As filed with the U.S. Securities and Exchange Commission on August 9, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23293

The Cushing Mutual Funds Trust

(Exact name of registrant as specified in charter)

300 Crescent Court, Suite 1700

Dallas, TX 75201

(Address of principal executive offices) (Zip code)

Jerry V. Swank

300 Crescent Court, Suite 1700

Dallas, TX 75201

(Name and address of agent for service)

214-692-6334

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: May 31, 2021

Item 1. Reports to Stockholders.

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports are no longer sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports are made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive all future reports in paper free of charge by contacting your financial intermediary or, if you invest directly with the Fund, calling 800-236-4424 to let the Fund know of your request. Your election to receive shareholder reports in paper will apply to all funds held in your account.

*formerly, Cushing® MLP Infrastructure Fund

Table of Contents

| | |

Shareholder Letters (Unaudited) | 1 |

Hypothetical Growth of a $10,000 Investment (Unaudited) | 9 |

Expense Examples (Unaudited) | 12 |

Allocation of Portfolio Assets (Unaudited) | 15 |

Schedules of Investments (Unaudited) | 18 |

Statements of Assets & Liabilities (Unaudited) | 26 |

Statements of Operations (Unaudited) | 27 |

Statements of Changes in Net Assets | 28 |

Financial Highlights | 30 |

Notes to Financial Statements (Unaudited) | 36 |

Additional Information (Unaudited) | 47 |

Board Approval of Investment Management Agreement (Unaudited) | 49 |

Cushing® NextGen Infrastructure Fund Shareholder Letter (Unaudited) |

Dear Fellow Shareholder,

For the six month fiscal period ended May 31, 2021 (the “Period”), the Cushing® NextGen Infrastructure Fund (formerly known as Cushing® MLP Infrastructure Fund), (Class I shares) (the “Fund”) delivered a 7.81% total return, versus total returns of 10.04% for the S&P Global Infrastructure Index, the Fund’s benchmark index and 16.95% for the S&P 500 Index.

Market and Strategy Overview

Last year the Fund benefitted from strong growth in NextGen infrastructure assets, like data centers and solar power, as the world emerged from the COVID-induced slowdown. The Period saw a rotation out of those names and into more cyclical sectors, such as energy and commodities. While energy infrastructure was our second largest theme position, we still lagged the benchmark because of our structural underweighting. We believe that most infrastructure indices ( including the Fund’s benchmark), which are overexposed to the Energy Infrastructure and Industrial Infrastructure sectors, are missing out on the potential long-term growth infrastructure sectors. This view hurt our relative performance in the period.

The Fund, which invests among four themes, is designed to withstand periods such as this when “reversion” trades happen. We feel that we accomplished this for period, as our exposure to the cyclical Energy and Industrial themes more than offset the declines in Clean Infrastructure and Communication themes.

We are firm believers that the secular trends of digitization, the continued development of cloud infrastructure, and less carbon intensity will drive winners over the long-term. Here are some data points that give us confidence despite the market volatility.

| | ● | $949 billion in green stimulus announced globally as of March 20211 |

| | ● | Renewables are the cheapest source of new electricity for more than two-thirds of the world population and 90% of electricity generation2 |

| | ● | Migration to the cloud is less than 15% complete, according to an EvercoreISI survey of CFOs3 |

Fund Performance & Positioning

The largest contributors to performance were the crude pipelines, electric vehicle (“EV”) suppliers, and diversified midstream sectors. Despite the pullback in these high growth sectors, we still made money in electric vehicles because we began to take profits in the period. The Fund’s top three stock contributors for the period were from each of these sectors: EV battery manufacturer, Akasol (ticker: ASL GY) and midstream companies Energy Transfer (ticker: ET) and Targa Resources (ticker: TRGP). Akasol outperformed as it agreed to be purchased by BorgWarner for a 16% premium. The midstream companies benefitted from rally in commodity prices because of increased demand from the extreme winter weather and improving demand expectations.

The largest detracting sectors were solar and fuel cell companies. Individually, the Fund’s largest detractors were data center 21Vianet Group (ticker: VNET), fuel cell manufacturer Bloom Energy (ticker: BE), and solar equipment manufacturer Enphase Energy (ticker: ENPH). The largest driver of the underperformance for all three names was the rotation out of growth equities. We still have conviction in the long-term prospects of these companies and the Fund continues to hold all three names.

1 | BNEF. “Green Stimulus: The Policies and Politics”, 6/9/2021 |

2 | BNEF. “2H 2020 LCOE Update”, 12/10/2020 |

3 | EvercoreISI. “Capex Spending & Hiring Plans Survey Show Strong Rebound in 2021”, 6/8/2021 |

1

At the end of the Period, the Fund’s largest sector holdings were renewable power generation and midstream energy. We remain believers that economics and global policy will lead to substantial growth in renewable development, despite the recent pullback in equity prices. We also believe that the steady earnings and strong cash flow of midstream energy stocks is under appreciated by the market.

Outlook

While the strong gains over the last few years in infrastructure investing took a pause during the Period, we are still highly confident in the ongoing investment mega trends in this space. Much of recent investor focus and returns were on Energy Infrastructure, but we believe that a broader scope of important and related areas could well position the Fund to capture the broader infrastructure investing trend. The Fund continues to invest among these themes:

| | ● | Clean & Sustainable Infrastructure – Renewable energy, sustainable and water |

| | ● | Communication & Technology Infrastructure – Data storage, information highway, and payments |

| | ● | Energy Infrastructure – Power and midstream energy |

| | ● | Industrial Infrastructure – Toll roads, freight transportation, ports and airports |

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Jerry V. Swank

Chairman, Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change. The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. An investment in the Fund involves risks.

The Fund invests in infrastructure companies, which may be subject to a variety of factors that may adversely affect their business or operations, including high interest costs in connection with capital construction and improvement programs, high leverage, costs associated with environmental and other regulations, the effects of economic slowdown, surplus capacity, increased competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies and other factors. Sustainable infrastructure investments are subject to certain additional risks including high dependency upon on government policies that support renewable power generation and enhance the economic viability of owning renewable electric generation assets; adverse impacts from the reduction or discontinuation of tax benefits and other similar subsidies that benefit sustainable infrastructure companies; dependency on suitable weather condition and risk of damage to components used in the generation of renewable energy by severe weather; adverse changes and volatility in the wholesale market price for electricity in the markets served; the use of newly developed, less proven, technologies and the risk of failure of new technology to perform as anticipated; and dependence on a limited number of suppliers of system components and the occurrence of shortages, delays or component price changes. There is a risk that regulations that provide incentives for renewable energy could change or expire in a manner that adversely impacts the market for sustainable infrastructure companies generally. Technology and communications infrastructure investments are subject to certain additional risks including rapidly changing technologies and existing product obsolescence; short product life cycles; fierce competition; high research and development costs; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; frequent new product introductions and new market entrants; cyber security risks that include, among other things, theft, unauthorized monitoring, release, misuse, loss, destruction

2

or corruption of confidential and highly restricted data, denial of service attacks, unauthorized access to relevant systems, compromises to networks or devices that the information infrastructure companies use, or operational disruption or failures in the physical infrastructure or operating systems, potentially resulting in, among other things, financial losses, violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, reimbursement or other compensation costs and/or additional compliance costs.

The Fund incurs operating expenses, including advisory fees. Investment returns for the Fund are shown net of fees and expenses

The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance. The S&P Global Infrastructure Index is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. To create diversified exposure, the index includes three distinct infrastructure clusters: energy, transportation, and utilities. Net total returns reflect the deduction of applicable withholding taxes. Indices include the reinvestment of dividends and do not include fees or expenses. It is not possible to invest directly in an index.

3

Cushing® SMID Growth Focused Fund Shareholder Letter (Unaudited) |

Dear Fellow Shareholder,

For the semi-annual period ended May 31, 2021 (the “Period”), the Cushing® SMID Growth Focused Fund, Class I Shares, (the “Fund”) delivered a total return of 14.76%, versus a total return of 12.01% for the Russell® 2500 Growth Index, the Fund’s primary benchmark, and a total return of 16.95% for the S&P 500.

Market Overview

The Period saw strong performance of the market segments that underperformed during the initial Covid snapback from market lows in March 2020. For the broad market indices, smaller was better as micro-cap stocks outperformed small cap and small cap outperformed large cap. From a stylistic view, value strongly outperformed growth across all market segments.

Sector rotation was evident during the Period. In the Russell® 2500 Growth Index the two largest weighted sectors, Health Care and Technology, both underperformed after strong performance in the previous period. For the current Period, the benchmark was led by the cyclical Energy and Materials sectors, which drove the rally in value stocks.

The run-up in cyclical sectors coincided with rising yields, strong economic data and continued aggressive fiscal and monetary policy. Value sectors increased and growth sectors sold off as increases in the U.S. 10-Year Treasury yield accelerated during the period.

Fund Performance

On an absolute basis the Fund returned 14.76%, outperforming the benchmark’s return of 12.01%.

Overall, performance was driven by positive stock selection. Sector selection had a slight negative impact on performance, where an underweight in Consumer Discretionary and an overweight in Health Care were minor detractors. The top three contributors for the Period were:

| | ● | SVB Financial Group (NASDAQ: SIVB) – Financials/Banks |

| | | Returning 69.0% for the period, the company continues to grow well above the industry and reported a strong close to 2020 as well as a solid outlook for 2021. They also entered the Wealth Management market with the acquisition of Boston Private Financial Holding (NASDAQ: BPFH). We continue to hold the name. |

| | ● | Intra-Cellular Therapies Inc (NASDAQ: ITCI) – Health Care/Biotech |

| | | ITCI increased 66.7% for the period. Lumateperone, recently approved to treat schizophrenia, continues to ramp sales as the drug is introduced to the market. Follow on studies for the drug in bipolar depression have been successful with more data expected this year. ITCI has also shown initial success with Lumateperone based compounds in neuro-degenerative diseases, such as Parkinson’s, and will launch a Phase 2 study later this year. We remain shareholders. |

| | ● | Orbcomm Inc (NASDAQ: ORBC) – Communication Services/Wireless Telecom |

| | | ORBC increased 80.1% for the Period. The telematics company agreed to a takeout offer from Private Equity. We exited the position on the news. |

4

The top three detractors for the Period were:

| | ● | Medallia Inc (NYSE: MDLA) – Technology/Software |

| | | A disappointing fourth quarter earnings report moved MDLA from one of the stronger performers in the Fund to the biggest detractors. A billings revenue shortfall and higher expenses to expand their go-to-market operations disappointed investors. We continue to hold the position as we believe MDLA will return to pre Covid levels of growth in coming quarters. |

| | ● | Planet Fitness Inc (NYSE: PLNT) – Consumer Discretionary/Entertainment Facilities |

| | | PLNT, which was added to the Fund during the Period, detracted from relative performance. The company had no negative news during the Period and continues to regain customers lost during Covid. The company’s under performance was more related to the market’s focus on cyclical investments. We continue to hold the position. |

| | ● | Teledoc Health Inc (NYSE: TDOC) – Health Care/Services |

| | | Teledoc share returned -24.2% for the Period. The shares decreased when membership guidance for 2021 disappointed investors. We view this guidance as conservative and believe all the gains that tele-medicine made during Covid will lead to increased uptake in periods to come. We remain holders of the name. |

Conclusion

We believe that we are in the early stages of a multi-year economic expansion. Our research, which includes many conversations with management teams and industry analysts, reflects optimism that the recovery will continue. Revenue and earnings growth have shown steady improvement from the pandemic-induced shutdowns in the first half of 2020. Improvements in macro employment and strong consumer balance sheets point to a continuation of increased consumer spending. Pending increases in fiscal stimulus should also provide a tailwind to capital expenditures and business spending.

After a sharp decrease in 2020, consensus earnings and revenue estimates for 2021 indicate a strong recovery. Earnings estimates for 2021 are predicting greater than 50% growth and estimates for 2022 are up double digits on top of that. Additionally, earnings estimate revisions thus far in 2021 are running strongly positive.

Red flags to monitor going forward include liquidity in the system, inflation, interest rates and the pandemic.

| | ● | The timing of when the Fed will begin to taper their bond market purchases and decrease the high level of liquidity injected into the system in response to the crisis impact of Covid on the economy. |

| | ● | Inflation data has shown an acceleration thus far in the year and we believe it is reasonable to expect more inflation with the massive amount of liquidity that has been pumped into the system. |

| | ● | This has created a balancing act for the Fed in managing rates as inflation increases and the outcome will likely have a significant impact on the market. The Fed has indicated that they expect rates to remain low until we see sustainable inflation at or above its target of 2% for an extended period. It has not defined what it views as an “extended period” and has classified the current increase as possibly transitory. The balance between inflation and rates will influence access to expansionary credit as we return to a more normalized economy. |

| | ● | With the distribution of vaccines worldwide, there is reason to be optimistic that the reopening will continue. If so, there will be some catch up in economic production. The replenishing of inventories and supply lines should be a tailwind for economic growth. |

5

A return to a more normal environment should benefit our long term secular growth investment focus. We believe the investment philosophy and process we employ will serve the Fund well. We will continue to invest in strong secular growth companies with large market opportunities and defensible competitive advantages. This investment strategy brings exposure to next generation themes such as the digitization of the economy, biogenetic innovation, clean technologies and innovation in health care. We believe such companies, typically driven by innovation, will outgrow the market and accrue capital appreciation ultimately benefitting the Fund’s shareholders.

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Jerry V. Swank

Chairman, Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change. The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. An investment in the Fund involves risks.

The Fund incurs operating expenses, including advisory fees. Investment returns for the Fund are shown net of fees and expenses.

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. Securities of small-cap and mid-cap companies may be subject to greater price volatility, significantly lower trading volumes, cyclical, static or moderate growth prospects and greater spreads between their bid and ask prices than securities of larger companies. Small-cap and mid-cap companies frequently rely on narrower product lines and niche markets and may be more vulnerable to adverse business or market developments. Securities of these types of companies have limited market liquidity, and their prices may be more volatile. There is a risk that the securities issued by companies of a certain market capitalization may underperform the broader market at any given time.

The Russell® 2500 Growth Index is comprised of smaller and mid-capitalization U.S. equities that exhibit growth characteristics. Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2019. FTSE Russell is a trading name of certain of the LSE Group companies. Russell® 2500 Growth Index is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. Index returns do not include fees or expenses. It is not possible to invest directly in an index.

Must be preceded or accompanied by a prospectus.

6

Global Clean Equity Fund Shareholder Letter (Unaudited) |

Dear Fellow Shareholder,

For the six-month period ended May 31, 2021 (the “Period”), the Global Clean Equity Fund (Class I shares) (the “Fund”) delivered a total return of -2.70%, versus a 15.99% total return for the MSCI ACWI Net index, the Fund’s benchmark index, and -0.95% for the NASDAQ Clean Edge Green Energy Index.

Market and Strategy Overview

The Period began, like fiscal 2020, with strong outperformance. The Fund was up over 30% in mid January for the Period. However, sentiment quickly shifted as rising concerns about inflation and commodities turned against growth stocks.

We are firm believers that the secular trend of less carbon intensity will drive winners over the long-term. Here are some data points that give us confidence despite the market volatility.

| | ● | $949 billion in green stimulus announced globally as of March 20211 |

| | ● | Renewables are the cheapest source of new electricity for more than two-thirds of the world population and 90% of electricity generation2 |

The market is currently digesting the astounding growth for the clean sector in 2019-20. The critical juncture of clean energy becoming the most cost-effective electricity generation occurred at essentially the same time that the world was going through a global lockdown. This meant that while nearly all markets were experiencing unprecedented contraction in sales, the growth outlook for renewables was skyrocketing. Battery manufacturing, electric vehicle production, fuel cells, and other subindustries also saw increases in the expected market potential.

The adoption curves for each market in the Fund’s investment universe will be different and some, like solar is now, will suffer some setbacks along the way. We still see plentiful attractive opportunities in the future.

Fund Performance

Top contributing sectors during the period were electric vehicle suppliers, wind equipment, and fuel cell vehicles. Those sectors align well with the top three individual performers because they are sectors where we took profits. Commercial EV battery manufacturer Akasol (ticker: ASL GR) was the best performer, after announcing a merger with BorgWarner. Fuel cell vehicle manufacturer Plug Power (ticker: PLUG) and wind blade manufacturer TPI Composites (ticker: TPIC) were both up at the beginning year on new contract wins, and we used that as an opportunity to reduce our positions.

The largest detractor were solar and fuel cell companies. All the worst performing stocks were solar names: generation company Azure Power Global (ticker: AZRE), residential equipment manufacturer Sunrun (ticker: RUN), and cell manufacturer JinkoSolar (ticker: JKS). The solar sector lagged because of increased costs stemming from higher raw materials. The fund still owned all three of these names at the end of the period.

1 | BNEF. “Green Stimulus: The Policies and Politics”, 6/9/2021 |

2 | BNEF. “2H 2020 LCOE Update”, 12/10/2020 |

7

Outlook

While the strong gains over the last few years in sustainable investing took a pause during the period, we are still highly confident in the ongoing investment mega trends in this space. President Biden’s infrastructure bill underpins that we are on the precipice of a massive investment cycle in sustainable businesses. We have used the downturn to high-grade the portfolio and are believe the Fund is poised for future growth.

We believe that a broad approach to the clean investing will result in better performance. The increased allocation of Clean Water this period, when Clean Energy was out of favor, proved to be advantageous. The Fund invests among these themes:

| | ● | Clean Energy – Renewable energy, sustainable and charging |

| | ● | Clean Infrastructure – Electrical transmission, smart cities, and waste |

| | ● | Clean Transportation – New energy vehicles, batteries, and future mobility |

| | ● | Clean Water – Treatment, management, and infrastructure |

Our view is that we are well positioned when one theme is out of favor, such as Clean Energy has been during the period.

We truly appreciate your support and look forward to continuing to help you achieve your investment goals.

Sincerely,

Jerry V. Swank

Chairman, Chief Executive Officer and President

The information provided herein represents the opinion of the Fund’s portfolio managers and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice. The opinions expressed are as of the date of this report and are subject to change. The information in this report is not a complete analysis of every aspect of any market, sector, industry, security or the Fund itself. Statements of fact are from sources considered reliable, but the Fund makes no representation or warranty as to their completeness or accuracy. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. Please refer to the Schedule of Investments for a complete list of Fund holdings.

Past performance does not guarantee future results. An investment in the Fund involves risks.

The Fund incurs operating expenses, including advisory fees. Investment returns for the Fund are shown net of fees and expenses.

Mutual fund investing involves risk. Principal loss is possible. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund. Securities of small-cap and mid-cap companies may be subject to greater price volatility, significantly lower trading volumes, cyclical, static or moderate growth prospects and greater spreads between their bid and ask prices than securities of larger companies. Small-cap and mid-cap companies frequently rely on narrower product lines and niche markets and may be more vulnerable to adverse business or market developments. Securities of these types of companies have limited market liquidity, and their prices may be more volatile. There is a risk that the securities issued by companies of a certain market capitalization may underperform the broader market at any given time.

The MSCI ACWI index is designed to represent pefromance of the full opportunity set of large- and mid-cap stocks across 23 developed and 27 emerging markets. The NASDAQ Clean Edge Green Energy Index is a modified market capitalization-weighted index designed to track the performance of companies that are manufacturers, developers, distributors and/or installers of clean-energy technologies. The indices include reinvested dividends by do not include fees or expenses. It is not possible to invest directly in an index.

8

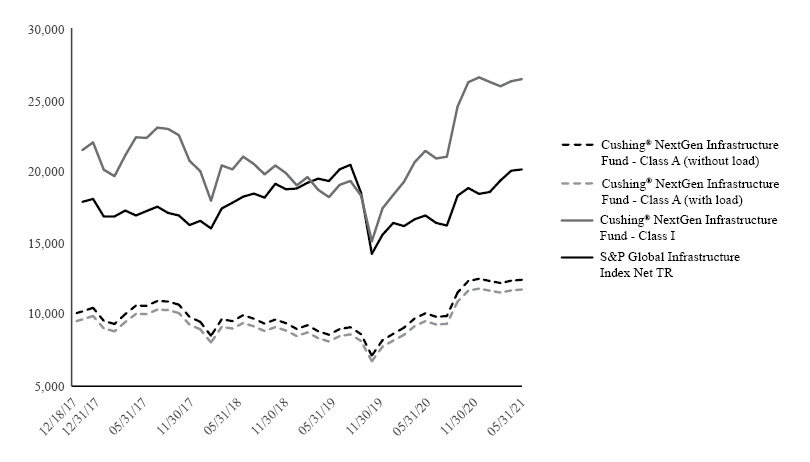

Cushing® NextGen Infrastructure Fund Hypothetical Growth of a $10,000 Investment (Unaudited) |

AVERAGE ANNUAL RETURNS |

May 31, 2021 | 1 Year | 5 Year | Since

Inception | Inception

Date |

Class A (without sales load) | 43.60% | n/a | 6.50% | 12/18/17 |

Class A (with sales load) | 35.73% | n/a | 4.78% | 12/18/17 |

| | | | | |

Class I | 44.03% | 5.35% | 6.87% | 3/1/10 |

| | | | |

S&P Global Infrastructure Index Net TR | 22.80% | n/a | 3.44% | 3/1/10 |

(1) | Performance figures for Class I shares reflect the historical performance of the Predecessor Fund for periods prior to December 18, 2017. |

The Fund’s expense ratio, as stated in the March 30, 2021 prospectus, is 4.05% and 1.50%, gross and net, respectively for Class A shares and 3.80% and 1.25%, gross and net, for Class I shares. Contractual expense waivers are effective through March 31, 2022.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-878-4080 or by visiting www.cushingfunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.75%. Class I is not subject to a sales charge or MDSC.

The S&P Global Infrastructure Index Net TR is designed to track 75 companies from around the world chosen to represent the listed infrastructure industry while maintaining liquidity and tradability. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

9

Cushing® SMID Growth Focused Fund Hypothetical Growth of a $10,000 Investment (Unaudited) |

AVERAGE ANNUAL RETURNS |

May 31, 2021 | 1 Year | 5 Year | Since

Inception | Inception

Date |

Class A (without sales load) | 44.25% | n/a | 27.30% | 1/31/20 |

Class A (with sales load) | 36.26% | n/a | 22.02% | 1/31/20 |

| | | | |

Class I | 44.62% | n/a | 27.64% | 1/31/20 |

| | | | |

Russell® 2500 Growth Index | 47.27% | n/a | 32.00% | 1/31/20 |

The Fund’s expense ratio, as stated in the March 30, 2021 prospectus, is 5.50% and 1.40%, gross and net, respectively for Class A shares and 5.25% and 1.15%, gross and net, for Class I shares. Contractual expense waivers are effective through March 31, 2022.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-878-4080 or by visiting www.cushingfunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.50%. Class I is not subject to a sales charge or MDSC.

The Russell® 2500 Growth Index which is comprised of smaller and mid-capitalization U.S. equities that exhibit growth characteristics. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

10

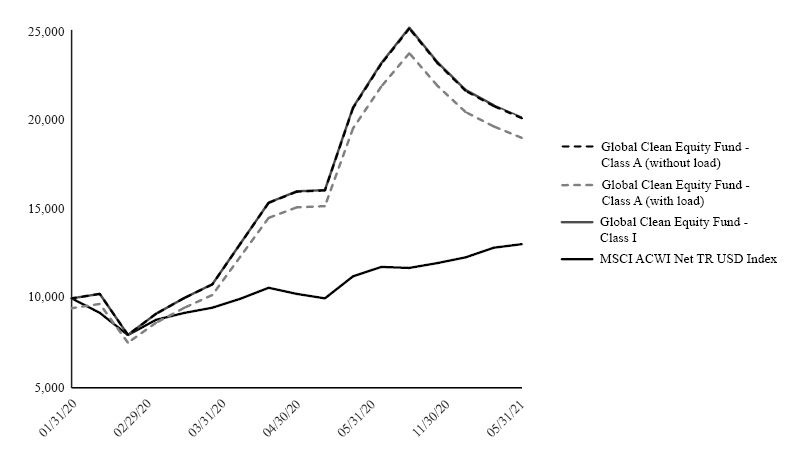

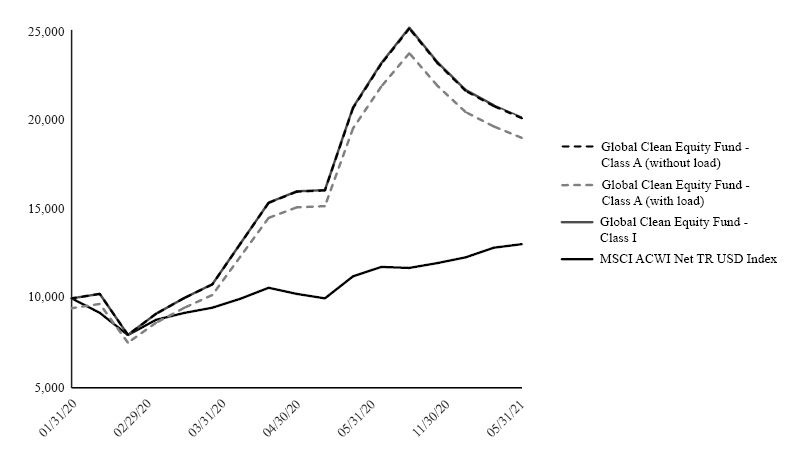

Global Clean Equity Fund Hypothetical Growth of a $10,000 Investment (Unaudited) |

AVERAGE ANNUAL RETURNS |

May 31, 2021 | 1 Year | 5 Year | Since

Inception | Inception

Date |

Class A (without sales load) | 100.24% | n/a | 68.71% | 1/31/20 |

Class A (with sales load) | 89.29% | n/a | 61.71% | 1/31/20 |

| | | | |

Class I | 100.75% | n/a | 69.03% | 1/31/20 |

| | | | |

MSCI ACWI Net TR USD Index | 41.85% | n/a | 21.99% | 1/31/20 |

The Fund’s expense ratio, as stated in the March 30, 2021 prospectus, is 7.31% and 1.35%, gross and net, respectively for Class A shares and 7.06% and 1.10%, gross and net, for Class I shares. Contractual expense waivers are effective through March 31, 2022.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-878-4080 or by visiting www.cushingfunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.50%. Class I is not subject to a sales charge or MDSC.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 26 emerging markets. You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

11

Cushing® NextGen Infrastructure Fund Expense Example (Unaudited) |

The example below is intended to describe the fees and expenses borne by shareholders during the period from December 1, 2020 to May 31, 2021, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the fiscal year and held for the entire period from December 1, 2020 to May 31, 2021.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the fiscal period from December 1, 2020 to May 31, 2021. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Share Class | | Beginning

Account Value

12/01/2020 | | | Ending

Account

Value (Based

on Actual

Returns and

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Ending

Account Value

(Based on

Hypothetical

5% Annualized

Return and

Actual

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Net Expense

Ratio During

Period2 | |

Class A Shares | | $ | 1,000.00 | | | $ | 1,077.00 | | | $ | 7.77 | | | $ | 1,017.45 | | | $ | 7.54 | | | | 1.50 | % |

Class I Shares | | $ | 1,000.00 | | | $ | 1,078.10 | | | $ | 6.48 | | | $ | 1,018.70 | | | $ | 6.29 | | | | 1.25 | % |

1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 182 (to reflect the period). The table above represents the actual expenses incurred during the period. |

2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the period. |

12

Cushing® SMID Growth Focused Fund Expense Example (Unaudited) |

The example below is intended to describe the fees and expenses borne by shareholders during the period from December 1, 2020 to May 31, 2021, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the fiscal year and held for the entire period from December 1, 2020 to May 31, 2021.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the fiscal period from December 1, 2020 to May 31, 2021. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Share Class | | Beginning

Account Value

12/01/2020 | | | Ending

Account

Value (Based

on Actual

Returns and

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Ending

Account Value

(Based on

Hypothetical

5% Annualized

Return and

Actual

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Net Expense

Ratio During

Period2 | |

Class A Shares | | $ | 1,000.00 | | | $ | 1,145.30 | | | $ | 7.22 | | | $ | 1,018.20 | | | $ | 6.79 | | | | 1.35 | % |

Class I Shares | | $ | 1,000.00 | | | $ | 1,147.60 | | | $ | 5.89 | | | $ | 1,019.45 | | | $ | 5.54 | | | | 1.10 | % |

1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 182 (to reflect the period). The table above represents the actual expenses incurred during the period. |

2. | Expenses are equal to the Fund’s annualized expense ratio to reflect the period. |

13

Global Clean Equity Fund Expense Example (Unaudited) |

The example below is intended to describe the fees and expenses borne by shareholders during the period from December 1, 2020 to May 31, 2021, and the impact of those costs on your investment.

Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including exchange fees and sales charges (loads) on purchases (as applicable), and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses (as applicable). This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 made at the beginning of the fiscal year and held for the entire period from December 1, 2020 to May 31, 2021.

This example illustrates your Fund’s ongoing costs in two ways:

Actual Expenses

The second and third data columns in the table below provide information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid during the fiscal period from December 1, 2020 to May 31, 2021. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The fourth and fifth data columns in the table below provide information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balances or expenses you paid for the six-month period shown. You may use this information to compare the ongoing costs of investing in the Fund with the ongoing costs of investing in other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other Funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as exchange fees or sales charges (loads). Therefore, the fourth and fifth data columns of the table are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Share Class | | Beginning

Account Value

12/01/2020 | | | Ending

Account

Value (Based

on Actual

Returns and

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Ending

Account Value

(Based on

Hypothetical

5% Annualized

Return and

Actual

Expenses)

05/31/21 | | | Expenses Paid

During Period1 | | | Net Expense

Ratio During

Period2 | |

Class A Shares | | $ | 1,000.00 | | | $ | 972.40 | | | $ | 6.88 | | | $ | 1,017.95 | | | $ | 7.04 | | | | 1.40 | % |

Class I Shares | | $ | 1,000.00 | | | $ | 973.00 | | | $ | 5.66 | | | $ | 1,019.20 | | | $ | 5.79 | | | | 1.15 | % |

1. | Expenses are equal to the Fund’s annualized expense ratio of each class multiplied by the average account value over the period, divided by 365 and multiplied by 182 (to reflect the period). The table above represents the actual expenses incurred during the period. |

2 | . Expenses are equal to the Fund’s annualized expense ratio to reflect the period. |

14

Cushing® NextGen Infrastructure Fund Allocation of Portfolio Assets(1) (Unaudited) May 31, 2021

(Expressed as a Percentage of Total Investments) |

(1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

(3) | Master Limited Partnerships and Related Companies |

(4) | Real Estate Investment Trusts |

15

Cushing® SMID Growth Focused Fund Allocation of Portfolio Assets(1) (Unaudited) May 31, 2021

(Expressed as a Percentage of Total Investments) |

(1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

16

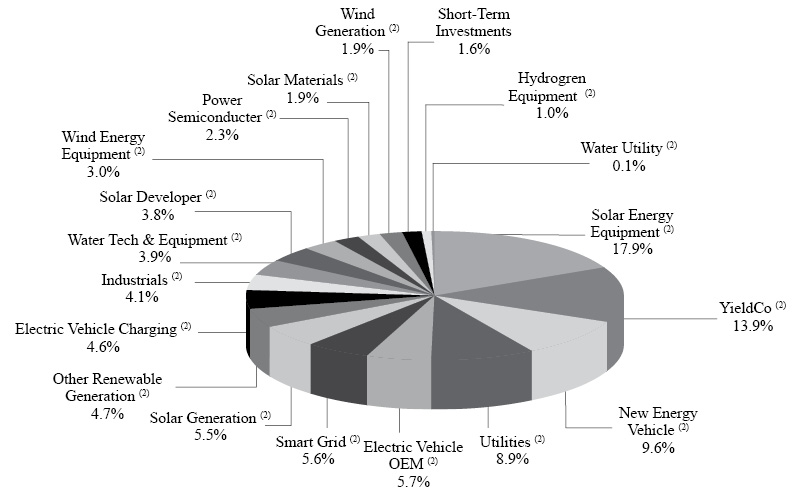

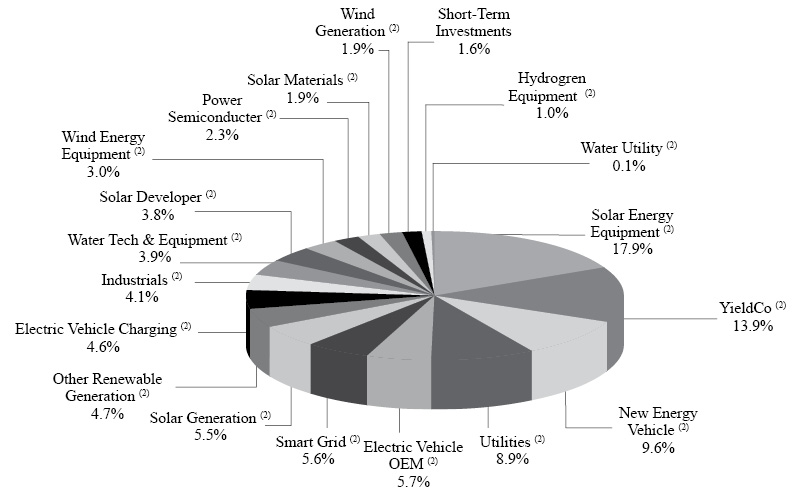

Global Clean Equity Fund Allocation of Portfolio Assets(1) (Unaudited) May 31, 2021

(Expressed as a Percentage of Total Investments) |

(1) | Fund holdings and sector allocations are subject to change and there is no assurance that the Fund will continue to hold any particular security. |

17

Cushing® NextGen Infrastructure Fund |

Schedule of Investments (Unaudited) | May 31, 2021 |

Common Stock — 81.1% | | Shares | | | Fair Value | |

Cloud Services — 1.5% | | | | | | | | |

United States — 1.5% | | | | | | | | |

Microsoft Corporation | | | 1,158 | | | $ | 289,129 | |

| | | | | | | | | |

Communication Services — 0.9% | | | | | | | | |

Italy — 0.8% | | | | | | | | |

Infrastrutture Wireless Italiane SpA | | | 16,008 | | | | 179,398 | |

| | | | | | | | | |

Data Centers — 1.0% | | | | | | | | |

United States — 1.0% | | | | | | | | |

Switch, Inc. | | | 10,000 | | | | 188,700 | |

| | | | | | | | | |

Electric Vehicle Charging — 2.5% | | | | | | | | |

United States — 2.5% | | | | | | | | |

Chargepoint Holdings Inc. (1) | | | 20,000 | | | | 487,000 | |

| | | | | | | | | |

Freight Rail — 2.0% | | | | | | | | |

United States — 2.0% | | | | | | | | |

CSX Corp. | | | 3,905 | | | | 390,969 | |

| | | | | | | | | |

GDS Services — 0.9% | | | | | | | | |

United States — 0.9% | | | | | | | | |

Sabre Corporation | | | 11,999 | | | | 166,186 | |

| | | | | | | | | |

Hydrogen Equipment — 0.8% | | | | | | | | |

Norway — 0.8% | | | | | | | | |

Nel ASA | | | 68,903 | | | | 150,692 | |

| | | | | | | | | |

Industrials — 2.5% | | | | | | | | |

Mexico — 1.5% | | | | | | | | |

Grupo Aeroportuario del Sureste, S.A.B. de C.V. (1) | | | 1,654 | | | | 292,146 | |

United States — 1.0% | | | | | | | | |

Plug Power, Inc. (1) | | | 6,000 | | | | 184,200 | |

| | | | | | | | 476,346 | |

Integrated Utility — 3.9% | | | | | | | | |

Chile — 0.6% | | | | | | | | |

Enel Americas SA | | | 16,241 | | | | 110,276 | |

France — 1.5% | | | | | | | | |

Electricite de France S.A. (1) | | | 20,705 | | | | 293,012 | |

Italy — 1.8% | | | | | | | | |

Enel Societa Per Azioni | | | 35,565 | | | | 350,671 | |

| | | | | | | | 753,959 | |

IT Services — 6.2% | | | | | | | | |

Cayman Islands — 5.4% | | | | | | | | |

21Vianet Group, Inc. (1) | | | 36,553 | | | | 815,863 | |

GDS Holdings Limited (1) | | | 3,018 | | | | 227,014 | |

Spain — 0.8% | | | | | | | | |

Amadeus IT Group (1) | | | 2,000 | | | | 151,212 | |

| | | | | | | | 1,194,089 | |

See Accompanying Notes to the Financial Statements.

18

Cushing® NextGen Infrastructure Fund |

Schedule of Investments (Unaudited) | May 31, 2021 — (Continued) |

Common Stock (Continued) | | Shares | | | Fair Value | |

Large Cap Diversified — 1.8% | | | | | | | | |

United States — 1.8% | | | | | | | | |

Kinder Morgan, Inc. | | | 19,224 | | | $ | 352,568 | |

| | | | | | | | | |

Natural Gas Gatherers & Processors — 4.1% | | | | | | | | |

United States — 4.1% | | | | | | | | |

Targa Resources Corporation | | | 20,293 | | | | 788,586 | |

| | | | | | | | | |

Natural Gas Transportation & Storage — 1.3% | | | | | | | | |

United States — 1.3% | | | | | | | | |

Equitrans Midstream Corporation | | | 30,100 | | | | 248,024 | |

| | | | | | | | | |

Other Renewable Generation — 2.0% | | | | | | | | |

Canada — 1.2% | | | | | | | | |

Brookfield Renewable Corporation | | | 5,352 | | | | 228,638 | |

United States — 0.8% | | | | | | | | |

Bloom Energy Corporation (1) | | | 6,838 | | | | 165,275 | |

| | | | | | | | 393,913 | |

Power Management — 3.6% | | | | | | | | |

United States — 3.6% | | | | | | | | |

Itron Inc. (1) | | | 7,305 | | | | 696,532 | |

| | | | | | | | | |

Railroads — 4.8% | | | | | | | | |

United States — 4.8% | | | | | | | | |

Norfolk Southern Corporation | | | 700 | | | | 196,630 | |

Union Pacific Corporation | | | 3,225 | | | | 724,754 | |

| | | | | | | | 921,384 | |

Refiners — 3.5% | | | | | | | | |

United States — 3.5% | | | | | | | | |

Marathon Petroleum Corporation | | | 10,940 | | | | 676,092 | |

| | | | | | | | | |

Renewable Distribution — 5.2% | | | | | | | | |

Spain — 1.1% | | | | | | | | |

Iberdrola S A | | | 3,991 | | | | 221,101 | |

United States — 4.1% | | | | | | | | |

NextEra Energy, Inc. | | | 10,708 | | | | 784,040 | |

| | | | | | | | 1,005,141 | |

Solar Developer — 1.3% | | | | | | | | |

Mauritius — 1.3% | | | | | | | | |

Azure Power Global Ltd (1) | | | 12,000 | | | | 249,720 | |

| | | | | | | | | |

Solar Energy Equipment — 9.7% | | | | | | | | |

United States — 9.7% | | | | | | | | |

Array Technologies Inc. (1) | | | 19,500 | | | | 317,850 | |

Enphase Energy, Inc. (1) | | | 3,998 | | | | 571,914 | |

Solaredge Technologies, Inc. (1) | | | 2,936 | | | | 757,517 | |

Sunrun, Inc. (1) | | | 49,212 | | | | 220,067 | |

| | | | | | | | 1,867,348 | |

Solar Generation — 3.3% | | | | | | | | |

Spain — 3.3% | | | | | | | | |

Solaria Energia y Medio Ambiente, SA (1) | | | 34,000 | | | | 640,786 | |

See Accompanying Notes to the Financial Statements.

19

Cushing® NextGen Infrastructure Fund |

Schedule of Investments (Unaudited) | May 31, 2021 — (Continued) |

Common Stock (Continued) | | Shares | | | Fair Value | |

Tollroads — 1.4% | | | | | | | | |

Italy — 1.4% | | | | | | | | |

Atlantia Spa (1) | | | 14,070 | | | $ | 268,518 | |

| | | | | | | | | |

Utilities — 6.0% | | | | | | | | |

France — 6.0% | | | | | | | | |

ENGIE (1) | | | 16,000 | | | | 239,325 | |

Suez SA | | | 25,000 | | | | 609,269 | |

Veolia Environnement SA | | | 10,000 | | | | 315,594 | |

| | | | | | | | 1,164,188 | |

Yield Co — 10.9% | | | | | | | | |

United Kingdom — 10.9% | | | | | | | | |

Atlantica Sustainable Infrastructure plc | | | 22,690 | | | | 824,782 | |

Clearway Energy, Inc. | | | 29,901 | | | | 802,244 | |

NextEra Energy Partners, L.P. | | | 6,965 | | | | 476,197 | |

| | | | | | | | 2,103,223 | |

| | | | | | | | | |

Total Common Stock (Cost $13,854,216) | | | | | | $ | 15,652,491 | |

| | | | | | | | | |

Master Limited Partnerships and Related Companies — 13.8% | | Units | | | | |

Crude Oil & Refined Products — 3.1% | | | | | | | | |

United States — 3.1% | | | | | | | | |

Magellan Midstream Partners, L.P. | | | 12,079 | | | $ | 595,374 | |

| | | | | | | | | |

Large Cap Diversified C Corps — 2.5% | | | | | | | | |

United States — 2.5% | | | | | | | | |

Plains GP Holdings, L.P. | | | 44,572 | | | | 486,280 | |

| | | | | | | | | |

Large Cap MLP — 8.2% | | | | | | | | |

United States — 8.2% | | | | | | | | |

Energy Transfer, L.P. | | | 65,000 | | | | 643,500 | |

MPLX, L.P. | | | 32,703 | | | | 936,287 | |

| | | | | | | | 1,579,787 | |

| | | | | | | | | |

Total Master Limited Partnerships (Cost $1,957,582) | | | | | | $ | 2,661,441 | |

| | | | | | | | | |

Real Estate Investment Trusts — 2.5% | | Shares | | | | |

Data Centers — 2.5% | | | | | | | | |

Singapore — 2.5% | | | | | | | | |

Keppel DC REIT | | | 253,473 | | | $ | 492,571 | |

Total Real Estate Investment Trusts (Cost $370,684) | | | | | | $ | 492,571 | |

Total Investments — 97.4% (Cost $16,182,482) | | | | | | $ | 18,806,503 | |

Other Assets in Excess of Liabilities — 2.6% | | | | | | | 510,768 | |

Total Net Assets Applicable to Unitholders — 100.0% | | | | | | $ | 19,317,271 | |

Percentages are stated as a percent of net assets.

(1) | No distribution or dividend was made during the period ended May 31, 2021. As such, it is classified as a non-income producing security as of May 31, 2021. |

See Accompanying Notes to the Financial Statements.

20

Cushing® SMID Growth Focused Fund |

Schedule of Investments (Unaudited) | May 31, 2021 |

Common Stock — 98.2% | | Shares | | | Fair Value | |

Biotechnology — 10.1% | | | | | | | | |

United States — 10.1% | | | | | | | | |

Alnylam Pharmaceuticals, Inc. (1) | | | 1,471 | | | $ | 208,867 | |

Exact Sciences Corporation (1) | | | 1,438 | | | | 158,942 | |

Flexion Therapeutics (1) | | | 19,607 | | | | 164,111 | |

| | | | | | | | 531,920 | |

Building Products — 4.2% | | | | | | | | |

United States — 4.2% | | | | | | | | |

View Inc. (1) | | | 27,745 | | | | 219,741 | |

| | | | | | | | | |

Chemicals — 4.4% | | | | | | | | |

United States — 4.4% | | | | | | | | |

Ingevity Corporation (1) | | | 2,829 | | | | 232,855 | |

| | | | | | | | | |

Consumer Discretionary — 4.2% | | | | | | | | |

United States — 4.2% | | | | | | | | |

Planet Fitness, Inc. (1) | | | 2,815 | | | | 221,738 | |

| | | | | | | | | |

Diversified Telecom Services — 2.8% | | | | | | | | |

United States — 2.8% | | | | | | | | |

Bandwidth Inc. (1) | | | 1,229 | | | | 145,379 | |

| | | | | | | | | |

Electronic Equipment — 2.9% | | | | | | | | |

United States — 2.9% | | | | | | | | |

Akoustis Technologies, Inc. (1) | | | 16,126 | | | | 154,487 | |

| | | | | | | | | |

Financial Services — 5.1% | | | | | | | | |

United States — 5.1% | | | | | | | | |

SVB Financial Group (1) | | | 459 | | | | 267,546 | |

| | | | | | | | | |

Healthcare — 2.5% | | | | | | | | |

United States — 2.5% | | | | | | | | |

Teladoc Health, Inc. (1) | | | 861 | | | | 129,649 | |

| | | | | | | | | |

Healthcare Equipment & Supplies — 14.0% | | | | | | | | |

Jersey — 3.6% | | | | | | | | |

Novocure Ltd. (1) | | | 918 | | | | 187,272 | |

United States — 10.4% | | | | | | | | |

Abiomed, Inc. (1) | | | 608 | | | | 173,025 | |

Hologic Inc. (1) | | | 2,822 | | | | 177,955 | |

Cytosorbents Corporation (1) | | | 24,481 | | | | 198,051 | |

| | | | | | | | 736,303 | |

Machinery — 13.6% | | | | | | | | |

Israel — 4.3% | | | | | | | | |

Kornit Digital Ltd (1) | | | 2,185 | | | | 227,677 | |

United States — 9.3% | | | | | | | | |

Charts Industrials, Inc. (1) | | | 1,734 | | | | 253,060 | |

Evoqua Water Technologies Corporation (1) | | | 7,520 | | | | 234,022 | |

| | | | | | | | 714,759 | |

See Accompanying Notes to the Financial Statements.

21

Cushing® SMID Growth Focused Fund |

Schedule of Investments (Unaudited) | May 31, 2021 — (Continued) |

Common Stock (Continued) | | Shares | | | Fair Value | |

Pharmaceuticals — 9.2% | | | | | | | | |

United States — 9.2% | | | | | | | | |

Aerie Pharmaceuticals, Inc. (1) | | | 14,008 | | | $ | 228,190 | |

Intra Cellular Therapies, Inc. (1) | | | 6,418 | | | | 252,933 | |

| | | | | | | | 481,123 | |

Software — 21.7% | | | | | | | | |

United States — 21.7% | | | | | | | | |

Everbridge, Inc. (1) | | | 1,520 | | | | 178,600 | |

Hubspot, Inc. (1) | | | 473 | | | | 238,572 | |

Medallia Inc. (1) | | | 5,364 | | | | 137,694 | |

Rapid7, Inc. (1) | | | 3,016 | | | | 252,288 | |

Ringcentral, Inc. (1) | | | 564 | | | | 148,033 | |

Smartsheet, Inc. (1) | | | 3,187 | | | | 188,288 | |

| | | | | | | | 1,143,475 | |

Specialty Retail — 3.5% | | | | | | | | |

United States — 3.5% | | | | | | | | |

Five Below, Inc. (1) | | | 1,003 | | | | 184,672 | |

Total Common Stock (Cost $4,211,765) | | | | | | $ | 5,163,647 | |

| | | | | | | | | |

Short-Term Investments —

Investment Companies — 1.9% | | | | | | |

United States — 1.9% | | | | | | | | |

First American Government Obligations Fund - Class X, 0.01%(2) | | | 49,825 | | | $ | 49,825 | |

First American Treasury Obligations Fund - Class X, 0.01%(2) | | | 49,825 | | | | 49,825 | |

Total Short-Term Investments (Cost $99,650) | | | | | | $ | 99,650 | |

Total Investments — 100.1% (Cost $4,311,415) | | | | | | $ | 5,263,297 | |

Liabilities in Excess of Other Assets — (0.1)% | | | | | | | (3,880 | ) |

Total Net Assets Applicable to Unitholders — 100.0% | | | | | | $ | 5,259,417 | |

Percentages are stated as a percent of net assets.

(1) | No distribution or dividend was made during the period ended May 31, 2021. As such, it is classified as a non-income producing security as of May 31, 2021. |

(2) | Rate reported is the current yield as of May 31, 2021. |

See Accompanying Notes to the Financial Statements.

22

Global Clean Equity Fund |

Schedule of Investments (Unaudited) | May 31, 2021 |

Common Stock — 98.1% | | Shares | | | Fair Value | |

Hydrogen Equipment — 1.0% | | | | | | | | |

Norway — 1.0% | | | | | | | | |

Nel ASA (1) | | | 45,000 | | | $ | 98,416 | |

| | | | | | | | | |

Electric Vehicle Charging — 4.6% | | | | | | | | |

United States — 4.6% | | | | | | | | |

Chargepoint Holdings Inc. (1) | | | 18,616 | | | | 453,300 | |

| | | | | | | | | |

Electric Vehicle OEM — 5.7% | | | | | | | | |

Cayman Islands — 5.7% | | | | | | | | |

Nio, Inc. (1) | | | 14,523 | | | | 560,878 | |

| | | | | | | | | |

Industrials — 4.1% | | | | | | | | |

United States — 4.1% | | | | | | | | |

Plug Power, Inc. (1) | | | 13,220 | | | | 405,854 | |

| | | | | | | | | |

New Energy Vehicle — 9.5% | | | | | | | | |

Canada — 0.6% | | | | | | | | |

Ballard Power Systems, Inc. (1) | | | 3,348 | | | | 57,987 | |

Cayman Islands — 4.4% | | | | | | | | |

NIU Technologies (1) | | | 13,084 | | | | 435,959 | |

Jersey — 1.0% | | | | | | | | |

Aptiv Plc (1) | | | 655 | | | | 98,525 | |

United States — 3.5% | | | | | | | | |

Tesla, Inc. (1) | | | 557 | | | | 348,248 | |

| | | | | | | | 940,719 | |

Other Renewable Generation — 4.6% | | | | | | | | |

Bermuda — 1.9% | | | | | | | | |

Brookfield Renewable Partners, L.P. | | | 4,663 | | | | 185,447 | |

Canada — 1.1% | | | | | | | | |

Brookfield Renewable Corporation | | | 2,673 | | | | 114,191 | |

United States — 1.6% | | | | | | | | |

Bloom Energy Corporation (1) | | | 3,496 | | | | 84,498 | |

FuelCell Energy, Inc. (1) | | | 7,578 | | | | 74,416 | |

| | | | | | | | 458,552 | |

Power Semiconductor — 2.3% | | | | | | | | |

Germany — 1.3% | | | | | | | | |

Infineon Technology | | | 3,233 | | | | 130,950 | |

Netherlands — 0.1% | | | | | | | | |

12658.26 | | | 339 | | | | 12,658 | |

United States — 0.9% | | | | | | | | |

Cree, Inc. (1) | | | 854 | | | | 85,409 | |

| | | | | | | | 229,017 | |

Smart Grid — 5.6% | | | | | | | | |

Switzerland — 0.9% | | | | | | | | |

Landis & Gyr Group | | | 1,204 | | | | 87,807 | |

United States — 4.7% | | | | | | | | |

Itron, Inc. (1) | | | 4,912 | | | | 468,359 | |

| | | | | | | | 556,166 | |

| | | | | | | | | |

See Accompanying Notes to the Financial Statements.

23

Global Clean Equity Fund |

Schedule of Investments (Unaudited) | May 31, 2021 — (Continued) |

Common Stock (Continued) | | Shares | | | Fair Value | |

Solar Developer — 3.8% | | | | | | | | |

Mauritius — 2.3% | | | | | | | | |

Azure Power Global Ltd (1) | | | 10,815 | | | $ | 225,060 | |

United States — 1.5% | | | | | | | | |

Sunnova Energy International, Inc. (1) | | | 5,038 | | | | 147,110 | |

| | | | | | | | 372,170 | |

Solar Energy Equipment — 17.9% | | | | | | | | |

France — 0.5% | | | | | | | | |

Schneider Electric | | | 1,608 | | | | 51,038 | |

United States — 17.4% | | | | | | | | |

Array Technologies Inc. | | | 19,000 | | | | 309,700 | |

Enphase Energy, Inc. (1) | | | 2,888 | | | | 413,128 | |

First Solar, Inc. (1) | | | 1,807 | | | | 137,531 | |

Solaredge Technologies, Inc. (1) | | | 1,934 | | | | 498,991 | |

Sunrun, Inc. (1) | | | 7,936 | | | | 354,898 | |

| | | | | | | | 1,765,286 | |

Solar Generation — 5.5% | | | | | | | | |

Spain — 5.5% | | | | | | | | |

Solaria Energia y Medio Ambiente, SA (1) | | | 28,664 | | | | 540,220 | |

| | | | | | | | | |

Solar Materials — 1.9% | | | | | | | | |

China — 1.9% | | | | | | | | |

JinkoSolar Holding Co., Ltd. (1) | | | 5,105 | | | | 186,894 | |

| | | | | | | | | |

Utilities — 8.9% | | | | | | | | |

Germany — 1.1% | | | | | | | | |

RWE AG | | | 2,879 | | | | 109,502 | |

Italy — 1.6% | | | | | | | | |

Enel S.p.A. | | | 15,297 | | | | 151,899 | |

Spain — 1.0% | | | | | | | | |

EDP Renovaveis S.A. | | | 4,250 | | | | 101,062 | |

United States — 5.2% | | | | | | | | |

NextEra Energy, Inc. | | | 7,033 | | | | 514,956 | |

| | | | | | | | 877,419 | |

Water Tech & Equipment — 3.9% | | | | | | | | |

United States — 3.9% | | | | | | | | |

Energy Recovery, Inc. (1) | | | 4,721 | | | | 89,746 | |

Evoqua Water Technologies Corporation (1) | | | 9,489 | | | | 295,298 | |

| | | | | | | | 385,044 | |

Water Utility — 0.1% | | | | | | | | |

United States — 0.1% | | | | | | | | |

American Water Works Co., Inc. | | | 27 | | | | 4,186 | |

Essential Utilities Inc. | | | 125 | | | | 5,975 | |

| | | | | | | | 10,161 | |

See Accompanying Notes to the Financial Statements.

24

Global Clean Equity Fund |

Schedule of Investments (Unaudited) | May 31, 2021 — (Continued) |

Common Stock (Continued) | | Shares | | | Fair Value | |

Wind Energy Equipment — 3.0% | | | | | | | | |

Denmark — 0.9% | | | | | | | | |

Vestas Wind System | | | 6,955 | | | $ | 90,624 | |

Germany — 0.7% | | | | | | | | |

Nordex SE (1) | | | 2,889 | | | | 66,303 | |

United States — 1.4% | | | | | | | | |

TPI Composites, Inc. (1) | | | 2,878 | | | | 139,007 | |

| | | | | | | | 295,934 | |

Wind Generation — 1.8% | | | | | | | | |

Denmark — 1.8% | | | | | | | | |

Vestas Wind System | | | 4,665 | | | | 182,677 | |

| | | | | | | | | |

YieldCo — 13.9% | | | | | | | | |

Canada — 0.8% | | | | | | | | |

Innergex Renewable Energy | | | 4,777 | | | | 80,075 | |

United Kingdom — 5.0% | | | | | | | | |

Atlantica Sustainable Infrastructure plc | | | 13,657 | | | | 496,432 | |

United States — 3.0% | | | | | | | | |

Clearway Energy, Inc. | | | 10,940 | | | | 293,520 | |

NextEra Energy Partners, L.P. | | | 7,301 | | | | 499,169 | |

| | | | | | | | 1,369,196 | |

| | | | | | | | | |

Total Common Stock (Cost $7,172,812) | | | | | | $ | 9,687,903 | |

| | | | | | | | | |

Short-Term Investments —

Investment Companies — 1.6% | | | | | | |

United States — 1.6% | | | | | | | | |

First American Government Obligations Fund - Class X, 0.01%(2) | | | 81,220 | | | $ | 81,220 | |

First American Treasury Obligations Fund - Class X, 0.01%(2) | | | 81,219 | | | | 81,219 | |

Total Short-Term Investments (Cost $162,439) | | | | | | $ | 162,439 | |

Total Investments — 99.7% (Cost $7,335,251) | | | | | | $ | 9,850,342 | |

Other Assets in Excess of Liabilities — 0.3% | | | | | | | 25,489 | |

Total Net Assets Applicable to Unitholders — 100.0% | | | | | | $ | 9,875,831 | |

Percentages are stated as a percent of net assets.

(1) | No distribution or dividend was made during the period ended May 31, 2021. As such, it is classified as a non-income producing security as of May 31, 2021. |

(2) | Rate reported is the current yield as of May 31, 2021. |

See Accompanying Notes to the Financial Statements.

25

Cushing Mutual Funds Trust Statements of Assets & Liabilities (Unaudited) May 31, 2021 |

| | | Cushing

NextGen

Infrastructure

Fund | | | Cushing

SMID Growth

Focused Fund | | | Global Clean

Equity Fund | |

Assets | | | | | | | | | | | | |

Investments at fair value (1) | | $ | 18,806,503 | | | $ | 5,263,297 | | | $ | 9,850,342 | |

Cash | | | 463,705 | | | | — | | | | — | |

Receivable from Adviser, net | | | 6,894 | | | | 11,327 | | | | 13,466 | |

Receivable for shares sold | | | 3,750 | | | | — | | | | 5,750 | |

Interest receivable | | | 7 | | | | 2 | | | | 10 | |

Dividends receivable | | | 39,319 | | | | — | | | | 12,275 | |

Prepaid expenses | | | 62,953 | | | | 24,558 | | | | 30,687 | |

Total assets | | | 19,383,131 | | | | 5,299,184 | | | | 9,912,530 | |

Liabilities | | | | | | | | | | | | |

Payable for Fund shares redeemed | | | 5,569 | | | | — | | | | — | |

Payable for 12b-1 distribution fee | | | 379 | | | | 1,388 | | | | 713 | |

Accrued expenses and other liabilities | | | 59,912 | | | | 38,379 | | | | 35,986 | |

Total liabilities | | | 65,860 | | | | 39,767 | | | | 36,699 | |

Net assets | | $ | 19,317,271 | | | $ | 5,259,417 | | | $ | 9,875,831 | |

Net Assets Consist of | | | | | | | | | | | | |

Additional paid-in capital | | $ | 17,125,428 | | | $ | 3,730,988 | | | $ | 5,368,479 | |

Total Distributable Earnings | | | 2,191,843 | | | | 1,528,429 | | | | 4,507,352 | |

Net assets | | $ | 19,317,271 | | | $ | 5,259,417 | | | $ | 9,875,831 | |

| | | | | | | | | | | | | |

(1) Investments in unaffiliated securities at cost | | $ | 16,182,482 | | | $ | 4,311,415 | | | $ | 7,335,251 | |

Unlimited shares authorized, no par value | | Class A | | | Class A | | | Class A | |

Net assets | | $ | 807,491 | | | $ | 1,507,599 | | | $ | 508,612 | |

Shares issued and outstanding | | | 38,835 | | | | 109,307 | | | | 26,014 | |

Net asset value, redemption price and minimum offering price per share | | $ | 20.79 | | | $ | 13.79 | | | $ | 19.55 | |

| | | | | | | | | | | | | |

| | | Class I | | | Class I | | | Class I | |

Net assets | | $ | 18,509,780 | | | $ | 3,751,818 | | | $ | 9,367,219 | |

Shares issued and outstanding | | | 878,597 | | | | 271,165 | | | | 477,801 | |

Net asset value, redemption price and minimum offering price per share | | $ | 21.07 | | | $ | 13.84 | | | $ | 19.60 | |

See Accompanying Notes to the Financial Statements.

26

Cushing Mutual Funds Trust Statements of Operations (Unaudited) Period From December 1, 2020 through May 31, 2021 |

| | | Cushing

NextGen

Infrastructure

Fund | | | Cushing

SMID Growth

Focused Fund | | | Global Clean

Equity Fund | |

Investment Income | | | | | | | | | | | | |

Distributions and dividends | | $ | 261,884 | | | $ | — | | | $ | 41,347 | |

Less: return of capital on distributions | | | (120,923 | ) | | | — | | | | (12,718 | ) |

Less: foreign taxes withheld | | | (8,784 | ) | | | — | | | | (2,900 | ) |

Distribution and dividend income | | | 132,177 | | | | — | | | | 25,729 | |

Interest income | | | 97 | | | | 21 | | | | 126 | |

Total Investment Income | | | 132,274 | | | | 21 | | | | 25,855 | |

Expenses | | | | | | | | | | | | |

Advisory fees | | | 78,898 | | | | 21,214 | | | | 50,580 | |

Administrator fees | | | 68,223 | | | | 33,194 | | | | 38,426 | |

Professional fees | | | 30,074 | | | | 23,686 | | | | 30,587 | |

Transfer agent expense | | | 27,718 | | | | 16,217 | | | | 17,200 | |

Blue Sky Expense | | | 17,848 | | | | 7,986 | | | | 9,219 | |

Custodian fees and expenses | | | 8,241 | | | | 2,523 | | | | 6,132 | |

Trustees’ fees | | | 7,857 | | | | 2,407 | | | | 3,148 | |

Reports to shareholders | | | 4,250 | | | | 2,953 | | | | 2,958 | |

Insurance expense | | | 2,586 | | | | 560 | | | | 1,034 | |

Other expense | | | 2,061 | | | | 30 | | | | 269 | |

Registration fees | | | 1,196 | | | | — | | | | — | |

12b-1 distribution fee - Class A | | | 763 | | | | 1,513 | | | | 651 | |

Total Expenses | | | 249,715 | | | | 112,283 | | | | 160,204 | |

Less: expense waived by Adviser | | | (130,865 | ) | | | (81,571 | ) | | | (90,853 | ) |

Net Expenses | | | 118,850 | | | | 30,712 | | | | 69,351 | |

Net Investment Income (Loss) | | | 13,424 | | | | (30,691 | ) | | | (43,496 | ) |

Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

Net realized gain on investments | | | 1,893,537 | | | | 637,550 | | | | 1,839,509 | |

Change in unrealized appreciation/depreciation on investments | | | (931,855 | ) | | | (53,082 | ) | | | (2,096,643 | ) |

Change in unrealized currency appreciation/depreciation | | | — | | | | — | | | | 11 | |

Change in unrealized appreciation/depreciation on currency and investments | | | (931,855 | ) | | | (53,082 | ) | | | (2,096,632 | ) |

Net Realized and Unrealized Gain (Loss) on Investments | | | 961,682 | | | | 584,468 | | | | (257,123 | ) |

Increase (decrease) in Net Assets Applicable to Shareholders Resulting from Operations | | $ | 975,106 | | | $ | 553,777 | | | $ | (300,619 | ) |

See Accompanying Notes to the Financial Statements.

27

Cushing Mutual Funds Trust Statements of Changes in Net Assets |

| | | Cushing NextGen

Infrastructure Fund | | | Cushing SMID Growth

Focused Fund | |

| | | Period From

December 1,

2020

through

May 31, 2021

(Unaudited) | | | Fiscal Year

Ended

November 30,

2020 | | | Period From

December 1,

2020

through

May 31, 2021

(Unaudited) | | | Period From

January 31,

2020(1)

through

November 30,

2020 | |

Operations | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | 13,424 | | | $ | 36,744 | | | $ | (30,691 | ) | | $ | (24,104 | ) |

Net realized gain (loss) on investments | | | 1,893,537 | | | | 434,092 | | | | 637,550 | | | | (30,312 | ) |

Net change in unrealized appreciation/depreciation on investments | | | (931,855 | ) | | | 3,061,739 | | | | (53,082 | ) | | | 1,004,964 | |

Net increase in net assets resulting from operations | | | 975,106 | | | | 3,532,575 | | | | 553,777 | | | | 950,548 | |

Dividends and Distributions to Class A Shareholders | | | | | | | | | | | | | | | | |

Distributions from distributable earnings | | | (16,149 | ) | | | (12,161 | ) | | | — | | | | — | |

Dividends and Distributions to Class I Shareholders | | | | | | | | | | | | | | | | |

Distributions from distributable earnings | | | (554,508 | ) | | | (336,552 | ) | | | — | | | | — | |

Total dividends and distributions to Fund shareholders | | | (570,657 | ) | | | (348,713 | ) | | | — | | | | — | |

Capital Share Transactions | | | | | | | | | | | | | | | | |

Proceeds from shareholder subscriptions | | | 7,248,546 | | | | 4,874,994 | | | | 1,256,640 | | | | 3,340,994 | |

Dividend reinvestments | | | 367,592 | | | | 250,869 | | | | — | | | | — | |

Payments for redemptions | | | (4,053,814 | ) | | | (6,631,424 | ) | | | (790,215 | ) | | | (52,327 | ) |

Net increase (decrease) in net assets from capital share transactions | | | 3,562,324 | | | | (1,505,561 | ) | | | 466,425 | | | | 3,288,667 | |

Total increase in net assets | | | 3,966,773 | | | | 1,678,301 | | | | 1,020,202 | | | | 4,239,215 | |

Net Assets | | | | | | | | | | | | | | | | |

Beginning of period | | | 15,350,498 | | | | 13,672,197 | | | | 4,239,215 | | | | — | |

End of period | | $ | 19,317,271 | | | $ | 15,350,498 | | | $ | 5,259,417 | | | $ | 4,239,215 | |

(1) | Commencement of operations. |

See Accompanying Notes to the Financial Statements.

28

Cushing Mutual Funds Trust Statements of Changes in Net Assets |

| | | Global Clean Equity Fund | |

| | | Period From

December 1,

2020

through

May 31, 2021

(Unaudited) | | | Period From

January 31,

2020(1)

through

November 30,

2020 | |

Operations | | | | | | | | |

Net investment loss | | $ | (43,496 | ) | | $ | (14,752 | ) |

Net realized gain on investments | | | 1,839,509 | | | | 269,424 | |

Net change in unrealized appreciation/depreciation on investments | | | (2,096,632 | ) | | | 4,611,723 | |

Net increase (decrease) in net assets resulting from operations | | | (300,619 | ) | | | 4,866,395 | |

Dividends and Distributions to Class A Shareholders | | | | | | | | |

Distributions from distributable earnings | | | (3,455 | ) | | | (365 | ) |

Dividends and Distributions to Class I Shareholders | | | | | | | | |

Distributions from distributable earnings | | | (239,497 | ) | | | (34,854 | ) |

Total dividends and distributions to Fund shareholders | | | (242,952 | ) | | | (35,219 | ) |

Capital Share Transactions | | | | | | | | |

Proceeds from shareholder subscriptions | | | 3,189,446 | | | | 7,306,905 | |

Dividend reinvestments | | | 161,786 | | | | 29,190 | |

Payments for redemptions | | | (3,962,970 | ) | | | (1,136,131 | ) |

Net increase (decrease) in net assets from capital share transactions | | | (611,738 | ) | | | 6,199,964 | |

Total increase (decrease) in net assets | | | (1,155,309 | ) | | | 11,031,140 | |

Net Assets | | | | | | | | |

Beginning of period | | | 11,031,140 | | | | — | |

End of period | | $ | 9,875,831 | | | $ | 11,031,140 | |

(1) | Commencement of operations. |

See Accompanying Notes to the Financial Statements.

29

Cushing® NextGen Infrastructure Fund Financial Highlights |

Class A Shares | | Period From

December 1,

2020

through

May 31, 2021

(Unaudited) | | | Fiscal Year

Ended

November 30,

2020 | | | Fiscal Year

Ended

November 30,

2019 | | | Period From

December 18,

2017(1)

through

November 30,

2018 | |

Per Common Share Data (2) | | | | | | | | | | | | | | | | |

Net Asset Value, beginning of period | | $ | 19.99 | | | $ | 15.33 | | | $ | 18.08 | | | $ | 20.00 | |

Income from Investment Operations: | | | | | | | | | | | | | | | | |

Net investment income (loss) (3) | | | (0.01 | ) | | | 0.03 | | | | (0.19 | ) | | | 0.12 | |

Net realized and unrealized gain (loss) on investments | | | 0.91 | | | | 5.14 | | | | (1.46 | ) | | | (1.07 | ) |

Net increase (decrease) from investment operations | | | 0.90 | | | | 5.17 | | | | (1.65 | ) | | | (0.95 | ) |

Less Distributions to Common Stockholders: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.10 | ) | | | (0.51 | ) | | | — | | | | (0.09 | ) |

Return of capital | | | — | | | | — | | | | (1.10 | ) | | | (0.88 | ) |

Total distributions to common stockholders | | | (0.10 | ) | | | (0.51 | ) | | | (1.10 | ) | | | (0.97 | ) |

Net Asset Value, end of period | | $ | 20.79 | | | $ | 19.99 | | | $ | 15.33 | | | $ | 18.08 | |

Total Investment Return (4) | | | 7.70 | % | | | 34.34 | % | | | (9.49 | )% | | | (5.06 | )% |

Supplemental Data and Ratios | | | | | | | | | | | | | | | | |

Net assets applicable to common stockholders, end of period (000’s) | | $ | 807 | | | $ | 436 | | | $ | 444 | | | $ | 252 | |