Investments in Commercial Mortgage Loans

On November 9, 2021 we originated a floating rate senior mortgage and mezzanine loan to finance the acquisition of a four building life science/office campus in Farmington, Massachusetts, amounting to $63.0 million and have committed to fund an additional $30.4 million for future renovations of the property. The advance rate was 65% LTV with an in-place debt yield of 8.47%. On November 16, 2021 we originated a floating rate senior mortgage and mezzanine loan in the amount of $77.5 million to finance the acquisition of a multifamily property in Seattle, Washington, with additional commitments to fund $11.1 million for future renovations. The advance rate was 74% LTV with an in-place debt yield of 5.14%. The secondary market execution for both of these loan facilities will be to sell the senior mortgage position and increase the mezzanine yield.

On March 28, 2022 we originated a floating rate senior mortgage and mezzanine loan to finance the acquisition and reposition of five multi-family properties located in Tucson, Arizona, amounting to $92.4 million and have committed to fund an additional $9.3 million for future renovations of the property. The advance rate was 70.9% LTV with an in-place debt yield of 5.25%. The secondary market execution is anticipated to be note-on-note.

In July 2022, the Company originated two senior and mezzanine loans to finance the acquisitions of multifamily properties located in Kissimmee, Florida and Scottsdale, Arizona amounting to $136.8 million, with commitments to fund an additional $1.0 million for future renovations.

During the nine months ended September 30, 2022, we sold three senior loans to unaffiliated parties and retained the subordinate mortgages, receiving total proceeds of $157.4 million, which are net of disposition fees and additional fundings. The sales did not qualify for sale accounting under GAAP and as such, the loans were not de-recognized.

In accordance with the adoption of the fair value option allowed under ASC 825, Financial Instruments, and at our election, the existing commercial mortgage loans are stated at fair value and were initially valued at the face amount of the loan funding. Subsequently, the commercial mortgage loans will be valued at least quarterly by an independent third-party valuation firm with additional oversight being performed by the Advisor’s internal valuation department. The value will be based on market factors, such as market interest rates and spreads for comparable loans, the performance of the underlying collateral (such as the loan-to-value ratio and the cash flow of the underlying collateral), and the credit quality of the borrower.

For the three and nine months ended September 30, 2022, we had unrealized gains (losses) on our commercial mortgage loans of loans of $0.7 million and $(1.6) million, respectively. For the three and nine months ended September 30, 2021, we did not have a commercial mortgage loan investment.

For the three and nine months ended September 30, 2022, we recognized interest income and loan origination fee income from our investment in commercial mortgage loans of $5.6 million and $9.5 million, respectively. For the three and nine months ended September 30, 2021, we did not have a commercial mortgage loan investment.

Factors Impacting Our Operating Results

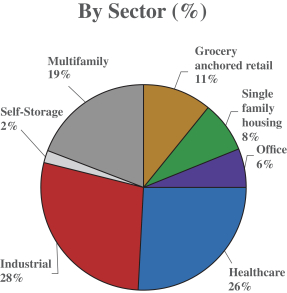

Results of operations are affected by a number of factors and depend on the rental revenue we receive from the properties that we acquire, the timing of lease expirations, general market conditions, operating expenses, the competitive environment for real estate assets and income from our investments in real estate-related securities, real estate debt, commercial mortgages and the International Affiliated Funds. Real estate has produced strong returns over the last few years and has priced in the effects of higher inflation and monetary policy to a more limited extent than other asset classes. Higher market rents, particularly from industrial, self-storage, and housing properties, are translating into strong net operating income growth, and investors are continuing to view real estate as a key portfolio diversifier in a high-inflation environment. U.S. commercial real estate should benefit

51