- DAY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Dayforce (DAY) PRE 14APreliminary proxy

Filed: 4 Mar 21, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to § 240.14a-12 |

Ceridian HCM Holding Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

ceridian notice of 2021 annual meeting and proxy statement April 27, 2021

Ceridian HCM Holding Inc.

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that Ceridian HCM Holding Inc. (“Ceridian”) will hold its 2021 Annual Meeting of Stockholders (the “Annual Meeting”) as follows:

Date and Time Tuesday, April 27, 2021 9:00 a.m., Central Daylight Time

|

Place Online at www.virtualshareholdermeeting.com/CDAY2021 |

Record Date March 1, 2021 |

Due to concerns relating to the COVID-19 pandemic, and to support the health and wellbeing of our stockholders, guests, and employees, our Annual Meeting will not be held in person but will be conducted as a virtual meeting hosted by means of a live webcast. Stockholders will vote on the following items of business:

Item

|

| Board Recommendation |

Election of directors

|

|

FOR each nominee

|

Approval of Ceridian’s Fourth Amended and Restated Certificate of Incorporation

|

|

FOR

|

Advisory vote on the compensation of Ceridian’s named executive officers

|

|

FOR

|

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021

|

|

FOR

|

In addition, Ceridian will consider any other business as may properly come before the Annual Meeting or any adjournment, continuation, or postponement thereof.

On or about March 17, 2021, Ceridian mailed or made available to its stockholders proxy materials, including the proxy statement for the Annual Meeting (the “Proxy Statement”), its 2020 Annual Report for the fiscal year ended December 31, 2020 (the “2020 Annual Report”) and form of proxy or the Notice of Internet Availability. These proxy materials can be accessed directly at www.proxyvote.com.

If you plan to attend the virtual Annual Meeting, please note the log-in procedures described under “Admission” on page 2 of the Proxy Statement.

If you have any questions regarding this information or the proxy materials, please contact Ceridian’s Corporate Secretary at stockholders@ceridian.com.

By Order of the Board of Directors,

William E. McDonald

Senior Vice President, Deputy General Counsel and Corporate Secretary

Minneapolis, Minnesota

March 17, 2021

This Notice of Annual Meeting and Proxy Statement and Form of Proxy

are being distributed and made available on or about March 17, 2021.

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Stockholders to Be Held on April 27, 2021. The Proxy Statement and 2020 Annual Report are available electronically on the “Investor Relations�� page of Ceridian’s website located at www.ceridian.com and at www.proxyvote.com.

2021 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

|

| Page |

| viii | |

| viii | |

Matters to be Voted on and Recommendations of the Board of Directors |

| ix |

| x | |

| xi | |

| 1 | |

| 6 | |

| 7 | |

| 8 | |

| 9 | |

| 9 | |

| 12 | |

| 12 | |

| 15 | |

| 15 | |

| 16 | |

| 16 | |

| 18 | |

| 19 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 22 | |

| 23 | |

| 23 | |

| 25 | |

| 28 | |

| 28 | |

| 28 | |

| 28 | |

| 29 | |

PROPOSAL TWO: APPROVAL OF CERIDIAN’S FOURTH AMENDED AND RESTATED CERTIFICATE OF INCORPORATION |

| 30 |

| 31 | |

| 31 | |

PROPOSAL THREE: ADVISORY VOTE ON THE COMPENSATION OF CERIDIAN’S NAMED EXECUTIVE OFFICERS |

| 59 |

| 60 | |

| 62 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 63 |

| 67 |

|

|

|

|

| 2021 PROXY STATEMENT |

CAUTIONARY STATEMENT PURSUANT TO THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their companies. With the exception of historical information, the matters discussed in this Proxy Statement are forward-looking statements and may be identified by the use of words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “intent,” “foresee,” “outlook,” “plan,” “project” and other words and terms of similar meaning. Such statements reflect our current view with respect to future events and are subject to certain risks, uncertainties and assumptions. A variety of factors could cause our future results to differ materially from the anticipated results expressed in such forward-looking statements. Readers should review Part I, Item 1A, Risk Factors, of our 2020 Annual Report for a description of important factors that could cause our future results to differ materially from those contemplated by the forward-looking statements made in this Proxy Statement. Our forward-looking statements speak only as of the date of this Proxy Statement or as of the date they are made, and we undertake no obligation to update our forward-looking statements.

|

|

|

|

| 2021 PROXY STATEMENT |

Together we are pleased to invite you to attend the 2021 Annual Meeting of Stockholders of Ceridian HCM Holding Inc. (“Ceridian”) to be held virtually on April 27, 2021 at 9:00 a.m., Central Daylight Time at www.virtualshareholdermeeting.com/CDAY2021. Out of our concern for the health and wellbeing of our stockholders, guests, and employees during the COVID-19 pandemic, we are holding our Annual Meeting virtually again in 2021.

We are proud of how Ceridian has risen to the challenge of the COVID-19 pandemic. At Ceridian, the wellbeing of our employees, customers, suppliers, and partners is our top priority. From the outset of the crisis, we pivoted to a virtual working environment for nearly all of our employees, implementing social distancing measures where possible, restricting non-essential business travel, and enhancing preventative cleaning services at all office locations. Our business demonstrated its resiliency throughout the crisis and our response did not include any layoffs related to COVID-19, and as vaccines provide us with hope, we see Ceridian emerging from this crisis stronger and closer as a workforce than ever before.

Further, we shared our leadership and best practices on how to address the challenges of the COVID-19 pandemic with our customers and the general public. We launched the COVID-19 Learning Portal for all of our customers and the general public. This portal offers curated COVID-19 content on the following topics: employee wellness, leading remote teams, working from home strategies: strategies for remote employees, and coronavirus preparedness and prevention. We held webinars on topics ranging from addressing workplace issues to business continuity, to safety and mental health implications of the pandemic.

While the COVID-19 pandemic challenges us, 2020 was another year of growth for Ceridian’s business and our corporate governance. We would like to take this opportunity to share an update on the progress we have made as a Board in ensuring we remain responsive and accountable to the views of our stockholders in this past year.

Enhanced Stockholder Engagement. Our Board values stockholder input as we provide oversight of the strategic growth of the Company. The chairs of our Compensation Committee and Corporate Governance and Nominating Committee have conducted listening sessions with holders of 65% of our outstanding Common Stock throughout the past year in order to solicit feedback on corporate governance, compensation practices, and environmental, social & governance topics. We incorporated that feedback directly into our decision making on corporate governance, compensation and environmental, social & governance practices, and will continue to place an emphasis on stockholder engagement moving forward.

Increased Board Responsiveness. One key piece of feedback we heard from our stockholders in 2020 was a desire for more methods of direct accountability by us as Board members to our stockholders. With that in mind, we are seeking your approval at the Annual Meeting to sunset the classified board system that was in place coming out of our 2018 initial public offering. Further, the Board would like to announce its commitment to move to the use of majority election standards for its elections no later than our 2024 Annual Stockholder Meeting. These are two significant steps that we believe will enhance our accountability to you as stockholders.

Commitment to Board Diversity. Our Board remains comprised of a majority of independent directors and welcomed Linda P. Mantia as an additional independent director in 2020. As you will see from the Board skills matrix we are disclosing for the first time in this Proxy Statement, the Board emphasizes diversity in its membership and we are proud that 44% of our membership is either ethnically or gender diverse. We ended the year with all Board committees being comprised entirely of independent members, and 33% of them led by a female chair.

|

|

|

| vi |

2021 PROXY STATEMENT |

2020 was an important year for our governance development and for Ceridian as a whole. For more information on our growth, governance, and compensation practices that we were focused on this past year, we would encourage you to read the accompanying Proxy Statement and the 2020 Annual Report.

With gratitude for your confidence and support,

|

|

|

|

David D. Ossip Chair and Chief Executive Officer

| Gerald C. Throop Lead Director, Chair of the Audit Committee, Member of the Compensation Committee |

|

|

|

| vii |

2021 PROXY STATEMENT |

2021 Annual Meeting of Stockholders

Virtual Annual Meeting

Due to the public health concerns relating to the COVID-19 pandemic, and to support the health and wellbeing of our stockholders, guests, and employees, our Annual Meeting will again be conducted in a virtual-only format. You may participate in the Annual Meeting by logging in at www.virtualshareholdermeeting.com/CDAY2021 and providing the control number found in your proxy card, voter instruction form, or Notice.

While you will not be able to attend the Annual Meeting at a physical location, you will have the same rights and opportunities to participate in the virtual Annual Meeting as you would at an in-person meeting. When you enter the Annual Meeting by entering the 16-digit control number found on your proxy card, voter instruction form, or Notice, as applicable, you will be able to vote and ask questions at the Annual Meeting. Questions by shareholders may be submitted in real time during the Annual Meeting and will be addressed by the Board or management of the Company as applicable.

Date and Time

9:00 a.m., Central Daylight Time, Tuesday, April 27, 2021

Place

www.virtualshareholdermeeting.com/CDAY2021

Record Date

March 1, 2021 (the “Record Date”)

How to Cast Your Vote

Your vote is important! Please vote your shares promptly using one of the following methods listed below. See page 2 of this Proxy Statement for additional voting information.

|

|

|

|

| |

Vote by Internet

|

|

|

| Go to www.proxyvote.com 24 hours a day, seven days a week (Have your proxy card in hand when you visit the website) | |

Vote by Telephone

|

|

|

| Call toll-free at 1-800-690-6903 (Have your proxy card in hand when you call)

| |

Vote by Mail

|

|

|

| Complete and mail your proxy card

| |

Vote at the Virtual Meeting

|

|

|

| Enter the 16-digit control number found on your proxy card, voter instruction form, or Notice, as applicable, at the time you log into the meeting at www.virtualshareholdermeeting.com/CDAY2021 | |

If you hold exchangeable shares of Ceridian AcquisitionCo ULC, please see page 2 below for voting instructions.

|

|

|

| viii |

2021 PROXY STATEMENT |

Matters to be Voted on and Recommendations of the Board of Directors (“Board”)

|

|

|

| |||

|

| Proposal

|

| Board Recommendation |

| Additional Information |

Proposal One

|

|

Election of directors

|

|

FOR each nominee

|

|

Page 6

|

Proposal Two

|

|

Approval of Ceridian’s Fourth Amended and Restated Certificate of Incorporation

|

|

FOR

|

|

Page 30

|

Proposal Three

|

|

Advisory vote on the compensation of Ceridian’s named executive officers

|

|

FOR

|

|

Page 59

|

Proposal Four

|

|

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2021

|

|

FOR

|

|

Page 60 |

Proposal One: Election of Directors

Our Board has nominated David D. Ossip, Andrea S. Rosen, and Gerald C. Throop for election as Class III directors to hold office until the 2024 Annual Meeting of Stockholders. Please refer to page 10 of this Proxy Statement for additional important information about each of the nominees. Each of the nominees is a current member of our Board and has consented to serve if elected. The Board recommends a vote “FOR” each nominee.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||

|

|

|

| Principal Occupation |

| Company Director |

|

|

| Committee Memberships | ||||

Nominee/Age |

| Class |

| Independent |

| Audit |

| Compensation |

| Corporate Governance and Nominating | ||||

|

|

|

|

|

|

|

| |||||||

David D. Ossip Age: 54

|

|

III |

|

Chief Executive Officer, Ceridian

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Andrea S. Rosen Age: 66 |

|

III |

|

Independent Director |

| 2018 |

| ✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

|

|

|

|

| |||||||

Gerald C. Throop Age: 63 |

|

III |

|

Independent Director |

| 2018 |

| ✓ |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Chair

Chair

Member

Member

Audit Committee Financial Expert

Audit Committee Financial Expert

Proposal Two: Approval of Fourth Amended and Restated Certificate of Incorporation

We are asking stockholders to approve the Fourth Amended and Restated Certificate of Incorporation which will de-classify our Board over three years in favor of annual director elections. We believe this change will provide stockholders with the opportunity to annually register their views on the collective performance of the Board and on each director individually. The Board recommends that you vote “FOR” the approval of the Fourth Amended and Restated Certificate of Incorporation.

Proposal Three: Advisory Vote on the Compensation of Ceridian’s Named Executive Officers (“NEOs”)

We are asking our stockholders to approve, on a non-binding, advisory basis, the compensation of our NEOs as disclosed in the Compensation Discussion and Analysis (“CD&A”) tabular disclosures and related narrative of this Proxy Statement. The Board recommends a vote “FOR” approval of NEO compensation because it believes that the policies and practices described in the CD&A beginning on page 31 of this Proxy Statement are based on

|

|

|

| ix |

2021 PROXY STATEMENT |

principles that reflect a “pay-for-performance” philosophy and are strongly aligned with our stockholders’ interests. Since the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to any NEO and will not be binding on or overrule any decisions by the Compensation Committee or the Board. However, because we value our stockholders’ view, the Compensation Committee and Board will carefully consider the results of this advisory vote when formulating future executive compensation philosophy, policies, and practices.

Proposal Four: Ratification of the Appointment of KPMG LLP as our Independent Registered Public Accounting Firm for Fiscal Year 2021

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2021, and we are asking our stockholders to ratify this appointment. The Board recommends a vote “FOR” this ratification.

Corporate Governance Highlights

We are committed to sound corporate governance practices. As we enter our fourth year following our initial public offering, our Board has continued to adopt measures designed to bolster the independent leadership on the Board and establish additional meaningful stockholder rights while continuing to maintain best practice efforts adopted previously.

Changes since 2020 Annual Meeting of Stockholders | |

» All committees comprised of independent directors » Commitment by Board to use majority election standards for director elections no later than 2024 Annual Meeting » Proposal to sunset classified board over three years » Publication of our initial corporate social responsibility report on March 31, 2021 |

» Developed and produced Board skills matrix to focus refreshment efforts and ensure diversity of skills and viewpoints on Board » Enhanced our stockholder engagement program, conducting meetings between the chairs of our Compensation Committee and Corporate Governance and Nominating Committee and holders of 56% of our outstanding stock following the Annual Meeting |

|

|

Continuing Priorities | ||||

Conduct annual Board and Board committee self-assessments

|

|

Ensure significant Board role in strategy and risk oversight

|

| Conduct regular executive sessions of independent directors at Board and Board committee meetings |

Maintain our commitment to diversity with 44% of our Board members being ethnically or gender diverse |

| No pledging or hedging of Ceridian stock by directors or executive officers |

| All directors and executive officers satisfy our robust stock ownership guidelines |

|

|

|

|

|

|

|

|

| x |

2021 PROXY STATEMENT |

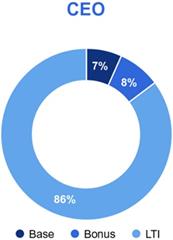

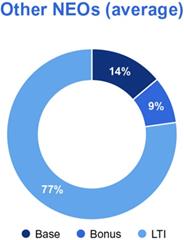

Consistent with our pay-for-performance policy, a significant portion of our executive compensation is tied to Ceridian’s performance – most notably through our annual short-term incentive plan and use of stock options as the majority equity vehicle. In 2020, we emphasized stockholder engagement, and we incorporated stockholder feedback into our 2020 and 2021 compensation program through enhanced emphasis on performance-based awards, including the use of performance-based restricted stock units in 2021 as a component of our executive officers’ annual long-term incentive equity awards.

Continuing Priorities | ||||||

Maintain Maintain compensation recovery (clawback) policy in the event of material accounting restatement in our financial statements |

|

Align NEO compensation

|

|

Utilize Willis Towers

|

|

Limit the number and

|

|

|

|

| xi |

2021 PROXY STATEMENT |

Ceridian HCM Holding Inc.

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

Our Board of Directors (the “Board”) solicits your proxy on our behalf for the 2021 Annual Meeting of Stockholders (the “Annual Meeting”), and at any adjournment, continuation or postponement of the Annual Meeting, for the purposes set forth in this proxy statement for the Annual Meeting (the “Proxy Statement”) and the accompanying Notice of 2021 Annual Meeting of Stockholders (the “Notice”).

In this Proxy Statement, the terms “Ceridian,” “the Company,” “we,” “us” and “our” refer to Ceridian HCM Holding Inc. and its subsidiaries. The mailing address of our principal executive office is Ceridian HCM Holding Inc., 3311 East Old Shakopee Road, Minneapolis, Minnesota 55425.

Time and Date

|

|

9:00 a.m., Central Daylight Time, Tuesday, April 27, 2021

|

Live Webcast

|

|

www.virtualshareholdermeeting.com/CDAY2021

|

Record Date

|

|

March 1, 2021 (“Record Date”)

|

Entitled to Vote

|

|

Holders of record of shares of our common stock, $0.01 par value (“Common Stock”), and the holder of the share of special voting preferred stock, par value $0.01 per share (the “Special Voting Share” and together with the Common Stock, the “Voting Stock”), at the close of business on the Record Date, will be entitled to notice of and to vote at the Annual Meeting.

Each share of Common Stock is entitled to one vote on any matter presented to stockholders at the Annual Meeting. In addition, as described below under “How to Vote”, the holder of the Special Voting Share is entitled to vote on all matters on which a holder of our Common Stock is entitled to vote and is entitled to cast a number of votes equal to the number of shares of Common Stock issuable upon exchange of the exchangeable shares of Ceridian AcquisitionCo ULC (the “Exchangeable Shares”) then outstanding.

|

Shares Outstanding

|

|

As of the Record Date, 146,775,771 shares of Common Stock were outstanding and the Special Voting Share represents an additional 2,038,993 shares of Common Stock issuable upon the exchange of the Exchangeable Shares, for a total of 148,814,764 votes represented by the outstanding shares of Voting Stock. The list of stockholders entitled to vote at the Annual Meeting will be (i) available for inspection by any stockholder during the ten-day period prior to the Annual Meeting at the principal place of business (3311 East Old Shakopee Road, Minneapolis, Minnesota 55425); and (ii) open for examination by any stockholder during the entire Annual Meeting within the virtual meeting platform.

|

Proxy Materials

|

|

On or about March 17, 2021, we mailed or made available to our stockholders the proxy materials, including our Proxy Statement, the 2020 Annual Report, and form of proxy or the Notice of Internet Availability.

|

|

|

|

| 1 |

2021 PROXY STATEMENT |

|

There are four ways a stockholder of record can vote:

(1) By internet at www.proxyvote.com 24 hours a day, seven days a week (have your proxy card in hand when you visit the website); (2) By toll-free telephone at 1-800-690-6903 (have your proxy card in hand when you call); (3) By completing and mailing your proxy card; or (4) By electronic ballot at the Annual Meeting.

In order to be counted, proxies submitted by telephone, internet or U.S. mail must be received before the start of the Annual Meeting.

If you hold your shares through a bank, broker or other nominee, please follow the bank’s, broker’s or other nominee’s instructions, as applicable.

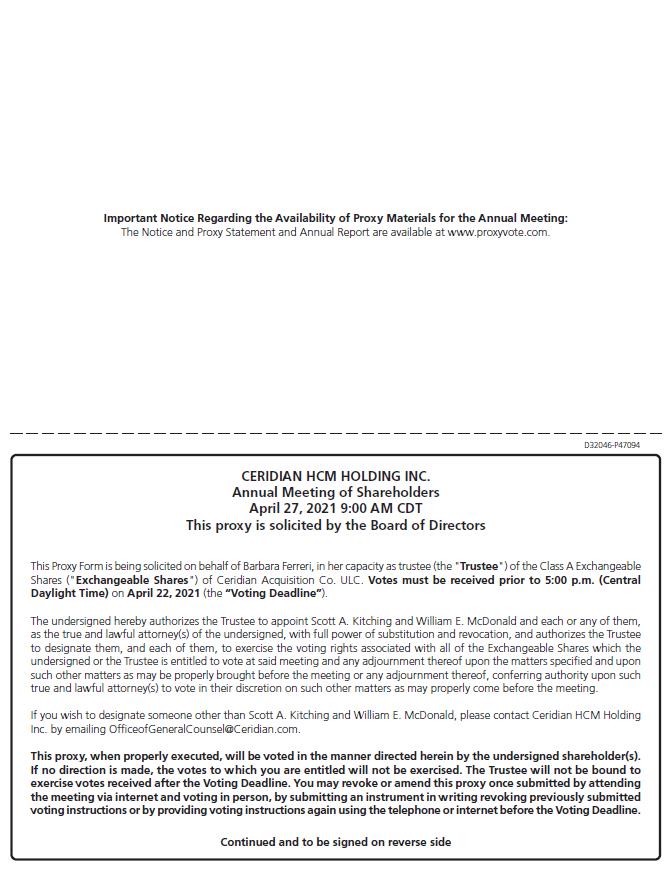

If you hold Exchangeable Shares, you are entitled to direct the trustee who holds the Special Voting Share (the “Trustee”) to cast the number of votes equal to the number of shares of Common Stock issuable upon the exchange of the Exchangeable Shares you held on the Record Date via one of the voting methods described above. The Trustee will vote pursuant to your voting instructions, which must be received prior to 5:00pm (Central Daylight Time) on April 22, 2021. Holders of Exchangeable Shares will receive a separate notice containing further details regarding voting instructions.

| |

|

|

The Annual Meeting will be a virtual meeting conducted on the following website: www.virtualshareholdermeeting.com/CDAY2021

Admission to the Annual Meeting is restricted to stockholders as of the close of business on the Record Date, valid proxy holders of such stockholders, and/or their designated representatives. To participate in the virtual meeting, you will need the 16-digit control number that is printed in the box marked by the arrow on your Notice of Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials). If your shares are held in the name of a bank, brokerage firm or other nominee, you should follow the instructions provided by them in order to participate in the virtual meeting. We recommend that you log in 15 minutes before the start of the Annual Meeting to ensure sufficient time to complete the check-in procedures.

|

Quorum

|

|

A majority of the shares of all issued and outstanding stock entitled to vote on the Record Date must be present at the Annual Meeting or represented by proxy to constitute a quorum. For purposes of determining whether a quorum is present, “all issued and outstanding stock entitled to vote” will include the number of shares of Common Stock issuable upon the exchange of the Exchangeable Shares.

|

Revoking Your Proxy

|

|

Stockholders of record may revoke their proxies by attending the Annual Meeting and voting, by submitting an instrument in writing revoking the proxy, by submitting another duly executed proxy bearing a later date to our Corporate Secretary before the vote is counted, or by voting again using the telephone or internet before the start of the Annual Meeting (your latest telephone or internet proxy is the one that will be counted). If you hold shares through a bank, broker or other nominee, please contact that firm for instructions on how to revoke your prior voting instructions.

|

|

|

|

| 2 |

2021 PROXY STATEMENT |

Votes Required to |

|

Each share of Common Stock outstanding on the Record Date is entitled to one vote on any proposal presented to stockholders at the Annual Meeting, and the Trustee is entitled to vote on all matters that a holder of our Common Stock is entitled to vote on and is entitled to cast a number of votes equal to the number of shares of Common Stock issuable upon exchange of the Exchangeable Shares then outstanding. As of the Record Date, 146,775,771 shares of Common Stock were outstanding and the Special Voting Share represents an additional 2,038,993 shares of Common Stock issuable upon exchange of the Exchangeable Shares, for a total of 148,814,764 votes represented by the outstanding shares of Voting Stock.

For Proposal One, the election of directors requires the approval of a plurality of votes cast. This means that the three nominees receiving the most “FOR” votes from the holders of the votes represented by the Voting Stock present at the Annual Meeting (either in person or by proxy) and voting on the matter will be elected. Only votes “FOR” will affect the outcome. There is no cumulative voting for the election of directors. If your broker holds your shares, your broker is not entitled to vote your shares on this proposal without your instruction. Votes “Withheld” and broker non-votes will have no effect on the outcome of the election of directors. For Proposal Two, the approval of the Fourth Amended and Restated Certificate of Incorporation, the proposal must receive “FOR” votes from the holders of a majority of the votes represented by the Voting Stock – which means it must receive approval from the holders of a majority of the votes represented by the Common Stock and Exchangeable Shares then outstanding. Votes may be cast in favor of or against the proposal or you may “Abstain.” If your broker holds your shares, your broker is not entitled to vote your shares on this proposal without your instruction. Abstentions and broker non-votes will have the effect of a vote against this Proposal Two pursuant to Delaware Law. Additionally, any Voting Stock not present at the Annual Meeting will have the effect of a vote against this Proposal Two.

|

|

|

For Proposal Three, regarding the advisory vote on the compensation of our Named Executive Officers, the proposal must receive “FOR” votes from the holders of a majority of the votes represented by the Voting Stock present at the Annual Meeting (in person or by proxy) and voting on the matter. Votes may be cast in favor of or against the proposal or you may “Abstain.” If your broker holds your shares, your broker is not entitled to vote your shares on this proposal without your instruction. As the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to any NEO and will not be binding on or overrule any decisions by the Compensation Committee or the Board. However, because we value our stockholders’ view, the Compensation Committee and Board will carefully consider the results of this advisory vote when formulating future executive compensation philosophy, policies and practices.

For Proposal Four, ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021, the proposal must receive “FOR” votes from the holders of at least a majority of the votes represented by the Voting Stock present at the Annual Meeting (in person or by proxy) and voting on the matter. Votes may be cast in favor of or against the proposal or you may “Abstain.” Your broker or other nominee will have the discretion to vote your shares on this proposal without your instruction.

|

|

|

|

| 3 |

2021 PROXY STATEMENT |

Broker Non-Votes |

|

A broker non-vote occurs when a nominee, such as a broker or bank, holding shares for a beneficial owner does not vote on a proposal because the nominee does not have discretionary authority to vote with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner. If a broker, bank, custodian, nominee or other record holder of our Common Stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then the votes represented by those shares will be treated as broker non-votes with respect to that proposal. In this regard, the election of directors (Proposal One), approval of the Fourth Amended and Restated Certificate of Incorporation (Proposal Two) and Say on Pay (Proposal Three) are matters considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore we expect broker non-votes on Proposal One, Proposal Two and Proposal Three. Proposal Four is a routine matter, so we do not expect any broker non-votes on this proposal.

If you do not instruct your broker how to vote with respect to Proposal One, Proposal Two or Proposal Three, your broker may not vote with respect to those proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on all proposals.

|

Voting Instructions |

|

If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not indicate how your shares should be voted on each item, the persons named as proxies will vote “FOR” the election of directors (Proposal One), “FOR” the approval of the Fourth Amended and Restated Certificate of Incorporation (Proposal Two), “FOR” the Say on Pay vote (Proposal Three) and “FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2021 (Proposal Four). The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment. We have not received timely notice of any other matters that may be properly presented for voting at the Annual Meeting.

|

Voting Results |

|

We will announce preliminary voting results at the Annual Meeting. We will report final voting results by filing a Current Report on Form 8-K with the Securities Exchange Commission (“SEC”) within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

|

|

|

|

| 4 |

2021 PROXY STATEMENT |

|

|

|

| 5 |

2021 PROXY STATEMENT |

Our third amended and restated certificate of incorporation provides that our Board is divided into three classes, with one class being elected at each annual meeting of stockholders. Each director serves a three-year term, with termination staggered according to class. The Class III directors whose terms will expire at the 2021 Annual Meeting of Stockholders are David D. Ossip, Andrea S. Rosen, and Gerald C. Throop. The Board has nominated each of David D. Ossip, Andrea S. Rosen, and Gerald C. Throop for re-election as Class III directors of the Board. As discussed further under Proposal Two, beginning on page 30 of this Proxy Statement, the Board has proposed eliminating this classified board structure over a three-year period starting with the 2022 Annual Meeting.

The following table sets forth summary information regarding each director nominee and continuing director as of the Record Date. Additional information regarding the six continuing directors is available in the Board of Directors section, beginning on page 12 of this Proxy Statement.

|

|

|

|

|

|

| ||||||||||

Name/Age |

| Class |

| Principal |

| Company |

| Independent |

| Other |

| Committee Memberships

| ||||

| Audit |

| Compensation |

| Corporate | |||||||||||

Nominees: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David D. Ossip Age: 54 |

| III |

| Chief Executive |

| 2015 |

|

|

| 22 |

|

|

|

|

|

|

Andrea S. Rosen Age: 66 |

| III |

| Independent |

| 2018 |

| ✓ |

| 3 |

|

|

|

|

|

|

Gerald C. Throop Age: 63 |

| III |

| Independent |

| 2018 |

| ✓ |

| 0 |

|

|

|

|

|

|

Continuing Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Brent B. Bickett Age: 56 |

| I |

| Senior Advisor, Cannae |

| 2013 |

| ✓ |

| 0 |

|

|

|

|

|

|

Ronald F. Clarke Age: 65 |

| I |

|

Chief Executive |

| 2018 |

| ✓ |

| 1 |

|

|

|

|

|

|

Ganesh B. Rao Age: 44 |

| I |

|

Managing Director, |

| 2013 |

|

|

| 2 |

|

|

|

|

|

|

Deborah A. Farrington Age: 70 |

| II |

| President, StarVest |

| 2019 |

| ✓ |

| 2 |

|

|

|

|

|

|

Thomas M. Hagerty Age: 58 |

| II |

|

Managing Director, |

| 2013 |

|

|

| 4 |

|

|

|

|

|

|

Linda P. Mantia Age: 52 |

| II |

| Independent Director |

| 2020 |

| ✓ |

| 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 | Indicates the year in which each individual was appointed to serve on the Board of Ceridian HCM Holding Inc. Please note that this date does not reflect past positions held by any director with predecessor entities of Ceridian HCM Holding Inc. For more information on our directors’ service on predecessor entities (if applicable), please refer to the director biographies beginning on page 10 of this Proxy Statement. |

2 | Mr. Ossip serves as a director of two public special purpose acquisition companies (“SPAC”) affiliated with Dragoneer Investment Group. His service on the SPAC boards has a minimal time commitment. |

|

|

|

| 6 |

2021 PROXY STATEMENT |

AGE DISTRIBUTION | |||

5 |

New Directors over the past 4 Years | 59 |

Average age of Directors and Director Nominees |

Age range: 44 - 70 | |||

BOARD TENURE |

|

| |

The Corporate Governance and Nominating Committee has recommended, and the Board has nominated, each Class III nominee for election to the Board after considering the following criteria:

| • | Personal qualities and characteristics, accomplishments and reputation in the business community; |

| • | Current knowledge and contacts in the communities in which Ceridian does business and in Ceridian’s industry or other industries relevant to Ceridian’s business; |

| • | Ability and willingness to commit adequate time to Board and committee matters; |

| • | The fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to Ceridian’s needs; and |

| • | Diversity of viewpoints, background, experience, and other demographics. In considering the diversity of a potential nominee, the Board will consider all aspects of diversity in order to enable the Board to perform its duties and responsibilities effectively. |

|

|

|

| 7 |

2021 PROXY STATEMENT |

As described above, the Board carefully considers the diversity of viewpoints, background, experience and other demographics in selecting nominees for election to the Board. This section will provide an overview of the information relied upon by the Board in performing this analysis.

Skill Diversity

The Board relies on the matrix below which summarizes what our Board believes are desirable types of experience, qualifications, attributes and skills possessed by one or more of our directors in selecting nominees for election to the Board.

|

|

|

|

|

|

|

|

|

| |

Strategic Transformation Leadership (Experience driving strategic direction and growth of an organization shifting its business strategy) | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

Public Company Board Service | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

C Suite or Senior Management Leadership | ● | ● | ● | ● | ● | ● |

| ● | ● | 8 |

Industry Background (Human Capital Management, Financial Services, Fintech, Payments) | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

Technology or Software Experience (Implementing technology strategies for long-term R&D, planning and strategy) |

| ● | ● | ● | ● | ● | ● |

| ● | 7 |

Financial Literacy (Experience or expertise in financial accounting and reporting or the financial management) | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

Global Business Background (Experience and exposure to markets and cultures outside the U.S.) | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

Mergers & Acquisitions; Corporate Finance | ● | ● | ● | ● | ● | ● | ● | ● | ● | 9 |

Human Resources and Talent Management |

| ● | ● |

| ● | ● | ● |

|

| 5 |

Enterprise Risk Management / Cybersecurity | ● |

| ● | ● | ● | ● | ● |

| ● | 7 |

ESG (Experience in ESG, community affairs, and/or corporate responsibility including sustainability, diversity and inclusion) |

|

| ● | ● | ● | ● | ● | ● |

| 6 |

|

|

|

| 8 |

2021 PROXY STATEMENT |

The Board also takes the ethnic and gender diversity of its membership into account when selecting nominees for election to the Board.

DIRECTOR DIVERSITY: GENDER AND ETHNICITY | BOARD COMMITTEES CHAIRED BY WOMEN |

| 33% of Committees Chaired by Women

|

The Board will consider all submitted stockholder recommendations for Board nominees in making its nominations. Stockholders may submit recommendations for director candidates to the Corporate Governance and Nominating Committee by sending the individual’s name and qualifications to Ceridian HCM Holding Inc., c/o Corporate Secretary, 3311 East Old Shakopee Road, Minneapolis, Minnesota 55425. The Corporate Secretary will forward all stockholder recommendations to the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management. Please see “Transaction of Other Business and Other Information” beginning on page 67 for more information.

Our Board has nominated David D. Ossip, Andrea S. Rosen, and Gerald C. Throop for election as Class III directors to hold office until the 2024 Annual Meeting or until their successors are duly elected and qualified, subject to their earlier death, resignation or removal. Each of the nominees is a current member of our Board and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each of the nominees. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on the Board. The Board may fill such vacancy at a later date or reduce the size of the Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

|

|

|

| 9 |

2021 PROXY STATEMENT |

Information Concerning Nominees for Election for a Three-Year Term Ending at the 2024 Annual Meeting

The biographies of each of the nominees contain information regarding each such person’s service as a director, business experience, public company director positions held as of February 15, 2021 and at any time during the last five years and the experience, qualifications, attributes or skills that caused our Board to determine that the person should serve as a director of the Company.

David D. Ossip

Age 54

Director and Chair of the Board since 2015

Non-Independent

|

| Background

| ||

|

Mr. Ossip is Chair of the Board and Chief Executive Officer for Ceridian HCM Holding Inc., positions he has held since August 2015 and July 2013, respectively. Mr. Ossip joined us following our acquisition of Dayforce Corporation in 2012, where he held the position of chief executive officer. Mr. Ossip currently serves as a director of the following special purpose acquisition companies: Dragoneer Growth Opportunities Corp, a New York Stock Exchange (“NYSE”) listed company; and Dragoneer Growth Opportunities Corp II, a NASDAQ listed company.3 | |||

|

Qualifications

| |||

|

We believe that Mr. Ossip’s managerial and strategic expertise along with his deep knowledge of our industry make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

| Dragoneer Growth Opportunities Corp Dragoneer Growth Opportunities Corp II

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

| ||

Andrea S. Rosen

Age 66

Director since 2018

Independent

Committees • Audit • Corporate Governance and |

| Background

| ||

|

Ms. Rosen has served as a director since July 2018. In addition, Ms. Rosen serves on the boards of directors of Emera Inc., a Toronto Stock Exchange (“TSX”) listed company, Manulife Financial Corporation, a NYSE and TSX listed company, and Element Fleet Management Corp., a TSX listed company. Ms. Rosen was vice chair of TD Bank Financial Group, a company which offered a full range of financial products and services, and president of TD Canada Trust from 2002 to 2005. Previously, she was executive vice president of TD Commercial Banking and vice chair of TD Securities. Further, she had previously served as a director of Hiscox Ltd., a company listed on the London Stock Exchange. | |||

|

Qualifications

| |||

|

We believe that Ms. Rosen’s experience on boards of directors and her strategic experience in those roles make her well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Element Fleet Management Corp. Emera Inc. Manulife Financial Corporation |

|

| |

|

|

|

|

| 10 |

2021 PROXY STATEMENT |

Gerald C. Throop

Age 63

Director since 2018 and Lead Director since 2019

Independent

Committees • Audit (Chair) • Compensation

|

| Background

| ||

|

Mr. Throop has served as a director since April 2018 and Lead Director since November 2019. Since 2011, Mr. Throop has worked independently as a private equity investor, director, and advisor to early stage companies. Prior to 2011, he spent 17 years in executive leadership positions in the securities and banking industry, including the position of executive vice president, managing director, and head of equities for both National Bank of Canada and Merrill Lynch Canada. Mr. Throop has served as either a member of the board of directors or the chief financial officer of several companies that were TSX listed at the time of his service, including Workbrain Corporation, Toronto Stock Exchange, Call-Net Enterprises/Sprint Canada Inc., and Tie Telecommunications Canada Limited. Mr. Throop is a Chartered Public Accountant. | |||

|

Qualifications

| |||

|

We believe that Mr. Throop’s financial, managerial, and investment experience make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

None

|

|

| |

Recommendation of the Board

In addition to each nominee’s specific experience, qualifications, attributes, and skills that led the Board to the conclusion that such person should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us and our Board. Finally, we value our directors’ experience in relevant areas of business management and on other boards of directors and board committees. As a result, the Board recommends that you vote “for” the election of each of the nominees.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES. |

|

|

|

|

|

| 11 |

2021 PROXY STATEMENT |

In addition to the director nominees described above, six directors will continue to serve on the Board following the Annual Meeting. The biographies of each of the incumbent directors is below, including information regarding each person’s service as a director, business experience, public company director positions held currently or at any time during the last five years and the experience, qualifications, attributes or skills that caused our Board to determine that the person should serve as a director of the Company.

Incumbent Class I Directors – Term Expiring at the 2022 Annual Meeting:

|

|

|

|

|

Brent B. Bickett

Age 56

Director since 2013

Independent

Committees • Compensation (Chair) • Corporate Governance and

|

| Background

| ||

|

Mr. Bickett has served as a director of Ceridian HCM Holding Inc. since December 2013. He also served as a director or manager for other Ceridian entities between May 2007 and April 2018. Mr. Bickett is currently a senior advisor of Cannae Holdings, Inc. (“Cannae”), a diversified holding company and a NYSE listed company, where he also previously served as president from April 2017 to December 2020. Mr. Bickett also previously served as executive vice president of corporate strategy at Fidelity National Financial, Inc., a provider of title insurance and settlement services. Mr. Bickett previously served as a director for J. Alexander’s Holdings, Inc. and Remy International, Inc. | |||

|

Qualifications

| |||

|

We believe that Mr. Bickett’s extensive investment, management, transaction, and corporate strategy expertise make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

| None. |

|

| |

|

|

|

| |

|

|

|

|

|

Ronald F. Clarke

Age 65

Director since 2018

Independent

Committees • Compensation

|

| Background

Mr. Clarke has served as a director of Ceridian HCM Holding Inc. since July 2018. Mr. Clarke has been the chief executive officer of FleetCor Technologies, Inc., a leading global business payments company and a NYSE listed company, since August 2000 and has served as chairman of its board of directors since March 2003. From 1999 to 2000, Mr. Clarke served as president and chief operating officer of AHL Services, Inc., a staffing firm. From 1990 to 1998, Mr. Clarke served as chief marketing officer and later as a division president with Automatic Data Processing, Inc., a computer services company. From 1987 to 1990, Mr. Clarke was a principal with Booz Allen Hamilton, a global management consulting firm. Earlier in his career, Mr. Clarke was a marketing manager for General Electric Company, a diversified technology, media, and financial services corporation. | ||

|

Qualifications

We believe that Mr. Clarke’s management and leadership experience make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

FleetCor Technologies, Inc. | |||

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| 12 |

2021 PROXY STATEMENT |

Ganesh B. Rao

Age 44

Director since 2013

Non-Independent |

| Background

| ||

|

Mr. Rao has served as a director of Ceridian HCM Holding Inc. since September 2013, and other Ceridian entities between May 2013 and April 2018. Mr. Rao is a managing director of Thomas H. Lee Partners, L.P. (“THL”), a private equity firm, which he joined in 2000. Prior to joining THL, Mr. Rao worked at Morgan Stanley & Co. Incorporated in the mergers & acquisitions department. Mr. Rao currently serves on the boards of directors of Black Knight, Inc. and Dun & Bradstreet Holdings, Inc., both NYSE listed companies. Previously, Mr. Rao also served as a director for MoneyGram International, Inc. a NASDAQ listed company. | |||

|

Qualifications

| |||

|

We believe that Mr. Rao’s managerial and strategic expertise working with large growth-oriented companies as a managing director of THL and his experience enhancing value at such companies make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Black Knight, Inc. Dun & Bradstreet Holdings, Inc.

|

|

| |

Incumbent Class II Directors – Term Expiring at the 2023 Annual Meeting:

Deborah A. Farrington

Age 70

Director since 2019

Independent

Committees • Audit • Corporate Governance and |

| Background

| |

|

Ms. Farrington has served as a director of Ceridian HCM Holding Inc. since April 2019. Ms. Farrington is a founder and President of StarVest Management, Inc., a registered investment firm, and since 1999 has been a general partner of StarVest Partners, L.P., a growth equity firm. Ms. Farrington currently serves on the boards of directors of NCR Corporation and RedBall Acquisition Corp., both NYSE listed companies. Within the past five years, Ms. Farrington also served on the board of directors of Collectors Universe, Inc., a NASDAQ listed company, and NetSuite, Inc., a NYSE listed company. Earlier in her career, Ms. Farrington was an investment banker and executive with Merrill Lynch & Co., an investment bank. | ||

|

Qualifications

| ||

|

We believe that Ms. Farrington’s executive leadership and extensive experience on boards of directors, as well as her experience in software and financial services, makes her well-qualified to serve as a director. | ||

|

Other Current Public Company Boards

NCR Corporation RedBall Acquisition Corp.

| ||

|

|

| |

|

|

|

| 13 |

2021 PROXY STATEMENT |

Thomas M. Hagerty

Age 58

Director since 2013

Non-Independent

|

| Background

| |

|

Mr. Hagerty has served as a director of Ceridian HCM Holding Inc. since September 2013, and other Ceridian entities between April 2008 and April 2018. Mr. Hagerty is a managing director of THL, a private equity firm, which he joined in 1988. Mr. Hagerty currently serves on the boards of directors of Black Knight, Inc., Dun & Bradstreet Holdings, Inc., Fidelity National Financial, Inc., FleetCor Technologies, Inc., and Foley Trasimene Acquisition Corp, all NYSE listed companies. Within the past five years, Mr. Hagerty also served as a director for First Bancorp and Fidelity National Information Services, Inc. | ||

|

Qualifications

| ||

|

We believe that Mr. Hagerty’s managerial and strategic expertise working with large growth-oriented companies as a managing director of THL and his experience in enhancing value at such companies, along with his expertise in corporate finance, make him well-qualified to serve as a director. | ||

|

Other Current Public Company Boards

| ||

|

Black Knight, Inc. Dun & Bradstreet Holdings, Inc. Fidelity National Financial, Inc. FleetCor Technologies, Inc. Foley Trasimene Acquisition Corp

| ||

Linda P. Mantia

Age 52

Director since 2020

Independent

Committees • Audit |

| Background

| |

|

Ms. Mantia has served as a director of Ceridian HCM Holding Inc. since June 2020. In addition, Ms. Mantia currently serves on the boards of directors of McKesson Corporation, a NYSE listed company, and MindBeacon Holdings Inc., a TSX listed company. Prior to joining our Board, Ms. Mantia was Senior Executive Vice President, Chief Operating Officer of Manulife Financial Corporation, an international insurance and financial service company listed on the NYSE and TSX. Ms. Mantia also previously served as Executive Vice President of Digital, Payments and Cards at Royal Bank of Canada (“RBC”), a multinational financial services company listed on the NYSE, as well as in other leadership roles at RBC, including Executive Vice President, Global Cards and Payments. Earlier in her career, Ms. Mantia worked at McKinsey & Co., a global management consulting firm, and prior to that, she practiced law at Davies Ward Phillips & Vineberg LLC. | ||

|

Qualifications

| ||

|

We believe that Ms. Mantia’s executive leadership roles and her financial services, payments and digital technology experience makes her well-qualified to serve as a director. | ||

|

Other Current Public Company Boards

| ||

|

|

McKesson Corporation MindBeacon Holdings Inc.

| |

|

|

|

| 14 |

2021 PROXY STATEMENT |

We have a majority of independent directors serving on our Board and each of the committees of our Board are comprised solely of independent directors. Our Board has affirmatively determined that Messrs. Bickett, Clarke and Throop, and Mses. Farrington, Mantia and Rosen are independent directors under the applicable rules of the New York Stock Exchange after considering, among other things, their interests, as applicable, in any related party transactions described below under “Certain Relationships and Related Party Transactions”. |

| INDEPENDENT DIRECTORS |

| 66% | |

| of Directors are Independent |

Under our Board’s current leadership structure, we have an executive Chair and an independent Lead Director.

Mr. Ossip, our Chief Executive Officer, serves as Chair of our Board. He presides over meetings of our Board and holds such other powers and carries out such other duties as are customarily carried out by the chair of a board of directors. Our Board believes that the current Board leadership structure, which includes a Lead Director, provides effective independent oversight of management while allowing our Board and management to benefit from Mr. Ossip’s leadership and years of managerial and strategic experience. Our Board believes Mr. Ossip is best positioned to identify strategic priorities, lead critical discussions and execute our strategy and business plans, and that he possesses detailed in-depth knowledge of the issues, opportunities and challenges facing Ceridian. Our Board believes that Mr. Ossip’s combined role enables strong leadership, creates clear accountability, facilitates information flow between management and our Board, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders.

Mr. Throop was elected by the independent directors to serve as our independent Lead Director. He is empowered with and exercises robust, well-defined duties as set forth in our Corporate Governance Guidelines, a copy of which is available on our website located at www.ceridian.com. The primary duties of the Lead Director include:

| • | advise the Chair concerning matters for the Board to consider and information to be provided to the Board, including through the retention of advisors and consultants who report directly to the Board, and collaborate with the Chair concerning meeting agendas and schedules; |

| • | preside at meetings of the Board in the absence of, or upon the request of, the Chair and call and preside over all executive sessions of non-employee directors and independent directors and report to the Board, as appropriate, concerning such executive sessions; and |

| • | serve as a liaison and supplemental channel of communication between non-employee directors and independent directors and the Chair, and as the principal liaison for consultation and communication between major stockholders and the non-employee directors and independent directors. |

|

|

|

| 15 |

2021 PROXY STATEMENT |

Meetings of the Board of Directors and Stockholders

Our Board held ten meetings in fiscal year 2020. Each director attended at least 92% of all meetings of the Board and the committees on which they served that were held during fiscal year 2020 (and to the extent that such meetings were held during the time that each director served on our Board). All directors are encouraged to attend our annual meeting of stockholders. All current directors attended last year’s annual meeting of stockholders except Ms. Mantia, who joined the Board following the annual meeting in June 2020.

BOARD MEETINGS |

| COMMITTEE MEETINGS |

| ATTENDANCE |

|

|

|

| Each director attended at least |

10 |

| 25 |

| 92% |

Board meetings in fiscal year 2020 |

| Meetings of all Board committees in fiscal year 2020 |

| of all meetings of the Board and committees on which they served |

Committees of the Board of Directors

Our Board has established an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee. Each committee operates under a charter that has been approved by our Board and has the composition and responsibilities described below. Members serve on these committees until their resignations or until otherwise determined by our Board. The charter of each committee is available on our website at www.ceridian.com.

|

|

|

| 16 |

2021 PROXY STATEMENT |

COMPENSATION COMMITTEE

|

Meetings held in 2020: Nine

Purpose: The primary purpose of our Compensation Committee is to assist the Board in overseeing our management compensation policies and practices, including, among other things:

• determining and approving the compensation of our executive officers;

• reviewing and approving incentive compensation awards to executive officers; and

• making recommendations to the Board with respect to all equity-based compensation plans.

Composition: Our Compensation Committee is composed of Messrs. Bickett, Clarke and Throop. Mr. Bickett serves as chair of the Compensation Committee. All members of the Compensation Committee meet the required independence standards under applicable NYSE and SEC rules. The Compensation Committee is governed by a charter that complies with the rules of the NYSE.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee has ever been one of our executive officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

|

|

|

|

| 17 |

2021 PROXY STATEMENT |

Board’s Role in Risk Oversight

Our Board works directly with management to review Ceridian’s major areas of risk, assess management’s strategies for adequately managing risk, and determine the levels of risk appropriate for Ceridian.

The Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee support the Board in exercising its risk oversight duties by overseeing the risks within the purview of their respective substantive areas. The chairs of each committee report on any committee-level risk-related discussions to the Board at each regular meeting of the Board. This reporting process enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

The Audit Committee oversees our process relating to risk management and the conduct and systems of internal control over financial reporting and disclosure controls and procedures. The Audit Committee regularly reviews with management our policies and practices with respect to risk assessment and risk management – including in the areas of cybersecurity and other information technology risk and privacy.

Our Compensation Committee oversees risks related to compensation policies and practices impacting recruitment and retention of executive talent, including reviewing and approving the annual compensation risk assessment conducted by management.

Our Corporate Governance and Nominating Committee oversees risks primarily related to corporate governance and related matters, including Board composition and refreshment and sustainability/ “ESG”.

Additional information regarding the responsibilities of each committee is available in the Committees of the Board of Directors section, beginning on page 16 of this Proxy Statement, and in the charters of each of the Board committees.

|

|

|

|

| 18 |

2021 PROXY STATEMENT |

The Board of Directors believes that compensation for directors should be competitive, aligned with shareholders, and reflect the highest standards of corporate governance.

Fiscal Year 2020 Director Compensation Changes

To meet the stated objectives for our director compensation program, the Compensation Committee thoroughly reviewed the program in 2020 and recommended some modifications to ensure that we continued to provide a competitive compensation program, which included enhanced shareholder alignment and reflected our corporate governance principles.

In 2020, the director compensation program was amended to:

| • | permit all non-employee directors of the Board of Directors to participate in the director compensation program based on the continued contributions of all such members of the Board; |

| • | increase the size of the annual equity grant to $250,000 from $150,000; |

| • | provide that directors may be able to elect to receive all equity and cash awards in the form of restricted stock units, stock options or a combination of the two; |

| • | have annual equity awards vest pro-rata on a quarterly basis instead of one-year cliff vesting on the first anniversary of the date of grant to have the vesting of equity awards be in line with the payment of cash compensation; |

| • | increase the fee paid to the Lead Director to $50,000 from $30,000; and |

| • | provide for a one-time equity grant valued at $200,000 be made to new non-employee directors added to the Board of Directors. |

The increase in the amount of the annual equity awards and the Lead Director fee were determined by our Compensation Committee to be in line with market competitive practices. The other compensation elements – annual cash retainer and additional cash Committee chair fees – were not changed.

Current Director Compensation Program

The current director compensation program consists of:

| • | An annual cash retainer of $50,000; |

| • | Annual equity award grants of $250,000; |

| • | Annual cash Committee chair fees (Audit - $20,000, Compensation - $12,500, Corporate Governance & Nominating Committee - $7,500); |

| • | Annual cash Lead Director fee of $50,000; and |

| • | One-time restricted stock unit grant with a value of $200,000 made to non-employee directors upon appointment to the Board. |

The annual cash retainer and annual cash Committee chair and Lead Director fees are paid pro-rata quarterly. Directors are given the flexibility to elect to receive any portion of their annual cash retainer or annual cash Committee chair and Lead Director fees in the form of equity award grants and to receive any annual equity awards in the form of either restricted stock units, time-based stock options or any combination of the two. Annual equity award grants, regardless of form, vest pro-rata quarterly over one year following the date of grant. The one-time restricted stock unit award vests pro-rata annually over a three-year period following the date of grant.

|

|

|

| 19 |

2021 PROXY STATEMENT |

All of our directors may be reimbursed for approved director education courses and out-of-pocket travel expenses incurred in connection with attendance at Board and Board committee meetings and other Board-related activities.

Director Stock Ownership Principles

Stock ownership and shareholder alignment are key principles of our director compensation program. We want these principles to be reinforced from a director’s appointment to the Board of Directors until their service concludes. Therefore, we provide for annual elections where directors may receive any portion of their annual cash fees in the form of equity awards and provide a one-time equity award totaling $200,000 upon a non-employee director’s appointment to the Board of Directors. Five directors received this one-time restricted stock unit award in 2020 (Mr. Clarke, Ms. Farrington, Ms. Mantia, Ms. Rosen, and Mr. Throop) as they were new to the Board since or at the initial public offering.

Not unlike our executives, the Board of Directors is also expected to own our common stock. Therefore, the Board of Directors has a stock ownership guideline covering all directors. The guideline calls for non-employee directors to hold shares totaling five times the annual cash retainer; such directors have five years to reach the guideline. The Board of Directors evaluates compliance relative to this guideline annually.

Director Compensation for Fiscal Year 2020

The following table presents the total annual compensation for each person who served as a member of our Board of Directors during 2020, other than Mr. Ossip, and includes a one-time $200,000 restricted stock unit grant in August 2020 for Messrs. Clarke and Throop and Mses. Farrington, Mantia, and Rosen. Mr. Ossip received no additional compensation for his service as a member of our Board of Directors during 2020.

Name |

| Fees Earned or Paid in Cash ($)(2)(3) | Stock Awards ($)(3)(4) | Option Awards ($)(3)(5) | Total ($)(6) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brent B. Bickett(1) |

|

|

| — |

|

|

| $ | 312,500 |

|

|

| $ | — |

|

|

| $ | 312,500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald F. Clarke |

|

|

| — |

|

|

| $ | 300,000 |

|

|

| $ | 200,000 |

|

|

| $ | 500,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deborah A. Farrington |

|

| $ | 44,148 |

|

|

| $ | 450,000 |

|

|

| $ | 20,000 |

|

|

| $ | 514,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thomas M. Hagerty(1) |

|

|

| — |

|

|

| $ | — |

|

|

| $ | 300,000 |

|

|

| $ | 300,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| — |

|

|

Linda Mantia(1) |

|

|

| — |

|

|

| $ | 400,000 |

|

|

| $ | 100,000 |

|

|

| $ | 500,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ganesh B. Rao(1) |

|

|

| — |

|

|

| $ | 300,000 |

|

|

|

| — |

|

|

| $ | 300,000 |

|

|

|

|

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Andrea S. Rosen |

|

| $ | 16,621 |

|

|

| $ | 200,000 |

|

|

| $ | 300,000 |

|

|

| $ | 516,621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ | — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gerald C. Throop |

|

| $ | 16,621 |

|

|

| $ | 200,000 |

|

|

| $ | 370,000 |

|

|

| $ | 586,621 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) | Mr. Bickett, Mr. Hagerty, and Mr. Rao began participating in the director compensation program in August 2020. Ms. Mantia began participating in the director compensation program when she became a director in June 2020. |

(2) | Represents fees earned in Fiscal Year 2020. Our directors are paid their cash fees in installments in arrears quarterly. |

(3) | When Mr. Bickett was added to the program in August 2020, he elected to receive all $300,000 of his 2020 annual cash and equity compensation and his $12,500 Compensation Committee Chair fee in the form of restricted stock units for a total of 4,211 restricted stock units. |

In May 2020, Mr. Clarke elected to receive all $200,000 of his 2020 annual cash and equity compensation in the form of stock options, for a total of 9,532 stock options. In August 2020, Mr. Clarke elected to receive all $100,000 of his 2020 annual equity compensation increase in the form of restricted stock units, for a total of 1,348 restricted stock units.

In May 2020, Ms. Farrington elected to receive all $150,000 of her 2020 annual equity compensation in the form of restricted stock units for a total of 2,298 restricted stock units, $12,500 of her annual cash compensation and $7,500 of her Nominating Chair fee in the form of stock options, for a total of 953 stock options, and the remaining $37,500 of her annual cash compensation in the form of cash. In August 2020, Ms. Farrington elected to receive all $100,000 of her 2020 annual compensation increase in the form of restricted stock units, for a total of 1,348 restricted stock units. In 2020, based on elections made in 2019 and 2020, Ms. Farrington earned (i) $41,655 of the $50,000 annual cash retainer, the remainder of

|

|

|

| 20 |