MANAGEMENT'S DISCUSSION & ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2023

GENERAL

This management's discussion and analysis ("MD&A") for Metalla Royalty & Streaming Ltd. (the "Company" or "Metalla") is intended to help the reader understand the significant factors that have affected Metalla and its subsidiaries performance and such factors that may affect its future performance. This MD&A, which has been prepared as of March 28, 2024, should be read in conjunction with the Company's consolidated financial statements for the year ended December 31, 2023, and the related notes thereto, which have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB").

Additional information relevant to the Company is available for viewing on SEDAR+ at www.sedarplus.ca and on the EDGAR section of the SEC website at www.sec.gov.

INDEX

COMPANY OVERVIEW

Metalla is a precious and base metals royalty and streaming company that is focused on acquiring gold, silver, and copper metal purchase agreements, Net Smelter Return ("NSR") royalties, Gross Value Return ("GVR") royalties, Net Profit Interests ("NPI"), Gross Proceeds ("GP") royalties, Gross Overriding Return ("GOR") royalties, Price Participation ("PP") royalties, Net Proceeds ("NP") royalties, and non-operating interests in mining projects that provide the right to the holder of a percentage of the gross revenue from metals produced from the project or a percentage of the gross revenue from metals produced from the project after deducting specified costs, if any, respectively. The Company's common shares ("Common Shares") are listed on the TSX Venture Exchange ("TSX-V") under the symbol "MTA" and on the NYSE American ("NYSE") under the symbol "MTA". The head office and principal address is 501 - 543 Granville Street, Vancouver, British Columbia, Canada.

COMPANY HIGHLIGHTS

During the year ended December 31, 2023, and subsequent period the Company:

- Effective December 1, 2023, acquired all of the issued and outstanding shares of Nova Royalty Corp. ("Nova") pursuant to a plan of arrangement (the "Nova Transaction"). In accordance with the Nova Transaction, Nova shareholders received 0.36 of a Common Share per common share of Nova (For additional details see Nova Royalty Acquisition);

- On October 19, 2023, entered into an agreement with Beedie Investments Ltd. (“Beedie”), which became effective at the closing of the Nova Transaction, whereby the parties agreed to amend the convertible loan facility (the “Beedie Loan Facility”) between Metalla and Beedie, to among other things, increase the principal amount from C$25.0 million to C$50.0 million and draw down from the Beedie Loan Facility, at closing of the Nova Transaction, an amount equal to the principal and unpaid interest and fees outstanding under the convertible loan agreement with Nova (the “Nova Loan Facility”) to refinance and retire the Nova Loan Facility (For additional details see Nova Royalty Acquisition);

- Completed a private placement, on closing of the Nova Transaction, pursuant to which Beedie subscribed to 2,835,539 Common Shares at a price of C$5.29 per share for aggregate gross proceeds of C$15.0 million;

- Acquired 28 royalties and 1 stream to bring the total held as at the date of this MD&A to 102 precious and base metals assets, through the following transactions:

i. Acquired 23 royalties in the Nova Transaction (For additional details see Nova Royalty Acquisition);

ii. Acquired an existing 2.5%-3.75% sliding scale GP royalty over gold, together with a 0.25%-3.0% NSR royalty on all non-gold and silver metals on the majority of Barrick Gold Corporation’s (“Barrick”) Lama project in Argentina, from an arm’s length seller for aggregate consideration of $7.5 million. The transaction closed on March 9, 2023, at which time the Company paid $2.5 million in cash, and issued 466,827 Common Shares to the seller (with a deemed value of $5.3553 per share). The remaining $2.5 million (the “Lama Payable”) is payable in cash or Common Shares, within 90 days upon the earlier of a 2 Moz gold Mineral Reserve estimate on the royalty area or 36 months after the closing date;

iii. Acquired one silver stream and three royalties from Alamos Gold Corp. (“Alamos”) for $5.0 million in Common Shares with a deemed value of $5.3228 per share. The transaction closed on February 23, 2023, at which time the Company issued 939,355 Common Shares to Alamos. The stream and royalties acquired in this transaction include:

- a 20% silver stream over the Esperanza project located in Morales, Mexico owned by Zacatecas Silver Corp.;

- a 1.4% NSR royalty on the Fenn Gibb South project located in Timmins, Ontario owned by Mayfair Gold Corp.;

- a 2.0% NSR royalty on the Ronda project located in Shining Tree, Ontario owned by PTX Metals Inc.; and

- a 2.0% NSR royalty on the Northshore West property located in Thunder Bay, Ontario owned by Newpath Resources Inc.

- Sold the JR mineral claims that make up the Pine Valley property, which is part of the Cortez complex in Nevada, to Nevada Gold Mines LLC ("NGM"), an entity formed by Barrick and Newmont Corporation ("Newmont"), for $5.0 million in cash. The Company has retained a 3.0% NSR royalty on the property. Additionally, sold the Conmee mineral claims that make up the Tower Mountain property to Thunder Gold Corp. ("Thunder Gold") for 4,000,000 common shares of Thunder Gold, valued at $0.1 million upon closing. The Company has retained a 2.0% NSR royalty on the property;

- Paid a special dividend in the amount of C$0.03 per share on September 15, 2023, with a record date of August 1, 2023;

- For the year ended December 31, 2023, received or accrued payments on 3,989 (December 31, 2022 - 2,681) attributable Gold Equivalent Ounces ("GEOs") at an average realized price of $1,867 (December 31, 2022 - $1,765) and an average cash cost of $6 (December 31, 2022 - $7) per attributable GEO (see Non-IFRS Financial Measures);

- For the year ended December 31, 2023, recognized revenue from royalty and stream interests, including fixed royalty payments, of $4.6 million (December 31, 2022 - $2.4 million), net loss of $5.8 million (December 31, 2022 - $10.9 million), and Adjusted EBITDA of $1.1 million (December 31, 2022 - negative $1.5 million) (see Non-IFRS Financial Measures);

- For the year ended December 31, 2023, generated operating cash margin of $1,861 (December 31, 2022 - $1,758) per attributable GEO from the Wharf, El Realito, La Encantada, the New Luika Gold Mine ("NLGM") stream held by Silverback Ltd. ("Silverback"), the Higginsville derivative royalty asset, and other royalty interests (see Non-IFRS Financial Measures);

- For the year ended December 31, 2023, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $2.9 million (December 31, 2022 - $2.4 million) (see Non-IFRS Financial Measures);

- On December 28, 2023, the Company exercised its right to terminate the equity distribution agreement entered into on May 27, 2022 to establish the 2022 ATM Program (as defined below), under which the Company was entitled to distribute up to $50.0 million (or the equivalent in Canadian Dollars) in Common Shares. From inception to the date of termination, the Company distributed 1,328,079 Common Shares under the 2022 ATM Program at an average price of $5.01 per share for gross proceeds of $6.6 million, of which none were sold during the three months ended December 31, 2023; and

- On May 19, 2023, prior to the announcement of the Nova Transaction, closed a second supplemental loan agreement with Beedie, to amend the Beedie Loan Facility (For additional details see Liquidity and Capital Resources - Convertible Loan Facility).

NOVA ROYALTY ACQUISITION

On December 1, 2023, the Company closed the Nova Transaction, pursuant to which the Company acquired all of the issued and outstanding common shares of Nova. Pursuant to the terms of an arrangement agreement between the Company and Nova dated September 7, 2023 (the "Arrangement Agreement"), Nova shareholders received 0.36 of a Common Share for each Nova common share held prior to the Nova Transaction, for a total of 33,893,734 Common Shares issued. In accordance with the Arrangement Agreement, each Nova restricted share unit vested into a Nova common share at the close of the Nova Transaction and was exchanged for 0.36 of a Common Share for a total of 741,597 Common Shares issued, and each Nova stock option was replaced with a fully vested replacement option. All replacement options were adjusted as per the terms of the Arrangement Agreement and are exercisable into Common Shares.

Upon completion of the Nova Transaction, existing Metalla and Nova shareholders owned approximately 60.41% and 39.59% of the combined company, respectively.

Nova Royalty

Nova is now a wholly-owned subsidiary of Metalla and is a royalty and streaming company that is focused on acquiring copper royalties and as at the close of the Nova Transaction had a portfolio of 23 royalties including:

| Property | | Operator | | Location | | Stage | | Metal | | Terms |

| Aranzazu | | Aura Minerals Inc. | | Mexico | | Production | | Cu-Au-Ag | | 1.0% NSR |

| Copper World Complex | | Hudbay Minerals Inc. | | USA | | Development | | Cu-Mo-Ag | | 0.315% NSR (2) |

| Dumont | | Waterton | | Canada | | Development | | Ni-Co | | 2.0% NSR (1) |

| Josemaria | | Lundin Mining | | Argentina | | Development | | Cu-Au-Ag | | 0.08% NPI (2)(3) |

| NuevaUnión | | Newmont/Teck Resources | | Chile | | Development | | Cu | | 2.0% NSR |

| Taca Taca | | First Quantum | | Argentina | | Development | | Cu-Au-Mo | | 0.42% NSR (1) |

| Tatogga | | Newmont Corporation | | Canada | | Development | | Cu-Au-Ag | | 0.25% NSR (2) |

| Twin Metals | | Antofagasta PLC | | USA | | Development | | Cu-Ni | | 2.4% NSR |

| Vizcachitas | | Los Andes Copper | | Chile | | Development | | Cu-Mo | | 0.98%; 0.49% NSR (4) |

| West Wall | | Anglo/Glencore | | Chile | | Development | | Cu-Au-Mo | | 1.0% NPR |

| Bancroft | | Transition Metals Corp. | | Canada | | Exploration | | Ni-Cu-PGM | | 1.0% NSR |

| Copper King | | Pacific Empire Minerals | | Canada | | Exploration | | Cu-Au | | 1.0% NSR |

| Dundonald | | Class 1 Nickel | | Canada | | Exploration | | Ni | | 1.25% NSR |

| Elephant Head | | Canadian Gold Miner | | Canada | | Exploration | | Au | | 1.0% NSR (1) |

| Homathko | | Transition Metals Corp. | | Canada | | Exploration | | Au | | 1.0% NSR |

| Janice Lake | | Rio Tinto/Forum Energy | | Canada | | Exploration | | Cu-Ag | | 1.0% NSR (1) |

| Maude Lake | | Transition Metals Corp. | | Canada | | Exploration | | Ni-Cu-PGM | | 1.0% NSR |

| Nub East | | Pacific Empire Minerals | | Canada | | Exploration | | Cu-Au | | 1.0% NSR |

| NWT | | Pacific Empire Minerals | | Canada | | Exploration | | Cu-Au | | 1.0% NSR |

| Pinnacle | | Pacific Empire Minerals | | Canada | | Exploration | | Cu-Au | | 1.0% NSR |

| Saturday Night | | Transition Metals Corp. | | Canada | | Exploration | | Ni-Cu-PGM | | 1.0% NSR |

| West Matachewan | | Laurion/Canadian Gold | | Canada | | Exploration | | Au | | 1.0% NSR (1) |

| Wollaston | | Transition Metals Corp | | Canada | | Exploration | | Cu-Ag | | 1.0% NSR |

(1) Subject to partial buy-back and/or exemption.

(2) Subject to a right of first refusal to acquire an additional portion of the royalty.

(3) Subject to closing conditions.

(4) 0.98% NSR royalty on open pit operations and 0.49% NSR royalty on underground operations.

Details on some of the royalties acquired in the Nova Transaction are discussed below, based on information publicly filed by the applicable project owner.

Aranzazu

Nova owns a 1.0% NSR royalty on the Aranzazu copper-gold-silver mine owned by Aura Minerals Inc. ("Aura"). Aranzazu is a copper-gold-silver deposit located within the Municipality of Concepcion del Oro in the State of Zacatecas, Mexico, approximately 250 kilometers to the southwest of the city of Zacatecas. The current mine at Aranzazu has been in operation since 1962, with documented evidence of mining in the area dating back nearly 500 years. Aura is the sole owner and operator of Aranzazu, having assumed ownership in 2010. The Aranzazu operation comprises an underground mine using long hole open stoping and an on-site plant, which produces copper concentrate with gold and silver by-product via conventional flotation processing.

Nova is entitled to 1.0% of the net smelter returns on all metals sold at Aranzazu, less certain allowable deductions, provided that the monthly average price per pound of copper, as quoted by the London Metals Exchange, equals or exceeds $2.00/lb. Aranzazu currently receives revenue from the sale of copper concentrate, including payment for gold and silver by-products, all of which is subject to the royalty. Nova receives Aranzazu royalty payments on a semi-annual basis in accordance with the terms of the royalty agreement.

Aura reported in their Annual Information Form for the year ended December 31, 2022, Proven and Probable Reserves at Aranzazu of 9.6 million tonnes at 1.23% copper, 0.81 g/t gold and 17.61 g/t silver (Proven Reserves: 5.9 million tonnes at 1.25% copper, 0.96 g/t gold, and 17.56 g/t silver; Probable Reserves: 3.6 million tonnes at 1.19% copper, 0.72 g/t gold and 17.69 g/t silver).

Taca Taca

Nova owns a 0.42% NSR royalty on all metals sold at the Taca Taca copper-gold-molybdenum project, owned by First Quantum Minerals Ltd. ("First Quantum"). Taca Taca is a porphyry copper-gold-molybdenum project located in northwestern Argentina in the Puna (Altiplano) region of Salta Province, approximately 55 kilometers east of the Chilean border and 90 kilometers east of Escondida, the world's largest copper mine. The project is located 10 kilometers from the railway line that connects Salta with Antofagasta, with previous studies showing available local power and water sources for the operation of the project.

On November 30, 2020, First Quantum published a NI 43-101 Technical Report on Taca Taca, which was subsequently updated in March 2021 to include additional financial disclosure. The restated NI 43-101 Technical Report from March 2021 showed Proven & Probable Mineral Reserves at Taca Taca of 1,758.5 million tonnes at 0.44% Copper, 0.09 g/t gold, and 0.012% molybdenum (Proven Reserves: 408.3 million tonnes at 0.59% copper, 0.13 g/t gold, and 0.016% molybdenum; Probable Reserves: 1,350.2 million tonnes at 0.39% copper, 0.08 g/t gold and 0.011% molybdenum).

On February 20, 2024, First Quantum reported that it has continued to progress through the project pre-development and engineering works and anticipates receiving approval for the Environmental and Social Impact Assessment in 2024 with construction and operation permits to follow.

Vizcachitas

Nova owns a 0.98% NSR royalty on the open pit operations and a 0.49% NSR royalty on underground operations at Vizcachitas. Vizcachitas is a large copper-molybdenum porphyry deposit in central Chile, owned by Los Andes Copper Ltd. ("Los Andes"). Los Andes released a Pre-Feasibility Study ("PFS") on Vizcachitas on February 23, 2023, that outlined an initial 26-year open pit mine life with annual copper production of 183,000 tonnes in the first eight years, a post-tax NPV8% of $2.8B and an IRR of 24%. The PFS indicates that the project has excellent existing infrastructure including transport, power, and access to desalinated water. On their corporate presentation dated March 4, 2024, Los Andes stated that it has resumed exploration and optimization drilling where several targets include possible deposit extensions to the east, west and at depth. Los Andes also stated that it expects to complete a feasibility study in 2024-2025 with potential commencement of commercial production in 2030. The royalty covers approximately 50% of the open pit.

Copper World Complex

Nova owns a 0.315% NSR royalty on the Copper World Complex project in Arizona, USA, 100% owned by Hudbay Minerals Inc. ("Hudbay"). The Copper World Complex royalty covers all metals, including copper, molybdenum, silver, and gold extracted from the majority of mining claims covering the Copper World Complex. Specifically, 132 patented claims (all the patented claims associated with the Copper World Complex), 603 unpatented claims, and one parcel of fee associated land are covered by the Copper World Royalty. Nova also retains a right of first refusal with respect to an additional 0.360% NSR royalty on the Copper World Complex.

On September 8, 2023, Hudbay announced the results of a phase one PFS at Copper World. The PFS contemplates four planned open pit mines with a two-phased mine-plan. A 20-year mine life Phase I plan is expected to produce 92,000 tonnes of copper per year in the first 10 years. Hudbay plans to receive the two outstanding operating state permits for Phase I by early 2024. Phase II is expected to expand mining activities onto federal land and to extend the mine life to 44 years with Phase II average annual copper production of approximately 100,000 tonnes at cash costs and all in sustaining cash costs of $1.11 and $1.42 per pound of copper, respectively.

Beedie Capital Strategic Partnership

In connection with the Nova Transaction, Beedie and the Company formed a strategic partnership pursuant to which:

- Beedie subscribed for C$15.0 million in an equity placement into Metalla;

- The parties agreed to amend and increase the existing Beedie Loan Facility; and

- The Nova Loan Facility was repaid and terminated.

Equity Placement

Beedie entered into a subscription agreement to complete a C$15.0 million equity placement (the "Equity Placement") in Metalla, pursuant to which concurrent with the closing of the Nova Transaction subscribed to 2,835,539 Common Shares at a price of C$5.29 per share, which was the closing price of the Common Shares on the TSX-Venture Exchange on September 7, 2023, the day prior to the announcement of the Nova Transaction. The Company expects that the proceeds of the Equity Placement will be used for the future acquisition of royalties and streams, and general and administrative expenses.

Metalla Convertible Loan

Effective December 1, 2023, Metalla and Beedie entered into an amended and restated convertible loan facility agreement (the "A&R Loan Facility") to amend and restate the Beedie Loan Facility. Pursuant to the A&R Loan Facility, the parties agreed to:

i. increase the maximum aggregate principal amount of the A&R Loan Facility from C$25.0 million to C$50.0 million;

ii. amend the conversion price of the C$4.2 million outstanding balance under the Beedie Loan Facility to a conversion price of C$6.00 per share under the A&R Loan Facility;

iii. drawdown a further C$12.2 million from the A&R Loan Facility with a conversion price of C$6.00 per share to refinance the principal amount due under the Nova Loan Facility;

iv. drawdown C$2.0 million from the A&R Loan Facility to refinance the accrued and unpaid interest outstanding under the Nova Loan Facility at the close of the Nova Transaction, with a conversion price equal to the market price of the shares of Metalla at the time of conversion;

v. drawdown C$0.8 million from the A&R Loan Facility to refinance the accrued and unpaid fees outstanding under the Nova Loan Facility at the close of the Nova Transaction, with such amounts not being convertible into shares of Metalla;

vi. establish an 18-month period during which the interest of 10.0% per annum compounded monthly will be added to the accrued and unpaid interest amount, and on June 1, 2025, reverting to a cash interest payment of 10.0% on a monthly basis;

vii. incur an amendment fee of C$0.1 million and any outstanding costs and expenses are to be paid by Metalla; and

viii. update the existing security arrangements to include security to be provided by Nova and certain other subsidiaries of Metalla and Nova for the A&R Loan Facility.

Nova Convertible Loan

As per the A&R Loan Facility and as discussed above, concurrent with closing of the Nova Transaction, Metalla drew down on the A&R Loan Facility and paid out and discharged all obligations under the Nova Loan Facility, which was terminated concurrently.

PORTFOLIO OF ROYALTIES AND STREAMS

As at the date of this MD&A, the Company owned 102 royalties, streams, and other interests. Five of the royalties and streams are in the production stage, forty-two are in the development stage, and the remainder are in the exploration stage.

Notes:

(1) Au: gold; Ag: silver; Cu: copper; Zn: zinc; and Pb: lead.

(2) Kt: kilotonnes; Mt: million tonnes; g/t: grams per tonne; oz: ounces; Koz: kilo ounces; Moz: million ounces; Ktpa: kilotonnes per annum; Mtpa: million tonnes per annum; and tpd: tonnes per day.

(3) A$: Australian Dollar.

(4) See the Company's website at https://www.metallaroyalty.com/ for the complete list and further details.

Producing Assets

As at the date of this MD&A, the Company owned an interest in production from the following properties that are in the production stage:

| Property | | Operator | | Location | | Metal | | Terms |

| Wharf | | Coeur Mining | | South Dakota, USA | | Au | | 1.0% GVR |

| New Luika | | Shanta Gold | | Tanzania | | Au, Ag | | 15% Ag Stream |

| El Realito | | Agnico Eagle Mines | | Sonora, Mexico | | Au, Ag | | 2.0% NSR(1) |

| La Encantada | | First Majestic Silver | | Coahuila, Mexico | | Au | | 100% GVR(2) |

| Aranzazu | | Aura Minerals Inc. | | Mexico | | Cu-Au-Ag | | 1.0% NSR |

(1) Subject to partial buy-back and/or exemption.

(2) 100% gross value royalty on gold produced at the La Encantada mine limited to 1.0 Koz annually.

Below are updates during the three months ended December 31, 2023, and subsequent period to certain production stage assets, based on information publicly filed by the applicable project owner:

La Encantada

On February 22, 2024, First Majestic Silver Corp. ("First Majestic") announced production of 61 oz of gold and 0.5 Moz of silver from La Encantada in the fourth quarter of 2023, and production of 321 oz gold and 2.7 Moz silver for the 2023 fiscal year.

Metalla accrued 79 GEOs from La Encantada for the fourth quarter of 2023 and 259 GEOs for the 2023 fiscal year.

Metalla holds a 100% GVR royalty on gold produced at the La Encantada mine limited to 1.0 Koz annually.

El Realito

On February 15, 2024, Agnico Eagle Mines Ltd. ("Agnico") reported that gold production from La India totaled 19.5 Koz for the fourth quarter of 2023 and 75.9 Koz gold for the 2023 fiscal year. Agnico also provided 2024 guidance for La India of 25-30 Koz gold which is expected to come from residual leaching of the heap leach pads.

Metalla accrued 267 GEOs from El Realito for the fourth quarter of 2023 and 1,066 GEOs for the 2023 fiscal year.

Metalla holds a 2.0% NSR royalty on the El Realito deposit which is subject to a 1.0% buyback right for $4.0 million.

Wharf

On February 21, 2024, Coeur Mining Inc. ("Coeur") reported 2023 fourth quarter production of 29.7 Koz gold and updated the full year guidance for 2024 at Wharf to 86 - 96 Koz gold. Exploration efforts in 2024 will focus adding additional Mineral Reserves at Wharf.

Metalla accrued 305 GEOs from Wharf for the fourth quarter of 2023 and 1,008 GEOs for the 2023 fiscal year.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

Aranzazu

On February 20, 2024, Aura announced 2023 production at Aranzazu totaled 106,119 GEOs with 2024 guidance of 94 - 108 Koz GEOs. Additionally in their corporate presentation dated March 2024, Aura stated a 29,400-meter drilling campaign is underway testing the continuity of the GH and Cabrestante connection with the goal of increasing mineral reserves and resources, along with drilling in El Cobre and Aranzazu extensions.

Metalla accrued 67 GEOs from Aranzazu for the period from December 1 to December 31, 2023, representing the period after the Nova Transaction closed.

Metalla holds a 1.0% NSR royalty on the Aranzazu mine.

New Luika

On January 22, 2024, Shanta Gold Limited ("Shanta") reported that it produced 18.3 Koz of gold and 30 Koz of silver at the New Luika Gold Mine ("NLGM") in Tanzania in the fourth quarter of 2023. Shanta also reiterated their guidance of 70 - 74 Koz of gold from NLGM in 2024. On January 11, 2024, Shanta released the results of the 2023 NLGM drill program with significant intercepts of 39.05 g/t gold over 11.6 meters and 7.49 g/t gold over 15.1 meters.

Metalla accrued 22 GEOs from NLGM for the fourth quarter of 2023 and 113 GEOs for the 2023 fiscal year.

Metalla holds a 15% interest in Silverback, whose sole business is receipt and distribution of a 100% silver stream on NLGM at an ongoing cost of 10% of the spot silver price.

Development Stage Assets

As at the date of this MD&A, the Company owned an interest in production from the following properties that are in the development stage:

| Property | | Operator | | Location | | Metal | | Terms |

| Akasaba West | | Agnico Eagle Mines | | Val d’Or, Quebec | | Au, Cu | | 2.0% NSR(1) |

| Amalgamated Kirkland | | Agnico Eagle Mines | | Kirkland Lake, Ontario | | Au | | 0.45% NSR |

| Aureus East | | Aurelius Minerals | | Halifax, Nova Scotia | | Au | | 1.0% NSR |

| Big Springs | | Warriedar Resources | | Nevada, USA | | Au | | 2.0% NSR(2) |

| Castle Mountain | | Equinox Gold | | California, USA | | Au | | 5.0% NSR |

| CentroGold | | BHP | | Maranhao, Brazil | | Au | | 1.0%-2.0% NSR(6) |

| Copper World Complex | | Hudbay Minerals Inc. | | USA | | Cu-Mo-Ag | | 0.315% NSR(3) |

| COSE(11) | | Pan American Silver | | Santa Cruz, Argentina | | Au, Ag | | 1.5% NSR |

| Côté and Gosselin | | IAMGOLD/Sumitomo | | Gogama, Ontario | | Au | | 1.35% NSR |

| Del Toro | | First Majestic Silver | | Zacatecas, Mexico | | Ag, Au | | 2.0% NSR |

| Dumont | | Waterton | | Canada | | Ni-Co | | 2.0% NSR(1) |

| Endeavor(11) | | Polymetals Resources | | NSW, Australia | | Zn, Pb, Ag | | 4.0% NSR |

| Esperanza | | Zacatecas Silver | | Morelos, Mexico | | Ag | | 20% Ag Stream(5) |

| Fifteen Mile Stream (“FMS") | | St. Barbara | | Halifax, Nova Scotia | | Au | | 1.0% NSR |

| FMS (Plenty Deposit) | | St. Barbara | | Halifax, Nova Scotia | | Au | | 3.0% NSR(1) |

| Fosterville | | Agnico Eagle Mines | | Victoria, Australia | | Au | | 2.5% GVR |

| Garrison | | STLLR Gold | | Kirkland Lake, Ontario | | Au | | 2.0% NSR |

| Hoyle Pond Extension | | Newmont Corporation | | Timmins, Ontario | | Au | | 2.0% NSR(1) |

| Joaquin(11) | | Pan American Silver | | Santa Cruz, Argentina | | Au, Ag | | 2.0% NSR |

| Josemaria | | Lundin Mining | | Argentina | | Cu-Au-Ag | | 0.08% NPI(3)(4) |

| La Fortuna | | Minera Alamos | | Durango, Mexico | | Au, Ag, Cu | | 3.5% NSR(7) |

| La Guitarra | | Sierra Madre Gold | | Mexico State, Mexico | | Ag | | 2.0% NSR(1) |

| La Joya | | Silver Dollar | | Durango, Mexico | | Ag, Cu, Au | | 2.0% NSR |

| La Parrilla | | Silver Storm Mining | | Durango, Mexico | | Au, Ag | | 2.0% NSR |

| Lama | | Barrick Gold Corp | | San Juan, Argentina | | Au | | 2.5% GPR(8) |

| Lama | | Barrick Gold Corp | | San Juan, Argentina | | Cu | | 0.25% NSR(9) |

| Lac Pelletier | | Maritime Resources | | Noranda, Quebec | | Au | | 1.0% NSR |

| North AK | | Agnico Eagle Mines | | Kirkland Lake, Ontario | | Au | | 0.45% NSR |

| NuevaUnión | | Newmont and Teck | | Atacama, Chile | | Au, Cu | | 2.0% NSR |

| Plomosas | | GR Silver | | Sinaloa, Mexico | | Ag | | 2.0% NSR(1) |

| Saddle North | | Newmont Corporation | | Canada | | Cu-Au-Ag | | 0.25% NSR(3) |

| San Luis | | SSR Mining | | Peru | | Au, Ag | | 1.0% NSR |

| San Martin | | First Majestic Silver | | Jalisco, Mexico | | Ag, Au | | 2.0% NSR |

| Santa Gertrudis | | Agnico Eagle Mines | | Sonora, Mexico | | Au | | 2.0% NSR(1) |

| Taca Taca | | First Quantum | | Argentina | | Cu-Au-Mo | | 0.42% NSR(1) |

| Timmins West Extension | | Pan American Silver | | Timmins, Ontario | | Au | | 1.5% NSR(1) |

| Tocantinzinho | | G Mining Ventures | | Para, Brazil | | Au | | 0.75% GVR |

| Twin Metals | | Antofagasta PLC | | USA | | Cu-Ni | | 2.4% NSR |

| Vizcachitas | | Los Andes Copper | | Chile | | Cu-Mo | | 0.98%; 0.49% NSR(10) |

| Wasamac | | Agnico Eagle Mines | | Rouyn-Noranda, Quebec | | Au | | 1.5% NSR(1) |

| West Wall | | Anglo/Glencore | | Chile | | Cu-Au-Mo | | 1.0% NPR |

| Zaruma | | Pelorus Minerals | | Ecuador | | Au | | 1.5% NSR |

(1) Subject to partial buy-back and/or exemption.

(2) Subject to fixed royalty payments.

(3) Subject to a right of first refusal to acquire an additional portion of the royalty.

(4) Subject to closing conditions.

(5) Subject to cap on payments.

(6) 1.0% NSR royalty on the first 500 Koz, 2.0% NSR royalty on next 1Moz, and 1.0% NSR royalty thereafter.

(7) 2.5% NSR royalty capped at $4.5 million, 1.0% NSR royalty uncapped.

(8) 2.5% GP royalty on first 5Moz gold, 3.75 GVR royalty thereafter.

(9) 0.25% NSR royalty on all metals except gold and silver, escalates to 3.0% based on cumulative net smelter returns from the royalty area.

(10) 0.98% NSR royalty on open pit operations and 0.49% NSR royalty on underground operations.

(11) The mine was previously classified as production, however it was placed on care and maintenance, as such the Company has reclassified it to development stage properties.

Below are updates during the three months ended December 31, 2023, and subsequent period to certain development stage assets, based on information publicly filed by the applicable project owner:

Côté-Gosselin

In a news release dated February 15, 2024, IAMGOLD Corporation ("IAMGOLD") reported that it had completed 98% of the construction at the Côté Gold Project. IAMGOLD also stated that production guidance is expected to be between 220 - 290 Koz for 2024.

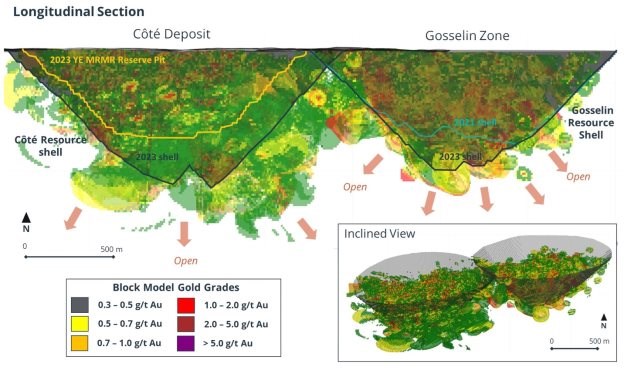

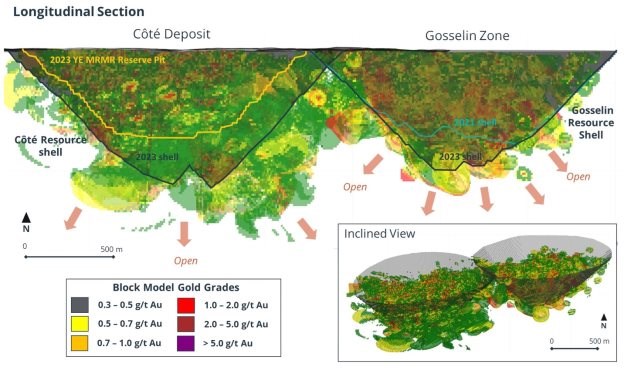

On its news release dated February 15, 2024, IAMGOLD also announced that the Gosselin Mineral Resource estimate increased, for a total of 4.4 million Indicated Resource gold ounces in 161.3 million tonnes at 0.85 g/t Au, and 3.0 million Inferred Resource gold ounces in 123.9 Mt at 0.75 g/t Au. Technical studies are planned to advance metallurgical testing, conduct mining and infrastructure study to review options for the potential inclusion of Gosselin into the future Côté life of mine plan. IAMGOLD announced planned exploration expenditures at Gosselin of $5.0 million on a resource delineation drilling program and in their corporate presentation dated February 2024, IAMGOLD also stated that it expects to complete 35,000 meters of exploration drilling at Gosselin in 2024. Please see Figure 1 for the Côté and Gosselin Longitudinal Section outlining the current extent of mineral resources and opportunities for resource expansion.

Figure 1: Gosselin Composite Longitudinal Section (Source: IAMGOLD press release dated February 15, 2024)

Metalla holds a 1.35% NSR royalty that covers less than 10% of the Côté Reserves and Resources estimate and covers all of the Gosselin Resource estimate.

Fosterville

On February 15, 2024, Agnico reported the results of the 2023 drill program completed at the Fosterville mine. Significant highlights within the Phoenix area include 69.1 g/t gold over 3.7 meters including 120 g/t gold over 2.1 meters in the Cardinal structure. Also, within the Phoenix area, a highlight drill hole in the newly identified mineralized trend named the Peregrine Zone intersected 17.3 g/t gold over 8.3 meters. Please see Figure 2 for an estimate of the royalty boundary proximity to mineralization on Agnico's Fosterville Longitudinal section.

In 2024, Agnico also stated it expects to spend $10.9 million for 38,700 meters of drilling focused on extensions of mineral reserves and mineral resources at Lower Phoenix and Robbins Hill. An additional $11.7 million is budgeted for 36,500 meters of drilling to test new geological targets, including underground extensional exploration at Harrier.

Figure 2: Fosterville Composite Longitudinal Section (Source: Agnico press release dated February 15, 2024)

Metalla holds a 2.5% GVR royalty on the northern and southern extensions of the Fosterville mining license and other areas in the land package.

Endeavor

On February 21, 2024, Polymetals Resources Inc ("Polymetals") announced the expansion of the drill program at the Carpark prospect which intersected upper-level mineralization with alteration similar to the main lodes at Endeavor.

On October 16, 2023, Polymetals released a robust mine restart study at Endeavor. Polymetals declared an initial 10-year mine life producing 9.8 Moz silver, 210 kt zinc and 62 kt lead over life of mine with first concentrate production targeted for H2-2024. The study produced A$201 million in pre-tax net present value at an 8% discount rate and an internal rate of return of 91%, with expenditures estimated to be A$23.7 million.

Metalla holds a 4.0% NSR royalty on lead, zinc and silver produced from Endeavor.

Copper World

On, September 8, 2023, Hudbay announced the results of the 2023 PFS at Copper World. The PFS contemplates four planned open pit mines with a two-phased mine-plan. A 20-year mine life Phase I plan is expected to produce 92,000 tonnes of copper per year in the first 10 years. Phase II extends the mine life to 44 years through an expansion of the processing facilities, resulting in up to 100,000 tonnes of annual copper production. Hudbay plans to receive the two outstanding operating state permits for Phase I by early 2024. Phase II expands mining activities onto federal land and extends the mine life to 44 years with Phase II average annual copper production of approximately 100,000 tonnes at cash costs and sustaining cash costs of $1.11 and $1.42 per pound of copper, respectively.

Metalla holds a 0.315% NSR royalty on Copper World.

Amalgamated Kirkland and North AK

On February 15, 2024, Agnico announced that production from the Near Surface deposits is planned to be processed at the Macassa mill in the first half of 2024 and at the La Ronde Zone 5 mill in the second half of 2024. Production from the AK deposit, which is expected to begin in the second half of 2024 is planned to be processed at the La Ronde facility. Production from the two deposits is forecast by Agnico to be ~19 Koz in 2024 and between 35 - 50 Koz gold from 2025 to 2028 and Agnico believes that the AK area remains prospective for future mineral resource growth. Additionally, Agnico reported an updated Mineral Reserve estimates of 160 Koz of Probable Reserves at 6.69 g/t gold and updated Mineral Resource estimates of 37 Koz of Indicated Resources at 6.95 g/t gold, and 52 Koz of Inferred Resources at 5.69 g/t gold.

Metalla holds a 0.45% NSR royalty on the Amalgamated Kirkland and North AK properties.

Tocantinzinho

On January 15, 2024, G Mining Ventures Corp. ("G Mining") reported that the Tocantinzinho project is 76% complete and remains on track for commercial production in H2-2024. G Mining also reported that the project remains on budget and is fully funded through completion and ramp-up to commercial production.

Metalla holds a 0.75% GVR royalty on Tocantinzinho.

Wasamac

On February 15, 2024, Agnico reported the results of the 2023 infill and conversion drilling completed at Wasamac with highlight intercepts of 4.9 g/t gold over 13.4 meters, 2.8 g/t gold over 18.8 meters and 4.4 g/t gold over 3.9 meters in the main zone. At the Wildcat zone, significant highlights include 3.6 g/t gold over 20.6 meters and 5.6 g/t golds over 4.1 meters. Agnico plans to spend $2.8 million for 16,700 meters of drilling at Wasamac in 2024 and continues to assess various scenarios to define the optimal mining rate and milling strategy for Wasamac.

Metalla holds a 1.5% NSR royalty on the Wasamac project subject to a buyback of 0.5% for C$7.5 million.

Castle Mountain

On February 21, 2024, Equinox Gold Corp. ("Equinox") reported that 10,993 meters of exploration drilling was completed during the fourth quarter to infill drill at the South Overburden and JSLA dumps for a total of 19,374 meters for 2023. One small target called Green and Gold was tested with 937 meters of drilling. In addition, a surface exploration program of geological mapping and channel sampling is expected to continue in 2024, with the primary goal to sample previously identified mineralization exposed on surface such that data can be used in future mineral resource estimation. Equinox also reported that the mine permitting amendment plan was submitted to the lead county and BLM agencies which reviewed the plan for completeness in early 2023. Work on the preliminary draft Environmental Impact Statement will occur throughout 2024 and 2025.

Metalla holds a 5.0% NSR royalty on the South Domes area of the Castle Mountain mine.

La Guitarra

On February 8, 2024, Sierra Madre Gold & Silver Ltd ("Sierra Madre") provided an update on development progress at La Guitarra, including positive progress on a mine restart study which is due for completion in the second quarter of 2024. In addition, Sierra Madre received a renewal of an explosives permit and all other operating permits remain current and in good standing. The mine restart study will focus on an initial production level of 350 tonnes per day with an evaluation of increasing the circuit to greater than 500 tpd.

Metalla holds a 2.0% NSR Royalty on La Guitarra, subject to a 1.0% buyback for $2.0 million.

La Parrilla

Through multiple press releases dated December 5, 2023, January 4, 2024, January 29, 2024, and February 22, 2024, Silver Storm Mining Ltd. ("Silver Storm") released highlighted intercepts from drilling at La Parrilla of 500 g/t AgEq over 14.8 meters, 1,810 g/t AgEq over 14.6 meters, 1000 g/t AgEq over 5.25 meters and 911 g/t AgEq over 13.05 meters, respectively.

Silver Storm also announced its plan to release a technical study and mine plan to support future restart of mining and processing with a target of mid-2025.

Metalla holds a 2.0% NSR royalty on La Parrilla.

Fifteen Mile Stream

On October 10, 2023, St. Barbara Limited ("St. Barbara") reported results of an updated PFS for Fifteen Mile Stream as a standalone project via the relocation of the Touquoy processing plant. The PFS proposes an eleven-year mine life producing an average of 55-60 Koz per annum at a cash cost of $992/oz. St. Barbara will focus on the preparation of an updated environmental and social impact assessment for the new project design and stated that development could begin as early as 2026.

Metalla holds a 1.0% NSR royalty on the Fifteen Mile Stream project, and 3.0% NSR royalty on the Plenty and Seloam Brook deposits.

Akasaba West

On February 15, 2024, Agnico announced that development of the Akasaba West project is on schedule and on budget to achieve commercial production in early 2024. Akasaba West is expected to contribute approximately 12 Koz of gold and 2.3 Kt of copper per year.

Metalla holds a 2.0% NSR royalty on the Akasaba West project subject to a 210 Koz gold exemption.

Exploration Stage Assets

As at the date of this MD&A, the Company owned an interest in production from a large portfolio of properties that are in the exploration stage including:

| Property | | Operator | | Location | | Metal | | Terms |

| Anglo/Zeke | | Nevada Gold Mines | | Nevada, USA | | Au | | 0.5% GOR |

| Bancroft | | Transition Metals Corp. | | Canada | | Ni-Cu-PGM | | 1.0% NSR |

| Beaudoin | | Explor Resources | | Timmins, Ontario | | Au, Ag | | 0.4% NSR |

| Big Island | | Voyageur Mineral Explorers | | Flin Flon, Manitoba | | Au | | 2.0% NSR |

| Bint Property | | Glencore | | Timmins, Ontario | | Au | | 2.0% NSR |

| Biricu | | Minaurum Gold | | Guerrero, Mexico | | Au, Ag | | 2.0% NSR |

| Boulevard | | Independence Gold | | Dawson Range, Yukon | | Au | | 1.0% NSR |

| Caldera | | Not Applicable | | Nevada, USA | | Au | | 1.0% NSR |

| Camflo Mine | | Agnico Eagle Mines | | Val d’Or, Quebec | | Au | | 1.0% NSR |

| Capricho | | Solaris Resources | | Peru | | Au, Ag | | 1.0% NSR |

| Carlin East | | Ridgeline Minerals | | Nevada, USA | | Au | | 0.5% NSR(3) |

| Colbert/Anglo | | Newmont | | Timmins, Ontario | | Au | | 2.0% NSR |

| Copper King | | Pacific Empire Minerals | | Canada | | Cu-Au | | 1.0% NSR |

| DeSantis Mine | | Canadian Gold Miner | | Timmins, Ontario | | Au | | 1.5% NSR |

| Detour DNA | | Agnico Eagle Mines | | Cochrane, Ontario | | Au | | 2.0% NSR |

| Dundonald | | Class 1 Nickel | | Canada | | Ni | | 1.25% NSR |

| Edwards Mine | | Alamos Gold | | Wawa, Ontario | | Au | | 1.25% NSR |

| Elephant Head | | Canadian Gold Miner | | Canada | | Au | | 1.0% NSR(2) |

| Fenn Gibb South | | Mayfair Gold | | Timmins, Ontario | | Au | | 1.4% NSR |

| Fortuity 89 | | Not Applicable | | Nevada, USA | | Au | | 2.0% NSR |

| Golden Brew | | Highway 50 Gold | | Nevada, USA | | Au | | 0.5% NSR |

| Golden Dome | | Warriedar Resources | | Nevada, USA | | Au | | 2.0% NSR(3) |

| Goodfish Kirana | | Kirkland Gold Discoveries | | Kirkland Lake, Ontario | | Au | | 1.0% NSR |

| Green Springs | | Contact Gold | | Nevada, USA | | Au | | 2.0% NSR |

| Homathko | | Transition Metals Corp. | | Canada | | Au | | 1.0% NSR |

| Hot Pot/Kelly Creek | | Nevada Exp./Austin Gold | | Nevada, USA | | Au | | 1.5% NSR(2)(3) |

| Island Mountain | | Tuvera Exploration | | Nevada, USA | | Au | | 2.0% NSR(3) |

| Janice Lake | | Rio Tinto/Forum Energy | | Canada | | Cu-Ag | | 1.0% NSR(2) |

| Jersey Valley | | Not Applicable | | Nevada, USA | | Au | | 2.0% NSR |

| Kings Canyon | | Pine Cliff Energy | | Utah, USA | | Au | | 2.0% NSR |

| Kirkland-Hudson | | Agnico Eagle Mines | | Kirkland Lake, Ontario | | Au | | 2.0% NSR |

| La Luz | | First Majestic | | San Luis Potosi, Mexico | | Ag | | 2.0% NSR |

| Los Patos | | Private | | Venezuela | | Au | | 1.5% NSR |

| Los Tambos | | Pucara Res. | | Peru | | Au | | 1.0% NSR |

| Maude Lake | | Transition Metals Corp. | | Canada | | Ni-Cu-PGM | | 1.0% NSR |

| Mirado Mine | | Orefinders | | Kirkland Lake, Ontario | | Au | | 1.0% NSR(1) |

| Montclerg | | GFG Resources | | Timmins, Ontario | | Au | | 1.0% NSR |

| Northshore West | | Newpath Resources Inc | | Thunderbay, Ontario | | Au | | 2.0% NSR |

| Nub East | | Pacific Empire Minerals | | Canada | | Cu-Au | | 1.0% NSR |

| NWT | | Pacific Empire Minerals | | Canada | | Cu-Au | | 1.0% NSR |

| Orion | | Minera Frisco | | Nayarit, Mexico | | Au, Ag | | 2.75% NSR(4) |

| Pelangio Poirier | | Pelangio Exploration | | Timmins, Ontario | | Au | | 1.0% NSR |

| Pine Valley | | Nevada Gold Mines | | Nevada, USA | | Au | | 3.0% NSR |

| Pinnacle | | Pacific Empire Minerals | | Canada | | Cu-Au | | 1.0% NSR |

| Pucarana | | Buenaventura | | Peru | | Au | | 1.8% NSR(1) |

| Puchildiza | | Not Applicable | | Chile | | Au | | 1.5% NSR |

| Red Hill | | NuLegacy Gold Corp. | | Nevada, USA | | Au | | 1.5% GOR |

| Ronda | | Platinex | | Shining Tree, Ontario | | Au | | 2.0% NSR(2) |

| Saturday Night | | Transition Metals Corp. | | Canada | | Ni-Cu-PGM | | 1.0% NSR |

| Sirola Grenfell | | Record Gold Corp. | | Kirkland Lake, Ontario | | Au | | 0.25% NSR |

| Solomon’s Pillar | | Private | | Greenstone, Ontario | | Au | | 1.0% NSR |

| Tower Mountain | | Thunder Gold Corp. | | Thunder Bay, Ontario | | Au | | 2.0% NSR |

| TVZ Zone | | Newmont | | Timmins, Ontario | | Au | | 2.0% NSR |

| West Matachewan | | Laurion/Canadian Gold | | Canada | | Au | | 1.0% NSR(2) |

| Wollaston | | Transition Metals Corp | | Canada | | Cu-Ag | | 1.0% NSR |

(1) Option to acquire the underlying and/or additional royalty.

(2) Subject to partial buy-back and/or exemption.

(3) Subject to fixed royalty payments.

(4) Subject to closing conditions.

Below are updates during the three months ended December 31, 2023, and subsequent period to certain exploration assets, based on information publicly filed by the applicable project owner:

Montclerg

On December 5, 2023, and January 17, 2024, GFG Resources Inc. reported highlight intercepts of 4.79 g/t gold over 12.8 meters and 3.09 g/t gold over 12.8 meters at the Montclerg deposit in Timmins, Ontario.

Metalla holds a 1.0% NSR royalty on the Montclerg property.

Camflo

On October 26, 2023, Agnico reported that the next phase of exploration drilling began at the Camflo property. On June 20, 2023, Agnico reported that it completed more than 14,000 meters of drilling, which marks the first exploration drill program since the 1.6 Moz past-producing deposit was closed in 1992. Significant results reported over multiple zones include 1.5 g/t gold over 81 meters, 3.3 g/t gold over 38.7 meters, 3.2 g/t gold over 16.2 meters, 3.7 g/t gold over 7.1 meters, and 1.6 g/t gold over 20.3 meters. The second phase of exploration drilling at Camflo will test for potential lateral extensions of mineralization and infill known zones. Agnico believes the mineralization could be mined via an open-pit and processed at the Canadian Malartic Mill, 4 Km away.

Metalla holds a 1.0% NSR royalty on the Camflo mine, located ~4km northeast of the Canadian Malartic operation.

Detour DNA

On February 15, 2024, Agnico reported underground drilling at Detour over a 2.5 km strike length west of the Detour West reserve pit margin. Highlights include 18.3 g/t gold over 12.6 meters, 7.8 g/t gold over 2.7 meters, and 6 g/t gold over 22.4 meters.

Metalla holds a 2.0% NSR royalty on the Detour DNA property which is approximately 7 km west of the Detour West reserve pit margin.

Production and Sales from Royalties and Streams

The following table summarizes the attributable GEOs sold by the Company's royalty partners, including any amounts related to derivative royalty assets:

| | | Year ended | |

| | | December 31, | |

| | | 2023 | | | 2022 | |

| Attributable GEOs(1) during the period from: | | | | | | |

| Higginsville(2) | | 1,476 | | | 1,324 | |

| Wharf | | 1,008 | | | 639 | |

| El Realito | | 1,066 | | | 226 | |

| La Encantada | | 259 | | | - | |

| Aranzazu | | 67 | | | - | |

| NLGM(3) | | 113 | | | 101 | |

| COSE | | - | | | 123 | |

| Joaquin | | - | | | 268 | |

| Total attributable GEOs(1) | | 3,989 | | | 2,681 | |

(1) For the methodology used to calculate attributable GEOs, see Non-IFRS Financial Measures.

(2) The Higginsville PP royalty is accounted for as a derivative royalty asset, as such any payments received under this royalty are treated as a reduction in the carrying value of the asset on the statement of financial position and not shown as revenue on the Company's statement of profit and loss. However, operationally the Company is paid for the ounces sold similar to the Company's other royalty interests, therefore the results have been included here for more accurate comparability and to allow the reader to accurately analyze the operations of the Company. For additional details on the derivative royalty asset see Note 5 of the Company's consolidated financial statements for the year ended December 31, 2023. The Higginsville participation royalty has reached the full 34,000 gold ounces threshold and is no longer payable to Metalla.

(3) Adjusted for the Company's proportionate share of NLGM held by Silverback.

OUTLOOK

Primary sources of cash flows from royalties and streams for 2024 are expected to be Wharf, Aranzazu, El Realito, NLGM, Tocantinzinho, Amalgamated Kirkland, and La Encantada. In 2024, the Company expects 2,500 to 3,500 attributable GEOs (1).

(1) For the methodology used to calculate attributable GEOs, see Non-IFRS Financial Measures.

SUMMARY OF QUARTERLY RESULTS

The following table provides selected financial information for the eight most recently completed financial quarters up to December 31, 2023:

| | | Three months ended | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| | | 2023 | | | 2023 | | | 2023 | | | 2023 | |

| Revenue from royalty and stream interests | $ | 1,296 | | $ | 1,359 | | $ | 959 | | $ | 981 | |

| Net loss | | 1,867 | | | 2,127 | | | 487 | | | 1,356 | |

| Loss per share - basic and diluted | | 0.03 | | | 0.04 | | | 0.01 | | | 0.03 | |

| Weighted average shares outstanding – basic | | 65,271,084 | | | 52,839,197 | | | 52,224,188 | | | 50,514,392 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | Three months ended | |

| | | December 31, | | | September 30, | | | June 30, | | | March 31, | |

| | | 2022 | | | 2022 | | | 2022 | | | 2022 | |

| Revenue from royalty and stream interests | $ | 628 | | $ | 656 | | $ | 460 | | $ | 669 | |

| Net loss | | 4,788 | | | 2,538 | | | 1,371 | | | 2,232 | |

| Loss per share - basic and diluted | | 0.11 | | | 0.06 | | | 0.03 | | | 0.05 | |

| Weighted average shares outstanding – basic | | 45,500,634 | | | 44,828,356 | | | 44,583,515 | | | 44,271,600 | |

Changes in revenues, net income (loss), and cash flows on a quarter-by-quarter basis are affected primarily by changes in production levels and the related commodity prices at producing mines, acquisitions of royalties and streams, as well as the commencement or cessation of mining operations at mines the Company has under royalty and stream agreements.

A summary of material changes impacting the Company's quarterly results are discussed below:

- For the three months ended December 31, 2023, revenue and net loss remained roughly consistent with the prior period as the primary sources of revenue remained unchanged.

- For the three months ended September 30, 2023, revenue increased compared to the prior period due to higher GEOs delivered from El Realito and La Encantada. Net loss was higher than the previous period as the prior quarter had a gain on sale of mineral claims, offset by higher revenue in the current period.

- For the three months ended June 30, 2023, revenue remained roughly consistent with the prior period as the primary sources of revenue remained unchanged. Net loss was lower than previous periods due to the gain on sale of mineral claims, offset by an impairment charge on the Del Carmen royalty.

- For the three months ended March 31, 2023, revenue increased with the start of payments from La Encantada, and a ramp up at El Realito. Net loss was lower than the previous periods primarily due to no impairment charges during the period.

- For the three months ended December 31, 2022, revenue remained roughly consistent with the prior period as the primary sources of revenue remained unchanged. Net loss was higher than previous periods due to the impairment charges on the Joaquin and COSE royalties.

- For the three months ended September 30, 2022, revenue remained roughly consistent with the prior period as the COSE royalty ended and the El Realito royalty started making payments. Net loss for the period was higher due to the impairment charge on the Joaquin royalty.

- For the three months ended June 30, 2022, revenue was roughly consistent with prior periods as the primary sources of revenue remained unchanged. Net loss was lower than previous periods due to the reduction in share-based payments expense related to the vesting conditions of the Company's previously issued stock options and restricted share units.

- For the three months ended March 31, 2022, revenue and net loss roughly consistent compared to the previous quarter as the primary sources of revenue remained unchanged being the Wharf, COSE and Joaquin royalties.

RESULTS OF OPERATIONS

Three Months Ended December 31, 2023

The Company's net loss totaled $1.9 million for the three months ended December 31, 2023 ("Q4 2023"), compared with a net loss of $4.8 million for the three months ended December 31, 2022 ("Q4 2022").

Significant items impacting the change in net loss included the following:

- an increase in gross profit from $0.2 million in Q4 2022 to $0.6 million in Q4 2023, primarily due to higher revenue amounts in Q4 2023;

- a decrease in royalty interest impairments from $2.0 million in Q4 2022 to $Nil in Q4 2023 as the Company had no impairment charges in the current period; and

- an increase in share of net income on Silverback from a loss of $0.7 million in Q4 2022 to income of less than $0.1 million in Q4 2023, related to a one-time catch-up depletion charge of $0.6 million that was recorded in Q4 2022.

Year Ended December 31, 2023

The Company's net loss totaled $5.8 million for the year ended December 31, 2023 ("2023 YTD"), compared with a net loss of $10.9 million for the year ended December 31, 2022 ("2022 YTD").

Significant items impacting the change in net loss included the following:

- an increase in gross profit from $0.6 million in 2022 YTD to $2.2 million in 2023 YTD, primarily due to higher revenue amounts in 2023 YTD;

- a decrease in royalty interest impairments from $3.7 million in 2022 YTD to $2.4 million in 2023 YTD as the Company had lower impairment charges in the current year;

- an increase in market-to-market gains on the derivative loan liabilities from $Nil in 2022 YTD to $0.7 million in 2023 YTD, this is related to the derivative loan liabilities that were recognized in May 2023 upon modification of the Beedie Loan Facility. Additionally, the Company recorded a charge of $1.7 million in 2023 YTD related to the modifications of the Beedie Loan Facility compared to gain of $0.3 million in 2022 YTD;

- the Company recorded a one-time gain of $5.1 million in 2023 YTD related to the sale of mineral claims; and

- an increase in income taxes from less than $0.1 million in 2022 YTD to $1.4 million in 2023 YTD, primarily related to taxes due from the sale of the mineral claims.

LIQUIDITY AND CAPITAL RESOURCES

The Company considers items included in shareholders' equity and long-term debt as capital. The Company's objective when managing capital is to safeguard the Company's ability to continue as a going concern, so that it can continue to add value for shareholders and benefits for other stakeholders.

The Company's cash balance as at December 31, 2023, was $14.1 million (December 31, 2022 - $4.6 million) and its working capital was $10.7 million (December 31, 2022 - $3.0 million). The Company manages its capital structure and makes adjustments in light of changes in economic conditions and the risk characteristics of the underlying assets.

The Company believes it will have access to sufficient resources to undertake its current business plan for the next twelve months. In order to meet its capital requirements, the Company's primary sources of cash flows are expected to be from the Wharf, Aranzazu, El Realito, La Encantada, Tocantinzinho, Amalgamated Kirkland, NLGM royalties and streams, drawdowns under the Beedie Loan Facility, and public and/or private placements. The Company may also enter into new debt agreements, or sell non-core assets.

During the year ended December 31, 2023, cash increased by $9.6 million. The increase was due to cash provided by financing activities of $12.8 million, cash provided by operating activities of $0.5 million, and offset by cash used in investing activities of $3.6 million. Exchange rate changes had an impact on cash of $0.2 million.

Debt

Convertible Loan Facility

In March 2019, the Company entered into a convertible loan facility with Beedie to fund acquisitions of new royalties and streams which has subsequently been amended from time to time. The loan facility bears interest on amounts advanced and a standby fee on funds available. Funds advanced are convertible into Common Shares at Beedie's option, with the conversion price determined at the date of each drawdown or at the conversion date (in the case of the conversion of accrued and unpaid interest).

In August 2022, the Company and Beedie closed a first supplemental loan agreement to extend the maturity date of the loan facility from April 22, 2023, to January 22, 2024. In consideration for the extension the Company incurred a fee of C$0.2 million (the "Loan Extension Fee") convertible into Common Shares at a conversion price of C$7.34 per share. Upon closing of the First Amendment, the Company recognized a gain of $0.3 million to reflect the change required in the amortized cost of the liability using the effective interest method over a longer period of time. Following the closing of the supplemental loan agreement the Company had C$5.0 million outstanding with a conversion price of C$14.30 per share (the "Third Drawdown"), C$3.0 million outstanding with a conversion price of C$11.16 per share (the "Fourth Drawdown"), C$0.2 million outstanding with a conversion price of C$7.34 per share from the Loan Extension Fee, and had C$12.0 million available under the loan facility. All future advances will have a minimum amount of C$2.5 million and each advance will have its own conversion price based on a 20% premium to the 30-day Volume-Weighted Average Price (“VWAP”) of the Company's shares on the earlier of the announcement of such advance and the funding date of such advance.

In May 2023, the Company and Beedie closed a second supplemental loan agreement to amend the loan facility by:

i. extending the maturity date to May 10, 2027;

ii. increasing the loan facility by C$5.0 million from C$20.0 million to C$25.0 million;

iii. increasing the interest rate from 8.0% to 10.0% per annum;

iv. amending the conversion price of the Fourth Drawdown from C$11.16 per share to C$8.67 per share, being a 30% premium to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment;

v. amending the conversion price of C$4.0 million of the Third Drawdown from C$14.30 per share to C$7.33 per share, being the 5-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment, and converting the C$4.0 million into shares at the new conversion price. Upon closing the Company issued Beedie 545,702 Common Shares for the conversion of the C$4.0 million; and

vi. amending the conversion price of the remaining C$1.0 million of the Third Drawdown from C$14.30 per share to C$8.67 per share, being to the 30-day VWAP of the Company shares measured at market close on the day prior to announcement of the amendment.

The amendment was considered a substantial modification of the loan facility, and for accounting purposes, the existing debt instruments were extinguished, and the new debt instruments were recognized at fair value on the amendment date. The difference in value between the amount that was retired for the old debt instrument and the amount recorded for the new debt instrument, taking into account the modification in conversion price to induce conversion of part of the old debt instrument, was recorded as a loss on extinguishment of loan payable of $1.4 million. Transaction costs of $0.1 million incurred were included in the loss on extinguishment of loan payable.

The conversion feature, prepayment options, and availability of credit under the new loan facility (together the "Derivative Loan Liabilities") have all been determined to be non-cash embedded derivatives that are not closely related to the principal amounts due under the loan facility, and as such are bifurcated from the loan facility and the Derivative Loan Liabilities will be accounted for at fair value through profit and loss. The debt portion of the loan facility along with any transaction costs and fees directly attributable to the loan facility will be included in the respective effective interest rate calculation for the debt portion and will be measured at amortized cost. Upon initial recognition on May 19, 2023, the Derivative Loan Liabilities were assigned a fair value of $0.4 million, and the debt portion of the liability was assigned a fair value at $2.7 million for a total face value of $3.1 million (C$4.2 million), with an implied effective interest rate of 14.6%.

Effective December 1, 2023, Metalla and Beedie entered into an amended and restated convertible loan facility agreement to amend and restate the loan facility. Pursuant to the A&R Loan Facility, the parties agreed to:

i. increase the maximum aggregate principal amount of the A&R Loan Facility from C$25.0 million to C$50.0 million;

ii. amend the conversion price of the of the C$4.2 million outstanding balance to a conversion price of C$6.00 per share under the A&R Loan Facility;

iii. drawdown a further C$12.2 million with a conversion price of C$6.00 per share to refinance the principal amount due under the Nova Loan Facility (the total C$16.4 million, comprised of the C$4.2 million outstanding balance plus the C$12.2 million additional drawdown being the "Principal Amount");

iv. drawdown C$2.0 million from the A&R Loan Facility to refinance the accrued and unpaid interest outstanding under the Nova Loan Facility at the close of the Nova Transaction with a conversion price equal to the market price of the shares of Metalla at the time of conversion (the "Accrued Interest Amount");

v. drawdown C$0.8 million to refinance the accrued and unpaid fees outstanding under the Nova Loan Facility at the close of the Nova Transaction, with such amounts not being convertible into Common Shares (the "Accrued Fees Amount");

vi. establish an 18-month period during which the interest of 10.0% per annum compounded monthly will be added to Accrued Interest Amount having a conversion price equal to the market price of the shares of Metalla at the time of conversion, and on June 1, 2025, reverting to a cash interest payment of 10.0% on a monthly basis.;

vii. incur an amendment fee of C$0.1 million and any outstanding costs and expenses are to be paid by Metalla; and

viii. update the existing security arrangements to include security provided by Nova and certain other subsidiaries of Metalla and Nova for the A&R Loan Facility, along with updated security arrangements at Metalla to reflect developments in our business.

On December 1, 2023, following the changes to the A&R Facility and the drawdown of the C$12.2 million, the Derivative Loan Liabilities were remeasured and were assigned a fair value of $0.9 million, and the debt portion was assigned a fair value of $11.2 million for a total face value of $12.1 million (C$16.4 million). The debt portion, including any directly attributable transaction costs and fees will be accounted for at amortized cost using the implied effective interest rate of 14.6%. The Accrued Interest Amount and the Accrued Fees Amount under the A&R Loan Facility are both accounted for as loans payable which were initially valued at fair value and subsequently measured at amortized cost and are included in the total A&R Loan Facility balance.

As at December 31, 2023, under the A&R Loan Facility, the Company had C$16.4 million outstanding from the Principal Amount with a conversion price of C$6.00 per share, C$2.1 million outstanding from the Accrued Interest Amount with a conversion price equal to the market price of the Common Shares of Metalla at the time of conversion, C$0.8 million outstanding from the Accrued Fees Amount which is not convertible into Common Shares, and had C$30.9 million available under the A&R Loan Facility with the conversion price to be determined on the date of any future advances.

Subsequent to December 31, 2023, on February 20, 2024, Beedie elected to convert C$1.5 million of the Accrued Interest Amount into Common Shares at a conversion price of C$3.49 per share, being the closing price of the shares of Metalla on the TSX-V on February 20, 2024, for a total of 429,800 Common Shares which were issued on March 19, 2024.

Other Loans

In connection with the Castle Mountain acquisition in October 2021, the Company entered into a $5.0 million loan agreement (the "Castle Mountain Loan") with the arm's length seller bearing interest at a rate of 4.0% per annum until fully repaid on June 1, 2023. On March 30, 2023, the Company signed an amendment with the arm's length seller of the Castle Mountain royalty to extend the maturity date of the Castle Mountain Loan from June 1, 2023, to April 1, 2024. As part of the amendment, on March 31, 2023, the Company paid all accrued interest on the loan, and effective April 1, 2023, the interest rate increased to 12.0% per annum, and the principal and accrued interest will be repaid no later than April 1, 2024. On July 7, 2023, the Company paid all accrued interest due at the time on the Castle Mountain Loan and made a principal repayment of $4.3 million and as at December 31, 2023, had a total of $0.7 million of principal and accrued interest owing on the Castle Mountain Loan.

Cash Flows from Operating Activities

During the year ended December 31, 2023, cash provided by operating activities was $0.5 million and was primarily the result of a net loss of $5.8 million, partially offset by $5.2 million for items not affecting cash, payments received from derivative royalty assets of $2.7 million, taxes paid of $0.8 million, and a $0.8 million decrease in non-cash working capital items. During the year ended December 31, 2022, cash used in operating activities was less than $0.1 million and was primarily the result of a net loss of $10.9 million, partially offset by $9.4 million for items not affecting cash, payments received from derivative royalty assets of $2.4 million, taxes paid of $0.3 million, and by a $0.6 million decrease in non-cash working capital items.

Cash Flows from Investing Activities

During the year ended December 31, 2023, cash used in the Company's investing activities was $3.6 million and was primarily related to acquisition of royalties and streams of $8.8 million, offset by the sale of mineral claims of $5.0 million. During the year ended December 31, 2022, cash used in the Company's investing activities was $1.3 million and was primarily related to the acquisition of royalties and streams.

Cash Flows from Financing Activities

During the year ended December 31, 2023, cash provided by the Company's financing activities was $12.8 million, which was primarily comprised of $11.1 million from the Equity Placement, $4.1 million in net proceeds from the At-The-Market equity programs, $0.4 million from the exercise of stock options, partially offset by $1.2 million in dividend payments, and $1.7 million in finance charges and interest payments. During the year ended December 31, 2022, cash provided by the Company's financing activities was $3.8 million, which was primarily comprised of $4.1 million in net proceeds from the At-The-Market equity programs, $0.3 million from the exercise of stock options, partially offset by $0.6 million of finance charges and interest payments.

At-The-Market Equity Programs

2022 ATM Program

On May 27, 2022, the Company announced that it had entered into an equity distribution agreement (the "2022 Distribution Agreement") with a syndicate of agents (collectively, the "Agents") to establish an At-The-Market equity program (the "2022 ATM Program"). Under the 2022 ATM Program, the Company could distribute up to $50.0 million (or the equivalent in Canadian Dollars) in Common Shares (the "Offered Shares"). The Offered Shares were sold by the Company, through the Agents, to the public from time to time, at the Company's discretion, at the prevailing market price at the time of sale. The net proceeds from the 2022 ATM Program were used to finance the future purchase of royalties and streams and for general working capital purposes.

The 2022 ATM Program and the 2022 Distribution Agreement were terminated by the Company on December 28, 2023. During the three months ended December 31, 2023, the Company did not distribute any Common Shares under the 2022 ATM Program. From inception to termination on December 28, 2023, the Company distributed 1,328,079 Common Shares under the 2022 ATM Program at an average price of $5.01 per share for gross proceeds of $6.6 million, with aggregate commissions paid or payable to the Agents and other share issue costs of $0.6 million, resulting in aggregate net proceeds of $6.0 million. The remaining $43.4 million of Common Shares not sold under the 2022 ATM Program are no longer available for sale and will not be issued.

2021 ATM Program

On May 14, 2021, the Company announced that it had entered into an equity distribution agreement (the "2021 Distribution Agreement") with a syndicate of agents (collectively, the "2021 Agents") to establish an At-The-Market equity program (the "2021 ATM Program"). Under the 2021 ATM Program, the Company could distribute up to $35.0 million (or the equivalent in Canadian Dollars) in Common Shares (the "2021 Offered Shares"). The 2021 Offered Shares were sold by the Company, through the 2021 Agents, to the public from time to time, at the Company's discretion, at the prevailing market price at the time of sale. The net proceeds from the 2021 ATM Program were used to finance the purchase of royalties and streams and for general working capital purposes.

The 2021 ATM Program and the 2021 Distribution Agreement were terminated on May 12, 2022. From inception on May 14, 2021, to termination on May 12, 2022, the Company distributed 1,990,778 Common Shares under the 2021 ATM Program at an average price of $8.18 per share for gross proceeds of $16.3 million, with aggregate commissions paid or payable to the 2021 Agents and other share issue costs of $1.0 million, resulting in aggregate net proceeds of $15.3 million. The remaining $18.7 million of Common Shares not sold under the 2021 ATM Program are no longer available for sale and will not be issued.

Outstanding Share Data

As at the date of this MD&A the Company had the following:

- 91,448,659 Common Shares issued and outstanding;

- 4,665,797 stock options outstanding with a weighted average exercise price of C$7.02; and

- 936,041 unvested restricted share units.

Dividends

The Company's long-term goal is to pay out dividends with a target rate of up to 50% of the annualized operating cash flow of the Company, however, the timing and amount of the payment of a dividend is determined by the Board of Directors by taking into account many factors, including (but not limited to), an increase and stabilization in operating cash flows, and the potential capital requirements related to acquisitions. Going forward, the Board of Directors of the Company will continually assess the Company's business requirements and projected cash flows to make a determination on whether to pay dividends in respect of a particular quarter during its financial year.

In July 2023, the Company announced the sale of the Pine Valley property for $5.0 million, while retaining a 3.0% NSR royalty on the property. Concurrent with the sale of the property, the Company declared a special dividend of $1.2 million (C$0.03 per share) with a record date of August 1, 2023, to allow shareholders to benefit from the sale of the property.

Requirement for additional financing

Management believes that the Company’s current operational requirements and capital investments can be funded from existing cash, cash generated from operations, and funds available under the A&R Loan Facility. If future circumstances dictate an increased cash requirement and the Company elects not to delay, limit, or eliminate some of its plans, the Company may raise additional funds through debt financing, the sale of non-core assets, the issuance of hybrid debt-equity securities, or additional equity securities. The Company has relied on equity financings and loans for its acquisitions, capital expansions, and operations. Capital markets may not be receptive to offerings of new equity from treasury or debt, whether by way of private placements or public offerings. The Company’s growth and success may be dependent on external sources of financing which may not be available on acceptable terms.

TRANSACTIONS WITH RELATED PARTIES

The aggregate value of transactions and outstanding balances relating to key management personnel were as follows:

Key management compensation for the Company consists of remuneration paid to management (which includes Brett Heath, the Chief Executive Officer, and Saurabh Handa, the Chief Financial Officer) for services rendered and compensation for members of the Board of Directors (which includes Lawrence Roulston, Alexander Molyneux, James Beeby, Amanda Johnston, and previously included Terry Krepiakevich (ret. effective May 22, 2022), Douglas Silver (res. effective May 17, 2023), and E.B. Tucker (ret. effective December 5, 2023) in their capacity as directors of the Company.

The Company's key management compensation was as follows:

| | | Year ended | |

| | | December 31, | |

| | | 2023 | | | 2022 | |

| Salaries and fees | $ | 1,718 | | $ | 1,304 | |

| Share-based payments | | 1,560 | | | 2,096 | |

| | $ | 3,278 | | $ | 3,400 | |

As at December 31, 2023, the Company had $0.6 million due to directors and management related to remuneration and expense reimbursements, which have been included in accounts payable and accrued liabilities. As at December 31, 2023, the Company had $Nil due from directors and management.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this MD&A, the Company does not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on the results of operations or financial condition of the Company, including, and without limitation, such considerations as liquidity and capital resources.

PROPOSED TRANSACTIONS

While the Company continues to pursue further transactions, there are no binding transactions of a material nature that have not already been disclosed publicly.

COMMITMENTS

Contractual Commitments

As at December 31, 2023, the Company had the following contractual commitments:

| | | Less than | | | 1 to | | | Over | | | | |

| | | 1 year | | | 3 years | | | 3 years | | | Total | |

| Trade and other payables | $ | 5,394 | | $ | - | | $ | - | | $ | 5,394 | |

| Loans payable principal and interest payments(1) | | 351 | | | 3,355 | | | 17,457 | | | 21,163 | |

| Payments related to acquisition of royalties and streams(2)(3)(4) | | 1,618 | | | 2,500 | | | - | | | 4,118 | |

| Total commitments | $ | 7,363 | | $ | 5,855 | | $ | 17,457 | | $ | 30,675 | |

(1) Payments required to be made on the A&R Loan Facility based on the closing balance as at December 31, 2023.

(2) Payment required for the Castle Mountain Loan including accrued interest.

(3) Payment required for the royalty on the Lama project of $2.5 million, payable in cash or Common Shares within 90 days upon the earlier of a 2 Moz gold Mineral Reserve estimate on the royalty area or March 9, 2026.

(4) Payment required for the Copper World acquisition of $0.9 million, payable by July 2024.

Contingent Commitments

In addition to the contractual commitments above, the Company could in the future have additional commitments payable in cash and/or shares related to the acquisition of royalty and stream interests. However, these payments are subject to certain triggers or milestone conditions that had not been met as of December 31, 2023.

As at December 31, 2023, the Company had the following contingent commitments:

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the CentroGold project of $7.0 million payable in Common Shares upon receipt of all project licenses, the lifting or extinguishment of the injunction imposed on the CentroGold project with no pending appeals and, if necessary, the completion of any and all community relocations, and $4.0 million in cash upon the achievement of commercial production at the project;

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the NuevaUnión copper-gold project of $2.0 million in cash and $2.0 million in Common Shares upon achievement of commercial production at the La Fortuna deposit in Chile;

- the Company is obligated to make additional potential payments in connection with its acquisition of its royalty on the Hoyle Pond Extension property, the Timmins West Extension property, and the DeSantis Mine property totalling C$5.0 million in cash and Common Shares upon achievement of various production milestones; and

- The Company is obligated to make additional potential payments in connection with its acquisition of its royalty on Vizcachitas of $4.5 million payable in Common Shares upon the first to occur of: (i) Los Andes Copper or its successors or assign makes a fully-financed construction decision on the Vizcachitas project; (ii) Los Andes Copper or its successor or assign enters into an earn-in transaction with respect to the Vizcachitas project or for Los Andes Copper itself, with a third party, for a minimum interest of 51%; or (iii) Los Andes Copper or its successor or assign sells the Vizcachitas project or Los Andes Copper to an arms' length third party.

FINANCIAL INSTRUMENTS

Classification

The Company classified its financial instruments as follows:

| | | As at | |

| | | December 31, | | | December 31, | |

| | | 2023 | | | 2022 | |

| Financial assets | | | | | | |

| Amortized cost: | | | | | | |

| Cash | $ | 14,107 | | $ | 4,555 | |

| Royalty, derivative royalty, and stream receivables | | 2,482 | | | 1,190 | |

| Other receivables | | 329 | | | 316 | |

| Fair value through profit or loss: | | | | | | |

| Derivative royalty asset | | - | | | 2,182 | |

| Marketable securities | | 295 | | | 30 | |

| Total financial assets | $ | 17,213 | | $ | 8,273 | |

| | | | | | | |