- TALO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Talos Energy (TALO) DEF 14ADefinitive proxy

Filed: 5 Apr 23, 8:00am

☐ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 | |

☒ | No fee required. | |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2023 PROXY STATEMENT

2023 Annual Meeting Information

| Time 10:00 a.m. local time |  | Date May 9, 2023 |  | Place Three Allen Center 333 Clay Street, Suite 3300 Houston, Texas 77002 |  | Record Date March 20, 2023 | |||||||||

Voting Methods

Even if you plan to attend the 2023 annual meeting of stockholders (the “Annual Meeting”) in person, we urge you to vote in advance of the meeting using one of these advance voting methods.

By Internet: www.proxydocs.com/TALO | By Phone: 1-866-291-6999 | By Mail: P.O. Box 8016 Cary, NC 27512-9903 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

The Annual Meeting is being held for the following purposes:

Matter | Page Reference (For More Detail) | |||

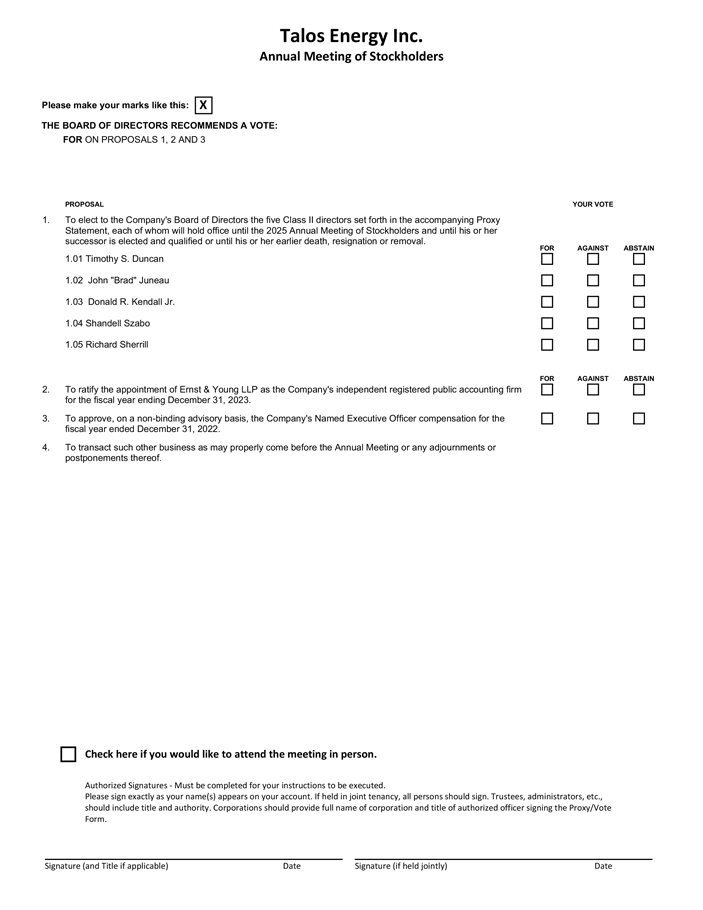

1. | To elect to the Company’s Board of Directors the five Class II directors set forth in the accompanying Proxy Statement, each of whom will hold office until the 2025 Annual Meeting of Stockholders and until his or her successor is elected and qualified or until his or her earlier death, resignation or removal. | 5 | ||

2. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. | 73 | ||

3. | To approve, on a non-binding advisory basis, the Company’s Named Executive Officer compensation for the fiscal year ended December 31, 2022. | 74 | ||

4. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | |||

Each outstanding share of Talos Energy Inc.’s common stock (NYSE: TALO) entitles the holder of record at the close of business on March 20, 2023 to receive notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF

THE METHODS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION TO ATTEND THE ANNUAL MEETING.

By order of the Board of Directors,

| Neal P. Goldman Chairman of the Board |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 9, 2023: THIS PROXY STATEMENT, THE PROXY CARD AND OUR ANNUAL REPORT ARE AVAILABLE AT WWW.PROXYDOCS.COM/TALO.

Dear Fellow Stockholders,

Every year is it is a privilege to share Talos’s key milestones and achievements with our stockholders and communicate how we are delivering on our mission to provide energy prosperity to improve people’s lives.

Driving Long-Term Value Creation

2022 was another transformative year that we believe will lead to long-term value creation for Talos. Last year, we attained record-setting financial performance, completed a major acquisition through acquiring EnVen, a private Gulf of Mexico operator, and continued to advance our leadership position in our Carbon Capture and Sequestration (“CCS”) business along the U.S. Gulf Coast. In our Upstream business, on a pro-forma basis for the acquired EnVen assets, we finished 2022 and started 2023 by drilling six successful development and exploitation wells. In our CCS business, we continued development and expansion in our carbon capture ventures with Talos Low Carbon Solutions, advancing our carbon capture portfolio, enhancing partnerships in core project areas, and progressing discussions with industrial emitters. Our proven track record of success in Upstream is based on our deep in-house technical and operational expertise focused on applying the latest technology and processes to optimize our asset base utilizing our largely Talos-owned infrastructure. At the same time, our Upstream skill sets are directly transferable to CCS and our growing portfolio of decarbonization projects that can assist industrial partners with carbon emissions capture, transportation and injection into sequestration sites that we believe will positively impact the environment for decades.

Our balance sheet and cash generation continue to be a key strength for us. In 2022, we meaningfully improved our credit statistics and liquidity profile with strong free cash flow generation. Today our credit profile is the best in our history following significant debt repayments in the past year, bringing our leverage metric near a record low level. Cash flow generation and a solid credit profile are long-standing goals for us. In addition, we recently announced our plan to return capital to our stockholders through our first-ever share repurchase program announced in March 2023.

Improving Corporate Governance

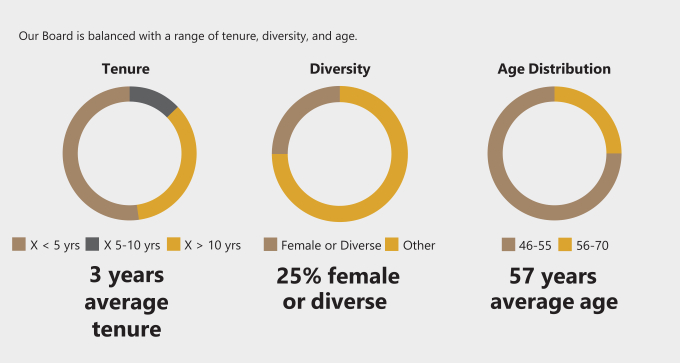

Since our last annual meeting, we have improved our corporate governance with our EnVen acquisition serving as a catalyst. First, we increased our Board independence by welcoming two new independent directors from the EnVen board of directors, Shandell Szabo and Richard Sherrill. With these additions, the size of our Board expanded to eight members, seven of which are independent directors, and our Board is more balanced with a range of tenure, diversity and age. Second, we began the process of declassifying our Board of Directors, which provides that all directors be elected every year for a one-year term beginning with the 2025 Annual Meeting of Stockholders, compared to the previous staggered three-year terms.

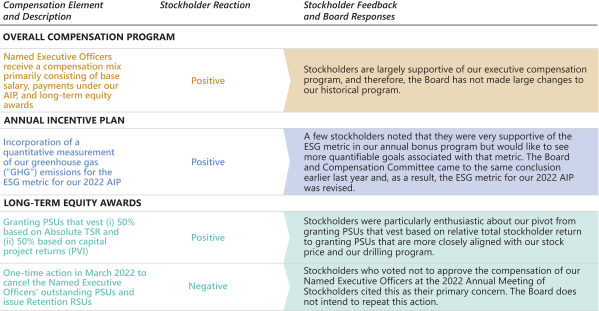

Enhancing Executive Compensation

We are committed to designing a program to attract, retain and motivate talented leaders in our company who possess the knowledge and expertise to create long-term value for our stockholders. We also want to make sure that our executives are incentivized by the things you care about as stockholders. To that end, in 2022 we shifted from 100% relative total shareholder return (“TSR”) PSUs to 50% PSUs that vest based on absolute TSR and 50% PSUs that vest based on capital efficiency returns (PVI). We also added greenhouse gas emissions (GHG) reductions as a specific metric in our Executive Compensation program. We firmly believe these changes continue to ensure that our pay aligns with the performance that shareholders want.

Leading Safety and Environmental Performance

Our success and accomplishments are founded on our strong commitment to the safety and well-being of our employees who enable Talos’s success. In 2022, we maintained our high level of safety performance with the lowest total recordable incident rate (“TRIR”) in the company’s history, outperforming the industry average of other offshore operators in the U.S. Gulf of Mexico. We are also proud of our zero lost time incident rate (“LTIR”).

We are steadfast in our goal to provide secure, reliable and responsibly produced energy to minimize environmental impacts, including reducing our GHG

intensity over time. In 2022, we reduced our Scope 1 GHG emissions intensity by 30% from our 2018 baseline year, achieving our initial goal three years sooner than anticipated on a pro-forma basis for the acquired EnVen assets.

Accessing Major Catalysts for Growth

We believe our evolution will continue in 2023 and beyond as our unique portfolio of catalysts drives future value creation across our Upstream and leading CCS businesses. These catalysts include growing our oil and gas business through our deep technical expertise and extensive physical operating experience, executing attractive acquisitions that are a good strategic fit and value accretive for our stockholders, and advancing our leadership in CCS to significantly reduce emissions from key industrial regions along the U.S. Gulf Coast. In addition, we remain focused on free cash flow generation and creating shareholder value. We believe significant upside remains from our Upstream reserves and new drilling and CCS opportunities.

We encourage you to read our 2023 Proxy Statement, our 2022 Annual Report, and the voting instructions on the pages that follow to ensure your shares are represented at the meeting.

On behalf of the entire Board, our executive leadership team and our employees, we sincerely thank you for your continued support and investment in Talos Energy.

Sincerely Yours,

|

Timothy S. Duncan President and CEO | |

|

Neal P. Goldman Chairman of the Board |

TALOS ENERGY INC.

Three Allen Center

333 Clay Street, Suite 3300

Houston, Texas 77002

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (the “Board of Directors” or the “Board”) of Talos Energy Inc. (the “Company”) requests your proxy for the 2023 Annual Meeting of Stockholders that will be held on May 9, 2023, at 10:00 a.m. Central Time, at Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002 (the “Annual Meeting”). By granting the proxy, you authorize the persons named on the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares at any adjournments or postponements of the Annual Meeting, and with respect to any other matters that properly come before the Annual Meeting or any adjournments or postponements thereof. This Proxy Statement, the enclosed proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (our “Annual Report”) are being mailed to stockholders beginning April 6, 2023.

2023 PROXY STATEMENT | 1 |

ABOUT THE ANNUAL MEETING

Purpose of the Annual Meeting

The purpose of the Annual Meeting is for our stockholders to consider and act upon the proposals described in this Proxy Statement and any other matters that properly come before the Annual Meeting or any adjournments or postponements thereof.

Proposals to be Voted Upon at the Annual Meeting

At the Annual Meeting, our stockholders will be asked to consider and vote upon the following three proposals:

| • | Proposal ONE: To elect to the Board the five Class II directors set forth in this Proxy Statement, each of whom will hold office until the 2025 Annual Meeting of Stockholders and until his or her successor is elected and qualified or until his or her earlier death, resignation or removal. |

| • | Proposal TWO: To ratify the appointment of Ernst & Young LLP (“EY”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. |

| • | Proposal THREE: To approve, on a non-binding advisory basis, the Company’s Named Executive Officer compensation, as disclosed in this Proxy Statement, for the fiscal year ended December 31, 2022. |

In addition, any other matters that properly come before the Annual Meeting or any adjournments or postponements thereof will be considered. Management is presently aware of no other business to come before the Annual Meeting.

Recommendation of the Board

The Board recommends that you vote FOR the election to the Board of each of the director nominees named in this Proxy Statement (Proposal ONE); FOR the ratification of the appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2023 (Proposal TWO); and FOR the approval, on a non-binding advisory basis, of the Company’s Named Executive Officer compensation for the fiscal year ended December 31, 2022 (Proposal THREE).

Voting at the Annual Meeting

Our common stock, par value $0.01 per share (our “common stock”), is the only class of securities that entitles holders to vote generally at meetings of the Company’s stockholders. Holders of our common stock will vote as a single class on all matters presented at the Annual Meeting. Each share of our common stock outstanding on March 20, 2023 (the “Record Date”) entitles the holder to one vote at the Annual Meeting.

If on the Record Date you held shares of our common stock that are represented by stock certificates or registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered the stockholder of record with respect to those shares and Computershare is sending these proxy materials directly to you on our behalf. Proxies may also be solicited on behalf of the Board of Directors, without additional compensation, by our directors, officers and other regular employees. We have not retained a professional proxy solicitor or other firm to assist with the solicitation of proxies, although we may do so if deemed appropriate. As a stockholder of record as of the Record Date, you may vote in person at the Annual Meeting or by proxy. Whether or not you plan to attend the Annual Meeting in person, we urge you to vote in advance of the Annual Meeting by way of the internet, by telephone or by filling out and returning the enclosed proxy card. If you submit a proxy but do not give voting instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of the Board stated in this Proxy Statement. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by (1) delivering a written notice of revocation addressed to Talos Energy Inc., Attn: William S. Moss III, Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002, (2) duly executing a proxy bearing a later date, (3) voting again by Internet or by telephone or (4) attending the Annual Meeting and voting in person. Your last vote or proxy will be the vote or proxy that is counted. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you vote or specifically so request.

| 2 |

|

About the Annual Meeting

If on the Record Date you held shares of our common stock in an account with a brokerage firm, bank or other nominee, then you are a beneficial owner of the shares and hold such shares in “street name,” and these proxy materials will be forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in their account, and the nominee has enclosed or provided voting instructions for you to use in directing it how to vote your shares. The nominee that holds your shares, however, is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you bring to the Annual Meeting a letter from your broker, bank or other nominee confirming your beneficial ownership of the shares as of the Record Date. Whether or not you plan to attend the Annual Meeting, we urge you to vote by following the voting instructions provided to you to ensure that your vote is counted.

If you are a beneficial owner and do not vote, and your broker, bank or other nominee does not have discretionary power to vote your shares, your shares may constitute “broker non-votes.” Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal and generally occur because the broker (1) does not receive voting instructions from the beneficial owner and (2) lacks discretionary authority to vote the shares. Brokers and other nominees have discretionary authority to vote on the ratification of our independent registered public accounting firm for clients who have not provided voting instructions. However, without voting instructions from their clients, they cannot vote on “non-routine” proposals, including the election of directors. Shares that constitute broker non-votes will be counted for the purpose of establishing a quorum at the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting.

A list of stockholders entitled to vote at the Annual Meeting will be available for inspection during ordinary business hours for a period of ten days before the Annual Meeting at our offices located at Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002. The list will also be available for inspection at the Annual Meeting.

Quorum Requirement for the Annual Meeting

The presence, in person or by proxy, at the Annual Meeting of the persons holding shares of our outstanding common stock on the Record Date that represent a majority of the voting power of all outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum, permitting us to conduct our business at the Annual Meeting. On the Record Date, there were 127,455,965 shares of our common stock held by 248 stockholders of record. Both abstentions (i.e., if you or your broker mark “ABSTAIN” on a proxy or voting instruction form, or if a stockholder of record attends the Annual Meeting, but does not vote (either before or during the Annual Meeting)) and broker non-votes will be considered to be shares present at the Annual Meeting for purposes of establishing a quorum.

Required Votes

Election of Directors. Each nominee for director will be elected by the affirmative vote of a majority of the votes cast with respect to such nominee’s election at the Annual Meeting. This means that the number of shares voted “for” a nominee must exceed the number of shares voted “against” that nominee. Abstentions and broker non-votes are not taken into account in determining the outcome of the election of directors.

Ratification of our Independent Registered Public Accounting Firm. Approval of the proposal to ratify the Audit Committee’s appointment of EY as our independent registered public accounting firm for the fiscal year ending December 31, 2023 requires the affirmative vote of a majority of the votes cast affirmatively or negatively at the Annual Meeting by the holders entitled to vote on the proposal. Abstentions and broker non-votes are not taken into account in determining the outcome of this proposal.

Approval of Named Executive Officer Compensation. Approval, on a non-binding advisory basis, of the Company’s Named Executive Officer compensation for the fiscal year ended December 31, 2022 requires the affirmative vote of a majority of the votes cast affirmatively or negatively at the Annual Meeting by the holders entitled to vote on the proposal. Abstentions and broker non-votes are not taken into account in determining the outcome of this proposal. This advisory vote on executive compensation is not binding on the Company, the Compensation Committee or the Board. However, the Compensation Committee and the Board will take into account the result of the vote when determining future executive compensation programs. This agenda item is also known as the “Say-on-Pay” vote.

2023 PROXY STATEMENT | 3 |

About the Annual Meeting

Resignation Policy

In the event of an uncontested election of directors (i.e., an election at which the number of nominees does not exceed the number of directors to be elected) that results in an incumbent director nominee receiving a greater number of votes “against” his election than votes “for” election, the resignation policy included in our Corporate Governance Guidelines requires that such nominee promptly tender his resignation to our Board of Directors.

The resignation policy permits the Board of Directors to delegate to a committee the responsibility to make recommendations regarding any such resignation tendered. The Board is required to take action with respect such resignation, taking into account any such committee recommendation (if applicable), and thereafter disclose the Board’s determination, as well as the rationale if the Board decided to reject such resignation.

Solicitation of Proxies

We will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock. We may solicit proxies by mail, personal interview, telephone, or via the Internet through our directors, officers and other regular employees, who will receive no additional compensation for their services.

Default Voting

A proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly execute and submit a proxy, but do not provide any voting instructions, your shares will be voted FOR the election to the Board of each of the director nominees listed in Proposal ONE, FOR Proposal TWO and FOR Proposal THREE.

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted in accordance with the discretion of the holders of the proxy. The Board of Directors knows of no matters, other than those previously stated, to be presented for consideration at the Annual Meeting.

| 4 |

|

PROPOSAL ONE: ELECTION OF DIRECTORS

Proposal One – Election of Directors

At the recommendation of the Nominating & Governance Committee, the Board of Directors has nominated the following five (5) individuals for election as Class II directors of the Company, to serve for a two-year term beginning at the Annual Meeting and expiring at the 2025 Annual Meeting of Stockholders, and until either they are re-elected or their successors are elected and qualified or until their earlier death, resignation or removal:

Mr. Timothy S. Duncan

Mr. John “Brad” Juneau

Mr. Donald R. Kendall, Jr.

Ms. Shandell Szabo

Mr. Richard Sherrill

Director

Age: 50

Director since: 2018

Committees: None

| Timothy S. Duncan

Mr. Duncan has served as our President and CEO and a co-founder of Talos Energy Inc. (NYSE: TALO). Headquartered in Houston, Texas and founded in 2012, Talos Energy is a leading offshore energy company focused on offshore oil and gas exploration and production as well as the development of future carbon capture and storage opportunities in the U.S. Gulf Coast, Gulf of Mexico and offshore Mexico. Talos became a public company in May 2018 following its merger with Stone Energy, transitioning from a private company initially funded with $600 million of capital commitments by two leading global investment firms. Talos is the third company that Duncan has built with partners over the last twenty years, following the success of Gryphon Exploration and Phoenix Exploration. Since inception, Talos has grown from 5 original employees to over 550 employees and is today one of the largest independent producers in the basin. Talos has been named a Houston Chronicle Top Workplace for the last ten consecutive years. Mr. Duncan is the past Chairman (2021-2022) and a past Vice Chair (2020-2021) of the National Offshore Industries Association (NOIA) and serves on their board of directors. He is a member of the board of directors of Chesapeake Energy Corporation (NASDAQ: CHK) and of the American Cancer Society CEOs Against Cancer. He also serves on various academically focused boards including the College of Engineering Dean’s Advisory Council and the Foundation Board at Mississippi State University. Mr. Duncan holds a BS in Petroleum Engineering from Mississippi State University and an MBA from the Bauer Executive Program at the University of Houston.

Based on Mr. Duncan’s significant experience as an officer of oil and gas companies, together with his training as a reservoir engineer and broad industry knowledge, we believe that he possesses the requisite skills to serve as a member of our Board of Directors.

Other public board directorships:

• Chesapeake Energy Corporation (NASDAQ: CHK)

|

2023 PROXY STATEMENT | 5 |

Proposal One – Election of Directors

Director

Age: 63

Director since: 2018

Committees:

• Nominating & Governance • Safety, Sustainability and Corporate Responsibility

| John “Brad” Juneau

Mr. Juneau has served as a member of our Board of Directors since May 2018. He previously served as a member of the board of directors of Stone Energy Corporation from March 2017 to May 2018. Mr. Juneau is the co-founder of Contango ORE, Inc. (“Contango”) (NYSE: CTGO), a publicly traded gold exploration company for which he serves as the Chairman of the board of directors. He previously served as President and Chief Executive Officer of Contango from August 2012 to January 6, 2020. Mr. Juneau is the sole manager and the general partner of Juneau Oil and Gas, L.L.C., a company involved in the exploration and production of oil and natural gas. Prior to forming Juneau Exploration in 1998, Mr. Juneau served as Senior Vice President of Exploration for Zilkha Energy Company from 1987 to 1998. Prior to joining Zilkha Energy Company, Mr. Juneau served as a Staff Petroleum Engineer with Texas International Company for three years, where his principal responsibilities included reservoir engineering, as well as acquisitions and evaluations. Prior to that, he was a Production Engineer with Enserch Corporation in Oklahoma City. Mr. Juneau holds a BS in Petroleum Engineering from Louisiana State University.

We believe that Mr. Juneau’s extensive energy industry background, particularly his expertise in reservoir engineering and involvement with exploration and production companies, make him a valuable member of our Board of Directors.

Other public board directorships

• Contango ORE, Inc. (NYSE: CTGO)

|

Director

Age: 70

Director since: 2018

Committees:

• Audit • Compensation

| Donald R. Kendall, Jr.

Mr. Kendall has served as a member of our Board of Directors since May 2018. Since October 1998, Mr. Kendall has served as Managing Director and Chief Executive Officer of Kenmont Capital Partners, a private investment and advisory firm. Mr. Kendall is also a General Partner at New Climate Ventures (an early-stage venture capital firm that focuses on innovative companies that reduce or avoid carbon). Mr. Kendall previously served as President of Cogen Technologies Capital Company, a power generation firm, and concurrently as Chairman and Chief Executive Officer of Palmetto Partners, an investment management firm, from July 1993 to October 1998. Mr. Kendall previously served as a director of American Midstream Partners LP on its Audit and Conflict Committees. Mr. Kendall also previously served as a member of the board of directors and Compensation Committee of Solar City Corporation and the chair of its Special and Audit Committees. Additionally, Mr. Kendall served as chair of the Audit, Compensation and Nominating and Governance Committees of privately held Stream Energy. Mr. Kendall received a BA in Economics from Hamilton College and an MBA from The Amos Tuck School of Business Administration at Dartmouth College.

We believe that Mr. Kendall’s many years of executive management experience, including experience as a chief executive officer, and his experience on multiple boards, make him a valuable member of our Board of Directors.

Other public board directorships

• None

|

| 6 |

|

Proposal One – Election of Directors

Director

Age: 48

Director since: 2023

Committees:

• Compensation • Safety, Sustainability and Corporate Responsibility

| Shandell Szabo

Ms. Szabo has served as a member of our Board of Directors since February 2023. Prior to joining Talos, Ms. Szabo served on the board of directors of EnVen Energy Corporation since February 2020, and served as Chair of the Risk Committee until February 2023. Ms. Szabo served nearly 20 years with Anadarko Petroleum Corporation (“Anadarko”) in various roles of steadily increasing responsibility throughout Anadarko’s U.S. onshore portfolio and deepwater Gulf of Mexico, including Vice President of US Exploration from 2018 to 2019, Vice President of Lower 48 Onshore Exploration from 2016 to 2018, Director of Investor Relations from 2015 to 2016, Exploration Manager Greater Permian from 2014 to 2015, General Manager of the Anadarko’s Freestone, Chalk, and Hugoton fields from 2013 to 2015, Geoscience Manager Haynesville East Texas from 2011 to 2013, and Regional Gulf of Mexico Manager from 2009 to 2010. Prior to Anadarko, Ms. Szabo held various subsurface and geoscience positions in basins in the U.S. onshore and Gulf of Mexico. Ms. Szabo is also active in her community, serving on the Montgomery County executive leadership team for the Leukemia and Lymphoma Society and Chairing the 2023 Student Visionaries of the Year leadership program. She is also a member of the Corporate Regional Council for the United Way. Ms. Szabo holds a Bachelor of Science in Environmental Geology from the University of Michigan and a Master of Science in Environmental Geology from Texas Christian University. She is a registered professional geologist in the state of Texas.

We believe that Ms. Szabo’s over 20 years of experience in the oil and gas industry makes Ms. Szabo well qualified to serve as a member of our Board of Directors.

Other public board directorships

• None

|

2023 PROXY STATEMENT | 7 |

Proposal One – Election of Directors

Director

Age: 57

Director since: 2023

Committees:

• Audit • Compensation

| Richard Sherrill

Mr. Sherrill has served as a member of our Board of Directors since February 2023. Prior to joining Talos, Mr. Sherrill served as a Lead Director, Chairman of the Audit Committee and a member of the Risk and Compensation Committees of EnVen Energy Corporation until February 2023. Mr. Sherrill currently serves as President of Clean Aire Partners (“CAP”) since 2021, an energy transition company focused on carbon capture, processing, transportation, and sequestration, and is the founding partner of the company. Prior to CAP, Mr. Sherrill was the President and a board member of Ceritas Energy LLC (“Ceritas”), a midstream natural gas company focused on providing producers with midstream gathering and process solution in various onshore regions of the U.S. and backed by private equity firms Quantum Energy Partners and Energy Spectrum Partners, since the founding of the company in 2003. Prior to forming Ceritas, Mr. Sherrill held various senior management roles at Duke Energy Corporation (NYSE: DUK) (“Duke”) over four years, which culminated in his position as Chief Operating Officer of Duke’s North American commercial activities. In this role, Mr. Sherrill oversaw all of the North American commercial activities for Duke in the deregulated natural gas and power space. Prior to Duke, Mr. Sherrill began in the industry at the private partnership Natural Gas Clearinghouse, which became Dynegy, Inc., ultimately holding the position of Vice President. Prior to Natural Gas Clearinghouse, Mr. Sherrill began his career with over four years at First Interstate Bank of Texas, now part of Wells Fargo, where he worked with upstream, midstream and energy merchant clients in the firm’s Energy Lending Group. Mr. Sherrill earned a Bachelor of Business Administration degree in finance from the University of Texas at Austin.

We believe that Mr. Sherrill’s over 30 years of experience in the oil and gas industry makes Mr. Sherrill’s well qualified to serve as a member of our Board of Directors.

Other public board directorships

• None

|

On February 13, 2023, pursuant to the Merger Agreement (as defined below), and in connection with the EnVen Acquisition (as defined below), we caused (a) the number of directors constituting our Board of Directors to be increased to eight (8) members and (b) two individuals designated by EnVen Energy Corporation (“EnVen”) to be appointed as members of our Board of Directors. Additionally, on February 13, 2023, in connection with the EnVen Acquisition, and pursuant to the termination of the Stockholders’ Agreement, Mr. Robert Tichio tendered his resignation as a member of the Board of Directors. On February 13, 2023, Ms. Shandell Szabo and Mr. Richard Sherrill were appointed to fill the two vacancies on the on our Board of Directors, to serve until the 2023 Annual Meeting of Stockholders or until their successors shall be elected and qualified, or, if earlier, until their respective deaths, disability, resignations, disqualifications or removals from office. See “—Stockholders’ Agreements” below for additional information.

Messrs. Duncan, Juneau, Kendall and Sherrill and Ms. Szabo are currently serving as directors of the Company, and if they are each elected to the Board, the size of the Board will continue to consist of eight (8) directors. Please see “Stockholders’ Agreements” and “Riverstone Support Agreement” below in addition to our Second Amended & Restated Bylaws attached as an exhibit to our Annual Report below for more information. Biographical information for each director nominee is contained in the “Directors and Executive Officers” section below.

The Board of Directors has no reason to believe that its director nominees will be unable or unwilling to serve if elected. If a director nominee becomes unable or unwilling to accept nomination or election, the persons acting under your proxy will vote for the election of a substitute nominee, if any, that the Board of Directors recommends.

| 8 |

|

Proposal One – Election of Directors

Stockholders’ Agreements

Pursuant to the Stockholders’ Agreement (the “Previous Stockholders’ Agreement”) we entered into in connection with the business combination of Talos Energy LLC and Stone Energy Corporation (“Stone”) on May 10, 2018, as amended, (the “Stone Combination”), and our Amended & Restated Bylaws (“Bylaws”), certain funds and other alternative investment vehicles managed by Apollo Management VII, L.P. and Apollo Commodities Management, L.P., with respect to Series I (the “Apollo Funds”) and certain entities controlled by or affiliated with Riverstone Energy Partners V, L.P. (the “Riverstone Funds,” and the Apollo Funds and the Riverstone Funds, each a “Stockholder Group”), each independently had the right to designate, in connection with any annual or special meeting of our stockholders at which directors would be elected, (i) two persons for nomination by the Board of Directors for election to the Board (each, a “Nominee”) for so long as such Stockholder Group owned at least (A) 15% of our outstanding common stock or (B) 50% of the number of shares of our common stock issued to such Stockholder Group in connection with the Stone Combination, after appropriate adjustment for any stock split, subdivision, combination or reclassification of any shares (such shares with respect to each Stockholder Group, the “Initial Group Shares,” and collectively, the “Initial Shares”) and (ii) one Nominee for so long as such Stockholder Group owned (A) at least 5% but less than 15% of our outstanding common stock or (B) at least 50% of the number of Initial Group Shares.

Further, the Previous Stockholders’ Agreement provided that (i) for so long as the Apollo Funds and the Riverstone Funds collectively owned at least (A) 50% of our outstanding common stock or (B) 80% of the number of Initial Shares, the Apollo Funds and the Riverstone Funds had the collective right to designate two Nominees, one of whom qualified as “independent” under the New York Stock Exchange (“NYSE”) listing standards (an “Independent Director”) and the other of whom must have either been our Chief Executive Officer or qualified as an Independent Director, and (ii) for so long as the Apollo Funds and the Riverstone Funds collectively owned (A) less than 50% of our outstanding common stock but at least 60% of the Initial Shares or (B) less than 80% of the Initial Shares but at least 40% of our outstanding common stock, the Apollo Funds and the Riverstone Funds had the collective right to designate one Nominee, whom must have either been our Chief Executive Officer or qualified as an Independent Director.

Pursuant to Amendment No. 1 to the Previous Stockholders’ Agreement entered into as of February 24, 2020, in connection with the Company’s acquisition of certain U.S. Gulf of Mexico producing assets, exploration prospects and acreage, the Previous Stockholders’ Agreement was amended to add certain affiliates of Riverstone Holdings as parties to the Previous Stockholders’ Agreement and to provide that for purposes of calculating whether the affiliates of Riverstone Holdings satisfied certain thresholds related to board nomination rights, the Series A Convertible Preferred Stock of the Company were considered on an as converted basis.

Pursuant to the Amended and Restated Stockholders’ Agreement entered into as of March 29, 2022 (the “Stockholders’ Agreement” and, together with the Previous Stockholders’ Agreement, the “Stockholders’ Agreements”), in connection with the resignation of Board members Olivia Wassenaar, Rajen Mahagoakar and Christine Hommes, the Previous Stockholders’ Agreement was amended and restated to, among other things, (i) terminate the rights of the Apollo Funds under the Previous Stockholders’ Agreement and (ii) eliminate the requirement that the Board consist of ten members. As a result of the Apollo Funds’ reduced ownership after recent share sales from long-dated funds holding their Company shares, the directors associated with the Apollo Funds resigned from the Board of Directors, effective December 8, 2021. Thereafter, the Board determined, pursuant to the Bylaws, that the size of the Board shall consist of seven members. Mr. Tichio served as the Riverstone Funds’ designee to the Board until his resignation on February 13, 2023 in connection with the termination of the Stockholders’ Agreement as described below.

The Riverstone Funds agreed to vote their shares of our common stock in favor of any nominee designated and nominated for election to the Board in accordance with the terms of the Stockholders’ Agreement and in a manner consistent with the recommendation of the Nominating and Governance Committee with respect to all other nominees. For additional information regarding the Previous Stockholders’ Agreement, as amended, and the Apollo Funds’ and the Riverstone Funds’ obligations with respect thereto, see “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreements—Previous Stockholders’ Agreement” and the copies of the Previous Stockholders’ Agreement and the Amendment No. 1 to the Previous Stockholders’ Agreement, each as filed with our Annual Report on Form 10-K for the year ended December 31, 2021. For additional information regarding the Stockholders’ Agreement and the Riverstone Funds’ obligations with respect thereto, including obligations with respect to voting on nominees for election to the Board, see “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreements—Stockholders’

2023 PROXY STATEMENT | 9 |

Proposal One – Election of Directors

Agreement.” A copy of the Stockholders’ Agreement can be found in our Current Report on Form 8-K filed with the U.S. Securities Exchange and Commission (“SEC”) on March 30, 2022. For additional information regarding the termination of the Stockholders’ Agreement, see “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreement—Termination of Stockholders’ Agreement.”

On September 21, 2022, we executed a merger agreement to acquire EnVen, a private operator in the Deepwater U.S. Gulf of Mexico, for stock and cash consideration (the “EnVen Acquisition,” and such agreement, the “Merger Agreement”). In connection with the $1.0 billion EnVen Acquisition, which closed on February 13, 2023, the Company and the Riverstone Funds agreed to terminate the Stockholders’ Agreement, which eliminated the Riverstone Funds’ designation rights with respect to the Company’s Board of Directors. Subsequent to the termination of the Stockholders’ Agreement, the Riverstone Funds’ designee to the Company’s Board of Directors, Mr. Robert M. Tichio, immediately tendered his resignation in connection with the closing of the EnVen Acquisition. See “—Riverstone Support Agreement” below and “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Riverstone Support Agreement & Letter Agreement,” and the copies of the Riverstone Support Agreement and Letter Agreement each as filed with our Annual Report for additional information.

Riverstone Support Agreement & Letter Agreement

In connection with the EnVen Acquisition, we, EnVen and the Riverstone Funds entered into a support agreement (the “Riverstone Support Agreement”) pursuant to which the Riverstone Funds agreed, among other things, to (i) vote all shares of Company common stock beneficially owned (a) in favor of the share issuance to EnVen equityholders, (b) in favor of the amendment and/or restatement of the Company’s organizational documents as necessary or appropriate to reflect the termination of the Stockholders’ Agreement, (c) in favor of any other proposals necessary or appropriate in connection with the EnVen Acquisition and (d) against, among other things, (A) any Acquisition Proposal (as defined in the Merger Agreement) with respect to the Company and (B) any other proposal that could reasonably be expected to materially impede or delay the EnVen Acquisition or result in a breach of any representation or covenant of the Company under that certain Merger Agreement, (ii) terminate the Stockholders’ Agreement, and (iii) cause Mr. Tichio to resign from the Company’s Board of Directors, in each case of the foregoing clauses (ii) and (iii), effective immediately prior to, but conditioned on, the occurrence of the closing of the EnVen Acquisition.

The EnVen Acquisition closed on February 13, 2023, and in connection therewith, we and the Riverstone Funds entered into a Letter Agreement, dated February 13, 2023 (the “Letter Agreement”), pursuant to which we and the Riverstone Funds agreed to execute and deliver such additional documents and take all such further action as may be reasonably necessary to cause the Stockholders’ Agreement to be terminated without any further force and effect. See also “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Riverstone Support Agreement & Letter Agreement.”

Vote Required

The election of each director in this Proposal ONE requires the affirmative vote of a majority of the votes cast by the holders entitled to vote in the election of directors. This means that the number of shares voted FOR a nominee must exceed the number of shares voted AGAINST that nominee. Neither abstentions nor broker non-votes will have any effect on the outcome of the election of directors.

Recommendation

The Board unanimously recommends that stockholders vote FOR the election to the Board of each of the director nominees.

| 10 |

|

DIRECTORS AND EXECUTIVE OFFICERS

After the Annual Meeting, assuming the stockholders elect to the Board of Directors the director nominees set forth in “Proposal ONE: Election of Directors” above, the Board of Directors of the Company will be, and the Executive Officers of the Company are:

Name | Age | Title | ||

Neal P. Goldman(3) | 53 | Chairman of the Board | ||

Timothy S. Duncan | 50 | President and Chief Executive Officer, Director | ||

Charles M. Sledge(1)(2)(3) | 57 | Director | ||

John “Brad” Juneau(1)(3)(4) | 63 | Director | ||

Donald R. Kendall, Jr.(1)(2)(4) | 70 | Director | ||

Paula R. Glover(4) | 55 | Director | ||

Shandell Szabo(2)(4) | 48 | Director | ||

Richard Sherrill(1)(2) | 57 | Director | ||

Robert D. Abendschein | 61 | Executive Vice President and Chief Operating Officer | ||

John A. Parker | 67 | Executive Vice President of New Ventures | ||

Shannon E. Young III | 52 | Executive Vice President and Chief Financial Officer | ||

William S. Moss III | 53 | Executive Vice President, General Counsel and Secretary | ||

Robin H. Fielder | 42 | Executive Vice President of Low Carbon Strategy and Chief Sustainability Officer | ||

Gregory M. Babcock | 39 | Vice President and Chief Accounting Officer | ||

| (1) | Member of the Audit Committee. In connection with the closing of the EnVen Acquisition, on February 13, 2023, (i) Mr. Juneau ceased to serve as a member on the Audit Committee and (ii) Mr. Sherrill was designated as a member of the Audit Committee. |

| (2) | Member of the Compensation Committee. In connection with the closing of the EnVen Acquisition, on February 13, 2023, (i) Mr. Sledge ceased to serve as a member on the Compensation Committee and (ii) Mr. Sherrill and Ms. Szabo were each designated as a member of the Compensation Committee. |

| (3) | Member of the Nominating & Governance Committee. In connection with the closing of the EnVen Acquisition and Mr. Tichio’s resignation, on February 13, 2023, Mr. Juneau was designated as a member of the Nominating & Governance Committee. |

| (4) | Member of the Safety, Sustainability and Corporate Responsibility Committee (the “SSCR Committee”). In connection with the closing of the EnVen Acquisition, on February 13, 2023, (i) Mr. Kendall ceased to serve as a member of the SSCR Committee and (ii) Ms. Szabo was designated as a member of the SSCR Committee. |

The Board of Directors is currently divided into three classes serving staggered three-year terms. Each year, the directors of one class stand for re-election as their terms of office expire. In connection with the closing of the EnVen Acquisition and pursuant to the Second Amended & Restated Bylaws adopted in connection therewith, the Board of Directors will be declassified from three classes to one class at the 2025 Annual Meeting of Stockholders, with each Class I, Class II and Class III director being elected annually for a one-year term thereafter. Until such meeting, the directors of our Board shall be elected as follows:

| • | At the 2023 Annual Meeting of Stockholders, each Class II director will be elected for a two-year term, ending at the 2025 Annual Meeting of Stockholders; and |

| • | At the 2024 Annual Meeting of Stockholders, each Class III director will be elected for a one-year team, ending at the 2025 Annual Meeting of Stockholders. |

In connection with the EnVen Acquisition, each of Mr. Sherrill and Ms. Szabo, in their capacity as the two EnVen Designated Directors (as such term is defined in the Merger Agreement), were appointed as Class II directors. As such, Messrs. Duncan, Juneau, Kendall and Sherrill and Ms. Szabo are each designated as Class II directors and assuming the stockholders elect them to the Board as set forth in “Proposal ONE: Election of Directors” above, their two-year terms of office will expire in 2025. Mr. Goldman and Ms. Glover are designated as Class III directors and their term of office will expire in 2024. Mr. Sledge is designated as a Class I director and his term of office will expire in 2025.

2023 PROXY STATEMENT | 11 |

Directors and Executive Officers

Director Resignations

Effective February 13, 2023, Mr. Robert Tichio, affiliated with the Riverstone Funds, resigned from the Board of Directors concurrent with the closing of the EnVen Acquisition pursuant to the Riverstone Support Agreement. The foregoing director was originally appointed to the Board of Directors pursuant to the Previous Stockholders’ Agreement and resigned in accordance with the term of the Riverstone Support Agreement. The foregoing director indicated that his departure from the Board was not the result of any disagreement with management or the Board. As a result of this resignation and the appointments made pursuant to the Merger Agreement, there are eight (8) members serving on the Board. Please see “—Stockholders’ Agreements” and “—Riverstone Support Agreement” above for more information. See also “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreements” and “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreements—Termination of Stockholders’ Agreement.”

Set forth below is biographical information about each of the Company’s directors, director nominees and Executive Officers.

Our Directors

Neal P. Chair of the Board |

Timothy S. President and CEO |

Paula R. Director |

John “Brad” Director | |||

Donald R. Director |

Charles M. Director |

Shandell Director |

Richard Director | |||

| 12 |

|

Directors and Executive Officers

Qualifications and Experience of Our Directors and Director Nominees

The members of our Board possess a broad variety of personal attributes, experience and skills giving our Board the depth and breadth necessary to effectively oversee management on behalf of our stockholders. Our Board is committed to diversity and the importance of different backgrounds, perspectives and views. The matrix below represents some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy. The matrix does not include all knowledge, skills, experience or other attributes of our directors and director nominees, which may be relevant and valuable to their service on our Board. The diversity of knowledge, skill, experience and attributes of our directors and director nominees, collectively, lends itself to a highly collaborative and effective Board. |  |

Board Diversity

Our Board actively seeks to consider women and underrepresented director candidates for membership on the Board. Consistent with our ongoing commitment to creating a balanced Board with diverse viewpoints and deep industry expertise, our Board will continue to maintain its commitment to seeking diverse perspectives and to overseeing an organization that is committed to creating a culture dedicated to diverse experiences, equitable treatment and inclusive behavior.

2023 PROXY STATEMENT | 13 |

Directors and Executive Officers

Chairman of the Board

Age: 53

Director since: 2018

Committees:

• Nominating & Governance

| Neal P. Goldman

Mr. Goldman has served as the Chairman of our Board of Directors since May 2018 and was re-elected as Chairman of the Board on July 21, 2020. He previously served as the Chairman of the board of directors of Stone Energy Corporation from March 2017 to May 2018. Mr. Goldman is currently the Managing Member of SAGE Capital Investments, LLC, a consulting firm specializing in independent board of director services, turnaround consulting and strategic planning. Mr. Goldman also serves on the boards of directors of Weatherford International plc (“Weatherford”) (NASDAQ: WFRD) and Diamond Offshore Drilling, Inc., (NYSE: DO) where he serves as the Chairman of the board of directors, in addition to serving as a director, and serving as chair of the Human Resources and Compensation Committee and a member of the Audit Committee of Mallinckrodt plc (NYSE: MNK) since June 2022. Mr. Goldman was a Managing Director at Och Ziff Capital Management, L.P. from 2014 to 2016 and a Founding Partner of Brigade Capital Management, LLC from 2007 to 2012. Prior to this, Mr. Goldman was a Portfolio Manager at MacKay Shields LLC and held various positions at Salomon Brothers Inc., both as a mergers and acquisitions banker and as an investor in the high yield trading group. Throughout his career, Mr. Goldman has held numerous board positions, including roles at the Center for Autism and Related Diseases, Magic Leap, Zenefits, NPC Restaurant Holdings, Healogics, David’s Bridal, J. Crew, Toys R Us, Southeastern Grocers, Midstates Petroleum, Ultra Petroleum, Lightsquared, NII Holdings, Jacuzzi Brands, and Pimco Income Strategy Fund I and II. Mr. Goldman received a BA from the University of Michigan and an MBA from the University of Illinois. Based upon Mr. Goldman’s involvement in strategic planning and his experience on multiple boards, we believe that Mr. Goldman is a valuable member of our Board of Directors.

Other public board directorships • Weatherford International plc (NASDAQ: WFRD) • Diamond Offshore Drilling, Inc. (NYSE: DO) • Mallinckrodt plc (NYSE: MNK)

|

| 14 |

|

Directors and Executive Officers

President and CEO, Director

Age: 50

Director since: 2018

Committees: None

| Timothy S. Duncan

Mr. Duncan has served as our President and CEO and a co-founder of Talos Energy Inc. (NYSE: TALO). Headquartered in Houston, Texas and founded in 2012, Talos Energy is a leading offshore energy company focused on offshore oil and gas exploration and production as well as the development of future carbon capture and storage opportunities in the U.S. Gulf Coast, Gulf of Mexico and offshore Mexico. Talos became a public company in May 2018 following its merger with Stone Energy, transitioning from a private company initially funded with $600 million of capital commitments by two leading global investment firms. Talos is the third company that Duncan has built with partners over the last twenty years, following the success of Gryphon Exploration and Phoenix Exploration. Since inception, Talos has grown from 5 original employees to over 550 employees and is today one of the largest independent producers in the basin. Talos has been named a Houston Chronicle Top Workplace for the last ten consecutive years. Mr. Duncan is the past Chairman (2021-2022) and a past Vice Chair (2020-2021) of the National Offshore Industries Association (NOIA) and serves on their board of directors. He is a member of the board of directors of Chesapeake Energy Corporation (NASDAQ: CHK) and of the American Cancer Society CEOs Against Cancer. He also serves on various academically focused boards including the College of Engineering Dean’s Advisory Council and the Foundation Board at Mississippi State University. Mr. Duncan holds a BS in Petroleum Engineering from Mississippi State University and an MBA from the Bauer Executive Program at the University of Houston. Based on Mr. Duncan’s significant experience as an officer of oil and gas companies, together with his training as a reservoir engineer and broad industry knowledge, we believe that he possesses the requisite skills to serve as a member of our Board of Directors.

Other public board directorships • Chesapeake Energy Corporation (NASDAQ: CHK)

|

Director

Age: 57

Director since: 2018

Committees:

• Nominating & Governance • Audit

| Charles M. Sledge

Mr. Sledge has served as a member of our Board of Directors since May 2018. He previously served as a member of the board of directors of Stone Energy Corporation from March 2017 to May 2018. Mr. Sledge served as the Chief Financial Officer of Cameron International Corporation, an oilfield services company, from 2008 until its sale to Schlumberger Limited in 2016. Prior to that, Mr. Sledge served as the Corporate Controller of Cameron International Corporation from 2001 to 2008. Mr. Sledge serves on the board of Weatherford International plc (NASDAQ: WFRD) and Noble Corporation plc (NYSE: NE), both of which he serves as non-executive chairman. He has previously served on the boards of Vine Resources, Inc. and Expro International as non-executive chairman. Mr. Sledge holds a BS in Accounting from Louisiana State University and is a graduate of the Harvard Business School Advanced Management Program. We believe that Mr. Sledge’s strong financial background, including his 20 years of experience as a financial executive, makes him a valuable member of our Board of Directors.

Other public board directorships • Weatherford International plc (NASDAQ: WFRD) • Noble Corporation plc (NYSE: NE)

|

2023 PROXY STATEMENT | 15 |

Directors and Executive Officers

Director

Age: 63

Director since: 2018

Committees:

• Nominating & Governance • Safety, Sustainability and Corporate Responsibility

| John “Brad” Juneau

Mr. Juneau has served as a member of our Board of Directors since May 2018. He previously served as a member of the board of directors of Stone Energy Corporation from March 2017 to May 2018. Mr. Juneau is the co-founder of Contango ORE, Inc. (“Contango”) (NYSE: CTGO), a publicly traded gold exploration company for which he serves as the Chairman of the board of directors. He previously served as President and Chief Executive Officer of Contango from August 2012 to January 6, 2020. Mr. Juneau is the sole manager and the general partner of Juneau Oil and Gas, L.L.C., a company involved in the exploration and production of oil and natural gas. Prior to forming Juneau Exploration in 1998, Mr. Juneau served as Senior Vice President of Exploration for Zilkha Energy Company from 1987 to 1998. Prior to joining Zilkha Energy Company, Mr. Juneau served as a Staff Petroleum Engineer with Texas International Company for three years, where his principal responsibilities included reservoir engineering, as well as acquisitions and evaluations. Prior to that, he was a Production Engineer with Enserch Corporation in Oklahoma City. Mr. Juneau holds a BS in Petroleum Engineering from Louisiana State University. We believe that Mr. Juneau’s extensive energy industry background, particularly his expertise in reservoir engineering and involvement with exploration and production companies, make him a valuable member of our Board of Directors.

Other public board directorships • Contango ORE, Inc. (NYSE: CTGO)

|

Director

Age: 70

Director since: 2018

Committees:

• Compensation • Audit

| Donald R. Kendall, Jr.

Mr. Kendall has served as a member of our Board of Directors since May 2018. Since October 1998, Mr. Kendall has served as Managing Director and Chief Executive Officer of Kenmont Capital Partners, a private investment and advisory firm. Mr. Kendall is also a General Partner at New Climate Ventures (an early-stage venture capital firm that focuses on innovative companies that reduce or avoid carbon). Mr. Kendall previously served as President of Cogen Technologies Capital Company, a power generation firm, and concurrently as Chairman and Chief Executive Officer of Palmetto Partners, an investment management firm, from July 1993 to October 1998. Mr. Kendall previously served as a director of American Midstream Partners LP on its Audit and Conflict Committees. Mr. Kendall also previously served as a member of the board of directors and Compensation Committee of Solar City Corporation and the chair of its Special and Audit Committees. Additionally, Mr. Kendall served as chair of the Audit, Compensation and Nominating and Governance Committees of privately held Stream Energy. Mr. Kendall received a BA in Economics from Hamilton College and an MBA from The Amos Tuck School of Business Administration at Dartmouth College. We believe that Mr. Kendall’s many years of executive management experience, including experience as a chief executive officer, and his experience on multiple boards, make him a valuable member of our Board of Directors.

Other public board directorships • None

|

| 16 |

|

Directors and Executive Officers

Director

Age: 55

Director since: 2021

Committees:

• Safety, Sustainability and Corporate Responsibility

| Paula R. Glover

Ms. Glover was elected to the Board of Directors in May 2021. Since June 2017, Ms. Glover has served as a member of the board of directors of the Alliance to Save Energy (the “Alliance”), and since January 2021, she has served as President of the Alliance. Ms. Glover previously served as President and Chief Executive Officer of the American Association of Blacks in Energy (the “AABE”), a non-profit professional association focused on ensuring that African Americans and other minorities have input into the discussions and development of energy policy, regulations and environmental issues. Prior to this role, she served as AABE’s Vice President of Operations and Director of Communications. In March 2014, Ms. Glover was appointed by the U.S. Secretary of Energy to the National Petroleum Council where she continues to be a member. Ms. Glover is also a member of the boards of directors of Groundswell and the Keystone Policy Center and serves as trustee at Cardigan Mountain School. Ms. Glover’s experience includes more than 25 years in the energy industry, having held positions of increasing scope and responsibility across the consumer and community sides of the industry. In addition to these roles, Ms. Glover was the Community Awareness Director for the Regional YMCA of Western Connecticut. Ms. Glover received her B.S. in Marketing Management from the University of Delaware. We believe that Ms. Glover’s professional experience in the energy industry and her experience on multiple boards will make her a valuable member of our Board of Directors.

Other public board directorships • None

|

Director

Age: 48

Director since: 2023

Committees:

• Compensation • Safety, Sustainability and Corporate Responsibility

| Shandell Szabo

Ms. Szabo has served as a member of our Board of Directors since February 2023. Prior to joining Talos, Ms. Szabo served on the board of directors of EnVen Energy Corporation since February 2020, and served as Chair of the Risk Committee until February 2023. Ms. Szabo served nearly 20 years with Anadarko Petroleum Corporation (“Anadarko”) in various roles of steadily increasing responsibility throughout Anadarko’s U.S. onshore portfolio and deepwater Gulf of Mexico, including Vice President of US Exploration from 2018 to 2019, Vice President of Lower 48 Onshore Exploration from 2016 to 2018, Director of Investor Relations from 2015 to 2016, Exploration Manager Greater Permian from 2014 to 2015, General Manager of the Anadarko’s Freestone, Chalk, and Hugoton fields from 2013 to 2015, Geoscience Manager Haynesville East Texas from 2011 to 2013, and Regional Gulf of Mexico Manager from 2009 to 2010. Prior to Anadarko, Ms. Szabo held various subsurface and geoscience positions in basins in the U.S. onshore and Gulf of Mexico. Ms. Szabo is also active in her community, serving on the Montgomery County executive leadership team for the Leukemia and Lymphoma Society and Chairing the 2023 Student Visionaries of the Year leadership program. She is also a member of the Corporate Regional Council for the United Way. Ms. Szabo holds a Bachelor of Science in Environmental Geology from the University of Michigan and a Master of Science in Environmental Geology from Texas Christian University. She is a registered professional geologist in the state of Texas. We believe that Ms. Szabo’s over 20 years of experience in the oil and gas industry makes Ms. Szabo well qualified to serve as a member of our Board of Directors.

Other public board directorships • None

|

2023 PROXY STATEMENT | 17 |

Directors and Executive Officers

Director

Age: 57

Director since: 2023

Committees:

• Audit • Compensation

| Richard Sherrill

Mr. Sherrill has served as a member of our Board of Directors since February 2023. Prior to joining Talos, Mr. Sherrill served as a Lead Director, Chairman of the Audit Committee and a member of the Risk and Compensation Committees of EnVen Energy Corporation, until February 2023. Mr. Sherill currently serves as President of Clean Aire Partners (“CAP”) since 2021, an energy transition company focused on carbon capture, processing, transportation, and sequestration, and is the founding partner of the company. Prior to CAP, Mr. Sherrill was the President and a board member of Ceritas Energy LLC (“Ceritas”), a midstream natural gas company focused on providing producers with midstream gathering and process solution in various onshore regions of the U.S. and backed by private equity firms Quantum Energy Partners and Energy Spectrum Partners, since the founding of the company in 2003. Prior to forming Ceritas, Mr. Sherrill held various senior management roles at Duke Energy Corporation (NYSE: DUK) (“Duke”) over four years, which culminated in his position as Chief Operating Officer of Duke’s North American commercial activities. In this role, Mr. Sherrill oversaw all of the North American commercial activities for Duke in the deregulated natural gas and power space. Prior to Duke, Mr. Sherrill began in the industry at the private partnership Natural Gas Clearinghouse, which became Dynegy, Inc., ultimately holding the position of Vice President. Prior to Natural Gas Clearinghouse, Mr. Sherrill began his career with over four years at First Interstate Bank of Texas, now part of Wells Fargo, where he worked with upstream, midstream and energy merchant clients in the firm’s Energy Lending Group. Mr. Sherrill earned a Bachelor of Business Administration degree in finance from the University of Texas at Austin. We believe that Mr. Sherrill’s over 30 years of experience in the oil and gas industry makes Mr. Sherrill’s well qualified to serve as a member of our Board of Directors.

Other public board directorships • None

|

| 18 |

|

Directors and Executive Officers

Our Other Executive Officers

Executive VP and Chief Operating Officer

Age: 61

Officer since: 2020

| Robert D. Abendschein

Mr. Abendschein has served as our Executive Vice President and Chief Operating Officer since February 2022 and previously served as our Executive Vice President and Head of Operations from 2020 to 2022. Prior to joining the Company, Mr. Abendschein served as the Chief Executive Officer of Venari Resources LLC (“Venari”) from August 2017 to December 2019, where he was appointed by a consortium of private equity investors to lead the advancement of multiple globally recognized development projects (Anchor and Shenandoah) and managed all stages of strategy, exploration and operational leadership activities. Prior to joining Venari, Mr. Abendschein served 33 years with Anadarko Petroleum Corporation, (“Anadarko”) and predecessor companies, including as the Vice President of Worldwide Deepwater from March 2015 to August 2017, in which he led Anadarko’s worldwide offshore portfolio. He also served in other key executive roles at Anadarko, including as the Vice President of Exploration and Production Services from June 2013 to March 2015 and Vice President of Corporate Development from February 2010 to June 2013. His career at Anadarko also included progressive roles in Reservoir Engineering, Production Services and Corporate Development. Mr. Abendschein serves on the board of directors of the Cynthia Woods Mitchell Pavilion and the Offshore Energy Center. Mr. Abendschein earned a BS in Petroleum Engineering from Texas A&M University.

|

Executive VP of New Ventures

Age: 67

Officer since: 2018

| John A. Parker

Mr. Parker currently serves as our Executive Vice President of New Ventures as of 2023, and previously served as our Executive Vice President of Exploration since May 2018. Mr. Parker is a founder of Talos Energy LLC and served as its Executive Vice President of Exploration from April 2012 to May 2018. Prior to Talos Energy LLC, Mr. Parker founded Phoenix Exploration in April 2006, where he served as Senior Vice President of Exploration and was responsible for Phoenix Exploration’s exploration program. Phoenix Exploration made several significant discoveries resulting in impactful reserve additions, which led to the sale of the company to a group of buyers led by Apache Corporation. Prior to Phoenix Exploration, Mr. Parker was Exploration Manager of the Texas Shelf at Gryphon Exploration Company, where he generated prospects and supervised the prospect generation of the Texas exploration team. His exploration team was responsible for 72% of the reserves discovered at Gryphon. Mr. Parker also worked as an exploration geologist for EOG Resources, Inc. in the Gulf of Mexico. Mr. Parker started his career at Shell Oil Company where he worked as an exploration geologist in the Gulf Coast onshore. He later worked exploring in international basins at Pecten, the international subsidiary of Shell Oil Company. Mr. Parker earned his BA from Louisiana State University and his MS in Earth Science from the University of New Orleans and has more than 34 years of industry experience.

|

2023 PROXY STATEMENT | 19 |

Directors and Executive Officers

Executive VP and CFO

Age: 52

Officer since: 2019

| Shannon E. Young III

Mr. Young has served as our Executive Vice President and Chief Financial Officer since May 2019. Previously Mr. Young served as Vice President and Chief Financial Officer of Sheridan Production Company, LLC (“Sheridan”) with responsibility for Sheridan’s finance organization, including accounting, treasury, tax, planning, marketing and information technology. Prior to joining Sheridan in August 2016, Mr. Young served in similar positions with Cobalt International Energy, Inc. and Talos Energy LLC. Previously, Mr. Young served as a Managing Director for the Global Energy Group at Goldman, Sachs & Co. from 2010 to 2014 and before that was an investment banker at Morgan Stanley from 1998 to 2010. Mr. Young earned a BBA in Finance from The University of Texas at Austin and an MBA with distinction from the Amos Tuck School of Business at Dartmouth College.

|

Executive VP, General Counsel and Secretary

Age: 53

Officer since: 2018

| William S. Moss III

Mr. Moss has served as our Executive Vice President, General Counsel and Secretary since May 2018. Mr. Moss previously served as Senior Vice President and General Counsel of Talos Energy LLC from May 2013 to May 2018. Prior to Talos Energy LLC, Mr. Moss was a partner at Mayer Brown LLP in Houston where he was the head of the Houston Corporate Practice. Mr. Moss joined Mayer Brown LLP in May 2005. At Mayer Brown LLP, Mr. Moss’s practice focused on mergers and acquisitions, securities offerings and general corporate and securities matters and he represented clients throughout the energy value chain. Mr. Moss joined Talos Energy LLC after having represented Talos Energy LLC as outside counsel in its initial formation and its subsequent acquisition of Energy Resource Technology, LLC from Helix Energy Solutions Group, Inc. in February of 2013. Mr. Moss also represented Phoenix Exploration in its initial formation in April 2006, acquisitions and ultimate sale to a group of buyers led by Apache Corporation. Prior to joining Mayer Brown LLP, Mr. Moss worked at Baker Botts, L.L.P. Mr. Moss has an AB from Dartmouth College, a MPhil from Cambridge University and a J.D. from The University of Texas School of Law.

|

| 20 |

|

Directors and Executive Officers

Executive Vice President, Low Carbon Strategy and Chief Sustainability Officer

Age: 42

Officer since: 2021

| Robin H. Fielder

Ms. Fielder has served as our Executive Vice President of Low Carbon Strategy and Chief Sustainability Officer, serving as the lead executive for our rapidly growing carbon capture, utilization, and sequestration business and overseeing strategic ESG initiatives since December 2021. Previously, Ms. Fielder served as President, CEO, and a member of the Noble Midstream Partners (NBLX) board of directors within Chevron and led integration efforts for the take-private transaction of NBLX in 2021 following the 2020 acquisition of its parent company, Noble Energy. Before her time with Noble Energy and Chevron, Ms. Fielder served as CEO, President, and Director for Western Midstream Partners (formerly Western Gas), where she led the Partnership and the Anadarko Petroleum Corporation commodity marketing organizations. With nearly 20 years of steadily increasing responsibility at Anadarko, Ms. Fielder built executive skills serving as Vice President of Investor Relations, General Manager of the company’s East Texas Shale assets, Worldwide Operations Business Advisor, and various business and technical leadership positions across basins in the U.S. Onshore and Gulf of Mexico. Ms. Fielder serves as a director of the Select Energy Services (NYSE: WTTR) board, as a member of the Greater Houston March of Dimes board, and on the KBH Energy Center for Business, Law, and Policy Executive Council. She graduated with a Bachelor of Science degree in Petroleum Engineering from Texas A&M University, is registered with the Texas Board of Professional Engineers, a member of the Society of Petroleum Engineers, and a member of Women Corporate Directors.

|

Vice President and Chief Accounting Officer

Age: 39

Officer since: 2019

| Gregory M. Babcock

Mr. Babcock has served as our Vice President and Chief Accounting Officer (Principal Accounting Officer) since August 2019. Previously, Mr. Babcock served as the Company’s Corporate Controller from May 2018 to August 2019. Prior to that, Mr. Babcock served as the Assistant Controller of Talos Energy LLC from September 2015 until the May 2018 business combination of Talos Energy LLC and Stone Energy Corporation pursuant to which Talos Energy LLC became a wholly owned subsidiary of the Company. Before his promotion to Assistant Controller, Mr. Babcock served as Financial Reporting Manager of Talos Energy LLC from May 2014 to September 2015. Prior to his tenure with Talos Energy LLC, Mr. Babcock worked for Deloitte & Touche, holding positions of increasing responsibility in audit and mergers and acquisitions transaction services. Mr. Babcock began his career with Deloitte & Touche in 2007. Mr. Babcock is a Certified Public Accountant and holds a MS in Finance and BBA in Accounting from Texas A&M University.

|

2023 PROXY STATEMENT | 21 |

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors held seventeen (17) meetings, consisting of both regular and special meetings, during 2022. During 2022, each of our incumbent directors attended at least 70% of the meetings of the Board of Directors and the meetings of the committees of the Board of Directors on which that director served (in each case, which were held during the period for which such incumbent director was a director and a member of the respective committee).

Executive Sessions. The Board of Directors holds regular executive sessions in which the Independent Directors meet without any non-independent directors or members of management. The purpose of these executive sessions is to promote open and candid discussion among the Independent Directors. The lead director, Mr. Goldman, presides at these meetings and provides the Board of Directors’ guidance and feedback to our management team.

The Board of Directors has four standing committees: the Audit Committee, the Compensation Committee, the Nominating & Governance Committee and the Safety, Sustainability and Corporate Responsibility Committee.

AUDIT

2022 Members: Charles M. Sledge (Chair) Donald R. Kendall, Jr. John “Brad” Juneau

2023 Members: Charles M. Sledge (Chair) Donald R. Kendall, Jr. Richard Sherrill

Meetings held | The primary responsibilities of the Audit Committee are to oversee our accounting and financial reporting processes as well as our affiliated and subsidiary companies, and to oversee the internal and external audit processes. The Audit Committee also assists our Board of Directors in fulfilling its oversight responsibilities by reviewing the financial information that is provided to stockholders and others and the system of internal controls that management and the Board have established. The Audit Committee oversees the independent auditors, including their independence and objectivity. However, the Audit Committee members do not act as professional accountants or auditors, and their functions are not intended to duplicate or substitute for the activities of management and the independent auditors. The Audit Committee is empowered to retain independent legal counsel and other advisors as it deems necessary or appropriate to assist the Audit Committee in fulfilling its responsibilities, and to approve the fees and other retention terms of the advisors. The Audit Committee is also tasked with periodically reviewing all related party transactions in accordance with our applicable policies and procedures and making a recommendation to the Board regarding the initial authorization or ratification of any such transaction.

The responsibilities of the Audit Committee are further detailed in the “Audit Committee Charter” that is posted on our website, www.talosenergy.com, and the “Audit Committee Report” included in this Proxy Statement.

Pursuant to the Previous Stockholders’ Agreement, the Audit Committee consisted solely of “Company Independent Directors” until the date that the Stockholders’ Agreement terminated with respect to both the Apollo Funds and the Riverstone Funds. In connection with the closing of the EnVen Acquisition the Stockholders’ Agreement was terminated.

In connection with the termination of the Stockholders’ Agreement, certain administrative/clarifying changes were made to the Audit Committee Charter.