Exhibit 99.1

0 Structure Update

CAUTION ABOUT FORWARD - LOOKING STATEMENTS The information in this press release may contain “forward - looking statements” within the meaning of Section 27A of the Securiti es Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our forward - looking statements include, but are not limited to, statements regarding our or our managemen t team’s expectations, hopes, beliefs, intentions or strategies regarding the future. Statements that are not historical fact s, including statements about the pending transaction among One Madison Corporation (the “Company”), Rack Holdings L.P. and Rack Ho ldings Inc. (“ Ranpak ”) and the transactions contemplated thereby, and the parties, perspectives and expectations, are forward - looking statements. In addition, any statements that refer to estimates, projections, forecasts or other characteri zations of future events or circumstances, including any underlying assumptions, are forward - looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,” “p otential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward - looking statements, but the abse nce of these words does not mean that a statement is not forward - looking. Forward - looking statements in this presentation may include, for example, statements about: our ability to complete our initial business combination; our expectations around the performance of the prospective target business or business; our success in retaining or recruiting, or changes required in, o ur officers, key employees or directors following our initial business combination; our officers and directors allocating their tim e to other businesses and potentially having conflicts of interest with our business or in approving our initial business combi nat ion; the proceeds of the forward purchase shares being available to us; our potential ability to obtain additional financing to complete our initial business combination; our public securities’ potential liquidity and trading; the lack of a market for o ur securities; the use of proceeds not held in the trust account or available to us from interest income on the trust account ba lan ce; the trust account not being subject to claims of third parties; or our financial performance following this offering. The forward - looking statements contained in this presentation are based on our current expectations and beliefs concerning futur e developments and their potential effects on us taking into account information currently available to us. There can be no assurance that future developments affecting us will be those that we have anticipated. These forward - looking statements involv e a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward - looking statements. These ri sks include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could result in the failure to consummate; (2) the possibility that the terms and conditions set forth in any definitive agreements with respect to the initial business combination may differ materially from the terms and conditions set forth herein; (3) the outcome of any le gal proceedings that may be instituted against the Company, Ranpak or others following the announcement of the initial business combination and any definitive agreements with respect thereto; (4 ) the inability to complete the initial business combination due to the failure to obtain approval of the stockholders of the Company, to obtain financing to complete the initial busines s c ombination or to satisfy other conditions to closing in the definitive agreements with respect to the initial business combin ati on; (5) changes to the proposed structure of the initial business combination that may be required or appropriate as a result of app licable laws or regulations or as a condition to obtaining regulatory approval of the initial business combination; (6) the a bil ity to meet and maintain NYSE’s listing standards following the consummation of the initial business combination; (7) the risk th at the initial business combination disrupts current plans and operations of Ranpak as a result of the announcement and consummation of the initial business combination; (8) costs related to the initial business combination; (9) changes in appli cab le laws or regulations; (10) the possibility that Ranpak or the Company may be adversely affected by other economic, business, and/or competitive factors; and (11) other risks and uncertainties indicated from time to time in filings made with th e SEC. Should one or more of these risks or uncertainties materialize, they could cause our actual results to differ materially from the forward - looking statements. We are not undertaking any obligation to update or revise any forward looking statements w hether as a result of new information, future events or otherwise. You should not take any statement regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should not put undue reliance on these statements. USE OF NON - GAAP FINANCIAL MEASURES This investor presentation includes non - GAAP financial measures for Ranpak , including adjusted EBITDA and free cash flow. Ranpak believes presentation of these non - GAAP measures is useful because they allow management to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers with out regard to financing methods or capital structure. Management does not consider these non - GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of EBITDA, adjusted EBIT DA and free cash flow may not be comparable to other similarly titled measures of other companies. These non - GAAP financial measures should not be considered as alternatives to, or more meaningful than, measures of financial performance as de termined in accordance with GAAP or as indicators of operating performance. Ranpak is not in a position to reasonably estimate the expected GAAP net income (loss) for fiscal year 2019. However, it expects to generate a GAAP net loss for such p eri od. FINANCIAL STATEMENTS OF RACK HOLDINGS INC. The financial statement data of Rack Holdings Inc. for fiscal year 2015 included herein have been derived from the financial sta tements of Rack Holdings that were prepared in accordance with US GAAP. However, such financial statements have not been audited in accordance with the US PCAOB auditing standards applicable to public companies and are not included in the Re gis tration Statement on Form S - 4 filed by One Madison with the SEC in connection with the business combination. Accordingly, such financial data may not be directly comparable to the audited financial data of Rack Holdings Inc. for fisca l y ears 2016, 2017 and 2018 presented herein, which have been audited in accordance with the US PCAOB auditing standards applicable to public companies. USE OF PROJECTIONS This presentation includes financial estimates and projections, including with respect to Ranpak’s estimated sales, net income, EBITDA, adjusted EBITDA, adjusted EBITDA margin, free cash flow and free cash flow conversion fo r future periods. Neither Ranpak’s independent auditors, nor the independent registered public accounting firm of the Company, have audited, reviewed, compiled, o r performed any procedures with respect to the estimates and projections for the purpose of their inclusion in this investor presentation, and accordingly, neither of them expressed an opinion or provided any other form of ass urance with respect thereto for the purpose of this investor presentation. You should not place undue reliance on these estimates and projections as they may not necessarily be indicative of future results. The assumptions underlying estimated a nd projected financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the pros pec tive financial information. Accordingly, there can be no assurance that the estimated and projected results are indicative of th e future performance of Ranpak or the Company or that actual results will not differ materially from those estimated or projected results presented . Inclus io n of the estimated and projected financial information in this presentation should not be regarded as a representation by any person that the results contained in the estimated and projected financial information will be ach iev ed. NO OFFER OR SOLICITATION This presentation is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offe r t o buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in an y jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the sec urities laws of any jurisdiction. No offer or securities shall be made except by means of a prospectus meeting the requiremen ts of Section 10 of the Securities Act. ADDITIONAL INFORMATION In connection with the proposed acquisition, the Company filed a registration statement on Form S - 4 (File No. 333 - 230030) (the “ Registration Statement”) with the Securities and Exchange Commission (the “SEC”), which includes a preliminary proxy statement/prospectus, that is both the proxy statement to be distributed to holders of the Company’s ordinary shares in conne cti on with the Company’s solicitation of proxies for the vote by the Company’s shareholders with respect to the business combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to the Company’s equityholders in connection with the Company’s proposed domestication as a Delaware corporation in connection with the completion of the business combination. The Registration Statement was declared e ffe ctive on May 2, 2019 and the definitive proxy statement/prospectus and other relevant documents have been mailed to the Company’s shareholders as of May 6, 2019, the record date for the extraordinary general meeting of the Company to be held in connection with the business combination. The Company’s shareholders and other interested persons are advised to read the definitive proxy statement/prospectus included in the Registration Statement as these materials contain important in for mation about the Company, Ranpak and the business combination. Stockholders may obtain a free copy of the proxy statement/prospectus (when available) and any other relevant documents filed with the SEC from the SEC’s website at http://ww w.s ec.gov. In addition, stockholders will be able to obtain, without charge, a copy of the proxy statement/prospectus and other relevant documents (when available) at the Company’s website at http://www.onemadisoncorp.com/corporate - governance -- invest or - relations.html or by contacting the Company’s investor relations department via e - mail at info@onemadisongroup.com . PARTICIPANTS IN THE SOLICITATION The Company and its directors, executive officers and other members of its management and employees may be deemed to be parti cip ants in the solicitation of proxies from the Company’s stockholders with respect to the proposed acquisition. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set for th in the Company’s filings with the SEC, including (i) the Annual Report on Form 10 - K for the fiscal year ended December 31, 2018, which was filed on February 28, 2019 and (ii) the Proxy Statement and Prospectus each filed on May 2, 2019. Stockho lde rs may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the proposed acquisition, including the interests of the Company’s directors and executive officer s i n the proposed acquisition, which may be different than those of the Company’s stockholders generally, by reading the proxy statement/prospectus and other relevant documents regarding the proposed acquisition, which will be filed with the SEC. 1 Disclaimer

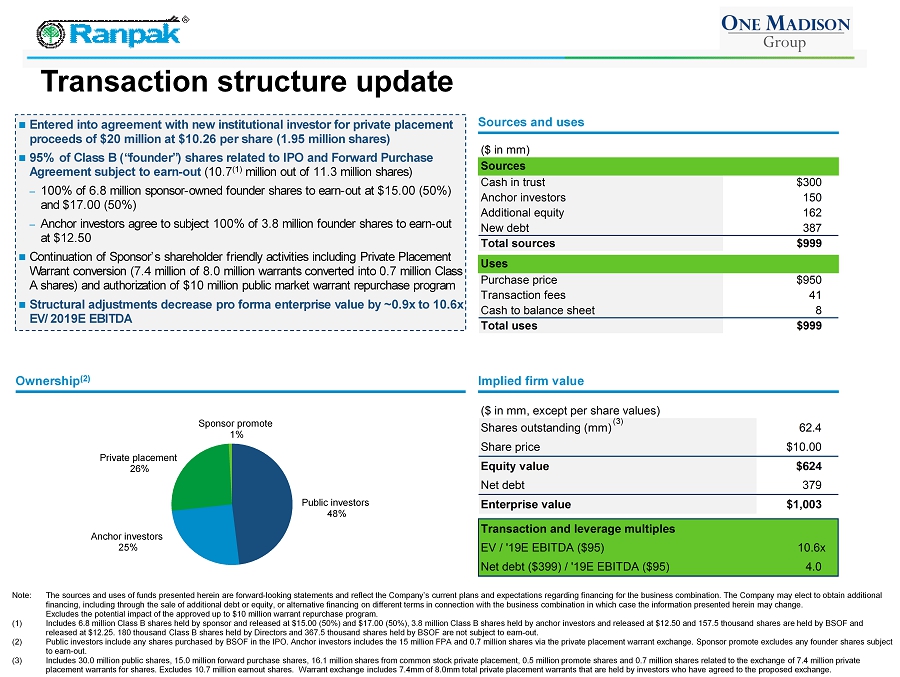

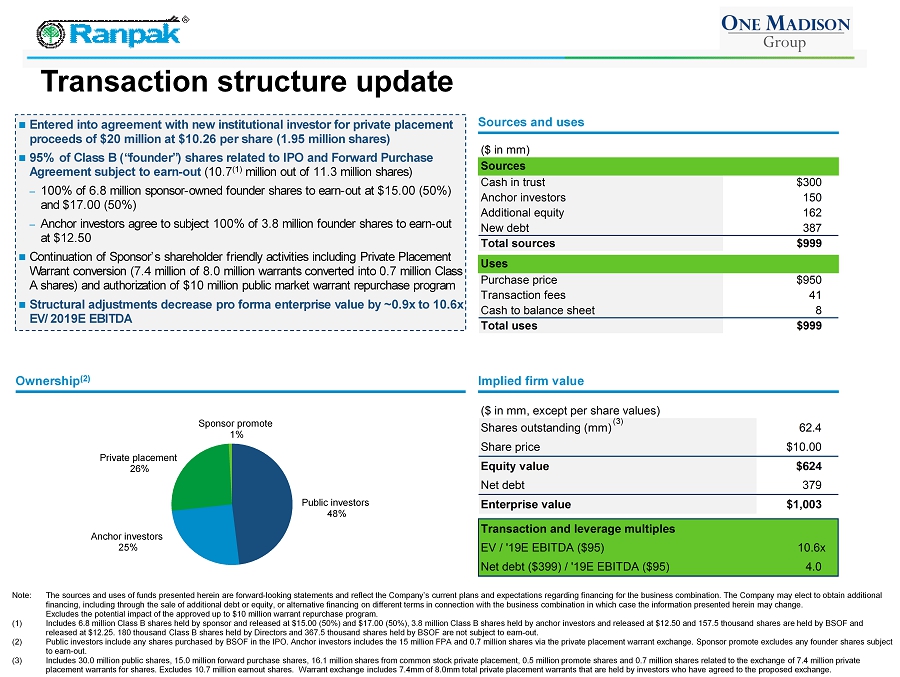

Public investors 48% Anchor investors 25% Private placement 26% Sponsor promote 1% 2 Transaction structure update Note: The sources and uses of funds presented herein are forward - looking statements and reflect the Company’s current plans and expectations regarding financing for the business combination. The Company may elect to obtain additional financing, including through the sale of additional debt or equity, or alternative financing on different terms in connection wi th the business combination in which case the information presented herein may change. Excludes the potential impact of the approved up to $10 million warrant repurchase program. (1) Includes 6.8 million Class B shares held by sponsor and released at $15.00 (50%) and $17.00 (50%), 3.8 million Class B share s held by anchor investors and released at $12.50 and 157.5 thousand shares are held by BSOF and released at $12.25. 180 thousand Class B shares held by Directors and 367.5 thousand shares held by BSOF are not subject to e arn - out. (2) Public investors include any shares purchased by BSOF in the IPO. Anchor investors includes the 15 million FPA and 0.7 milli on shares via the private placement warrant exchange. Sponsor promote excludes any founder shares subject to earn - out. (3) Includes 30.0 million public shares, 15.0 million forward purchase shares, 16.1 million shares from common stock private pla cement, 0.5 million promote shares and 0.7 million shares related to the exchange of 7.4 million private placement warrants for shares. Excludes 10.7 million earnout shares. Warrant exchange includes 7.4mm of 8.0mm total private pla cement warrants that are held by investors who have agreed to the proposed exchange. Implied firm value Sources and uses Ownership (2) ($ in mm, except per share values) Shares outstanding (mm) 62.4 Share price $10.00 Equity value $624 Net debt 379 Enterprise value $1,003 Transaction and leverage multiples EV / '19E EBITDA ($95) 10.6x Net debt ($399) / '19E EBITDA ($95) 4.0 (3) ($ in mm) Sources Cash in trust $300 Anchor investors 150 Additional equity 162 New debt 387 Total sources $999 Uses Purchase price $950 Transaction fees 41 Cash to balance sheet 8 Total uses $999 Entered into agreement with new institutional investor for private placement proceeds of $20 million at $10.26 per share (1.95 million shares) 95% of Class B (“founder”) shares related to IPO and Forward Purchase Agreement subject to earn - out (10.7 (1) million out of 11.3 million shares) – 100% of 6.8 million sponsor - owned founder shares to earn - out at $15.00 (50%) and $17.00 (50%) – Anchor investors agree to subject 100% of 3.8 million founder shares to earn - out at $12.50 Continuation of Sponsor’s shareholder friendly activities including Private Placement Warrant conversion (7.4 million of 8.0 million warrants converted into 0.7 million Class A shares) and authorization of $10 million public market warrant repurchase program Structural adjustments decrease pro forma enterprise value by ~0.9x to 10.6x EV/2019E EBITDA

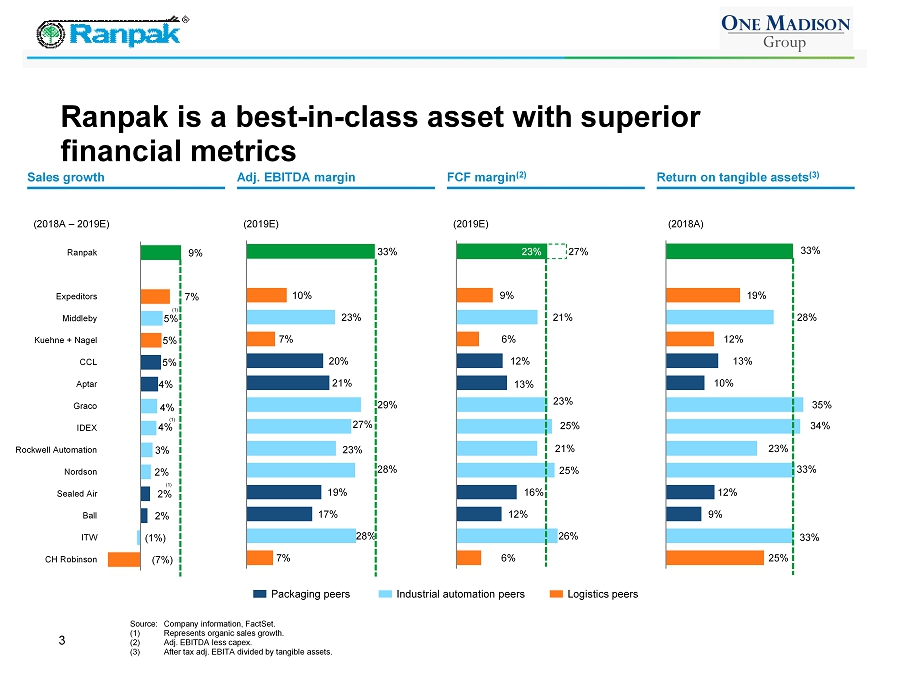

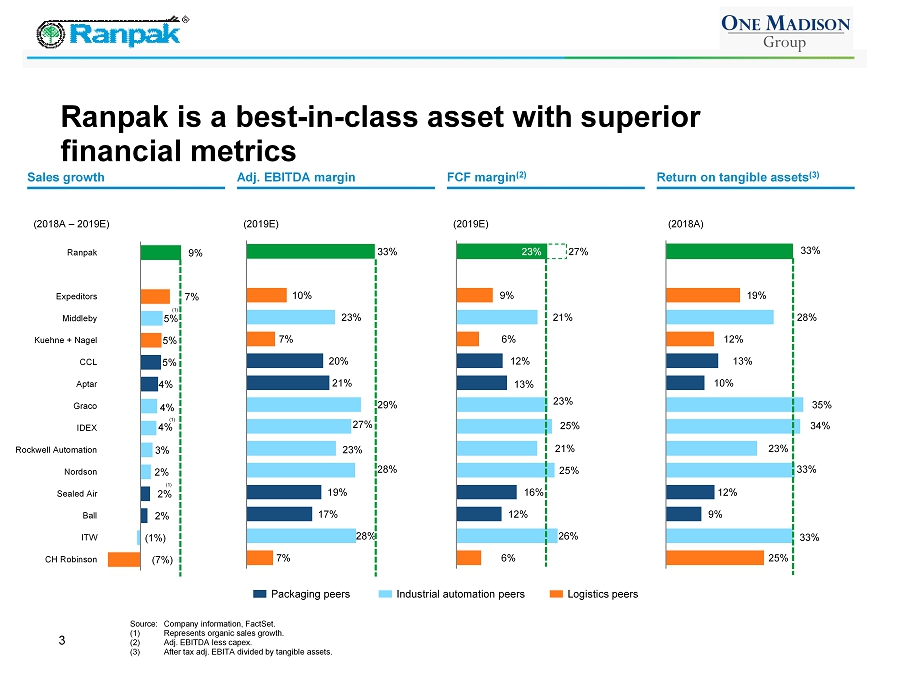

3 Ranpak is a best - in - class asset with superior financial metrics Sales growth Adj. EBITDA margin Return on tangible assets (3) (7%) (1%) 2% 2% 2% 3% 4% 4% 4% 5% 5% 5% 7% 9% CH Robinson ITW Ball Sealed Air Nordson Rockwell Automation IDEX Graco Aptar CCL Kuehne + Nagel Middleby Expeditors Ranpak 7% 28% 17% 19% 28% 23% 27% 29% 21% 20% 7% 23% 10% 33% 6% 26% 12% 16% 25% 21% 25% 23% 13% 12% 6% 21% 9% 23% 27% Packaging peers Logistics peers Industrial automation peers (2018A – 2019E) (2019E) (2019E) Source: Company information, FactSet . (1) Represents organic sales growth. (2) Adj. EBITDA less capex. (3) After tax adj. EBITA divided by tangible assets. FCF margin (2) 25% 33% 9% 12% 33% 23% 34% 35% 10% 13% 12% 28% 19% 33% (1) (1) (2018A) (1)

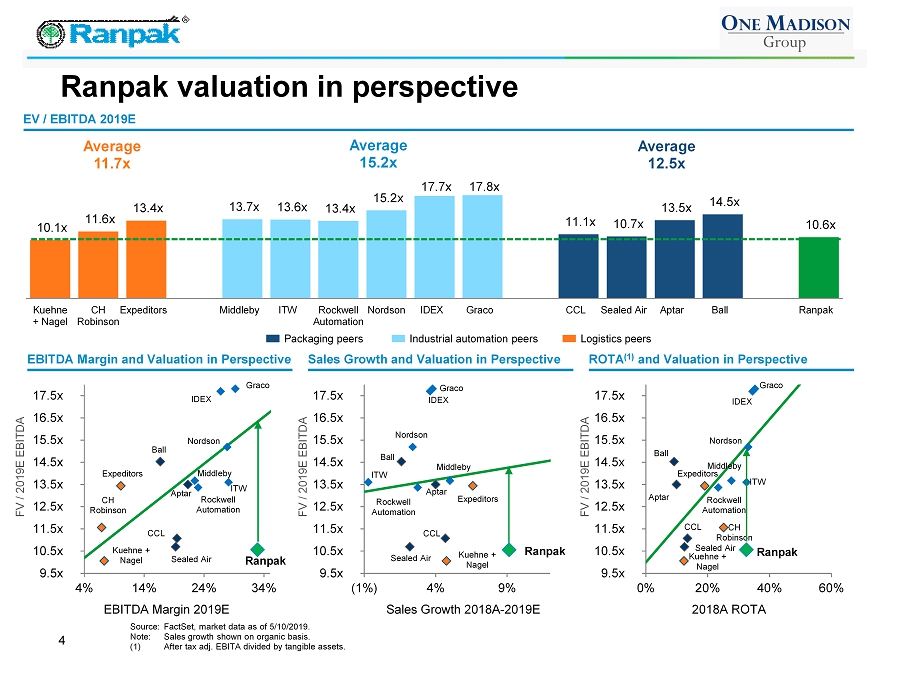

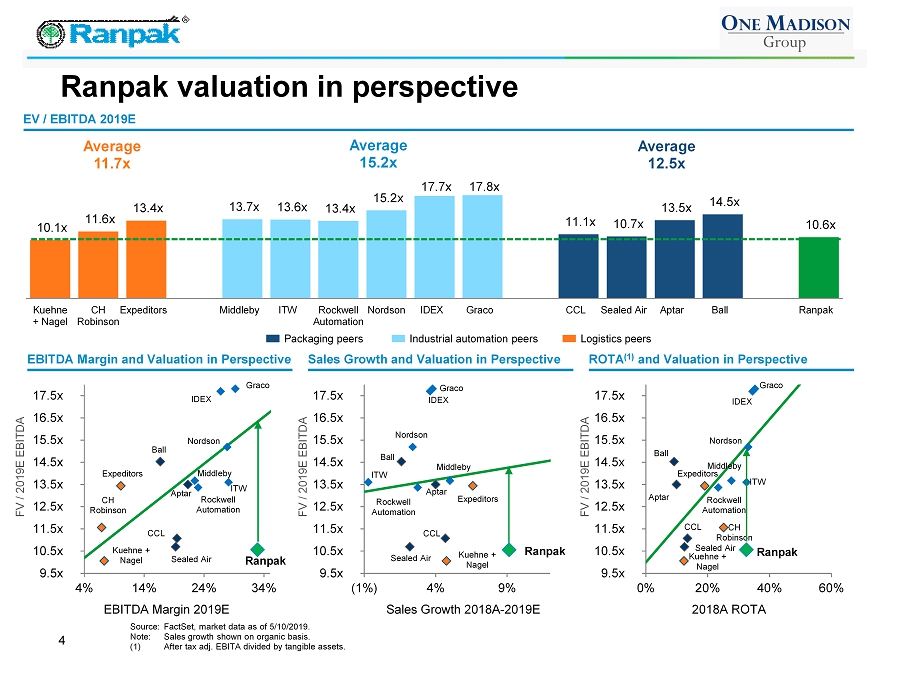

4 Ranpak valuation in perspective Source: FactSet, market data as of 5/10/2019. Note: Sales growth shown on organic basis. (1) After tax adj. EBITA divided by tangible assets. Sales Growth and Valuation in Perspective EBITDA Margin and Valuation in Perspective Sales Growth 2018A - 2019E FV / 2019E EBITDA EBITDA Margin 2019E FV / 2019E EBITDA ROTA (1) and Valuation in Perspective FV / 2019E EBITDA 2018A ROTA Packaging peers Logistics peers Industrial automation peers Average 15.2x Average 12.5x Average 11.7x EV / EBITDA 2019E 10.1x 11.6x 13.4x 13.7x 13.6x 13.4x 15.2x 17.7x 17.8x 11.1x 10.7x 13.5x 14.5x 10.6x Kuehne + Nagel CH Robinson Expeditors Middleby ITW Rockwell Automation Nordson IDEX Graco CCL Sealed Air Aptar Ball Ranpak Ranpak Ball Sealed Air CCL Aptar ITW Rockwell Automation IDEX Nordson Middleby Graco Kuehne + Nagel Expeditors 9.5x 10.5x 11.5x 12.5x 13.5x 14.5x 15.5x 16.5x 17.5x (1%) 4% 9% Ranpak Ball Sealed Air CCL Aptar ITW Rockwell Automation IDEX Nordson Middleby Graco Kuehne + Nagel CH Robinson Expeditors 9.5x 10.5x 11.5x 12.5x 13.5x 14.5x 15.5x 16.5x 17.5x 4% 14% 24% 34% Ranpak Ball Sealed Air CCL Aptar ITW Rockwell Automation IDEX Nordson Middleby Graco Kuehne + Nagel CH Robinson Expeditors 9.5x 10.5x 11.5x 12.5x 13.5x 14.5x 15.5x 16.5x 17.5x 0% 20% 40% 60%

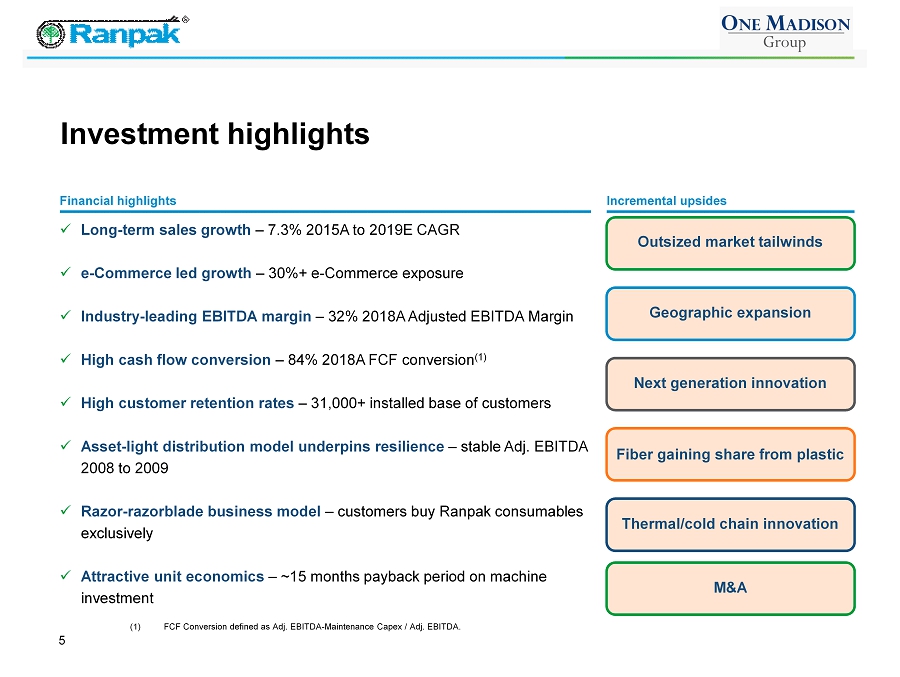

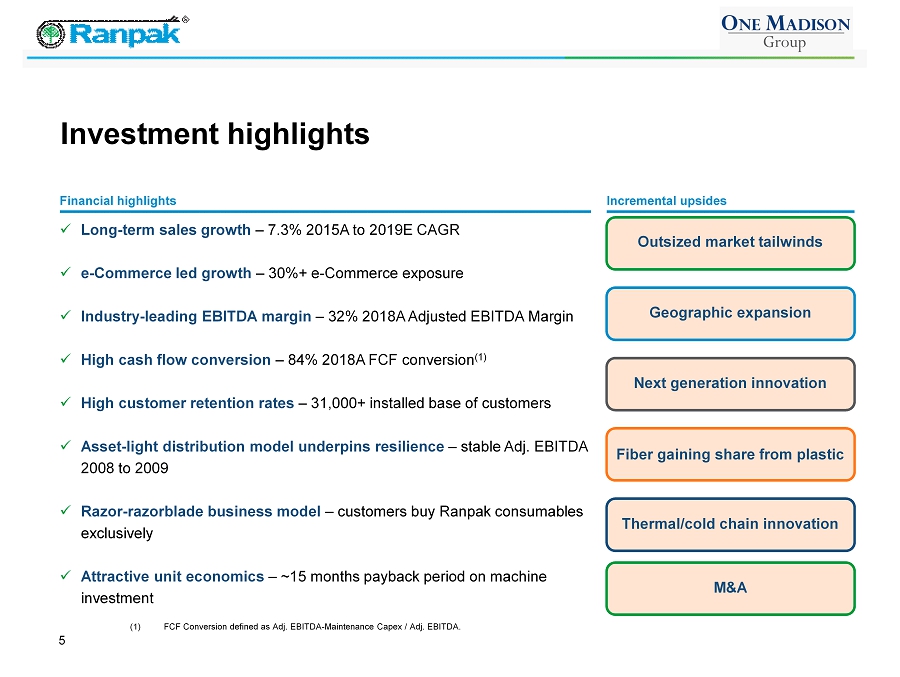

5 Investment highlights (1) FCF Conversion defined as Adj. EBITDA - Maintenance Capex / Adj. EBITDA. x Long - term sales growth – 7.3% 2015A to 2019E CAGR x e - Commerce led growth – 30%+ e - Commerce exposure x Industry - leading EBITDA margin – 32% 2018A Adjusted EBITDA Margin x High cash flow conversion – 84% 2018A FCF conversion (1) x High customer retention rates – 31,000+ installed base of customers x Asset - light distribution model underpins resilience – stable Adj. EBITDA 2008 to 2009 x Razor - razorblade business model – customers buy Ranpak consumables exclusively x Attractive unit economics – ~15 months payback period on machine investment Financial highlights Incremental upsides Outsized market tailwinds Geographic expansion Next generation innovation Fiber gaining share from plastic Thermal/cold chain innovation M&A