UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-23309

Destra International & Event-Driven Credit Fund

(Exact name of registrant as specified in charter)

444 West Lake Street, Suite 1700

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Robert A. Watson

C/O Destra Capital Advisors LLC

444 West Lake Street, Suite 1700

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 843-6161

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

ITEM 1. REPORTS TO STOCKHOLDERS.

Destra International & Event-Driven Credit Fund

Annual Report

September30, 2019

Beginning on January1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website at www.destracapital.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank), through the Fund’s transfer agent by calling the Fund toll-free at 844-9DESTRA (933-7872), or if you are a direct investor, by enrolling at www.destracapital.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call toll-free at 844-9DESTRA (933-7872) to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the Destra Fund Complex if you invest directly with the Fund.

2

Fellow Shareholders,

We are pleased to present you with your Fiscal 2019 Annual Report (the “Report”) for the Destra International & Event Driven Credit Fund (the “Fund”), a closed-end interval fund. This Annual Report covers the period between October1, 2018 and September30, 2019 (the “Fiscal Year”).

An Annual Report can serve like an “owner’s manual” for a fund and you should read it just as carefully. This Report includes a list of the investments for the fund, as well as a summary of market conditions over the fiscal year and comments from the fund’s Sub-Advisor, BlueBay Asset Management LLP (“BlueBay”), that looks at the performance during the period covered and provides insights into the manager’s view of the current market and their outlook for the strategy going forward.

For the 12months ended, September30, 2019, the Stock market, as represented by the S&P 500 index (“S&P”) returned a seemingly modest 4.25%. But that modest return belied a dramatic series of events in stocks that saw the index fall by over-13.5% in the 4th quarter of 2018 (the first quarter of the Fund’s Fiscal Year) and then rally over +20.5% in the first three quarters of 2019. This extreme market volatility had many investors looking at other asset classes like Bonds and Alternatives as potential diversifiers from the volatility of stocks.

Bonds, as measured by the Bloomberg Barclays US Aggregate Index (“Agg”) returned 10.30% for the Fiscal Year period, handily outpacing Stocks. Alternatives, such as the Morningstar Diversified Alternative Index (“MDA”) were more muted, posting a flat +0.43% return in the Fiscal Year.

By contrast, the Destra International & Event Driven Credit Fund returned 7.85%, for the I shares during the period. This handily outpaced the Stock and Alt indexes and compared favorably to Bonds during the period.

The Fund was launched on May 9th, 2018 and is sub-advised by BlueBay. BlueBay is a premier alternative income asset manager based in the UK, with over $62billion under management and 18 years of experience managing credit, debt, and distressed assets. We are thrilled to be working with such a storied and tenured manager.

Thank you for being a Shareholder of the Fund. We appreciate the trust you have placed in us and our investment partner, BlueBay, to manage your money. Please read this Report carefully and be sure to contact your Financial Advisor or Destra Capital if you have any follow on questions.

Sincerely,

Robert A. Watson, CFP(R)

President

Destra Capital Advisors LLC

Destra International & Event-Driven Credit Fund

3

Destra International & Event-Driven Credit Fund |

Manager’s Commentary (unaudited) |

|

Investment Environment

It is fair to say that international fixed income markets have endured an eventful period. The last quarter of 2018 saw rising fears over global growth led by China and Europe mostly triggered by concerns around the implications of an escalating trade war. This came at a time when the European Central Bank was ending QE and the Federal Reserve was still signalling further rate hikes, which in turn, led to a risk off environment, pushing spreads significantly wider and government bond yields lower as investors sought higher quality assets. As we entered 2019, the expectations of renewed stimulus from global central banks helped resurrect confidence and market sentiment. As central bank messaging started to indicate that further stimulus was coming, the risk rally took hold and credit spreads recovered much of their losses from 2018. Over the 12month period to end September, German bund and US Treasury yields fell well over 100bps, while corporate credit spreads have recovered all their widening in late 2018 to end up close to unchanged. Clearly the meaningful rally in core government yields means that total returns on bond indices are generally very strong over the period and leaves yields on bonds indices back near the lows. Despite the renewed optimism and general market strength, one of the most noteworthy themes has been that of “bullish decompression” whereby better-quality assets have outperformed their lower rated peers. Underlying this unusual move is investors preference for “safe risk” and ongoing concerns as to the overall resilience of the global economy. As a result, in High Yield assets for instance, we have seen BB rated securities significantly outperform CCC rated securities. For our event driven strategy that phenomenon is presenting a growing opportunity set and the chance to employ credit selection skills (rather than being reliant on market beta for returns).

Performance Discussion

For the twelve-month period ended September30, 2019, the Fund had a return of 7.85%, net of fees. All the asset classes invested in the Fund delivered positive returns.

The largest contribution to returns over the year came from the allocation to multi-asset credit assets, which represented 60% of managed assets. Notably, after a difficult fourth quarter to 2018, exposure to Contingent Convertibles (“Cocos”) in European national champion banks, specifically in Italy, France and the Netherlands, were the main driver for returns. This was primarily driven by expectations of accommodating European Central Bank monetary policy — specific tiered deposits (protecting financial institution’s deposits from negative interest rates) and the restarting of the bank’s quantitative easing program.

Emerging market hard currency and local currency assets also both contributed to returns over the period. In the hard currency space, notable contributors were holdings in oil-sensitive and high yielding assets, such as Nigeria, Ecuador and Egypt. While in local currency, duration in local-currency assets in Mexico, Colombia and Peru were a key contributor to performance over the period.

Holdings in Catalonia and Greece helped drive the positive returns. This was driven by a strong recovery in the periphery, fuelled by the hope of ECB stimulus to prevent the eurozone economy from stalling.

The allocation to less liquid high yield and loans, which represented 40% of managed assets, was also positive and driven by holdings in the basic industry (Momentive, Maccaferri), banking (Monte dei Paschi), capital goods, media and technology and electronics.

Portfolio Activity

The Fund maintained a well-diversified mix of assets during the period, with meaningful allocations in Europe (53%), North America (17%), South and Central America (7%), Africa & the Middle East (8%) and Asia (9%). The remainder of the Fund was allocated to cash and derivatives at the end of the reporting period.

The Fund benefited from increasing leverage to 24% during the first half of 2019 when most asset classes rallied. In July, the Fund started to decrease leverage locking-in gains; leverage at the end of the period was 9%.

Viewpoint & Outlook

The backdrop of a somewhat accommodative Federal Reserve, confirmation of renewed support from the European Central Bank and a growing band of negative yielding assets across global risk markets, in theory extend the runway for global corporates and credit markets more generally over the medium term. Mediocre but positive growth and low rates is historically a good environment for credit risk. Political, economic and trade related volatility are still clearly rife however and the apparent safety net from monetary policy cannot be viewed in isolation. Indeed, the variance in corporate results across sectors and individual issuers underline that a degree of caution remains prudent and that good credit selection is paramount. That said, this variance in results is producing a much more fertile environment for our Event Driven sleeve where we see increased levels of volatility when a company does miss earnings or disappoint in some way as producing a wide range of capital appreciation opportunities for us to capitalize on. Drawing on the skill set of our wider global leveraged finance team of analysts is crucial at this point in the cycle as we are able to react quickly to developing situations with which we as a team are already familiar.

4

Destra International & Event-Driven Credit Fund |

Performance and Graphical Illustration |

September30, 2019 (unaudited) |

Average Annual and Cumulative Total Return for the period ended September 30, 2019 |

Inception Date: May 9, 2018 | | Inception Date: December 21, 2018 |

Share Class | | 1 Year | | Since Inception

Average Annual | | Since Inception

Cumulative | | Share Class | | Since Inception

Cumulative |

Class I | | 7.85% | | 5.31% | | 7.48% | | Class A at NAV | | 11.42 | % |

| | | | | | | | Class A with Load | | 5.03 | % |

Class L at NAV | | 11.22 | % |

Class L with Load | | 6.49 | % |

Class T at NAV | | 11.01 | % |

Class T with Load | | 7.69 | % |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Please read the Fund’s Prospectus, including the description of the Fund’s repurchase policy carefully before investing. For performance information current to the most recent month-end, please call the Fund at 1-844-9DESTRA (933-7873).

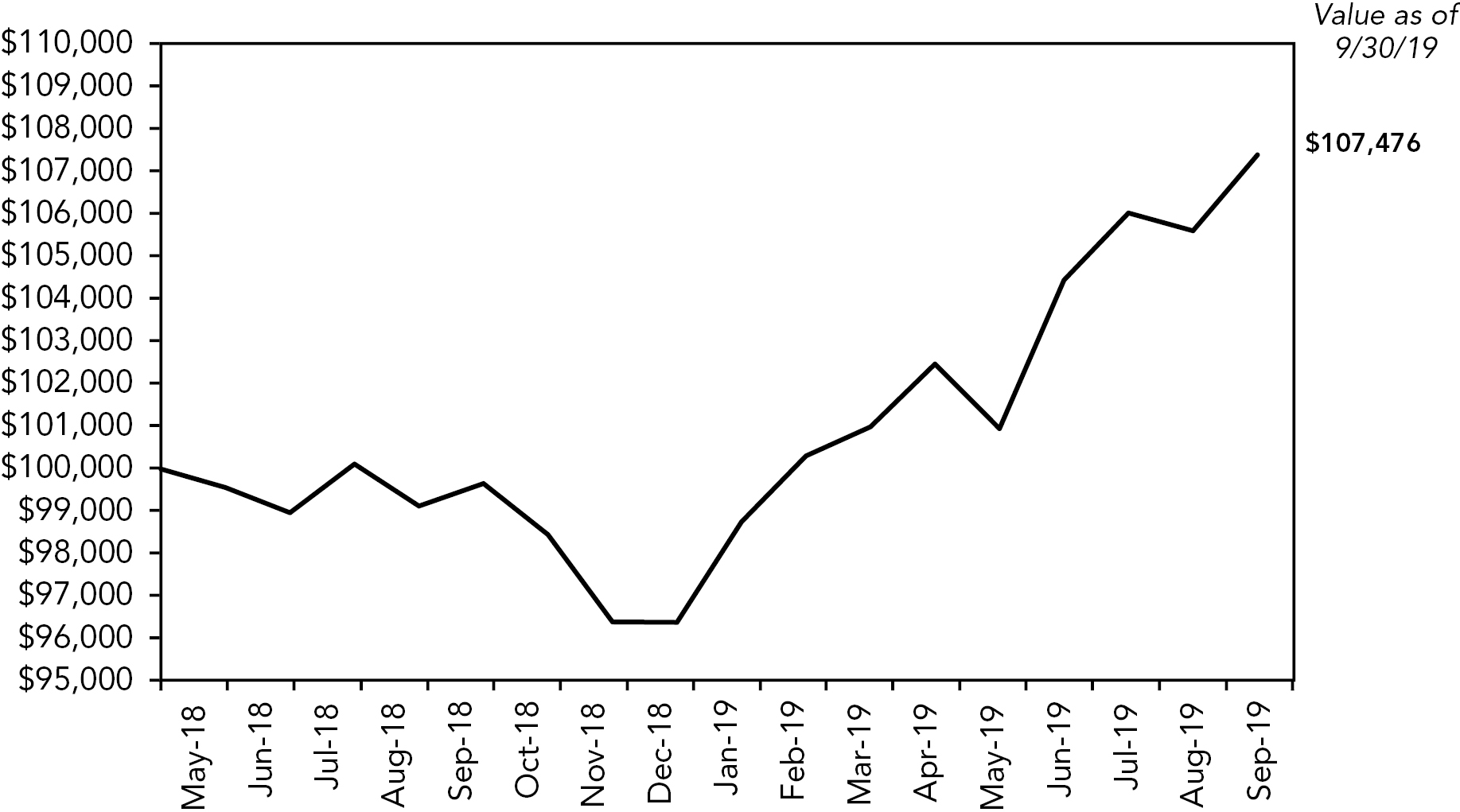

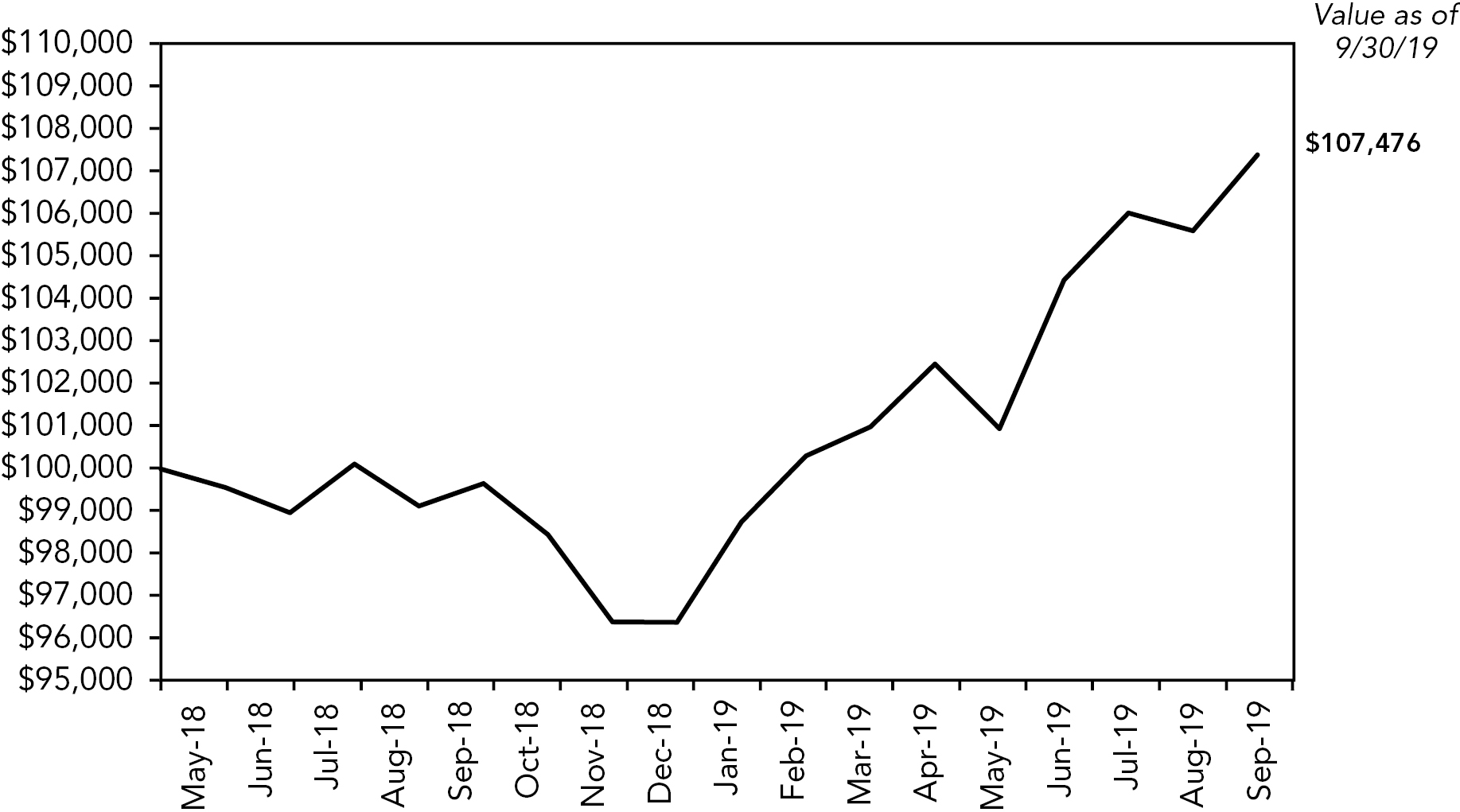

Growth of an Assumed $100,000 Investment

This graph illustrates the hypothetical investment of $100,000 in the Fund, Class I, from May9, 2018 (inception date) to September30, 2019. The Average Annual and Cumulative Total Return table and Growth of Assumed $100,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

5

Destra International & Event-Driven Credit Fund |

Performance and Graphical Illustration (continued) |

September30, 2019 (unaudited) |

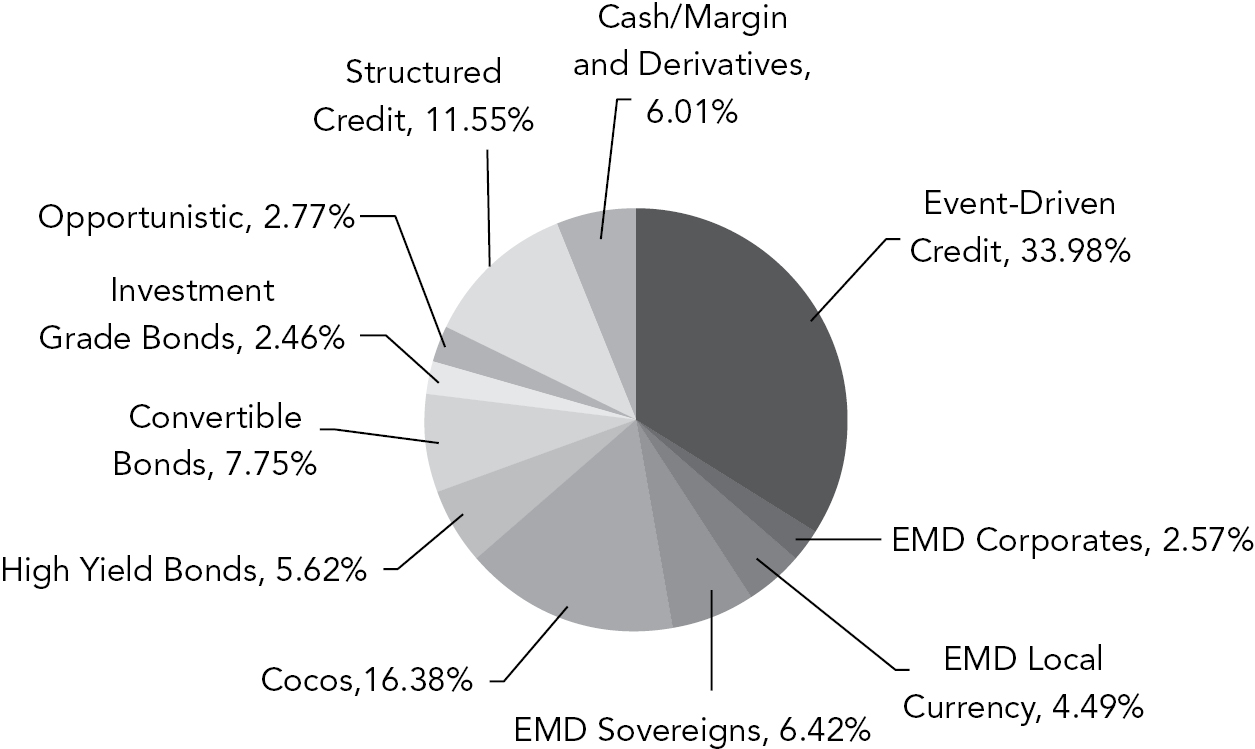

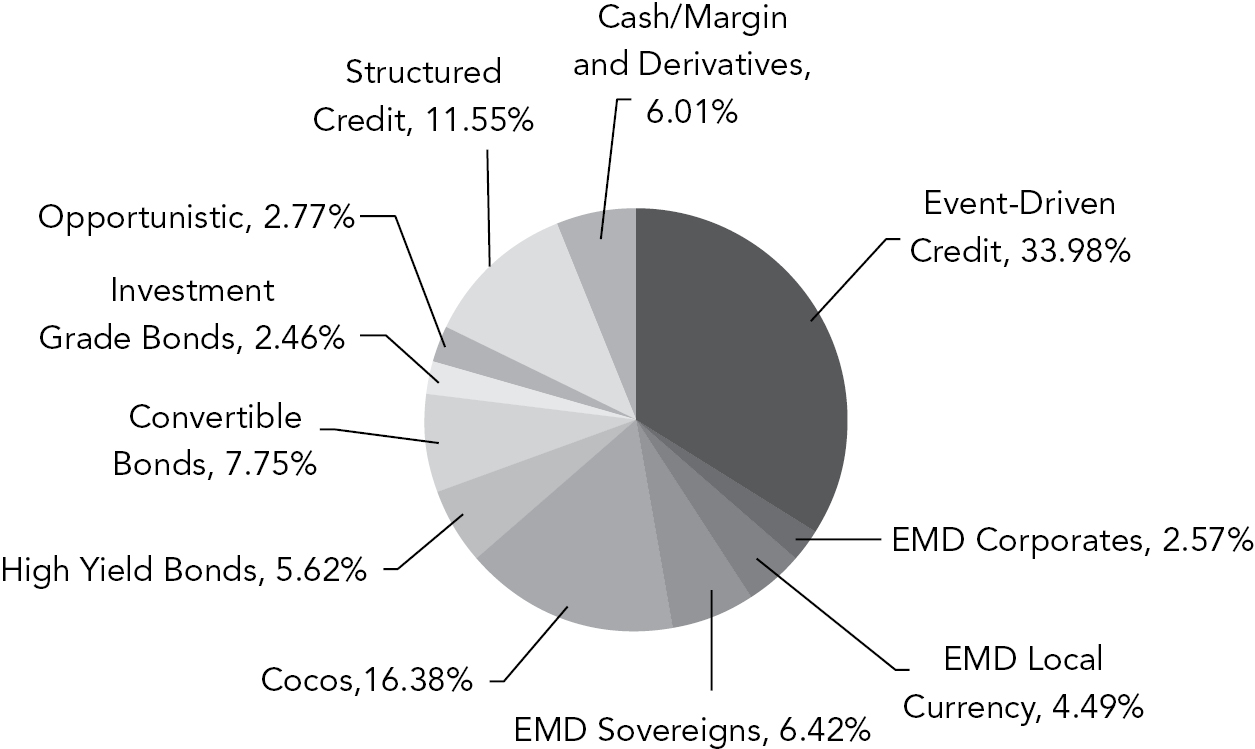

Summary of Portfolio Assets Allocation

The above chart provides a visual breakdown of the Fund’s major investment types that the underlying securities represent, as a percentage of the total investments held as of September30, 2019. Please see the Schedule of Investments on the following pages for a detailed list of the Fund’s holdings. The Fund’s portfolio composition is subject to change at any time and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

6

Destra International & Event-Driven Credit Fund |

Schedule of Investments |

As of September30, 2019 |

Shares or

Principal

Amounts | | Description | | Value |

| | | ASSET-BACKED SECURITIES – 12.5% |

| | | IRELAND – 11.7% | | | |

500,000 | | Crosthwaite Park CLO DAC, Class C, (Series 1A), 4.250% (3-Month EUR Libor + 425 basis points), 4.250% Floor, 03/15/2032(1)(2) | | $ | 547,699 |

1,000,000 | | Euro-Galaxy V CLO BV, Class ER, (Series 2016-5A), 6.000% (3-Month EUR Libor + 600 basis points), 6.000% Floor,

11/10/2030(1)(2) | | | 1,090,401 |

500,000 | | Jubilee CLO BV, Class D, (Series 2018-21X), 3.550% (3-Month EUR Libor + 355 basis points), 3.550% Floor, 01/15/2032(1) | | | 538,253 |

1,250,000 | | OCP Euro CLO DAC, Class E, (Series 2019-3A), 5.750% (3-Month EUR Libor + 575 basis points), 5.750% Floor, 04/20/2030(1)(2) | | | 1,343,249 |

500,000 | | Penta CLO 5 DAC, Class DE, (Series 2018-5X), 3.600% (3-Month EUR Libor + 360 basis points), 3.600% Floor, 10/20/2032(1) | | | 547,505 |

500,000 | | Providus CLO II DAC, Class D, (Series 2X), 3.450% (3-Month EUR Libor + 345 basis points), 3.450% Floor, 07/15/2031(1) | | | 546,797 |

250,000 | | Providus CLO II DAC, Class DNE, (Series 2X), 3.450% (3-Month EUR Libor + 345 basis points), 3.450% Floor, 07/15/2031(1) | | | 273,398 |

500,000 | | Rockford Tower Europe CLO DAC, Class CE, (Series 2018-1X), 2.470% (3-Month EUR Libor + 247 basis points), 2.470% Floor, 12/20/2031(1) | | | 545,948 |

1,000,000 | | Tikehau CLO, Class F, (Series 5A), 8.420% (3-Month EUR Libor + 842 basis points), 8.420% Floor, 04/15/2032(1)(2) | | | 1,028,344 |

| | | | | | 6,461,594 |

| | | UNITED STATES – 0.8% | | | |

500,000 | | Ballyrock CLO, Ltd., Class D, (Series 2018-1A), 8.078% (3-Month USD Libor + 580 basis points), 0.00% Floor, 04/20/2031(1)(2) | | | 453,457 |

| | | TOTAL ASSET-BACKED SECURITIES | | | |

| | | (Cost $7,084,853) | | | 6,915,051 |

Shares or

Principal

Amounts | | Description | | Value |

| | | BANK LOANS – 5.2% | | | |

| | | FRANCE – 0.8% | | | |

287,000 | | Casper Bidco SASU, 8.500% (3-Month EUR Libor + 850 basis points), 8.500% Floor, 07/30/2027(1) | | $ | 313,657 |

133,000 | | Casper Bidco SASU, 8.500% (3-Month EUR Libor + 850 basis points), 8.500% Floor, 07/12/2027(1) | | | 145,353 |

| | | | | | 459,010 |

| | | | | | |

| | | LUXEMBOURG – 0.6% | | | |

352,000 | | Connect Finco SARL, 5.500% (3-Month USD Libor + 450 basis points), 09/23/2026(1)(3) | | | 347,077 |

| | | | | | |

| | | NETHERLANDS – 0.7% | | | |

397,906 | | MediArena Acquisition BV, 8.350% (3-Month USD Libor + 575 basis points), 08/13/2021(1) | | | 393,927 |

| | | | | | |

| | | SWEDEN – 0.4% | | | |

180,000 | | Verisure Holding AB, 3.500% (3-Month EUR Libor + 350 basis points), 10/21/2022(1) | | | 197,517 |

| | | | | | |

| | | UNITED STATES – 2.7% | | | |

200,000 | | Advanced Drainage Systems, Inc., 2.250% (3-Month USD Libor + 225 basis points), 09/18/2026(1)(3) | | | 201,167 |

295,000 | | California Resources Corp., 6.794% (3-Month USD Libor + 475 basis points), 12/31/2022(1) | | | 264,025 |

383,839 | | Dell International LLC, 4.050% (3-Month USD Libor + 200 basis points), 09/19/2025(1) | | | 386,101 |

500,000 | | Fieldwood Energy LLC, 9.506% (3-Month USD Libor + 725 basis points), 04/11/2023(1) | | | 377,777 |

255,215 | | Granite Holdings US Acquisition Co., 7.266% (3-Month USD Libor + 525 basis points), 09/30/2026(1) | | | 249,473 |

| | | | | | 1,478,543 |

| | | TOTAL BANK LOANS | | | |

| | | (Cost $3,033,476) | | | 2,876,074 |

| | | | | | |

| | | COMMON STOCKS – 0.1% | | | |

| | | MARSHALL ISLANDS – 0.1% | | | |

2,411 | | Scorpio Tankers, Inc. | | | 71,757 |

| | | TOTAL COMMON STOCKS | | | |

| | | (Cost $48,540) | | | 71,757 |

See accompanying Notes to Financial Statements.

7

Destra International & Event-Driven Credit Fund |

Schedule of Investments(continued) |

As of September30, 2019 |

Shares or

Principal

Amounts | | Description | | Value |

| | | CORPORATE DEBT SECURITIES – 25.0% | | | |

| | | AUSTRALIA – 0.2% | | | |

| | | Quintis Australia Pty, Ltd.: | | | |

6,750 | | 7.500%, 10/01/2026(2)(8) | | $ | 6,750 |

117,000 | | 0.000%, 10/01/2028(2)(8) | | | 76,190 |

| | | | | | 82,940 |

| | | | | | |

| | | AUSTRIA – 0.9% | | | |

241,000 | | Eldorado Intl. Finance GmbH, 8.625%, 06/16/2021(2) | | | 251,697 |

200,000 | | Erste Group Bank AG, 6.500%(4)(5)(6) | | | 252,035 |

| | | | | | 503,732 |

| | | | | | |

| | | CANADA – 1.5% | | | |

500,000 | | First Quantum Minerals, Ltd., 7.250%, 05/15/2022(2) | | | 497,715 |

300,000 | | Telesat Canada / Telesat LLC, 8.875%, 11/15/2024(2) | | | 322,200 |

| | | | | | 819,915 |

| | | | | | |

| | | CAYMAN ISLANDS – 3.6% | | | |

600,000 | | China Overseas Finance Investment Cayman V, Ltd., 0.000%, 01/05/2023(7) | | | 662,749 |

560,000 | | Ctrip.com International, Ltd., 1.990%, 07/01/2025 | | | 567,472 |

200,000 | | GEMS MENASA Cayman, Ltd. / GEMS Education Delaware LLC, 7.125%, 07/31/2026(2) | | | 207,000 |

500,000 | | Huazhu Group, Ltd., 0.375%, 11/01/2022 | | | 520,384 |

| | | | | | 1,957,605 |

| | | | | | |

| | | COLOMBIA – 0.6% | | | |

1,084,000,000 | | Empresas Publicas de Medellin ESP, 8.375%, 11/08/2027(2) | | | 334,039 |

| | | | | | |

| | | FRANCE – 0.4% | | | |

200,000 | | Altice France SA/France, 7.375%, 05/01/2026(2)(4) | | | 214,942 |

| | | | | | |

| | | LUXEMBOURG – 4.5% | | | |

| | | Altice Luxembourg SA: | | | |

742,000 | | 10.500%, 05/15/2027(2) | | | 838,089 |

991,000 | | 8.000%, 05/15/2027(2) | | | 1,189,303 |

420,000 | | LHMC Finco 2 Sarl, 7.250%, 10/02/2025(2) | | | 467,080 |

| | | | | | 2,494,472 |

| | | | | | |

| | | NETHERLANDS – 0.6% | | | |

300,000 | | Telefonica Europe BV, 3.875%(4)(5)(6) | | | 351,860 |

| | | | | | |

| | | UNITED KINGDOM – 0.8% | | | |

400,000 | | Lloyds Banking Group PLC, 7.500%(4)(5)(6) | | | 426,842 |

Shares or

Principal

Amounts | | Description | | Value |

| | | CORPORATE DEBT SECURITIES (continued) | | | |

| | | UNITED STATES – 11.9% | | | |

223,000 | | American Axle & Manufacturing, Inc., 6.250%, 04/01/2025 | | $ | 217,425 |

258,000 | | Capitol Investment Merger Sub 2 LLC, 10.000%, 08/01/2024(2) | | | 268,320 |

209,000 | | CITGO Petroleum Corp., 6.250%, 08/15/2022(2) | | | 212,135 |

646,000 | | CSC Holdings LLC,

10.875%, 10/15/2025(2) | | | 732,774 |

196,000 | | Diamond Sports Group LLC / Diamond Sports Finance Co., 6.625%, 08/15/2027(2) | | | 203,840 |

509,000 | | Freedom Mortgage Corp., 8.250%, 04/15/2025(2) | | | 469,553 |

173,000 | | Frontier Communications Corp., 8.500%, 04/01/2026(2) | | | 173,415 |

| | | Gulfport Energy Corp.: | | | |

297,000 | | 6.375%, 05/15/2025 | | | 212,355 |

298,000 | | 6.375%, 01/15/2026 | | | 210,090 |

400,000 | | Intrepid Aviation Group Holdings LLC / Intrepid Finance Co., 8.500%, 08/15/2021(2) | | | 411,400 |

428,000 | | KB Home, 8.000%, 03/15/2020 | | | 439,428 |

567,000 | | Laureate Education, Inc.,

8.250%, 05/01/2025(2) | | | 619,447 |

500,000 | | Nationstar Mortgage Holdings, Inc., 9.125%, 07/15/2026(2) | | | 533,125 |

75,000 | | Neon Holdings, Inc., 10.125%, 04/01/2026(2) | | | 75,750 |

245,000 | | Realogy Group LLC / Realogy Co.-Issuer Corp., 9.375%, 04/01/2027(2) | | | 228,835 |

314,000 | | Resolute Forest Products, Inc., 5.875%, 05/15/2023 | | | 315,570 |

350,000 | | Teva Pharmaceutical Finance IV LLC, 2.250%, 03/18/2020 | | | 346,063 |

891,000 | | TransDigm, Inc., 6.000%, 07/15/2022 | | | 906,592 |

| | | | | | 6,576,117 |

| | | TOTAL CORPORATE DEBT SECURITIES | | | |

| | | (Cost $13,380,907) | | | 13,762,464 |

| | | | | | |

| | | INTERNATIONAL DEBT SECURITIES – 54.4% | | | |

| | | BERMUDA – 0.9% | | | |

500,000 | | Ship Finance International, Ltd., 5.750%, 10/15/2021 | | | 523,465 |

| | | | | | |

| | | BRAZIL – 0.8% | | | |

400,000 | | Banco do Brasil SA/Cayman, 9.000%(4)(5)(6) | | | 449,400 |

See accompanying Notes to Financial Statements.

8

Destra International & Event-Driven Credit Fund |

Schedule of Investments(continued) |

As of September30, 2019 |

Shares or

Principal

Amounts | | Description | | Value |

| | | INTERNATIONAL DEBT SECURITIES (continued) | | | |

| | | CAYMAN ISLANDS – 1.7% | | | |

4,000,000 | | China Education Group Holdings, Ltd., 2.000%, 03/28/2024 | | $ | 544,047 |

520,000 | | Logan Property Holdings Co., Ltd., 6.125%, 04/16/2021 | | | 380,203 |

| | | | | | 924,250 |

| | | | | | |

| | | CHINA – 1.6% | | | |

3,000,000 | | China Railway Construction Corp., Ltd., 1.500%, 12/21/2021 | | | 415,253 |

500,000 | | CRRC Corp., Ltd., 0.000%, 02/05/2021(7) | | | 479,071 |

| | | | | | 894,324 |

| | | | | | |

| | | COLOMBIA – 0.7% | | | |

400,000 | | Colombia Telecomunicaciones SAESP, 8.500%(5)(6) | | | 411,500 |

| | | | | | |

| | | ECUADOR – 1.2% | | | |

| | | Ecuador Government International Bond: | | | |

200,000 | | 8.875%, 10/23/2027 | | | 200,002 |

500,000 | | 7.875%, 01/23/2028 | | | 475,630 |

| | | | | | 675,632 |

| | | | | | |

| | | EGYPT – 1.0% | | | |

| | | Egypt Government International Bond: | | | |

200,000 | | 4.750%, 04/16/2026 | | | 224,156 |

312,000 | | 6.375%, 04/11/2031 | | | 354,728 |

| | | | | | 578,884 |

| | | | | | |

| | | FRANCE – 2.9% | | | |

| | | BNP Paribas SA: | | | |

200,000 | | 7.000%(4)(5)(6) | | | 220,354 |

810,000 | | 6.625%(2)(4)(5)(6) | | | 854,117 |

200,000 | | Electricite de France SA, 5.375%(4)(5)(6) | | | 249,918 |

200,000 | | Orange SA, 5.000%(4)(5)(6) | | | 266,104 |

| | | | | | 1,590,493 |

| | | | | | |

| | | GERMANY – 0.3% | | | |

200,000 | | KME AG, 6.750%, 02/01/2023 | | | 180,854 |

| | | | | | |

| | | GHANA – 0.5% | | | |

260,000 | | Ghana Government International Bond, 8.125%, 03/26/2032 | | | 261,911 |

| | | | | | |

| | | GREECE – 2.5% | | | |

| | | Hellenic Republic Government Bond: | | | |

425,000 | | 3.875%, 03/12/2029(2)(4) | | | 567,107 |

110,000 | | 3.900%, 01/30/2033(4) | | | 150,080 |

Shares or

Principal

Amounts | | Description | | Value |

| | | INTERNATIONAL DEBT SECURITIES (continued) | | | |

| | | GREECE (continued) | | | |

230,000 | | 4.000%, 01/30/2037(4) | | $ | 321,599 |

230,000 | | 4.200%, 01/30/2042(4) | | | 336,337 |

| | | | | | 1,375,123 |

| | | | | | |

| | | ITALY – 7.9% | | | |

967,000 | | Banca Monte dei Paschi di Siena SpA, 5.375%, 01/18/2028(6) | | | 766,961 |

360,000 | | Enel SpA, 3.375%, 11/24/2081(4)(6) | | | 423,570 |

| | | Intesa Sanpaolo SpA: | | | |

247,000 | | 7.750%(4)(5)(6) | | | 317,561 |

800,000 | | 6.250%(4)(5)(6) | | | 940,371 |

440,000 | | Moby SpA, 7.750%,

02/15/2023 | | | 143,160 |

703,000 | | Officine Maccaferri-SpA, 5.750%, 06/01/2021 | | | 421,509 |

600,000 | | Saxa Gres SpA, 7.000%, 07/10/2023(8) | | | 654,093 |

600,000 | | UniCredit SpA, 6.625%(4)(5)(6) | | | 683,878 |

| | | | | | 4,351,103 |

| | | | | | |

| | | JERSEY – 0.8% | | | |

400,000 | | AA Bond Co., Ltd., 5.500%, 07/31/2043(4) | | | 428,012 |

| | | | | | |

| | | LUXEMBOURG – 3.3% | | | |

404,000 | | Avation Capital SA, 6.500%, 05/15/2021(2) | | | 420,160 |

1,404,000 | | Lecta SA, 6.500%, 08/01/2023 | | | 655,507 |

200,000 | | LSF10 Wolverine Investments SCA, 5.000%, 03/15/2024(4) | | | 224,304 |

1,400,000 | | Swiss Insured Brazil Power Finance Sarl, 9.850%, 07/16/2032(4) | | | 381,476 |

100,000 | | Telecom Italia Finance SA, 7.750%, 01/24/2033(4) | | | 162,001 |

| | | | | | 1,843,448 |

| | | | | | |

| | | MEXICO – 0.8% | | | |

8,800,000 | | America Movil SAB de C.V., 8.460%, 12/18/2036(4) | | | 434,562 |

| | | | | | |

| | | NETHERLANDS – 6.5% | | | |

600,000 | | ABN AMRO Bank, 4.750%(4)(5)(6) | | | 684,553 |

800,000 | | Cooperatieve Rabobank UA, 4.625%(4)(5)(6) | | | 948,715 |

714,000 | | EA Partners II BV, 6.750%, 06/01/2021(9) | | | 324,870 |

500,000 | | ING Groep, 6.750%(5)(6) | | | 526,202 |

370,000 | | Petrobras Global Finance BV, 6.900%, 03/19/2049 | | | 425,130 |

See accompanying Notes to Financial Statements.

9

Destra International & Event-Driven Credit Fund |

Schedule of Investments(continued) |

As of September30, 2019 |

Shares or

Principal

Amounts | | Description | | Value |

| | | INTERNATIONAL DEBT SECURITIES (continued) | | | |

| | | NETHERLANDS (continued) | | | |

391,000 | | Summer BidCo BV, 9.000%, 11/15/2025(2) | | $ | 450,619 |

175,000 | | UPC Holding BV, 3.875%, 06/15/2029 | | | 201,139 |

| | | | | | 3,561,228 |

| | | | | | |

| | | NIGERIA – 1.0% | | | |

500,000 | | Nigeria Government International Bond, 7.875%, 02/16/2032 | | | 527,735 |

| | | | | | |

| | | PERU – 0.7% | | | |

1,200,000 | | Peru Government Bond, 5.940%, 02/12/2029(2) | | | 402,370 |

| | | | | | |

| | | POLAND – 0.7% | | | |

1,400,000 | | Republic of Poland Government Bond, 2.750%, 04/25/2028(4) | | | 371,036 |

| | | | | | |

| | | PORTUGAL – 0.9% | | | |

400,000 | | Caixa Geral de Depositos SA, 10.750%(4)(5)(6) | | | 508,017 |

| | | | | | |

| | | SINGAPORE – 0.6% | | | |

368,405 | | Mulhacen Pte, Ltd., 6.500%, 08/01/2023 | | | 331,621 |

| | | | | | |

| | | SOUTH AFRICA – 0.6% | | | |

5,700,000 | | Republic of South Africa Government Bond, 8.750%, 02/28/2048 | | | 332,551 |

| | | | | | |

| | | SPAIN – 3.8% | | | |

200,000 | | Autonomous Community of Catalonia, 4.220%, 04/26/2035(4) | | | 273,681 |

| | | Bankia SA: | | | |

400,000 | | 6.000%(4)(5)(6) | | | 451,585 |

400,000 | | 6.375%(4)(5)(6) | | | 462,403 |

| | | CaixaBank SA: | | | |

400,000 | | 6.750%(4)(5)(6) | | | 479,884 |

200,000 | | 5.250%(4)(5)(6) | | | 212,308 |

206,000 | | Haya Finance 2017 SA, 5.250%, 11/15/2022 | | | 200,655 |

| | | | | | 2,080,516 |

| | | | | | |

| | | SWEDEN – 0.8% | | | |

300,000 | | Fastighets AB Balder, 3.000%, 03/07/2078(4)(6) | | | 334,814 |

100,000 | | Intrum AB, 3.125%, 07/15/2024(4) | | | 111,056 |

| | | | | | 445,870 |

| | | | | | |

| | | SWITZERLAND – 1.2% | | | |

600,000 | | Credit Suisse Group AG, 7.250%(4)(5)(6) | | | 642,513 |

Shares or

Principal

Amounts | | Description | | Value |

| | | INTERNATIONAL DEBT SECURITIES (continued) | | | |

| | | TUNISIA – 2.4% | | | |

| | | Banque Centrale de Tunisie International Bond: | | | |

400,000 | | 5.625%, 02/17/2024 | | $ | 424,257 |

1,030,000 | | 5.750%, 01/30/2025 | | | 925,634 |

| | | | | | 1,349,891 |

| | | | | | |

| | | UNITED KINGDOM – 7.0% | | | |

570,000 | | Barclays PLC, 8.000%(4)(5)(6) | | | 606,603 |

300,000 | | BP Capital Markets PLC, 1.000%, 04/28/2023(4) | | | 461,878 |

405,000 | | Debenhams PLC, 5.250%, 07/15/2021(9) | | | 214,603 |

130,000 | | EI Group PLC, 6.000%, 10/06/2023(4) | | | 164,034 |

3,150,000 | | House of Fraser Funding PLC, 6.530% (3-Month GBP Libor + 575 basis points), 09/15/2020(1)(9)(10) | | | 135,859 |

200,000 | | Jerrold Finco Plc, 6.125%, 01/15/2024(4) | | | 250,437 |

500,000 | | Lloyds Banking Group PLC, 6.375%(4)(5)(6) | | | 561,933 |

100,000 | | Miller Homes Group Holdings PLC, 5.500%, 10/15/2024(4) | | | 126,155 |

260,000 | | Tullow Oil PLC, 6.250%, 04/15/2022 | | | 263,640 |

796,000 | | Voyage Care BondCo PLC, 10.000%, 11/01/2023 | | | 924,498 |

100,000 | | William Hill PLC, 4.875%, 09/07/2023(4) | | | 132,360 |

| | | | | | 3,842,000 |

| | | | | | |

| | | VIETNAM – 0.9% | | | |

500,000 | | No Va Land Investment Group Corp., 5.500%, 04/27/2023 | | | 493,425 |

| | | | | | |

| | | VIRGIN ISLANDS (BRITISH) – 0.4% | | | |

200,000 | | Yingde Gases Investment, Ltd., 6.250%, 01/19/2023 | | | 204,549 |

| | | TOTAL INTERNATIONAL DEBT SECURITIES | | | |

| | | (Cost $29,887,015) | | | 30,016,283 |

| | | | | | |

| | | INTERNATIONAL EQUITIES – 0.5% |

| | | GERMANY – 0.4% | | | |

96,745 | | Tele Columbus AG(2)(10) | | | 185,833 |

| | | | | | |

| | | UNITED KINGDOM – 0.1% | | | |

94,740 | | AA PLC | | | 70,048 |

| | | TOTAL INTERNATIONAL EQUITIES | | | |

| | | (Cost $310,945) | | | 255,881 |

See accompanying Notes to Financial Statements.

10

Destra International & Event-Driven Credit Fund |

Schedule of Investments(continued) |

As of September30, 2019 |

Shares or

Contracts | | Description | | Value |

| | | INVESTMENT COMPANIES – 1.1% | | | |

| | | UNITED STATES – 1.1% | | | |

22,000 | | ProShares Short S&P500 | | $ | 574,860 |

| | | TOTAL INVESTMENT COMPANIES | | | |

| | | (Cost $616,264) | | | 574,860 |

| | | | | | |

| | | PRIVATE COMPANIES – 2.7% | | | |

901,752 | | V Global Holdings LLC, Common Shares(8)(10) | | | 1,505,926 |

| | | TOTAL PRIVATE COMPANIES | | | |

| | | (Cost $946,840) | | | 1,505,926 |

| | | | | | |

| | | PURCHASED OPTIONS CONTRACTS – 0.2% | | | |

| | | PUT OPTIONS – 0.2% | | | |

25 | | S&P 500 INDEX

Excercise Price: $2,900, Notional Amount: $7,250,000, Expiration Date: 11/16/2019(10) | | | 91,625 |

| | | TOTAL PURCHASED OPTIONS CONTRACTS | | | |

| | | (Cost $96,312) | | | 91,625 |

Shares or

Contracts | | Description | | Value |

| | | SHORT-TERM INVESTMENTS – 3.2% | | | | |

| | | UNITED STATES – 3.2% | | | | |

1,770,721 | | BlackRock Liquidity Funds FedFund Portfolio - Institutional Class, 1.860%(11) | | $ | 1,770,721 | |

| | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | (Cost $1,770,721) | | | 1,770,721 | |

| | | | | | | |

| | | TOTAL INVESTMENTS – 104.9% | | | | |

| | | (Cost $57,175,873) | | | 57,840,642 | |

| | | Liabilities in Excess of Other Assets – (4.9)% | | | (2,675,825 | ) |

| | | TOTAL NET ASSETS – 100.0% | | $ | 55,164,817 | |

See accompanying Notes to Financial Statements.

11

Destra International & Event-Driven Credit Fund |

Schedule of Investments(continued) |

As of September30, 2019 |

At September30, 2019, the Destra International & Event-Driven Credit Fund had outstanding forward foreign exchange contracts as set forth below:

Settlement

Date | |

Counterparty

| | Currency

Purchased | | Currency

Sold | | Contract Amount | |

Value

| | Unrealized

Appreciation |

Buy | | Sell | |

November 26, 2019 | | Australia and New Zealand Banking | | U.S. Dollar | | Euro Currency | | $ | 5,705,583 | | EUR | | 5,134,862 | | $ | 5,620,502 | | $ | 85,081 |

November 26, 2019 | | Barclays Capital, Inc. | | U.S. Dollar | | Euro Currency | | $ | 19,752,996 | | EUR | | 17,784,400 | | | 19,466,394 | | | 286,602 |

November 26, 2019 | | BNP Paribas Securities Corp. | | U.S. Dollar | | Chinese Yuan Renminbi | | $ | 436,751 | | CNH | | 3,078,000 | | | 430,436 | | | 6,315 |

November 26, 2019 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 101,165 | | EUR | | 91,000 | | | 99,607 | | | 1,558 |

November 26, 2019 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 106,357 | | EUR | | 96,000 | | | 105,079 | | | 1,278 |

November 26, 2019 | | Citibank, N.A. | | U.S. Dollar | | Hong Kong Dollar | | $ | 544,353 | | HKD | | 4,258,000 | | | 543,678 | | | 675 |

November 26, 2019 | | Citibank, N.A. | | U.S. Dollar | | Pound Sterling | | $ | 1,828,572 | | GBP | | 1,461,000 | | | 1,800,602 | | | 27,970 |

November 26, 2019 | | Citibank, N.A. | | U.S. Dollar | | Pound Sterling | | $ | 2,105,176 | | GBP | | 1,682,000 | | | 2,072,972 | | | 32,204 |

November 26, 2019 | | Deutsche Bank | | U.S. Dollar | | Euro Currency | | $ | 58,051 | | EUR | | 53,000 | | | 58,013 | | | 38 |

November 26, 2019 | | Royal Bank of Scotland | | U.S. Dollar | | Pound Sterling | | $ | 66,355 | | GBP | | 53,000 | | | 65,320 | | | 1,035 |

| | | | | | | | | | | | | | | | | | | $ | 442,756 |

At September30, 2019, the Destra International & Event-Driven Credit Fund had credit default swap contracts as set forth below:

Underlying Instrument | | Counterparty | | Pay Rate /

Frequency | | Maturity

Date | | Notional

Amount at

Value(1) | | Premium

Received | | Unrealized

Loss | | Value |

Casino Guichard Perrachon

SA Swap(2) | | Citibank, N.A. | | 1.00% / Quarterly | | 12/20/2024 | | $ | 190,000 | | $ | 47,192 | | $ | (3,307) | | $ | 43,885 |

See accompanying Notes to Financial Statements.

12

Destra International & Event-Driven Credit Fund |

Summary of Investments |

As of September30, 2019 |

| | Value | | % of Net

Assets |

Asset-Backed Securities | | | | | | |

Other Asset-Backed Securities | | $ | 6,915,051 | | 12.5 | % |

Total Asset-Backed Securities | | | 6,915,051 | | 12.5 | |

Bank Loans | | | | | | |

Commercial Services | | | 197,516 | | 0.4 | |

Computers | | | 386,101 | | 0.7 | |

Lodging | | | 459,010 | | 0.8 | |

Machinery-Diversified | | | 249,473 | | 0.4 | |

Media | | | 393,927 | | 0.7 | |

Metal Fabricate/Hardware | | | 201,167 | | 0.4 | |

Oil & Gas | | | 641,803 | | 1.2 | |

Telecommunications | | | 347,077 | | 0.6 | |

Total Bank Loans | | | 2,876,074 | | 5.2 | |

Common Stocks | | | | | | |

Transportation | | | 71,757 | | 0.1 | |

Total Common Stocks | | | 71,757 | | 0.1 | |

Corporate Debt Securities | | | | | | |

Aerospace/Defense | | | 906,592 | | 1.7 | |

Auto Parts & Equipment | | | 217,425 | | 0.4 | |

Banks | | | 1,148,430 | | 2.1 | |

Chemicals | | | 75,750 | | 0.1 | |

Commercial Services | | | 1,094,767 | | 2.0 | |

Diversified Financial Services | | | 944,525 | | 1.7 | |

Electric | | | 334,039 | | 0.6 | |

Entertainment | | | 467,080 | | 0.9 | |

Forest Products & Paper | | | 650,207 | | 1.2 | |

Home Builders | | | 439,428 | | 0.8 | |

Internet | | | 567,472 | | 1.0 | |

Lodging | | | 520,385 | | 0.9 | |

Media | | | 2,964,006 | | 5.4 | |

Mining | | | 497,715 | | 0.9 | |

Oil & Gas | | | 634,580 | | 1.2 | |

Pharmaceuticals | | | 346,063 | | 0.6 | |

Real Estate | | | 891,583 | | 1.6 | |

Telecommunications | | | 1,062,417 | | 1.9 | |

Total Corporate Debt Securities | | | 13,762,464 | | 25.0 | |

International Debt Securities | | | | | | |

Airlines | | | 324,870 | | 0.6 | |

Banks | | | 11,667,247 | | 21.1 | |

Building Materials | | | 654,094 | | 1.2 | |

Chemicals | | | 204,549 | | 0.4 | |

Commercial Services | | | 972,059 | | 1.8 | |

Diversified Financial Services | | | 1,494,750 | | 2.7 | |

Electric | | | 673,488 | | 1.2 | |

Engineering & Construction | | | 836,762 | | 1.5 | |

Entertainment | | | 132,360 | | 0.2 | |

Forest Products & Paper | | | 655,507 | | 1.2 | |

Healthcare-Services | | | 924,498 | | 1.7 | |

See accompanying Notes to Financial Statements.

13

Destra International & Event-Driven Credit Fund |

Summary of Investments (continued) |

As of September30, 2019 |

| | Value | | % of Net

Assets |

International Debt Securities (continued) | | | | | | | |

Home Builders | | $ | 126,155 | | | 0.2 | % |

Media | | | 651,758 | | | 1.2 | |

Mining | | | 180,854 | | | 0.3 | |

Miscellaneous Manufacturing | | | 479,071 | | | 0.9 | |

Municipal | | | 273,681 | | | 0.5 | |

Oil & Gas | | | 1,150,648 | | | 2.1 | |

Real Estate | | | 1,409,098 | | | 2.6 | |

Retail | | | 738,800 | | | 1.3 | |

Sovereign | | | 4,525,242 | | | 8.2 | |

Telecommunications | | | 1,274,168 | | | 2.3 | |

Transportation | | | 666,624 | | | 1.2 | |

Total International Debt Securities | | | 30,016,283 | | | 54.4 | |

International Equities | | | | | | | |

Commercial Services | | | 70,048 | | | 0.1 | |

Media | | | 185,833 | | | 0.4 | |

Total International Equities | | | 255,881 | | | 0.5 | |

Investment Companies | | | | | | | |

Equity Fund | | | 574,860 | | | 1.1 | |

Total Investment Companies | | | 574,860 | | | 1.1 | |

Private Companies | | | | | | | |

Chemicals | | | 1,505,926 | | | 2.7 | |

Total Private Companies | | | 1,505,926 | | | 2.7 | |

Purchased Options Contracts | | | | | | | |

Put Options | | | 91,625 | | | 0.2 | |

Total Purchased Options Contracts | | | 91,625 | | | 0.2 | |

Short-Term Investments | | | | | | | |

Money Market Fund | | | 1,770,721 | | | 3.2 | |

Total Short-Term Investments | | | 1,770,721 | | | 3.2 | |

Total Investments | | | 57,840,642 | | | 104.9 | |

Liabilities in Excess of Other Assets | | | (2,675,825 | ) | | (4.9 | ) |

Total Net Assets | | $ | 55,164,817 | | | 100.0 | % |

See accompanying Notes to Financial Statements.

14

Destra International & Event-Driven Credit Fund |

Statement of Assets and Liabilities |

September 30, 2019 |

Assets: | | | | |

Investments, at value | | $ | 57,749,017 | |

Purchased options contracts, at value | | | 91,625 | |

Premium received on credit default swap contracts | | | 47,192 | |

Cash | | | 50 | |

Restricted Cash: | | | | |

Deposits held at broker for credit default swap contracts | | | 10,428 | |

Foreign currency, at value | | | 2,119,688 | (1) |

Unrealized appreciation on forward foreign exchange contracts | | | 442,756 | |

Receivables: | | | | |

Interest | | | 842,346 | |

Investments sold | | | 629,438 | |

Dividends | | | 2,346 | |

Prepaid expenses | | | 13,982 | |

Total assets | | | 61,948,868 | |

Liabilities: | | | | |

Unrealized depreciation on credit default swap contract | | | 3,307 | |

Credit facility (see note 10) | | | 4,999,999 | |

Payables: | | | | |

Investments purchased | | | 1,493,992 | |

Due to adviser (see note 5) | | | 169,232 | |

Professional fees | | | 45,929 | |

Custody fees | | | 32,316 | |

Accounting and administrative fees | | | 17,457 | |

Transfer agent fees and expenses | | | 10,642 | |

Chief compliance officer fees | | | 5,000 | |

Distribution fees | | | 637 | |

Shareholder servicing fees | | | 637 | |

Accrued other expenses | | | 4,903 | |

Total liabilities | | | 6,784,051 | |

Net assets | | $ | 55,164,817 | |

Net assets consist of: | | | | |

Paid-in capital (unlimited shares authorized at $0.001 par value common stock) | | $ | 53,154,508 | |

Total distributable earnings | | | 2,010,309 | |

Net assets | | $ | 55,164,817 | |

Net assets: | | | | |

Class I | | $ | 51,828,074 | |

Class A | | | 1,114,387 | |

Class L | | | 1,112,246 | |

Class T | | | 1,110,110 | |

Shares outstanding: | | | | |

Class I | | | 2,056,524 | |

Class A | | | 44,216 | |

Class L | | | 44,134 | |

Class T | | | 44,051 | |

See accompanying Notes to Financial Statements.

15

Destra International & Event-Driven Credit Fund |

Statement of Assets and Liabilities (continued) |

September 30, 2019 |

Net asset value per share: | | | |

Class I | | $ | 25.20 |

Class A | | | 25.20 |

Maximum offering price per share(2) | | | 26.74 |

Class L | | | 25.20 |

Maximum offering price per share(3) | | | 26.32 |

Class T | | | 25.20 |

Maximum offering price per share(4) | | | 25.98 |

Total investments, at cost | | $ | 57,079,561 |

Total purchased options contracts, at cost | | $ | 96,312 |

See accompanying Notes to Financial Statements.

16

Destra International & Event-Driven Credit Fund |

Statement of Operations |

For the Year Ended September 30, 2019 |

Investment income: | | | | |

Interest income(1) | | $ | 3,033,130 | |

Dividend income | | | 18,649 | |

Total investment income | | | 3,051,779 | |

Expenses: | | | | |

Management fees (see note 4) | | | 913,815 | |

Interest expense | | | 214,078 | |

Professional fees | | | 183,804 | |

Accounting and administrative fees | | | 162,214 | |

Custody fees | | | 109,534 | |

Offering costs (see note 6) | | | 93,510 | |

Transfer agent fees and expenses | | | 57,191 | |

Registration fees | | | 44,641 | |

Trustee fees | | | 28,455 | |

Chief financial officer fees | | | 21,856 | |

Chief compliance officer fees | | | 20,077 | |

Shareholder reporting fees | | | 17,697 | |

Insurance expense | | | 2,141 | |

Distribution fees Class L | | | 2,039 | |

Distribution fees Class T | | | 4,074 | |

Shareholder servicing fees Class A (see note 8) | | | 2,041 | |

Shareholder servicing fees Class L (see note 8) | | | 2,039 | |

Shareholder servicing fees Class T (see note 8) | | | 2,037 | |

Other expenses | | | 10,236 | |

Total expenses: | | | 1,891,479 | |

Expenses waived and reimbursed from adviser (see note 5) | | | (520,927 | ) |

Net expenses | | | 1,370,552 | |

Net investment income | | | 1,681,227 | |

Net realized and unrealized gain (loss): | | | | |

Net realized gain (loss) on: | | | | |

Investments | | | (416,004 | ) |

Foreign currency transactions | | | (35,224 | ) |

Forward foreign exchange contracts | | | 1,381,173 | |

Futures contracts | | | 6 | |

Swap contracts | | | 482,537 | |

Purchased options contracts | | | 270,679 | |

Written options contracts | | | 9,299 | |

Total net realized gain | | | 1,692,466 | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments | | | 1,078,286 | |

Foreign currency translations | | | (27,212 | ) |

Forward foreign exchange contracts | | | 467,313 | |

Swap contracts | | | (3,307 | ) |

Purchased options contracts | | | (4,687 | ) |

Total net change in unrealized appreciation | | | 1,510,393 | |

Net realized and unrealized gain | | | 3,202,859 | |

Net increase in net assets resulting from operations | | $ | 4,884,086 | |

See accompanying Notes to Financial Statements.

17

Destra International & Event-Driven Credit Fund |

Statements of Changes in Net Assets |

| |

| | Year Ended

September 30,

2019(1) | | Period Ended

September 30,

2018(2),(3) |

Increase (decrease) in net assets resulting from operations: | | | | | | | | |

Net investment income | | $ | 1,681,227 | | | $ | 245,833 | |

Net realized gain on investments | | | 1,692,466 | | | | 91,047 | |

Net change in unrealized appreciation (depreciation) | | | 1,510,393 | | | | (425,805 | ) |

Net increase (decrease) in net assets resulting from operations | | | 4,884,086 | | | | (88,925 | ) |

Distributions to shareholders: | | | | | | | | |

Class I | | | (2,320,088 | ) | | | (419,581 | ) |

Class A | | | (47,974 | ) | | | — | |

Class L | | | (45,940 | ) | | | — | |

Class T | | | (43,909 | ) | | | — | |

Total distributions to shareholders | | | (2,457,911 | ) | | | (419,581 | ) |

Capital transactions: | | | | | | | | |

Proceeds from shares sold: | | | | | | | | |

Class I | | | 22,070,000 | | | | 25,200,000 | |

Class A | | | 1,000,000 | | | | — | |

Class L | | | 1,000,000 | | | | — | |

Class T | | | 1,000,000 | | | | — | |

Reinvestment of distributions: | | | | | | | | |

Class I | | | 2,319,744 | | | | 419,581 | |

Class A | | | 47,974 | | | | — | |

Class L | | | 45,940 | | | | — | |

Class T | | | 43,909 | | | | — | |

Net increase in net assets from capital transactions | | | 27,527,567 | | | | 25,619,581 | |

Total increase in net assets | | | 29,953,742 | | | | 25,111,075 | |

Net assets: | | | | | | | | |

Beginning of period | | | 25,211,075 | | | | 100,000 | |

End of period | | $ | 55,164,817 | | | $ | 25,211,075 | |

Capital share transactions: | | | | | | | | |

Shares sold: | | | | | | | | |

Class I | | | 932,209 | | | | 1,008,087 | |

Class A | | | 42,248 | | | | — | |

Class L | | | 42,248 | | | | — | |

Class T | | | 42,248 | | | | — | |

Shares reinvested: | | | | | | | | |

Class I | | | 95,137 | | | | 17,091 | |

Class A | | | 1,968 | | | | — | |

Class L | | | 1,886 | | | | — | |

Class T | | | 1,803 | | | | — | |

Net increase from capital share transactions | | | 1,159,747 | | | | 1,025,178 | |

See accompanying Notes to Financial Statements.

18

Destra International & Event-Driven Credit Fund |

Statement of Cash Flows |

For the Year Ended September 30, 2019 |

Cash flows from operating activities: | | | | |

Net increase in net assets from operations | | $ | 4,884,086 | |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

Purchase of investments | | | (174,437,662 | ) |

Proceeds from redemptions, sales, or other dispositions of investments | | | 142,359,747 | |

Amortization of premium on investments | | | (18,845 | ) |

Net realized (gain) loss on: | | | | |

Investments | | | 416,004 | |

Foreign currency transactions | | | 35,224 | |

Forward foreign exchange contracts | | | (1,381,173 | ) |

Futures contracts | | | (6 | ) |

Swap contracts | | | (482,537 | ) |

Purchased options contracts | | | (270,679 | ) |

Written options contracts | | | (9,299 | ) |

Principal paydowns on investments | | | (8,548 | ) |

Net change in unrealized (appreciation) depreciation on: | | | | |

Investments | | | (1,078,286 | ) |

Foreign currency translations | | | 27,212 | |

Forward foreign exchange contracts | | | (467,313 | ) |

Swap contracts | | | 3,307 | |

Purchased options contracts | | | 4,687 | |

Change in operating assets and liabilities: | | | | |

Receivables: | | | | |

Investments sold | | | (629,438 | ) |

Interest | | | (507,050 | ) |

Dividends | | | (2,346 | ) |

Deferred offering costs | | | 93,510 | |

Due from adviser | | | 9,021 | |

Prepaid expenses | | | (13,594 | ) |

Payables: | | | | |

Investments purchased | | | 1,039,664 | |

Due to adviser | | | 169,232 | |

Custody fees | | | 11,286 | |

Accounting and administrative fees | | | 9,060 | |

Professional fees | | | (63,122 | ) |

Transfer agent fees and expenses | | | 4,467 | |

Chief compliance officer fees | | | 77 | |

Chief financial officer fees | | | (144 | ) |

Distribution fees | | | 637 | |

Shareholder servicing fees | | | 637 | |

Accrued other expenses | | | 2,699 | |

Net cash used in operating activities | | | (30,299,485 | ) |

See accompanying Notes to Financial Statements.

19

Destra International & Event-Driven Credit Fund |

Statement of Cash Flows (continued) |

For the Year Ended September 30, 2019 |

Cash flows from financing activities: | | | | |

Advances from credit facility | | $ | 12,483,686 | |

Repayments on credit facility | | | (7,483,687 | ) |

Proceeds from shares sold | | | 25,070,000 | |

Cash distributions paid to shareholders, net of reinvestment | | | (344 | ) |

Net cash provided by financing activities | | | 30,069,655 | |

Effect offoreign currency exchangerate changes in cash | | | 1,318,737 | |

Net change in cash, cash equivalents, restricted cash, and foreign currency | | | 1,088,907 | |

Cash,cash equivalents, restricted cash, and foreign currency at beginning of year | | | 1,041,259 | |

Cash,cash equivalents, restricted cash, and foreign currency at end of year | | $ | 2,130,166 | |

Supplementaldisclosureof cash activity: | | | | |

Cash interest paid during the year | | $ | 214,078 | |

Supplementaldisclosureof non-cash activity: | | | | |

Reinvestment of distributions paid to shareholders | | $ | 2,457,567 | |

See accompanying Notes to Financial Statements.

20

Destra International & Event-Driven Credit Fund |

Financial Highlights |

For a share of common stock outstanding throughout the periods indicated |

Period ending

September 30, | | Net asset

value,

beginning

of period | | Net

investment

income(1) | | Net

realized

and

unrealized

gain (loss) | | Total from

investment

operations | | Distributions

to

shareholders

from net

investment

income | | Distributions

to

shareholders

from net

realized gain | | Total

distributions | | Net

asset

value,

end of

period | | Total

return(2)(3) | | Gross

expenses(4)(5) | | Net

expenses(4)(5)(6) | | Net

investment

income(4)(6) | | Net assets,

end of period

(in thousands) | | Portfolio

turnover

rate(3) |

ClassI | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019 | | $ | 24.50 | | $ | 0.90 | | $ | 0.96 | | | $ | 1.86 | | | $ | (1.16 | ) | | $ | — | | $ | (1.16 | ) | | $ | 25.20 | | 7.85 | % | | 4.08 | % | | 2.95 | % | | 3.68 | % | | $ | 51,828 | | 124 | % |

2018(7) | | | 25.00 | | | 0.24 | | | (0.33 | ) | | | (0.09 | ) | | | (0.41 | ) | | | — | | | (0.41 | ) | | | 24.50 | | (0.35 | ) | | 5.56 | | | 2.25 | | | 2.50 | | | | 25,211 | | 30 | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019(8) | | | 23.67 | | | 0.65 | | | 2.00 | | | | 2.65 | | | | (1.12 | ) | | | — | | | (1.12 | ) | | | 25.20 | | 11.42 | | | 4.26 | | | 3.24 | | | 3.41 | | | | 1,114 | | 124 | |

Class L | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019(8) | | | 23.67 | | | 0.60 | | | 2.00 | | | | 2.60 | | | | (1.07 | ) | | | — | | | (1.07 | ) | | | 25.20 | | 11.22 | | | 4.50 | | | 3.49 | | | 3.16 | | | | 1,112 | �� | 124 | |

Class T | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019(8) | | | 23.67 | | | 0.55 | | | 2.00 | | | | 2.55 | | | | (1.02 | ) | | | — | | | (1.02 | ) | | | 25.20 | | 11.01 | | | 4.76 | | | 3.74 | | | 2.91 | | | | 1,110 | | 124 | |

| | | | Gross

expenses | | Net

expenses | | |

Class I | | | | | | | |

2019 | | 3.62 | % | | 2.48 | % | |

2018(7) | | 5.56 | | | 2.25 | | |

Class A | | | | | | | |

2019(8) | | 3.77 | | | 2.75 | | |

Class L | | | | | | | |

2019(8) | | 4.02 | | | 3.00 | | |

Class T | | | | | | | |

2019(8) | | 4.27 | | | 3.25 | | |

See accompanying Notes to Financial Statements.

21

Destra International & Event-Driven Credit Fund |

Notes to Financial Statements |

September30, 2019 |

1. Organization

Destra International & Event-Driven Credit Fund (the “Fund”) was established as a Delaware statutory trust on November13, 2017. The Fund is registered with the Securities and Exchange Commission (the “SEC”) as a non-diversified, closed-end management investment company that operates as an “interval fund” under the Investment Company Act of 1940, as amended (the “1940 Act”). The shares of beneficial interest of the Fund (the “Shares”) are continuously offered under Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Fund currently offers four classes of Shares, Classes I, A, L, and T. All classes of Shares have equal rights and voting privileges, except in matters affecting a single class. The Fund has adopted a fundamental policy to make quarterly repurchase offers (“Repurchase Offers”) between 5% and 25% of the Fund’s outstanding Shares. The Fund’s inception date was May9, 2018 (Class I Shares). The Fund’s commencement of investment operations date was on the business day following the inception date.

The Fund’s investment adviser is Destra Capital Advisors LLC (the “Adviser”), the Fund’s sub-adviser is BlueBay Asset Management LLP (the “Sub-Adviser”), and the Fund’s sub-sub-adviser is BlueBay Asset Management USA LLC (the “Sub-Sub-Adviser,”) (the Sub-Adviser, Sub-Sub-Adviser and together with the Adviser, are referred to herein as the “Advisers”). The Sub-Adviser and Sub-Sub-Adviser are wholly-owned subsidiaries of Royal Bank of Canada (“RBC”).

The Fund’s investment objective is to provide attractive total returns, consisting of income and capital appreciation. Under normal market conditions, the Fund will invest at least 80% of its total assets (including borrowings for investment purposes) in credit related instruments and/or investments that have similar economic characteristics as credit related instruments that are considered by the Fund to have the potential to provide a high level of total return. Credit related instruments include bonds, debt securities and loans issued by various U.S. and non-U.S. public- or private-sector entities, including issuers in emerging markets, derivatives and cash equivalents. There is no limit on the credit quality, duration or maturity of any investment in the Fund’s portfolio. Under normal market conditions, the Fund will invest at least 40% of its total assets in securities of non-U.S. issuers.

The Fund will allocate its assets between two strategies: (i) Multi-Strategy International Credit and (ii) Event-Driven Credit. The Fund’s allocation to the strategies will vary from time to time, when the Advisers deem such variances appropriate from a portfolio management standpoint. The allocation to Multi-Strategy International Credit is expected to be between 0% and 100% of the Fund’s total assets. Due to the episodic nature of Event-Driven Credit opportunities, the Fund will have a varying degree of exposure to the strategy, but during normal market conditions such exposure will be significant and is expected to be up to 50% of the Fund’s total assets.

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946,Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

2. Significant Accounting Policies

(a) Use of Estimates

The preparation of the financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the statement of assets and liabilities. Actual results could differ from those estimates.

(b) Investment Income, Expenses and Distributions

Investment income, expenses other than class specific expenses and realized and unrealized gains and losses are allocated daily to each class of Shares based upon the proportion of the net asset value (“NAV”) of each class of Shares at the beginning of each day. Investment transactions are recorded on a trade-date basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. The Fund distributes net investment income, if any, quarterly and net realized gains (net of any capital loss carryovers) annually. Discounts and premiums on securities purchased are accreted and amortized over the lives of the respective securities. Withholding taxes on foreign interest have been provided in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

(c)Cash, Cash Equivalents and Restricted Cash

Cash and cash equivalents include U.S. dollar deposits at bank accounts at amounts which may exceed insured limits. The Fund is subject to risk to the extent that the institutions may be unable to fulfill their obligations. As of September30, 2019, the Fund has restricted cash in the amount of $10,428. The restricted cash represents deposits held at the broker of the credit default swap contract.

22

Destra International & Event-Driven Credit Fund |

Notes to Financial Statements |

September30, 2019 (continued) |

(d) Investment Valuation

The Adviser determines the values of the Fund’s assets in good faith pursuant to the Fund’s valuation policy and consistently applied valuation process, which was developed by the audit committee of the Fund’s board of trustees (the “Board”) and approved by the Board. Portfolio securities and other assets for which market quotes are readilyavailable are valued at market value. In circumstances where market quotes are not readily available, the Board has adopted methods for determining the fair value of such securities and other assets, and has delegated the responsibility for applying the valuation methods to the Adviser. On a quarterly basis, the Board reviews the valuation determinations made with respect to the Fund’s investments during the preceding quarter and evaluates whether such determinations were made in a manner consistent with the Fund’s valuation process.

In determining NAV, portfolio instruments generally are valued using prices provided by independent pricing services or obtained from other sources, such as broker-dealer quotations. Exchange-traded instruments generally are valued at the last reported sales price or official closing price on an exchange, if available. Independent pricing services typically value non-exchange-traded instruments utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained from broker-dealers making markets in such instruments, cash flows, and transactions for comparable instruments. In pricing certain instruments, the pricing services may consider information about an instrument’s issuer or market activity provided by the Fund’s Sub-Adviser. Non-U.S. securities and currency are valued in U.S. dollars based on non-U.S. currency exchange rate quotations supplied by an independent quotation service.

For non-U.S. traded securities whose principal local markets close before the close of the NYSE, the Fund may adjust the local closing price based upon such factors as developments in non-U.S. markets, the performance of U.S. securities markets and the performance of instruments trading in U.S. markets that represent non-U.S. securities. The Fund may rely on an independent fair valuation service in making any such fair value determinations. If the Fund holds portfolio instruments that are primarily listed on non-U.S. exchanges, the value of such instruments may change on days when shareholders will not be able to purchase or redeem the Fund’s Shares.

In certain situations, the Adviser, with input from the Sub-Adviser and Sub-Sub-Adviser, may use the fair value of a portfolio instrument if such portfolio instrument is not priced by a pricing service, if the pricing service’s price is deemed unreliable or if events occur after the close of a securities market (usually a foreign market) and before the Fund values its assets that would materially affect NAV. A portfolio instrument that is fair valued may be valued at a price higher or lower than actual market quotations or the value determined by other funds using their own fair valuation procedures. Because non-U.S. portfolio instruments may trade on days when Fund Shares are not priced, the value of portfolio instruments held by the Fund can change on days when Fund Shares cannot be redeemed. The Adviser expects to use fair value pricing primarily when a portfolio instrument is not priced by a pricing service or a pricing service’s price is deemed unreliable.

Due to the subjective nature of fair value pricing, the Fund’s value for a particular portfolio instrument may be different from the last price determined by the pricing service or the last bid or ask price in the market.

Certain short-term instruments maturing within 60 days or less are valued at amortized cost, which approximates fair value. The value of the securities of other open-end funds held by the Fund, if any, will be calculated using the NAV of such open-end funds, and the prospectuses for such open-end funds explain the circumstances under which they use fair value pricing and the effects of using fair value pricing.

Below is a description of factors that may be considered when valuing securities for which no active secondary market exists.

Valuation of fixed income investments, such as loans and debt securities, depends upon a number of factors, including prevailing interest rates for like securities, expected volatility in future interest rates, call features, put features and other relevant terms of the debt. For investments without readily available market prices, these factors may be incorporated into discounted cash flow models to arrive at fair value. Other factors that may be considered include the borrower’s ability to adequately service its debt, the fair market value of the portfolio company in relation to the face amount of its outstanding debt and the quality of the collateral securing its debt investments.

Asset-backed securities are generally issued as pass-through certificates or as debt instruments. Asset-backed securities issued as pass-through certificates represent undivided fractional ownership interests in an underlying pool of assets. Asset-backed securities issued as debt instruments, which are also known as collateralized obligations, are typically issued as the debt of a special purpose entity organized solely for the purpose of owning such assets and issuing such debt. Asset-backed securities are often backed by a pool of assets representing the obligations of a number of different parties. The yield characteristics of certain asset-backed securities may differ from traditional debt securities. One such major difference is that all or a principal part of the obligations may be prepaid at any time because the underlying assets (i.e., loans) may be prepaid at any time. As a result, a decrease in interest rates in the market may result in increases in the level of prepayments as borrowers, particularly mortgagors, refinance and repay their loans. An increased prepayment

23

Destra International & Event-Driven Credit Fund |

Notes to Financial Statements |

September30, 2019 (continued) |

rate with respect to an asset-backed security will have the effect of shortening the maturity of the security. In addition, the Fund may subsequently have to reinvest the proceeds at lower interest rates. If the Fund has purchased such an asset-backed security at a premium, a faster than anticipated prepayment rate could result in a loss of principal to the extent of the premium paid.

For convertible debt securities, fair value will generally approximate the fair value of the debt plus the fair value of an option to purchase the underlying security (the security into which the debt may convert) at the conversion price. To value such an option, a standard option pricing model may be used.

For private company equity interests, various factors may be considered in determining fair value, including but not limited to multiples of earnings before interest, taxes, depreciation and amortization (“EBITDA”), cash flows, net income, revenues or, in limited instances, book value or liquidation value. All of these factors may be subject to adjustments based upon the particular circumstances of a private company or the Fund’s actual investment position. For example, adjustments to EBITDA may take into account compensation to previous owners or an acquisition, recapitalization, restructuring or other related items.

Other factors that may be considered in valuing securities include private merger and acquisition statistics, public trading multiples discounted for illiquidity and other factors, valuations implied by third-party investments in the private companies, the acquisition price of such investment or industry practices in determining fair value. The Adviser may also consider the size and scope of a private company and its specific strengths and weaknesses, and may apply discounts or premiums, where and as appropriate, due to the higher (or lower) financial risk and/ or the size of the private company relative to comparable firms, as well as such other factors as the Adviser, in consultation with any third-party valuation or pricing service, if applicable, may consider relevant in assessing fair value.

If the Fund receives warrants or other equity securities at nominal or no additional cost in connection with an investment in a debt security, the cost basis in the investment will be allocated between the debt securities and any such warrants or other equity securities received at the time of origination. Such warrants or other equity securities will subsequently be valued at fair value.

Portfolio securities that carry certain restrictions on sale will typically be valued at a discount from the public market value of the security, where applicable.

If events materially affecting the price of foreign portfolio securities occur between the time when their price was last determined on such foreign securities exchange or market and the time when the Fund’s NAV was last calculated (for example, movements in certain U.S. securities indices which demonstrate strong correlation to movements in certain foreign securities markets), such securities may be valued at their fair value as determined in good faith in accordance with procedures established by the Board. For purposes of calculating NAV, all assets and liabilities initially expressed in foreign currencies will be converted into U.S. dollars at prevailing exchange rates as may be determined in good faith by the Adviser, under the supervision of the Board.

Swaps typically will be valued using valuations provided by a third-party pricing service. Such pricing service valuations generally will be based on the present value of fixed and projected floating rate cash flows over the term of the swap contract and, in the case of credit default swaps, generally will be based on credit spread quotations obtained from broker-dealers and expected default recovery rates determined by the third-party pricing service using proprietary models. Future cash flows will be discounted to their present value using swap rates provided by electronic data services or by broker-dealers.

(e) Federal Income Taxes

The Fund intends to qualify as a “regulated investment company��� under Subchapter M of the Internal Revenue Code of 1986. If so qualified, the Fund will not be subject to federal income tax to the extent it distributes substantially all of its net investment income and capital gains to shareholders. Therefore, no federal income tax provision is required. Management of the Fund is required to determine whether a tax position taken by the Fund is more likely than not to be sustained upon examination by the applicable taxing authority, based on the technical merits of the position. Based on its analysis, there were no tax positions identified by management of the Fund which did not meet the “more likely than not” standard as of September30, 2019 and all open tax years.

(f) Commitments and Contingencies

In the normal course of business, the Fund may enter into contracts that contain a variety of representations which provide general indemnifications for certain liabilities. The Fund’s maximum exposure under these arrangements is unknown. However, since its commencement of operations, the Fund has not had claims or losses pursuant to these contracts and expects the risk of loss to be remote.

24

Destra International & Event-Driven Credit Fund |

Notes to Financial Statements |

September30, 2019 (continued) |

(g) Derivatives

Swap Contracts —The Fund may engage in various swap transactions, including forward rate and interest rate agreements, primarily to manage risk, or as alternatives to direct investments. The Fund may also engage in credit default swaps, which involve the exchange of a periodic premium for protection against a defined credit event (such as payment default, refinancing or bankruptcy). The Fund engaged in credit default swaps to protect against credit events and interest rate swaps to hedge currency risks.

Under the terms of a credit default swap contract, one party acts as a guarantor receiving a periodic payment that is a fixed percentage applied to a notional amount. In return, the party agrees to purchase the notional amount of the underlying instrument, at par, if a credit event occurs during the term of the contract. The Fund may enter into credit default swaps in which the Fund acts as guarantor (a seller of protection), and may enter into credit default swaps in which the counterparty acts as guarantor (a buyer of protection). Premiums paid to or by the Fund are accrued daily and included in realized gain (loss) on swaps. The contracts are marked-to-market daily using fair value estimates provided by an independent pricing service. Changes in value are recorded as net change in unrealized appreciation/(depreciation) on the statement of operations. Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the statement of assets and liabilities. Gains or losses are realized upon termination of the contracts. The risk of loss under a swap contract may exceed the amount recorded as an asset or a liability. The notional amount of a swap contract is the reference amount pursuant to which the counterparties make payments. For swaps in which the referenced obligation is an index, in the event of default of any debt security included in the corresponding index, the Fund pays or receives the percentage of the corresponding index that the defaulted security comprises (1) multiplied by the notional value and (2) multiplied by the ratio of one minus the ratio of the market value of the defaulted debt security to its par value.

Interest rate swaps are agreements between two parties to exchange cash flows based on a notional principal amount. The Fund may elect to pay a fixed rate and receive a floating rate or receive a fixed rate and pay a floating rate on a notional principal amount. The net interest received or paid on interest rate swap agreements is accrued daily as interest income/expense. Interest rate swaps are marked-to-market daily using fair value estimates provided by an independent pricing service. Changes in value, including accrued interest, are recorded as net change in unrealized appreciation/(depreciation) on the statement of operations. Unrealized gains are reported as an asset and unrealized losses are reported as a liability on the statement of assets and liabilities. Gains or losses are realized upon termination of the contracts. The risk of loss under a swap contract may exceed the amount recorded as an asset or a liability.

Risks associated with swap contracts include changes in the returns of underlying instruments, failure of the counterparties to perform under the contracts’ terms and the possible lack of liquidity with respect to the contracts. Credit default swaps can involve greater risks than if an investor had invested in the reference obligation directly since, in addition to general market risks, credit default swaps are subject to counterparty credit risk, leverage risk, hedging risk, correlation risk and liquidity risk. The Fund discloses swap contracts on a gross basis, with no netting of contracts held with the same counterparty. As of September30, 2019, the Fund had one outstanding credit default swap contract.

Foreign Exchange Contracts —The Fund may enter into foreign currency exchange contracts. The Fund may enter into these contracts for the purchase or sale of a specific foreign currency at a fixed price on a future date to hedge various investments, for investment purposes, for risk management and/or in a manner intended to increase income or gain to the Fund. All foreign currency exchange contracts are market-to-market daily at the applicable translation rates resulting in unrealized gains or losses. Realized gains or losses are recorded at the time the foreign currency exchange contract is offset by entering into a closing transaction, or by the delivery, or receipt, of the currency. Risk may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

Options — The Fund may purchase put and call options on currencies or securities. A put option gives the purchaser the right to compel the writer of the option to purchase from the option holder an underlying currency or security or its equivalent at a specified price at any time during the option period. In contrast, a call option gives the purchaser the right to buy the underlying currency or security covered by the option or its equivalent from the writer of the option at the stated exercise price.

As a holder of a put option, the Fund will have the right to sell the currencies or securities underlying the option and as the holder of a call option, the Fund will have the right to purchase the currencies or securities underlying the option, in each case at their exercise price at any time prior to the option’s expiration date. The Fund may seek to terminate its option positions prior to their expiration by entering into closing transactions. The ability of the Fund to enter into a closing sale transaction depends on the existence of a liquid secondary market. There can be no assurance that a closing purchase or sale transaction can be effected when the Fund so desires. The Fund may close out a position when writing options by purchasing an option on the same security with the same exercise price and expiration date as the option that it has previously written on the security. In such a case, the Fund will realize a profit or loss if the amount paid to purchase an option is less or more than the amount received from the sale of the option.

25

Destra International & Event-Driven Credit Fund |

Notes to Financial Statements |

September30, 2019 (continued) |

The hours of trading for options may not conform to the hours during which the underlying securities are traded. To the extent that the options markets close before the markets for the underlying securities, significant price and rate movements can take place in the underlying markets that cannot be reflected in the options markets. The purchase of options is a highly specialized activity which involves investment techniques and risks different from those associated with ordinary portfolio securities transactions. The purchase of options involves the risk that the premium and transaction costs paid by the Fund in purchasing an option will be lost as a result of unanticipated movements in prices of the securities on which the option is based. Imperfect correlation between the options and securities markets may detract from the effectiveness of attempted hedging. Options transactions may result in significantly higher transaction costs and portfolio turnover for the Fund.

(h) Restricted Securities

Restricted securities are securities that may be resold only upon registration under federal securities laws or in transactions exempt from such registration. In some cases, the issuer of restricted securities has agreed to register such securities for resale, at the issuer’s expense either upon demand by the Fund or in connection with another registered offering of the securities. Many restricted securities may be resold in the secondary market in transactions exempt from registration. Such restricted securities may be determined to be liquid under criteria established by the Board. The restricted securities are valued at the price provided by dealers in the secondary market or, if no market prices are available, the fair value as determined in good faith using methods approved by the Board.

Additional information on each illiquid and restricted investment held by the Fund at September30, 2019 is as follows:

Security | | Acquisition

Date | | Cost | | Value | | Percentage

of Net Assets |