Exhibit 99.2

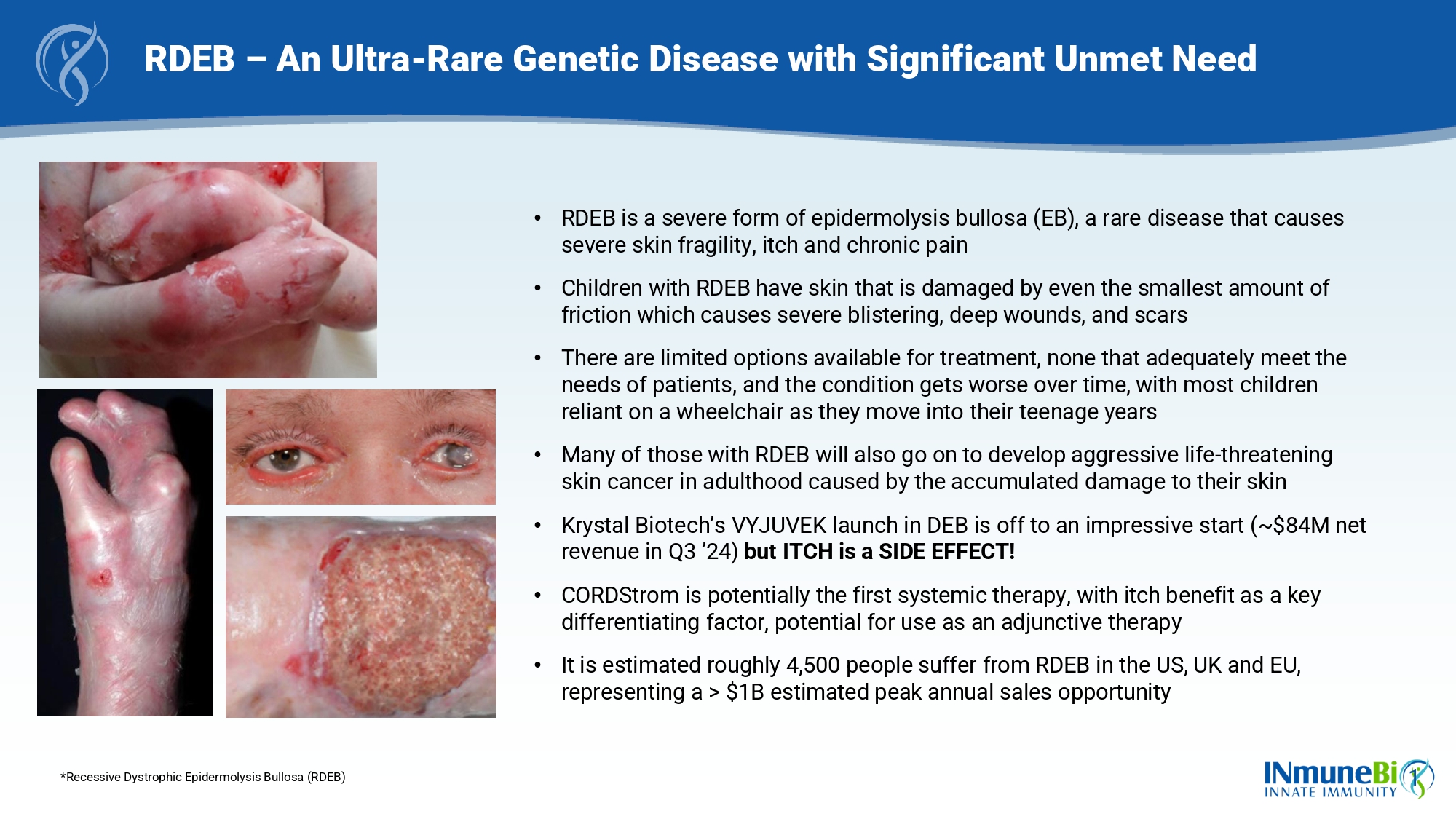

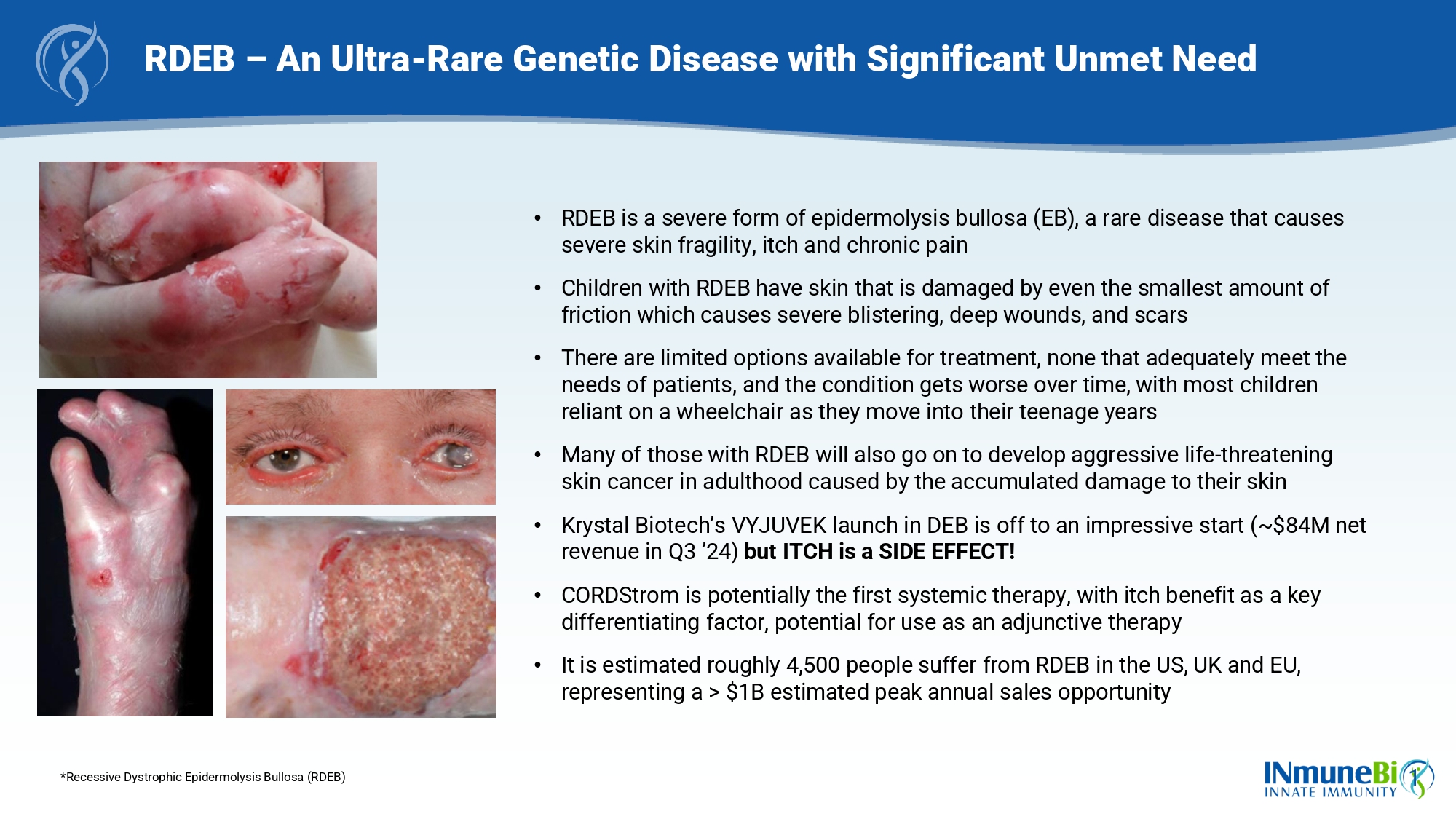

1 RDEB – An Ultra - Rare Genetic Disease with Significant Unmet Need *Recessive Dystrophic Epidermolysis Bullosa (RDEB) • RDEB is a severe form of epidermolysis bullosa (EB), a rare disease that causes severe skin fragility, itch and chronic pain • Children with RDEB have skin that is damaged by even the smallest amount of friction which causes severe blistering, deep wounds, and scars • There are limited options available for treatment, none that adequately meet the needs of patients, and the condition gets worse over time, with most children reliant on a wheelchair as they move into their teenage years • Many of those with RDEB will also go on to develop aggressive life - threatening skin cancer in adulthood caused by the accumulated damage to their skin • Krystal Biotech’s VYJUVEK launch in DEB is off to an impressive start (~$84M net revenue in Q3 ’24) but ITCH is a SIDE EFFECT! • CORDStrom is potentially the first systemic therapy, with itch benefit as a key differentiating factor, potential for use as an adjunctive therapy • It is estimated roughly 4,500 people suffer from RDEB in the US, UK and EU, representing a > $1B estimated peak annual sales opportunity

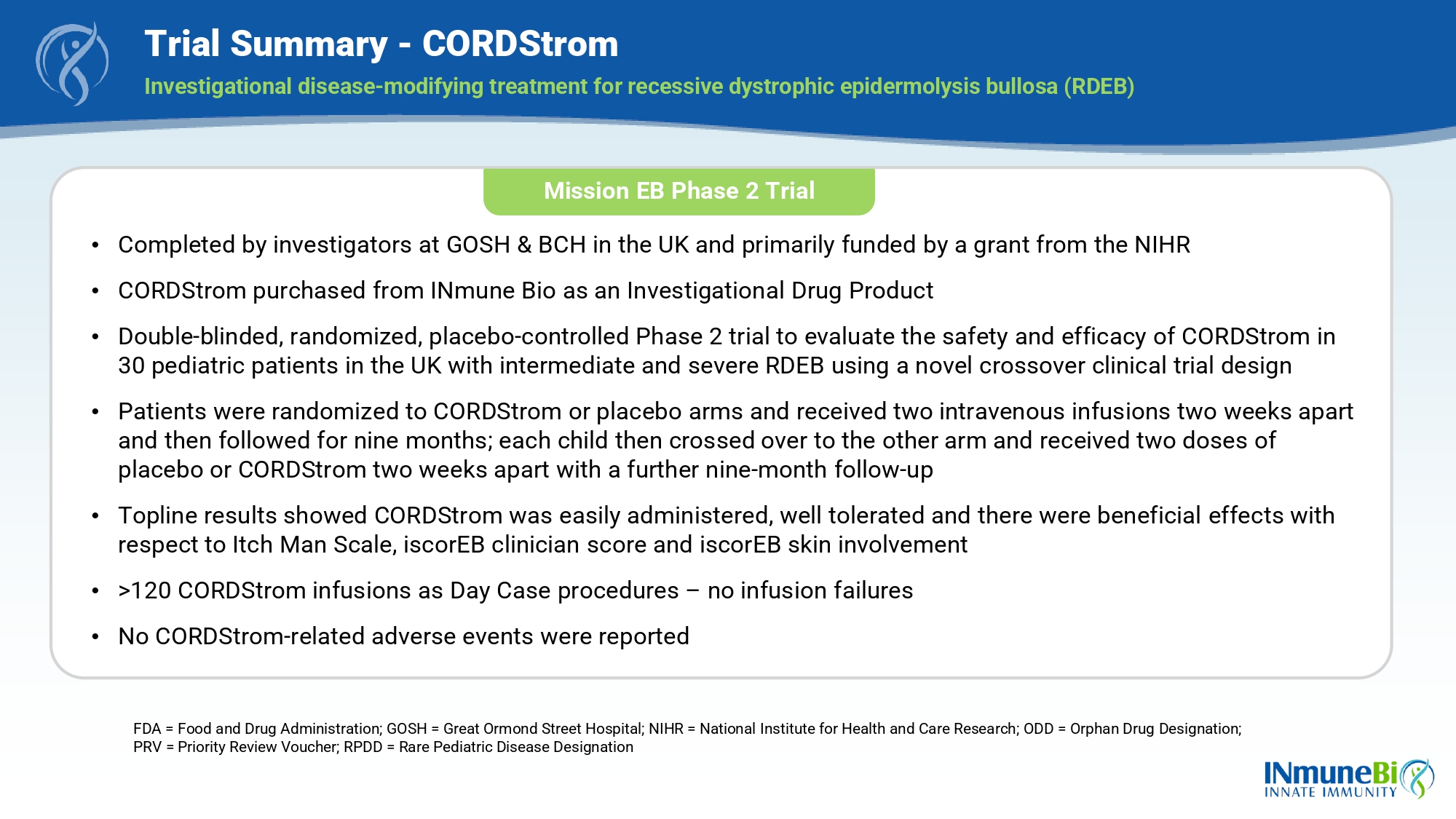

Trial Summary - CORDStrom Investigational disease - modifying treatment for recessive dystrophic epidermolysis bullosa (RDEB) FDA = Food and Drug Administration; GOSH = Great Ormond Street Hospital; NIHR = National Institute for Health and Care Resear ch; ODD = Orphan Drug Designation; PRV = Priority Review Voucher; RPDD = Rare Pediatric Disease Designation Mission EB Phase 2 Trial • Completed by investigators at GOSH & BCH in the UK and primarily funded by a grant from the NIHR • CORDStrom purchased from INmune Bio as an Investigational Drug Product • Double - blinded, randomized, placebo - controlled Phase 2 trial to evaluate the safety and efficacy of CORDStrom in 30 pediatric patients in the UK with intermediate and severe RDEB using a novel crossover clinical trial design • Patients were randomized to CORDStrom or placebo arms and received two intravenous infusions two weeks apart and then followed for nine months; each child then crossed over to the other arm and received two doses of placebo or CORDStrom two weeks apart with a further nine - month follow - up • Topline results showed CORDStrom was easily administered, well tolerated and there were beneficial effects with respect to Itch Man Scale, iscorEB clinician score and iscorEB skin involvement • >120 CORDStrom infusions as Day Case procedures – no infusion failures • No CORDStrom - related adverse events were reported

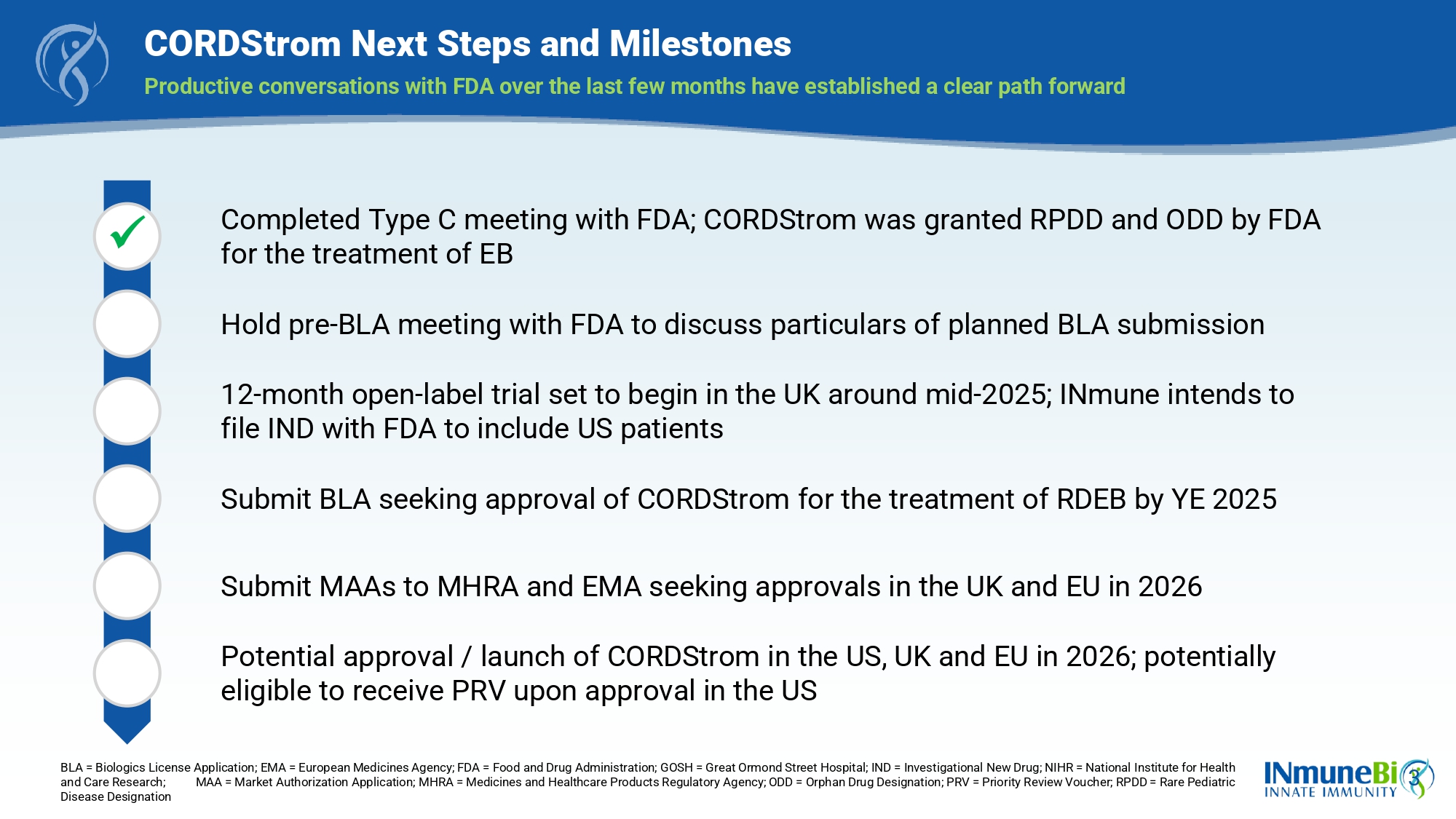

3 CORDStrom Next Steps and Milestones Productive conversations with FDA over the last few months have established a clear path forward BLA = Biologics License Application; EMA = European Medicines Agency; FDA = Food and Drug Administration; GOSH = Great Ormond St reet Hospital; IND = Investigational New Drug; NIHR = National Institute for Health and Care Research; MAA = Market Authorization Application; MHRA = Medicines and Healthcare Products Regulatory Agenc y; ODD = Orphan Drug Designation; PRV = Priority Review Voucher; RPDD = Rare Pediatric Disease Designation Completed Type C meeting with FDA; CORDStrom was granted RPDD and ODD by FDA for the treatment of EB Hold pre - BLA meeting with FDA to discuss particulars of planned BLA submission 12 - month open - label trial set to begin in the UK around mid - 2025; INmune intends to file IND with FDA to include US patients Submit BLA seeking approval of CORDStrom for the treatment of RDEB by YE 2025 Submit MAAs to MHRA and EMA seeking approvals in the UK and EU in 2026 Potential approval / launch of CORDStrom in the US, UK and EU in 2026; potentially eligible to receive PRV upon approval in the US x

Introduction to CORDStrom platform …. The most advanced mesenchymal stem/stromal cell product for clinical development

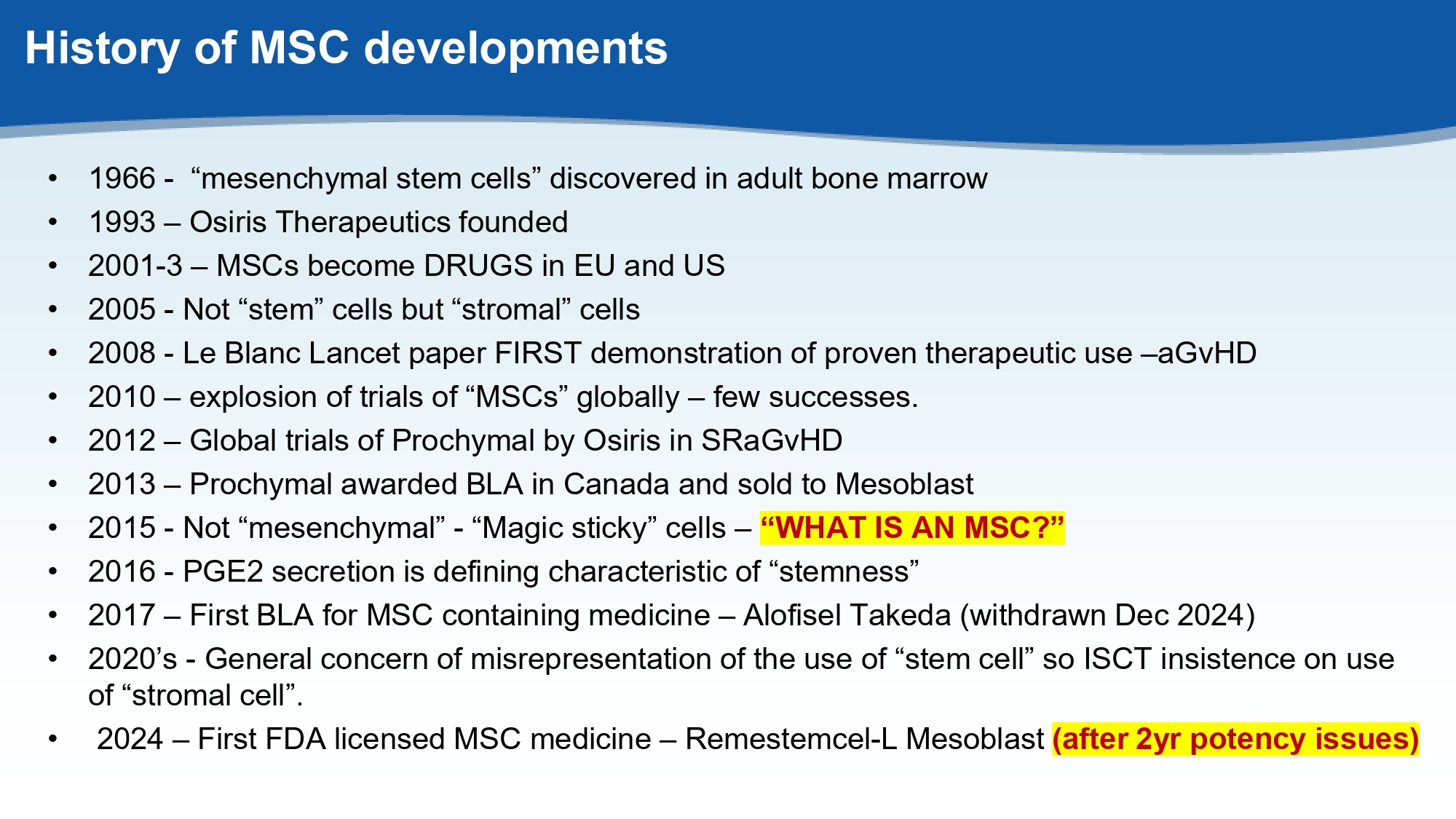

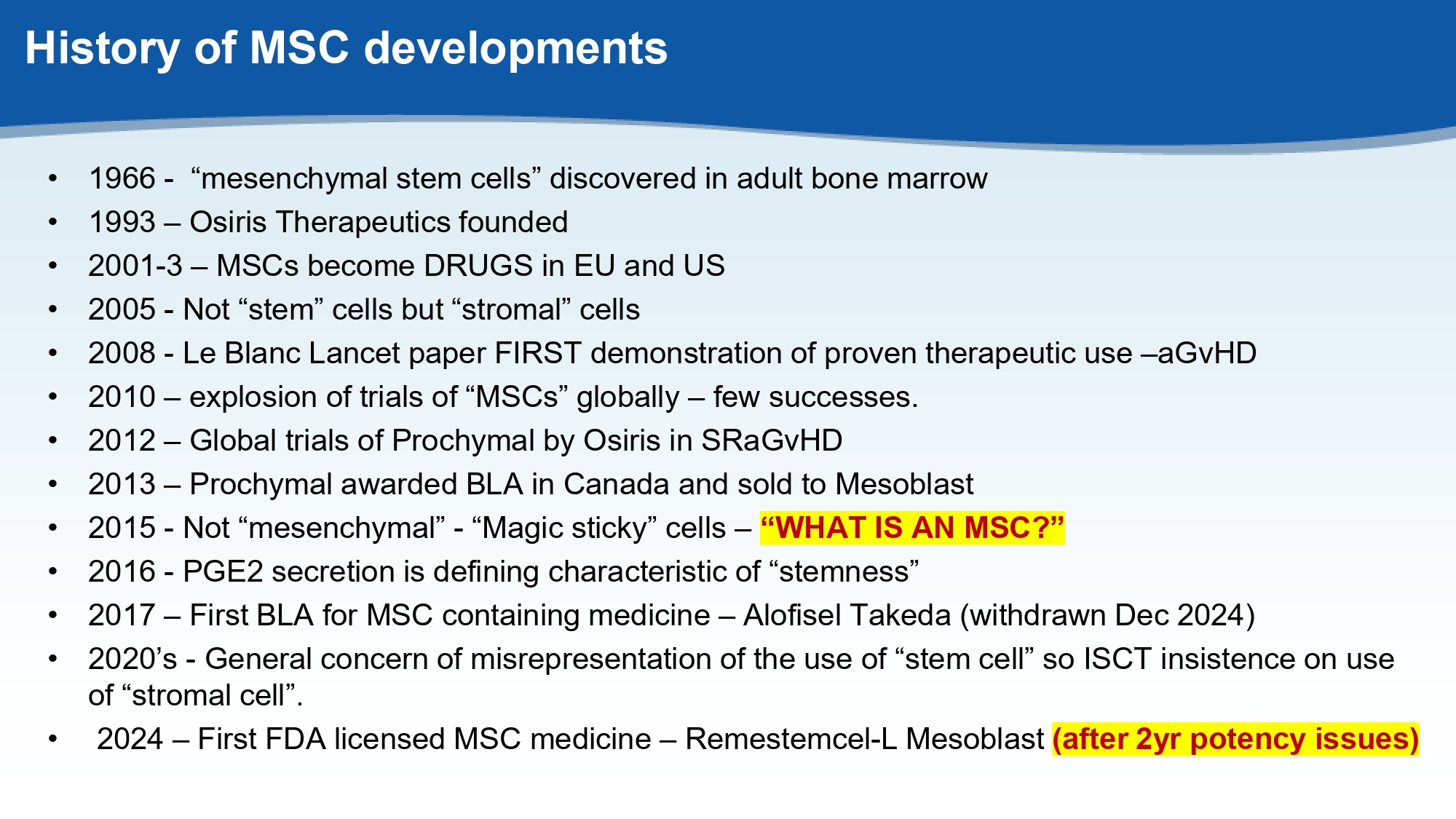

History of MSC developments • 1966 - “mesenchymal stem cells” discovered in adult bone marrow • 1993 – Osiris Therapeutics founded • 2001 - 3 – MSCs become DRUGS in EU and US • 2005 - Not “stem” cells but “stromal” cells • 2008 - Le Blanc Lancet paper FIRST demonstration of proven therapeutic use – aGvHD • 2010 – explosion of trials of “MSCs” globally – few successes. • 2012 – Global trials of Prochymal by Osiris in SRaGvHD • 2013 – Prochymal awarded BLA in Canada and sold to Mesoblast • 2015 - Not “mesenchymal” - “Magic sticky” cells – “WHAT IS AN MSC?” • 2016 - PGE2 secretion is defining characteristic of “stemness” • 2017 – First BLA for MSC containing medicine – Alofisel Takeda (withdrawn Dec 2024) • 2020’s - General concern of misrepresentation of the use of “stem cell” so ISCT insistence on use of “stromal cell”. • 2024 – First FDA licensed MSC medicine – Remestemcel - L Mesoblast (after 2yr potency issues)

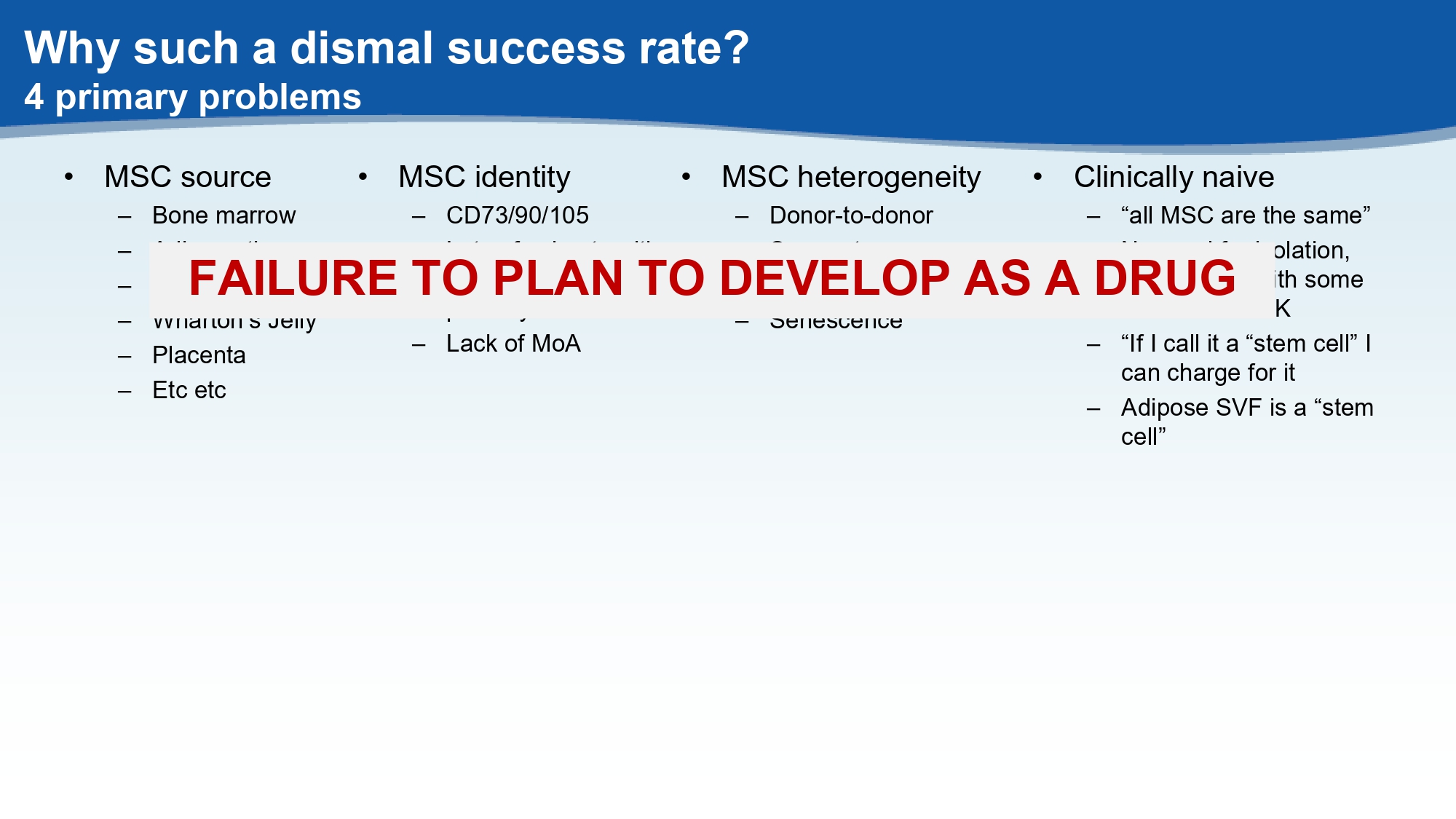

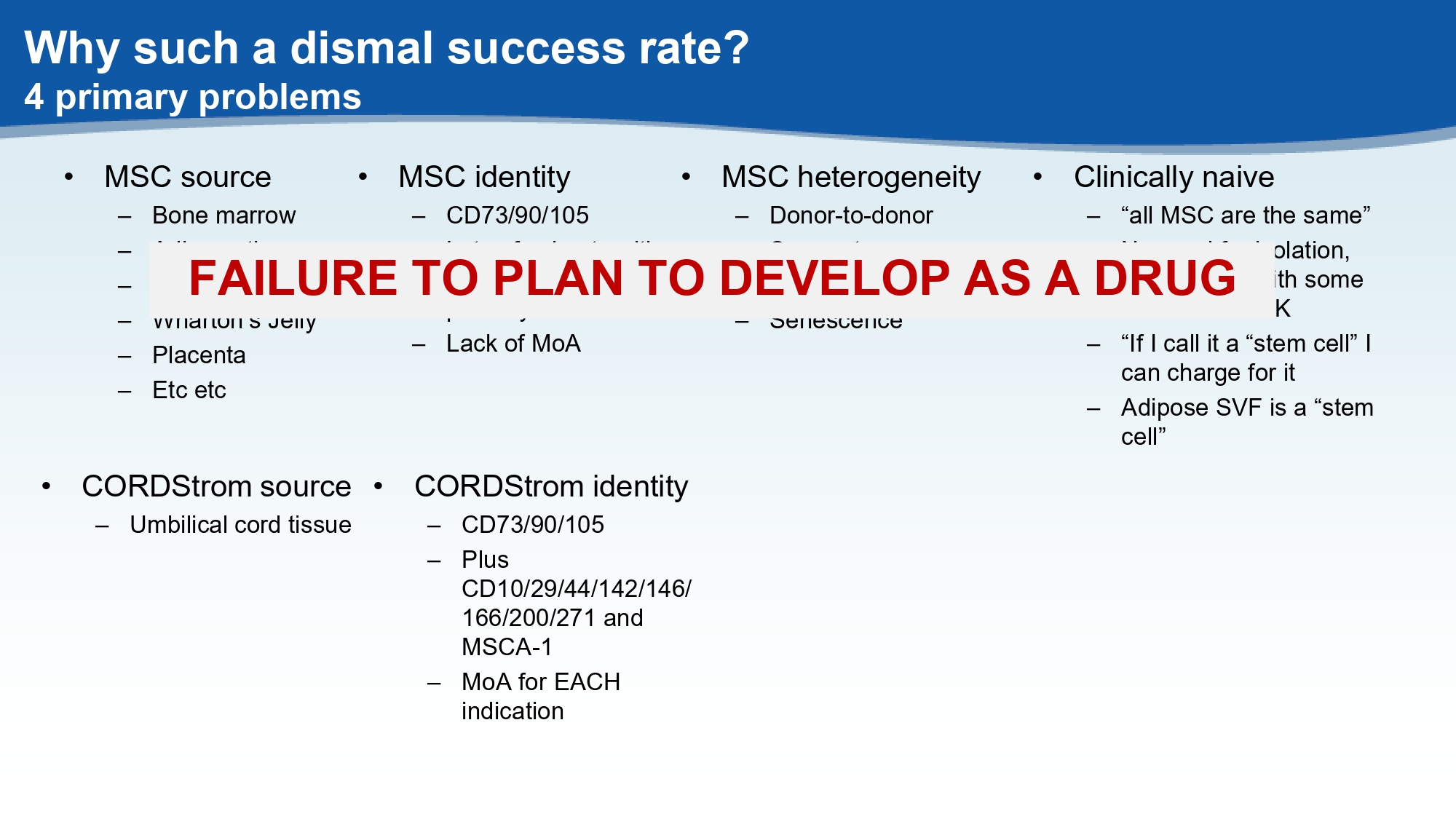

Why such a dismal success rate? 4 primary problems

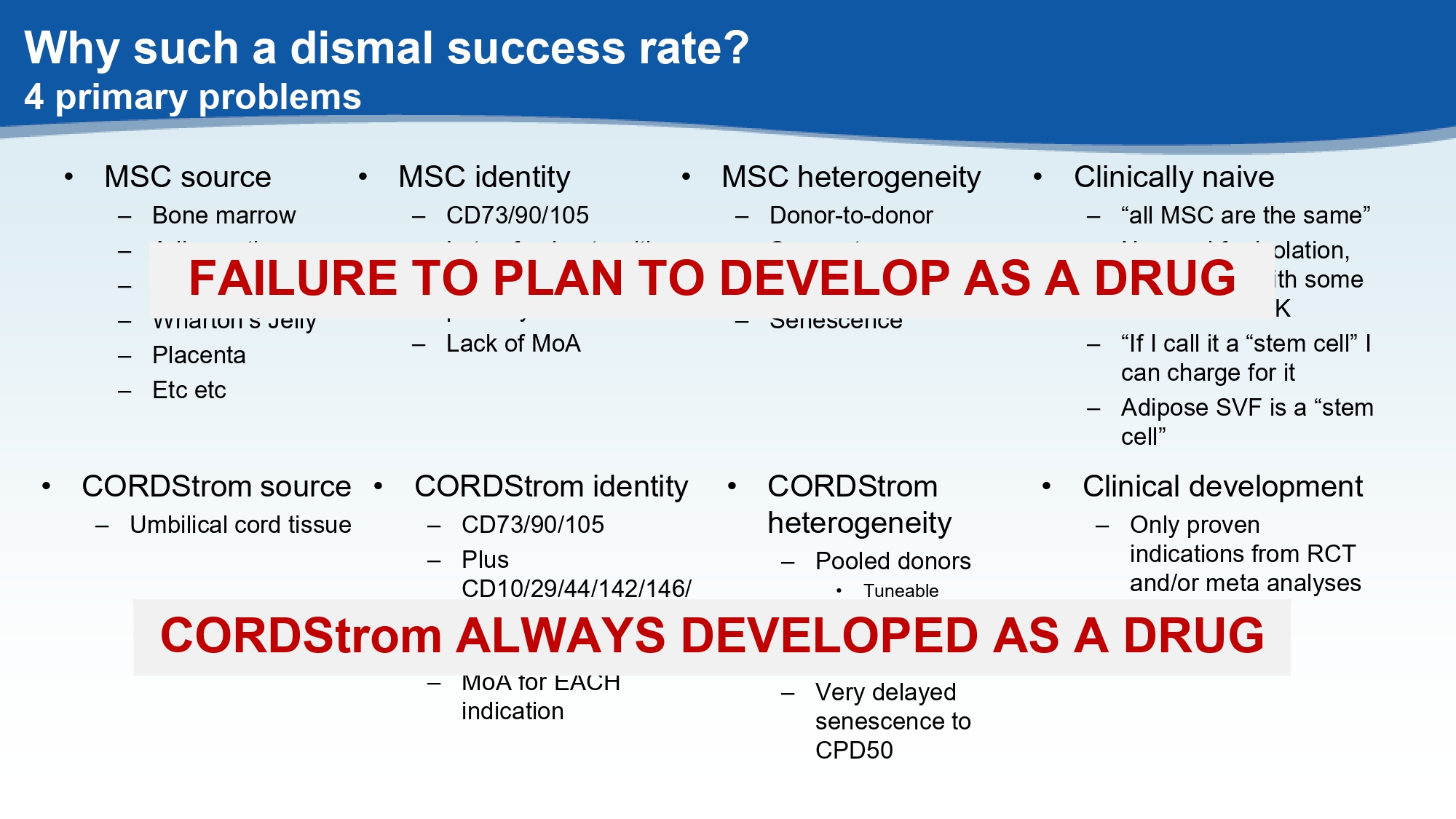

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc

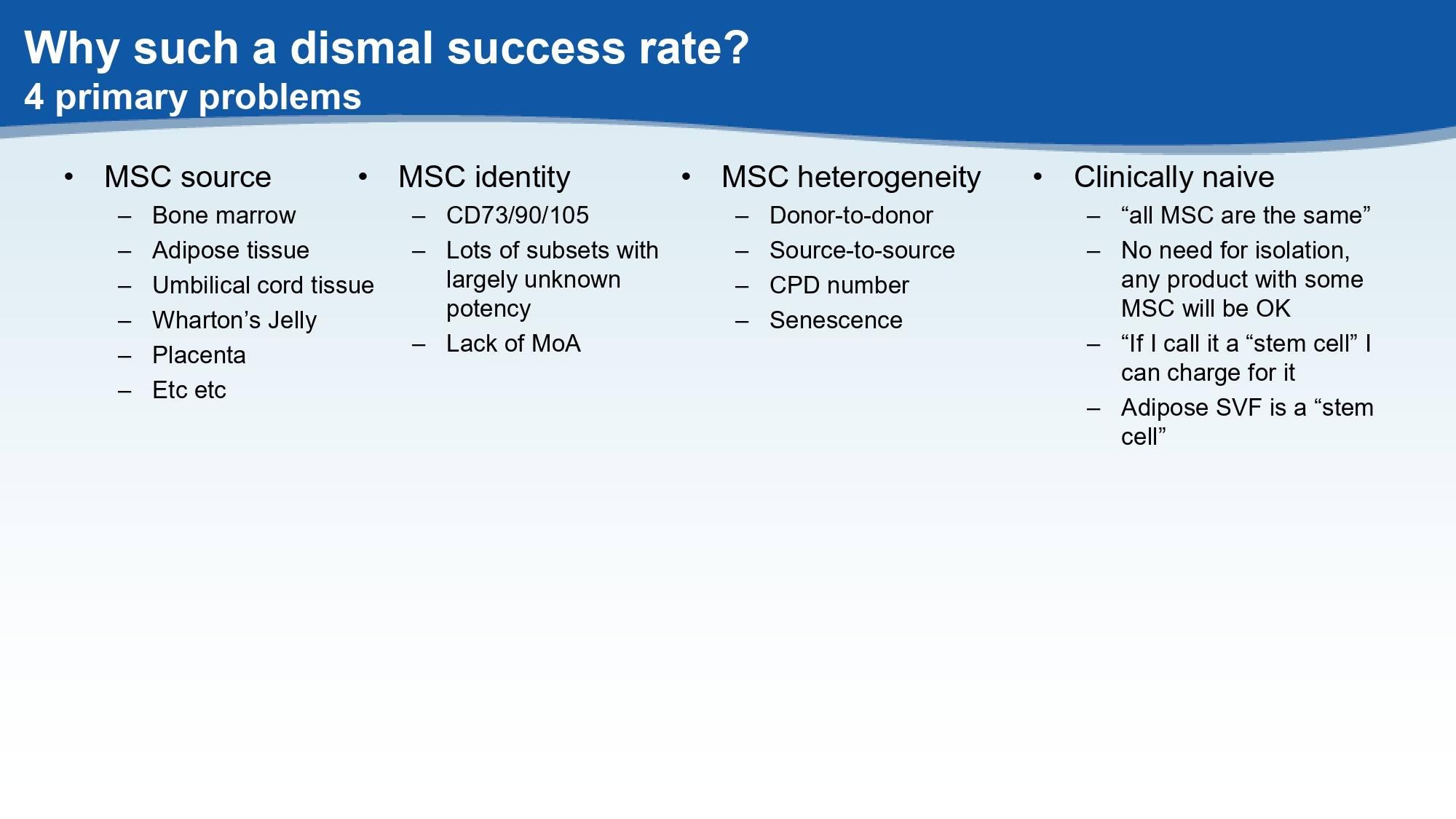

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence

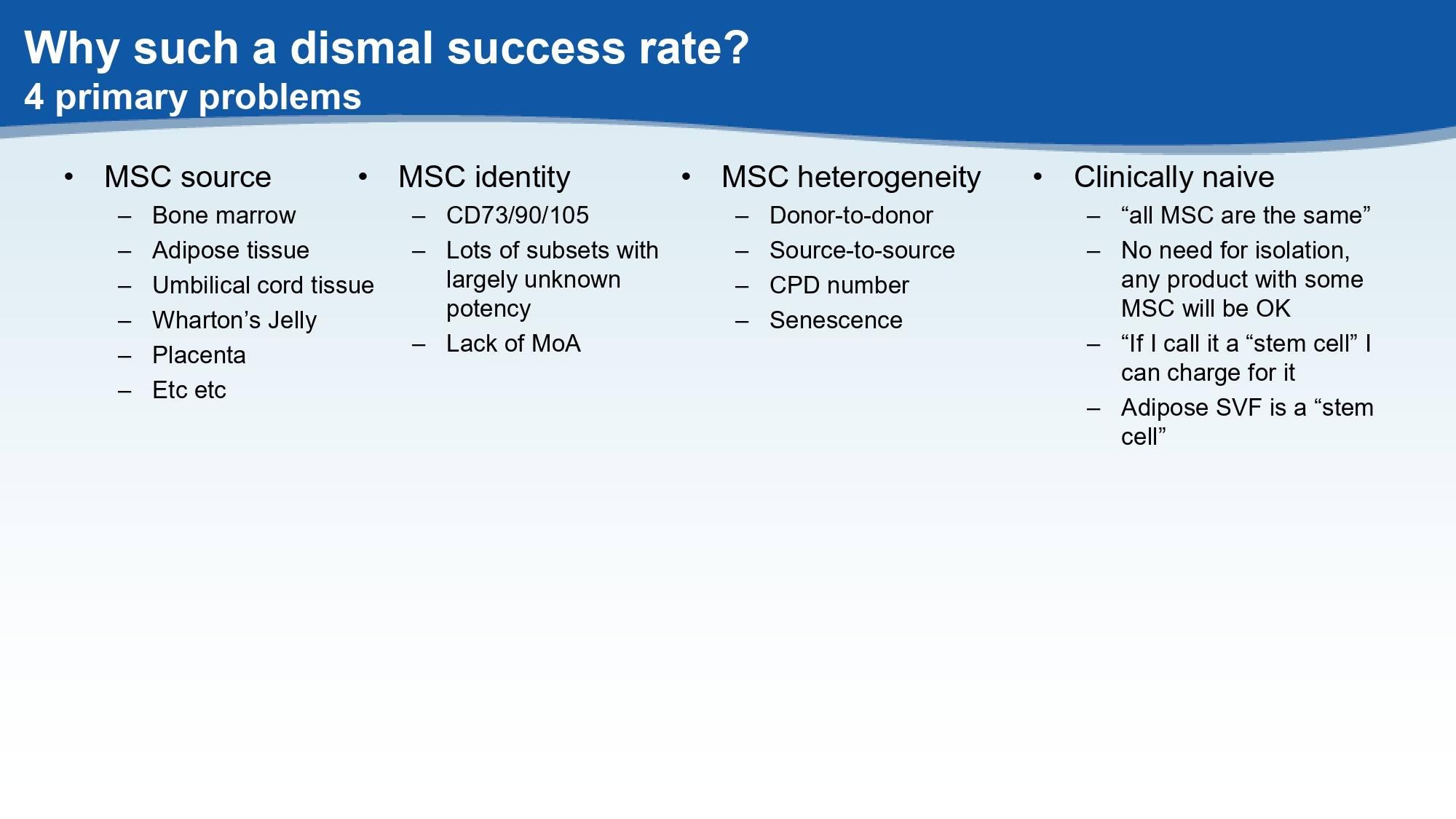

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence

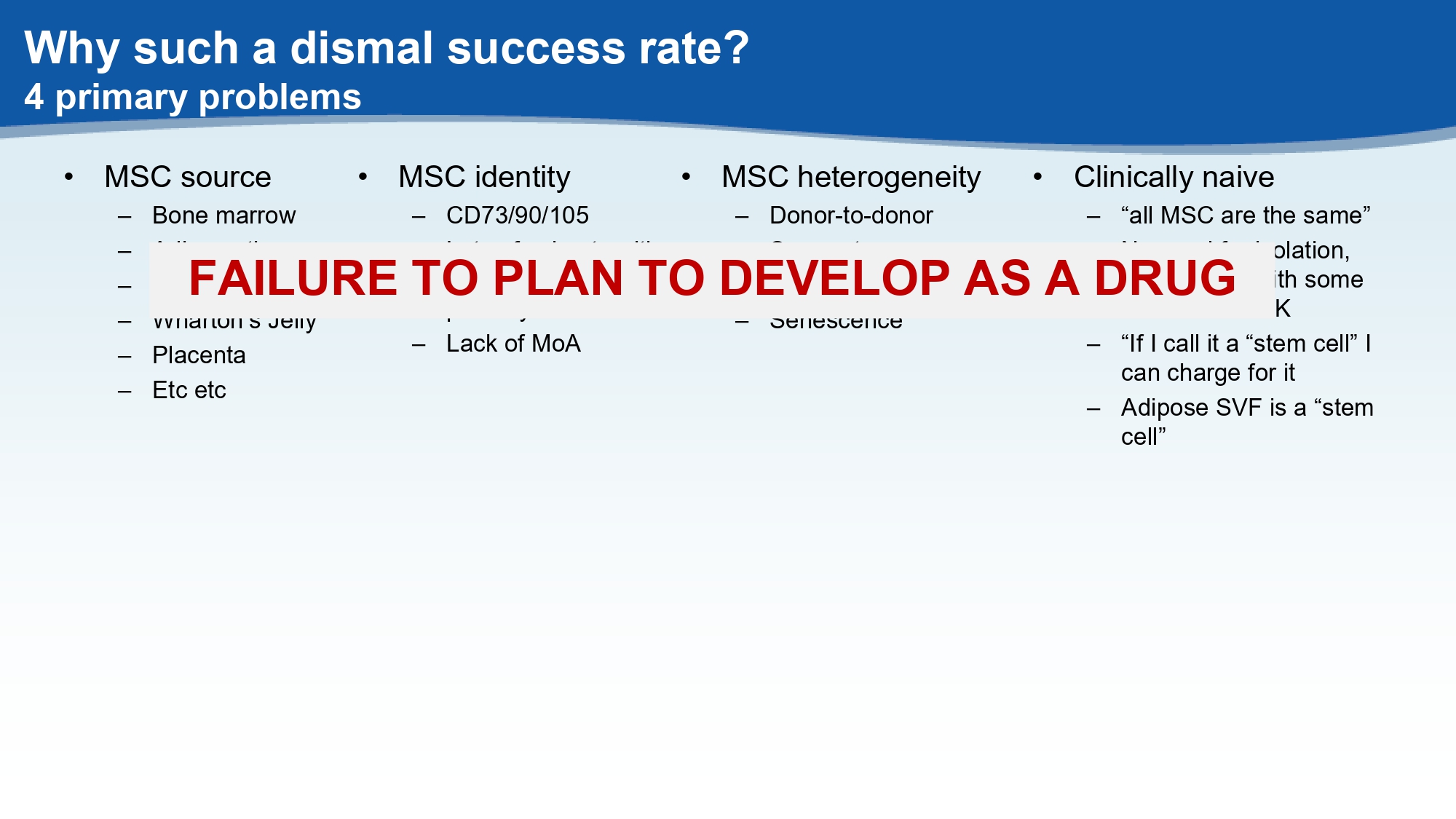

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG

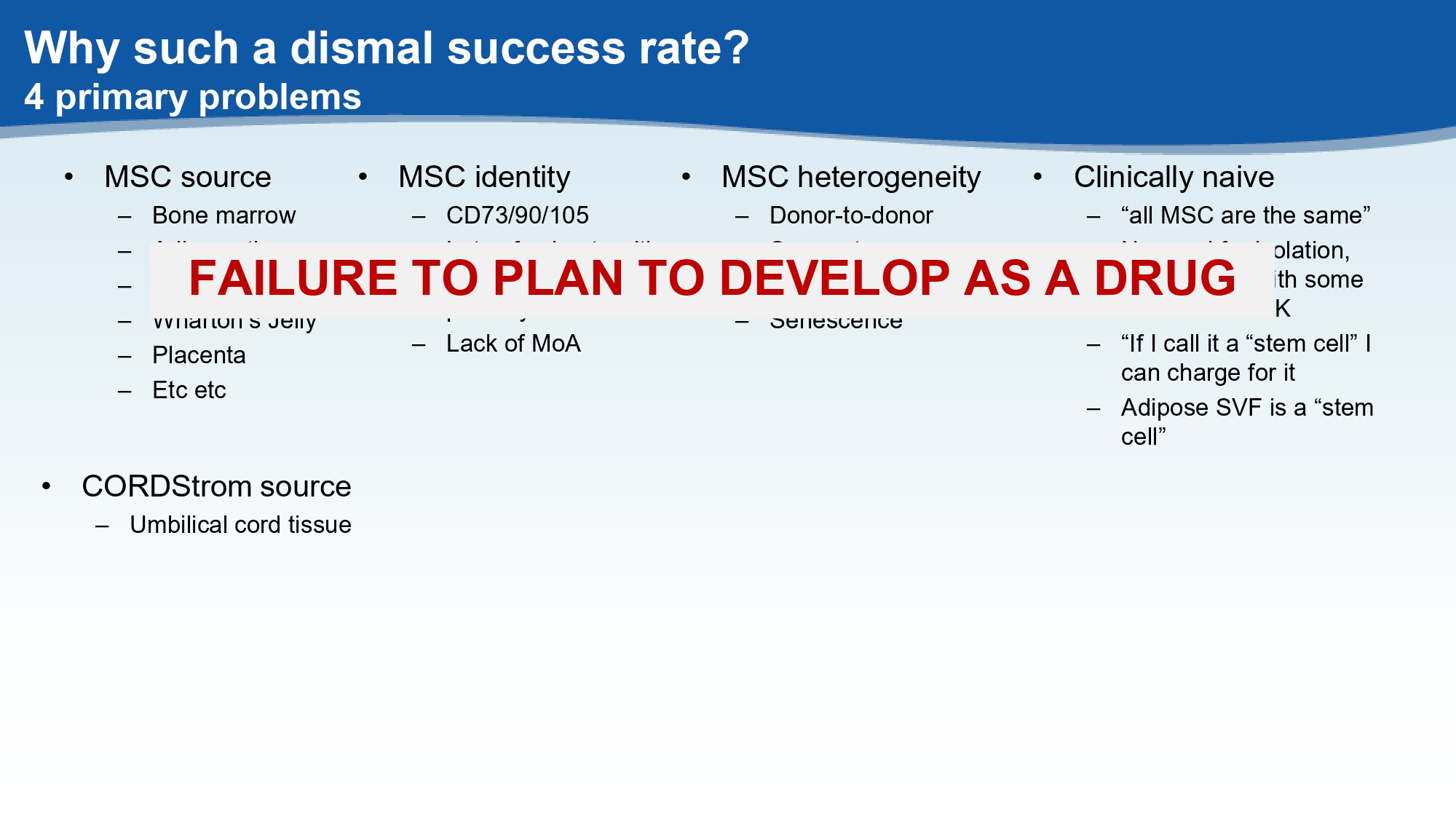

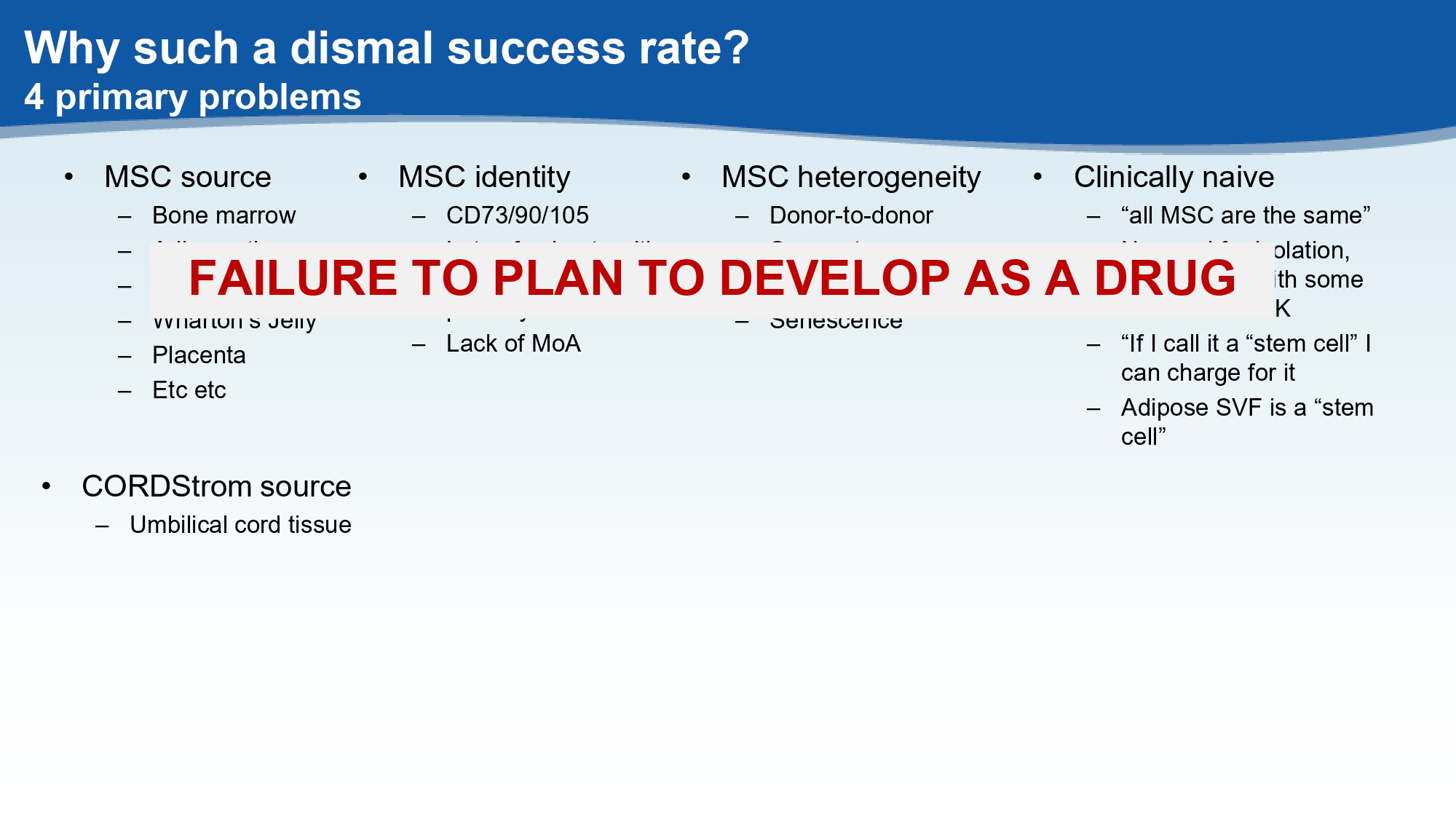

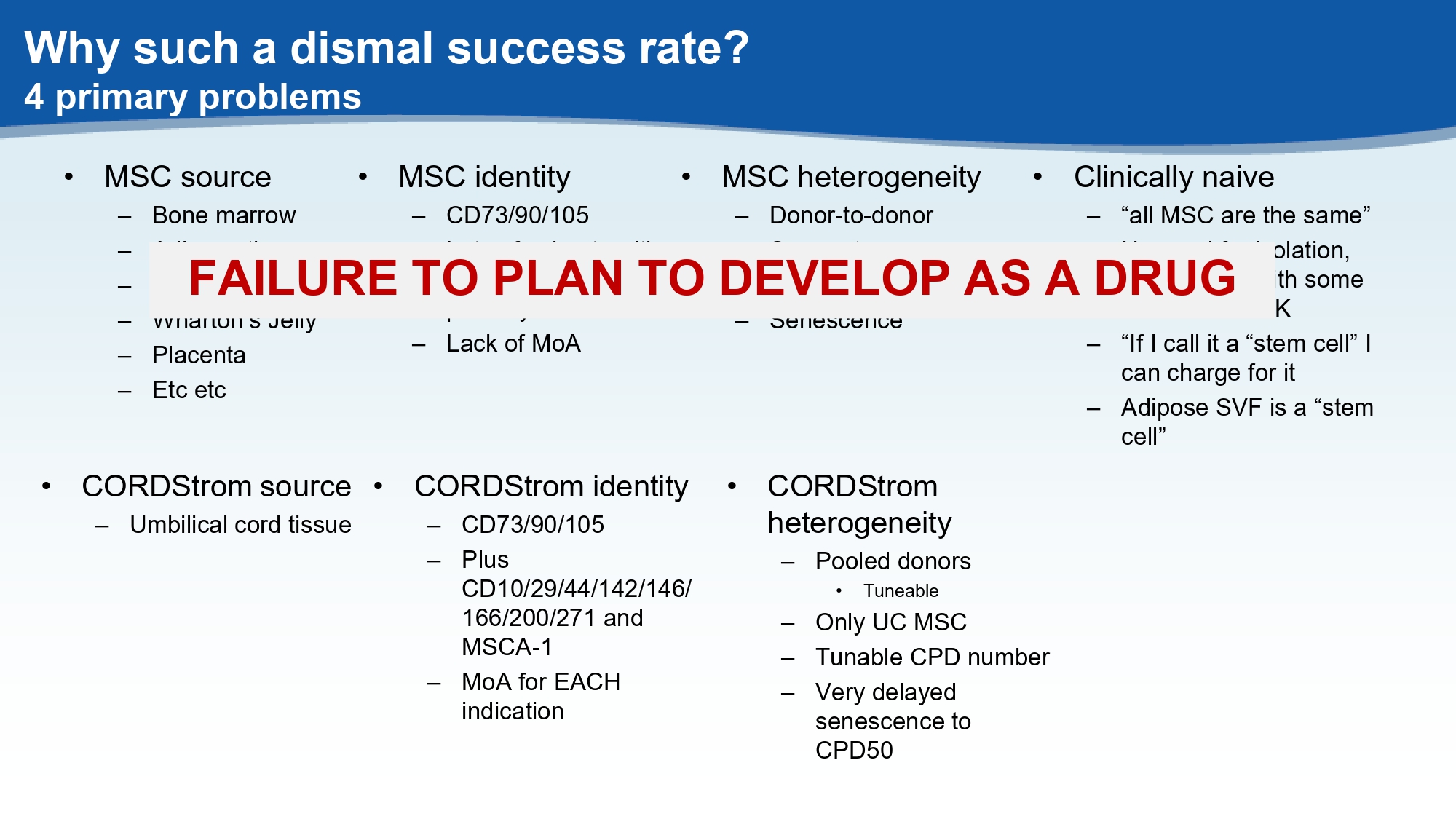

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG • CORDStrom source – Umbilical cord tissue

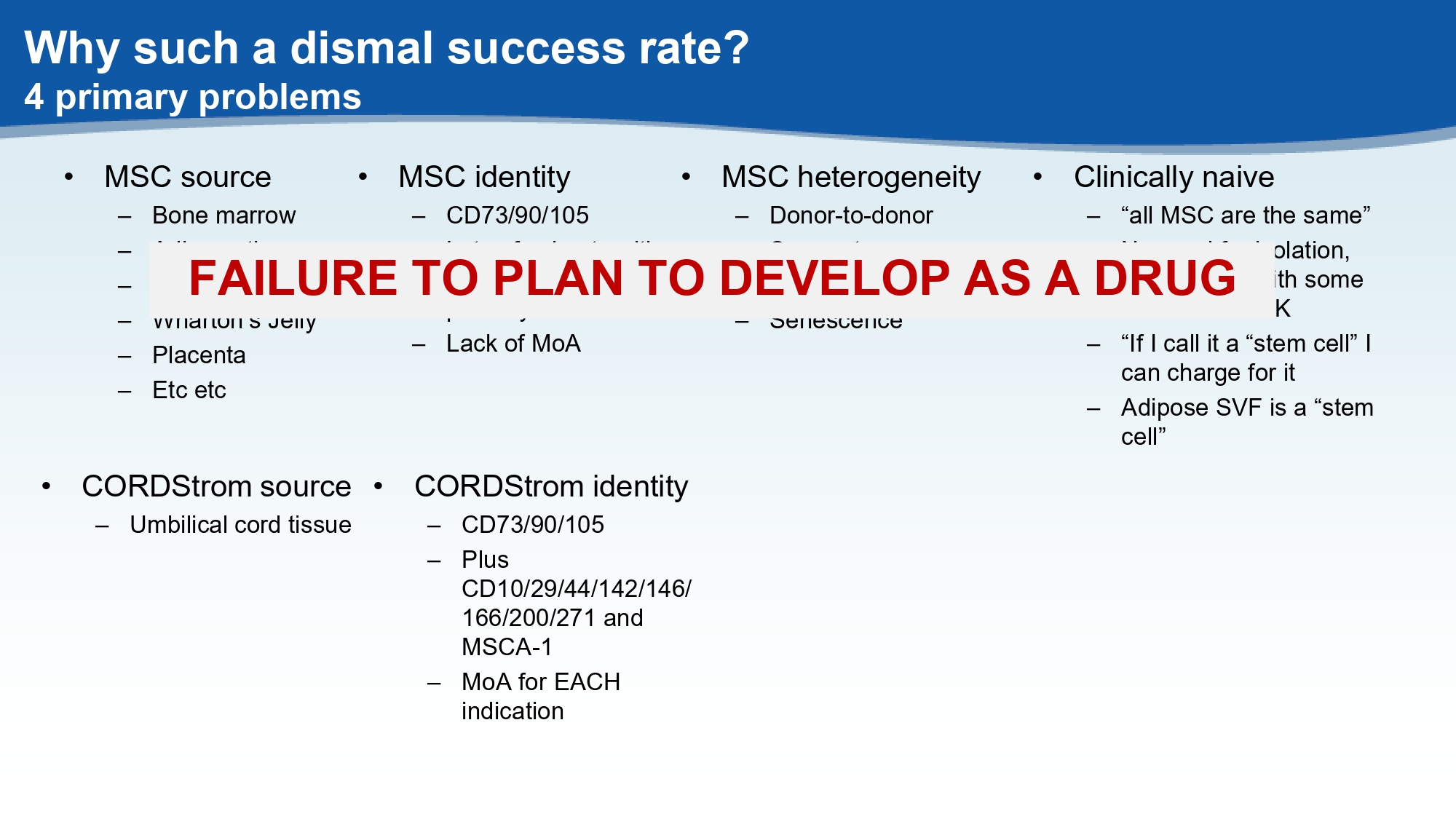

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG • CORDStrom source – Umbilical cord tissue • CORDStrom identity – CD73/90/105 – Plus CD10/29/44/142/146/ 166/200/271 and MSCA - 1 – MoA for EACH indication

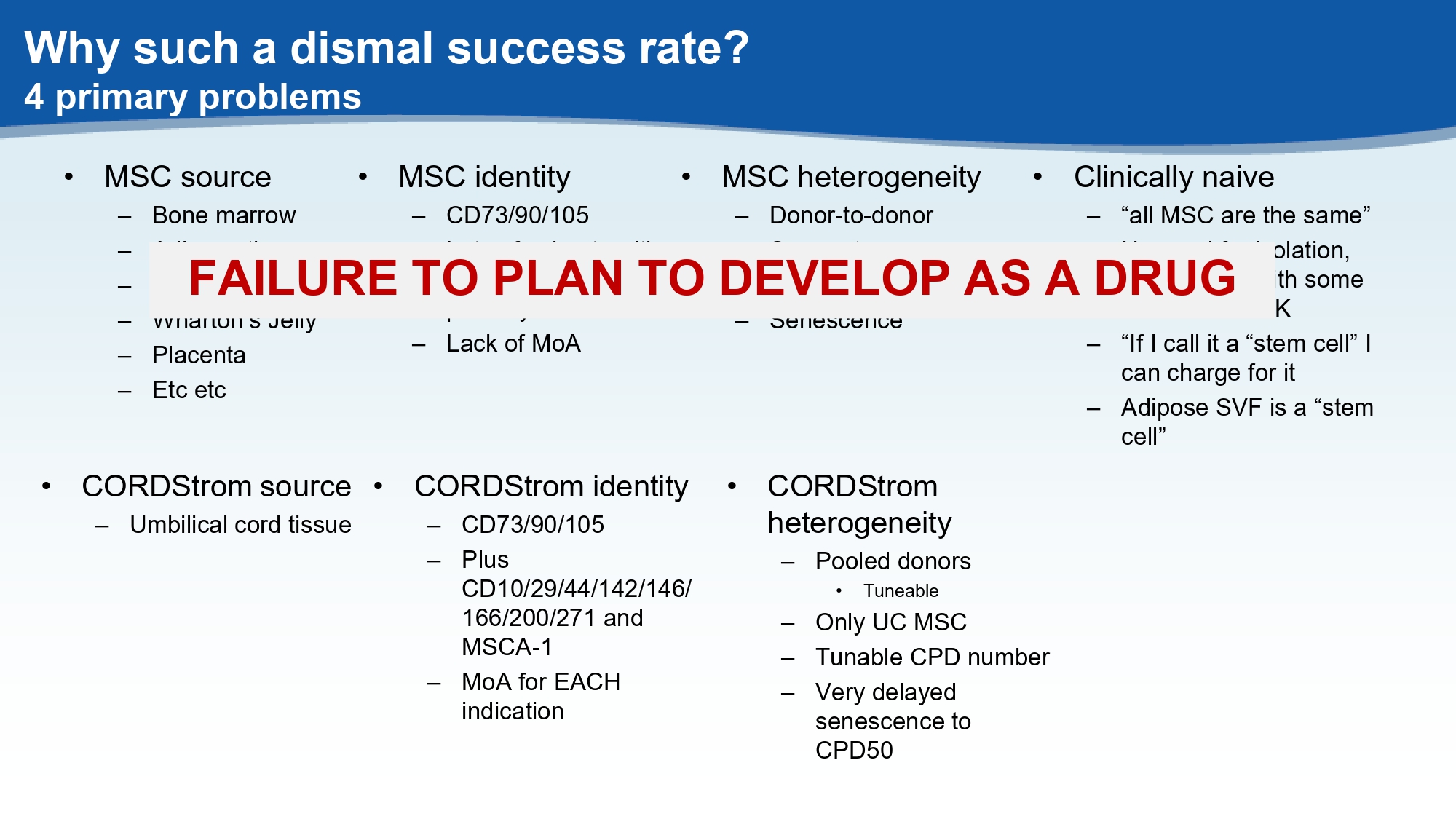

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG • CORDStrom source – Umbilical cord tissue • CORDStrom identity – CD73/90/105 – Plus CD10/29/44/142/146/ 166/200/271 and MSCA - 1 – MoA for EACH indication • CORDStrom heterogeneity – Pooled donors • Tuneable – Only UC MSC – Tunable CPD number – Very delayed senescence to CPD50

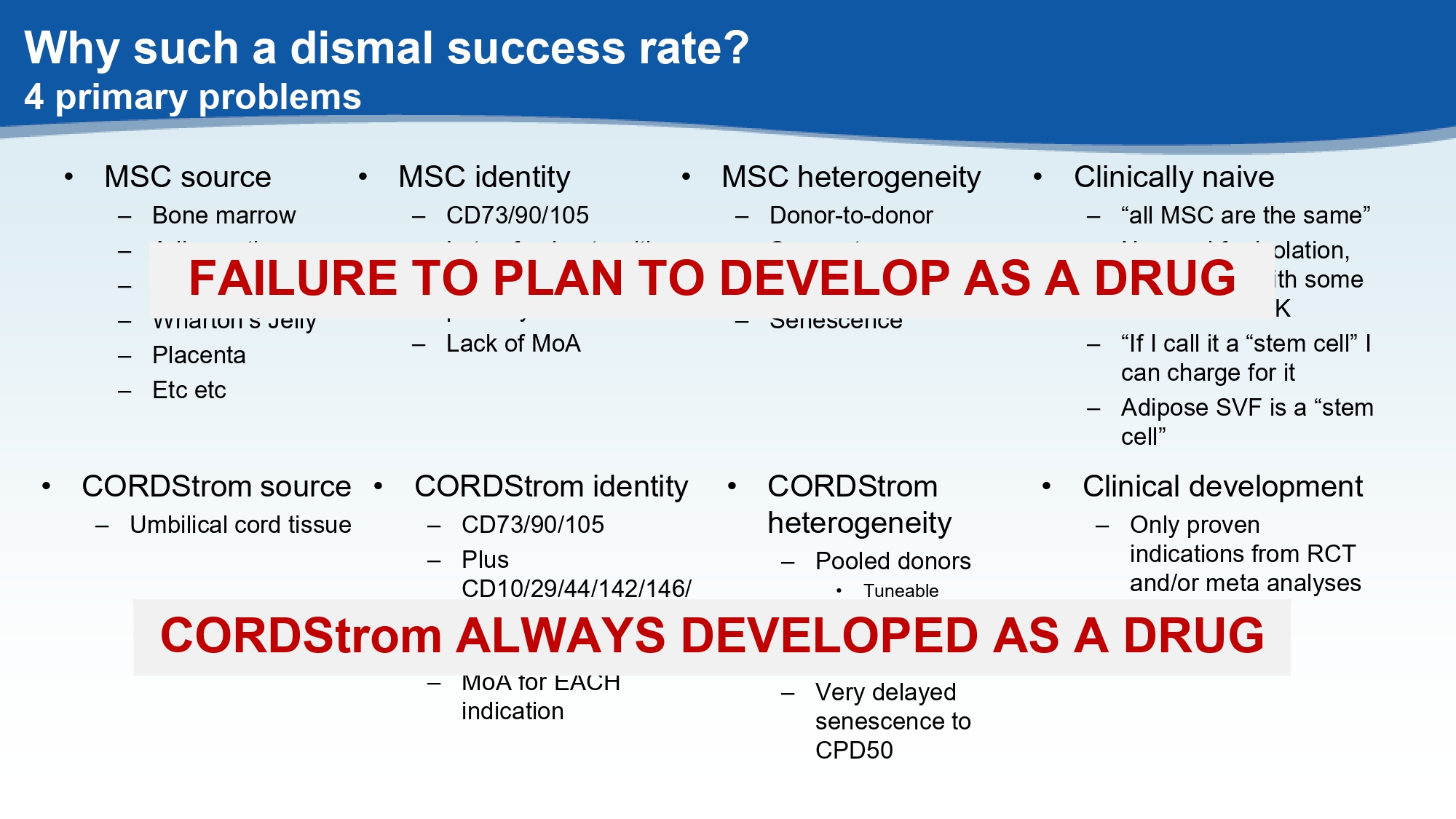

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG • CORDStrom source – Umbilical cord tissue • CORDStrom identity – CD73/90/105 – Plus CD10/29/44/142/146/ 166/200/271 and MSCA - 1 – MoA for EACH indication • CORDStrom heterogeneity – Pooled donors • Tuneable – Only UC MSC – Tunable CPD number – Very delayed senescence to CPD50 • Clinical development – Only proven indications from RCT and/or meta analyses

Why such a dismal success rate? 4 primary problems • MSC source – Bone marrow – Adipose tissue – Umbilical cord tissue – Wharton’s Jelly – Placenta – Etc etc • MSC identity – CD73/90/105 – Lots of subsets with largely unknown potency – Lack of MoA • Clinically naive – “all MSC are the same” – No need for isolation, any product with some MSC will be OK – “If I call it a “stem cell” I can charge for it – Adipose SVF is a “stem cell” • MSC heterogeneity – Donor - to - donor – Source - to - source – CPD number – Senescence FAILURE TO PLAN TO DEVELOP AS A DRUG • CORDStrom source – Umbilical cord tissue • CORDStrom identity – CD73/90/105 – Plus CD10/29/44/142/146/ 166/200/271 and MSCA - 1 – MoA for EACH indication • CORDStrom heterogeneity – Pooled donors • Tuneable – Only UC MSC – Tunable CPD number – Very delayed senescence to CPD50 • Clinical development – Only proven indications from RCT and/or meta analyses CORDStrom ALWAYS DEVELOPED AS A DRUG

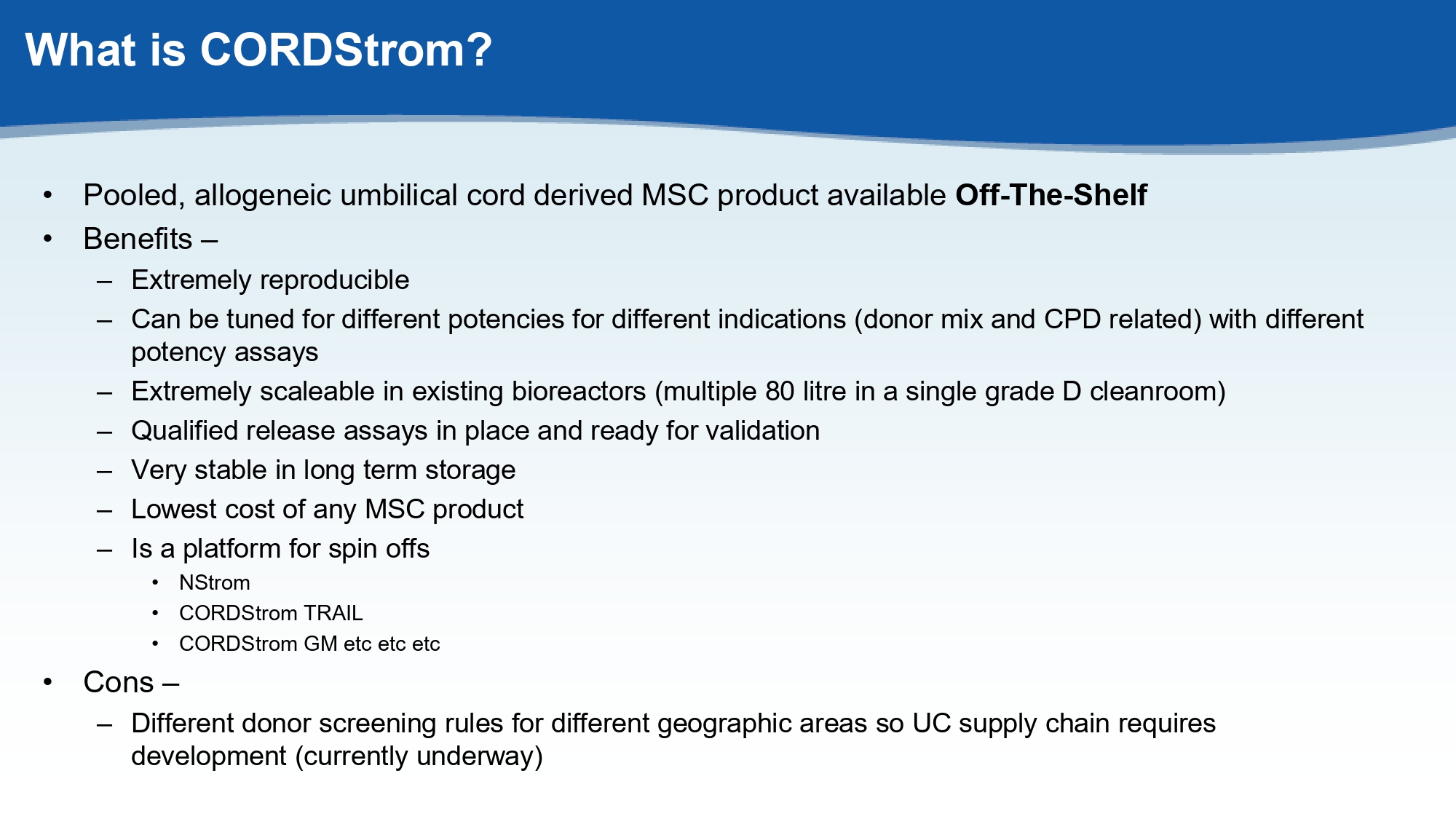

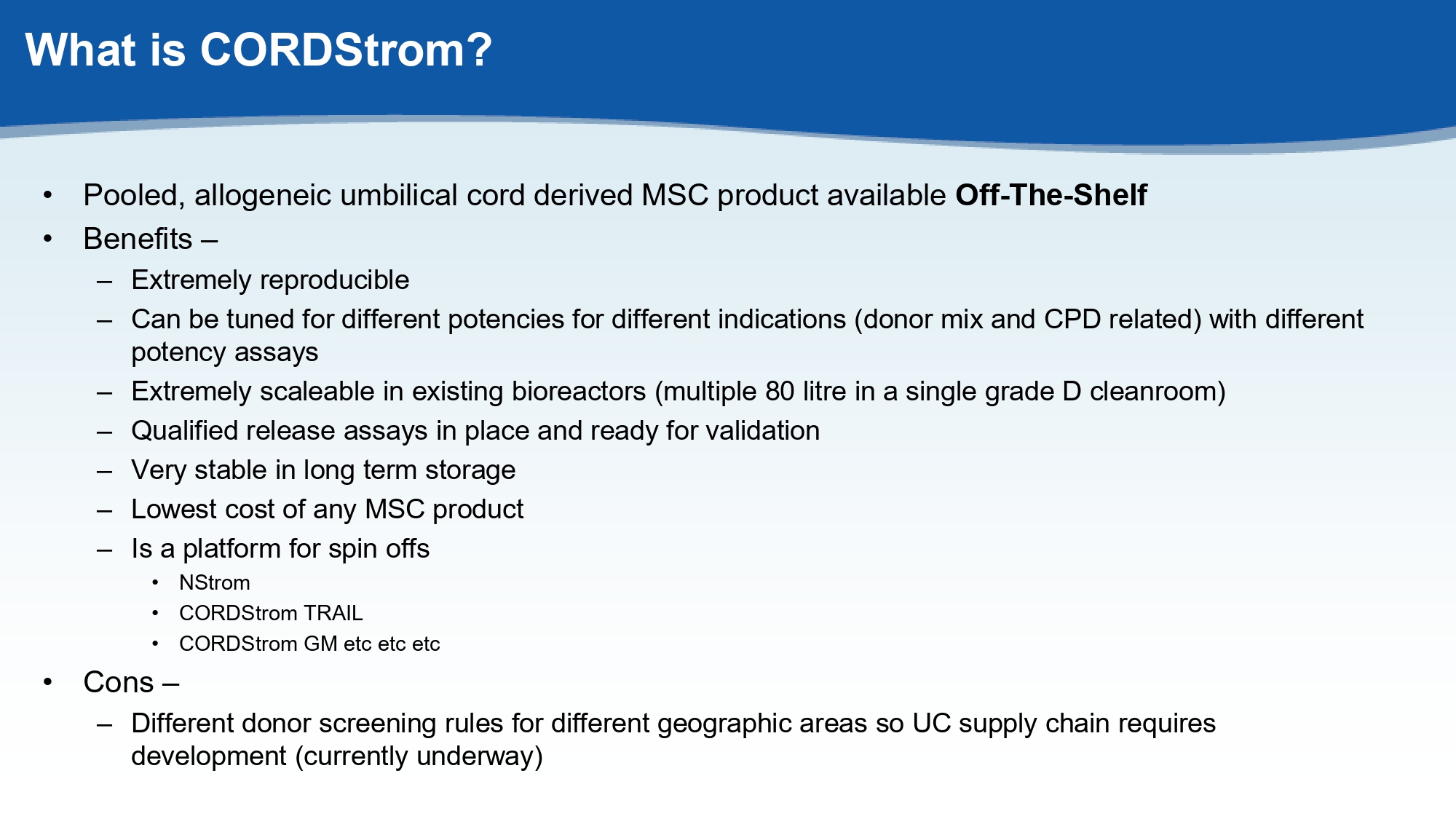

What is CORDStrom ? • Pooled, allogeneic umbilical cord derived MSC product available Off - The - Shelf • Benefits – – Extremely reproducible – Can be tuned for different potencies for different indications (donor mix and CPD related) with different potency assays – Extremely scaleable in existing bioreactors (multiple 80 litre in a single grade D cleanroom) – Qualified release assays in place and ready for validation – Very stable in long term storage – Lowest cost of any MSC product – Is a platform for spin offs • NStrom • CORDStrom TRAIL • CORDStrom GM etc etc etc • Cons – – Different donor screening rules for different geographic areas so UC supply chain requires development (currently underway)

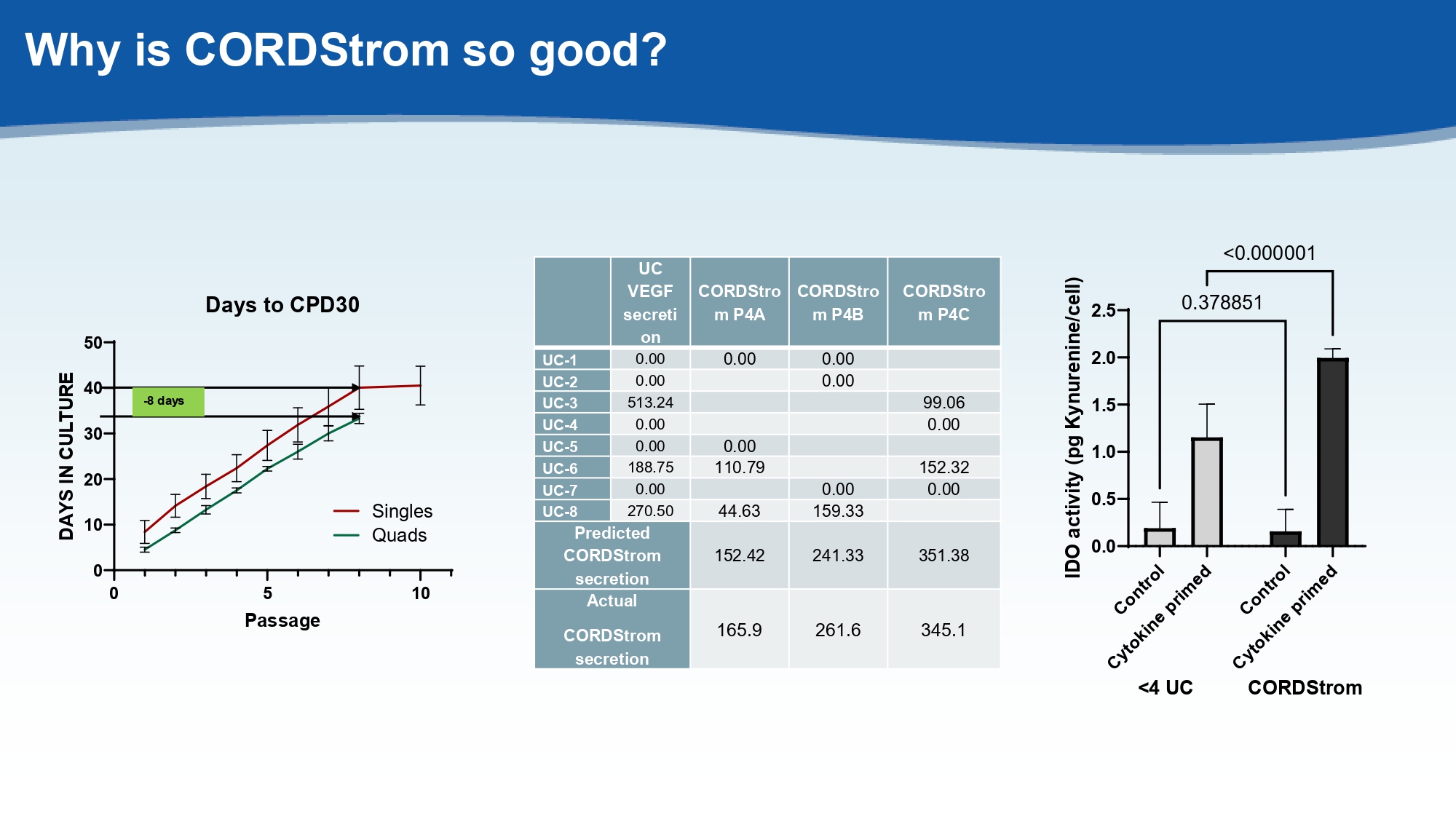

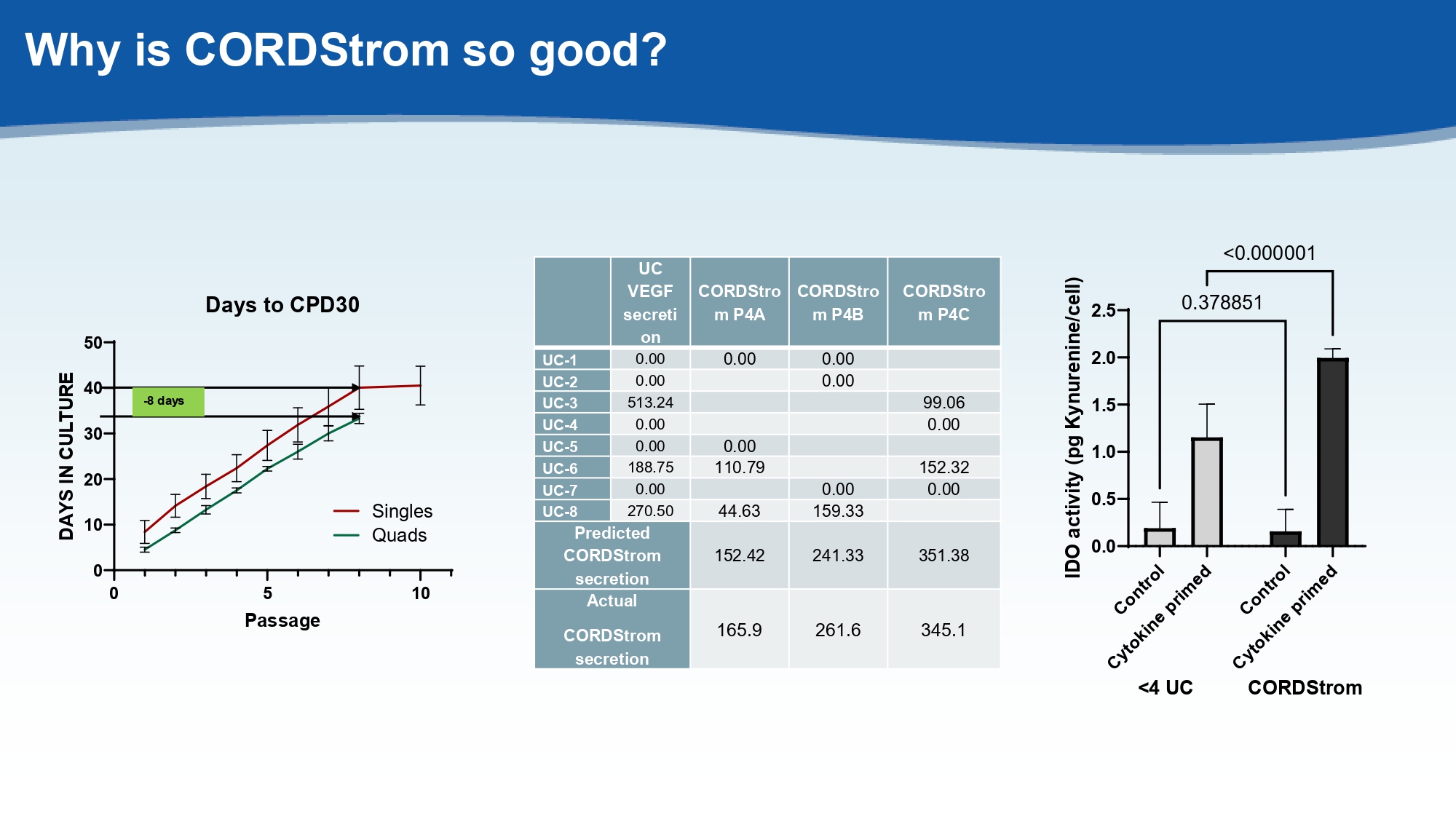

Why is CORDStrom so good? CORDStro m P4C CORDStro m P4B CORDStro m P4A UC VEGF secreti on 0.00 0.00 0.00 UC - 1 0.00 0.00 UC - 2 99.06 513.24 UC - 3 0.00 0.00 UC - 4 0.00 0.00 UC - 5 152.32 110.79 188.75 UC - 6 0.00 0.00 0.00 UC - 7 159.33 44.63 270.50 UC - 8 351.38 241.33 152.42 Predicted CORDStrom secretion 345.1 261.6 165.9 Actual CORDStrom secretion 0 5 10 0 10 20 30 40 50 Days to CPD30 Passage D A Y S I N C U L T U R E Singles Quads - 8 days

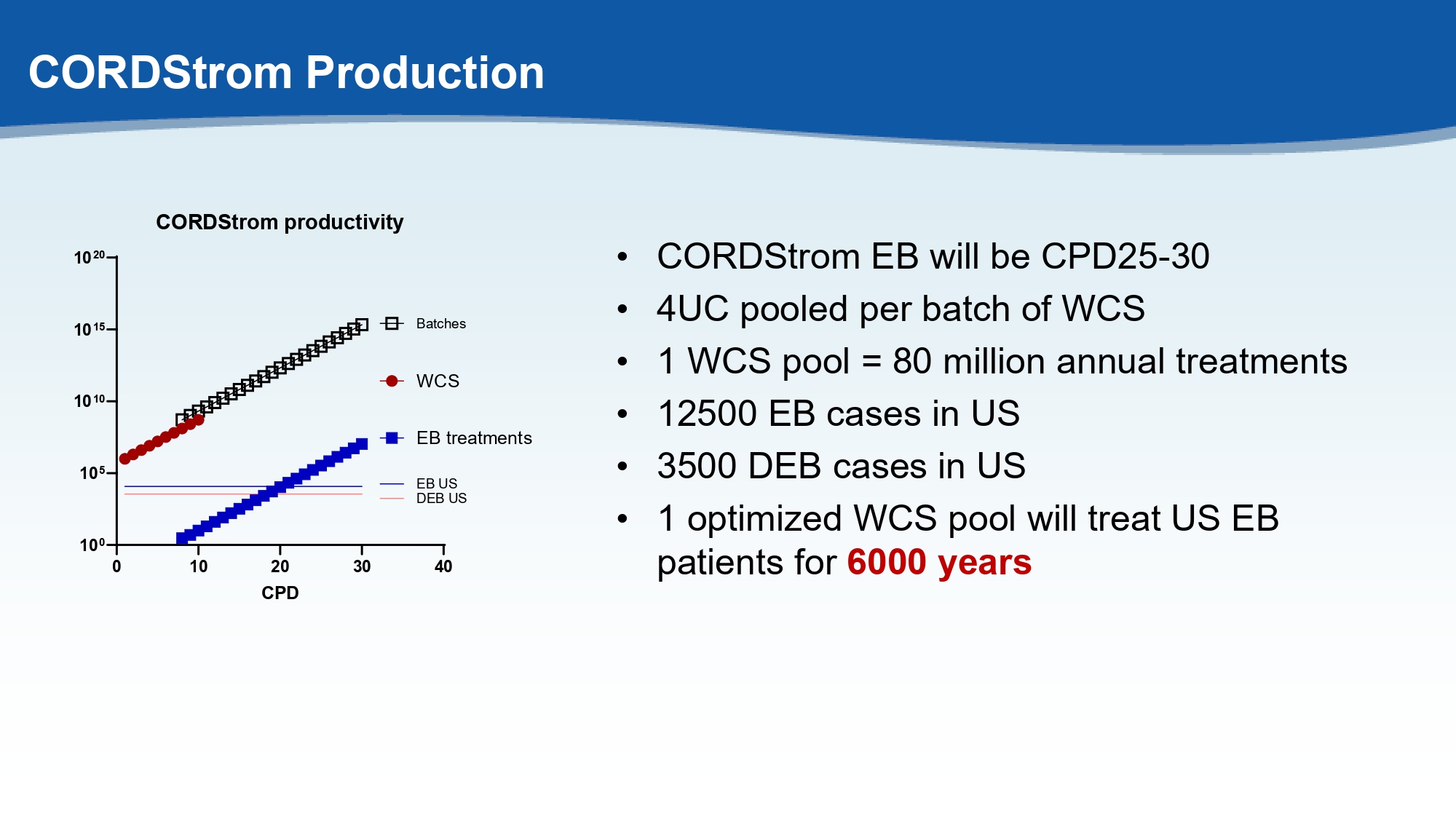

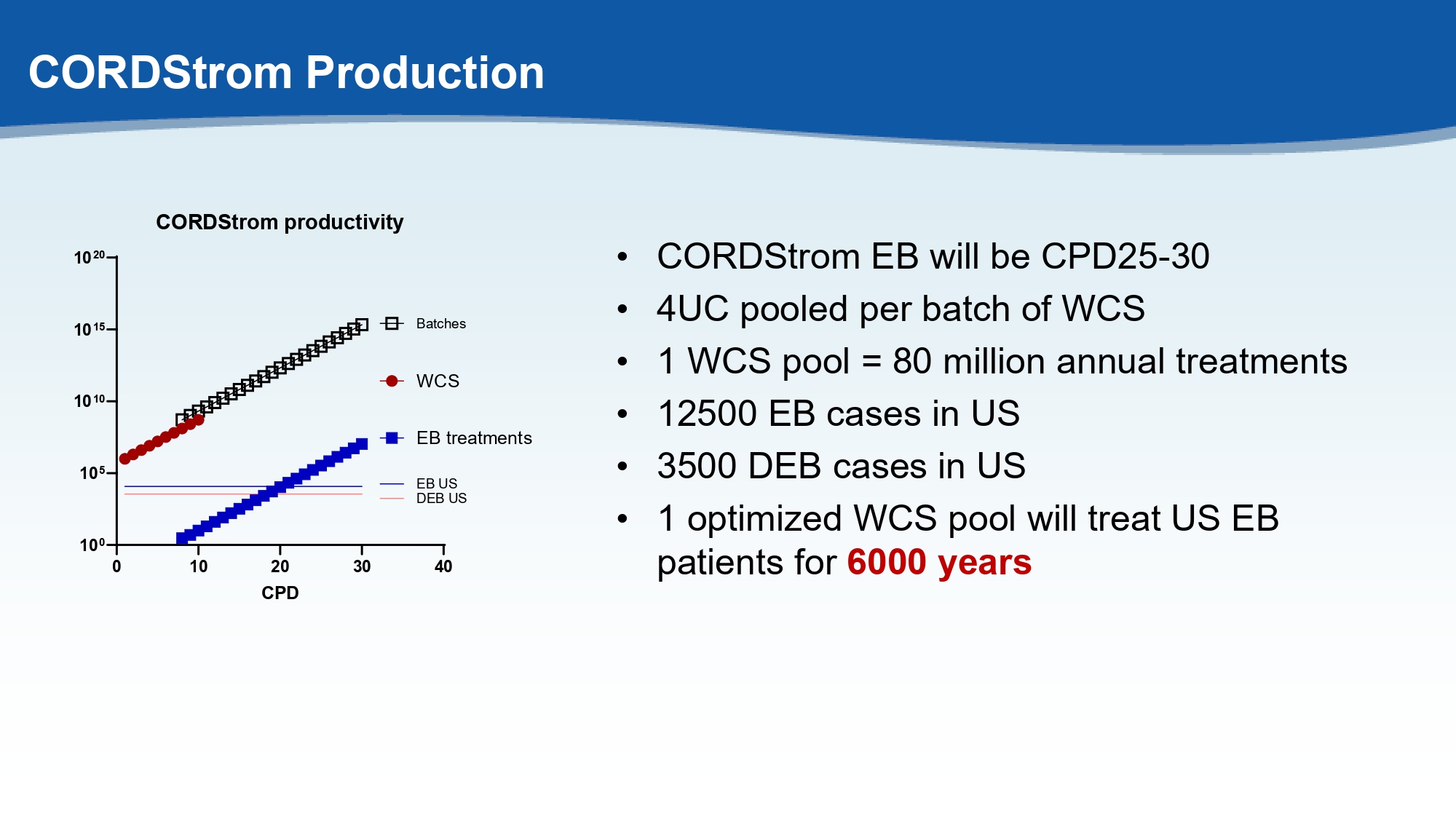

CORDStrom Production • CORDStrom EB will be CPD25 - 30 • 4UC pooled per batch of WCS • 1 WCS pool = 80 million annual treatments • 12500 EB cases in US • 3500 DEB cases in US • 1 optimized WCS pool will treat US EB patients for 6000 years 0 10 20 30 40 10 0 10 5 10 10 10 15 10 20 CORDStrom productivity CPD WCS EB treatments DEB US Batches EB US

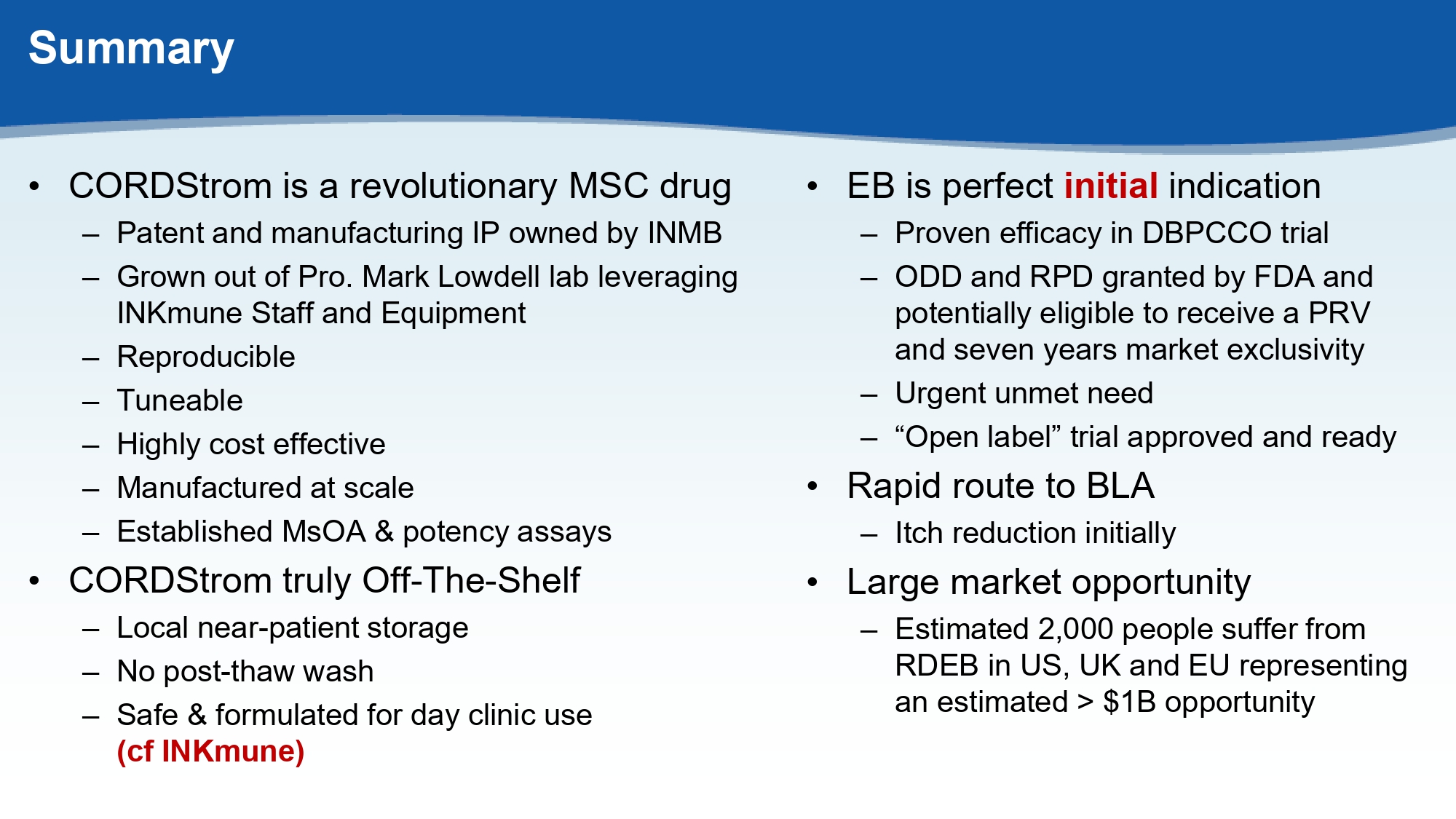

Summary • CORDStrom is a revolutionary MSC drug – Patent and manufacturing IP owned by INMB – Grown out of Pro. Mark Lowdell lab leveraging INKmune Staff and Equipment – Reproducible – Tuneable – Highly cost effective – Manufactured at scale – Established MsOA & potency assays • CORDStrom truly Off - The - Shelf – Local near - patient storage – No post - thaw wash – Safe & formulated for day clinic use ( cf INKmune ) • EB is perfect initial indication – Proven efficacy in DBPCCO trial – ODD and RPD granted by FDA and potentially eligible to receive a PRV and seven years market exclusivity – Urgent unmet need – “Open label” trial approved and ready • Rapid route to BLA – Itch reduction initially • Large market opportunity – Estimated 2,000 people suffer from RDEB in US, UK and EU representing an estimated > $1B opportunity

21 Questions & Answers Thank you Q&A instructions