commercialize will compete with existing therapies and new therapies that may become available in the future. We believe that a significant number of products are currently under development, and may become commercially available in the future, for the treatment of IBD. Our competitors include larger and better funded pharmaceutical, specialty pharmaceutical and biotechnology companies. Moreover, we may also compete with universities, governmental agencies and other research institutions who may be active in the indications we are targeting and could be in direct competition with us. We also compete with these organizations in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

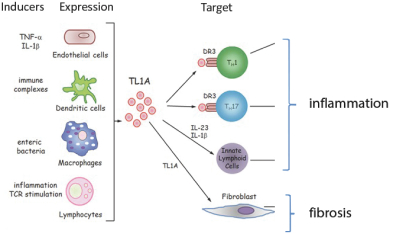

We expect to face competition from existing products and products in development for each of our therapeutic product candidates. If approved for the treatment of patients with moderate-to-severe IBD, PRA023, would compete with Entyvio, which is an a4b7 integrin antibody marketed by Takeda, Humira, which is a TNF antibody marketed by Abbvie Inc., Stelara, which is an IL-12/IL-23 antibody marketed by Janssen Pharmaceuticals, Inc., Xeljanz, which is a JAK1 inhibitor marketed by Pfizer Inc., and Simponi, which is a TNF antibody marketed by Johnson & Johnson.

We are aware of several companies with product candidates for the treatment of patients with UC and/or CD, including Pfizer’s PF-06480605, which is a fully human anti-TL1A antibody being developed in Phase 2 trials for UC, Rinvoq, which is a JAK1 inhibitor being developed in Phase 3 clinical trials by AbbVie, ozanimod, which is a S1P inhibitor being developed in Phase 3 clinical trials by Bristol-Myers Squibb Company, etrolizumab, which is a b7 integrin being developed in Phase 3 clinical trials by Roche, mirikizumab, which is an anti-IL-23 antibody being developed in Phase 3 clinical trials by Eli Lilly and filgotinib, a JAK1 inhibitor being developed in Phase 3 clinical trials by Gilead Sciences, Inc. We are also aware of additional product candidates in clinical trials by AbbVie Inc., Abivax SA, Amgen Inc., Arena Pharmaceuticals, Inc., C.H. Boehringer Ingelheim Sohn AG & Ko. KG, Bristol-Myers Squibb Company, Celgene Corporation, Gilead Sciences, Inc., GlaxoSmithKline plc, Gossamer Bio, Inc., Incyte Corp., Janssen Pharmaceutica N.V., Landos Biopharma, Inc., Protagonist Therapeutics, Inc., Theravance Biopharma, Inc., Applied Molecular Transport Inc., Pandion Therapeutics, Inc., RedHill Biopharma Ltd. and Seres Therapeutics, Inc.

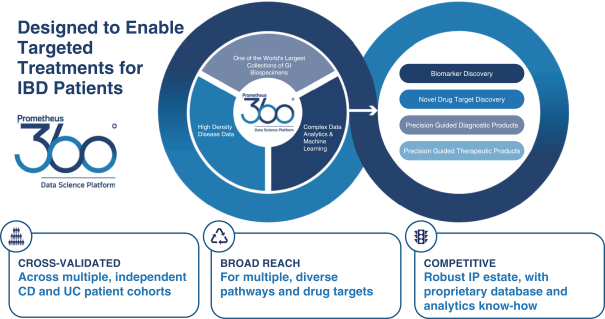

Many of our competitors have significantly greater financial, technical, manufacturing, marketing, sales and supply resources or experience than we do. If we successfully obtain approval for any product candidate, we will face competition based on many different factors, including the safety and effectiveness of our products, the ease with which our products can be administered, the effectiveness of any related companion diagnostic tests, the timing and scope of regulatory approvals for these products, the availability and cost of manufacturing, marketing and sales capabilities, price, reimbursement coverage and patent position. Competing products could present superior treatment alternatives, including by being more effective, safer, more convenient, less expensive or marketed and sold more effectively than any products we may develop. Competitive products or technological approaches may make any products we develop, or Prometheus360, obsolete or noncompetitive before we recover the expense of developing and commercializing our product candidates. If we are unable to compete effectively, our opportunity to generate revenue from the sale of our products we may develop, if approved, could be adversely affected.

If the market opportunities for our products are smaller than we believe they are, our revenue may be adversely affected, and our business may suffer.

The precise incidence and prevalence for all the conditions we aim to address with our product candidates are unknown. Our projections of both the number of people who have these diseases, as well as the subset of people with these diseases who have the potential to benefit from treatment with our therapeutic product candidates, are based on our beliefs and estimates. These estimates have been derived from a variety of sources, including the scientific literature, surveys of clinics, patient foundations or market research, and may prove to be

- 36 -