UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811- 23312

Impact Shares Trust I

(Exact name of registrant as specified in charter)

2189 Broken Bend

Frisco, Texas 75034

(Address of principal executive offices)

Ethan Powell

2189 Broken Bend

Frisco, Texas 75034

(Name and address of agent for service)

COPY TO:

Brian McCabe

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, Massachusetts 02199-3600

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-469-442-8424

Date of fiscal year end: June 30, 2024

Date of reporting period: December 31, 2023

Item 1. Reports to Stockholders.

| | (a) | A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR § 270.30e-1), is attached hereto. |

IMPACT SHARES TRUST I

Impact Shares YWCA Women’s Empowerment ETF

Impact Shares NAACP Minority Empowerment ETF

Impact Shares Affordable Housing MBS ETF

Semi-Annual Report

December 31, 2023

Impact Shares Trust I

Table of Contents

Each Fund files its complete schedule of Fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year or as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT is available on the Commission’s website at http://www.sec.gov.

A description of the policies and procedures that Impact Shares, Corp. uses to determine how to vote proxies relating to Fund securities, as well as information relating to how a Fund voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-844-448-3383; and (ii) on the Commission’s website at http://www.sec.gov.

Impact Shares YWCA Women’s Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

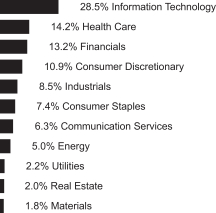

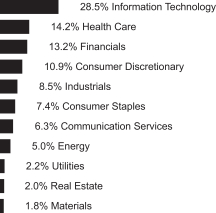

Sector Weightings†:

† Percentages based on total investments.

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

COMMON STOCK — 100.5% | | | | | | | | |

|

Communication Services— 6.4% | |

Electronic Arts | | | 615 | | | $ | 84,138 | |

Interpublic Group | | | 967 | | | | 31,563 | |

Match Group* | | | 678 | | | | 24,747 | |

Meta Platforms, Cl A* | | | 5,640 | | | | 1,996,334 | |

Netflix* | | | 599 | | | | 291,641 | |

Omnicom Group | | | 504 | | | | 43,601 | |

Pinterest, Cl A* | | | 1,397 | | | | 51,745 | |

T-Mobile US | | | 1,227 | | | | 196,725 | |

Verizon Communications | | | 10,675 | | | | 402,448 | |

| | | | | | | | |

| | | | | | | 3,122,942 | |

| | | | | | | | |

|

Consumer Discretionary— 10.9% | |

Amazon.com* | | | 16,287 | | | | 2,474,647 | |

Best Buy | | | 731 | | | | 57,223 | |

Deckers Outdoor* | | | 94 | | | | 62,833 | |

DoorDash, Cl A* | | | 650 | | | | 64,279 | |

eBay | | | 2,268 | | | | 98,930 | |

Etsy* | | | 471 | | | | 38,174 | |

Expedia Group* | | | 515 | | | | 78,172 | |

Ford Motor | | | 17,163 | | | | 209,217 | |

General Motors | | | 5,979 | | | | 214,766 | |

Lululemon Athletica* | | | 483 | | | | 246,953 | |

McDonald’s | | | 3,167 | | | | 939,047 | |

Service International | | | 632 | | | | 43,260 | |

Starbucks | | | 4,960 | | | | 476,210 | |

Target | | | 1,146 | | | | 163,213 | |

Williams-Sonoma | | | 237 | | | | 47,822 | |

Yum! Brands | | | 1,225 | | | | 160,058 | |

| | | | | | | | |

| | |

| | | | | | | 5,374,804 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

|

Consumer Staples— 7.4% | |

Archer-Daniels-Midland | | | 1,367 | | | $ | 98,725 | |

Brown-Forman, Cl A | | | 157 | | | | 9,356 | |

Brown-Forman, Cl B | | | 770 | | | | 43,967 | |

Campbell Soup | | | 498 | | | | 21,529 | |

Church & Dwight | | | 604 | | | | 57,114 | |

Clorox | | | 305 | | | | 43,490 | |

Coca-Cola | | | 9,900 | | | | 583,407 | |

Colgate-Palmolive | | | 2,079 | | | | 165,717 | |

Conagra Brands | | | 1,191 | | | | 34,134 | |

Estee Lauder, Cl A | | | 571 | | | | 83,509 | |

General Mills | | | 1,477 | | | | 96,212 | |

Hershey | | | 364 | | | | 67,864 | |

J M Smucker | | | 263 | | | | 33,238 | |

Kellanova | | | 639 | | | | 35,726 | |

Kimberly-Clark | | | 841 | | | | 102,190 | |

Kraft Heinz | | | 1,982 | | | | 73,294 | |

Kroger | | | 1,619 | | | | 74,004 | |

Molson Coors Beverage, Cl B | | | 467 | | | | 28,585 | |

Mondelez International, Cl A | | | 3,446 | | | | 249,594 | |

PepsiCo | | | 3,494 | | | | 593,421 | |

Procter & Gamble | | | 5,984 | | | | 876,895 | |

Walmart | | | 1,789 | | | | 282,036 | |

| | | | | | | | |

| | |

| | | | | | | 3,654,007 | |

| | | | | | | | |

|

Energy— 5.1% | |

Baker Hughes, Cl A | | | 2,655 | | | | 90,748 | |

Chevron | | | 4,509 | | | | 672,562 | |

ConocoPhillips | | | 3,047 | | | | 353,665 | |

Exxon Mobil | | | 10,170 | | | | 1,016,797 | |

Occidental Petroleum | | | 1,683 | | | | 100,492 | |

Phillips 66 | | | 1,073 | | | | 142,859 | |

Williams | | | 2,976 | | | | 103,654 | |

| | | | | | | | |

| | |

| | | | | | | 2,480,777 | |

| | | | | | | | |

|

Financials— 13.3% | |

Allstate | | | 660 | | | | 92,387 | |

American Express | | | 1,482 | | | | 277,638 | |

American International Group | | | 1,636 | | | | 110,839 | |

Ameriprise Financial | | | 261 | | | | 99,136 | |

Bank of America | | | 17,402 | | | | 585,925 | |

Bank of New York Mellon | | | 1,835 | | | | 95,512 | |

BlackRock, Cl A | | | 357 | | | | 289,813 | |

Capital One Financial | | | 949 | | | | 124,433 | |

Citigroup | | | 4,819 | | | | 247,889 | |

Citizens Financial Group | | | 553 | | | | 18,326 | |

Fifth Third Bancorp | | | 1,707 | | | | 58,875 | |

The accompanying notes are an integral part of the financial statements.

1

Impact Shares YWCA Women’s Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Hartford Financial Services Group | | | 791 | | | $ | 63,580 | |

Huntington Bancshares | | | 3,600 | | | | 45,792 | |

KeyCorp | | | 2,327 | | | | 33,509 | |

Mastercard, Cl A | | | 2,112 | | | | 900,789 | |

MetLife | | | 1,644 | | | | 108,718 | |

Moody’s | | | 391 | | | | 152,709 | |

Morgan Stanley | | | 3,281 | | | | 305,953 | |

Northern Trust | | | 516 | | | | 43,540 | |

PayPal Holdings* | | | 2,834 | | | | 174,036 | |

Principal Financial Group | | | 567 | | | | 44,606 | |

Progressive | | | 1,460 | | | | 232,549 | |

Prudential Financial | | | 917 | | | | 95,102 | |

Raymond James Financial | | | 477 | | | | 53,185 | |

Regions Financial | | | 2,331 | | | | 45,175 | |

S&P Global | | | 789 | | | | 347,570 | |

State Street | | | 716 | | | | 55,461 | |

Synchrony Financial | | | 996 | | | | 38,037 | |

T Rowe Price Group | | | 555 | | | | 59,768 | |

US Bancorp | | | 3,953 | | | | 171,086 | |

Visa, Cl A | | | 4,004 | | | | 1,042,441 | |

Wells Fargo | | | 9,098 | | | | 447,804 | |

Willis Towers Watson | | | 259 | | | | 62,471 | |

| | | | | | | | |

| | |

| | | | | | | 6,524,654 | |

| | | | | | | | |

|

Health Care— 14.3% | |

AbbVie | | | 4,486 | | | | 695,195 | |

Agilent Technologies | | | 509 | | | | 70,766 | |

Amgen | | | 1,358 | | | | 391,131 | |

Baxter International | | | 1,256 | | | | 48,557 | |

Biogen* | | | 358 | | | | 92,640 | |

BioMarin Pharmaceutical* | | | 464 | | | | 44,739 | |

Bristol-Myers Squibb | | | 5,057 | | | | 259,475 | |

Cardinal Health | | | 649 | | | | 65,419 | |

Cigna Group | | | 706 | | | | 211,412 | |

Elevance Health | | | 562 | | | | 265,017 | |

Eli Lilly | | | 2,137 | | | | 1,245,700 | |

Gilead Sciences | | | 3,126 | | | | 253,237 | |

Johnson & Johnson | | | 6,111 | | | | 957,838 | |

Merck | | | 6,442 | | | | 702,307 | |

Regeneron Pharmaceuticals* | | | 267 | | | | 234,503 | |

UnitedHealth Group | | | 2,350 | | | | 1,237,204 | |

Vertex Pharmaceuticals* | | | 640 | | | | 260,410 | |

| | | | | | | | |

| | |

| | | | | | | 7,035,550 | |

| | | | | | | | |

|

Industrials— 8.5% | |

3M | | | 1,372 | | | | 149,987 | |

Automatic Data Processing | | | 1,028 | | | | 239,493 | |

Booz Allen Hamilton Holding, Cl A | | | 324 | | | | 41,443 | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Carrier Global | | | 2,041 | | | $ | 117,255 | |

Ceridian HCM Holding* | | | 729 | | | | 48,931 | |

Cummins | | | 364 | | | | 87,203 | |

Delta Air Lines | | | 1,593 | | | | 64,086 | |

Eaton PLC | | | 992 | | | | 238,894 | |

Emerson Electric | | | 1,470 | | | | 143,075 | |

Fortive | | | 1,803 | | | | 132,755 | |

General Electric | | | 2,615 | | | | 333,753 | |

Ingersoll Rand | | | 988 | | | | 76,412 | |

Johnson Controls International PLC | | | 1,713 | | | | 98,737 | |

Norfolk Southern | | | 574 | | | | 135,682 | |

Owens Corning | | | 233 | | | | 34,538 | |

Paychex | | | 783 | | | | 93,263 | |

Pentair PLC | | | 411 | | | | 29,884 | |

Republic Services, Cl A | | | 500 | | | | 82,455 | |

Robert Half International | | | 270 | | | | 23,738 | |

Rockwell Automation | | | 283 | | | | 87,866 | |

Southwest Airlines | | | 1,477 | | | | 42,656 | |

Stanley Black & Decker | | | 361 | | | | 35,414 | |

Trane Technologies PLC | | | 561 | | | | 136,828 | |

TransUnion | | | 478 | | | | 32,843 | |

Uber Technologies* | | | 9,745 | | | | 600,000 | |

Union Pacific | | | 1,531 | | | | 376,044 | |

United Parcel Service, Cl B | | | 1,817 | | | | 285,687 | |

Verisk Analytics, Cl A | | | 386 | | | | 92,200 | |

Waste Management | | | 932 | | | | 166,921 | |

WW Grainger | | | 109 | | | | 90,327 | |

Xylem | | | 608 | | | | 69,531 | |

| | | | | | | | |

| | |

| | | | | | | 4,187,901 | |

| �� | | | | | | | |

|

Information Technology— 28.6% | |

Accenture PLC, Cl A | | | 3,080 | | | | 1,080,803 | |

Adobe* | | | 2,234 | | | | 1,332,804 | |

ANSYS* | | | 441 | | | | 160,030 | |

Apple | | | 12,529 | | | | 2,412,209 | |

Autodesk* | | | 1,049 | | | | 255,411 | |

Cisco Systems | | | 19,961 | | | | 1,008,430 | |

Global Payments | | | 604 | | | | 76,708 | |

Hewlett Packard Enterprise | | | 6,299 | | | | 106,957 | |

HP | | | 4,448 | | | | 133,840 | |

HubSpot* | | | 237 | | | | 137,588 | |

Intel | | | 20,710 | | | | 1,040,678 | |

International Business Machines | | | 4,484 | | | | 733,358 | |

Intuit | | | 1,307 | | | | 816,914 | |

Keysight Technologies* | | | 902 | | | | 143,499 | |

Microsoft | | | 4,086 | | | | 1,536,500 | |

Monolithic Power Systems | | | 217 | | | | 136,879 | |

Motorola Solutions | | | 796 | | | | 249,219 | |

Okta, Cl A* | | | 784 | | | | 70,975 | |

Salesforce* | | | 4,778 | | | | 1,257,283 | |

The accompanying notes are an integral part of the financial statements.

2

Impact Shares YWCA Women’s Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

ServiceNow* | | | 956 | | | $ | 675,404 | |

Splunk* | | | 772 | | | | 117,614 | |

TE Connectivity | | | 1,473 | | | | 206,957 | |

Tyler Technologies* | | | 198 | | | | 82,788 | |

Workday, Cl A* | | | 1,046 | | | | 288,759 | |

| | | | | | | | |

| | |

| | | | | | | 14,061,607 | |

| | | | | | | | |

|

Materials— 1.8% | |

Air Products and Chemicals | | | 549 | | | | 150,316 | |

Albemarle | | | 296 | | | | 42,766 | |

Celanese, Cl A | | | 247 | | | | 38,376 | |

Corteva | | | 1,780 | | | | 85,298 | |

Dow | | | 1,754 | | | | 96,189 | |

DuPont de Nemours | | | 1,019 | | | | 78,392 | |

Ecolab | | | 613 | | | | 121,589 | |

International Flavors & Fragrances | | | 632 | | | | 51,173 | |

Newmont | | | 2,823 | | | | 116,844 | |

PPG Industries | | | 585 | | | | 87,487 | |

| | | | | | | | |

| | |

| | | | | | | 868,430 | |

| | | | | | | | |

|

Real Estate— 2.0% | |

American Tower, Cl A‡ | | | 1,179 | | | | 254,522 | |

CBRE Group, Cl A* | | | 783 | | | | 72,889 | |

Equinix‡ | | | 227 | | | | 182,824 | |

Equity LifeStyle Properties‡ | | | 432 | | | | 30,473 | |

Essex Property Trust‡ | | | 157 | | | | 38,926 | |

Healthpeak Properties‡ | | | 1,341 | | | | 26,552 | |

Host Hotels & Resorts‡ | | | 1,778 | | | | 34,618 | |

Invitation Homes‡ | | | 1,417 | | | | 48,334 | |

Iron Mountain‡ | | | 725 | | | | 50,735 | |

Rexford Industrial Realty‡ | | | 496 | | | | 27,826 | |

Ventas‡ | | | 996 | | | | 49,641 | |

Welltower‡ | | | 1,313 | | | | 118,393 | |

Zillow Group, Cl A* | | | 137 | | | | 7,771 | |

Zillow Group, Cl C* | | | 392 | | | | 22,681 | |

| | | | | | | | |

| | |

| | | | | | | 966,185 | |

| | | | | | | | |

|

Utilities— 2.2% | |

Alliant Energy | | | 645 | | | | 33,088 | |

American Electric Power | | | 1,328 | | | | 107,860 | |

American Water Works | | | 451 | | | | 59,527 | |

Avangrid | | | 177 | | | | 5,737 | |

CenterPoint Energy | | | 1,567 | | | | 44,769 | |

CMS Energy | | | 720 | | | | 41,810 | |

Consolidated Edison | | | 880 | | | | 80,054 | |

Dominion Energy | | | 2,072 | | | | 97,384 | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Edison International | | | 950 | | | $ | 67,916 | |

Entergy | | | 548 | | | | 55,452 | |

Exelon | | | 2,467 | | | | 88,565 | |

NiSource | | | 1,012 | | | | 26,869 | |

PG&E | | | 5,308 | | | | 95,703 | |

Pinnacle West Capital | | | 283 | | | | 20,331 | |

PPL | | | 1,833 | | | | 49,674 | |

Public Service Enterprise Group | | | 1,218 | | | | 74,481 | |

Sempra Energy | | | 1,567 | | | | 117,102 | |

Vistra | | | 932 | | | | 35,901 | |

| | | | | | | | |

| | |

| | | | | | | 1,102,223 | |

| | | | | | | | |

| | |

Total Common Stock

(Cost $44,395,290) | | | | | | | 49,379,080 | |

| | | | | | | | |

Total Investments—100.5%

(Cost $44,395,290) | | | | | | $ | 49,379,080 | |

| | | | | | | | |

Percentages are based on Net Assets of $49,117,276.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

Cl — Class

PLC — Public Limited Company

As of December 31, 2023, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance under U.S. Generally Accepted Accounting Principles.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

3

Impact Shares NAACP Minority Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

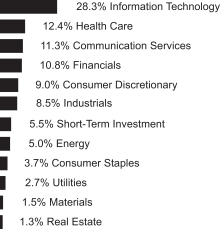

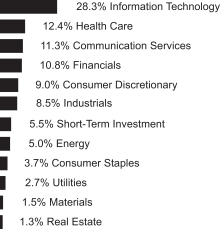

Sector Weightings†:

† Percentages based on total investments.

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

| | |

COMMON STOCK — 94.4% | | | | | | | | |

|

Communication Services— 11.3% | |

Alphabet, Cl A* | | | 8,975 | | | $ | 1,253,718 | |

Alphabet, Cl C* | | | 7,955 | | | | 1,121,098 | |

AT&T | | | 14,591 | | | | 244,837 | |

Electronic Arts | | | 538 | | | | 73,604 | |

Interpublic Group | | | 810 | | | | 26,439 | |

Lumen Technologies* | | | 1,955 | | | | 3,577 | |

Meta Platforms, Cl A* | | | 4,611 | | | | 1,632,109 | |

Verizon Communications | | | 8,601 | | | | 324,258 | |

| | | | | | | | |

| | |

| | | | | | | 4,679,640 | |

| | | | | | | | |

|

Consumer Discretionary— 9.0% | |

Amazon.com* | | | 9,966 | | | | 1,514,234 | |

Aptiv* | | | 458 | | | | 41,092 | |

BorgWarner | | | 405 | | | | 14,519 | |

Dollar Tree* | | | 355 | | | | 50,428 | |

eBay | | | 917 | | | | 39,999 | |

Ford Motor | | | 6,699 | | | | 81,661 | |

General Motors | | | 2,409 | | | | 86,531 | |

Hasbro | | | 223 | | | | 11,386 | |

Lear | | | 100 | | | | 14,121 | |

Lowe’s | | | 1,052 | | | | 234,123 | |

MercadoLibre* | | | 77 | | | | 121,009 | |

NIKE, Cl B | | | 2,137 | | | | 232,014 | |

Phinia | | | 86 | | | | 2,599 | |

Royal Caribbean Cruises* | | | 374 | | | | 48,429 | |

Target | | | 778 | | | | 110,803 | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Tesla* | | | 4,567 | | | $ | 1,134,808 | |

VF | | | 559 | | | | 10,509 | |

| | | | | | | | |

| | |

| | | | | | | 3,748,265 | |

| | | | | | | | |

|

Consumer Staples— 3.7% | |

Archer-Daniels-Midland | | | 929 | | | | 67,092 | |

Bunge Global | | | 255 | | | | 25,742 | |

Campbell Soup | | | 341 | | | | 14,742 | |

Clorox | | | 210 | | | | 29,944 | |

Coca-Cola | | | 6,592 | | | | 388,467 | |

Constellation Brands, Cl A | | | 274 | | | | 66,239 | |

Hormel Foods | | | 491 | | | | 15,766 | |

J M Smucker | | | 180 | | | | 22,748 | |

Kellanova | | | 434 | | | | 24,265 | |

Kimberly-Clark | | | 572 | | | | 69,504 | |

Kraft Heinz | | | 1,350 | | | | 49,923 | |

Kroger | | | 1,104 | | | | 50,464 | |

Molson Coors Beverage, Cl B | | | 318 | | | | 19,465 | |

Mondelez International, Cl A | | | 2,312 | | | | 167,458 | |

PepsiCo | | | 2,334 | | | | 396,407 | |

Sysco | | | 859 | | | | 62,819 | |

Tyson Foods, Cl A | | | 492 | | | | 26,445 | |

US Foods Holding* | | | 354 | | | | 16,075 | |

Walgreens Boots Alliance | | | 1,215 | | | | 31,723 | |

WK Kellogg | | | 109 | | | | 1,426 | |

| | | | | | | | |

| | |

| | | | | | | 1,546,714 | |

| | | | | | | | |

|

Energy— 5.0% | |

Cheniere Energy | | | 421 | | | | 71,869 | |

Chevron | | | 3,015 | | | | 449,717 | |

ConocoPhillips | | | 2,112 | | | | 245,140 | |

Devon Energy | | | 1,108 | | | | 50,192 | |

Exxon Mobil | | | 6,973 | | | | 697,161 | |

Hess | | | 470 | | | | 67,755 | |

Kinder Morgan | | | 3,355 | | | | 59,182 | |

Marathon Petroleum | | | 793 | | | | 117,650 | |

ONEOK | | | 757 | | | | 53,157 | |

Phillips 66 | | | 800 | | | | 106,512 | |

Range Resources | | | 73 | | | | 2,222 | |

Valero Energy | | | 652 | | | | 84,760 | |

Williams | | | 2,064 | | | | 71,889 | |

| | | | | | | | |

| | |

| | | | | | | 2,077,206 | |

| | | | | | | | |

|

Financials— 10.7% | |

American Express | | | 1,014 | | | | 189,963 | |

Aon PLC, Cl A | | | 352 | | | | 102,439 | |

Bank of America | | | 11,819 | | | | 397,946 | |

Bank of New York Mellon | | | 1,247 | | | | 64,906 | |

The accompanying notes are an integral part of the financial statements.

4

Impact Shares NAACP Minority Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Charles Schwab | | | 2,588 | | | $ | 178,055 | |

Citigroup | | | 3,284 | | | | 168,929 | |

Huntington Bancshares | | | 2,442 | | | | 31,062 | |

JPMorgan Chase | | | 4,970 | | | | 845,397 | |

Mastercard, Cl A | | | 1,439 | | | | 613,748 | |

MetLife | | | 1,115 | | | | 73,735 | |

Moody’s | | | 266 | | | | 103,889 | |

Morgan Stanley | | | 2,233 | | | | 208,227 | |

Nasdaq | | | 574 | | | | 33,372 | |

PayPal Holdings* | | | 1,933 | | | | 118,706 | |

PNC Financial Services Group | | | 684 | | | | 105,917 | |

Regions Financial | | | 1,584 | | | | 30,698 | |

S&P Global | | | 564 | | | | 248,453 | |

Synchrony Financial | | | 763 | | | | 29,139 | |

T Rowe Price Group | | | 378 | | | | 40,707 | |

Travelers | | | 398 | | | | 75,815 | |

Truist Financial | | | 2,248 | | | | 82,996 | |

Visa, Cl A | | | 2,770 | | | | 721,169 | |

| | | | | | | | |

| | |

| | | | | | | 4,465,268 | |

| | | | | | | | |

|

Health Care— 12.4% | |

Abbott Laboratories | | | 2,954 | | | | 325,147 | |

AbbVie | | | 2,993 | | | | 463,825 | |

Agilent Technologies | | | 503 | | | | 69,932 | |

Baxter International | | | 851 | | | | 32,900 | |

Becton Dickinson | | | 484 | | | | 118,014 | |

Biogen* | | | 244 | | | | 63,140 | |

Boston Scientific* | | | 2,426 | | | | 140,247 | |

Bristol-Myers Squibb | | | 3,598 | | | | 184,613 | |

Cigna Group | | | 518 | | | | 155,115 | |

CVS Health | | | 2,228 | | | | 175,923 | |

Edwards Lifesciences* | | | 1,047 | | | | 79,834 | |

Elevance Health | | | 411 | | | | 193,811 | |

Fortrea Holdings* | | | 151 | | | | 5,270 | |

Gilead Sciences | | | 2,121 | | | | 171,822 | |

Illumina* | | | 268 | | | | 37,316 | |

Johnson & Johnson | | | 4,423 | | | | 693,261 | |

Laboratory Corp of America Holdings | | | 151 | | | | 34,321 | |

Medtronic PLC | | | 2,247 | | | | 185,108 | |

Merck | | | 4,287 | | | | 467,369 | |

Pfizer | | | 9,482 | | | | 272,987 | |

Quest Diagnostics | | | 193 | | | | 26,611 | |

ResMed | | | 249 | | | | 42,833 | |

Teleflex | | | 78 | | | | 19,448 | |

Thermo Fisher Scientific | | | 664 | | | | 352,445 | |

UnitedHealth Group | | | 1,584 | | | | 833,928 | |

| | | | | | | | |

| | |

| | | | | | | 5,145,220 | |

| | | | | | | | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

|

Industrials— 8.5% | |

3M | | | 935 | | | $ | 102,214 | |

AECOM | | | 241 | | | | 22,276 | |

American Airlines Group* | | | 1,104 | | | | 15,169 | |

AMETEK | | | 390 | | | | 64,307 | |

Automatic Data Processing | | | 702 | | | | 163,545 | |

Boeing* | | | 949 | | | | 247,366 | |

Booz Allen Hamilton Holding, Cl A | | | 223 | | | | 28,524 | |

CSX | | | 3,564 | | | | 123,564 | |

Cummins | | | 239 | | | | 57,257 | |

Deere | | | 465 | | | | 185,940 | |

Delta Air Lines | | | 1,089 | | | | 43,810 | |

Eaton PLC | | | 674 | | | | 162,313 | |

Emerson Electric | | | 1,002 | | | | 97,525 | |

Expeditors International of Washington | | | 269 | | | | 34,217 | |

FedEx | | | 407 | | | | 102,958 | |

General Electric | | | 1,854 | | | | 236,626 | |

Honeywell International | | | 1,140 | | | | 239,070 | |

Howmet Aerospace | | | 624 | | | | 33,771 | |

Illinois Tool Works | | | 473 | | | | 123,898 | |

Jacobs Solutions | | | 219 | | | | 28,426 | |

JB Hunt Transport Services | | | 140 | | | | 27,964 | |

Johnson Controls International PLC | | | 1,190 | | | | 68,592 | |

Lennox International | | | 56 | | | | 25,061 | |

Lincoln Electric Holdings | | | 100 | | | | 21,746 | |

Nordson | | | 91 | | | | 24,039 | |

Northrop Grumman | | | 246 | | | | 115,162 | |

Rockwell Automation | | | 195 | | | | 60,543 | |

Southwest Airlines | | | 1,006 | | | | 29,053 | |

Stanley Black & Decker | | | 251 | | | | 24,623 | |

Textron | | | 352 | | | | 28,308 | |

Uber Technologies* | | | 6,984 | | | | 430,005 | |

Union Pacific | | | 1,041 | | | | 255,690 | |

United Airlines Holdings* | | | 556 | | | | 22,941 | |

United Parcel Service, Cl B | | | 1,239 | | | | 194,808 | |

United Rentals | | | 119 | | | | 68,237 | |

Xylem | | | 307 | | | | 35,108 | |

| | | | | | | | |

| | |

| | | | | | | 3,544,656 | |

| | | | | | | | |

|

Information Technology— 28.2% | |

Accenture PLC, Cl A | | | 2,204 | | | | 773,406 | |

Apple | | | 11,547 | | | | 2,223,144 | |

Cisco Systems | | | 14,353 | | | | 725,114 | |

Dell Technologies, Cl C | | | 905 | | | | 69,233 | |

The accompanying notes are an integral part of the financial statements.

5

Impact Shares NAACP Minority Empowerment ETF

Schedule of Investments

December 31, 2023 (Unaudited)

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

HP | | | 3,094 | | | $ | 93,098 | |

Intel | | | 14,437 | | | | 725,459 | |

International Business Machines | | | 3,159 | | | | 516,654 | |

Micron Technology | | | 3,796 | | | | 323,951 | |

NVIDIA | | | 8,728 | | | | 4,322,280 | |

Palo Alto Networks* | | | 1,021 | | | | 301,073 | |

QUALCOMM | | | 3,916 | | | | 566,371 | |

Salesforce* | | | 3,503 | | | | 921,779 | |

Workday, Cl A* | | | 704 | | | | 194,346 | |

| | | | | | | | |

| | |

| | | | | | | 11,755,908 | |

| | | | | | | | |

|

Materials— 1.5% | |

Albemarle | | | 199 | | | | 28,752 | |

Alcoa | | | 301 | | | | 10,234 | |

CF Industries Holdings | | | 332 | | | | 26,394 | |

DuPont de Nemours | | | 844 | | | | 64,929 | |

Eastman Chemical | | | 204 | | | | 18,323 | |

Ecolab | | | 419 | | | | 83,109 | |

FMC | | | 215 | | | | 13,556 | |

Freeport-McMoRan, Cl B | | | 2,424 | | | | 103,190 | |

International Flavors & Fragrances | | | 432 | | | | 34,979 | |

Martin Marietta Materials | | | 106 | | | | 52,885 | |

Mosaic | | | 577 | | | | 20,616 | |

Newmont | | | 1,345 | | | | 55,669 | |

PPG Industries | | | 399 | | | | 59,670 | |

Southern Copper | | | 147 | | | | 12,652 | |

Vulcan Materials | | | 224 | | | | 50,850 | |

| | | | | | | | |

| | |

| | | | | | | 635,808 | |

| | | | | | | | |

|

Real Estate— 1.4% | |

American Homes 4 Rent, Cl A‡ | | | 520 | | | | 18,699 | |

AvalonBay Communities‡ | | | 237 | | | | 44,371 | |

Equinix‡ | | | 158 | | | | 127,252 | |

Equity Residential‡ | | | 577 | | | | 35,289 | |

Healthpeak Properties‡ | | | 911 | | | | 18,038 | |

Jones Lang LaSalle* | | | 81 | | | | 15,298 | |

Prologis‡ | | | 1,563 | | | | 208,348 | |

Regency Centers‡ | | | 259 | | | | 17,353 | |

Welltower‡ | | | 800 | | | | 72,136 | |

| | | | | | | | |

| | |

| | | | | | | 556,784 | |

| | | | | | | | |

|

Utilities— 2.7% | |

AES | | | 1,134 | | | | 21,830 | |

Alliant Energy | | | 421 | | | | 21,597 | |

American Electric Power | | | 881 | | | | 71,555 | |

Avangrid | | | 119 | | | | 3,857 | |

CMS Energy | | | 493 | | | | 28,629 | |

| | | | | | | | |

| Description | | Shares | | | Fair Value | |

Consolidated Edison | | | 600 | | | $ | 54,582 | |

Dominion Energy | | | 1,411 | | | | 66,317 | |

DTE Energy | | | 328 | | | | 36,165 | |

Edison International | | | 649 | | | | 46,397 | |

Eversource Energy | | | 591 | | | | 36,476 | |

Exelon | | | 1,681 | | | | 60,348 | |

FirstEnergy | | | 921 | | | | 33,764 | |

NextEra Energy | | | 3,369 | | | | 204,633 | |

NiSource | | | 689 | | | | 18,293 | |

NRG Energy | | | 391 | | | | 20,215 | |

PPL | | | 1,248 | | | | 33,821 | |

Public Service Enterprise Group | | | 848 | | | | 51,855 | |

Sempra Energy | | | 1,066 | | | | 79,662 | |

Southern | | | 1,844 | | | | 129,301 | |

WEC Energy Group | | | 535 | | | | 45,031 | |

Xcel Energy | | | 929 | | | | 57,514 | |

| | | | | | | | |

| | |

| | | | | | | 1,121,842 | |

| | | | | | | | |

| | |

Total Common Stock

(Cost $32,209,463) | | | | | | | 39,277,311 | |

| | | | | | | | |

|

SHORT-TERM INVESTMENT — 5.5% | |

Invesco Government & Agency Portfolio, Cl Institutional, 5.282% (A) | | | 2,302,002 | | | | 2,302,002 | |

| | | | | | | | |

| | |

Total Short-Term Investment

(Cost $2,302,002) | | | | | | | 2,302,002 | |

| | | | | | | | |

Total Investments—99.9%

(Cost $34,511,465) | | | | | | $ | 41,579,313 | |

| | | | | | | | |

Percentages are based on Net Assets of $41,633,381.

| * | Non-income producing security. |

| ‡ | Real Estate Investment Trust |

| (A) | Rate shown represents the 7-day effective yield as of December 31, 2023. |

Cl — Class

PLC — Public Limited Company

As of December 31, 2023, all of the Fund’s investments were considered Level 1 in accordance with the authoritative guidance under U.S. Generally Accepted Accounting Principles.

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

6

Impact Shares Affordable Housing MBS ETF

Schedule of Investments

December 31, 2023 (Unaudited)

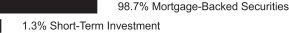

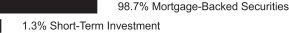

Sector Weightings†:

† Percentages based on total investments.

| | | | | | | | |

| | | |

| Description | | Face Amount | | | Fair Value | |

|

MORTGAGE-BACKED SECURITIES — 98.7% | |

|

Agency Mortgage-Backed Obligations — 98.7% | |

FHLMC | | | | | | | | |

7.000%,11/01/2053 | | $ | 207,853 | | | $ | 215,397 | |

6.500%, 11/01/2053 to 12/01/2053 | | | 1,278,611 | | | | 1,311,303 | |

6.000%, 11/01/2052 to 12/01/2053 | | | 1,601,835 | | | | 1,632,568 | |

5.500%, 02/01/2029 to 11/01/2053 | | | 1,379,369 | | | | 1,390,712 | |

5.000%, 03/01/2050 to 09/01/2053 | | | 1,523,987 | | | | 1,513,805 | |

4.500%, 09/01/2052 to 05/01/2053 | | | 1,596,125 | | | | 1,548,145 | |

4.000%, 10/01/2037 to 11/01/2052 | | | 1,487,067 | | | | 1,416,655 | |

3.500%, 10/01/2051 to 08/01/2052 | | | 3,488,964 | | | | 3,205,659 | |

3.000%, 09/01/2034 to 08/01/2052 | | | 7,616,158 | | | | 6,826,879 | |

2.500%, 08/01/2051 to 03/01/2052 | | | 8,974,228 | | | | 7,652,843 | |

2.000%, 08/01/2036 to 01/01/2052 | | | 13,553,190 | | | | 11,330,362 | |

1.500%,08/01/2036 | | | 392,715 | | | | 341,088 | |

FNMA | | | | | | | | |

7.500%,12/01/2053 | | | 207,375 | | | | 216,737 | |

7.000%, 11/01/2053 to 01/01/2054 | | | 823,849 | | | | 850,243 | |

6.500%, 10/01/2053 to 12/01/2053 | | | 1,539,909 | | | | 1,578,253 | |

6.000%, 11/01/2052 to 01/01/2054 | | | 4,741,232 | | | | 4,817,079 | |

5.500%, 04/01/2031 to 12/01/2053 | | | 7,380,497 | | | | 7,417,409 | |

5.000%, 12/01/2052 to 12/01/2053 | | | 6,791,185 | | | | 6,721,028 | |

4.500%, 11/01/2052 to 09/01/2053 | | | 5,884,049 | | | | 5,705,617 | |

4.000%, 03/01/2049 to 09/01/2053 | | | 8,806,302 | | | | 8,333,438 | |

3.500%, 06/01/2028 to 06/01/2052 | | | 6,269,783 | | | | 5,842,483 | |

3.000%, 04/01/2025 to 08/01/2052 | | | 4,790,669 | | | | 4,295,898 | |

2.500%, 05/01/2026 to 04/01/2052 | | | 14,609,884 | | | | 12,673,678 | |

2.000%, 04/01/2036 to 02/01/2052 | | | 18,949,186 | | | | 15,705,832 | |

1.500%, 10/01/2036 | | | 472,249 | | | | 413,223 | |

| | | | | | | | |

| | | |

| Description | | Face Amount / Shares | | | Fair Value | |

GNMA | | | | | | | | |

5.000%,03/20/2050 | | $ | 123,663 | | | $ | 124,697 | |

4.500%,02/20/2050 | | | 354,211 | | | | 349,932 | |

4.000%, 10/20/2050 to 01/20/2051 | | | 139,613 | | | | 134,599 | |

3.500%,12/20/2050 | | | 1,713,076 | | | | 1,608,540 | |

3.000%,03/20/2050 | | | 2,110,331 | | | | 1,924,323 | |

2.500%,08/20/2051 | | | 1,169,480 | | | | 1,018,307 | |

| | | | | | | | |

| | |

| | | | | | | 118,116,732 | |

| | | | | | | | |

| | |

Total Mortgage-Backed Securities (Cost $127,883,810) | | | | | | | 118,116,732 | |

| | | | | | | | |

|

SHORT-TERM INVESTMENT — 1.3% | |

Morgan Stanley Institutional Liquidity Fund, Government Portfolio Institutional Class, 5.260% (A) | | | 1,560,235 | | | | 1,560,235 | |

| | | | | | | | |

| | |

Total Short-Term Investment

(Cost $1,560,235) | | | | | | | 1,560,235 | |

| | | | | | | | |

| | |

Total Investments -100.0%

(Cost $129,444,045) | | | | | | $ | 119,676,967 | |

| | | | | | | | |

Percentages are based on Net Assets of $119,685,429.

| (A) | Rate shown represents the 7-day effective yield as of December 31, 2023. |

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

The following is a summary of the inputs used as of December 31, 2023 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

Investments in

Securities | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | |

Mortgage-Backed Securities | | $ | — | | | $ | 118,116,732 | | | $ | — | | | $ | 118,116,732 | |

Short-Term Investment | | | 1,560,235 | | | | — | | | | — | | | | 1,560,235 | |

| | | | |

Total Investments in Securities | | $ | 1,560,235 | | | $ | 118,116,732 | | | $ | — | | | $ | 119,676,967 | |

| | | | |

For more information on valuation inputs, see Note 2 in Notes to Financial Statements.

The accompanying notes are an integral part of the financial statements.

7

Impact Shares Trust I

Statements of Assets and Liabilities

December 31, 2023 (Unaudited)

| | | | | | | | |

| | | Impact Shares

YWCA

Women’s

Empowerment

ETF | | | Impact Shares

NAACP

Minority

Empowerment

ETF | |

Assets: | | | | | | | | |

Investments, at Cost | | $ | 44,395,290 | | | $ | 34,511,465 | |

| | | | | | | | |

Investments, at Fair Value | | $ | 49,379,080 | | | $ | 41,579,313 | |

Cash and Cash Equivalents | | | — | | | | 39,239 | |

Dividend and Interest Receivable | | | 34,361 | | | | 31,276 | |

Reclaims Receivable | | | 994 | | | | 590 | |

| | | | | | | | |

Total Assets | | | 49,414,435 | | | | 41,650,418 | |

| | | | | | | | |

| | |

Liabilities: | | | | | | | | |

Due to Custodian | | | 268,336 | | | | — | |

Advisory Fees Payable | | | 28,823 | | | | 17,037 | |

| | | | | | | | |

Total Liabilities | | | 297,159 | | | | 17,037 | |

| | | | | | | | |

| | |

Net Assets | | $ | 49,117,276 | | | $ | 41,633,381 | |

| | | | | | | | |

| | |

Net Assets Consist of: | | | | | | | | |

Paid-in Capital | | $ | 43,482,961 | | | $ | 34,047,590 | |

Total Distributable Earnings | | | 5,634,315 | | | | 7,585,791 | |

| | | | | | | | |

| | |

Net Assets | | $ | 49,117,276 | | | $ | 41,633,381 | |

| | | | | | | | |

| | |

Outstanding Shares of Beneficial Interest (unlimited authorization — no par value) | | | 1,475,001 | | | | 1,225,000 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 33.30 | | | $ | 33.99 | |

| | | | | | | | |

Amounts designated as “-“ are $0.

The accompanying notes are an integral part of the financial statements.

8

Impact Shares Trust I

Statements of Assets and Liabilities

December 31, 2023 (Unaudited)

| | | | |

| | | Impact Shares

Affordable

Housing MBS

ETF | |

Assets: | | | | |

Investments, at Cost | | $ | 129,444,045 | |

| | | | |

Investments, at Fair Value | | $ | 119,676,967 | |

Dividend and Interest Receivable | | | 377,922 | |

| | | | |

Total Assets | | | 120,054,889 | |

| | | | |

| |

Liabilities: | | | | |

Due to Custodian | | | 259,329 | |

Payable for Audit Fees | | | 17,882 | |

Payable for Custodian | | | 17,275 | |

Payable for Legal Fees | | | 15,926 | |

Payable for Exchange Listing Fees | | | 15,027 | |

Payable due to Administrator | | | 8,019 | |

Advisory Fees Payable | | | 7,417 | |

Payable for Trustees’ Fee | | | 5,507 | |

Other Accrued Expenses | | | 23,078 | |

| | | | |

Total Liabilities | | | 369,460 | |

| | | | |

| |

Net Assets | | $ | 119,685,429 | |

| | | | |

| |

Net Assets Consist of: | | | | |

Paid-in Capital | | $ | 133,926,463 | |

Total Distributable Loss | | | (14,241,034) | |

| | | | |

| |

Net Assets | | $ | 119,685,429 | |

| | | | |

Outstanding Shares of Beneficial Interest (unlimited authorization — no par value) | | | 6,950,000 | |

Net Asset Value, Offering and Redemption Price Per Share | | $ | 17.22 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

9

Impact Shares Trust I

Statements of Operations

Period ended December 31, 2023 (Unaudited)

| | | | | | | | |

| | | Impact Shares

YWCA

Women’s

Empowerment

ETF | | | Impact Shares

NAACP

Minority

Empowerment

ETF | |

| | |

Investment Income: | | | | | | | | |

Dividend Income | | $ | 381,325 | | | $ | 386,677 | |

| | | | | | | | |

Total Investment Income | | | 381,325 | | | | 386,677 | |

| | | | | | | | |

| | |

Expenses: | | | | | | | | |

Advisory Fees | | | 155,447 | | | | 102,696 | |

| | | | | | | | |

| | |

Total Expenses | | | 155,447 | | | | 102,696 | |

| | | | | | | | |

Net Investment Income | | | 225,878 | | | | 283,981 | |

| | | | | | | | |

Net Realized Gain (Loss) on: | | | | | | | | |

Investments | | | 2,562,065 | | | | 2,059,481 | |

| | | | | | | | |

Net Realized Gain (Loss) | | | 2,562,065 | | | | 2,059,481 | |

| | | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | |

Investments | | | 1,473,768 | | | | 952,273 | |

| | | | | | | | |

Net Change in Unrealized Appreciation (Depreciation) | | | 1,473,768 | | | | 952,273 | |

| | | | | | | | |

Net Realized and Unrealized Gain (Loss) | | | 4,035,833 | | | | 3,011,754 | |

| | | | | | | | |

| | |

Net Increase in Net Assets Resulting from Operations | | $ | 4,261,711 | | | $ | 3,295,735 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

10

Impact Shares Trust I

Statements of Operations

Period ended December 31, 2023 (Unaudited)

| | | | |

| | | Impact Shares

Affordable

Housing MBS

ETF | |

Investment Income: | | | | |

Dividend Income | | $ | 51,589 | |

Interest Income | | | 2,025,326 | |

| | | | |

Total Investment Income | | | 2,076,915 | |

| | | | |

| |

Expenses: | | | | |

Advisory Fees | | | 169,660 | |

Trustee Fees | | | 4,845 | |

Administration fees | | | 40,705 | |

Audit fees | | | 15,082 | |

Legal fees | | | 12,568 | |

Custodian Fees | | | 17,593 | |

Pricing fees | | | 7,955 | |

Printing Fees | | | 4,255 | |

Registration fees | | | 749 | |

Exchange Listing Fees | | | 5,027 | |

Transfer Agent Fees | | | 114 | |

Other Fees | | | 11,036 | |

| | | | |

| |

Total Expenses | | | 289,589 | |

| | | | |

| |

Less: | | | | |

Advisory Waiver | | | (121,408) | |

| | | | |

Net Expenses | | | 168,181 | |

| | | | |

Net Investment Income | | | 1,908,734 | |

| | | | |

| |

Net Realized Gain (Loss) on: | | | | |

Investments | | | (1,873,690) | |

| | | | |

Net Realized Gain (Loss) | | | (1,873,690) | |

| | | | |

| |

Net Change in Unrealized Appreciation (Depreciation) on: | | | | |

Investments | | | 2,913,271 | |

| | | | |

| |

Net Change in Unrealized Appreciation (Depreciation) | | | 2,913,271 | |

| | | | |

| |

Net Realized and Unrealized Gain (Loss) | | | 1,039,581 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 2,948,315 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

11

Impact Shares Trust I

Statements of Changes in Net Assets

| | | | | | | | |

| | | Impact Shares YWCA Women’s

Empowerment ETF | |

| | | Period Ended

December 31, 2023

(Unaudited) | | | Year ended

June 30, 2023 | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 225,878 | | | $ | 414,055 | |

Net Realized Gain (Loss) | | | 2,562,065 | | | | (1,160,321) | |

Net Change in Unrealized Appreciation (Depreciation) | | | 1,473,768 | | | | 6,996,026 | |

| | | | | | | | |

| | |

Net Increase in Net Assets Resulting from Operations | | | 4,261,711 | | | | 6,249,760 | |

| | | | | | | | |

| | |

Distributions | | | (599,973) | | | | (2,789,774) | |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Issued | | | 6,430,568 | | | | 7,770,799 | |

Redeemed | | | (1,562,622) | | | | (711,911) | |

| | | | | | | | |

| | |

Increase in Net Assets from Capital Share Transactions | | | 4,867,946 | | | | 7,058,888 | |

| | | | | | | | |

| | |

Total Increase in Net Assets | | | 8,529,684 | | | | 10,518,874 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of Period | | | 40,587,592 | | | | 30,068,718 | |

| | | | | | | | |

End of Period | | $ | 49,117,276 | | | $ | 40,587,592 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Issued | | | 200,000 | | | | 275,000 | |

Redeemed | | | (50,000) | | | | (25,000) | |

| | | | | | | | |

Net Increase in Shares Outstanding from Share Transactions | | | 150,000 | | | | 250,000 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

12

Impact Shares Trust I

Statements of Changes in Net Assets

| | | | | | | | |

| | | Impact Shares NAACP Minority

Empowerment ETF | |

| | | Period Ended

December 31, 2023

(Unaudited) | | | Year ended

June 30, 2023 | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 283,981 | | | $ | 539,678 | |

Net Realized Gain (Loss) | | | 2,059,481 | | | | (1,276,038) | |

Net Change in Unrealized Appreciation (Depreciation) | | | 952,273 | | | | 7,600,128 | |

| | | | | | | | |

| | |

Net Increase in Net Assets Resulting from Operations | | | 3,295,735 | | | | 6,863,768 | |

| | | | | | | | |

| | |

Distributions | | | (280,004) | | | | (1,399,198) | |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Issued | | | – | | | | 4,349,942 | |

Redeemed | | | (6,433,304) | | | | – | |

| | | | | | | | |

| | |

Increase (Decrease) in Net Assets from Capital Share Transactions | | | (6,433,304) | | | | 4,349,942 | |

| | | | | | | | |

| | |

Total Increase (Decrease) in Net Assets | | | (3,417,573) | | | | 9,814,512 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of Period | | | 45,050,954 | | | | 35,236,442 | |

| | | | | | | | |

End of Period | | $ | 41,633,381 | | | $ | 45,050,954 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Issued | | | – | | | | 150,000 | |

Redeemed | | | (200,000) | | | | – | |

| | | | | | | | |

Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | (200,000) | | | | 150,000 | |

| | | | | | | | |

Amounts designated as “-“ are $0.

The accompanying notes are an integral part of the financial statements.

13

Impact Shares Trust I

Statements of Changes in Net Assets

| | | | | | | | |

| | | Impact Shares Affordable Housing

MBS ETF | |

| | | Period Ended

December 31, 2023

(Unaudited) | | | Year ended

June 30, 2023 | |

Operations: | | | | | | | | |

Net Investment Income | | $ | 1,908,734 | | | $ | 2,549,379 | |

Net Realized Gain (Loss) | | | (1,873,690) | | | | (655,922) | |

Net Change in Unrealized Appreciation (Depreciation) | | | 2,913,271 | | | | (3,257,788) | |

| | | | | | | | |

| | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 2,948,315 | | | | (1,364,331) | |

| | | | | | | | |

| | |

Distributions | | | (1,787,171) | | | | (2,915,245) | |

| | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Issued | | | 7,457,151 | | | | 26,909,850 | |

Redeemed | | | – | | | | (3,375,453) | |

| | | | | | | | |

| | |

Increase in Net Assets from Capital Share Transactions | | | 7,457,151 | | | | 23,534,397 | |

| | | | | | | | |

| | |

Total Increase in Net Assets | | | 8,618,295 | | | | 19,254,821 | |

| | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of Period | | | 111,067,134 | | | | 91,812,313 | |

| | | | | | | | |

End of Period | | $ | 119,685,429 | | | $ | 111,067,134 | |

| | | | | | | | |

Share Transactions: | | | | | | | | |

Issued | | | 450,000 | | | | 1,550,000 | |

Redeemed | | | – | | | | (200,000) | |

| | | | | | | | |

Net Increase in Shares Outstanding from Share Transactions | | | 450,000 | | | | 1,350,000 | |

| | | | | | | | |

Amount designated as “-“ is $0.

The accompanying notes are an integral part of the financial statements.

14

Impact Shares Trust I

Financial Highlights

Selected Per Share Data & Ratios

For the six month period ended December 31, 2023 (Unaudited) and the year/periods ended June 30,

For a Share Outstanding Throughout the Year/Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

Beginning of

Period ($) | | | Net

Investment

Income ($)* | | | Net Realized

and Unrealized

Gain (Loss)

($) | | | Total from

Operations ($) | | | Distributions

from Net

Investment

Income ($) | | | Distributions

from Net

Realized

Capital

Gains ($) | | | Return of

Capital ($) | | | Total

Distributions ($) | | | Net Asset

Value, End

of Period ($) | | | Market

Price, End

of Period

($)

(Unaudited) | | | Total

Return(%)(1) | | | Net

Assets

End of

Period ($)

(000) | | | Ratio of

Expenses to

Average Net

Assets (%) | | | Ratio of Net

Investment

Income to

Average Net

Assets (%) | | | Portfolio

Turnover

(%)(2) | |

Impact Shares YWCA Women’s Empowerment ETF | |

2023** | | | 30.63 | | | | 0.17 | | | | 2.94 | | | | 3.11 | | | | (0.17 | ) | | | (0.27 | ) | | | — | | | | (0.44 | ) | | | 33.30 | | | | 33.31 | | | | 10.19 | | | | 49,117 | | | | 0.75 | (3) | | | 1.09 | (3) | | | 23 | |

2023 | | | 27.97 | | | | 0.35 | | | | 4.63 | | | | 4.98 | | | | (0.34 | ) | | | (1.98 | ) | | | — | | | | (2.32 | ) | | | 30.63 | | | | 30.67 | | | | 19.16 | | | | 40,588 | | | | 0.75 | | | | 1.22 | | | | 17 | |

2022 | | | 32.85 | | | | 0.27 | | | | (3.99 | ) | | | (3.72 | ) | | | (0.27 | ) | | | (0.89 | ) | | | — | | | | (1.16 | ) | | | 27.97 | | | | 27.92 | | | | (11.98 | ) | | | 30,069 | | | | 0.75 | | | | 0.83 | | | | 36 | |

2021 | | | 22.81 | | | | 0.21 | | | | 11.59 | | | | 11.80 | | | | (0.47 | ) | | | (1.29 | ) | | | — | | | | (1.76 | ) | | | 32.85 | | | | 32.88 | | | | 52.85 | | | | 29,562 | | | | 0.75 | (4) | | | 0.73 | | | | 39 | |

2020 | | | 20.63 | | | | 0.28 | | | | 2.16 | | | | 2.44 | | | | (0.26 | ) | | | — | | | | — | | | | (0.26 | ) | | | 22.81 | | | | 22.77 | | | | 11.92 | | | | 7,414 | | | | 0.75 | (5) | | | 1.30 | | | | 47 | |

2019(6) | | | 20.00 | | | | 0.27 | | | | 0.63 | | | | 0.90 | | | | (0.25 | ) | | | (0.02 | ) | | | — | ^ | | | (0.27 | ) | | | 20.63 | | | | 20.62 | | | | 4.71 | | | | 4,126 | | | | 0.76 | (3),(7) | | | 1.60 | (3) | | | 7 | |

Impact Shares NAACP Minority Empowerment ETF | |

2023** | | | 31.61 | | | | 0.22 | | | | 2.39 | | | | 2.61 | | | | (0.23 | ) | | | — | | | | — | | | | (0.23 | ) | | | 33.99 | | | | 33.96 | | | | 8.29 | | | | 41,633 | | | | 0.49 | (3) | | | 1.36 | (3) | | | — | |

2023 | | | 27.64 | | | | 0.40 | | | | 4.63 | | | | 5.03 | | | | (0.40 | ) | | | (0.66 | ) | | | — | | | | (1.06 | ) | | | 31.61 | | | | 31.65 | | | | 18.90 | | | | 45,051 | | | | 0.49 | | | | 1.41 | | | | 9 | |

2022 | | | 32.69 | | | | 0.33 | | | | (4.25 | ) | | | (3.92 | ) | | | (0.32 | ) | | | (0.81 | ) | | | — | | | | (1.13 | ) | | | 27.64 | | | | 27.70 | | | | (12.70 | ) | | | 35,236 | | | | 0.49 | | | | 1.00 | | | | 35 | |

2021 | | | 23.17 | | | | 0.30 | | | | 9.68 | | | | 9.98 | | | | (0.35 | ) | | | (0.11 | ) | | | — | | | | (0.46 | ) | | | 32.69 | | | | 32.76 | | | | 43.35 | | | | 31,875 | | | | 0.50 | (8) | | | 1.03 | | | | 49 | |

2020 | | | 21.16 | | | | 0.28 | | | | 1.97 | | | | 2.25 | | | | (0.24 | ) | | | — | | | | — | | | | (0.24 | ) | | | 23.17 | | | | 23.23 | | | | 10.71 | | | | 5,792 | | | | 0.75 | (4) | | | 1.27 | | | | 25 | |

2019(9) | | | 20.00 | | | | 0.28 | | | | 1.17 | | | | 1.45 | | | | (0.28 | ) | | | (0.01 | ) | | | — | | | | (0.29 | ) | | | 21.16 | | | | 21.11 | | | | 7.37 | | | | 2,222 | | | | 0.75 | (3),(10) | | | 1.46 | (3) | | | 19 | |

| Amounts | designated as “-“ are $0. |

| * | Per share data calculated using average shares method. |

| ** | For the six month period ended December 31, 2023 (Unaudited). |

| ^ | Amount is less than 0.005. |

| (1) | Total return is based on the change in net asset value of a share during the year or period and assumes reinvestment of dividends and distributions at net asset value. Total return is for the period indicated and periods of less than one year have not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (2) | Portfolio turnover rate is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| (4) | The ratio of Expenses to Average Net Assets includes the voluntary expense reimbursements. If these reimbursements were excluded, the ratio would have been 0.86% for the year ended June 30, 2021. |

| (5) | The ratio of Expenses to Average Net Assets includes the voluntary expense reimbursements. If these reimbursements were excluded, the ratio would have been 1.11% for the year ended June 30, 2020. |

| (6) | Commenced operations on August 24, 2018. |

| (7) | The ratio of Expenses to Average Net Assets includes the voluntary expense reimbursements. If these reimbursements were excluded, the ratio would have been 2.24% for the period ended June 30, 2019. |

| (8) | The ratio of Expenses to Average Net Assets includes the voluntary expense reimbursements. If these reimbursements were excluded, the ratio would have been 0.61% for the year ended June 30, 2021. |

| (9) | Commenced operations on July 18, 2018. |

| (10) | The ratio of Expenses to Average Net Assets includes the voluntary expense reimbursements. If these reimbursements were excluded, the ratio would have been 1.66% for the period ended June 30, 2019. |

The accompanying notes are an integral part of the financial statements.

15

Impact Shares Trust I

Financial Highlights

Selected Per Share Data & Ratios

For the six month period ended December 31, 2023 (Unaudited) and the year/periods ended June 30,

For a Share Outstanding Throughout the Year/Period

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Asset

Value,

Beginning of

Period ($) | | | Net

Investment

Income ($)* | | | Net Realized

and Unrealized

Gain (Loss) ($) | | | Total from

Operations

($) | | | Distributions

from Net

Investment

Income ($) | | | Distributions

from Net

Realized

Capital

Gains ($) | | | Total

Distributions

($) | | | Net Asset

Value, End

of Period ($) | | | Market

Price, End

of Period

($)

(Unaudited) | | | Total

Return(%)(1) | | | Net Assets

End of

Period ($)

(000) | | | Ratio of

Expenses to

Average Net

Assets (%) | | | Ratio of Net

Investment

Income to

Average Net

Assets (%) | | | Portfolio

Turnover

(%)(2) | |

Impact Shares Affordable Housing MBS ETF | |

2023** | | | 17.09 | | | | 0.28 | | | | 0.11 | | | | 0.39 | | | | (0.26 | ) | | | — | | | | (0.26 | ) | | | 17.22 | | | | 17.24 | | | | 2.35 | | | | 119,685 | | | | 0.30 | (3)(4) | | | 3.38 | (3) | | | 30 | |

2023 | | | 17.83 | | | | 0.44 | | | | (0.69 | ) | | | (0.25 | ) | | | (0.49 | ) | | | — | | | | (0.49 | ) | | | 17.09 | | | | 17.10 | | | | (1.38 | ) | | | 111,067 | | | | 0.30 | (4) | | | 2.52 | | | | 26 | |

2022(5) | | | 20.00 | | | | 0.14 | | | | (1.97 | ) | | | (1.83 | ) | | | (0.34 | ) | | | — | | | | (0.34 | ) | | | 17.83 | | | | 17.88 | | | | (9.22 | ) | | | 91,812 | | | | 0.30 | (3),(6) | | | 0.81 | (3) | | | 78 | |

Amounts designated as “-“ are $0.

| * | Per share data calculated using average shares method. |

| ** | For the six month period ended December 31, 2023 (Unaudited). |

| (1) | Total return is based on the change in net asset value of a share during the year or period and assumes reinvestment of dividends and distributions at net asset value. Total return is for the period indicated and periods of less than one year have not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (2) | Portfolio turnover rate is for the period indicated and has not been annualized. Excludes effect of in-kind transfers. |

| (4) | The ratio of Expenses to Average Net Assets excluding waivers is 0.51% for the periods ended December 31, 2023 (Unaudited) and June 30, 2023. |

| (5) | Commenced operations on July 26, 2021. |

| (6) | The ratio of Expenses to Average Net Assets excluding waivers is 0.53% for the period ended June 30, 2023. |

The accompanying notes are an integral part of the financial statements.

16

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

1. ORGANIZATION

Impact Shares Trust I (the “Trust”), is an open-end management investment company organized as a Delaware statutory trust pursuant to a Declaration of Trust dated May 19, 2016. The Trust is registered with the Securities and Exchange Commission (the “Commission”) under the Investment Company Act of 1940 (the “1940 Act”), as amended, as an open-end management investment company with three separate exchange-traded funds or series. The financial statements herein and the related notes are those of Impact Shares YWCA Women’s Empowerment ETF (the “Women’s ETF”), Impact Shares NAACP Minority Empowerment ETF (the “Minority ETF”), and the Impact Shares Affordable Housing MBS ETF (the “Affordable Housing ETF”) (each a “Fund” and collectively, the “Funds”). The Women’s ETF and Minority ETF each seek to provide investment results that, before fees and expenses, track the total return performance of the Morningstar Women’s Empowerment Index and the Morningstar Minority Empowerment Index (the “Underlying Indices” or “Index”), respectively. The primary investment objective of the Affordable Housing ETF is to generate current income. The Minority ETF and the Women’s ETF are classified as diversified Funds, and the Affordable Housing ETF is classified as non-diversified. With respect to Affordable Housing ETF, Impact Shares, Corp. (“Impact Shares”) serves as the investment adviser with responsibility for overseeing the management and business affairs of the Minority ETF. Impact Shares has engaged a sub-adviser, Community Capital Management, LLC. (“CCM”) to provide the day-to-day management of the portfolio of the Affordable Housing ETF. With respect to Minority ETF, as of January 29, 2024, Tidal Investment LLC (“Tidal”) serves as the investment adviser and Impact Shares serves as sub-adviser to Minority ETF. With respect to Women’s ETF, as of August 31, 2023, Tidal serves as the investment adviser and Impact Shares serves as sub-adviser. Prior to these dates, Impact Shares served as investment adviser to Women’s ETF and Minority ETF.

The Women’s ETF commenced operations on August 24, 2018.

The Minority ETF commenced operations on July 18, 2018.

The Affordable Housing ETF commenced operations on July 26, 2021.

Shares of the Funds (“Shares”) are listed and traded on NYSE Arca, Inc. Market prices for the Shares may be different from their net asset value (“NAV”). The Funds will issue and redeem Shares on a continuous basis at NAV only in large blocks of Shares, each of which currently comprises 50,000 shares (“Creation Units”) or such other amount as may be from time to time determined to be in the best interests of a Fund by the President of the Fund (the President of the Funds has determined that it is in the best interests of the Women’s ETF and Minority ETF, that the size of a creation unit in each of these Funds remain at 25,000 shares indefinitely). Creation Units will be issued and redeemed principally in-kind for securities included in the Funds’ underlying indices (the “Underlying Indices” or “Index) and/or for cash at the discretion of the Funds. Once created, Shares will trade in a secondary market at market prices that change throughout the day in amounts less than a Creation Unit.

On June 12, 2023, the Board approved, subject to shareholder approval, an Agreement and Plan of Reorganization (the “Plan”) to reorganize the Affordable Housing ETF into a corresponding ETF with the name CCM Affordable Housing MBS ETF, which is a newly-created series of Quaker Investment Trust. At a shareholder meeting on September 15, 2023, shareholder of Affordable Housing ETF approve the reorganization. It is expected that the reorganization will occur on March 18, 2024.

17

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of the significant accounting policies followed by the Funds:

Use of Estimates — The Funds are registered investment companies under Accounting Standard Codification in Topic 946 by the Financial Accounting Standards Board. The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could materially differ from those estimates.

Security Valuation — Equity securities including Real Estate Investment Trusts, listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on the NASDAQ Stock Market (the “NASDAQ”)), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded (or at approximately 4:00 pm Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale, at the most recent quoted bid. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. If available, debt securities, including mortgage-backed obligations, are priced based upon valuations provided by independent, third-party pricing agents. The third-party pricing agents generally value debt securities at an evaluated bid price by employing methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the fair value for such securities. Such methodologies generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. On the first day a new debt security purchase is recorded, if a price is not available on the automated pricing feeds from our primary and secondary pricing vendors nor is it available from an independent broker, the security may be valued at its purchase price. Each day thereafter, the debt security will be valued according to the Funds’ Fair Value Procedures until an independent source can be secured. Debt obligations with remaining maturities of sixty days or less may be valued at their amortized cost, if the Valuation Designee (discussed below) concludes it approximates fair value after taking into account factors such as credit, liquidity and interest rate conditions as well as issuer specific factors. Foreign securities listed on foreign exchanges are valued based on quotations from the primary market in which they are traded and are translated from the local currency into U.S. dollars using current exchange rates. Foreign securities may trade on weekends or other days when the Fund does not calculate NAV. As a result, the fair value of these investments may change on days when you cannot buy or redeem shares of the Fund. Prices for most securities held in the Funds are provided daily by recognized independent pricing agents. If a security price cannot be obtained from an independent, third-party pricing agent, the Funds seek to obtain a bid price from at least one independent broker. Portfolio securities for which market quotations are readily available are valued at their current market value. When market quotations are not readily available (or are deemed unreliable) for one or more portfolio securities, the 1940 Act requires the Funds to use the investment’s fair value, as determined in good faith. Effective September 8, 2022, and pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Adviser as the valuation designee to perform fair value determinations, subject to Board oversight. Pursuant to the Valuation Designee’s fair value policies and procedures, securities for which market quotations are not readily available or for which the market price is determined to be unreliable, may include but are not limited to securities that are subject to legal or contractual restrictions on resale, securities for which no or limited trading activity has occurred for a period of time, or securities that are

18

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

otherwise deemed to be illiquid (i.e., securities that cannot be disposed of within seven days at approximately the price at which the security is currently priced by the Fund which holds the security). Market quotations may also be not “readily available” if a significant event occurs after the close of the principal exchange on which a portfolio security trades (but before the time for calculation of such Fund’s NAV) if that event affects or is likely to affect (more than minimally) the NAV per share of such Fund. In determining the fair value price of a security, the Valuation Designee may use a number of other methodologies, including those based on discounted cash flows, multiples, recovery rates, yield to maturity or discounts to public comparables. The Valuation Designee may also employ independent pricing services. Fair value pricing involves judgments that are inherently subjective and inexact; as a result, there can be no assurance that fair value pricing will reflect actual market value, and it is possible that the fair value determined for a security will be materially different from the value that actually could be or is realized upon the sale of that asset. Valuing the Funds’ investments using fair value pricing will result in using prices for those investments that may differ from current market valuations. Use of fair value prices and certain current market valuations could result in a difference between the prices used to calculate each Fund’s NAV and the prices used by each applicable Underlying Index, which, in turn, could result in a difference between a Fund’s performance and the performance of its Underlying Index.

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

| | • | | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| | • | | Level 2 – Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | • | | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The valuation techniques used by the Funds to measure fair value during the period ended December 31, 2023 maximized the use of observable inputs and minimized the use of unobservable inputs.

For the period ended December 31, 2023, there have been no significant changes to the Funds’ fair valuation methodologies.

For details of the investment classification, reference the Schedules of Investments.

Federal Income Taxes — It is each of the Funds’ intention to qualify as a regulated investment company for Federal income tax purposes by complying with the appropriate provisions of Subchapter M of the Internal Revenue Code of 1986 (the “Code”), as amended. Accordingly, no provisions for federal income taxes have been made in the financial statements.

The Funds evaluate tax positions taken or expected to be taken in the course of preparing the Funds’ tax returns to determine whether it is “more-likely-than not” (i.e., greater than 50-percent) that each tax

19

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current period. The Funds did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities (i.e., the last 3 year ends, as applicable), on-going analysis of and changes to tax laws, regulations and interpretations thereof. As of and during the period ended December 31, 2023, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. For the period ended December 31, 2023, the Funds did not recognize any interest or penalties.

Security Transactions and Investment Income — Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Withholding taxes and reclaims on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. Discounts and premiums on securities purchased are accreted and amortized using the effective. interest method. Realized gains (losses) on paydowns of mortgage-backed and asset backed securities are recorded as an adjustment to interest income.

Dividends and Distributions to Shareholders — The Funds intend to declare and pay dividends of net investment income quarterly and to pay any capital gain distributions on an annual basis. All distributions are recorded on ex-dividend date.

Cash and Cash Equivalents — Idle cash may be swept into various time deposits and is classified as cash and cash equivalents on the Statements of Assets and Liabilities. The Funds maintain cash in bank deposit accounts which, at times, may exceed United States federally insured limits (“FDIC”). Amounts swept overnight are available on the next business day.

Cash Overdraft Charges — Per the terms of an agreement with the Bank of New York Mellon, if a Fund has a cash overdraft on a given day, it will be assessed an overdraft charge. Cash overdraft charges are included in other fees on the Statements of Operations.

Creation Units — The Funds issue and redeem Shares at NAV and only in large blocks of Shares currently comprised of 25,000 shares for the Funds with the exception of the Affordable Housing ETF which is comprised of 50,000. Shares (each such block of Shares for the Funds are called a “Creation Unit” or multiples thereof). Purchasers of Creation Units at NAV must pay a standard creation transaction fee of $500 per transaction. The fee is a single charge and will be the same regardless of the number of Creation Units purchased by an investor on the same day. An Authorized Participant who holds Creation Units (“Authorized Participants”) and wishes to redeem at NAV would also pay a standard redemption transaction fee of $500 per transaction to the custodian on the date of such redemption, regardless of the number of Creation Units redeemed that day. Creations and redemptions are also subject to an additional variable charge of up to 1% of the net asset value per Creation Unit, inclusive of the standard transaction fee, for (i) in-kind creations or redemptions effected outside the normal Clearing Process, (ii) in whole or partial cash creations, (iii) in whole or partial cash redemptions or (iv) non-standard orders. The variable component is primarily designed to cover non-standard charges, e.g., brokerage, taxes, foreign exchange, execution, market impact and other costs and expenses related to the execution of trades resulting from such transaction. In all cases, the Transaction Fee will be limited in accordance

20

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

with the requirements of the SEC applicable to management investment companies offering redeemable securities. The Fund may determine not to charge the variable portion of a Transaction Fee on certain orders when the Adviser has determined that doing so is in the best interests of Fund shareholders, e.g., for redemption orders that facilitate the rebalance of the Fund’s portfolio in a more tax efficient manner than could be achieved without such order. The variable portion of a Transaction Fee may be higher or lower than the trading expenses incurred by a Fund with respect to the transaction.

Except when aggregated in Creation Units, Shares are not redeemable securities of the Funds. Shares of the Funds may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company (“DTC”) participant and, in each case, must have executed an Authorized Participant Agreement with the Funds’ distributor. Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the Shares directly from the Funds. Rather, most retail investors will purchase Shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

The size of a creation unit for a Fund may be changed from time to time in the future if determined to be in the best interests of a Fund by the President of the Fund.

If a Creation Unit is purchased or redeemed in cash, a higher transaction fee will be charged. The following table discloses the Creation Unit breakdown based on the NAV as of December 31, 2023:

| | | | | | | | | | | | | | | | |

| | | Creation Unit

Shares | | | Creation Transaction Fee | | | Value | | | Redemption

Transaction Fee | |

Women’s ETF | | | 25,000 | | | $ | 500 | | | $ | 832,500 | | | $ | 500 | |

Minority ETF | | | 25,000 | | | | 500 | | | | 849,750 | | | | 500 | |

Affordable Housing ETF | | | 50,000 | | | | 500 | | | | 861,000 | | | | 500 | |

Foreign Currency Translation — The books and records of the Funds are maintained in U.S. dollars. Investment securities and other asset and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains and losses on investments on the Statements of Operations. Net realized and unrealized gains and losses on foreign currency transactions represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settle dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid.

Indemnifications — In the normal course of business, the Funds enter into contracts that provide general indemnifications. The Funds’ maximum exposure under these arrangements is dependent on future claims that may be made against the Funds and, therefore, cannot be established; however, based on experience, the risk of loss from such claims is considered remote.

21

Impact Shares Trust I

Notes to Financial Statements

December 31, 2023 (Unaudited)

3. AGREEMENTS

Investment Advisory Agreements

Tidal serves as investment adviser to Women’s ETF and the Minority ETF and Impact Shares serves as investment adviser to Affordable Housing ETF, pursuant to separate investment advisory agreements (each an “Advisory Agreement”). “Adviser” as used herein, applies to Tidal or Impact Shares, as applicable. The Adviser arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Funds to operate. The Adviser administers the Funds’ business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provides its officers and employees to serve as officers or Trustees of the Trust.

Women’s ETF and the Minority ETF

For the services it provides to the Women’s ETF and the Minority ETF, the Adviser receives a fee, which is calculated daily and paid monthly, at an annual rate of 0.75% of average daily net assets of the Women’s ETF and 0.49% of average daily net assets with respect to Minority ETF. Under the Advisory Agreement, the Adviser agrees to pay all expenses incurred by the Trust and fund (except for advisory fees payable to the Adviser under the Agreement) pursuant to this Agreement, excluding interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, distribution fees and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act, and litigation expenses, and other non-routine or extraordinary expenses.

Affordable Housing ETF