Filed Pursuant to Rule 424(b)(3)

Registration No. 333-262589

STARWOOD REAL ESTATE INCOME TRUST, INC.

SUPPLEMENT NO. 2 DATED MAY 15, 2024

TO THE PROSPECTUS DATED APRIL 10, 2024

This prospectus supplement (“Supplement”) is part of and should be read in conjunction with the prospectus of Starwood Real Estate Income Trust, Inc., dated April 10, 2024 (as supplemented to date, the “Prospectus”). Unless otherwise defined herein, capitalized terms used in this Supplement shall have the same meanings as in the Prospectus. References herein to the “Company,” “we,” “us,” or “our” refer to Starwood Real Estate Income Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

The purposes of this Supplement are as follows:

•to provide an update on our liquidity position;

•to disclose the transaction price for each class of our common stock as of June 1, 2024;

•to disclose the calculation of our April 30, 2024 NAV per share for each class of our common stock;

•to update the “Risk Factors” section of the Prospectus;

•to provide an update on our share repurchase requests;

•to provide an update on the status of our current public offering (the “Offering”); and

•to include our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

Liquidity Position Update

As of April 30, 2024, we maintain approximately $752 million or approximately 8% of our April 2024 NAV of immediate liquidity comprised of cash, undrawn unsecured line of credit, and liquid securities. This liquidity level does not include any pending net proceeds from asset sales or any potential future asset sales.

June 1, 2024 Transaction Price

The transaction price for each share class of our common stock for subscriptions accepted as of June 1, 2024 (and repurchases as of May 31, 2024) is as follows:

| | | | |

| | Transaction Price

(per share) | |

Class S | | $ | 23.06 | |

Class T | | $ | 23.07 | |

Class D | | $ | 22.62 | |

Class I | | $ | 22.87 | |

The June 1, 2024 transaction price for each of our share classes is equal to such class’s NAV per share as of April 30, 2024. A detailed presentation of the NAV per share is set forth below. The purchase price of our common stock for each share class equals the transaction price of such class, plus applicable upfront selling commissions and dealer manager fees.

April 30, 2024 NAV Per Share

NAV per share is calculated in accordance with the valuation guidelines that have been approved by our board of directors. Our NAV per share, which is updated as of the last calendar day of each month, is posted on our website at www.starwoodNAV.reit. Please refer to “Net Asset Value Calculation and Valuation Guidelines” in the Prospectus for information on how our NAV is determined. The Advisor is ultimately responsible for determining our NAV. We have included a breakdown of the components of total NAV and NAV per share as of April 30, 2024 along with the immediately preceding month.

SREIT-SUP2-0524

Our total NAV presented in the following tables includes the NAV of our Class S, Class T, Class D, and Class I common shares, as well as partnership interests of the Operating Partnership held by parties other than the Company. The following table provides a breakdown of the major components of our NAV as of April 30, 2024 ($ and shares/units in thousands):

| | | | |

Components of NAV | | April 30, 2024 | |

Investments in real estate | | $ | 22,324,402 | |

Investments in real estate debt | | | 1,033,895 | |

Cash and cash equivalents | | | 446,054 | |

Restricted cash | | | 252,669 | |

Other assets | | | 711,675 | |

Debt obligations | | | (12,555,435 | ) |

Secured financings on investments in real estate debt | | | (552,113 | ) |

Subscriptions received in advance | | | (16,041 | ) |

Other liabilities | | | (1,664,803 | ) |

Performance participation accrual | | | — | |

Management fee payable | | | (10,360 | ) |

Accrued stockholder servicing fees (1) | | | (3,215 | ) |

Non-controlling interests in consolidated joint ventures | | | (76,490 | ) |

Net asset value | | $ | 9,890,238 | |

Number of outstanding shares/units | | | 431,140 | |

(1)Stockholder servicing fees only apply to Class S, Class T and Class D shares. For purposes of NAV we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis. Under accounting principles generally accepted in the United States of America (“GAAP”), we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class S, Class T and Class D shares. As of April 30, 2024, we have accrued under GAAP $266.9 million of stockholder servicing fees payable to the Dealer Manager related to the Class S, Class T and Class D shares sold.

The following table provides a breakdown of our total NAV and NAV per share, by share class, as of April 30, 2024 ($ and shares/units in thousands, except per share/unit data):

| | | | | | | | | | | | | | | | | | | | | | | | |

NAV Per Share | | Class S

Shares | | | Class T

Shares | | | Class D

Shares | | | Class I

Shares | | | Third-party Operating Partnership Units (1) | | | Total | |

Net asset value | | $ | 4,290,469 | | | $ | 119,135 | | | $ | 596,849 | | | $ | 4,424,562 | | | $ | 459,223 | | | $ | 9,890,238 | |

Number of outstanding shares/units | | | 186,068 | | | | 5,164 | | | | 26,387 | | | | 193,444 | | | | 20,077 | | | | 431,140 | |

NAV Per Share/Unit as of April 30, 2024 | | $ | 23.06 | | | $ | 23.07 | | | $ | 22.62 | | | $ | 22.87 | | | $ | 22.87 | | | | |

(1)Includes the Operating Partnership units held by the Special Limited Partner and other third parties.

Set forth below are the weighted averages of the key assumptions in the discounted cash flow methodology used in the April 30, 2024 valuations, based on property types. Once we own more than one single-family, one self-storage and one extended stay investment, we will include the key assumptions for the property types.

| | | | |

Property Type | | Discount

Rate | | Exit

Capitalization

Rate |

Multifamily | | 7.0% | | 5.5% |

Industrial | | 7.2% | | 5.8% |

Office | | 8.0% | | 6.8% |

Other | | 8.2% | | 6.7% |

These assumptions are determined by the Advisor (except for investments valued by a third party appraisal firm), and reviewed by our independent valuation advisor. A change in these assumptions would impact the calculation of the value of our property investments. For example, assuming all other factors remain unchanged, the changes listed below would result in the following effects on our investment values:

| | | | | | | | | | |

Input | | Hypothetical

Change | | Multifamily

Investment

Values | | Industrial

Investment

Values | | Office

Investment

Values | | Other

Investment

Values |

Discount Rate | | 0.25% decrease | | +1.9% | | +1.9% | | +1.8% | | +1.9% |

(weighted average) | | 0.25% increase | | (1.9)% | | (1.9)% | | (1.9)% | | (1.8)% |

Exit Capitalization Rate | | 0.25% decrease | | +2.9% | | +2.9% | | +2.3% | | +2.3% |

(weighted average) | | 0.25% increase | | (2.7)% | | (2.6)% | | (2.2)% | | (2.1)% |

The following table provides a breakdown of the major components of our NAV as of March 31, 2024 ($ and shares/units in thousands):

| | | | |

Components of NAV | | March 31, 2024 | |

Investments in real estate | | $ | 22,437,036 | |

Investments in real estate debt | | | 1,388,138 | |

Cash and cash equivalents | | | 316,144 | |

Restricted cash | | | 231,721 | |

Other assets | | | 698,428 | |

Debt obligations | | | (12,589,700 | ) |

Secured financings on investments in real estate debt | | | (738,384 | ) |

Subscriptions received in advance | | | (11,569 | ) |

Other liabilities | | | (1,606,179 | ) |

Performance participation accrual | | | — | |

Management fee payable | | | (10,513 | ) |

Accrued stockholder servicing fees (1) | | | (3,353 | ) |

Non-controlling interests in consolidated joint ventures | | | (75,031 | ) |

Net asset value | | $ | 10,036,738 | |

Number of outstanding shares/units | | | 434,644 | |

(1)Stockholder servicing fees only apply to Class S, Class T and Class D shares. For purposes of NAV we recognize the stockholder servicing fee as a reduction of NAV on a monthly basis. Under accounting principles generally accepted in the United States of America (“GAAP”), we accrue the full cost of the stockholder servicing fee as an offering cost at the time we sell Class S, Class T and Class D shares. As of March 31, 2024, we have accrued under GAAP $272.9 million of stockholder servicing fees payable to the Dealer Manager related to the Class S, Class T and Class D shares sold.

The following table provides a breakdown of our total NAV and NAV per share, by share class, as of March 31, 2024 ($ and shares/units in thousands, except per share/unit data):

| | | | | | | | | | | | | | | | | | | | | | | | |

NAV Per Share | | Class S

Shares | | | Class T

Shares | | | Class D

Shares | | | Class I

Shares | | | Third-party Operating Partnership Units (1) | | | Total | |

Net asset value | | $ | 4,347,963 | | | $ | 120,330 | | | $ | 602,860 | | | $ | 4,503,300 | | | $ | 462,285 | | | $ | 10,036,738 | |

Number of outstanding shares/units | | | 187,329 | | | | 5,182 | | | | 26,474 | | | | 195,582 | | | | 20,077 | | | | 434,644 | |

NAV Per Share/Unit as of March 31, 2024 | | $ | 23.21 | | | $ | 23.22 | | | $ | 22.77 | | | $ | 23.03 | | | $ | 23.03 | | | | |

(1)Includes the Operating Partnership units held by the Special Limited Partner and other third parties.

Prospectus Updates

The following disclosure supersedes and replaces the section of the Prospectus entitled “Risk Factors—Risks Related to our REIT Status and Certain Other Tax Items—Non-U.S. holders may be required to file U.S. federal income tax returns and pay U.S. federal income tax upon their disposition of shares of our common stock or upon their receipt of certain distributions from us.”

Non-U.S. holders may be required to file U.S. federal income tax returns and pay U.S. federal income tax upon their disposition of shares of our common stock or upon their receipt of certain distributions from us.

In addition to any potential withholding tax on ordinary dividends, a non-U.S. holder other than a “qualified shareholder” or a “qualified foreign pension fund,” as each is defined for purposes of the Code, that disposes of a “United States real property interest” (“USRPI”) (which includes shares of stock of a U.S. corporation whose assets consist principally of USRPIs), is generally subject to U.S. federal income tax under the Foreign Investment in Real Property Tax Act of 1980, as amended (“FIRPTA”), on the gain from such disposition. FIRPTA gains must be reported on U.S. federal income tax returns and are taxable at regular U.S. federal income tax rates. Such tax does not apply, however, to the gain on disposition of stock in a REIT that is “domestically controlled.” Generally, a REIT is domestically controlled if less than 50% of its stock, by value, has been owned directly or indirectly by non-U.S. persons during a continuous five-year period ending on the date of disposition or, if shorter, during the entire period of the REIT’s existence. We cannot assure our stockholders that we will qualify as or that we will remain a domestically controlled REIT. Final Treasury regulations effective April 25, 2024 (the “Final Regulations”) modify the existing prior tax guidance relating to the manner in which we determine whether we are a domestically controlled REIT. These regulations provide a look through rule for our stockholders that are non-publicly traded partnerships, non-public REITs, non-public regulated investment companies or domestic C corporations owned more than 50% or more directly or indirectly by foreign persons (“foreign-controlled domestic corporations”) treat “qualified foreign pension funds” as foreign persons. The look-through rule in the Final Regulations applicable to foreign-controlled domestic corporations will not apply to a REIT for a period of up to ten years if the REIT is able to satisfy certain requirements during that time, including not undergoing a significant change in its ownership and not acquiring a significant amount of new U.S. real property interests, in each case since April 24, 2024, the date the Final Regulations were issued. If a REIT fails to satisfy such requirements during the ten-year period, the look-through rule in the Final Regulations applicable to foreign-controlled domestic corporations will apply to such REIT beginning on the day immediately following the date of such failure. While we cannot predict when we will commence being subject to such look-through rule in the Final Regulations, we may not be able to satisfy the applicable requirements for the duration of the ten-year period. Prospective investors are urged to consult with their tax advisors regarding the application and impact of these rules.

Even if we are domestically controlled, a non-U.S. holder, other than a “qualified shareholder” or a “qualified foreign pension fund” that receives a distribution from a REIT attributable to gains from the disposition of a USRPI as described above, including in connection with a repurchase of our common stock, is generally subject to U.S. federal income tax under FIRPTA to the extent such distribution is attributable to gains from such disposition, regardless of whether the difference between the fair market value and the tax basis of the USRPI giving rise to such gains is attributable to periods prior to or during such non-U.S. holder’s ownership of our common stock unless the relevant class of stock is regularly traded on an established securities market in the United States and such non-U.S. holder did not own more than 10% of such class at any time during the one-year period ending on the date of such distribution. In addition, a repurchase of our common stock, to the extent not treated as a sale or exchange, may be subject to withholding as an ordinary dividend.

We seek to act in the best interests of our company as a whole and not in consideration of the particular tax consequences to any specific holder of our stock. Potential non-U.S. holders should inform themselves as to the U.S. tax consequences, and the tax consequences within the countries of their citizenship, residence, domicile, and place of business, with respect to the purchase, ownership and disposition of shares of our common stock.

The following disclosure supersedes and replaces the section of the Prospectus entitled “Material U.S. Federal Income Tax Considerations—Taxation of Non-U.S. Holders of Our Common Stock—Sales of Our Common Stock.”

Sales of Our Common Stock. Subject to the discussion below under “—Repurchases of Our Common Stock,” gain recognized by a non-U.S. holder upon the sale or exchange of our stock generally would not be subject to U.S. taxation unless:

| | | |

| • | | the investment in our common stock is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States (and, if required by an applicable income tax treaty, is attributable to a U.S. permanent establishment of the non-U.S. holder), in which case the non-U.S. holder will be subject to the same treatment as domestic holders with respect to any gain; |

| | | |

| • | | the non-U.S. holder is a nonresident alien individual who is present in the United States for 183 days or more during the taxable year and has a tax home in the United States, in which case the nonresident alien individual will be subject to a 30% tax on the individual’s net capital gains for the taxable year; or |

| | | |

| • | | the non-U.S. holder is not a “qualified shareholder” or a “qualified foreign pension fund” (each as defined in the Code) and our common stock constitutes a USRPI within the meaning of FIRPTA, as described below. |

We anticipate that our common stock will constitute a USRPI within the meaning of FIRPTA unless we are a domestically controlled REIT. We will be a domestically controlled REIT if, at all times during a specified testing period, less than 50% in value of our stock is held directly or indirectly by non-U.S. holders. No assurance can be given, however, that we are, will be or will remain a domestically controlled REIT. The Final Regulations effective April 25, 2024 modify prior tax guidance relating to the manner in which we determine whether we are a domestically controlled REIT. These regulations provide a look-through rule for our stockholders that are non-publicly traded partnerships, non-public REITs, non-public regulated investment companies, or non-public domestic C corporations owned more than 50% directly or indirectly by foreign persons (“foreign-controlled domestic corporations”) and treat “qualified foreign pension funds” as foreign persons. The look-through rule in the Final Regulations applicable to foreign-controlled domestic corporations will not apply to a REIT for a period of up to ten years if the REIT is able to satisfy certain requirements during that time, including not undergoing a significant change in its ownership and not acquiring a significant amount of new U.S. real property interests, in each case since April 24, 2024, the date the Final Regulations were issued. If a REIT fails to satisfy such requirements during the ten-year period, the look-through rule in the Final Regulations applicable to foreign-controlled domestic corporations will apply to such REIT beginning on the day immediately following the date of such failure. While we cannot predict when we will commence being subject to such look-through rule in the Final Regulations, we may not be able to satisfy the applicable requirements for the duration of the ten-year period. Prospective investors are urged to consult with their tax advisors regarding the application and impact of these rules.

Even if we were not a domestically controlled REIT, a sale of common stock by a non-U.S. holder would nevertheless not be subject to taxation under FIRPTA as a sale of a USRPI if:

| | | |

| • | | our common stock were “regularly traded” on an established securities market within the meaning of applicable Treasury regulations; and |

| | | |

| • | | the non-U.S. holder did not actually, or constructively under specified attribution rules under the Code, own more than 10% of our common stock at any time during the specified testing period. |

However, it is not anticipated that our common stock will be “regularly traded” on an established securities market. If gain on the sale or exchange of our common stock were subject to taxation under FIRPTA, the non-U.S. holder would be subject to regular U.S. income tax with respect to any gain in the same manner as a taxable U.S. holder, subject to a special alternative minimum tax in the case of nonresident alien individuals. In such a case, under FIRPTA the purchaser of common stock from a non-U.S. holder may be required to withhold 15% of the purchase price and remit this amount to the IRS.

Our transfer agent’s overnight address set forth in the “Prospectus Summary” section and the “Share Repurchases” section of the Prospectus is hereby deleted and replaced with the following:

Overnight Address:

SS&C GIDS, Inc.

430 W 7th St. Suite 219426

Kansas City, MO 64105

Our transfer agent’s overnight address set forth under Section 9. Delivery Instructions in the Form of Subscription Agreement set forth in Appendix B of the Prospectus is hereby deleted and replaced with the following:

|

Overnight Mail |

Starwood c/o SS&C GIDS, Inc. as Processing Agent 430 W 7th Street, STE 219426 Kansas City, MO 64105-1407 |

Share Repurchase Request Update

Pursuant to the terms of our share repurchase plan, the total amount of aggregate share repurchases is limited to no more than 2% of our aggregate NAV per month (measured using the aggregate NAV attributable to stockholders as of the end of the immediately preceding month) and no more than 5% of our aggregate NAV per calendar quarter (measured using the aggregate NAV attributable to stockholders as of the end of the immediately preceding quarter). In April 2024, we received repurchase requests in excess of the 2% monthly limit. As per the terms of our share repurchase plan, we honored all repurchase requests for April 2024 on a pro rata basis up to the 2% monthly limitation. As such, approximately 37% of each stockholder’s April repurchase request was satisfied. In accordance with our repurchase plan, on April 30, 2024, we repurchased all of the shares from stockholders that held less than $500 in shares of our common stock and, as such, we exceeded the 2% monthly limitation by $56,431, as authorized by our board of directors.

Status of our Current Public Offering

This Offering was declared effective by the SEC on August 10, 2022 and we are currently offering on a continuous basis up to $18.0 billion in shares of common stock, consisting of up to $16.0 billion in shares in our primary offering and up to $2.0 billion in shares pursuant to our distribution reinvestment plan. As of the date hereof, we had issued and sold (i) 48,256,757 shares of our common stock (consisting of 17,176,985 Class S shares, 257,873 Class T shares, 2,436,710 Class D shares and 28,385,189 Class I shares) in the primary offering for total proceeds of approximately $1.3 billion and (ii) 14,499,507 shares of our common stock (consisting of 6,690,981 Class S shares, 246,740 Class T shares, 874,694 Class D shares and 6,687,092 Class I shares) pursuant to our distribution reinvestment plan for a total value of approximately $0.4 billion. As of April 30, 2024, our aggregate NAV was approximately $9.9 billion. We intend to continue selling shares in the Offering on a monthly basis.

Quarterly Report on Form 10-Q

The Prospectus is hereby supplemented with our Quarterly Report on Form 10-Q, excluding exhibits, for the quarter ended March 31, 2024, that was filed with the SEC on May 13, 2024, a copy of which is attached to this Supplement No. 2 as Appendix A.

APPENDIX A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Transition period from to .

Commission file number 000-56046

Starwood Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in Its Charter)

| | |

Maryland | 2340 Collins Avenue Miami Beach, FL 33139 | 82-2023409 |

(State or other jurisdiction of incorporation or organization) | (Address of principal executive offices) (Zip Code) | (I.R.S. Employer Identification No.) |

Registrant’s telephone number, including area code: (305) 695-5500

Securities registered pursuant to Section 12(b) of the Act: None

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | |

Large accelerated filer | | ☐ | | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☒ | | | Smaller reporting company | | ☐ |

| | | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of May 6, 2024, the registrant had the following shares outstanding: 5,135,722 shares of Class T common stock, 183,308,868 shares of Class S common stock, 26,138,604 shares of Class D common stock and 189,671,582 shares of Class I common stock.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Starwood Real Estate Income Trust, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| | | | | | | | |

| | March 31, 2024 | | | December 31, 2023 | |

Assets | | | | | | |

Investments in real estate, net | | $ | 19,351,915 | | | $ | 19,580,358 | |

Investments in real estate debt | | | 1,388,138 | | | | 1,589,350 | |

Investments in unconsolidated real estate ventures | | | 451,645 | | | | 456,002 | |

Cash and cash equivalents | | | 316,144 | | | | 294,984 | |

Restricted cash | | | 231,721 | | | | 245,651 | |

Other assets | | | 951,262 | | | | 947,629 | |

Total assets | | $ | 22,690,825 | | | $ | 23,113,974 | |

Liabilities and Equity | | | | | | |

Mortgage notes and credit facility, net | | $ | 12,975,325 | | | $ | 13,028,910 | |

Secured financings on investments in real estate debt, net | | | 737,451 | | | | 762,352 | |

Unsecured line of credit | | | 1,225,000 | | | | 907,500 | |

Other liabilities | | | 437,726 | | | | 484,358 | |

Subscriptions received in advance | | | 11,569 | | | | 13,225 | |

Due to affiliates | | | 289,341 | | | | 320,957 | |

Total liabilities | | | 15,676,412 | | | | 15,517,302 | |

| | | | | | |

Commitments and contingencies | | | — | | | | — | |

Redeemable non-controlling interests | | | 462,285 | | | | 459,862 | |

| | | | | | |

Equity | | | | | | |

Preferred stock, $0.01 par value per share, 100,000,000 shares authorized;

none issued and outstanding as of March 31, 2024 and December 31, 2023 | | | — | | | | — | |

Common stock — Class T shares, $0.01 par value per share, 500,000,000 shares

authorized; 5,181,829 and 5,282,025 shares issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively | | | 52 | | | | 53 | |

Common stock — Class S shares, $0.01 par value per share, 1,000,000,000 shares

authorized; 187,328,914 and 195,023,616 shares issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively | | | 1,873 | | | | 1,950 | |

Common stock — Class D shares, $0.01 par value per share, 500,000,000 shares

authorized; 26,474,013 and 27,512,551 shares issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively | | | 265 | | | | 275 | |

Common stock — Class I shares, $0.01 par value per share, 1,000,000,000 shares

authorized; 195,582,276 and 202,990,052 shares issued and outstanding as of

March 31, 2024 and December 31, 2023, respectively | | | 1,956 | | | | 2,030 | |

Additional paid-in capital | | | 9,269,243 | | | | 9,641,219 | |

Accumulated other comprehensive loss | | | (25,342 | ) | | | (15,729 | ) |

Accumulated deficit and cumulative distributions | | | (2,739,431 | ) | | | (2,537,302 | ) |

Total stockholders’ equity | | | 6,508,616 | | | | 7,092,496 | |

Non-controlling interests in consolidated joint ventures | | | 43,512 | | | | 44,314 | |

Total equity | | | 6,552,128 | | | | 7,136,810 | |

Total liabilities and equity | | $ | 22,690,825 | | | $ | 23,113,974 | |

See accompanying notes to condensed consolidated financial statements.

Starwood Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | |

| | For the Three Months Ended March 31, | |

| | 2024 | | | 2023 | |

Revenues | | | | | | | | |

Rental revenue | | $ | | 413,083 | | | $ | | 431,000 | |

Other revenue | | | | 10,967 | | | | | 15,444 | |

Total revenues | | | | 424,050 | | | | | 446,444 | |

Expenses | | | | | | | | |

Property operating | | | | 179,657 | | | | | 189,651 | |

General and administrative | | | | 12,492 | | | | | 10,569 | |

Management fees | | | | 31,996 | | | | | 42,181 | |

Performance participation allocation | | | | — | | | | | — | |

Impairment of investments in real estate | | | | — | | | | | 79,846 | |

Depreciation and amortization | | | | 186,398 | | | | | 200,434 | |

Total expenses | | | | 410,543 | | | | | 522,681 | |

Other expense | | | | | | | | |

Loss from unconsolidated real estate ventures | | | | (3,968 | ) | | | | (3,089 | ) |

Income from investments in real estate debt | | | | 40,497 | | | | | 31,841 | |

Net gain (loss) on dispositions of real estate | | | | 2,083 | | | | | (423 | ) |

Interest expense | | | | (154,033 | ) | | | | (137,290 | ) |

Other income (expense), net | | | | 15,628 | | | | | (140,034 | ) |

Total other expense | | | | (99,793 | ) | | | | (248,995 | ) |

Net loss | | $ | | (86,286 | ) | | $ | | (325,232 | ) |

Net loss attributable to non-controlling interests in

consolidated joint ventures | | $ | | 187 | | | $ | | 1,492 | |

Net loss attributable to non-controlling

interests in Operating Partnership | | | | 4,753 | | | | | 13,103 | |

Net loss attributable to stockholders | | $ | | (81,346 | ) | | $ | | (310,637 | ) |

Net loss per share of common stock, basic and diluted | | $ | | (0.19 | ) | | $ | | (0.63 | ) |

Weighted-average shares of common stock

outstanding, basic and diluted | | | | 420,777,452 | | | | | 496,673,860 | |

| | | | | | | | |

Comprehensive loss: | | | | | | | | |

Net loss | | $ | | (86,286 | ) | | $ | | (325,232 | ) |

Other comprehensive (loss) income item: | | | | | | | | |

Foreign currency translation adjustments | | | | (9,613 | ) | | | | 6,601 | |

Other comprehensive (loss) income | | $ | | (9,613 | ) | | $ | | 6,601 | |

Comprehensive loss | | $ | | (95,899 | ) | | $ | | (318,631 | ) |

See accompanying notes to condensed consolidated financial statements.

Starwood Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Changes in Equity (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock

Class T | | | Common

Stock

Class S | | | Common

Stock

Class D | | | Common

Stock

Class I | | | Additional

Paid-in

Capital | | | Accumulated

Other

Comprehensive

Loss | | | Accumulated

Deficit and

Cumulative

Distributions | | | Total

Stockholders’

Equity | | | Non-

controlling

Interests | | | Total

Equity | |

Balance at December 31, 2023 | $ | | 53 | | | $ | | 1,950 | | | $ | | 275 | | | $ | | 2,030 | | | $ | | 9,641,219 | | | $ | | (15,729 | ) | | $ | | (2,537,302 | ) | | $ | | 7,092,496 | | | $ | | 44,314 | | | $ | | 7,136,810 | |

Common stock issued, net | | | (1 | ) | | | | 3 | | | | | 2 | | | | | 34 | | | | | 89,674 | | | | | — | | | | | — | | | | | 89,712 | | | | | — | | | | | 89,712 | |

Offering costs, net | | | — | | | | | — | | | | | — | | | | | — | | | | | 17,393 | | | | | — | | | | | — | | | | | 17,393 | | | | | — | | | | | 17,393 | |

Distribution reinvestments | | | — | | | | | 10 | | | | | 2 | | | | | 9 | | | | | 48,672 | | | | | — | | | | | — | | | | | 48,693 | | | | | — | | | | | 48,693 | |

Amortization of restricted stock grants | | | — | | | | | — | | | | | — | | | | | — | | | | | 210 | | | | | — | | | | | — | | | | | 210 | | | | | — | | | | | 210 | |

Common stock repurchased | | | — | | | | | (90 | ) | | | | (14 | ) | | | | (117 | ) | | | | (514,295 | ) | | | | — | | | | | — | | | | | (514,516 | ) | | | | — | | | | | (514,516 | ) |

Net loss ($4,753 allocated to redeemable

non-controlling interest) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (81,346 | ) | | | | (81,346 | ) | | | | (187 | ) | | | | (81,533 | ) |

Distributions to non-controlling interests | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (615 | ) | | | | (615 | ) |

Distributions declared on common stock

(see Note 11) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (120,783 | ) | | | | (120,783 | ) | | | | — | | | | | (120,783 | ) |

Other comprehensive loss | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (9,613 | ) | | | | — | | | | | (9,613 | ) | | | | — | | | | | (9,613 | ) |

Allocation to redeemable non-controlling

interest | | | — | | | | | — | | | | | — | | | | | — | | | | | (13,630 | ) | | | | — | | | | | — | | | | | (13,630 | ) | | | | — | | | | | (13,630 | ) |

Balance at March 31, 2024 | $ | | 52 | | | $ | | 1,873 | | | $ | | 265 | | | $ | | 1,956 | | | $ | | 9,269,243 | | | $ | | (25,342 | ) | | $ | | (2,739,431 | ) | | $ | | 6,508,616 | | | $ | | 43,512 | | | $ | | 6,552,128 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Par Value | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock

Class T | | | Common

Stock

Class S | | | Common

Stock

Class D | | | Common

Stock

Class I | | | Additional

Paid-in

Capital | | | Accumulated

Other

Comprehensive

Loss | | | Accumulated

Deficit and

Cumulative

Distributions | | | Total

Stockholders’

Equity | | | Non-

controlling

Interests | | | Total

Equity | |

Balance at December 31, 2022 | $ | | 57 | | | $ | | 2,246 | | | $ | | 310 | | | $ | | 2,445 | | | $ | | 11,466,270 | | | $ | | (24,307 | ) | | $ | | (1,355,256 | ) | | $ | | 10,091,765 | | | $ | | 54,026 | | | $ | | 10,145,791 | |

Common stock issued, net | | | 1 | | | | | 23 | | | | | — | | | | | 47 | | | | | 184,977 | | | | | — | | | | | — | | | | | 185,048 | | | | | — | | | | | 185,048 | |

Offering costs, net | | | — | | | | | — | | | | | — | | | | | — | | | | | 7,920 | | | | | — | | | | | — | | | | | 7,920 | | | | | — | | | | | 7,920 | |

Distribution reinvestments | | | — | | | | | 9 | | | | | 1 | | | | | 9 | | | | | 55,921 | | | | | — | | | | | — | | | | | 55,940 | | | | | — | | | | | 55,940 | |

Amortization of restricted stock grants | | | — | | | | | — | | | | | — | | | | | — | | | | | 210 | | | | | — | | | | | — | | | | | 210 | | | | | — | | | | | 210 | |

Common stock repurchased | | | (1 | ) | | | | (72 | ) | | | | (11 | ) | | | | (171 | ) | | | | (670,841 | ) | | | | — | | | | | — | | | | | (671,096 | ) | | | | — | | | | | (671,096 | ) |

Net loss ($13,103 allocated to redeemable

non-controlling interest) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (310,637 | ) | | | | (310,637 | ) | | | | (1,492 | ) | | | | (312,129 | ) |

Distributions to non-controlling interests | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | - | | | | | (798 | ) | | | | (798 | ) |

Distributions declared on common stock

(see Note 11) | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | (141,127 | ) | | | | (141,127 | ) | | | | — | | | | | (141,127 | ) |

Other comprehensive income | | | — | | | | | — | | | | | — | | | | | — | | | | | — | | | | | 6,601 | | | | | — | | | | | 6,601 | | | | | — | | | | | 6,601 | |

Allocation to redeemable non-controlling

interest | | | — | | | | | — | | | | | — | | | | | — | | | | | (3,332 | ) | | | | — | | | | | — | | | | | (3,332 | ) | | | | — | | | | | (3,332 | ) |

Balance at March 31, 2023 | $ | | 57 | | | $ | | 2,206 | | | $ | | 300 | | | $ | | 2,330 | | | $ | | 11,041,125 | | | $ | | (17,706 | ) | | $ | | (1,807,020 | ) | | $ | | 9,221,292 | | | $ | | 51,736 | | | $ | | 9,273,028 | |

See accompanying notes to condensed consolidated financial statements.

Starwood Real Estate Income Trust, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | |

| | For the Three Months Ended March 31, | |

| | 2024 | | | 2023 | |

Cash flows from operating activities | | | | | | |

Net loss | | $ | (86,286 | ) | | $ | (325,232 | ) |

Adjustments to reconcile net loss to net cash provided by operating

activities | | | | | | |

Management fees | | | 31,996 | | | | 42,181 | |

Performance participation allocation | | | — | | | | — | |

Impairment of investments in real estate | | | — | | | | 79,846 | |

Depreciation and amortization | | | 186,398 | | | | 200,434 | |

Amortization of deferred financing costs | | | 6,392 | | | | 7,123 | |

Straight-line rent amortization | | | (3,403 | ) | | | (3,612 | ) |

Deferred income amortization | | | (6,253 | ) | | | (3,931 | ) |

Unrealized (gain) loss on changes in fair value of financial

instruments | | | (35,179 | ) | | | 150,420 | |

Foreign currency loss | | | 20,295 | | | | 306 | |

Amortization of restricted stock grants | | | 210 | | | | 210 | |

Net (gain) loss on disposition of investments in real estate | | | (2,083 | ) | | | 423 | |

Realized loss on sale of investments in real estate debt | | | 1,468 | | | | — | |

Loss from unconsolidated real estate ventures | | | 3,968 | | | | 3,089 | |

Distributions of earnings from unconsolidated real estate ventures | | | 389 | | | | — | |

Other items | | | (2,172 | ) | | | (1,859 | ) |

Change in assets and liabilities | | | | | | |

Decrease (increase) in other assets | | | 16,585 | | | | (827 | ) |

Decrease in due to affiliates | | | (2,836 | ) | | | (1,000 | ) |

(Decrease) increase in other liabilities | | | (11,243 | ) | | | 577 | |

Net cash provided by operating activities | | | 118,246 | | | | 148,148 | |

Cash flows from investing activities | | | | | | |

Acquisitions of real estate | | | — | | | | (134 | ) |

Proceeds from dispositions of real estate | | | 77,450 | | | | 2,051 | |

Capital improvements to real estate | | | (32,887 | ) | | | (35,624 | ) |

Proceeds from paydown of principal and settlement of investments in real estate debt and equity securities | | | 110,602 | | | | — | |

Purchase of derivative instruments | | | (15 | ) | | | (14,994 | ) |

Proceeds from derivative contracts | | | 6,140 | | | | 5,864 | |

Net cash provided by (used in) investing activities | | | 161,290 | | | | (42,837 | ) |

Cash flows from financing activities | | | | | | |

Proceeds from issuance of common stock, net | | | 44,157 | | | | 101,649 | |

Offering costs paid | | | (11,058 | ) | | | (14,558 | ) |

Subscriptions received in advance | | | 11,569 | | | | 20,728 | |

Repurchases of common stock | | | (514,516 | ) | | | (671,096 | ) |

Borrowings from mortgage notes, credit facility and unsecured line of credit | | | 588,500 | | | | 236,314 | |

Repayments of mortgage notes, credit facility and unsecured line of credit | | | (314,604 | ) | | | (2,263 | ) |

Payment of deferred financing costs | | | (89 | ) | | | (253 | ) |

Distributions to non-controlling interests | | | (615 | ) | | | (798 | ) |

Distributions | | | (79,963 | ) | | | (92,478 | ) |

Net cash used in financing activities | | | (276,619 | ) | | | (422,755 | ) |

Effect of exchange rate changes | | | 4,313 | | | | 303 | |

Net change in cash and cash equivalents and restricted cash | | | 7,230 | | | | (317,141 | ) |

Cash and cash equivalents and restricted cash, beginning of the year | | | 540,635 | | | | 956,609 | |

Cash and cash equivalents and restricted cash, end of the period | | $ | 547,865 | | | $ | 639,468 | |

Reconciliation of cash and cash equivalents and restricted cash to the

consolidated balance sheets: | | | | | | |

Cash and cash equivalents | | $ | 316,144 | | | $ | 360,098 | |

Restricted cash | | | 231,721 | | | | 279,370 | |

Total cash and cash equivalents and restricted cash | | $ | 547,865 | | | $ | 639,468 | |

Supplemental disclosure of cash flow information: | | | | | | |

Cash paid for interest | | $ | 241,384 | | | $ | 205,203 | |

Non-cash investing and financing activities: | | | | | | |

Accrued stockholder servicing fees due to affiliate | | $ | (17,858 | ) | | $ | (8,773 | ) |

Issuance of Class I shares for payment of management fee | | $ | 32,331 | | | $ | 43,055 | |

Redeemable non-controlling interest issued as settlement for performance participation allocation | | $ | — | | | $ | 102,348 | |

Accrued distributions | | $ | 41,625 | | | $ | 48,226 | |

Distribution reinvestment | | $ | 48,693 | | | $ | 55,940 | |

Allocation to redeemable non-controlling interests | | $ | 13,630 | | | $ | 3,332 | |

Accrued capital expenditures | | $ | 4,308 | | | $ | 12,346 | |

See accompanying notes to condensed consolidated financial statements.

Starwood Real Estate Income Trust, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

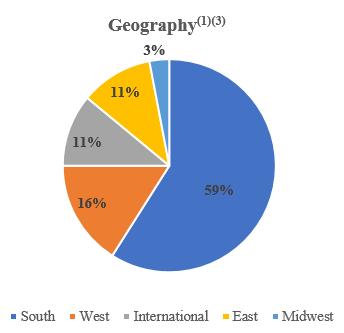

1.Organization and Business Purpose

Starwood Real Estate Income Trust, Inc. (the “Company”) was formed on June 22, 2017 as a Maryland corporation and has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes. The Company is organized to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. The Company’s portfolio is principally comprised of properties located in the United States. The Company has diversified its portfolio on a global basis through the acquisition of properties outside of the United States, with a focus on Europe. To a lesser extent, the Company invests in debt secured by commercial real estate and real estate-related securities. The Company is the sole general partner of Starwood REIT Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). Starwood REIT Special Limited Partner, L.L.C. (the “Special Limited Partner”), a wholly owned subsidiary of Starwood Capital Group Holdings, L.P. (the “Sponsor” and together with any entity that is controlled by, controls or is under common control with the Sponsor, and any of their respective predecessor entities, “Starwood Capital”), owns a special limited partner interest in the Operating Partnership. Substantially all of the Company’s business is conducted through the Operating Partnership. The Company and the Operating Partnership are externally managed by Starwood REIT Advisors, L.L.C. (the “Advisor”), an affiliate of the Sponsor.

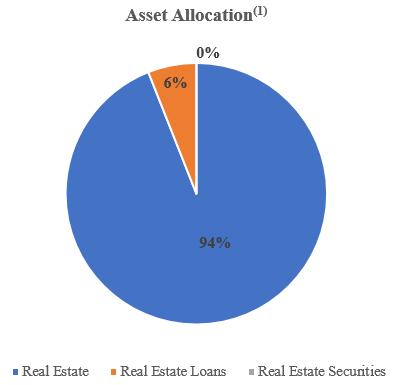

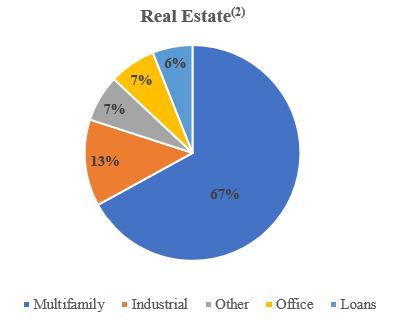

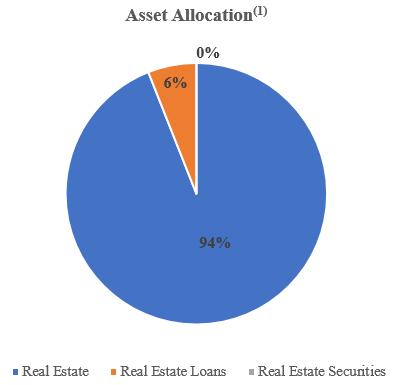

As of March 31, 2024, the Company owned 469 consolidated real estate properties, 989 single-family rental units, two investments in unconsolidated real estate ventures and four positions in real estate debt investments. The Company currently operates in seven reportable segments: Multifamily, Single-Family Rental, Industrial, Office, Self-Storage, Other, and Investments in Real Estate Debt. Financial results by segment are reported in Note 15.

On December 27, 2017, the Company commenced its initial public offering of up to $5.0 billion in shares of common stock. On June 2, 2021, the initial public offering terminated and the Company commenced a follow-on public offering of up to $10.0 billion in shares of common stock. On August 10, 2022, the follow-on public offering terminated and the Company commenced its third public offering of up to $18.0 billion in shares of common stock, consisting of up to $16.0 billion in shares in its primary offering and up to $2.0 billion in shares pursuant to its distribution reinvestment plan. As of March 31, 2024, the Company had received aggregate net proceeds of $13.9 billion from the sale of shares of its common stock through its public offerings.

In December 2023, the Company announced it would launch a program (the “DST Program”) to raise capital, through its Operating Partnership, through private placement offerings exempt from registration under the Securities Act of 1933, as amended, by selling beneficial interests in specific Delaware statutory trusts holding real properties (the “DST Properties”). As of March 31, 2024, the Company has not yet begun to raise offering proceeds through the DST Program.

2.Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. All significant intercompany balances and transactions have been eliminated in consolidation. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the condensed consolidated financial statements are presented fairly and that estimates made in preparing its condensed consolidated financial statements are reasonable and prudent. The accompanying unaudited condensed consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the “SEC”).

Certain amounts in the Company’s prior period unaudited condensed consolidated financial statements have been reclassified to conform to the current period presentation. The Company has chosen to reflect net losses on dispositions of real estate from “Other income (expense), net” to “Net gain (loss) on dispositions of real estate” for the three months ended March 31, 2023 on the Condensed Consolidated Statements of Operations and Comprehensive Loss. Such reclassification had no effect on the previously reported totals included in the Condensed Consolidated Statements of Operations and Comprehensive Loss.

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company, the Company’s subsidiaries and joint ventures in which the Company has a controlling interest. For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities and operations of the joint ventures is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage. Certain of the joint ventures formed by the Company provide the other partner a profits interest based on certain return hurdles being achieved. Any profits interest due to the other partner is reported within non-controlling interests.

In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. The Operating Partnership is considered to be a VIE. The Company consolidates the Operating Partnership because it has the ability to direct the most significant activities of the entity such as purchases, dispositions, financings, budgets, and overall operating plans. The Company meets the VIE disclosure exemption criteria, as the Company’s interest in the Operating Partnership is considered a majority voting interest. Where the Company does not have the power to direct the activities of the VIE that most significantly impact its economic performance, the Company’s interest for those partially owned entities are accounted for using the equity method of accounting.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

Investments in Real Estate

Refer to Note 2 — “Summary of Significant Accounting Policies” to the Company’s consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, for further details of the GAAP treatment regarding the Company’s investments in real estate.

Impairment of Investments in Real Estate

The Company’s management reviews its real estate properties for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value. If the carrying amount of the real estate investment is no longer recoverable and exceeds the fair value of such investment, an impairment loss is recognized. The impairment loss is recognized based on the excess of the carrying amount of the asset over its fair value. The evaluation of anticipated future cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results. Since cash flows on real estate properties considered to be “long-lived assets to be held and used” are considered on an undiscounted basis to determine whether an asset has been impaired, the Company’s strategy of holding properties over the long term decreases the likelihood of recording an impairment loss. If the Company’s strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could be material to the Company’s results. If the Company determines that an impairment has occurred, the affected assets must be reduced to their fair value. Impairment charges are recorded in the Condensed Consolidated Statements of Operations and Comprehensive Loss.

During the three months ended March 31, 2024, the Company did not recognize any impairment on its investments in real estate. During the three months ended March 31, 2023, the Company recognized an aggregate $79.8 million impairment charge on various single-family rental properties in the Condensed Consolidated Statements of Operations and Comprehensive Loss.

Properties Held-for-Sale

The Company classifies the assets and liabilities related to its investments in real estate as held-for-sale when a sale is probable to occur within one year. The Company considers a sale to be probable when a binding contract has been executed, the buyer has posted a non-refundable deposit, and there are limited contingencies to closing. The Company records held-for-sale investments in real estate at the lower of depreciated cost or fair value, less estimated closing costs. Held-for-sale assets and liabilities are presented within Other assets and Other liabilities on the Company’s Condensed Consolidated Balance Sheets. As of March 31, 2024 and December 31, 2023, there were no real estate investments that met the criteria to be classified as held-for-sale.

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). Additionally, there is a hierarchal framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value.

Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment and the state of the market place, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

Valuation of assets and liabilities measured at fair value

The Company’s investments in real estate debt are reported at fair value. The Company’s investments in real estate debt include commercial mortgage-backed securities (“CMBS”). The Company generally determines the fair value of its CMBS investments by utilizing third-party pricing service providers. In determining the value of a particular investment, the pricing service providers may use broker-dealer quotations, reported trades or valuation estimates from their internal pricing models to determine the reported price. The pricing service providers’ internal models for real estate-related securities usually consider the attributes applicable to a particular class of security (e.g., credit rating or seniority), current market data, and estimated cash flows for each class and incorporate deal collateral performance such as prepayment speeds and default rates, as available.

Certain of the Company’s investments in real estate debt include loans secured by real estate, such as its term loans, which may not have readily available market quotations. In such cases, the Company will generally determine the initial value based on the origination amount or acquisition price of such investment if acquired by the Company or the par value of such investment if originated by the Company. Following the initial measurement, the Company will determine fair value by utilizing or reviewing certain of the following inputs (i) market yield data, (ii) discounted cash flow modeling, (iii) collateral asset performance, (iv) local or macro real estate performance, (v) capital market conditions, (vi) debt yield or loan-to-value ratios and (vii) borrower financial condition and performance.

During the three months ended March 31, 2024 and 2023, the Company recorded net unrealized gains on its investments in real estate debt securities of $5.1 million and $0.6 million, respectively. Such amounts are recorded as a component of Income from investments in real estate debt on the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss.

The Company’s derivative financial instruments are reported at fair value. The Company’s interest rate swap agreements are valued using a discounted cash flow analysis based on the terms of the contract and the forward interest rate curve adjusted for the Company’s non-performance risk. The Company’s interest rate cap positions are valued using models developed by the respective counterparty as well as third party pricing service providers that use as their basis readily observable market parameters (such as forward yield curves and credit default swap data).

The fair values of the Company’s foreign currency forward contracts are determined by comparing the contracted forward exchange rate to the current market exchange rate. The current market exchange rates are determined by using market spot rates, forward rates and interest rate curves for the underlying instruments.

The fair values of the Company’s financial instruments (other than investments in real estate debt, mortgage notes, credit facility, unsecured line of credit and derivative instruments), including cash and cash equivalents, restricted cash and other financial instruments, approximate their carrying or contract value. The Company utilizes a discounted cash flow model to value its loans secured by real estate (considering loan features, credit quality of the loans and includes a review of market yield data, collateral asset performance, local and macro real estate performance, capital market conditions, debt yield, loan-to-value ratios, borrower financial condition and performance, among other factors). The Company continuously monitors and assesses the credit quality of individual loans including the review of delinquency and loan-to-value ratios on our loans secured by real estate. Such loans have floating interest rates with market terms and there are no underlying credit quality issues as of March 31, 2024.

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis ($ in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | | December 31, 2023 | |

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in real estate debt | | $ | — | | | $ | 45,164 | | | $ | 1,342,974 | | | $ | 1,388,138 | | | $ | — | | | $ | 201,070 | | | $ | 1,388,280 | | | $ | 1,589,350 | |

Derivatives | | | — | | | | 570,582 | | | | — | | | | 570,582 | | | | — | | | | 554,263 | | | | — | | | | 554,263 | |

Total | | $ | — | | | $ | 615,746 | | | $ | 1,342,974 | | | $ | 1,958,720 | | | $ | — | | | $ | 755,333 | | | $ | 1,388,280 | | | $ | 2,143,613 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Derivatives | | $ | — | | | $ | 30,663 | | | $ | — | | | $ | 30,663 | | | $ | — | | | $ | 46,178 | | | $ | — | | | $ | 46,178 | |

Total | | $ | — | | | $ | 30,663 | | | $ | — | | | $ | 30,663 | | | $ | — | | | $ | 46,178 | | | $ | — | | | $ | 46,178 | |

The following table details the Company’s assets measured at fair value on a recurring basis using Level 3 inputs ($ in thousands):

| | | | |

| | Investments in

Real Estate Debt | |

Balance as of December 31, 2023 | | $ | 1,388,280 | |

Included in net loss | | | |

Foreign currency exchange | | | (45,306 | ) |

Balance as of March 31, 2024 | | $ | 1,342,974 | |

The following table contains the quantitative inputs and assumptions used for items categorized in Level 3 of the fair value hierarchy ($ in thousands):

| | | | | | | | | | | | |

| | March 31, 2024 |

| | Fair Value | | | Valuation Technique | | Unobservable Inputs | | Weighted Average | | Impact to Valuation from an Increase in Input |

Investments in real estate debt | | $ | 1,342,974 | | | Discounted Cash Flow | | Discount Rate | | 9.7% | | Decrease |

| | | | | | | | | | | | |

| | December 31, 2023 |

| | Fair Value | | | Valuation Technique | | Unobservable Inputs | | Weighted Average | | Impact to Valuation from an Increase in Input |

Investments in real estate debt | | $ | 1,388,280 | | | Discounted Cash Flow | | Discount Rate | | 9.7% | | Decrease |

Valuation of assets measured at fair value on a nonrecurring basis

Certain of the Company’s assets are not measured at fair value on an ongoing basis but are subject to fair value adjustments, such as when there is evidence of impairment, and therefore measured at fair value on a nonrecurring basis. The Company reviews its real estate properties for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value.

During the three months ended March 31, 2024, the Company did not recognize any impairment on its investments in real estate. During the three months ended March 31, 2023, the Company recognized an aggregate $79.8 million impairment charge on various single-family rental properties. As of March 31, 2024 and December 31, 2023, the estimated fair value of the Company’s remaining impaired assets was $43.9 million and $53.8 million, respectively. The estimated fair values of the impaired properties held as of March 31, 2024, were primarily based on recently completed sales transactions, letters of intent, or non-binding purchase and sales contracts. These inputs are considered Level 2 inputs for purposes of the fair value hierarchy. There are inherent uncertainties in making these estimates such as current and future macroeconomic conditions.

Valuation of liabilities not measured at fair value

Fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using an appropriate discount rate. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3. As of March 31, 2024, the fair value of the Company’s mortgage notes, credit facility and secured financings on investments in real estate debt was approximately $457.3 million below the outstanding principal balance.

Income Taxes

The Company elected to be taxed as a REIT under the Internal Revenue Code (the “Code”), for federal income tax purposes, beginning with its taxable year ended December 31, 2019. As long as the Company qualifies for taxation as a REIT, it generally will not be subject to U.S. federal corporate income tax on its net taxable income that is currently distributed to its stockholders. A REIT is subject to a number of organizational and operational requirements, including a requirement that it currently distributes at least 90% of its REIT taxable income (subject to certain adjustments) to its stockholders. If the Company fails to qualify as a REIT in a taxable year, without the benefit of certain relief provisions, it will be subject to federal and state income tax on its taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, it may also be subject to certain federal, state, local, and foreign taxes on its income and assets, including (i) taxes on any undistributed income, (ii) taxes related to its taxable REIT subsidiaries (“TRSs”) and (iii) certain state or local income taxes. The Company and the Operating Partnerships’ tax returns for three years from the date filed are subject to examination.

The Company has formed wholly owned subsidiaries to function as TRSs and filed TRS elections, together with such subsidiaries, with the Internal Revenue Service. In general, a TRS may perform additional services for the Company’s tenants and generally may engage in any real estate or non-real estate-related business other than management or operation of a lodging facility or a health care facility. The TRSs are subject to taxation at the federal, state, local, and foreign levels, as applicable, at regular corporate tax rates. The Company accounts for applicable income taxes by utilizing the asset and liability method. As such, the Company records deferred tax assets and liabilities for the future tax consequences resulting from the difference between the carrying value of existing assets and liabilities and their respective tax basis. A valuation allowance for deferred tax assets is provided if the Company believes all or some portion of the deferred tax asset may not be realized.

The Organization for Economic Co-operation and Development (“OECD”) has a framework to implement a global minimum corporate tax of 15% for companies with global revenues and profits above certain thresholds (referred to as “Pillar 2”), with certain aspects of Pillar 2 effective January 1, 2024 and other aspects effective January 1, 2025. While it is uncertain whether the U.S. will enact legislation to adopt Pillar 2, certain foreign jurisdictions where the Company owns real estate assets has adopted legislation. The Company does not expect Pillar 2 to have a material impact on the Company’s effective tax rate or the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss.

For the three months ended March 31, 2024, the Company recognized an income tax benefit of $4.4 million, within Other income (expense), net in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss. For the three months ended March 31, 2023, the Company recognized an income tax benefit of $0.3 million, within Other income (expense), net in the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss. As of March 31, 2024 and December 31, 2023, the Company recorded a net deferred tax liability of $26.5 million and $30.7 million, respectively, primarily due to assumed capital gains from two European investments, within Other liabilities on the Company’s Condensed Consolidated Balance Sheets.

As of December 31, 2023, net operating loss (“NOL”) carryforwards for federal and state income tax purposes totaled $61.9 million, and are primarily driven by dispositions of residential rental units within one of the Company’s TRSs. Although the federal NOL carryforwards do not expire, the Company has recorded full valuation allowances against certain deferred tax assets for which the Company believes it is more likely than not that the Company will not realize a benefit from these in future taxable years.

Recent Accounting Pronouncements

In November of 2023, the Financial Accounting Standards Board issued Accounting Standards Update 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures.” The amendments are intended to increase reportable segment disclosure requirements primarily through enhanced disclosures about significant segment expenses. ASU 2023-07 is effective on a retrospective basis for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. The Company is currently evaluating the impact of this guidance on the disclosures within its Consolidated Financial Statements.

Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | | | | | | | |

| | March 31, 2024 | | | December 31, 2023 | |

Building and building improvements | | $ | 17,571,430 | | | $ | 17,612,162 | |

Land and land improvements | | | 3,116,386 | | | | 3,144,932 | |

Furniture, fixtures and equipment | | | 298,638 | | | | 304,650 | |

Right-of-use asset - operating lease(1) | | | 105,230 | | | | 105,230 | |

Total | | | 21,091,684 | | | | 21,166,974 | |

Accumulated depreciation and amortization | | | (1,739,769 | ) | | | (1,586,616 | ) |

Investments in real estate, net | | $ | 19,351,915 | | | $ | 19,580,358 | |

(1)Refer to Note 14 for additional details on the Company’s leases.

Asset Dispositions

During the three months ended March 31, 2024, the Company sold an aggregate of $48.5 million of investments in real estate, net, generating total cash proceeds, net of mortgage repayments, of approximately $33.1 million. During the three months ended March 31, 2024, the Company recorded $2.1 million of net gains from the disposition of two hospitality properties and 27 single-family rental units.

For the three months ended March 31, 2023, the Company sold five single-family rental units for net proceeds of approximately $1.8 million, resulting in total losses of $0.4 million.

Investments in Unconsolidated Real Estate Ventures

The following table details the Company’s equity investments in unconsolidated entities ($ in thousands):

| | | | | | | | | | | | | | | | |

Investments in Unconsolidated

Real Estate Ventures | | Segment | | Date

Acquired | | Number of Properties | | Ownership Interest | | March 31, 2024 | | | December 31, 2023 | |

Extended Stay Portfolio | | Other | | July 2022 | | 196 | | 45% | | $ | 441,368 | | | $ | 446,424 | |

Fort Lauderdale Hotel | | Other | | March 2019 | | 1 | | 43% | | | 10,277 | | | | 9,578 | |

Total investments in unconsolidated real estate ventures | | | | | | $ | 451,645 | | | $ | 456,002 | |

The following table details the Company’s (loss) income from equity investments in unconsolidated entities ($ in thousands):

| | | | | | | | | | |

| | | | Three Months Ended March 31, | |

Investments in Unconsolidated Real Estate Ventures | | Segment | | 2024 | | | 2023 | |

Extended Stay Portfolio | | Other | | $ | (5,056 | ) | | $ | (3,468 | ) |

Fort Lauderdale Hotel | | Other | | | 1,088 | | | | 379 | |

Total loss from unconsolidated real estate ventures | $ | (3,968 | ) | | $ | (3,089 | ) |

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities consisted of the following ($ in thousands):

| | | | | | | | | |

| March 31, 2024 | | | December 31, 2023 | |

Intangible assets: (1) | | | | | | | |

In-place lease intangibles | $ | | 291,626 | | | $ | | 292,348 | |

Above-market lease intangibles | | | 38,359 | | | | | 44,463 | |

Other | | | 41,992 | | | | | 41,823 | |

Total intangible assets | | | 371,977 | | | | | 378,634 | |

Accumulated amortization: | | | | | | | |

In-place lease amortization | | | (135,316 | ) | | | | (127,185 | ) |

Above-market lease amortization | | | (19,956 | ) | | | | (18,913 | ) |

Other | | | (13,231 | ) | | | | (12,500 | ) |

Total accumulated amortization | | | (168,503 | ) | | | | (158,598 | ) |

Intangible assets, net | $ | | 203,474 | | | $ | | 220,036 | |

Intangible liabilities: (2) | | | | | | | |

Below-market lease intangibles | $ | | 81,176 | | | $ | | 87,173 | |

Total intangible liabilities | | | 81,176 | | | | | 87,173 | |

Accumulated amortization: | | | | | | | |

Below-market lease amortization | | | (29,491 | ) | | | | (27,606 | ) |

Total accumulated amortization | | | (29,491 | ) | | | | (27,606 | ) |

Intangible liabilities, net | $ | | 51,685 | | | $ | | 59,567 | |

(1)Included in Other assets on the Company’s Condensed Consolidated Balance Sheets.

(2)Included in Other liabilities on the Company’s Condensed Consolidated Balance Sheets.

The estimated future amortization on the Company’s intangibles for each of the next five years and thereafter as of March 31, 2024 is as follows ($ in thousands):

| | | | | | | | | | | | | | | | |

| | In-place

Lease Intangibles | | | Above-market

Lease Intangibles | | | Other | | | Below-market

Lease Intangibles | |

2024 (remaining) | | $ | 25,590 | | | $ | 3,417 | | | $ | 2,559 | | | $ | (6,200 | ) |

2025 | | | 26,031 | | | | 3,302 | | | | 3,412 | | | | (5,989 | ) |

2026 | | | 21,334 | | | | 3,015 | | | | 3,412 | | | | (4,926 | ) |

2027 | | | 17,436 | | | | 2,318 | | | | 3,412 | | | | (4,174 | ) |

2028 | | | 14,144 | | | | 1,773 | | | | 3,412 | | | | (4,364 | ) |

Thereafter | | | 51,775 | | | | 4,578 | | | | 12,554 | | | | (26,032 | ) |

| | $ | 156,310 | | | $ | 18,403 | | | $ | 28,761 | | | $ | (51,685 | ) |

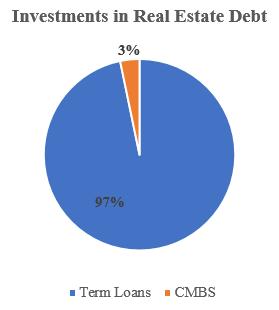

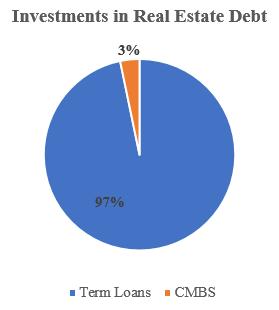

5.Investments in Real Estate Debt

The following tables detail the Company’s investments in real estate debt as of March 31, 2024 and December 31, 2023 ($ in thousands):

| | | | | | | | | | | | | | |

| | | | March 31, 2024 | |

Type of Security/Loan | | Number of Positions | | Weighted

Average

Coupon (1) | | Weighted Average

Maturity Date (2) | | Cost Basis | | | Fair Value | |

CMBS - floating | | 2 | | B + 6.19% | | August 2035 | | $ | 45,304 | | | $ | 45,164 | |

Term loans | | 2 | | B + 4.95% | | January 2027 | | | 1,451,462 | | | | 1,342,974 | |

Total investments in real estate debt | | 4 | | B + 4.99% | | April 2027 | | $ | 1,496,766 | | | $ | 1,388,138 | |

| | | | | | | | | | | | | | |

| | | | December 31, 2023 | |

Type of Security/Loan | | Number of

Positions | | Weighted

Average

Coupon (1) | | Weighted Average

Maturity Date (2) | | Cost Basis | | | Fair Value | |

CMBS - floating | | 6 | | B + 4.69% | | October 2036 | | $ | 206,252 | | | $ | 201,070 | |

Term loans | | 2 | | B + 4.95% | | January 2027 | | | 1,451,462 | | | | 1,388,280 | |

Total investments in real estate debt | | 8 | | B + 4.92% | | March 2028 | | $ | 1,657,714 | | | $ | 1,589,350 | |

(1)The symbol “B” refers to the relevant benchmark rates, which includes one-month Secured Overnight Financing Rate (“SOFR”), three-month Bank Bill Swap Bid Rate (“BBSY”) and Sterling Overnight Index Average (“SONIA”) as applicable to each security and loan.

(2)Weighted average maturity date is based on the fully extended maturity date of the underlying collateral.

During June 2022, the Company provided financing in the form of a term loan to an unaffiliated entity in connection with its acquisition of Australia’s largest hotel and casino company. The loan is in the amount of AUD 1,377 million and has an initial term of five years, with a two-year extension option. The loan is pre-payable at the option of the borrower at any time.

During February 2021, the Company provided financing in the form of a term loan to an unaffiliated entity in connection with its acquisition of a premier United Kingdom holiday company. The original loan was in the amount of £360 million and has an initial term of five years, with a two-year extension option. The loan is pre-payable at the option of the borrower at any time. In November 2023, the borrower partially prepaid £8.0 million of the original loan amount.

The Company’s investments in real estate debt include CMBS collateralized by properties owned by Starwood Capital investment vehicles. The following table details the Company’s affiliate investments in real estate debt ($ in thousands):

| | | | | | | | |

| | Fair Value | |

| | March 31, 2024 | | | December 31, 2023 | |

CMBS | | $ | 45,164 | | | $ | 201,070 | |

Total | | $ | 45,164 | | | $ | 201,070 | |

Such CMBS were purchased in fully or over-subscribed offerings. Each investment in such CMBS by the Company represented a minority participation in any individual tranche. The Company acquired its minority participation interest from third-party investment banks on market terms negotiated by the majority third-party investors.

During the three months ended March 31, 2024, the Company recorded net realized losses resulting from sales on a portion of its investments in real estate debt securities of $1.5 million. During the three months ended March 31, 2023, the Company did not dispose of any of its investments in real estate debt securities. Such amounts are recorded as a component of Income from investments in real estate debt on the Company’s Condensed Consolidated Statements of Operations and Comprehensive Loss.

6. Mortgage Notes and Credit Facility

The following table is a summary of the mortgage notes and credit facility secured by the Company’s properties as of March 31, 2024 and December 31, 2023 ($ in thousands):

| | | | | | | | | | | | | | |

| | | | | | | | Principal Balance Outstanding(3) | |

Indebtedness | | Weighted

Average

Interest Rate(1) | | Weighted

Average

Maturity Date(2) | | Maximum

Facility

Size | | March 31, 2024 | | | December 31, 2023 | |

Fixed rate loans | | | | | | | | | | | | |

Fixed rate mortgages | | 3.09% | | March 2031 | | N/A | | $ | 3,018,053 | | | $ | 3,049,322 | |

Total fixed rate loans | | | | | | | | | 3,018,053 | | | | 3,049,322 | |

Variable rate loans | | | | | | | | | | | | |

Floating rate mortgages | | B + 1.83% | | July 2027 | | N/A | | | 9,863,917 | | | | 9,893,894 | |

Variable rate credit facility(4) | | B + 2.25% | | December 2024 | | $165,000 | | | 165,000 | | | | 165,000 | |

Total variable rate loans | | | | | | | | | 10,028,917 | | | | 10,058,894 | |

Total loans secured by the Company’s

properties | | | | | | | | | 13,046,970 | | | | 13,108,216 | |

Deferred financing costs, net | | | | | | | | | (65,453 | ) | | | (73,066 | ) |

Discount on assumed debt, net | | | | | | | | | (6,192 | ) | | | (6,240 | ) |

Mortgage notes and credit facility, net | | | | $ | 12,975,325 | | | $ | 13,028,910 | |

(1)The symbol “B” refers to the relevant floating benchmark rates, which includes one-month SOFR, Federal Reserve Bank of New York (“NYFED”) 30-day SOFR, three-month Euro Interbank Offered Rate (“EURIBOR”) and three-month Copenhagen Interbank Offered Rate (“CIBOR”), as applicable to each loan.

(2)For loans where the Company, at its own discretion, has extension options, the maximum maturity date has been assumed.