As at June 30, 2018, $1,256 million (December 31, 2017 (PotashCorp) – $104 million) of our cash and cash equivalents was held in certain foreign subsidiaries. As there are plans to repatriate the majority of these funds, a deferred tax liability of $239 million was recorded at June 30, 2018. On May 17, 2018, the company entered into an agreement with a third party for the sale of its shares of SQM for approximately $4,066 million before taxes and closing costs. The agreement is subject to customary closing conditions (including applicable regulatory approvals) and is expected to close by the fourth quarter of 2018. Repatriation of the net cash from this sale is expected to result in tax consequences.

Liquidity and Capital Resources

The following section explains how we manage our cash and capital resources to carry out our strategy and deliver results.

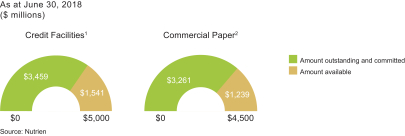

Liquidity risk arises from our general funding needs and in the management of our assets, liabilities and capital structure. We manage liquidity risk to maintain sufficient liquid financial resources to fund our financial position and meet our commitments and obligations in a cost-effective manner.

| | |

Liquidity needs can be met through a variety of sources: | | Our primary uses of funds are: |

• Cash generated from operations. | | • Operational expenses. |

• Drawdowns under our revolving credit facility. | | • Sustaining, opportunity and integration capital spending. |

• Issuances of commercial paper. | | • Intercorporate investments. |

• Short-term borrowings under our line of credit. | | • Dividends and interest. |

• Proceeds from sales of investments. | | • Principal payments on our debt securities. |

• Accounts receivable securitization program. | | • Share repurchases. |

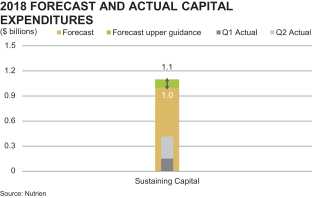

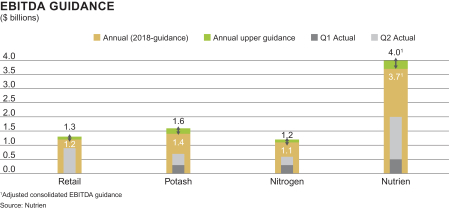

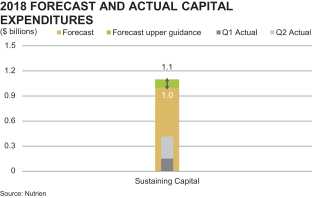

Based on an expected average exchange rate of 1.28 Canadian dollars per US dollar in 2018, we expect to incur capital expenditures, including capitalized interest, of approximately $1.0 billion to $1.1 billion to sustain operations at existing levels and for major repairs and maintenance (including plant turnarounds). We target a stable and growing dividend that represents 40 to 60 percent of free cash flow after sustaining capital through the agricultural cycle. Our Board has also approved the purchase of up to five percent of our outstanding common shares over aone-year period through a NCIB. The NCIB is being effected in accordance with the Toronto Stock Exchange’s (TSX) normal course issuer bid rules and/or Rule10b-18 under the US Securities Exchange Act of 1934, which contain restrictions on the number of common shares that may be purchased on a single day, subject to certain exceptions for block purchases, based on the average daily trading volumes of Nutrien’s common shares on the applicable exchange. The TSX has approved our notice of NCIB to purchase up to 32,209,923 of our common shares until February 22, 2019. A copy of our notice can be obtained, without charge, by contacting our Investor Relations department. During the six months ended June 30, 2018, 24,938,123 common shares were repurchased at a cost of $1,269 million at an average price per share of $50.88. As of July 31, 2018, an additional 4,400,000 common shares were repurchased as a cost of $235 million and an average price per share of $53.31.

On July 23, 2018, we entered into an agreement with a third party for the sale of the company’s equity interest in APC for approximately $502 million. The agreement is subject to customary closing conditions (including applicable regulatory approvals) and is expected to close by the fourth quarter of 2018.

Cash Requirements

Contractual Obligations and Other Commitments

Our contractual obligations and other commitments detailed on page 22 of our first quarter interim report summarize certain of our liquidity and capital resource requirements as of March 31, 2018, excluding obligations that have original maturities of less than one year, planned (but not legally committed) capital expenditures, or potential share repurchases. There were no significant changes to these contractual obligations and other commitments since March 31, 2018. During the second quarter of 2018, the company made a decision to close the small phosphate facility at Geismar. As a result, contracted purchases of phosphate rock from Morocco are expected to end by December 31, 2018 with associated cash outflows of $38 million occurring by the end of the first quarter of 2019.

| | |

| 20 | | Nutrien 2018 Second Quarter Report |