- DAY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Dayforce (DAY) DEF 14ADefinitive proxy

Filed: 16 Mar 23, 4:07pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

Ceridian HCM Holding Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Ceridian HCM Holding Inc.

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

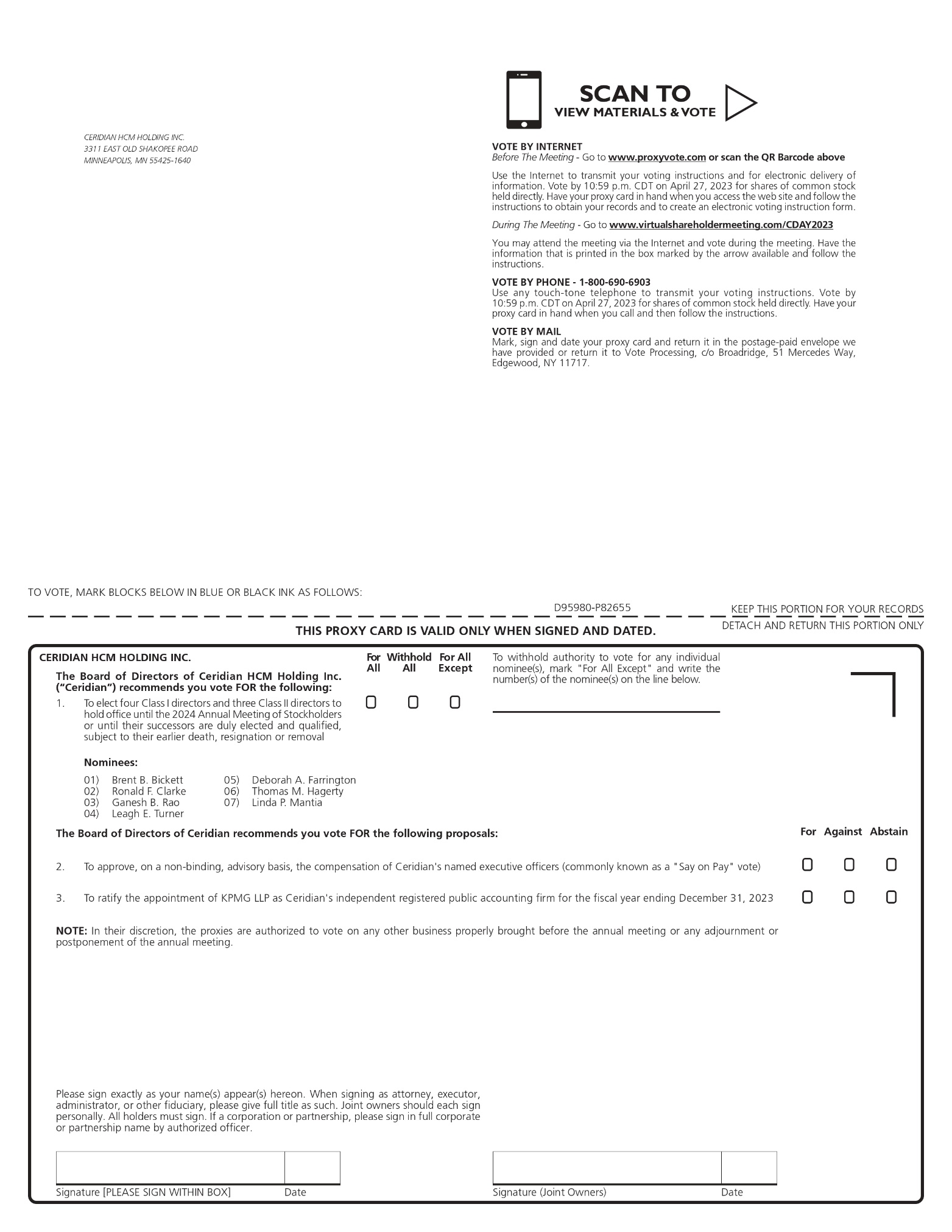

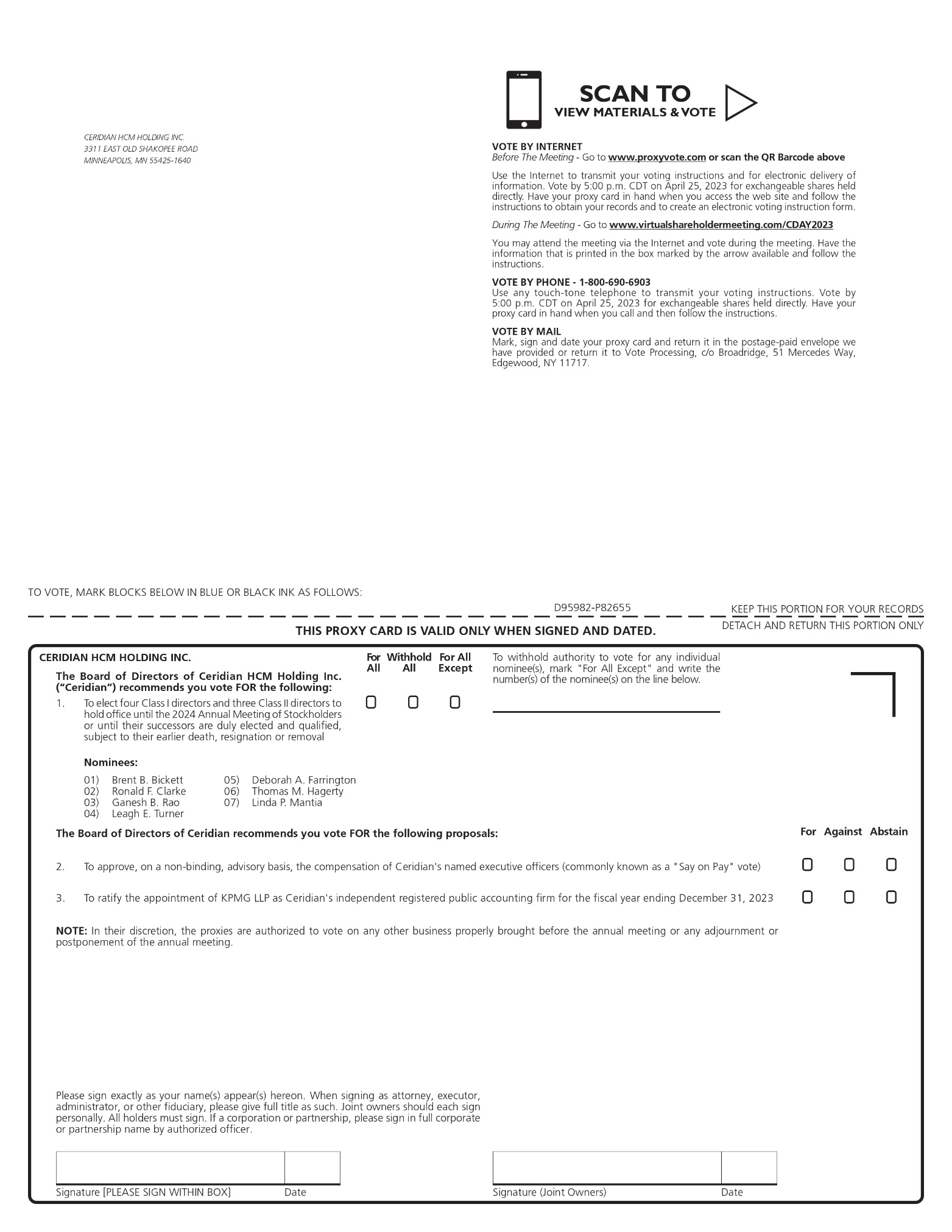

Notice is hereby given that Ceridian HCM Holding Inc. (“Ceridian”) will hold its 2023 Annual Meeting of Stockholders (the “Annual Meeting”) as follows:

Date and Time Friday, April 28, 2023 9:00 a.m., Central Daylight Time

|

Place Online at www.virtualshareholdermeeting.com/CDAY2023

|

Record Date March 1, 2023 |

Once again, we are holding our Annual Meeting virtually by means of a live webcast in order to make the meeting conveniently accessible to all of our stockholders and guests. Stockholders will vote on the following items of business:

Item

|

| Board Recommendation |

Election of directors

|

|

FOR each nominee

|

Advisory vote on the compensation of Ceridian’s named executive officers |

|

FOR

|

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2023

|

|

FOR

|

In addition, Ceridian will consider any other business as may properly come before the Annual Meeting or any adjournment, continuation, or postponement thereof.

On or about March 16, 2023, Ceridian mailed or made available to its stockholders proxy materials, including the proxy statement for the Annual Meeting (the “Proxy Statement”), its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), and form of proxy or the Notice of Internet Availability. These proxy materials can be accessed directly at proxyvote.com.

If you plan to attend the virtual Annual Meeting, please note the log-in procedures described under “Admission” on page 68 of the Proxy Statement.

If you have any questions regarding this information or the proxy materials, please contact Ceridian’s Corporate Secretary at stockholders@ceridian.com.

By Order of the Board of Directors,

William E. McDonald

Executive Vice President, General Counsel, and Corporate Secretary

Minneapolis, Minnesota

March 16, 2023

This Notice of Annual Meeting and Proxy Statement and Form of Proxy

are being distributed and made available on or about March 16, 2023.

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Stockholders to be Held on April 28, 2023. The Proxy Statement and 2022 Annual Report are available electronically on the “Investor Relations” page of Ceridian’s website located at www.ceridian.com and at proxyvote.com.

CERIDIAN HCM HOLDING INC.

2023 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

TABLE OF CONTENTS

|

| Page |

| 1 | |

| 1 | |

| 2 | |

| 3 | |

| 5 | |

| 8 | |

| 8 | |

| 8 | |

| 10 | |

| 12 | |

| 12 | |

| 17 | |

| 17 | |

| 19 | |

| 19 | |

| 19 | |

| 20 | |

| 22 | |

| 23 | |

| 25 | |

| 25 | |

| 25 | |

| 25 | |

| 26 | |

| 26 | |

| 26 | |

| 27 | |

| 30 | |

| 30 | |

| 30 | |

| 31 | |

| 32 | |

| 32 | |

PROPOSAL TWO: ADVISORY VOTE ON THE COMPENSATION OF CERIDIAN’S NAMED EXECUTIVE OFFICERS |

| 59 |

| 60 | |

| 62 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 63 |

| 67 | |

| 71 | |

| 73 |

|

|

|

|

|

2023 PROXY STATEMENT |

2023 PROXY STATEMENT SUMMARY |

Corporate Governance Journey

We are committed to sound corporate governance practices. As we enter our sixth year as a public company, our Board of Directors (“Board”) has continued to adopt measures designed to bolster the independent leadership on the Board and establish additional meaningful stockholder rights while continuing to maintain best practice efforts adopted previously. The following timeline summarizes the evolution of the Board’s corporate governance practices since our initial public offering in 2018:

2018

|

• Initial Public Offering • Added three independent directors • Joined Russell 1000 index

|

2019

|

• Added an independent director • Appointed independent Lead Director • Adopted Director “Overboarding” Guidelines • No longer a “Controlled Company” • Deemed to be a “Large Accelerated Filer”; no longer “Emerging Growth Company”

|

2020

|

• Adopted Compensation Recovery (Clawback) Policy • Adopted Stock Ownership Guidelines • Added an independent director • Fully independent Audit, Compensation, and Corporate Governance and Nominating Committees

|

2021

|

• Began to sunset classified Board structure over three years • Committed to implement majority voting standard with director resignation by the 2024 Annual Meeting of Stockholders • Created the Acquisition and Finance Committee • Produced Board “skills matrix” to focus refreshment efforts and ensure diversity of skills on Board • Adopted a Related Person Transactions Policy • Published first Environmental, Social, & Governance (“ESG”) Report • Joined S&P 500 index

|

2022

|

• Published second ESG Report • Determined that Thomas M. Hagerty and Ganesh B. Rao are deemed to be independent directors • Added Co-Chief Executive Officer Leagh E. Turner to the Board • Removed “evergreen refresh” provision from our 2018 Equity Incentive Plan (“2018 EIP”)

|

2023 |

• Ongoing commitment to board refreshment and diversity • Continued robust stockholder engagement with independent director participation • Enhanced executive compensation program and disclosure in response to stockholder feedback • Published third ESG Report

|

|

|

|

| 1 |

2023 PROXY STATEMENT |

Corporate Governance Priorities

Board Composition and Refreshment

Our Board believes in the importance of achieving and maintaining the proper board composition with an appropriate mix of skills. We are proud that our entire Board boasts experience relevant to the oversight of our long-term strategy – including in areas such as Strategic Transformation Leadership, Technology or Software, and Human Resources / Talent Management.

6 New Directors over the past 4 years |

| 60 Average age of Directors and Director Nominees | 4.2 Years Average Tenure |

For more information on our board composition, please see “Proposal One” on page 8 of this Proxy Statement.

Independent Board Oversight

Our Board is committed to providing frank, strategic leadership, independent from management.

80% of Directors are Independent |

| 100% of Board Committees are fully |

For more information on our board makeup and independence, please see “Director Independence” on page 19 of this Proxy Statement.

Board Diversity

Our Board believes that a diverse board is a more capable board. We are proud that:

50% of Directors are women or people of color |

| 25% of Board Committees are |

For more information on our board diversity, please see “Board Diversity” on page 10 of this Proxy Statement.

|

|

|

| 2 |

2023 PROXY STATEMENT |

Robust Stockholder Engagement

Our Board is committed to engaging stockholders in the governance process. Our robust engagement process in 2022 included:

Reached out to stockholders 74% of the outstanding Common Stock compensation and corporate governance matters in 2022 |

| Directors met with 65% of the outstanding Common Stock of the Company to discuss compensation and corporate governance matters in 2022

|

For more information on our stockholder engagement program, please see “Stockholder Engagement” on page 27 of this Proxy Statement.

Corporate Governance Best Practices

In the five years since our IPO, the Board has routinely evaluated our policies and practices against evolving best practices for alignment with stockholder interests. Key policies and practices we have adopted include:

Board Governance Procedures | Board Governance Policies |

✓ Annual Board and Committee self-evaluations ✓ Board Orientation Program for new directors ✓ Sunsetting of staggered board in favor of annual elections ✓ Commitment to move to majority voting in director elections by 2024 | ✓ Corporate Governance Guidelines ✓ Director “Overboarding” Guidelines ✓ Stock Ownership Guidelines for Directors ✓ No-Hedging and No-Pledging Policy ✓ Related Person Transactions Policy |

For more information, please see “Corporate Governance” on page 25 of this Proxy Statement.

Executive Compensation Priorities

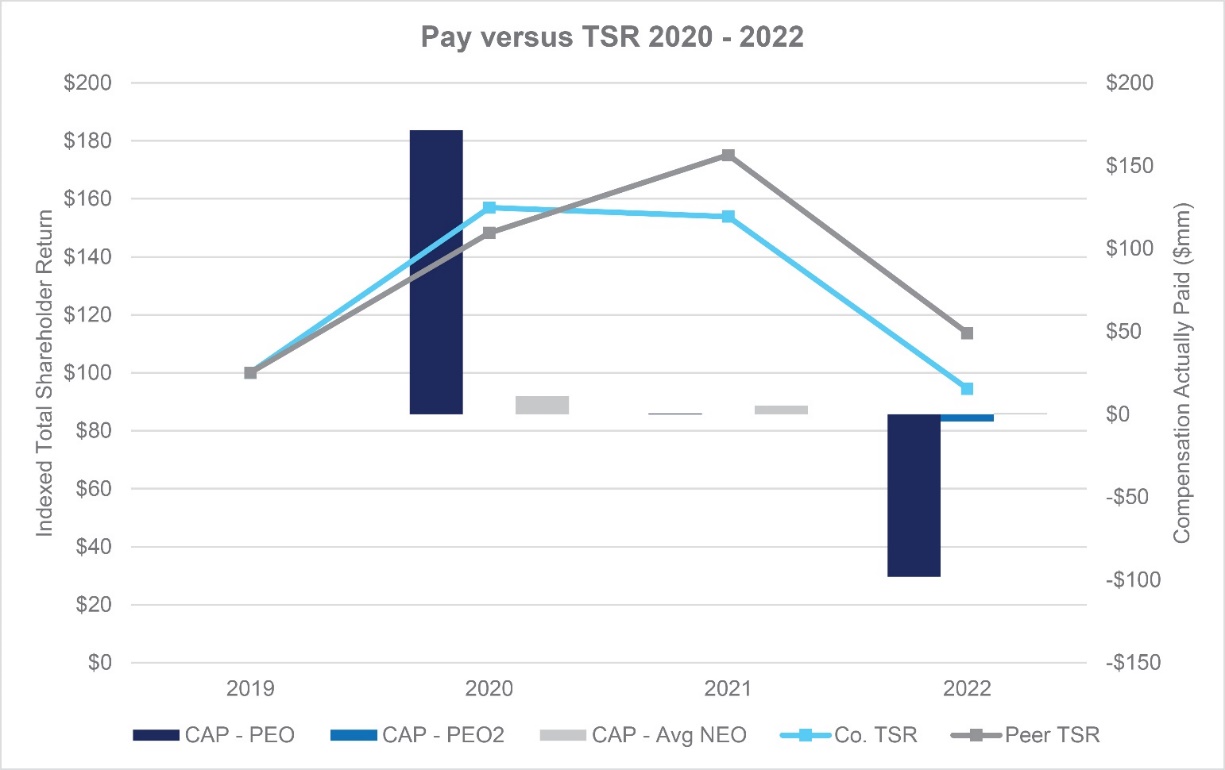

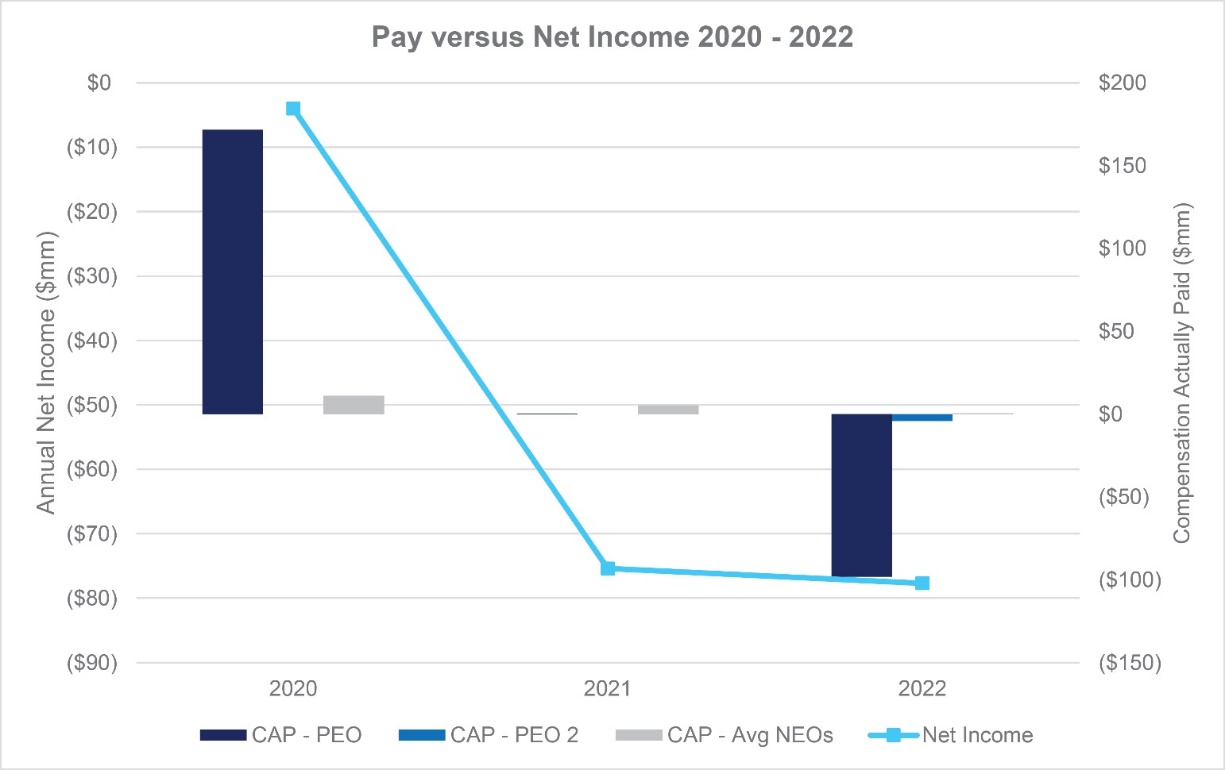

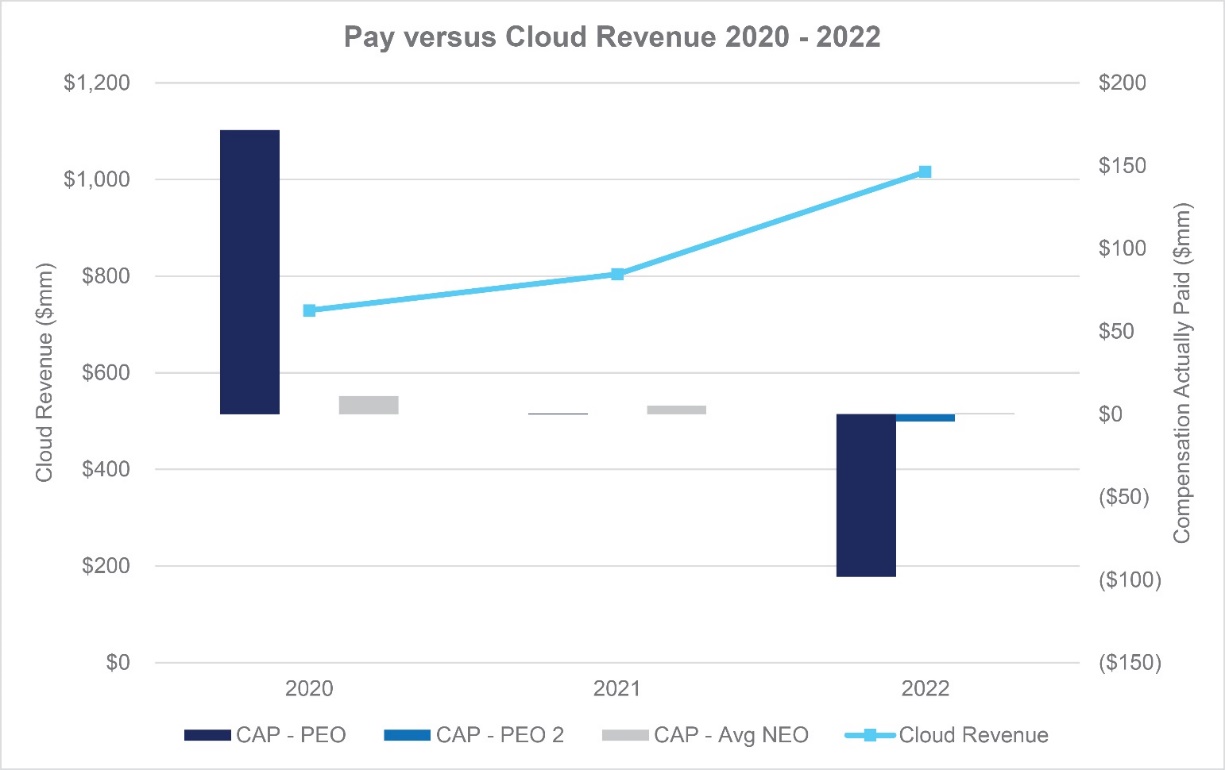

Our Board has been focused on building an executive compensation program that is significantly performance-based and stockholder aligned. We believe our executive compensation program was effective in incenting strong financial performance in fiscal year 2022, including the delivery of more than $1.0 billion in total Cloud revenue. On the Dayforce platform, we are proud to now have 5.95 million global employees and 5,993 customers live, and we have maintained our Dayforce revenue retention rate of 97.1%.1 We also demonstrated our ability to scale and gain efficiencies in our operations, as evidenced by significant expansion of adjusted EBITDA as a percentage of revenue. The Board believes these results reflect another strong year of profitable growth for Ceridian, and these key underpinnings of growth were directly connected to the performance components of the fiscal year 2022 performance compensation program.

|

1 | Excluding the 2021 acquisitions of Ascender and ADAM HCM. |

|

|

|

| 3 |

2023 PROXY STATEMENT |

Key Actions taken in Response to Stockholder Feedback

Our Board has consistently focused on incorporating stockholder feedback into our executive compensation programs. At Ceridian’s 2022 Annual Meeting, holders of approximately 69.5% of our outstanding stock were represented and voted in favor of our Say on Pay proposal – a significant improvement of approximately 43.4% from the 2021 Annual Meeting results. We believe open dialogue with our stockholders and incorporation of their feedback into our executive compensation program was instrumental in the growth in stockholder support for our compensation program at the 2022 Annual Meeting.

After another robust cycle of stockholder engagement following our 2022 Annual Meeting, we continued to make changes to the compensation program, including:

| • | Awarded our Co-CEOs compensation in line with relevant data sets and broader market competitive data |

| • | Introduced a relative total shareholder return (“TSR”) component into the 2023 long-term incentive grants made in February 2023 |

| • | Differentiated two of the three the corporate target metrics embedded in our short-term and long-term incentive programs in February 2023 |

| • | Included true long-term performance aspects into annual long-term incentive program by moving from a one-year performance period with three-year time-based vesting to three one-year performance periods |

For more information on the compensation program changes made in response to stockholder feedback, please see “Stockholder Engagement” on page 27 of this Proxy Statement.

The above changes are in addition to the following actions which were taken in 2022 in response to stockholder feedback following our failed Say on Pay vote in 2021:

| • | Awarded Mr. Ossip long-term incentive compensation in 2021 in line with relevant data sets and broader market competitive data |

| • | Removed “evergreen refresh” provision from our 2018 EIP |

| • | Awarded short-term incentive payout in accordance with terms of the Management Incentive Plan (“MIP”) |

| • | Introduced performance-based stock units (“PSUs”) into annual long-term incentive award program for named executive officers (“NEOs”) |

| • | Added “double trigger” change in control provisions to equity awards moving forward |

| • | Used and disclosed a broader “Peer Group” in considering market competitive compensation for NEOs |

For more information on our stockholder engagement program, please see “Stockholder Engagement” on page 27 of this Proxy Statement.

Executive Compensation Program Best Practices

We have worked closely with our independent compensation consultant, our stockholders, and other stakeholders to continue incorporating best practices into our executive compensation program. Key policies and practices we have adopted since our initial public offering include:

Compensation Procedures | Compensation Policies |

✓ “Pay for Performance” with majority of compensation “at risk” ✓ Peer Group of 15 companies ✓ Independent compensation consultant ✓ “Double trigger” acceleration following a change-in-control ✓ Limited executive perquisites | ✓ Stock Ownership Guidelines for Senior Management ✓ Compensation Recovery (Clawback) Policy ✓ No-Hedging and No-Pledging Policy |

For more information on our executive compensation program, please see our Compensation Discussion & Analysis (“CD&A”) beginning on page 32 of this Proxy Statement.

|

|

|

| 4 |

2023 PROXY STATEMENT |

2023 Annual Meeting Information | ||

Date and Time Friday, April 28, 2023 9:00 a.m., Central Daylight Time | Location – Online www.virtualshareholdermeeting.com/CDAY2023 | Record Date March 1, 2023 (the “Record Date”) |

Meeting Agenda and Voting Recommendations |

|

Proposal |

| Board Recommendation | Additional Information |

Proposal One

|

Election of directors

| FOR each nominee | Page 8

|

Proposal Two

|

Advisory vote on the compensation of Ceridian’s named executive officers

| FOR

| Page 59

|

Proposal Three

| Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2023

| FOR

| Page 60

|

How to Cast Your Vote | |||||

|

|

| |||

Your vote is important! Please vote your shares promptly using one of the following methods listed below. See page 67 of this Proxy Statement for additional voting information.

| |||||

Internet | Telephone | Virtual Meeting | |||

Go to proxyvote.com up until 10:59 PM CDT on April 27, 2023 (Have your proxy card in hand when you visit the website) | Call toll-free at 1-800-690-6903 up until 10:59 PM CDT on April 27, 2023 (Have your proxy card in hand when you call) | Complete and mail | Enter the 16-digit control number found on your proxy card, voter instruction form, or Notice, as applicable, at the time you log into the virtual meeting | ||

If you hold exchangeable shares of Ceridian AcquisitionCo ULC (“Exchangeable Shares”), please see page 67 for voting instructions. | |||||

Proposal One:

|

|

|

| 5 |

2023 PROXY STATEMENT |

Election of Directors

Our Board has nominated each of (i) Brent B. Bickett, Ronald F. Clarke, Ganesh B. Rao, and Leagh E. Turner for election as Class I directors of the Board, and (ii) Deborah A. Farrington, Thomas M. Hagerty, and Linda P. Mantia for election as Class II directors of the Board to hold office until the 2024 Annual Meeting of Stockholders. Please see “Proposal One” on page 8 of this Proxy Statement for additional important information about each of the nominees. Each of the nominees is a current member of our Board and has consented to serve if elected. The Board recommends a vote “FOR” each nominee.

Name | Class | Director | Independent | Age | Gender | Race/ | Principal | ||

Nominees: |

|

|

|

|

|

|

| ||

Brent B. Bickett | I | 2013 | ✓ | 58 | M | W | President and CEO | ||

Ronald F. Clarke | I | 2018 | ✓ | 67 | M | W | Chief Executive Officer FleetCor Technologies, Inc. | ||

Ganesh B. Rao | I | 2013 | ✓ | 46 | M | A | Managing Director Thomas H. Lee Partners, L.P. | ||

Leagh E. Turner | I | 2022 |

| 51 | F | W | Co-Chief Executive Officer Ceridian HCM Holding Inc. | ||

Deborah A. Farrington | II | 2019 | ✓ | 72 | F | W | President StarVest Management, Inc. | ||

Thomas M. Hagerty | II | 2013 | ✓ | 60 | M | W | Managing Director Thomas H. Lee Partners, L.P. | ||

Linda P. Mantia | II | 2020 | ✓ | 54 | F | W | Independent Director | ||

Continuing Directors: | |||||||||

David D. Ossip | III | 2015 |

| 56 | M | W | Co-Chief Executive Officer Ceridian HCM Holding Inc. | ||

Andrea S. Rosen | III | 2018 | ✓ | 68 | F | W | Independent Director | ||

Gerald C. Throop

| III | 2018 | ✓ | 65 | M | W | Independent Director | ||

|

|

|

|

|

|

|

| ||

| M Male | W White/Caucasian

| |||||||

| F Female | A Asian | |||||||

|

2 | Indicates the year in which each individual was appointed to serve on the Board of Ceridian HCM Holding Inc. Please note that this date does not reflect past positions held by any director with predecessor entities of Ceridian HCM Holding Inc. For more information on our directors’ service on predecessor entities (if applicable), please refer to the director biographies beginning on page 13 of this Proxy Statement. |

|

|

|

| 6 |

2023 PROXY STATEMENT |

Proposal Two:

Advisory Vote on the Compensation of Ceridian’s Named Executive Officers

We are asking our stockholders to approve, on a non-binding, advisory basis, the compensation of our NEOs as disclosed in the CD&A tabular disclosures and related narrative of this Proxy Statement. The Board recommends a vote “FOR” approval of NEO compensation because it believes that the policies and practices described in the CD&A beginning on page 32 of this Proxy Statement are based on principles that reflect a “pay-for-performance” philosophy and are strongly aligned with our stockholders’ interests. Since the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to any NEO and will not be binding on or overrule any decisions by our Compensation Committee or Board. However, because we value our stockholders’ view, our Compensation Committee and Board will carefully consider the results of this advisory vote when formulating future executive compensation philosophy, policies, and practices.

Proposal Three:

Ratification of the Appointment of KPMG LLP as our Independent Registered Public Accounting Firm for Fiscal Year 2023

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2023, and we are asking our stockholders to ratify this appointment. The Board recommends a vote “FOR” this ratification.

|

|

|

| 7 |

2023 PROXY STATEMENT |

Ceridian HCM Holding Inc.

3311 East Old Shakopee Road

Minneapolis, Minnesota 55425

2023 PROXY STATEMENT

Our Board solicits your proxy on our behalf for the 2023 Annual Meeting, and at any adjournment, continuation, or postponement of the 2023 Annual Meeting, for the purposes set forth in this Proxy Statement and the accompanying Notice of 2023 Annual Meeting of Stockholders (the “Notice of Internet Availability”).

In this Proxy Statement, the terms “Ceridian,” “the Company,” “we,” “us,” and “our” refer to Ceridian HCM Holding Inc. and its subsidiaries. The mailing address of our principal executive office is Ceridian HCM Holding Inc., 3311 East Old Shakopee Road, Minneapolis, Minnesota 55425.

PROPOSAL ONE Election of Directors |

Our fourth amended and restated certificate of incorporation provides that our Board is divided into three classes. At the 2023 Annual Meeting, successors to the directors whose terms expire at that annual meeting shall be elected to hold office for a one-year term expiring at the 2024 Annual Meeting. The Class I directors whose terms will expire at the 2023 Annual Meeting of Stockholders are Brent B. Bickett, Ronald F. Clarke, Ganesh B. Rao, and Leagh E. Turner. The Class II directors whose terms will expire at the 2023 Annual Meeting of Stockholders are Deborah A. Farrington, Thomas M. Hagerty, and Linda P. Mantia. The Board has nominated each of (i) Brent B. Bickett, Ronald F. Clarke, Ganesh B. Rao, and Leagh E. Turner for election as Class I directors of the Board, and (ii) Deborah A. Farrington, Thomas M. Hagerty, and Linda P. Mantia for election as Class II directors of the Board.

Board Selection Criteria

Pursuant to the Corporate Governance Guidelines and the Corporate Governance and Nominating Committee charter, the Corporate Governance and Nominating Committee is responsible for identifying individuals qualified to become Board members, consistent with criteria approved by the Board, and to recommend to the Board the nominees to stand for election as directors at the annual meeting of stockholders.

The Corporate Governance and Nominating Committee has recommended, and the Board has nominated, each Class I and Class II nominee for election to the Board after considering the following criteria:

| • | Personal qualities and characteristics, accomplishments, and reputation in the business community; |

| • | Current knowledge and contacts in the communities in which Ceridian does business and in Ceridian’s industry or other industries relevant to Ceridian’s business; |

| • | Ability and willingness to commit adequate time to Board and committee matters; |

| • | The fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial, and responsive to Ceridian’s needs; and |

| • | Diversity of viewpoints, background, experience, and other demographics. In considering the diversity of a potential nominee, the Board will consider all aspects of diversity in order to enable the Board to perform its duties and responsibilities effectively. |

|

|

|

| 8 |

2023 PROXY STATEMENT |

The following table sets forth summary information regarding each director nominee and continuing director as of the Record Date. Additional information regarding the three continuing directors is available in the Board of Directors section, beginning on page 17 of this Proxy Statement.

|

|

|

|

| Committee Memberships | |||

Name/Age | Class | Company Director Since3 | Independent | Other Public Company Boards | Acquisition and Finance | Audit | Compensation | Corporate Governance and Nominating |

Nominees: | ||||||||

Brent B. Bickett Age: 58

| I | 2013 | ✓ | 0 |

|

|

|

|

Ronald F. Clarke Age: 67

| I | 2018 | ✓ | 1 |

|

|

|

|

Ganesh B. Rao Age: 46

| I | 2013 | ✓ | 2 |

|

|

|

|

Leagh E. Turner Age: 51 | I | 2022 |

| 1 |

|

|

|

|

Deborah A. Farrington Age: 72

| II | 2019 | ✓ | 2 |

|

|

|

|

Thomas M. Hagerty Age: 60

| II | 2013 | ✓ | 4 |

|

|

|

|

Linda P. Mantia Age: 54

| II | 2020 | ✓ | 1 |

|

|

|

|

Continuing Directors: | ||||||||

David D. Ossip Age: 56

| III | 2015 |

| 14 |

|

|

|

|

Andrea S. Rosen Age: 68

| III | 2018 | ✓ | 3 |

|

|

|

|

Gerald C. Throop Age: 65

| III | 2018 | ✓ | 0 |

|

|

|

|

|

|

| ||||||

|

| |||||||

|

3 | Indicates the year in which each individual was appointed to serve on the Board of Ceridian HCM Holding Inc. Please note that this date does not reflect past positions held by any director with predecessor entities of Ceridian HCM Holding Inc. For more information on our directors’ service on predecessor entities (if applicable), please refer to the director biographies beginning on page 13 of this Proxy Statement. |

4 | Mr. Ossip serves as a director of Dragoneer Growth Opportunities Corp. III, a public special purpose acquisition company affiliated with Dragoneer Investment Group (the “Dragoneer SPAC”). On March 10, 2023, the Dragoneer SPAC issued a press release announcing it will redeem all of its outstanding Class A ordinary shares, par value $0.0001, effective as of March 24, 2023, because the Dragoneer SPAC will not consummate an initial business combination within the time period required by its amended and restated memorandum and articles of association. |

|

|

|

| 9 |

2023 PROXY STATEMENT |

SIGNIFICANT BOARD REFRESHMENT | AGE DISTRIBUTION | ||

6 |

New Directors over the past 4 years | 60 |

Average age of Directors and Director Nominees |

Age range: 46 – 72 | |||

BOARD TENURE |

|

5.2 Years Average Tenure

| |

Board Diversity

As described above, the Board carefully considers the diversity of viewpoints, background, experience, and other demographics in selecting nominees for election to the Board. This section will provide an overview of the information relied upon by the Board in performing this analysis.

Demographic Diversity

The Board also takes the ethnic and gender diversity of its membership into account when selecting nominees for election to the Board.

DIRECTOR DIVERSITY: GENDER AND ETHNICITY | BOARD COMMITTEES CHAIRED BY WOMEN |

| 25% of committees chaired by women

|

|

|

|

| 10 |

2023 PROXY STATEMENT |

Skill Diversity

The Board relies on the matrix below which summarizes what our Board believes are desirable types of experience, qualifications, attributes, and skills possessed by one or more of our directors in selecting nominees for election to the Board.

|

|

|

|

|

|

|

|

|

|

|

|

Strategic Transformation Leadership (Experience driving strategic direction and growth of an organization shifting its business strategy) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

Public Company Board Service | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

C Suite / Senior Management Leadership | ● | ● | ● | ● | ● | ● |

| ● | ● | ● | 10 |

Industry Background (Human Capital Management, Financial Services, Fintech, Payments) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

Technology or Software Experience (Implementing technology strategies for long-term R&D, planning, and strategy) | ● | ● | ● | ● | ● | ● | ● |

| ● | ● | 9 |

Financial Literacy (Experience or expertise in financial accounting and reporting or financial management) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

Global Business Background (Experience and exposure to markets and cultures outside the U.S.) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

Mergers & Acquisitions / Corporate Finance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | 10 |

Human Resources / Talent Management |

| ● | ● |

| ● | ● | ● |

|

| ● | 6 |

Enterprise Risk Management / Cybersecurity | ● |

| ● | ● | ● | ● | ● |

| ● | ● | 8 |

Environmental, Social, & Governance (Experience in ESG, community affairs, and/or corporate responsibility including sustainability, diversity, and inclusion) | ● |

| ● | ● | ● | ● | ● | ● |

| ● | 8 |

|

|

|

| 11 |

2023 PROXY STATEMENT |

Stockholder Recommendations

The Board will consider all submitted stockholder recommendations for Board nominees in making its nominations. Stockholders may submit recommendations for director candidates to the Corporate Governance and Nominating Committee by sending the individual’s name and qualifications to Ceridian HCM Holding Inc., c/o Corporate Secretary, 3311 East Old Shakopee Road, Minneapolis, Minnesota 55425. The Corporate Secretary will forward all stockholder recommendations to the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management. Please see “Transaction of Other Business and Additional Information” beginning on page 71 for more information.

Director Nominees

Our Board has nominated Brent B. Bickett, Ronald F. Clarke, Ganesh B. Rao, and Leagh E. Turner for election as Class I directors and Deborah A. Farrington, Thomas M. Hagerty, and Linda P. Mantia for election as Class II directors to hold office until the 2024 Annual Meeting or until their successors are duly elected and qualified, subject to their earlier death, resignation, or removal. Each of the nominees is a current member of our Board and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each of the nominees. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on the Board. The Board may fill such vacancy at a later date or reduce the size of the Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

|

|

|

| 12 |

2023 PROXY STATEMENT |

Information Concerning Nominees for Election for a One-Year Term Ending at the 2024 Annual Meeting

The biographies of each of the nominees contain information regarding each such person’s service as a director, business experience, public company director positions held as of February 28, 2023, and at any time during the last five years and the experience, qualifications, attributes, or skills that caused our Board to determine that the person should serve as a director of the Company.

Class I Directors

|

|

|

|

| |

Brent B. Bickett

Age 58

Director since 2013

Independent

Committees • Acquisition and Finance • Compensation (Chair) • Corporate Governance and

|

| Background

| |||

|

Mr. Bickett has served as a director of Ceridian HCM Holding Inc. since December 2013. He also served as a director or manager for other Ceridian entities between May 2007 and April 2018. Mr. Bickett currently serves as president and chief executive officer of 3B Capital Partners, Inc., a private principal investment and capital advisory company. Mr. Bickett previously served as president until December 2020 and senior advisor until December 2021 for Cannae Holdings, Inc. (“Cannae”), a New York Stock Exchange (“NYSE”) listed diversified investment company. Mr. Bickett also previously served as president and executive vice president of corporate strategy at Fidelity National Financial, Inc., a leading provider of title insurance and real estate settlement services. | ||||

|

Qualifications

| ||||

|

We believe that Mr. Bickett’s extensive investment, management, transaction, capital allocation, and corporate strategy expertise make him well-qualified to serve as a director. | ||||

|

Other Current Public Company Boards

| ||||

| None |

|

| ||

|

|

|

| ||

|

|

|

|

| |

Ronald F. Clarke

Age 67

Director since 2018

Independent

Committees • Compensation

|

| Background

Mr. Clarke has served as a director of Ceridian HCM Holding Inc. since July 2018. Mr. Clarke has been the chief executive officer of FleetCor Technologies, Inc., a leading global business payments company and a NYSE listed company, since August 2000 and has served as chairman of its board of directors since March 2003. From 1999 to 2000, Mr. Clarke served as president and chief operating officer of AHL Services, Inc., a staffing firm. From 1990 to 1998, Mr. Clarke served as chief marketing officer and later as a division president with Automatic Data Processing, Inc., a computer services company. From 1987 to 1990, Mr. Clarke was a principal with Booz Allen Hamilton, a global management consulting firm. Earlier in his career, Mr. Clarke was a marketing manager for General Electric Company, a diversified technology, media, and financial services corporation. | |||

|

Qualifications

We believe that Mr. Clarke’s management and leadership experience make him well-qualified to serve as a director. | ||||

|

Other Current Public Company Boards

FleetCor Technologies, Inc. | ||||

|

|

|

| ||

|

|

|

| ||

|

|

|

| ||

|

|

|

| 13 |

2023 PROXY STATEMENT |

Ganesh B. Rao

Age 46

Director since 2013

Independent

Committees • Acquisition and Finance • Corporate Governance and Nominating

|

| Background

| ||

|

Mr. Rao has served as a director of Ceridian HCM Holding Inc. since September 2013, and other Ceridian entities between May 2013 and April 2018. Mr. Rao is a managing director of Thomas H. Lee Partners, L.P. (“THL”), a private equity firm, which he joined in 2000. Prior to joining THL, Mr. Rao worked at Morgan Stanley & Co. Incorporated in the mergers & acquisitions department. Mr. Rao currently serves on the boards of directors of Black Knight, Inc. and Dun & Bradstreet Holdings, Inc., both NYSE listed companies. Previously, Mr. Rao also served as a director for MoneyGram International, Inc., a NASDAQ listed company. | |||

|

Qualifications

| |||

|

We believe that Mr. Rao’s managerial and strategic expertise working with large growth-oriented companies as a managing director of THL and his experience enhancing value at such companies make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Black Knight, Inc. Dun & Bradstreet Holdings, Inc.

|

|

| |

Leagh E. Turner

Age 51

Director since 2022

Non-Independent

|

| Background

| ||

| Ms. Turner has served as Co-Chief Executive Officer of Ceridian HCM Holding Inc. since February 2022, and has served as a director since February 2022. Ms. Turner joined Ceridian in 2018, serving as President from August 2018 until February 2022 and Chief Operating Officer from February 2020 until February 2022. Prior to joining Ceridian, Ms. Turner held the position of global chief operating officer, strategic customer program of SAP, an enterprise software and programming company, from October 2016 to August 2018. Ms. Turner is a member of the board of directors for Manulife Financial Corporation, a NYSE and Toronto Stock Exchange (“TSX”) listed company. | |||

|

Qualifications

| |||

|

We believe that Ms. Turner’s managerial and operational expertise along with her deep knowledge of our industry make her well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Manulife Financial Corporation

|

|

| |

|

|

|

| 14 |

2023 PROXY STATEMENT |

Class II Directors

Deborah A. Farrington

Age 72

Director since 2019

Independent

Committees • Acquisition and Finance • Audit • Corporate Governance and |

| Background

| ||

|

Ms. Farrington has served as a director of Ceridian HCM Holding Inc. since April 2019. Ms. Farrington is a co-founder and President of StarVest Management, Inc., the management company for the StarVest funds, and since 1999 has been a general partner of StarVest Partners, L.P., an expansion stage venture capital and growth equity firm. Ms. Farrington currently serves on the board of directors of Cumulus Media Inc., a NASDAQ listed company, and NCR Corporation, a New York Stock Exchange listed company. Within the past five years, Ms. Farrington also served on the board of directors of the following companies which were publicly listed at the time of her service: Collectors Universe, Inc., formerly a NASDAQ listed company, and RedBall Acquisition Corp., formerly a New York Stock Exchange listed company. Earlier in her career, Ms. Farrington was an investment banker and executive with Merrill Lynch & Co., an investment bank. | |||

|

Qualifications

| |||

|

We believe that Ms. Farrington’s executive leadership and extensive experience on boards of directors, as well as her experience in software and financial services, make her well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

Cumulus Media Inc. NCR Corporation

| |||

|

|

|

| |

Thomas M. Hagerty

Age 60

Director since 2013

Independent Committees • Acquisition and Finance (Chair) • Compensation

|

| Background

| ||

|

Mr. Hagerty has served as a director of Ceridian HCM Holding Inc. since September 2013, and other Ceridian entities between April 2008 and April 2018. Mr. Hagerty is a managing director of THL, a private equity firm, which he joined in 1988. Mr. Hagerty currently serves on the boards of directors of Black Knight, Inc., Dun & Bradstreet Holdings, Inc., Fidelity National Financial, Inc., and FleetCor Technologies, Inc., all NYSE listed companies. Within the past five years, Mr. Hagerty also served as a director for Fidelity National Information Services, Inc. and Foley Trasimene Acquisition Corp., both NYSE listed companies. | |||

|

Qualifications

| |||

|

We believe that Mr. Hagerty’s managerial and strategic expertise working with large growth-oriented companies as a managing director of THL and his experience in enhancing value at such companies, along with his expertise in corporate finance, make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Black Knight, Inc.5 Dun & Bradstreet Holdings, Inc. Fidelity National Financial, Inc. FleetCor Technologies, Inc.

| |||

|

5 | On February 8, 2023, Mr. Hagerty notified the board of directors of Black Knight, Inc. (“Black Knight”) of his intention to retire from the Black Knight board of directors when his term ends at Black Knight’s 2023 Annual Meeting of Shareholders. |

|

|

|

| 15 |

2023 PROXY STATEMENT |

Linda P. Mantia

Age 54

Director since 2020

Independent

Committees • Audit

|

| Background

| |

|

Ms. Mantia has served as a director of Ceridian HCM Holding Inc. since June 2020. In addition, Ms. Mantia currently serves on the board of directors of McKesson Corporation, a NYSE listed company. Previously, she served on the board of MindBeacon Holdings Inc., a TSX listed company at the time of her service. Prior to joining our Board, Ms. Mantia was Senior Executive Vice President, Chief Operating Officer of Manulife Financial Corporation, an international insurance and financial service company listed on the NYSE and TSX. Ms. Mantia also previously served as Executive Vice President of Digital Banking, Payments and Cards at Royal Bank of Canada (“RBC”), a multinational financial services company listed on the NYSE, as well as in other leadership roles at RBC, including Executive Vice President, Global Cards and Payments. Earlier in her career, Ms. Mantia worked at McKinsey & Co., a global management consulting firm, and prior to that, she practiced law at Davies Ward Phillips & Vineberg LLC. | ||

|

Qualifications

| ||

|

We believe that Ms. Mantia’s executive leadership roles and her financial services, payments, and digital technology experience make her well-qualified to serve as a director. | ||

|

Other Current Public Company Boards

| ||

| McKesson Corporation |

| |

Recommendation of the Board

In addition to each nominee’s specific experience, qualifications, attributes, and skills that led the Board to the conclusion that such person should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty, and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to us and our Board. Finally, we value our directors’ experience in relevant areas of business management and on other boards of directors and board committees. As a result, the Board recommends that you vote “for” the election of each of the nominees.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES. |

|

|

|

|

|

| 16 |

2023 PROXY STATEMENT |

|

BOARD OF DIRECTORS |

In addition to the director nominees described above, three directors will continue to serve on the Board following the Annual Meeting. The biographies of each of the incumbent directors is below, including information regarding each person’s service as a director, business experience, public company director positions held as of February 28, 2023, and at any time during the last five years and the experience, qualifications, attributes, or skills that caused our Board to determine that the person should serve as a director of the Company.

Incumbent Class III Directors – Term Expiring at the 2024 Annual Meeting:

David D. Ossip

Age 56

Director and Chair of the Board since 2015

Non-Independent

|

| Background

| ||

|

Mr. Ossip is Chair of the Board and Co-Chief Executive Officer for Ceridian HCM Holding Inc. Mr. Ossip has held the position of Chair since August 2015 and Co-Chief Executive Officer since February 2022. Mr. Ossip served as Chief Executive Officer of Ceridian from July 2013 until February 2022. Mr. Ossip joined Ceridian following the acquisition of Dayforce Corporation in 2012, where he held the position of chief executive officer. Mr. Ossip currently serves as a director of Dragoneer Growth Opportunities Corp III, a NASDAQ listed special acquisition company. Mr. Ossip previously served as a director for Dragoneer Growth Opportunities Corp, a NYSE listed company at the time of his service, and Dragoneer Growth Opportunities Corp II, a NASDAQ listed company at the time of his service. | |||

|

Qualifications

| |||

|

We believe that Mr. Ossip’s managerial and strategic expertise along with his deep knowledge of our industry make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

| Dragoneer Growth Opportunities Corp III6 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

| ||

Andrea S. Rosen

Age 68

Director since 2018

Independent

Committees • Audit • Corporate Governance and |

| Background

| ||

|

Ms. Rosen has served as a director of Ceridian HCM Holding Inc. since July 2018. In addition, Ms. Rosen serves on the boards of directors of Element Fleet Management Corp., a TSX listed company, Emera Inc., a TSX listed company, and Manulife Financial Corporation, a NYSE and TSX listed company. Ms. Rosen was vice chair of TD Bank Financial Group, a company which offered a full range of financial products and services, and president of TD Canada Trust from 2002 to 2005. Previously, she was executive vice president of TD Commercial Banking and vice chair of TD Securities. | |||

|

Qualifications

| |||

|

We believe that Ms. Rosen’s experience on boards of directors and her strategic experience in those roles make her well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

Element Fleet Management Corp. Emera Inc. Manulife Financial Corporation | |||

|

6 | On March 10, 2023, the Dragoneer SPAC issued a press release announcing it will redeem all of its outstanding Class A ordinary shares, par value $0.0001, effective as of March 24, 2023, because the Dragoneer SPAC will not consummate an initial business combination within the time period required by its amended and restated memorandum and articles of association. |

|

|

|

| 17 |

2023 PROXY STATEMENT |

Gerald C. Throop

Age 65

Director since 2018 and Lead Director since 2019

Independent

Committees • Audit (Chair) • Compensation

|

|

Background

| ||

|

Mr. Throop has served as a director of Ceridian HCM Holding Inc. since April 2018 and Lead Director since November 2019. Since 2011, Mr. Throop has worked independently as a private equity investor, director, and advisor to early-stage companies. Prior to 2011, he spent 17 years in executive leadership positions in the securities and banking industry, including the position of executive vice president, managing director, and head of equities for both the National Bank of Canada and Merrill Lynch Canada. Mr. Throop has served as either a member of the board of directors or the chief financial officer of several companies that were TSX listed at the time of his service, including Workbrain Corporation, Toronto Stock Exchange, Call-Net Enterprises/Sprint Canada Inc., and Tie Telecommunications Canada Limited. Mr. Throop is a Chartered Public Accountant. | |||

|

Qualifications

| |||

|

We believe that Mr. Throop’s accounting, financial, managerial, and investment experience make him well-qualified to serve as a director. | |||

|

Other Current Public Company Boards

| |||

|

None

|

|

| |

|

|

|

| 18 |

2023 PROXY STATEMENT |

Director Independence

We have a majority of independent directors serving on our Board and each of the committees of our Board are comprised solely of independent directors. Our Board has affirmatively determined that Messrs. Bickett, Clarke, Hagerty, Rao, and Throop, and Mses. Farrington, Mantia, and Rosen are independent directors under the applicable rules of the NYSE after considering, among other things, their interests, as applicable, in any related party transactions described below under “Certain Relationships and Related Party Transactions.” |

| INDEPENDENT DIRECTORS |

| 80% | |

| of Directors are Independent |

Board Leadership Structure

Under our Board’s current leadership structure, we have an executive Chair and an independent Lead Director.

Mr. Ossip, our Co-Chief Executive Officer, serves as Chair of our Board. He presides over meetings of our Board and holds such other powers and carries out such other duties as are customarily carried out by the chair of a board of directors. Our Board believes that the current Board leadership structure, which includes a Lead Director, provides effective independent oversight of management while allowing our Board and management to benefit from Mr. Ossip’s leadership and years of managerial and strategic experience. Our Board believes Mr. Ossip is best positioned to identify strategic priorities, lead critical discussions, and execute our strategy and business plans, and that he possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing Ceridian. Our Board believes that Mr. Ossip’s combined role enables strong leadership, creates clear accountability, facilitates information flow between management and our Board, and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders.

Mr. Throop was elected by the independent directors to serve as our independent Lead Director. He is empowered with and exercises robust, well-defined duties as set forth in our Corporate Governance Guidelines, a copy of which is available on our website located at www.ceridian.com. The primary duties of the Lead Director include:

| • | advise the Chair concerning matters for the Board to consider and information to be provided to the Board, including through the retention of advisors and consultants who report directly to the Board, and collaborate with the Chair concerning meeting agendas and schedules; |

| • | preside at meetings of the Board in the absence of, or upon the request of, the Chair and call and preside over all executive sessions of non-employee directors and independent directors and report to the Board, as appropriate, concerning such executive sessions; and |

| • | serve as a liaison and supplemental channel of communication between non-employee directors and independent directors and the Chair, and as the principal liaison for consultation and communication between stockholders and the non-employee directors and independent directors. |

Meetings of the Board of Directors and Stockholders

Our Board held seven meetings in fiscal year 2022. Each director attended at least 90% of all meetings of the Board and the committees on which they served that were held during fiscal year 2022. All directors are encouraged to attend our annual meeting of stockholders.

Our 2022 Annual Meeting was held virtually, and eight directors were in attendance.

BOARD MEETINGS |

| COMMITTEE MEETINGS |

| ATTENDANCE |

|

|

|

| Each director attended at least |

7 |

| 19 |

| 90% |

Board meetings in fiscal year 2022 |

| Meetings of all Board committees in fiscal year 2022 |

| of all meetings of the Board and committees on which they served |

|

|

|

| 19 |

2023 PROXY STATEMENT |

Committees of the Board of Directors

Our Board has established an Acquisition and Finance Committee, Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee. Each committee operates under a charter that has been approved by our Board and has the composition and responsibilities described below. Members serve on these committees until their resignations or until otherwise determined by our Board. The charter of each committee is available on our website at www.ceridian.com.

ACQUISITION AND FINANCE COMMITTEE |

Meetings held in 2022: None. Note that the Acquisition and Finance Committee meets on an as needed basis to fulfill the responsibilities set out in its charter.

Purpose: The primary purpose of our Acquisition and Finance Committee is to assist the Board’s oversight of, among other things, reviewing and providing direction regarding matters involving capital expenditures, investments, acquisitions, dispositions, financing activities, and other related matters.

Composition: The Acquisition and Finance Committee is currently composed of Messrs. Bickett, Hagerty, and Rao and Ms. Farrington. Mr. Hagerty serves as chair.

|

AUDIT COMMITTEE

|

Meetings held in 2022: 10

Purpose: The primary purpose of our Audit Committee is to assist the Board’s oversight of, among other things: • audits of our financial statements; • the quality and integrity of our financial statements and related disclosure; • our policies and practices with respect to risk assessment and risk management (except with respect to those risks for which oversight is assigned to another Board committee); • the conduct and systems of internal control over financial reporting and disclosure controls and procedures; • the qualifications, engagement, compensation, independence, and performance of our independent auditor; • the performance of our internal audit function; and • review with management the Company’s policies and practices with respect to risk assessment and risk management.

Composition: The Audit Committee is currently composed of Mses. Farrington, Mantia, and Rosen and Mr. Throop. Mr. Throop serves as chair of the Audit Committee, and each of Mses. Farrington, Mantia, and Rosen and Mr. Throop qualify as an “audit committee financial expert” as such term has been defined by the SEC in Item 407(d) of Regulation S-K. Our Board has affirmatively determined that each of Mses. Farrington, Mantia, and Rosen and Mr. Throop qualify as audit committee financial experts and meet the definition of an “independent director” for the purposes of serving on the Audit Committee under applicable NYSE rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). The Audit Committee is governed by a charter that complies with the rules of the NYSE.

|

|

|

|

| 20 |

2023 PROXY STATEMENT |

COMPENSATION COMMITTEE

|

Meetings held in 2022: 5

Purpose: The primary purpose of our Compensation Committee is to assist the Board in overseeing our management compensation policies and practices, including, among other things: • determining and approving the compensation of our executive officers; • reviewing and approving incentive compensation awards to executive officers; • making recommendations to the Board with respect to compensation of our directors; • reviewing and approving selection of peer companies used for compensation analysis; and • making recommendations to the Board with respect to all equity-based compensation plans.

The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the committee. In particular, the Compensation Committee may delegate the approval of certain decisions relating to equity compensation to a subcommittee consisting solely of members of the Compensation Committee who are “Non-Employee Directors” for the purposes of Rule 16b-3 under the Exchange Act.

Composition: Our Compensation Committee is composed of Messrs. Bickett, Clarke, Hagerty, and Throop. Mr. Bickett serves as chair of the Compensation Committee. All members of the Compensation Committee meet the required independence standards under applicable NYSE and SEC rules. The Compensation Committee is governed by a charter that complies with the rules of the NYSE.

Compensation Committee Interlocks and Insider Participation No member of our Compensation Committee has ever been one of our executive officers or employees. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

|

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

|

Meetings held in 2022: 4

Purpose: The primary purposes of our Corporate Governance and Nominating Committee are to, among other things: • make recommendations to the Board regarding nomination of individuals as members of the Board and its committees; • assist the Board with identifying individuals qualified to become Board members; and • determine corporate governance practices and related matters.

Further, the Corporate Governance and Nominating Committee provides oversight of Ceridian’s ESG efforts.

Composition: Our Corporate Governance and Nominating Committee is comprised of Mses. Farrington and Rosen and Messrs. Bickett and Rao. Ms. Farrington serves as chair of the Corporate Governance and Nominating Committee. Our Board has affirmatively determined that each of Mses. Farrington and Rosen and Messrs. Bickett and Rao meet the definition of an “independent director” for purposes of serving on the Corporate Governance and Nominating Committee under applicable NYSE rules. The Corporate Governance and Nominating Committee is governed by a charter that complies with the rules of the NYSE.

|

|

|

|

| 21 |

2023 PROXY STATEMENT |

Board’s Role in Risk Oversight

Our Board works directly with management to review Ceridian’s major areas of risk, assess management’s strategies for adequately managing risk, and determine the levels of risk appropriate for Ceridian.

The committees of the Board support the Board in exercising its risk oversight duties by overseeing the risks within the purview of their respective substantive areas. While the Audit Committee has responsibility to review corporate practices and policies with regard to risk management, the chairs of the Audit Committee, Compensation Committee, and Corporate Governance and Nominating Committee report on any committee-level risk-related discussions to the Board at each regular meeting of the Board, and the Acquisition and Finance Committee reports regularly to the Board summarizing the committee’s actions and any significant issues considered by the committee. This reporting process enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

A breakdown of the type of risks overseen by each committee is provided here:

Acquisition and Finance Committee |

| Compensation Committee | |

• Capital expenditures, investments, acquisitions, dispositions, financing activities, and other related matters not addressed by the entire Board |

| • Compensation policies and practices impacting recruitment and retention of executive talent, including reviewing and approving the annual compensation risk assessment conducted by management | |

Audit Committee |

| Corporate Governance and Nominating Committee | |

• Oversight over risk management process • The conduct and systems of internal control over financial reporting and disclosure controls and procedures • Oversight responsibility includes regular review of policies and practices with respect to risk assessment and risk management – including in the areas of cybersecurity and other information technology risk and privacy |

| • Corporate governance and related matters, including Board composition and refreshment and ESG related items | |

Additional information regarding the responsibilities of each committee is available in the “Committees of the Board of Directors” section on page 20 of this Proxy Statement, and in the charters of each of the Board committees.

|

|

|

| 22 |

2023 PROXY STATEMENT |

DIRECTOR COMPENSATION |

Our Board believes that compensation for directors should be competitive, aligned with stockholders, and reflect the highest standards of corporate governance. Our compensation program for directors is reviewed periodically by our Compensation Committee to ensure that we continue to provide a competitive compensation program.

Current Director Compensation Program

The current director compensation program for non-employee directors consists of:

| • | An annual cash retainer of $50,000; |

| • | Annual equity award grants of $250,000; |

| • | Annual cash committee chair fees (Audit Committee – $20,000, Compensation Committee – $12,500, Corporate Governance & Nominating Committee – $7,500); |

| • | Annual cash Lead Director fee of $50,000; and |

| • | One-time time-based restricted stock unit (“RSU”) grant with a value of $200,000 made to non-employee directors upon appointment to the Board. |

The annual cash retainer and annual cash committee chair and Lead Director fees are paid pro-rata quarterly. Directors are given the flexibility to elect to receive any portion of their annual cash retainer or annual cash committee chair and Lead Director fees in the form of equity award grants and to receive any annual equity awards in the form of either RSUs, time-based stock options, or any combination of the two. Annual equity award grants, regardless of form, vest pro-rata quarterly over one year following the date of grant. The one-time RSU award granted upon appointment to the Board vests pro-rata annually over a three-year period following the date of grant.

Our directors may be reimbursed for approved director education courses and out-of-pocket travel expenses incurred in connection with attendance at Board and Board committee meetings and other Board-related activities.

In 2022, there were no annual cash fees paid to the chair of the Acquisition and Finance Committee.

Director Stock Ownership Principles

Stock ownership and stockholder alignment are key principles of our director compensation program and are reinforced from a director’s appointment to the Board until their service concludes. Therefore, we provide for annual elections where directors may receive any portion of their annual cash fees in the form of equity awards and provide a one-time equity award upon a non-employee director’s appointment to the Board.

Stock Ownership Guidelines

The Compensation Committee has established Stock Ownership Guidelines to encourage equity ownership by our executive officers and non-employee directors to reinforce the link between their financial interests and those of our stockholders. A person covered by the Stock Ownership Guidelines will have five years from the later of February 27, 2020, or the date the individual becomes a covered person to satisfy the stock ownership requirements.

We set the Stock Ownership Guidelines for our non-employee directors based on a multiple of their annual base cash retainer as of December 31 of each year. Qualifying shares under the Stock Ownership Guidelines consist of:

| • | shares of our outstanding common stock, $0.01 par value (“Common Stock”) or Exchangeable Shares held directly or beneficially owned by the non-employee director; and |

| • | vested time-based vesting RSUs held directly by the non-employee director and granted to the non-employee director under a Ceridian equity plan. |

|

|

|

| 23 |

2023 PROXY STATEMENT |

Under our Stock Ownership Guidelines, each non-employee director is expected to own an amount of our stock equal in value to five times his or her annual base cash retainer. As of December 31, 2022, each of our non-employee directors complied with the requirements of the Stock Ownership Guidelines.

Discussion of the Stock Ownership Guidelines as they apply to the NEOs is contained in the CD&A on page 43 of this Proxy Statement.

Director Compensation for Fiscal Year 2022

The following table presents the total annual compensation for each person who served as a member of our Board during 2022, other than Mr. Ossip and Ms. Turner. Mr. Ossip and Ms. Turner received no additional compensation for their service as a member of our Board during 2022.

Name |

|

| Fees Earned in Cash ($)(1)(2) |

|

| Stock Awards ($)(2)(3)(5) | Option Awards ($)(2)(4)(5) | Total ($) | |||||||||||||

Brent B. Bickett |

|

|

| — |

|

|

|

| — |

|

|

|

| 312,500 |

|

|

| $ | 312,500 |

|

|

Ronald F. Clarke |

|

|

| — |

|

|

|

| 300,000 |

|

|

|

| — |

|

|

| $ | 300,000 |

|

|

Deborah A. Farrington |

|

|

| 57,500 |

|

|

|

| 125,000 |

|

|

|

| 125,000 |

|

|

| $ | 307,500 |

|

|

Thomas M. Hagerty |

|

|

| 29,125 |

|

|

|

| 300,000 |

|

|

|

| — |

|

|

| $ | 329,125 |

|

|

Linda Mantia |

|

|

| 16,666 |

|

|

|

| 175,000 |

|

|

|

| 100,000 |

|

|

| $ | 291,666 |

|

|

Ganesh B. Rao |

|

|

| — |

|

|

|

| 300,000 |

|

|

|

| — |

|

|

| $ | 300,000 |

|

|

Andrea S. Rosen |

|

|

| — |

|

|

|

| — |

|

|

|

| 300,000 |

|

|

| $ | 300,000 |

|

|

Gerald C. Throop |

|

|

| — |

|

|

|

| — |

|

|

|

| 370,000 |

|

|

| $ | 370,000 |

|

|

(1) | Represents cash fees earned in fiscal year 2022. Our directors are paid their cash fees in installments in arrears quarterly. |

(2) | In May 2022, Mr. Bickett elected to receive all $300,000 of his 2022 annual cash and equity compensation and his $12,500 Compensation Committee Chair fee in the form of stock options for a total of 14,826 stock options. |

|

|

|

| 24 |

2023 PROXY STATEMENT |

(3) | Represents the aggregate grant date fair value of the RSU awards granted in 2022, computed in accordance with Financial Accounting Standards Board Account Standards Codification (“FASB ASC”) Topic 718. These values have been determined based on the assumptions set forth in Note 2 to our consolidated financial statements included in the 2022 Annual Report. The closing price on the grant date of May 11, 2022, was $50.23. |

(4) | Represents the aggregate grant date fair value of the stock option awards granted in 2022, computed in accordance with FASB ASC Topic 718. These values have been determined based on the assumptions set forth in Note 2 to our consolidated financial statements included in the 2022 Annual Report. The grant date fair value of the stock options awards is based on a Black-Scholes model valuation determined on the date of grant, which was May 11, 2022. The exercise price is the closing price on the grant date of May 11, 2022, of $50.23. The actual value of the stock option awards, if any, to be realized by a director depends on whether the price of our Common Stock at exercise is greater than the exercise price of the stock options. |

(5) | Unvested equity as of December 31, 2022, vesting in two quarterly installments on February 11, 2023, and May 11, 2023. |

| (a) | Mr. Bickett holds 7,412 stock options; |

| (b) | Mr. Clarke holds 2,986 RSUs; |

| (c) | Ms. Farrington holds 1,244 RSUs and 2,964 stock options; |

| (d) | Mr. Hagerty holds 2,986 RSUs; |

| (e) | Ms. Mantia holds 1,741 RSUs and 2,372 stock options; |

| (f) | Mr. Rao holds 2,986 RSUs; |

| (g) | Ms. Rosen holds 7,116 stock options; and |

| (h) | Mr. Throop holds 8,777 stock options. |

CORPORATE GOVERNANCE |

Code of Conduct

We have a Code of Conduct that applies to all employees, contractors, officers, and directors of Ceridian HCM Holding Inc. and its majority-owned subsidiaries and controlled affiliates. A copy of the Code of Conduct is available on our website located at www.ceridian.com. Any amendments to or waivers from our Code of Conduct granted to directors or executive officers will be disclosed on our website promptly following the date of such amendment or waiver.

Corporate Governance Guidelines

Our Board has adopted corporate governance guidelines in accordance with the corporate governance rules of the NYSE and the TSX, which serve as a flexible framework within which our Board and its committees operate. These guidelines cover several areas, including Board composition, roles of the Chair and Lead Director, director nominations and Board membership criteria, Board meetings and executive sessions, Board committees, management succession, Board compensation, expectations of directors, Board performance evaluations, and access to management and outside advisors. A copy of our Corporate Governance Guidelines is posted on our website at www.ceridian.com.

Director Service on Other Public Company Boards

We value the experience directors bring from other boards on which they serve, but also recognize that those boards may present demands on a director’s time and availability and may present conflicts or legal issues. Accordingly, under our Corporate Governance Guidelines, a director is required to receive approval from the Chair of the Corporate Governance and Nominating Committee and the Corporate Secretary prior to joining a new board of directors or undertaking other significant commitments involving affiliation with other businesses or governmental agencies. The guidelines state that no director may sit on more than five public company boards (including the Company’s), and no director who is a CEO of a public company may sit on the board of more than two public companies besides the public company for which they are CEO. As of the time of mailing of this Proxy Statement, all directors satisfy the “overboarding” guidelines.

|

|

|

| 25 |

2023 PROXY STATEMENT |

No-Hedging and No-Pledging Policy

Our Insider Trading and Tipping Policy prohibits the hedging or pledging of Ceridian stock by our directors or executive officers unless an exception is granted by the Board. No exceptions to the policy were granted in 2022.

Director Evaluations

Our Board and Board committees conduct annual self-assessments of the effectiveness of the Board, Board committees, and our directors. The evaluation process was developed by and is administered under the direction of the Corporate Governance and Nominating Committee. The assessment is facilitated through a questionnaire process and is designed to elicit feedback with respect to areas such as Board and committee composition, governance, communication, culture, risk, and strategy. Responses are discussed with each of the Board committees and the full Board. Recommendations are discussed with the Board and within the appropriate Board committees, and then considered and implemented as appropriate.

Indemnification of Directors and Officers

Our fourth amended and restated certificate of incorporation provides that we will indemnify our directors and officers to the fullest extent permitted by the Delaware General Corporation Law (“DGCL”).

We have entered into indemnification agreements with each of our directors. These indemnification agreements provide the directors with contractual rights to indemnification and expense advancement and reimbursement to the fullest extent permitted under the DGCL, subject to certain exceptions contained in those agreements.

|

|

|

| 26 |

2023 PROXY STATEMENT |

STOCKHOLDER ENGAGEMENT |

A key part of our corporate governance program is our annual stockholder engagement process. We routinely engage with our stockholders to both seek their input on and address any questions they may have related to Company policies and practices. The direct conversations with stockholders also present an opportunity to provide perspective on recent or ongoing Company actions. As further detailed below, stockholder feedback has prompted further consideration by the Board and several actions and enhancements to our policies and practices over the years.

We value investors input and insights and are committed to meaningful engagement with investors, as demonstrated by our outreach efforts this year.

Scope of Engagement

Following our 2022 Annual Meeting of Stockholders, in order to better understand the executive compensation, corporate governance, and ESG concerns of our stockholders, we reached out to stockholders holding approximately 74% of the outstanding Common Stock of the Company as of June 30, 2022, to offer meetings with both the Chair of our Compensation Committee and Chair of our Corporate Governance and Nominating Committee. Ultimately, both the Chair of our Compensation Committee and Chair of our Corporate Governance and Nominating Committee participated in eight meetings this past fall with stockholders holding approximately 65% of the outstanding Common Stock of the Company as of June 30, 2022.

Outreach | 74% |

• Reached out to stockholders holding approximately 74% of the outstanding Common Stock of Ceridian to solicit feedback on compensation, corporate governance, and ESG matters.

| |

Meetings with | 8 |

• The Chair of our Compensation Committee and the Chair of our Corporate Governance and Nominating Committee held meetings with eight stockholders.

| |

Percentage Ownership | 65% |

• Directors and management met with stockholders holding approximately 65% of the outstanding Common Stock of Ceridian to discuss compensation, corporate governance, and ESG.

| |

In addition to the above meetings, our executive team regularly met with investors and stakeholders throughout 2022 to discuss company performance, corporate governance, and ESG initiatives. These meetings offer investors and stakeholders a form to engage in constructive conversations with management around the aforementioned topics.

|

|

|

| 27 |

2023 PROXY STATEMENT |

Compensation Feedback

Our Board continued to focus much of its engagement efforts on understanding stockholder concerns around executive compensation. Overall, stockholders were generally receptive to the recent and proposed changes to our executive compensation program. The Board heard the following feedback on compensation-related items and responded as noted:

Stockholder Feedback | Board Response | Timing |

Pay quantum for CEO has historically been too high.

| Adjusted pay quantum for CEO and then Co-CEOs to be in line with proxy peers. | Continued throughout 2021, 2022, and 2023. |

Concern about the dilutive effect of the 3% “evergreen refresh” provision in the 2018 EIP.

| The Board eliminated the evergreen feature in the 2018 EIP.

| Completed in April 2022. |

Desire for relative comparison performance metrics in long-term incentive program.

| The Board introduced a relative TSR component into the 2023 long-term incentive (“LTI”) program for NEOs.

| Added in February 2023. |

Concern over the use of similar metrics under both the short-term and long-term incentive plans. | The Board implemented a short-term incentive (“STI”) program (referred to as the “MIP”) and LTI plans in 2023 with two out of three differentiated metrics.

| Added in February 2023. |

Desire to include true long-term performance aspects into annual long-term incentive program. | The Board added a relative TSR component that is measured over a three-year performance period with cliff vesting in the 2023 LTI.

Additionally, starting in 2023, the Board expanded the financial performance period for NEOs in the LTI by granting PSUs with a one-year performance period and a three-year time-based vesting schedule. This change is designed to ensure continued performance throughout the entire vesting period.

| Added in February 2023. |

|

|

|

| 28 |

2023 PROXY STATEMENT |

Corporate Governance Feedback

In addition to the compensation focus, our discussions with stockholders also touched on corporate and ESG matters. The Board reviewed the feedback from our stockholders and responded as follows:

Stockholder Feedback | Board Response | Timing |

Support for Board responsiveness and transparent disclosure on stockholder engagement and feedback.

| Continued focus on clear and transparent disclosure, as well as continued responsiveness where it is deemed beneficial to the Company and its stockholders.

| Ongoing. |

Expressed interest in the Co-CEO structure and the efficacy of the model in the future.

| The Board believes that the Co-CEO model best leverages each of the unique strengths, backgrounds, and skill sets of each Co-CEO. This structure formalized a continuation of the close working relationship between Mr. Ossip and Ms. Turner, which has been instrumental in driving our growth, market leadership, strategy, and technological innovation. Under this model, Mr. Ossip has continued to focus on product development, customer interactions, and strategy, while Ms. Turner manages all stages of the customer lifecycle and the corporate functions.

| Ongoing. |

Appreciation of our efforts to declassify the Board and the commitment to adopt a majority vote standard in uncontested director elections by 2024, while also encouraging consideration of additional stockholder rights. | The Board has determined that our current corporate governance structure, coupled with our robust stockholder engagement program, permits adequate and appropriate stockholder input into company decision-making and further changes in these areas are not needed at this time.

| Declassification of the Board and the adoption of majority vote standard by 2024. |

Praise for improvements made in ESG reporting over the past couple of years. | Continued commitment to clear and transparent disclosure on ESG matters, including through annual ESG reports published to our website.

| Ongoing. |

|

|

|

| 29 |

2023 PROXY STATEMENT |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |