- ILPT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Industrial Logistics Properties Trust (ILPT) PRE 14APreliminary proxy

Filed: 3 Apr 20, 5:08pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | Filed by a Party other than the Registrant |

| | Check the appropriate box: | | ||||||

| Preliminary Proxy Statement | ||||||||

| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) | ||||||||

| Definitive Proxy Statement | ||||||||

| Definitive Additional Materials | ||||||||

| Soliciting Material under §.240.14a-12 | ||||||||

Industrial Logistics Properties Trust

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | Payment of Filing Fee (Check the appropriate box): | | ||||||

| No fee required. | ||||||||

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||

| | | | | | | | | |

| (1) Title of each class of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (2) Aggregate number of securities to which transaction applies: | ||||||||

| | | | | | | | | |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) : | ||||||||

| | | | | | | | | |

| (4) Proposed maximum aggregate value of transaction: | ||||||||

| | | | | | | | | |

| (5) Total fee paid: | ||||||||

| Fee paid previously with preliminary materials. | ||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||

| | | | | | | | | |

| (1) Amount Previously Paid: | ||||||||

| | | | | | | | | |

| (2) Form, Schedule or Registration Statement No.: | ||||||||

| | | | | | | | | |

| (3) Filing Party: | ||||||||

| | | | | | | | | |

| (4) Date Filed: | ||||||||

(PRELIMINARY PROXY MATERIALS—SUBJECT TO COMPLETION)

Notice of 2020 Annual Meeting

of Shareholders and Proxy Statement

, , 2020 at [9:30 a.m.], Eastern time

Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458

LETTER TO OUR SHAREHOLDERS FROM OUR

BOARD OF TRUSTEES

| |  | |  | |  | |  | |  | |  | |  | |

Dear Fellow Shareholders:

Please join us for our annual meeting on , , 2020. The business to be conducted at the meeting is explained in the attached Notice of Meeting and Proxy Statement. We believe furnishing these materials over the internet expedites shareholders' receipt of these important materials while lowering cost and reducing the environmental impact of our annual meeting.

Please be assured that our Board takes seriously our role in the oversight of our Company's long term business strategy, which is the best path to long term value creation for you, our shareholders. In 2019, some highlights of the implementation of our long term business strategy were:

We also continue to make significant progress on our previously announced multiyear process of examining our fundamental governance policies. Shareholder engagement and feedback have been critical components of this re-examination. Last year we adopted a proxy access bylaw and amended our Declaration of Trust to provide for a plurality vote standard in contested elections of our Trustees. This year, we are proposing that shareholders vote to amend our Declaration of Trust to provide for annual Trustee elections. We have expanded our Board to include two new Independent Trustees who bring significant industry experience and result in our Board being comprised of more than 70% Independent Trustees, two women and one African American. We discuss our continuing plans and progress in more detail in the accompanying Proxy Statement.

Since we began writing this letter to you, 2019 has been overshadowed by the COVID-19 pandemic and market tumult. With events and circumstances in constant flux, any commentary we give here may be outdated by the time you have the opportunity to read this letter. Instead, we simply want to assure you that we are vigilantly monitoring changing events and circumstances with an eye to managing for the global good, mitigating the negative impact on our business and best positioning us for stability and recovery when this crisis passes. As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the annual meeting may be held virtually solely by means of remote communication or via a live webcast. If we take this step, we will announce the decision to do so in advance, and we will provide details on how to participate in a press release and on our website atwww.ilptreit.com.

We thank you for your investment in Industrial Logistics Properties Trust and for the confidence you put in this Board to oversee your interests in our business.

, 2020

| Bruce M. Gans Lisa Harris Jones Joseph L. Morea John G. Murray | Kevin C. Phelan Adam D. Portnoy Laura A. Wilkin |

NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS OF INDUSTRIAL LOGISTICS PROPERTIES TRUST

| | Agenda: • Elect the Trustee nominees identified in the accompanying Proxy Statement to the Company's Board of Trustees; • Approve an amendment to our Declaration of Trust to provide for the annual election of all Trustees; • Advisory vote to approve executive compensation; • Advisory vote on the frequency of future advisory votes to approve executive compensation; • Ratify the appointment of Ernst & Young LLP as independent auditors to serve for the 2020 fiscal year; and • Transact such other business as may properly come before the meeting and at any postponements or adjournments of the meeting. Record date: You can vote if you were a shareholder of record as of the close of business on March 16, 2020. If you are attending the meeting, you will be asked to present photo identification for admission. |

| | Please see the accompanying Proxy Statement for additional information. By Order of our Board of Trustees,

Jennifer B. Clark , 2020 |

* As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that our 2020 Annual Meeting may be held virtually solely by means of remote communication or live webcast. If we take this step, we will announce the decision to do so in advance, and will provide details on how to participate in a press release and on our website atwww.ilptreit.com.

TABLE OF CONTENTS

PLEASE VOTE | 1 | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | 2 | |

Review of Corporate Governance Policies and Shareholder Engagement | 2 | |

Board Composition, Expansion and Refreshment | 2 | |

Process for Selecting Trustees | 3 | |

ISG Corporate Governance Framework | 3 | |

Sustainability | 4 | |

Key Responsibilities of Our Board | 5 | |

Our Board's Role in Oversight of Risk Management | 6 | |

Trustee Independence | 7 | |

Executive Sessions of Independent Trustees | 7 | |

Board Leadership Structure | 8 | |

Lead Independent Trustee | 8 | |

Code of Business Conduct and Ethics and Committee Governance | 9 | |

Prohibition on Hedging | 9 | |

Nominations for Trustees | 9 | |

Communications with Our Board | 10 | |

Shareholder Nominations and Other Proposals | 10 | |

PROPOSAL 1: ELECTION OF TRUSTEES | 12 | |

Trustee Nominees to be Elected at Our 2020 Annual Meeting | 14 | |

Continuing Trustees | 16 | |

Summary of Trustee Qualifications and Experience | 19 | |

Executive Officers | 20 | |

BOARD COMMITTEES | 21 | |

Audit Committee | 21 | |

Compensation Committee | 21 | |

Nominating and Governance Committee | 21 | |

BOARD MEETINGS | 22 | |

TRUSTEE COMPENSATION | 22 | |

Compensation of Trustees | 22 | |

Trustee Share Ownership Guidelines | 22 | |

2019 Annual Trustee Compensation | 23 | |

OWNERSHIP OF EQUITY SECURITIES OF THE COMPANY | 24 | |

Trustees and Executive Officers | 24 | |

Principal Shareholders | 25 | |

PROPOSAL 2: APPROVAL OF AN AMENDMENT TO OUR DECLARATION OF TRUST TO PROVIDE FOR THE ANNUAL ELECTION OF ALL TRUSTEES | 26 | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | 28 | |

PROPOSAL 4: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE EXECUTIVE COMPENSATION | 29 | |

COMPENSATION DISCUSSION AND ANALYSIS | 30 | |

Compensation Overview | 30 | |

Compensation Philosophy | 33 | |

Overview of 2019 Compensation Actions | 33 | |

Analysis of 2019 Awards under the Share Award Plan | 34 | |

REPORT OF OUR COMPENSATION COMMITTEE | 36 | |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 36 | |

EXECUTIVE COMPENSATION | 37 | |

Summary Compensation Table | 37 | |

2019 Grants of Plan Based Awards | 38 | |

2019 Outstanding Equity Awards at Fiscal Year End | 38 |

2019 Stock Vested | 39 | |

Potential Payments upon Termination or Change in Control | 39 | |

Pay Ratio | 39 | |

PROPOSAL 5: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT AUDITORS | 40 | |

Audit Fees and All Other Fees | 40 | |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors | 41 | |

Other Information | 41 | |

REPORT OF OUR AUDIT COMMITTEE | 42 | |

FREQUENTLY ASKED QUESTIONS | 43 | |

RELATED PERSON TRANSACTIONS | 48 | |

OTHER INFORMATION | 49 | |

ANNEX A—CERTAIN RELATED PERSON TRANSACTIONS | A-1 |

Our Board of Trustees (our "Board") of Industrial Logistics Properties Trust (the "Company," "we," "us" or "our") is furnishing this proxy statement and accompanying proxy card (or voting instruction form) to you in connection with the solicitation of proxies by our Board for our 2020 annual meeting of shareholders. Our annual meeting will be held at Two Newton Place, 255 Washington Street, Suite 100, Newton, Massachusetts 02458 on , , 2020, at [9:30 a.m.], Eastern time, subject to any adjournments or postponements thereof (the "2020 Annual Meeting").* We are first making these proxy materials available to shareholders on or about , 2020.

Only owners of record of common shares of beneficial interest of the Company ("Common Shares") as of the close of business on March 16, 2020, the record date for our 2020 Annual Meeting, are entitled to notice of, and to vote at, the meeting and at any postponements or adjournments of the meeting. Holders of Common Shares are entitled to one vote for each Common Share held on the record date. On March 16, 2020, there were approximately 65,185,677 Common Shares issued and outstanding.

The mailing address of our principal executive offices is Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

* As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that our 2020 Annual Meeting may be held virtually solely by means of remote communication or via a live webcast. If we take this step, we will announce the decision to do so in advance, and we will provide details on how to participate in a press release and on our website atwww.ilptreit.com.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR OUR 2020

ANNUAL MEETING TO BE HELD ON , , 2020.

The Notice of 2020 Annual Meeting, Proxy Statement and Annual Report to Shareholders for the year

ended December 31, 2019 are available atwww.proxyvote.com.

Please vote to play a part in our Company's future. The Nasdaq Stock Market LLC (the "Nasdaq") rules do not allow a broker, bank or other nominee who holds shares on your behalf to vote on nondiscretionary matters without your instructions.

PROPOSALS THAT REQUIRE YOUR VOTE

| PROPOSAL | MORE INFORMATION | BOARD RECOMMENDATION | VOTES REQUIRED FOR APPROVAL | |||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| 1 | Election of Trustees | Page 12 | ✓ FOR | Plurality of all votes cast | ||||

| 2 | Approval of an amendment to our Declaration of Trust to provide for the annual election of all Trustees | Page 26 | ✓ FOR | Two-thirds of all votes entitled to be cast | ||||

| 3 | Advisory vote to approve executive compensation* | Page 28 | ✓ FOR | Majority of all votes cast | ||||

| 4 | Advisory vote on the frequency of future advisory votes to approve executive compensation* | Page 29 | ✓ THREE YEARS | Majority of all votes cast | ||||

| 5 | Ratification of independent auditors* | Page 40 | ✓ FOR | Majority of all votes cast | ||||

| | | | | | | | | |

You can vote in advance in one of three ways:

via the internet  | Visitwww.proxyvote.com and enter your 16 digit control number provided in your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form before 11:59 p.m., Eastern time, on , 2020 to authorize a proxyVIA THE INTERNET. | |

by phone | Call 1-800-690-6903 if you are a shareholder of record and 1-800-454-8683 if you are a beneficial owner before 11:59 p.m., Eastern time, on , 2020 to authorize a proxyBY TELEPHONE. You will need the 16 digit control number provided on your Notice Regarding the Availability of Proxy Materials, proxy card or voting instruction form. | |

by mail  | Sign, date and return your proxy card if you are a shareholder of record or voting instruction form if you are a beneficial owner to authorize a proxyBY MAIL. |

If the meeting is postponed or adjourned, these times will be extended to 11:59 p.m., Eastern time, on the day before the reconvened meeting.

PLEASE VISIT:www.proxyvote.com

![]() 2020 Proxy Statement 1

2020 Proxy Statement 1

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Review of Corporate Governance Policies and Shareholder Engagement |

Last year, our Board announced that, in recognition of the relationship between corporate governance and long term performance, and as a result of engagement with and feedback from our shareholders, our Board was embarking on a review of the Company's corporate governance principles. Our Board expects that corporate governance reform will be a multi-year process and, as it weighs various alternatives, our Board is prioritizing its consideration based on a review of best practices and input from our shareholders. Based on these principles, last year our Board:

Our Board is continuing to evaluate the Company's corporate governance principles and has established the following priorities and taken the following steps:

As our Board continues on the path to enhanced governance practices, we appreciate your support of our Board and these initiatives.

Board Composition, Expansion and Refreshment |

We are currently governed by a seven member Board of Trustees. Ensuring our Board is comprised of Trustees who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds and effectively represent the long term interests of shareholders is a top priority of our Board and our Nominating and Governance Committee. Our Board has recently added two Independent Trustees, Kevin C. Phelan and Laura A. Wilkin, to expand and refresh its composition for several reasons, including to increase the ratio of Independent Trustees to Managing Trustees, create more skill mix and

2 ![]() 2020 Proxy Statement

2020 Proxy Statement

diversity and ensure a smooth transition if and when a Trustee decides to retire or otherwise leaves our Board. Our Board believes that continuity is important to the effective conduct of our business and expects a continued refreshment process will take place over several years. To facilitate these efforts, in 2019 our Board retained Korn Ferry, a leading executive search and consulting firm, to act as an advisor and to assist our Nominating and Governance Committee in:

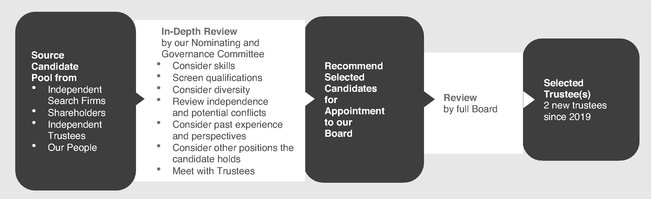

Process for Selecting Trustees |

Our Nominating and Governance Committee screens and recommends candidates for nomination by our full Board. Our Bylaws provide that the size of our Board shall initially be five members until increased or decreased by our Board. Our Board's recent increase in size reflects our Board's current view of its optimal size. Our Nominating and Governance Committee is assisted with its recruitment efforts by its ongoing engagement with Korn Ferry, which recommends candidates that satisfy our Board's criteria. They also provide research and pertinent information regarding candidates, as requested.

ISG Corporate Governance Framework |

We follow the Investor Stewardship Group's ("ISG") Corporate Governance Framework for U.S. Listed Companies, as summarized below:

| ISG Principle | Our Practice | |

|---|---|---|

| | | |

| Principle 1: Boards are accountable to shareholders. | • Assuming Proposal 2 is approved by our shareholders, beginning in 2023, all of our Trustees will stand for election annually. • We adopted a proxy access bylaw. | |

| | | |

| Principle 2: Shareholders should be entitled to voting rights in proportion to their economic interest. | • We do not have a dual class structure; each shareholder gets one vote per share. | |

| | | |

![]() 2020 Proxy Statement 3

2020 Proxy Statement 3

| ISG Principle | Our Practice | |

|---|---|---|

| | | |

| Principle 3: Boards should be responsive to shareholders and be proactive in order to understand their perspectives. | • In 2019, our proactive shareholder outreach extended to all of our shareholders who hold 1% or more of our common shares, and we had meaningful engagements with more than 44.3% of our shareholders. • Our engagement topics included governance reform priorities, sustainability and social strategy, Board composition, leadership and refreshment, succession planning and executive compensation program disclosure. | |

| | | |

| Principle 4: Boards should have a strong, independent leadership structure. | • We have a Lead Independent Trustee with clearly defined duties and responsibilities that are disclosed to shareholders. • Our Board considers the appropriateness of its leadership structure at least annually. • We have strong Independent Committee Chairs. | |

| | | |

| Principle 5: Boards should adopt structures and practices that enhance their effectiveness. | • 71% of Board members are independent. • Our Board is comprised of 29% women and 14% African American. • We have an active Board refreshment plan, including an ongoing engagement with an executive search and consulting firm to identify and evaluate candidates to expand and refresh our Board; two new Board members have joined our Board in the last year. • Our Trustees then in office attended 95% of all Board and applicable committee meetings in 2019, and each of our Trustees then in office attended the 2019 annual meeting of shareholders. | |

| | | |

| Principle 6: Boards should develop management incentive structures that are aligned with the long term strategy of the company. | • Our Compensation Committee annually reviews and approves incentive compensation program design, goals and objectives for alignment with compensation and business strategies. • Although we do not pay any cash compensation directly to our officers and have no employees, we have adopted the Company's 2018 Equity Compensation Plan (the "Share Award Plan") to reward our named executive officers and other employees of our manager, The RMR Group LLC ("RMR LLC"), who provide services to us and to align their interests with those of our shareholders. |

Sustainability |

Overview. Our business strategy incorporates a focus on sustainable approaches to operating our properties in a manner that benefits our shareholders, tenants and the communities in which we are located. We seek to operate our properties in ways that improve the economic performance of their operations, while simultaneously managing energy and water consumption, as well as greenhouse gas emissions.

4 ![]() 2020 Proxy Statement

2020 Proxy Statement

Our environmental sustainability and community engagement strategies are primarily implemented by our manager, RMR LLC, and focus on a complementary set of objectives, including the following:

Our manager, RMR LLC, earned recognition in 2019 and 2020 as an ENERGY STAR® Partner of the Year in the Service and Product Provider category.

To learn more about our and RMR LLC's sustainability initiatives, visitwww.rmrgroup.com/corporate-sustainability.

Key Responsibilities of Our Board |

| Oversight of Strategy | Oversight of Risk | Succession Planning | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Our Board oversees and monitors strategic planning. | Our Board oversees risk management. | Our Board oversees succession planning and talent development for senior executive positions. | ||||||||||||||||

Business strategy is a key focus of our Board and embedded in the work of Board committees. | Board committees, which meet regularly and report back to our full Board, play significant roles in carrying out the risk oversight function. | Our Nominating and Governance Committee makes an annual report to our Board on succession planning. | ||||||||||||||||

Company management is charged with executing business strategy and provides regular performance updates to our Board. | Company management is charged with managing risk, through robust internal processes and effective internal controls. | In the event of a succession, our entire Board may work with our Nominating and Governance Committee, or the Independent Trustees, as applicable, to nominate and evaluate potential successors. | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | |

![]() 2020 Proxy Statement 5

2020 Proxy Statement 5

Our Board's Role in Oversight of Risk Management |

Our Board is elected by shareholders to oversee our business and long term strategy. As part of fulfilling its responsibilities, our Board oversees the safeguarding of our assets, the maintenance of appropriate financial and other internal controls and our compliance with applicable laws and regulations. Inherent in these responsibilities is our Board's understanding and oversight of the various risks we face. Our Board considers that risks should not be viewed in isolation and should be considered in virtually every business decision and as part of our business strategy.

Our Board oversees risk as part of its general oversight of our Company. Oversight of risk is addressed as part of various Board and Board committee activities and through regular and special Board and Board committee meetings. Our day to day business is conducted by our manager, RMR LLC, and RMR LLC and our officers and Director of Internal Audit are responsible for incorporating risk management in their activities. Our Director of Internal Audit reports to our Audit Committee and provides us with advice and assistance with our risk management function.

In discharging their oversight responsibilities, our Board and Board committees review regularly a wide range of reports RMR LLC and other service providers provide, including:

Our Board and Board committees discuss these matters among themselves and with representatives of RMR LLC, our officers, our Director of Internal Audit, legal counsel, our independent auditors and other professionals, as appropriate.

Our Audit Committee takes a leading role in helping our Board fulfill its responsibilities for oversight of our financial reporting, internal audit function, risk management, including cybersecurity, and our compliance with legal and regulatory requirements. Our Board and Audit Committee review periodic reports from our independent auditors regarding potential risks, including risks related to our internal control over financial reporting. Our Audit Committee also reviews, approves and oversees an internal audit plan developed by our Director of Internal Audit with the goal of helping us systematically evaluate the effectiveness of its risk management, control and governance processes on an annual basis. Our Audit Committee meets at least quarterly and reports its findings to our Board. Our Audit Committee also meets periodically with our Director of Internal Audit to review the results of our internal audits, and directs or recommends to our Board actions or changes it determines appropriate to enhance or improve the effectiveness of our risk management.

Our Audit Committee considers risks related to cybersecurity and receives regular reports from management regarding cybersecurity risks and countermeasures being undertaken or considered by our Company, including updates on the internal and external cybersecurity landscape and relevant technical developments.

6 ![]() 2020 Proxy Statement

2020 Proxy Statement

Our Compensation Committee whose duties are detailed in its charter, among other duties, evaluates the performance of our Director of Internal Audit and RMR LLC's performance under our business and property management agreements, including any perceived risks created by compensation arrangements. Also, our Compensation Committee and our Board consider that we have a share award program that requires share awards to executive officers to vest over a period of years. We believe that the use of share awards vesting over time rather than stock options mitigates the incentives for our management to undertake undue risks and encourages management to make longer term and appropriately risk balanced decisions.

It is not possible to identify all of the risks that may affect us or to develop processes and controls to eliminate all risks and their possible effects, and processes and controls employed to address risks may be limited in their effectiveness. Moreover, it is necessary for us to bear certain risks to achieve our objectives. As a result of the foregoing and other factors, our ability to manage risk is subject to substantial limitations.

To learn more about the risks we face, you can review the matters discussed in Part I, "Item 1A. Risk Factors" and "Warning Concerning Forward-Looking Statements" in our Annual Report for the year ended December 31, 2019 (the "Annual Report"). The risks described in the Annual Report are not the only risks we face. Additional risks and uncertainties not currently known or that may currently be deemed to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

Trustee Independence |

Under the corporate governance listing standards of the Nasdaq and our governing documents, our Board must consist of a majority of Independent Trustees. Under our governing documents, Independent Trustees are Trustees who are not employees of RMR LLC, are not involved in our day to day activities and who meet the qualifications for independence under the applicable rules of the Nasdaq and the Securities and Exchange Commission (the "SEC").

Our Board affirmatively determines whether Trustees have a direct or indirect material relationship with us, including our subsidiaries, other than serving as our Trustees or trustees or directors of our subsidiaries. In making independence determinations, our Board observes the Nasdaq and SEC criteria, as well as the criteria set forth in our governing documents. When assessing a Trustee's relationship with us, our Board considers all relevant facts and circumstances, not merely from the Trustee's standpoint, but also from that of the persons or organizations with which the Trustee has an affiliation. Based on this review, our Board has determined that Bruce M. Gans, Lisa Harris Jones, Joseph L. Morea, Kevin C. Phelan and Laura A. Wilkin currently qualify as independent trustees under applicable Nasdaq and SEC criteria and as Independent Trustees under our governing documents. In making these independence determinations, our Board reviewed and discussed additional information provided by us and the Trustees with regard to each of the Trustees' relationships with us, RMR LLC or The RMR Group Inc. ("RMR Inc."), the managing member of RMR LLC, and the other companies to which RMR LLC or its subsidiaries provide management services. Our Board has concluded that none of these five Trustees possessed or currently possesses any relationship that could impair his or her judgment in connection with his or her duties and responsibilities as a Trustee or that could otherwise be a direct or indirect material relationship under applicable Nasdaq and SEC standards.

Executive Sessions of Independent Trustees |

Pursuant to our Governance Guidelines, our Independent Trustees are expected to meet at least twice per year in regularly scheduled meetings at which only Independent Trustees are present. Our Independent Trustees also meet separately with our officers, with our Director of Internal Audit and with our independent auditors. The presiding Trustee for purposes of leading Independent Trustee sessions will be the Lead Independent Trustee, unless the Independent Trustees determine otherwise.

![]() 2020 Proxy Statement 7

2020 Proxy Statement 7

Board Leadership Structure |

In accordance with our governing documents, our Board is comprised of seven Trustees, including five Independent Trustees and two Managing Trustees, and our Board is currently divided into three classes, with each Trustee of each class elected at an annual meeting of shareholders serving for a term that continues until the third annual meeting of shareholders following his or her election and until his or her successor is elected and qualifies; however, our Board has approved an amendment to our Declaration of Trust to require the annual election of all Trustees beginning with the 2023 annual meeting of shareholders. If this amendment is approved by our shareholders at our 2020 Annual Meeting, beginning with the 2021 annual meeting of shareholders, the Trustees whose terms expire at an annual meeting will stand for election at the meeting for one-year terms and all Trustees will stand for election at the 2023 annual meeting of shareholders, and thereafter, for one-year terms. For more information on this amendment, see "Proposal 2: Approval of an Amendment to the Declaration of Trust to Provide for the Annual Election of All Trustees" on page 26.

All Trustees play an active role in overseeing our business both at our Board and committee levels. As set forth in our Governance Guidelines, the core responsibility of our Trustees is to exercise sound, informed and independent business judgment in overseeing the Company and its strategic direction. Our Trustees are skilled and experienced leaders and currently serve or have served as members of senior management in public and private for profit organizations and law firms, and have also served in academia and government. Our Trustees may be called upon to provide solutions to various complex issues and are expected to, and do, ask hard questions of our officers and advisers. Our Board is small, which facilitates informal discussions and communication from management to our Board and among Trustees.

On June 3, 2019, Adam D. Portnoy was appointed Chair of our Board. Our Board believes that Mr. Portnoy's leadership of RMR LLC and extensive familiarity with our day to day business provide valuable insight for our Board.

Five of our Trustees, including one of our Trustee nominees for election at our 2020 Annual Meeting, are independent under the applicable Nasdaq and SEC criteria and our governing documents. All of the members of our Audit Committee, Nominating and Governance Committee and Compensation Committee are independent under the applicable listing requirements and rules of the Nasdaq and other applicable laws, rules and regulations, including those of the SEC. As set forth in our governing documents, two of our Trustees are Managing Trustees, persons who have been employees, officers or directors of RMR LLC or who have been involved in our day to day activities for at least one year prior to his, her or their election as Trustees.

Lead Independent Trustee |

We have a Lead Independent Trustee who is selected annually by the vote of a majority of our Independent Trustees. Currently, Dr. Gans serves as our Lead Independent Trustee. Our Lead Independent Trustee has well-defined, substantive responsibilities that include:

8 ![]() 2020 Proxy Statement

2020 Proxy Statement

Code of Business Conduct and Ethics and Committee Governance |

Our Board is committed to corporate governance that promotes the long term interests of our shareholders. Our Board has established Governance Guidelines that provide a framework for effective governance. Our Board regularly reviews developments in corporate governance and updates our Governance Guidelines and other governance materials as it deems necessary and appropriate.

We have also adopted a Code of Business Conduct and Ethics (the "Code") to, among other things, provide guidance to our Trustees and officers and RMR LLC, its officers and employees and its parent's and subsidiaries' directors, trustees, officers and employees to ensure compliance with applicable laws and regulations.

Our Board has an Audit Committee, Compensation Committee and Nominating and Governance Committee. Our Audit Committee, Compensation Committee and Nominating and Governance Committee each have adopted a written charter, and reviews its written charter on an annual basis to consider whether any changes are required.

Our corporate governance materials are available for review in the governance section of our website, including our Governance Guidelines, the charter for each Board committee, the Code and information about how to report concerns or complaints about accounting, internal accounting controls or auditing matters and any violations or possible violations of the Code and how to communicate with our Trustees. To access these documents on our website visitwww.ilptreit.com.

Prohibition on Hedging |

Our Insider Trading Policies and Procedures expressly prohibits members of our Board and our officers from engaging in hedging transactions involving our securities and those of RMR Inc. or any other public company to which RMR LLC or its affiliates provide management services.

Nominations for Trustees |

Shareholders who would like to recommend a nominee for the position of Trustee should submit their recommendations in writing by mail to the Chair of our Nominating and Governance Committee, c/o Industrial Logistics Properties Trust, Secretary, at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@ilptreit.com. Any such recommendation should include a description of the candidate's qualifications for Board service, the candidate's written consent to

![]() 2020 Proxy Statement 9

2020 Proxy Statement 9

be considered for nomination and to serve if nominated and elected, as well as the addresses and telephone numbers for contacting the shareholder and the candidate for more information. Our Nominating and Governance Committee may request additional information about the shareholder recommended nominee or about the shareholder recommending the nominee. Recommendations by shareholders will be considered by our Nominating and Governance Committee in its discretion using the same criteria as other candidates it considers.

A shareholder, or a group of up to 20 shareholders, owning at least three percent of the outstanding Common Shares continuously for at least three years may utilize our proxy access bylaw to nominate and include in our proxy materials Trustee candidate(s) for election at an annual meeting of shareholders provided that the shareholder(s) and the nominee(s) satisfy the informational, documentation and other requirements specified by Section 2.17 of our Bylaws.

Shareholders seeking to nominate one or more individuals as a Trustee candidate without relying on our proxy access bylaw must comply with the advance notice requirements for shareholder nominations set forth in Section 2.13 of our Bylaws, which include, among other things, requirements as to the proposing shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares and submission of specified documentation and information.

Communications with Our Board |

Our Board has established a process to facilitate communication by shareholders and other interested parties with Trustees. Communications should be addressed to Trustees in care of the Secretary, Industrial Logistics Properties Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458 or by email to secretary@ilptreit.com.

Shareholder Nominations and Other Proposals |

Deadline to Submit Proposals pursuant to Rule 14a-8 for the 2021 Annual Meeting of Shareholders: Shareholder proposals pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act") must be received at our principal executive offices on or before , 2020 in order to be eligible to be included in the proxy statement for the 2021 annual meeting of shareholders; provided, that, if the date of the 2021 annual meeting of shareholders is more than 30 days before or after , 2021, such a proposal must be submitted within a reasonable time before we begin to print its proxy materials. Under Rule 14a-8, we are not required to include shareholder proposals in our proxy materials in certain circumstances or if conditions specified in the rule are not met.

Deadline to Submit Other Nominations and Proposals for the 2021 Annual Meeting of Shareholders under our Bylaws: To be timely, shareholder nominations and proposals intended to be made outside of Rule 14a-8 under the Exchange Act and outside of the proxy access bylaw at the 2021 annual meeting of shareholders must be received by our Secretary at our principal executive offices, in accordance with the requirements of our Declaration of Trust and Bylaws, not later than 5:00 p.m., Eastern time, on , 2020 and not earlier than , 2020; provided, that, if the date of the 2021 annual meeting of shareholders is more than 30 days earlier or later than , 2021, then a shareholder's notice must be so delivered not later than 5:00 p.m., Eastern time, on the tenth day following the earlier of the day on which (i) notice of the date of the 2021 annual meeting of shareholders is mailed or otherwise made available or (ii) public announcement of the date of the 2021 annual meeting of shareholders is first made by us. Shareholders making such a nomination or proposal must comply with the advance notice and other requirements set forth in our Declaration of Trust and Bylaws, which include, among other things, requirements as to the shareholder's timely delivery of advance notice, continuous requisite ownership of Common Shares, holding of a share certificate for such shares at the time of the advance notice and submission of specified information.

10 ![]() 2020 Proxy Statement

2020 Proxy Statement

The foregoing description of the deadlines and other requirements for shareholders to submit a nomination for election to our Board or a proposal of other business for consideration at an annual meeting of shareholders is only a summary and is not a complete listing of all requirements. Copies of our Declaration of Trust and Bylaws, including the requirements for proxy access or other shareholder nominations and other shareholder proposals, may be obtained by writing to our Secretary at Industrial Logistics Properties Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458, or from the SEC's website,www.sec.gov. Any shareholder considering making a nomination or proposal should carefully review and comply with those provisions.

![]() 2020 Proxy Statement 11

2020 Proxy Statement 11

PROPOSAL 1: ELECTION OF TRUSTEES

Upon the recommendation of our Nominating and Governance Committee, our Board has nominated Bruce M. Gans as an Independent Trustee in Class II and Adam D. Portnoy as a Managing Trustee in Class II. Messrs. Gans and Portnoy currently serve on our Board. If elected, each of Messrs. Gans and Portnoy would serve until the Company's 2023 annual meeting of shareholders and until his successor is duly elected and qualifies, subject to his earlier death, resignation, retirement, disqualification or removal.

We expect each nominee will be able to serve if elected. However, if a nominee should become unable or unwilling to serve, proxies may be voted for the election of a substitute nominee designated by our Board.

Trustee Criteria, Qualifications, Experience and Tenure

Our Board performs an assessment of the skills and the experience needed to properly oversee the interests of the Company. Generally, our Board reviews both the short and long term strategies of the Company to determine what current and future skills and experience are required of our Board in exercising its oversight function and in the context of the Company's strategic priorities. Our Nominating and Governance Committee and our Board consider the qualifications, characteristics and skills of Trustees and Trustee candidates individually and in the broader context of our Board's overall composition when evaluating potential nominees for election as Trustee. Our Nominating and Governance Committee and our Board also received input from an executive search and consulting firm, Korn Ferry, in considering the qualifications of, and evaluating, potential nominees.

Our Board believes that its members should:

• exhibit high standards of integrity and ethics; • have business acumen, practical wisdom, ability to exercise sound judgment in a congenial manner and be able to make independent analytical inquiries; • have a strong record of achievements; • have knowledge of the commercial real estate ("CRE") industry and real estate investment trusts ("REITs"); | • be familiar with the industrial and logistics markets; • have diverse perspectives, backgrounds and experiences, including professional background, gender, ethnicity and skills; and • be committed to serving on our Board over a period of years in order to develop knowledge about the Company's operations and have sufficient time and availability to devote to Board and committee matters. |

In addition, our Board has determined that our Board, as a whole, should strive to have the right mix of characteristics and skills necessary to effectively perform its oversight responsibilities. Our Board believes that Trustees with one or more of the following professional skills or experiences can assist in meeting this goal:

• work experience with a proven record of success in his, her or their field; • risk oversight/management expertise; • accounting and finance, including a high level of financial literacy and understanding of the impact of financial market trends on the real estate industry; • operating business and/or transactional experience; • management/leadership experience; • knowledge of the Company's historical business activities; | • familiarity with public capital markets; • experience at a strategic or policymaking level in a business, government, non-profit or academic organization of high standing; • service on other public company boards and committees; • qualifying as a Managing Trustee in accordance with the requirements of our governing documents; and • qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents. |

12 ![]() 2020 Proxy Statement

2020 Proxy Statement

A plurality of all the votes cast is required to elect a Trustee at our 2020 Annual Meeting.

The names, principal occupations and certain other information and the nominees for Trustees, as well as a summary of the key experiences, qualifications, attributes and skills that led our Nominating and Governance Committee and our Board to conclude that such persons are currently qualified to serve as Trustees, are set forth on the following pages. We have also included a chart that covers the assessment for our full Board.

Our Board of Trustees recommends a vote "FOR" the election of both Trustee nominees.

![]() 2020 Proxy Statement 13

2020 Proxy Statement 13

Trustee Nominees to be Elected at Our 2020 Annual Meeting |

| | | | Bruce M. Gans Age: 73 Independent Trustee since 2018 Lead Independent Trustee since 2019 Class/Term: Class II with a term expiring at our 2020 Annual Meeting | | | Board Committees: • Audit • Compensation (Chair) • Nominating and Governance | | | Other RMR Managed Public Company Boards(1): • Five Star Senior Living Inc. (since 2001) Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Dr. Gans has been executive vice president and chief medical officer at the Kessler Institute for Rehabilitation since 2001 and national medical director for Rehabilitation Select Medical, the parent company of the Kessler Institute, since 2003. He is also a professor of physical medicine and rehabilitation at Rutgers University—New Jersey Medical School. Dr. Gans was an independent trustee of Service Properties Trust from 2009 until 2015. Dr. Gans has also served as president and chief executive officer of the Rehabilitation Institute of Michigan. In Dr. Gans's extensive academic career, he has served as professor of physical medicine and rehabilitation at a number of universities, in addition to his current position at Rutgers University—New Jersey Medical School. Dr. Gans has also served as president of the American Academy of Physical Medicine and Rehabilitation, a medical society with more than 7,500 members, and as a leader in numerous other professional organizations. | | | Specific Qualifications, Attributes, Skills and Experience: • Demonstrated leadership capability, including through his service in many healthcare management, professional, academic and civic leadership positions • Business experience as the chief executive of a large medical organization • Experience in, and knowledge of, the CRE industry and REITs • Work on public company boards and board committees • Many academic and professional achievements • Institutional knowledge earned through prior service on our Board since shortly after the Company's formation • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents | | |||||||||

14 ![]() 2020 Proxy Statement

2020 Proxy Statement

| | | | Adam D. Portnoy Age: 49 Managing Trustee since 2017 Chair of our Board since 2019 Class/Term: Class II with a term expiring at our 2020 Annual Meeting | | | Board Committees: None | | | Other RMR Managed Public Company Boards: • Service Properties Trust (formerly known as Hospitality Properties Trust, since 2007) • Diversified Healthcare Trust (formerly known as Senior Housing Properties Trust, since 2007) • Office Properties Income Trust (since 2009) • RMR Real Estate Income Fund, including its predecessor funds (since 2009) • The RMR Group Inc. (since 2015) • Tremont Mortgage Trust (since 2017) • Five Star Senior Living Inc. (since 2018) • TravelCenters of America Inc. (since 2018) Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Mr. Portnoy has been president and chief executive officer of RMR Inc. since shortly after its formation in 2015. Mr. Portnoy has been president and chief executive officer of RMR LLC since 2005 and was a director of RMR LLC from 2006 until June 5, 2015 when RMR LLC became a majority owned subsidiary of RMR Inc. and RMR Inc. became RMR LLC's managing member. Mr. Portnoy has been a director of RMR Advisors LLC since 2007 and served as its president from 2007 to September 2017 and its chief executive officer from 2015 to September 2017. Mr. Portnoy has been a director of Tremont Realty Advisors LLC since March 2016 and served as its president and chief executive officer from March 2016 through December 2017. Mr. Portnoy is the sole trustee and controlling shareholder and an officer of ABP Trust. Mr. Portnoy is a director and controlling shareholder of Sonesta International Hotels Corporation and its affiliates ("Sonesta"). Mr. Portnoy served as president and chief executive officer of RMR Real Estate Income Fund from 2007 to 2015 and as president of Office Properties Income Trust from 2009 to 2011. Mr. Portnoy was a managing trustee of Select Income REIT from 2011 until it merged with a wholly owned subsidiary of Office Properties Income Trust in December 2018. Prior to joining RMR LLC in 2003, Mr. Portnoy held various positions in the finance industry and public sector, including working as an investment banker at Donaldson, Lufkin & Jenrette and working in private equity at DLJ Merchant Banking Partners and at the International Finance Corporation (a member of The World Bank Group). In addition, Mr. Portnoy previously founded and served as chief executive officer of a privately financed telecommunications company. Mr. Portnoy currently serves as the Honorary Consul General of the Republic of Bulgaria to Massachusetts and on the board of directors of the Pioneer Institute, and previously served on the board of governors for the National Association of Real Estate Investment Trusts and the board of trustees of Occidental College. | | | Specific Qualifications, Attributes, Skills and Experience: • Extensive experience in, and knowledge of, the CRE industry and REITs • Leadership position with RMR LLC and demonstrated management ability • Public company trustee and director service • Experience in investment banking and private equity • Experience in starting a telecommunications company and serving as its senior executive • Institutional knowledge earned through prior service on our Board since the Company's formation and in leadership positions with RMR LLC • Qualifying as a Managing Trustee in accordance with the requirements of our governing documents | | |||||||||

![]() 2020 Proxy Statement 15

2020 Proxy Statement 15

Continuing Trustees |

| | | | Lisa Harris Jones Age: 52 Independent Trustee since 2018 Class/Term: Class I with a term expiring at the 2022 annual meeting of shareholders | | | Board Committees: • Audit • Compensation • Nominating and Governance (Chair) | | | Other RMR Managed Public Company Boards: • TravelCenters of America Inc. (since 2013) • Diversified Healthcare Trust (formerly known as Senior Housing Properties Trust, since 2015) Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | ��� | | | | | |

| | | | | | | | | | | | | | | |

| | Ms. Harris Jones is the founding member of Harris Jones & Malone, LLC, a law firm based in Maryland. Since founding Harris Jones & Malone, LLC in 2000, Ms. Harris Jones has represented a wide range of clients, focusing her practice in government relations and procurement at both the state and local levels. Prior to founding Harris, Jones & Malone, LLC, Ms. Harris Jones was associated with other Maryland law firms from 1993 to 1999, and she has represented the City of Baltimore and many of its agencies and related quasi-public entities in various real estate development and financing transactions. In addition to her professional accomplishments, Ms. Harris Jones has held leadership positions in many community service and civic organizations for which she has received recognitions and awards, including being the recipient of the YWCA Greater Baltimore Special Leadership Award in 2012. | | | Specific Qualifications, Attributes, Skills and Experience: • Professional skills and experience in legal and business finance matters • Experience in public policy matters • Experience in real estate matters • Demonstrated leadership capability as an entrepreneur and founding member of a law firm • Work on public company boards and board committees • Institutional knowledge earned through prior service on our Board • Identifies as African American • Identifies as female • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our Declaration of Trust Our Nominating and Governance Committee and our Board also consider historical levels of shareholder support for our Trustees. In this regard, our Nominating and Governance Committee and our Board considered that, last year, Ms. Harris Jones did not receive the support of a majority of votes cast. Based on our shareholder engagement and feedback, our Nominating and Governance Committee and our Board believe that this is due to our historical governance shortcomings and not personal to Ms. Harris Jones. Our Nominating and Governance Committee and our Board also believe Ms. Harris Jones brings important perspectives and experiences to our Board and enhances its diversity. As a result of these factors, among others, no action was taken with regard to the voting results. | | |||||||||

| | | | Joseph L. Morea Age: 65 Independent Trustee since 2018 Class/Term: Class III with a term expiring at the 2021 annual meeting of shareholders | | | Board Committees: • Audit (Chair) • Compensation • Nominating and Governance | | | Other RMR Managed Public Company Boards: • TravelCenters of America Inc. (since 2015) • RMR Real Estate Income Fund (since 2016) • Tremont Mortgage Trust (since 2017) Other Non-RMR Managed Public Company Boards: • THL Credit Senior Loan Fund (since 2013) • Eagle Growth & Income Opportunities Fund (since 2015) • Garrison Capital Inc. (since 2015) | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Mr. Morea was a vice chairman and managing director, serving as head of U.S. Equity Capital Markets, at RBC Capital Markets, an international investment bank, from 2003 until 2012. From 2008 to 2009, Mr. Morea also served as the head of U.S. Investment Banking for RBC Capital Markets. Previously, Mr. Morea was employed as an investment banker, including as a managing director and the co-head of U.S. Equity Capital Markets at UBS, Inc., the chief operating officer of the Investment Banking Division and head of U.S. Equity Capital Markets at PaineWebber, Inc. and a managing director of Equity Capital Markets at Smith Barney, Inc. Prior to working as an investment banker, Mr. Morea was employed as a certified public accountant. | | | Specific Qualifications, Attributes, Skills and Experience: • Experience in and knowledge of the investment banking industry and public capital markets • Demonstrated leadership and management abilities • Experience in capital raising and strategic business transactions • Experience as a public company trustee and director and board committee member • Professional training, skills and expertise in, among other things, finance matters • Institutional knowledge earned through prior service on our Board since shortly after the Company's formation • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents | | |||||||||

16 ![]() 2020 Proxy Statement

2020 Proxy Statement

| | | | John G. Murray Age: 59 Managing Trustee since 2018 President and Chief Executive Officer Class/Term: Class I with a term expiring at the 2022 annual meeting of shareholders | | | Board Committees: None | | | Other RMR Managed Public Company Boards: • Service Properties Trust (formerly known as Hospitality Properties Trust, since 2018) Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Mr. Murray has been the president of Service Properties Trust since June 1996 and its chief executive officer since June 2018, and before then he was its chief operating officer from 1996 until June 2018, and its chief financial officer and treasurer from 1995 to 1996. Mr. Murray has been an executive vice president of RMR LLC since 2001 and served in various other capacities with RMR LLC and its subsidiaries since 1993, including as a senior vice president of RMR LLC from 1993 to 2001. Mr. Murray is also a director of Sonesta. From 2014 to 2017, Mr. Murray served as a member of the board of directors of the American Hotel & Lodging Association representing the owners' segment of the association. Prior to joining RMR LLC, Mr. Murray was employed at Fidelity Brokerage Services Inc. and at Ernst & Young LLP. | | | Specific Qualifications, Attributes, Skills and Experience: • Leadership position with the Company and RMR LLC and demonstrated management ability • Extensive experience in, and knowledge of, the CRE industry and REITs • Institutional knowledge earned through prior service as an officer of the Company and in leadership positions with RMR LLC • Professional skills and expertise in accounting and financing and experience as a chief executive officer and chief operating officer • Qualifying as a Managing Trustee in accordance with the requirements of our governing documents | | |||||||||

| | | | Kevin C. Phelan Age: 75 Independent Trustee since 2020 Class/Term: Class I with a term expiring at the 2022 annual meeting of shareholders | | | Board Committees: • Compensation • Nominating and Governance | | | Other RMR Managed Public Company Boards: None Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Mr. Phelan, age 75, has been co-chairman of the Boston office of Colliers International Group, Inc. (formerly known as Meredith & Grew, or M&G), a full service commercial real estate firm, since 2010. Prior to that he served as president since 2007 and prior to that as executive vice president of the executive committee, and director and partner of M&G. Mr. Phelan joined M&G in 1978 and established the finance and capital markets group. Prior to joining M&G, Mr. Phelan was a vice president at State Street Bank & Trust Co., where he was responsible for commercial lending. Mr. Phelan serves on a number of non-profit boards. | | | Specific Qualifications, Attributes, Skills and Experience: • Professional skills and experience in business finance matters • Experience in and knowledge of the public capital markets • Demonstrated leadership and management abilities • Experience in real estate matters • Experience in capital raising and strategic business transactions • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents | | |||||||||

![]() 2020 Proxy Statement 17

2020 Proxy Statement 17

| | | | Laura A. Wilkin Age: 55 Independent Trustee since 2020 Class/Term: Class III with a term expiring at the 2021 annual meeting of shareholders | | | Board Committees: • Audit • Compensation • Nominating and Governance | | | Other RMR Managed Public Company Boards: None Other Non-RMR Managed Public Company Boards: None | | ||||

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | Ms. Wilkin has been a senior advisor at Boston Consulting Group, Inc., a management consulting firm, since November 2019. Prior to that she served as executive vice president and chief supply chain officer of Petco Animal Supplies, Inc., a retailer of pet food, supplies, services and companion animals in the United States, or Petco, from 2018 to 2019. Prior to joining Petco, Ms. Wilkin served as senior vice president, logistics, from 2016 to 2017, senior vice president, replenishment and flow strategy, from 2013 to 2016, and divisional vice president, supply chain, from 2010 to 2012, of Walmart Inc. Prior to joining Walmart, Ms. Wilkin held various senior supply chain roles at large retailers. | | | Specific Qualifications, Attributes, Skills and Experience: • Demonstrated leadership and management abilities • Experience in strategic business transactions • Professional training, skills and expertise in, among other things, operations, logistics and distribution matters • Operating experience in the logistics field • Identifies as female • Qualifying as an Independent Trustee in accordance with the requirements of the Nasdaq, the SEC and our governing documents | | |||||||||

18 ![]() 2020 Proxy Statement

2020 Proxy Statement

Summary of Trustee Qualifications and Experience |

| | | | | | | | | | | | | | | | | | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Experience/Skills | Gans | | Harris Jones | | Morea | | Murray | | Phelan | | Portnoy | | Wilkin | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Strategic Planning and Leadership | | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CEO/Executive Management | ✓

| ✓

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Risk Oversight | | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| REIT/Real Estate | ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Asset Management | | ✓

| | | | ✓

| | ✓

| | | | ✓

| | | | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capital Markets/Investment Banking | ✓

| ✓

| ✓

| ✓

| ||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Other Public Company Board Experience | | ✓

| | ✓

| | ✓

| | ✓

| | | | ✓

| | | | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Government/Public Policy | ✓

| ✓

| ✓

| |||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Financial Literacy | | ✓

| | ✓

| | ✓

| | ✓

| | | | ✓

| | ✓

| | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Corporate Governance | ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Sustainability | | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ✓

| | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Talent Management | ✓

| ✓

| ✓

| ✓

| ✓

| ✓

| ✓

| |||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Identifies as Female | | | | ✓

| | | | | | | | | | ✓

| | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Identifies as African American | ✓

| |||||||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

![]() 2020 Proxy Statement 19

2020 Proxy Statement 19

Executive Officers |

Our executive officers serve at the discretion of our Board. There are no family relationships among any of our Trustees or executive officers.

| | | | John G. Murray Age: 59 | | | President and Chief Executive Officer since 2018 | | |||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Additional information regarding Mr. Murray's background and qualifications are described above. | | ||||||||

| | | | Richard W. Siedel, Jr. Age: 40 | | | Chief Financial Officer and Treasurer since 2018 | | |||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Mr. Siedel has been a senior vice president of RMR LLC since 2016 and was a vice president of RMR LLC from 2015 to 2016. He has been chief financial officer and treasurer of Diversified Healthcare Trust since 2016 and was chief accounting officer of Five Star Senior Living Inc. from 2014 through 2015, and he previously served as controller of RMR LLC from 2013 to 2014. Mr. Siedel's former experience also includes various accounting leadership positions, including corporate controller at Sensata Technologies (NYSE: ST) from 2010 to 2013 and an auditor at Ernst & Young LLP from 2001 to 2010. | | ||||||||

| | | | Yael Duffy Age: 40 | | | Vice President since 2019 | | |||

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | Ms. Duffy has been a vice president of The RMR Group LLC ("RMR LLC") since 2019 and has served in various finance and accounting leadership roles with RMR LLC and its subsidiaries since 2006, including currently being responsible for asset management oversight for a portfolio of office and industrial properties managed by RMR LLC. | | ||||||||

20 ![]() 2020 Proxy Statement

2020 Proxy Statement

Audit Committee |

| Members Joseph L. Morea (Chair) Bruce M. Gans Lisa Harris Jones Laura A. Wilkin 8 meetings held in 2019 | Our Audit Committee is comprised solely of Independent Trustees. Its primary role is to help our Board fulfill its oversight responsibilities related to the integrity of our financial statements and financial reporting process, the qualifications, independence and performance of our independent registered public accounting firm, the performance of our internal audit function, risk management and our compliance with legal and regulatory requirements. Our Audit Committee is responsible for the appointment, compensation, retention and oversight, and the evaluation of the qualifications, performance and independence, of our independent auditor and the resolution of disagreements between management and the independent auditor. The independent auditor reports directly to our Audit Committee. Our Audit Committee also has final authority and responsibility for the appointment and assignment of duties to our Director of Internal Audit. Our Audit Committee reviews the overall audit scope and plans of the audit with the independent auditor. Our Audit Committee also reviews with management and the independent auditors our quarterly reports on Form 10-Q, annual reports on Form 10-K and earnings releases. Our Board has determined that each member of our Audit Committee is financially literate and that Mr. Morea is our Audit Committee's "financial expert." Ms. Wilkin was appointed to our Audit Committee on February 21, 2020. |

Compensation Committee |

| Members Bruce M. Gans (Chair) Lisa Harris Jones Joseph L. Morea Kevin C. Phelan Laura A. Wilkin 4 meetings held in 2019 | Our Compensation Committee is comprised solely of Independent Trustees. Its primary responsibilities pertain to evaluating the performance and compensation of RMR LLC, our executive officers and our Director of Internal Audit, evaluating and approving any changes in our agreements with RMR LLC and approving equity compensation awards. Our Compensation Committee recommends to our Board the cash compensation payable to our Trustees for Board and committee service. It also reviews amounts payable by us to RMR LLC under our business and property management agreements and approves any proposed amendments to or termination of those agreements. Mr. Phelan and Ms. Wilkin were appointed to our Compensation Committee on February 21, 2020. |

Nominating and Governance Committee |

| Members Lisa Harris Jones (Chair) Bruce M. Gans Joseph L. Morea Kevin C. Phelan Laura A. Wilkin 3 meetings held in 2019 | Our Nominating and Governance Committee is comprised solely of Independent Trustees. Its primary role is to identify individuals qualified to become Board members, consistent with criteria approved by our Board, and to recommend candidates to the entire Board for nomination or selection as Board members for each annual meeting of shareholders or when vacancies occur, to perform certain assessments of our Board and Board committees, including to assess the independence of Trustees and Trustee nominees, and to develop and recommend to our Board governance principles for our Company. Under its charter, our Nominating and Governance Committee is also responsible for considering and reporting on our succession planning to our Board. Mr. Phelan and Ms. Wilkin were appointed to our Nominating and Governance Committee on February 21, 2020. |

![]() 2020 Proxy Statement 21

2020 Proxy Statement 21

In 2019, our Board held 6 meetings. In 2019, each then Trustee attended 75% or more of the aggregate of all meetings of our Board and the committees on which he, she or they served or that were held during the period in which the Trustee served as a Trustee or committee member. All of the then Trustees attended last year's annual meeting of shareholders. Our policy with respect to Board members' attendance at meetings of our Board and annual meetings of shareholders can be found in our Governance Guidelines, the full text of which appears at our website,www.ilptreit.com.

Compensation of Trustees |

Our Board believes that competitive compensation arrangements are necessary to attract and retain qualified Independent Trustees. On June 3, 2019, after conducting a market review with respect to leading companies of similar size to us as well as an industry peer group and other companies managed by RMR LLC or its subsidiaries, upon the recommendation of our Compensation Committee, our Board approved our compensation arrangements for our Independent Trustees, including eliminating meeting fees with respect to meetings of our Board and its committees in favor of annual retainers, which our Board believes is consistent with market practice.

Under the currently effective Trustee compensation arrangements, each Independent Trustee receives an annual fee of $75,000 for services as a Trustee. Each Independent Trustee who serves as a committee chair of our Audit Committee, Compensation Committee or Nominating and Governance Committee also receives an additional annual fee of $17,500, $12,500 and $12,500, respectively, and our Lead Independent Trustee also receives an additional annual cash retainer fee of $15,000 for serving in this role. Trustees are reimbursed for travel expenses they incur in connection with their duties as Trustees and for out of pocket costs they incur in connection with their attending certain continuing education programs.

Each Independent Trustee and Managing Trustee also receives an award of Common Shares annually, which was 3,000 Common Shares in 2019. Managing Trustees do not receive cash compensation for their services as Trustees.

Trustee Share Ownership Guidelines |

Our Board believes it is important to align the interests of Trustees with those of our shareholders, and for Trustees to hold equity ownership positions in the Company. Accordingly, each Trustee is expected to retain at least 20,000 Common Shares within five years following: (i) if elected by shareholders, the annual meeting of shareholders of the Company at which such Trustee was initially elected, or (ii) if appointed by our Board, the first annual meeting of shareholders of the Company following the initial appointment of such Trustee to our Board. Compliance with these ownership guidelines is measured annually. Any Trustee who is prohibited by law or by applicable regulation of his, her or their employer from owning equity in the Company is exempt from this requirement. Our Nominating and Governance Committee may consider whether exceptions should be made for any Trustee on whom this requirement could impose a financial hardship.

As of March 16, 2020, all Trustees have met or, within the applicable period, are expected to meet, these share ownership guidelines.

22 ![]() 2020 Proxy Statement

2020 Proxy Statement

2019 Annual Trustee Compensation |

The following table details the total compensation of the Trustees for the year ended December 31, 2019 for services as a Trustee.

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | All Other Compensation ($) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | |

Bruce M. Gans | | 107,500 | | 56,190 | | — | | 163,690 | |||||

Lisa Harris Jones | 93,750 | 56,190 | �� | 149,940 | |||||||||

Joseph L. Morea | | 98,750 | | 56,190 | | — | | 154,940 | |||||

John G. Murray(3) | — | 56,190 | — | 56,190 | |||||||||

Adam D. Portnoy(3) | | — | | 56,190 | | — | | 56,190 | |||||

Kevin C. Phelan(4) | — | — | — | — | |||||||||

Laura A. Wilkin(4) | | — | | — | | — | | — | |||||

| | | | | | | | | | | | | | |

![]() 2020 Proxy Statement 23

2020 Proxy Statement 23

OWNERSHIP OF EQUITY SECURITIES OF THE COMPANY

Trustees and Executive Officers |

The following table sets forth information regarding the beneficial ownership of the outstanding Common Shares by each Trustee nominee, each Trustee, each of our named executive officers and our Trustees, Trustee nominees, named executive officers and other executive officers as a group, all as of March 16, 2020. Unless otherwise noted, to our knowledge, voting power and investment power in the Common Shares are exercisable solely by the named person and the principal business address of the named person is c/o Industrial Logistics Properties Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458.

| Name and Address | Aggregate Number of Shares Beneficially Owned* | Percent of Outstanding Shares** | Additional Information | |||||

| Adam D. Portnoy | | 806,708 | | 1.24 | % | Includes 745,672 Common Shares owned by ABP Trust. Voting and investment power with respect to Common Shares owned by ABP Trust may be deemed to be shared by Adam D. Portnoy as ABP Trust's sole trustee. | ||

John G. Murray | 24,554 | Less than 1 | % | |||||

Richard W. Siedel, Jr. | | 10,421 | | Less than 1 | % | | ||

Lisa Harris Jones | 7,398 | Less than 1 | % | |||||

Bruce M. Gans | | 7,000 | | Less than 1 | % | | ||

Joseph L. Morea | 7,000 | Less than 1 | % | |||||

Kevin C. Phelan | | 3,000 | | Less than 1 | % | | ||

Laura A. Wilkin | 3,000 | Less than 1 | % | |||||

Yael Duffy | | 1,946 | | Less than 1 | % | | ||

All Trustees, the Trustee nominees, named executive officers and other executive officers as a group (nine persons) | 871,027 | 1.34 | % |

24 ![]() 2020 Proxy Statement

2020 Proxy Statement

Principal Shareholders |

Set forth in the table below is information about the number of Common Shares held by persons we know to be the beneficial owners of more than 5.0% of the outstanding Common Shares.

| Name and Address | Aggregate Number of Shares Beneficially Owned* | Percent of Outstanding Shares** | Additional Information | |||||

| | | | | | | | | |

| BlackRock, Inc. ("BlackRock") 55 East 52nd Street New York, New York 10055 | | 10,955,408 | | 16.8% | Based on a Schedule 13G/A filed with the SEC on January 10, 2020 by BlackRock reporting that, at December 31, 2019, BlackRock beneficially owned and had sole dispositive power over 10,955,408 Common Shares and sole voting power over 10,630,870 Common Shares. | |||

| The Vanguard Group, Inc. ("Vanguard") 100 Vanguard Boulevard Malvern, Pennsylvania 19355 | 10,219,327 | 15.7% | Based on a Schedule 13G/A filed with the SEC on February 11, 2020 by Vanguard reporting that, at December 31, 2019, Vanguard beneficially owned 10,219,327 Common Shares and had sole voting power over 134,370 Common Shares, shared voting power over 79,900 Common Shares, sole dispositive power over 10,085,466 Common Shares and shared dispositive power over 133,861 Common Shares. | |||||

| Massachusetts Financial Services Company ("MFS") 111 Huntington Avenue, Boston MA 02199 | | 6,110,942 | | 9.4% | Based on a Schedule 13G/A filed with the SEC on February 14, 2020 by MFS reporting that, at December 31, 2019, MFS beneficially owned and had sole dispositive power over 6,110,942 Common Shares and sole voting power over 5,994,719 Common Shares. |

![]() 2020 Proxy Statement 25

2020 Proxy Statement 25

PROPOSAL 2: APPROVAL OF AN AMENDMENT TO OUR DECLARATION OF TRUST TO PROVIDE FOR THE ANNUAL ELECTION OF ALL TRUSTEES

Our Board has unanimously approved, and we are seeking shareholder approval for, an amendment to our Declaration of Trust to provide for the annual election of all Trustees. Our Declaration of Trust currently provides for a Board divided into three classes of Trustees, with each class elected for a three-year term.