UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2020

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition period from to .

Commission file number 000-56046

Starwood Real Estate Income Trust, Inc.

(Exact name of Registrant as specified in Governing Instruments)

Maryland | 1601 Washington Avenue, Suite 800 Miami Beach, FL 33139 | 82-2023409 |

(State or other jurisdiction of incorporation or organization) | (Address of principal executive offices) (Zip Code) | (I.R.S. Employer Identification No.) |

Registrant’s telephone number, including area code: (305) 695-5500

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

Large accelerated filer | | ☐ | | | Accelerated filer | | ☐ |

Non-accelerated filer | | ☒ | | | Smaller reporting company | | ☒ |

| | | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Securities registered pursuant to Section 12(b) of the Act: None.

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

As of May 12, 2020, the registrant had the following shares outstanding: 2,117,183 shares of Class T common stock, 37,371,265 shares of Class S common stock, 2,386,535 shares of Class D common stock and 26,033,765 shares of Class I common stock.

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION

ITEM 1. | FINANCIAL STATEMENTS |

Starwood Real Estate Income Trust, Inc.

Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share data)

| | March 31, 2020 | | | December 31, 2019 | |

Assets | | | | | | | | |

Investments in real estate, net | | $ | 3,216,839 | | | $ | 1,798,044 | |

Investments in real estate-related securities | | | 314,465 | | | | 277,651 | |

Investments in unconsolidated real estate ventures | | | 12,253 | | | | 12,169 | |

Cash and cash equivalents | | | 61,222 | | | | 48,479 | |

Restricted cash | | | 94,261 | | | | 140,482 | |

Other assets | | | 219,845 | | | | 113,497 | |

Total assets | | $ | 3,918,885 | | | $ | 2,390,322 | |

Liabilities and Equity | | | | | | | | |

Mortgage notes and revolving credit facility, net | | $ | 2,238,903 | | | $ | 1,238,102 | |

Repurchase agreements | | | 198,434 | | | | 81,035 | |

Accounts payable, accrued expenses and other liabilities | | | 101,114 | | | | 47,979 | |

Subscriptions received in advance | | | 41,012 | | | | 110,618 | |

Due to affiliates | | | 69,953 | | | | 63,341 | |

Total liabilities | | | 2,649,416 | | | | 1,541,075 | |

| | | | | | | | |

Commitments and contingencies | | | — | | | | — | |

Redeemable non-controlling interest | | | 10,187 | | | | — | |

| | | | | | | | |

Equity | | | | | | | | |

Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding as of March 31, 2020 and December 31, 2019 | | | — | | | | — | |

Common stock — Class T shares, $0.01 par value per share, 250,000,000 shares authorized; 2,016,251 and 1,412,563 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | | 20 | | | | 14 | |

Common stock — Class S shares, $0.01 par value per share, 250,000,000 shares authorized; 35,762,788 and 26,164,794 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | | 358 | | | | 262 | |

Common stock — Class D shares, $0.01 par value per share, 250,000,000 shares authorized; 2,293,273 and 1,653,094 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | | 23 | | | | 17 | |

Common stock — Class I shares, $0.01 par value per share, 250,000,000 shares authorized; 25,118,918 and 16,114,284 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively | | | 251 | | | | 161 | |

Additional paid-in capital | | | 1,291,542 | | | | 883,506 | |

Accumulated deficit and cumulative distributions | | | (102,742 | ) | | | (46,697 | ) |

Total stockholders' equity | | | 1,189,452 | | | | 837,263 | |

Non-controlling interests in consolidated joint ventures | | | 69,830 | | | | 11,984 | |

Total equity | | | 1,259,282 | | | | 849,247 | |

Total liabilities and equity | | $ | 3,918,885 | | | $ | 2,390,322 | |

See accompanying notes to consolidated financial statements.

1

Starwood Real Estate Income Trust, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| | Three Months Ended March 31, | |

| | 2020 | | | 2019 | |

Revenues | | | | | | | | |

Rental revenue | | $ | 46,465 | | | $ | 4,310 | |

Hotel revenue | | | 10,215 | | | | 10,852 | |

Other revenue | | | 357 | | | | 253 | |

Total revenues | | | 57,037 | | | | 15,415 | |

Expenses | | | | | | | | |

Rental property operating | | | 15,544 | | | | 1,762 | |

Hotel operating | | | 5,964 | | | | 5,503 | |

General and administrative | | | 2,358 | | | | 912 | |

Management fees | | | 3,946 | | | | — | |

Performance participation allocation | | | 46 | | | | 857 | |

Depreciation and amortization | | | 30,543 | | | | 5,358 | |

Total expenses | | | 58,401 | | | | 14,392 | |

Other income (expense) | | | | | | | | |

Earnings from unconsolidated real estate ventures | | | 360 | | | | 43 | |

(Loss) income from real estate-related securities, net | | | (20,173 | ) | | | 102 | |

Interest income | | | 303 | | | | 58 | |

Interest expense | | | (19,641 | ) | | | (3,598 | ) |

Other expense | | | (132 | ) | | | (96 | ) |

Total other expense | | | (39,283 | ) | | | (3,491 | ) |

Net loss | | $ | (40,647 | ) | | $ | (2,468 | ) |

Net loss attributable to non-controlling interests in consolidated joint ventures | | $ | 638 | | | $ | — | |

Net loss attributable to non-controlling interests in Operating Partnership | | | 332 | | | | — | |

Net loss attributable to stockholders | | $ | (39,677 | ) | | $ | (2,468 | ) |

Net loss per share of common stock, basic and diluted | | $ | (0.69 | ) | | $ | (0.24 | ) |

Weighted-average shares of common stock outstanding, basic and diluted | | | 57,844,231 | | | | 10,089,598 | |

See accompanying notes to consolidated financial statements.

2

Starwood Real Estate Income Trust, Inc.

Consolidated Statements of Changes in Equity (Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2020 | |

| | Par Value | | | | | | | Accumulated | | | | | | | | | | | | | |

| | Common Stock Class T | | | Common Stock Class S | | | Common Stock Class D | | | Common Stock Class I | | | Additional Paid-In Capital | | | Deficit and Cumulative Distributions | | | Total Stockholders' Equity | | | Non- controlling Interests | | | Total Equity | |

Balance at December 31, 2019 | | $ | 14 | | | $ | 262 | | | $ | 17 | | | $ | 161 | | | $ | 883,506 | | | $ | (46,697 | ) | | $ | 837,263 | | | $ | 11,984 | | | $ | 849,247 | |

Common stock issued | | | 6 | | | | 94 | | | | 6 | | | | 89 | | | | 421,464 | | | | — | | | | 421,659 | | | | — | | | | 421,659 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (20,528 | ) | | | — | | | | (20,528 | ) | | | — | | | | (20,528 | ) |

Distribution reinvestments | | | — | | | | 2 | | | | — | | | | 1 | | | | 8,361 | | | | — | | | | 8,364 | | | | — | | | | 8,364 | |

Amortization of restricted stock grants | | | — | | | | — | | | | — | | | | — | | | | 21 | | | | — | | | | 21 | | | | — | | | | 21 | |

Common stock repurchased | | | — | | | | — | | | | — | | | | — | | | | (980 | ) | | | — | | | | (980 | ) | | | — | | | | (980 | ) |

Net loss ($332 allocated to redeemable non- controlling interest) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (39,677 | ) | | | (39,677 | ) | | | (638 | ) | | | (40,315 | ) |

Contributions from non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 58,840 | | | | 58,840 | |

Distributions to non-controlling interests | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | (356 | ) | | | (356 | ) |

Distributions declared on common stock (see Note 9) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (16,368 | ) | | | (16,368 | ) | | | — | | | | (16,368 | ) |

Allocation to redeemable non- controlling interest | | | — | | | | — | | | | — | | | | — | | | | (302 | ) | | | — | | | | (302 | ) | | | — | | | | (302 | ) |

Balance at March 31, 2020 | | $ | 20 | | | $ | 358 | | | $ | 23 | | | $ | 251 | | | $ | 1,291,542 | | | $ | (102,742 | ) | | $ | 1,189,452 | | | $ | 69,830 | | | $ | 1,259,282 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2019 | |

| | Par Value | | | | | | | Accumulated | | | | | | | | | | | | | |

| | Common Stock Class T | | | Common Stock Class S | | | Common Stock Class D | | | Common Stock Class I | | | Additional Paid-In Capital | | | Deficit and Cumulative Distributions | | | Total Stockholders' Equity | | | Non- controlling Interests | | | Total Equity | |

Balance at December 31, 2018 | | $ | — | | | $ | 66 | | | $ | — | | | $ | 15 | | | $ | 148,770 | | | $ | (1,729 | ) | | $ | 147,122 | | | $ | — | | | $ | 147,122 | |

Common stock issued | | | 2 | | | | 17 | | | | 3 | | | | 21 | | | | 85,543 | | | | — | | | | 85,586 | | | | — | | | | 85,586 | |

Offering costs | | | — | | | | — | | | | — | | | | — | | | | (4,049 | ) | | | — | | | | (4,049 | ) | | | — | | | | (4,049 | ) |

Distribution reinvestments | | | — | | | | — | | | | — | | | | — | | | | 396 | | | | — | | | | 396 | | | | — | | | | 396 | |

Amortization of restricted stock grants | | | — | | | | — | | | | — | | | | — | | | | 29 | | | | — | | | | 29 | | | | — | | | | 29 | |

Net loss | | | — | | | | — | | | | — | | | | — | | | | — | | | | (2,468 | ) | | | (2,468 | ) | | | — | | | | (2,468 | ) |

Distributions declared on common stock (see Note 9) | | | — | | | | — | | | | — | | | | — | | | | — | | | | (1,631 | ) | | | (1,631 | ) | | | — | | | | (1,631 | ) |

Balance at March 31, 2019 | | $ | 2 | | | $ | 83 | | | $ | 3 | | | $ | 36 | | | $ | 230,689 | | | $ | (5,828 | ) | | $ | 224,985 | | | $ | — | | | $ | 224,985 | |

See accompanying notes to consolidated financial statements.

3

Starwood Real Estate Income Trust, Inc.

Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | Three Months Ended March 31, | |

| | 2020 | | | 2019 | |

Cash flows from operating activities | | | | | | | | |

Net loss | | $ | (40,647 | ) | | $ | (2,468 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities | | | | | | | | |

Management fee | | | 3,946 | | | | — | |

Performance participation allocation | | | 46 | | | | 857 | |

Depreciation and amortization | | | 30,543 | | | | 5,358 | |

Amortization of deferred financing costs | | | 436 | | | | 156 | |

Deferred income amortization | | | (235 | ) | | | — | |

Unrealized loss on changes in fair value of financial instruments | | | 26,973 | | | | 130 | |

Losses on sales of real estate-related securities | | | 1,329 | | | | — | |

Amortization of restricted stock grants | | | 21 | | | | 29 | |

Distributions from investments in unconsolidated real estate ventures | | | 276 | | | | — | |

Earnings from unconsolidated real estate ventures | | | (360 | ) | | | (43 | ) |

Other items | | | (266 | ) | | | — | |

Change in assets and liabilities | | | | | | | | |

Increase in other assets | | | (12,472 | ) | | | (10,302 | ) |

Increase in due to affiliates | | | 144 | | | | 189 | |

Increase in accounts payable, accrued expenses and other liabilities | | | 17,711 | | | | 8,256 | |

Net cash provided by operating activities | | | 27,445 | | | | 2,162 | |

Cash flows from investing activities | | | | | | | | |

Acquisitions of real estate | | | (1,512,285 | ) | | | (205,980 | ) |

Capital improvements to real estate | | | (1,838 | ) | | | (389 | ) |

Purchase of real estate-related securities | | | (65,754 | ) | | | (107,325 | ) |

Proceeds from settlement of real estate-related securities | | | 5,029 | | | | — | |

Net cash used in investing activities | | | (1,574,848 | ) | | | (313,694 | ) |

Cash flows from financing activities | | | | | | | | |

Proceeds from issuance of common stock, net | | | 307,520 | | | | 85,586 | |

Offering costs paid | | | (3,901 | ) | | | (730 | ) |

Subscriptions received in advance | | | 41,012 | | | | 40,354 | |

Repurchase of common stock | | | (980 | ) | | | — | |

Borrowings from mortgage notes and revolving credit facility | | | 1,007,273 | | | | 47,948 | |

Repayments of mortgage notes and revolving credit facility | | | (734 | ) | | | (363 | ) |

Net borrowings under repurchase agreements | | | 117,399 | | | | 63,567 | |

Payment of deferred financing costs | | | (5,971 | ) | | | (3,020 | ) |

Contributions from non-controlling interests | | | 58,840 | | | | — | |

Distributions to non-controlling interests | | | (356 | ) | | | — | |

Distributions | | | (6,177 | ) | | | (178 | ) |

Net cash provided by financing activities | | | 1,513,925 | | | | 233,164 | |

Net change in cash and cash equivalents and restricted cash | | | (33,478 | ) | | | (78,368 | ) |

Cash and cash equivalents and restricted cash at the beginning of the period | | | 188,961 | | | | 164,921 | |

Cash and cash equivalents and restricted cash at the end of the period | | $ | 155,483 | | | $ | 86,553 | |

Reconciliation of cash and cash equivalents and restricted cash to the consolidated balance sheets: | | | | | | | | |

Cash and cash equivalents | | $ | 61,222 | | | $ | 31,038 | |

Restricted cash | | | 94,261 | | | | 55,515 | |

Total cash and cash equivalents and restricted cash | | $ | 155,483 | | | $ | 86,553 | |

Non-cash financing activities: | | | | | | | | |

Assumption of mortgage notes in conjunction with acquisitions in real estate | | $ | — | | | $ | 220,932 | |

Accrued stockholder servicing fee due to affiliate | | $ | 18,151 | | | $ | 3,150 | |

Accrued offering costs due to affiliates | | $ | — | | | $ | 159 | |

Right of use asset/liability | | $ | 6,408 | | | $ | — | |

Redeemable non-controlling interest issued as settlement for performance participation allocation | | $ | 10,366 | | | $ | — | |

Accrued distributions | | $ | 6,191 | | | $ | 1,058 | |

Distribution reinvestment | | $ | 8,364 | | | $ | 396 | |

See accompanying notes to consolidated financial statements.

4

Starwood Real Estate Income Trust, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

1. | Organization and Business Purpose |

Starwood Real Estate Income Trust, Inc. (the “Company”) was formed on June 22, 2017 as a Maryland corporation and intends to qualify and elect to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with the taxable year ended December 31, 2019. The Company was organized to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. The Company’s portfolio is principally comprised of properties and debt secured by properties located in the United States but may also be diversified on a global basis through the acquisition of properties, and debt secured by properties, outside of the United States, with a focus on Europe. To a lesser extent, the Company invests in real estate-related securities. The Company is the sole general partner of Starwood REIT Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). Starwood REIT Special Limited Partner, L.L.C. (the “Special Limited Partner”), a wholly owned subsidiary of Starwood Capital Group Holdings, L.P. (the “Sponsor”), owns a special limited partner interest in the Operating Partnership. Substantially all of the Company’s business is conducted through the Operating Partnership. The Company and the Operating Partnership are externally managed by Starwood REIT Advisors, L.L.C. (the “Advisor”), an affiliate of the Sponsor.

The Company has registered with the Securities and Exchange Commission (the “SEC”) an offering of up to $5.0 billion in shares of common stock, consisting of up to $4.0 billion in shares in its primary offering and up to $1.0 billion in shares pursuant to its distribution reinvestment plan (the “Offering”). The Company is selling in the Offering any combination of four classes of shares of its common stock, with a dollar value up to the maximum aggregate amount. The share classes have different upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. The Company intends to continue selling shares on a monthly basis.

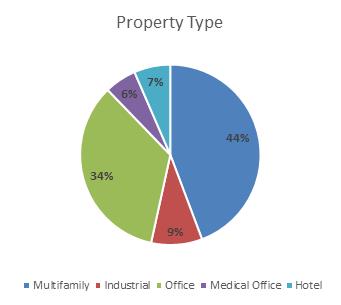

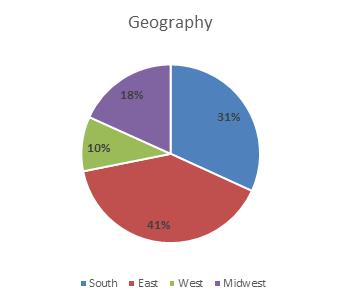

As of March 31, 2020, the Company owned 93 investments in real estate and 84 positions in real estate-related securities. The Company currently operates in six reportable segments: Multifamily, Hotel, Industrial, Office, Medical Office and Real Estate-Related Securities. Financial results by segment are reported in Note 13.

2. | Summary of Significant Accounting Policies |

Principles of Consolidation and Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. All significant intercompany balances and transactions have been eliminated in consolidation. Management believes it has made all necessary adjustments, consisting of only normal recurring items, so that the consolidated financial statements are presented fairly and that estimates made in preparing its consolidated financial statements are reasonable and prudent. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 filed with the SEC.

The accompanying unaudited consolidated financial statements include the accounts of the Company, the Company’s subsidiaries and joint ventures in which the Company has a controlling interest. For consolidated joint ventures, the non-controlling partner’s share of the assets, liabilities and operations of the joint ventures is included in non-controlling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage.

In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. The Operating Partnership is considered to be a VIE. The Company consolidates the Operating Partnership because it has the ability to direct the most significant activities of the entities such as purchases, dispositions, financings, budgets, and overall operating plans. Where the Company does not have the power to direct the activities of the VIE that most significantly impact its economic performance, the Company's interest for those partially owned entities are accounted for using the equity method of accounting. The Company meets the VIE disclosure exemption criteria, as the Company’s interest in the Operating Partnership is considered a majority voting interest.

5

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the balance sheet. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents represent cash held in banks, cash on hand, and liquid investments with original maturities of three months or less. The Company may have bank balances in excess of federally insured amounts; however, the Company deposits its cash and cash equivalents with high credit-quality institutions to minimize credit risk exposure.

Restricted Cash

Restricted cash primarily consists of cash received for subscriptions prior to the date in which the subscriptions are effective. The Company’s restricted cash is held primarily in a bank account controlled by the Company’s transfer agent but in the name of the Company. The remaining balance of restricted cash primarily consists of amounts in escrow related to real estate taxes and insurance in connection with mortgages at certain of the Company’s properties and tenant security deposits.

Investments in Real Estate

In accordance with the guidance for business combinations, the Company determines whether the acquisition of a property qualifies as a business combination, which requires that the assets acquired and liabilities assumed constitute a business. If the property acquired is not a business, the Company accounts for the transaction as an asset acquisition. All property acquisitions to date have been accounted for as asset acquisitions.

The Company capitalizes acquisition-related costs associated with asset acquisitions. Upon acquisition of a property, the Company assesses the fair value of acquired tangible and intangible assets (including land, buildings, tenant improvements, “above-market” and “below-market” leases, acquired in-place leases, other identified intangible assets and assumed liabilities) and allocates the purchase price to the acquired assets and assumed liabilities. The Company assesses and considers fair value based on estimated cash flow projections that utilize discount and/or capitalization rates that it deems appropriate, as well as other available market information. Estimates of future cash flows are based on a number of factors including the historical operating results, known and anticipated trends and market and economic conditions.

The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant. The Company also considers an allocation of purchase price of other acquired intangibles, including acquired in-place leases that may have a customer relationship intangible value, including (but not limited to) the nature and extent of the existing relationship with the tenants, the tenants’ credit quality and expectations of lease renewals. Based on its acquisitions to date, the Company’s allocation to customer relationship intangible assets has not been material.

The cost of buildings and improvements includes the purchase price of the Company’s properties and any acquisition-related costs, along with any subsequent improvements to such properties. The Company’s investments in real estate are stated at cost and are generally depreciated on a straight-line basis over the estimated useful lives of the assets as follows:

Description | | Depreciable Life |

Building | | 35 - 40 years |

Building and land improvements | | 5 - 15 years |

Furniture, fixtures and equipment | | 5 - 7 years |

Lease intangibles and leasehold improvements | | Shorter of useful life or lease term |

Repairs and maintenance are expensed to operations as incurred and are included in Rental property operating and Hotel operating expenses on the Company’s Consolidated Statements of Operations. Significant improvements to properties are capitalized. When assets are sold or retired, their costs and related accumulated depreciation are removed from the accounts with the resulting gains or losses reflected in net income or loss for the period.

6

The Company records acquired above-market and below-market leases at their fair values (using a discount rate which reflects the risks associated with the leases acquired) equal to the difference between (1) the contractual amounts to be paid pursuant to each in-place lease and (2) management’s estimate of fair market lease rates for each corresponding in-place lease, measured over a period equal to the remaining term of the lease for above-market leases and the initial term plus the term of any below-market fixed rate renewal options for below-market leases. Other intangible assets acquired include amounts for in-place lease values that are based on the Company’s evaluation of the specific characteristics of each tenant’s lease. Factors to be considered include estimates of carrying costs during hypothetical expected lease-up periods considering current market conditions, and costs to execute similar leases. In estimating carrying costs, the Company includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, depending on local market conditions. In estimating costs to execute similar leases, the Company considers leasing commissions, legal and other related expenses.

The amortization of acquired above-market and below-market leases is recorded as an adjustment to rental revenue on the Company’s Consolidated Statements of Operations. The amortization of in-place leases is recorded as an adjustment to Depreciation and amortization expense on the Company’s Consolidated Statements of Operations.

Certain of the Company’s investments in real estate are subject to a ground lease, for which a lease liability and corresponding right-of-use (“ROU”) asset were recognized. The Company calculates the amount of the lease liability and ROU asset by taking the present value of the remaining lease payments, and adjusting the ROU asset for any existing straight-line ground rent liability and acquired ground lease intangibles. The Company’s estimated incremental borrowing rate of a loan with a similar term as the ground lease was used as the discount rate. The lease liability is included as a component of Accounts payable, accrued expenses, and other liabilities and the related ROU asset is recorded as a component of Investments in real estate, net on the Company’s Consolidated Balance Sheets. The amortization of the below-market ground lease will be recorded as an adjustment to Depreciation and amortization expense on the Company’s Consolidated Statements of Operations.

The Company’s management reviews its real estate properties for impairment when there is an event or change in circumstances that indicates an impaired value. Since cash flows on real estate properties considered to be “long-lived assets to be held and used” are considered on an undiscounted basis to determine whether an asset has been impaired, the Company’s strategy of holding properties over the long term directly decreases the likelihood of recording an impairment loss. If the Company’s strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could be material to the Company’s results. If the Company determines that an impairment has occurred, the affected assets must be reduced to their fair value. During the periods presented, no such impairment occurred.

Investments in Unconsolidated Real Estate Ventures

Investments in unconsolidated joint ventures are initially recorded at cost, and subsequently adjusted for equity in earnings and cash contributions and distributions. Under the equity method of accounting, the net equity investment of the Company is reflected within the Consolidated Balance Sheets, and the Company’s share of net income or loss from the joint ventures is included within the Consolidated Statements of Operations. The joint venture agreements may designate different percentage allocations among investors for profits and losses; however, the Company’s recognition of joint venture income or loss generally follows the joint venture’s distribution priorities, which may change upon the achievement of certain investment return thresholds. The Company’s investments in unconsolidated joint ventures are reviewed for impairment periodically and the Company records impairment charges when events or circumstances change indicating that a decline in the fair values below the carrying values has occurred and such decline is other-than-temporary. The ultimate realization of the investment in unconsolidated joint ventures is dependent on a number of factors, including the performance of each investment and market conditions.

Investments in Real Estate-Related Securities

The Company has elected to classify its investment in real estate-related securities as trading securities and carry such investments at estimated fair value. As such, the resulting gains and losses are recorded as a component of (Loss) income from real estate-related securities, net on the Consolidated Statements of Operations.

Interest income from the Company’s investments in real estate securities is recognized over the life of each investment using the effective interest method and is recorded on the accrual basis. Recognition of premiums and discounts associated with these investments is deferred and recorded over the term of the investment as an adjustment to yield. Such items are recorded as components of Investments in real estate-related securities on the Company’s Consolidated Balance Sheets.

7

Derivative Instruments

In the normal course of business, the Company is exposed to the effect of interest rate changes. The Company seeks to manage these risks by following established risk management policies and procedures including the use of derivatives to hedge interest rate risk on debt instruments. The Company recognizes all derivatives as either assets or liabilities in the Consolidated Balance Sheets and measures those instruments at fair value.

Fair Value Measurements

Under normal market conditions, the fair value of an investment is the amount that would be received to sell an asset or transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). Additionally, there is a hierarchal framework that prioritizes and ranks the level of market price observability used in measuring investments at fair value. Market price observability is impacted by a number of factors, including the type of investment and the characteristics specific to the investment and the state of the market place, including the existence and transparency of transactions between market participants. Investments with readily available active quoted prices or for which fair value can be measured from actively quoted prices generally will have a higher degree of market price observability and a lesser degree of judgment used in measuring fair value.

Investments measured and reported at fair value are classified and disclosed in one of the following levels within the fair value hierarchy:

Level 1 — quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2 — quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3 — pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

Valuation

The Company generally determines the fair value of its real estate-related securities by utilizing broker-dealer quotations, reported trades or valuation estimates from pricing models to determine the reported price. Pricing models for real estate-related securities are generally discounted cash flow models that usually consider the attributes applicable to a particular class of security (e.g., credit rating, seniority), current market data, and estimated cash flows for each class and incorporate deal collateral performance such as prepayment speeds and default rates, as available. As of December 31, 2019 and March 31, 2020 the Company’s investments in real estate-related securities are classified as Level 2 and Level 3, respectively. On January 1, 2020, the entire Investments in Real Estate-Related Securities portfolio was transferred into Level 3 primarily due to decreased price transparency.

The significant unobservable input in our Level 3 measurements for the real estate-related securities measured at fair value on a recurring basis is the yield of the security. The yield ranged from 1.8% to 17.9% and had a weighted average of 5.5% for the period ended March 31, 2020. A significant increase (decrease) in the yield in isolation would result in a significantly lower (higher) fair value measurement. Refer to Note 5 for additional information.

Fair value of the Company’s indebtedness is estimated by modeling the cash flows required by the Company’s debt agreements and discounting them back to the present value using an appropriate discount rate. Additionally, the Company considers current market rate and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company’s indebtedness are considered Level 3. As of March 31, 2020, the fair value of the Company’s mortgage notes, revolving credit facility and repurchase agreements was approximately $8.3 million below the outstanding principal balance.

The Company’s derivative positions are valued using models developed by the respective counterparty as well as third party pricing service providers that use as their basis readily observable market parameters (such as forward yield curves and credit default swap data). The Company’s derivative positions are classified as Level 2. As of March 31, 2020, the fair value of the Company’s derivatives was approximately $4.4 million below their cost.

8

The fair values of the Company’s financial instruments (other than real estate-related securities, mortgage notes, revolving credit facility and derivative instruments), including cash and cash equivalents and other financial instruments, approximate their carrying or contract value.

Deferred Charges

The Company’s deferred charges include financing and leasing costs. Deferred financing costs include legal, structuring and other loan costs incurred by the Company for its financing agreements. Deferred financing costs related to the Company’s mortgage notes are recorded as an offset to the related liability and amortized over the term of the applicable financing instruments as interest expense. Deferred financing costs related to the Company’s revolving credit facility are recorded as a component of Other assets on the Company’s Consolidated Balance Sheets and amortized over the term of the applicable financing agreement. Deferred leasing costs incurred in connection with new leases, which consist primarily of brokerage commissions, are recorded as a component of Investments in real estate, net on the Company’s Consolidated Balance Sheets and amortized over the life of the related lease.

Revenue Recognition

The Company commences revenue recognition on its leases based on a number of factors, including the initial determination that the contract is or contains a lease. Generally, all of the Company’s contracts are, or contain leases, and therefore revenue is recognized when the lessee takes possession of or controls the physical use of the leased assets. In most instances this occurs on the lease commencement date. At the inception of a new lease, including new leases that arise from amendments, the Company assesses the terms and conditions of the lease to determine the proper lease classification.

The Company adopted the provisions of Accounting Standards Update (“ASU”) 2016-02, Leases (Topic 842) and related ASUs subsequently issued (collectively, “ASC 842”) as of January 1, 2019. A lease is classified as an operating lease if none of the following criteria are met: (i) ownership transfers to the lessee at the end of the lease term, (ii) the lessee has a purchase option that is reasonably expected to be exercised, (iii) the lease term is for a major part of the economic life of the leased property, (iv) the present value of the future lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the leased property, and (v) the leased property is of such a specialized nature that it is expected to have no future alternative use to the Company at the end of the lease term. If one or more of these criteria are met, the lease will generally be classified as a sales-type lease, unless the lease contains a residual value guarantee from a third party other than the lessee, in which case it would be classified as a direct financing lease under certain circumstances in accordance with ASC 842.

The Company’s rental revenue primarily consists of fixed contractual base rent arising from tenant leases at the Company’s properties under operating leases. Revenue under operating leases that are deemed probable of collection, is recognized as revenue on a straight-line basis over the non-cancelable terms of the related leases. For leases that have fixed and measurable rent escalations, the difference between such rental income earned and the cash rent due under the provisions of the lease is recorded in the Consolidated Balance Sheets. The Company’s Hotel revenue consists of room revenue and food and beverage revenue. Room revenue is recognized when the related room is occupied and other hotel revenue is recognized when the service is rendered.

Certain of the Company’s contracts contain nonlease components (e.g., charges for management fees, common area maintenance, and reimbursement of third-party maintenance expenses) in addition to lease components (i.e., monthly rental charges). Services related to nonlease components are provided over the same period of time as, and billed in the same manner as, monthly rental charges. The Company elected to apply the practical expedient available under ASC 842, for all classes of assets, not to segregate the lease components from the nonlease components when accounting for operating leases. Since the lease component is the predominant component under each of these leases, combined revenues from both the lease and nonlease components are accounted for in accordance with ASC 842 and reported as rental revenues in the accompanying Consolidated Statements of Operations.

In connection with its investments, the Company has utilized loan programs designed to encourage housing development. The proceeds from these loans are governed by restrictive covenants. For certain housing development loans, so long as the Company remains in compliance with the covenants and program requirements, the loans will be forgiven in equal annual installments until the loans are discharged in full. The Company treats these loans as deferred income and records them as a component of Accounts payable, accrued expenses and other liabilities on the Company’s Consolidated Balance Sheets. As of March 31, 2020 and December 31, 2019, deferred income related to these loans amounted to $6.4 million and $6.6 million, respectively. As the loan balances are reduced during the compliance period, the Company will record income associated with the discharge of the loans as a component of Other revenue on the Consolidated Statements of Operations. For the three months ended March 31, 2020 and 2019, Other revenue related to these loans amounted to $0.2 million and $0.2 million, respectively.

Other revenues and interest income are recorded on an accrual basis.

9

Organization and Offering Expenses

Organization costs are expensed as incurred and recorded as a component of General and administrative expenses on the Company’s Consolidated Statements of Operations and offering costs are charged to equity as such amounts are incurred.

The Advisor advanced $7.3 million of organization and offering expenses on behalf of the Company (including legal, accounting, and other expenses attributable to the organization, but excluding upfront selling commissions, dealer manager fees and stockholder servicing fees) through December 21, 2019, the first anniversary of the date on which the proceeds from escrow were released. The Company reimburses the Advisor for all such advanced expenses ratably over a 60 month period following December 21, 2019. These organization and offering costs are recorded as a component of Due to affiliates on the Company’s Consolidated Balance Sheets as of March 31, 2020 and December 31, 2019.

Starwood Capital, L.L.C. (the “Dealer Manager”), a registered broker-dealer affiliated with the Advisor, serves as the dealer manager for the Offering. The Dealer Manager is entitled to receive selling commissions and dealer manager fees based on the transaction price of each applicable class of shares sold in the primary offering. The Dealer Manager is also entitled to receive a stockholder servicing fee based on the aggregate net asset value (“NAV”) of the Company’s outstanding Class T shares, Class S shares, and Class D shares.

The following table details the selling commissions, dealer manager fees, and stockholder servicing fees for each applicable share class as of March 31, 2020:

| | Common Stock Class T | | | Common Stock Class S | | | Common Stock Class D | | | Common Stock Class I |

Selling commissions and dealer manager fees (% of transaction price) | | up to 3.5% | | | up to 3.5% | | | up to 1.5% | | | — |

Stockholder servicing fee (% of NAV) | | 0.85% | | | 0.85% | | | 0.25% | | | — |

For Class S shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.5% of the transaction price. For Class T shares sold in the primary offering, investors will pay upfront selling commissions of up to 3.0% of the transaction price and upfront dealer manager fees of 0.5% of the transaction price, however such amounts may vary at certain participating broker-dealers, provided that the sum will not exceed 3.5% of the transaction price. For Class D shares sold in the primary offering, investors will pay upfront selling commissions of up to 1.5% of the transaction price. Prior to February 4, 2020, no upfront selling commissions were paid on Class D shares.

The Dealer Manager is entitled to receive stockholder servicing fees of 0.85% per annum of the aggregate NAV for Class S shares and Class T shares. For Class T shares such stockholder servicing fee includes, an advisor stockholder servicing fee of 0.65% per annum, and a dealer stockholder servicing fee of 0.20% per annum, of the aggregate NAV for the Class T shares, however, with respect to Class T shares sold through certain participating broker-dealers, the advisor stockholder servicing fee and the dealer stockholder servicing fee may be other amounts, provided that the sum of such fees will always equal 0.85% per annum of the NAV of such shares. The Class D shares will incur a stockholder servicing fee equal to 0.25% per annum of the aggregate NAV for the Class D shares. There is no stockholder servicing fee with respect to Class I shares.

The Dealer Manager has entered into agreements with the selected dealers distributing the Company’s shares in the Offering, which provide, among other things, for the re-allowance of the full amount of the selling commissions and dealer manager fees received and all or a portion of the stockholder servicing fees to such selected dealers. The Company will cease paying the stockholder servicing fee with respect to any Class T share, Class S share or Class D share sold in the primary offering at the end of the month in which the total selling commissions, dealer manager fees and stockholder servicing fees paid with respect to the shares held by such stockholder within such account would exceed 8.75% (or, in the case of Class T shares sold through certain participating broker-dealers, a lower limit as set forth in any applicable agreement between the Dealer Manager and a participating broker-dealer) of the gross proceeds from the sale of such share (including the gross proceeds of any shares issued under the Company’s distribution reinvestment plan with respect thereto). The Company will accrue the full cost of the stockholder servicing fee as an offering cost at the time each Class T, Class S and Class D share is sold during the primary offering. As of March 31, 2020 and December 31, 2019, the Company had accrued $60.8 million and $44.1 million respectively, of stockholder servicing fees related to shares sold and recorded such amount as a component of Due to affiliates on the Company’s Consolidated Balance Sheets.

10

Income Taxes

The Company intends to elect to be taxed as a REIT under the Internal Revenue Code (the “Code”), for federal income tax purposes, beginning with its taxable year ended December 31, 2019. If the Company qualifies for taxation as a REIT, it generally will not be subject to U.S. federal corporate income tax on its net taxable income that is currently distributed to its stockholders. A REIT is subject to a number of organizational and operational requirements, including a requirement that it currently distributes at least 90% of its REIT taxable income (subject to certain adjustments) to its stockholders. If the Company fails to qualify as a REIT in a taxable year, without the benefit of certain relief provisions, it will be subject to federal and state income tax on its taxable income at regular corporate tax rates. Even if the Company qualifies for taxation as a REIT, it may also be subject to certain federal, state, and local taxes on its income and assets, including (1) taxes on any undistributed income, (2) taxes related to its taxable REIT subsidiaries (“TRSs”) and (3) certain state or local income taxes.

In anticipation of the Company’s REIT election, the Company has formed wholly-owned subsidiaries to function as TRSs and filed TRS elections, together with such subsidiaries, with the Internal Revenue Service. In general, a TRS may perform additional services for the Company’s tenants and generally may engage in any real estate or non-real estate-related business other than management or operation of a lodging facility or a health care facility. The TRSs will be subject to taxation at the federal, state and local levels, as applicable, at the regular corporate tax rates. The Company accounts for applicable income taxes by utilizing the asset and liability method. As such, the Company records deferred tax assets and liabilities for the future tax consequences resulting from the difference between the carrying value of existing assets and liabilities and their respective tax basis. A valuation allowance for deferred tax assets is provided if the Company believes all or some portion of the deferred tax asset may not be realized.

For the three months ended March 31, 2020 and 2019, the Company recognized an income tax provision of $0.1 million and $0.0 million, respectively, within Other expense on the Company’s Consolidated Statements of Operations. As of March 31, 2020 and December 31, 2019, the Company recorded a deferred tax liability of $0.1 million and $0.1 million, respectively, due to its hotel investments within Other assets on the Company’s Consolidated Balance Sheets.

Net Loss per Share

Basic net loss per share is computed by dividing net loss for the period by the weighted average number of common shares outstanding during the period. All classes of common stock are allocated net loss at the same rate per share and receive the same gross distribution per share. Diluted loss per share is computed by dividing net loss for the period by the weighted average number of common shares and common share equivalents outstanding (unless their effect is antidilutive) for the period. There are no common share equivalents outstanding that would have a dilutive effect as a result of the net loss, and accordingly, the weighted average number of common shares outstanding is identical for the periods ended March 31, 2020 and 2019, for both basic and diluted shares.

The restricted stock grants of Class I shares held by the Company’s independent directors are not considered to be participating securities because they do not contain non-forfeitable rights to distributions. As a result, there is no impact of these restricted stock grants on basic and diluted net loss per common share until the restricted stock grants have fully vested.

Recent Accounting Pronouncements

In June 2016, the Financial Accounting Standards Board (the “FASB”) issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, to amend the accounting for credit losses for certain financial instruments. Under the new guidance, an entity recognizes its estimate of expected credit losses as an allowance, which the FASB believes will result in more timely recognition of such losses. In November 2018, the FASB released ASU 2018-19, Codification Improvements to Topic 326, Financial Instruments—Credit Losses. This amendment clarifies that receivables arising from operating leases are not within the scope of Subtopic 326-20. Instead, impairment of receivables arising from operating leases should be accounted for in accordance with Subtopic 842-30, Leases—Lessor. These ASUs are effective for interim and annual reporting periods in fiscal years beginning after December 15, 2019, with early adoption permitted as of the fiscal year beginning after December 15, 2018, including adoption in an interim period. The majority of the Company’s receivables arise in the ordinary course of business from operating leases with its tenants and are therefore not subject to the guidance in Subtopic 326-20. Adopted as of January 1, 2020, the Company has determined the adoption of this guidance did not have a material effect on its consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, “Fair Value Measurement (Topic 820) – Disclosure Framework,” which adds new disclosure requirements and modifies or eliminates existing disclosure requirements of ASC 820. This ASU is effective for annual periods, and interim periods therein, beginning after December 15, 2019. The Company has determined the application of this ASU does not materially impact the Company.

11

In December 2019, the FASB issued ASU 2019-12, "Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes." The amendments simplify the accounting for income taxes by removing certain exceptions to the general principles of Topic 740, "Income Taxes" and also improve consistent application by clarifying and amending existing guidance. The new standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020. Early adoption is permitted, with the amendments to be applied on a retrospective, modified retrospective or prospective basis, depending on the specific amendment. The Company is currently evaluating the impact of adopting this guidance.

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting.” This ASU provides optional expedients for applying GAAP to contract modifications and hedging relationships, subject to meeting certain criteria that reference LIBOR or another rate that is expected to be discontinued. The amendments in the ASU are effective for all entities as of March 12, 2020 through December 31, 2022. The adoption of this guidance did not have a material impact on the Company’s consolidated financial statements.

Investments in Real Estate

Investments in real estate, net consisted of the following ($ in thousands):

| | | March 31, 2020 | | | | | | December 31, 2019 | |

Building and building improvements | | $ | | 2,622,792 | | | | | $ | | 1,455,204 | |

Land and land improvements | | | | 483,415 | | | | | | | 322,520 | |

Furniture, fixtures and equipment | | | | 52,779 | | | | | | | 46,268 | |

Right of use asset - operating lease(1) | | | | 101,717 | | | | | | | — | |

Total | | | | 3,260,703 | | | | | | | 1,823,992 | |

Accumulated depreciation | | | | (43,864 | ) | | | | | | (25,948 | ) |

Investments in real estate, net | | $ | | 3,216,839 | | | | | $ | | 1,798,044 | |

(1) | Refer to Note 12 for additional details on the Company’s leases. |

During the three months ended March 31, 2020, the Company acquired interests in 21 properties, which were comprised of 18 multifamily properties, two office buildings and one medical office building. As of December 31, 2019, the Company acquired interests in 71 properties, which were comprised of 16 multifamily properties, eight hotel properties, 12 office buildings, 33 industrial assets and two other properties.

The following table provides further details of the properties acquired during the three months ended March 31, 2020 ($ in thousands):

Investment | | Ownership Interest | | Number of Properties | | Location | | Sector | | Acquisition Date | | Real Estate Acquisition (1) | |

Southeast Affordable Housing Portfolio | | 99.99% | | 18 | | Various (2) | | Multifamily | | February 13, 2020 | | $ | 465,523 | |

Nashville Office | | 100% | | 1 | | Nashville, TN | | Office | | February 21, 2020 | | | 265,404 | |

Barlow Building | | 100% | | 1 | | Chevy Chase, MD | | Medical Office | | March 6, 2020 | | | 162,212 | |

60 State St | | 75% | | 1 | | Boston, MA | | Office | | March 20, 2020 | | | 613,052 | |

| | | | 21 | | | | | | | | $ | 1,506,190 | |

(1) | Purchase price is inclusive of acquisition-related costs. |

(2) | The Southeast Affordable Housing Portfolio is primarily concentrated in Orlando, FL (27% of units), Newport News, VA (14%), Tucson, AZ (10%), Jacksonville, FL (9%), Charlotte, NC (8%) and Raleigh, NC (8%). |

12

The following table summarizes the purchase price allocation for the properties acquired during the three months ended March 31, 2020 ($ in thousands):

| 60 State St | | | Southeast Affordable Housing Portfolio | | | Nashville Office | | | Barlow Building | | | Total | |

Building and building improvements | $ | | 479,291 | | | $ | | 360,356 | | | $ | | 228,180 | | | $ | | 110,793 | | | $ | | 1,178,620 | |

Land and land improvements | | | 472 | | | | | 88,378 | | | | | 21,636 | | | | | 31,681 | | | | | 142,167 | |

Furniture, fixtures and equipment | | | — | | | | | 5,886 | | | | | — | | | | | — | | | | | 5,886 | |

Below-market ground lease(1) | | | 95,536 | | | | | — | | | | | — | | | | | — | | | | | 95,536 | |

In-place lease intangibles | | | 47,625 | | | | | 6,254 | | | | | 18,791 | | | | | 12,188 | | | | | 84,858 | |

Above-market lease intangibles | | | 10,345 | | | | | — | | | | | 410 | | | | | 5,848 | | | | | 16,603 | |

Below-market lease intangibles | | | (19,019 | ) | | | | — | | | | | (4,917 | ) | | | | (510 | ) | | | | (24,446 | ) |

Total purchase price(2) | $ | | 614,250 | | | $ | | 460,874 | | | $ | | 264,100 | | | $ | | 160,000 | | | $ | | 1,499,224 | |

Non-controlling interest | | | (56,155 | ) | | | | — | | | | | — | | | | | — | | | | | (56,155 | ) |

Net purchase price | $ | | 558,095 | | | $ | | 460,874 | | | $ | | 264,100 | | | $ | | 160,000 | | | $ | | 1,443,069 | |

(1) | The below-market ground lease value was recorded as a component of the Right of use asset – operating leases on the Consolidated Balance Sheet. Refer to Note 12 for additional details on the Company’s leases. |

(2) | Purchase price does not include acquisition related costs and acquired working capital of $7.0 million. |

The weighted-average amortization periods for the acquired in-place lease intangibles, above-market lease intangibles, below-market lease intangibles and below-market ground lease for the properties acquired during the three months ended March 31, 2020 were seven years, seven years, eight years and 47 years, respectively.

The estimated future amortization on the Company’s below-market ground lease for each of the next five years and thereafter as of March 31, 2020 is as follows ($ in thousands):

| | Below-market Ground | |

| | Lease | |

2020 (remaining) | | $ | 1,529 | |

2021 | | | 2,039 | |

2022 | | | 2,039 | |

2023 | | | 2,039 | |

2024 | | | 2,039 | |

Thereafter | | | 85,624 | |

| | $ | 95,309 | |

Investments in unconsolidated real estate ventures

On March 13, 2019, the Company entered into a joint venture (the "Joint Venture") to acquire a Fort Lauderdale hotel. The Company owns a 43% interest in the Joint Venture. The Joint Venture is accounted for using the equity method of accounting and is included in Investment in unconsolidated real estate venture in the Company’s Consolidated Balance Sheets. The Company's investment in the Joint Venture totaled $12.3 million and $12.2 million as of March 31, 2020 and December 31, 2019, respectively. The Company’s income from its investment in the Joint Venture is presented in Earnings from unconsolidated real estate ventures on the Company’s Consolidated Statements of Operations and totaled $0.4 million and $0.04 million for the three months ended March 31, 2020 and 2019, respectively.

13

The gross carrying amount and accumulated amortization of the Company’s intangible assets and liabilities consisted of the following ($ in thousands):

| March 31, 2020 | | | December 31, 2019 | |

Intangible assets: (1) | | | | | | | | | |

In-place lease intangibles | $ | | 162,892 | | | $ | | 77,311 | |

Above-market lease intangibles | | | 22,045 | | | | | 5,387 | |

Other | | | 31,019 | | | | | 30,801 | |

Total intangible assets | | | 215,956 | | | | | 113,499 | |

Accumulated amortization: | | | | | | | | | |

In-place lease amortization | | | (24,434 | ) | | | | (12,341 | ) |

Above-market lease intangibles | | | (709 | ) | | | | (318 | ) |

Other | | | (1,369 | ) | | | | (635 | ) |

Total accumulated amortization | | | (26,512 | ) | | | | (13,294 | ) |

Intangible assets, net | $ | | 189,444 | | | $ | | 100,205 | |

Intangible liabilities: (2) | | | | | | | | | |

Below-market lease intangibles | $ | | 31,440 | | | $ | | 7,032 | |

Accumulated amortization | | | (784 | ) | | | | (331 | ) |

Intangible liabilities, net | $ | | 30,656 | | | $ | | 6,701 | |

(1) | Included in Other assets on the Company’s Consolidated Balance Sheets. |

(2) | Included in Accounts payable, accrued expenses and other liabilities on the Company’s Consolidated Balance Sheets. |

The estimated future amortization on the Company’s intangibles for each of the next five years and thereafter as of March 31, 2020 is as follows ($ in thousands):

| | In-place Lease Intangibles | | | Above-market Lease Intangibles | | | Other | | | Below-market Lease Intangibles | |

2020 (remaining) | | $ | 23,542 | | | $ | 2,846 | | | $ | 2,724 | | | $ | (2,658 | ) |

2021 | | | 27,912 | | | | 3,779 | | | | 2,933 | | | | (3,486 | ) |

2022 | | | 21,763 | | | | 3,294 | | | | 2,924 | | | | (3,206 | ) |

2023 | | | 15,990 | | | | 2,850 | | | | 2,839 | | | | (2,950 | ) |

2024 | | | 11,462 | | | | 1,859 | | | | 2,825 | | | | (2,514 | ) |

Thereafter | | | 37,789 | | | | 6,708 | | | | 15,405 | | | | (15,842 | ) |

| | $ | 138,458 | | | $ | 21,336 | | | $ | 29,650 | | | $ | (30,656 | ) |

5. | Investments in Real Estate-Related Securities |

The following tables detail the Company’s investments in real estate-related securities ($ in thousands):

| | | | | | March 31, 2020 | |

Instrument | | Number of Positions | | | Weighted Average Coupon (1) | | | Weighted Average Maturity Date (2) | | Cost Basis | | | Fair Value | |

RMBS | | 72 | | | 3.45% | | | June 13, 1944 | | $ | 298,966 | | | $ | 285,640 | |

CLO | | 8 | | | 6.11% | | | August 15, 2031 | | | 25,166 | | | | 17,631 | |

CMBS | | 4 | | | 4.28% | | | December 22, 2036 | | | 11,443 | | | | 11,194 | |

| | | 84 | | | | | | | | | $ | 335,575 | | | $ | 314,465 | |

14

| | | | | | December 31, 2019 | |

Instrument | | Number of Positions | | | Weighted Average Coupon (1) | | | Weighted Average Maturity Date (2) | | Cost Basis | | | Fair Value | |

RMBS | | 59 | | | 3.76% | | | October 17, 1940 | | $ | 235,405 | | | $ | 236,844 | |

CLO | | 12 | | | 6.12% | | | May 11, 2031 | | | 29,302 | | | | 29,236 | |

CMBS | | 4 | | | 3.73% | | | March 13, 2037 | | | 11,473 | | | | 11,571 | |

| | | 75 | | | | | | | | | $ | 276,180 | | | $ | 277,651 | |

(1) | As of March 31, 2020, our RMBS investments had floating rate coupons ranging from 2.40% to 7.00%, our CLO securities had floating rate coupons ranging from 5.75% to 9.60% and our CMBS investments had floating rate coupons ranging from 4.07% to 5.00%. |

(2) | Weighted average maturity date is based on the fully extended maturity date of the underlying collateral. |

The majority of the Company’s real estate-related securities portfolio consist of non-agency residential mortgage-backed securities (“RMBS”). The Company has also invested in collateralized loan obligations (“CLOs”) and commercial mortgage-backed securities (“CMBS”).

During the three months ended March 31, 2020, the Company recorded net unrealized and realized losses on its real estate-related securities portfolio of $22.6 million and $1.3 million, respectively. During the three months ended March 31, 2019, the Company recorded an unrealized loss of $0.1 million on its real estate-related securities portfolio. During the three months ended March 31, 2019, the Company did not sell any securities. Such amounts are recorded as a component of (Loss) income from real estate-related securities, net on the Company’s Consolidated Statements of Operations.

6. | Mortgage Notes and Revolving Credit Facility |

The following table is a summary of the mortgage notes and revolving credit facility secured by the Company’s properties ($ in thousands):

| | | | | | | | | | | | Principal Balance Outstanding (2) | |

Indebtedness | | Weighted Average Interest Rate(1) | | | Weighted Average Maturity Date | | Maximum Facility Size | | | March 31, 2020 | | | December 31, 2019 | |

Fixed rate loans | | | | | | | | | | | | | | | | | | |

Fixed rate mortgages | | 3.50% | | | 7/20/2029 | | N/A | | | $ | 1,340,373 | | | $ | 1,004,423 | |

Total fixed rate loans | | | | | | | | | | | | | 1,340,373 | | | | 1,004,423 | |

Variable rate loans | | | | | | | | | | | | | | | | | | |

Floating rate mortgages | | L + 1.75% | | | 1/27/2025 | | N/A | | | | 738,389 | | | | 240,599 | |

Variable rate revolving credit facility (3) | | L + 2.00% | | | 10/21/2020 | | $ | 200,000 | | | | 172,800 | | | | — | |

Total variable rate loans | | | | | | | | | | | | | 911,189 | | | | 240,599 | |

Total loans secured by the Company's properties | | | | | | | | | | | | | 2,251,562 | | | | 1,245,022 | |

Deferred financing costs, net | | | | | | | | | | | | | (12,892 | ) | | | (7,136 | ) |

Discount on assumed debt, net | | | | | | | | | | | | | 233 | | | | 216 | |

Mortgage notes and revolving credit facility, net | | | | | | | | | | | | $ | 2,238,903 | | | $ | 1,238,102 | |

(1) | The term “L” refers to the one-month LIBOR. As of March 31, 2020, one-month LIBOR was equal to 0.99%. |

(2) | The majority of the Company’s mortgages contain yield or spread maintenance provisions. |

(3) | The Company’s revolving credit facility is used as bridge financing and can be drawn upon to fund the acquisition of future real estate investments. |

15

The following table presents the future principal payments under the Company’s mortgage notes and revolving credit facility as of March 31, 2020 ($ in thousands):

Year | | Amount | |

2020 (remaining) | | $ | | 175,029 | |

2021 | | | | 51,049 | |

2022 | | | | 3,235 | |

2023 | | | | 3,931 | |

2024 | | | | 213,561 | |

Thereafter | | | | 1,804,757 | |

Total | | $ | | 2,251,562 | |

Interest paid on the Company’s mortgage notes and revolving credit facility for the three months ended March 31, 2020 and 2019 was $9.9 million and $2.2 million, respectively.

The Company’s mortgage notes and revolving credit facility may contain customary events of default and covenants, including limitations on liens and indebtedness. The Company is not aware of any instance of noncompliance with financial covenants as of March 31, 2020.

Repurchase agreements are treated as collateralized financing transactions and are carried at their contractual amounts, including accrued interest, as specified in the respective agreements. Although structured as a sale and repurchase obligation, a repurchase agreement operates as a financing under which securities are pledged as collateral to secure a short-term loan equal in value to a specified percentage of the market value of the pledged collateral. While used as collateral, the Company retains beneficial ownership of the pledged collateral, including the right to distributions. At the maturity of a repurchase agreement, the Company is required to repay the loan and concurrently receive the pledged collateral from the lender or, with the consent of the lender, renew such agreement at the then prevailing financing rate. The Company’s repurchase agreements typically have terms of up to one month at inception.

The carrying amount of the Company’s repurchase agreements approximates fair value due to their short-term maturities or floating rate coupons. Interest rates on these borrowings are fixed based on prevailing rates corresponding to the terms of the borrowings, and interest is paid at the termination of the borrowing at which time the Company may enter into a new borrowing arrangement at prevailing market rates with the same counterparty or repay that counterparty and negotiate financing with a different counterparty.

The fair value of financial instruments pledged as collateral on the Company’s repurchase agreements disclosed in the tables below represent the Company’s fair value of such instruments, which may differ from the fair value assigned to the collateral by its counterparties.

For financial statement purposes, the Company does not offset its repurchase agreements and securities lending transactions because the conditions for netting as specified by GAAP are not met. Although not offset on the Consolidated Balance Sheets, these transactions are included in the following tables ($ in thousands):

| | | | | | March 31, 2020 | |

Security Interest | | Weighted Average Coupon | | | Collateral Assets(1) | | | Outstanding Balance | |

RMBS | | 2.22% | | | $ | 212,050 | | | $ | 182,518 | |

CLO | | 3.08% | | | | 14,886 | | | | 12,583 | |

CMBS | | 1.91% | | | | 4,064 | | | | 3,333 | |

| | | | | | $ | 231,000 | | | $ | 198,434 | |

16

| | | | | | December 31, 2019 | |

Security Interest | | Weighted Average Coupon | | | Collateral Assets(1) | | | Outstanding Balance | |

RMBS | | 2.62% | | | $ | 89,784 | | | $ | 74,876 | |

CLO | | 4.71% | | | | 7,962 | | | | 6,159 | |

| | | | | | $ | 97,746 | | | $ | 81,035 | |

(1) | Represents the fair value of the Company’s investments in real estate-related securities. |

Interest paid on the Company’s repurchase agreements for the three months ended March 31, 2020 and 2019 was $0.7 million and $0.4 million, respectively.

8. | Other Assets and Other Liabilities |

The following table summarizes the components of Other assets ($ in thousands):

| | March 31, 2020 | | | December 31, 2019 | |

Intangible assets, net | | $ | 189,444 | | | $ | 100,205 | |

Receivables | | | 12,476 | | | | 7,763 | |

Acquisition deposits | | | 8,807 | | | | 3,050 | |

Derivative instruments | | | 1,763 | | | | 203 | |

Prepaid expenses | | | 1,093 | | | | 1,456 | |

Interest receivable | | | 21 | | | | — | |

Other | | | 6,241 | | | | 820 | |

Total | | $ | 219,845 | | | $ | 113,497 | |

The following table summarizes the components of Accounts payable, accrued expenses, and other liabilities ($ in thousands):

| | March 31, 2020 | | | December 31, 2019 | |

Intangible liabilities, net | | $ | 30,656 | | | $ | 6,701 | |

Accounts payable and accrued expenses | | | 12,119 | | | | 10,188 | |

Real estate taxes payable | | | 10,401 | | | | 6,513 | |

Deferred income | | | 9,760 | | | | 6,707 | |

Tenant security deposits | | | 6,677 | | | | 3,547 | |

Right of use liability - operating lease | | | 6,408 | | | | — | |

Distributions payable | | | 6,191 | | | | 4,216 | |

Accrued interest expense | | | 3,882 | | | | 1,993 | |

Derivative instruments | | | 2,901 | | | | — | |

Other | | | 12,119 | | | | 8,114 | |

Total | | $ | 101,114 | | | $ | 47,979 | |

17

9. | Equity and Redeemable Non-controlling interest |

Authorized Capital

The Company is authorized to issue preferred stock and four classes of common stock consisting of Class T shares, Class S shares, Class D shares, and Class I shares. The Company’s board of directors has the ability to establish the preferences and rights of each class or series of preferred stock, without stockholder approval, and as such, it may afford the holders of any series or class of preferred stock preferences, powers and rights senior to the rights of holders of common stock. The differences among the common share classes relate to upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees. See Note 2 for a further description of such items. Other than the differences in upfront selling commissions, dealer manager fees and ongoing stockholder servicing fees, each class of common stock is subject to the same economic and voting rights.

As of March 31, 2020, the Company had the authority to issue 1,100,000,000 shares of capital stock, consisting of the following:

Classification | | Number of Shares | | | Par Value | |

Preferred Stock | | | 100,000,000 | | | $ | 0.01 | |

Class T Shares | | | 250,000,000 | | | $ | 0.01 | |

Class S Shares | | | 250,000,000 | | | $ | 0.01 | |

Class D Shares | | | 250,000,000 | | | $ | 0.01 | |

Class I Shares | | | 250,000,000 | | | $ | 0.01 | |

Total | | | 1,100,000,000 | | | | | |

Common Stock

The following table details the movement in the Company’s outstanding shares of common stock:

| | Three months ended March 31, 2020 | |

| | Class T | | | Class S | | | Class D | | | Class I | | | Total | |

December 31, 2019 | | | 1,412,563 | | | | 26,164,794 | | | | 1,653,094 | | | | 16,114,284 | | | | 45,344,735 | |

Common stock issued | | | 599,008 | | | | 9,387,247 | | | | 626,202 | | | | 8,890,951 | | | | 19,503,408 | |

Distribution reinvestment | | | 9,345 | | | | 236,427 | | | | 16,565 | | | | 126,469 | | | | 388,806 | |

Common stock repurchased | | | (4,665 | ) | | | (25,680 | ) | | | (2,588 | ) | | | (12,786 | ) | | | (45,719 | ) |

March 31, 2020 | | | 2,016,251 | | | | 35,762,788 | | | | 2,293,273 | | | | 25,118,918 | | | | 65,191,230 | |

Distributions

The Company generally intends to distribute substantially all of its taxable income, which does not necessarily equal net income as calculated in accordance with GAAP, to its stockholders each year to comply with the REIT provisions of the Code.

Each class of common stock receives the same gross distribution per share. The net distribution varies for each class based on the applicable stockholder servicing fee, which is deducted from the monthly distribution per share and paid directly to the applicable distributor.

The following table details the aggregate distributions declared for each applicable class of common stock for the three months ended March 31, 2020:

| | Class T | | | Class S | | | Class D | | | Class I | |

Gross distributions declared per share of common stock | | $ | | 0.3105 | | | $ | | 0.3105 | | | $ | | 0.3105 | | | $ | | 0.3105 | |

Stockholder servicing fee per share of common stock | | | | (0.0454 | ) | | | | (0.0458 | ) | | | | (0.0134 | ) | | | | — | |

Net distributions declared per share of common stock | | $ | | 0.2651 | | | $ | | 0.2647 | | | $ | | 0.2971 | | | $ | | 0.3105 | |

18

Redeemable Non-controlling Interest

In connection with its performance participation interest, the Special Limited Partner holds Class I units in the Operating Partnership. See Note 10 for further details of the Special Limited Partner’s performance participation interest. Because the Special Limited Partner has the ability to redeem its Class I units for cash, at the election of the Special Limited Partner, the Company has classified these Class I units as Redeemable non-controlling Interest in mezzanine equity on the Company’s Consolidated Balance Sheets. The Redeemable non-controlling Interest is recorded at the greater of the carrying amount, adjusted for its share of the allocation of income or loss and dividends, or the redemption value, which is equivalent to fair value, of such units at the end of each measurement period. As the redemption value was greater than the adjusted carrying value at March 31, 2020, the Company recorded an allocation adjustment of $0.3 million between Additional paid-in capital and Redeemable non-controlling Interest.

The following table summarizes the redeemable non-controlling interest activity for the three months ended March 31, 2020 ($ in thousands):

December 31, 2019 | $ | — | |

Settlement of 2019 performance participation allocation | | 10,366 | |

GAAP income allocation | | (332 | ) |

Distributions | | (149 | ) |

Fair value allocation | | 302 | |

March 31, 2020 | $ | 10,187 | |

Share Repurchase Plan

The Company has adopted a share repurchase plan, whereby on a monthly basis, stockholders may request that the Company repurchase all or any portion of their shares. The Company may choose to repurchase all, some or none of the shares that have been requested to be repurchased at the end of any particular month, in its discretion, subject to any limitations in the share repurchase plan. The total amount of aggregate repurchases of Class T, Class S, Class D, and Class I shares is limited to 2% of the aggregate NAV per month and 5% of the aggregate NAV per calendar quarter. Shares are repurchased at a price equal to the transaction price on the applicable repurchase date, subject to any early repurchase deduction. Shares that have not been outstanding for at least one year are repurchased at 95% of the transaction price. Due to the illiquid nature of investments in real estate, the Company may not have sufficient liquid resources to fund repurchase requests and may elect not to repurchase some or all of the shares submitted for repurchase in a given period. Further, the Company may modify, suspend or terminate the share repurchase plan. For the three months ended March 31, 2020, the Company repurchased 45,719 shares of common stock representing a total of $1.0 million. The Company had no unfulfilled repurchase requests during the three months ended March 31, 2020.

Distribution Reinvestment Plan