- BFICQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BurgerFi International (BFICQ) DEF 14ADefinitive proxy

Filed: 21 Jul 21, 5:18pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under Rule 14a-12 | |

BurgerFi International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

105 U.S. Highway 1

North Palm Beach, Florida 33408

July 21, 2021

Dear Fellow BurgerFi Stockholder:

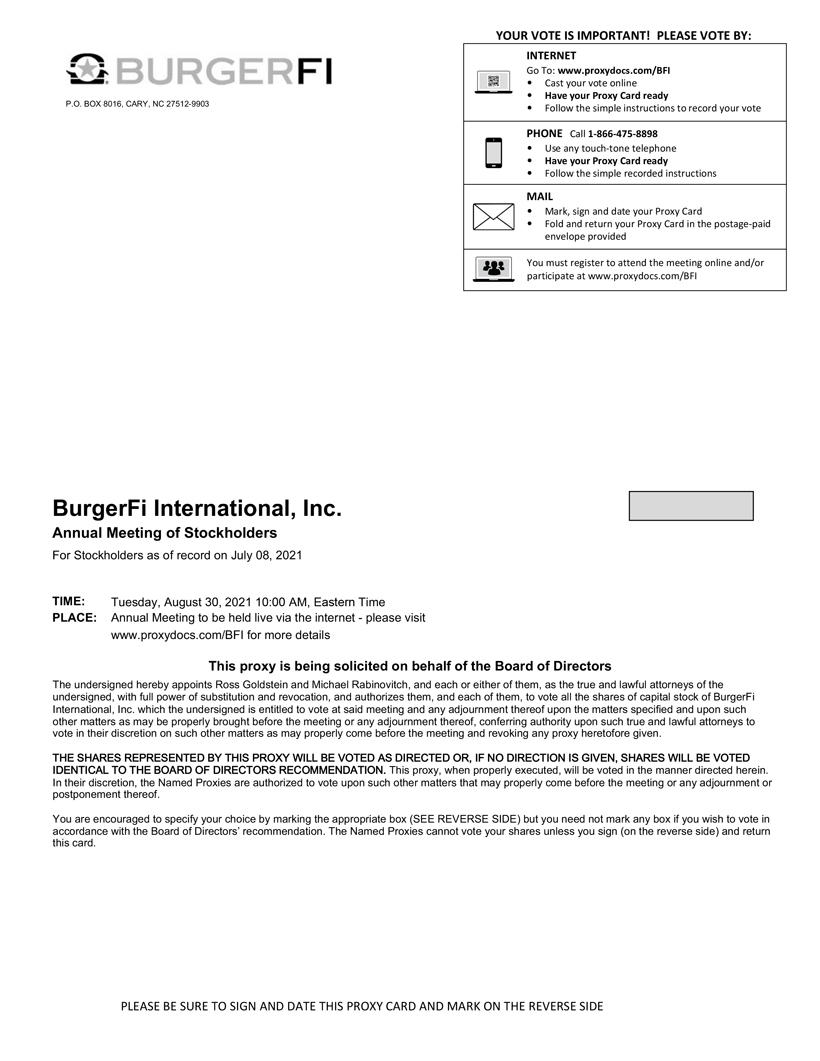

We are pleased to invite you to join us at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of BurgerFi International, Inc. (the “Company” or “BurgerFi”) to be held at 10:00 a.m. Eastern Time on Monday, August 30, 2021 by means of a live virtual-only on-line webcast.

The accompanying Notice of Annual Meeting and Proxy Statement describe the specific matters to be voted upon during the Annual Meeting. At the meeting, we also will report on our business and provide an opportunity for you to ask questions pertaining to our business.

Whether you own a few or many shares of BurgerFi stock and whether or not you plan to attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. Your vote is important and we ask that you please cast your vote as soon as possible.

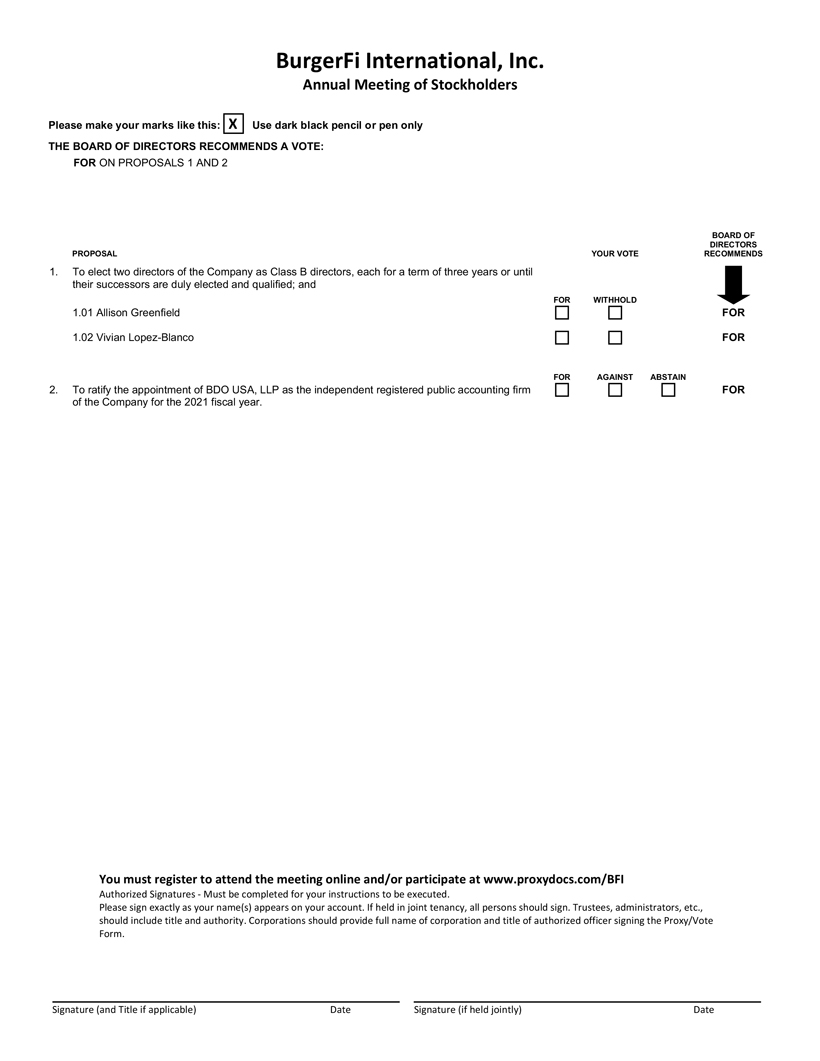

The Board of Directors recommends that you vote FOR the election of all the Class B director nominees and FOR the ratification of the appointment of BDO USA, LLP (“BDO”) as the independent registered public accounting firm of the Company for the 2021 fiscal year. Please refer to the accompanying Proxy Statement for detailed information on each of the proposals and the Annual Meeting.

Sincerely,

Ophir Sternberg

Executive Chairman of the Board

BurgerFi International, Inc.

105 U.S. Highway 1

North Palm Beach, Florida 33408

NOTICE OF THE 2021 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of BurgerFi International, Inc.:

The 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of BurgerFi International, Inc. (the “Company”) will be held at 10:00 a.m. Eastern Time on Monday, August 30, 2021 by means of a live, virtual-only on-line webcast for the following purposes, as more fully described in the accompanying proxy statement:

| (1) | To elect two Class B directors of the Company as Class B directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal; |

| (2) | To ratify the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the 2021 fiscal year; and |

| (3) | To transact any other business that is properly presented during the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Only stockholders of record as of the close of business on July 8, 2021, the record date, are entitled to receive notice of the Annual Meeting and to vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We cordially invite you to attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we ask that you please cast your vote as soon as possible. As more fully described in the accompanying proxy statement, you may revoke your proxy and reclaim your right to vote at any time prior to its use.

Sincerely,

Ophir Sternberg

Executive Chairman of the Board

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 30, 2021

The accompanying proxy statement and the 2020 Annual Report on Form 10-K are available at

https://www.proxydocs.com/ BFI.

ACCESS TO THE 2021 VIRTUAL-ONLY

ANNUAL MEETING

The Annual Meeting will be conducted virtually over the Internet by means of a live audio webcast. The Company will not conduct an in-person meeting of stockholders in 2021. You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on July 8, 2021, the record date, or hold a valid proxy for the meeting.

In order to attend the Annual Meeting, you must register in advance at https://www.proxydocs.com/BFI. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. You will find more information on the matters for voting on the following pages. If you are a stockholder of record, you may vote by using the Internet, by telephone, by mail, or during the Annual Meeting. If you are a beneficial owner, please follow the voting instructions provided in the notice you receive from your broker, bank or other intermediary, and direct such organization to vote your shares in accordance with your instructions. A beneficial holder may also attend the Annual Meeting, but because a beneficial owner is not a stockholder of record, you may not vote during the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:00 a.m. Eastern Time.

Our virtual Annual Meeting will allow stockholders to submit questions before and during the Annual Meeting. During a designated question and answer period at the Annual Meeting, we will respond to appropriate questions submitted by stockholders.

TABLE OF CONTENTS

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 8 | ||||

| 13 | ||||

| 16 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 17 | |||

| 19 | ||||

| 20 | ||||

POLICY FOR APPROVAL OF AUDIT AND PERMITTED NON-AUDIT SERVICES | 21 | |||

| 22 | ||||

| 23 | ||||

| 26 |

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of BurgerFi International, Inc. (“BurgerFi” or the “Company”) for use at our 2021 Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held at 10:00 a.m. Eastern Time on Monday, August 30, 2021 by means of a live virtual-only on-line webcast.

Only stockholders of record as of the close of business on July 8, 2021 (the “Record Date”) are entitled to receive notice of the Annual Meeting and to vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the Record Date, there were 17,838,476 shares of common stock, par value $0.0001 per share (the “Common Stock”) issued and outstanding and entitled to vote during the Annual Meeting. In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials, including this proxy statement and our Form 10-K for the year ended December 31, 2020, to our stockholders via the Internet. On or about July 21, 2021, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how to access our proxy materials on the Internet and how to vote. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice of Internet Availability.

All references in this Proxy Statement to “we”, “us” and “our” refer to BurgerFi International, Inc.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of our 2021 Annual Meeting?

Our 2021 Annual Meeting will be held for the following purposes:

| (1) | To elect two Class B directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal. We refer to this as the “Director Election Proposal.” |

| (2) | To ratify the appointment of BDO USA, LLP as the independent registered public accounting firm of the Company for the 2021 fiscal year. We refer to this as the “Auditor Ratification Proposal.” |

| (3) | To transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

In addition, senior management will report on our business and respond to your questions pertaining to the business of the Company.

How can I attend the Annual Meeting?

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on the Record Date, or hold a valid proxy for the Annual Meeting.

In order to attend the Annual Meeting, you must register in advance at https://www.proxydocs.com/BFI. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions during the Annual Meeting. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. You will find more information on the matters for voting on the following pages. If you are a stockholder of record, you may vote by using the Internet, by telephone, by mail, or during the Annual Meeting. If you are a beneficial owner, please follow the voting

1

instructions provided in the notice you receive from your broker, bank or other intermediary, and direct such organization to vote your shares in accordance with your instructions. A beneficial holder may also attend the Annual Meeting, but because a beneficial owner is not a stockholder of record, you may not vote during the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:00 a.m. Eastern Time.

What are the voting rights of BurgerFi stockholders?

Each stockholder of Common Stock is entitled to one vote per share on each of the two Class B director nominees and one vote per share on each other matter properly presented at the Annual Meeting for each share of Common Stock owned by that stockholder on the Record Date.

What is the difference between holding shares as a “stockholder of record” and a “street name” holder?

If your shares are registered directly in your name through Continental Stock Transfer & Trust, the Company’s transfer agent, you are considered a “stockholder of record.” If your shares are held in a brokerage account, bank or through another intermediary, you are considered a “street name” holder.

What constitutes a quorum?

The presence in person or by proxy of the holders of a majority of the shares issued and outstanding and entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business at the meeting. If you submit a properly executed proxy or voting instruction card or properly cast your vote via the Internet, or by telephone, your shares will be considered part of the quorum, even if you abstain from voting or withhold authority to vote as to a particular proposal. Under Delaware law, we also will consider as present for purposes of determining whether a quorum exists any abstentions and any shares represented by “broker non-votes.”

How do I vote?

You can vote in any of the following ways. Please check your proxy card or contact your broker for voting instructions.

If your shares are registered in your name (as a stockholder of record)

To vote by Internet or telephone: Log on to the website or call the toll-free number set forth in the notice of meeting mailed to you and follow the instructions.

To vote by mail: If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope.

To vote during the meeting: Withdraw your early proxy and vote at the Annual Meeting via the Internet.

If your shares are held in “street name”

You should give instructions to your broker on how to vote your shares. If you do not provide voting instructions to your broker, your broker has discretion to vote those shares on matters that are routine. However, a broker cannot vote shares on non-routine matters without your instructions. This is referred to as a “broker

2

non-vote.” Under the rules of The Nasdaq Stock Market LLC (“Nasdaq”), the Director Election Proposal is non-routine and, as such, a broker does not have the discretion to vote on the Director Election Proposal if such broker has not received instructions from the beneficial owner of the shares represented. The Auditor Ratification Proposal is considered a routine proposal and may be voted in the absence of instructions.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the meeting. If you are a registered holder of shares, you may vote again on a later date by telephone or via the Internet, but submitting a subsequently dated proxy by mail or by attending the meeting and voting during the meeting (only your latest proxy submitted prior to the meeting will be counted). However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again during the meeting or specifically request in writing that your prior proxy be revoked. If your shares are held in street name, you must contact your broker to revoke your proxy and change your vote.

What vote is required to approve each proposal at the Annual Meeting?

Proposal 1—Director Election Proposal.

The vote required to elect our two Class B directors, each for a term of three years or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast. Abstentions and broker non-votes will have no effect on the election of directors.

Proposal 2—Auditor Ratification Proposal.

The vote required to approve the Auditor Ratification Proposal is a majority of the stock having voting power present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will have the same effect as a vote against this proposal.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

| • | FOR Proposal 1: the Director Election Proposal; and |

| • | FOR Proposal 2: the Auditor Ratification Proposal. |

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your voting instructions. If you submit a proxy but do not provide instructions or if your instructions are unclear, the persons named as proxies will vote your shares in accordance with the recommendations of the Board, as set forth above.

With respect to any other proposal that properly comes before the Annual Meeting, the persons named as proxies will vote as recommended by our Board or, if no recommendation is given, in their own discretion.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers, and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of Common Stock held of record by them.

3

PROPOSAL 1: DIRECTOR ELECTION PROPOSAL

Our Board of Directors currently consists of five directors divided into three classes: Class A, Class B and Class C. Each class is as nearly equal in number as possible, with one class being elected each year to serve a staggered three-year term. Class A directors shall serve for a term expiring at the 2023 Annual Meeting of Stockholders, Class B directors shall serve for a term expiring at the 2021 Annual Meeting of Stockholders and Class C directors shall serve for a term expiring at the 2022 Annual Meeting of Stockholders. At this Annual Meeting of Stockholders and each Annual Meeting of Stockholders thereafter, the successors to the class of directors whose terms expire at that meeting would be elected for a term of office to expire at the third succeeding Annual Meeting of Stockholders after their election, or until their successors have been duly elected and qualified. On December 16, 2020, the Company entered into a Voting Agreement (the “Voting Agreement”) with Axis Capital Management (the “Initial Sponsor” or the “Sponsor”), certain initial stockholders (the “Initial Stockholders”) who held founders’ shares (“Founders’ Shares”) prior to the Company’s initial public offering (“IPO”), the members (the “Members”) of BurgerFi International, LLC and then-serving officers and directors of the Company, pursuant to which all stockholders party thereto agreed that the size of the Board will be set at five members and agreed to vote their shares of the Company in favor of Ophir Sternberg, Steven Berrard, Gregory Mann, Allison Greenfield and A.J. Acker, or, if any of them ceases to serve as a director (such as Mr. Berrard and Ms. Acker), such other person designated by our Executive Chairman, in consultation with the Members’ Representative (as defined in the Voting Agreement).

Our Class A directors are Martha Stewart and Gregory Mann; our Class B directors are Vivian Lopez-Blanco, who the parties to the Voting Agreement have agreed to vote for pursuant to the terms thereof, and Allison Greenfield; and our Class C director is Ophir Sternberg. Effective July 14, 2021, our Board of Directors appointed Ms. Lopez-Blanco to the Board to fill the vacancy created by the death of Mr. Berrard until her successor is duly elected and qualified or until her earlier resignation or removal.

Our Board of Directors is recommending that Vivian Lopez-Blanco and Allison Greenfield, our Class B directors, be re-elected to serve for a term until the 2024 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier resignation or removal. If Vivian Lopez-Blanco or Allison Greenfield become unavailable for any reason, including a situation which is not anticipated, substitute nominees may be proposed by the Board, and any shares represented by proxy will be voted for the substitute nominee, unless the Board reduces the number of directors.

The following table sets forth certain information concerning the nominees for Class B directors and each of the other members of the Board of Directors:

Directors and Executive Officers

Below are the names of and certain information regarding our executive officers and directors:

Name | Age | Position | ||

Ophir Sternberg | 51 | Executive Chairman of the Board and Class C Director | ||

Julio Ramirez | 67 | Chief Executive Officer | ||

Michael Rabinovitch | 51 | Chief Financial Officer | ||

James Esposito | 57 | Chief Operating Officer | ||

Ross Goldstein | 47 | Chief Legal Officer | ||

Allison Greenfield | 48 | Class B Director | ||

Vivian Lopez-Blanco | 63 | Class B Director | ||

Gregory Mann | 49 | Class A Director | ||

Martha Stewart | 79 | Class A Director |

Directors

Ophir Sternberg has been the Company’s Executive Chairman of the Board since December 2020, having served as a member of our Board of Directors since October 2019, Chairman since April 2020, and Chief

4

Executive Officer from June 2020 to December 2020. Mr. Sternberg has over 26 years of experience investing in all segments of the real estate industry, including land acquisitions, luxury residential, hospitality, commercial and retail. Mr. Sternberg has served as the Chief Executive Officer, President and Chairman of Lionheart Acquisition Corporation II (Nasdaq: LCAP) (“Lionheart”) since December 2019. He is the Founder of Lionheart Capital, LLC, a Miami-based diversified investment firm focused on value and growth investments, and has served as its Chief Executive Officer since its formation in 2009. From 1993 to 2009, Mr. Sternberg was the Founder and Managing Partner of Oz Holdings, LLC, a private real estate investment and management company. Once a member of an elite Israeli Defense Force unit, Mr. Sternberg studied finance at Sy Syms School of Business at Yeshiva University. We believe Mr. Sternberg is well-qualified to serve on our board of directors due to his business experience and contacts and relationships.

Allison Greenfield has served as a member of the Company’s Board of Directors since June 2020. Ms. Greenfield has over two decades of experience in real estate development. Ms. Greenfield is the Chief Development Officer and has been a partner of Lionheart Capital, LLC since it was founded in 2009 and has over 25 years of experience in the entitlement, design, construction and management of projects in all segments of the real estate industry, including industrial, retail, hospitality, and ultra-luxury residential condominiums. At Lionheart Capital, LLC, she has been responsible for the successful acquisition, development, and repositioning of real estate assets around the world. Prior to her tenure at Lionheart Capital, LLC, Ms. Greenfield ran the development and construction arm of Oz Holdings, LLC as a partner from 2001-2010. Ms. Greenfield studied Architecture at The New School University, Parsons School of Design and holds a B.A. in History from Barnard College/Columbia University. We believe Ms. Greenfield is well-qualified to serve on our board of directors due to her business experience, contacts and relationships.

Vivian Lopez-Blanco has served as a member of the Company’s Board of Directors since July 2021. Ms. Lopez-Blanco also serves on the board of Jumptuit Health, Inc. Prior to joining the Company, Ms. Lopez-Blanco served as an advisory board member of BBVA, South Florida operations, from 2019 until June 2021, Chief Financial Officer of Mednax, Inc. (NYSE: MD) from 2010 until 2018, Vice President and Treasurer of Mednax, Inc. from 2008 to 2010 and Chief Financial Officer of Carrols Corporation’s Hispanic Restaurants Division, which includes the Pollo Tropical and Taco Cabana concepts, from 2003 to 2008. Ms. Lopez-Blanco joined Pollo Tropical in 1997 as Controller and was promoted to Chief Financial Officer in 1998, and led the company through its acquisition by Carrols Corporation, developed and realigned key business processes and implemented several financial systems. Earlier in her career, Ms. Lopez-Blanco spent years in an international accounting firm where she progressed through different management roles and gained extensive experience in public company reporting and capital market expansions. Ms. Lopez-Blanco earned a bachelor’s degree in accounting from Florida International University and is a certified public accountant. We believe Ms. Lopez-Blanco is well-qualified to serve on our board of directors due to her business experience, including her experience in public accounting and as the Chief Financial Officer of public companies, her contacts and relationships.

Gregory Mann has served as a member of the Company’s Board of Directors since December 2020. Mr. Mann has served Hydrus Technology as a Board Member and in a variety of advising, consulting, leadership, and managerial roles where he developed the firm’s commercialization and go to market (GTM) strategy that led to the company’s first long-term commercial contract from January 2019 to June 2020. Prior to Hydrus, from March 2017 to November 2018, Mr. Mann created a stand-alone P&L division at Catalina Marketing as President of Emerging Brands where he architected and implemented a new three-year business strategy that included the launch of new data and marketing services which significantly increased new client deal size and improved client retention. Mr. Mann also developed and drove the vision and general management for the newly founded Emerging Brands division focused on thousands of consumer-packaged goods (CPG) companies. Prior to Catalina, from May 2014 to October 2016, Mr. Mann worked as the Chief Marketing Officer for LoopPay where he was part of the founding team which was then acquired by Samsung in order to develop and launch Samsung Pay. Mr. Mann holds an MBA from The Wharton School and a Master’s Degree in International Studies from the University of Pennsylvania’s Lauder Institute. We believe that Mr. Mann’s experience as an

5

entrepreneurial executive and corporate innovator that has built and led established startup, turnaround, and hyper-growth companies and divisions globally will continue to be a valuable asset to the Company’s Board of Directors.

Martha Stewart has served as a member of the Company’s Board of Directors since February 2021. Ms. Stewart is a businesswoman, writer, and television personality. As founder of Martha Stewart Living Omnimedia, “MSLO”, she gained success through a variety of business ventures, encompassing publishing, broadcasting, merchandising and e-commerce. She has written numerous bestselling books, is the publisher of Martha Stewart Living magazine and hosted two syndicated television programs: Martha Stewart Living, which ran from 1993 to 2004, and Martha, which ran from 2005 to 2012. Ms. Stewart currently serves as the Chief Creative Officer of Marquee Brands, a position she has held since June 2019. Prior to that, Ms. Stewart served as Chief Creative Officer of Sequential Brands Group, Inc. from December 2015 to June 2019. Ms. Stewart has served on the board of directors of the Sequential Brands Group, Inc. since December 2015. Ms. Stewart has also served on the board of AppHarvest, Inc. since May 2020. Ms. Stewart was Founder, Chief Creative Officer and Non-Executive Chairman of the board of directors of MSLO from 1996 through June 2003. She also served as Chief Executive Officer from 1996 through June 2003. Ms. Stewart earned a bachelor’s degree in European history and architectural history from Barnard College. We believe Ms. Stewart is well-qualified to serve on our board of directors due to her business experience, extensive contacts and relationships.

Executive Officers

Julio Ramirez has served as Chief Executive Officer of BurgerFi since December 2020 and continues to serve in that role within the Company. Mr. Ramirez has over 40 years of experience in the multi-unit restaurant industry. Mr. Ramirez founded JEM Global, Inc. (“JEM”), a company specializing in assisting QSR and fast casual brands with franchising and development efforts domestically and internationally. Through JEM, he consulted Dunkin Brands on its Brazil entry strategy and Buffalo Wings and Rings on its Mexico development strategy. He was also co-owner of Giardino Gourmet Salads, South Florida’s fast-casual concept focused on garden-to-bowl nutrition, helping to grow the brand in Miami, Fort Lauderdale and Naples, Florida. Prior to JEM, Mr. Ramirez was with Burger King Corporation for over 25 years. In his tenure at Burger King, Mr. Ramirez held several key senior executive roles. These roles included Senior Vice President of North America Franchise Operations & Development, and twice the President of the Latin American region, where he had teams that opened Burger King franchises in over 10 countries, including Brazil, Colombia, and many others. Additionally, he was the Executive Vice President of Global Operations. In this role he effectively managed the supply chain, selecting outstanding franchisees, directed the operations team and developed food safety and training programs. Mr. Ramirez holds an MBA from the University of Georgia. He has also completed the Advanced Management Program from The Wharton School at the University of Pennsylvania. He served as an Executive Board Member of the United Way of Miami-Dade County, was a founding member of the Burger King “Have it Your Way” Foundation and is currently a member of the prestigious Orange Bowl Committee. Mr. Ramirez was an external director at Grupo Intur—the largest franchisee of American QSR brands in Central America with over 200 locations of 8 different brands across several nations.

Michael Rabinovitch joined the Company on February 26, 2021 and assumed the position of Chief Financial Officer on May 3, 2021. Mr. Rabinovitch served as Senior Vice President and Chief Accounting Officer of Tech Data Corporation from March 2018 until September 2020. Prior thereto, Mr. Rabinovitch was employed at Office Depot, where he served as Vice President of Finance, North America from January 2015 to 2017 and Senior Vice President, Finance and Chief Accounting Officer from March 2017 to February 2018. From 2005 through 2015, he served as Executive Vice President and Chief Financial Officer of Birks Group (a/k/a Mayors Jewelers), a North American manufacturer and retailer of fine jewelry and luxury timepieces. Prior to joining Birks Group, Mr. Rabinovitch was Vice President of Finance of Claire’s Stores, Inc., a specialty retailer of fashion jewelry and accessories, from 1999 to 2005. Mr. Rabinovitch began his career as an auditor with PricewaterhouseCoopers LLP. Mr. Rabinovitch is a licensed certified public accountant (inactive) and a member of the American Institute of Certified Public Accountants.

6

James Esposito has served, since February 2021, as the Company’s Chief Operating Officer. Mr. Esposito is recognized as an influential leader in the restaurant industry with over 20 years of experience and a successful track record of delivering best-in-class results for public and private growth companies. From January 2016 until March 2020, Mr. Esposito served as Senior Vice President of Operations for Planet Fitness LLC. Prior to joining Planet Fitness, he served as Joint Venture Partner at Panera Bread from December 2014 to January 2016, where he collaborated with a cross-functional team to drive business results and key initiatives. From February 2011 to May 2014, Mr. Esposito held the position of Chief Operating Officer at Papa Gino’s and D’Angelo, where he was directly responsible for creating an environment that delivered exceptional operations, sales growth, and increased profitability. Mr. Esposito also spent 11 years with Burger King Corporation from August 1999 to January 2011, where he held a number of key operations positions, one of which where he led the Global Restaurant Systems group, which consisted of over 1,400 restaurants in 10 countries around the world.

Ross Goldstein has served as the Chief Legal Officer of BurgerFi since 2012 and continues to serve in that role within the Company, assisting in the Company’s growth from approximately 10 units to over 120, in 20+ states and three countries. He has over 20 years of legal experience, specializing in franchising, real estate, general corporate and business transactions. At BurgerFi, Mr. Goldstein focuses on the negotiation, drafting and execution of all franchise agreements and real estate leases, drafting and filing the Franchise Disclosure Document and any amendments in all registration states, and mergers, acquisitions, joint ventures and other business combinations. Prior to that, from 2009 to 2012, Mr. Goldstein was the General Counsel for The Learning Experience, LLC, a fast-growing childcare franchise, and before that, from 2007 to 2009, he was the Associate General Counsel for Dycom Industries, Inc., a public telecommunications company. Prior to going in-house, from 2005 to 2007, Mr. Goldstein was a Senior Associate at the law firm of Nason Yeager Gerson Harris & Fumero P.A. Mr. Goldstein holds a J.D. from the Seton Hall University School of Law and a B.A. from Gettysburg College, where he played varsity baseball.

Vote Required and Board Recommendation

The vote required to elect our two Class B directors, each for a three-year term expiring at the 2024 Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast at the Annual Meeting. The Board recommends that you vote “FOR” the election of each of the Class B director nominees.

7

Corporate Governance Principles and Code of Ethics

Our Board is committed to sound corporate governance principles and practices. In order to clearly set forth our commitment to conduct our operations in accordance with our high standards of business ethics and applicable laws and regulations, our Board adopted a Code of Ethics applicable to our directors, executive officers and employees that complies with the rules and regulations of Nasdaq. A copy of our Code of Ethics is available on our corporate website at https://ir.burgerfi.com/corporate-governance/governance-documents, under “Governance Documents.” You also may obtain without charge a printed copy of the Code of Ethics by sending a written request to: 105 U.S. Highway 1, North Palm Beach, FL 33408.

Board of Directors

The business and affairs of the Company are managed by or under the direction of the Board. The Board is currently composed of five members.

The Board held one (1) meeting and acted by written consent without a meeting on five (5) occasions during the year ended December 31, 2020. In 2020, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he or she served.

It is the policy of the Board that all directors should attend the annual meetings in person or by teleconference. All of our directors serving at the time of the 2020 Annual Meeting of Stockholders were in attendance.

Board Committees

Pursuant to our bylaws, our Board may establish one or more committees of the Board however designated, and delegate to any such committee the full power of the Board, to the fullest extent permitted by law.

The standing committees of our Board currently include an Audit Committee, a Compensation Committee, a Nominating Committee and a Product & Innovation Committee. Each of the committees report to the Board as they deem appropriate and as the Board may request. The composition, duties and responsibilities of these committees are set forth below.

Audit Committee

Ms. Lopez-Blanco, Mr. Mann, and Ms. Greenfield serve on the Audit Committee. Ms. Lopez-Blanco joined the Audit Committee on July 14, 2021, the date of her appointment of the Board. Ms. Lopez-Blanco qualifies as the Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act and serves as Chairman of the Audit Committee. The Audit Committee operates under a written charter adopted by the Board. The charter contains a detailed description of the scope of the Audit Committee’s responsibilities and how they will be carried out. The Audit Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents, under “Governance Documents.” The Audit Committee held four (4) meetings and did not act by written consent without a meeting during the year ended December 31, 2020.

According to its charter, the Audit Committee consists of at least three members, each of whom shall be a non-employee director who has been determined by the Board to meet the independence requirements of Nasdaq, and also Rule 10A-3(b)(1) of the SEC, subject to the exemptions provided in Rule 10A-3(c). The Audit Committee charter describes the primary functions of the Audit Committee, including the following:

| • | reviewing and discussing with management and the independent auditor the annual audited financial statements, and recommending to the Board whether the audited financial statements should be included in our Form 10-K; |

8

| • | discussing with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| • | discussing with management major risk assessment and risk management policies; |

| • | monitoring the independence of the independent auditor; |

| • | verifying the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law; |

| • | reviewing and approving all related-party transactions; |

| • | inquiring and discussing with management our compliance with applicable laws and regulations; |

| • | pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; |

| • | appointing or replacing the independent auditor; |

| • | determining the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies; and |

| • | approving reimbursement of expenses incurred by our management team in identifying potential target businesses. |

Compensation Committee

Ms. Greenfield, Mr. Mann, and Ms. Lopez-Blanco serve on the Compensation Committee. Ms. Lopez-Blanco joined the Compensation Committee on July 14, 2021, the date of her appointment to the Board. Ms. Greenfield serves as the Chairperson of the Compensation Committee. The Compensation Committee operates under a written charter adopted by the Board. The charter contains a detailed description of the scope of the Compensation Committee’s responsibilities and how they will be carried out. The Compensation Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents, under “Governance Documents.” The Compensation Committee may delegate any of its responsibilities to one or more subcommittees as the Compensation Committee may from time to time deem appropriate. The Compensation Committee held no meetings and did not act by written consent without a meeting during the year ended December 31, 2020.

The Compensation Committee’s duties, which are specified in our Compensation Committee charter, include, but are not limited to:

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and determining and approving the remuneration (if any) of our Chief Executive Officer based on such evaluation; |

| • | reviewing and approving the compensation of all other executive officers; |

| • | reviewing our executive compensation policies and plans; |

| • | implementing and administering our incentive compensation equity-based remuneration plans; |

| • | assisting management in complying with our proxy statement and annual report disclosure requirements; |

9

| • | approving all special perquisites, special cash payments and other special compensation and benefit arrangements for our executive officers and employees; |

| • | if required, producing a report on executive compensation to be included in our annual proxy statement; and |

| • | reviewing, evaluating, and recommending changes, if appropriate, to the remuneration for directors. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by Nasdaq and the SEC. In addition, members of our senior management may report on the performance of the other executive officers of the Company and make compensation recommendations to the Compensation Committee, which will review and, as appropriate, approve the compensation recommendations.

Nominating Committee

Ms. Greenfield, Ms. Lopez-Blanco and Mr. Mann serve on the Nominating Committee. Ms. Lopez-Blanco joined the Nominating Committee on July 14, 2021, the date of her appointment to the Board. Ms. Greenfield serves as the Chairperson of the Nominating Committee. The Nominating Committee operates under a written charter adopted by the Board. The charter contains a detailed description of the scope of the Nominating Committee’s responsibilities and how they will be carried out. The Nominating Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents, under “Governance Documents.” The Nominating Committee did not hold any meetings and acted by written consent without a meeting on one (1) occasion during the year ended December 31, 2020.

The Nominating Committee will identify, evaluate and recommend candidates to become members of the Board with the goal of creating a balance of knowledge and experience. The Nominating Committee has no specific minimum qualifications for director candidates. However, the Nominating Committee will consider several qualifications relating to management and leadership experience, background and integrity and professionalism in evaluating a person’s candidacy for membership on the board of directors. The Nominating Committee may require certain skills or attributes, such as financial or accounting experience, to meet specific board needs that arise from time to time and will also consider the overall experience and makeup of its members to obtain and maintain a broad and diverse mix of board members, including with respect to race, gender, ethnicity, background, experience and viewpoints of the Board. The Nominating Committee does not distinguish among nominees recommended by stockholders and other persons.

Product & Innovation Committee

Ms. Stewart and Ophir Sternberg serve on the Product & Innovation Committee. Ms. Stewart serves as the Chairperson of the Product & Innovation Committee. The Product & Innovation Committee’s duties include advising on new product and innovation efforts of the Company.

Board Leadership

The positions of Executive Chairman of the Board and Chief Executive Officer are currently held by Ophir Sternberg and Julio Ramirez, respectively. The Board has not designated a lead independent director. Given the limited number of directors comprising the Board, the independent directors call, plan, and chair their executive sessions collaboratively and, between Board meetings, communicate with management and one another directly. Under these circumstances, the directors believe designating a lead independent director to take on responsibility for functions in which they all currently participate might detract from rather than enhance performance of their responsibilities as directors. The Company believes that these arrangements afford the independent directors sufficient resources to supervise management effectively, without being overly engaged in day-to-day operations.

10

Board Oversight of Enterprise Risk

The Board is actively involved in the oversight and management of risks that could affect the Company. This oversight and management is conducted primarily through the committees of the Board identified above but the full Board has retained responsibility for general oversight of risks. The Audit Committee is primarily responsible for overseeing the risk management function, specifically with respect to management’s assessment of risk exposures (including risks related to liquidity, credit, operations and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The other committees of the Board consider the risks within their areas of responsibility. The Board satisfies its oversight responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Independence

Our Board has determined that four of our directors, Allison Greenfield, Vivian Lopez-Blanco, Gregory Mann and Martha Stewart, qualify as “independent” directors within the meaning of the independent director guidelines of Nasdaq and applicable SEC rules. The Nasdaq independence definition includes a series of objective tests regarding a director’s independence and requires that the Board make an affirmative determination that a director has no relationship with us that would interfere with such director’s exercise of independent judgment in carrying out the responsibilities of a director.

Anti-Hedging and Anti-Pledging Policies

The Company has policies (i) prohibiting each director, officer, consultant and employee of the Company from trading in options, puts and calls or similar instruments on securities of the Company, including shares of common stock or preferred stock and warrants (“BurgerFi Securities”), or selling BurgerFi Securities “short,” including a “sale against the box,” (ii) prohibiting each director, officer and employee of the Company, each such person’s spouse, minor children and anyone else living in such person’s household, partnerships in which such person is a general partner, trusts of which such person is a trustee, estates of which such person is an executor and other equivalent legal entities that such person controls from holding BurgerFi Securities in margin accounts and (iii) prohibiting each director, officer, consultant and employee of the Company from pledging BurgerFi Securities when he or she has knowledge of material information concerning the Company that has not been disclosed to the public.

Communications with the Company and the Board

Stockholders may communicate with the Company through its Investor Relations Department by writing to: Investor Relations, BurgerFi International, Inc., 105 U.S. Highway 1, North Palm Beach, FL 33408.

Stockholders interested in communicating with our Board, any Board committee, any individual director, or any group of directors (such as our independent directors) should send written correspondence to BurgerFi International, Inc. Board of Directors, Attn: Secretary, 105 U.S. Highway 1, North Palm Beach, FL 33408. The Secretary will forward all such communications directly to our Board, such Board committee, such individual director or such group of directors, as applicable.

Stockholder Proposals for the 2022 Annual Meeting

Under our bylaws, to be timely, notice of any stockholder proposal to be considered at the 2022 Annual Meeting of Stockholders, including nominations of persons for election to our Board and other business, must be delivered to or mailed and received at the principal executive officers of the Company not less than sixty (60) nor more than ninety (90) days prior to the meeting; provided, however, that in the event that less than seventy (70) days’ notice or prior public disclosure of the date of the annual meeting is given or made to stockholders,

11

notice, to be timely, must be received no later than the close of business on the tenth (10th) day following the day on which such notice of the annual meeting was mailed or such public disclosure was made, whichever first occurs. The deadline for any stockholder proposal to be eligible for inclusion in our proxy statement and proxy related to that meeting pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is March 23, 2022.

Stockholder Director Nominations

The Nominating Committee has established a policy pursuant to which it considers director candidates recommended by our stockholders. All director candidates recommended by our stockholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other persons. To recommend a director candidate for consideration by our Nominating Committee, a stockholder must submit the recommendation in writing to our Nominating Committee not later than 30 calendar days after the end of the Company’s fiscal year, and the recommendation must provide the following information: (i) the name of the candidate; (ii) the age of the candidate; (iii) the business and current residence address of the candidate, as well as residence addresses for the past 20 years; (iv) the proposed candidate’s principal occupation or employment and employment history (name and address of employer and job title) for the past 10 years (or such shorter period as the candidate has been in the workforce); (v) the candidate’s educational background; (vi) the candidate’s permission for the Company to conduct a background investigation, including the right to obtain education, employment and credit information; (vii) the number of shares of common stock of the Company beneficially owned by the candidate, (viii) the information that would be required to be disclosed by the Company about the candidate under the rules of the SEC in a proxy statement soliciting proxies for the election of such candidate as a director and (ix) a signed consent of the nominee to serve as a director of the Company, if elected.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of our common stock, to file reports regarding ownership of, and transactions in, our securities with the SEC and to provide us with copies of those filings. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the year ended December 31, 2020, all such filing requirements applicable to persons who were directors, executive officers or greater than 10% beneficial owners of the Company during the year ended December 31, 2020 were complied with, except, inadvertently and/or due to clerical error, (i) former Chief Operating Officer Nick Raucci did not file his Form 3, (ii) Messrs. Esposito and Mann, the John Rosatti Family Trust Dated 8/27/2001, Ms. Greenfield, Ms. Stewart, LH Equities LLC, Lionheart Equities, LLC, former chief financial officer Bryan McGuire and former director James Stephen Anderson each filed his, her or its Form 3 late, (iii) LH Equities LLC, former officer José Luis Córdova Vera and former director Martha Byorum each filed one late Form 4 with respect to one transaction, (iv) Lionheart Equities, LLC filed two late Forms 4, one with respect to one transaction and the other with respect to two transactions and (v) Ophir Sternberg filed one late Form 4 with respect to four transactions. In addition, during the year ended December 31, 2019, former officer José Luis Córdova Vera filed his Form 3 late.

12

Executive and Director Compensation

Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by, and paid to the named executive officers of BurgerFi for services rendered to BurgerFi in all capacities for the years indicated.

Name and Principal Position(1) | Year | Salary ($) | Bonus ($) | Stock Awards ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

Ophir Sternberg | 2020 | — | — | 14,535,000 | (5)(7) | — | 14,535,000 | |||||||||||||||||

Executive Chairman of the Board | 2019 | — | — | — | — | |||||||||||||||||||

Julio Ramirez | 2020 | 55,000 | — | 5,355,000 | (6)(7) | 3,600 | 5,413,600 | |||||||||||||||||

Chief Executive Officer(2) | 2019 | — | — | — | — | |||||||||||||||||||

Bryan McGuire | 2020 | 105,505 | — | — | 105,505 | |||||||||||||||||||

Former Chief Financial Officer(3) | 2019 | — | — | — | — | |||||||||||||||||||

Ross Goldstein | 2020 | 207,625 | — | — | 207,625 | |||||||||||||||||||

Chief Legal Officer | 2019 | 200,000 | — | 200,000 | ||||||||||||||||||||

Nick Raucci | 2020 | 215,435 | — | 3,600 | 219,035 | |||||||||||||||||||

Former Chief Operating Officer(4) | 2019 | 160,000 | 19,422 | — | 179,422 | |||||||||||||||||||

| (1) | Also, David Mack, David Brain and Ophir Sternberg served as the Company’s Chief Executive Officer during the year ended December 31, 2020 but did not receive any consideration in connection with such service to the Company. |

| (2) | Mr. Ramirez was appointed Chief Executive Officer effective December 16, 2020. |

| (3) | Mr. McGuire was appointed as Chief Financial Officer effective December 16, 2020 and resigned effective May 3, 2021. Effective May 3, 2021, Michael Rabinovitch assumed the position of Chief Financial Officer. |

| (4) | Mr. Raucci left the Company on February 17, 2021. |

| (5) | Represents the grants of 250,000 restricted stock units and 700,000 incentive restrictive stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Sternberg. The applicable restricted stock unit agreement provides that 73% (511,000) of the total incentive restricted stock units will not be issued (deemed or otherwise) under the BurgerFi International, Inc. Omnibus Equity Incentive Plan (the “Plan”) until the aggregate number of shares reserved for awards under the Plan is increased consistent with Section 5.1 of the Plan, which is scheduled to occur on January 1, 2022. See the Outstanding Equity Awards table below for additional information relating to these grants. |

| (6) | Represents the grants of 250,000 restricted stock units and 100,000 benchmark restrictive stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Ramirez. The applicable restricted stock unit agreement provides that 36% (89,000) of the total 250,000 incentive restricted stock units and 100% (100,000) of the total 100,000 benchmark restricted stock units will not be issued (deemed or otherwise) under the Plan until the aggregate number of shares reserved for awards under the Plan is increased consistent with Section 5.1 of the Plan, which is scheduled to occur on January 1, 2022. See the Outstanding Equity Awards table below for additional information relating to these grants. |

| (7) | The amounts reflected in this column represent the aggregate grant date fair value of the awards made during 2020, as computed in accordance with FASB ASC Topic 718. For additional information related to the measurement of stock-based compensation awards, see Note 14 to the financial statements included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020. |

13

Narrative Disclosure to Summary Compensation Table

For 2020, the principal elements of compensation provided to the named executive officers were base salaries, grants of equity-based compensation and broad-based employee benefits. Base salaries are generally set at levels deemed necessary to attract and retain individuals with superior talent commensurate with their relative expertise and experience. Grants of restricted stock units vest either in equal parts over a number of years or based on the Company’s achievement of certain performance benchmarks, satisfaction of certain key performance indicators set by the Compensation Committee or by meeting certain share price thresholds of the Company’s common stock. See the Outstanding Equity Awards table below for additional information relating to these grants.

Employment Agreements. We have entered into Employment Agreements with Ophir Sternberg, Julio Ramirez and Ross Goldstein.

Employment Agreement with Ophir Sternberg.

Under the terms of Mr. Sternberg’s employment agreement, Mr. Sternberg serves as our Executive Chairman of the Board of Directors and does not receive a base salary. Mr. Sternberg has the ability to earn restricted stock unit grants (“Restricted Stock Unit Grants”) and incentive restricted stock unit grants (“Incentive Restricted Stock Unit Grants”). During the term of Mr. Sternberg’s employment agreement, which is initially five years, subject to earlier termination and extension, Mr. Sternberg will be bound by non-competition and non-solicitation obligations. If there is a Change of Control (as defined in Mr. Sternberg’s employment agreement) during the term of employment all unearned Restricted Stock Unit Grants and Incentive Restricted Stock Unit Grants shall be deemed to have been earned and vested immediately prior to the Change of Control.

Employment Agreement with Julio Ramirez

Under the terms of Mr. Ramirez’s employment agreement, Mr. Ramirez serves as our Chief Executive Officer and earns a base salary of $275,000. Mr. Ramirez will be eligible to earn an annual incentive bonus of up to $100,000 payable in Restricted Stock Unit Grants, based on the achievement of certain key performance indicators. Mr. Ramirez also can earn Restricted Stock Unit Grants and benchmark restricted stock unit grants (“Benchmark Restricted Stock Unit Grants”). During the term of Mr. Ramirez’s employment agreement, which is initially one year, subject to earlier termination and extension, Mr. Ramirez will be bound by non-competition obligations. If there is a Change of Control (as defined in Mr. Ramirez’s employment agreement) during the term of employment all unearned Restricted Stock Unit Grants and Benchmark Restricted Stock Unit Grants shall be deemed to have been earned and vested immediately prior to the Change of Control.

Employment Agreement with Ross Goldstein

Mr. Goldstein serves as our Chief Legal Officer. Under the terms of Mr. Goldstein’s employment agreement, which has an initial term of one year, he earns a base salary of $200,000. Mr. Goldstein can also earn Restricted Stock Unit Grants and Benchmark Restricted Stock Unit Grants. During the term of Mr. Goldstein’s employment agreement, which is initially one year, subject to earlier termination and extension, Mr. Goldstein will be bound by non-competition obligations. If there is a Change of Control (as defined in Mr. Goldstein’s employment agreement) during the term of employment, all unearned Restricted Stock Unit Grants and Benchmark Restricted Stock Unit Grants shall be deemed to have been earned and vested immediately prior to the Change of Control.

Potential Payments upon Termination or Change in Control

Except as discussed above, no named executive officer has a contractual or other entitlement to severance or other payments upon termination or a change in control.

14

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth certain information regarding equity-based awards held by the named executive officers as of December 31, 2020.

| Stock awards | ||||||||

Name | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested(5) | ||||||

Ophir Sternberg | 250,000 | (1) | $ $ | 3,422,500 9,583,000 |

| |||

| 700,000 | (2) | |||||||

Julio Ramirez | 250,000 | (3) | $ | 3,422,500 | ||||

| 100,000 | (4) | $ | 1,369,000 | |||||

Bryan McGuire | — | — | ||||||

Ross Goldstein | — | — | ||||||

Nick Raucci | — | — | ||||||

| (1) | Represents restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Sternberg. The restricted stock units vest in five equal parts, with 20% vesting on the grant date and an additional 20% vesting on January 1 for each of the ensuing four years, beginning on January 1, 2022. If there is a change of control (as defined in the employment agreement) or certain termination or resignation events occur during the term of employment, all unearned incentive restricted stock units shall be deemed to have been earned and vested immediately prior to the change of control or termination or resignation event. |

| (2) | Represents incentive restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Sternberg. The restricted stock units vest as follows upon the achievement by the Company of the following benchmarks; provided, however, that 73% (511,000) of the total incentive restricted stock units will not be issued (deemed or otherwise) under the Plan until the aggregate number of shares reserved for awards under the Plan is increased consistent with Section 5.1 of the Plan, which is scheduled to occur on January 1, 2022: (i) 20%, or 140,000 incentive restricted stock units, if Company revenue (“Company Revenue”) for fiscal year 2021, as calculated and presented in the Company’s audited financial statements included in the Form 10-K report for the relevant year, is 10% or greater than $34,382,000 (the “Base Year Revenue”); (ii) 20%, or 140,000 incentive restricted stock units, if Company Revenue for fiscal year 2022 is 20% or greater than Base Year Revenue; (iii) 20%, or 140,000 incentive restricted stock units, if Company Revenue for fiscal year 2023 is 30% or greater than Base Year Revenue; (iv) 20%, or 140,000 incentive restricted stock units, if Company Revenue for fiscal year 2024 is 40% or greater than Base Year Revenue; (v) 20%, or 140,000 incentive restricted stock units, if Company Revenue for fiscal year 2025 is 50% or greater than Base Year Revenue. If there is a change of control (as defined in the employment agreement) or certain termination or resignation events during the term of employment, all unearned incentive restricted stock units shall be deemed to have been earned and vested immediately prior to the change of control or termination or resignation event. |

| (3) | Represents restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Ramirez. The restricted stock units vest in equal amounts at the yearly anniversary of the date Mr. Ramirez began providing services to the Company (December 16, 2020) for each of the first five years of employment, subject to the achievement of certain annual key performance indicators, including the Company’s adjusted EBITDA plan, opening of planned number of restaurant locations, improvement in company-owned restaurant operating income as a percentage of restaurant sales, and a diversity target, as set by the Compensation Committee; provided, however, that 36% (89,000) of the total 250,000 incentive restricted stock units will not be issued (deemed or otherwise) under the Plan until |

15

| the aggregate number of shares reserved for awards under the Plan is increased consistent with Section 5.1 of the Plan. If there is a change of control (as defined in the employment agreement) or certain termination events during the term of employment, all unearned restricted stock units shall be deemed to have been earned and vested immediately prior to the change of control or termination event. |

| (4) | Represents benchmark restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Ramirez The benchmark restricted stock units vest as follows; provided, however, that 100% (100,000) of the total 100,000 benchmark restricted stock units will not be issued (deemed or otherwise) under the Plan until the aggregate number of shares reserved for awards under the Plan is increased consistent with Section 5.1 of the Plan: (i) 25,000 shares, when the last reported closing price of the Company’s common stock for any 20 trading days within any consecutive 30 trading day period is greater than or equal to $19.00 per share; (ii) 25,000 shares, when the last reported closing price of the Company’s common stock for any 20 trading days within any consecutive 30 trading day period is greater than or equal to $22.00 per share; and (iii) 50,000 shares, when the last reported closing price of the Company’s common stock for any 20 trading days within any consecutive 30 trading day period is greater than or equal to $25.00 per share. If there is a change of control (as defined in the employment agreement) during the term of employment, all unearned benchmark restricted stock units shall be deemed to have been earned and vested immediately prior to the change of control. |

| (5) | Market value of the restricted stock units was determined using the $13.69 closing price per share of the Company’s common stock on December 31, 2020. |

None of our directors received compensation for services as a director during the year ended December 31, 2020. Since the year ended December 31, 2020, each director has been granted 5,000 restricted stock units, to vest and be settled in shares of common stock on December 31, 2021, subject to such director’s continuous service as a director until such time and earlier vesting due to a change of control; provided, however, that the grant made to Mr. Berrard vested on the grant date. In addition, each committee chair is entitled to receive annual cash compensation of $7,500.

16

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of the Record Date, the number of shares of BurgerFi common stock beneficially owned by (i) each person who is known by us to be the beneficial owner of more than five percent of our issued and outstanding ordinary shares, (ii) each of our named executive officers and directors; and (iii) all of our officers and directors as a group.

Beneficial ownership is determined in accordance with SEC rules and includes voting or investment power with respect to securities. Except as indicated by the footnotes below, the Company believes, based on the information furnished to it, that the persons and entities named in the table below have sole voting and investment power with respect to all stock that they beneficially own, subject to applicable community property laws. All of the Company’s shares of common stock subject to options or warrants exercisable within 60 days are deemed to be outstanding and beneficially owned by the persons holding those options or warrants for the purpose of computing the number of shares beneficially owned and the percentage ownership of that person. They are not, however, deemed to be outstanding and beneficially owned for the purpose of computing the percentage ownership of any other person.

Subject to the paragraph above, the percentage ownership of issued shares is based on 17,838,476 shares of common stock issued and outstanding as of the Record Date.

Name and Address of Beneficial Owner(1) | Amount and Nature of Beneficial Ownership | Percent of Class | ||||||

Ophir Sternberg(2) | 2,060,112 | 10.9 | % | |||||

Julio Ramirez | — | * | ||||||

Bryan McGuire | 5,000 | * | ||||||

Ross Goldstein | — | * | ||||||

Nick Raucci | — | * | ||||||

Allison Greenfield(3) | 20,000 | * | ||||||

Martha Stewart | 3,000 | * | ||||||

Vivian Lopez-Blanco | — | * | ||||||

Gregory Mann | — | * | ||||||

All directors and executive officers as a group (eleven individuals) | 2,088,112 | 11.0 | % | |||||

Greater than 5% Beneficial Owners | ||||||||

Lionheart Equities, LLC(4) | 2,010,112 | 10.6 | % | |||||

The John Rosatti Family Trust dated August 27, 2001, as amended(5) | 4,041,852 | 22.7 | % | |||||

Lion Point Capital, LP(6) | 2,745,938 | 15.4 | % | |||||

| * | Less than one percent. |

| (1) | Unless otherwise indicated, the business address of each of the individuals is c/o BurgerFi International, Inc., 105 US Highway 1, North Palm Beach, Florida 33408. |

| (2) | Consist of (i) 870,725 shares (the “Unit Shares”) of common stock underling units, each of which consists of one share of common stock and one warrant (“Warrant”) exercisable to purchase one share of common stock, and 1,139,387 shares of common stock underlying Warrants, which are currently exercisable, owned directly by Lionheart Equities, LLC and (ii) 50,000 shares owned by Mr. Sternberg. Mr. Sternberg, as manager of Lionheart Equities, LLC, has sole voting control over the Unit Shares and Warrants held by Lionheart Equities, LLC. The business address for Lionheart Equities, LLC is 4218 NE 2nd Avenue, Miami, FL 33137. The business address for Mr. Sternberg is 4218 NE 2nd Avenue, Miami, FL 33137. |

| (3) | Consist of 10,000 shares of common stock owned by Allison Greenfield and 10,000 shares of common stock owned by Leviathan Group, LLC. Ms. Greenfield possesses sole voting and dispositive control over the shares. |

17

| (4) | Consist of 870,725 Unit Shares and 1,139,387 shares of common stock underlying Warrants, which are currently exercisable, owned directly by Lionheart Equities, LLC. Mr. Sternberg, as manager of Lionheart Equities, LLC, has sole voting control and dispositive control over the Unit Shares and Warrants held by Lionheart Equities, LLC. The business address for Lionheart Equities, LLC is 4218 NE 2nd Avenue, Miami, FL 33137. |

| (5) | Shares of common stock held by The John Rosatti Family Trust dated August 27, 2001, as amended (the “JR Trust”). The business address of 101 US Highway 1, North Palm Beach, FL 33408. John Rosatti, as trustee of the JR Trust, may be deemed to beneficially own the securities beneficially owned by the JR Trust and has sole voting and dispositive power over the shares held by the JR Trust. Information included in this footnote is derived from a Form 4 filed on June 29, 2021. |

| (6) | Shares of common stock held by Lion Point Capital, LP (“Lion Point”). The business address of Lion Point is 250 West 55th Street, 33rd Floor, New York, NY 10019. Lion Point Capital, LP is the investment manager to its investment fund client Lion Point Master, LP. Lion Point Holdings is the general partner of Lion Point. Didric Cederholm is a Founding Partner and Chief Investment Officer of Lion Point. Mr. Cederholm is also a Member and a Manager of Lion Point Holdings. Mr. Freeman is a Founding Partner and Head of Research of Lion Point. Mr. Freeman is also a Member and a Manager of Lion Point Holdings. By virtue of these relationships, each of Lion Point, Lion Point Holdings, Mr. Cederholm and Mr. Freeman may be deemed to beneficially own the securities beneficially owned by its investment fund client. Information included in this footnote is derived from a Schedule 13G/A filed on January 11, 2021. |

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes the compensation plan under which our equity securities are authorized for issuance as of December 31, 2020.

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |||||||||

Equity compensation plans approved by security holders(1) | 1,300,000 | (2) | $ | N/A | 700,000 | |||||||

Equity compensation plans not approved by security holders | — | N/A | — | |||||||||

|

|

|

|

|

| |||||||

Total | 1,300,000 | $ | — | 700,000 | ||||||||

|

|

|

|

|

| |||||||

| (1) | The equity compensation plan approved by security holders is the 2020 Omnibus Equity Incentive Plan, which allows for an initial allotment of 2,000,000 shares. The aggregate number of shares reserved for awards under the Plan (other than Incentive Stock Options) will automatically increase on January 1 of each year, for a period of not more than ten (10) years, commencing on January 1 of the year following the year after the date the plan became effective, in an amount equal to five percent (5%) of the total number of shares of common stock outstanding on December 31 of the preceding calendar year, provided that the Company’s Compensation Committee may determine prior to the first day of the applicable fiscal year to lower the amount of such annual increase. |

| (2) | Represents the maximum number of shares of common stock to be issued upon the vesting of restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company, Mr. Sternberg and Mr. Ramirez. |

18

PROPOSAL 2: AUDITOR RATIFICATION PROPOSAL

BDO USA, LLP

On December 16, 2020, the Board approved the appointment of BDO as the Company’s independent registered public accounting firm, effective December 22, 2020. BDO has been the independent registered public accounting firm for BurgerFi International, LLC since 2015. During the two most recent fiscal years ended December 31, 2019 and 2018 and during the subsequent interim period through December 16, 2020, neither Opes Acquisition Corp. (the Company’s predecessor), nor anyone on its behalf consulted BDO regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that BDO concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement” or a “reportable event”, each as defined in Regulation S-K Item 304(a)(1)(iv) and 304(a)(1)(v), respectively.

Marcum, LLP

On December 22, 2020, the Audit Committee dismissed Marcum, LLP (“Marcum”), Opes Acquisition Corp.’s independent registered public accounting firm prior to the business combination with BurgerFi International, LLC (the “Business Combination”), as the Company’s independent registered public accounting firm.

The reports of Marcum on the financial statements of Opes Acquisition Corp. for the years ended December 31, 2019 and 2018 did not contain any adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope, or accounting principles, except for an explanatory paragraph in such reports regarding substantial doubt about Opes Acquisition Corp.’s ability to continue as a going concern.