Burford Capital Fourth Quarter and Full Year 2024 Financial Results March 3, 2025 This presentation is for the use of Burford’s public shareholders and is not an offering of any Burford private fund.

Burford Capital Notice and disclaimer 2 This presentation (this “Presentation”) provides certain information to facilitate review and understanding of the business, financial condition and results of operations of Burford Capital Limited and its subsidiaries (the “Company”, “Burford”, “we”, “our” or “us”) as of and for the three months and the year ended December 31, 2024 and does not purport to be a complete description of the Company’s business, financial condition or results of operations. The information contained in this Presentation is provided as of the dates and for the periods indicated in this Presentation and is subject to change without notice. All figures as of and for the three months and the year ended December 31, 2024 contained in this Presentation are preliminary and unaudited. Forward-looking statements. This Presentation contains “forward-looking statements” within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US Securities Exchange Act of 1934, as amended, that are intended to be covered by the safe harbor provided for under these sections. In some cases, words such as “aim”, “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “forecast”, “guidance”, “intend”, “may”, “plan”, “potential”, “predict”, “projected”, “should” or “will”, or the negative of such terms or other comparable terminology, are intended to identify forward-looking statements. Although the Company believes that the assumptions, expectations, projections, intentions and beliefs about future results and events reflected in forward-looking statements have a reasonable basis and are expressed in good faith, forward-looking statements involve known and unknown risks, uncertainties and other factors, which could cause the Company’s actual results and events to differ materially from (and be more negative than) future results and events expressed, projected or implied by these forward-looking statements. Factors that might cause future results and events to differ include, among others, the following: (i) adverse litigation outcomes and timing of resolution of litigation matters; (ii) the Company’s ability to identify and select suitable legal finance assets; (iii) improper use or disclosure of, or access to, privileged information under the Company’s control due to cybersecurity breaches, unauthorized use or theft; (iv) inaccuracy or failure of the probabilistic model and decision science tools, including machine learning technology and generative artificial intelligence (collectively, “AI technologies”), the Company uses to predict the returns on its legal finance assets and in its operations; (v) changes and uncertainty in laws, regulations and rules relating to the legal finance industry, including those relating to privileged information and/or disclosure and enforceability of legal finance arrangements; (vi) inadequacies in the Company’s due diligence process or unforeseen developments; (vii) credit risk and concentration risk relating to the Company’s legal finance assets; (viii) lack of liquidity of the Company’s legal finance assets and commitments in excess of its available capital; (ix) the Company’s ability to obtain attractive external capital, refinance its outstanding indebtedness or raise capital to meet its liquidity needs; (x) competitive factors and demand for the Company’s services and capital; (xi) failure of lawyers to prosecute and/or defend claims which the Company has financed with necessary skill and care or misalignment of their clients’ interests with the Company’s; (xii) poor performance by the commitments the Company makes on behalf of its private funds; (xiii) negative publicity or public perception of the legal finance industry or the Company; (xiv) valuation uncertainty with respect to the fair value of the Company’s capital provision assets; (xv) current and future legal, political and economic factors, including uncertainty surrounding the effects, severity and duration of public health threats and/or military actions; (xvi) developments in AI technologies and expectations relating to environmental, social and governance considerations; (xvii) potential liability from litigation and legal proceedings against the Company; (xviii) the Company’s ability to hire and retain key personnel; (xix) risks relating to the Company’s international operations as a result of differing legal and regulatory requirements, political, social and economic conditions and unforeseeable developments; (xx) exposure to foreign currency exchange rate fluctuations; (xxi) uncertainty relating to the tax treatment of the Company’s financing arrangements; (xxii) cybersecurity risks and improper functioning of the Company’s information systems or those of its third-party service providers; (xxiii) failure of the Company’s third-party service providers to fulfill their obligations or misconduct by its third-party service providers; (xxiv) failure by the Company to maintain the privacy and security of personal information and comply with applicable data privacy and protection laws and regulations; (xxv) failure by the Company to maintain effective internal control over financial reporting or effective disclosure controls and procedures; (xxvi) failure by the Company to comply with the requirements of being a US domestic public company and the costs associated therewith; and (xxvii) certain risks relating to the Company’s incorporation in Guernsey. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements contained in the Company’s periodic and current reports that it files with or furnishes to the US Securities and Exchange Commission (the “SEC"). Many of these factors are beyond the Company’s ability to control or predict, and new factors emerge from time to time. Furthermore, the Company cannot assess the impact of each such factor on its business or the extent to which any factor or combination of factors may cause actual results and events to be materially different from those contained in any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on the Company’s forward-looking statements. All subsequent written and oral forward-looking statements attributable to the Company or to persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements speak only as of the date of this Presentation and, except as required by applicable law, the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.. In addition to forward-looking statements, this Presentation includes certain data based on calculations derived from the Company’s probabilistic modeling of individual matters and its portfolio as a whole. This data is not a forecast of future results, and past performance is not a guide to future performance. The inherent volatility and unpredictability of legal finance assets precludes forecasting and limits the predictive nature of the Company’s probabilistic model. Furthermore, the inherent nature of the probabilistic model is that actual results will differ from the modeled results, and such differences could be material. The data based on calculations derived from the Company’s probabilistic model contained in this Presentation is for informational purposes only and is not intended to be a profit forecast or be relied upon as a guide to future performance.

Burford Capital Notice and disclaimer (continued) 3 Basis of presentation; non-GAAP financial measures; key performance indicators; definitions. The Company reports its financial results in accordance with the generally accepted accounting principles in the United States (“US GAAP”). US GAAP requires the Company to present financial statements that consolidate some of the limited partner interests in private funds the Company manages as well as assets held on the Company’s balance sheet where it has a partner or minority investor. As a result, the Company uses various measures, including Burford-only and adjusted Burford-only financial measures, which are calculated and presented using methodologies other than in accordance with US GAAP, to supplement analysis and discussion of its consolidated financial statements prepared in accordance with US GAAP. The Company believes that the presentation of Burford-only financial measures is consistent with how management measures and assesses the performance of the Company’s reporting segments, which are evaluated by management on a Burford-only basis, and that the presentation of Burford-only and adjusted Burford-only financial measures provides valuable and useful information to investors to aid in understanding the Company’s performance in addition to its consolidated financial statements prepared in accordance with US GAAP by eliminating the effect of the consolidation. In addition, the Company’s segment reporting, which conveys the performance of its business across two reportable segments—Principal Finance and Asset Management and Other Services—is presented on a Burford-only basis. The Company refers to its segment reporting in the aggregate as “total segments”. The Company also uses additional non-GAAP financial measures, such as cash receipts, tangible book value attributable to Burford Capital Limited per ordinary share (“TBVPS”), return on tangible common equity (“ROTCE”) and various indebtedness leverage ratios. The Company believes that (i) cash receipts are an important measure of the Company’s operating and financial performance and are useful to management and investors when assessing the performance of Burford-only capital provision assets, (ii) TBVPS is an important measures of the Company’s financial condition and is useful to management and investors when assessing capital adequacy and the Company’s ability to generate earnings on tangible equity invested by its shareholders and (iii) ROTCE is an important measure of the Company’s operating and financial performance and is useful to management and investors when assessing the performance of Burford-only capital provision assets. In addition, the Company uses certain unaudited key performance indicators(“KPIs”). The KPIs are presented because the Company uses them to monitor its financial condition and results of operations and/or the Company believes they are useful to investors, securities analysts and other interested parties. The presentation of the KPIs is for informational purposes only and does not purport to present what the Company’s actual financial condition or results of operations would have been, nor does it project its financial condition at any future date or its results of operations for any future period. The presentation of the KPIs is based on information available as of the date of this Presentation and certain assumptions and estimates that the Company believes are reasonable. The non-GAAP financial measures should not be considered in isolation from, as substitutes for, or superior to, financial measures calculated in accordance with US GAAP. Additional information with respect to these non-GAAP financial measures and KPIs, their respective definitions and calculations and related reconciliations are provided in “Reconciliations” and “Glossary” sections of this Presentation. Industry and market data. Any industry and market information contained in this Presentation, or on which this Presentation is based, has been obtained from sources that the Company believes to be reliable and accurate. However, no representation or warranty, express or implied, is made as to the fairness, accuracy or completeness of the information or opinions contained in this Presentation, which information and opinions should not be relied or acted on. Neither the Company, its affiliates nor any officer, director, employee or representative of the Company or its affiliates accepts any liability whatsoever for any loss howsoever arising, directly or indirectly, from any use of this Presentation or its contents. * * * * * This Presentation does not constitute or form part of, and should not be construed as, an issue for sale or subscription of, or solicitation of any offer or invitation to subscribe for, underwrite or otherwise acquire or dispose of any securities of the Company or any of its affiliates, nor should this Presentation or any part of it form the basis of, or be relied on in connection with, any contract or commitment whatsoever which may at any time be entered into by the recipient nor any other person, nor does this Presentation constitute an invitation or inducement to engage in investment activity under Section 21 of the Financial Services and Markets Act 2000, as amended. This Presentation does not constitute an invitation to effect any transaction with the Company or any of its affiliates or to make use of any services provided by the Company. This Presentation does not constitute an offer to sell, or a solicitation of an offer to buy, any ordinary shares or other securities of the Company or any of its affiliates. This Presentation is not an offering of any private fund of the Company. Burford Capital Investment Management LLC, which acts as the fund manager of all private funds of the Company, is registered as an investment adviser with the SEC. The information relating to the private funds of the Company provided in this Presentation is for informational purposes only. Past performance is not indicative of future results. Any information contained in this Presentation is not, and should not be construed as, an offer to sell or the solicitation of an offer to buy any securities (including interests or shares in the private funds). Any such offer or solicitation may be made only by means of a final confidential private placement memorandum and other offering documents.

Burford Capital Burford Reports 4Q24 and FY24 Financial Results “Burford had a splendid 2024. We achieved record- breaking cash realizations with returns well above our historical averages as well as strong growth in new business. We were also added to the Russell indices and cemented our transition to reporting as a US domestic issuer. Our 2025 Investor Day on April 3 will be a great forum to share even more with you on the potential of the current portfolio as well as Burford’s path forward as we continue to grow. We hope you can join us.” Christopher Bogart Chief Executive Officer Dividend On February 28, 2025, Burford’s board of directors declared a final dividend for the year ended December 31, 2024 of $0.0625 per ordinary share to be paid, subject to shareholder approval at the 2025 annual general meeting, on June 13, 2025 to shareholders of record on May 23, 2025. Conference Call Burford will hold a conference call for investors and analysts at 10.00am EST / 3.00pm GMT on Monday, March 3, 2025. The dial-in numbers for the conference call are +1 (646) 307-1963 (USA) or +1 (800) 715-9871 (USA and Canada toll free) / +44 (0)20 3481 4247 (UK) or +44 800 260 6466 (UK toll free) and the access code is 37665. To minimize the risk of delayed access, participants are urged to dial into the conference call by 9.40am EST / 2.40pm GMT. A live audio webcast and replay will also be available at https://events.q4inc.com/attendee/169138797, and pre-registration at that link is encouraged. About Burford Burford Capital is the leading global finance and asset management firm focused on law. Its businesses include litigation finance and risk management, asset recovery and a wide range of legal finance and advisory activities. Burford is publicly traded on the New York Stock Exchange (NYSE: BUR) and the London Stock Exchange (LSE: BUR), and it works with companies and law firms around the world from its offices in New York, London, Chicago, Washington, D.C., Singapore, Dubai and Hong Kong. For more information, please visit www.burfordcapital.com. 4

Burford Capital Contents 5 Burford has always focused on providing disclosure that represents what shareholders actually own, which is reflected in the “Burford-only” basis of financial reporting. “Burford-only” reporting removes the impact of private fund entities that must be consolidated under accounting standards, even though economic ownership resides with a third party. Beginning with the 4Q24 and FY24 financial results, the Burford-only disclosure will be enhanced with a more prominent use of segment reporting through two reportable segments: (i) “Principal Finance” (which captures the financial impact of the legal finance portfolio funded by Burford’s balance sheet) and (ii) “Asset Management and Other Services” (which captures fee income from Burford’s private funds funded by third-party capital and income earned from other service-related operations). Under US reporting standards, the use of segment reporting allows for more efficient and helpful disclosure on the key metrics that illuminate how Burford generates shareholder value in each segment. The sum of Burford’s two reportable segments will be referred to as “Total Segments” in certain disclosures, which is consistent with and identical to reporting on an aggregate “Burford-only” basis. The Principal Finance segment reporting will be further simplified by discontinuing the use of the labels “capital provision-direct” or “core portfolio” (which described direct funding of legal finance assets by Burford’s balance sheet) and “capital provision-indirect” (which described indirect funding of legal finance assets through commitments made by Burford’s balance sheet to private funds). Performance track record measures such as return on invested capital (ROIC) and internal rate of return (IRR) will be entirely consistent with prior reporting and reflect direct funding by the balance sheet (formerly referred to as “capital provision-direct” or “core portfolio”), excluding the impact of any balance sheet commitments to private funds. Additionally, we have added new disclosures to the earnings presentation that we believe investors will find useful: • Portfolio exposure by geography and asset type • Portfolio fair value bridge for quarter and full year • Implied ROIC on realizations by period • Weighted average life of active deployed cost 6 Consolidated GAAP Financial Results 7 4Q24 and FY24 Key Messages 8 Financial Metrics Summary 9 Total Segments (Burford-only) Financial Results 12 Segment Reporting: Principal Finance 22 Segment Reporting: Asset Management and Other Services 26 Liquidity and Capital Management 31 Consolidated Financial Statement Reconciliations 36 Reconciliations 49 Glossary Page Important updates to financial reporting structure and terminology NOTE: All data in this Presentation is preliminary and unaudited and is for the three months and year ended December 31, 2024 (“4Q24” and “FY24”, respectively) compared to the three months and year ended December 31, 2023 (“4Q23” and “FY23”, respectively), unless noted otherwise. Throughout this Presentation, amounts may not sum and/or tables may not foot due to rounding.

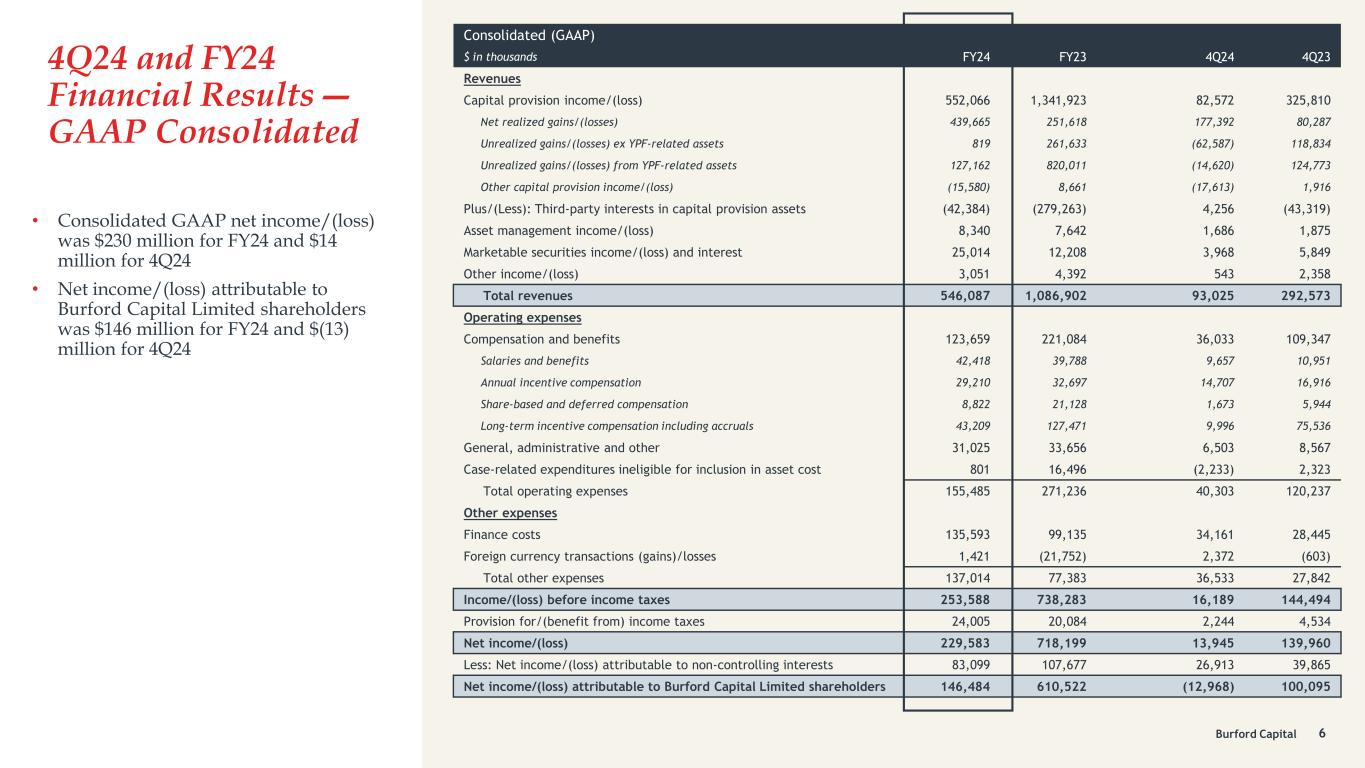

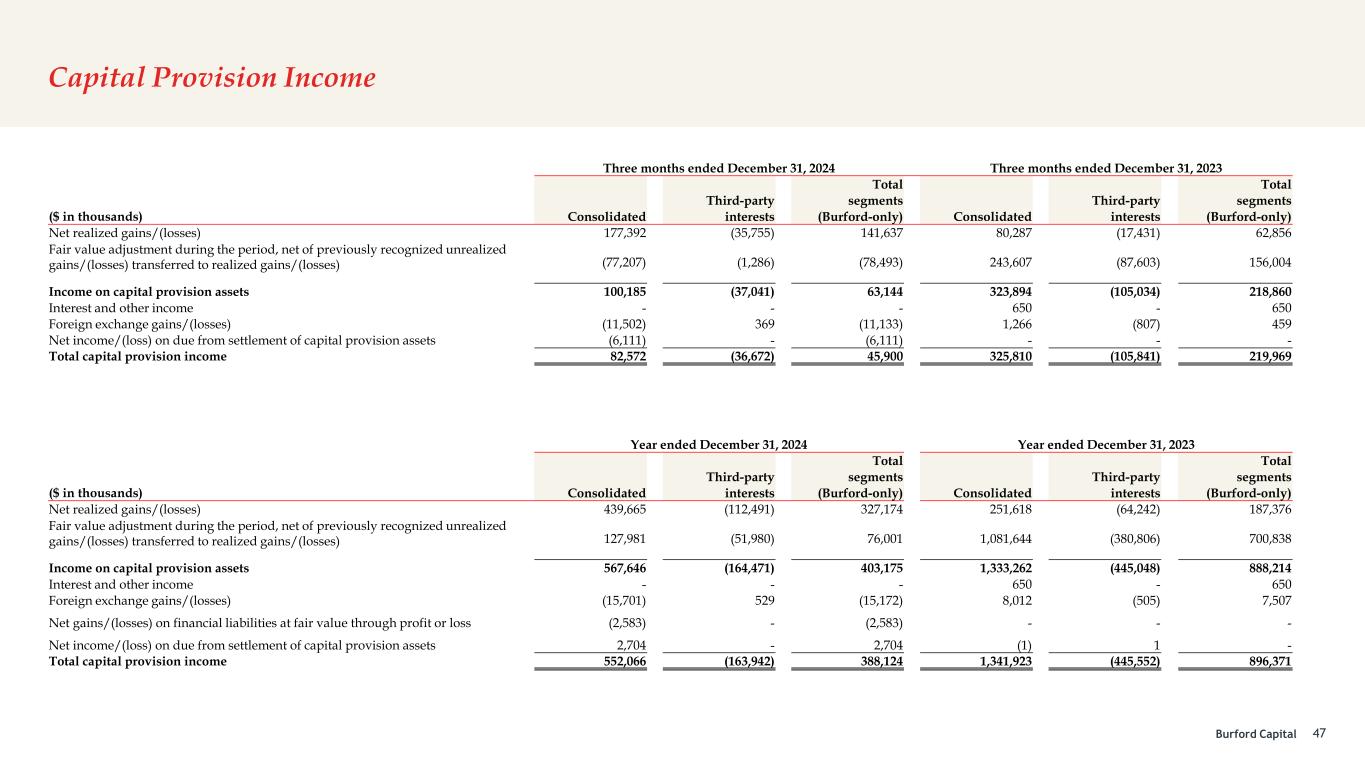

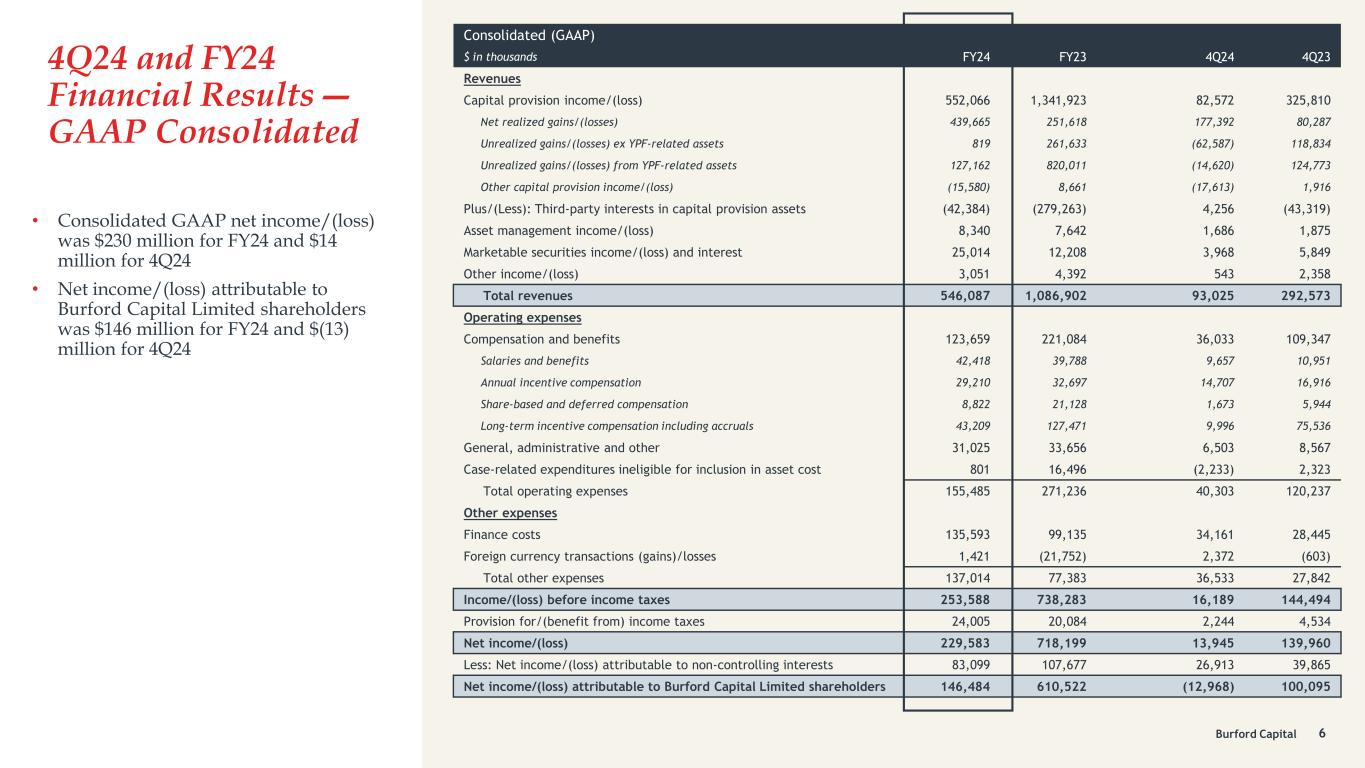

Burford Capital 4Q24 and FY24 Financial Results ― GAAP Consolidated Consolidated (GAAP) $ in thousands FY24 FY23 4Q24 4Q23 Revenues Capital provision income/(loss) 552,066 1,341,923 82,572 325,810 Net realized gains/(losses) 439,665 251,618 177,392 80,287 Unrealized gains/(losses) ex YPF-related assets 819 261,633 (62,587) 118,834 Unrealized gains/(losses) from YPF-related assets 127,162 820,011 (14,620) 124,773 Other capital provision income/(loss) (15,580) 8,661 (17,613) 1,916 Plus/(Less): Third-party interests in capital provision assets (42,384) (279,263) 4,256 (43,319) Asset management income/(loss) 8,340 7,642 1,686 1,875 Marketable securities income/(loss) and interest 25,014 12,208 3,968 5,849 Other income/(loss) 3,051 4,392 543 2,358 Total revenues 546,087 1,086,902 93,025 292,573 Operating expenses Compensation and benefits 123,659 221,084 36,033 109,347 Salaries and benefits 42,418 39,788 9,657 10,951 Annual incentive compensation 29,210 32,697 14,707 16,916 Share-based and deferred compensation 8,822 21,128 1,673 5,944 Long-term incentive compensation including accruals 43,209 127,471 9,996 75,536 General, administrative and other 31,025 33,656 6,503 8,567 Case-related expenditures ineligible for inclusion in asset cost 801 16,496 (2,233) 2,323 Total operating expenses 155,485 271,236 40,303 120,237 Other expenses Finance costs 135,593 99,135 34,161 28,445 Foreign currency transactions (gains)/losses 1,421 (21,752) 2,372 (603) Total other expenses 137,014 77,383 36,533 27,842 Income/(loss) before income taxes 253,588 738,283 16,189 144,494 Provision for/(benefit from) income taxes 24,005 20,084 2,244 4,534 Net income/(loss) 229,583 718,199 13,945 139,960 Less: Net income/(loss) attributable to non-controlling interests 83,099 107,677 26,913 39,865 Net income/(loss) attributable to Burford Capital Limited shareholders 146,484 610,522 (12,968) 100,095 6 • Consolidated GAAP net income/(loss) was $230 million for FY24 and $14 million for 4Q24 • Net income/(loss) attributable to Burford Capital Limited shareholders was $146 million for FY24 and $(13) million for 4Q24

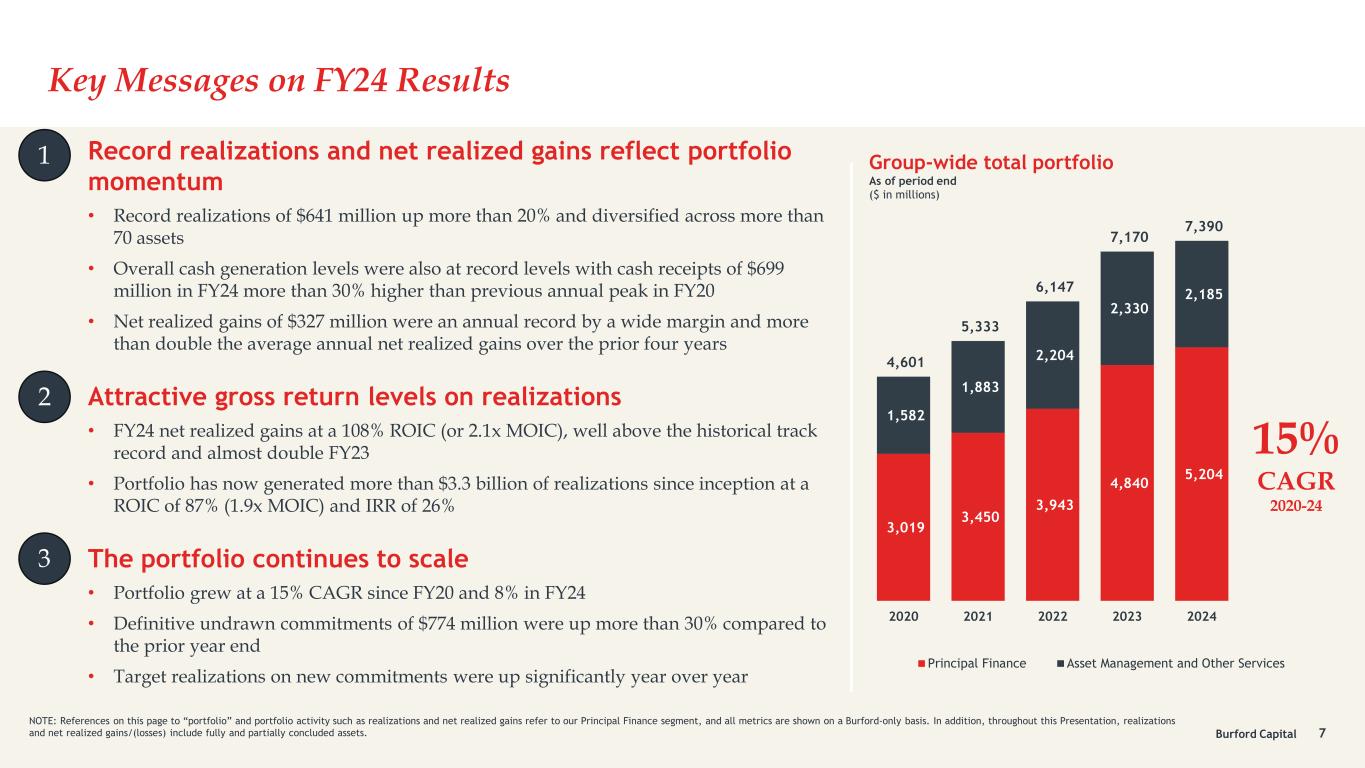

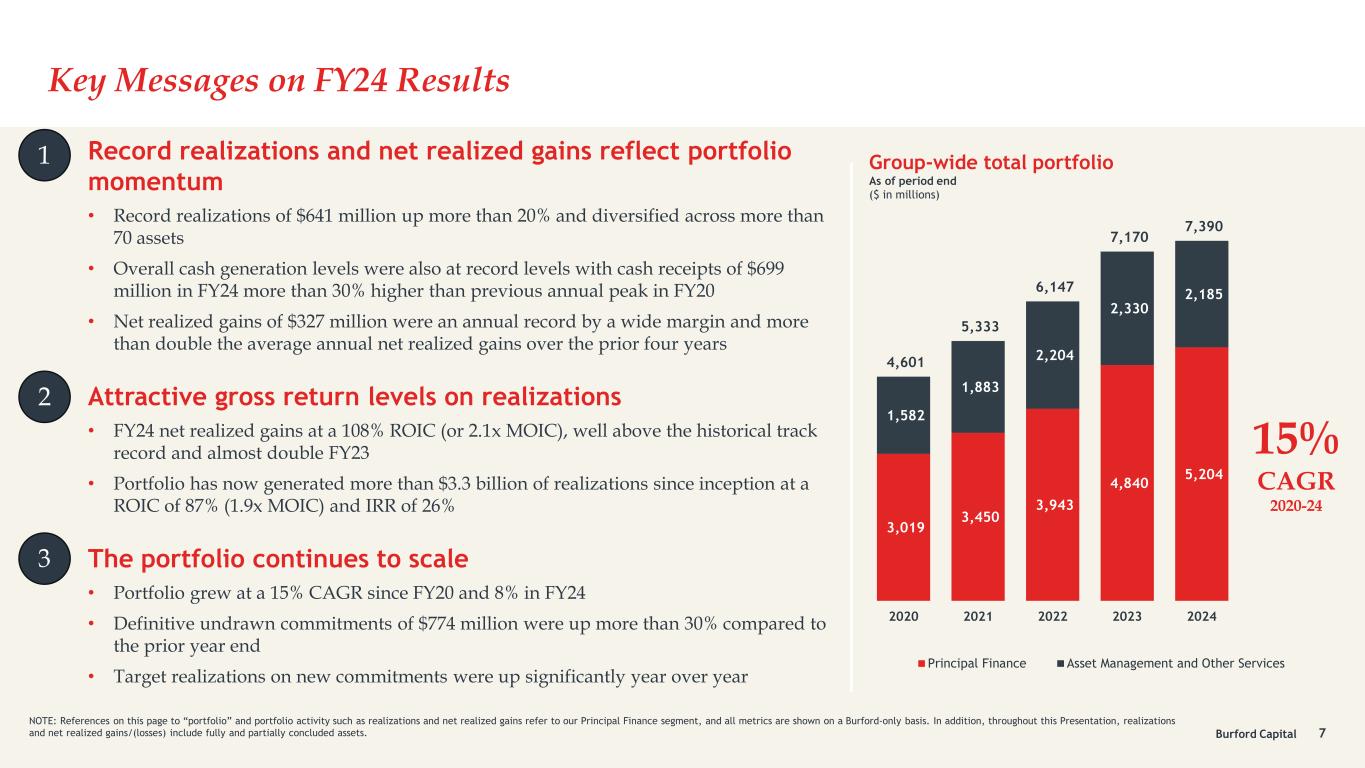

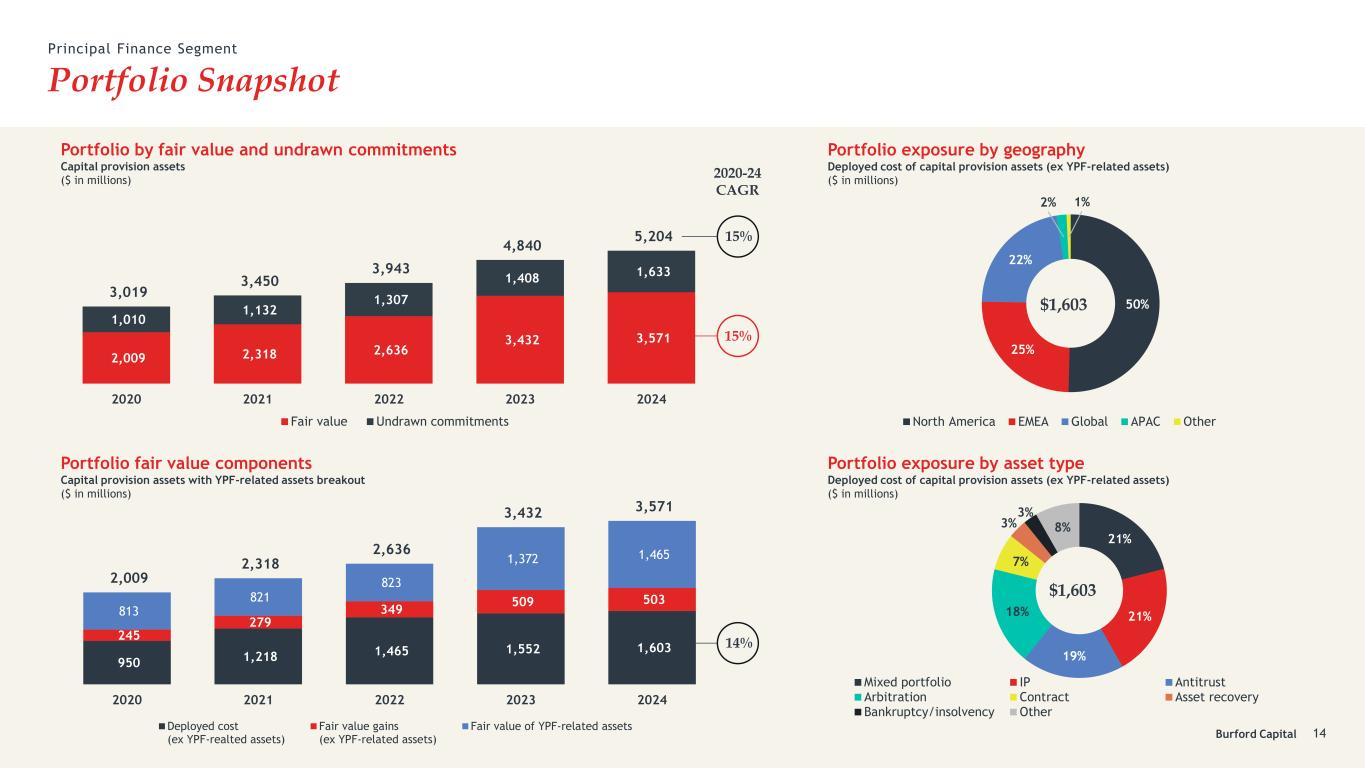

Burford Capital Key Messages on FY24 Results Record realizations and net realized gains reflect portfolio momentum • Record realizations of $641 million up more than 20% and diversified across more than 70 assets • Overall cash generation levels were also at record levels with cash receipts of $699 million in FY24 more than 30% higher than previous annual peak in FY20 • Net realized gains of $327 million were an annual record by a wide margin and more than double the average annual net realized gains over the prior four years Attractive gross return levels on realizations • FY24 net realized gains at a 108% ROIC (or 2.1x MOIC), well above the historical track record and almost double FY23 • Portfolio has now generated more than $3.3 billion of realizations since inception at a ROIC of 87% (1.9x MOIC) and IRR of 26% The portfolio continues to scale • Portfolio grew at a 15% CAGR since FY20 and 8% in FY24 • Definitive undrawn commitments of $774 million were up more than 30% compared to the prior year end • Target realizations on new commitments were up significantly year over year 7 Group-wide total portfolio As of period end ($ in millions) 3,019 3,450 3,943 4,840 5,204 1,582 1,883 2,204 2,330 2,185 4,601 5,333 6,147 7,170 7,390 2020 2021 2022 2023 2024 Principal Finance Asset Management and Other Services 1 2 3 NOTE: References on this page to “portfolio” and portfolio activity such as realizations and net realized gains refer to our Principal Finance segment, and all metrics are shown on a Burford-only basis. In addition, throughout this Presentation, realizations and net realized gains/(losses) include fully and partially concluded assets. 15% CAGR 2020-24

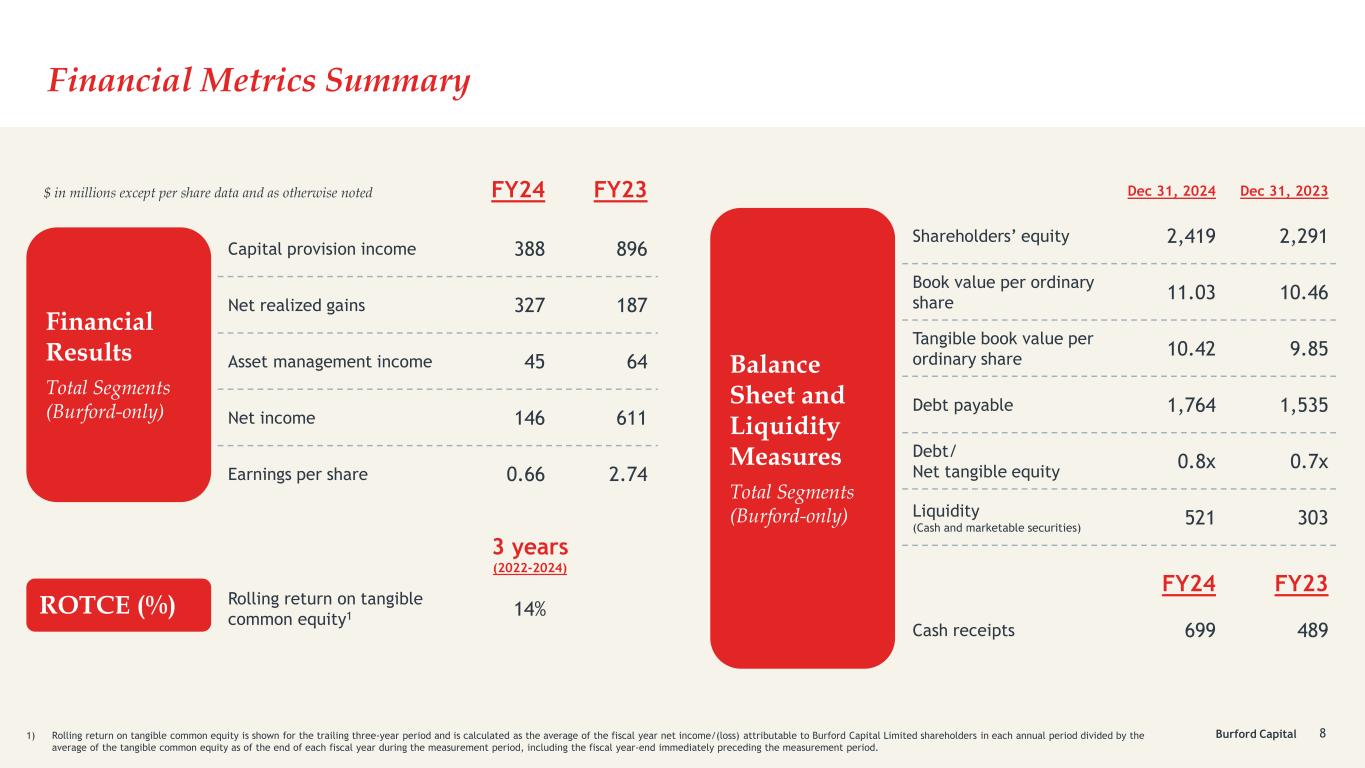

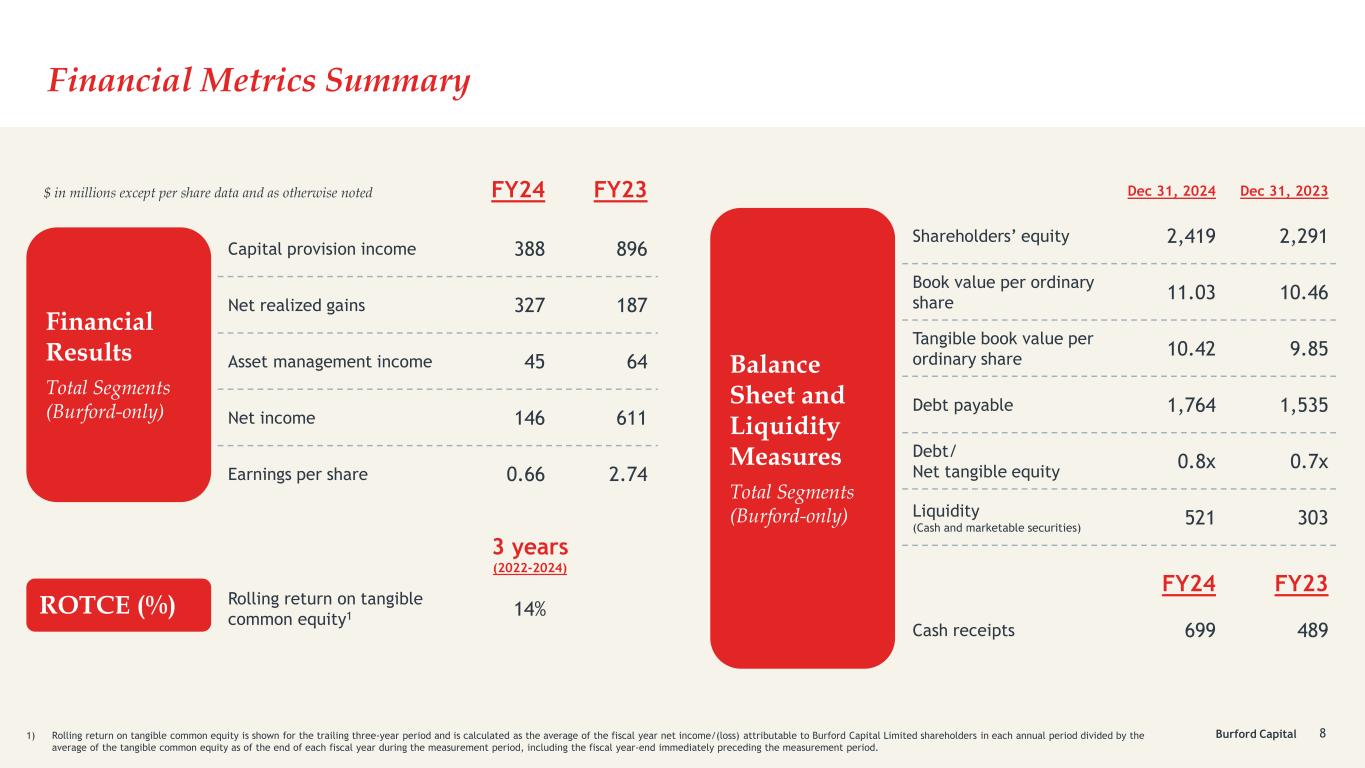

Burford Capital Financial Metrics Summary $ in millions except per share data and as otherwise noted FY24 FY23 Capital provision income 388 896 Net realized gains 327 187 Asset management income 45 64 Net income 146 611 Earnings per share 0.66 2.74 8 Dec 31, 2024 Dec 31, 2023 Shareholders’ equity 2,419 2,291 Book value per ordinary share 11.03 10.46 Tangible book value per ordinary share 10.42 9.85 Debt payable 1,764 1,535 Debt/ Net tangible equity 0.8x 0.7x Liquidity (Cash and marketable securities) 521 303 FY24 FY23 Cash receipts 699 489 Financial Results Total Segments (Burford-only) Balance Sheet and Liquidity Measures Total Segments (Burford-only) 3 years (2022-2024) Rolling return on tangible common equity1 14%ROTCE (%) 1) Rolling return on tangible common equity is shown for the trailing three-year period and is calculated as the average of the fiscal year net income/(loss) attributable to Burford Capital Limited shareholders in each annual period divided by the average of the tangible common equity as of the end of each fiscal year during the measurement period, including the fiscal year-end immediately preceding the measurement period.

Total Segments

Burford Capital Segment Reporting Overview 10 Consolidated (GAAP) Total Segments (Burford-only) Reflects financial results and business economics attributable to BUR shareholders Adjustments to remove the financial impact of certain consolidated private funds and other third-party interests1 Principal Finance segment Asset Management and Other Services segment FY24 Revenues $413 million Total Portfolio $5.2 billion FY24 Revenues $48 million Total Portfolio $2.2 billion Captures the financial impact of the legal finance portfolio funded by Burford’s balance sheet Captures fee income from Burford’s private funds funded by third-party capital and income earned from other service-related operations Consolidated private funds and third-party interests 1) See consolidated financial statement reconciliations.

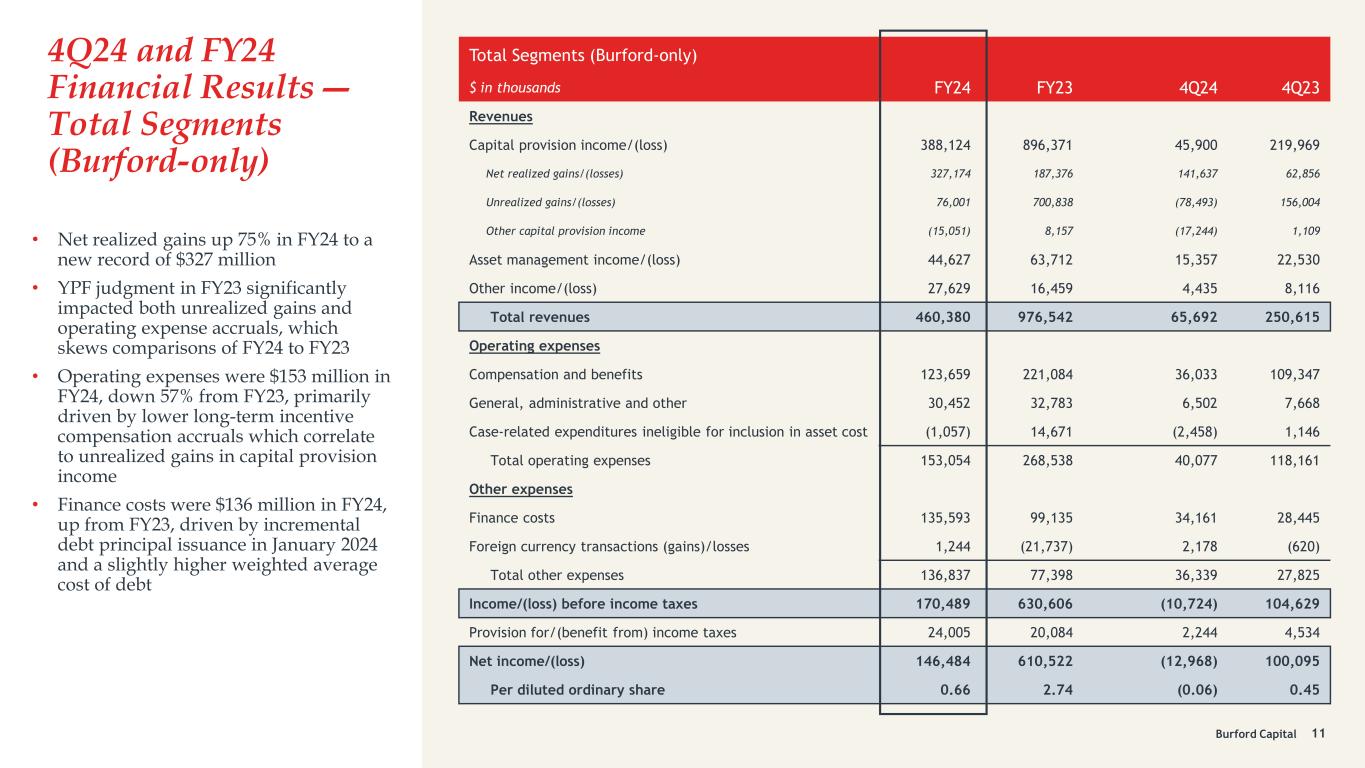

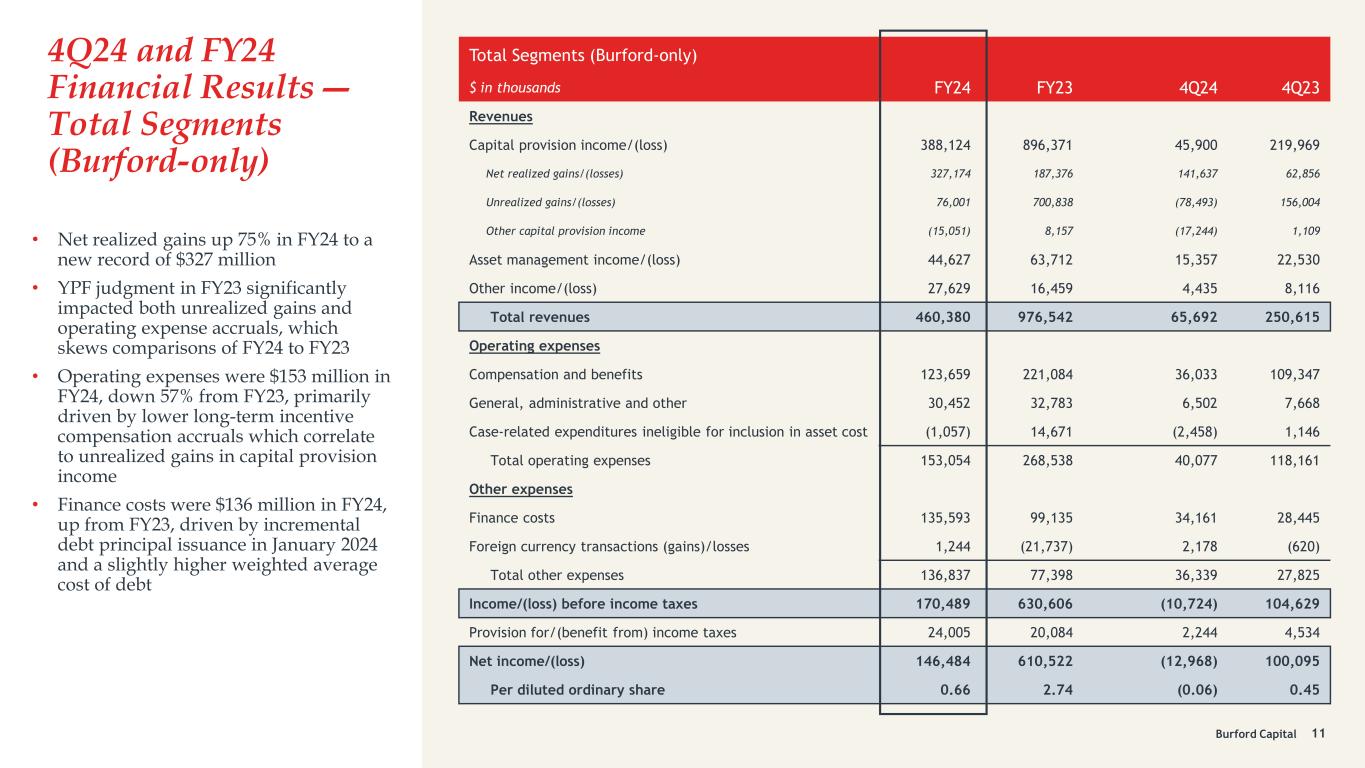

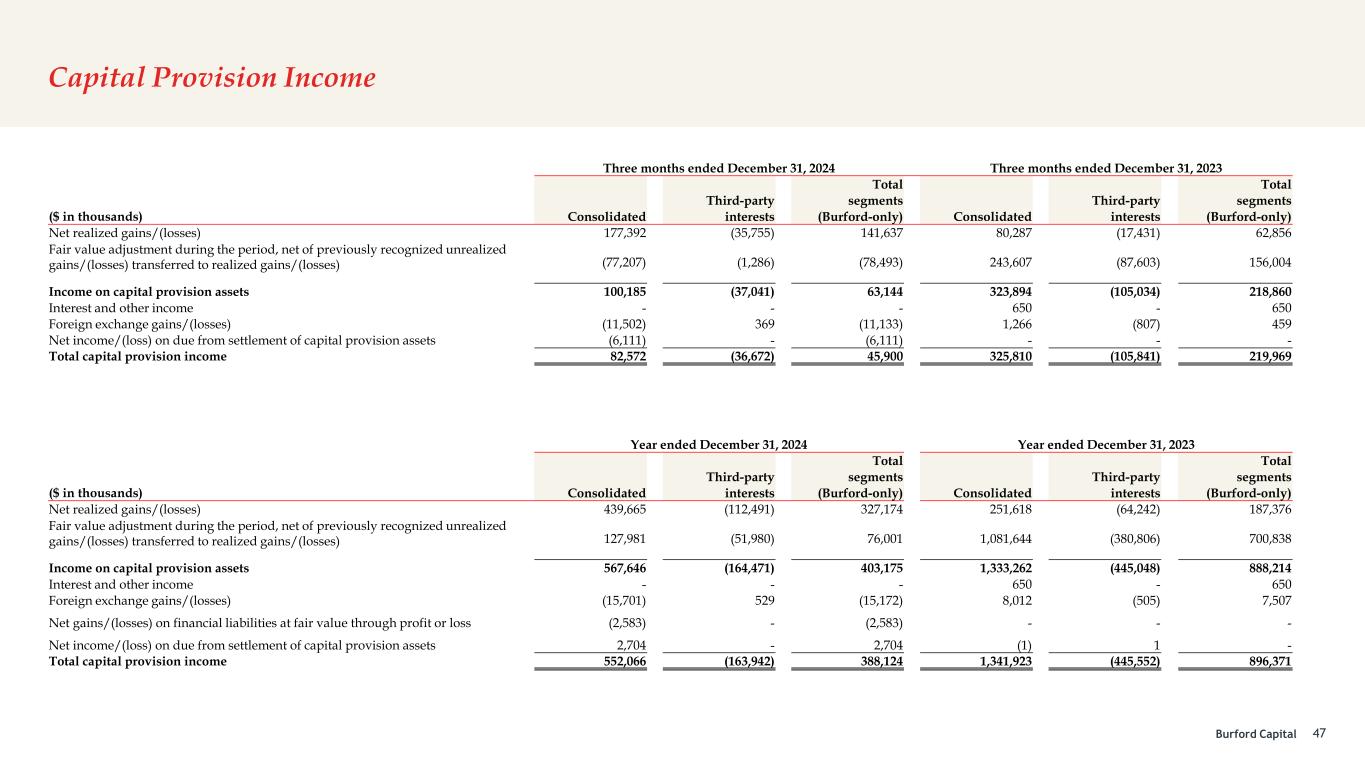

Burford Capital 4Q24 and FY24 Financial Results ― Total Segments (Burford-only) Total Segments (Burford-only) $ in thousands FY24 FY23 4Q24 4Q23 Revenues Capital provision income/(loss) 388,124 896,371 45,900 219,969 Net realized gains/(losses) 327,174 187,376 141,637 62,856 Unrealized gains/(losses) 76,001 700,838 (78,493) 156,004 Other capital provision income (15,051) 8,157 (17,244) 1,109 Asset management income/(loss) 44,627 63,712 15,357 22,530 Other income/(loss) 27,629 16,459 4,435 8,116 Total revenues 460,380 976,542 65,692 250,615 Operating expenses Compensation and benefits 123,659 221,084 36,033 109,347 General, administrative and other 30,452 32,783 6,502 7,668 Case-related expenditures ineligible for inclusion in asset cost (1,057) 14,671 (2,458) 1,146 Total operating expenses 153,054 268,538 40,077 118,161 Other expenses Finance costs 135,593 99,135 34,161 28,445 Foreign currency transactions (gains)/losses 1,244 (21,737) 2,178 (620) Total other expenses 136,837 77,398 36,339 27,825 Income/(loss) before income taxes 170,489 630,606 (10,724) 104,629 Provision for/(benefit from) income taxes 24,005 20,084 2,244 4,534 Net income/(loss) 146,484 610,522 (12,968) 100,095 Per diluted ordinary share 0.66 2.74 (0.06) 0.45 11 • Net realized gains up 75% in FY24 to a new record of $327 million • YPF judgment in FY23 significantly impacted both unrealized gains and operating expense accruals, which skews comparisons of FY24 to FY23 • Operating expenses were $153 million in FY24, down 57% from FY23, primarily driven by lower long-term incentive compensation accruals which correlate to unrealized gains in capital provision income • Finance costs were $136 million in FY24, up from FY23, driven by incremental debt principal issuance in January 2024 and a slightly higher weighted average cost of debt

Segments: Principal Finance

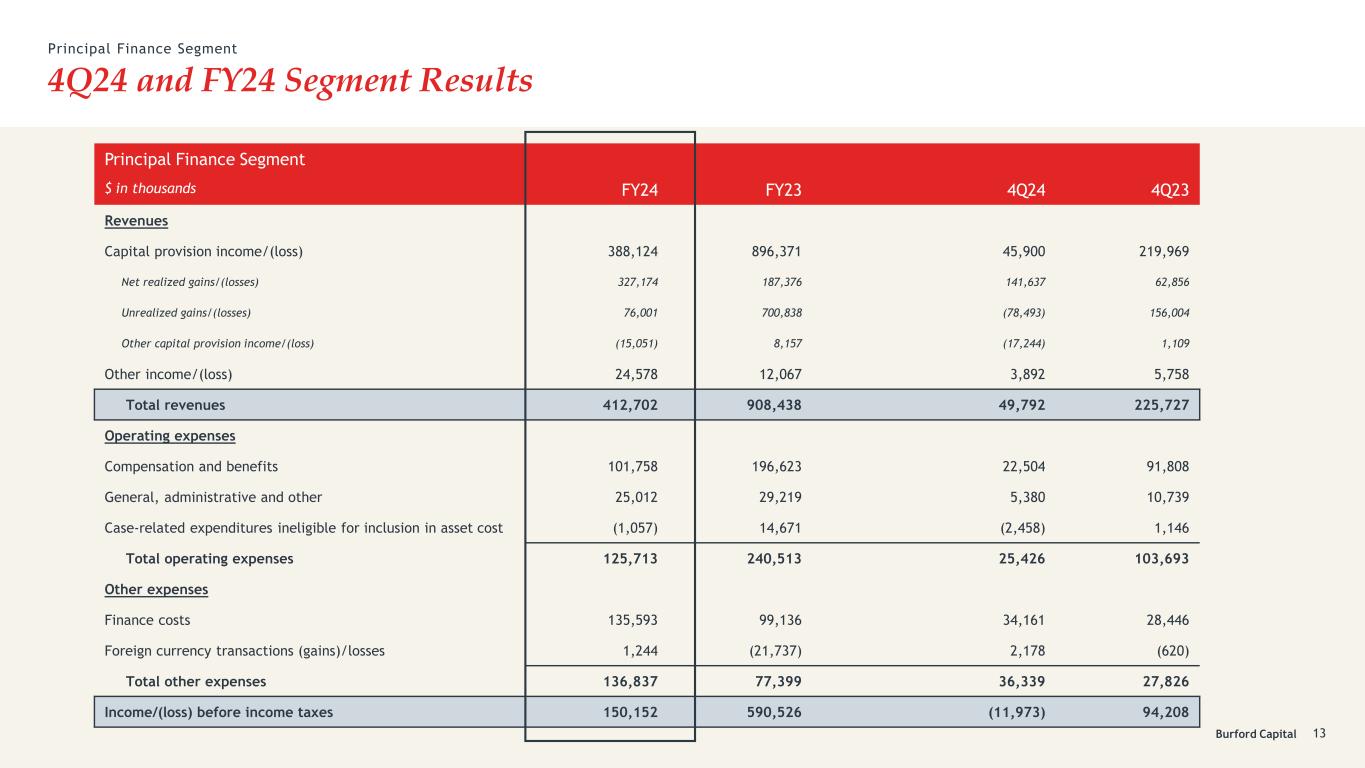

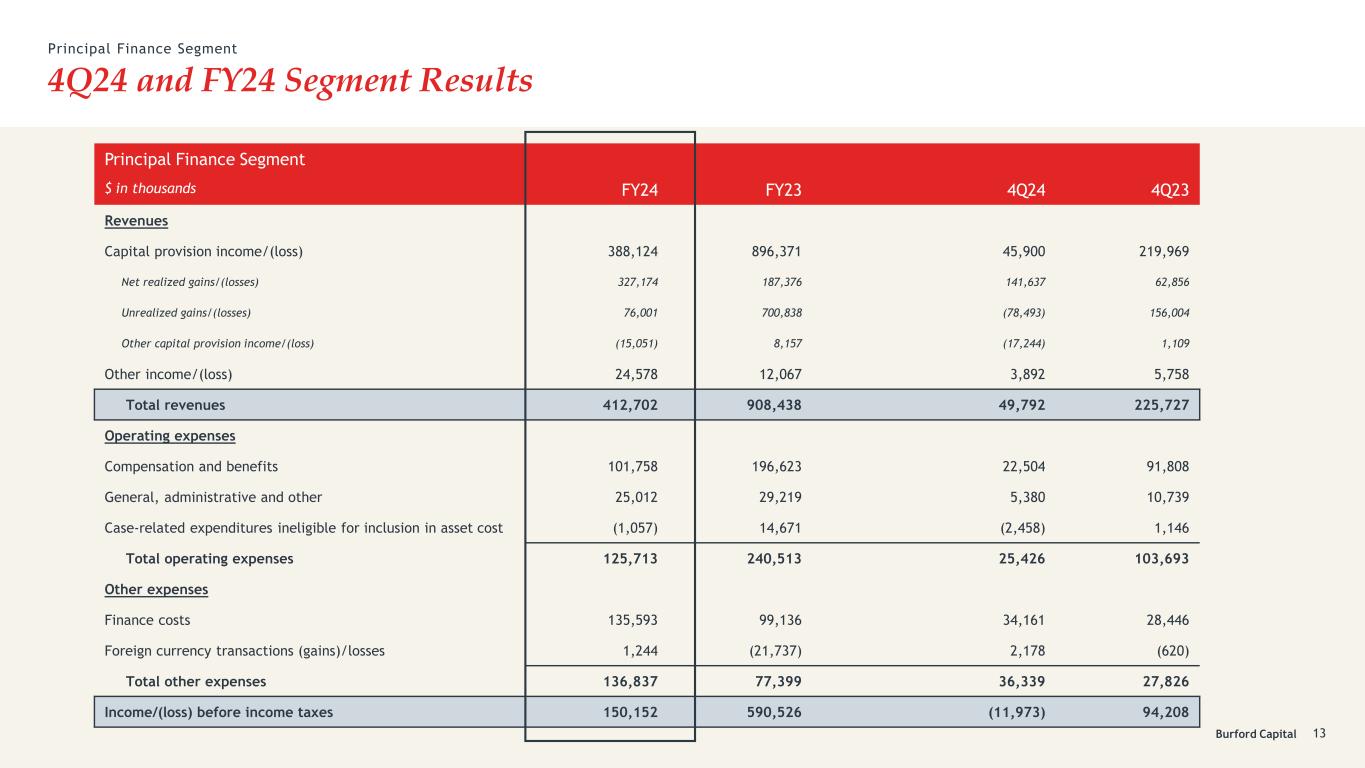

Burford Capital 4Q24 and FY24 Segment Results Principal Finance Segment Principal Finance Segment $ in thousands FY24 FY23 4Q24 4Q23 Revenues Capital provision income/(loss) 388,124 896,371 45,900 219,969 Net realized gains/(losses) 327,174 187,376 141,637 62,856 Unrealized gains/(losses) 76,001 700,838 (78,493) 156,004 Other capital provision income/(loss) (15,051) 8,157 (17,244) 1,109 Other income/(loss) 24,578 12,067 3,892 5,758 Total revenues 412,702 908,438 49,792 225,727 Operating expenses Compensation and benefits 101,758 196,623 22,504 91,808 General, administrative and other 25,012 29,219 5,380 10,739 Case-related expenditures ineligible for inclusion in asset cost (1,057) 14,671 (2,458) 1,146 Total operating expenses 125,713 240,513 25,426 103,693 Other expenses Finance costs 135,593 99,136 34,161 28,446 Foreign currency transactions (gains)/losses 1,244 (21,737) 2,178 (620) Total other expenses 136,837 77,399 36,339 27,826 Income/(loss) before income taxes 150,152 590,526 (11,973) 94,208 13

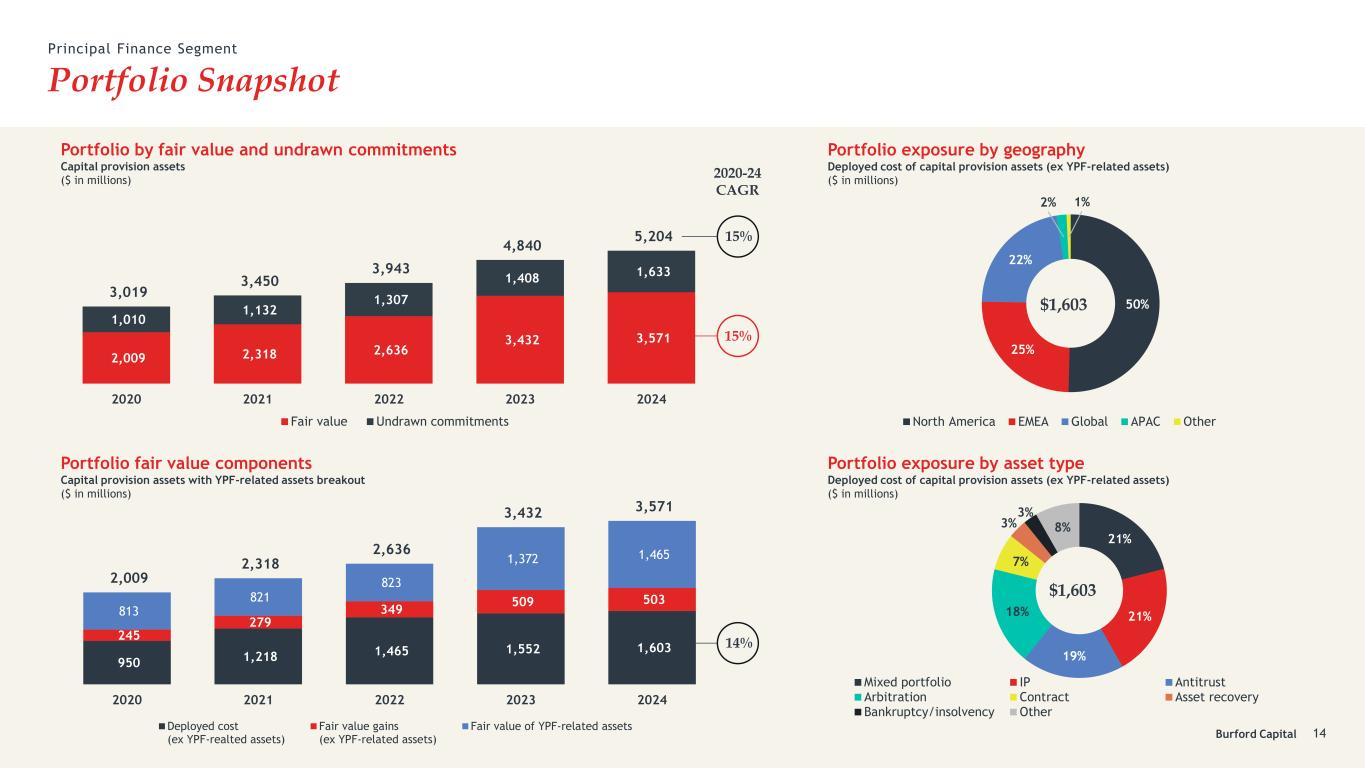

Burford Capital 21% 21% 19% 18% 7% 3% 3% 8% Mixed portfolio IP Antitrust Arbitration Contract Asset recovery Bankruptcy/insolvency Other Portfolio Snapshot Principal Finance Segment 14 2,009 2,318 2,636 3,432 3,571 1,010 1,132 1,307 1,408 1,633 3,019 3,450 3,943 4,840 5,204 2020 2021 2022 2023 2024 Fair value Undrawn commitments Portfolio by fair value and undrawn commitments Capital provision assets ($ in millions) 950 1,218 1,465 1,552 1,603 245 279 349 509 503 813 821 823 1,372 1,465 2,009 2,318 2,636 3,432 3,571 2020 2021 2022 2023 2024 Deployed cost (ex YPF-realted assets) Fair value gains (ex YPF-related assets) Fair value of YPF-related assets Portfolio fair value components Capital provision assets with YPF-related assets breakout ($ in millions) 50% 25% 22% 2% 1% North America EMEA Global APAC Other Portfolio exposure by geography Deployed cost of capital provision assets (ex YPF-related assets) ($ in millions) Portfolio exposure by asset type Deployed cost of capital provision assets (ex YPF-related assets) ($ in millions) 2020-24 CAGR 14% 15% 15% $1,603 $1,603

Burford Capital Capital Provision Income and Fair Value Bridge Principal Finance Segment ($ in millions) FY24 FY23 4Q24 4Q23 Net realized gains/(losses) 327,174 187,376 141,637 62,856 Unrealized gains/(losses), ex YPF-related assets (8,579) 157,929 (68,663) 72,602 Total realized and unrealized gains/(losses), ex YPF-related assets 318,595 345,305 72,974 135,458 Unrealized gains/(losses) from YPF-related assets 84,580 542,909 (9,830) 83,402 Other capital provision income/(loss) (15,051) 8,157 (17,244) 1,109 Total capital provision income/(loss) 388,124 896,371 45,900 219,969 15 3,653 3,571 129 59 61 65 256 18 Fair value at Sept 30, 2024 Deployments Duration impact (passage of time) Change in discount rate Milestones & other model impacts Realizations Foreign exchange impact Fair value at Dec 31, 2024 Fair value of capital provision assets ― FY24 and 4Q24 Bridge 3,432 3,571 399 243 6 166 647 16 Fair value at Dec 31, 2023 Deployments Duration impact (passage of time) Change in discount rate Milestones & other model impacts Realizations Foreign exchange impact Fair value at Dec 31, 2024 4Q24FY24 Income for the PeriodIncome for the Period 1) “Duration impact (passage of time)“ represents the change in fair value on assets that were held in the portfolio as of the beginning of the measurement period and continue to be held as of the end of the measurement period assuming there was no change to discount rate or any other inputs during the measurement period. 2) “Change in discount rate” represents the difference in fair value between using the actual discount rates in effect as of the end of the measurement period applied to the portfolio as of the end of the measurement period versus using the discount rates that were in effect as of the start of the measurement period applied to the portfolio as of the end of the measurement period. 3) “Milestones and other model impacts” represent all other change in fair value during the measurement period (realized or unrealized) attributable to all other input and model updates including the impact of litigation milestone events, changes in expected proceeds and changes in expected duration. (1) (2) (3)(1) (2) (3)

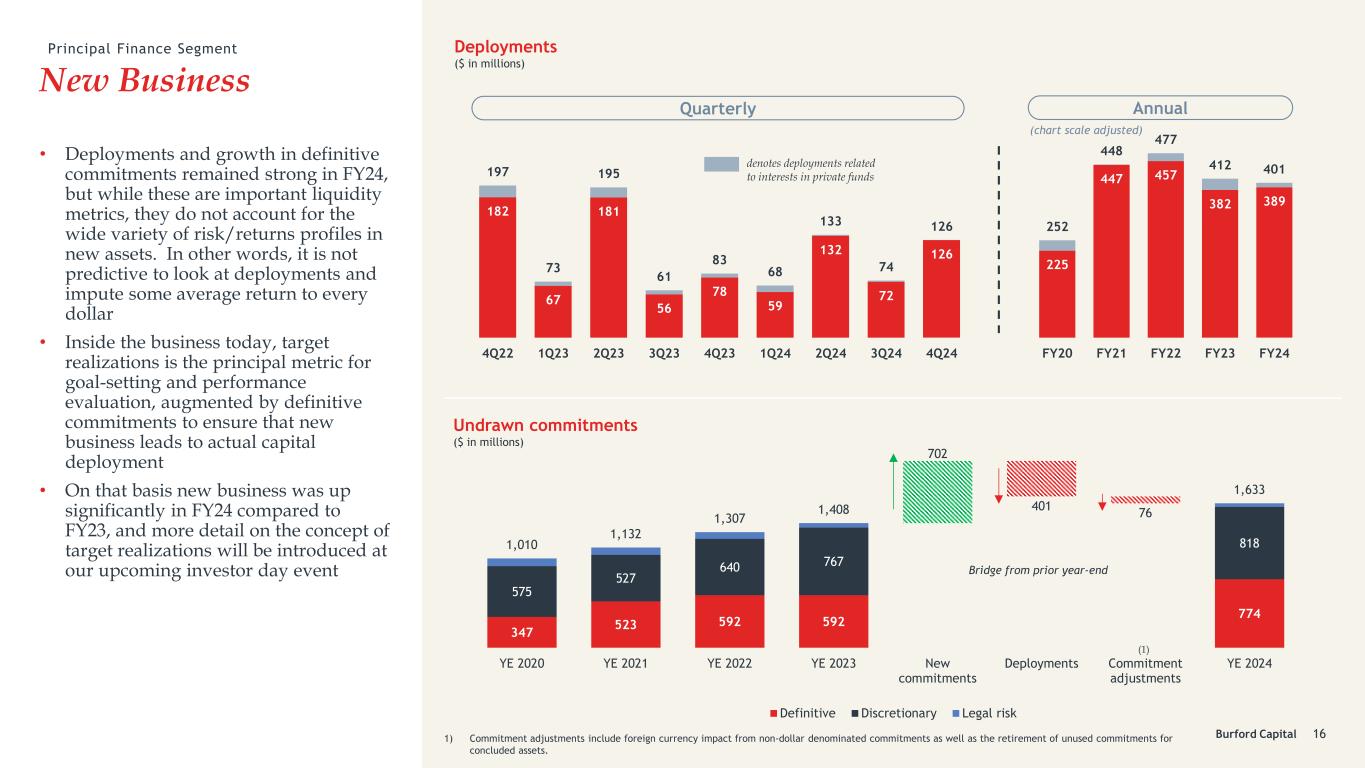

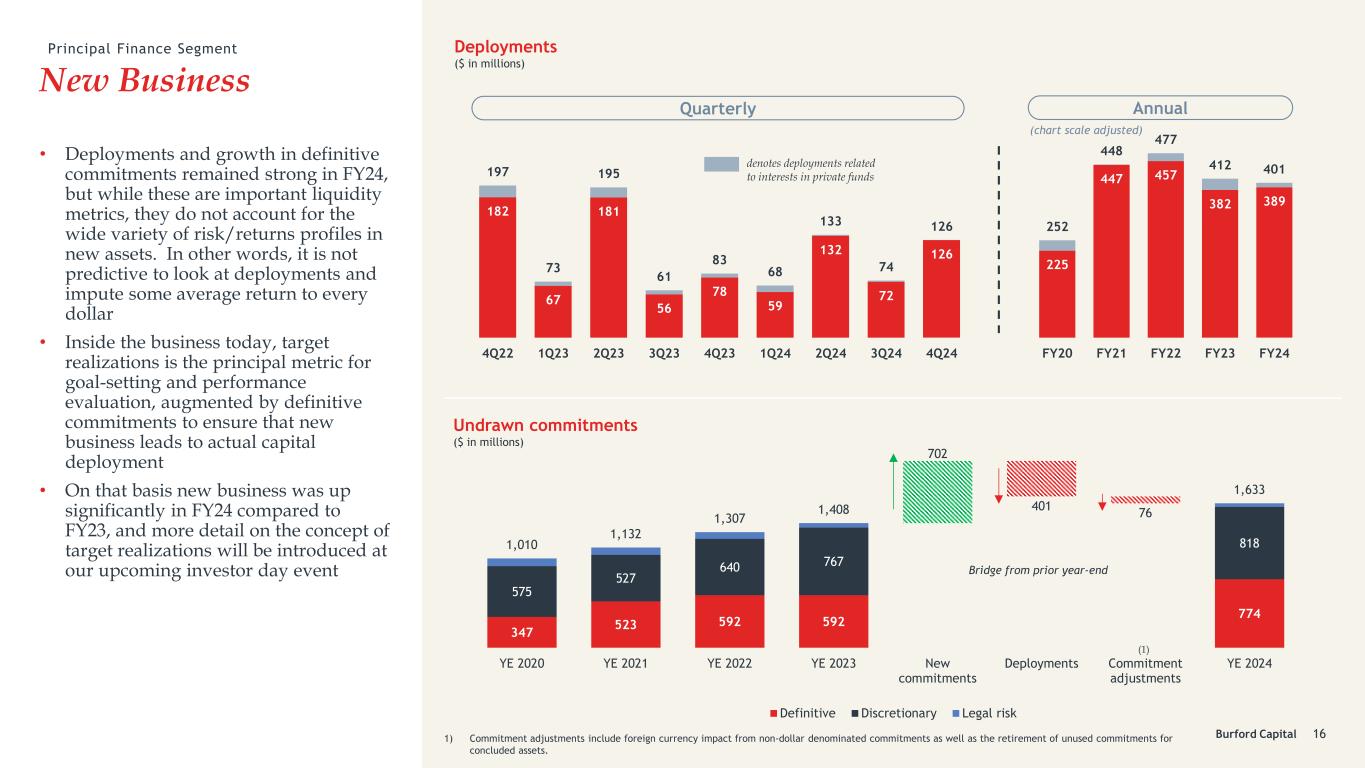

Burford Capital New Business Undrawn commitments ($ in millions) Deployments ($ in millions) 16 • Deployments and growth in definitive commitments remained strong in FY24, but while these are important liquidity metrics, they do not account for the wide variety of risk/returns profiles in new assets. In other words, it is not predictive to look at deployments and impute some average return to every dollar • Inside the business today, target realizations is the principal metric for goal-setting and performance evaluation, augmented by definitive commitments to ensure that new business leads to actual capital deployment • On that basis new business was up significantly in FY24 compared to FY23, and more detail on the concept of target realizations will be introduced at our upcoming investor day event 347 523 592 592 774 575 527 640 767 818 702 401 76 1,010 1,132 1,307 1,408 1,633 YE 2020 YE 2021 YE 2022 YE 2023 New commitments Deployments Commitment adjustments YE 2024 Definitive Discretionary Legal risk 182 67 181 56 78 59 132 72 126 197 73 195 61 83 68 133 74 126 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 Principal Finance Segment 225 447 457 382 389 252 448 477 412 401 FY20 FY21 FY22 FY23 FY24 Quarterly Annual (chart scale adjusted) denotes deployments related to interests in private funds Bridge from prior year-end (1) 1) Commitment adjustments include foreign currency impact from non-dollar denominated commitments as well as the retirement of unused commitments for concluded assets.

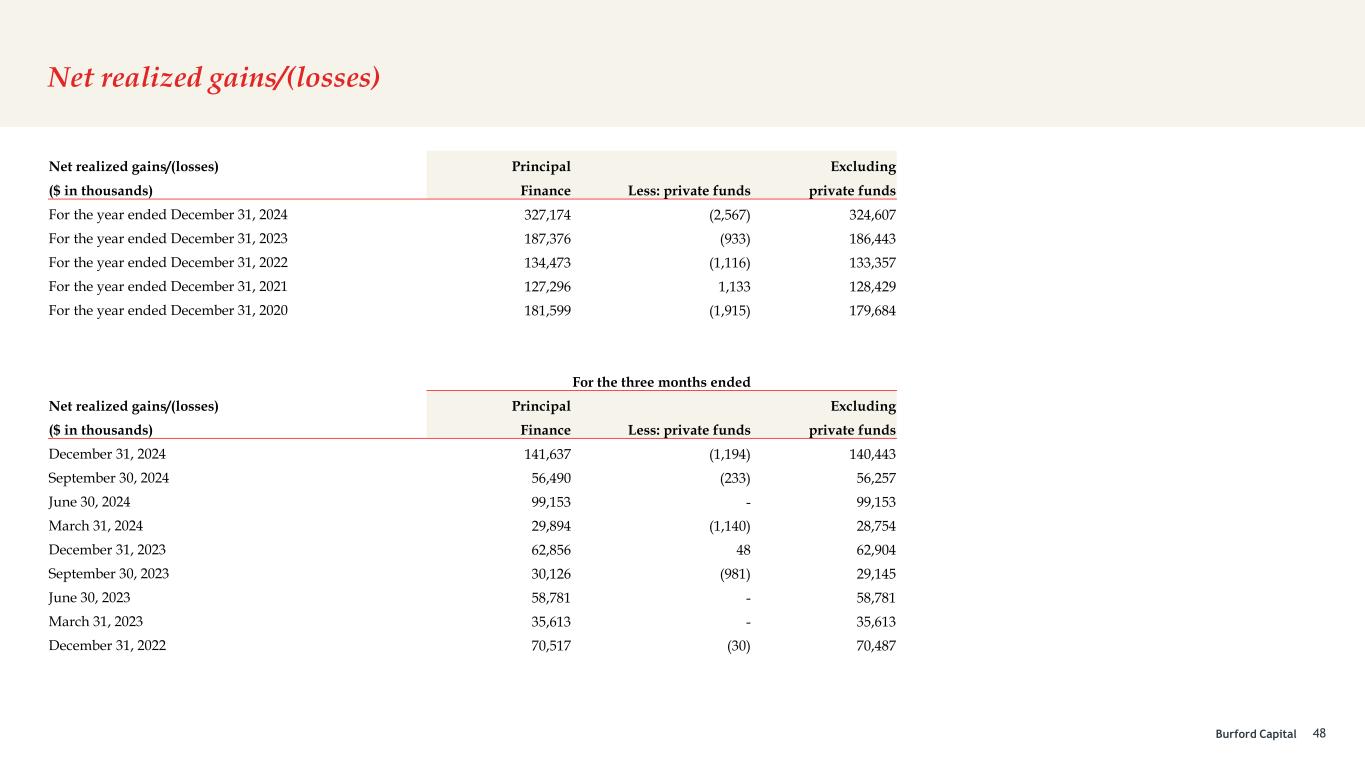

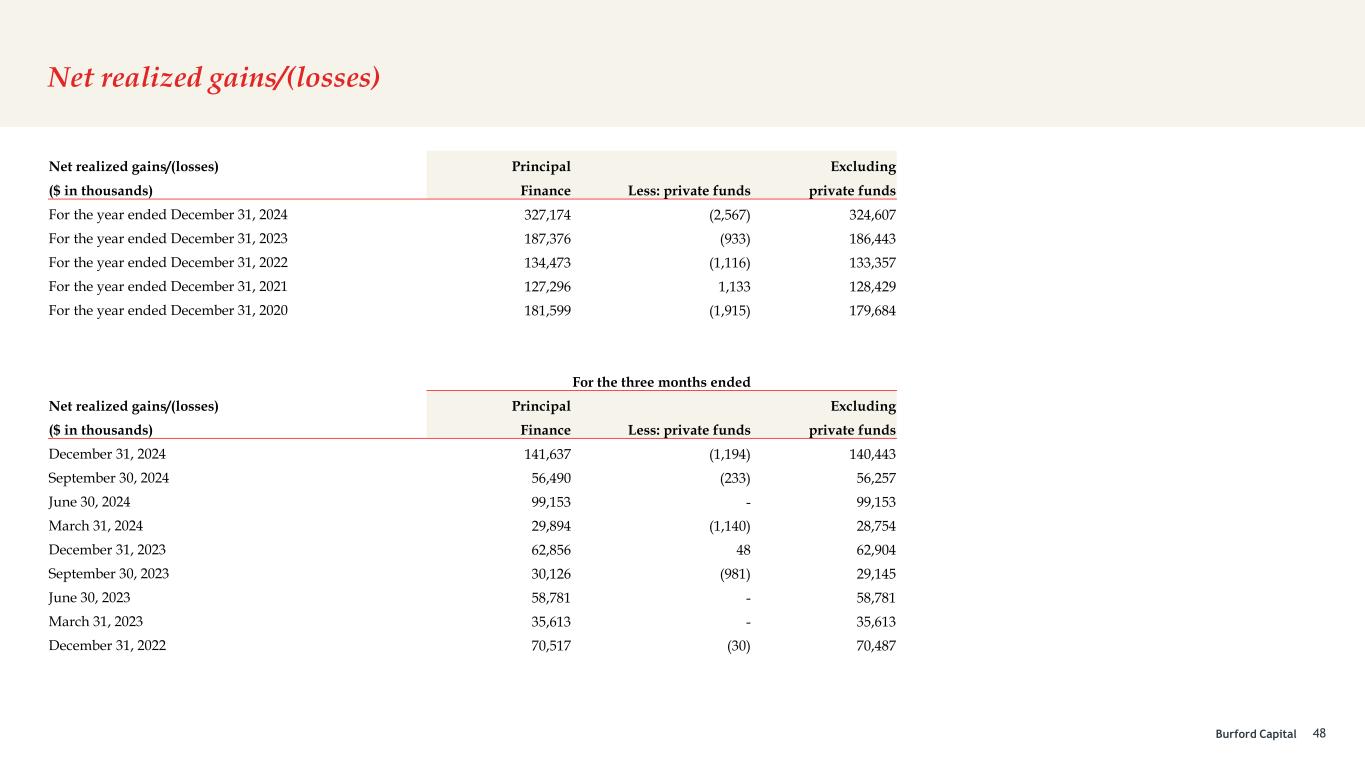

Burford Capital Portfolio Realizations and Realized Gains • Realizations of $641 million in FY24 were an annual record and up 21% compared to FY23 • FY24 realizations were well diversified, with seven assets each generating more than $20 million in realizations o Three of those seven generated $50 million or more o Four of those seven were from pre- 2020 vintages and generated $187 million • Very strong ROICs in 2Q24 (179%) and 4Q24 (135%) pushed FY24 ROIC up to 108%, the highest annual result since FY20 and well above historical average • Net realized gains of $327 million in FY24 were an annual record by a wide margin and more than double the average annual net realized gains over the prior four years 17 Realizations ($ in millions) Principal Finance Segment Principal Finance 71 36 59 30 63 30 99 56 142 excluding private fund interests 70 36 59 29 63 29 99 56 140 Implied ROIC1 81% 136% 79% 58% 40% 89% 179% 52% 135% 1) Implied ROIC excludes the impact of amounts related to balance sheet commitments to private funds (formerly referred to as capital provision-indirect). 158 62 133 79 222 61 155 165 244 158 64 138 93 237 63 157 168 253 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 337 264 350 496 625 509 299 361 531 641 FY20 FY21 FY22 FY23 FY24 Quarterly Annual (chart scale adjusted) denotes realizations related to interests in private funds 182 127 134 187 327 180 128 133 186 325 114% 95% 61% 60% 108% Net Realized Gains ($ in millions)

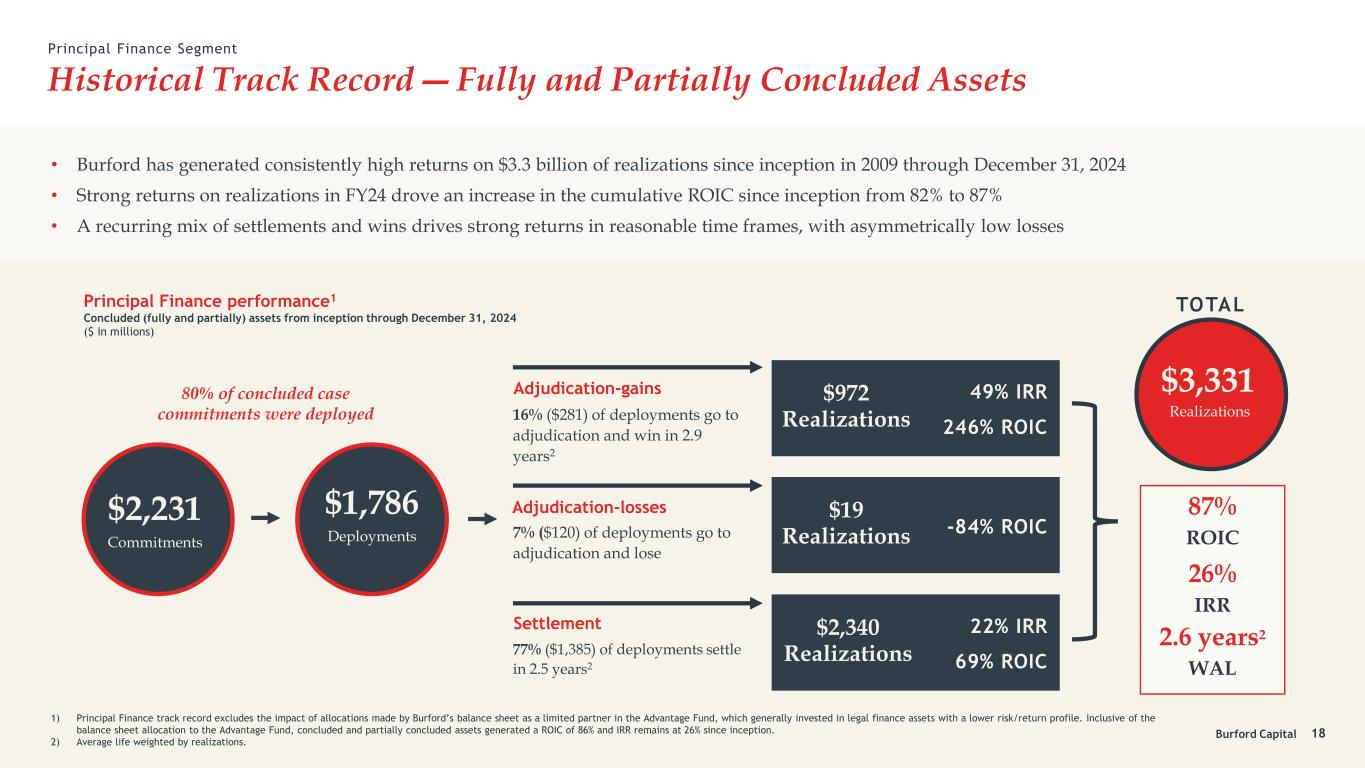

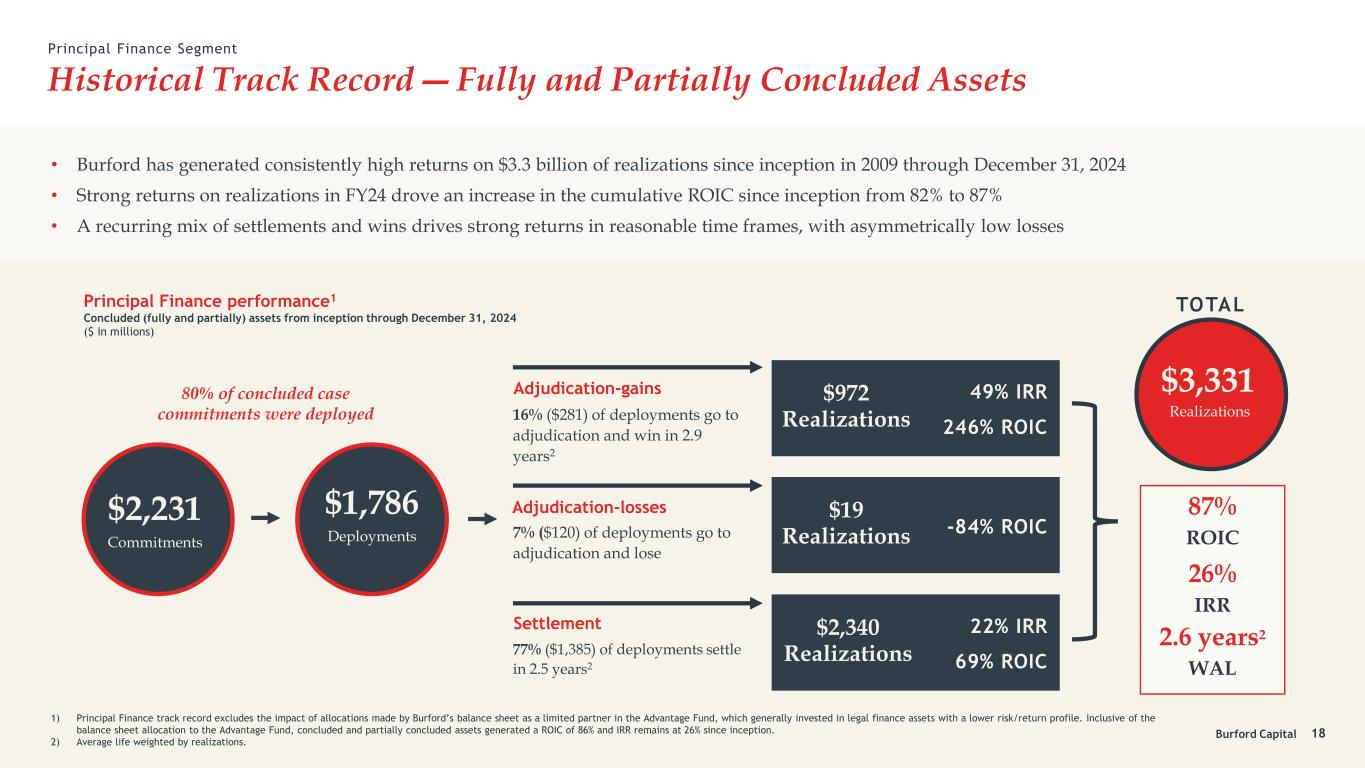

Burford Capital Historical Track Record ― Fully and Partially Concluded Assets 18 $16 Recoveries $889 Recoveries $956 Recoveries Principal Finance performance1 Concluded (fully and partially) assets from inception through December 31, 2024 ($ in millions) 1) Principal Finance track record excludes the impact of allocations made by Burford’s balance sheet as a limited partner in the Advantage Fund, which generally invested in legal finance assets with a lower risk/return profile. Inclusive of the balance sheet allocation to the Advantage Fund, concluded and partially concluded assets generated a ROIC of 86% and IRR remains at 26% since inception. 2) Average life weighted by realizations. • Burford has generated consistently high returns on $3.3 billion of realizations since inception in 2009 through December 31, 2024 • Strong returns on realizations in FY24 drove an increase in the cumulative ROIC since inception from 82% to 87% • A recurring mix of settlements and wins drives strong returns in reasonable time frames, with asymmetrically low losses 80% of concluded case commitments were deployed $2,231 Commitments Adjudication-losses 77% ($1,385) of deployments settle in 2.5 years2 Settlement 7% ($120) of deployments go to adjudication and lose 16% ($281) of deployments go to adjudication and win in 2.9 years2 Adjudication-gains $972 Realizations 49% IRR 246% ROIC $1,786 Deployments $3,331 Realizations $19 Realizations -84% ROIC $2,340 Realizations 22% IRR 69% ROIC 87% ROIC 26% IRR 2.6 years2 WAL TOTAL Principal Finance Segment

Burford Capital -100 0 100 200 300 400 500 600 Net loss < $1m 0% or less ROIC 0% to 99% ROIC 100% to 199% ROIC 200%+ ROIC • Favorable risk-adjusted return dynamics exemplified by the positive skew of the distribution of returns since inception • Since inception through December 31, 2024, 50 matters (including 11 matters in FY24) representing 14% of the total deployed cost of concluded cases have generated ROICs greater than 200%, showing repeatable nature of Burford’s business • 14% of deployments experienced losses, but when that occurred, we recovered 32% of deployed cost, resulting in a 9.5% lifetime loss rate on fully and partially concluded assets 0% or less ROIC 0 to 99% ROIC 100 to 199% ROIC Greater than 200% ROIC Total Deployed: Realized losses: Deployed: Realized gains: Deployed: Realized gains: Deployed: Realized gains: Deployed: Realized losses: Realized gains: $250 ($169) $1,066 $446 $224 $317 $246 $951 $1,786 ($169) $1,715 14% of total 60% of total 26% of total 12% of total 18% of total 14% of total 56% of total Concluded (fully and partially) assets arrayed by ROIC From inception through December 31, 2024 ($ in millions) Cumulative weighted average ROIC 87% Gains Losses >700 % RO IC 19 1 1) Reflects fully and partially concluded assets with a ROIC of 0% or less where the net loss is below $1 million. Asset ROIC Distribution ― Asymmetric Returns Principal Finance Segment

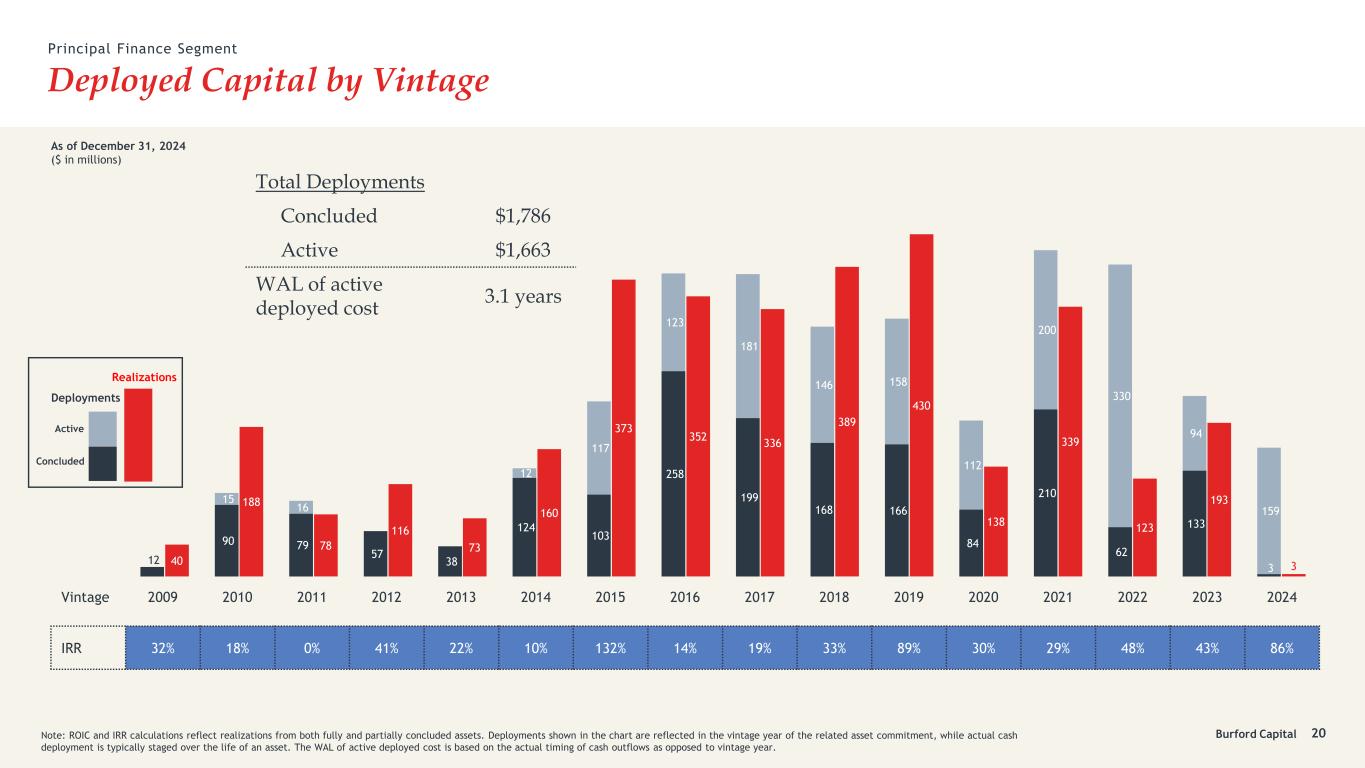

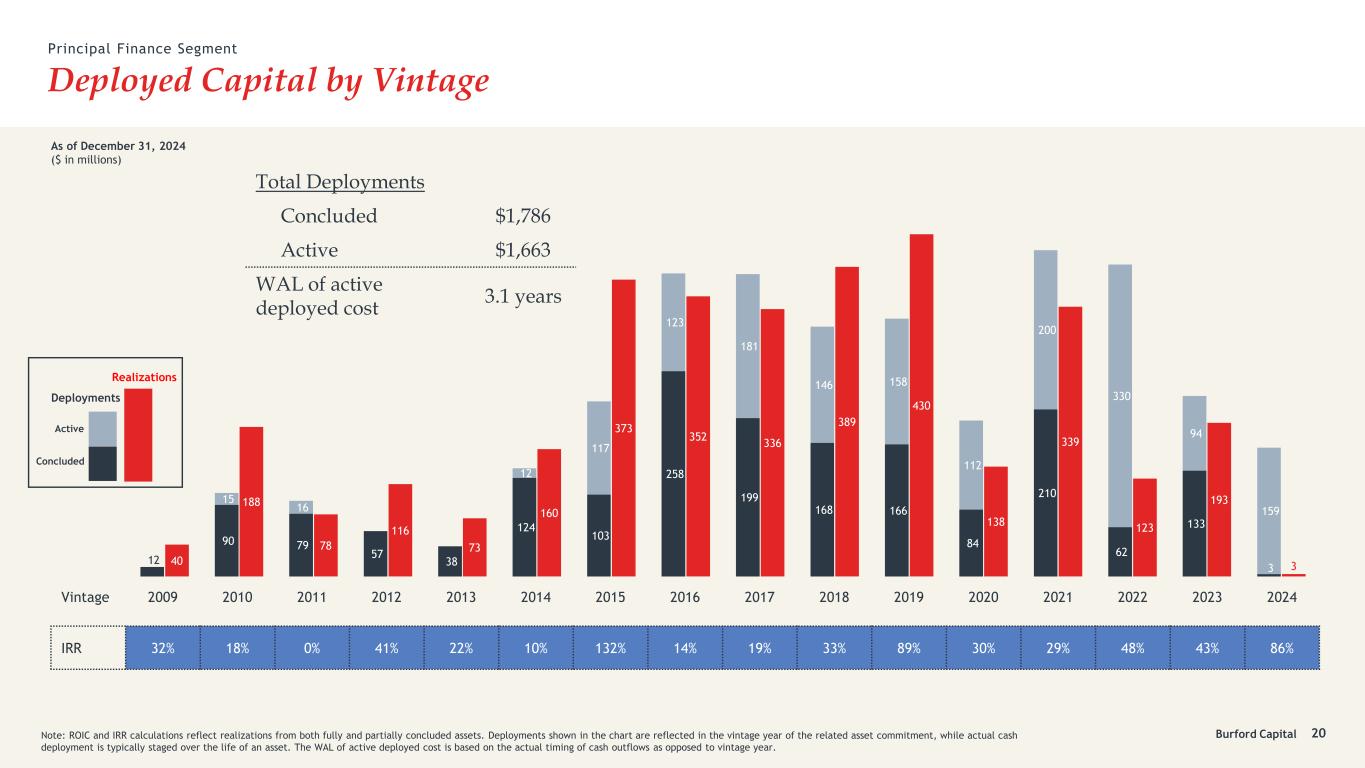

Burford Capital Deployed Capital by Vintage Principal Finance Segment 20 12 90 79 57 38 124 103 258 199 168 166 84 210 62 133 3 15 16 12 117 123 181 146 158 112 200 330 94 159 40 188 78 116 73 160 373 352 336 389 430 138 339 123 193 3 As of December 31, 2024 ($ in millions) Note: ROIC and IRR calculations reflect realizations from both fully and partially concluded assets. Deployments shown in the chart are reflected in the vintage year of the related asset commitment, while actual cash deployment is typically staged over the life of an asset. The WAL of active deployed cost is based on the actual timing of cash outflows as opposed to vintage year. Vintage 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 IRR 32% 18% 0% 41% 22% 10% 132% 14% 19% 33% 89% 30% 29% 48% 43% 86% Total Deployments Concluded $1,786 Active $1,663 WAL of active deployed cost 3.1 years Deployments Active Concluded Realizations

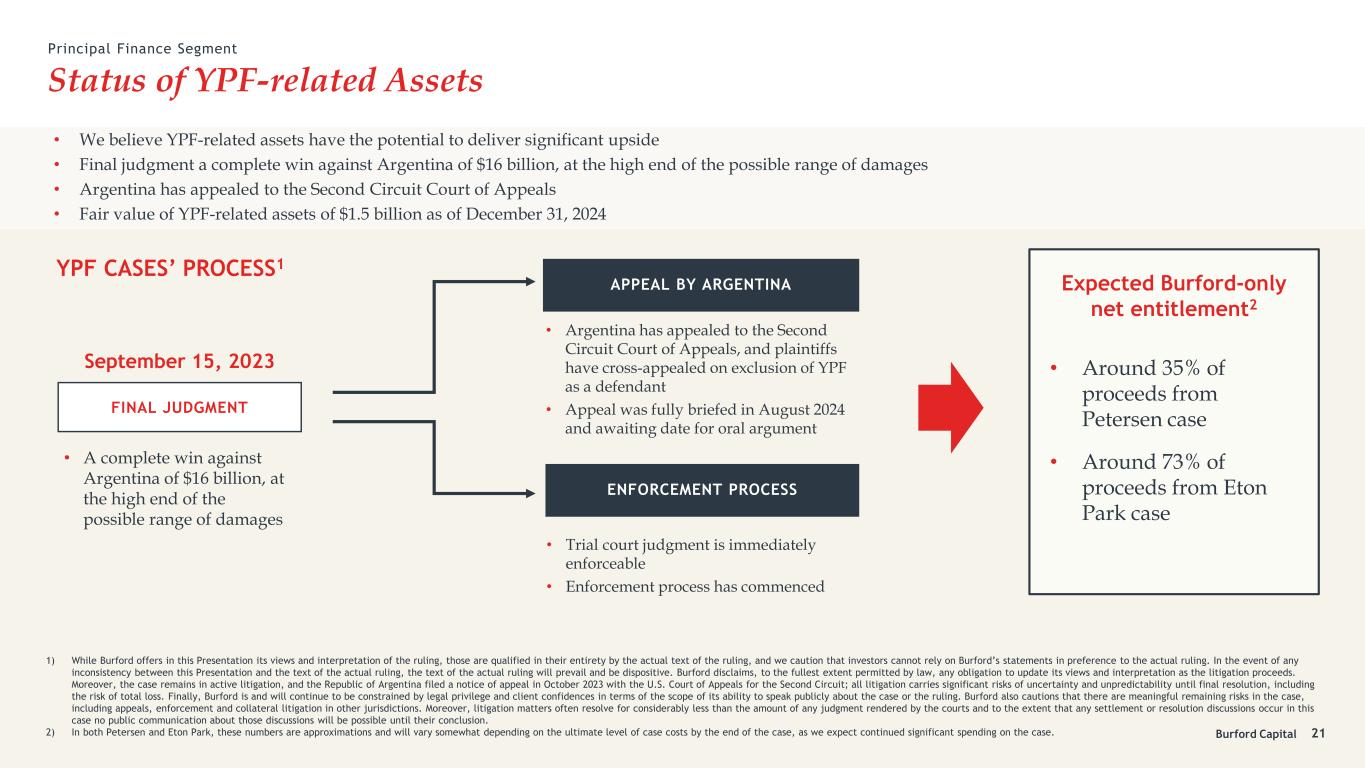

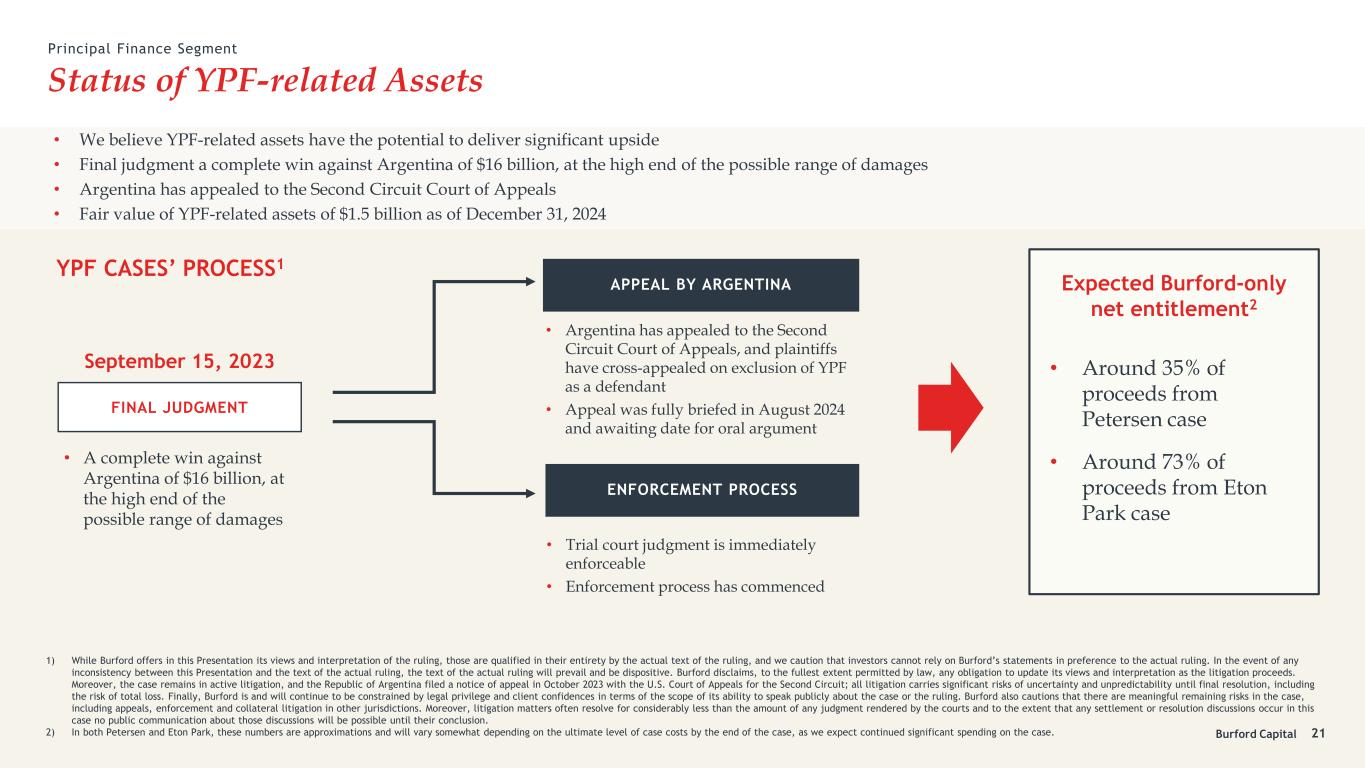

Burford Capital Status of YPF-related Assets • We believe YPF-related assets have the potential to deliver significant upside • Final judgment a complete win against Argentina of $16 billion, at the high end of the possible range of damages • Argentina has appealed to the Second Circuit Court of Appeals • Fair value of YPF-related assets of $1.5 billion as of December 31, 2024 YPF CASES’ PROCESS1 September 15, 2023 21 1) While Burford offers in this Presentation its views and interpretation of the ruling, those are qualified in their entirety by the actual text of the ruling, and we caution that investors cannot rely on Burford’s statements in preference to the actual ruling. In the event of any inconsistency between this Presentation and the text of the actual ruling, the text of the actual ruling will prevail and be dispositive. Burford disclaims, to the fullest extent permitted by law, any obligation to update its views and interpretation as the litigation proceeds. Moreover, the case remains in active litigation, and the Republic of Argentina filed a notice of appeal in October 2023 with the U.S. Court of Appeals for the Second Circuit; all litigation carries significant risks of uncertainty and unpredictability until final resolution, including the risk of total loss. Finally, Burford is and will continue to be constrained by legal privilege and client confidences in terms of the scope of its ability to speak publicly about the case or the ruling. Burford also cautions that there are meaningful remaining risks in the case, including appeals, enforcement and collateral litigation in other jurisdictions. Moreover, litigation matters often resolve for considerably less than the amount of any judgment rendered by the courts and to the extent that any settlement or resolution discussions occur in this case no public communication about those discussions will be possible until their conclusion. 2) In both Petersen and Eton Park, these numbers are approximations and will vary somewhat depending on the ultimate level of case costs by the end of the case, as we expect continued significant spending on the case. FINAL JUDGMENT • A complete win against Argentina of $16 billion, at the high end of the possible range of damages Expected Burford-only net entitlement2 • Around 35% of proceeds from Petersen case • Around 73% of proceeds from Eton Park case APPEAL BY ARGENTINA • Argentina has appealed to the Second Circuit Court of Appeals, and plaintiffs have cross-appealed on exclusion of YPF as a defendant • Appeal was fully briefed in August 2024 and awaiting date for oral argument ENFORCEMENT PROCESS • Trial court judgment is immediately enforceable • Enforcement process has commenced Principal Finance Segment

Segments: Asset Management and Other Services

Burford Capital 4Q24 and FY24 Segment Results Asset Management and Other Services Segment Asset Management and Other Services Segment $ in thousands FY24 FY23 4Q24 4Q23 Revenues Asset management income 44,627 63,712 15,357 22,530 Other income/(loss) 3,051 4,392 543 2,358 Total revenues 47,678 68,104 15,900 24,888 Operating expenses Compensation and benefits 21,901 24,461 13,529 17,539 General, administrative and other 5,440 3,564 1,122 (3,071) Case-related expenditures ineligible for inclusion in asset cost -- -- -- -- Total operating expenses 27,341 28,025 14,651 14,468 Other expenses Finance costs -- -- -- -- Foreign currency transactions (gains)/losses -- -- -- -- Total other expenses -- -- -- -- Income/(loss) before income taxes 20,337 40,079 1,249 10,420 23

Burford Capital 11 11 7 8 7 6 6 2 2 12 12 47 56 36 29 29 56 64 45 FY20 FY21 FY22 FY23 FY24 Management fees Performance fees Income from profit sharing Asset Management Income and Portfolio • Asset management income of $45 million in FY24 was down from $64 million in FY23, with lower profit- sharing income from BOF-C driven by lower capital provision income from underlying assets • Cash receipts from asset management of $26 million in FY24, down from $32 million in FY23, but down proportionately less than asset management income • Fair value and undrawn commitments within private funds totaled $2.2 billion as of December 31, 2024, with BOF-C higher and other private funds lower compared to December 31, 2023 • BOF-C is currently the most significant driver of asset management income, and had $845 million of active commitments and $452 million of active deployments as of December 31, 2024 24 Asset management income ($ in millions) 1) Represents third-party fair value and undrawn commitments. 1,161 1,200 1,315 1,285 1,103 421 683 889 1,045 1,082 1,582 1,883 2,204 2,330 2,185 FY20 FY21 FY22 FY23 FY24 Funds BOF-C Portfolio of private funds1 As of period end ($ in millions) Asset Management and Other Services Segment 16 18 15 32 26 FY20 FY21 FY22 FY23 FY24 Cash receipts from asset management ($ in millions)

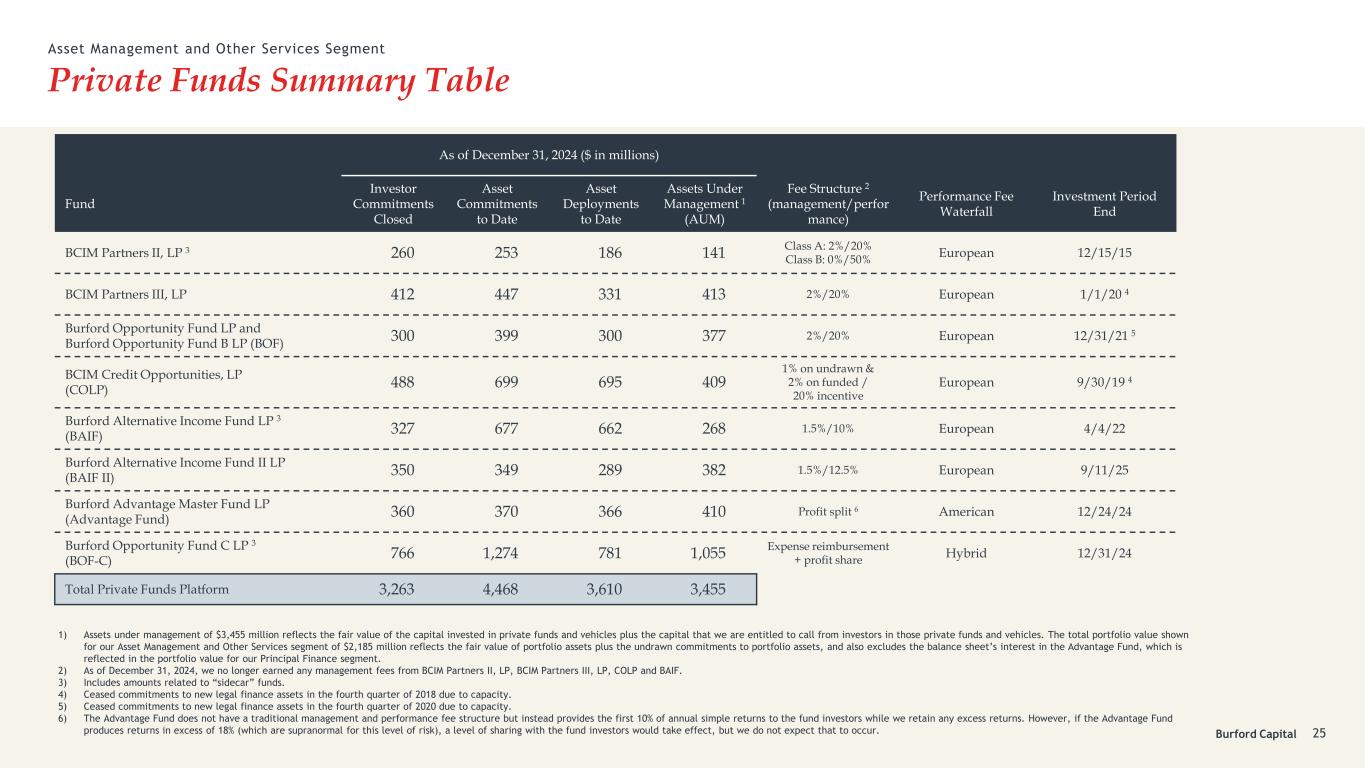

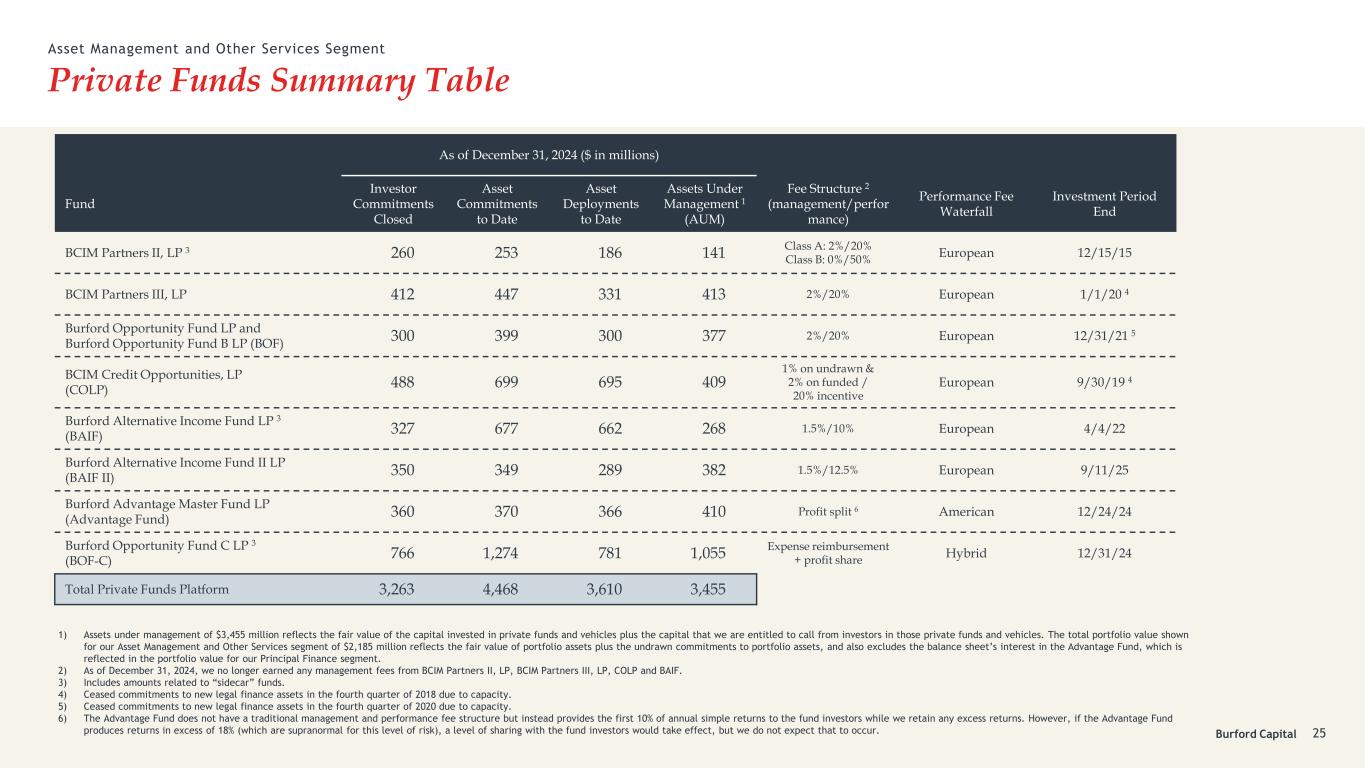

Burford Capital Private Funds Summary Table Asset Management and Other Services Segment 25 As of December 31, 2024 ($ in millions) Fund Investor Commitments Closed Asset Commitments to Date Asset Deployments to Date Assets Under Management 1 (AUM) Fee Structure 2 (management/perfor mance) Performance Fee Waterfall Investment Period End BCIM Partners II, LP 3 260 253 186 141 Class A: 2%/20% Class B: 0%/50% European 12/15/15 BCIM Partners III, LP 412 447 331 413 2%/20% European 1/1/20 4 Burford Opportunity Fund LP and Burford Opportunity Fund B LP (BOF) 300 399 300 377 2%/20% European 12/31/21 5 BCIM Credit Opportunities, LP (COLP) 488 699 695 409 1% on undrawn & 2% on funded / 20% incentive European 9/30/19 4 Burford Alternative Income Fund LP 3 (BAIF) 327 677 662 268 1.5%/10% European 4/4/22 Burford Alternative Income Fund II LP (BAIF II) 350 349 289 382 1.5%/12.5% European 9/11/25 Burford Advantage Master Fund LP (Advantage Fund) 360 370 366 410 Profit split 6 American 12/24/24 Burford Opportunity Fund C LP 3 (BOF-C) 766 1,274 781 1,055 Expense reimbursement + profit share Hybrid 12/31/24 Total Private Funds Platform 3,263 4,468 3,610 3,455 1) Assets under management of $3,455 million reflects the fair value of the capital invested in private funds and vehicles plus the capital that we are entitled to call from investors in those private funds and vehicles. The total portfolio value shown for our Asset Management and Other Services segment of $2,185 million reflects the fair value of portfolio assets plus the undrawn commitments to portfolio assets, and also excludes the balance sheet’s interest in the Advantage Fund, which is reflected in the portfolio value for our Principal Finance segment. 2) As of December 31, 2024, we no longer earned any management fees from BCIM Partners II, LP, BCIM Partners III, LP, COLP and BAIF. 3) Includes amounts related to “sidecar” funds. 4) Ceased commitments to new legal finance assets in the fourth quarter of 2018 due to capacity. 5) Ceased commitments to new legal finance assets in the fourth quarter of 2020 due to capacity. 6) The Advantage Fund does not have a traditional management and performance fee structure but instead provides the first 10% of annual simple returns to the fund investors while we retain any excess returns. However, if the Advantage Fund produces returns in excess of 18% (which are supranormal for this level of risk), a level of sharing with the fund investors would take effect, but we do not expect that to occur.

Liquidity and Capital Management

Burford Capital Liquidity Bridge and Cash Receipts A. Cash and marketable securities as of December 31, 2023 B. Cash receipts C. Proceeds from debt issuance, net of debt purchases, interest and debt issuance costs D. Operating expenses net of change in payables E. Dividends and acquisitions of ordinary shares into treasury F. Cash balance before deployments G. Burford-only deployments H. Cash and marketable securities as of December 31, 2024 27 699 75 123 32 401 303 922 521 A B C D E F G H FY24 cash bridge Burford-only ($ in millions) Cash receipts Burford-only ($ in millions) • Cash and marketable securities were $521 million as of December 31, 2024, up from $303 million as of December 31, 2023 driven by record cash receipts during FY24 • A portion of current liquidity supports upcoming debt maturity of $129 million in August 2025 • Burford-only cash receipts of $699 million in FY24 were up 43% from FY23 and represent an annual record by a wide margin • Due from settlement balance of $184 million as of December 31, 2024 was flat compared to $185 million as of December 31, 2023, however 97% of the prior period balance was collected during FY24 and replaced with additional due from settlement receivables during FY24 99 97 150 133 109 138 107 310 144 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 519 281 328 489 699 FY20 FY21 FY22 FY23 FY24 Quarterly Annual (chart scale adjusted)

Burford Capital Operating Expenses 28 Operating expense detail Total Segments (Burford-only) ($ in millions) • In FY24, operating expenses fell 43% year on year, primarily due to a 66% decrease in long-term incentive compensation, attributable mainly to the absence in FY24 of extraordinary fair value increases in the YPF-related assets • Lower share-based and deferred compensation primarily reflected movements in market value of underlying deferred compensation plan investments including Burford stock • Case-related expenditures were also sharply lower due to the resolution of certain assets in FY23 and recoveries from an insurance policy in FY24 • Operating expenses as a percentage of total revenues remained well below 2020-22 levels, despite the non- recurrence of extraordinary unrealized gains in YPF-related assets • As a proportion of group-wide portfolio, operating expenses were at the low end of a recent range of 2.0- 2.5%, even without significant growth in portfolio fair value in FY24 $ in thousands FY24 FY23 4Q24 4Q23 Compensation and benefits Salaries and benefits 42,418 39,788 9,657 10,951 Annual incentive compensation 29,210 32,697 14,707 16,916 Share-based and deferred compensation 8,822 21,128 1,673 5,944 Long-term incentive compensation including accruals 43,209 127,471 9,996 75,536 Total compensation and benefits 123,659 221,084 36,033 109,347 General, administrative and other 30,452 32,783 6,502 7,668 Case-related expenditures ineligible for inclusion in asset cost (1,057) 14,671 (2,458) 1,146 Total operating expenses 153,054 268,538 40,077 118,161 2.7% 1.0% 2.5% 2.7% 2.0% 3.7% 2.1% 2020 2021 2022 2023 2024 2023 carry accrual from YPF-related assets Operating expenses as % of total revenues Total Segments (Burford-only) Operating expenses as % of group-wide portfolio Total Segments (Burford-only) As of period end 25% 59% 34% 23% 27% 12% 17% 15% 4% 6% 37% 76% 49% 27% 33% 2020 2021 2022 2023 2024 Compensation and benefits Other

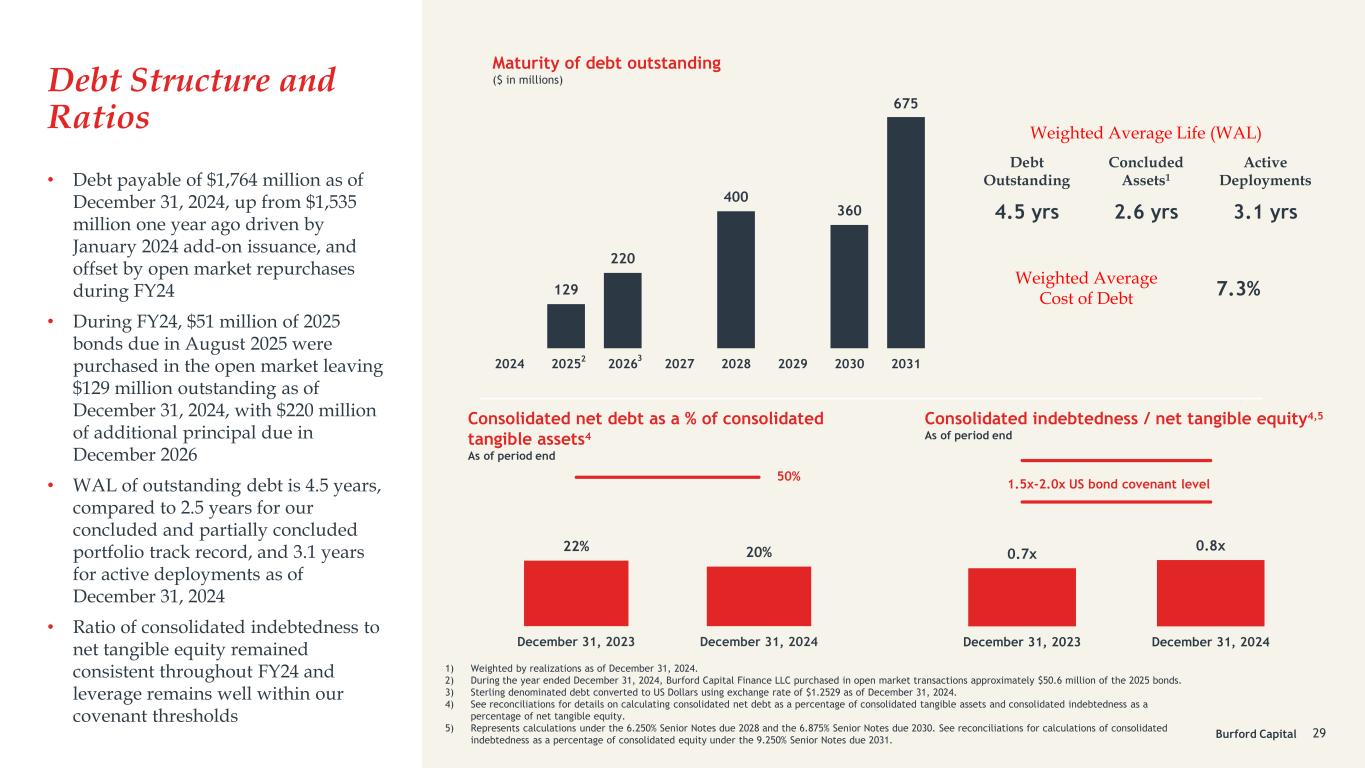

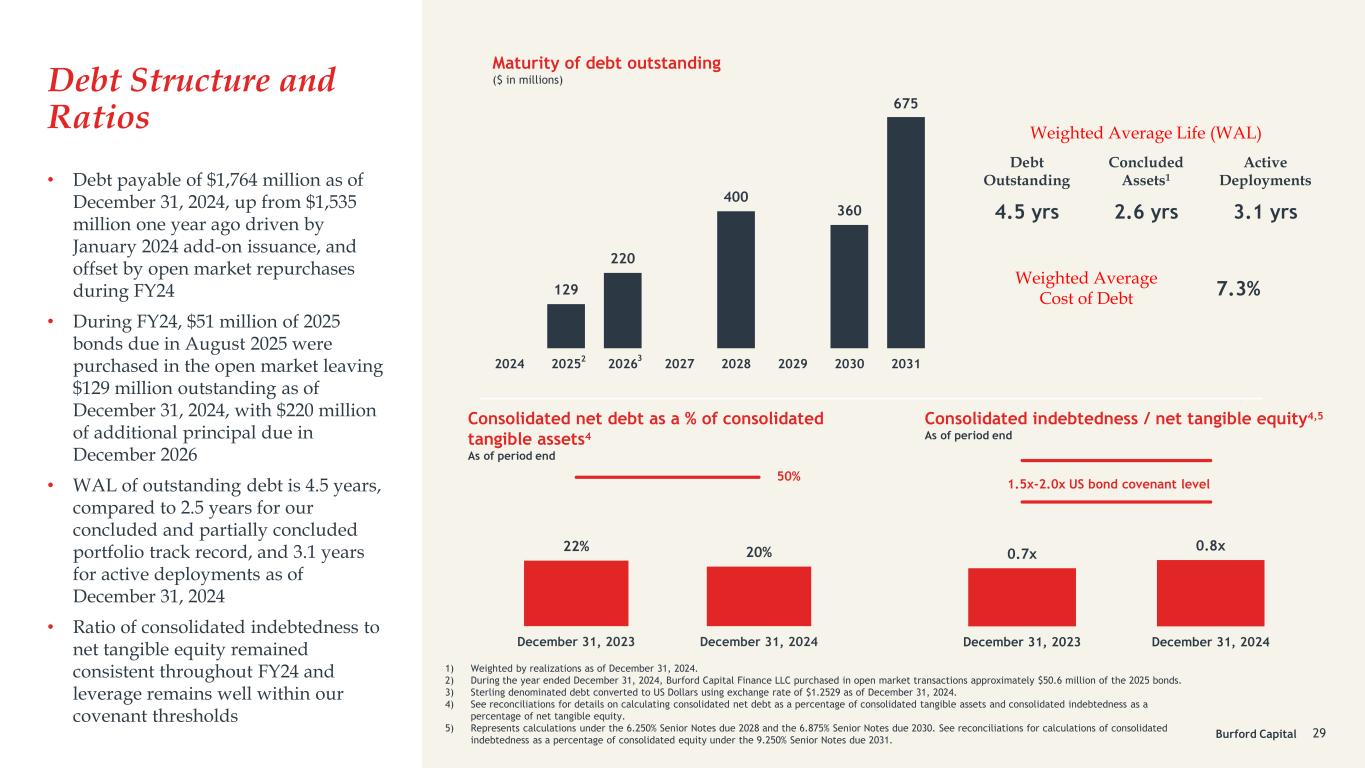

Burford Capital 0.7x 0.8x December 31, 2023 December 31, 2024 1.5x-2.0x US bond covenant level 22% 20% 50% December 31, 2023 December 31, 2024 Debt Structure and Ratios • Debt payable of $1,764 million as of December 31, 2024, up from $1,535 million one year ago driven by January 2024 add-on issuance, and offset by open market repurchases during FY24 • During FY24, $51 million of 2025 bonds due in August 2025 were purchased in the open market leaving $129 million outstanding as of December 31, 2024, with $220 million of additional principal due in December 2026 • WAL of outstanding debt is 4.5 years, compared to 2.5 years for our concluded and partially concluded portfolio track record, and 3.1 years for active deployments as of December 31, 2024 • Ratio of consolidated indebtedness to net tangible equity remained consistent throughout FY24 and leverage remains well within our covenant thresholds 29 1) Weighted by realizations as of December 31, 2024. 2) During the year ended December 31, 2024, Burford Capital Finance LLC purchased in open market transactions approximately $50.6 million of the 2025 bonds. 3) Sterling denominated debt converted to US Dollars using exchange rate of $1.2529 as of December 31, 2024. 4) See reconciliations for details on calculating consolidated net debt as a percentage of consolidated tangible assets and consolidated indebtedness as a percentage of net tangible equity. 5) Represents calculations under the 6.250% Senior Notes due 2028 and the 6.875% Senior Notes due 2030. See reconciliations for calculations of consolidated indebtedness as a percentage of consolidated equity under the 9.250% Senior Notes due 2031. Consolidated net debt as a % of consolidated tangible assets4 As of period end Consolidated indebtedness / net tangible equity4,5 As of period end Maturity of debt outstanding ($ in millions) 129 220 400 360 675 2024 2025 2026 2027 2028 2029 2030 203132 Weighted Average Life (WAL) Debt Outstanding Concluded Assets1 Active Deployments 4.5 yrs 2.6 yrs 3.1 yrs Weighted Average Cost of Debt 7.3%

Burford Capital Four Pillars of Burford’s Value Proposition 30 Core portfolio • Principal Finance cumulative realizations since inception through December 31, 2024 of $3.3 billion with an 87% ROIC (up from 82% as of December 31, 2023) and a 26% IRR • Group-wide portfolio of $7.4 billion as of December 31, 2024 • Cash generation momentum accelerated in FY24 with a record $641 million of Principal Finance realizations from a mix of pre- and post-pandemic vintages Origination platform • Market leader1 with 160 full-time employees as of December 31, 2024, including 47 lawyers on staff, across our offices in the US, UK, UAE and Singapore and other jurisdictions around the world where we do not have formal offices • Scale and scope enable Burford to structure large transactions for major law firms and corporates, including two Fortune 50 companies • New business generation continued to thrive in FY24 with $886 million of group-wide new commitments Asset management • Asset manager for eight private funds focused on pre-settlement, post-settlement and lower risk legal finance with $3.5 billion in AUM as of December 31, 2024 • Arrangement with sovereign wealth fund (BOF-C) a key driver of Burford-only asset management income, producing 80% of FY24 asset management income and $171 million since BOF-C’s inception in December 2018 YPF-related assets2 • Enforcement of $16 billion final judgment against Argentina has commenced • Fair value of YPF-related assets of $1.5 billion on a Burford-only basis as of December 31, 2024 • YPF-related assets have already produced $236 million in realizations, more than 3x total deployed capital 1. 2. 3. 4. 1 Litigation Finance Insider, at https://litigationfinanceinsider.com/c/league-leaders/. 2 See slide 21 for additional information with respect to the YPF appeal and enforcement processes and related disclaimers.

Consolidated Financial Statement Reconciliations

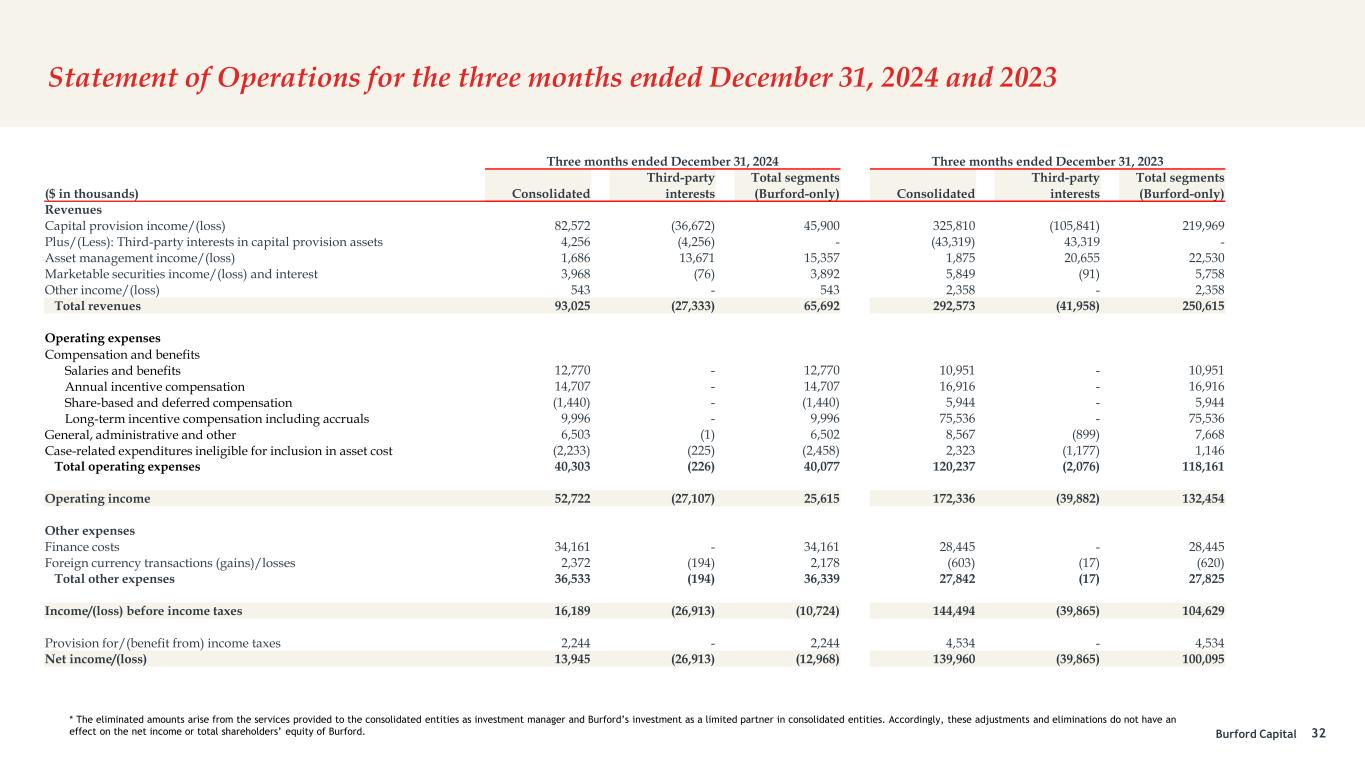

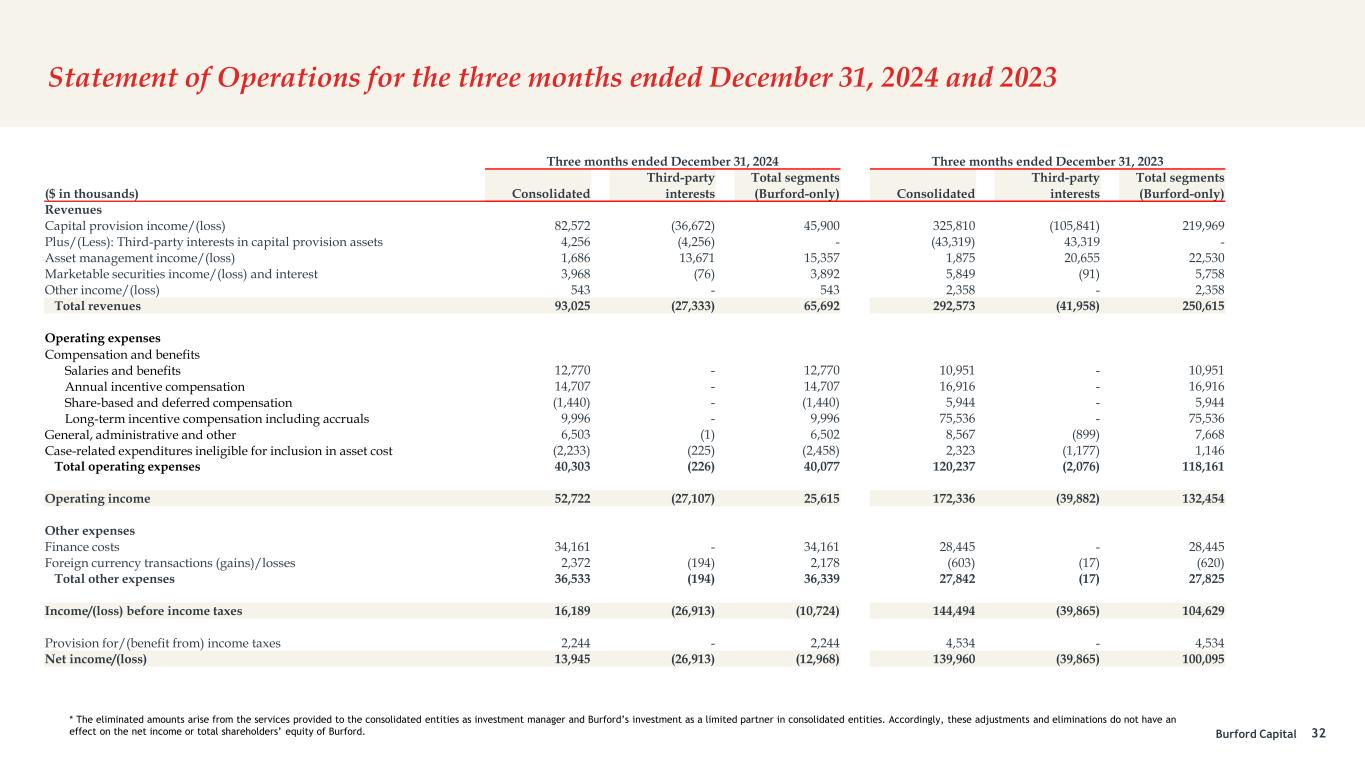

Burford Capital Statement of Operations for the three months ended December 31, 2024 and 2023 32 * The eliminated amounts arise from the services provided to the consolidated entities as investment manager and Burford’s investment as a limited partner in consolidated entities. Accordingly, these adjustments and eliminations do not have an effect on the net income or total shareholders’ equity of Burford. Three months ended December 31, 2024 Three months ended December 31, 2023 Third-party Total segments Third-party Total segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Revenues Capital provision income/(loss) 82,572 (36,672) 45,900 325,810 (105,841) 219,969 Plus/(Less): Third-party interests in capital provision assets 4,256 (4,256) - (43,319) 43,319 - Asset management income/(loss) 1,686 13,671 15,357 1,875 20,655 22,530 Marketable securities income/(loss) and interest 3,968 (76) 3,892 5,849 (91) 5,758 Other income/(loss) 543 - 543 2,358 - 2,358 Total revenues 93,025 (27,333) 65,692 292,573 (41,958) 250,615 Operating expenses Compensation and benefits Salaries and benefits 12,770 - 12,770 10,951 - 10,951 Annual incentive compensation 14,707 - 14,707 16,916 - 16,916 Share-based and deferred compensation (1,440) - (1,440) 5,944 - 5,944 Long-term incentive compensation including accruals 9,996 - 9,996 75,536 - 75,536 General, administrative and other 6,503 (1) 6,502 8,567 (899) 7,668 Case-related expenditures ineligible for inclusion in asset cost (2,233) (225) (2,458) 2,323 (1,177) 1,146 Total operating expenses 40,303 (226) 40,077 120,237 (2,076) 118,161 Operating income 52,722 (27,107) 25,615 172,336 (39,882) 132,454 Other expenses Finance costs 34,161 - 34,161 28,445 - 28,445 Foreign currency transactions (gains)/losses 2,372 (194) 2,178 (603) (17) (620) Total other expenses 36,533 (194) 36,339 27,842 (17) 27,825 Income/(loss) before income taxes 16,189 (26,913) (10,724) 144,494 (39,865) 104,629 Provision for/(benefit from) income taxes 2,244 - 2,244 4,534 - 4,534 Net income/(loss) 13,945 (26,913) (12,968) 139,960 (39,865) 100,095

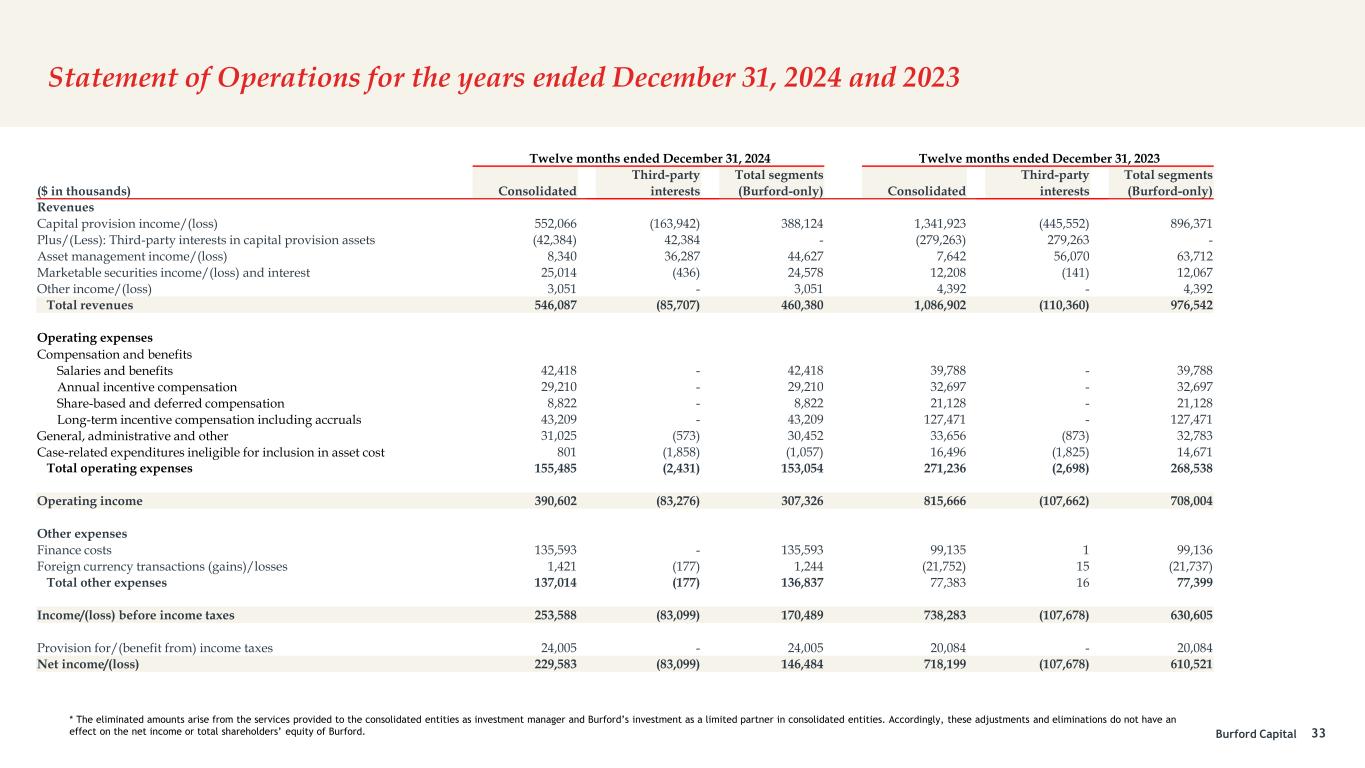

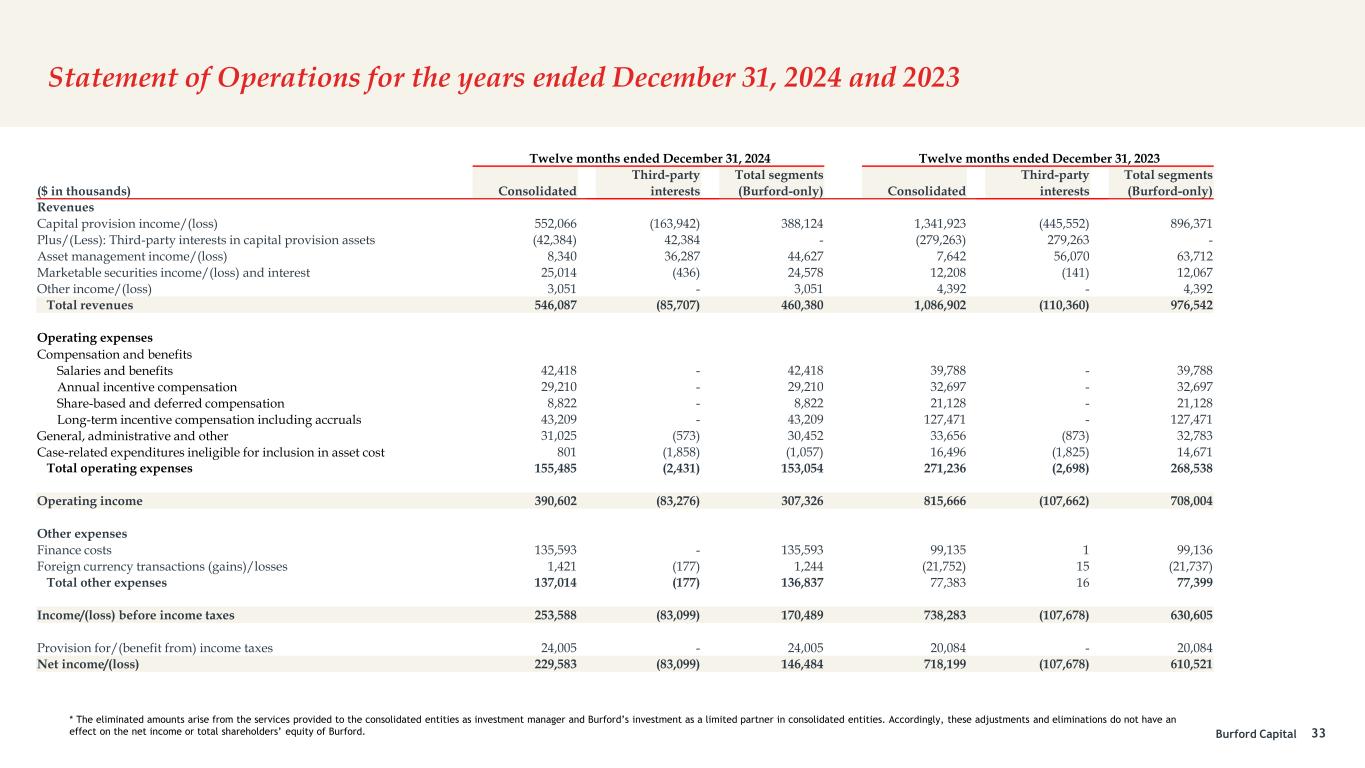

Burford Capital Statement of Operations for the years ended December 31, 2024 and 2023 33 * The eliminated amounts arise from the services provided to the consolidated entities as investment manager and Burford’s investment as a limited partner in consolidated entities. Accordingly, these adjustments and eliminations do not have an effect on the net income or total shareholders’ equity of Burford. Twelve months ended December 31, 2024 Twelve months ended December 31, 2023 Third-party Total segments Third-party Total segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Revenues Capital provision income/(loss) 552,066 (163,942) 388,124 1,341,923 (445,552) 896,371 Plus/(Less): Third-party interests in capital provision assets (42,384) 42,384 - (279,263) 279,263 - Asset management income/(loss) 8,340 36,287 44,627 7,642 56,070 63,712 Marketable securities income/(loss) and interest 25,014 (436) 24,578 12,208 (141) 12,067 Other income/(loss) 3,051 - 3,051 4,392 - 4,392 Total revenues 546,087 (85,707) 460,380 1,086,902 (110,360) 976,542 Operating expenses Compensation and benefits Salaries and benefits 42,418 - 42,418 39,788 - 39,788 Annual incentive compensation 29,210 - 29,210 32,697 - 32,697 Share-based and deferred compensation 8,822 - 8,822 21,128 - 21,128 Long-term incentive compensation including accruals 43,209 - 43,209 127,471 - 127,471 General, administrative and other 31,025 (573) 30,452 33,656 (873) 32,783 Case-related expenditures ineligible for inclusion in asset cost 801 (1,858) (1,057) 16,496 (1,825) 14,671 Total operating expenses 155,485 (2,431) 153,054 271,236 (2,698) 268,538 Operating income 390,602 (83,276) 307,326 815,666 (107,662) 708,004 Other expenses Finance costs 135,593 - 135,593 99,135 1 99,136 Foreign currency transactions (gains)/losses 1,421 (177) 1,244 (21,752) 15 (21,737) Total other expenses 137,014 (177) 136,837 77,383 16 77,399 Income/(loss) before income taxes 253,588 (83,099) 170,489 738,283 (107,678) 630,605 Provision for/(benefit from) income taxes 24,005 - 24,005 20,084 - 20,084 Net income/(loss) 229,583 (83,099) 146,484 718,199 (107,678) 610,521

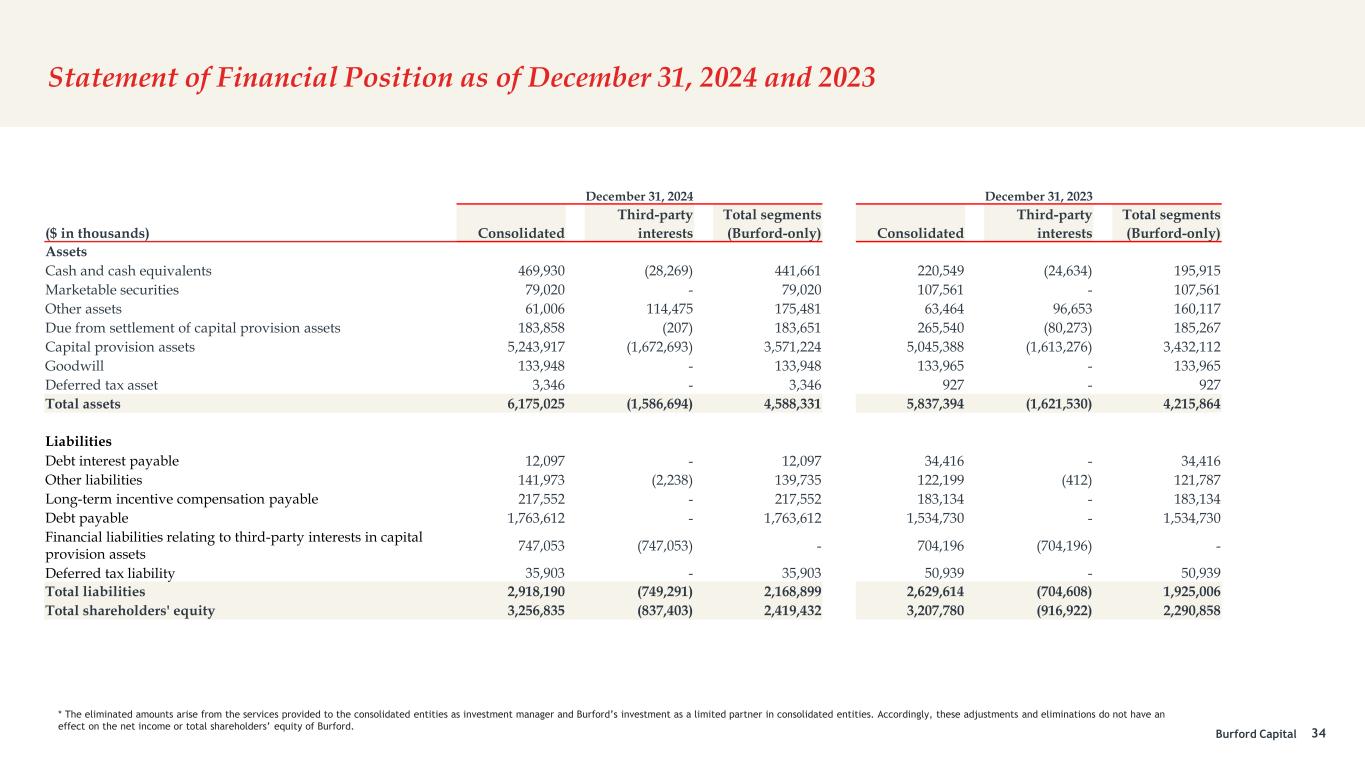

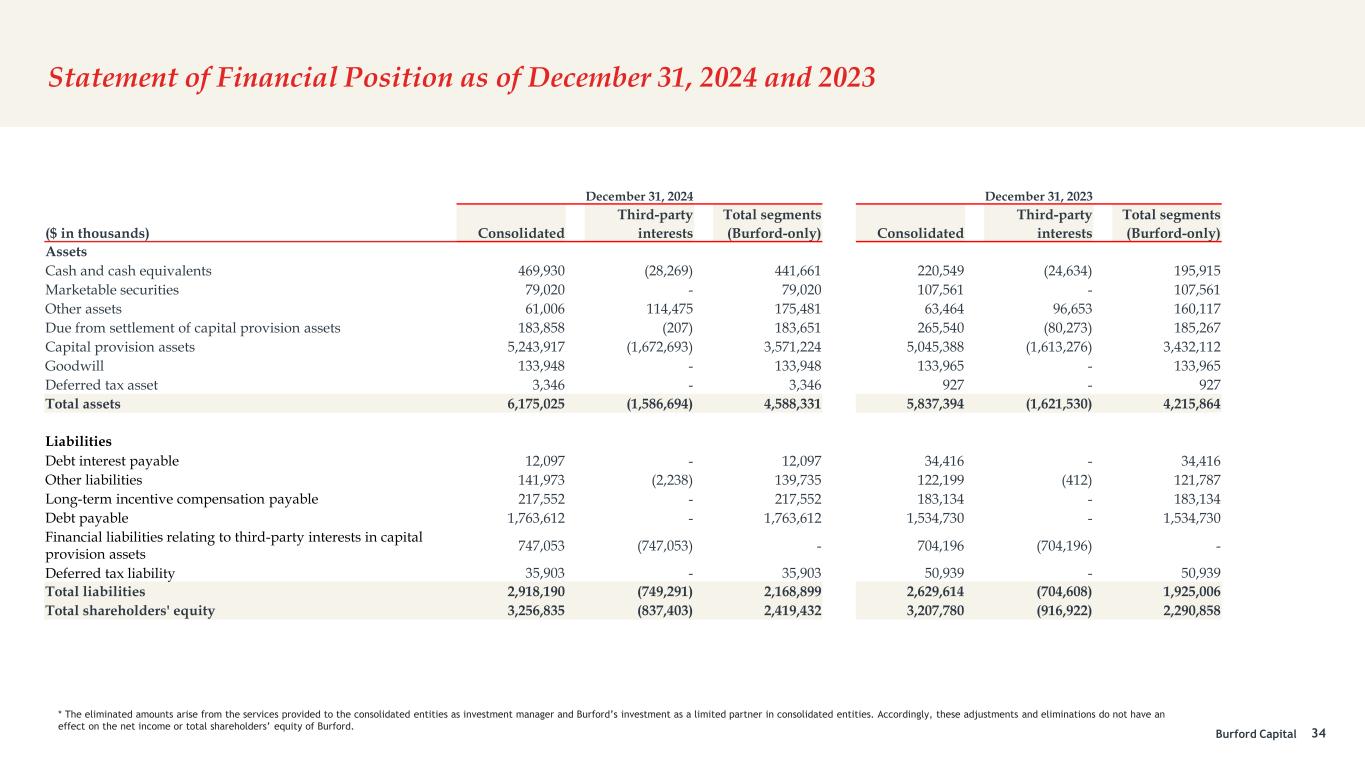

Burford Capital Statement of Financial Position as of December 31, 2024 and 2023 34 * The eliminated amounts arise from the services provided to the consolidated entities as investment manager and Burford’s investment as a limited partner in consolidated entities. Accordingly, these adjustments and eliminations do not have an effect on the net income or total shareholders’ equity of Burford. December 31, 2024 December 31, 2023 Third-party Total segments Third-party Total segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Assets Cash and cash equivalents 469,930 (28,269) 441,661 220,549 (24,634) 195,915 Marketable securities 79,020 - 79,020 107,561 - 107,561 Other assets 61,006 114,475 175,481 63,464 96,653 160,117 Due from settlement of capital provision assets 183,858 (207) 183,651 265,540 (80,273) 185,267 Capital provision assets 5,243,917 (1,672,693) 3,571,224 5,045,388 (1,613,276) 3,432,112 Goodwill 133,948 - 133,948 133,965 - 133,965 Deferred tax asset 3,346 - 3,346 927 - 927 Total assets 6,175,025 (1,586,694) 4,588,331 5,837,394 (1,621,530) 4,215,864 Liabilities Debt interest payable 12,097 - 12,097 34,416 - 34,416 Other liabilities 141,973 (2,238) 139,735 122,199 (412) 121,787 Long-term incentive compensation payable 217,552 - 217,552 183,134 - 183,134 Debt payable 1,763,612 - 1,763,612 1,534,730 - 1,534,730 Financial liabilities relating to third-party interests in capital provision assets 747,053 (747,053) - 704,196 (704,196) - Deferred tax liability 35,903 - 35,903 50,939 - 50,939 Total liabilities 2,918,190 (749,291) 2,168,899 2,629,614 (704,608) 1,925,006 Total shareholders' equity 3,256,835 (837,403) 2,419,432 3,207,780 (916,922) 2,290,858

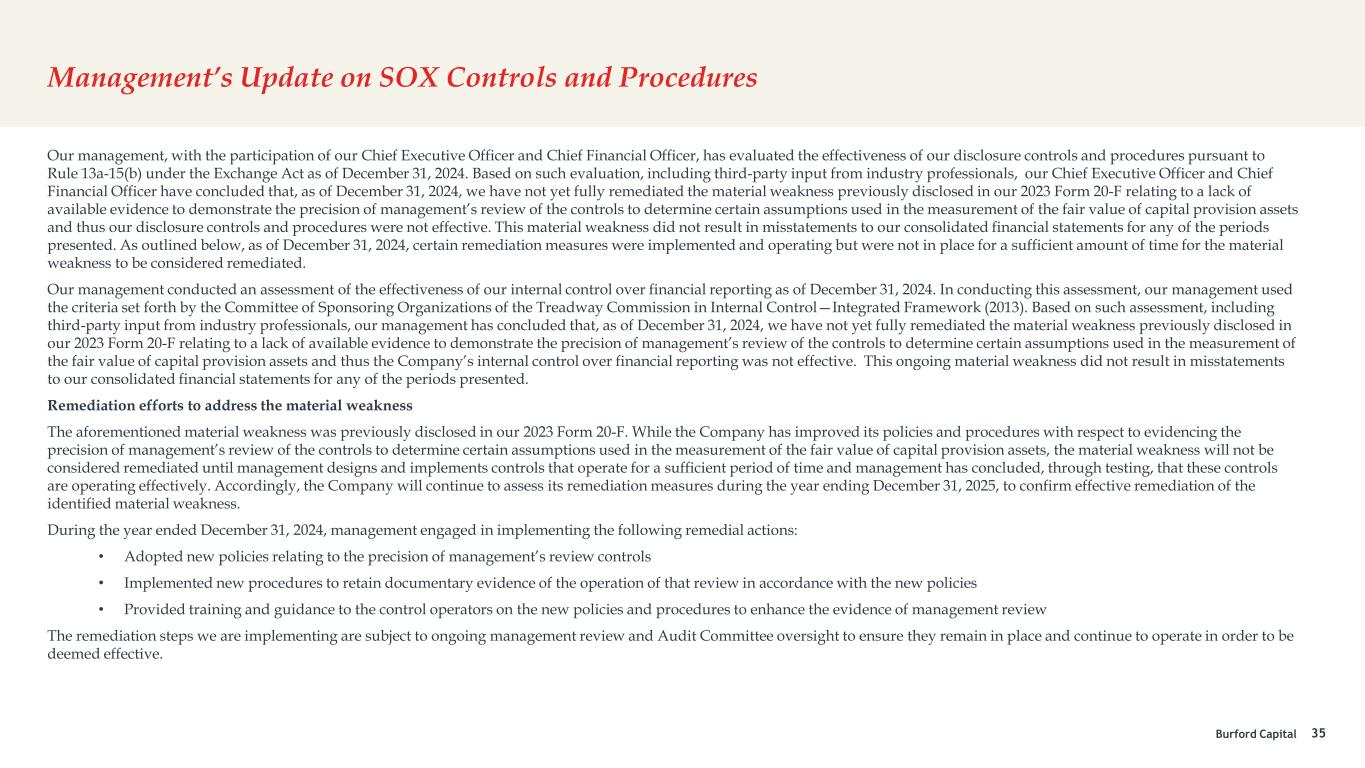

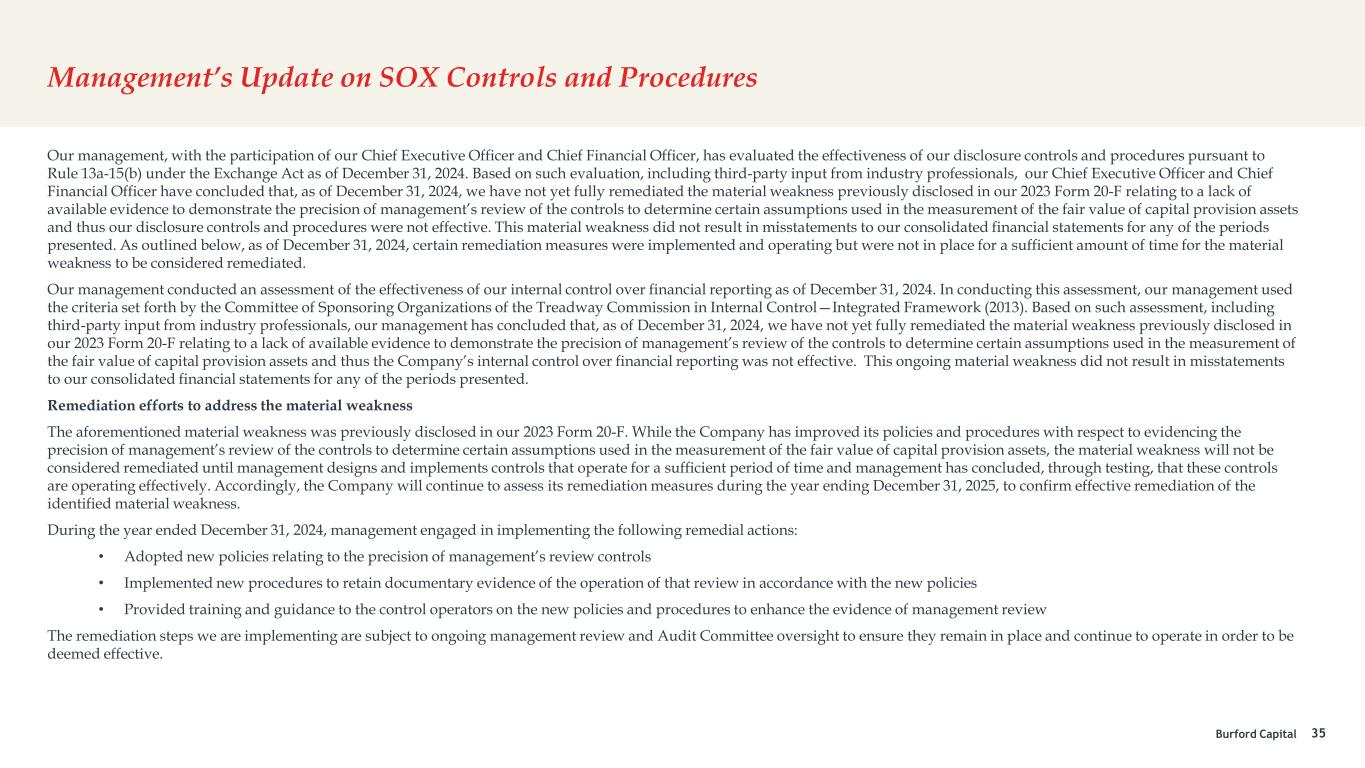

Burford Capital Management’s Update on SOX Controls and Procedures 35 Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15(b) under the Exchange Act as of December 31, 2024. Based on such evaluation, including third-party input from industry professionals, our Chief Executive Officer and Chief Financial Officer have concluded that, as of December 31, 2024, we have not yet fully remediated the material weakness previously disclosed in our 2023 Form 20-F relating to a lack of available evidence to demonstrate the precision of management’s review of the controls to determine certain assumptions used in the measurement of the fair value of capital provision assets and thus our disclosure controls and procedures were not effective. This material weakness did not result in misstatements to our consolidated financial statements for any of the periods presented. As outlined below, as of December 31, 2024, certain remediation measures were implemented and operating but were not in place for a sufficient amount of time for the material weakness to be considered remediated. Our management conducted an assessment of the effectiveness of our internal control over financial reporting as of December 31, 2024. In conducting this assessment, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control—Integrated Framework (2013). Based on such assessment, including third-party input from industry professionals, our management has concluded that, as of December 31, 2024, we have not yet fully remediated the material weakness previously disclosed in our 2023 Form 20-F relating to a lack of available evidence to demonstrate the precision of management’s review of the controls to determine certain assumptions used in the measurement of the fair value of capital provision assets and thus the Company’s internal control over financial reporting was not effective. This ongoing material weakness did not result in misstatements to our consolidated financial statements for any of the periods presented. Remediation efforts to address the material weakness The aforementioned material weakness was previously disclosed in our 2023 Form 20-F. While the Company has improved its policies and procedures with respect to evidencing the precision of management’s review of the controls to determine certain assumptions used in the measurement of the fair value of capital provision assets, the material weakness will not be considered remediated until management designs and implements controls that operate for a sufficient period of time and management has concluded, through testing, that these controls are operating effectively. Accordingly, the Company will continue to assess its remediation measures during the year ending December 31, 2025, to confirm effective remediation of the identified material weakness. During the year ended December 31, 2024, management engaged in implementing the following remedial actions: • Adopted new policies relating to the precision of management’s review controls • Implemented new procedures to retain documentary evidence of the operation of that review in accordance with the new policies • Provided training and guidance to the control operators on the new policies and procedures to enhance the evidence of management review The remediation steps we are implementing are subject to ongoing management review and Audit Committee oversight to ensure they remain in place and continue to operate in order to be deemed effective.

Other Reconciliations

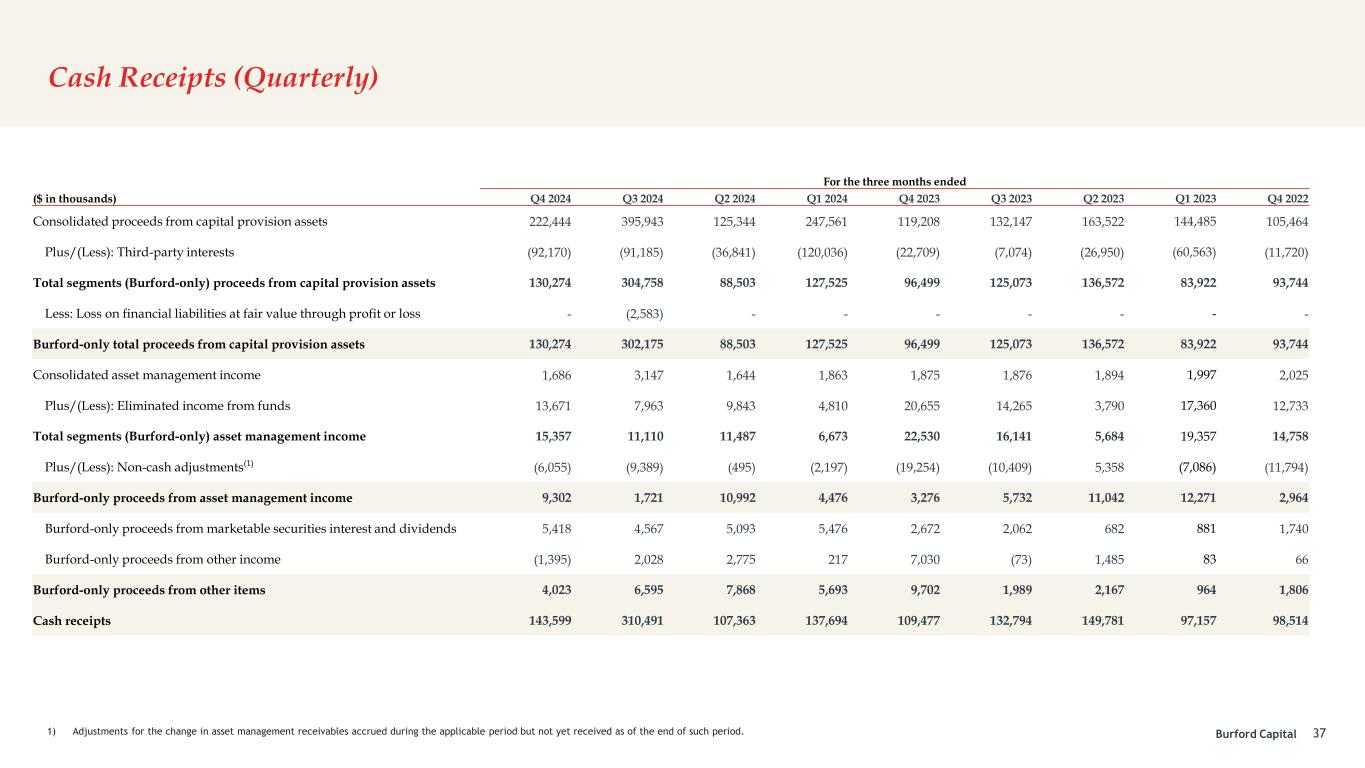

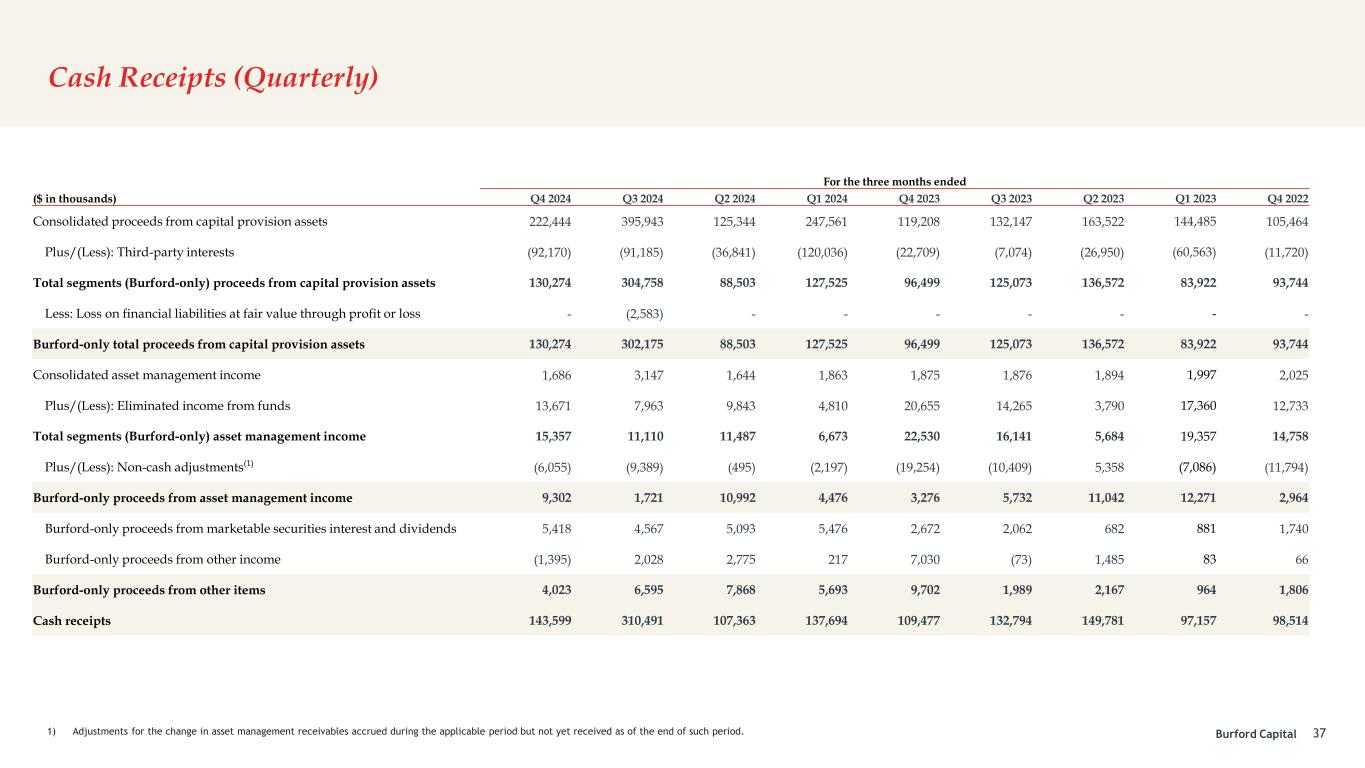

Burford Capital Cash Receipts (Quarterly) 1) Adjustments for the change in asset management receivables accrued during the applicable period but not yet received as of the end of such period. 37 For the three months ended ($ in thousands) Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Consolidated proceeds from capital provision assets 222,444 395,943 125,344 247,561 119,208 132,147 163,522 144,485 105,464 Plus/(Less): Third-party interests (92,170) (91,185) (36,841) (120,036) (22,709) (7,074) (26,950) (60,563) (11,720) Total segments (Burford-only) proceeds from capital provision assets 130,274 304,758 88,503 127,525 96,499 125,073 136,572 83,922 93,744 Less: Loss on financial liabilities at fair value through profit or loss - (2,583) - - - - - - - Burford-only total proceeds from capital provision assets 130,274 302,175 88,503 127,525 96,499 125,073 136,572 83,922 93,744 Consolidated asset management income 1,686 3,147 1,644 1,863 1,875 1,876 1,894 1,997 2,025 Plus/(Less): Eliminated income from funds 13,671 7,963 9,843 4,810 20,655 14,265 3,790 17,360 12,733 Total segments (Burford-only) asset management income 15,357 11,110 11,487 6,673 22,530 16,141 5,684 19,357 14,758 Plus/(Less): Non-cash adjustments(1) (6,055) (9,389) (495) (2,197) (19,254) (10,409) 5,358 (7,086) (11,794) Burford-only proceeds from asset management income 9,302 1,721 10,992 4,476 3,276 5,732 11,042 12,271 2,964 Burford-only proceeds from marketable securities interest and dividends 5,418 4,567 5,093 5,476 2,672 2,062 682 881 1,740 Burford-only proceeds from other income (1,395) 2,028 2,775 217 7,030 (73) 1,485 83 66 Burford-only proceeds from other items 4,023 6,595 7,868 5,693 9,702 1,989 2,167 964 1,806 Cash receipts 143,599 310,491 107,363 137,694 109,477 132,794 149,781 97,157 98,514

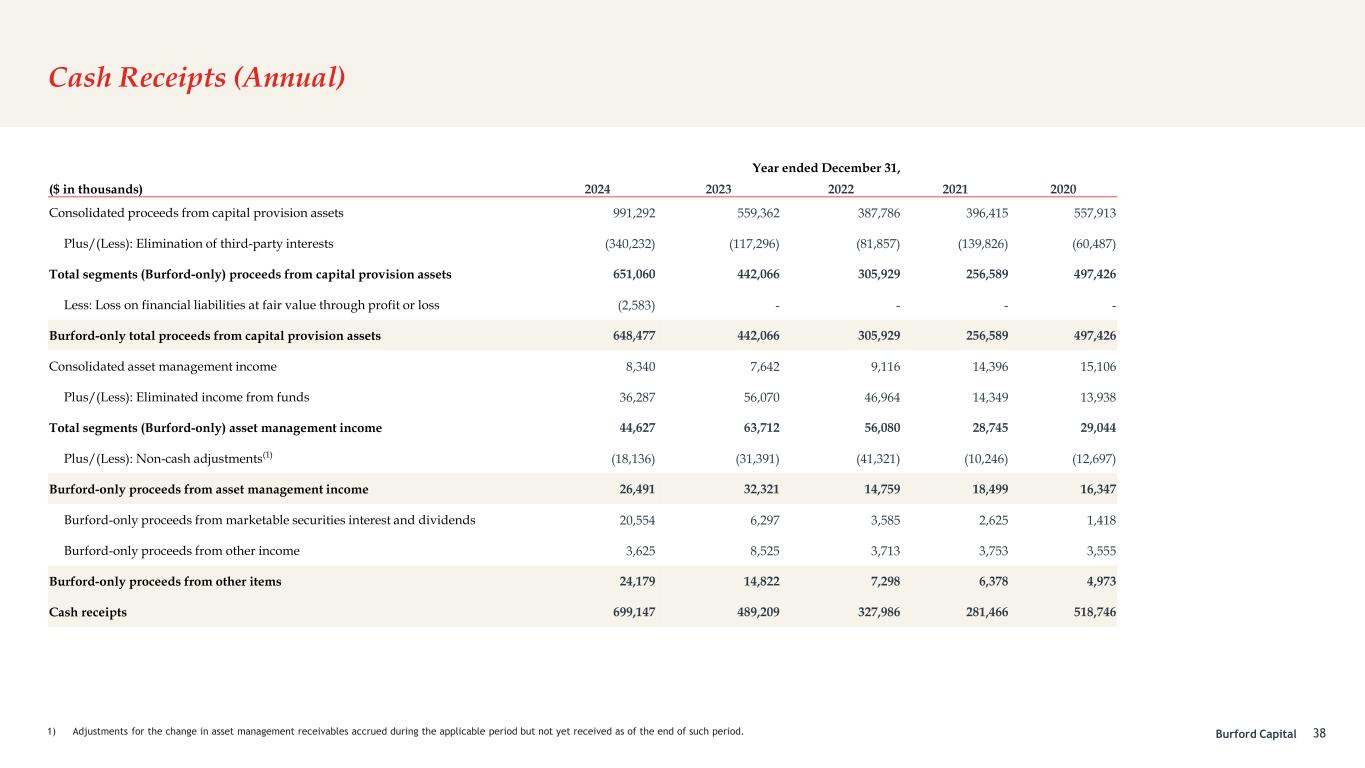

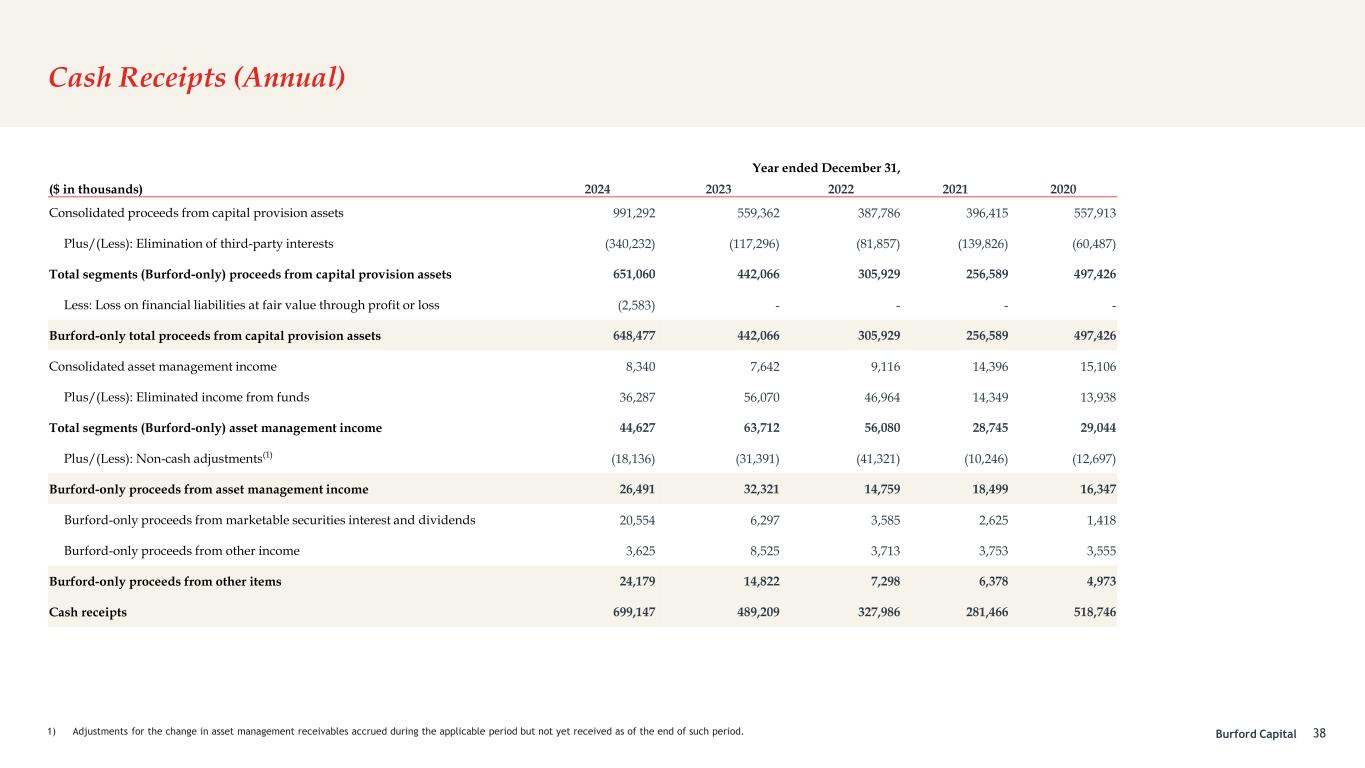

Burford Capital Cash Receipts (Annual) 1) Adjustments for the change in asset management receivables accrued during the applicable period but not yet received as of the end of such period. 38 Year ended December 31, ($ in thousands) 2024 2023 2022 2021 2020 Consolidated proceeds from capital provision assets 991,292 559,362 387,786 396,415 557,913 Plus/(Less): Elimination of third-party interests (340,232) (117,296) (81,857) (139,826) (60,487) Total segments (Burford-only) proceeds from capital provision assets 651,060 442,066 305,929 256,589 497,426 Less: Loss on financial liabilities at fair value through profit or loss (2,583) - - - - Burford-only total proceeds from capital provision assets 648,477 442,066 305,929 256,589 497,426 Consolidated asset management income 8,340 7,642 9,116 14,396 15,106 Plus/(Less): Eliminated income from funds 36,287 56,070 46,964 14,349 13,938 Total segments (Burford-only) asset management income 44,627 63,712 56,080 28,745 29,044 Plus/(Less): Non-cash adjustments(1) (18,136) (31,391) (41,321) (10,246) (12,697) Burford-only proceeds from asset management income 26,491 32,321 14,759 18,499 16,347 Burford-only proceeds from marketable securities interest and dividends 20,554 6,297 3,585 2,625 1,418 Burford-only proceeds from other income 3,625 8,525 3,713 3,753 3,555 Burford-only proceeds from other items 24,179 14,822 7,298 6,378 4,973 Cash receipts 699,147 489,209 327,986 281,466 518,746

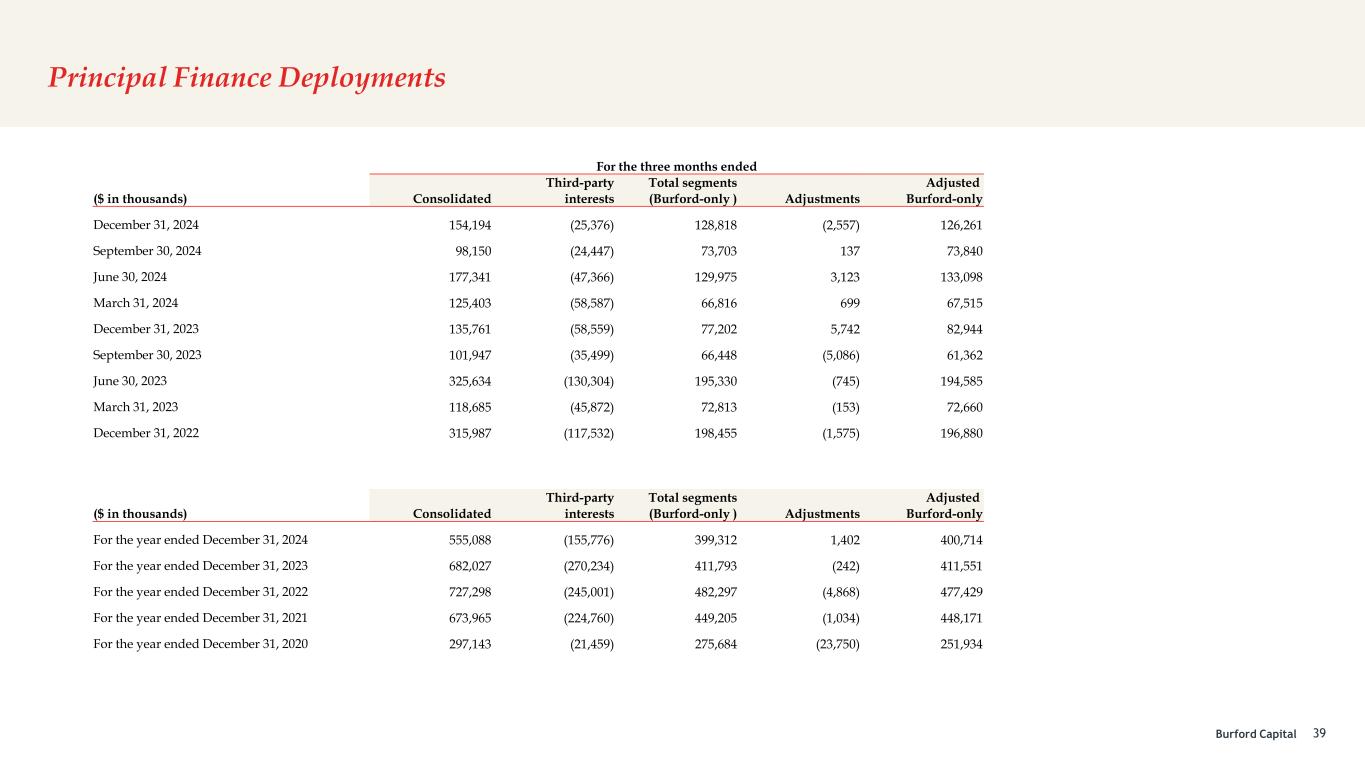

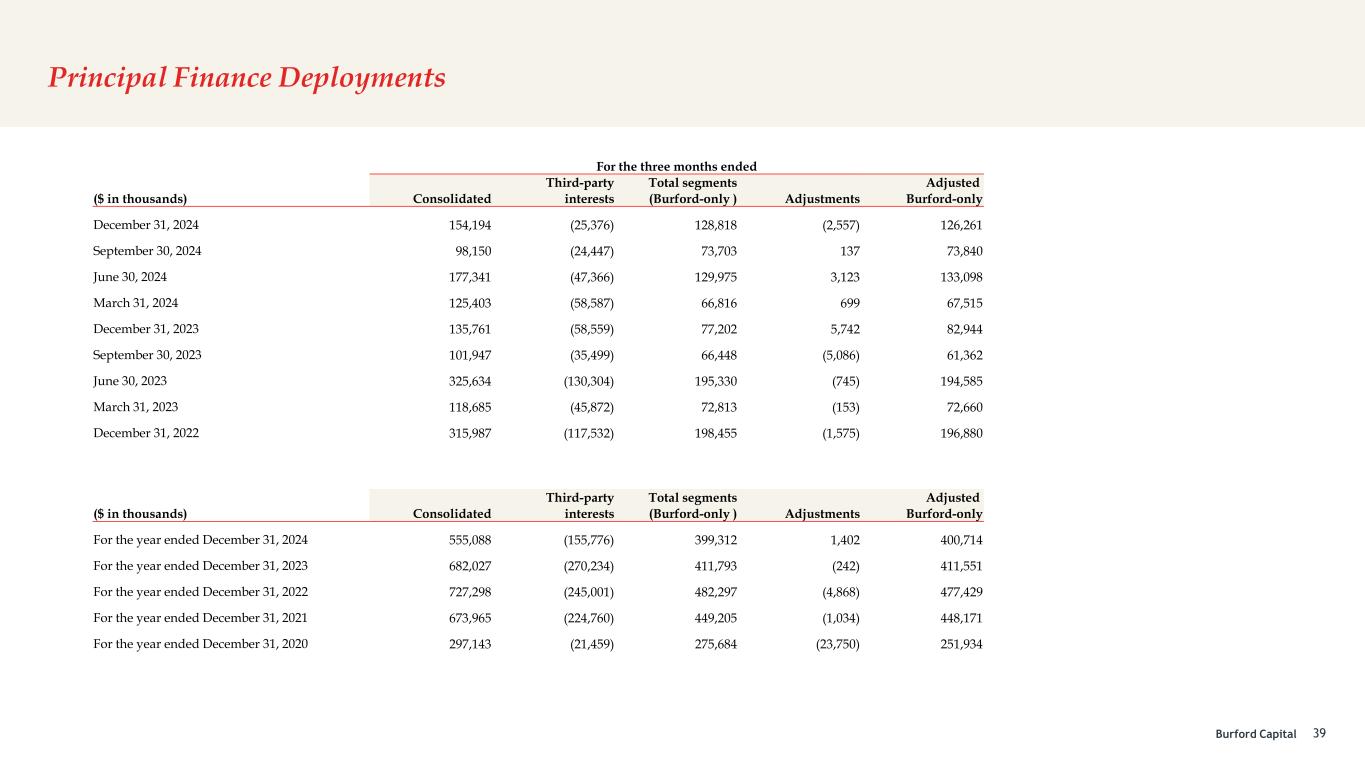

Burford Capital Principal Finance Deployments 39 For the three months ended Third-party Total segments Adjusted ($ in thousands) Consolidated interests (Burford-only ) Adjustments Burford-only December 31, 2024 154,194 (25,376) 128,818 (2,557) 126,261 September 30, 2024 98,150 (24,447) 73,703 137 73,840 June 30, 2024 177,341 (47,366) 129,975 3,123 133,098 March 31, 2024 125,403 (58,587) 66,816 699 67,515 December 31, 2023 135,761 (58,559) 77,202 5,742 82,944 September 30, 2023 101,947 (35,499) 66,448 (5,086) 61,362 June 30, 2023 325,634 (130,304) 195,330 (745) 194,585 March 31, 2023 118,685 (45,872) 72,813 (153) 72,660 December 31, 2022 315,987 (117,532) 198,455 (1,575) 196,880 Third-party Total segments Adjusted ($ in thousands) Consolidated interests (Burford-only ) Adjustments Burford-only For the year ended December 31, 2024 555,088 (155,776) 399,312 1,402 400,714 For the year ended December 31, 2023 682,027 (270,234) 411,793 (242) 411,551 For the year ended December 31, 2022 727,298 (245,001) 482,297 (4,868) 477,429 For the year ended December 31, 2021 673,965 (224,760) 449,205 (1,034) 448,171 For the year ended December 31, 2020 297,143 (21,459) 275,684 (23,750) 251,934

Burford Capital Principal Finance Realizations 40 Reconciliation of cumulative realizations from concluded or partially concluded assets since inception - consolidated to Burford-only Eliminations and Total segments ($ in millions) Consolidated adjustments (Burford-only ) For the year ended December 31, 2024 3,617 (286) 3,331 For the three months ended Third-party Total segments Adjusted ($ in thousands) Consolidated interests (Burford-only) Adjustments Burford-only December 31, 2024 348,023 (92,377) 255,646 (2,221) 253,425 September 30, 2024 254,165 (91,185) 162,980 5,436 168,416 June 30, 2024 191,883 (36,841) 155,042 1,704 156,746 March 31, 2024 112,971 (39,763) 73,208 (10,671) 62,537 December 31, 2023 313,660 (101,228) 212,432 24,191 236,623 September 30, 2023 108,737 (7,075) 101,662 (9,157) 92,505 June 30, 2023 157,584 (26,949) 130,635 7,021 137,656 March 31, 2023 128,312 (60,386) 67,926 (4,084) 63,842 December 31, 2022 169,719 (11,497) 158,222 143 158,365 Third-party Total segments Adjusted ($ in thousands) Consolidated interests (Burford-only) Adjustments Burford-only For the year ended December 31, 2024 907,042 (260,166) 646,876 (5,752) 641,124 For the year ended December 31, 2023 708,293 (195,638) 512,655 17,971 530,626 For the year ended December 31, 2022 426,734 (69,603) 357,131 3,400 360,531 For the year ended December 31, 2021 455,148 (164,786) 290,362 8,822 299,184 For the year ended December 31, 2020 540,294 (13,992) 526,302 (17,157) 509,145

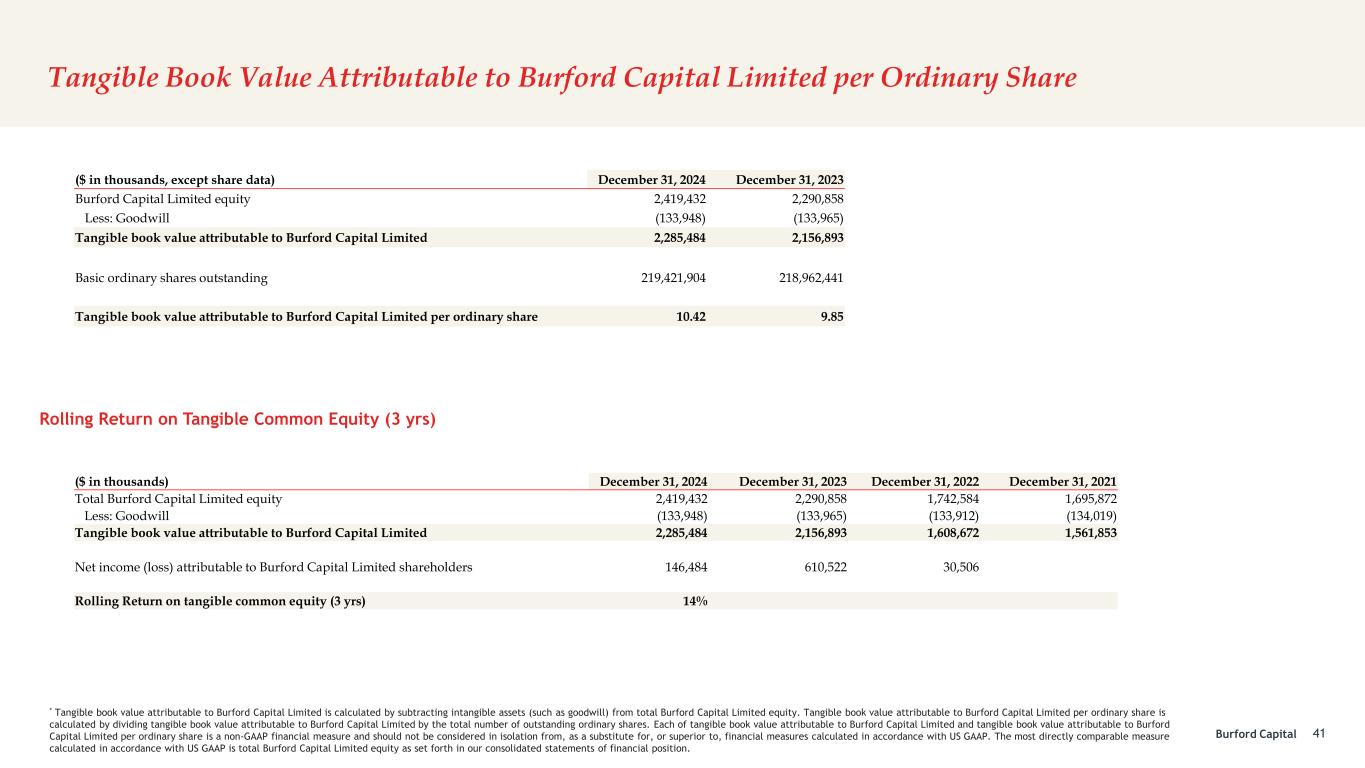

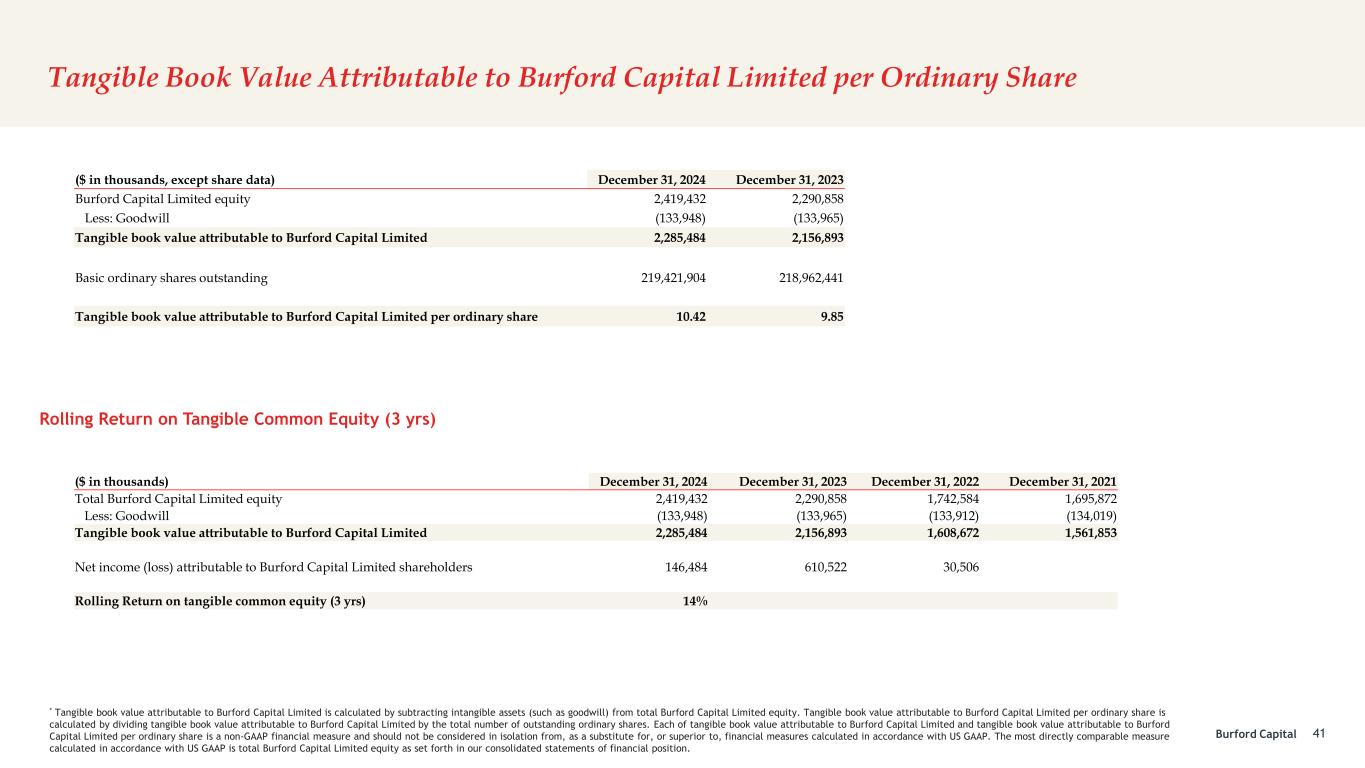

Burford Capital Tangible Book Value Attributable to Burford Capital Limited per Ordinary Share 41 * Tangible book value attributable to Burford Capital Limited is calculated by subtracting intangible assets (such as goodwill) from total Burford Capital Limited equity. Tangible book value attributable to Burford Capital Limited per ordinary share is calculated by dividing tangible book value attributable to Burford Capital Limited by the total number of outstanding ordinary shares. Each of tangible book value attributable to Burford Capital Limited and tangible book value attributable to Burford Capital Limited per ordinary share is a non-GAAP financial measure and should not be considered in isolation from, as a substitute for, or superior to, financial measures calculated in accordance with US GAAP. The most directly comparable measure calculated in accordance with US GAAP is total Burford Capital Limited equity as set forth in our consolidated statements of financial position. ($ in thousands, except share data) December 31, 2024 December 31, 2023 Burford Capital Limited equity 2,419,432 2,290,858 Less: Goodwill (133,948) (133,965) Tangible book value attributable to Burford Capital Limited 2,285,484 2,156,893 Basic ordinary shares outstanding 219,421,904 218,962,441 Tangible book value attributable to Burford Capital Limited per ordinary share 10.42 9.85 Rolling Return on Tangible Common Equity (3 yrs) ($ in thousands) December 31, 2024 December 31, 2023 December 31, 2022 December 31, 2021 Total Burford Capital Limited equity 2,419,432 2,290,858 1,742,584 1,695,872 Less: Goodwill (133,948) (133,965) (133,912) (134,019) Tangible book value attributable to Burford Capital Limited 2,285,484 2,156,893 1,608,672 1,561,853 Net income (loss) attributable to Burford Capital Limited shareholders 146,484 610,522 30,506 Rolling Return on tangible common equity (3 yrs) 14%

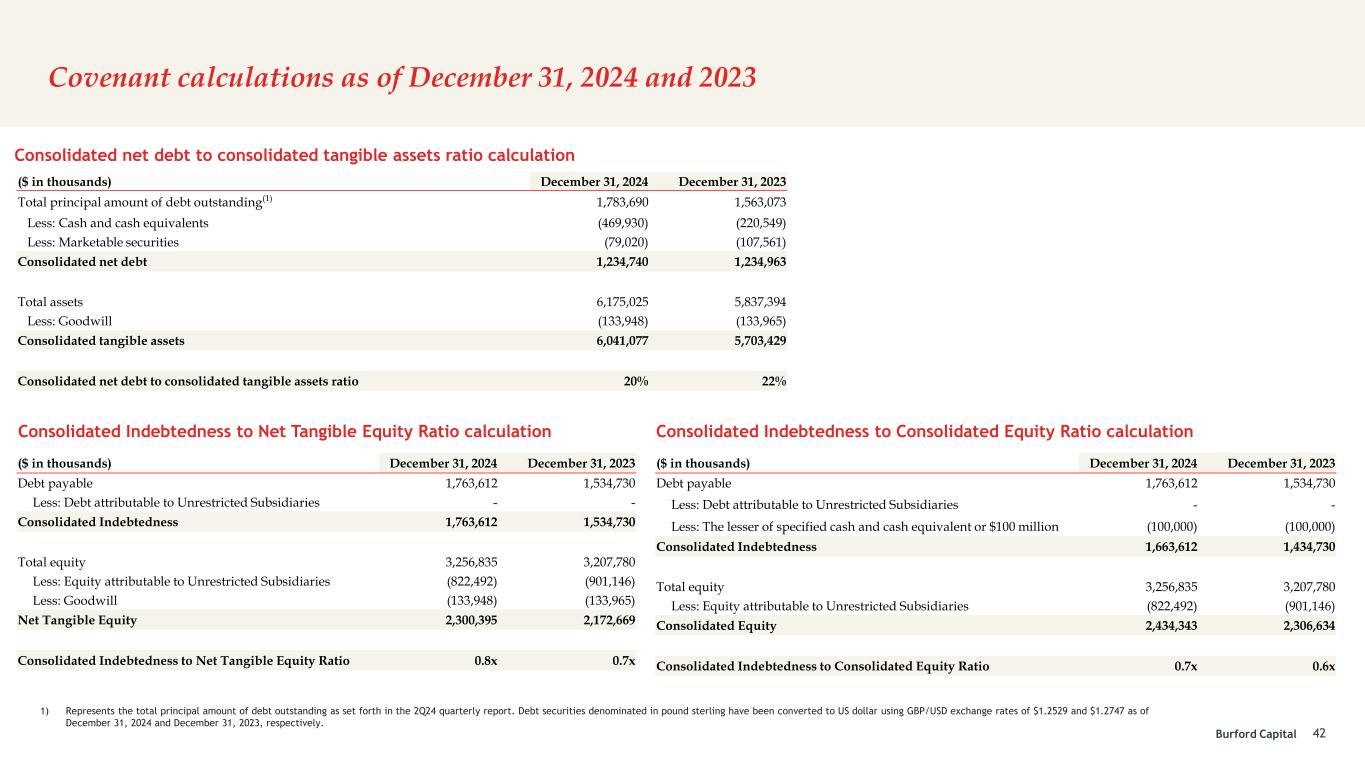

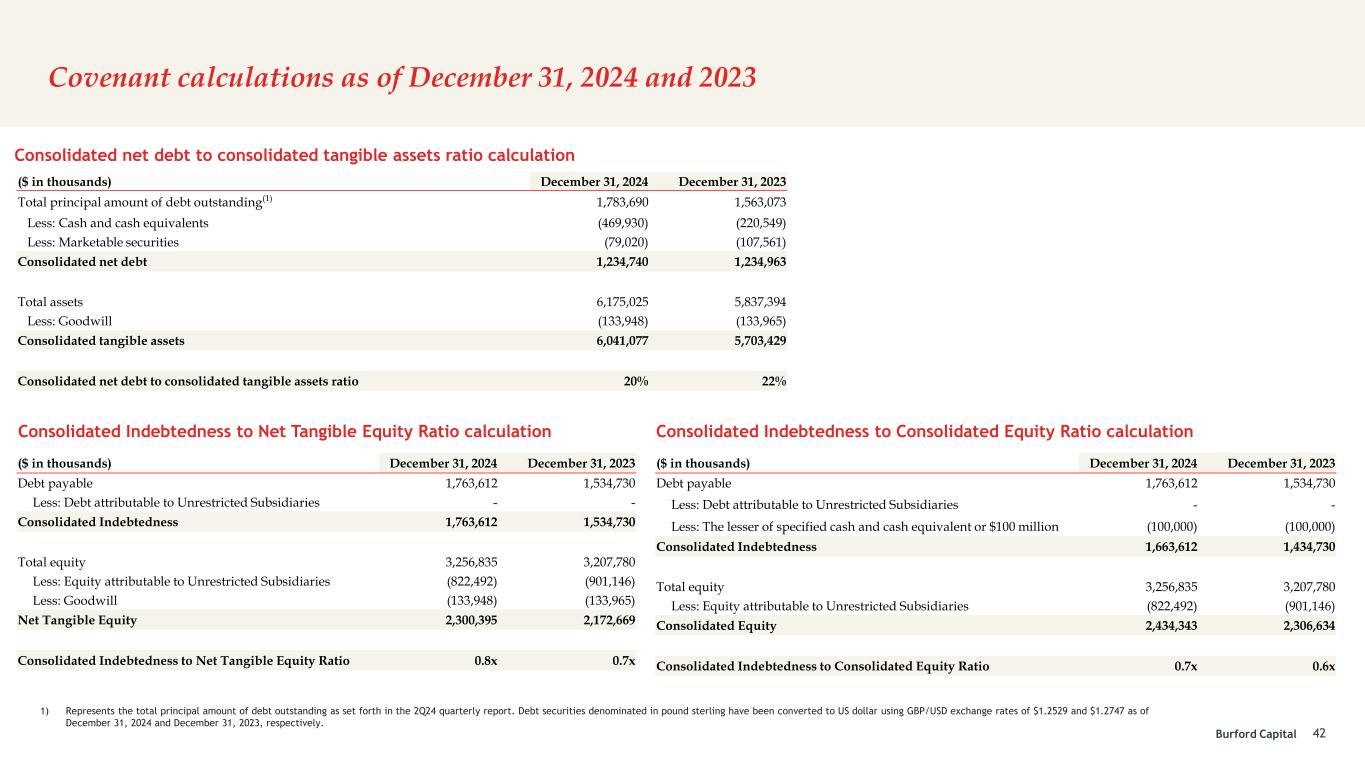

Burford Capital Covenant calculations as of December 31, 2024 and 2023 42 Consolidated net debt to consolidated tangible assets ratio calculation Consolidated Indebtedness to Net Tangible Equity Ratio calculation 1) Represents the total principal amount of debt outstanding as set forth in the 2Q24 quarterly report. Debt securities denominated in pound sterling have been converted to US dollar using GBP/USD exchange rates of $1.2529 and $1.2747 as of December 31, 2024 and December 31, 2023, respectively. Consolidated Indebtedness to Consolidated Equity Ratio calculation ($ in thousands) December 31, 2024 December 31, 2023 Total principal amount of debt outstanding(1) 1,783,690 1,563,073 Less: Cash and cash equivalents (469,930) (220,549) Less: Marketable securities (79,020) (107,561) Consolidated net debt 1,234,740 1,234,963 Total assets 6,175,025 5,837,394 Less: Goodwill (133,948) (133,965) Consolidated tangible assets 6,041,077 5,703,429 Consolidated net debt to consolidated tangible assets ratio 20% 22% ($ in thousands) December 31, 2024 December 31, 2023 Debt payable 1,763,612 1,534,730 Less: Debt attributable to Unrestricted Subsidiaries - - Consolidated Indebtedness 1,763,612 1,534,730 Total equity 3,256,835 3,207,780 Less: Equity attributable to Unrestricted Subsidiaries (822,492) (901,146) Less: Goodwill (133,948) (133,965) Net Tangible Equity 2,300,395 2,172,669 Consolidated Indebtedness to Net Tangible Equity Ratio 0.8x 0.7x ($ in thousands) December 31, 2024 December 31, 2023 Debt payable 1,763,612 1,534,730 Less: Debt attributable to Unrestricted Subsidiaries - - Less: The lesser of specified cash and cash equivalent or $100 million (100,000) (100,000) Consolidated Indebtedness 1,663,612 1,434,730 Total equity 3,256,835 3,207,780 Less: Equity attributable to Unrestricted Subsidiaries (822,492) (901,146) Consolidated Equity 2,434,343 2,306,634 Consolidated Indebtedness to Consolidated Equity Ratio 0.7x 0.6x

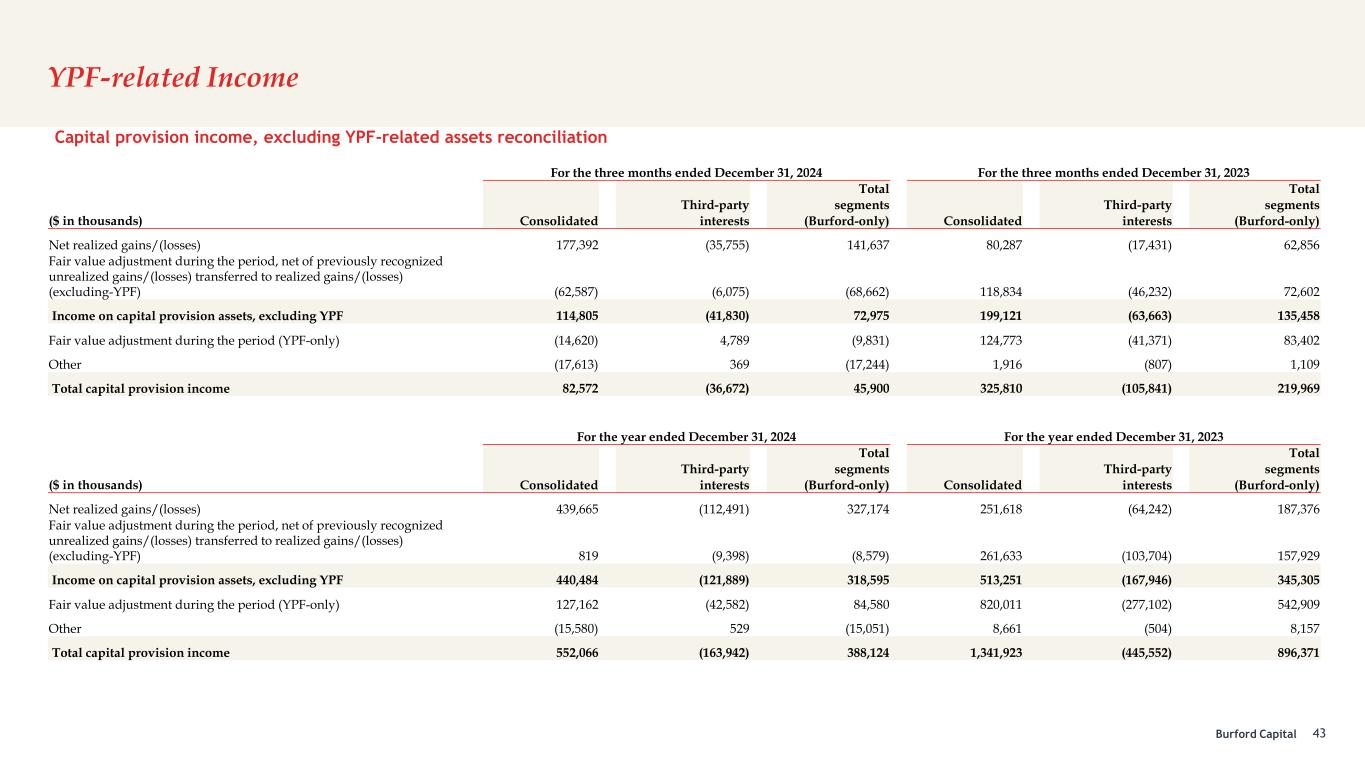

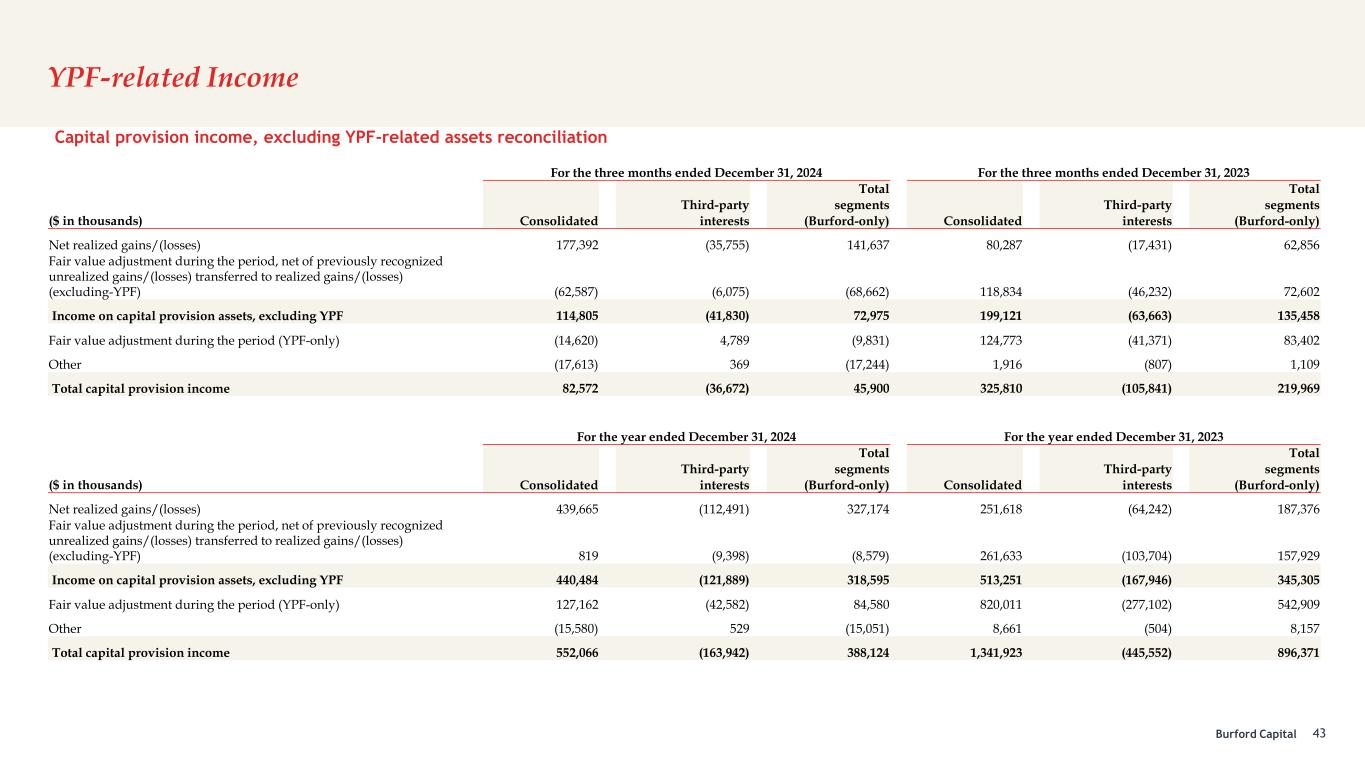

Burford Capital YPF-related Income 43 Capital provision income, excluding YPF-related assets reconciliation For the three months ended December 31, 2024 For the three months ended December 31, 2023 Total Total Third-party segments Third-party segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Net realized gains/(losses) 177,392 (35,755) 141,637 80,287 (17,431) 62,856 Fair value adjustment during the period, net of previously recognized unrealized gains/(losses) transferred to realized gains/(losses) (excluding-YPF) (62,587) (6,075) (68,662) 118,834 (46,232) 72,602 Income on capital provision assets, excluding YPF 114,805 (41,830) 72,975 199,121 (63,663) 135,458 Fair value adjustment during the period (YPF-only) (14,620) 4,789 (9,831) 124,773 (41,371) 83,402 Other (17,613) 369 (17,244) 1,916 (807) 1,109 Total capital provision income 82,572 (36,672) 45,900 325,810 (105,841) 219,969 For the year ended December 31, 2024 For the year ended December 31, 2023 Total Total Third-party segments Third-party segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Net realized gains/(losses) 439,665 (112,491) 327,174 251,618 (64,242) 187,376 Fair value adjustment during the period, net of previously recognized unrealized gains/(losses) transferred to realized gains/(losses) (excluding-YPF) 819 (9,398) (8,579) 261,633 (103,704) 157,929 Income on capital provision assets, excluding YPF 440,484 (121,889) 318,595 513,251 (167,946) 345,305 Fair value adjustment during the period (YPF-only) 127,162 (42,582) 84,580 820,011 (277,102) 542,909 Other (15,580) 529 (15,051) 8,661 (504) 8,157 Total capital provision income 552,066 (163,942) 388,124 1,341,923 (445,552) 896,371

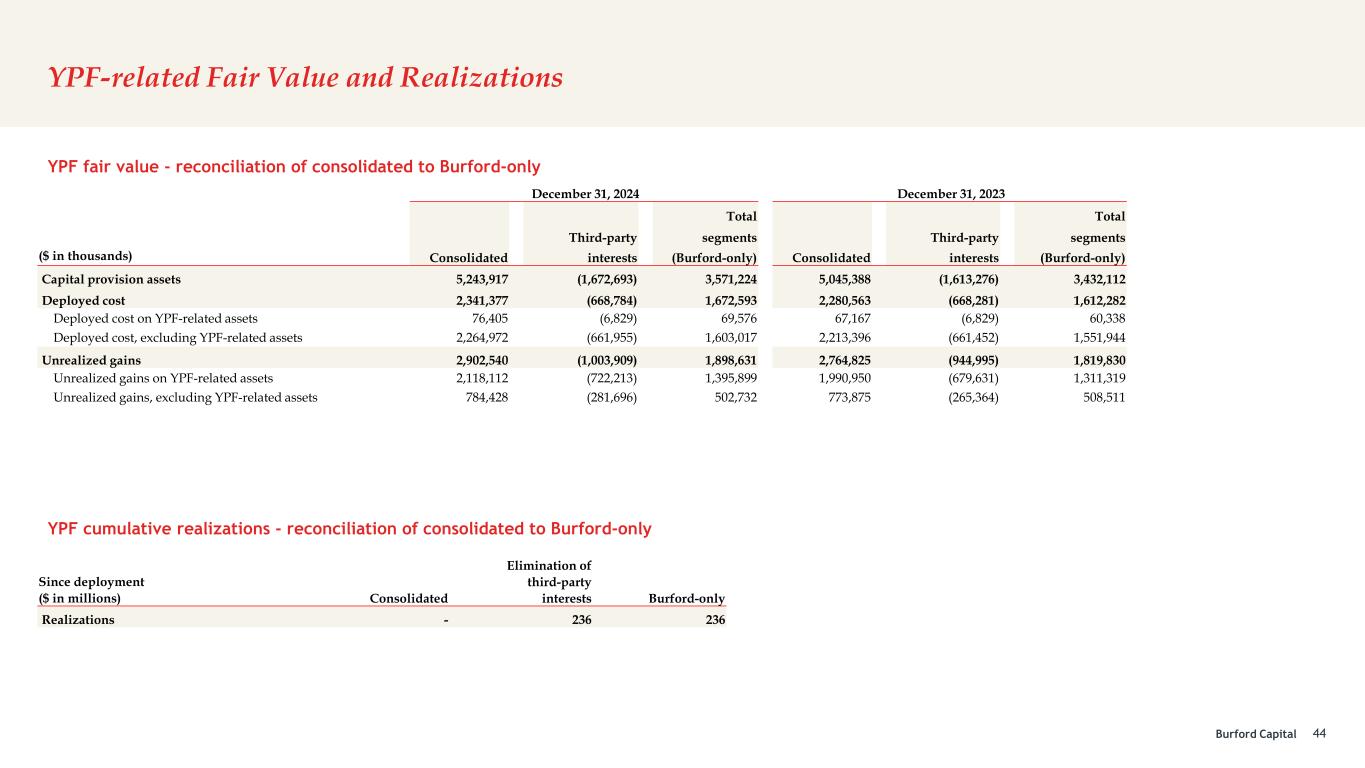

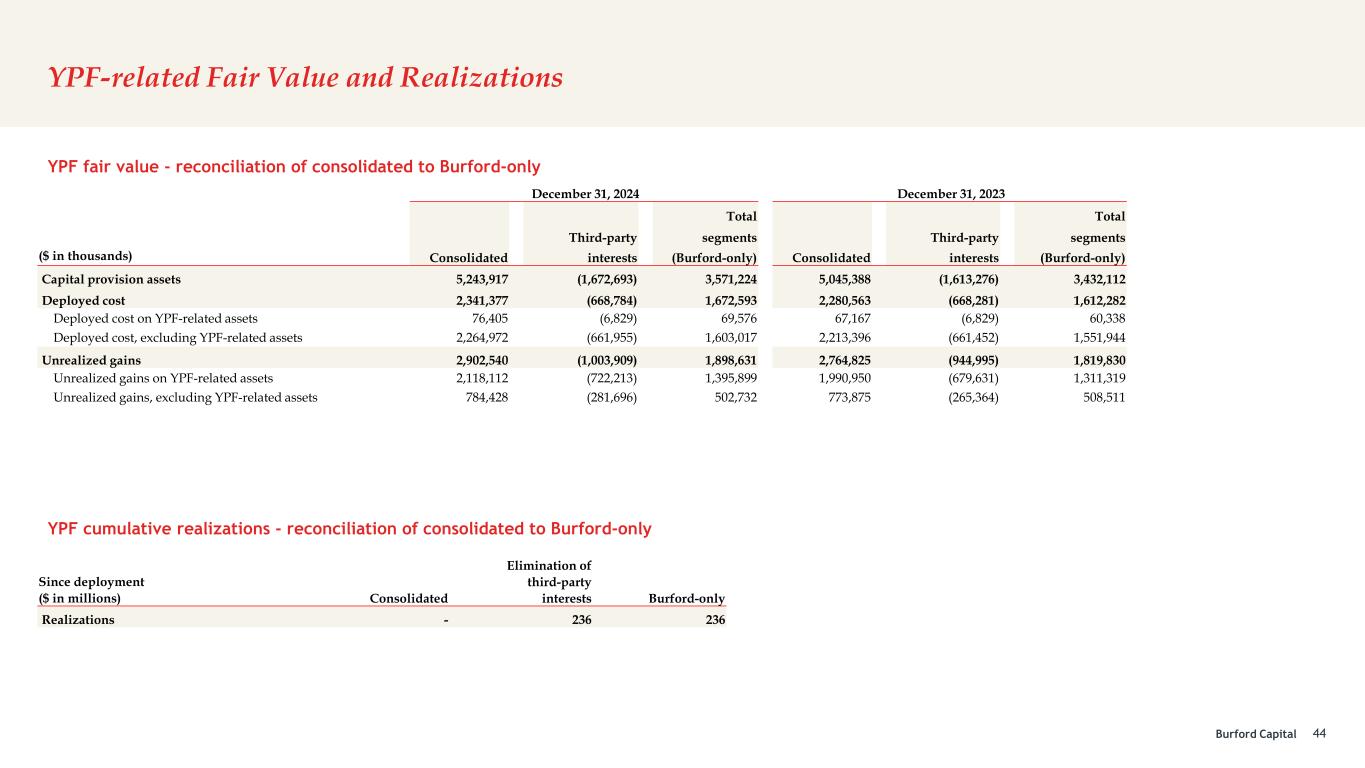

Burford Capital YPF-related Fair Value and Realizations 44 YPF cumulative realizations - reconciliation of consolidated to Burford-only YPF fair value - reconciliation of consolidated to Burford-only Elimination of Since deployment third-party ($ in millions) Consolidated interests Burford-only Realizations - 236 236 December 31, 2024 December 31, 2023 Total Total Third-party segments Third-party segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Capital provision assets 5,243,917 (1,672,693) 3,571,224 5,045,388 (1,613,276) 3,432,112 Deployed cost 2,341,377 (668,784) 1,672,593 2,280,563 (668,281) 1,612,282 Deployed cost on YPF-related assets 76,405 (6,829) 69,576 67,167 (6,829) 60,338 Deployed cost, excluding YPF-related assets 2,264,972 (661,955) 1,603,017 2,213,396 (661,452) 1,551,944 Unrealized gains 2,902,540 (1,003,909) 1,898,631 2,764,825 (944,995) 1,819,830 Unrealized gains on YPF-related assets 2,118,112 (722,213) 1,395,899 1,990,950 (679,631) 1,311,319 Unrealized gains, excluding YPF-related assets 784,428 (281,696) 502,732 773,875 (265,364) 508,511

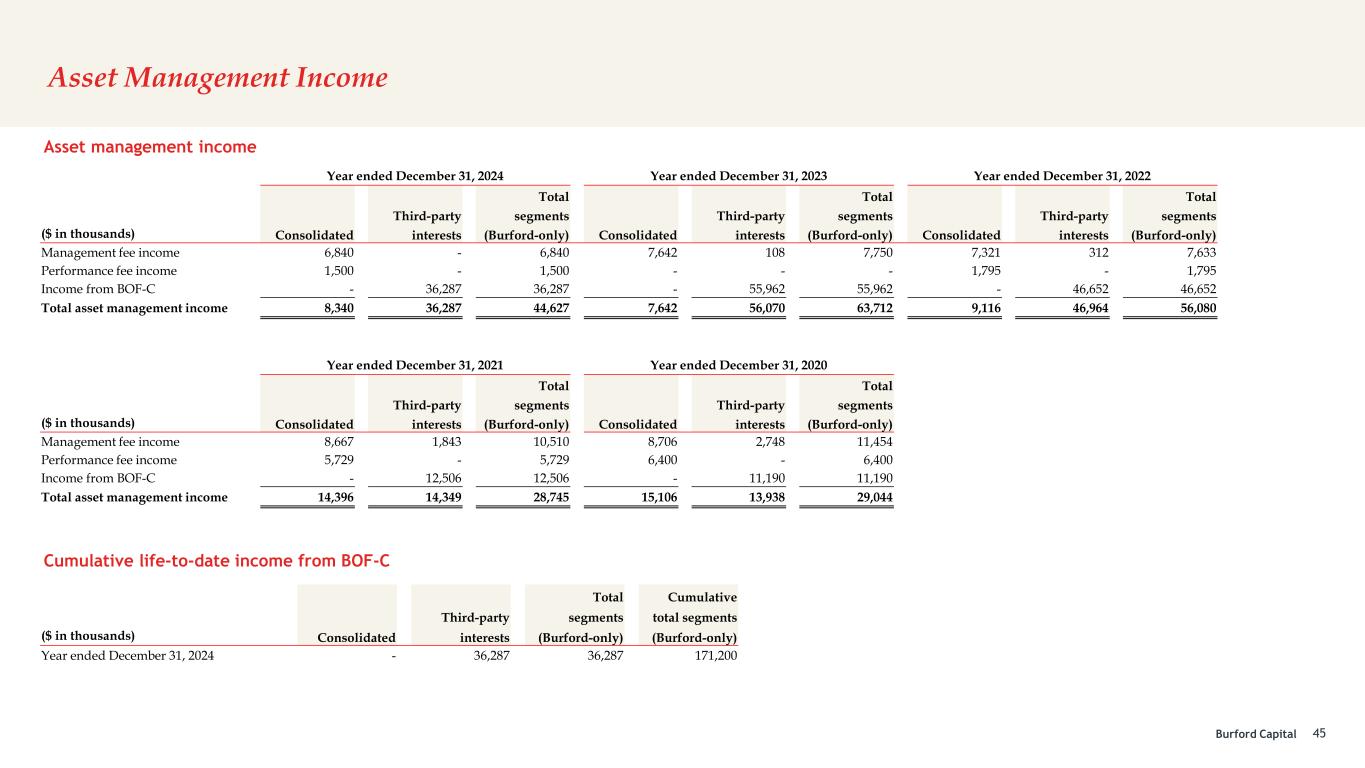

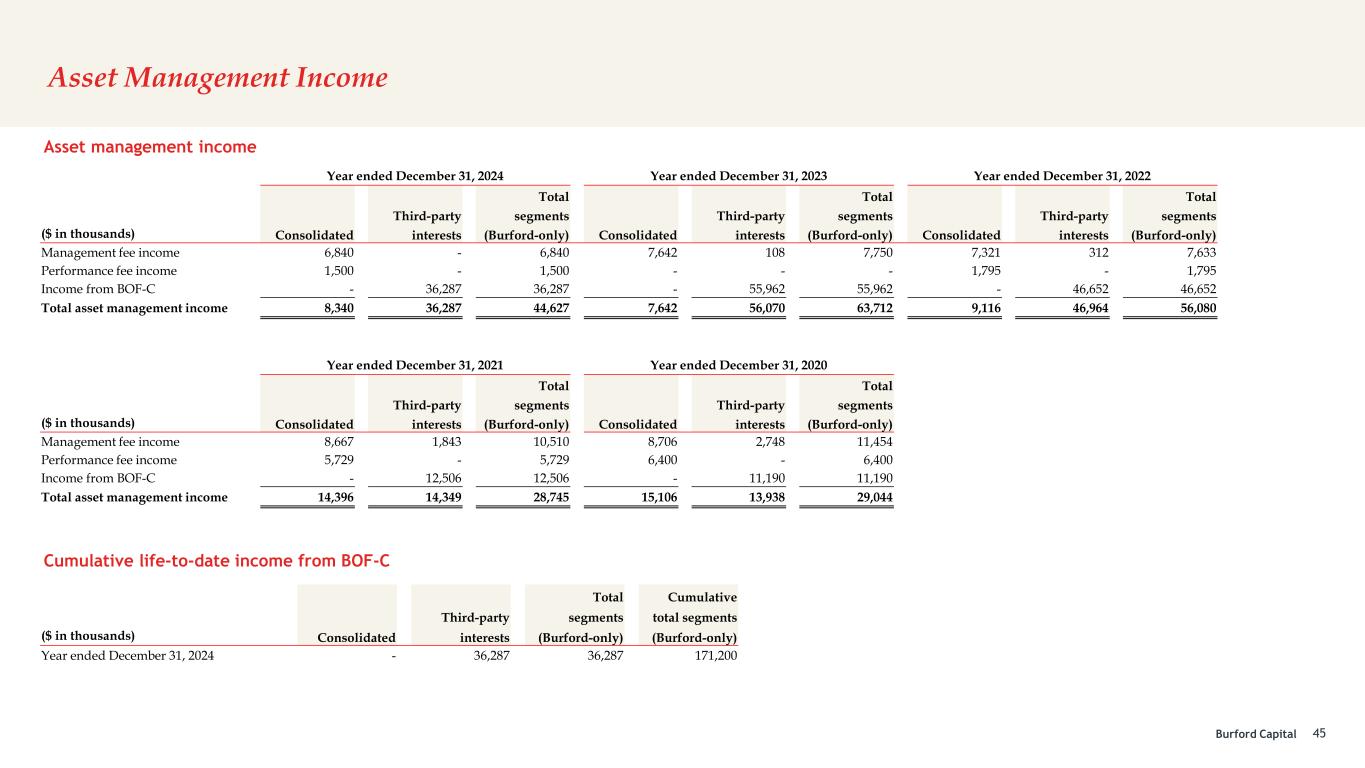

Burford Capital Asset Management Income 45 Asset management income Cumulative life-to-date income from BOF-C Year ended December 31, 2024 Year ended December 31, 2023 Year ended December 31, 2022 Total Total Total Third-party segments Third-party segments Third-party segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Management fee income 6,840 - 6,840 7,642 108 7,750 7,321 312 7,633 Performance fee income 1,500 - 1,500 - - - 1,795 - 1,795 Income from BOF-C - 36,287 36,287 - 55,962 55,962 - 46,652 46,652 Total asset management income 8,340 36,287 44,627 7,642 56,070 63,712 9,116 46,964 56,080 Year ended December 31, 2021 Year ended December 31, 2020 Total Total Third-party segments Third-party segments ($ in thousands) Consolidated interests (Burford-only) Consolidated interests (Burford-only) Management fee income 8,667 1,843 10,510 8,706 2,748 11,454 Performance fee income 5,729 - 5,729 6,400 - 6,400 Income from BOF-C - 12,506 12,506 - 11,190 11,190 Total asset management income 14,396 14,349 28,745 15,106 13,938 29,044 Total Cumulative Third-party segments total segments ($ in thousands) Consolidated interests (Burford-only) (Burford-only) Year ended December 31, 2024 - 36,287 36,287 171,200

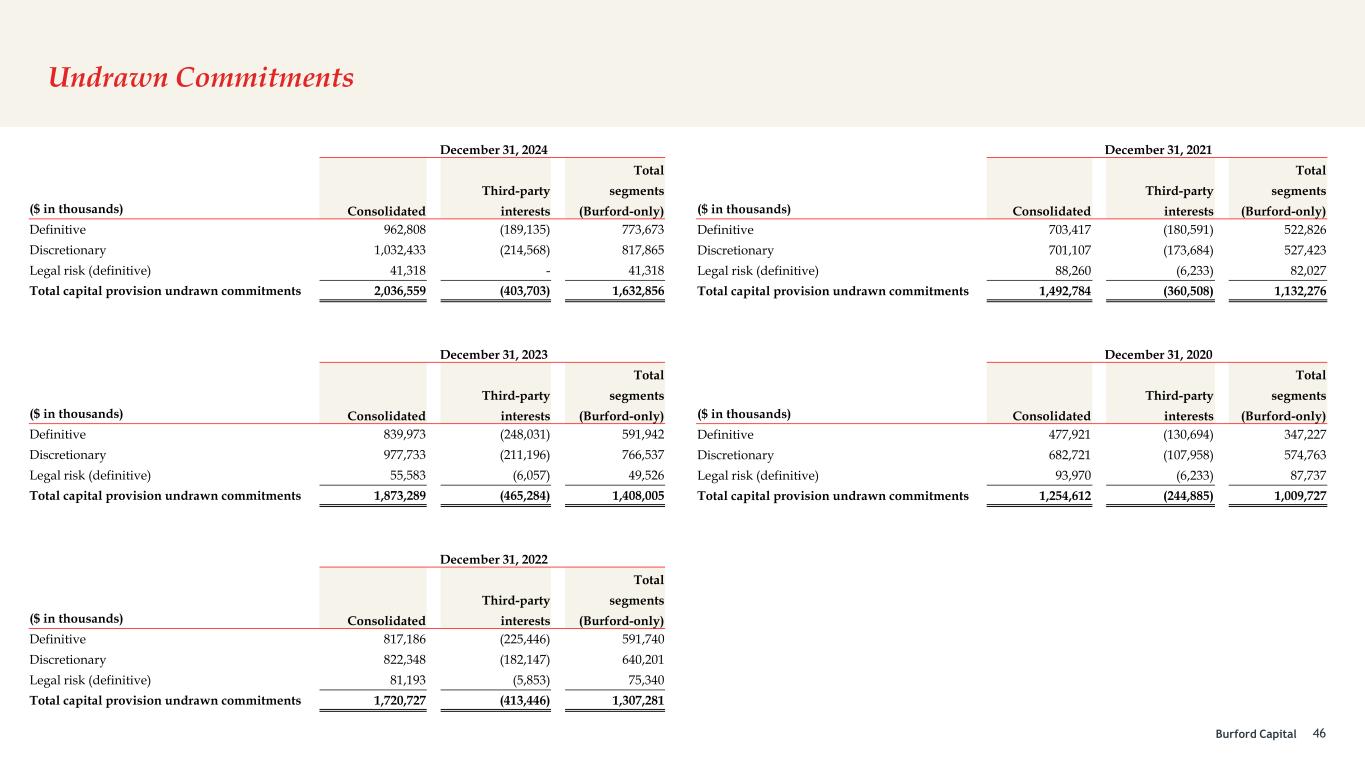

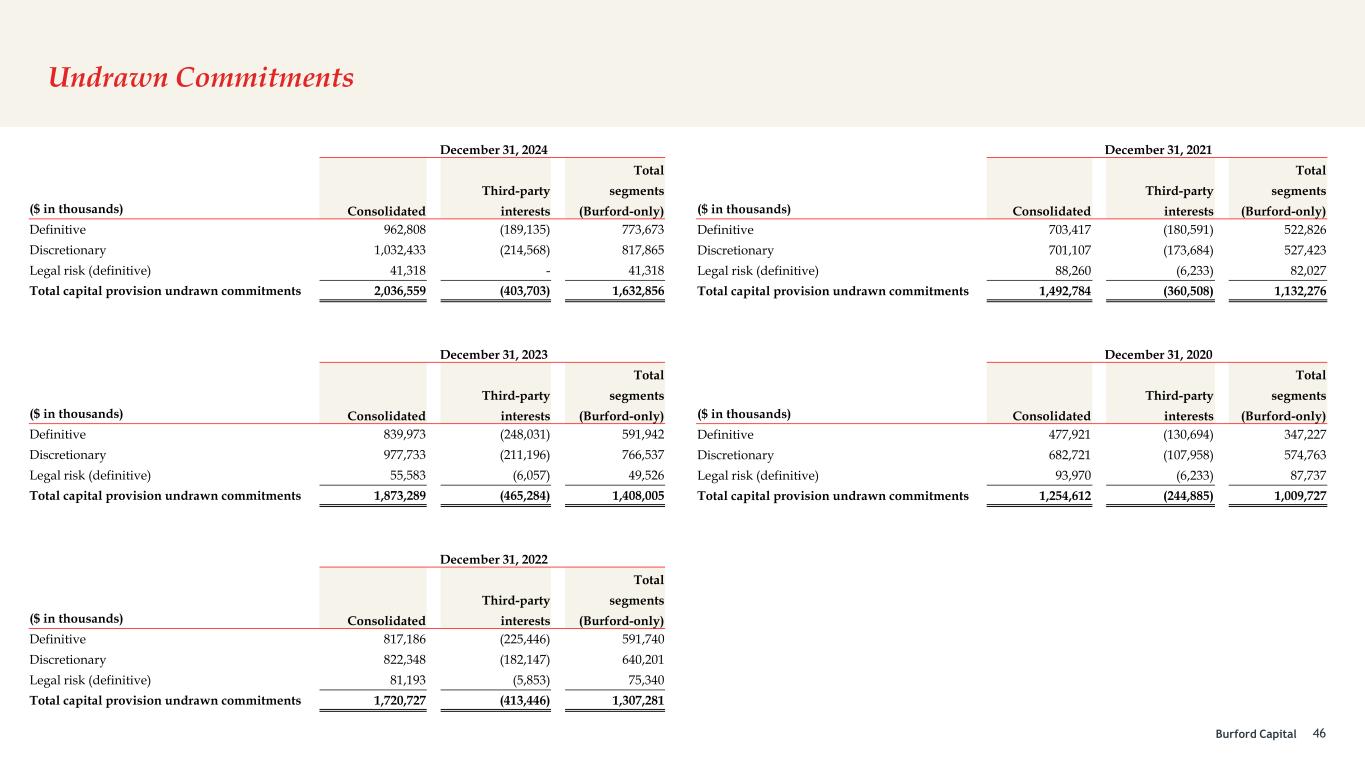

Burford Capital Undrawn Commitments 46 December 31, 2024 Total Third-party segments ($ in thousands) Consolidated interests (Burford-only) Definitive 962,808 (189,135) 773,673 Discretionary 1,032,433 (214,568) 817,865 Legal risk (definitive) 41,318 - 41,318 Total capital provision undrawn commitments 2,036,559 (403,703) 1,632,856 December 31, 2023 Total Third-party segments ($ in thousands) Consolidated interests (Burford-only) Definitive 839,973 (248,031) 591,942 Discretionary 977,733 (211,196) 766,537 Legal risk (definitive) 55,583 (6,057) 49,526 Total capital provision undrawn commitments 1,873,289 (465,284) 1,408,005 December 31, 2022 Total Third-party segments ($ in thousands) Consolidated interests (Burford-only) Definitive 817,186 (225,446) 591,740 Discretionary 822,348 (182,147) 640,201 Legal risk (definitive) 81,193 (5,853) 75,340 Total capital provision undrawn commitments 1,720,727 (413,446) 1,307,281 December 31, 2021 Total Third-party segments ($ in thousands) Consolidated interests (Burford-only) Definitive 703,417 (180,591) 522,826 Discretionary 701,107 (173,684) 527,423 Legal risk (definitive) 88,260 (6,233) 82,027 Total capital provision undrawn commitments 1,492,784 (360,508) 1,132,276 December 31, 2020 Total Third-party segments ($ in thousands) Consolidated interests (Burford-only) Definitive 477,921 (130,694) 347,227 Discretionary 682,721 (107,958) 574,763 Legal risk (definitive) 93,970 (6,233) 87,737 Total capital provision undrawn commitments 1,254,612 (244,885) 1,009,727