UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number 811-23309

BlueBay Destra International Event-Driven Credit Fund

(Exact name of registrant as specified in charter)

443 North Willson Ave.

Bozeman, MT 59715

(Address of principal executive offices) (Zip code)

Robert A. Watson

C/O Destra Capital Advisors LLC

443 North Willson Ave.

Bozeman, MT 59715

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877) 855-3434

Date of fiscal year end: September 30

Date of reporting period: September 30, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

(a)

BlueBay Destra International Event-Driven Credit Fund

Annual Report

September 30, 2023

Table of Contents

| Bluebay Destra International Event-Driven Credit Fund |

| Shareholder Letter (unaudited) |

Dear Shareholders,

We are pleased to present you with your 2023 Annual Report (the “Report”) for the BlueBay Destra International Event-Driven Credit Fund (the “Fund”). This Report covers the period between October 1, 2022, and September 30, 2023 (the “Fiscal Year”).

During the Fiscal Year, there were innumerable macro events and crises: the war in Ukraine, continued central bank interest rate hikes, a U.S. banking crisis, a looming government shutdown, industry union labor strikes, rising geopolitical tensions, and now, as we write this letter, heightened conflict and war in the Middle East. Our thoughts and prayers go out to all the innocent lives lost and impacted at this time.

Despite these market pressures during the Fiscal Year, the stock market, as represented by the S&P 500 Index, finished the Fiscal Year with a return of +21.62%, and global equities, as represented by the MSCI All Country World Index, were positive as well, returning +21.41% over the same period. This was a near complete reversal of the negative equity bear market environment experienced in the prior fiscal year period (October 1, 2021 – September 30, 2022).

At the beginning of the Fiscal Year, the 2022 equity bear market hit bottom in early October 2022. The stock market then staged a strong rally with the S&P 500 Index finishing the month up over +8.10%. The strong performance in October 2022 failed to continue, as the market stalled out for the remainder of calendar year 2022, finishing the first quarter of the Fiscal Year up +7.56%. Stock market performance charged higher in January 2023, before faltering in February and cratering in March during the U.S. banking crisis, which resulted in the collapse of several high-profile regional banks. The U.S. Federal Reserve (“Fed”) was quick to intervene and reinstate confidence in the banking system, driving the market higher through the spring and summer months of 2023, led by the “Magnificent Seven” stocks – Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta Platforms, and Tesla. Ultimately, the S&P 500 Index rounded out the final three quarters of the Fiscal Year, up over +13.07% year-to-date through September 30, 2023, despite “higher for longer” rhetoric and increased volatility in late August and September.

Turning to interest rates and credit markets, the Fed rate hiking campaign continued during the Fiscal Year, despite the Federal Funds Rate increasing over 300 basis points from 0.25% to 3.25% in the Fund’s prior fiscal year. Interestingly, 10-Year U.S. Treasury yields reached their relative peak of 4.25% on October 24, 2022, very early in the Fiscal Year, a peak that would not be breached until ten months later in August 2023. The Fed maintained rate hikes through July 2023 to 5.50%, and soon after, market optimism for Fed rate cuts began to dissipate and “higher for longer” rhetoric settled in. As of October 23, 2023, 10-Year US Treasury yields have now crossed over 5% for the first time since 2007.

Bond performance, as represented by the Bloomberg Global Aggregate Bond Index, was up +2.24% during the Fiscal Year. However, long-term bonds, as represented by the Bloomberg Long Term US Treasury Index were down -9.09% during the Fiscal Year, further demonstrating the perils of long-duration securities in rising interest rate environments.

Alternatives performance, as represented by the Wilshire Liquid Alt Multi-Strategy Index, rebounded from the Fund’s prior fiscal year, returning +6.16% during the Fiscal Year. Other alternatives, including commodities, as represented by the Bloomberg Commodity Index; hedge funds as represented by the Morningstar Broad Hedge Fund Index; equity real estate investment trusts (REITs), as represented by the FTSE Nareit All Equity REIT Index; and mortgage REITs as represented by the FTSE Nareit Mortgage REIT Index returned -1.30%, -6.08%, -1.71%, and +19.62%, respectively.

The Fund outperformed many alternative and bond asset classes, returning +16.66% for the Class I shares during the Fiscal Year. The Fund celebrated its 5-year anniversary earlier this year and remains one of the top performing interval funds based on its 3-Year, 5-Year, and since inception Total Returns as of the Fiscal Year end (Source: Morningstar Direct, Data as September 30, 2023. Fund Inception Date was May 9, 2018.) We believe that the Fund’s performance during the Fiscal Year reflects the excellent work of the Fund’s sub-advisor in managing the strategy during these trying and volatile market environments.

On the subsequent pages, you will find commentary from the Fund’s sub-advisor, RBC Global Asset Management (UK) Limited (“BlueBay”), discussing the factors that most affected performance during the Fiscal Year, as well as specific details regarding investment results and portfolio holdings. BlueBay also discusses the accelerating market opportunity for stressed, distressed, and special situation credit amongst the backdrop of rising interest rates, tightening lending standards, cost-of-living crises, and continued war and geopolitical tensions.

BlueBay is a premier alternative credit asset manager based in London, United Kingdom, with over $110 billion in assets under management and 20+ years of experience managing credit, debt, and distressed assets globally. We are thrilled to be working with such a storied and tenured manager.

We appreciate the continued confidence you have placed in Destra and our investment partners. Please read this Report carefully and be sure to contact your Financial Advisor or Destra Capital if you have any additional questions.

Sincerely,

| Robert Watson, CFP® | Jake Schultz, CFA® |

| President | Secretary |

BlueBay Destra International Event-Driven Credit Fund

Destra Capital Advisors LLC

| Bluebay Destra International Event-Driven Credit Fund |

| Risk Disclosure |

As of September 30, 2023 (unaudited)

This document may contain forward-looking statements representing Destra Capital Advisors LLC’s (“Destra”), the portfolio managers’ or sub-adviser’s beliefs concerning future operations, strategies, financial results or other developments. Investors are cautioned that such forward-looking statements involve risks and uncertainties. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond Destra’s, the portfolio managers’ or sub-advisers’ control or are subject to change, actual results could be materially different. There is no guarantee that such forward-looking statements will come to pass.

Investors should consider the investment objective and policies, risk considerations, charges and ongoing expenses of an investment carefully before investing. The prospectus contains this and other information relevant to an investment in the Fund. Please read the prospectus carefully before investing. To obtain a prospectus, please contact your investment representative or Destra Capital Investments LLC at 877-855-3434 or access our website at www.destracapital.com.

| Bluebay Destra International Event-Driven Credit Fund |

| Performance and Graphical Illustrations |

September 30, 2023 (unaudited)

| Average Annual Total Returns for the period ended September 30, 2023 | | |

| Inception Date: May 9, 2018 | Inception Date: December 21, 2018 |

| Share Class | 1 Year | 3 Year | 5 Year | Since

Inception | Share Class | 1 Year | 3 Year | Since

Inception |

| Class I | 16.66% | 20.18% | 13.51% | 12.39% | Class A at NAV | 16.38% | 19.88% | 14.73% |

| Bloomberg Global Aggregate Index | 2.24% | -6.93% | -1.62% | -1.73% | Class A with Load | 9.69% | 17.54% | 13.32% |

| | | | | | Class L at NAV | 16.06% | 19.58% | 14.44% |

| | | | | | Class L with Load | 11.13% | 17.86% | 13.40% |

| | | | | | Class T at NAV | 15.80% | 19.28% | 14.16% |

| | | | | | Class T with Load | 12.34% | 18.07% | 13.43% |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions of Fund shares. Please read the Fund’s Prospectus, including the description of the Fund’s repurchase policy carefully before investing. For performance information current to the most recent month-end, please call the Fund at 877-855-3434. Class A shares have a maximum sales charge of 5.75% and a shareholder service fee of 0.25%. Class L shares have a maximum sales charge of 4.25%, a 12b-1 fee of 0.25%, and a shareholder service fee of 0.25%. Class T shares have a maximum sales charge of 3.00%, a 12b-1 fee of 0.50%, and a shareholder service fee of 0.25%.

Growth of an Assumed $100,000 Investment

This graph illustrates the hypothetical investment of $100,000 in the Fund, Class I, from May 9, 2018 (inception date) to September 30, 2023. The Average Annual Total Returns table and Growth of an Assumed $100,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Additionally, the performance of the other classes will be greater than or less than the performance shown in the graph above due to different sales loads and expenses applicable to such class.

| Bluebay Destra International Event-Driven Credit Fund |

| Performance and Graphical Illustrations (continued) |

September 30, 2023 (unaudited)

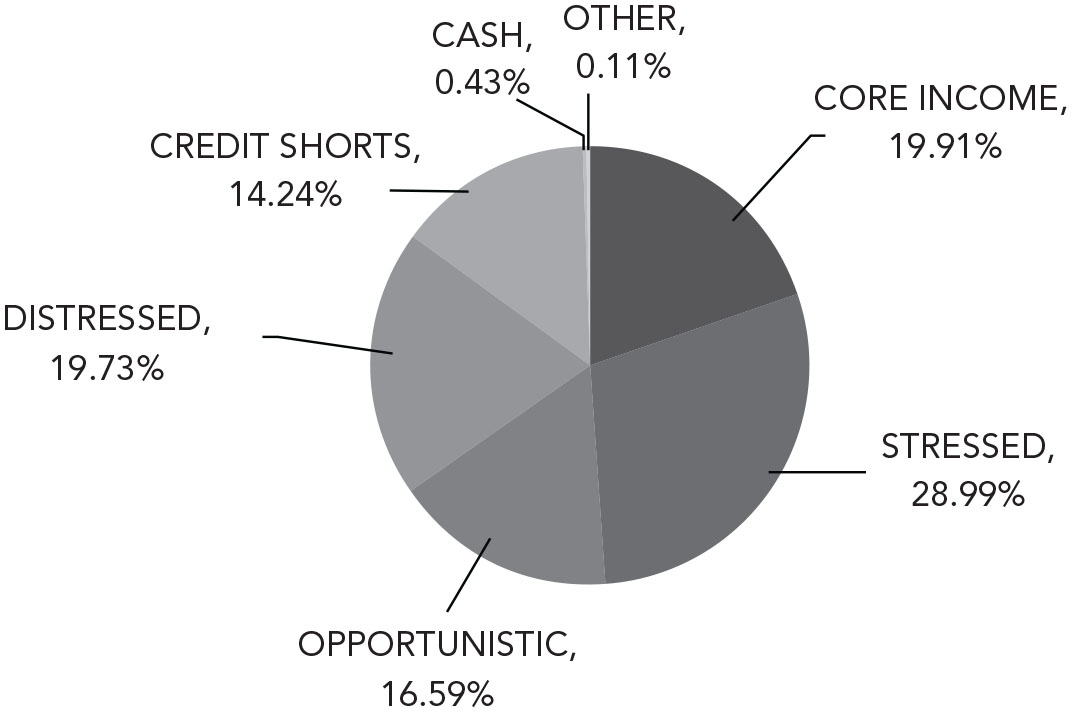

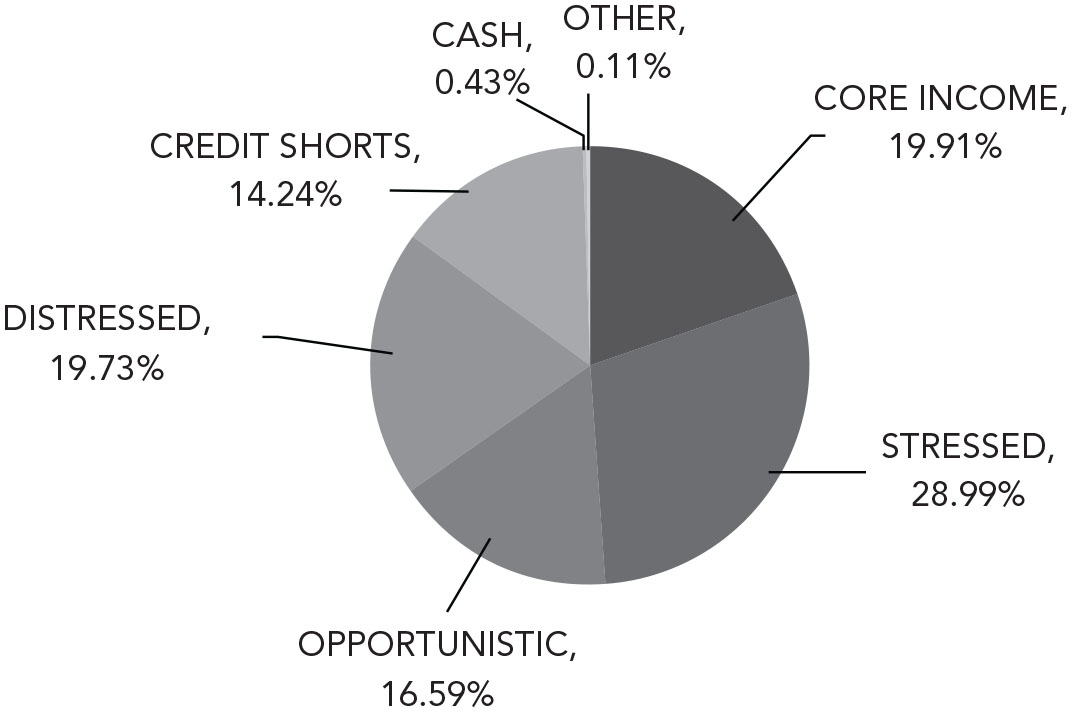

Summary of Portfolio Assets Allocation

The above chart provides a visual breakdown of the Fund’s major investment types that the underlying securities represent, as a percentage of the total investments held as of September 30, 2023. Please see the Schedule of Investments on the following pages for a detailed list of the Fund’s holdings. The Fund’s portfolio composition is subject to change at any time and may not necessarily reflect adjustments that are routinely made when presenting net assets for formal financial statement processes.

| Bluebay Destra International Event-Driven Credit Fund |

| Portfolio Manager Letter (unaudited) |

Investment environment

The fiscal year, October 1, 2022 - September 30, 2023 (the “Fiscal Year”) started with market sentiment turning positive based on its outlook for inflation, interest rates and the possibility of a conclusion to the conflict in Ukraine. However, as we entered 2023, it became clear that many of the challenges of the previous year were likely to continue into the new year. Inflation proved to be sticky, and consequently central banks around the world maintained a hawkish stance. Fears grew of recession on both sides of the Atlantic and the geopolitical stress in Ukraine did not resolve itself as quickly as had been hoped.

We have consequently remained cautious throughout the Fiscal Year. Nonetheless, we have been able to identify a steady stream of opportunities for the strategy, where our bottom-up fundamental analysis has suggested limited downside and attractive potential upside even in a challenging environment for markets overall.

Performance Discussion

For the Fiscal Year, Class I of the Fund had a return of 16.66%, net of fees.

In terms of sub-strategies, the two largest contributors were the Event-Driven/Opportunistic and Distressed sleeves; while the Stressed and Core Income sleeves also made significant contributions. Single name shorts and Market Hedging sleeves were negative contributors during the Fiscal Year.

The top single name contributor to Fund performance during the Fiscal Year was a position in the Distressed sleeve, BOA OCV, which announced the sale of its remaining maritime vessel for $87 million during the Fiscal Year. The company has realized and distributed the majority of its assets and in aggregate, the expected recovery on the bonds will be above par. By the end of the Fiscal Year, the position had been significantly reduced by these distributions and the Fund’s remaining exposure is less than 50 basis points.

An Event Driven/Opportunistic position, Shelf Drilling, was the second strongest contributor. Sector-level news flow about new contracts, utilization levels and day rates during the Fiscal Year positively contributed to the Fund’s performance, and Shelf Drilling specifically announced the completion and funding of an acquisition of additional oil rigs in the North Sea. The Fund had fully exited from this position by the end of the Fiscal Year.

The worst single name detractor was Metalcorp, as the market digested news surrounding its debt restructuring towards the end of the Fiscal Year.

Viewpoint & Outlook

As we approached the fourth quarter of calendar year 2023, sentiment turned more bearish, as hopes for a soft landing gave way to fears over a higher-for-longer scenario for interest rates. Inflation has not disappeared and recent elevated commodity prices and wage demands, suggest that central bank policymakers will remain hawkish. We have commented before that consumers and corporations will continue to face challenges and we believe that this is still very much the case. It is hard to find a part of the economy that is not being impacted negatively by the recent and ongoing macroeconomic, supply chain and geopolitical issues. Against this backdrop, we have continued to see a steady flow of stressed and distressed opportunities across a broad range of sectors and countries; and we anticipate that this will continue during the months ahead. The Fund has performed strongly throughout recent quarters, displaying low correlation to traditional markets and we remain positive on the outlook for the strategy.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments |

As of September 30, 2023 |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | BANK LOANS – 18.6% | | | | |

| | | | | FRANCE – 3.7% | | | | |

| | 6,110,000 | | | Biscuit Holding SASU, | | | | |

| | | | | 7.269% (6-Month Euribor + 400 basis points), 02/14/2027(1)(2)(4) | | $ | 5,677,222 | |

| | | | | | | | | |

| | | | | GERMANY – 0.7% | | | | |

| | | | | IFA Holding GmbH TL: | | | | |

| $ | 401,087 | | | 4.000%, 03/31/2025(2)(3)(10) | | | 123,150 | |

| $ | 401,087 | | | 0.000%, 03/31/2029(2)(3)(10) | | | 4,246 | |

| | 1,368,009 | | | IFA Holding GmbH TL2, | | | | |

| | | | | 7.714%, 03/31/2025(3)(4)(10) | | | 463,487 | |

| | 1,237,723 | | | IFA Holding GmbH TL3, | | | | |

| | | | | 7.714%, 03/31/2025(3)(4)(10) | | | 419,345 | |

| | | | | | | | 1,010,228 | |

| | | | | LUXEMBOURG – 3.5% | | | | |

| | 1,348,742 | | | Takko Luxembourg TL, | | | | |

| | | | | 15.000%, 12/09/2026(3)(4)(5)(10) | | | 1,356,596 | |

| | 4,046,226 | | | Takko Luxembourg TL B, | | | | |

| | | | | 12.500%, 11/09/2026(3)(4)(10) | | | 4,069,788 | |

| | | | | | | | 5,426,384 | |

| | | | | SAUDI ARABIA – 0.5% | | | | |

| | | | | Ahmad Hamad Al Gosaibi & Brothers TL: | | | | |

| $ | 3,047,652 | | | 0.000%, 01/01/2050(3)(6) | | | 167,621 | |

| | 3,240,000 | | | 0.000%, 01/01/2050(3)(4)(6) | | | 175,807 | |

| | 8,400,000 | | | 0.000%, 01/01/2050(3)(4)(6) | | | 455,797 | |

| | | | | | | | 799,225 | |

| | | | | SINGAPORE – 0.6% | | | | |

| | 532,315 | | | Teide Pte, Ltd. 1L, | | | | |

| | | | | 10.000%, 07/31/2026(4)(5) | | | 402,970 | |

| | 1,126,138 | | | Teide Pte, Ltd. 2L, | | | | |

| | | | | 8.000%, 12/01/2026(4)(5) | | | 536,540 | |

| | | | | | | | 939,510 | |

| | | | | SPAIN – 2.7% | | | | |

| | | | | Celsa Group: | | | | |

| | 373,739 | | | 7.998%, 12/31/2024(4) | | | 387,787 | |

| | 3,077,316 | | | 5.680%, 06/30/2025(5)(12) | | | 645,058 | |

| | 3,129,485 | | | 2.500%, 06/30/2025(2)(4)(5) | | | 3,031,740 | |

| | | | | | | | 4,064,585 | |

| | | | | UNITED ARAB EMIRATES – 1.7% | | | | |

| | | | | Gulf Marine Middle East FZE: | | | | |

| $ | 2,318,465 | | | 0.000%, 06/09/2025(2)(3)(5)(10) | | | 2,028,657 | |

| $ | 626,817 | | | 0.000%, 06/09/2025(2)(3)(5)(10) | | | 548,465 | |

| | | | | | | | 2,577,122 | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | BANK LOANS (continued) | | | | |

| | | | | UNITED KINGDOM – 5.2% | | | | |

| | 4,175,185 | | | Platform Bidco, Ltd., | | | | |

| | | | | 8.136% (6-Month Euribor + 400 basis points), 09/23/2028(1)(2)(4) | | $ | 4,026,213 | |

| | | | | Praesidiad, Ltd.: | | | | |

| $ | 1,633,322 | | | 9.906% (3-Month USD Libor + 425 basis points), 10/04/2024(1) | | | 824,828 | |

| $ | 5,753,754 | | | 7.802% (3-Month Euribor + 400 basis points), 10/04/2024(1)(2) | | | 3,100,752 | |

| | | | | | | | 7,951,793 | |

| | | | | TOTAL BANK LOANS | | | | |

| | | | | (Cost $30,311,363) | | | 28,446,069 | |

| | | | | | | | | |

| | | | | COMMON STOCK – 2.9% | | | | |

| | | | | MARSHALL ISLANDS – 2.9% | | | | |

| | 82,363 | | | Scorpio Tankers, Inc. | | | 4,457,486 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCK | | | | |

| | | | | (Cost $3,554,019) | | | 4,457,486 | |

| | | | | | | | | |

| | | | | CORPORATE DEBT SECURITIES – 2.9% | | | | |

| | | | | FRANCE – 2.8% | | | | |

| | 4,770,000 | | | Iliad Holding SASU, | | | | |

| | | | | 7.000%, 10/15/2028(7) | | | 4,347,120 | |

| | | | | | | | | |

| | | | | UNITED STATES – 0.1% | | | | |

| | 138,000 | | | Voyager Aviation Holdings LLC, | | | | |

| | | | | 8.500%, 05/09/2026(3)(7)(8)(10) | | | 111,090 | |

| | | | | | | | | |

| | | | | TOTAL CORPORATE DEBT SECURITIES | | | | |

| | | | | (Cost $4,614,012) | | | 4,458,210 | |

| | | | | | | | | |

| | | | | INTERNATIONAL DEBT SECURITIES – 45.7% | | | | |

| | | | | BERMUDA – 10.2% | | | | |

| | 4,600,000 | | | Borr Drilling, Ltd., | | | | |

| | | | | 9.500%, 02/09/2026 | | | 4,749,500 | |

| | | | | Floatel International, Ltd.: | | | | |

| | 2,820,000 | | | 11.250%, 03/23/2026(7) | | | 2,890,500 | |

| | 2,066,552 | | | 10.000%, 09/24/2026(5) | | | 1,642,909 | |

| | 1,924,072 | | | 6.000%, 09/24/2026 | | | 1,587,360 | |

| | 452,355 | | | 0.000%, 09/24/2026(5) | | | 359,622 | |

| | 4,200,000 | | | Odfjell Rig III, Ltd., | | | | |

| | | | | 9.250%, 05/31/2028 | | | 4,305,000 | |

| | | | | | | | 15,534,891 | |

| | | | | CANADA – 2.7% | | | | |

| | 4,300,000 | | | International Petroleum Corp., | | | | |

| | | | | 7.250%, 02/01/2027(7) | | | 4,043,075 | |

| | | | | | | | | |

| | | | | GERMANY – 1.7% | | | | |

| | 3,500,000 | | | DEMIRE Deutsche Mittelstand Real Estate AG, | | | | |

| | | | | 1.875%, 10/15/2024 | | | 2,631,022 | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments (continued) |

As of September 30, 2023 |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | INTERNATIONAL DEBT SECURITIES (continued) | | | | |

| | | | | ITALY – 3.3% | | | | |

| | 3,508,000 | | | Moby SpA, | | | | |

| | | | | 7.750%, 07/17/2024(8)(9) | | $ | 2,228,480 | |

| | 2,930,000 | | | Rekeep SpA, | | | | |

| | | | | 7.250%, 02/01/2026 | | | 2,825,848 | |

| | | | | | | | 5,054,328 | |

| | | | | JERSEY – 2.5% | | | | |

| | 4,927,000 | | | Petrofac, Ltd., | | | | |

| | | | | 9.750%, 11/15/2026 | | | 3,784,601 | |

| | | | | | | | | |

| | | | | LUXEMBOURG – 8.8% | | | | |

| | 6,664,000 | | | Avation Capital SA, | | | | |

| | | | | 9.000%, 10/31/2026(5)(7) | | | 5,707,016 | |

| | 2,200,000 | | | Gategroup Finance Luxembourg SA, | | | | |

| | | | | 3.000%, 02/28/2027 | | | 1,617,293 | |

| | 5,470,146 | | | Mangrove Luxco III Sarl, | | | | |

| | | | | 7.775%, 10/09/2025(5) | | | 5,342,731 | |

| | 15,700,000 | | | Metalcorp Group SA, | | | | |

| | | | | 8.500%, 06/28/2026 | | | 332,451 | |

| | 557,384 | | | Paper Industries Intermediate Financing Sarl, | | | | |

| | | | | 10.803% (3-Month Euribor + 700 basis points), 03/01/2025(1)(7) | | | 485,388 | |

| | | | | | | | 13,484,879 | |

| | | | | NETHERLANDS – 1.6% | | | | |

| | 3,070,000 | | | Metinvest BV, | | | | |

| | | | | 5.625%, 06/17/2025 | | | 2,487,886 | |

| | | | | | | | | |

| | | | | NORWAY – 0.9% | | | | |

| | 1,455,846 | | | BOA OCV AS, | | | | |

| | | | | 2.000%, 12/31/2024(5)(7) | | | 547,264 | |

| | 9,969,770 | | | REM Saltire Holding AS, | | | | |

| | | | | 7.000%, 12/31/2024(7) | | | 890,083 | |

| | | | | | | | 1,437,347 | |

| | | | | UKRAINE – 2.9% | | | | |

| | | | | Ukraine Government International Bond: | | | | |

| | 7,290,000 | | | 7.750%, 09/01/2029 | | | 2,103,377 | |

| | 8,060,000 | | | 9.750%, 11/01/2030 | | | 2,389,935 | |

| | | | | | | | 4,493,312 | |

| | | | | UNITED KINGDOM – 11.1% | | | | |

| | 9,100,000 | | | Agps Bondco PLC, | | | | |

| | | | | 6.000%, 08/05/2025 | | | 4,226,755 | |

| | | | | Frigo Debtco PLC: | | | | |

| | 1,632,403 | | | 11.000%, 04/20/2026(5)(7) | | | 1,522,067 | |

| | 5,401,770 | | | 10.000%, 04/20/2028(5) | | | 2,783,356 | |

| | 5,810,000 | | | House of Fraser Funding PLC, | | | | |

| | | | | 0.000% (3-Month GBP Libor + 575 basis points), 07/17/2024(1)(3)(8)(9) | | | 42,548 | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | INTERNATIONAL DEBT SECURITIES (continued) | | | | |

| | | | | UNITED KINGDOM (continued) | | | | |

| | 5,050,000 | | | KCA Deutag UK Finance PLC, | | | | |

| | | | | 9.875%, 12/01/2025 | | $ | 5,106,792 | |

| | 3,219,926 | | | Waldorf Production UK, Ltd., | | | | |

| | | | | 9.750%, 10/01/2024 | | | 3,236,026 | |

| | | | | | | | 16,917,544 | |

| | | | | TOTAL INTERNATIONAL DEBT SECURITIES | | | | |

| | | | | (Cost $68,370,209) | | | 69,868,885 | |

| | | | | | | | | |

| | | | | INTERNATIONAL EQUITIES – 9.4% | | | | |

| | | | | LUXEMBOURG – 0.0% | | | | |

| | 423,995 | | | Takko, A Shares(3)(10) | | | 5 | |

| | 423,995 | | | Takko, B Shares(3)(10) | | | 5 | |

| | 423,995 | | | Takko, C Shares(3)(10) | | | 5 | |

| | 423,995 | | | Takko, D Shares(3)(10) | | | 5 | |

| | 423,995 | | | Takko, E Shares(3)(10) | | | 5 | |

| | 423,995 | | | Takko, F Shares(3)(10) | | | 4 | |

| | 423,995 | | | Takko, G Shares(3)(10) | | | 4 | |

| | 423,995 | | | Takko, H Shares(3)(10) | | | 4 | |

| | 423,995 | | | Takko, I Shares(3)(10) | | | 4 | |

| | 423,995 | | | Takko, J Shares(3)(10) | | | 4 | |

| | | | | | | | 45 | |

| | | | | NORWAY – 6.7% | | | | |

| | 396,244 | | | DOF Group ASA, B Shares(3)(10) | | | 1,908,811 | |

| | 570,764 | | | DOF Group ASA, Common Shares(9) | | | 2,735,574 | |

| | 5,260,901 | | | Jacktel AS(9) | | | 1,112,408 | |

| | 2,750,192 | | | MPC Container Ships AS | | | 4,506,160 | |

| | | | | | | | 10,262,953 | |

| | | | | SINGAPORE – 0.2% | | | | |

| | 24,603,214 | | | Teide, Ltd.(3)(10) | | | 260,490 | |

| | | | | | | | | |

| | | | | UNITED KINGDOM – 2.5% | | | | |

| | 2,789,648 | | | Gym Group PLC(7)(9) | | | 3,779,457 | |

| | | | | | | | | |

| | | | | TOTAL INTERNATIONAL EQUITIES | | | | |

| | | | | (Cost $11,797,152) | | | 14,302,945 | |

| | | | | | | | | |

| | | | | PRIVATE COMPANIES – 1.2% | | | | |

| | | | | AUSTRALIA – 0.0% | | | | |

| | 65,000 | | | Quintis Australia Pty, Ltd., Common Shares(3)(10) | | | — | |

| | | | | Quintis Australia Pty, Ltd., Corporate Debt: | | | | |

| | 8,538 | | | 7.500%, 10/01/2026(3)(5)(7)(10) | | | 2,937 | |

| | 117,000 | | | 0.000%, 10/01/2028(3)(5)(7)(10) | | | — | |

| | | | | | | | 2,937 | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments (continued) |

As of September 30, 2023 |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | PRIVATE COMPANIES (continued) | | | | |

| | | | | BERMUDA – 0.1% | | | | |

| | 695,358 | | | Floatel International, Ltd., | | | | |

| | | | | Common Shares(3)(10) | | $ | 213,823 | |

| | 436,438 | | | Floatel International, Ltd., | | | | |

| | | | | Warrants, 03/16/2025(3)(9)(10) | | | 4 | |

| | | | | | | | 213,827 | |

| | | | | LUXEMBOURG – 0.4% | | | | |

| | 3,500 | | | Avation PLC, | | | | |

| | | | | Warrants, 10/31/2026(9)(10) | | | 2,136 | |

| | 28,205,068 | | | Paper Industries TopCo, Ltd., | | | | |

| | | | | Common Shares(3)(10) | | | 597,249 | |

| | | | | | | | 599,385 | |

| | | | | UNITED KINGDOM – 0.7% | | | | |

| | 5,956 | | | Frigo Debtco PLC, Common Shares | | | 189,179 | |

| | 15,874 | | | KCA Deutag, Common Shares(3) | | | 873,070 | |

| | | | | | | | 1,062,249 | |

| | | | | UNITED STATES – 0.0% | | | | |

| | 64 | | | Voyager Aviation Holdings LLC, | | | | |

| | | | | Common Shares(3)(10) | | | — | |

| | 384 | | | Voyager Aviation Holdings LLC, | | | | |

| | | | | Preferred Shares(3)(10) | | | 4 | |

| | | | | | | | 4 | |

| | | | | TOTAL PRIVATE COMPANIES | | | | |

| | | | | (Cost $2,054,061) | | | 1,878,402 | |

| | | | | | | | | |

| | | | | U.S. TREASURY BILLS – 9.0% | | | | |

| | | | | UNITED STATES – 9.0% | | | | |

| | | | | United States Treasury Bill: | | | | |

| | 4,500,000 | | | 0.000%, 10/03/2023 | | | 4,499,343 | |

| | 9,200,000 | | | 0.000%, 10/05/2023 | | | 9,195,970 | |

| | | | | | | | 13,695,313 | |

| | | | | TOTAL U.S. TREASURY BILLS | | | | |

| | | | | (Cost $13,693,319) | | | 13,695,313 | |

| | | | | | | | | |

| | | | | U.S. TREASURY NOTES – 5.2% | | | | |

| | | | | UNITED STATES – 5.2% | | | | |

| | 7,900,000 | | | United States Treasury Note, | | | | |

| | | | | 0.125%, 10/15/2023 | | | 7,885,219 | |

| | | | | | | | | |

| | | | | TOTAL U.S. TREASURY NOTES | | | | |

| | | | | (Cost $7,884,625) | | | 7,885,219 | |

| Shares or | | | | | | |

| Principal | | | | | | |

| Amounts | | | Description | | Value | |

| | | | | SHORT-TERM INVESTMENTS – 6.8% | | | |

| | | | | UNITED STATES – 6.8% | | | |

| | 10,431,779 | | | BlackRock Liquidity Funds FedFund Portfolio – Institutional Class, 5.236%(11) | | $ | 10,431,779 | |

| | | | | | | | | |

| | | | | TOTAL SHORT-TERM INVESTMENTS | | | | |

| | | | | (Cost $10,431,779) | | | 10,431,779 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS – 101.7% | | | | |

| | | | | (Cost $152,710,539) | | | 155,424,308 | |

| | | | | Liabilities in Excess of Other Assets – (1.7)% | | | (2,635,305 | ) |

| | | | | TOTAL NET ASSETS – 100.0% | | $ | 152,789,003 | |

| (1) | Floating rate security. Rate as of September 30, 2023 is disclosed. |

| (2) | When-issued security that has not settled as of September 30, 2023. Rate is not in effect at September 30, 2023. |

| (3) | Fair valued using significant unobservable inputs. |

| (4) | Principal amount shown in Euro; value shown in U.S. Dollars. |

| (5) | Payment-in-kind interest is generally paid by issuing additional par/shares of the security rather than paying cash. |

| (6) | Investment made through participation in a settlement claim (see Note 2). |

| (7) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. These securities have been determined to be liquid under guidelines established by management. At September 30, 2023 the total value of these securities is $24,325,997 representing 15.9% of net assets. |

| (8) | Security is in default. |

| (9) | Non-income producing security. |

| (10) | Restricted investment as to resale (see Note 2). |

| (11) | The rate is the annualized seven-day yield as of September 30, 2023. |

| (12) | Principal amount shown in Polish Zloty; value shown in U.S. Dollars. |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments (continued) |

As of September 30, 2023 |

At September 30, 2023, the BlueBay Destra International Event-Driven Credit Fund had outstanding forward foreign exchange contracts as set forth below:

| | | | | | | | | Contract Amount | | | | | | Unrealized | |

Settlement

Date | | Counterparty | | Currency

Purchased | | Currency

Sold | | Buy | | | Sell | | | Value | | | Appreciation

(Depreciation) | |

| December 13, 2023 | | BNP Paribas Securities Corp. | | U.S. Dollar | | Poland Zloty | | $ | 594,401 | | | PLN | 2,499,525 | | | $ | 570,259 | | | $ | 24,142 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 326,557 | | | EUR | 305,022 | | | | 323,791 | | | | 2,766 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 396,477 | | | EUR | 376,155 | | | | 399,301 | | | | (2,824 | ) |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 539,845 | | | EUR | 500,000 | | | | 530,767 | | | | 9,078 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 41,804,357 | | | EUR | 38,718,887 | | | | 41,101,399 | | | | 702,958 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 405,174 | | | EUR | 375,757 | | | | 398,878 | | | | 6,296 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 578,970 | | | EUR | 540,000 | | | | 573,228 | | | | 5,742 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Euro Currency | | $ | 502,390 | | | EUR | 468,610 | | | | 497,445 | | | | 4,945 | |

| December 13, 2023 | | Brown Brothers Harriman | | U.S. Dollar | | Norwegian Krone | | $ | 266,532 | | | NOK | 2,861,548 | | | | 268,330 | | | | (1,798 | ) |

| December 13, 2023 | | Citibank, N.A. | | U.S. Dollar | | Euro Currency | | $ | 581,813 | | | EUR | 540,000 | | | | 573,228 | | | | 8,585 | |

| December 13, 2023 | | Citibank, N.A. | | U.S. Dollar | | Pound Sterling | | $ | 196,953 | | | GBP | 161,616 | | | | 197,319 | | | | (366 | ) |

| December 13, 2023 | | JP Morgan | | Euro Currency | | U.S. Dollar | | EUR | 362,407 | | | $ | 389,333 | | | | 384,707 | | | | (4,626 | ) |

| December 13, 2023 | | JP Morgan | | U.S. Dollar | | Pound Sterling | | $ | 5,448,927 | | | GBP | 4,338,302 | | | | 5,296,695 | | | | 152,232 | |

| December 13, 2023 | | Morgan Stanley & Co. LLC | | U.S. Dollar | | Norwegian Krone | | $ | 10,303,185 | | | NOK | 109,928,431 | | | | 10,308,096 | | | | (4,911 | ) |

| December 13, 2023 | | Morgan Stanley & Co. LLC | | U.S. Dollar | | Swis Franc | | $ | 78,800 | | | CHF | 70,000 | | | | 77,158 | | | | 1,642 | |

| December 13, 2023 | | Morgan Stanley & Co. LLC | | U.S. Dollar | | Swis Franc | | $ | 148,627 | | | CHF | 135,148 | | | | 148,967 | | | | (340 | ) |

| December 13, 2023 | | NatWest Markets Securities, Inc. | | Norwegian Krone | | U.S. Dollar | | NOK | 4,780,803 | | | $ | 443,268 | | | | 448,301 | | | | 5,033 | |

| December 13, 2023 | | Nomura Securities Co., Ltd. | | U.S. Dollar | | Euro Currency | | $ | 646,852 | | | EUR | 600,000 | | | | 636,920 | | | | 9,932 | |

| December 13, 2023 | | State Street | | U.S. Dollar | | Euro Currency | | $ | 322,602 | | | EUR | 304,706 | | | | 323,455 | | | | (853 | ) |

| December 13, 2023 | | State Street | | U.S. Dollar | | Swis Franc | | $ | 1,523,723 | | | CHF | 1,341,929 | | | | 1,479,144 | | | | 44,579 | |

| December 13, 2023 | | UBS AG | | U.S. Dollar | | Euro Currency | | $ | 1,725,535 | | | EUR | 1,600,000 | | | | 1,698,454 | | | | 27,081 | |

| | | | | | | | | | | | | | | | | | | | | $ | 989,293 | |

At September 30, 2023, the BlueBay Destra International Event-Driven Credit Fund had open swap contracts as set forth below:

Credit Default Swap Contracts:

| Underlying Instrument | | Counterparty | | Pay Rate/

Frequency | | Maturity

Date | | Notional

Amount at

Value(1) | | | Premium

(Paid)

Received | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

| Markit iTraxx Europe Crossover Index Swap(2) | | HSBC Securities | | 5.000%/Quarterly | | 12/20/2027 | | EUR | 3,305,311 | | | $ | (108,043 | ) | | $ | (209,664 | ) | | $ | (101,621 | ) |

| Markit iTraxx Europe Crossover Index Swap(3) | | Merrill Lynch | | 5.000%/Quarterly | | 6/20/2028 | | EUR | 7,340,750 | | | | (182,258 | ) | | | (407,027 | ) | | | (224,769 | ) |

| Next PLC Credit Default Swap(4) | | Citigroup, Inc. | | 1.000%/Quarterly | | 6/20/2027 | | EUR | 1,100,000 | | | | 59,888 | | | | (10,612 | ) | | | (70,500 | ) |

| | | | | | | | | | | | | | | | | | | | | $ | (396,890 | ) |

| (1) | The maximum potential amount the Fund may pay or receive should a credit event take place as defined under the terms of the contract. |

| (2) | The underlying issuer is ITRX XOVER CDSI S38 5Y Corp. |

| (3) | The underlying issuer is ITRX XOVER CDSI S39 5Y Corp. |

| (4) | The underlying issuer is NXTLN CDS EUR SR 5Y D14 |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments (continued) |

As of September 30, 2023 |

| Summary by Industry Group | | Value | | | % of Net

Assets | |

| Bank Loans | | | | | | | | |

| Apparel | | $ | 5,426,384 | | | | 3.5 | % |

| Auto Parts & Equipment | | | 1,010,228 | | | | 0.7 | |

| Commercial Services | | | 6,502,702 | | | | 4.3 | |

| Diversified Financial Services | | | 939,510 | | | | 0.6 | |

| Food | | | 9,703,435 | | | | 6.3 | |

| Investment Companies | | | 799,225 | | | | 0.5 | |

| Iron/Steel | | | 4,064,585 | | | | 2.7 | |

| Total Bank Loans | | | 28,446,069 | | | | 18.6 | |

| Common Stock | | | | | | | | |

| Transportation | | | 4,457,486 | | | | 2.9 | |

| Total Common Stock | | | 4,457,486 | | | | 2.9 | |

| Corporate Debt Securities | | | | | | | | |

| Diversified Financial Services | | | 111,090 | | | | 0.1 | |

| Telecommunications | | | 4,347,120 | | | | 2.8 | |

| Total Corporate Debt Securities | | | 4,458,210 | | | | 2.9 | |

| International Debt Securities | | | | | | | | |

| Commercial Services | | | 2,825,848 | | | | 1.8 | |

| Diversified Financial Services | | | 5,707,016 | | | | 3.7 | |

| Forest Products & Paper | | | 485,388 | | | | 0.3 | |

| Investment Companies | | | 4,305,423 | | | | 2.8 | |

| Iron/Steel | | | 2,487,886 | | | | 1.6 | |

| Machinery-Diversified | | | 5,342,731 | | | | 3.5 | |

| Mining | | | 332,451 | | | | 0.2 | |

| Oil & Gas | | | 23,708,093 | | | | 15.6 | |

| Oil & Gas Services | | | 8,887,375 | | | | 5.9 | |

| Real Estate | | | 6,857,777 | | | | 4.5 | |

| Retail | | | 42,548 | | | | 0.0 | |

| Sovereign | | | 4,493,312 | | | | 2.9 | |

| Transportation | | | 4,393,037 | | | | 2.9 | |

| Total International Debt Securities | | | 69,868,885 | | | | 45.7 | |

| International Equities | | | | | | | | |

| Apparel | | | 45 | | | | 0.0 | |

| Commercial Services | | | 1,112,408 | | | | 0.7 | |

| Diversified Financial Services | | | 260,490 | | | | 0.2 | |

| Leisure Time | | | 3,779,457 | | | | 2.5 | |

| Oil & Gas Services | | | 4,644,385 | | | | 3.0 | |

| Transportation | | | 4,506,160 | | | | 3.0 | |

| Total International Equities | | | 14,302,945 | | | | 9.4 | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Schedule of Investments (continued) |

As of September 30, 2023 |

| Summary by Industry Group | | Value | | | % of Net

Assets | |

| Private Companies | | | | | | | | |

| Airlines | | $ | 2,136 | | | | 0.0 | % |

| Diversified Financial Services | | | 4 | | | | 0.0 | |

| Energy | | | 873,070 | | | | 0.6 | |

| Forest Products & Paper | | | 600,186 | | | | 0.4 | |

| Investment Companies | | | 189,179 | | | | 0.1 | |

| Oil & Gas | | | 213,827 | | | | 0.1 | |

| Total Private Companies | | | 1,878,402 | | | | 1.2 | |

| U.S. Treasury Bills | | | | | | | | |

| Sovereign | | | 13,695,313 | | | | 9.0 | |

| Total U.S. Treasury Bills | | | 13,695,313 | | | | 9.0 | |

| U.S. Treasury Notes | | | | | | | | |

| Sovereign | | | 7,885,219 | | | | 5.2 | |

| Total U.S. Treasury Notes | | | 7,885,219 | | | | 5.2 | |

| Short-Term Investments | | | | | | | | |

| Money Market Fund | | | 10,431,779 | | | | 6.8 | |

| Total Short-Term Investments | | | 10,431,779 | | | | 6.8 | |

| Total Investments | | | 155,424,308 | | | | 101.7 | |

| Liabilities in Excess of Other Assets | | | (2,635,305 | ) | | | (1.7 | ) |

| Net Assets | | $ | 152,789,003 | | | | 100.0 | % |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statement of Assets and Liabilities |

September 30, 2023 |

| Assets: | | | | |

| Investments, at value (cost $152,710,539) | | $ | 155,424,308 | |

| Cash | | | 50,000 | |

| Restricted cash: | | | | |

| Deposits held at broker for forward contracts | | | 1,480,000 | |

| Deposits held at broker for swap contracts | | | 1,177,365 | |

| Foreign currency, at value (cost $1,753,369) | | | 1,719,387 | |

| Unrealized appreciation on: | | | | |

| Forward foreign exchange contracts | | | 1,005,011 | |

| Receivables: | | | | |

| Interest | | | 2,406,424 | |

| Dividends | | | 34,741 | |

| Fund shares sold | | | 4,579,938 | |

| Investments sold | | | 9,963 | |

| Paydowns from loans | | | 465,670 | |

| Escrow proceeds | | | 62,074 | |

| Prepaid expenses | | | 31,682 | |

| Total assets | | | 168,446,563 | |

| | | | | |

| Liabilities: | | | | |

| Premiums paid on credit default swap contracts | | | 230,413 | |

| Unrealized depreciation on: | | | | |

| Forward foreign exchange contracts | | | 15,718 | |

| Credit default swap contracts | | | 396,890 | |

| Payables: | | | | |

| Investments purchased | | | 14,621,863 | |

| Management fee (see note 4) | | | 115,878 | |

| Professional fees | | | 112,844 | |

| Custody fees | | | 49,716 | |

| Accounting and administrative fees | | | 48,472 | |

| Transfer agent fees and expenses | | | 43,454 | |

| Distribution fees | | | 5,156 | |

| Shareholder servicing fees | | | 4,644 | |

| Accrued other expenses | | | 12,512 | |

| Total liabilities | | | 15,657,560 | |

| Commitments and Contingencies (see note 2(f)) | | | | |

| Net assets | | $ | 152,789,003 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid-in capital (unlimited shares authorized at $0.001 par value common stock) | | $ | 148,404,169 | |

| Total distributable earnings | | | 4,384,834 | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statement of Assets and Liabilities (continued) |

September 30, 2023 |

| Net assets | | $ | 152,789,003 | |

| | | | | |

| Net assets: | | | | |

| Class I | | $ | 130,453,911 | |

| Class A | | | 8,857,464 | |

| Class L | | | 1,904,368 | |

| Class T | | | 11,573,260 | |

| Shares outstanding: | | | | |

| Class I | | | 5,641,098 | |

| Class A | | | 383,294 | |

| Class L | | | 82,466 | |

| Class T | | | 503,267 | |

| Net asset value per share: | | | | |

| Class I | | $ | 23.13 | |

| Class A | | | 23.11 | |

| Maximum offering price per share(1) | | | 24.52 | |

| Class L | | | 23.09 | |

| Maximum offering price per share(2) | | | 24.11 | |

| Class T | | | 23.00 | |

| Maximum offering price per share(3) | | | 23.71 | |

| (1) | Include a sales charge of 5.75%. |

| (2) | Include a sales charge of 4.25%. |

| (3) | Include a sales charge of 3.00%. |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statement of Operations |

For the Year Ended September 30, 2023 |

| Investment income: | | | | |

| Interest income(1) | | $ | 11,083,862 | |

| Dividend income | | | 232,913 | |

| Total investment income | | | 11,316,775 | |

| | | | | |

| Expenses: | | | | |

| Management fee (see note 4) | | | 1,707,032 | |

| Professional fees | | | 260,365 | |

| Accounting and administrative fees | | | 246,918 | |

| Transfer agent fees and expenses | | | 187,863 | |

| Custody fees | | | 132,771 | |

| Registration fees | | | 63,702 | |

| Shareholder reporting fees | | | 38,080 | |

| Trustee fees (see note 15) | | | 25,593 | |

| Chief financial officer fees (see note 15) | | | 22,000 | |

| Chief compliance officer fees (see note 15) | | | 15,000 | |

| Insurance expense | | | 10,878 | |

| Distribution fees Class L (see note 7) | | | 4,469 | |

| Distribution fees Class T (see note 7) | | | 49,601 | |

| Shareholder servicing fees Class A (see note 7) | | | 14,948 | |

| Shareholder servicing fees Class L (see note 7) | | | 4,468 | |

| Shareholder servicing fees Class T (see note 7) | | | 24,801 | |

| Other expenses | | | 39,580 | |

| Total expenses | | | 2,848,069 | |

| Expenses waived by adviser (see note 5) | | | (555,026 | ) |

| Net expenses | | | 2,293,043 | |

| Net investment income | | | 9,023,732 | |

| | | | | |

| Net realized and unrealized gain (loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 4,337,367 | |

| Foreign currency transactions | | | (235,264 | ) |

| Forward foreign exchange contracts | | | 993,392 | |

| Swap contracts | | | (424,638 | ) |

| Purchased options contracts | | | (640,361 | ) |

| Written options contracts | | | 110,562 | |

| Total net realized gain | | | 4,141,058 | |

| | | | | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 1,470,704 | |

| Foreign currency translations | | | 61,536 | |

| Forward foreign exchange contracts | | | (328,833 | ) |

| Swap contracts | | | (435,152 | ) |

| Total net change in unrealized appreciation | | | 768,255 | |

| Net realized and unrealized gain | | | 4,909,313 | |

| Net increase in net assets resulting from operations | | $ | 13,933,045 | |

| (1) | Net of foreign withholding taxes of $57,860. |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statements of Changes in Net Assets |

| | | Year Ended

September 30,

2023 | | | Year Ended

September 30,

2022 | |

| Increase in net assets resulting from operations: | | | | | | | | |

| Net investment income | | $ | 9,023,732 | | | $ | 3,579,471 | |

| Net realized gain | | | 4,141,058 | | | | 3,507,029 | |

| Net change in unrealized appreciation (depreciation) | | | 768,255 | | | | (472,910 | ) |

| Net increase in net assets resulting from operations | | | 13,933,045 | | | | 6,613,590 | |

| | | | | | | | | |

| Distributions to shareholders: | | | | | | | | |

| Class I | | | (10,834,466 | ) | | | (13,219,934 | ) |

| Class A | | | (775,472 | ) | | | (603,835 | ) |

| Class L | | | (233,808 | ) | | | (544,500 | ) |

| Class T | | | (1,322,700 | ) | | | (1,442,739 | ) |

| Total distributions to shareholders | | | (13,166,446 | ) | | | (15,811,008 | ) |

| | | | | | | | | |

| Capital transactions: | | | | | | | | |

| Proceeds from shares sold: | | | | | | | | |

| Class I | | | 83,395,458 | | | | 10,444,205 | |

| Class A | | | 6,027,822 | | | | 699,308 | |

| Class T | | | 6,171,927 | | | | 3,276,420 | |

| Reinvestment of distributions: | | | | | | | | |

| Class I | | | 8,514,111 | | | | 13,041,974 | |

| Class A | | | 469,766 | | | | 590,570 | |

| Class L | | | 233,809 | | | | 544,500 | |

| Class T | | | 919,537 | | | | 1,160,394 | |

| Cost of shares repurchased: | | | | | | | | |

| Class I | | | (9,221,184 | ) | | | (4,608,290 | ) |

| Class A | | | (31,066 | ) | | | - | |

| Class T | | | (2,175,931 | ) | | | - | |

| Net increase in net assets from capital transactions | | | 94,304,249 | | | | 25,149,081 | |

| Total increase in net assets | | | 95,070,848 | | | | 15,951,663 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 57,718,155 | | | | 41,766,492 | |

| End of year | | $ | 152,789,003 | | | $ | 57,718,155 | |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Shares sold: | | | | | | | | |

| Class I | | | 3,598,424 | | | | 430,517 | |

| Class A | | | 259,176 | | | | 29,191 | |

| Class T | | | 266,682 | | | | 136,937 | |

| Shares reinvested: | | | | | | | | |

| Class I | | | 377,918 | | | | 573,959 | |

| Class A | | | 20,801 | | | | 25,999 | |

| Class L | | | 10,415 | | | | 24,000 | |

| Class T | | | 41,144 | | | | 51,230 | |

| Shares repurchased: | | | | | | | | |

| Class I | | | (399,708 | ) | | | (161,330 | ) |

| Class A | | | (1,374 | ) | | | - | |

| Class T | | | (96,343 | ) | | | - | |

| Net increase from capital share transactions | | | 4,077,135 | | | | 1,110,503 | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statement of Cash Flows |

For the Year Ended September 30, 2023 |

| Cash flows from operating activities: | | | | |

| Net increase in net assets from operations | | $ | 13,933,045 | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | |

| Purchase of investments | | | (186,427,499 | ) |

| Proceeds from redemptions, sales, or other dispositions of investments | | | 100,329,241 | |

| Amortization of premium | | | (5,825,431 | ) |

| Net realized (gain) loss on: | | | | |

| Investments | | | (4,337,367 | ) |

| Foreign currency transactions | | | 235,264 | |

| Forward foreign exchange contracts | | | (993,392 | ) |

| Swap contracts | | | 424,638 | |

| Purchased options contracts | | | 640,361 | |

| Written options contracts | | | (110,562 | ) |

| Principal paydowns | | | (45,575 | ) |

| Net change in unrealized (appreciation) depreciation on: | | | | |

| Investments | | | (1,470,704 | ) |

| Foreign currency translations | | | (61,536 | ) |

| Forward foreign exchange contracts | | | 328,833 | |

| Swap contracts | | | 435,152 | |

| Change in operating assets and liabilities: | | | | |

| Receivables: | | | | |

| Investments sold | | | 476,454 | |

| Interest | | | (1,833,322 | ) |

| Dividends | | | 138,742 | |

| Escrow proceeds | | | 115,239 | |

| Prepaid expenses | | | (11,302 | ) |

| Payables: | | | | |

| Investments purchased | | | 11,865,805 | |

| Management fees | | | 73,961 | |

| Custody fees | | | 32,647 | |

| Accounting and administration fees | | | 15,319 | |

| Professional fees | | | 20,913 | |

| Transfer agent fees and expenses | | | 27,978 | |

| Distribution fees | | | 2,161 | |

| Shareholder servicing fees | | | 2,486 | |

| Accrued other expenses | | | 2,299 | |

| Net cash used in operating activities | | | (72,016,152 | ) |

| | | | | |

| Cash flows from financing activities: | | | | |

| Due to broker | | | (450,000 | ) |

| Proceeds from shares sold, net of receivable for fund shares sold | | | 91,135,014 | |

| Payments for shares repurchased | | | (11,428,181 | ) |

| Cash distributions paid, net of reinvestment | | | (3,029,223 | ) |

| Net cash provided by financing activities | | | 76,227,610 | |

| | | | | |

| Effect of exchange rate changes in cash | | | 490,831 | |

| | | | | |

| Net change in cash and cash equivalents | | | 4,702,289 | |

| | | | | |

| Cash, restricted cash, and foreign currency at beginning of period | | | (275,537 | ) |

| | | | | |

| Cash, restricted cash, and foreign currency at end of period | | $ | 4,426,752 | |

| | | | | |

| Supplemental schedule of non-cash activity: | | | | |

See accompanying Notes to Financial Statements.

Bluebay Destra International Event-Driven Credit Fund |

Statement of Cash Flows (continued) |

For the Year Ended September 30, 2023 |

| Reinvestment of distributions | | $ | 10,137,223 | |

| | | | | |

| Reconciliation of cash, restricted cash, and foreign currency at the beginning of year to the Statement of Assets and Liabilities | | | | |

| Cash | | $ | 50,000 | |

| Restricted cash: | | | | |

| Deposits held at broker | | | 84,466 | |

| Deposits due to broker | | | (450,000 | ) |

| Foreign currency | | | 39,997 | |

| | | $ | (275,537 | ) |

| Reconciliation of cash, restricted cash, and foreign currency at the end of year to the Statement of Assets and Liabilities | | | | |

| Cash | | $ | 50,000 | |

| Restricted cash: | | | | |

| Deposits held at broker for forward contracts | | | 1,480,000 | |

| Deposits held at broker for swap contracts | | | 1,177,365 | |

| Foreign currency | | | 1,719,387 | |

| | | $ | 4,426,752 | |

See accompanying Notes to Financial Statements.

| Bluebay Destra International Event-Driven Credit Fund |

| Financial Highlights |

| For a share of common stock outstanding throughout the periods indicated |

Period ended

September 30, | | Net asset value, beginning of period | | | Net

investment

income(1) | | | Net realized and unrealized gain (loss) | | | Total from

investment

operations | | | Distributions to shareholders from net

investment

income | | | Distributions to shareholders from net

realized gain | | | Distributions to shareholders

from return

of capital | | | Total

distributions | | | Net asset value, end of period | | | Total return(2),(3) | | | Gross expenses(4),(5) | | | Net

expenses(4),(5),(6) | | | Net investment

income(4),(6) | | | Net assets, end of period

(in thousands) | | | Portfolio turnover rate(3) | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | $ | 22.80 | | | $ | 2.16 | | | $ | 1.41 | | | $ | 3.57 | | | $ | (2.84 | ) | | $ | (0.40 | ) | | $ | - | | | $ | (3.24 | ) | | $ | 23.13 | | | | 16.66 | % | | | 2.82 | % | | | 2.25 | % | | | 9.32 | % | | $ | 130,454 | | | | 60 | % |

| 2022 | | | 29.37 | | | | 1.99 | | | | 1.89 | | | | 3.88 | | | | (3.55 | ) | | | (6.90 | ) | | | - | | | | (10.45 | ) | | | 22.80 | | | | 16.93 | | | | 3.46 | | | | 2.25 | | | | 8.04 | | | | 47,067 | | | | 72 | |

| 2021 | | | 23.94 | | | | 1.22 | | | | 5.26 | | | | 6.48 | | | | (1.05 | ) | | | - | | | | - | | | | (1.05 | ) | | | 29.37 | | | | 27.25 | | | | 3.05 | | | | 2.28 | | | | 4.55 | | | | 35,866 | | | | 98 | |

| 2020 | | | 25.20 | | | | 0.71 | | | | (0.59 | ) | | | 0.12 | | | | (0.48 | ) | | | (0.16 | ) | | | (0.74 | ) | | | (1.38 | ) | | | 23.94 | | | | 0.64 | | | | 3.06 | | | | 2.32 | | | | 2.98 | | | | 52,398 | | | | 130 | |

| 2019 | | | 24.50 | | | | 0.90 | | | | 0.96 | | | | 1.86 | | | | (1.16 | ) | | | - | | | | - | | | | (1.16 | ) | | | 25.20 | | | | 7.85 | | | | 4.08 | | | | 2.95 | | | | 3.68 | | | | 51,828 | | | | 124 | |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | | 22.79 | | | | 2.03 | | | | 1.48 | | | | 3.51 | | | | (2.79 | ) | | | (0.40 | ) | | | - | | | | (3.19 | ) | | | 23.11 | | | | 16.38 | | | | 3.07 | | | | 2.50 | | | | 8.80 | | | | 8,857 | | | | 60 | |

| 2022 | | | 29.37 | | | | 1.95 | | | | 1.86 | | | | 3.81 | | | | (3.49 | ) | | | (6.90 | ) | | | - | | | | (10.39 | ) | | | 22.79 | | | | 16.61 | | | | 3.71 | | | | 2.50 | | | | 7.93 | | | | 2,386 | | | | 72 | |

| 2021 | | | 23.94 | | | | 1.45 | | | | 4.97 | | | | 6.42 | | | | (0.99 | ) | | | - | | | | - | | | | (0.99 | ) | | | 29.37 | | | | 26.96 | | | | 3.30 | | | | 2.53 | | | | 5.33 | | | | 1,454 | | | | 98 | |

| 2020 | | | 25.20 | | | | 0.65 | | | | (0.59 | ) | | | 0.06 | | | | (0.46 | ) | | | (0.16 | ) | | | (0.70 | ) | | | (1.32 | ) | | | 23.94 | | | | 0.39 | | | | 3.31 | | | | 2.57 | | | | 2.72 | | | | 1,145 | | | | 130 | |

| 2019(7) | | | 23.67 | | | | 0.65 | | | | 2.00 | | | | 2.65 | | | | (1.12 | ) | | | - | | | | - | | | | (1.12 | ) | | | 25.20 | | | | 11.42 | | | | 4.26 | | | | 3.24 | | | | 3.41 | | | | 1,114 | | | | 124 | |

| Class L | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | | 22.77 | | | | 2.19 | | | | 1.25 | | | | 3.44 | | | | (2.72 | ) | | | (0.40 | ) | | | - | | | | (3.12 | ) | | | 23.09 | | | | 16.06 | | | | 3.32 | | | | 2.75 | | | | 9.48 | | | | 1,904 | | | | 60 | |

| 2022 | | | 29.35 | | | | 1.80 | | | | 1.94 | | | | 3.74 | | | | (3.42 | ) | | | (6.90 | ) | | | - | | | | (10.32 | ) | | | 22.77 | | | | 16.33 | | | | 3.96 | | | | 2.75 | | | | 7.28 | | | | 1,641 | | | | 72 | |

| 2021 | | | 23.94 | | | | 1.38 | | | | 4.96 | | | | 6.34 | | | | (0.93 | ) | | | - | | | | - | | | | (0.93 | ) | | | 29.35 | | | | 26.64 | | | | 3.55 | | | | 2.78 | | | | 5.08 | | | | 1,410 | | | | 98 | |

| 2020 | | | 25.20 | | | | 0.60 | | | | (0.60 | ) | | | - | | | | (0.44 | ) | | | (0.16 | ) | | | (0.66 | ) | | | (1.26 | ) | | | 23.94 | | | | 0.13 | | | | 3.56 | | | | 2.82 | | | | 2.49 | | | | 1,114 | | | | 130 | |

| 2019(7) | | | 23.67 | | | | 0.60 | | | | 2.00 | | | | 2.60 | | | | (1.07 | ) | | | - | | | | - | | | | (1.07 | ) | | | 25.20 | | | | 11.22 | | | | 4.50 | | | | 3.49 | | | | 3.16 | | | | 1,112 | | | | 124 | |

| Class T | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 | | | 22.70 | | | | 2.05 | | | | 1.33 | | | | 3.38 | | | | (2.68 | ) | | | (0.40 | ) | | | - | | | | (3.08 | ) | | | 23.00 | | | | 15.80 | | | | 3.57 | | | | 3.00 | | | | 8.90 | | | | 11,573 | | | | 60 | |

| 2022 | | | 29.31 | | | | 1.86 | | | | 1.80 | | | | 3.66 | | | | (3.37 | ) | | | (6.90 | ) | | | - | | | | (10.27 | ) | | | 22.70 | | | | 16.01 | | | | 4.21 | | | | 3.00 | | | | 7.62 | | | | 6,624 | | | | 72 | |

| 2021 | | | 23.93 | | | | 1.43 | | | | 4.84 | | | | 6.27 | | | | (0.89 | ) | | | - | | | | - | | | | (0.89 | ) | | | 29.31 | | | | 26.32 | | | | 3.80 | | | | 3.03 | | | | 5.26 | | | | 3,037 | | | | 98 | |

| 2020 | | | 25.20 | | | | 0.44 | | | | (0.50 | ) | | | (0.06 | ) | | | (0.42 | ) | | | (0.16 | ) | | | (0.63 | ) | | | (1.21 | ) | | | 23.93 | | | | (0.11 | ) | | | 3.81 | | | | 3.07 | | | | 1.86 | | | | 1,636 | | | | 130 | |

| 2019(7) | | | 23.67 | | | | 0.55 | | | | 2.00 | | | | 2.55 | | | | (1.02 | ) | | | - | | | | - | | | | (1.02 | ) | | | 25.20 | | | | 11.01 | | | | 4.76 | | | | 3.74 | | | | 2.91 | | | | 1,110 | | | | 124 | |

| (1) | Based on average shares outstanding during the period. |

| (2) | Based on the net asset value as of period end. Assumes an investment at net asset value at the beginning of the period, reinvestment of all distributions during the period and does not include payment of the maximum sales charge. The return would have been lower if certain expenses had not been waived or reimbursed by the investment adviser. |

| (3) | Not annualized for periods less than one year. |

| (4) | Annualized for periods less than one year, with the exception of non-recurring organizational costs. |

See accompanying Notes to Financial Statements.

| Bluebay Destra International Event-Driven Credit Fund |

| Financial Highlights (continued) |

| For a share of common stock outstanding throughout the periods indicated |

| (5) | Percentages shown include interest expense. Gross and net expense ratios, respectively, excluding interest expense are as follows: |

| | | Gross | | | Net | |

| | | Expenses(4) | | | Expenses(4),(6) | |

| Class I | | | | | | | | |

| 2023 | | | 2.82 | % | | | 2.25 | % |

| 2022 | | | 3.45 | | | | 2.25 | |

| 2021 | | | 3.02 | | | | 2.25 | |

| 2020 | | | 3.01 | | | | 2.27 | |

| 2019 | | | 3.62 | | | | 2.48 | |

| Class A | | | | | | | | |

| 2023 | | | 3.07 | | | | 2.50 | |

| 2022 | | | 3.70 | | | | 2.50 | |

| 2021 | | | 3.27 | | | | 2.50 | |

| 2020 | | | 3.26 | | | | 2.52 | |

| 2019(7) | | | 3.77 | | | | 2.75 | |

| | | Gross | | | Net | |

| | | Expenses(4) | | | Expenses(4),(6) | |

| Class L | | | | | | | | |

| 2023 | | | 3.32 | % | | | 2.75 | % |

| 2022 | | | 3.95 | | | | 2.75 | |

| 2021 | | | 3.52 | | | | 2.75 | |

| 2020 | | | 3.51 | | | | 2.77 | |

| 2019(7) | | | 4.02 | | | | 3.00 | |

| Class T | | | | | | | | |

| 2023 | | | 3.57 | | | | 3.00 | |

| 2022 | | | 4.20 | | | | 3.00 | |

| 2021 | | | 3.77 | | | | 3.00 | |

| 2020 | | | 3.76 | | | | 3.02 | |

| 2019(7) | | | 4.27 | | | | 3.25 | |

| (6) | The contractual fee and expense waiver is reflected in both the net expense and net investment income (loss) ratios (see Note 5). Effective November 19, 2018, the Adviser agreed to reimburse and/or pay “ordinary operating expenses” that exceed 0.50% per annum of the Fund’s average daily net assets. Prior to November 19, 2018, the Adviser had agreed to reimburse and/or pay its investment management fee and ordinary operating expenses that exceeded 2.25% per annum of the Fund’s daily “managed assets.” |

| (7) | Reflects operations for the period from December 21, 2018 (inception date of Class A, Class L and Class T) to September 30, 2019. |

| Credit Facility, period ended: | | September 30,

2023 | | | September 30,

2022 | | | September 30,

2021 | | | September 30,

2020 | | | September 30,

2019 | |

| Senior securities, end of period (000’s) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | 5,000 | |

| Asset coverage, per $1,000 of senior security principal amount | | | - | | | | - | | | | - | | | | - | | | | 12,033 | |

| Asset coverage ratio of senior securities | | | - | % | | | - | % | | | - | % | | | - | % | | | 1,203 | % |

See accompanying Notes to Financial Statements.

| Bluebay Destra International Event-Driven Credit Fund |

| Notes to Financial Statements |

| September 30, 2023 |

1. Organization

BlueBay Destra International Event-Driven Credit Fund (the “Fund”) was established as a Delaware statutory trust on November 13, 2017. The Fund is registered with the Securities and Exchange Commission (the “SEC”) as a non-diversified, closed-end management investment company that operates as an “interval fund” under the Investment Company Act of 1940, as amended (the “1940 Act”). The shares of beneficial interest of the Fund (the “Shares”) are continuously offered under Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”). The Fund currently offers four classes of Shares, Classes I, A, L, and T. All classes of Shares have equal rights and voting privileges, except in matters affecting a single class. The Fund has adopted a fundamental policy to make a quarterly repurchase offer (“Repurchase Offer”) between 5% and 25% of the Fund’s outstanding Shares. The Fund’s inception date was May 9, 2018 (Class I Shares). The Fund’s commencement of investment operations date was on the business day following the inception date.

The Fund’s investment adviser is Destra Capital Advisors LLC (the “Adviser”), the Fund’s sub-adviser is RBC Global Asset Management (UK) Limited (the “Sub-Adviser”). RBC Global Asset Management (U.S.) Inc. (the “Former Sub-Sub-Adviser”) previously served as investment sub-sub-adviser to the Fund through November 10, 2022. The Sub-Adviser and Former Sub-Sub-Adviser are wholly-owned subsidiaries of Royal Bank of Canada (“RBC”).

The Fund’s investment objective is to provide attractive total returns, consisting of income and capital appreciation. Under normal market conditions, the Fund will invest at least 80% of its total assets (including borrowings for investment purposes) in credit related instruments and/or investments that have similar economic characteristics as credit related instruments that are considered by the Fund to have the potential to provide a high level of total return. Credit related instruments include bonds, debt securities and loans issued by various U.S. and non-U.S. public- or private-sector entities, including issuers in emerging markets, derivatives and cash equivalents. There is no limit on the credit quality, duration or maturity of any investment in the Fund’s portfolio. Under normal market conditions, the Fund will invest at least 40% of its total assets in securities of non-U.S. issuers, which may include those in emerging markets.

The Fund focuses on investing in long and short positions of debt (fixed or floating rate bonds and loans) or equity securities, including exchange-traded funds, preferred stock, warrants, and options on these securities, depositary receipts such as American Depositary Receipts, and derivatives such as futures and options on futures. These investments may be traded over-the-counter or on an exchange. The Fund may invest in issuers of any size, and in U.S. and non-U.S. issuers. Under normal market conditions, the Fund’s investments in equity securities, at the time of investment, will be limited to 20% of its total assets.

The Fund is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services — Investment Companies. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

2. Significant Accounting Policies

(a) Use of Estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the statement of assets and liabilities. Actual results could differ from those estimates.

(b) Investment Income, Expenses and Distributions

Investment income, expenses other than class specific expenses and realized and unrealized gains and losses are allocated daily to each class of Shares based upon the proportion of the net asset value (“NAV”) of each class of Shares at the beginning of each day. Investment transactions are recorded on a trade-date basis. Interest income and expenses are accrued daily. Dividend income and distributions to shareholders are recorded on the ex-dividend date. The Fund distributes net investment income, if any, quarterly and net realized gains (net of any capital loss carryovers) annually. Discounts and premiums on securities purchased are accreted and amortized using the yield-to-maturity method over the lives of the respective securities. Withholding taxes on foreign interest have been provided in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

| Bluebay Destra International Event-Driven Credit Fund |

| Notes to Financial Statements (continued) |

| September 30, 2023 |

(c) Cash and Restricted Cash

Cash and cash equivalents include U.S. dollar deposits at bank accounts at amounts which may exceed insured limits. The Fund is subject to risk to the extent that the institutions may be unable to fulfill their obligations. As of September 30, 2023, the Fund has restricted cash in the amount of $2,657,365. The restricted cash represents deposits held at brokers.

(d) Investment Valuation

The Board of Trustees of the Fund (“the Board”) has approved valuation procedures for the Fund (the “Valuation Procedures”) which are used for determining the fair value of any Fund investments for which a market quotation is not readily available. The valuation of the Fund’s investments is performed in accordance with the principles found in Rule 2a-5 of the 1940 Act and in conjunction with FASB’s Accounting Standards Codification Topic 820, Fair Value Measurement (“ASC 820-10). The Board has designated the Adviser as the valuation designee of the Fund. As valuation designee, the Adviser performs the fair value determination relating to any and all Fund investments, subject to the conditions and oversight requirements described in the Valuation Procedures. In furtherance of its duties as valuation designee, the Adviser has formed a valuation committee (the “Valuation Committee”), to perform fair value determinations and oversee the day-to-day functions related to the fair valuation of the Fund’s investments. The Valuation Committee may consult with representatives from the Fund’s Sub-Adviser, outside legal counsel, or other third-party consultants in their discussions and deliberations.

In determining NAV, portfolio instruments generally are valued using prices provided by independent pricing services or obtained from other sources, such as broker-dealer quotations. Exchange-traded instruments, including futures contracts, generally are valued at the last reported sales price or official closing price on an exchange, if available. Independent pricing services typically value non-exchange-traded instruments utilizing a range of market-based inputs and assumptions, including readily available market quotations obtained from broker-dealers making markets in such instruments, cash flows, and transactions for comparable instruments. In pricing certain instruments, the pricing services may consider information about an instrument’s issuer or market activity provided by the Fund’s Sub-Adviser. Non-U.S. securities and currency are valued in U.S. dollars based on non-U.S. currency exchange rate quotations supplied by an independent quotation service.

For non-U.S. traded securities whose principal local markets close before the close of the NYSE, the Fund may adjust the local closing price based upon such factors as developments in non-U.S. markets, the performance of U.S. securities markets and the performance of instruments trading in U.S. markets that represent non-U.S. securities. The Fund may rely on an independent fair valuation service in making any such fair value determinations. If the Fund holds portfolio instruments that are primarily listed on non-U.S. exchanges, the value of such instruments may change on days when shareholders will not be able to purchase or redeem the Fund’s Shares.

In certain situations, the valuation designee may use the fair value of a portfolio instrument if such portfolio instrument is not priced by a pricing service, if the pricing service’s price is deemed unreliable or if events occur after the close of a securities market (usually a foreign market) and before the Fund values its assets that would materially affect NAV. A portfolio instrument that is fair valued may be valued at a price higher or lower than actual market quotations or the value determined by other funds using their own fair valuation procedures. Because non-U.S. portfolio instruments may trade on days when Fund Shares are not priced, the value of portfolio instruments held by the Fund can change on days when Fund Shares cannot be redeemed. The valuation designee expects to use fair value pricing primarily when a portfolio instrument is not priced by a pricing service or a pricing service’s price is deemed unreliable.

Due to the subjective nature of fair value pricing, the Fund’s value for a particular portfolio instrument may be different from the last price determined by the pricing service or the last bid or ask price in the market.

Certain short-term instruments maturing within 60 days or less are valued at amortized cost, which approximates fair value. The value of the securities of other open-end funds held by the Fund, if any, will be calculated using the NAV of such open-end funds, and the prospectuses for such open-end funds explain the circumstances under which they use fair value pricing and the effects of using fair value pricing.

| Bluebay Destra International Event-Driven Credit Fund |

| Notes to Financial Statements (continued) |

| September 30, 2023 |

Below is a description of factors that may be considered when valuing securities for which no active secondary market exists:

Valuation of fixed income investments, such as loans and debt securities, depends upon a number of factors, including prevailing interest rates for like securities, expected volatility in future interest rates, call features, put features and other relevant terms of the debt. For investments without readily available market prices, these factors may be incorporated into discounted cash flow models to arrive at fair value. Other factors that may be considered include the borrower’s ability to adequately service its debt, the fair market value of the portfolio company in relation to the face amount of its outstanding debt and the quality of the collateral securing its debt investments.

Asset-backed securities are generally issued as pass-through certificates or as debt instruments. Asset-backed securities issued as pass-through certificates represent undivided fractional ownership interests in an underlying pool of assets. Asset-backed securities issued as debt instruments, which are also known as collateralized obligations, are typically issued as the debt of a special purpose entity organized solely for the purpose of owning such assets and issuing such debt. Asset-backed securities are often backed by a pool of assets representing the obligations of a number of different parties. The yield characteristics of certain asset-backed securities may differ from traditional debt securities. One such major difference is that all or a principal part of the obligations may be prepaid at any time because the underlying assets (i.e., loans) may be prepaid at any time. As a result, a decrease in interest rates in the market may result in increases in the level of prepayments as borrowers, particularly mortgagors, refinance and repay their loans. An increased prepayment rate with respect to an asset-backed security will have the effect of shortening the maturity of the security. In addition, the Fund may subsequently have to reinvest the proceeds at lower interest rates. If the Fund has purchased such an asset-backed security at a premium, a faster than anticipated prepayment rate could result in a loss of principal to the extent of the premium paid. For convertible debt securities, fair value will generally approximate the fair value of the debt plus the fair value of an option to purchase the underlying security (the security into which the debt may convert) at the conversion price. To value such an option, a standard option pricing model may be used.

For private company equity interests, various factors may be considered in determining fair value, including but not limited to multiples of earnings before interest, taxes, depreciation and amortization (“EBITDA”), cash flows, net income, revenues or, in limited instances, book value or liquidation value. All of these factors may be subject to adjustments based upon the particular circumstances of a private company or the Fund’s actual investment position. For example, adjustments to EBITDA may take into account compensation to previous owners or an acquisition, recapitalization, restructuring or other related items.

Other factors that may be considered in valuing securities include private merger and acquisition statistics, public trading multiples discounted for illiquidity and other factors, valuations implied by third-party investments in the private companies, the acquisition price of such investment or industry practices in determining fair value. The valuation designee may also consider the size and scope of a private company and its specific strengths and weaknesses, and may apply discounts or premiums, where and as appropriate, due to the higher (or lower) financial risk and/ or the size of the private company relative to comparable firms, as well as such other factors as the valuation designee, in consultation with any third-party valuation or pricing service, if applicable, may consider relevant in assessing fair value.

If the Fund receives warrants or other equity securities at nominal or no additional cost in connection with an investment in a debt security, the cost basis in the investment will be allocated between the debt securities and any such warrants or other equity securities received at the time of origination. Such warrants or other equity securities will subsequently be valued at fair value.

Portfolio securities that carry certain restrictions on sale will typically be valued at a discount from the public market value of the security, where applicable.

If events materially affecting the price of foreign portfolio securities occur between the time when their price was last determined on such foreign securities exchange or market and the time when the Fund’s NAV was last calculated (for example, movements in certain U.S. securities indices which demonstrate strong correlation to movements in certain foreign securities markets), such securities may be valued at their fair value as determined in good faith in accordance with the Valuation Procedures. For purposes of calculating NAV, all assets and liabilities initially expressed in foreign currencies will be converted into U.S. dollars at prevailing exchange rates as may be determined in good faith by the valuation designee, under the supervision of the Board.

Swaps typically will be valued using valuations provided by a third-party pricing service. Such pricing service valuations generally will be based on the present value of fixed and projected floating rate cash flows over the term of the swap contract and, in the case of credit default swaps, generally will be based on credit spread quotations obtained from broker-dealers and expected default recovery rates determined by the third-party pricing service using proprietary models. Future cash flows will be discounted to their present value using swap rates provided by electronic data services or by broker-dealers.

| Bluebay Destra International Event-Driven Credit Fund |

| Notes to Financial Statements (continued) |

| September 30, 2023 |

(e) Participations and Assignments

The Fund may acquire interests in loans either directly (by way of original issuance, transfer or assignment) or indirectly (by way of participation). The purchaser of an assignment typically succeeds to all the rights and obligations of the assigning institution and becomes a lender under the credit agreement with respect to the debt obligation. Participation interests in a portion of a debt obligation typically result in a contractual relationship only with the institution participating out the interest, not with the borrower. In purchasing participations, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement, nor any rights of set-off against the borrower, and the Fund may not directly benefit from the collateral supporting the debt obligation in which it has purchased the participation. As a result, the Fund will assume the credit risk of both the borrower and the institution selling the participation.

(f) Commitments and Contingencies