and President of Pinnacle Pharmaceuticals, Inc. from 2009 to 2011. He also served as Chief Financial Officer and Chief Operating Officer of New River Pharmaceuticals, Inc. from 2004 to 2007 (previously listed on Nasdaq prior to its acquisition by Shire plc in 2007), and was a member of its board of directors from 2003 until 2007. He served as a Senior Managing Director of Third Security, LLC between 2001 and 2008 and as a board member of Biotie Therapies Oyj (BTH1V:Helsinki) between 2008 and 2009. He served as Managing Principal at Ariba before joining Third Security and also served with the management consulting firm A.T. Kearney, where he advised Fortune 50 companies on business strategy. Mr. Krishnan started his career as an engineer with E.I. Dupont de Nemours in Wilmington, Delaware. He received a B.S. in Mechanical Engineering from the Indian Institute of Technology, an M.S. in Engineering from the University of Toledo, and an M.B.A. in Finance from The Wharton School at the University of Pennsylvania.

Kirti Ganorkar. Kirti Ganorkar has served as a member of our board of directors since September 2017. Mr. Ganorkar is currently the Executive Vice President of Sun Pharmaceutical Industries Ltd, a multinational pharmaceutical company and the largest pharmaceutical company headquartered in India. Mr. Ganorkar joined Sun Pharma in 1996 and has worked in a number of roles during his time there, most recently as head of Global Business Development & Portfolio Management. Prior to Sun Pharma, Mr. Ganorkar worked for German Remedies as a senior product manager, and with Rallis India Ltd. and Sudarshan Chemical Industries prior to that. Mr. Ganorkar has a Bachelor of Technology degree in chemical engineering from Nagpur University and an MBA in marketing management from Poona University.

Class I Directors with Terms Expiring at the 2021 Annual Meeting of Stockholders

Suma M. Krishnan. Suma M. Krishnan is our founder and has served as our Chief Operating Officer and director of us and our predecessor limited liability company since inception. Ms. Krishnan has over two decades of experience in drug development. She previously served as Senior Vice President and head of the Human Therapeutics Division, as well as Senior Vice President of Regulatory Affairs at Intrexon Corporation (NYSE: XON) from 2012 to 2016. She previously served as Senior Vice President, Product Development at Pinnacle Pharmaceuticals, Inc. from 2009 to 2011. Ms. Krishnan served as Vice President, Product Development at New River Pharmaceuticals, Inc. from 2002 until 2007 (previously listed on Nasdaq prior to its acquisition by Shire plc in 2007). Prior to serving at New River Pharmaceuticals, Inc., Ms. Krishnan served in the following capacities: Director, Regulatory Affairs at Shire plc; Senior Project Manager at Pfizer, Inc. (NYSE: PFE), a multi-national pharmaceutical company; and a consultant at the Weinberg Group, a pharmaceutical and environmental consulting firm. Ms. Krishnan began her career as a discovery scientist for Janssen Pharmaceuticals, Inc., a subsidiary of Johnson & Johnson (NYSE: JNJ), in May 1991. Ms. Krishnan received an M.S. in Organic Chemistry from Villanova University, an M.B.A. from Institute of Management and Research (India) and an undergraduate degree in Organic Chemistry from Ferguson University (India).

Julian Gangolli. Julian Gangolli has served as a member of our Board of Directors since March 2019, and serves on the Nominating and Corporate Governance Committee. He is currently President, North America of

7

Table of Contents

Greenwich Biosciences, a GW Pharmaceuticals PLC Company. Mr. Gangolli is responsible for building out the US commercial infrastructure and spearheading the launch of its lead therapeutic product Epidiolex®, which is indicated for the treatment of two orphan epilepsy indications, Dravet Syndrome and Lennox Gastaut Syndrome. Epidiolex launched in the US in November of 2018. Prior to joining GW Pharmaceuticals, Mr. Gangolli served as President of the North American Pharmaceutical division of Allergan, Inc. for 11 years and was a member of the Executive Committee of Allergan, where he was responsible for a1,400-person commercial operation with sales exceeding $3.8 billion in 2014. Previously, he served as Senior Vice President, US Eye Care at Allergan, during a period in which this division launched eight new products, helping to drive growth at more than 20% annually over a five-year period. Prior to Allergan, Mr. Gangolli served as Vice President, Sales and Marketing at VIVUS, Inc., where he facilitated the successful transition of the company from a research and developmentstart-up into a niche pharmaceutical company. Before VIVUS, Mr. Gangolli served in a number of increasingly senior marketing roles at Syntex Pharmaceuticals, Inc., and Ortho-Cilag Pharmaceuticals Ltd in the UK. Mr. Gangolli received a BSc (Honors) degree in Applied Chemistry and Business Studies from Kingston University in England.

R. Douglas Norby. R. Douglas Norby has served as a director of us and our predecessor limited liability company since January 2017, and is Chairman of the Audit Committee and a member of the Compensation Committee and the Nominating and Corporate Governance Committee. He previously served as lead independent director on the board of directors of Alexion Pharmaceuticals, Inc. (Nasdaq: ALXN), where he was a board member from September 1999 to September 2017. Mr. Norby has held positions of responsibility at many companies, including serving as Senior Vice President and Chief Financial Officer of Tessera, Inc., a provider of intellectual property for advanced semiconductor packaging; and as Senior Vice President and Chief Financial Officer of Zambeel, Inc., a data storage systems company. Mr. Norby has also served as Senior Vice President and Chief Financial Officer of Novalux, Inc., a manufacturer of lasers for optical networks; as Executive Vice President and Chief Financial Officer of LSI Logic Corporation, a semiconductor company which was acquired by Avago Technologies in 2013; as Senior Vice President and Chief Financial Officer of Mentor Graphics Corporation, a software company; and as President and Chief Operating Officer at Lucasfilm, Ltd., an entertainment company. His pharmaceutical experience includes serving as President of Pharmetrix Corporation, a drug delivery company, as Senior Vice President and Chief Financial Officer of Syntex Corporation, a pharmaceutical company, which was later acquired by Roche Holding Ltd., and as Vice President and member of the Board of Directors of Recordati S.p.A., a public Italian pharmaceutical company headquartered in Milan and the parent company of Pharmetrics. Mr. Norby received a bachelor’s degree in Economics from Harvard University and an MBA from Harvard Business School. We believe that Mr. Norby’s extensive experience in the pharmaceutical industry as both an executive officer and a director qualifies him to serve as a member of our Board.

8

Table of Contents

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board, which is composed entirely of independent directors, has appointed Mayer Hoffman as our independent registered public accounting firm for the fiscal year ending December 31, 2019. After careful consideration of the matter and in recognition of the importance of this matter to our stockholders, the Board has determined that it is in the best interests of the Company and our stockholders to seek the ratification by our stockholders of our Audit Committee’s selection of our independent registered public accounting firm.

Vote Required and Recommendation

The affirmative vote of the holders of a majority of all the votes cast at the Annual Meeting with respect to the matter is necessary for the approval of the ratification of the appointment of Mayer Hoffman as our independent registered public accounting firm. For purposes of vote on this proposal, abstentions will not be counted as votes cast and will have no effect on the result of the vote. Even if the appointment of Mayer Hoffman as our independent registered public accounting firm is ratified, the Audit Committee may, in its discretion, change that appointment at any time during the year should it determine such a change would be in our and our stockholders’ best interests. In the event that the appointment of Mayer Hoffman is not ratified, the Audit Committee will consider the appointment of another independent registered public accounting firm, but will not be required to appoint a different firm.

THE BOARD RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF MAYER HOFFMAN AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2019.

Audit andNon-Audit Fees for 2018 and 2017

Our consolidated financial statements for the fiscal years ended December 31, 2018 and December 31, 2017, respectively, have been audited by Mayer Hoffman, which served as our independent registered public accounting firm for those years.

The following summarizes the fees billed by Mayer Hoffman, our independent registered public accounting firm, for services performed for the Company for the fiscal years ended December 31, 2018 and December 31, 2017, respectively.

| Year Ended December 31, 2018 | Year Ended December 31, 2017 | |||||||

Audit Fees(1) | $ | 199,808 | $ | 265,887 | ||||

Audit-Related Fees | — | — | ||||||

Tax Fees | — | — | ||||||

All Other Fees | — | — | ||||||

|

|

|

| |||||

Total | $ | 199,808 | $ | 265,887 | ||||

|

|

|

| |||||

| (1) | Audit Fees for 2017 include actual fees for the 2017 audit, review of our quarterly report on Form10-Q, additional services associated with our initial public offering and registration statements and the issuance of comfort letters and consents. Audit Fees for 2018 include actual fees for the 2018 audit, review of our quarterly report on Form10-Q, additional services associated with our registration statements and the issuance of comfort letters and consents. |

9

Table of Contents

Pre-Approval Policies and Procedures

The Audit Committee’s policy is to review andpre-approve, either pursuant to the Company’s Audit andNon-Audit ServicesPre-Approval Policy (the“Pre-Approval Policy”) or through a separatepre-approval by the Audit Committee, any engagement of the Company’s independent auditor to provide any audit-related andnon-audit services to the Company. Pursuant to thePre-Approval Policy, which the Audit Committee reviews and reassesses periodically, a list of specific services within certain categories of services, including audit, audit-related and tax services, are specificallypre-approved for the upcoming or current fiscal year, subject to an aggregate maximum annual fee payable by us for each category ofpre-approved services. Any service that is not included in the approved list of services must be separatelypre-approved by the Audit Committee. In addition, the Audit Committee may delegate authority to its chairman topre-approve engagements for the performance of audit-related andnon-audit services. Additionally, all audit-related andnon-audit services in excess of thepre-approved fee level, whether or not included on thepre-approved list of services, must be separatelypre-approved by the Audit Committee. The Audit Committee has delegated authority to its chairperson topre-approve engagements for the performance of audit andnon-audit services, for which the estimated cost for such services shall not exceed $100,000 in the aggregate for any calendar year. The chairperson must report allpre-approval decisions to the Audit Committee at its next scheduled meeting and provide a description of the terms of the engagement. During each of the years ended December 31, 2018 and December 31, 2017, 100% of the services provided by Mayer Hoffman following completion of our initial public offering werepre-approved under thePre-Approval Policy.

10

Table of Contents

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Structure and Leadership

Our second amended and restated certificate of incorporation and amended and restated bylaws provide for a classified board of directors consisting of three classes of directors, each serving staggered three-year terms. As a result, one class of directors will be elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our directors are divided equally among the three classes as follows.

| • | the Class I directors are Ms. Krishnan, Mr. Gangolli and Mr. Norby, and their terms will expire at the 2021 annual meeting; |

| • | the Class II directors are Mr. Janney and Mr. Rossi, and their terms will expire at the Annual Meeting and they will stand for reelection at the Annual Meeting; |

| • | the Class III directors are Mr. Krishnan and Mr. Ganorkar, and their terms will expire at the 2020 annual meeting of stockholders. |

Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal. Our second amended and restated certificate of incorporation and amended and restated bylaws that will be effective upon the closing of this offering will authorize only our board of directors to fill vacancies on our board of directors. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist ofone-third of the directors.

Combined Chairman and Chief Executive Officer Positions

Mr. Krishnan serves as the Chairman of the Board and Chief Executive Officer. The Board has reviewed its current leadership structure and has determined that the use of the lead independent director, as described below, along with the combined Executive Chairman and Chief Executive Officer positions, is currently the most appropriate and effective leadership structure for the Company. As the individual primarily responsible for theday-to-day management of business operations, he is best positioned to chair regular Board meetings as the directors discuss key business and strategic issues. Coupled with a lead independent director, this leadership structure allows the Board to exercise independent oversight and enables the Board to have direct access to information related to theday-to-day management of business operations.

Lead Independent Director

The Board believes that its governance structure ensures a strong, independent Board even though the Board does not have an independent Chairman. To strengthen the role of our independent directors and encourage independent Board leadership, the Board also has established the position of lead independent director, which currently is held by Mr. Norby. The responsibilities of the lead independent director include, among others:

| • | presiding at all meetings of the Board at which the Chairman of the Board is not present; |

| • | scheduling meetings of the independent directors from time to time, but not less than twice a year; |

| • | developing the agendas for, and presiding at, executive sessions of the independent directors of the Board; |

| • | communicating the sense of the Board to the Chief Executive Officer of the Company; |

| • | assisting the Chairman of the Board to review and set the agenda and schedule for each of the Board’s meetings, including bringing to the attention of the Chairman of the Board particular issues for the Board’s attention and consideration and assuring there is sufficient time for discussion of all agenda items; |

| • | assisting in improving the effectiveness of Board meeting; |

11

Table of Contents

| • | assisting the Chairman of the Board in the review and approval of information and materials to be sent to the Board, including in particular providing input as to the quality, quantity and timeliness of the information submitted by the Company’s management that is necessary or appropriate for the independent directors to effectively and responsibly perform their duties; and |

| • | coordinating with committee heads with respect to committee self-evaluations. |

As required under Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent registered public accounting firms, the Board has affirmatively determined that the following four current directors are independent directors within the meaning of the applicable Nasdaq listing standards: Messrs. Janney, Gangolli, Norby, Rossi and Ganorkar. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company.

In making those independence determinations, the Board took into account certain relationships and transactions that occurred in the ordinary course of business between the Company and entities with which some of its directors are or have been affiliated. The Board considered all relationships and transactions that occurred during any12-month period within the last three fiscal years and determined that they were not relationships that would interfere with their exercise of independent judgment in carrying out their responsibilities as directors.

Role of the Board in Risk Oversight

One of the key functions of the Board is informed oversight of our risk management process. The Board administers this oversight function directly, with support from its three standing committees, the Audit Committee, the Nominating and Corporate Governance Committee and the Compensation Committee, each of which addresses risks specific to their respective areas of oversight. In particular, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Our Board of Directors has established three standing committees: an audit committee, a compensation committee and a nominating and corporate governance committee. The principal functions of each committee are described below. We comply with the listing requirements and other rules and regulations of Nasdaq, as amended or modified from time to time, and each of these committees is comprised exclusively of independent directors. Additionally, our Board of Directors may from time to time establish certain other committees to facilitate the management of our company.

12

Table of Contents

The table below provides membership information for each of the Board committees as of the date of this Proxy Statement:

Member | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

Daniel S. Janney | X | X (Chair) | ||||

Julian Gangolli | X | |||||

R. Douglas Norby* | X (Chair) | X | X | |||

Dino A. Rossi | X | X | X (Chair) |

| * | Audit committee financial expert. |

Audit Committee

Our audit committee is composed of Messrs. Norby, Janney and Rossi. Mr. Norby is the chairperson of our audit committee. Messrs. Norby, Janney and Rossi each meet the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations. Each member of our audit committee is financially literate. In addition, our board of directors has determined that Mr. Norby is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of RegulationS-K promulgated under the Securities Act. This designation does not impose any duties, obligations or liabilities that are greater than are generally imposed on members of our audit committee and our board of directors. Our audit committee is responsible for, among other things:

| • | our accounting and financial reporting processes, including our financial statement audits and the integrity of our financial statements; |

| • | our compliance with legal and regulatory requirements; |

| • | reviewing and approving related person transactions; |

| • | selecting and hiring our registered independent public accounting firm; |

| • | the qualifications, independence and performance of our independent auditors; and |

| • | the preparation of the audit committee report to be included in our annual proxy statement. |

During the fiscal year ended December 31, 2018, the Audit Committee met 4 times, including telephonic meetings.

Compensation Committee

Our Compensation Committee is composed of Messrs. Norby, Janney and Rossi. Mr. Janney is the chairperson of our Compensation Committee. The composition of our Compensation Committee meets the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations. Each member of this committee is: (i) an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Code; and (ii) anon-employee director, as defined in Rule16b-3 promulgated under the Exchange Act. Our Compensation Committee is responsible for, among other things:

| • | evaluating, recommending, approving and reviewing executive officer and director compensation arrangements, plans, policies and programs; |

| • | administering our cash-based and equity-based compensation plans; and |

| • | making recommendations to the Board regarding any other Board responsibilities relating to executive compensation. |

13

Table of Contents

During the fiscal year ended December 31, 2018, the Compensation Committee met once in a telephonic meeting.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is composed of Messrs. Norby, Gangolli and Rossi. Mr. Rossi is the chairperson of our Nominating and Corporate Governance Committee. The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under the current Nasdaq listing standards and SEC rules and regulations. Our Nominating and Corporate Governance Committee is responsible for, among other things:

| • | identifying, considering and recommending candidates for membership on our Board; |

| • | overseeing the process of evaluating the performance of our Board; and |

| • | advising our Board on other corporate governance matters. |

During the fiscal year ended December 31, 2018, the Nominating and Corporate Governance Committee did not meet.

The Nominating and Corporate Governance Committee is responsible for, among other things, the selection and recommendation to the Board of nominees for election as directors. In accordance with the Nominating and Corporate Governance Committee charter and our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee develops on an annual basis guidelines and criteria for the selection of candidates for directors of the Board. The Nominating and Corporate Governance Committee considers whether a potential candidate for director has the time available, in light of other business and personal commitments, to perform the responsibilities required for effective service on the Board, along with their personal and professional integrity, demonstrated ability and judgement, experience, familiarity with the Company, diversity (of both experience and background) as well as certain other relevant factors. Applying these criteria, the Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and the chairman of the Board and chief executive officer as well as stockholders. After completing the identification and evaluation process described above, the Nominating and Corporate Governance Committee recommends the nominees for directorship to the Board. Taking the Nominating and Corporate Governance Committee’s recommendation into consideration, the Board then approves the nominees for directorship for stockholders to consider and vote upon at the annual stockholders’ meeting.

In August 2017, we issued 914,107 shares of Series A Preferred Stock, or Series A Preferred, to Sun Pharma (Netherlands) B.V., or Sun Pharma, an indirect subsidiary of Sun Pharmaceutical Industries Limited, pursuant to a stock purchase agreement for aggregate proceeds to us of approximately $7.0 million. Sun Pharma is a multinational pharmaceutical company and the largest pharmaceutical company headquartered in India. For so long as it remained a holder of Series A Preferred, Sun Pharma had a right to designate and have elected a single representative to our board of directors and accordingly, in September 2017, Kirti Ganorkar was elected to our board of directors. Each share of Series A Preferred held by Sun Pharma converted into a share of common stock upon the closing of our initial public offering.

Stockholders wishing to recommend individuals for consideration as directors must follow the procedures described in Article II, Section 11 of the Company’s bylaws, including (among other requirements) the giving of written notice of the nomination to our Secretary no later than 120 days prior to the first anniversary of the date of the proxy statement for the previous year’s annual meeting. The stockholder’s notice must set forth as to each nominee all information relating to the person that would be required to be disclosed in a solicitation of proxies for election of directors pursuant to Regulation 14A under the Exchange Act if the candidate had been nominated

14

Table of Contents

by or on behalf of the Board. Recommendations by stockholders that are made in this manner will be evaluated in the same manner as other candidates. See “Other Matters—Stockholder Proposals and Nominations for the 2019 Annual Meeting.”

Code of Business Conduct and Ethics

The Board has established a code of business conduct and ethics that applies to our officers, directors and employees. Among other matters, our code of business conduct and ethics is designed to deter wrongdoing and to promote:

| • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| • | full, fair, accurate, timely and understandable disclosure in the reports and documents the Company files with, or submits to, the SEC and in other public communications made by the Company; |

| • | compliance with applicable governmental laws, rules and regulations; |

| • | the prompt internal reporting to the appropriate person of violations of the code of business conduct and ethics; and |

| • | accountability for adherence to the code of business conduct and ethics. |

Any waiver of the code of business conduct and ethics for our executive officers or directors must be approved by the Board, and any such waiver shall be promptly disclosed to stockholders.

Availability of Corporate Governance Materials

Stockholders may view our corporate governance materials, including the charters of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics, on our website atwww.krystalbio.com under “Corporate Governance” on the “Investors” page, and these documents are available in print to any stockholder who sends a written request to such effect to Krystal Biotech, Inc., 2100 Wharton Street, Suite 701, Pittsburgh, Pennsylvania 15203, Attention: Secretary. Information on or accessible from our website is not and should not be considered a part of this Proxy Statement.

During the fiscal year ended December 31, 2018, the Board met 5 times, including telephonic meetings. The Board voted by unanimous written consent in several instances during the fiscal year ended December 31, 2018.

Our directors are not expected to attend the Annual Meeting.

Executive Sessions ofNon-Management Directors

Pursuant to our Corporate Governance Guidelines and the Nasdaq listing standards, in order to promote open discussion amongnon-management directors, ournon-management directors meet in executive sessions without management participation regularly. The lead independent director presides at these sessions.

Stockholders and other interested parties may communicate with the Board by sending written correspondence to the “Lead Independent Director” c/o the Chief Executive Officer of Krystal Biotech, Inc., 2100 Wharton Street,

15

Table of Contents

Suite 701, Pittsburgh, Pennsylvania 15203, who will then directly forward such correspondence to the lead independent director. The lead independent director will decide what action should be taken with respect to the communication, including whether such communication should be reported to the full Board.

As compensation for serving on the Board, each of our independent directors receives: (1) an annual cash fee of $37,500; (2) an annual cash fee of $15,000 for the Audit Committee Chair, an annual cash fee of $10,000 for the Compensation Committee Chair and an annual cash fee of $8,000 for the Nominating and Corporate Governance Committee Chair; and (3) annual cash fees for service as anon-Chair member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of $7,500, $5,000 and $4,000, respectively. Mr. Krishnan and Ms. Krishnan do not receive any additional compensation for their service on the Board.

The following provides compensation information pursuant to the scaled disclosure rules applicable to emerging growth companies under SEC rules and the JOBS Act.

Director Compensation Table

The following table provides information on the compensation of our directors for the fiscal year ended December 31, 2018, other than Mr. Krishnan and Ms. Krishnan, each of whom received no separate compensation for their service as directors. For information related to the compensation of Mr. Krishnan and Ms. Krishnan, please refer to “Compensation of Executive Officers—Summary Compensation Table.”

Name | Fees Paid in Cash | Option Awards(1) | All Other Compensation | Total | ||||||||||||

Daniel S. Janney | $ | 42,500 | $ | 120,166 | $ | — | $ | 162,666 | ||||||||

R. Douglas Norby | $ | 46,292 | $ | 87,454 | $ | — | $ | 133,746 | ||||||||

Dino A. Rossi | $ | 44,250 | $ | 171,603 | $ | — | $ | 215,853 | ||||||||

Kirti Ganorkar(2) | $ | — | $ | — | $ | — | $ | — | ||||||||

Julian Gangolli(3) | $ | — | $ | — | $ | — | $ | — | ||||||||

| (1) | Represents the grant date fair value of the option awards. The options vest ratably ranging from one year to four years. |

| (2) | Mr. Ganorkar has declined to receive any compensation for his service as a director. |

| (3) | Mr. Gangolli was appointed to our Board in March 2019. |

16

Table of Contents

EXECUTIVE OFFICERS

The following table sets forth information concerning our executive officers. Executive officers are elected annually by the Board and serve at the Board’s discretion.

Name | Age(1) | Title | ||||

| Krish S. Krishnan | 54 | Chairman and Chief Executive Officer | ||||

| Suma M. Krishnan | 54 | Chief Operating Officer | ||||

| Antony A. Riley | 52 | Chief Financial Officer | ||||

| Pooja Agarwal | 40 | Vice President, Product Development | ||||

| (1) | Age as of April 15, 2019. |

Set forth below are descriptions of the background of our Chief Financial Officer, Antony A. Riley, and our Vice President, Product Development, Pooja Agarwal. The biographies of our Chairman and Chief Executive Officer, Krish S. Krishnan, and our Chief Operating Officer, Suma M. Krishnan, can be found under the heading “Proposals To Be Voted On—Proposal 1: Election of Class I Directors—Continuing Directors” above.

Antony A. Riley. Antony A. Riley was appointed our Chief Financial Officer on March 8, 2018 after serving in that position on an interim basis. Mr. Riley was previously a founding partner since 2002 of the CFO Network LLC, a consulting firm. Previously, Mr. Riley was Acting Chief Financial Officer at Avanex Corporation and Corporate Controller at Kosan Biosciences. He also served in numerous capacities at Troy Chemical Corporation from 1997 to 2000. He received a B.Sc. (Honors) from the University of Bristol (England) and an M.B.A. (Honors) from the University of Chicago, Booth School of Business.

Pooja Agarwal. Pooja Agarwal has served as Vice President, Product Development since the Company’s inception. Prior to joining Krystal in 2016, she was Senior Director, Human Therapeutics, at Intrexon Corporation from 2010 to 2016 where she managed the preclinical development of several gene therapy programs in Ophthalmology, Oncology, and Neuropathic Diseases, as well as strategic alliances with internal and external partners. Pooja holds a PhD in Biomedical Sciences from University of California San Francisco, a Master of Science in Molecular and Medical Genetics from University of Toronto, and a Bachelor of Science (Summa Cum Laude) in Biochemistry from McMaster University.

17

Table of Contents

COMPENSATION OF NAMED EXECUTIVE OFFICERS

The following provides compensation information pursuant to the scaled disclosure rules applicable to emerging growth companies under SEC rules and the JOBS Act.

The compensation of our named executive officers (“NEOs”) consists of a combination of base salary and equity-based compensation. The equity portion of awards is delivered to NEOs in the form of restricted stock, which vests ratably over four years.

The following tables contain certain compensation information for our NEOs in the fiscal year ended December 31, 2018.

The following table sets forth a summary of all compensation earned, awarded or paid, as applicable, to our NEOs in the fiscal year ended December 31, 2018.

Name and Principal Position | Year | Salary | Bonus | Option Awards | All Other Compensation | Total | ||||||||||||||||||

Krish S. Krishnan | 2018 | $ | 469,994 | (1) | $ | 235,000 | $ | — | $ | — | $ | 704,994 | ||||||||||||

Chairman and Chief Executive Officer | 2017 | 69,444 | — | — | — | 69,444 | ||||||||||||||||||

Suma M. Krishnan | 2018 | $ | 366,994 | (2) | $ | 128,450 | $ | — | $ | — | $ | 495,444 | ||||||||||||

Chief Operating Officer | 2017 | 79,444 | — | — | — | 79,444 | ||||||||||||||||||

Pooja Agarwal | 2018 | $ | 189,938 | (3) | $ | 40,000 | $ | 211,020 | (4) | $ | — | $ | 440,958 | |||||||||||

Vice President, Product Development | 2017 | 110,000 | 35,000 | 61,366 | — | 206,366 | ||||||||||||||||||

Antony A. Riley(5) | 2018 | $ | 103,561 | $ | — | $ | 174,600 | (4) | $ | — | $ | 278,161 | ||||||||||||

Chief Financial Officer | ||||||||||||||||||||||||

| (1) | Mr. Krishnan’s 2018 salary includes $200,000 in cash and the award of 26,213 shares of restricted stock granted on June 1, 2019 with a grant-date fair value of $269,994. The restricted stock vest ratably over 12 months. |

| (2) | Ms. Krishnan’s 2018 salary includes $200,000 in cash and the award of 16,213 shares of restricted stock granted on June 1, 2019 with a grant-date fair value of $166,994. The restricted stock vest ratably over 12 months. |

| (3) | Ms. Agarwal’s 2018 salary includes $7,438 in reimbursed moving expenses. |

| (4) | Represents the grant-date fair value of the option award. The options vest ratably over four years. |

| (5) | Mr. Riley was appointed as Chief Financial Officer of the Company in March 2018. |

18

Table of Contents

Outstanding Equity Awards at FiscalYear-End December 31, 2018

The following table presents information about our NEOs’ outstanding equity awards as of December 31, 2018.

| Stock Awards | ||||||||||||||||||||||||||

Name | Grant Date | Number of Securities Underlying Unexercised Options Exercisable | Option Exercise Price | Option Expiration Date | Number of Shares That Have Not Vested | Market Value of Shares of Stock That Have Not Vested | ||||||||||||||||||||

Krish S. Krishnan Chairman and Chief Executive Officer | 6/1/2018 | — | — | $ | — | — | 13,106 | $ | 272,343 | |||||||||||||||||

Suma M. Krishnan Chief Operating Officer | 6/1/2018 | — | — | $ | — | — | 8,106 | $ | 168,443 | |||||||||||||||||

Pooja Agarwal | 11/10/16 | 18,947 | 18,948 | (1) | $ | 2.46 | 11/10/2026 | |||||||||||||||||||

Vice President, | 5/1/2017 | 2,250 | 6,750 | (2) | $ | 2.46 | 4/30/2027 | |||||||||||||||||||

Product Development | 6/30/2018 | — | 20,000 | (3) | $ | 14.87 | 5/30/2028 | |||||||||||||||||||

Antony A. Riley Chief Financial Officer | 3/8/2018 | — | 25,000 | (4) | $ | 9.85 | 3/8/2028 | |||||||||||||||||||

| (1) | 18,948 of the shares subject to this option are scheduled to vest on each of November 10, 2018, November 10, 2019 and November 10, 2020, subject to Ms. Agarwal’s continued service. |

| (2) | 6,750 of the shares subject to this option are scheduled to vest on each of May 1, 2019, May 1, 2020 and May 1, 2021, subject to Ms. Agarwal’s continued service. |

| (3) | 20,000 of the shares subject to this option are scheduled to vest on each of June 30, 2019, June 30, 2020, June 30, 2021 and June 30, 2022, subject to Ms. Agarwal’s continued service. |

| (4) | 25,000 of the shares subject to this option are scheduled to vest on each of March 8, 2019, March 8, 2020, March 8, 2021 and March 8, 2022, subject to Mr. Riley’s continued service. |

Krish S. Krishnan

We entered into an“at-will” employment agreement with Krish S. Krishnan dated as of July 1, 2017. Prior to entering into this agreement, between April 15, 2016, on which date we commenced operations, and June 30, 2017, Mr. Krishnan served as our President and Chief Executive Officer without compensation. Under the terms of the employment agreement, Mr. Krishnan served as President and Chief Executive Officer with a base salary of sixty thousand dollars ($60,000) per year, in addition to benefits made available by the Company to similarly-situated employees. Upon closing of our initial public offering, Mr. Krishnan’s base salary increased to $200,000 per year. On June 1, 2018, Mr. Krishnan’s annual base compensation was increased to $470,000, of which $200,000 is paid in cash and the remaining $270,000 of which is provided in the form of a grant of restricted shares of the Company’s Common Stock. Mr. Krishnan’s employment agreement provides that he will be bound by the terms of the Company’s Proprietary Information and Inventions Agreement and that he shall not disclose to the Company any third party proprietary information or trade secrets.

Suma M. Krishnan

We entered into an“at-will” employment agreement with Suma M. Krishnan dated as of May 1, 2017. Prior to entering into this agreement, and between the dates of April 15, 2016, the date we commenced operations, and May 1, 2017, Ms. Krishnan served as the Company’s Chief Operating Officer without compensation. Under the terms of the employment agreement, Ms. Krishnan continues to serve as the Chief Operating Officer. She received a base salary of sixty thousand dollars ($60,000) per year, in addition to benefits made available by the

19

Table of Contents

Company to similarly-situated employees. Upon the closing of our initial public offering, Ms. Krishnan’s base salary increased to $200,000 per year. On June 1, 2018, Ms. Krishnan’s annual base salary was increased to $367,000 of which $200,000 is paid in cash and the remaining $167,000 of which is provided in the form of a grant of restricted shares of the Company’s Common Stock. Ms. Krishnan’s employment agreement provides that she will be bound by the terms of the Company’s Proprietary Information and Inventions Agreement and that she shall not disclose to the Company any third party proprietary information or trade secrets.

Pooja Agarwal

We entered into an“at-will” employment agreement with Pooja Agarwal dated as of May 1, 2017. Prior to entering into this agreement, and between the dates of May 1, 2016 and May 1, 2017, Ms. Agarwal served as a consultant. Under the terms of her employment agreement, Ms. Agarwal serves as the Vice President of Product Development with a base salary of one hundred and sixty-five thousand dollars ($165,000) per year, in addition to benefits made available by the Company to similarly-situated employees. On June 1, 2018, Ms. Agrawal’s annual base salary was increased to $195,000. Ms. Agarwal’s employment agreement provides that she will be bound by the terms of the Company’s Proprietary Information and Inventions Agreement and that she shall not disclose to the Company any third-party proprietary information or trade secrets.

Antony A. Riley

We entered into an“at-will” employment agreement with Antony A. Riley dated as of March 8, 2018. Prior to entering into this agreement, Mr. Riley served as interim Chief Financial Officer. Under the terms of his employment agreement, Mr. Riley serves as the Chief Financial Officer with a base salary of one hundred and twenty thousand dollars ($120,000) per year, in addition to benefits made available by the Company to similarly-situated employees. On June 1, 2018, Mr. Riley’s base salary was increased to $130,000. Mr. Riley’s employment agreement provides that he will be bound by the terms of the Company’s Proprietary Information and Inventions Agreement and that he shall not disclose to the Company any third-party proprietary information or trade secrets.

20

Table of Contents

The Audit Committee is currently composed of Messrs. Janney, Norby and Rossi, with Mr. Norby serving as its chairperson. The members of the Audit Committee are appointed by and serve at the discretion of the Board.

One of the principal purposes of the Audit Committee is to assist the Board in the oversight of the integrity of the Company’s financial statements. The Company’s management team has the primary responsibility for the financial statements and the reporting process, including the system of internal controls and disclosure controls and procedures. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Annual Report on Form10-K for the fiscal year ended December 31, 2018 with our management.

The Audit Committee also is responsible for assisting the Board of Directors in the oversight of the qualification, independence and performance of the Company’s independent auditors. The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards and those matters required to be discussed by Auditing Standard No. 1301,Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”).

The Audit Committee has received both the written disclosures and the letter from Mayer Hoffman McCann P.C. required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with Mayer Hoffman McCann P.C. its independence. In addition, the Audit Committee has considered whether the provision ofnon-audit services, and the fees charged for suchnon-audit services, by Mayer Hoffman McCann P.C. are compatible with maintaining the independence of Mayer Hoffman McCann P.C. from management and the Company.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the Company’s audited financial statements for 2018 be included in its Annual Report on Form10-K for the fiscal year ended December 31, 2018 for filing with the SEC.

Respectfully submitted,

The Audit Committee of the Board of Directors

R. Douglas Norby (Chairman)

Daniel S. Janney

Dino A. Rossi

The Audit Committee Report above does not constitute “soliciting material” and will not be deemed “filed” or incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or the Exchange Act, that might incorporate SEC filings by reference, in whole or in part, notwithstanding anything to the contrary set forth in those filings.

21

Table of Contents

The following table sets forth certain information as of April 2, 2019, regarding the beneficial ownership of shares of our Common Stock by (a) each of our directors, (b) each of our named executive officers, (c) all of our directors and executive officers as a group, and (d) each person known to us to be the beneficial owner of more than five percent of our Common Stock. Unless otherwise indicated, all shares are owned directly and the indicated person has sole voting and dispositive power with respect to such shares. The SEC has defined “beneficial ownership” of a security to mean the possession, directly or indirectly, of voting power and/or dispositive power with respect to such security. A stockholder is also deemed to be, as of any date, the beneficial owner of all securities that such stockholder has the right to acquire within 60 days after that date through (a) the exercise of any option, warrant or right, (b) the conversion of a security, (c) the power to revoke a trust, discretionary account or similar arrangement, or (d) the automatic termination of a trust, discretionary account or similar arrangement.

Unless otherwise indicated, the address of each person listed below is c/o Krystal Biotech, Inc., 2100 Wharton Street, Suite 701, Pittsburgh, Pennsylvania 15203.

Name | Number of Shares Beneficially Owned | % of All Shares(1) | ||||||

Krish S. Krishnan | 2,148,624 | 14.9 | % | |||||

Suma M. Krishnan | 2,113,624 | 14.6 | % | |||||

Pooja Agarwal | 33,589 | * | ||||||

Antony A. Riley | 9,050 | * | ||||||

Daniel S. Janney | 481,493 | 3.3 | % | |||||

R. Douglas Norby | 25,975 | * | ||||||

Dino A. Rossi | 140,666 | 1.0 | % | |||||

Kirti Ganorkar | — | * | ||||||

Julian Gangolli | 1,666 | * | ||||||

All executive officers, directors and director nominees as a group (9 people) | 4,954,687 | 34.3 | % | |||||

More than 5% Beneficial Owners | ||||||||

FMR LLC(5) | 1,235,400 | 8.6 | % | |||||

Sun Pharma (Netherlands) B.V.(6) | 914,107 | 6.3 | % | |||||

Frazier Life Sciences IX, L.P.(7) | 875,000 | 6.1 | % | |||||

Baker Bros. Advisors LP(8) | 784,674 | 5.4 | % | |||||

| (1) | Based on an aggregate of 14,443,569 shares of our Common Stock outstanding as of April 2, 2019. |

| (2) | Includes 112,162 shares of common stock held by the Krishnan Family Trust. Mr. and Ms. Krishnan are each joint beneficial owners of the trust with joint voting and investment control of the entity. |

| (3) | Includes 112,162 shares of common stock held by the Krishnan Family Trust. Mr. and Ms. Krishnan are each joint beneficial owners of the trust with point voting and investment control of the entity. |

| (4) | Directly beneficially owned by Alta Bioequities, L.P. Alta Bioequities Management, LLC is the general partner of Alta Bioequities, L.P. and may be deemed to have sole voting and investment power over the shares beneficially owned by Alta Bioequities, L.P. Mr. Janney is the Managing Director of Alta Bioequities Management, LLC and disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

| (5) | The information regarding FMR LLC is based solely on a Schedule 13G filed by FMR LLC on February 13, 2019 (the “FMR 13G”). According to the FMR 13G, Select Biotechnology Portfolio has sole voting power with respect to 935,400 shares, and FMR LLC and Abigail P. Johnson, a Director, Chairman and Chief Executive Officer of FMR LLC, each have sole dispositive power with respect to 1,200,000 shares. The address of FMR, LLC is 245 Summer Street, Boston, Massachusetts 02210. |

22

Table of Contents

| (6) | The information regarding Sun Pharma (Netherlands) B.V. (“Sun Pharma”) is based solely on a Schedule 13G filed by Sun Pharma on February 14, 2018 (the “Sun Pharma 13G”). According to the Sun Pharma 13G, Sun Pharma has shared voting and dispositive power with respect to the 914,107 shares with Sun Pharmaceutical Industries Limited and Dilip S. Shanghvi. The address of Sun Pharma (Netherlands) B.V. is Polarisavenue 87, Hoofddorp, 2132 JH the Netherlands. |