| | | | |

| Unaudited | | | | in millions of US dollars except as otherwise noted |

In the second quarter of 2018, the company launched a commercial paper program having an aggregate authorized amount of $4,500. Nutrien has discontinued new issuances under the legacy commercial paper programs of PotashCorp and Agrium.

In the second quarter of 2018, the company replaced the existing $3,500 unsecured revolving credit facility and the $2,500 multi-jurisdictional unsecured revolving credit facility with a new Nutrien $4,500 unsecured revolving credit facility (“Nutrien Credit Facility”). The Nutrien Credit Facility matures April 10, 2023, subject to extension at the request of Nutrien provided that the resulting maturity date shall not exceed five years from the date specified in the request. Principal covenants and events of default under the Nutrien Credit Facility include a debt to capital ratio of less than or equal to 0.65:1 and other customary events of default and covenant provisions. Non-compliance with such covenants could result in accelerated repayment and/or termination of the credit facility.

In the second quarter of 2018, the company exchanged an aggregate of $7,578 of legacy companies’ senior notes and debentures for the same amount of new notes issued by Nutrien (the “Nutrien Notes”). The Nutrien Notes have interest rates and maturities identical to those of the applicable exchanged series of senior notes or debentures. A small portion of senior

notes and debentures, excluding the 7.800 percent debentures due in 2027 (the “2027 debentures”), were not exchanged and remain outstanding with the issuing subsidiary. The indentures governing these remaining senior notes and debentures have been amended to eliminate certain covenants and events of default provisions. In addition, none of the 2027 debentures were exchanged, but debt holders consented to amend the financial reporting covenant in the indenture governing the 2027 debentures to allow Nutrien’s financial reports, rather than the reports of the issuing subsidiary, to satisfy its reporting obligations thereunder.

The debt exchange is accounted for as a modification of debt without substantial modification of terms as the financial terms of the Nutrien Notes were identical to the exchanged senior notes and debentures and there is no substantial difference between the present value of cash flows under the Nutrien Notes compared to the notes and debentures. Accordingly, there is no gain or loss on the exchange. The transaction costs from the debt exchange of $19 were recorded to the carrying amount of the long-term debt and will be amortized over the life of the Nutrien Notes.

Further information relating to the Nutrien Notes was previously described in Note 21 of the company’s first quarter financial statements.

Authorized

The company is authorized to issue an unlimited number of common shares without par value and an unlimited number of preferred shares. The common shares are not redeemable or convertible. The preferred shares may be issued in one or more series with rights and conditions to be determined by the Board of Directors. No preferred shares have been issued.

Share repurchase program

On February 20, 2018, the company’s Board of Directors approved a share repurchase program of up to five percent of the company’s outstanding common shares over aone-year period through a normal course issuer bid. Purchases under the normal course issuer bid will be made through open market purchases at market price as well as by other means as may be permitted by applicable securities regulatory authorities, including private agreements. Purchases of common shares commenced on February 23, 2018 and will expire on the earlier of February 22, 2019, the date on which the company has acquired the maximum number of common shares allowable or the date on which the company determines not to make any further repurchases.

The company repurchased for cancellation 15,616,536 common shares during the three months ended June 30, 2018, at a cost of $812 and an average price per share of $52.00. During the six months ended June 30, 2018, the company repurchased for cancellation 24,938,123 common shares at a cost of $1,269 and an average price per share of $50.88. The repurchase resulted in a reduction of share capital of $685, and the excess of net cost over the average book value of the shares was recorded as a reduction of contributed surplus of $23 and a reduction of retained earnings of $561.

As of July 31, 2018, an additional 4,400,000 common shares were repurchased for cancellation at a cost of $235 and an average price per share of $53.31.

Issued

| | | | | | | | | | | | |

| | | Number of Common Shares (Pre-Merger) | | | Number of Common Shares (Post-Merger) | | | Consideration | |

Balance – December 31, 2017(Pre-Merger) | | | 840,223,041 | | | | | | | | | |

Conversion ratio | | | 0.40 | | | | | | | | | |

PotashCorp shares converted to Nutrien shares | | | | | | | 336,089,216 | | | $ | 1,806 | |

Agrium shares – December 31, 2017(Pre-Merger) | | | 138,165,765 | | | | | | | | | |

Conversion ratio | | | 2.23 | | | | | | | | | |

Agrium shares converted to Nutrien shares | | | | | | | 308,109,656 | | | | 15,898 | |

Fractional shares cancelled | | | | | | | (1,399 | ) | | | – | |

| | | | | | | | | | | | | |

Balance – January 1, 2018 (Post-Merger) | | | | | | | 644,197,473 | | | $ | 17,704 | |

Issued under option plans and share-settled plans | | | | | | | 105,608 | | | | 5 | |

Repurchased | | | | | | | (24,938,123 | ) | | | (685 | ) |

| | | | | | | | | | | | | |

Balance – June 30, 2018 | | | | | | | 619,364,958 | | | $ | 17,024 | |

| | | | | | | | | | | | | |

Dividends declared

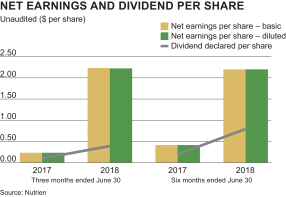

The company declared dividends per share of $0.40 (2017 – $0.10) during the three months ended June 30, 2018 and $0.80 (2017 – $0.20) during the six months ended June 30, 2018.

| | |

| 14 | | Nutrien 2018 Second Quarter Report |