UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23325

SIX CIRCLES TRUST

On behalf of the following series:

Six Circles U.S. Unconstrained Equity Fund

Six Circles International Unconstrained Equity Fund

Six Circles Tax Aware Ultra Short Duration Fund

Six Circles Ultra Short Duration Fund

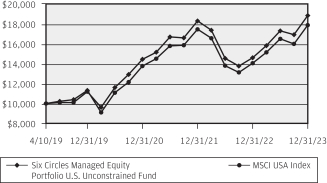

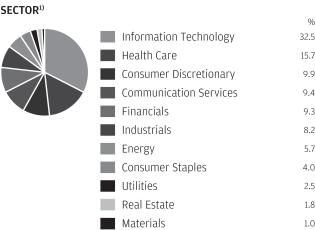

Six Circles Managed Equity Portfolio U.S. Unconstrained Fund

Six Circles Managed Equity Portfolio International Unconstrained Fund

Six Circles Global Bond Fund

Six Circles Tax Aware Bond Fund

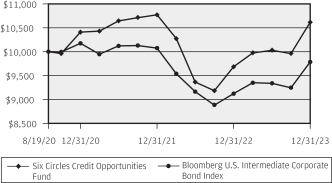

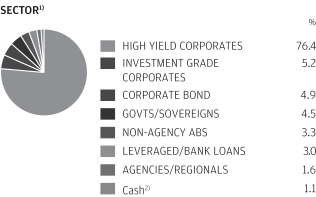

Six Circles Credit Opportunities Fund

(Exact name of registrant as specified in charter)

383 Madison Avenue, New York, NY 10179

(Address of principal executive offices) (Zip Code)

The Corporation Trust Company

1209 Orange Street

Wilmington, DE 19801

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 464-2070

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

Annual Report

SIX CIRCLES® FUNDS

December 31, 2023

Six Circles Ultra Short Duration Fund

Six Circles Tax Aware Ultra Short Duration Fund

Six Circles U.S. Unconstrained Equity Fund

Six Circles International Unconstrained Equity Fund

Six Circles Global Bond Fund

Six Circles Tax Aware Bond Fund

Six Circles Credit Opportunities Fund

CONTENTS

| * | The Schedule of Portfolio Investments, Financial Statements and Financial Highlights have been consolidated for the Six Circles Credit Opportunities Fund. |

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

For more complete information about the Funds, including the Funds’ objectives, risks, charges and expenses, call your J.P. Morgan representative or call 1-212-464-2070 or go to www.sixcirclesfunds.com for a prospectus. Read the prospectus carefully. An investment in these Funds and any other Fund is not designed to be a complete investment program. The Funds are NOT designed to be used as stand-alone investments.

PRESIDENT’S LETTER

Six Circles Funds Annual Report

December 31, 2023

Dear Shareholder,

We hope this letter finds you well.

In 2023, volatility in the financial markets dissipated as equity markets posted solid broad-based returns and indicators pointed to falling inflation rates. As the year ended, attention turned once more to the Federal Reserve as it signaled rate cuts to come in 2024.

The Six Circles Funds are designed to help our discretionary portfolios navigate through changing markets by giving us the flexibility to target key themes and our highest conviction ideas. On the following pages, we provide detailed discussions on the strategies we implemented in each of the Six Circles Funds during the 12-month period covered by this report and how they performed.

As a reminder, the Six Circles Funds are not meant to be standalone investments. They are purposefully constructed as com-

pletion funds and, as such, we believe they should be reviewed and evaluated within the context of your broader portfolio for a complete picture of their performance.

I hope you find the information on these pages to be informative and helpful. If you should have any questions about the Funds, you can contact your J.P. Morgan team, visit the Fund’s website at www.sixcirclesfunds.com, or call us at 212-464-2070.

Wishing you and yours a healthy, happy and prosperous 2024.

Sincerely,

Mary Savino

President, Six Circles Funds

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 1 |

Market Overview

As Of December 31, 2023 (Unaudited)

Year-to-date December 2023, equities outperformed global bond and cash markets, with the MSCI USA Index, MSCI World ex-USA Index, MSCI Emerging Markets Index and MSCI World Index up 27.10%, 17.94%, 9.83% and 23.79% during the period, respectively. Whereas the Bloomberg 1-3 Month U.S. Treasury Bill Index and the Bloomberg Global-Aggregate Index – Hedged USD returned 5.14% and 7.15% respectively.

In order to curb high inflation, the Federal Reserve hiked rates by 5% since the start of 2022. Economic growth has slowed but

overall, has remained resilient, and the U.S. has so far avoided a recession. Earnings growth was below trend in 2022 and 2023, but we currently believe the worst of the slowdown is behind us. We do not believe equity valuations are outright cheap at the broad index level, but we are hopeful that positive earnings growth may fuel returns in 2024.

| | | | | | | | | | |

| | | | | |

| 2 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

Six Circles Ultra Short Duration Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 5.92% | |

| Bloomberg 1-3 Month U.S. Treasury Bill Index | | | 5.14% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 593,710 | |

| Duration | | | 0.50 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Ultra Short Duration Fund (the “Fund”) seeks to generate current income consistent with capital preservation. The Fund mainly invests in U.S. dollar and non-U.S. dollar denominated investment grade short-term fixed and floating rate debt securities. The Fund allocates assets among securities with various maturities which, under normal market conditions, will not exceed an average effective portfolio duration of two years.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”).

The Adviser currently engages the following Sub-Advisers:

| • | | Goldman Sachs Asset Management, L.P. (“Goldman”)(a) |

| • | | BlackRock Investment Management, LLC (“BlackRock”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

| (a) | During the reporting period, the Adviser did not allocate Fund assets to Goldman. |

The Adviser may adjust allocations to the Sub-Advisers at any time or make recommendations to the Board of Trustees of the Six Circles Trust (the “Board”) with respect to the hiring, termination or replacement of a Sub-Adviser. As such, the identity of the Fund’s Sub-Advisers, the investment strategies they pursue and the portion of the Fund allocated to them, may change over time.

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2023 through December 31, 2023 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the Bloomberg

1-3 Month U.S. Treasury Bill Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

By sector composition, Investment Grade Credit and Securitized Credit comprised approximately 75% of the Fund’s exposure on a look-through basis at the end of the reporting period and were the Fund’s largest sector overweights relative to the Index. During the reporting period, both sectors contributed to the Fund’s performance on an absolute basis, as well as relative to the Index.

The Fund’s exposure to Government Bonds was the Fund’s largest sector underweight relative to the Index and comprised approximately 17% of the Fund’s exposure on a look-through basis at the end of the reporting period. During the reporting period, this sector contributed to the Fund’s performance on an absolute basis as well as relative to the Index.

On an allocation level, the Fund’s allocations to Core Ultra Short and Global Markets strategies contributed to the Fund’s return on an absolute basis.

During the reporting period, the use of fixed income futures contracts detracted from the Fund’s performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period the Fund was allocated to two Sub-Advisers as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Core Ultra Short (BlackRock) | | | 70 | % |

| Global Markets (PIMCO) | | | 30 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 3 |

Six Circles Ultra Short Duration Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited) (continued)

Within the fixed income allocation on the broader Portfolio level, the Adviser prefers high-quality liquid investments combined with flexibility to implement opportunistic ideas across fixed income markets. The majority of the Fund’s assets were invested into the more liquid segments of the fixed income market, with approximately 100% of the Fund invested in instruments with maturities of three years and under as of December 31, 2023.

The Adviser allocates to the two Sub-Advisers, with the expectation that the Sub-Advisers will capitalize on the opportunities present in the segment of the fixed income market that their specific mandate is focused on.

The Core Ultra Short allocation, which comprised approximately 70% of the Fund as of December 31, 2023, invests in a diversified fixed income portfolio on the shorter end of the U.S. fixed income market, balancing income against credit quality, within the context of the broader portfolios.

The Global Markets allocation, which comprised approximately 30% of the Fund as of December 31, 2023, has a broad investment universe, seeking total return opportunities within the global fixed income markets.

| | | | | | | | | | | | | | | | |

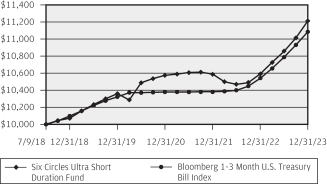

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | | | | 1 Year | | | 5 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles Ultra Short Duration Fund | | | | | | | 5.92 | % | | | 2.18 | % | | | 2.11 | % |

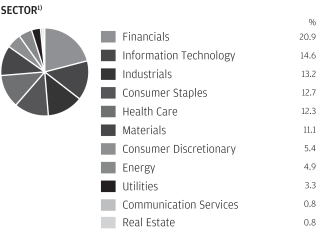

GROWTH OF $10,000 REPORT (07/9/2018 TO 12/31/2023)

| 1) | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

| 2) | (0.19)% of the amount shown in the Fund’s “Cash” line item reflects the mark-to-market value of the Fund’s derivative positions. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.32% and 0.19% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Ultra Short Duration Fund and the Bloomberg 1-3 Month U.S. Treasury Bill Index from July 9, 2018 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

The Bloomberg 1-3 Month U.S. Treasury Bill Index measures the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | | | |

| | | | | |

| 4 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

Six Circles Tax Aware Ultra Short Duration Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 3.84% | |

| iMoneyNet Tax-Free National Institutional Money Market Index | | | 2.64% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 698,186 | |

| Duration | | | 0.73 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Tax Aware Ultra Short Duration Fund (the “Fund”) seeks to generate current income consistent with capital preservation. The Fund invests at least 50% of its net assets in municipal securities, the income from which is exempt from federal income tax1). The Fund also may invest in taxable instruments. The Fund allocates assets among securities with various maturities which, under normal market conditions, will not exceed an average effective portfolio duration of two years.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”).

The Adviser currently engages the following Sub-Advisers:

| • | | Goldman Sachs Asset Management, L.P. (“Goldman”)(a) |

| • | | Insight North America LLC (“Insight”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

| (a) | During the reporting period, the Adviser did not allocate Fund assets to Goldman. |

The Adviser may adjust allocations to the Sub-Advisers at any time or make recommendations to the Board of Trustees of the Six Circles Trust (the “Board”) with respect to the hiring, termination or replacement of a Sub-Adviser. As such, the identity of the Fund’s Sub-Advisers, the investment strategies they pursue and the portion of the Fund allocated to them, may change over time.

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2023 through December 31, 2023 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the iMoneyNet

Tax-Free National Institutional Money Market Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

By sector composition, Municipal Bonds and Investment Grade Credit were the largest sector exposures in the Fund on a look-through basis and comprised approximately 54% and 14% of the Fund, respectively, at the end of the reporting period. Exposure to both Investment Grade Credit and Municipals contributed to the Fund’s performance on an absolute basis and relative to the Index.

On an allocation level, the Fund’s allocations to both Core Municipal Ultra Short and Global Markets strategies contributed to the Fund’s return on an absolute basis.

During the reporting period, the use of fixed income futures contracts detracted from the Fund’s performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period the Fund was allocated to two Sub-Advisers as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Core Municipal Ultra Short (Insight) | | | 70 | % |

| Global Markets (PIMCO) | | | 30 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

| 1) | | Interest on Municipal securities is exempt from federal income tax however interest on certain bonds may be subject to the federal alternative minimum tax for individuals. |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 5 |

Six Circles Tax Aware Ultra Short Duration Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited) (continued)

Within the fixed income allocation on the broader Portfolio level, the Adviser prefers high-quality liquid investments combined with flexibility to implement opportunistic ideas across fixed income markets. The majority of the Fund’s assets were invested into the more liquid segments of the fixed income market, with approximately 98% of the Fund invested in instruments with maturities of three years and under as of December 31, 2023.

The Adviser allocates to the two Sub-Advisers, with the expectation that the Sub-Advisers will capitalize on the opportunities present in the segment of the fixed income market that their specific mandate is focused on.

The Core Municipal Ultra Short allocation, which comprised approximately 70% of the Fund as of December 31, 2023, invests in a diversified fixed income portfolio on the shorter end of the U.S. municipal fixed income market, balancing income against credit quality, within the context of the broader Portfolio.

The Global Markets allocation, which comprised approximately 30% of the Fund as of December 31, 2023, has a broad investment universe, seeking total return opportunities within the global taxable fixed income markets.

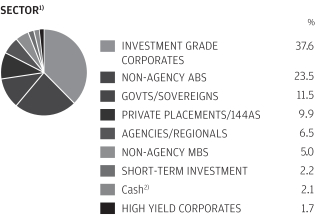

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | 1 Year | | | 5 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles Tax Aware Ultra Short Duration Fund | | | 3.84 | % | | | 1.46 | % | | | 1.42 | % |

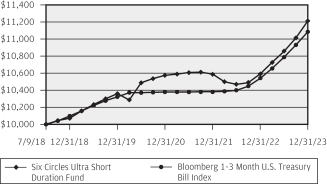

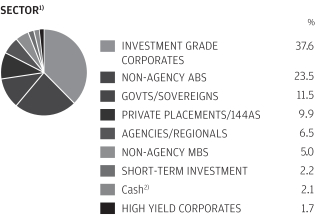

GROWTH OF $10,000 REPORT (07/9/2018 TO 12/31/2023)

| 1) | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.31% and 0.15% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Tax Aware Ultra Short Duration Fund and the iMoneyNet Tax-Free National Institutional Money Market Index from July 9, 2018 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. Although the performance of the iMoneyNet Tax-Free National Institutional Money Market Index reflects returns of constituent mutual funds net of expenses, the index itself is unmanaged and no expenses are deducted at the index level. The performance of the Index has also been adjusted to reflect reinvestment of all dividends and capital gain distributions of the mutual funds included in the Index, if applicable.

The iMoneyNet Tax-Free National Institutional Money Market Index is an average of all tax-free and municipal, U.S.-domiciled institutional and retail money market funds. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | | | |

| | | | | |

| 6 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

Six Circles U.S. Unconstrained Equity Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 30.43% | |

| MSCI USA Index | | | 27.10% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 22,024,769 | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles U.S. Unconstrained Equity Fund (the “Fund”) seeks to provide capital appreciation. The Fund invests at least 80% of its net assets in equity securities issued by U.S. companies and other instruments with economic characteristics similar to equity securities issued by U.S. companies. The Fund is generally unconstrained by any particular capitalization, style or industry sector.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”), actively allocates the Fund’s investments among a range of indexed investment strategies that are managed by the current sub-adviser, BlackRock Investment Management, LLC (the “Sub-Adviser” or “BlackRock”). For each indexed investment strategy, the Sub-Adviser seeks to replicate the performance of an index or sub-index selected by the Adviser. In addition to allocating and reallocating the Fund’s assets among one or more indexed investment strategies, the Adviser may also select securities of specific individual companies for the Fund to purchase or sell on an ongoing basis and the amount of the Fund’s assets to allocate to such securities. The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2023 through December 31, 2023 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the MSCI USA Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

Energy, Financials and HealthCare sectors comprised approximately 39% of the Fund’s sector exposure on a look-through basis at the end of the reporting period and were the Fund’s largest sector overweights relative to the Index. On an absolute

basis, Energy and Financials contributed to performance while HealthCare detracted. Relative to the Index, Energy contributed to the Fund’s performance, whereas Financials and HealthCare detracted.

Consumer Staples, Consumer Discretionary and Materials sectors comprised approximately 12% of the Fund’s sector exposure on a look-through basis at the end of the reporting period and were the Fund’s largest sector underweights relative to the Index. On an absolute basis and relative to the Index, all three sectors contributed to the Fund’s performance.

Additionally, the Fund’s exposure to Communication Services and Information Technology sectors comprised approximately 37% of the Fund’s exposure on a look-through basis at the end of the reporting period and were slight underweights relative to the Index. Information Technology was the largest contributor to the Fund’s performance on an absolute basis and Communication Services was the largest contributor relative to the Index.

On an allocation level, the Fund’s allocation to U.S. Software was the largest contributor to the Fund’s return on an absolute basis, whereas Life Sciences Tools & Services was the largest detractor to the Fund’s return on an absolute basis during the reporting period.

The Fund employed equity futures in order to maintain market exposures during the reporting period. The use of equity futures contributed to the Fund’s performance during the year.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to eleven strategies managed by one Sub-Adviser, across various sector and sub-industry exposures as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | | | |

| USA | | | 33 | % |

| U.S. Custom Equity Sleeve (JPMPI) | | | 27 | |

| U.S. Financials | | | 10 | |

| U.S. Software | | | 8 | |

| U.S. Technology, Hardware & Equipment | | | 6 | |

| U.S. Pharmaceuticals | | | 6 | |

| U.S. Semiconductors & Semiconductor Equipment | | | 4 | |

| US Interactive Media & Services | | | 2 | |

| U.S. Energy | | | 2 | |

| Life Sciences Tools & Services | | | 1 | |

| U.S. Beverages | | | 1 | |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 7 |

Six Circles U.S. Unconstrained Equity Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited) (continued)

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

Allocation to Broad USA comprised approximately 33% of the Fund as of December 31, 2023. Within the context of the broader Portfolios, the Adviser believes that an allocation to Broad USA provides the ability to tactically allocate to broad U.S. large cap exposure and use as a potential funding source for future targeted allocations.

Allocation to the Custom Equity Sleeve was approximately 27% of the Fund as of December 31, 2023. This portion of the Fund’s investments is allocated to individual publicly traded large capitalization U.S. equity securities selected by the Adviser. Securities included in the U.S. Custom Equity Sleeve may be represented by a variety of U.S. sectors, sub-sectors or industries and are selected for inclusion by the Adviser based on its investment analysis in order to assist with either portfolio construction, risk management, liquidity considerations, or a combination thereof.

Allocation to U.S. Software provides what the Adviser believes is a multi-year opportunity for the leaders in this space to take advantage of businesses shifting workloads onto Cloud-based platforms. This exposure comprised approximately 8% of the Fund as of December 31, 2023.

Allocation to U.S. Financials comprised approximately 10% of the Fund as of December 31, 2023. The Adviser believes in capital adequacy and dividend sustainability in the sector and has conviction in the sector given compelling valuations and more realistic market expectations about potential credit costs and buybacks.

Allocation to U.S. Pharmaceuticals comprised approximately 6% of the Fund, as of December 31, 2023. The Adviser believes that pharmaceutical companies have strong fundamentals with attractive valuations in the current market.

Allocation to U.S. Technology, Hardware & Equipment allows the Adviser to access specific exposures within the Technology sector. The allocation comprised approximately 6% of the Fund as of December 31, 2023.

Allocation to U.S. Interactive Media & Services focuses on companies engaged in content and information creation or

distribution through proprietary platforms, where revenues are derived primarily through pay-per-click advertisements. This allocation was approximately 2% of the Fund as of December 31, 2023. The Adviser believes in the opportunities available in the cloud market and views this exposure as potential for continued strength in earnings growth.

Allocation to Life Sciences Tools & Services was approximately 1% of the Fund as of December 31, 2023. The Adviser believes that the sector is comprised of high quality and large cap companies with potential for double digit earnings growth.

The Adviser believes that valuations for U.S. Semiconductors & Semiconductor Equipment companies are now more reasonable and provide an attractive entry point. This allocation comprised approximately 4% of the Fund as of December 31, 2023.

Allocation to U.S. Beverages was approximately 1% of the Fund’s exposure as of December 31, 2023, and reflects the Adviser’s belief that this industry is relatively defensive relative to the market. The Adviser currently believes that certain companies in this sector are going through structural changes and may have the potential to improve free cash flow conversion.

Allocation to U.S. Energy was approximately 2% of the Fund’s exposure as of December 31, 2023. The Adviser added to this allocation as a portfolio construction trade, aiming to rebalance risks within the Portfolio.

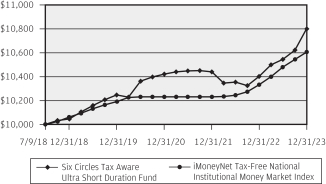

| | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | 1 Year | | | 5 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles U.S. Unconstrained Equity Fund | | | 30.43 | % | | | 16.41 | % | | | 12.89 | % |

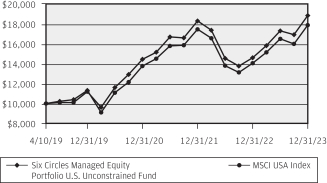

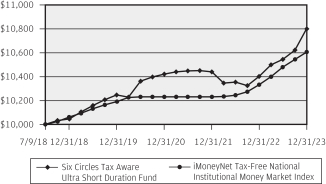

GROWTH OF $10,000 REPORT (07/9/2018 TO 12/31/2023)

| | | | | | | | | | |

| | | | | |

| 8 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

| 1) | Presented percentages may not sum to 100% due to rounding to the nearest percent. Cash and mark-to-market value on derivatives contracts represent less than 0.5%. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.27% and 0.06% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles U.S. Unconstrained Equity Fund and the MSCI USA Index from July 9, 2018 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI USA Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

The MSCI USA Index is designed to measure the performance of the large and mid-cap segments of the U.S. market. With 609 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in the United States. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 9 |

Six Circles International Unconstrained Equity Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 18.96% | |

| MSCI World ex-USA Index | | | 17.94% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 13,764,429 | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles International Unconstrained Equity Fund (the “Fund”) seeks to provide capital appreciation. The Fund invests

at least 80% of its net assets in equity securities and other instruments with economic characteristics similar to equity

securities. The Fund primarily invests in the equity securities of non-U.S. companies and is generally unconstrained by any particular capitalization, style or sector or non-U.S. country.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”), actively allocates the Fund’s investments among a range of indexed investment strategies that are managed by the current sub-adviser, BlackRock Investment Management, LLC (the “Sub-Adviser” or “BlackRock”). For each indexed investment strategy, the Sub-Adviser seeks to replicate the performance of an index or sub-index selected by the Adviser. The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period of January 1, 2023 through December 31, 2023 (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed the MSCI World ex-USA Index (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

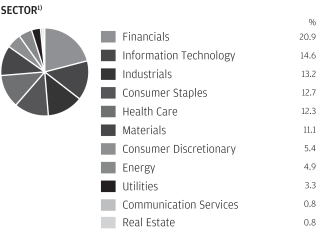

Information Technology, Consumer Staples and Materials sectors comprised approximately 39% of the Fund’s sector exposure on a look-through basis at the end of the reporting period and were the Fund’s largest sector overweights relative to the Index. Information Technology and Materials contributed to the Fund’s performance on an absolute basis, whereas Consumer Staples detracted. Relative to the Index, Consumer

Staples and Materials detracted from performance while Information Technology contributed to the Fund’s performance.

Consumer Discretionary, Communication Services and Industrials sectors comprised approximately 18% of the Fund’s sector exposure on a look-through basis at the end of the reporting period and were the Fund’s largest sector underweights relative to the Index. All three sectors contributed to the Fund’s performance on an absolute basis. Relative to the Index, Consumer Discretionary and Communication Services contributed to the Fund’s performance, while Industrials detracted.

On an allocation level, Europe Financials was the largest contributor to the Fund’s performance on an absolute basis, while the allocation to Europe Beverages was the largest detractor from the Fund’s return on an absolute basis during the reporting period.

The Fund employed equity futures in order to maintain market exposures during the reporting period. The use of equity futures contributed to the Fund’s performance during the year.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to seventeen strategies managed by one Sub-Adviser, across various sector and sub-industry exposures as follows.

| | | | |

| PORTFOLIO ALLOCATION*** | | | |

| Europe ex-UK | | | 15 | % |

| Europe Financials | | | 13 | |

| Europe Materials | | | 9 | |

| Broad UK | | | 8 | |

| Europe Semiconductor & Semiconductor Equipment | | | 7 | |

| Europe Pharmaceuticals | | | 6 | |

| Europe Industrials | | | 6 | |

| Europe Beverage | | | 6 | |

| Japan | | | 5 | |

| Switzerland Food Products | | | 4 | |

| German Application Software | | | 4 | |

| Europe Insurance | | | 4 | |

| Denmark Pharmaceuticals Biotechnology & Life Sciences | | | 4 | |

| Europe Textile Luxury Goods | | | 3 | |

| Europe Integrated Oil & Gas | | | 3 | |

| Taiwan Semiconductor & Semiconductor Equipment | | | 2 | |

| Europe ex-UK Utilities | | | 1 | |

| | | | | | | | | | |

| | | | | |

| 10 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

Allocation to Europe ex-UK comprised approximately 15% of the Fund as of December 31, 2023. Within the context of the broader Portfolios, the Adviser believes that this is a defensive position, and the exposure to renewable energy helps diversify against European Energy positions and provides a growth dynamic to the sector, while trading at reasonable valuations.

Allocation to Europe Financials was approximately 13% of the Fund as of December 31, 2023. The Adviser has conviction in this sector due to improved capital levels and currently believes that Financials can directly benefit from higher inflation and interest rates through higher lending costs and better net interest margin.

Allocation to Broad UK comprised approximately 8% of the Fund as of December 31, 2023. Within the context of the broader Portfolios, the Adviser believes that the allocation provides exposure to a more cyclical European market that has clarity as COVID-19 subsides.

Allocation to Switzerland Food Products was approximately 4% of the Fund as of December 31, 2023, and serves as a defensive position, allowing the Adviser access to mainly large cap companies.

Allocation to Europe Integrated Oil & Gas was approximately 3% of the Fund as of December 31, 2023. The Adviser believes that the sector provides exposure to a cyclical industry that can take advantage of the early cycle environment.

The Adviser believes that companies within the Europe Semiconductors sector have reasonable valuations making the exposure very attractive with potential demand for semiconductors and semiconductor equipment following the theme of electrification. The sector comprised approximately 7% of the Fund as of December 31, 2023.

Allocation to Europe Beverages was approximately 6% of the Fund as of December 31, 2023. Europe accounts for a large portion of the industry’s demand. Although many European Beverage companies struggled in 2022, the Adviser believes that allocation to Europe Beverage could perform well as the China reopening provides strong headwinds to the demand.

Allocation to Europe Industrials was approximately 6% of the Fund as of December 31, 2023. The Adviser believes that the Industrials sector is built on cyclical exposures that benefit from economic recovery and growth.

Allocation to Europe Textile Luxury Goods was approximately 3% of the Fund as of December 31, 2023. The Adviser believes that the sector provides cyclical exposures in Europe that benefit from economic recovery and growth.

Allocation to Europe Pharmaceuticals comprised approximately 6% of the Fund as of December 31, 2023, and provides what the Adviser believes to be a defensive exposure with attractive fundamentals and valuations, within the context of the broader Portfolios.

The Adviser believes that the allocation to Broad Japan provides exposure to high quality Japanese companies with evolving business models. The allocation was approximately 5% of the Fund as of December 31, 2023.

Allocation to German Application Software was approximately 4% of the Fund as of December 31, 2023. German Investable Markets Index is primarily made up of SAP, a company the Advisor believes that the market is currently underappreciating given its cloud transition, value of defensive cashflows, and positive business model changes.

The Adviser believes that allocation to Europe ex-UK Utilities serves as a defensive position with exposure to renewable energy, which helps diversify against European Energy positions and provides a growth dynamic to the sector. This allocation was approximately 1% of the Fund as of December 31, 2023.

Allocation to Taiwan Semiconductors was approximately 2% of the Fund as of December 31, 2023. The Adviser believes that the allocation helps build out full international semiconductor exposure within the broader Portfolios.

Allocation to Europe Materials was approximately 9% of the Fund’s exposure as of December 31, 2023. The Adviser believes that the sector is currently undervalued due to poor operating environments, and views this exposure as potential for continued strength in earnings growth.

The Adviser believes that European Insurance is currently operating in a favorable environment given current interest rates and continued strength in the operating environment, where demand is greater than supply. Allocation to European Insurance was approximately 4% of the Fund’s exposure as of December 31, 2023.

Allocation to Denmark Pharmaceuticals Biotechnology & Life Sciences was approximately 4% of the Fund’s exposure as of December 31, 2023. The Adviser believes that the opportunity

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 11 |

Six Circles International Unconstrained Equity Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited) (continued)

that exists in this space is currently undervalued by the market, and currently believes that the growth potential in the industry could be significant over the next 10 years.

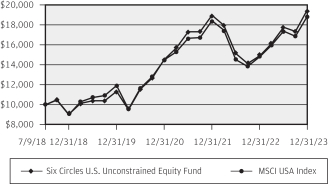

| | | | | | | | | | | | |

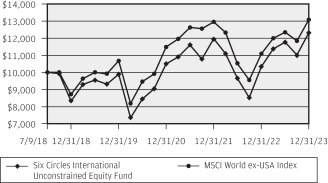

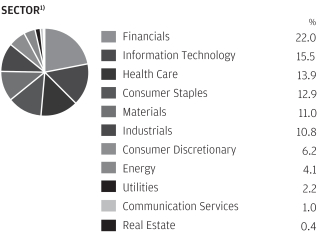

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | 1 Year | | | 5 Year | | | Since

Inception

(July 9, 2018) | |

| Six Circles International Unconstrained Equity Fund | | | 18.96 | % | | | 8.15 | % | | | 3.86 | % |

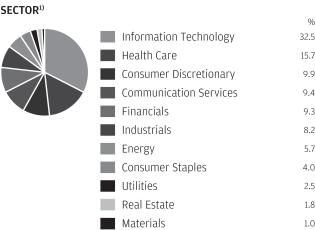

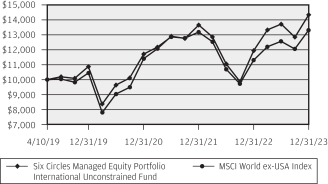

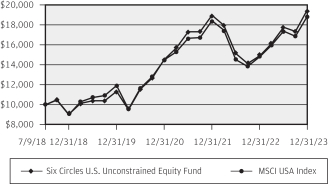

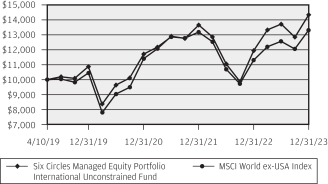

GROWTH OF $10,000 REPORT (07/9/2018 TO 12/31/2023)

| 1) | Presented percentages may not sum to 100% due to rounding to the nearest percent. Cash and mark-to-market value on derivatives contracts represent less than 0.5%. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were

0.28% and 0.08% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on July 9, 2018.

The graph illustrates comparative performance for $10,000 invested in the Six Circles International Unconstrained Equity Fund and the MSCI World ex-USA Index from July 9, 2018 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the MSCI World ex-USA Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

The MSCI World ex-USA Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries—excluding the United States. With 871 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in each country. Investors cannot invest directly in an index.

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,441 constituents, the Index covers approximately 85% of the free float-adjusted market capitalization in each country.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

International investing has a greater degree of risk and increased volatility due to political and economic instability of some overseas markets. Changes in currency exchange rates and different accounting and taxation policies outside the U.S. can affect returns.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | | | |

| | | | | |

| 12 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

Six Circles Global Bond Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | | | |

| Fund* | | | 8.16% | |

| Bloomberg Global-Aggregate Index - Hedged USD | | | 7.15% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 10,193,090 | |

| Duration | | | 6.19 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Global Bond Fund (the “Fund”) seeks to provide total return. The Fund invests mainly in a global portfolio of investment grade fixed income securities with varying maturities across government, corporate, and securitized fixed income sectors. The Fund will also allocate across a number of different countries around the World.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”).

The Adviser currently engages the following Sub-Advisers:

| • | | BlackRock Investment Management, LLC (“BlackRock”) |

| • | | Pacific Investment Management Company LLC (“PIMCO”) |

The Adviser may adjust allocations to the Sub-Advisers at any time or make recommendations to the Board of Trustees of the Six Circles Trust (the “Board”) with respect to the hiring, termination or replacement of a Sub-Adviser. As such, the identity of the Fund’s Sub-Advisers, the investment strategies they pursue and the portion of the Fund allocated to them, may change over time.

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period January 1, 2023 through December 31, 2023, (the “reporting period”) the Fund posted a positive return on an absolute basis and outperformed relative to the Bloomberg Global-Aggregate Index – Hedged USD (the “Index”). References to the Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the

Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

By sector composition, Investment Grade Credit was the largest sector exposure in the Fund on a look-through basis and comprised approximately 37% of the Fund at the end of the reporting period, with the Fund being overweight this sector relative to the Index. Investment Grade Credit contributed to the Fund’s performance both on an absolute basis as well as relative to the Index during the reporting period.

Government Bonds comprised approximately 37% of the Fund’s exposure on a look-through basis at the end of the reporting period, with the Fund being underweight this sector relative to the Index. During the reporting period, exposure to Government Bonds contributed to the Fund’s performance on an absolute basis and relative to the Index.

On an allocation level, the Fund’s allocation to Pan European Credit was the largest contributor to the Fund’s performance on an absolute basis during the reporting period.

The Fund employed currency forwards to seek to minimize active currency risk from investments in non-dollar denominated securities. The currency forwards detracted from the Fund’s performance during the reporting period.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to twelve strategies across various sectors, credit ratings, maturity buckets, and regional exposures.

| | | | |

| PORTFOLIO ALLOCATION*** | | | |

| Pan-European Credit (BlackRock) | | | 40 | % |

| Pan-European Government (BlackRock) | | | 11 | |

| China Treasury & Policy Bank (BlackRock) | | | 10 | |

| U.S. Treasury 10-20 Year (BlackRock) | | | 9 | |

| Global Credit (PGIM) | | | 7 | |

| Global Securitized (PIMCO) | | | 7 | |

| U.S. Securitized (BlackRock) | | | 6 | |

| Global Government (PGIM) | | | 3 | |

| U.S. Credit (BlackRock) | | | 3 | |

| U.S. Government (BlackRock) | | | 2 | |

| Asia Pacific Government ex-China (BlackRock) | | | 1 | |

| Pan European Securitized (BlackRock) | | | 1 | |

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 13 |

Six Circles Global Bond Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited) (continued)

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

Allocation to Global Credit and Pan European Credit comprised approximately 47% of the Fund as of December 31, 2023, and provides what the Adviser believes to be a full tracking error, flexible access point to a broad range of global corporate bonds across different regions, sectors, and credit qualities.

Allocations to Asia Pacific Government ex-China and Pan-European Government comprised approximately 12% of the Fund as of December 31, 2023, and provide what the Adviser believes is a low tracking error, tactical way to allocate to government bonds within these regions.

Allocation to Global Securitized and Pan European Securitized comprised approximately 8% of the Fund as of December 31, 2023, and provides what the Adviser believes to be full tracking error, flexible access to a broad range of securitized debt across different regions, sectors, and credit qualities.

The Adviser believes that the allocation to Global Government provides full tracking error access to a broad range of government bonds across different regions. The allocation was approximately 3% of the Fund as of December 31, 2023.

Allocations to U.S. Treasury, U.S. Credit, U.S. Government, and U.S. Securitized comprised approximately 20% of the Fund as of December 31, 2023. These allocations provide what the Adviser believes is a low tracking error, tactical way to allocate within these sectors.

Allocations to China Treasury & Policy Bank comprised approximately 10% of the Fund as of December 31, 2023. This exposure allows the portfolio to tactically allocate to Chinese government bonds.

| | | | | | | | |

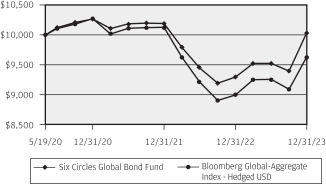

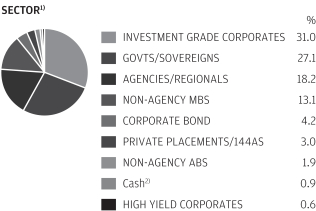

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | 1 Year | | | Since

Inception

(May 19, 2020) | |

| Six Circles Global Bond Fund | | | 8.16 | % | | | 0.10 | % |

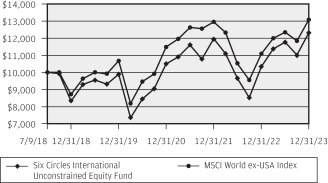

GROWTH OF $10,000 REPORT (05/19/2020 TO 12/31/2023)

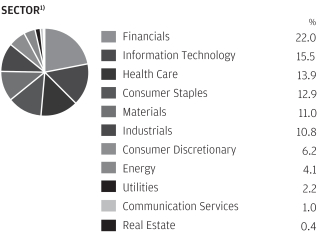

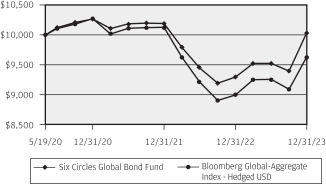

| 1) | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

| 2) | (0.76)% of the amount shown in the Fund’s “Cash” line item reflects the mark-to-market value of the Funds derivative positions. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.31% and 0.12% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on May 19, 2020.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Global Bond Fund and the Bloomberg Global-Aggregate Index - Hedged USD from May 19, 2020 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg Global-Aggregate Index - Hedged USD does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

| | | | | | | | | | |

| | | | | |

| 14 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

The Bloomberg Global-Aggregate Index - Hedged USD provides a broad-based measure of the global investment grade fixed income markets. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.

International investing has a greater degree of risk and increased volatility due to political and economic instability of some overseas markets. Changes in currency exchange rates and different accounting and taxation policies outside the U.S. can affect returns.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”) and is licensed for use by JP MORGAN CHASE BANK NA. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classifications makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability and fitness for a particular purpose with respect to any of such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of their affiliates or any third party involved in making or compiling the GICS or any GICS classifications have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

| | | | | | | | | | |

| | | | | |

| DECEMBER 31, 2023 | | SIX CIRCLES TRUST | | | | | | | | 15 |

Six Circles Tax Aware Bond Fund

FUND COMMENTARY

Twelve Months Ended December 31, 2023 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN | |

| Fund* | | | 6.37% | |

| Bloomberg 1-15 Year Municipal Bond Index | | | 5.26% | |

| |

| Net Assets as of 12/31/2023 (In Thousands) | | $ | 8,065,630 | |

| Duration | | | 5.62 years | |

INVESTMENT OBJECTIVES AND STRATEGY**

Six Circles Tax Aware Bond Fund (the “Fund”) seeks to provide after-tax total return. The Fund invests at least 50% in municipal securities across varying maturity ranges, the income from which is exempt from federal income tax1). The Fund also may invest in taxable instruments.

INVESTMENT APPROACH

J.P. Morgan Private Investments Inc., the Fund’s investment adviser (“JPMPI” or the “Adviser”) constructs the Fund’s portfolios by allocating the Fund’s assets among investment strategies managed by one or more sub-advisers retained by the Adviser (each a “Sub-Adviser”).

The Adviser currently engages the following Sub-Advisers:

| • | | Allspring Global Investments, LLC (“Allspring”) |

| • | | BlackRock Investment Management, LLC (“BlackRock”)(a) |

| • | | Capital International Inc. (“Capital Group”) |

| • | | Nuveen Asset Management, LLC (“Nuveen”) |

| (a) | During the reporting period, the Adviser did not allocate Fund assets to this Sub-Adviser. |

The Adviser may adjust allocations to the Sub-Advisers at any time or make recommendations to the Board of Trustees of the Six Circles Trust (the “Board”) with respect to the hiring, termination or replacement of a Sub-Adviser. As such, the identity of the Fund’s Sub-Advisers, the investment strategies they pursue and the portion of the Fund allocated to them, may change over time.

The Fund is specifically designed to serve as a completion portfolio and accomplish particular goals within discretionary portfolios managed by JPMPI or its affiliates (the “Portfolios”). The Adviser utilizes the Fund to express targeted investment views, while taking into consideration positions held at the aggregate level in the broader Portfolios. As such, the Fund’s allocations and performance should be evaluated in the context of the broader Portfolios and not on a standalone basis.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

During the period January 1, 2023 through December 31, 2023, (the “reporting period”), the Fund posted a positive return on an absolute basis, and outperformed relative to the Bloomberg 1-15 Year Municipal Bond Index (the “Index”). References to the

Index are for informational purposes. The use of the Index does not imply the Fund is being managed to the Index, but rather is disclosed to allow for comparison of the Fund’s performance to that of a well-known and widely recognized index.

By sector composition, Investment Grade Rated Municipal Bonds were the largest sector exposure in the Fund on a look-through basis and comprised approximately 73% of the Fund at the end of the reporting period, with the Fund being underweight this sector relative to the Index. This sector contributed to the Fund’s performance both on an absolute basis as well as relative to the Index during the reporting period.

High Yield Municipal Bonds were approximately 25% of the Fund’s exposure on a look-through basis at the end of the reporting period, with the Fund being overweight to this sector relative to the Index. During the reporting period, exposure to High Yield Municipal Bonds contributed to the Fund’s performance on an absolute basis and relative to the Index.

On an allocation level, the full tracking error Municipal allocation managed by Nuveen was the largest contributor to the Fund’s return.

The Fund employed interest rate futures in order to manage interest rate risk and duration during the reporting period. The use of derivatives detracted from the Fund’s performance.

HOW WAS THE FUND POSITIONED?

At the end of the reporting period, the Fund was allocated to three strategies across various sectors, credit ratings, maturity buckets, and regional exposures.

| | | | |

| PORTFOLIO ALLOCATION*** | |

| Municipals (Allspring) | | | 35 | % |

| Municipals (Nuveen) | | | 35 | |

| 1-17 Year Municipal (Capital Group) | | | 30 | |

| * | | The return shown is based on the net asset value calculated for shareholder transactions. Certain adjustments were made to the net assets of the Fund at December 31, 2023 for financial reporting purposes, and as a result, the net asset value for shareholder transactions and the total return based on that net asset value may differ from the adjusted net assets and the total return for financial reporting. |

| | | | | | | | | | |

| | | | | |

| 16 | | | | | | | | SIX CIRCLES TRUST | | DECEMBER 31, 2023 |

| ** | | The Adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages are based on total investments as of December 31, 2023. The portfolio allocation is subject to change. |

| 1) | | Interest on Municipal securities is exempt from federal income tax however interest on certain bonds may be subject to the federal alternative minimum tax for individuals. |

An allocation to Capital Group 1-17 Year Municipal strategy comprised approximately 30% as of December 31, 2023. This allocation provides what the Adviser believes to be low tracking error, flexible access points to municipal debt within short, intermediate and long maturity ranges.

The Adviser believes that the allocations to Municipal strategies sub-advised by Nuveen and Allspring provide full tracking error, flexible access to a broad range of municipals across different sectors and credit qualities. Each of these allocations were approximately 35% of the Fund as of December 31, 2023.

| | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS

AS OF DECEMBER 31, 2023 | |

| | | 1 Year | | | Since

Inception

(May 19, 2020) | |

| Six Circles Tax Aware Bond Fund | | | 6.37 | % | | | 1.26 | % |

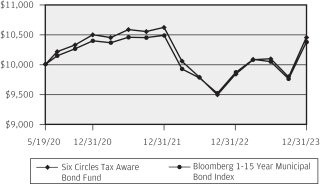

GROWTH OF $10,000 REPORT (05/19/2020 TO 12/31/2023)

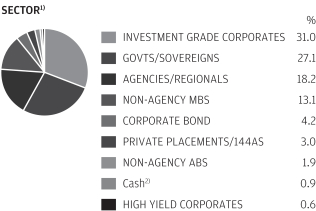

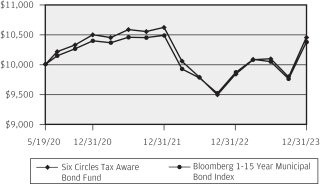

| 2) | Presented percentages may not sum to 100% due to rounding to the nearest percent. The above Sector allocation uses The Global Industry Classification Standard (GICS®) and may differ from categories listed within the Schedule of Investments. |

The allocation of the various strategies employed by the Fund may shift and therefore, the performance shown may not be a true indication of how the Fund may perform going forward. Performance quoted is past performance and is no guarantee of future results. Investment returns and principal value will fluctuate, so shares, when sold, may be worth more or less than original cost. Current performance may be higher or lower than returns shown. As of the latest prospectus, the gross and net expense ratios for the Fund were 0.28% and 0.14% respectively. Contact your J.P. Morgan representative or call 1-212-464-2070 for the most recent month-end performance.

The Fund commenced operations on May 19, 2020.

The graph illustrates comparative performance for $10,000 invested in the Six Circles Tax Aware Bond Fund and the Bloomberg 1-15 Year Municipal Bond Index from May 19, 2020 to December 31, 2023. The performance of the Fund reflects the deduction of Fund expenses and assumes reinvestment of all dividends and capital gain distributions, if any. The performance of the Bloomberg 1-15 Year Municipal Bond Index does not reflect the deduction of expenses associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the Index, if applicable.

The Bloomberg 1-15 Year Municipal Bond Index consists of a broad selection of investment grade general obligation and revenue bonds of maturities ranging from one year to 17 years. Investors cannot invest directly in an index.

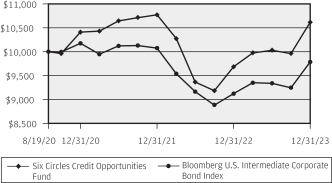

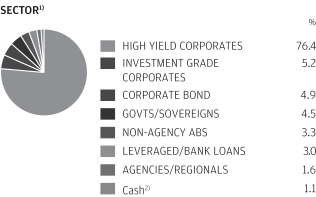

Fund performance may reflect the waiver of the Fund’s fees and/or reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or redemptions or sales of Fund shares.