- TALO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Talos Energy (TALO) PRE 14APreliminary proxy

Filed: 28 Mar 24, 5:23pm

☒ | Preliminary Proxy Statement | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 | |

☒ | No fee required. | |||

☐ | Fee paid previously with preliminary materials. | |||

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

TALOS ENERGY 2024 PROXY STATEMENT

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION DATED MARCH 28, 2024

Talos Energy Inc.’s 2024 Annual Meeting of Stockholders Information

| Time 10:00 a.m. Central time |  | Date May 23, 2024 |  | Place Three Allen Center 333 Clay Street, Suite 3300 Houston, Texas 77002 |  | Record Date April 3, 2024 | |||||||||

Voting Methods

Even if you plan to attend the Talos Energy Inc. 2024 annual meeting of stockholders (the “Annual Meeting”) in person, we urge you to vote in advance of the meeting using one of these advance voting methods.

By Internet: www.proxydocs.com/TALO | By Phone: 1-866-291-6999 | By Mail: P.O. Box 8016 Cary, NC 27512-9903 |

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, BY TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

The Annual Meeting is being held for the following purposes:

Matter | Page Reference (For More Detail) | |||

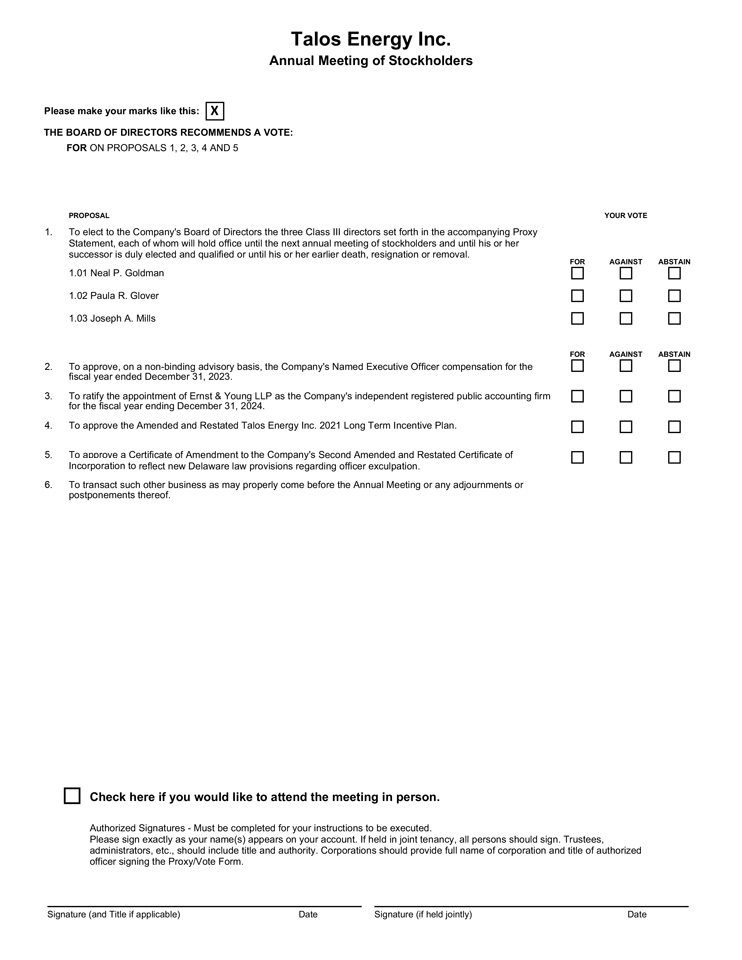

| 1 | To elect to the Company’s Board of Directors the three Class III directors nominees, set forth in the accompanying Proxy Statement, each of whom will hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. | 6 | ||

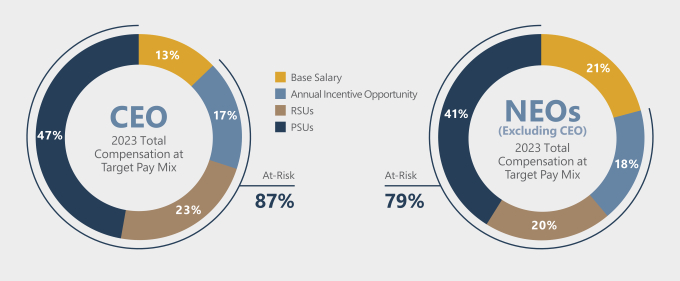

| 2 | To approve, on a non-binding advisory basis, the Company’s Named Executive Officer compensation for the fiscal year ended December 31, 2023. | 64 | ||

| 3 | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. | 66 | ||

| 4 | To approve the Amended and Restated Talos Energy Inc. 2021 Long Term Incentive Plan (the “Amended 2021 LTIP”). | 68 | ||

| 5 | To approve a Certificate of Amendment to the Company’s Second Amended and Restated Certificate of Incorporation to reflect new Delaware law provisions regarding officer exculpation (the “Exculpation Amendment”). | 78 | ||

| 6 | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. | |||

Each outstanding share of common stock, par value $0.01 per share (“common stock”) of Talos Energy Inc. (NYSE: TALO), entitles the holder of record at the close of business on April 3, 2024 to receive notice of and to vote at the Annual Meeting or any adjournments or postponements of the Annual Meeting.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION TO ATTEND THE ANNUAL MEETING.

By order of the Board of Directors,

|

William S. Moss III Executive Vice President, General Counsel and Secretary |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 23, 2024: THIS PROXY STATEMENT, THE PROXY CARD AND OUR ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023 ARE AVAILABLE AT WWW.PROXYDOCS.COM/TALO.

TABLE OF CONTENTS

ROAD MAP OF VOTING ITEMS

PROPOSAL 1 |

To Elect to the Company’s Board of Directors the Three Director Nominees Set (Page 6) | Board Vote Recommendation | ||

| We are asking our stockholders to vote on each of the three director nominees named in this proxy statement (this “Proxy Statement”) to the Board of Directors (the “Board of Directors” or “Board”) of Talos Energy Inc. (the “Company”). Both the Board and Nominating & Governance Committee of the Board (the “Nominating & Governance Committee”) believe that the director nominees have the qualifications, experience and skills necessary to represent stockholder interests through service on our Board. | FOR EACH NOMINEE ☑ | |||

PROPOSAL 2 |

To Approve, on a Non-Binding Advisory Basis, the Company’s Named Executive (Page 64) | Board Vote Recommendation | ||

| We have designed our executive compensation program to attract and retain experienced executives and align executive pay with Company performance and the long-term interests of our stockholders. We are seeking a non-binding advisory vote from our stockholders to approve the compensation of our named executive officers as described in this Proxy Statement. The Board values stockholders’ opinions, and the Compensation Committee of the Board (the “Compensation Committee”) will take into account the outcome of the non-binding advisory vote when considering future executive compensation decisions. | FOR ☑ | |||

PROPOSAL 3 |

To Ratify the Appointment of Ernst & Young LLP as the Company’s Independent (Page 66) | Board Vote Recommendation | ||

| The Audit Committee of the Board (the “Audit Committee”) has appointed Ernst & Young LLP (“EY”) to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. Both the Board and the Audit Committee believe that the appointment of the firm of EY to audit the Company’s consolidated financial statements for the year ending December 31, 2024 is in the best interests of the Company and its stockholders. As a matter of good corporate governance, stockholders are being asked to ratify the Audit Committee’s appointment of EY as independent registered public accounting firm for the year ending December 31, 2024. | FOR ☑ | |||

PROPOSAL 4 |

To Approve the Amended and Restated Talos Energy Inc. 2021 Long Term (Page 68) | Board Vote Recommendation | ||

| We are asking our stockholders to approve the Amended 2021 LTIP, which the Board has adopted subject to stockholder approval, to enable us to continue making equity awards to executive officers, directors, employees and other service providers. The proposed Amended 2021 LTIP would increase the number of shares of our common stock issuable under the plan by 3,680,000 shares. The plan is an important part of our pay-for-performance philosophy, as it allows us to award compensation that is tied to our performance and aligned with the interests of our stockholders. | FOR ☑ | |||

PROPOSAL 5 |

To Approve a Certificate of Amendment to the Company’s Second Amended and (Page 78) | Board Vote Recommendation | ||

| We are asking our stockholders to approve the Exculpation Amendment, which the Board has adopted subject to stockholder approval, to reflect new Delaware law provisions regarding officer exculpation pursuant to the State of Delaware’s recently enacted legislation under the Delaware General Corporation Law (“DGCL”). Both the Board and the Nominating & Governance Committee believe that aligning the protections available to our directors with those available to our officers will strike a balance between stockholders’ interest in accountability and their interest in the Company being able to attract and retain quality officers to work on the Company’s behalf. | FOR ☑ | |||

2024 PROXY STATEMENT | i |

ABOUT TALOS ENERGY INC.

Headquartered in Houston, Texas, Talos Energy Inc. is a leading independent offshore exploration and production (“E&P”) company with operations in the U.S. Gulf of Mexico and offshore Mexico.

Talos became a public company in May 2018 following its business combination with Stone Energy Corporation, transitioning from a private company with five original employees in 2012 to over 700 employees after our acquisition of QuarterNorth Energy Inc. (“QuarterNorth”) in March 2024. Since its founding over a decade ago, Talos has maintained its entrepreneurial spirit while growing to become the fifth largest operator on a combined Talos/QuarterNorth basis in the Gulf of Mexico offshore basin.

We take pride in leveraging our technical and operational expertise to acquire, explore and develop offshore assets in order to provide responsibly-produced energy with a commitment to safe and efficient operations, environmental responsibility, and good governance and ethics.

AREAS OF OPERATION

| ii |

|

PROXY STATEMENT SUMMARY

This summary highlights information that you will find throughout this Proxy Statement (this “Proxy Statement”) in connection with the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Talos Energy Inc. (“Talos,” the “Company,” “we,” “us” or “our”). This summary does not contain all of the information that you should consider. You should read this Proxy Statement in its entirety and the information contained in our Annual Report on Form 10-K for the year ended December 31, 2023 (our “Annual Report”), which is available under the “Presentations & Filings” tab within the “Investor Relations” section on our website at www.talosenergy.com. We are making this Proxy Statement available to you on or about April 17, 2024, in connection with the solicitation of proxies by our board of directors (our “Board” or “Board of Directors”).

2024 Annual Meeting of Shareholders

Time and Date: Thursday, May 23, 2024, 10:00 a.m. (Central time)

Location: Three Allen Center, 333 Clay Street, Suite 3300, Houston, Texas 77002

Record Date: Wednesday, April 3, 2024

Voting: In accordance with the Company’s Second Amended and Restated Certificate of Incorporation, each share of our common stock, par value $0.01 per share (“common stock”), is entitled to one vote for each proposal to be voted on.

Materials: Our proxy materials are available at www.talosenergy.com under the “Presentation & Filings” tab within the “Investor Relations” section of our website.

Voting Matters and Board Recommendations

The Board recommends that you vote on the various proposals as indicated in the “Road Map of Voting Items” on page i.

Questions and Answers about the Meeting

Please see “Questions and Answers About the Annual Meeting” beginning on page 86 for additional information about the proxy materials, the Annual Meeting and voting.

Board of Directors and Director Nominees

Independent Board: Our Board is comprised of a majority of independent directors.

Non-Executive Chairman of the Board: Neal P. Goldman has served as the independent, non-executive Chairman of the Board since 2018.

Standing Committees of the Board:

AUDIT

|

COMPENSATION

|

NOMINATING & GOVERNANCE |

SAFETY, SUSTAINABILITY AND CORPORATE RESPONSIBILITY

|

TECHNICAL

|

Independent Board Committees: Each of the Board’s committees is composed entirely of independent directors.

2024 PROXY STATEMENT | 1 |

Proxy Statement Summary

Board Committee Membership: The following table below provides for the current members and chairpersons of each standing committee of the Board.

Director | Audit Committee | Compensation Committee | Nominating & Governance Committee | SSCR Committee | Technical Committee | |||||

Duncan |

|

|

|

|

| |||||

Glover |

|

|

| ✓* |

| |||||

Goldman |

|

| ✓* |

|

| |||||

Juneau | ✓ |

| ✓ | ✓ | ✓* | |||||

Kendall | ✓ | ✓* |

|

|

| |||||

Mills |

|

|

|

|

| |||||

Sherrill |

|

|

|

|

| |||||

Sledge | ✓* | ✓ | ✓ |

|

| |||||

Szabo |

| ✓ |

| ✓ | ✓* | |||||

| * | Serves as the Chairperson |

Please see “Governance and Board Matters—Committees of the Board” for additional information regarding our Board’s standing committees.

Director Nominees:

The Company has proposed the following three (3) director nominees for election to the Board at the Annual Meeting, each for a one-year term until the Company’s next annual meeting of stockholders to be held in 2025.

Director Nominees | Age | Director Since | Independent* | Current Committee Memberships | ||||||||||

Neal P. Goldman Chairman

Managing Member, SAGE Capital Investments | 54 | 2018 | ✓ | • Nominating & Governance (Chair) | ||||||||||

Paula R. Glover Director

President, Alliance to Save Energy | 56 | 2021 | ✓ | • SSCR (Chair) | ||||||||||

Joseph A. Mills Director**

Chief Executive Officer, Samson Resources II, LLC & Founder/Owner, Waterford Energy, LLC | 64 | 2024 | ✓ | • None | ||||||||||

| * | As determined by the Board. |

| ** | Serves as the designee of QuarterNorth pursuant to the QuarterNorth Merger Agreement (as defined herein). |

| 2 |

|

Proxy Statement Summary

Other Directors:

The Company’s other directors include:

Directors | Age | Director Since | Independent* | Current Committee Memberships | ||||||||

Timothy S. Duncan President and Chief Executive Officer, | 51 | 2018 | No | • None | ||||||||

Charles M. Sledge Director

Former Chief Financial Officer, | 58 | 2018 | ✓ | • Audit (Chair) • Compensation • Nominating & Governance | ||||||||

John “Brad” Juneau Director

Co-Founder and Chairman, Contango Ore, Inc. (NYSE: CTGO) | 64 | 2018 | ✓ | • Audit • Nominating & Governance • SSCR • Technical (Co-Chair) | ||||||||

Donald R. Kendall, Jr. Director

Managing Director and Chief Executive Officer, Kenmont Capital Partners | 71 | 2018 | ✓ | • Audit • Compensation (Chair) | ||||||||

Shandell Szabo Director

Former Vice President of US Exploration, Anadarko Petroleum Corporation | 49 | 2023 | ✓ | • Compensation • SSCR • Technical (Co-Chair) | ||||||||

Richard Sherrill Director

President of Howard Low Carbons Solutions, Howard Energy Partners | 58 | 2023 | ✓ | • None | ||||||||

| * | As determined by the Board. |

2024 PROXY STATEMENT | 3 |

Proxy Statement Summary

Board and Governance Practices and Highlights

The Company is committed to good corporate governance as part of our efforts to promote the long-term interests of stockholders, maintain strong Board and management accountability, and continue building public trust in the Company. Our Board and governance practices include:

BOARD AND GOVERNANCE PRACTICES | ||

Size of Board | 9 members | |

Average Age of Directors | 58 years | |

Average Tenure of Directors | 4.5 years | |

Number of Independent Directors(1) | 8 of 9 | |

Fully Independent Standing Board Committees | Yes | |

Annual Election of Directors | Declassified Board beginning in 2025 | |

Majority Voting for Directors | Yes | |

Director Resignation Policy | Yes | |

Supermajority Voting Provisions | No | |

Independent Non-Executive Chairman | Yes | |

Regular Executive Sessions of Independent Directors | Yes | |

Annual Board and Committee Self-Evaluations | Yes | |

Active Board Refreshment (4 new directors since 2021) | Yes | |

Equity Grants to Non-Executive Directors | Yes | |

Number of Board Meetings Held in 2023 | 18 | |

Code of Business Conduct and Ethics Applicable to Directors | Yes | |

Policy on Related Person Transactions | Yes | |

Board Oversight of Enterprise Risk Management and Long-Term Strategy | Yes | |

Full and Free Access for Directors to Officers, Employees and Company Books and Records | Yes | |

Board-Level Oversight of Safety, Sustainability and Corporate Responsibility Matters | Yes | |

Management-Level Disclosure Committee for Financial Reporting | Yes | |

Annual Non-Binding Advisory Vote on Executive Compensation | Yes | |

Poison Pill | No | |

Stock Ownership Policy for Senior Executives and Non-Employee Directors | Yes | |

Anti-Hedging and Anti-Pledging Policies | Yes | |

Clawback Policy | Yes | |

Directors Sit on the Board of More than Three Other Public Companies in Addition to our Board | No | |

| (1) | All directors, other than Mr. Duncan, have been deemed independent by the Board in accordance with NYSE standards. |

The Board recognizes the importance of maintaining strong corporate governance practices for both enabling effective oversight of the Company’s business and helping to fulfill the Board’s responsibilities to the Company’s stockholders. The Board is therefore committed to continuing to monitor—and implementing where practicable—best practices for corporate governance, as well as seeking to listen to feedback on these topics from its stockholders and other key stakeholders.

| 4 |

|

Proxy Statement Summary

The Board proactively reviews the Company’s corporate governance policies and considers corporate governance issues and feedback from our stockholders and other key stakeholders. Examples of recent changes in corporate governance practices include:

| • | declassifying our Board, with each of our directors being elected annually, beginning at the annual meeting of stockholders to be held in 2025; and |

| • | ongoing Board refreshment which is informed by the Board’s assessment of skills, experience and tenure with the recent appointments of Ms. Glover in 2021, Mr. Sherrill and Ms. Szabo in 2023, and Mr. Mills in 2024. |

2024 PROXY STATEMENT | 5 |

PROPOSAL 1: ELECTION OF DIRECTORS

At the recommendation of the Nominating & Governance Committee, the Board of Directors has nominated the following three (3) individuals for election as Class III directors of the Company:

|  |  | ||

Neal P. Goldman Chair of Board |

Paula R. Glover Director |

Joseph A. Mills Director |

Each of the directors nominated by the Board has consented to serving as a director nominee, being named in this Proxy Statement, and serving on the Board if elected. Each director elected at the Annual Meeting will be elected to serve a one-year term beginning at the Annual Meeting and expiring at the next annual meeting of stockholders, and until either they are re-elected or their successors are duly elected and qualified or until their earlier death, resignation or removal. If any nominee is unable to serve or otherwise will not serve as a director at the time of the Annual Meeting, the proxy holders may vote for any nominee designated by the present Board to fill the vacancy. See “Governance and Board Matters—Board Composition” beginning on page 7 for biographical information regarding our directors, including our director nominees.

On January 13, 2024, we executed a merger agreement to acquire QuarterNorth, a privately-held U.S. Gulf of Mexico E&P company (such acquisition, the “QuarterNorth Acquisition,” and such agreement, the “QuarterNorth Merger Agreement”). Pursuant to the QuarterNorth Merger Agreement, we (a) increased our Board size from eight (8) to nine (9) members and (b) pursuant to the QuarterNorth Merger Agreement, appointed QuarterNorth’s Board designee, Mr. Joseph A. Mills, as a new member of our Board of Directors, effective as of the closing of QuarterNorth Acquisition on March 4, 2024.

Mr. Mills was appointed to serve until the 2024 Annual Meeting of Stockholders or until his successor is elected and qualified, or, if earlier, until his respective death, disability, resignation, disqualification or removal from office.

Mr. Goldman, Ms. Glover and Mr. Mills are each designated as a Class III director and assuming the stockholders elect them to the Board, their one-year term of office will expire in 2025. Messrs. Duncan, Sledge, Juneau, Kendall and Sherrill and Ms. Szabo are currently serving as directors of the Company. See “Governance and Board Matters—Corporate Governance—Declassified Board Structure” for additional information.

The Board of Directors has no reason to believe that its director nominees will be unable or unwilling to serve if elected. If a director nominee becomes unable or unwilling to accept nomination or election, the persons acting under your proxy will vote for the election of a substitute nominee, if any, that the Board of Directors recommends.

Vote Required

The election of each nominee for director in this Proposal 1 requires the affirmative vote of a majority of the votes cast with respect to that nominee’s election.

For this Proposal 1, a “majority of the votes cast” means that the number of votes cast FOR a nominee’s election exceeds the number of votes cast AGAINST that nominee’s election.

Abstentions and broker non-votes with respect to this proposal are not treated as votes cast and, therefore, will have no effect on the outcome of this Proposal 1.

Recommendation

The Board unanimously recommends that stockholders vote FOR the election to the Board of each of the three (3) director nominees named in this Proxy Statement. |

| 6 |

|

GOVERNANCE AND BOARD MATTERS

Board Composition

Set forth below is biographical information about each of our current directors, including our director nominees, each as noted below.

|

Neal P. Goldman

Background: • Managing Member, SAGE Capital Investments, LLC, a consulting firm specializing independent board of director services, restructuring, strategic planning and transformations for companies in multiple industries including energy, technology, media, retail, gaming and industrials (2013 to Present) • Managing Director, Och Ziff Capital Management, LP (2014 to 2016) • Founding Partner, Brigade Capital Management, LLC (2007 to 2012) • Portfolio Manager, MacKay Shields LLC • Various positions at Salomon Brothers Inc. (mergers and acquisitions and high yield trading)

Current Public Boards: • Weatherford International plc (NASDAQ: WFRD) (December 2019 to Present) – Nominating and Governance Committee (Chair) – Audit Committee (Vice Chair; audit committee financial expert) – Compensation and Human Resources Committee • Diamond Offshore Drilling, Inc. (NYSE: DO) (May 2021 to Present) – Chairman • KLDisccovery Inc. (OTC: KLDI) (March 2024 to Present)

Prior Public Boards: • Stone Energy Corporation (March 2017 to May 2018) – Chairman • Mallinckrodt plc (NYSE: MNK) (June 2022 to November 2023) – Human Resources and Compensation Committee (Chair) – Audit Committee (audit committee financial expert) • Core Scientific, Inc. (OTC: CORZQ) (2002 to 2023) • Various other public boards held prior to 2019, including Redbox Entertainment Inc., Ultra Petroleum Corporation, Midstates Petroleum Company, LLC, Ditech Holding Corporation (f/k/a Walter Investment Management Corp.) and Pimco Income Strategy Fund I and II

| |||||

Chairman

Age: 54 Director since: 2018

| ||||||

Committees: • Nominating & Governance (Chair)

| ||||||

Education: University of Michigan, B.A.

University of Illinois, M.B.A.

| ||||||

| We believe Mr. Goldman’s involvement in strategic and financial planning, and public company corporate governance, and his leadership experience on multiple boards, bring valuable leadership and perspective to our Board of Directors. | ||||||

2024 PROXY STATEMENT | 7 |

Governance and Board Matters

|

Timothy S. Duncan

Background: • Co-founder, President and Chief Executive Officer, Talos Energy Inc. (NYSE: TALO) (February 2012 to Present) • Senior Vice President of Business Development and Founder, Phoenix Exploration Company, LP, which was sold to Apache Corporation in August 2011 (2006 to 2011) • Manager of Reservoir Engineering and Evaluations, Gryphon Exploration (2000 to 2005) • Various reservoir engineering and portfolio evaluation functions for Amerada Hess Corporation, Zilkha Energy Company and Pennzoil E&P Company (1995 to 2000)

Leadership/Service: • Dean’s Advisory Council for College of Engineering and the Foundation Board at Mississippi State University • National Ocean Industries Association (NOIA) – Chair (2021 to 2022) – Vice Chair (2020 to 2021) – Director (Present) • American Cancer Society CEOs Against Cancer • Appointed by U.S. Secretary of Energy to the National Petroleum Council (2024-2025)

Current Public Boards: • Chesapeake Energy Corporation (NASDAQ: CHK) (February 2021 to Present) – Audit Committee (audit committee financial expert) – Compensation Committee – ESG Committee

Other Expertise, Associations and Honors: • Over the last 20 years, helped developed two other exploration and production companies from the ground up • Society of Petroleum Engineers • Independent Petroleum Association of America • Named Ernst & Young Entrepreneur of the Year for the Energy & Energy Services sector in the Gulf Coast area (June 2016) • Honored as a Distinguished Fellow of the College of Engineering at Mississippi State University (2012) • Honored as one of 20 Agents of Change in Energy for Hart Energy’s 50th anniversary inaugural recognition ceremony (2023)

| |||||

President and Chief Executive Officer, Director

Age: 51 Director since: 2018

| ||||||

Committees: • None

| ||||||

Education: Mississippi State University, B.S. (Petroleum Engineering)

Bauer Executive Program at the University of Houston, M.B.A.

| ||||||

| Mr. Duncan brings executive leadership as a senior officer of oil and gas companies as well as extensive experience as a reservoir engineer and broad industry knowledge as a member of our Board of Directors. | ||||||

| 8 |

|

Governance and Board Matters

|

Paula R. Glover

Background: • President, Alliance to Save Energy (January 2021 to Present) • President and Chief Executive Officer, American Association of Blacks in Energy (“AABE”), a non-profit professional association focused on ensuring that African Americans and other minorities have input into the discussions and development of energy policy, regulations and environmental issues (July 2013 to January 2021) • Vice President of Operations and Director of Communications, AABE (October 2008 to July 2013) • Appointed by the U.S. Secretary of Energy to the National Petroleum Council (March 2014 to Present) • More than 25 years in the energy industry, having held positions of increasing scope and responsibility across the consumer and community sides of the energy industry

Leadership: • Alliance to Save Energy, Board of Directors (June 2017 to Present) • Groundswell, Board of Directors (Governance Committee Chair) • Keystone Policy Center, Board of Directors (member of Executive Committee) • Resources for the Future, Board of Directors

Other Current Public Boards: • None | |||||

Director

Age: 56 Director since: 2021 | ||||||

Committees: • SSCR (Chair) | ||||||

Education: University of Delaware, B.S. (Marketing Management)

| ||||||

| We believe that Ms. Glover’s diverse professional experience in the energy industry and experience with public policy in the energy industry make her a valuable member of our Board of Directors. | ||||||

|

John “Brad” Juneau

Background: • Co-founder and Chairman of the Board, Contango ORE, Inc. (NYSE: CTGO), a publicly traded gold exploration company (2012 to Present) • President and Chief Executive Officer, CTGO (August 2012 to January 2020) • Founder, Sole Manager and General Partner, Juneau Oil and Gas, LLC, an exploration and production oil and natural gas company (1998 to Present) • Senior Vice President of Exploration, Zilkha Energy Company (1987 to 1998) • Staff Petroleum Engineer, Texas International Company responsible for reservoir engineering, acquisitions and evaluations • Production Engineer, Enserch Corporation

Current Public Boards: • Contango ORE, Inc. (NYSE: CTGO) (2012 to Present) – Chairman (2013 to Present)

Prior Boards: • Stone Energy Corporation (March 2017 to May 2018) | |||||

Director

Age: 64 Director since: 2018

| ||||||

Committees: • Audit • Nominating & Governance • SSCR • Technical (Co-Chair)

| ||||||

Education: Louisiana State University, B.S. (Petroleum Engineering)

| ||||||

| We believe that Mr. Juneau’s extensive industry background, including his expertise in reservoir engineering and exploration and production, bring valuable perspective and technical expertise to the Board of Directors. | ||||||

2024 PROXY STATEMENT | 9 |

Governance and Board Matters

|

Donald R. Kendall, Jr.

Background: • Founding Managing Director and Chief Executive Officer, Kenmont Capital Partners, a private investment and advisory firm (October 1998 to Present) • General Partner, New Climate Ventures (an early-stage venture capital firm that focuses on innovative companies that reduce or avoid carbon) (November 2020 to Present) • Former President, Cogen Technologies Capital Company, a power generation firm (1993 to 1998) • Executive Chairman and Chief Executive Officer, Palmetto Partners, a family office and investment management company for a Forbes 400 family (1993 to 1998) • Formerly ran project finance and leasing groups at Credit Suisse First Boston, Drexel Burnham and Morgan Stanley

Other Current Public Boards: • None

Prior Boards: • American Midstream Partners LP (2013 to 2019) – Audit Committee – Conflicts Committee • Solar City Corporation (2012 to 2016) – Audit Committee (Chair) – Special Committee (Chair) for SolarCity’s acquisition by Tesla – Compensation Committee • Stream Energy (privately held) (2012 to 2017) – Audit Committee (Chair) – Compensation Committee – Nominating and Governance Committee

Other Leadership and Experience: • Extensive experience in restructurings and workouts, reorganizations and recapitalizations, mergers and acquisitions, and public offerings • Board Member of Bat Conservation International, Earthwatch International, Ecological Defense Group, Incorporated and Mar Alliance • Trustee of Hamilton College and member of the Investment Committee, the Board of Overseers of The Amos Tuck School of Business Administration at Dartmouth College, Chair of the Jane Goodall Institute, Vice Chair of the Houston Zoo, Inc. and a member of its Conservation Committee and chair of multiple committees of various nonprofits boards

| |||||

Director

Age: 71 Director since: 2018

| ||||||

Committees: • Audit • Compensation (Chair)

| ||||||

Education: Hamilton College, B.A. (Economics)

The Amos Tuck School of Business Administration at Dartmouth College, M.B.A.

| ||||||

| We believe that Mr. Kendall’s extensive executive management experience, including as a chief executive officer, and his perspective having served on various public and private company boards, make him a valuable member of our Board of Directors. | ||||||

| 10 |

|

Governance and Board Matters

|

Joseph A. Mills

Background: • Chief Executive Officer, Samson Resources II, LLC, a privately held exploration and production company (September 2023 to Present; March 2017 to March 2021) • Executive Chairman and Principle Executive Officer, Roan Resources Company (f/k/a NYSE: ROAN) (November 2018 to December 2019) • Founder and Owner, Waterford Energy, LLC (October 2015 to Present) • Chairman of the Board and Chief Executive Officer, Eagle Rock Energy Partners, L.P. (f/k/a NASDAQ: EROC) a midstream/upstream master limited partnership (May 2007 to October 2015) • Founder and Chief Executive Officer, Montierra Minerals & Production, L.P. (April 2006 to October 2016) • Senior Vice President of Operations, Black Stone Minerals Company, L.P. (September 2003 to January 2006) • Senior Vice President, Technical Services and Gulf of Mexico Division (2001 to 2003); Vice President of Land and Acquisitions (1999 to 2001) of El Paso Production Company • Various Vice President level management roles on and offshore, Sonat Exploration Company (1982 to 1999)

Other Current Public Boards: • None

Current Private Boards: • Samson Resources II, LLC (March 2017 to Present) • Riviera Resources, Inc. (f/k/a Linn Energy Inc.) (January 2020 to Present) – Audit Committee (Chair) • Liberty Resources Company (October 2020 to Present) • Caliber Midstream Company (March 2022 to Present) – Chairman

Prior Boards: • QuarterNorth Energy Inc. (August 2021 to February 2024) – Audit Committee (Chair; audit committee financial expert) – Operations/ESG and Compensation Committees • Hawkes Acquisition Corporation (NYSE: HWKZ) (March 2021 to July 2023) – Audit and Compensation Committees • Roan Resources Company (f/k/a NYSE: ROAN) (2018 to 2019) – Executive Chairman • CUI Global, Inc. (NASDAQ: CUI) (2015 to 2016) – Audit Committee • Eagle Rock Energy Partners, L.P. (f/k/a NASDAQ: EROC) (May 2007 to October 2015) – Chairman • Montierra Minerals and Production, LP (April 2006 to October 2016)

Other Leadership and Experience: • Former audit committee and audit committee financial expert for NYSE / NASDAQ criteria • Governance, Risk Assessment and Mitigation background • Financial Oversight experience • Operational execution and turnaround expertise • Completed over $28 billion of M&A transactions over 40-year career

| |||||

Director

Age: 64 Director since: 2024

| ||||||

Committees: • None

Education: The University of Texas at Austin, B.A., Petroleum Land Management

University of Houston, M.B.A

| ||||||

| We believe Mr. Mills’ 40+ year career in the upstream, midstream and mineral industry, as well as public company CEO-level management experience and prior board leadership in the exploration and production industry, make him a valuable member of our Board of Directors. | ||||||

2024 PROXY STATEMENT | 11 |

Governance and Board Matters

|

Richard Sherrill

Background: • President, Howard Low Carbon Solutions (“HLCS”), an energy transition company focused on carbon capture, transportation and sequestration of CO2 which was formed in 2023 with the merger of CAP (November 2023 to Present) • Founding Partner and President, Clean Aire Partners (“CAP”), an energy transition company formed in 2021 which focused on carbon capture, processing, transportation, and sequestration of CO2 and merged with HLCS in 2023 (2021 to 2023) • President and Director, Ceritas Energy (“Ceritas”), a midstream natural gas company focused on providing producers with midstream gathering and processing solutions in various onshore regions of the U.S. and backed by private equity firms Quantum Energy Partners and Energy Spectrum Partners (2003 to 2019) • Chief Commercial Officer, Duke Energy North America (“DENA”), a subsidiary of Duke Corporation (NYSE: DUK) with commercial responsibilities for nonregulated natural gas and power (1998 to 2003) • Vice President, Natural Gas Clearinghouse (ultimately Dynegy, Inc.) holding various commercial positions in finance, physical and financial trading (1992 to 1998) • Vice President, First Interstate Bank of Texas (now part of Wells Fargo) working with upstream, midstream and energy merchant clients in the Energy Lending Group (1988 to 1992)

Other Current Public Boards: • None

Current Private Boards: • ARM Energy

Prior Boards: • EnVen Energy Corporation (2015 to February 2023 when EnVen was acquired by Talos) – Lead Director – Audit Committee (Chair) – Risk and Compensation Committees • Castex Energy (2018 to 2021) – Audit Committee (Chair) – Risk Committee • Ceritas Energy, Director

| |||||

Director

Age: 58 Director since: 2023

| ||||||

Committees: • None

Education: The University of Texas at Austin, B.B.A. (Finance)

| ||||||

| We believe that Mr. Sherrill’s over 30 years of experience in the oil and gas industry and prior board experience in the energy sector bring valuable skills and perspective to our Board of Directors | ||||||

| 12 |

|

Governance and Board Matters

|

Charles M. Sledge

Background: • Chief Financial Officer, Cameron International Corporation, an oilfield services company (2008 until its sale to Schlumberger Limited in 2016) • Corporate Controller, Cameron International Corporation (2001 to 2008)

Current Public Boards: • Weatherford International plc (NASDAQ: WFRD) (December 2019 to Present) – Chairman – Audit Committee (Chair) – Safety, Environment and Sustainability Committee • Noble Corporation plc (NYSE: NE) (February 2021 to Present) – Chairman

Prior Boards: • Stone Energy Corporation (March 2017 to May 2018) • Vine Resources, Inc., Non-executive Chairman • Expro International, Non-executive Chairman | |||||

Director

Age: 58 Director since: 2018

| ||||||

Committees: • Audit (Chair) • Compensation • Nominating & Governance

Education: Louisiana State University, B.S. (Accounting)

Harvard Business School Advanced Management Program

| ||||||

| We believe that Mr. Sledge’s extensive financial, public company reporting and accounting background, including 20 years of experience as a financial executive in the energy industry, and experience in M&A, capital market transactions, capital allocation strategy and evaluating cybersecurity risk, makes him a valuable member of our Board of Directors. | ||||||

2024 PROXY STATEMENT | 13 |

Governance and Board Matters

|

Shandell Szabo

Background: • Nearly 20 years with Anadarko Petroleum Corporation (“Anadarko”) in various roles of steadily increasing responsibility throughout Anadarko’s U.S. onshore portfolio and deepwater Gulf of Mexico, including: – Vice President of US Exploration (2018 to 2019) – Vice President of Lower 48 Onshore Exploration (2016 to 2018) – Director of Investor Relations (2015 to 2016) – Exploration Manager Greater Permian (2014 to 2015) – General Manager of the Anadarko’s Freestone, Chalk, and Hugoton fields (2013 to 2015) – Geoscience Manager Haynesville East Texas (2011 to 2013) – Regional Gulf of Mexico Manager (2009 to 2010) • Prior to Anadarko, various subsurface and geoscience positions in basins in the U.S. onshore and Gulf of Mexico • Advisor, Bain Co., consulting on energy matters (Present)

Leadership: • Montgomery County executive leadership team for the Leukemia and Lymphoma Society • Chair - 2022 & 2023 Student Visionaries of the Year leadership program, Leukemia and Lymphoma Society • Corporate Regional Council for the United Way of Greater Houston

Other Current Public Boards: • None

Current Private Boards: • Biota Technologies – Chairman – Compensation Committee (Chair)

Prior Boards: • EnVen Energy Corporation (2020 until February 2023 when EnVen was acquired by Talos) – Risk/Safety Committee (Chair) – Compensation Committee | |||||

Director

Age: 49 Director since: 2023

| ||||||

Committees: • Compensation • SSCR • Technical (Co-Chair)

Education: University of Michigan, B.S. (Environmental Science, concentration Geology)

Texas Christian University, M.S. (Environmental Science, concentration Geology) | ||||||

| We believe that Ms. Szabo’s extensive experience in the oil and gas sector at various management level positions for nearly 20 years and her expertise in exploration and geologic risk and reservoir engineering, economics, and planning provide a valuable, operations-level perspective as a member of the Board of Directors. | ||||||

| 14 |

|

Governance and Board Matters

Director Independence

Assuming the stockholders elect to the Board of Directors the director nominees set forth in “Proposal 1: Election of Directors” above, the Board of Directors has determined that each of the following directors are “independent” pursuant to the New York Stock Exchange (“NYSE”) Listing rules:

| • | Neal P. Goldman |

| • | Paula R. Glover |

| • | John “Brad” Juneau |

| • | Donald R. Kendall, Jr. |

| • | Joseph A. Mills |

| • | Richard Sherrill |

| • | Charles M. Sledge |

| • | Shandell Szabo |

On February 13, 2023, in connection with the closing of our acquisition of EnVen Energy Corporation (“EnVen” and such acquisition, the “EnVen Acquisition”) and the related termination of the Stockholders’ Agreement (as defined herein), Robert M. Tichio resigned from the Board of Directors and each of Ms. Szabo and Mr. Sherrill were appointed to the Board of Directors. At such time, the Board of Directors determined that each of Mr. Sherrill and Ms. Szabo were “independent” pursuant to NYSE rules and were assigned their respective committees based on such determination. See “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreement” for additional information.

On October 30, 2023, the Board of Directors deferred a determination of Mr. Sherrill’s independence due to his new role as President of Howard Low Carbon Solutions, an affiliate of Howard Energy Partners, a co-member in our Coastal Bend LLC (“Coastal Bend”) carbon capture and sequestration (“CCS”) project in Corpus Christi, Texas. Accordingly, Mr. Sherrill stepped down from the Audit Committee and Compensation Committee on October 30, 2023 and each of Mr. Juneau and Mr. Sledge replaced Mr. Sherrill on the Audit Committee and Compensation Committee, respectively. On March 18, 2024, Talos sold its entire CCS business, including Coastal Bend. On March 26, 2024, in light of the sale of the Company’s CCS business, the Board reaffirmed that Mr. Sherrill was “independent” pursuant to NYSE rules.

On March 4, 2024, in connection with the closing of the QuarterNorth Acquisition, Mr. Mills was appointed to the Board of Directors to serve until the Annual Meeting. On March 26, 2024, the Board determined that Mr. Mills was “independent” pursuant to NYSE rules.

The Board anticipates appointing Messrs. Mills and Sherrill to committees in connection with the Board’s annual evaluation of committee membership and structure.

In connection with its assessment of the independence of each non-management director, the Board of Directors also determined that:

| • | each of Messrs. Sledge, Kendall and Juneau is independent as defined in Section 10A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and under the standards set forth by the NYSE applicable to members of the Audit Committee; and |

| • | each of Messrs. Kendall and Sledge and Ms. Szabo is independent under the standards set forth by the NYSE applicable to members of the Compensation Committee. |

2024 PROXY STATEMENT | 15 |

Governance and Board Matters

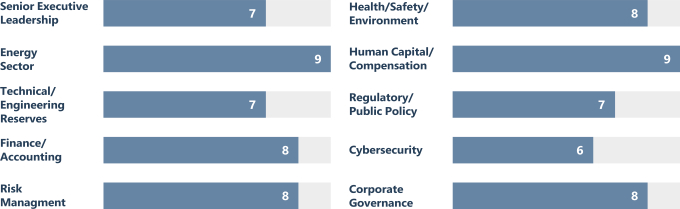

Qualifications, Skills and Experience of Our Directors & Director Nominees

We believe the members of our Board possess a broad variety of personal attributes, experience and skills giving our Board the depth and breadth necessary to effectively oversee management on behalf of our stockholders. Our Board is committed to diversity and the importance of different backgrounds, perspectives and views. The matrix below represents some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy. The matrix does not include all knowledge, skills, experience or other attributes of our directors and director nominees, which may be relevant and valuable to their service on our Board. The diversity of knowledge, skill, experience and attributes of our directors and director nominees, collectively, lends itself to a highly collaborative and effective Board.

QUALIFICATIONS AND EXPERIENCE OUT OF 9 DIRECTORS

Board Diversity

Our Board seeks to consider women and underrepresented director candidates for membership on the Board. Consistent with our ongoing commitment to creating a balanced Board with diverse viewpoints and deep industry expertise, our Board will continue to maintain its commitment to seeking diverse perspectives and experiences when evaluating nominees to the Board.

| 16 |

|

Governance and Board Matters

COMMITTEES OF THE BOARD

Overview of Responsibilities of our Board’s Standing Committees

| Audit | Compensation | Nominating & Governance | Safety, Sustainability and Corporate Responsibility (SSCR) | Technical | ||||||||||||

Assists the Board with:

• monitoring the integrity of financial statements

• evaluating independent registered public accounting firm’s qualifications, performance and independence

• evaluating effectiveness and performance of internal audit

• legal and regulatory compliance matters

• enterprise risk management and major cybersecurity risks

|

Assists the Board with:

• executive and director compensation

• overseeing compensation-related risks |

Assists the Board with:

• evaluating director nominees

• Board structure

• corporate governance practices

• executive succession planning

• annual Board, committee and CEO performance reviews |

Assists the Board with oversight of:

• safety matters

• environmental issues (including sustainability and climate change)

• social matters (including diversity, equity and inclusion)

• other corporate responsibility matters |

Assists the Board with oversight of:

• asset and portfolio development

• evaluation of reserves |

Non-Standing Committees: From time to time, the Board may designate various non-standing special committees such as the CCS Investment Committee which was formed in February 2023 with specific authority to review and recommend strategic transactions with respect to CCS matters and/or transactions. Each of Messrs. Goldman, Kendall and Sledge currently serve on the CCS Investment Committee.

2024 PROXY STATEMENT | 17 |

Governance and Board Matters

AUDIT COMMITTEE

2023 Members(1)(2) Sledge (Chair) Juneau Kendall

Meetings held |

|

| Primary Responsibilities

• overseeing our accounting and financial reporting processes

• overseeing the internal and external audit functions and processes and compliance responsibilities

• authorizing investigations into any matter, including, but not limited to, complaints relating to accounting, internal accounting controls or auditing matters within the scope of responsibilities delegated to the Audit Committee

• reviewing the Company’s enterprise risk management framework and policies and procedures for risk assessment and the Company’s major financial risks, major legal, regulatory and compliance risks and major cybersecurity risks

• assisting our Board of Directors in fulfilling its oversight responsibilities by reviewing the financial information that is provided to stockholders and others and the system of internal controls that management and the Board have established

• appointing, compensating, retaining and overseeing the independent registered public accounting firm, including their independence and objectivity; however, the Audit Committee members do not act as professional accountants or auditors, and their functions are not intended to duplicate or substitute for the activities of management and the independent registered public accounting firm

• retaining independent legal counsel and other advisors as it deems necessary or appropriate to assist the Audit Committee in fulfilling its responsibilities

• approving the fees and other retention terms of the advisors

• reviewing related party transactions in accordance with our Related Party Transaction Policy that would require disclosure under Item 404(a) of Regulation S-K and procedures and making a recommendation to the Board regarding the initial authorization or ratification of any such transaction

• reviewing and discussing with management and the independent registered public accounting firm the Company’s annual audited financial statements or quarterly financial statements prior to the filing of its annual report on Form 10-K (including recommending that such audited financial statements be included therein) or quarterly reports on Form 10-Q, including disclosures made in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” • discussing with the independent registered public accounting firms the matters required to be discussed by the independent registered public accounting firm with the Audit Committee under auditing standards established by the Public Company Accounting Oversight Board (“PCAOB”)

The Audit Committee Charter is posted in the “Corporate Governance” tab within the “Investor Relations” section of our website at www.talosenergy.com.

See also “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreement.” | |||||

| (1) | Each Member of the Audit Committee is financially literate and is an audit committee financial expert as defined by the U.S. Securities and Exchange Commission (the “SEC”). See “—Financial Literacy of Audit Committee and Designation of Financial Experts” below for additional information. |

| (2) | From January 1, 2023 through February 13, 2023, Mr. Juneau served on the Audit Committee prior to Mr. Sherrill’s appointment on February 13, 2023. As of October 30, 2023, Mr. Sherrill stepped down as a member of the Audit Committee and Mr. Juneau was redesignated as a member of the Audit Committee. |

Financial Literacy of Audit Committee and Designation of Financial Experts

The Board of Directors evaluated each of the members of the Audit Committee for financial literacy and the attributes of a financial expert.

On February 13, 2023, the Board of Directors determined that each of the Audit Committee members, Messrs. Kendall, Sledge and Sherrill, is financially literate and is an audit committee financial expert as defined by the SEC for the fiscal year ended December 31, 2023. On October 30, 2023, the Board of Directors reaffirmed that Mr. Juneau is financially literate and is an audit committee financial expert as defined by the SEC.

| 18 |

|

Governance and Board Matters

COMPENSATION COMMITTEE

2023 Members(1) Kendall (Chair) Sledge K Szabo

Meetings held in 2023: 7 | Primary Responsibilities

• reviewing, approving and recommending periodically the compensation and other benefits for our employees, officers and independent directors

• reviewing and approving corporate goals and objectives relevant to the compensation of our executive officers in light of those goals and objectives, and setting compensation for these officers based on those evaluations

• administering the issuance of stock awards under any stock compensation plans

• ensuring stockholders are given the opportunity to vote on the Company’s equity-compensation plans (as may be required by law), the Company’s organizational documents (as amended from time to time), the Company’s Corporate Governance Guidelines and the listing standards of the NYSE

• monitoring the Company’s compliance with the requirements of the Sarbanes-Oxley Act of 2002 relating to loans to directors and officers and other applicable laws affecting employee compensation and benefits

• assessing periodically the need for changes to the Company’s stock ownership guidelines and recommending any changes to the Board

• reviewing and discussing with the Company’s management the Compensation Discussion and Analysis included in this Proxy Statement

• producing the Compensation Committee Report as required by Item 407(e)(5) of Regulation S-K included in this Proxy Statement

• reviewing, modifying (as applicable) and administering the Company’s Clawback policy

• discharging the Board’s responsibilities relating to compensation of the Company’s executive officers and directors

• performing such other functions as the Board may assign to the Compensation Committee from time to time

The Compensation Committee is delegated all authority of the Board of Directors as may be required or advisable to fulfill its purposes. The Compensation Committee may delegate to its Chairman, any one of its members or any subcommittee it may form, the responsibility and authority for any particular matter, as it deems appropriate from time to time under the circumstances. The Compensation Committee is also generally able to delegate authority to review and approve the compensation of our employees to certain executive officers, including with respect to stock option or stock appreciation rights grants made under any stock option plans, stock compensation plans or stock appreciation rights plans.

Meetings of the Compensation Committee may, at the discretion of the Compensation Committee, include members of the Company’s management, other members of the Board of Directors, consultants or advisors and such other persons as the Compensation Committee believes to be necessary or appropriate.

The Compensation Committee may, in its sole discretion, retain and determine funding for legal counsel, compensation consultants, as well as other experts and advisors (collectively, “Committee Advisors”), including the authority to retain, approve the fees payable to, amend the engagement with and terminate any Committee Advisor, as it deems necessary or appropriate to fulfill its responsibilities. The Compensation Committee assesses the independence of any Committee Advisor prior to retaining such Committee Advisor.

The Compensation Committee Charter is posted in the “Corporate Governance” tab within the “Investor Relations” section of our website at www.talosenergy.com. | |||||||

| (1) | From January 1, 2023 through February 13, 2023, Mr. Sledge served on the Compensation Committee prior to Mr. Sherrill’s appointment on February 13, 2023. As of October 30, 2023, Mr. Sherrill stepped down as a member of the Compensation Committee and Mr. Sledge was redesignated as a member of the Compensation Committee. |

2024 PROXY STATEMENT | 19 |

Governance and Board Matters

NOMINATING & GOVERNANCE COMMITTEE

2023 Members Goldman (Chair) Juneau Sledge

Meetings held in 2023: 4 | Primary Responsibilities

• reviewing and making recommendations to the Board regarding the nature, organization, composition and the structure, format and frequency of the meetings of the Board and Board committees, and the individual director to serve on each Board committee

• actively seeking individuals qualified to become Board members, including in the event of a vacancy on the Board, and recommending such director nominees

• reviewing each director’s continuation on the Board prior to expiration of each director’s term

• reviewing the criteria for the nomination of director candidates and approving changes to criteria, as appropriate

• reviewing and considering any stockholder-recommended candidates for nomination to the Board

• reporting to the Board with an assessment of the performance of the Board, the Board’s committees and management

• reviewing and reassessing the adequacy of the Company’s Corporate Governance Guidelines and recommending any proposed changes to the Board for approval annually

• considering corporate governance issues that arise from time to time and developing appropriate recommendations for the Board

• reviewing the Company’s compliance programs and policies, including the Company’s Corporate Code of Business Conduct and Ethics

• meeting with the Board annually on succession planning and identifying and periodically updating, the qualities and characteristics necessary for an effective CEO and the Board’s policy on structure and offices of Chairperson and CEO

• developing and evaluating general education and orientation programs for directors

• reviewing regularly with management the Company’s major governance risks and executive succession risks, steps taken, and monitoring such exposures

Additional information regarding the functions performed by the Nominating & Governance Committee is set forth below under the “—Corporate Governance” and “Stockholder Proposals; Identification of Director Candidates” sections included herein. See also “Certain Relationships and Related Party Transactions—Historical Transactions with Affiliates—Stockholders’ Agreement.”

The Nominating & Governance Committee Charter is posted in the “Corporate Governance” tab within the “Investor Relations” section of our website at www.talosenergy.com. | |||||||

| 20 |

|

Governance and Board Matters

SAFETY, SUSTAINABILITY AND CORPORATE RESPONSIBILITY COMMITTEE

2023 Members Glover (Chair) Juneau Szabo

Meetings held in 2023: 4 | Primary Responsibilities

• overseeing safety and environmental (including sustainability and climate change), social (including diversity, equity and inclusion) and other corporate social responsibility (“CSR”) matters

• reviewing the Company’s safety programs and policies annually and recommending any proposed changes to the Board for approval

• monitoring compliance with the Company’s safety programs and policies, and reviewing the Company’s safety statistics

• meeting at least annually with management regarding the implementation and effectiveness of the Company’s safety programs and policies

• reviewing regularly with management the Company’s major operations risks, environmental, health and safety risks, social and human capital risks, and climate change and other sustainability risks and reviewing the steps management has taken to monitor and control such exposures

• identifying, evaluating and monitoring reports to the Board on, Safety and CSR issues, trends, risk and opportunities, including public policy, legislative, and regulatory, that affect or could reasonably affect the Company’s business, operations, performance and reputation

• reviewing the Company’s annual Environmental, Social and Governance Report and Climate Risk and Opportunity Report seeking alignment with the Task Force on Climate-related Financial Disclosures Framework (TCFD) Report

• advising the Board and management on significant stakeholder concerns or proposals relating to safety and CSR issues

The SSCR Committee Charter is posted in the “Corporate Governance” tab within the “Investor Relations” section of our website at www.talosenergy.com. | |||||||

TECHNICAL COMMITTEE

2023 Members Juneau Szabo (Co-Chairs)

Meetings held in 2023: 4 | Primary Responsibilities

• overseeing the Company’s portfolio development and assisting management and the Board with its oversight of the review and evaluation of the Company’s oil, natural gas and natural gas liquids reserves

• reviewing and monitoring the Company’s

i. portfolio development activities, including its drilling program, capital allocation, pre- and post-drill appraisals, lease sales and third party prospects; and

ii. reserves, including a review of the year-end audit performed by the Company’s independent engineering consultants and internal mid-year updates.

The Technical Committee was formed in May 2023 and each of John “Brad” Juneau and Shandell Szabo were appointed as Co-Chairs of the Technical Committee.

The Technical Committee Charter is posted in the “Corporate Governance” tab within the “Investor Relations” section of our website at www.talosenergy.com. | |||||||

2024 PROXY STATEMENT | 21 |

Governance and Board Matters

Annual Board Evaluations and Charter Reviews

The Board conducts annual performance evaluations to determine whether the Board and its committees are functioning effectively. In addition, each standing committee evaluates its performance annually and recommends any changes to the Board. The Company’s secretary oversees the annual review and each committee Chair facilitates reporting results to the committees and full Board.

Each standing committee operates under a written charter adopted by the Board, which the applicable committee reviews and evaluates at least annually. If a committee deems it to be appropriate, the committee may amend, or recommend to the full Board amendments to, such committee’s charter.

Board Oversight of Risk Management

BOARD OF DIRECTORS

Risk Management Oversight | ||||||||||||||||

AUDIT COMMITTEE

Oversight of Risk Management Process, Financial, Compliance and Cybersecurity Risks

|

COMPENSATION COMMITTEE

Oversight of Compensation Risk |

NOMINATING & GOVERNANCE COMMITTEE

Oversight of Governance and Executive Succession Risk |

SSCR COMMITTEE

Oversight of Safety, Social, Human Capital and Climate Related Risk |

TECHNICAL COMMITTEE

Oversight of Portfolio and Reserves Risk | ||||||||||||

Enterprise Risk Management

Effective risk oversight is a priority of the Board. Executive management is responsible for the day-to-day management of Company risks through internal processes and controls, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management.

In connection with its oversight, the Board as a whole oversees the Company’s assessment of major risks and the measures taken to manage such risks. For example, the Board of Directors:

| • | oversees the long-term strategic plans of the Company and assesses risks and efforts to mitigate such risks that would cause the Company to fail to achieve its strategic goals |

| • | reviews management’s capital spending plans, approves the Company’s capital budget and requires that management present, for Board review, significant departures from those plans |

| • | oversees management of the Company’s commodity price risk through regular review with executive management of the Company’s derivatives strategy |

| 22 |

|

Governance and Board Matters

| • | monitors the Company’s liquidity profile and its compliance with the financial covenants contained in its borrowing arrangements |

| • | has established specific dollar limits on the commitment authority of members of senior management for certain transactions and requires Board approval of expenditures exceeding that authority and of other material contracts and transactions |

Audit Committee. The Audit Committee oversees the Company’s enterprise risk management framework and policies and procedures for risk assessment and risk management, and the Company’s major financial risks, major legal regulatory and compliance risks and major cybersecurity risks. The Audit Committee additionally oversees the work of, and relationship with, the independent registered public accounting firm, the Company’s financial statements and related disclosure and the Company’s internal audit function and related party transactions.

Compensation Committee. The Compensation Committee exercises oversight of all matters of executive compensation policy, including the Company’s plans, policies and programs to compensate the Company’s employees, including with respect to management and mitigation of compensation-related risks and the administration of the Company’s Clawback Policy (as described below) and compliance with applicable rules and regulations pertaining thereto.

Nominating & Governance Committee. The Nominating & Governance Committee oversees the nomination of director candidates, including the skills, qualifications and criteria related thereto, the Company’s succession planning, the Company’s corporate governance practices in accordance with the Company’s Corporate Governance Guidelines, and the Company’s compliance programs and policies, including the Company’s Corporate Code of Business Conduct and Ethics.

SSCR Committee. The SSCR Committee oversees the Company’s strategies, policies and procedures for addressing safety (“Safety”) and environmental (including sustainability and climate change), social (including diversity, equity and inclusion) and other CSR matters.

Technical Committee. The Technical Committee oversees the Company’s portfolio development and the evaluation of the Company’s oil, natural gas and natural gas liquids reserves.

DIRECTOR ATTENDANCE

Board and Committee Meetings

The Board held eighteen (18) meetings consisting of four (4) regular and fourteen (14) special meetings during 2023. During fiscal year ended December 31, 2023, each director attended at least 75% of the aggregate total number of Board and applicable Board committee meetings on which such director sits.

2023 Annual Meeting of Stockholders

Under our Corporate Governance Guidelines, our directors are encouraged to attend our annual meeting of stockholders. 100% of our then-serving directors attended the 2023 Annual Meeting of Stockholders. We anticipate that all of our directors will attend this upcoming Annual Meeting.

Executive Sessions

The Board of Directors holds regular executive sessions in which the non-management directors meet without any management directors or members of management. During 2023, non-management directors of the Board met in executive session nine (9) times. The purpose of these executive sessions is to promote open and candid discussion among the non-management directors. Mr. Goldman, in his capacity as the “lead director,” presides at these meetings and provides the Board of Directors’ guidance and feedback to our management team.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors believes that sound governance practices and policies provide an important framework to assist it in fulfilling its duty to stockholders. The Company’s “Corporate Governance Guidelines” cover the following subjects, among others:

| • | the size of the Board of Directors; |

| • | qualifications and independence standards for the Board of Directors; |

2024 PROXY STATEMENT | 23 |

Governance and Board Matters

| • | director responsibilities; |

| • | Board leadership; |

| • | meetings of the Board and of non-management directors; |

| • | committee requirements and functions and independence of committee members; |

| • | director compensation; |

| • | annual performance evaluations and succession planning; |

| • | review of governance policies, copies of which are posted on the Company’s website at www.talosenergy.com; |

| • | stockholder communications with directors; and |

| • | access to independent advisors, senior management and other employees. |

The Corporate Governance Guidelines are posted on the Company’s website at www.talosenergy.com. The Corporate Governance Guidelines are reviewed periodically and as necessary by the Company’s Nominating & Governance Committee, and any proposed additions to or amendments of the Corporate Governance Guidelines will be presented to the Board of Directors for its approval.

The NYSE has adopted rules that require listed companies to adopt governance guidelines covering certain matters. The Company believes that the Corporate Governance Guidelines comply with the NYSE rules.

Board Leadership

One of the Board’s responsibilities is to provide leadership to the Company and independent oversight of management. The Board understands that the optimal Board leadership structure may vary as circumstances warrant. Consistent with this understanding, the Nominating & Governance Committee considers the Board’s leadership structure periodically.

Our Second Amended and Restated Bylaws provide that the Chairman of the Board may be any director elected by a majority of the Board. On May 10, 2023, Neal P. Goldman was re-elected as Chairman of the Board. At this time, the Board believes that separating of the roles of Chairman of the Board and the Chief Executive Officer provides the optimal Board leadership structure for us because it balances the needs for the Chief Executive Officer to manage the Company’s operations with the benefit provided to the Company by the Chairman’s perspective as an independent member of the Board.

The Corporate Governance Guidelines require that the Chairman of the Board, if he or she is a non-management director, will be the “lead director” responsible for preparing an agenda for the meetings of the non-management directors in executive session. In the event the Chairman of the Board is a member of management, a lead director will be chosen by the non-management members of the Board. Mr. Goldman, the current Chairman of the Board, is a non-management director and therefore serves as lead director of the Board.

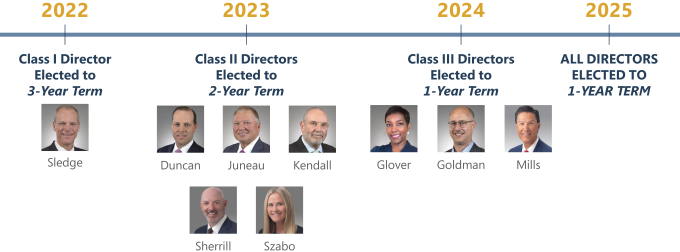

Declassified Board Structure by 2025

| 24 |

|

Governance and Board Matters

Beginning at the 2025 Annual Meeting of Stockholders, the Board of Directors will be fully declassified, with all directors up for re-election on an annual basis for a one-year term thereafter. The Board of Directors determined that a declassified board structure is appropriate for the Company, with such declassification occurring in stages beginning with the 2023 Annual Meeting of Stockholders and that annual voting on director nominees provides stockholders with a more active voice in shaping the composition of the Board and implementing corporate governance policies.

As part of the transition to a declassified board structure at the 2025 Annual Meeting of Stockholders, the Board of Directors is currently divided into three classes serving staggered three-year terms. Pursuant to our Second Amended and Restated Bylaws adopted in February 2023, the Board of Directors will be declassified from three classes to one class at the 2025 Annual Meeting of Stockholders, with each director being elected annually for a one-year term thereafter. Until the 2025 Annual Meeting of Stockholders, the Board shall remain classified, and accordingly, at the Annual Meeting, each Class III director nominated herein will be elected for a one-year team, ending at the 2025 Annual Meeting of Stockholders.

In connection with the QuarterNorth Acquisition, Mr. Mills, in his capacity as the “Company Designated Director” (as such term is defined in the QuarterNorth Merger Agreement), was appointed as a Class III director at the closing of the QuarterNorth Acquisition to serve until the Annual Meeting. As such, Mr. Goldman, Ms. Glover and Mr. Mills are each designated as a Class III director and assuming the stockholders elect them to the Board as set forth in “Proposal 1: Election of Directors” above, their one-year term of office will expire in 2025. Messrs. Duncan, Juneau, Kendall and Sherrill and Ms. Szabo are each designated as Class II directors and their two-year terms of office will expire in 2025. Mr. Sledge is designated as a Class I director and his term of office will expire in 2025.

BOARD EVOLUTION

Our Board is committed to maintaining a composition that includes a range of expertise aligned with our business as well as a fresh perspective on our strategy. One of the ways the Board acts on this commitment is through the thoughtful refreshment of directors when appropriate. The Board has a process to seek out highly qualified director candidates who would bring relevant experience to the Board in light of our strategy, including with respect to our growing scale. Since 2021, we have added four directors to our Board of Directors, of which three were recently added to our Board pursuant to applicable Board designation rights. See “Certain Relationships and Related Party Transactions—Board Designation Rights” for additional information.

2024 PROXY STATEMENT | 25 |

Governance and Board Matters

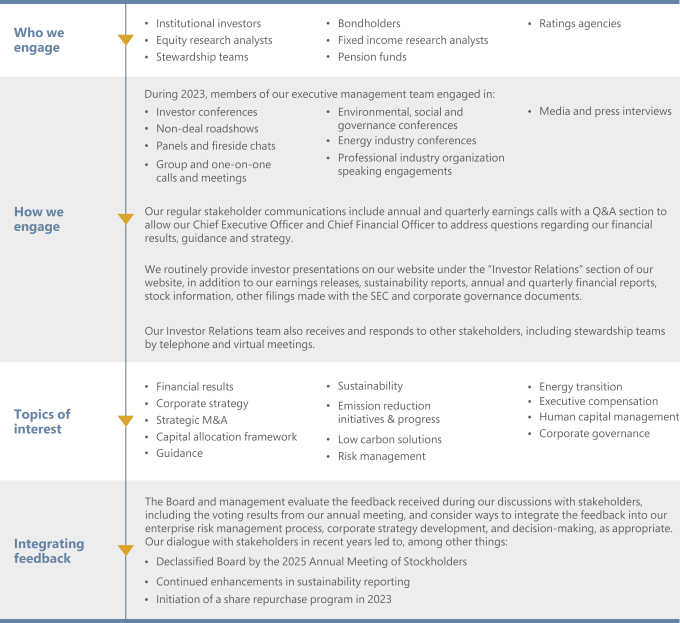

Stakeholder Engagement

To foster ongoing dialogue and build relationships, we proactively engage with and obtain feedback from our stakeholders throughout the year to help identify the emerging issues our stakeholders consider to be most important when evaluating our company. We seek opportunities to discuss and solicit stakeholder views on our strategy, business, corporate governance, executive compensation, sustainability and other topics of concern. The feedback we receive helps broaden our perspective, shape business and governance decisions, and align with stakeholder expectations, as appropriate.

| 26 |

|

Governance and Board Matters

Director Compensation

Non-employee director compensation elements are designed to:

| • | Align director compensation with long-term stockholder interests; |

| • | Ensure the Company can attract and retain outstanding director candidates; |

| • | Recognize substantial time commitments necessary to fulfill the responsibilities of a director and oversee the affairs of the Company; and |

| • | Support the independence of thought and action expected of directors. |

Non-employee director compensation levels are reviewed by the Compensation Committee each year, and resulting recommendations are presented to the full Board for approval. The Compensation Committee’s independent compensation consultant provides information on current developments and practices in director compensation. The Compensation Committee utilizes the same independent compensation consultant retained by the committee to advise on executive compensation to provide this analysis regarding director compensation.

The non-employee director compensation program includes:

| • | annual cash retainers; |

| • | annual grants of restricted stock units (“RSUs”); |

| • | supplemental cash retainers for chair and committee service; |

| • | for certain committee(s), a monthly retainer (in addition to or in lieu of supplemental committee retainers) based on the time commitment, technical nature of responsibilities and/or other factors; and |

| • | reimbursement of reasonable expenses incurred to attend Board meetings or other functions relating to responsibilities as a director. |

The tables below set forth the 2023 compensation program for our non-employee directors.

Type of Payment | Amount Paid | Features | ||

Annual Cash Retainer | Non-Executive Chairman:

• $150,000

Directors:

• $80,000 | Paid in quarterly installments. | ||

Annual Equity Award | Non-Executive Chairman:

• $230,000

Directors:

• $160,000 | Granted in the form of RSUs that vest on the first anniversary of the date of grant.

Directors may elect to defer settlement of their RSUs until a later date.

New non-employee directors receive a pro-rated annual equity grant.

Shares issued in settlement of RSUs are subject to the Company’s stock ownership requirements. | ||

2024 PROXY STATEMENT | 27 |

Governance and Board Matters

Directors also received supplemental cash retainers for service on Board committees in the following amounts during 2023:

Role | Type of Payment | Amount Paid(1) | Terms of Payment | |||

Audit Committee |

| Chair: • $25,000 Member: • $12,500 |

| |||

Compensation Committee |

| Chair: • $15,000 Member: • $7,500 |

| |||

Safety, Sustainability and Corporate Responsibility Committee | Supplemental annual cash retainer | Chair: • $15,000 Member: • $7,500 | Paid in quarterly installments | |||

Nominating & Governance Committee |

| Chair: • $10,000 Member: • $5,000 |

| |||

Technical Committee

(established May 2023) |

| Co-Chairs: • $15,000(2) |

| |||

CCS Investment Committee

(established February 2023) | Monthly cash retainer | Member:

$20,000 per month | Paid monthly | |||

| (1) | The Non-Executive Chairman, who currently also serves as the Chairman of the Nominating & Governance Committee, is not eligible to receive the supplemental retainers provided to chairs and members of the committees. |

| (2) | Beginning on April 1, 2024 for an initial period of six months, members of the Technical Committee will be paid a monthly cash retainer of $20,000 per month for their service on that committee. Thereafter, the Company intends that members will receive a supplemental annual cash retainer of $10,000 and chairpersons will receive a supplemental annual cash retainer of $20,000, paid quarterly. |

Each non-employee director may additionally receive $1,500 for each meeting of the Board or a committee (other than the CCS Investment Committee) above 10 meetings (both in-person and telephonic). Each director is also reimbursed for reasonable travel and miscellaneous expenses incurred to attend meetings and activities of the Board and the committees. Our Non-Executive Chairman participates in our medical and dental plans but pays the full cost of the premiums out of pocket.

In accordance with our non-employee director compensation program, we granted RSUs to each non-employee director on March 5, 2023, which vested in full on March 5, 2024, subject to the non-employee director’s continued service. In the year prior to grant, each non-employee director was provided the opportunity to defer the settlement of their RSUs until a later date, as timely selected pursuant to the deferral election form. Following the vesting date, or such later date as elected by the director pursuant to the deferral election, these RSUs are settled 60% in shares of our common stock and 40% in cash, unless the director timely elects for the awards to be settled 100% in shares of our common stock. Vesting of the RSUs will accelerate in full upon (i) a termination of the non-employee director’s service due to death or (ii) a “change in control” (as defined in the applicable long-term incentive plan). Our non-employee directors are also subject to the Talos Energy Inc. Stock Ownership Policy (the “Stock Ownership Policy”), as further described below under “Executive Compensation Matters—Compensation Discussion and Analysis—Other Matters—Stock Ownership Policy.”

| 28 |

|

Governance and Board Matters

2023 DIRECTOR COMPENSATION TABLE

The table below reflects the cash compensation earned during 2023 and the value of RSUs granted during 2023 by the members of the Board that are compensated by us for their service on the Board.

Name | Fees earned or paid in Cash | Stock Awards(1) | Total | |||||||||