- BFICQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

BurgerFi International (BFICQ) DEF 14ADefinitive proxy

Filed: 1 Jun 23, 4:15pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (As Permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

BurgerFi International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

200 West Cypress Creek Dr., Suite 220

Fort Lauderdale, Florida 33309

June 1, 2023

Dear Fellow BurgerFi Stockholder:

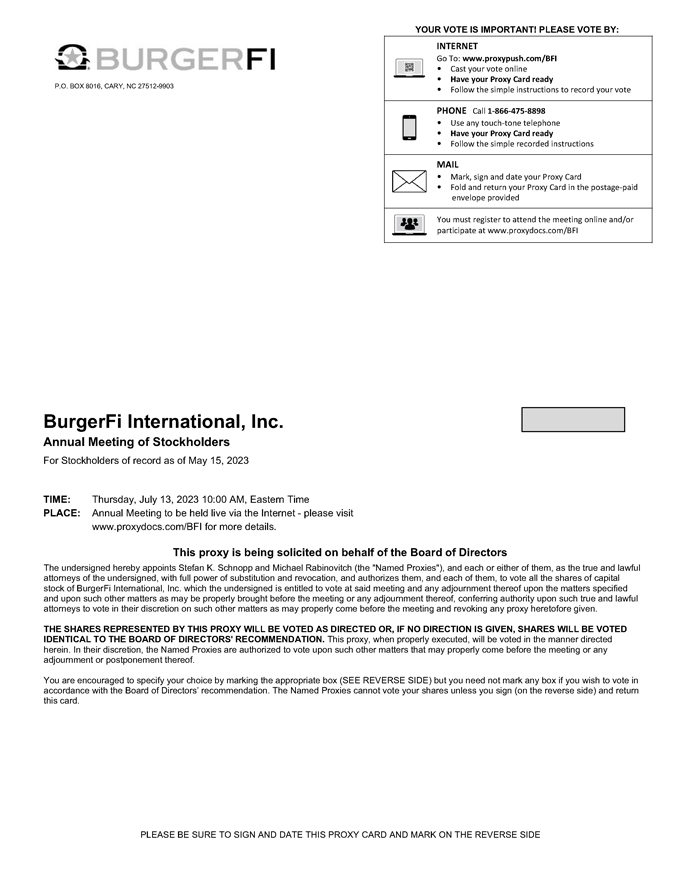

We are pleased to invite you to join us at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of BurgerFi International, Inc. (the “Company” or “BurgerFi”) to be held at 10:00 a.m. Eastern Time on Thursday, July 13, 2023 by means of a live virtual-only on-line webcast.

The accompanying Notice of Annual Meeting and Proxy Statement describe the specific matters to be voted upon during the Annual Meeting. At the meeting, we also will report on our business and provide an opportunity for you to ask questions pertaining to our business.

Whether you own a few or many shares of BurgerFi Common Stock and whether or not you plan to attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. Your vote is important, and we ask that you please cast your vote as soon as possible.

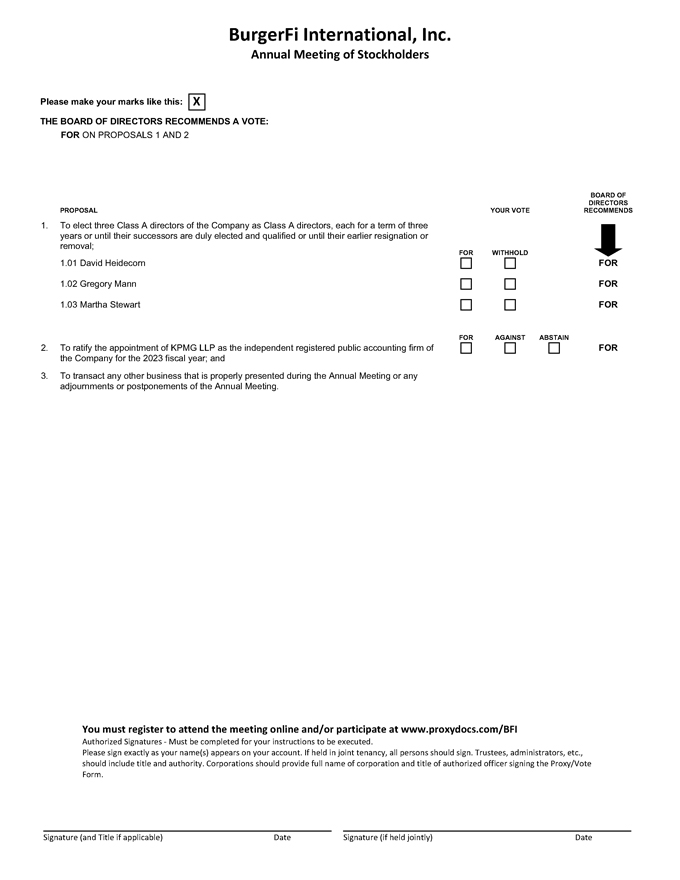

The Board of Directors recommends that you vote FOR the election of all the Class A director nominees and FOR the ratification of the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the 2023 fiscal year. Please refer to the accompanying Proxy Statement for detailed information on each of the proposals and the Annual Meeting.

Sincerely,

Ophir Sternberg

Executive Chairman of the Board

BurgerFi International, Inc.

200 West Cypress Creek Rd., Suite 220

Fort Lauderdale, Florida 33309

NOTICE OF THE 2023 ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of BurgerFi International, Inc.:

The 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of BurgerFi International, Inc. (the “Company” or “BurgerFi”) will be held at 10:00 a.m. Eastern Time on Thursday, July 13, 2023 by means of a live, virtual-only on-line webcast for the following purposes, as more fully described in the accompanying proxy statement:

| (1) | To elect three Class A directors of the Company as Class A directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal; |

| (2) | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the 2023 fiscal year; and |

| (3) | To transact any other business that is properly presented during the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

Only stockholders of record as of the close of business on May 15, 2023, the record date, are entitled to receive notice of the Annual Meeting and to vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting.

We cordially invite you to attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we ask that you please cast your vote as soon as possible. As more fully described in the accompanying proxy statement, you may revoke your proxy and reclaim your right to vote at any time prior to its use.

Sincerely,

Ophir Sternberg

Executive Chairman of the Board

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 13, 2023

The accompanying proxy statement and the 2022 Annual Report on Form 10-K are available at

https://www.proxydocs.com/ BFI.

ACCESS TO THE 2023 VIRTUAL-ONLY

ANNUAL MEETING

The Annual Meeting will be conducted virtually over the Internet by means of a live audio webcast. The Company will not conduct an in-person meeting of stockholders in 2023. You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on May 15, 2023, the record date, or hold a valid proxy for the meeting.

In order to attend the Annual Meeting, you must register in advance at https://www.proxydocs.com/BFI. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to submit questions. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. You will find more information on the matters for voting on the following pages.

If you are a stockholder of record, you may vote by using the Internet, by telephone, by mail, or during the Annual Meeting. If you are a beneficial owner, please follow the voting instructions provided in the notice you receive from your broker, bank or other nominee, and direct such organization to vote your shares in accordance with your instructions. A beneficial holder may also attend the Annual Meeting, but because a beneficial owner is not a stockholder of record, you may not vote during the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:00 a.m. Eastern Time.

Our virtual Annual Meeting will allow stockholders to submit questions before and during the Annual Meeting. During a designated question and answer period at the Annual Meeting, we will respond to appropriate questions submitted by stockholders.

PROXY STATEMENT

| 1 | ||||

| 1 | ||||

| 4 | ||||

| 9 | ||||

| 16 | ||||

| 20 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 20 | |||

| 23 | ||||

| 24 | ||||

POLICY FOR APPROVAL OF AUDIT AND PERMITTED NON-AUDIT SERVICES | 26 | |||

| 26 | ||||

| 27 | ||||

| 30 |

This Proxy Statement contains information relating to the solicitation of proxies by the Board of Directors (the “Board”) of BurgerFi International, Inc. (the “Company” or “BurgerFi”) for use at our 2023 Annual Meeting of Stockholders (“Annual Meeting”). Our Annual Meeting will be held at 10:00 a.m. Eastern Time on Thursday, July 13, 2023 by means of a live virtual-only on-line webcast.

Only stockholders of record as of the close of business on May 15, 2023 (the “Record Date”) are entitled to receive notice of and vote during the Annual Meeting or any adjournments or postponements of the Annual Meeting. As of the Record Date, there were 23,853,927 shares of common stock, par value $0.0001 per share (the “Common Stock”), issued and outstanding and entitled to vote during the Annual Meeting. In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials, including this proxy statement and our Form 10-K for the year ended January 2, 2023, to our stockholders via the Internet. On or about June 1, 2023, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on how to access our proxy materials on the Internet and how to vote. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice of Internet Availability.

All references in this Proxy Statement to “we”, “us” and “our” refer to BurgerFi International, Inc.

QUESTIONS AND ANSWERS ABOUT OUR ANNUAL MEETING

What is the purpose of our 2023 Annual Meeting?

Our 2023 Annual Meeting will be held for the following purposes:

| (1) | To elect three Class A directors, each for a term of three years or until their successors are duly elected and qualified or until their earlier resignation or removal. We refer to this as the “Director Election Proposal.” |

| (2) | To ratify the appointment of KPMG LLP as the independent registered public accounting firm of the Company for the 2023 fiscal year. We refer to this as the “Auditor Ratification Proposal.” |

| (3) | To transact any other business that is properly presented at the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

In addition, senior management will respond to your questions pertaining to the business of the Company.

How can I attend the Annual Meeting?

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting.

In order to attend the Annual Meeting, you must register in advance at https://www.proxydocs.com/ BFI. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting and will also permit you to vote and submit questions during the Annual Meeting. Please be sure to follow instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email. You will find more information on the matters for voting on the following pages.

If you are a stockholder of record, you may vote by using the Internet, by telephone, by mail, or during the Annual Meeting via the Internet. If you are a beneficial owner, please follow the voting instructions provided in the notice you receive from your broker, bank or other nominee, and direct such organization to vote your shares

1

in accordance with your instructions. A beneficial holder may also attend the Annual Meeting, but because a beneficial owner is not a stockholder of record, you may not vote during the Annual Meeting unless you obtain a “legal proxy” from the organization that holds your shares, giving you the right to vote the shares during the Annual Meeting.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Notice of Internet Availability. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the Annual Meeting, stockholders may begin to log in to the virtual-only Annual Meeting 15 minutes prior to the Annual Meeting. The Annual Meeting will begin promptly at 10:00 a.m. Eastern Time.

What are the voting rights of BurgerFi stockholders?

Each stockholder of Common Stock is entitled to one vote per share on each of the three Class A director nominees and one vote per share on each other matter properly presented at the Annual Meeting for each share of Common Stock owned by that stockholder on the Record Date.

What is the difference between holding shares as a “stockholder of record” and a “street name” holder?

If your shares are registered directly in your name through Continental Stock Transfer & Trust, the Company’s transfer agent, you are considered a “stockholder of record.” If your shares are held in a brokerage account, bank or through another nominee, you are considered a “street name” holder.

What constitutes a quorum?

The presence in person or by proxy of the holders of a majority of the shares issued and outstanding and entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business at the meeting. If you submit a properly executed proxy or voting instruction card or properly cast your vote via the Internet, or by telephone, your shares will be considered part of the quorum, even if you abstain from voting or withhold authority to vote as to a particular proposal. Under Delaware law, we also will consider as present for purposes of determining whether a quorum exists any abstentions and any shares represented by “broker non-votes.”

How do I vote?

You can vote in any of the following ways. Please check your proxy card or contact your broker for voting instructions.

If your shares are registered in your name (as a stockholder of record)

To vote by Internet or telephone: Log on to the website or call the toll-free number set forth in the notice of meeting mailed to you and follow the instructions.

To vote by mail: If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope.

To vote during the meeting: Withdraw your earlier proxy and vote at the Annual Meeting via the Internet.

If your shares are held in “street name”

You should give instructions to your broker on how to vote your shares. If you do not provide voting instructions to your broker, your broker has discretion to vote those shares on matters that are routine. A broker

2

cannot, however, vote shares on non-routine matters without your instructions. This is referred to as a “broker non- vote.” Under the rules of The Nasdaq Stock Market LLC (“Nasdaq”), the Director Election Proposal is non-routine and, as such, a broker does not have the discretion to vote on the Director Election Proposal if such broker has not received instructions from the beneficial owner of the shares represented. The Auditor Ratification Proposal is considered a routine proposal and may be voted in the absence of instructions.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the meeting. If you are a registered holder of shares, you may vote again on a later date by telephone, via the Internet, by submitting a subsequently dated proxy by mail, or by attending the meeting and voting during the meeting via the Internet. Only your latest proxy and vote submitted prior to the meeting will be counted. Your attendance at the Annual Meeting, however, will not automatically revoke your proxy unless you vote again during the meeting or specifically request in writing that your prior proxy be revoked. If your shares are held in street name, you must contact your broker, bank or other nominee to revoke your proxy and change your vote.

What vote is required to approve each proposal at the Annual Meeting?

Proposal 1—Director Election Proposal.

The vote required to elect our three Class A directors, each for a term of three years or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast. Abstentions and broker non-votes will have no effect on the election of directors.

Proposal 2—Auditor Ratification Proposal.

The vote required to approve the Auditor Ratification Proposal is a majority of the stock having voting power present in person or represented by proxy and entitled to vote at the Annual Meeting. Abstentions will have the same effect as a vote against this proposal.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote:

| • | FOR Proposal 1: the Director Election Proposal; and |

| • | FOR Proposal 2: the Auditor Ratification Proposal. |

How will the persons named as proxies vote?

If you complete and submit a proxy, the persons named as proxies will follow your voting instructions. If you submit a proxy but do not provide instructions or if your instructions are unclear, the persons named as proxies will vote your shares in accordance with the recommendations of the Board, as set forth above.

With respect to any other proposal that properly comes before the Annual Meeting, the persons named as proxies will vote as recommended by our Board or, if no recommendation is given, in their own discretion.

Who will pay for the cost of soliciting proxies?

We will pay for the cost of soliciting proxies. Our directors, officers, and other employees, without additional compensation, may also solicit proxies personally or in writing, by telephone, e-mail, or otherwise. As is customary, we will reimburse brokerage firms, fiduciaries, voting trustees, and other nominees for forwarding our proxy materials to each beneficial owner of Common Stock held of record.

3

PROPOSAL 1: DIRECTOR ELECTION PROPOSAL

Our Board of Directors currently consists of seven directors divided into three classes: Class A, Class B and Class C. The Board of Directors is classified into three classes, each comprising as nearly as possible one-third of the directors to serve three-year terms.

| • | Class A directors shall serve for a term expiring at the 2023 Annual Meeting of Stockholders; |

| • | Class B directors shall serve for a term expiring at the 2024 Annual Meeting of Stockholders; and |

| • | Class C directors shall serve for a term expiring at the 2025 Annual Meeting of Stockholders. |

At this Annual Meeting of Stockholders and each Annual Meeting of Stockholders thereafter, the successors to the class of directors whose terms expire at that meeting would be elected for a term of office to expire at the third succeeding Annual Meeting of Stockholders after their election, or until their successors have been duly elected and qualified. On December 16, 2020, the Company entered into a Voting Agreement with Axis Capital Management, certain initial stockholders (the “Initial Stockholders”) who held founders’ shares (“Founders’ Shares”) prior to the Company’s initial public offering (“IPO”), the members (the “Members”) of BurgerFi International, LLC and then-serving officers and directors of the Company, pursuant to which all stockholders party thereto agreed to vote their shares of the Company in favor of Ophir Sternberg, Allison Greenfield, and Gregory Mann and two other former directors of the Company, or, if any of them ceases to serve as a director, such other person designated by our Executive Chairman, in consultation with John Rosatti, a significant stockholder of the Company. In addition, in connection with the Company’s acquisition (the “Anthony’s acquisition”) of Anthony’s Coal Fired Pizza & Wings (“Anthony’s”), on November 3, 2021, we entered into an additional Voting Agreement with Cardboard Box, LLC (“Cardboard”), Ophir Sternberg and Lionheart Equities, LLC (“Lionheart Equities”), pursuant to which all such stockholders agreed to vote their shares of the Company in favor of Ophir Sternberg, Allison Greenfield, Vivian Lopez-Blanco, Gregory Mann, Martha Stewart and Andrew Taub, the director designee of Cardboard (or any successor director designee of Cardboard). Both of the above-mentioned voting agreements have terminated by their terms.

Our Class A directors are David Heidecorn, Gregory Mann, and Martha Stewart; our Class B directors are Vivian Lopez- Blanco and Allison Greenfield; and our Class C directors are Ophir Sternberg and Andrew Taub. Messrs. Heidecorn and Taub serve as a director pursuant to the right of CP7 Warming Bag, L.P. (“CP7), an affiliate of L Catterton Fund L.P., under that certain amended and restated certificate of designation, dated as of February 24, 2023 (“A&R CoD”), regarding the Company’s shares of preferred stock, par value $0.0001 per share, designated as Series A Preferred Stock (the “Series A Junior Preferred Stock”), whereby, for so long as CP7, its affiliates or certain related persons of CP7, directly or indirectly, hold collectively 70% or more of the shares of the Series A Junior Preferred Stock issued as of the date of the A&R CoD, CP7 shall have the option and the right (but not the obligation) to designate two directors.

Our Board of Directors is recommending that David Heidecorn, Gregory Mann, and Martha Stewart, our Class A directors, be re-elected to serve for a term until the 2026 Annual Meeting of Stockholders or until their successors are duly elected and qualified or until their earlier resignation or removal. If David Heidecorn, Gregory Mann, or Martha Stewart becomes unavailable for any reason, including a situation that is not anticipated, substitute nominees may be proposed by the Board, and any shares represented by proxy will be voted for the substitute nominees, unless the Board reduces the number of directors.

4

The following table sets forth certain information concerning the nominees for Class A directors and each of the other members of the Board of Directors:

Directors and Executive Officers

Below are the names of and certain information regarding our executive officers and directors:

Name | Age | Position | ||||

Ophir Sternberg | 53 | Executive Chairman of the Board and Class C Director | ||||

Ian Baines | 66 | Chief Executive Officer | ||||

Mike Rabinovitch | 53 | Chief Financial Officer | ||||

Allison Greenfield | 50 | Class B Director | ||||

David Heidecorn | 66 | Class A Director | ||||

Vivian Lopez-Blanco | 65 | Class B Director | ||||

Gregory Mann | 51 | Class A Director | ||||

Martha Stewart | 81 | Class A Director | ||||

Andrew Taub | 54 | Class C Director | ||||

Directors

Ophir Sternberg has been the Company’s Executive Chairman of the Board since December 2020, having served as a member of our Board of Directors since October 2019, Chairman since April 2020, and Chief Executive Officer from June 2020 to December 2020. Mr. Sternberg has over 30 years of experience in investing across numerous industries and segments. Mr. Sternberg additionally serves on the Board of Directors for MSP Recovery, Inc. d/b/a LifeWallet (NASDAQ: LIFW) and is Chairman of the Board for Security Matters Public Limited Company (NASDAQ: SMX). Mr. Sternberg is the Founder and Chief Executive Officer of Miami-based Lionheart Capital, LLC founded in 2009. We believe Mr. Sternberg is well qualified to serve on our board of directors due to his business experience, contacts and relationships, as well as his extensive experience in both the public and private company sectors.

Allison Greenfield has served as a member of the Company’s Board of Directors since June 2020. Ms. Greenfield has over two decades of experience in real estate development. Ms. Greenfield is the Chief Development Officer and has been a partner of Lionheart Capital, LLC, since it was founded in 2009 and has over 25 years of experience in the entitlement, design, construction and management of projects in all segments of the real estate industry, including industrial, retail, hospitality, and ultra-luxury residential condominiums. At Lionheart Capital, LLC, she has been responsible for the successful acquisition, development, and repositioning of real estate assets around the world. Prior to her tenure at Lionheart Capital, LLC, Ms. Greenfield ran the development and construction arm of Oz Holdings, LLC as a partner from 2001-2010. Ms. Greenfield studied Architecture at The New School University, Parsons School of Design and holds a B.A. in History from Barnard College/Columbia University. We believe Ms. Greenfield is well-qualified to serve on our Board of Directors due to her business experience, contacts and relationships.

David Heidecorn is a Senior Advisor to L Catterton, the world’s largest consumer-focused private equity firm. Prior to becoming a Senior Advisor, Mr. Heidecorn was a Partner and Chief Risk Officer for over 2 decades at L Catterton. Prior to joining L Catterton, Mr. Heidecorn was the Chief Financial Officer of Alarmguard Holdings, Inc. (AMEX: AGD). In 1992, Mr. Heidecorn joined Nantucket Holding Company, a merchant bank specializing in the acquisition and management of troubled companies and the consolidation of fragmented sectors within the consumer products and services industry. From 1986 to 1992, Mr. Heidecorn held various senior positions in the Corporate Finance Group of GE Capital, including heading up the Restructuring Group for the Northeast. Mr. Heidecorn received a B.A in Economics from Lehigh University and an M.B.A. in Finance from Columbia Business School. We believe Mr. Heidecorn is qualified to serve on our board of directors due to his extensive business experience. Mr. Heidecorn serves as a director pursuant to CP7’s right under the A&R CoD regarding

5

the Company’s Series A Junior Preferred Stock, whereby, for so long as CP7, its affiliates or certain related persons of CP7, directly or indirectly, hold collectively 70% or more of the shares of the Series A Junior Preferred Stock issued as of the date of the A&R CoD, CP7 shall have the option and the right (but not the obligation) to designate two directors.

Vivian Lopez-Blanco has served as a member of the Company’s Board of Directors since July 2021. Ms. Lopez- Blanco also serves on the board of Jumptuit Health, Inc. Prior to joining the Company, Ms. Lopez-Blanco served as an advisory board member of BBVA, South Florida operations, from 2019 until June 2021, Chief Financial Officer of Mednax, Inc. (NYSE: MD) from 2010 until 2018, Vice President and Treasurer of Mednax, Inc. from 2008 to 2010 and Chief Financial Officer of Carrols Corporation’s Hispanic Restaurants Division, which includes the Pollo Tropical and Taco Cabana concepts, from 2003 to 2008. Ms. Lopez-Blanco joined Pollo Tropical in 1997 as Controller and was promoted to Chief Financial Officer in 1998 and led the company through its acquisition by Carrols Corporation, developed and realigned key business processes and implemented several financial systems. Earlier in her career, Ms. Lopez-Blanco spent years in an international accounting firm where she progressed through different management roles and gained extensive experience in public company reporting and capital market expansions. Ms. Lopez-Blanco earned a bachelor’s degree in accounting from Florida International University and is a certified public accountant. We believe Ms. Lopez-Blanco is well qualified to serve on our Board of Directors due to her business experience, including her experience in public accounting and as the Chief Financial Officer of public companies, her contacts and relationships.

Gregory Mann has served as a member of the Company’s Board of Directors since December 2020. Mr. Mann has over 20 years of experience in delivering outstanding results for leading U.S. and global companies. Mr. Mann previously served as Chief Marketing Officer for Trustly, Inc. He has also previously served at Hydrus Technology as a Board member and in a variety of advising, consulting, leadership, and managerial roles where he developed the firm’s commercialization and go to market (GTM) strategy that led to the company’s first long-term commercial contract. Prior to Hydrus, from March 2017 to November 2018, Mr. Mann created a stand-alone P&L division at Catalina Marketing as President of Emerging Brands where he architected and implemented a new three-year business strategy that included the launch of new data and marketing services which significantly increased new client deal size and improved client retention. Mr. Mann also developed and drove the vision and general management for the newly founded Emerging Brands division focused on thousands of consumer-packaged goods companies. Prior to Catalina, Mr. Mann worked as the Chief Marketing Officer for LoopPay, where he was part of the founding team which was then acquired by Samsung in order to develop and launch Samsung Pay. Mr. Mann holds an MBA from The Wharton School and a Master’s Degree in International Studies from the University of Pennsylvania’s Lauder Institute. We believe that Mr. Mann’s experience as an entrepreneurial executive and corporate innovator that has built and led established startup, turnaround, and hyper-growth companies and divisions globally will continue to be a valuable asset to the Company’s Board of Directors.

Martha Stewart has served as a member of the Company’s Board of Directors since February 2021. Ms. Stewart is a businesswoman, writer, and television personality. As founder of Martha Stewart Living Omnimedia, “MSLO,” she gained success through a variety of business ventures, encompassing publishing, broadcasting, merchandising and e-commerce. She has written numerous bestselling books, is the publisher of Martha Stewart Living magazine and hosted two syndicated television programs: Martha Stewart Living, which ran from 1993 to 2004, and Martha, which ran from 2005 to 2012. Ms. Stewart currently serves as the Chief Creative Officer of Marquee Brands, a position she has held since June 2019. Prior to that, Ms. Stewart served as Chief Creative Officer of Sequential Brands Group, Inc. from December 2015 to June 2019. Ms. Stewart has served on the board of directors of the Sequential Brands Group, Inc. since December 2015. Ms. Stewart has also served on the board of AppHarvest, Inc. since May 2020. Ms. Stewart was Founder, Chief Creative Officer and Non-Executive Chairman of the board of directors of MSLO from 1996 through June 2003. She also served as Chief Executive Officer from 1996 through June 2003. Ms. Stewart earned a bachelor’s degree in European history and architectural history from Barnard College. We believe Ms. Stewart is well qualified to serve on the Company’s Board of Directors due to her business experience, extensive contacts and relationships.

6

Andrew Taub has served as a member of the Company’s Board of Directors since November 2021. Mr. Taub has been a Managing Partner of L Catterton, where he focuses on the Flagship Buyout Fund, since 1996. L Catterton is the world’s largest consumer-focused private equity firm, with approximately $30 billion of equity capital across six fund strategies in 17 offices globally and has advised certain funds affiliated with the entity that sold Anthony’s to the Company and has provided advisory services to subsidiaries of the Company. Mr. Taub’s investment and operating expertise spans the consumer and healthcare services landscape through investments in the pet, optical, restaurant, food and marketing services industries. In addition to serving on the Company’s Board of Directors, Mr. Taub currently serves as a director of several L Catterton portfolio companies, including JustFoodForDogs, PatientPoint Health Technologies, and FYidoctors. Mr. Taub holds a Bachelor of Arts degree in Finance and Accounting from the University of Michigan at Ann Arbor and a Master of Business Administration degree from Columbia Business School. We believe Mr. Taub is qualified to serve on our Board of Directors due to his extensive business experience. Mr. Taub serves as a director pursuant to CP7’s right under the A&R CoD regarding the Company’s Series A Junior Preferred Stock, whereby, for so long as CP7, its affiliates or certain related persons of CP7, directly or indirectly, hold collectively 70% or more of the shares of the Series A Junior Preferred Stock issued as of the date of the A&R CoD, CP7 shall have the option and the right (but not the obligation) to designate two directors.

| Board Diversity Matrix | ||||||||||||||||

Part I: Gender Identity | Male | Female | Non-Binary | Did Not Disclose Gender | ||||||||||||

Directors | 4 | 3 | ||||||||||||||

Part II: Demographic Background | ||||||||||||||||

African American or Black | ||||||||||||||||

Alaskan Native or American Indian | ||||||||||||||||

Asian | ||||||||||||||||

Hispanic, Latino or Latina | 1 | |||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||||

White | 3 | 1 | ||||||||||||||

Two or More Races or Ethnicities | 1 | |||||||||||||||

LGBTQ+ | 1 | |||||||||||||||

Undisclosed | 1 | |||||||||||||||

Executive Officers

Ian Baines has served as our Chief Executive Officer since November 2021. On May 8, 2023, Mr. Baines notified the Company that he is retiring and resigning from his positions with the Company effective June 7, 2023. Mr. Baines served as the President and Chief Executive Officer of ACFP Management, Inc. from January 2020 until November 2021. Mr. Baines has over four decades of experience in the restaurant and hospitality business, beginning as a classically trained chef in his native England, followed by 25 years in Canada with ever increasing roles and responsibilities culminating into Chief Operating Officer of SIR Corp restaurants. In 2004, Mr. Baines was actively recruited to join Brinker International, Inc. where he served in various executive roles. He joined Darden Restaurants Inc. and led the Smokey Bones brand as President before the sale to Sun Capital Partners, Inc., where he continued for several years as President and Chief Executive Officer. He was recruited back to Brinker International, Inc. in 2011 as Senior Vice President of Strategic Innovation. From 2013 to 2014, Mr. Baines served as President and Chief Executive Officer of Uno Restaurant Holdings Corporation. From 2014 to 2018, he served as President and Chief Executive Officer of Cheddar’s Scratch Kitchen (“Cheddar’s”); after the sale of Cheddar’s to Darden Restaurants Inc. in 2017 he continued as Brand President. In 2019, he was Chief Executive Officer of Del Frisco’s Restaurant Group, Inc. during the transition from a public company to three independent brands and ultimately the sale of the steak division. Except for the Amended and Restated Stock Purchase Agreement dated November 3, 2021 (as subsequently amended) by and among the Company, Cardboard, and Hot Air, Inc., a Delaware corporation (“Hot Air”), pursuant to which the Anthony’s acquisition was consummated., there are no arrangements or understandings between Mr. Baines and any other person pursuant to which he was appointed.

7

Michael Rabinovitch joined the Company on February 26, 2021 and assumed the position of Chief Financial Officer on May 3, 2021. Mr. Rabinovitch served as Senior Vice President and Chief Accounting Officer of Tech Data Corporation from March 2018 until September 2020. Prior thereto, Mr. Rabinovitch was employed at Office Depot, where he served as Vice President of Finance, North America from January 2015 to March 2017 and Senior Vice President, Finance and Chief Accounting Officer from March 2017 to February 2018. From 2005 through 2015, he served as Executive Vice President and Chief Financial Officer of Birks Group (a/k/a Mayors Jewelers), a North American manufacturer and retailer of fine jewelry and luxury timepieces. Prior to joining Birks Group, Mr. Rabinovitch was Vice President of Finance of Claire’s Stores, Inc., a specialty retailer of fashion jewelry and accessories, from 1999 to 2005. Mr. Rabinovitch began his career as an auditor with Price Waterhouse LLP. Mr. Rabinovitch is a licensed certified public accountant (inactive) and a member of the American Institute of Certified Public Accountants.

Vote Required and Board Recommendation

The vote required to elect our three Class A directors, each for a three-year term expiring at the 2026 Annual Meeting or until their successors are duly elected and qualified, is a plurality of the votes of the shares of Common Stock cast at the Annual Meeting. The Board recommends that you vote “FOR” the election of each of the Class A director nominees.

8

Corporate Governance Principles and Code of Ethics

Our Board is committed to sound corporate governance principles and practices. In order to clearly set forth our commitment to conduct our operations in accordance with our high standards of business ethics and applicable laws and regulations, our Board adopted a Code of Ethics applicable to our directors, executive officers and employees that complies with the rules and regulations of Nasdaq. A copy of our Code of Ethics is available on our corporate website at https://ir.burgerfi.com/corporate-governance/governance-documents under “Governance Documents.” The information on our website shall not be deemed incorporated by reference in this proxy statement. You also may obtain without charge a printed copy of the Code of Ethics by sending a written request to: Legal Department, Attn: Chief Legal Officer & Corporate Secretary, 200 West Cypress Creek Rd., Suite 220, Fort Lauderdale, Florida 33309.

Board of Directors

The business and affairs of the Company are managed by or under the direction of the Board. The Board is currently composed of seven members.

The Board held eight (8) meetings and acted by written consent without a meeting on four (4) occasions during the year ended January 2, 2023. In 2022, each person serving as a director attended at least 75% of the total number of meetings of our Board and any Board committee on which he or she served.

It is the policy of the Board that all directors should attend the annual meetings in person or by teleconference. All of our directors serving at the time of the 2022 Annual Meeting of Stockholders were in attendance.

Board Committees

Pursuant to our bylaws, our Board may establish one or more committees of the Board however designated, and delegate to any such committee the full power of the Board, to the fullest extent permitted by law.

The standing committees of our Board currently include an Audit Committee, a Compensation Committee, a Nominating Committee, and a Product & Innovation Committee. Each of the committees reports to the Board as such committee deems appropriate and as the Board may request. The composition, duties and responsibilities of these committees are set forth below.

Audit Committee

Ms. Greenfield, Ms. Lopez-Blanco, and Mr. Mann serve on the Audit Committee. Ms. Lopez-Blanco qualifies as the Audit Committee financial expert as defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and serves as Chairperson of the Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors. The charter contains a detailed description of the scope of the Audit Committee’s responsibilities and how they will be carried out. The Audit Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents under “Governance Documents.” The information on our website shall not be deemed incorporated by reference in this proxy statement. The Audit Committee held seven (7) meetings and acted by written consent without a meeting on one (1) occasion during the year ended January 2, 2023.

According to its charter, the Audit Committee consists of at least three members, each of whom shall be a non-employee director who has been determined by the Board to meet the independence requirements of Nasdaq,

9

and also Rule 10A-3(b)(1) of the SEC, subject to the exemptions provided in Rule 10A-3(c). The Audit Committee Charter describes the primary functions of the Audit Committee, including the following:

| • | reviewing and discussing with management and the independent auditor the annual audited financial statements, and recommending to the Board whether the audited financial statements should be included in our Form 10-K; |

| • | discussing with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of our financial statements; |

| • | discussing with management major risk assessment and risk management policies; |

| • | monitoring the independence of the independent auditor; |

| • | verifying the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law; |

| • | reviewing and approving, subject to subsequent Board approval, all related-party transactions; |

| • | inquiring and discussing with management our compliance with applicable laws and regulations; |

| • | pre-approving all audit services and permitted non-audit services to be performed by our independent auditor, including the fees and terms of the services to be performed; |

| • | appointing or replacing the independent auditor; |

| • | determining the compensation and oversight of the work of the independent auditor (including resolution of disagreements between management and the independent auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or reports which raise material issues regarding our financial statements or accounting policies; and |

| • | approving reimbursement of expenses incurred by our management team in identifying potential target businesses. |

Compensation Committee

Ms. Greenfield, Mr. Mann, and Ms. Lopez-Blanco serve on the Compensation Committee. Ms. Greenfield serves as the Chairperson of the Compensation Committee. The Compensation Committee operates under a written charter adopted by the Board of Directors. The charter contains a detailed description of the scope of the Compensation Committee’s responsibilities and how they will be carried out. The Compensation Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents under “Governance Documents.” The information on our website shall not be deemed incorporated by reference in this proxy statement. The Compensation Committee held five (5) meetings and acted by written consent without a meeting on five (5) occasions during the year ended January 2, 2023. The Compensation Committee may delegate any of its responsibilities to one or more subcommittees as the Compensation Committee may from time to time deem appropriate.

The Compensation Committee’s duties, which are specified in our Compensation Committee Charter, include, but are not limited to:

| • | reviewing and recommending approval to the Board on an annual basis the corporate goals and objectives relevant to our Chief Executive Officer’s compensation, evaluating our Chief Executive Officer’s performance in light of such goals and objectives and recommending to the Board the remuneration (if any) of our Chief Executive Officer based on such evaluation; |

| • | reviewing and recommending approval to the Board the compensation of all other executive officers; |

10

| • | reviewing our executive compensation policies and plans; |

| • | implementing and administering our incentive compensation equity-based remuneration plans; provided, however, that grants of stock options, restricted stock, and other equity awards for executive officers of the Company or as inducements for new executive officers shall be approved by the Board upon the recommendation of such grants by the Committee; |

| • | assisting management in complying with our proxy statement and annual report disclosure requirements; |

| • | recommending approval by the Board of all special perquisites, special cash payments and other special compensation and benefit arrangements for our executive officers and employees; |

| • | if required, producing a report on executive compensation to be included in our annual proxy statement; and |

| • | reviewing, evaluating, and recommending changes, if appropriate, to the remuneration for directors. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by Nasdaq and the SEC. In addition, members of our senior management may report on the performance of the other executive officers of the Company and make compensation recommendations to the Compensation Committee, which will review and, as appropriate, approve the compensation recommendations.

In April of 2022, the Compensation Committee engaged the services of BDA VIII, Inc., d/b/a Verittas Executive Compensation Consultants (the “Compensation Consultant”), to assist the Compensation Committee in evaluating its executive compensation plans. During 2022, the Compensation Consultant did not provide any services to us other than regarding executive and director compensation and broad-based plans that do not discriminate in scope, terms, or operation, in favor of our executive officers or directors, and that are available generally to all salaried employees. Neither the Compensation Consultant nor any of its affiliates maintains any other direct or indirect business relationships with us or any of our subsidiaries. The Compensation Committee evaluated whether any work provided by the Compensation Consultant raised any conflict of interest for services performed during 2022 and determined that it did not.

Nominating Committee

Ms. Greenfield, Ms. Lopez-Blanco, and Mr. Mann serve on the Nominating Committee. Ms. Greenfield serves as the Chairperson of the Nominating Committee. The Nominating Committee operates under a written charter adopted by the Board of Directors. The charter contains a detailed description of the scope of the Nominating Committee’s responsibilities and how they will be carried out. The Nominating Committee’s charter is available on our website at https://ir.burgerfi.com/corporate-governance/governance-documents under “Governance Documents.” The information on our website shall not be deemed incorporated by reference in this proxy statement. The Nominating Committee held two (2) meetings and did not act by written consent without a meeting during the year ended January 2, 2023.

The Nominating Committee will identify, evaluate and recommend candidates to become members of the Board with the goal of creating a balance of knowledge and experience. The Nominating Committee has no specific minimum qualifications for director candidates. However, the Nominating Committee will consider several qualifications relating to management and leadership experience, background and integrity and professionalism in evaluating a person’s candidacy for membership on the Board of Directors. The Nominating Committee may require certain skills or attributes, such as financial or accounting experience, to meet specific

11

Board needs that arise from time to time and will also consider the overall experience and makeup of its members to obtain and maintain a broad and diverse mix of Board members, including with respect to race, gender, ethnicity, background, experience and viewpoints of the Board. The Nominating Committee does not distinguish among nominees recommended by stockholders and other persons.

Product & Innovation Committee

Ms. Stewart and Mr. Sternberg serve on the Product & Innovation Committee. Ms. Stewart serves as the Chairperson of the Product & Innovation Committee. The Product & Innovation Committee’s duties include advising on new product and innovation efforts of the Company.

Board Leadership

The positions of Executive Chairman of the Board and Chief Executive Officer are currently held by Ophir Sternberg and Ian Baines, respectively. On May 8, 2023, Mr. Baines notified the Company that he is retiring and resigning from his positions with the Company effective June 7, 2023. The Board has not designated a lead independent director. Given the limited number of directors comprising the Board, the independent directors call, plan, and chair their executive sessions collaboratively and, between Board meetings, communicate with management and one another directly. Under these circumstances, the directors believe designating a lead independent director to take on responsibility for functions in which they all currently participate might detract from rather than enhance performance of their responsibilities as directors. The Company believes that these arrangements afford the independent directors sufficient resources to supervise management effectively, without distractions and being overly engaged in day-to-day operations.

Board Oversight of Enterprise Risk

The Board is actively involved in the oversight and management of risks that could affect the Company. This oversight and management is conducted primarily through the committees of the Board identified above but the full Board has retained responsibility for general oversight of risks. The Audit Committee is primarily responsible for overseeing the risk management function, specifically with respect to management’s assessment of risk exposures (including risks related to cyber, liquidity, credit, operations and regulatory compliance, among others), and the processes in place to monitor and control such exposures. The other committees of the Board consider the risks within their areas of responsibility. The Board satisfies its oversight responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

Director Independence

Our Board has determined that four of our directors, Allison Greenfield, Vivian Lopez-Blanco, Gregory Mann, and Martha Stewart, qualify as “independent” directors within the meaning of the independent director guidelines of Nasdaq and applicable SEC rules, including with respect to the committees on which they serve. The Nasdaq independence definition includes a series of objective tests regarding a director’s independence and requires that the Board make an affirmative determination that a director has no relationship with us that would interfere with such director’s exercise of independent judgment in carrying out the responsibilities of a director. As part of the Board’s determination, among other factors, the Board considered certain relationships of directors with the Executive Chairman of the Board, including employment by Lionheart Capital, LLC.

Environmental, Social, and Governance Highlights

The Company is a leading multi-brand restaurant company that develops, markets and acquires fast-casual and premium-casual dining restaurant concepts around the world, including corporate-owned stores and franchises. As of January 2, 2023, we were the owner and franchisor of two brands: “BurgerFi,” which is our fast

12

casual “better burger” concept with 114 franchise and corporate-owned locations in the United States and internationally as of January 2, 2023, and “Anthony’s Coal Fired Pizza & Wings,” which is our upscale casual, “well-done” premium pizza and wing concept with 60 corporate-owned locations in the United States as of January 2, 2023.

Sustainability. Environmental sustainability guides our decision-making when it comes to BurgerFi brand restaurant construction and design – we are all-natural and proud of it. From using number two southern pine lumber, some of the most renewable wood on the planet, to our energy efficient appliances, we constantly look at the ways in which we can minimize our environmental footprint. There are many fixtures and furnishings inside that tell a story of sustainability, like upcycled furniture items and LED lighting that reduce our overall carbon footprint. These products and materials are sourced through our preferred vendors to meet the needs of the restaurants.

Sourcing. Our philosophy is to work with best-in-class suppliers across our supply chain so that we can always provide top quality, better-for-you food for our guests.

For the BurgerFi brand’s meat, we source currently from some of best ranches in the United States including Snake River Farms and Springer Mountain Farms, who share in our commitment to all-natural food, with no hormones or antibiotics, that is humanely raised and source verified. In 2021, in Consumer Report’s Chain Reaction Report, BurgerFi was praised for serving “no antibiotic beef” across all its restaurants, and Consumer Reports awarded BurgerFi an “A-Grade Angus Beef” rating for the third consecutive year. In addition, our bread is free of synthetic chemicals, our ketchup is free of corn syrup, and we use cage-free eggs. At BurgerFi, we ensure that our beef is always freshly ground at all domestic locations. In addition, we have developed our proprietary meat alternative VegeFi burger and also utilize a 100% plant-based burger from Beyond Meat®.

At Anthony’s, we are also committed to using fresh ingredients and take pride in our sourcing. We do not use freezers for any of our products to ensure the best quality food for the customer. In addition, by sourcing locally where available, such as our fresh tomatoes and our sausage, we strive to bring the freshest ingredients so we can deliver high-quality products.

Diversity, Equity, and Inclusion. We are committed to creating an inclusive and equitable environment that supports the growth and success of our team members from diverse socioeconomic backgrounds, genders, races, experiences, and more. Rooted in our purpose and beliefs, we strive to become an employer of choice by providing equal opportunities for, and removing obstacles to, success, while also fostering a culture of diversity, equity, and inclusion. We are continually looking to enhance our culture of inclusion, and we have stepped up our efforts, as evidenced by our continuing to develop our mentorship program, which will allow us to enhance our philosophy of partnering seasoned team members with new team members looking to build their career. As part of our continuous trainings, in particular for those in leadership positions, we include programs on topics such as overcoming biases, conflict resolution, de-escalation, difficult conversations, and professionalism. The intention behind these trainings is to enhance our inclusive culture and allow our team members the opportunity to fulfill their potential.

Charitable Partners. We are also dedicated to helping build supportive and caring communities. By encouraging volunteerism and working with community organizations, such as local hunger relief organizations, as well as inviting local “hometown heroes” like firefighters, police officers and EMTs to enjoy a complimentary meal in BurgerFi brand restaurant grand openings, we are partnering with our employees to support charitable services that help strengthen the communities where our employees work and live.

Food Safety. Food safety is of the utmost importance. Within our restaurants we have stringent food safety and quality protocols that help our teams ensure they are providing a safe place to eat for our guests and team members alike. Utilizing in-house temperature and quality audits throughout the day, we strive to verify that all products are safe and of highest quality. Additionally, we use third-party auditing systems, designed to ensure we

13

meet or exceed local health standards. These audits are completed periodically and without notice with the goal of ensuring that our restaurants maintain our high standards at all hours of the day.

Anti-Hedging and Anti-Pledging Policies

The Company has policies prohibiting (1) each director, officer, consultant and employee of the Company from trading in options, puts and calls or similar instruments on securities of the Company, including shares of Common Stock or preferred stock and warrants (“BurgerFi Securities”), or selling BurgerFi Securities “short,” including a “sale against the box;” (2) each director, officer and employee of the Company, each such person’s spouse, minor children and anyone else living in such person’s household, partnerships in which such person is a general partner, trusts of which such person is a trustee, estates of which such person is an executor and other equivalent legal entities that such person controls from holding BurgerFi Securities in margin accounts; and (3) each director, officer, consultant and employee of the Company from pledging BurgerFi Securities when he or she has knowledge of material information concerning the Company that has not been disclosed to the public.

Communications with the Company and the Board

Stockholders may communicate with the Company through its Investor Relations Department by writing to: Investor Relations, BurgerFi International, Inc., 200 West Cypress Creek Rd., Suite 220, Fort Lauderdale, Florida 33309.

Stockholders interested in communicating with our Board, any Board committee, any individual director, or any group of directors (such as our independent directors) should send written correspondence to BurgerFi International, Inc. Board of Directors, Attn: Corporate Secretary, 200 West Cypress Creek Rd., Suite 220, Fort Lauderdale, Florida 33309. The Corporate Secretary will forward all such communications directly to our Board, such Board committee, such individual director or such group of directors, as applicable.

Householding of Meeting Materials

Unless we have received contrary instructions from one or more of the affected stockholders, we will send a single copy of our 2022 annual report and 2023 proxy statement or Notice of Internet Availability to any household at which two or more stockholders reside. Each stockholder in the household will continue to receive a separate proxy card. This process, known as “householding,” reduces the volume of duplicate information received at your household and helps to reduce our expenses.

If, at any time, a stockholder no longer wishes to participate in “householding” and would prefer to receive a separate copy of the 2022 annual report and 2023 proxy statement or Notice of Internet Availability, and/or wishes to receive separate copies of annual reports and proxy statements or Notices of Internet Availability in the future, or if, at any time, stockholders who share an address and receive separate copies of the 2022 annual report and 2023 proxy statement or Notice of Internet Availability would like to receive a single copy of our annual report and proxy statement or Notice of Internet Availability in the future, such stockholder or stockholders may (1) notify its or their broker or brokers, or (2) direct its or their written request to Legal Department, Attn: Chief Legal Officer and Corporate Secretary, BurgerFi International, Inc., 200 West Cypress Creek Rd., Suite 220, Fort Lauderdale, Florida 33309 or make such request orally by calling (954) 618-2000.

Upon written or oral request of a stockholder at a shared address to which a single copy of the 2022 annual report and 2023 proxy statement or Notice of Internet Availability was delivered, we will deliver promptly separate copies of these documents.

Stockholder Proposals for the 2024 Annual Meeting

Under our bylaws, to be timely, notice of any stockholder proposal to be considered at the 2024 Annual Meeting of Stockholders, including nominations of persons for election to our Board and other business, must be

14

delivered to or mailed and received at the principal executive officers of the Company not less than 60 nor more than 90 days prior to the meeting. In the event, however, that less than 70 days’ notice or prior public disclosure of the date of the annual meeting is given or made to stockholders, notice, to be timely, must be received no later than the close of business on the tenth day following the day on which such notice of the annual meeting was mailed or such public disclosure was made, whichever first occurs. The deadline for any stockholder proposal to be eligible for inclusion in our proxy statement and proxy related to that meeting pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is February 2, 2024.

Stockholder Director Nominations

The Nominating Committee has established a policy pursuant to which it considers director candidates recommended by our stockholders. All director candidates recommended by our stockholders are considered for selection to the Board on the same basis as if such candidates were recommended by one or more of our directors or other persons. To recommend a director candidate for consideration by our Nominating Committee, a stockholder must submit the recommendation in writing to our Nominating Committee not later than 30 calendar days after the end of the Company’s fiscal year, and the recommendation must provide the following information: (1) the name of the candidate; (2) the age of the candidate; (3) the business and current residence address of the candidate, as well as residence addresses for the past 20 years; (4) the proposed candidate’s principal occupation or employment and employment history (name and address of employer and job title) for the past 10 years (or such shorter period as the candidate has been in the workforce); (5) the candidate’s educational background; (6) the candidate’s permission for the Company to conduct a background investigation, including the right to obtain education, employment and credit information; (7) the number of shares of Common Stock of the Company beneficially owned by the candidate; (8) the information that would be required to be disclosed by the Company about the candidate under the rules of the SEC in a proxy statement soliciting proxies for the election of such candidate as a director; and (9) a signed consent of the nominee to serve as a director of the Company, if elected.

In addition to satisfying the foregoing advance notice requirements, to comply with the universal proxy rules under the Exchange Act (which will be in effect for next year’s annual meeting), stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act, including a statement that they will solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on the election of directors. Please note that the notice deadline under Rule 14a-19 is the same as the applicable notice period under the advance notice provisions of our bylaws described above.

Delinquent Section 16(a) Reports

Section 16(a) of the Securities Exchange Act requires our executive officers and directors, and persons who own more than 10% of our Common Stock, to file reports regarding ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of those filings. To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, all such filing requirements applicable to the Company’s directors, executive officers and greater than 10% beneficial owners were complied with during the year ended January 2, 2023, except that: (1) Cardboard Box LLC did not timely file one Form 4 representing one transaction, and (2) the John Rosatti Revocable Trust Dated 8/27/2001 did not timely file five Form 4s, each representing one transaction.

15

The following table presents information regarding the total compensation awarded to, earned by, and paid to the named executive officers of BurgerFi for services rendered to BurgerFi in all capacities for the years indicated.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

Ophir Sternberg | 2022 | — | — | 1,902,765 | (4) | 13,429 | (8) | 1,916,194 | ||||||||||||||||

Executive Chairman | 2021 | — | — | — | — | — | ||||||||||||||||||

Ian Baines | 2022 | 523,628 | — | — | 10,560 | (9) | 534,188 | |||||||||||||||||

Chief Executive Officer(1) | 2021 | 543,000 | 178,000 | — | — | 721,000 | ||||||||||||||||||

Michael Rabinovitch | 2022 | 400,000 | (3) | 1,093,077 | (5) | 89,901 | (10) | 1,582,970 | ||||||||||||||||

Chief Financial Officer(2) | 2021 | 215,000 | 250,000 | 3,295,000 | (6) (7) | — | 3,760,000 | |||||||||||||||||

| (1) | Mr. Baines was appointed as Chief Executive Officer in November 2021. On May 8, 2023, Mr. Baines notified the Company that he is retiring and resigning from his positions with the Company effective June 7, 2023. |

| (2) | Mr. Rabinovitch was appointed as Chief Financial Officer in February 2021. |

| (3) | In February 2022. Mr. Rabinovitch’s annual salary was increased to $400,000. |

| (4) | Represents the grant of 303,956 unrestricted shares of Company common stock on January 3, 2022. The amounts reflected in this column represent the aggregate grant date fair value of the awards made during 2022, as computed in accordance with FASB ASC Topic 718. For additional information related to the measurement of stock-based compensation awards, refer to Note 12, “Stockholders’ Equity,” to the financial statements included in our Annual Report on Form 10-K for the year ended January 2, 2023. See the Outstanding Equity Awards table below for additional information relating to these grants. |

| (5) | Represents the grant of 174,613 unrestricted shares of Company common stock on January 3, 2022. See the Outstanding Equity Awards table below for additional information relating to these grants. |

| (6) | Represents the grants of 52,000 restricted stock units, 78,000 incentive restrictive stock units, and 100,000 benchmark restricted stock units, granted on July 13, 2021. See the Outstanding Equity Awards table below for additional information relating to these grants. |

| (7) | The amounts reflected in this column represent the aggregate grant date fair value of the awards made during 2021, as computed in accordance with FASB ASC Topic 718. For additional information related to the measurement of stock-based compensation awards, refer to Note 12, “Stockholders’ Equity,” to the financial statements included in our Annual Report on Form 10-K for the year ended January 2, 2023. |

| (8) | Represents the value of services provided for a driver of Mr. Sternberg’s vehicle, which was not a Company-owned vehicle. This service to Mr. Sternberg was discontinued by the Company during 2022. |

| (9) | Represents the aggregate value of a monthly allowance relating to a personal vehicle and cell phone provided by the Company to Mr. Baines. |

| (10) | Represents the value of $63,501 paid to Mr. Rabinovitch in 2022 relating to a certain relocation allowance, as well as the aggregate value of $26,400 with respect to a monthly allowance relating to a personal vehicle. |

Narrative Disclosure to Summary Compensation Table

For 2022, the principal elements of compensation provided to the named executive officers were base salaries, grants of equity-based compensation and broad-based employee benefits. Base salaries are generally set at levels deemed necessary to attract and retain individuals with superior talent commensurate with their relative expertise and experience. Grants of restricted stock units vest in installments over a number of years subject to continued employment, the Company’s achievement of certain performance benchmarks, satisfaction of certain key performance indicators set by the Compensation Committee or by meeting certain share price thresholds of the Company’s Common Stock. See the Outstanding Equity Awards table below for additional information relating to these grants.

16

Employment Agreements. We have entered into Employment Agreements with Ophir Sternberg, Ian Baines, and Michael Rabinovitch.

Employment Agreement with Ophir Sternberg

Under the terms of Mr. Sternberg’s employment agreement, Mr. Sternberg serves as our Executive Chairman of the Board of Directors and does not receive a base salary. Mr. Sternberg has the ability to earn restricted stock grants (“Restricted Stock Grants”) and incentive restricted stock grants (“Incentive Restricted Stock Grants”) and has been granted restricted stock unit grants (the “Sternberg RSU Grants”) in lieu of such Restricted Stock Grants and Incentive Restricted Stock Grants. During the term of Mr. Sternberg’s employment agreement, which is initially five years, subject to earlier termination or extension, Mr. Sternberg will be bound by confidentiality and non-disparagement obligations. If there is a Change of Control (as defined in Mr. Sternberg’s employment agreement) during the term of employment all unearned Restricted Stock Grants and Incentive Restricted Stock Grants, therefore, effectively, all Sternberg RSU Grants, shall be deemed to have been earned immediately prior to the Change of Control.

Employment Agreement with Ian Baines

In connection with the Anthony’s Acquisition, the Company entered into an amended and restated employment agreement with Mr. Baines to serve as the Company’s Chief Executive Officer. Under the terms of his employment agreement, he will earn a base salary of not less than $523,628, subject to annual review by the Board. In addition, Mr. Baines is eligible to receive an annual cash performance bonus of up to 60% of his base salary, based upon the achievement of individual and Company performance objectives as mutually agreed by the Board and Mr. Baines. On May 8, 2023, Mr. Baines notified the Company that he is retiring and resigning from his positions with the Company effective June 7, 2023.

In relation to Mr. Baines’ previous role as Chief Executive Officer of Anthony’s, Mr. Baines received options to purchase common stock of Hot Air (the “Anthony’s Options”) pursuant to a Non-Qualified Stock Option Agreement (the “Option Agreement”) dated September 30, 2020 under the Hot Air, Inc. Amended and Restated 2016 Stock Option Plan (the “Hot Air Plan”). In relation to the consummation of the Anthony’s acquisition, the Company and Mr. Baines entered into an Amendment to the Option Agreement pursuant to which the Anthony’s Options held by Mr. Baines were converted (the “Option Conversion”) into 211,662 shares of common stock of the Company (the “Baines Issued Shares”). Except with respect to certain permitted transfers by operation of law, to permitted transferees or to pay up to forty percent (40%) of his federal and state income tax obligations arising from the Option Conversion, Mr. Baines could not, without the express written consent of the Board, (1) transfer any Baines Issued Shares until June 20, 2022, or (2) during the period beginning on June 20, 2022 and ending on December 31, 2022, transfer more than 50% of any Baines Issued Shares then held by Mr. Baines. All restrictions on the transfer of Baines Issued Shares ceased as of December 31, 2022.

During the term of Mr. Baines’s employment agreement, Mr. Baines will be bound by non-competition and non-solicitation obligations. Upon a termination of Mr. Baines’ employment without Cause (as defined in his employment agreement) or the resignation by Mr. Baines for Good Reason (as defined in his employment agreement), Mr. Baines will be entitled to receive all accrued, determined and unpaid compensation, a pro-rata bonus payment for the fiscal year of termination based on actual performance results for the full annual performance period and severance payment of Mr. Baines’ base salary for a period of twelve (12) months after the date of termination.

Amended Employment Agreement with Michael Rabinovitch

Under the terms of Mr. Rabinovitch’s amended employment agreement, he will earn a base salary of $400,000 (subject to annual review) and will be entitled to receive such performance bonuses as determined by

17

the Compensation Committee of our Board of Directors in its sole discretion in consultation with the Executive Chairman and Chief Executive Officer. In addition, Mr. Rabinovitch is entitled to up to six months’ severance and reimbursement of COBRA expenses in the event of termination of the employment agreement by the Company without cause or by Mr. Rabinovitch for good reason (as defined in the employment agreement). Mr. Rabinovitch has the ability to earn Restricted Stock Grants and benchmark restricted stock grants (“Benchmark Restricted Stock Grants”) and has been granted restricted stock unit grants (the “Rabinovitch RSU Grants”) in lieu of such Restricted Stock Grants and Benchmark Restricted Stock Unit Grants. During the term of Mr. Rabinovitch’s employment agreement Mr. Rabinovitch will be bound by non-competition and non-solicitation obligations. If there is a Change of Control during the term of employment all unearned Restricted Stock Grants and Benchmark Restricted Stock Grants, therefore, effectively, all Rabinovitch RSU Grants, shall be deemed to have been earned and vested immediately prior to the Change of Control. If Mr. Rabinovitch is terminated without cause, or resigns due to good reason, as defined in the employment agreement, all unvested portions of the Restricted Stock Grants and Benchmark Restricted Stock Grants, therefore, effectively, the Rabinovitch RSU Grants, scheduled to vest in the year of such termination or resignation shall be deemed to have been earned and vested immediately.

Potential Payments upon Termination or Change in Control

Except as discussed above, no named executive officer has a contractual or other entitlement to severance or other payments upon termination or a change in control.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

| Stock Awards | ||||||||

Name | Number of shares or units of stock that have not vested (#) | Market value of shares or units of stock that have not vested(6) | ||||||

Ophir Sternberg | 100,000 | (1) | $ | 126,000 | ||||

| 560,000 | (2) | $ | 705,600 | |||||

Michael Rabinovitch | 63,000 | (3) | $ | 79,380 | ||||

| 60,000 | (4) | $ | 75,600 | |||||

| 42,000 | (5) | $ | 52,920 | |||||

| (1) | Represents restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Sternberg. The restricted stock units vest in five equal parts, with 20% vesting on the grant date and an additional 20% vesting on January 1 for each of the ensuing four years of employment, beginning on January 1, 2022. If there is a change of control (as defined in the employment agreement) or certain termination or resignation events occur during the term of employment all unearned restricted stock units shall be deemed to have been earned immediately prior to the change of control or termination or resignation event. |

| (2) | Represents incentive restricted stock units granted, for financial reporting purposes, on December 16, 2020. The legal grant date of the restricted stock units was July 13, 2021, the date that applicable grant award agreements were executed by the Company and Mr. Sternberg. The restricted stock units vest upon achievement by the Company of the following benchmarks: (i) 20%, or 140,000 incentive restricted stock units, vested because Company revenue for fiscal year 2021, as calculated and presented in the Company’s audited financial statements included in the Form 10-K report for the relevant year, was 10% or greater than $34,382,000 (the “Base Year Revenue”); (ii) 20%, or 140,000 incentive restricted stock units, if Company revenue for fiscal year 2022 is 20% or greater than Base Year Revenue; (iii) 20%, or 140,000 incentive restricted stock units, if Company revenue for fiscal year 2023 is 30% or greater than Base Year Revenue; (iv) 20%, or 140,000 incentive restricted stock units, if Company revenue for fiscal year 2024 is 40% or greater than Base Year Revenue; (v) 20%, or 140,000 incentive restricted stock units, if Company revenue |

18

| for fiscal year 2025 is 50% or greater than Base Year Revenue. If there is a change of control (as defined in the employment agreement) or certain termination or resignation events occur during the term of employment all unearned incentive restricted stock units shall be deemed to have been earned immediately prior to the change of control. |

| (3) | Represents restricted stock units granted on July 13, 2021. The restricted stock units were initially scheduled to vest in equal amounts at the yearly anniversary of his commencement date (February 26, 2021) for each of the first four years of employment, subject to the achievement of annual key performance indicators, including the Company’s adjusted EBITDA target, and diversity targets as set by the Compensation Committee. On March 4, 2022, the Compensation Committee approved of an amendment to the applicable grant agreement to revise the time of vesting so that, subject to achievement of such annual key performance indicators for the respective prior fiscal year, the third and fourth-year vesting dates were accelerated to occur on the second-year anniversary date, which is measured from February 26, 2021. If there is a change of control (as defined in the employment agreement) during the term of employment all unearned restricted stock units shall be deemed to have been earned and vested immediately prior to the change of control. |