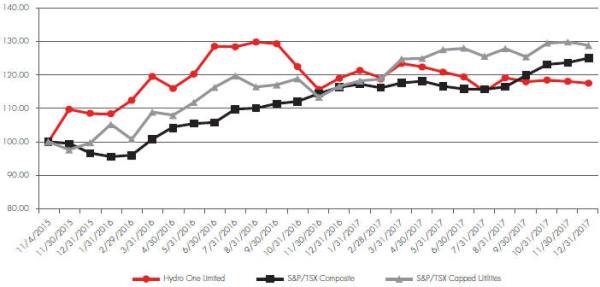

Exhibit 4.6

Notice of 2018 annual meeting of shareholders and availability of proxy materials

Hydro One Limited(Hydro Oneor thecompany)is providing you with access to its management information circular (thecircular) for its 2018 annual meeting of shareholders (themeeting)electronically via notice and access, instead of mailing out paper copies, as permitted by Canadian securities regulators. Electronic delivery is more environmentally friendly and significantly reduces the cost of printing and mailing materials to shareholders. All shareholders are reminded to review the circular before voting. Shareholders with questions about notice and access can call1-855-887-2244 toll-free, for service in English or French. This notice provides details of the date, time and place of the meeting, including the matters to be voted on at the meeting. Accompanying this notice is a form of proxy or voting instruction form that you will need to vote by proxy.

Notice is hereby given that an annual meeting of shareholders of Hydro One will be held:

| When: | Where: | |

| Tuesday, May 15, 2018 | Ryerson University | |

| 9:30 a.m. (Eastern Time) | 7th Floor Auditorium | |

| 55 Dundas St. W. | ||

| Toronto, Ontario | ||

| M5G 2C3 | ||

for the following purposes and to transact any other business that may properly come before the meeting and any postponement(s) or adjournment(s) thereof:

| Matters to be Voted on by Shareholders | Section of Circular | |

| Financial Statements:receive Hydro One’s 2017 audited consolidated financial statements together with the report of the external auditors on those statements | See “Business of the Meeting – 1. Financial Statements” | |

| Election of Directors:elect directors to the board for the ensuing year | See “Business of the Meeting – 2. Election of Directors” | |

| Appointment of External Auditors:appoint KPMG LLP as external auditors for the ensuing year and authorize the directors to fix their remuneration | See “Business of the Meeting – 3. Appointment of External Auditors” | |

| Say on Pay:an advisory resolution on Hydro One’s approach to executive compensation | See “Business of the Meeting – 4. Advisory Vote on Executive Compensation” | |

| Other Business:to transact such other business as may properly come before the meeting and any postponement(s) or adjournment(s) thereof | See “Other Information – Other Business” | |

How do I get an electronic copy of the circular?

Electronic copies of the circular may be accessed online on Hydro One’s website athttps://www.hydroone.com/investor-relations/agm or under the Hydro One Limited profile on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com. You can also access our 2017 annual report (theannual report) in the same manner.

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

i

How do I get a paper copy of the circular?

In addition to being able to quickly view or print the circular and/or annual report online at our website, you can request a paper copy of either or both documents be sent to you by regular postal delivery, free of charge. Requests may be made by phone, email or online, as may be applicable, using the methods below, which are different depending on whether you are: (i) anon-registered (beneficial) shareholder who holds common shares through a broker or other intermediary; or (ii) a registered shareholder who holds a share certificate or statement from a direct registration system confirming your ownership of common shares.

| If you are anon-registered (beneficial) shareholder | By phone (English/French):1-877-907-7643 (toll-free within North America) or905-507-5450 (outside of North America) | |

| By email: noticeandaccess@broadridge.com (outside of North America) | ||

| Online: www.proxyvote.com (enter the control number located on the voting instruction form) | ||

| If you are a registered shareholder | By phone (English/French):1-855-887-2243 (toll-free within North America) | |

| By email: investor.relations@HydroOne.com | ||

A paper copy will be mailed to you within three business days of receiving your request, if the request is made at any time prior to the meeting. To receive the meeting materials prior to the proxy deadline (as defined below) for the meeting, you should make your request before 5:00 p.m. (Eastern Time) on May 3, 2018. For requests received on or after the date of the meeting, a paper copy will be mailed to you within 10 calendar days after receiving your request. Following the meeting, the meeting materials will also remain available at www.proxyvote.com for a period of at least one year after the meeting materials were filed on SEDAR.

How do I vote my shares?

If you cannot attend the meeting, you may vote by proxy in any of the following ways. You will need the control number contained in the accompanying form of proxy or voting instruction form in order to vote.

| Internet voting |  | Fornon-registered (beneficial) shareholders, go to www.proxyvote.com

For registered shareholders, go to www.investorvote.com | ||

| Telephone voting |  | Call the toll-free number shown on the form of proxy or voting instruction form | ||

| Voting by mail or delivery |  | Complete the form of proxy or voting instruction form and return it in the envelope provided | ||

To be valid, registered shareholders must return their proxies using one of the above applicable methods to Computershare Trust Company of Canada, Hydro One’s transfer agent, byno later than 9:30 a.m. (Eastern Time) on May 11, 2018 (theproxy deadline) or, if the meeting is postponed or adjourned, no later than 48 hours (not including Saturdays, Sundays or statutory holidays in Ontario) prior to the reconvened meeting.Non-registered shareholders should return their voting instruction forms using one of the above methodsat least one business day in advance of the proxy deadline to allow sufficient time for their voting instructions to be provided by their intermediary to Computershare Trust Company of Canada.

Hydro One reserves the right to accept late proxies and to waive the proxy deadline, with or without notice, but is under no obligation to accept or reject any particular late proxy.

The meeting

The meeting will be audio webcast live and a rebroadcast will also be available following the meeting at:

https://www.hydroone.com/investor-relations/agm

The contents of the circular and the sending thereof to the shareholders have been approved by Hydro One’s board of directors.

DATED at Toronto, Ontario this 19th day of March, 2018.

By order of the board of directors

Maureen Wareham

Corporate Secretary

Pleasereviewthe circularpriorto voting

ii 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

Letter from the chair of the board

Dear Shareholder,

You are invited to attend Hydro One Limited’s annual meeting of shareholders (themeeting), which will be held at the 7th Floor Auditorium of Ryerson University located at 55 Dundas St. W., Toronto, Ontario M5G 2C3, at 9:30 a.m. (Eastern Time) on Tuesday, May 15, 2018. At the meeting, you will have an opportunity to ask questions and to meet with the board of directors, management and your fellow shareholders. If you are unable to attend in person you may view a live webcast of the meeting on our website at https://www.hydroone.com/investor-relations/agm.

At this meeting, you will be voting on several important matters so please take the time to carefully consider the information set out in the management information circular. Your vote is important. If you cannot attend the meeting in person and you owned Hydro One Limited common shares on April 3, 2018, you may use the enclosed proxy or voting instruction form to submit your vote prior to the meeting.

Sincerely,

| David F. Denison, O.C. |

| Chair of the Board |

| Hydro One Limited |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

iii

Table of Contents

1

| ||||

Business of the meeting

|

| |||

| Information about voting | 4 | |||

| Delivery of Proxy Materials | 4 | |||

| Shares Outstanding | 4 | |||

| Who Can Vote | 4 | |||

| How to Vote | 5 | |||

| How to Vote by Proxy | 6 | |||

| Confidentiality | 7 | |||

| Voting Results | 7 | |||

| Special Arrangements | 7 | |||

| Questions at the Meeting | 7 | |||

| Questions About Voting | 7 | |||

| About the nominated directors | 8 | |||

| Independence | 8 | |||

| Length of Service | 8 | |||

| Majority Voting Policy | 8 | |||

| Director Profiles | 9 | |||

| Our Director Nominees at a Glance | 9 | |||

| Director Compensation | 27 | |||

| Director Share Ownership Requirements | 27 | |||

| Director Compensation Table | 28 | |||

2

| ||||

Corporate governance

|

| |||

| Hydro One’s Corporate Governance Practices | 29 | |||

| Board Structure | 32 | |||

| Orientation and Continuing Education | 33 | |||

| Independence of the Board of Directors | 36 | |||

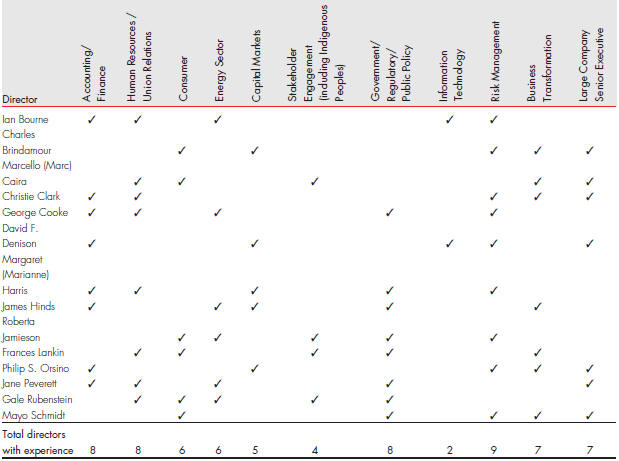

| Skills and Experience of the Board | 37 | |||

| Nomination of Directors | 38 | |||

| Board Renewal and Term Limits | 38 | |||

| Diversity Policy | 38 | |||

| Service on Other Boards | 40 | |||

| Assessments | 40 | |||

| Committee Reports | 41 | |||

3

| ||||

Executive compensation

|

| |||

| Letter to Shareholders | 50 | |||

| Compensation Discussion and Analysis | 52 | |||

Other information

|

| |||

| Directors’ and Officers’ Liability Insurance | 96 | |||

| Indebtedness of Directors, Officers and Employees | 96 | |||

| Interest of Informed Persons in Material Transactions | 96 | |||

| Interest of Certain Persons in Matters to be Acted Upon | 96 | |||

| Shareholder Proposals and Nominations | 96 | |||

| Other Business | 96 | |||

Schedule “A”

|

| |||

| Hydro One Limited Board Mandate | A-1 | |||

iv 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

2018 Management Information Circular

You have received this management information circular (thecircular) because you owned Hydro One common shares as of the close of business on April 3, 2018 (therecord date), and have the right to vote at our annual meeting.

Management is soliciting your proxy for the shareholder meeting on May 15, 2018.

|

|

| ||

In this document: · we, us, our,thecompanyandHydro Onemean Hydro One Limited · you andyourmean holders of our common shares · common sharesandsharesmean the common shares of Hydro One

| ||||

This document tells you about the meeting and governance and compensation matters at Hydro One. We have organized it into separate sections to make it easy to find what you’re looking for, and to help you vote with confidence.

We pay the cost of proxy solicitation for all registered owners and for beneficial owners, other than beneficial owners who object to their name and address being given to the company. We are soliciting proxies mainly by mail, but you may also be contacted by phone, mail or in person by employees of Hydro One or Computershare Trust Company of Canada (Computershare), our transfer agent. We may also engage solicitation agents at a nominal cost to contact you.

The date of this circular is March 19, 2018 but all information in the circular is provided as of March 14, 2018 and all dollar amounts are in Canadian dollars, unless indicated otherwise.

All references to financial results are based on Hydro One’s financial statements, prepared in accordance with United States Generally Accepted Accounting Principles (US GAAP). References in this circular to the meeting include any postponement(s) or adjournment(s) that may occur.

|

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR 1

BUSINESS OF THE MEETING

Business of the Meeting

Items of Business

As set out in the notice of meeting, shareholders of Hydro One will be asked to consider and, as required, vote on the following four matters at the meeting:

1. Financial Statements

The audited consolidated financial statements of Hydro One for the fiscal year ended December 31, 2017 and the report of the external auditors on the financial statements will be received.

2. Election of Directors

The company’s board of directors (theboard) currently comprises 15 directors. On January 24, 2018, Ms. Kathryn Jackson informed the Chair of the board of her decision to not stand forre-election at the company’s 2018 annual meeting of shareholders. The board has approved the reduction in size of the board to 14 members as of the date of the company’s 2018 annual meeting of shareholders. As such, at the meeting, the shareholders will be asked to elect 14 directors in accordance with Hydro One’s majority voting policy

(themajority voting policy), which is explained in more detail starting on page 8. All directors so elected will hold office until the next annual meeting of shareholders or until their successors are elected or appointed.

Other details respecting the nominees for election as directors are set out under “About the nominated directors” starting on page 8.

The board recommends that you voteFORthe election to the board of each of the nominated directors.

3. Appointment of External Auditors

The external auditor of Hydro One is KPMG LLP (KPMG), Chartered Professional Accountants, located in Toronto, Ontario. KPMG was initially appointed as the external auditor of Hydro One on August 31, 2015. KPMG has also acted as the external auditor of Hydro One’s principal subsidiary (Hydro One Inc.) since 2008. Shareholders are being asked to approve the appointment of KPMG as the external auditor of Hydro One for the ensuing year and to authorize the directors of Hydro One to fix their remuneration.

The aggregate fees billed by KPMG to Hydro One and its subsidiaries in 2017 and 2016 for professional services are presented below:

Year ended December 31, 2017 | Year ended December 31, 2016 | |||||||

Audit Fees(1) | $ | 1,559,514 | $ | 1,524,814 | ||||

Audit-Related Fees(2) | $ | 1,171,700 | $ | 488,854 | ||||

Tax Fees(3): | ||||||||

Tax Compliance and SR&ED Claim | $ | 161,000 | $ | 90,000 | ||||

General Tax Advice | $ | 100,000 | $ | 57,500 | ||||

Tax advice on Avista Acquisition | $ | 311,300 | — | |||||

Other Fees(4) | — | $ | 413,643 | |||||

Total | $ | 3,303,514 | $ | 2,574,811 | ||||

Notes:

| 1 | The nature of the services rendered was: audit of annual financial statements of the company and its subsidiaries, and statutory and regulatory filings. |

| 2 | The nature of the services rendered was: due diligence related to the Avista acquisition, translations and audit of the Hydro One Pension Plan, IFRS reporting to the Province and related services reasonably related to the performance of the audit or review of the company’s financial statements that are not reported under Audit Fees. |

| 3 | The nature of the services rendered was: procedures in connection with a scientific research, experimental development (“SR&ED”) investment tax credit claim, tax compliance services for Hydro One’s Pension Funds and general tax advice. |

| 4 | The nature of the services rendered was: due diligence activities. |

2 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

The board recommends that you vote FOR the approval of the appointment of KPMG as the external auditors of Hydro One and authorize the directors of Hydro One to fix their remuneration.

4. Advisory Vote on Executive Compensation

Our compensation program seeks to attract, retain, motivate and reward individuals through competitive pay practices which reinforce Hydro One’spay-for-performance philosophy. It is designed to focus employees on developing and implementing strategies that create and deliver value for shareholders. Hydro One believes that its compensation program is consistent with these objectives, and is in the best interests of shareholders. For detailed disclosure of our executive compensation program, see “Executive Compensation” starting on page 48.

The board has adopted a policy to hold an advisory vote on the approach to executive compensation (say on pay) at each annual meeting. This shareholder say on pay vote forms an important part of the ongoing process of engagement between shareholders and the board on executive compensation.

At the meeting, shareholders will have an opportunity to vote on our approach to executive compensation through consideration of the following say on pay advisory resolution:

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the board of directors, that the shareholders accept the approach to executive compensation disclosed in the management information circular delivered in advance of the 2018 annual meeting of shareholders of the company.”

This resolution conforms to the form of resolution recommended by the Canadian Coalition for Good Governance and is in the same form as our say on pay resolution that was approved by the shareholders at our 2017 annual meeting of shareholders. Approval of this resolution requires that it be passed by a majority of the votes cast by shareholders thereon in person and by proxy. Because your vote is advisory, it will not be binding upon the board. However, the board will take into account the results of the vote when considering future executive compensation arrangements.

The board recommends that you vote FOR approval of the advisory resolution on Hydro One’s approach to executive compensation.

At our 2017 annual meeting, the say on pay resolution was approved by shareholders, with shareholders holding 489,688,822 common shares voting in favour representing approximately 99.76% of the votes cast on the resolution.

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

3

BUSINESS OF THE MEETING

Information About Voting

Delivery of Proxy Materials

As permitted by Canadian securities regulators, Hydro One is providing shareholders with electronic access to its circular for the company’s annual meeting of shareholders and its 2017 annual report, instead of mailing out paper copies. This means of delivery is more environmentally friendly and will reduce the cost of printing and mailing materials to shareholders.

Shareholders will receive a notice of availability of proxy materials (notice) together with a form of proxy or voting instruction form. The notice provides instructions on how shareholders may access and review an electronic copy of the circular and how shareholders may request a paper copy. Shareholders who have already provided instructions on their account to receive paper copies of the circular will receive a paper copy of the circular with a copy of the notice

regarding its electronic availability. The notice also provides instructions on voting at the meeting.

Proxy materials are being sent to registered shareholders directly and will be sent to intermediaries to be forwarded to allnon-registered (beneficial) shareholders. We pay the cost of proxy solicitation for all registered owners and for beneficial owners other than beneficial owners who object to their name and address being given to the company. An objecting beneficial owner will only receive proxy materials if their intermediary assumes the cost of delivery.

Shares Outstanding

As of March 14, 2018, there were 595,386,711 common shares outstanding, each carrying the right to one vote per common share.

TheElectricity Act, 1998(Ontario) and our articles preclude any person or company (or combination of persons or companies acting jointly or in concert), other than Her Majesty the Queen in Right of Ontario, as represented by the Minister of Energy (theProvince), from owning, or exercising control or direction over, more than 10% of any class or series of voting securities, including common shares of Hydro One.

Who Can Vote

You have the right to one vote per common share held on the record date for the meeting, April 3, 2018.

Other than the Province, any person, or an entity controlled by a person, who beneficially owns shares that are, in the aggregate, more than 10% of the eligible votes that may be cast at the meeting, may not vote any of their shares.

As of March 14, 2018, our directors and executive officers were not aware of any person or entity who beneficially owns, directly or

indirectly, or exercises control or direction over more than 10% of our outstanding common shares, other than the Province, which holds 282,412,648 common shares (representing approximately 47.4% of the outstanding common shares).

Under a governance agreement the company entered into with the Province on November 5, 2015 (thegovernance agreement), the Province is required to vote in favour of the nominees identified in this circular except in the case of contested director elections and where the Province seeks to replace the board in accordance with the governance agreement by withholding votes or voting for removal.

4 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

How to Vote

How you vote depends on whether you are anon-registered (beneficial) shareholder who holds common shares through a broker or other intermediary or a registered shareholder who holds a share certificate or statement from a direct registration system confirming your ownership of common shares. You can vote in person or you can appoint someone to attend the meeting and vote your shares for you (called voting by proxy). Please read these instructions carefully.

| Non-Registered (Beneficial) Shareholders | Registered Shareholders | |||

Your intermediary has sent you a voting instruction form. We may not have records of your shareholdings as anon-registered shareholder and you must follow the instructions from your intermediary to vote. |

Our transfer agent has sent you a proxy form. | |||

If you want to come to the meeting and vote in person |

Use the voting instruction form provided by your intermediary.

In most cases, you simply print your name in the space provided for appointing a proxyholder and return the voting instruction form as instructed by your intermediary. Your intermediary may also allow you to do this through the Internet. Donotcomplete the voting section of the voting instruction form, because you will be voting at the meeting.

If the voting instruction form does not provide a space for appointing a proxyholder, you may have to indicate on the voting instruction form that you wish to receive a proxy form, and then return the form as instructed by your intermediary. The intermediary will mail a proxy form that you will need to complete, sign and return to our transfer agent, Computershare.

When you arrive at the meeting, please register with Computershare. |

Donotcomplete the proxy form or return it to us. Simply bring it with you to the meeting.

When you arrive at the meeting, please register with our transfer agent, Computershare. | ||

If you do not plan to attend the meeting |

Complete the enclosed voting instruction form and return it to your intermediary.

You can either mark your voting instructions on the voting instruction form and return it to your intermediary or you can appoint a proxyholder to attend the meeting and vote your common shares for you. Alternatively, shareholders may also vote online, by telephone or by mail or delivery, by following the instructions shown on the voting instruction form.

|

Complete the enclosed proxy form and return it to Computershare.

You can either mark your voting instructions on the proxy form or you can appoint another person to attend the meeting and vote your shares for you.

Alternatively, shareholders may also vote online, by telephone or by mail or delivery, by following the instructions shown on the proxy form. | ||

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

5

BUSINESS OF THE MEETING

| Non-Registered (Beneficial) Shareholders | Registered Shareholders | |||

Returning the form |

Return your voting instruction form using one of the methods noted on the voting instruction form provided by your intermediary.

Remember that your intermediary must receive your voting instructions in sufficient time to act on them, generally one business day before the proxy deadline below.

For your votes to count, Computershare must receive your voting instructions from your intermediary by no later than the proxy deadline, which is 9:30 a.m. Eastern Time on May 11, 2018, or if the meeting is postponed or adjourned, no later than 48 hours (not including Saturdays, Sundays or statutory holidays in Ontario) before the postponed or adjourned meeting convenes.

|

The enclosed proxy form tells you how to submit your voting instructions.

Computershare must receive your proxy, including any amended proxy, by no later than the proxy deadline, which is 9:30 a.m. Eastern Time on May 11, 2018, or if the meeting is postponed or adjourned, no later than 48 hours (not including Saturdays, Sundays or statutory holidays in Ontario) before the postponed or adjourned meeting convenes.

You may return your proxy by mail, in the envelope provided. | ||

Changing your vote/revoking your proxy |

If you have provided voting instructions to your intermediary and change your mind about your vote, or you decide to attend the meeting and vote in person, contact your intermediary to find out what to do.

If your intermediary gives you the option of using the Internet to provide your voting instructions, you can also use the Internet tochangeyour instructions, as long as your intermediary receives the new instructions in enough time to act on them before the proxy deadline. Contact your intermediary to confirm the deadline. |

If you change your mind about how you voted before the meeting and you want to revoke your proxy, you must deliver a signed written notice specifying your instructions to one of the following:

· our Corporate Secretary, by 4:00 p.m. Eastern Time on the last business day before the meeting (or any postponement(s) or adjournment(s), if the meeting is postponed or adjourned).

Deliver to: 483 Bay Street, South Tower, 8thFloor Reception, Toronto, Ontario, Canada M5G 2P5 Attention: Corporate Secretary

· the chair of the meeting, before the meeting starts or any postponed or adjourned meeting reconvenes.

You can also change your voting instructions by sending amended instructions to Computershare by the proxy deadline noted above, or by voting in person at the meeting.

| ||

How to Vote by Proxy

Appointing your Proxyholder

Your proxy form or voting instruction form names David F. Denison or failing him, Mayo Schmidt (thenamed proxyholders), the chair of the board (board chair) and the President and Chief Executive Officer (President and CEO) of the company, respectively, as your proxyholder.You have the right to appoint someone else to

represent you at the meeting. Simply print the person’s name in the blank space on the form or, if voting online, follow the instructions online. Your proxyholder does not have to be a shareholder of the company. Your proxyholder must attend the meeting to vote for you.

We reserve the right to accept late proxies and to waive the proxy deadline with or without notice, but are under no obligation to accept or reject a late proxy.

6 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

How your Proxyholder will Vote

Your proxyholder must vote according to the instructions you provided on your proxy form or voting instruction form, including on any ballot that may be called for at the meeting. For directors and the appointment of the external auditors, you may either vote for or withhold, and for all other matters, you may vote for or against.If you do not specify how you want to vote, your proxyholder can vote your shares as he or she wishes. Your proxyholder will also decide how to vote on any amendment or

| variation to any item of business in the notice of meeting or any new matters that are properly brought before the meeting, or any postponement(s) or adjournment(s).

If you properly complete and return your proxy form or voting instruction form, but do not appoint a different proxyholder, and do not specify how you want to vote, David F. Denison or failing him, Mayo Schmidt, the named proxyholders, will vote for you as follows:

|

Matters to Vote on | How Management Proxyholders Will Vote if No Choice is Specified | |

Election of directors | FOReach nominee | |

Appointment of the external auditors at a remuneration to be fixed by the board | FOR | |

Advisory vote on executive compensation | FOR | |

Confidentiality

To keep voting confidential, Computershare counts all proxies. Computershare only discusses proxies with us when legally necessary, when a shareholder clearly intends to communicate with management or the board of directors, or when there is a proxy contest.

Voting Results

We will file the voting results with securities regulators after the meeting and also post the results on our website at https://www.hydroone.com/investor-relations/agm. The results will include details regarding the percentage of support received on each matter.

Special Arrangements

If you plan on attending the meeting and require special arrangements for hearing, access and/or translation, please contact our Corporate Secretary at CorporateSecretary@HydroOne.com.

Questions at the Meeting

At the meeting, you will have an opportunity to ask questions and to meet with the board of directors, management and your fellow shareholders. The chair of the meeting reserves the right to limit questions from shareholders in order to ensure as many shareholders as possible will have the opportunity to ask questions.

Questions About Voting

If you are a registered shareholder, please contact Computershare with any questions about voting. You will find their contact information on the inside of the back cover of this circular. If you are anon-registered (beneficial) shareholder and you have questions about voting, please contact your intermediary by following the instructions on your voting instruction form.

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

7

BUSINESS OF THE MEETING

About the nominated directors

This year, 14 directors are proposed for election to our board. On January 24, 2018, Ms. Kathryn Jackson informed the board chair of her decision to not stand forre-election at the company’s 2018 annual meeting of shareholders. The board has approved the reduction in size of the board to 14 members (from the current 15 members) as of the date of the company’s 2018 annual meeting of shareholders.

The director profiles, starting on page 9, tell you about each director’s skills, experience and other important things to consider, including how much equity in Hydro One they own and any other public company boards they sit on.

Just as important are the skills these directors have as a group. These directors have been selected based on their abilities, independence, commercial experience, governance expertise with public companies, customer service, and knowledge about the electricity sector and public policy. You can learn more about our expectations for directors and how the board functions beginning on page 26.

Independence

Of the 14 nominated directors, 13 are independent. For Hydro One’s purposes, an independent director is one who is independent of Hydro One and independent of the Province. Directors will be independent of Hydro One if they are independent within the meaning of all Canadian securities laws governing the disclosure of corporate governance practices and stock exchange requirements imposing a number or percentage of independent directors. Pursuant to Canadian securities laws, a director who is “independent” within the meaning of applicable securities laws is one who is free from any direct or indirect relationship which could, in the view of the board, be reasonably expected to interfere with a director’s independent judgement, with certain specified relationships deemed to benon-independent. A director will be “independent of the Province” if he or she is independent of Hydro One under Ontario securities laws governing the disclosure of corporate governance practices, where the Province and certain specified provincial entities are treated as Hydro One’s parent under that definition, but excluding current directors where the relationship ended before August 31, 2015. The governance agreement requires each of the directors, other than the CEO, to be both independent of Hydro One and independent of the Province.

The Chair of Hydro One is independent of Hydro One and the Province.

None of the independent directors have ever served as an executive of the company. Having an independent board is one of the ways we ensure that the board is able to operate independently of management and make decisions in the best interests of Hydro One and our shareholders. Mayo Schmidt is not an independent director because of his role as the company’s President and CEO.

Length of Service

Each of the nominated directors is currently a member of the board. All of the nominees were initially elected to the board on August 31, 2015 in connection with the formation of the company and werere-elected to the board at our 2017 annual meeting of shareholders. If elected, each nominated director will serve until the earlier of our next annual meeting of shareholders or until his or her successor is elected or appointed.

Prior to becoming directors of the company, two of the independent director nominees and the board chair previously served on the board of directors of the company’s wholly owned subsidiary, Hydro One Inc. Ms. Gale Rubenstein and Mr. George Cooke have served on the board of directors of Hydro One Inc. since March 30, 2007 and January 26, 2010, respectively. Mr. David F. Denison, the board chair, served on the board of directors and as the chair of the board of Hydro One Inc. since April 16, 2015. The board benefits from the continuity and insight of these director nominees.

Majority Voting Policy

The board has adopted a majority voting policy for the election of directors. This policy provides that in an uncontested election, any nominee for director who receives morewithheldvotes thanforvotes will immediately tender his or her resignation for consideration by the board. The board will review the matter and take whatever actions it determines are appropriate in the circumstances. The director who has tendered his or her resignation pursuant to this policy will not participate in any deliberations of the committee or the board regarding the resignation. In this instance, the other directors shall consider, and within 90 days of the election meeting, determine whether or not to accept the resignation.

The Province and Hydro One entered into the governance agreement on closing of Hydro One’s initial public offering on November 5, 2015 which addresses the role of the Province in the governance of Hydro One and, among other things, requires Hydro One to maintain a majority voting policy for director elections. For more details about the governance agreement, see the description of our corporate governance practices starting on page 29.

8 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

Under the governance agreement, the Province may not withhold its votes for the nominees proposed for election in an uncontested election unless the Province withholds from voting for all nominees other than the CEO and, at the Province’s discretion, the chair. Where directors have received a majority withheld vote as a result of the Province withholding its vote from their election in an uncontested election and have tendered their resignations, the board will take whatever actions it determines are appropriate, and the directors who received a majority withheld vote may participate in that determination. A resignation will be accepted absent exceptional circumstances and is effective when accepted by the board. A press release disclosing the directors’ determination shall be issued promptly following such determination and, if the resignation is not accepted, will include the reasons fornon-acceptance.

The majority voting policy does not apply to a contested election where the number of candidates for director validly nominated exceeds the number of directors to be elected at that meeting.

Director Profiles

Unless indicated otherwise, the information in each director profile is provided as of March 14, 2018. The profiles tell you about the directors who are currently standing for election, including:

| · | a brief biography of each nominee, their age and their place of residence; |

| · | principal occupation and education; |

| · | the year they were first elected or appointed as a director and their independence status; |

| · | whether they are a nominee of the Province under the governance agreement; |

| · | their experience and skills; |

| · | other public company boards they serve on (other than the company and Hydro One Inc.); |

| · | how much equity they hold in Hydro One and the percentage of their share ownership requirements achieved; |

| · | their attendance at board and committee meetings held in 2017; and |

| · | the voting results from their election at our 2017 annual meeting held on May 4, 2017 and at our 2016 annual meeting held on May 31, 2016. |

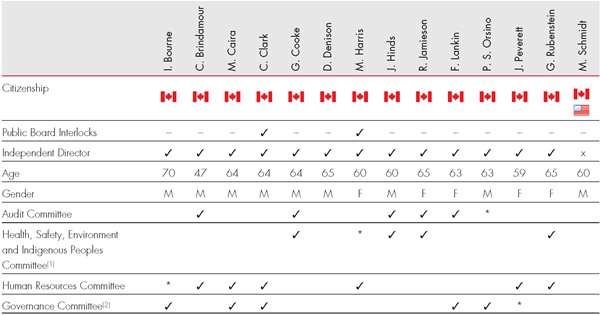

Our Director Nominees at a Glance

| * | denotes committee chair |

| 1 | Formerly named the “Health, Safety, Environment and First Nations & Métis Committee”. The name change was approved by the board on July 13, 2017. |

| 2 | Formerly named the “Nominating, Corporate Governance, Public Policy & Regulatory Committee”. The name change was approved by the board on February 13, 2018. |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR | ||

9

BUSINESS OF THE MEETING

Ian Bourne, 70

Alberta, Canada

Director since

August 31, 2015

Independent

Chair, Ballard Power Systems Inc.

Other Public Company Directorships

∎ Ballard Power Systems Inc.

∎ Wajax Corporation

Skills/Areas of Expertise include:

Accounting/Finance

Energy Sector

Human Resources/Union Relations

Information Technology

Risk Management

Not eligible for re-election in 2023

Mr. Ian Bourne is the chair of the board of directors of Ballard Power Systems Inc. (2006-present), a leader in proton exchange membrane fuel cell technology. He is a director of the Canada Pension Plan Investment Board (CPPIB), Wajax Corporation (WJX) and the Canadian Public Accountability Board (CPAB). He is also the former chair of the board of directors of SNC-Lavalin Group Inc. (2013-2015), for which he was a director from 2009 to 2015 and also served as that company’s Interim Chief Executive Officer from March 2012 to October 2012. Mr. Bourne is chair of the Governance Committee of CPPIB and has been a member of the Human Resources committee of CPPIB, CPAB, Ballard Power Systems Inc. (BLDP) and SNC-Lavalin Group Inc. (SNC). Mr. Bourne has also served on the Audit Committees of CPPIB, WJX, BLDP and SNC. He was a director of Canadian Oil Sands Limited (2007-2016) and served as the chair of the Corporate Governance and Compensation Committee and was a member of the Audit Committee. Mr. Bourne has been active in serving on a variety of community based organizations including the Calgary Philharmonic Orchestra, the Glenbow Museum and the Calgary Foundation. He holds a Bachelor of Commerce degree from Mount Allison University and is a Fellow of the Institute of Corporate Directors.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee (Chair) | 5 of 5 | 100% | ||||

Governance Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,575,161 | 99.94% | 306,670 | 0.06% | ||||||||

2016 | 536,332,303 | 99.97% | 142,752 | 0.03% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 4,000 | 8,841 | 94,240 | 210,052 | 304,292 | On target | ||||||

2016 | 2,000 | 4,713 | 47,740 | 111,129 | 158,869 | On target | ||||||

Net Change | +2,000 | +4,128 | +46,500 | +98,923 | +145,423 |

10 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

Charles Brindamour, 47

Ontario, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

Chief Executive Officer, Intact Financial Corporation

Other Public Company Directorships

∎ Intact Financial Corporation

Skills/Areas of Expertise include:

Business Transformation

Capital Markets

Consumer

Large Company Senior Executive

Risk Management

Not eligible for re-election in 2027

Mr. Charles Brindamour is the Chief Executive Officer of Intact Financial Corporation, the largest provider of property and casualty insurance in Canada and a leading provider of specialty insurance in North America. Mr. Brindamour is a director of Intact Financial Corporation, The Geneva Association, the Business Council of Canada, the C.D. Howe Institute and Branksome Hall. He is also a member of the Advisory Committee of the University of Waterloo’s Climate Change Adaptation Project and serves on the advisory board of Gibraltar Growth Corporation. Mr. Brindamour is a graduate of Laval University in Actuarial Sciences and an associate of the Casualty Actuarial Society.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 11 of 13 | 85% | ||||

Human Resources Committee | 5 of 5 | 100% | ||||

Audit Committee | 6 of 6 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,192,246 | 99.86% | 689,585 | 0.14% | ||||||||

2016 | 535,579,304 | 99.83% | 895,751 | 0.17% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 15,000 | 15,718 | 328,950 | 373,426 | 702,376 | Yes (4.4x) | ||||||

2016 | 15,000 | 8,378 | 328,950 | 197,563 | 526,513 | Yes (3.3x) | ||||||

Net Change | 0 | +7,340 | 0 | +175,863 | +175,863 |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

11

BUSINESS OF THE MEETING

Marcello (Marc) Caira, 64

Ontario, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

Vice-Chairman, Restaurant Brands

International Inc.

Other Public Company Directorships

∎ Restaurant Brands International Inc.

Skills/Areas of Expertise include:

Business Transformation

Consumer

Human Resources/Union Relations

Large Company Senior Executive

Stakeholder Engagement (including Indigenous Peoples)

Not eligible for re-election in 2027

Mr. Marc Caira is the vice-chairman of the board of directors of Restaurant Brands International Inc., a multinational quick service restaurant company. He is also a director of the Minto Group, a private real estate developer and on the board of governors of Seneca College, a leading post-secondary educational institution. Prior to his appointment as vice-chairman of Restaurant Brands International Inc. in December 2014, Mr. Caira was President and Chief Executive Officer of Tim Hortons Inc. (July 2013-December 2014), a multinational fast food restaurant, a member of the executive board of Nestlé S.A. in Switzerland, a transnational food and beverage company, and Chief Executive Officer of Nestlé Professional. Mr. Caira holds a Diploma in Marketing Management from Seneca College, Toronto (1977) and is a graduate of the Director Program at The International Institute for Management Development, Lausanne, Switzerland.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee | 5 of 5 | 100% | ||||

Governance Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,651,045 | 99.95% | 230,786 | 0.05% | ||||||||

2016 | 536,336,453 | 99.97% | 138,602 | 0.03% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

| 2017 | 9,100 | 15,718 | 199,290 | 373,426 | 572,716 | Yes (3.6x) | ||||||

| 2016 | 9,100 | 8,378 | 199,290 | 197,563 | 396,853 | On target | ||||||

Net Change | 0 | +7,340 | 0 | +175,863 | +175,863 |

12 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

Christie Clark, 64

Ontario, Canada

Director since

August 31, 2015

Independent

Corporate Director

Other Public Company Directorships

∎ Air Canada

∎ Choice Properties Real Estate Investment Trust

∎ Loblaw Companies Limited

Skills/Areas of Expertise include:

Accounting/Finance

Business Transformation

Human Resources/Union Relations

Large Company Senior Executive

Risk Management

Not eligible for re-election in 2027

Mr. Christie Clark is a corporate director. He serves as a director of Loblaw Companies Limited, a Canadian food and pharmacy retailer, Air Canada, a Canadian airline company, and Choice Properties Real Estate Investment Trust, an owner, manager and developer of retail and commercial real estate across Canada. He previously served as the Chief Executive Officer and Senior Partner of PricewaterhouseCoopers LLP from July 2005 to July 2011. Mr. Clark is a Fellow of the Chartered Professional Accountants of Ontario, and in addition to his public company board memberships, he is on the Boards of the Canadian Olympic Committee and Own the Podium. He is also a member of the Advisory Board of the Smith School of Business at Queen’s University. He is currently the Director in Residence for the Institute of Corporate Directors’ national short course, “Audit Committee Effectiveness”. Mr. Clark holds a Bachelor of Commerce degree from Queen’s University and a Master of Business Administration degree from the University of Toronto.

Public Board Interlocks

Loblaw Companies Limited with Marianne Harris

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee | 5 of 5 | 100% | ||||

Governance Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,691,533 | 99.96% | 190,298 | 0.04% | ||||||||

2016 | 536,368,012 | 99.98% | 107,043 | 0.02% | ||||||||

Equity Ownership(2)

| Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 15,718 | 0 | 373,426 | 373,426 | On target | ||||||

2016 | 0 | 8,378 | 0 | 197,563 | 197,563 | On target | ||||||

Net Change | 0 | +7,340 | 0 | +175,863 | +175,863 |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

13

BUSINESS OF THE MEETING

George Cooke, 64

Ontario, Canada

Director since

August 31, 2015

Independent

Corporate Director

Chair, OMERS Administration Corporation

Other Public Company Directorships

∎ N/A

Skills/Areas of Expertise include:

Accounting/Finance

Energy Sector

Government/Regulatory/Public Policy

Human Resources/Union Relations

Risk Management

Not eligible for re-election in 2022

Mr. George Cooke is a corporate director and the chair of the board of directors of OMERS Administration Corporation and the Ontario Lottery and Gaming Corporation. He is also a governor of Curling Canada. Mr. Cooke is the former President and CEO of The Dominion of Canada General Insurance Company (The Dominion), a property and casualty insurance company, a position he held from 1992 to August 2012. In August 2012, Mr. Cooke retired from his role as President of The Dominion and continued to hold the position of Chief Executive Officer of The Dominion until December 31, 2012. Mr. Cooke obtained a Bachelor of Arts degree (Hons.) in Political Studies and a Master of Business Administration degree from Queen’s University. He also holds an Honorary Doctor of Laws degree from Assumption University in Windsor.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Audit Committee | 6 of 6 | 100% | ||||

Health, Safety, Environment and Indigenous Peoples Committee |

4 of 4 |

100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,722,093 | 99.97% | 159,738 | 0.03% | ||||||||

2016 | 536,367,192 | 99.98% | 107,863 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 15,718 | 0 | 373,426 | 373,426 | On target | ||||||

2016 | 0 | 8,378 | 0 | 197,563 | 197,563 | On target | ||||||

Net Change | 0 | +7,340 | 0 | +175,863 | +175,863 |

14 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

David F. Denison, 65

Ontario, Canada

Director since

August 31, 2015

Independent

Board Chair, Hydro One Limited and Hydro One Inc.

Other Public Company Directorships

∎ BCE Inc.

∎ Royal Bank of Canada

Skills/Areas of Expertise include:

Accounting/Finance

Capital Markets

Information Technology

Large Company Senior Executive

Risk Management

Not eligible for re-election in 2027

Mr. David F. Denison is the board chair of Hydro One and Hydro One Inc. He is a corporate director and previously served as President and Chief Executive Officer of the Canada Pension Plan Investment Board, a global investment management organization, from 2005 to 2012 and as a director of Allison Transmission Holdings Inc. from 2013 to 2016. Prior to that, Mr. Denison was President of Fidelity Investments Canada Limited. Mr. Denison is a director of the Royal Bank of Canada, BCE Inc. and Bell Canada. He is also a member of the Investment Board and International Advisory Committee of the Government of Singapore Investment Corporation, the International Advisory Council of China Investment Corporation, and co-chairs the University of Toronto Investment Committee. Mr. Denison earned Bachelor degrees in mathematics and education from the University of Toronto and is a Chartered Professional Accountant and a Fellow of the Chartered Professional Accountants of Ontario. Mr. Denison is an Officer of the Order of Canada. In 2018, Mr. Denison was awarded a Fellowship from the Institute of Corporate Directors.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

| Mr. Denison is not a member of any committee but does attend all committee meetings | ||||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 487,984,037 | 99.41% | 2,897,794 | 0.59% | ||||||||

2016 | 536,244,627 | 99.96% | 240,428 | 0.04% | ||||||||

Equity Ownership(2)

| Year | Common shares | Director DSUs | Value of common shares ($)(3) | Value of director DSUs ($)(2) | Total value of DSUs ($)(2)(3) | Meets share ownership requirements(4)(5) | ||||||||||||||||||

2017 | 1,036 | 25,540 | 24,361 | 606,817 | 631,178 | On target | ||||||||||||||||||

2016 | 1,000 | 13,615 | 23,530 | 321,040 | 344,570 | On target | ||||||||||||||||||

Net Change | +36 | +11,925 | +831 | +285,777 | +286,608 | |||||||||||||||||||

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

15

BUSINESS OF THE MEETING

Margaret (Marianne)

Harris, 60

Ontario, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

Corporate Director

Other Public Company Directorships

∎ Loblaw Companies Limited

∎ Sun Life Assurance Company of Canada

∎ Sun Life Financial Inc.

Skills/Areas of Expertise include:

Accounting/Finance

Capital Markets

Government/Regulatory/Public Policy

Human Resources/Union Relations

Risk Management

Not eligible for re-election in 2027

Ms. Marianne Harris is a corporate director. She is the chair of the board of directors of the Investment Industry Regulatory Organization of Canada (IIROC), a self-regulatory organization that oversees investment dealers and trading activity on debt and equity marketplaces in Canada. Prior to becoming a corporate director, Ms. Harris was Managing Director of the Bank of America Merrill Lynch and President, Corporate and Investment Banking for Merrill Lynch Canada Inc. In addition to her position as chair of IIROC, she is a director of Sun Life Financial Inc., Sun Life Assurance Company of Canada and Loblaw Companies Limited. Ms. Harris is also a member of the Dean’s Advisory Council at the Schulich School of Business (York University) and the Advisory Council of the Hennick Centre for Business and Law (York University). Ms. Harris holds a Master of Business Administration degree from the Schulich School of Business, a Juris Doctor degree from Osgoode Hall Law School (York University) and a B.Sc. (Honours) from Queen’s University.

Public Board Interlocks

Loblaw Companies Limited with Christie Clark

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee | 4 of 5 | 80% | ||||

Health, Safety, Environment and Indigenous Peoples Committee (Chair) |

4 of 4 |

100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,715,972 | 99.97% | 165,859 | 0.03% | ||||||||

2016 | 536,372,194 | 99.98% | 102,861 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 17,682 | 0 | 420,104 | 420,104 | On target | ||||||

2016 | 0 | 9,426 | 0 | 222,258 | 222,258 | On target | ||||||

Net Change | 0 | +8,256 | 0 | +197,846 | +197,846 |

16 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

James Hinds, 60

Ontario, Canada

Director since

August 31, 2015

Independent

Corporate Director

Other Public Company Directorships

∎ Allbanc Split Corp.

Skills/Areas of Expertise include:

Accounting/Finance

Business Transformation

Capital Markets

Energy Sector

Government/Regulatory/Public Policy

Not eligible for re-election in 2027

Mr. James Hinds is a corporate director. He is also a director of Allbanc Split Corp., a mutual fund company. He is a retired investment banker, having previously served as Managing Director of TD Securities Inc., prior to which he held positions at CIBC Wood Gundy Inc. and Newcrest Capital Inc. Mr. Hinds was the past chair of the Independent Electricity System Operator (IESO), a Crown corporation responsible for operating the electricity market, and was also chair of the former Ontario Power Authority Board of Directors (2010-2014) until its merger with the IESO effective January 1, 2015.

Mr. Hinds received a Bachelor of Arts degree from Victoria College at the University of Toronto, a Master of Business Administration from the Wharton School of Business and a law degree from the University of Toronto Law School.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Audit Committee | 6 of 6 | 100% | ||||

Health, Safety, Environment and Indigenous Peoples Committee |

4 of 4 |

100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,667,230 | 99.96% | 214,601 | 0.04% | ||||||||

2016 | 536,373,645 | 99.98% | 101,410 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 50,000 | 15,715 | 1,183,115 | 373,426 | 1,556,541 | Yes (9.7x) | ||||||

2016 | 50,000 | 8,378 | 1,183,115 | 197,563 | 1,380,678 | Yes (8.6x) | ||||||

Net Change | 0 | +7,337 | 0 | +175,863 | +175,863 |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

17

BUSINESS OF THE MEETING

Roberta Jamieson, 65

Ontario, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

President and Chief Executive Officer, Indspire

Other Public Company Directorships

∎ N/A

Skills/Areas of Expertise include:

Consumer

Energy Sector

Government/Regulatory/Public Policy

Risk Management

Stakeholder Engagement (including Indigenous

Peoples)

Not eligible for re-election in 2027

Ms. Roberta Jamieson is a Mohawk woman from the Six Nations of the Grand River Territory in Ontario, where she still resides. She is also President and Chief Executive Officer of Indspire, Canada’s premiere Indigenous-led charity, and Executive Producer of the Indspire Awards, a nationally broadcast gala honouring Indigenous achievement. Ms. Jamieson was the first First Nations woman to earn a law degree in Canada; the first non-parliamentarian appointed an ex-officio member of a House of Commons Committee; the first woman Ombudsman of Ontario (1989-1999); and in December 2011, she was the first woman elected Chief of the Six Nations of the Grand River Territory. She was also a director of the Ontario Power Generation Inc. board of directors (2012-2015). Ms. Jamieson was appointed a Member of the Order of Canada in 1994 and promoted to an Officer in 2016.

Ms. Jamieson holds a Bachelor of Laws from the University of Western Ontario. Ms. Jamieson is the recipient of the Canadian Council for Aboriginal Business 2018 Indigenous Women in Leadership Award. On March 7, 2018 Ms. Jamieson was appointed to the Gender Equality Advisory Council for Canada’s G7 Presidency.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors |

13 of 13

|

100%

| ||||

Audit Committee | 6 of 6

| 100%

| ||||

Health, Safety, Environment and Indigenous Peoples Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,738,816 | 99.97% | 143,015 | 0.03% | ||||||||

2016 | 536,364,089 | 99.98% | 110,966 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 7,858 | 0 | 186,713 | 186,713 | On target | ||||||

2016 | 0 | 4,189 | 0 | 98,781 | 98,781 | On target | ||||||

Net Change | 0 | +3,669 | 0 | +87,932 | +87,932 |

18 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

Frances Lankin, 63

Ontario, Canada

Director since

August 31, 2015

Independent

Corporate Director

Other Public Company Directorships

∎ N/A

Skills/Areas of Expertise include:

Business Transformation

Consumer

Government/Regulatory/Public Policy

Human Resources/Union Relations

Stakeholder Engagement (including Indigenous Peoples)

Not eligible for re-election in 2027

Hon. Frances Lankin is a corporate director. She was the former President and CEO of the United Way Toronto (2001-2010), a Toronto-based charity. In 2009, Ms. Lankin was appointed to the Queen’s Privy Council for Canada and served for five years as a member of the Security Intelligence Review Committee. In 2014, Ms. Lankin was appointed to the Premier’s Advisory Council on Government Assets whose mandate was to review and identify opportunities to modernize government business enterprises, and in 2011 and 2012, she co-led a review of Ontario’s social assistance system as part of the province’s poverty reduction strategy. Ms. Lankin is a director of the Ontario Lottery and Gaming Corporation. Ms. Lankin was appointed a Member of the Order of Canada in 2012 and in April of 2016, was appointed to the Senate of Canada where she sits as an Independent Senator from Ontario.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 11 of 13 | 85% | ||||

Audit Committee | 5 of 6 | 83% | ||||

Governance Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,640,179 | 99.95% | 241,652 | 0.05% | ||||||||

2016 | 536,361,389 | 99.98% | 113,666 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 7,858 | 0 | 186,713 | 186,713 | On target | ||||||

2016 | 0 | 4,189 | 0 | 98,781 | 98,781 | On target | ||||||

Net Change | 0 | +3,669 | 0 | +87,932 | +87,932 |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

19

BUSINESS OF THE MEETING

Philip S. Orsino, 63

Ontario, Canada

Director since

August 31, 2015

Independent

Corporate Director

Other Public Company Directorships

∎ Bank of Montreal

Skills/Areas of Expertise include:

Accounting/Finance

Business Transformation

Capital Markets

Large Company Senior Executive

Risk Management

Not eligible for re-election in 2027

Mr. Philip S. Orsino is a corporate director. He was the President and Chief Executive Officer of Jeld-Wen Inc., a global integrated manufacturer of building products from 2011 until he retired in 2014. Formerly until October 2005, Mr. Orsino was the President and Chief Executive Officer of Masonite International Corporation for 22 years. Mr. Orsino is a director of The Bank of Montreal and chair of its Audit and Conduct Review Committee and a director of The Minto Group, a private real estate developer, and chair of the Audit Committee. He was the recipient of the 2003 Canada’s Outstanding CEO of the Year Award and received the University of Toronto’s Distinguished Business Alumni Award for 2002. He is a Fellow of the Chartered Professional Accountants of Ontario and holds a degree from Victoria College at the University of Toronto. Mr. Orsino was appointed an Officer of the Order of Canada in 2004.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 12 of 13 | 92% | ||||

Audit Committee (Chair) | 6 of 6 | 100% | ||||

Governance Committee | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,727,068 | 99.97% | 154,763 | 0.03% | ||||||||

2016 | 536,364,932 | 99.98% | 110,123 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 10,000 | 12,788 | 257,519 | 301,316 | 558,835 | Yes (3.5x) | ||||||

2016 | 10,000 | 4,713 | 257,519 | 111,129 | 368,648 | On target | ||||||

Net Change | 0 | +8,075 | 0 | +190,187 | +190,187 |

20 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

Jane Peverett, 59

British Columbia, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

Corporate Director

Other Public Company Directorships

∎ Canadian Imperial Bank of Commerce

∎ Canadian Pacific Railway Limited

∎ Northwest Natural Gas Company

Skills/Areas of Expertise include:

Accounting/Finance

Energy Sector

Government/Regulatory/Public Policy

Human Resources/Union Relations

Large Company Senior Executive

Not eligible for re-election in 2027

Ms. Jane Peverett is a corporate director. She was President and Chief Executive Officer (2005-2009) of the British Columbia Transmission Corporation, which was responsible for the high voltage electricity transmission system in British Columbia. Prior to that, she was President and CEO of Union Gas Limited. Ms. Peverett currently serves as a director of the Canadian Imperial Bank of Commerce and chairs its Audit Committee, a director of Northwest Natural Gas Company, and a director of Canadian Pacific Railway and chairs its Audit Committee. Ms. Peverett previously served as a director of British Columbia Ferry Services Inc. and Encana Corporation and chaired its Audit Committee. Ms. Peverett earned a Bachelor of Commerce degree from McMaster University and a Master of Business Administration degree from Queen’s University. She is also a Certified Management Accountant, a Fellow of the Society of Management Accountants and holds the ICD.D designation from the Institute of Corporate Directors.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee | 5 of 5 | 100% | ||||

Governance Committee (Chair) | 4 of 4 | 100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,389,072 | 99.90% | 492,759 | 0.10% | ||||||||

2016 | 536,372,397 | 99.98% | 102,658 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 8,840 | 0 | 210,052 | 210,052 | On target | ||||||

2016 | 0 | 4,713 | 0 | 111,129 | 111,129 | On target | ||||||

Net Change | 0 | +4,127 | 0 | +98,923 | +98,923 |

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

21

BUSINESS OF THE MEETING

Gale Rubenstein, 65

Ontario, Canada

Director since

August 31, 2015

Independent

Nominee of the Province

Partner, Goodmans LLP

Other Public Company Directorships

∎ N/A

Skills/Areas of Expertise include:

Consumer

Energy Sector

Government/Regulatory/Public Policy

Human Resources/Union Relations

Stakeholder Engagement (including Indigenous Peoples)

Not eligible for re-election in 2019

Ms. Gale Rubenstein is a partner of the law firm Goodmans LLP and a member of the firm’s Executive Committee. Ms. Rubenstein was senior counsel to the Pan Canadian Investors Committee for Third Party Structured Asset Backed Commercial Paper, counsel to liquidators of numerous financial institutions, counsel to the Province in connection with the General Motors and Chrysler restructurings and counsel to the Superintendent of Financial Services (Ontario) and Province of Ontario regarding the Algoma and Stelco restructurings. She has been counsel to liquidators of numerous financial institutions. She obtained her Bachelor of Laws degree from Osgoode Hall Law School (York University) and is a member of the Canada Deposit Insurance Corporation Advisory Panel on Bank Resolution, a Fellow of the Insolvency Institute of Canada, and a director of the Ontario Heart and Stroke Foundation and Outside the March Theatre Company.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Human Resources Committee | 5 of 5 | 100% | ||||

Health, Safety, Environment and Indigenous Peoples Committee |

4 of 4 |

100% | ||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,663,244 | 99.96% | 218,587 | 0.04% | ||||||||

2016 | 536,372,805 | 99.98% | 102,250 | 0.02% | ||||||||

Equity Ownership(2)

Total value of | ||||||||||||

| Value of | Value of | common shares | Meets share | |||||||||

| Common | Director | common | director | and director | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | DSUs ($)(2) | DSUs ($)(2)(3) | requirements(4)(5) | ||||||

2017 | 0 | 7,858 | 0 | 186,713 | 186,713 | On target | ||||||

2016 | 0 | 4,189 | 0 | 98,781 | 98,781 | On target | ||||||

Net Change | 0 | +3,669 | 0 | +87,932 | +87,932 |

22 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H

Mayo Schmidt, 60

Ontario, Canada

Director since

August 31, 2015

Not Independent

President and Chief Executive Officer,

Hydro One Limited and Hydro One Inc.

Other Public Company Directorships

∎ Nutrien Ltd.

Skills/Areas of Expertise include:

Business Transformation

Consumer

Governmental/Regulatory/Public Policy

Large Company Senior Executive

Risk Management

Mr. Mayo Schmidt is the President and Chief Executive Officer of Hydro One. Prior to joining Hydro One, Mr. Schmidt served as President and Chief Executive Officer at Viterra Inc., a global food ingredients company operating in 14 countries providing critical nutritional food ingredients to over 50 countries. Early in his career, Mr. Schmidt held a number of key management positions of increasing responsibility at General Mills, Inc. until he joined ConAgra as President of their Canadian operations and spearheaded ConAgra’s expansion into Canada. In 2007, he led the consolidation of Canada’s agriculture sector which included the acquisition of Agricore United, following which he led the acquisition of ABB, Australia’s leading agriculture corporation growing Viterra Inc. from a $200 Million market capitalization to finally a sale in 2012 for over $7.5 Billion. Mr. Schmidt currently sits on the Board of Directors of Nutrien Ltd. and is also Chairman of its Governance Committee. He is a member of Harvard University Private and Public, Scientific, Academic and Consumer Food Policy Group, and is on Washburn University’s Foundation board of Trustees. Mr. Schmidt received his Honorary Doctorate of Commerce from Washburn in 2016 and his B.B.A. from Washburn in 1980.

Public Board Interlocks

None

| Board/Committee Memberships | 2017 Attendance(1) | |||||

Board of Directors | 13 of 13 | 100% | ||||

Mr. Schmidt is not a member of any committee but does attend all committee meetings. | ||||||

Annual Meeting Voting Results

| Votes For | Votes Withheld | |||||||||||

2017 | 490,717,781 | 99.97% | 154,050 | 0.03% | ||||||||

2016 | 536,370,965 | 99.98% | 104,090 | 0.02% | ||||||||

Re-election eligibility criteria is not applicable for the President and CEO

Equity Ownership

| �� |

Total value of | |||||||||||

| Value of | common shares | |||||||||||

| PSUs/RSUs/ | Value of | management | and PSUs/RSUs/ | Meets share | ||||||||

| Common | management | common | DSUs, PSUs | management | ownership | |||||||

| Year | shares | DSUs | shares ($)(3) | and RSUs ($)(2) | DSUs ($)(2)(3) | requirements(4) | ||||||

For details on Mr. Schmidt’s equity ownership please refer to page 71. | ||||||||||||

TSX: H HYDRO ONE LIMITED2018 MANAGEMENT INFORMATION CIRCULAR

23

BUSINESS OF THE MEETING

Notes:

| 1 | The directors of Hydro One are also directors of Hydro One Inc. and the two boards and each committee thereof hold joint meetings. See also “Director Attendance” on page 25. While Ms. Kathryn Jackson is not standing forre-election at the company’s 2018 annual general meeting, her 2017 meeting attendance record was as follows: (a) board meetings: 11 of 13 or 85%; (b) Governance Committee meetings: 4 of 4 or 100% and (c) Health, Safety, Environment and Indigenous Peoples Committee meetings: 4 of 4 or 100%. |

| 2 | The equity ownership of each director is presented as at March 17, 2017 in respect of 2016 and March 14, 2018 in respect of 2017. The value of director DSUs is calculated using the closing price of our common shares on the TSX on the date of grant of the director DSU being: |

Date of Grant | TSX Closing Value | |

December 31, 2015 | $22.29 | |

March 31, 2016 | $24.31 | |

March 31, 2016 (dividend equivalents) | $23.48 (value date of March 18, 2016) | |

June 30, 2016 | $25.96 | |

June 30, 2016 (dividend equivalents) | $24.49 (value date of June 15, 2016) | |

September 30, 2016 | $25.90 | |

September 30, 2016 (dividend equivalents) | $25.62 (value date of September 15, 2016) | |

December 30, 2016 | $23.58 | |

December 30, 2016 (dividend equivalents) | $23.22 (value date of December 15, 2016) | |

March 31, 2017 | $24.25 | |

March 31, 2017 (dividend equivalents) | $23.50 (value date of March 15, 2017) | |

June 30, 2017 | $23.23 | |

June 30, 2017 (dividend equivalents) | $23.37 (value date of June 14, 2017) | |

September 29, 2017 | $22.72 | |

September 29, 2017 (dividend equivalents) | $22.62 (value date of September 13, 2017) | |

December 29, 2017 | $22.40 | |

December 29, 2017 (dividend equivalents) | $22.49 (value date of December 13, 2017) | |

Fractional director DSUs can be granted, with fractions computed to three decimal places. The number of director DSUs in this table have been rounded. Mr. Schmidt, as President and CEO, is not eligible to receive director DSUs as he is not anon-employee director.

| 3 | The value of the common shares held by each applicable director is calculated using the acquisition cost per share of such common shares on the date of purchase. |

| 4 | Pursuant to the corporate governance guidelines, eachnon-employee director is expected to achieve his or her share ownership target (being 3x the annual board membership retainer) within the later of six years following the closing of the company’s initial public offering and the date of appointment to the board. The current corporate governance guidelines require anon-employee director’s share ownership to be calculated on December 31st each year (based on the original acquisition cost or grant value) and compared to the share ownership requirement. Mr. Schmidt, as the President and CEO, is subject to different share ownership requirements. For details on the share ownership requirements applicable to him, and the status of his compliance with them, see pages 55 and 71. |

| 5 | The status under share ownership requirement is calculated by dividing the directors’ total value of common shares and director DSUs as of December 31st of the relevant year by the amount of the annual retainer being $160,000 for 2017 for all directors (other than the Chair) and $260,000 for 2017 for the Chair. |

24 2018 MANAGEMENT INFORMATION CIRCULARHYDRO ONE LIMITED TSX: H | ||

Cease Trade Orders and Bankruptcies

Except as described below, no director: