UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | | 811-23324 |

| |

| Exact name of registrant as specified in charter: | | PGIM ETF Trust |

|

(This Form NCSR relates solely to the Registrant’s PGIM Ultra Short Bond ETF) |

| |

| Address of principal executive offices: | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Deborah A. Docs |

| | | 655 Broad Street, 17th Floor |

| | | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 8/31/2018 |

| |

| Date of reporting period: | | 8/31/2018 |

Item 1 – Reports to Stockholders

PGIM ULTRA SHORT BOND ETF (NYSE Arca: PULS)

ANNUAL REPORT

AUGUST 31, 2018

To enroll in e-delivery, go to pgiminvestments.com/edelivery

|

Objective: Total return through a combination of current income and capital

appreciation, consistent with preservation of capital |

Highlights (unaudited)

| • | | The Fund’s investments in credit sectors helped the Fund outperform the ICE BofAML USD LIBOR 3-Month CM Index (the Index) for the reporting period. Credit spreads tightened during the period as short-term investors, along with prime money market and other non-Rule 2a-7 ultra-short funds, sought higher yields in the short-term space. |

| • | | Additionally, with more than 50% of the Fund’s assets positioned in the one- to three-year segment of the yield curve, higher yields relative to the Index were captured. |

| • | | Versus the Index, the Fund was appropriately positioned to capture excess returns with a minimal amount of risk. During the period, there were no unexpected developments in interest rates, yield curves, or credit trends that limited these results. |

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Fund’s portfolio holdings are for the period covered by this report and are subject to change thereafter.

Funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2018 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| | |

| 2 | | Visit our website at pgiminvestments.com |

Table of Contents

| | | | |

| PGIM Ultra Short Bond ETF | | | 3 | |

This Page Intentionally Left Blank

Letter from the President

Dear Shareholder:

We hope you find the annual report for the PGIM Ultra Short Bond ETF informative and useful. The report covers performance for the reporting period that began April 5, 2018 (the Fund’s inception), and ended August 31, 2018.

Over the reporting period, the global economy continued to grow, and central banks gradually tightened monetary policy. In the US, the economy expanded and employment increased. In June, the Federal Reserve hiked interest rates for the seventh time since 2015, based on confidence in the economy.

Equity returns were strong, due to optimistic earnings expectations and investor sentiment. Global equities, including emerging markets, generally posted positive returns. However, they trailed the performance of US equities, which rose on higher corporate profits, new regulatory policies, and tax reform benefits. Volatility spiked briefly in the middle of the period on inflation concerns, rising interest rates, and a potential global trade war, but it decreased as the period ended.

The overall bond market declined modestly during the period, as measured by the Bloomberg Barclays US Aggregate Bond Index. The best performance came from higher-yielding, economically sensitive sectors. Although they finished the period with negative returns, US investment-grade corporate bonds outperformed US government nominal bonds. A major trend during the period was the flattening of the US Treasury yield curve, which increased the yield on fixed income investments with shorter maturities and made them more attractive to investors.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This investment expertise allows us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Ultra Short Bond ETF

October 15, 2018

| | | | |

| PGIM Ultra Short Bond ETF | | | 5 | |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at www.pgiminvestments.com or by calling (800) 225-1852.

| | |

| | | Total Returns as of 8/31/18 |

| | | Since Inception (%) |

Net Asset Value | | 1.08 (4/5/18) |

| Market Price* | | 1.10 (4/5/18) |

| ICE BofAML 3-Month T Bill Index | | 0.79 |

| ICE BofAML USD LIBOR 3-Month CM Index | | 1.00 |

| Lipper Ultra-Short Obligations Funds Average | | 1.00 |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the Market Price returns.

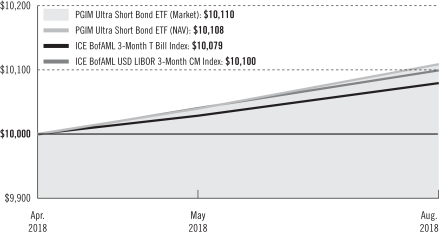

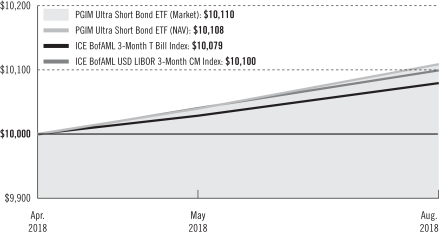

Growth of a $10,000 Investment

The graph compares a $10,000 investment in the Fund with a similar investment in the ICE BofAML 3-Month T Bill Index and the ICE BofAML USD LIBOR 3-Month CM Index by portraying the initial account values at the beginning of the period (April 5, 2018) and the account values at the end of the current fiscal period (August 31, 2018) as measured on a quarterly basis. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted; and (b) all dividends and distributions were reinvested.

| | |

| 6 | | Visit our website at pgiminvestments.com |

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

Source: PGIM Investments LLC and Lipper Inc.

Since inception returns for the Indexes and the Lipper Average are measured from the closest month-end to the Fund’s inception date.

The returns in the tables do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

Benchmark Definitions

ICE BofAML 3-Month T Bill Index—The ICE BofAML 3-Month US Treasury Bill Index tracks the performance of US dollar denominated US Treasury Bills publicly issued in the US domestic market with a remaining term to final maturity of 3 months.

ICE BofAML USD LIBOR 3-Month CM Index—The ICE BofA Merrill Lynch US Dollar LIBOR 3-Month Constant Maturity Index is an unmanaged index that tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that current day fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

ICE BOFA MERRILL LYNCH IS LICENSING THE BOFA MERRILL LYNCH INDICES “AS IS,” MAKES NO WARRANTIES REGARDING THE SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BOFA MERRILL LYNCH INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND THE FUND, OR ANY OF ITS PRODUCTS OR SERVICES.

Lipper Ultra-Short Obligations Funds Average—The Lipper Ultra Short Obligation Funds Average (Lipper Average) is based on the average return of all funds in the Lipper Ultra Short Obligation Funds universe for the periods noted. Funds in the Lipper Average are funds that invest primarily in investment-grade debt issues or better and maintain a portfolio dollar weighted average maturity between 91 days and 365 days.

Investors cannot invest directly in an index or average. The returns for the Index would be lower if they included the effects of sales charges, operating expenses of a mutual fund, or taxes. Returns for the Lipper Average reflect the deduction of operating expenses of a mutual fund, but not sales charges or taxes.

| | | | |

| PGIM Ultra Short Bond ETF | | | 7 | |

Your Fund’s Performance (continued)

| | | | |

| Credit Quality expressed as a percentage of total investments as of 8/31/18 (%) | |

| AAA | | | 18.9 | |

| AA | | | 20.1 | |

| A | | | 35.6 | |

| BBB | | | 24.2 | |

| Cash/Cash Equivalents | | | 1.4 | |

| Total Investments | | | 100.0 | |

Source: PGIM Fixed Income

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investor Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. Credit ratings are subject to change. Values may not sum to 100% due to rounding.

| | | | | | |

| Distributions and Yields as of 8/31/18 |

| | Total Dividends

Paid Since

Inception ($) | | SEC 30-Day

Subsidized

Yield* (%) | | SEC 30-Day

Unsubsidized

Yield** (%) |

| | | 0.42 | | 2.55 | | 2.55 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements).

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses.

| | |

| 8 | | Visit our website at pgiminvestments.com |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Ultra Short Bond ETF returned 1.08% based on net asset value since the Fund’s inception on April 5, 2018, through the end of the reporting period on August 31, 2018, outperforming the 0.79% return of the ICE BofAML 3-Month T-Bill Index and also the 1.00% return of the ICE BofAML USD LIBOR 3-Month CM Index (the Index). In addition, the Fund outperformed the 1.00% return of the Lipper Ultra Short Obligations Funds Average.

What were market conditions?

| • | | During the reporting period, the Federal Reserve (the Fed) increased the range of the federal funds rate one time, from 1.50% to 1.75% at the start of the period to 1.75% to 2.00% in June 2018. The global economy continued its impressive performance though the approximate five-month period, stemming from strong macro fundamentals, low and stable inflation, and solid business confidence. This scenario allowed the Fed to continue its path toward normalizing the federal funds rate. |

| • | | In the short maturity segment of the bond market where the Fund focuses its investments, yields increased to a greater degree than they did at the longer end, with three-month and two-year Treasuries rising 39 and 36 basis points (bps), respectively, during the period, versus 11 bps for the bellwether 10-year Treasury note. (A basis point is 0.01%.) The three-month London Interbank Offered Rate (LIBOR), from which the Fund’s floating-rate securities are set and reset, remained relatively stable at around 2.34% for the period, after increasing steadily since 2015. |

| • | | In the short-term credit markets, investment-grade credit quality spreads tightened over the reporting period, as an abundance of cash seeking higher yield, including short-term focused portfolios, worked to squeeze spreads tighter. As such, the Bloomberg Barclays 1-3 Year Credit Index, a proxy for the short-term spread market, outperformed similar short-duration Treasuries by 0.35% during the period, compared to longer-term corporate assets that lagged Treasurys. |

What worked?

| • | | The Fund’s investments in credit sectors helped the Fund outperform the Index for the reporting period. As previously mentioned, credit spreads tightened during the period as short-term investors, along with prime money market and other non-Rule 2a-7 ultra-short funds, sought higher yields in the short-term space. |

| • | | Additionally, with more than 50% of the Fund’s assets positioned in the one- to three-year segment of the yield curve, higher yields relative to the Index were captured. |

What didn’t work?

| • | | Versus the Index, the Fund was appropriately positioned to capture excess returns with a minimal amount of risk. During the period, there were no unexpected developments in interest rates, yield curves, or credit trends that limited these results. |

| | | | |

| PGIM Ultra Short Bond ETF | | | 9 | |

Strategy and Performance Overview (continued)

Did the Fund use derivatives, and how did they affect performance?

| • | | During the reporting period, the Fund used interest-rate swaps to help manage duration positioning and yield curve exposure. Duration measures a portfolio’s sensitivity to changes in interest rates. These instruments allowed the Fund to capture higher yields available farther out on the short-term portion of the yield curve and in spread-sector assets versus Treasurys, while mitigating interest-rate risk. |

Current outlook

| • | | PGIM Fixed Income expects the Fed to raise rates two more times in 2018 and perhaps two more times in 2019, with the Fed following a data-dependent process. Spread markets are also expected to grind tighter still, as favorable economic conditions along with solid fundamental and robust demand from yield-seeking investors will make corporates and other non-government fixed income assets attractive. |

| | |

| 10 | | Visit our website at pgiminvestments.com |

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur ongoing costs, including investment management fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 held through the period ended August 31, 2018. The example is for illustrative purposes only.

Actual Expenses

The information under each column in the line entitled “Actual” on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information under each column in the line entitled “Hypothetical” on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, brokerage commissions paid on purchases and sales of Fund shares. Therefore, the ending account values and expenses paid for the period are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| PGIM Ultra Short Bond ETF | | | 11 | |

Fees and Expenses (continued)

| | | | | | | | | | | | | | | | | | |

| PGIM Ultra Short Bond ETF | | Beginning Account

Value

March 1, 2018 | | | Ending Account

Value

August 31, 2018 | | | Annualized

Expense Ratio

based on the

Six-Month Period | | | Expenses Paid

During the

Six-Month Period* | |

Actual** Hypothetical | | $

$ | 1,000.00

1,000.00 |

| | $

$ | 1,010.80

1,024.45 |

| |

| 0.15

0.15 | %

% | | $

$ | 0.61

0.77 |

|

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2018, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2018. Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**“Actual” expenses are calculated using the 148-day period ended August 31, 2018 due to the Fund’s inception date of April 5, 2018.

| | |

| 12 | | Visit our website at pgiminvestments.com |

Schedule of Investments

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

LONG-TERM INVESTMENTS 79.9% | | | | | |

| |

ASSET-BACKED SECURITIES 8.2% | | | | | |

| |

Collateralized Loan Obligations 8.2% | | | | | |

Battalion CLO VII Ltd. (Cayman Islands), Series 2014-7A, Class A1RR, 144A, 3 Month LIBOR + 1.040% | | | 3.376 | %(c) | | | 07/17/28 | | | | 250 | | | $ | 250,012 | |

Birchwood Park CLO Ltd. (Cayman Islands), Series 2014-1A, Class AR, 144A, 3 Month LIBOR + 1.180% | | | 3.519 | (c) | | | 07/15/26 | | | | 525 | | | | 524,862 | |

CIFC Funding 2015-II Ltd. (Cayman Islands), Series 2015-2A, Class AR, 144A, 3 Month LIBOR + 0.780% | | | 3.119 | (c) | | | 04/15/27 | | | | 575 | | | | 572,663 | |

Limerock CLO III LLC (Cayman Islands), Series 2014-3A, Class A1R, 144A, 3 Month LIBOR + 1.200% | | | 3.548 | (c) | | | 10/20/26 | | | | 250 | | | | 249,989 | |

Magnetite XI Ltd. (Cayman Islands), Series 2014-11A, Class A1R, 144A, 3 Month LIBOR + 1.120% | | | 3.453 | (c) | | | 01/18/27 | | | | 300 | | | | 300,062 | |

Mill Creek II CLO Ltd. (Cayman Islands), Series 2016-1A, Class A, 144A, 3 Month LIBOR + 1.750% | | | 4.098 | (c) | | | 04/20/28 | | | | 250 | | | | 250,017 | |

Silver Spring CLO Ltd. (Cayman Islands), Series 2014-1A, Class AR, 144A, 3 Month LIBOR + 1.250% | | | 3.589 | (c) | | | 10/15/26 | | | | 550 | | | | 550,174 | |

THL Credit Wind River CLO Ltd. (Cayman Islands), Series 2015-1A, Class AR, 144A, 3 Month LIBOR + 1.050% | | | 3.398 | (c) | | | 07/20/27 | | | | 800 | | | | 800,131 | |

TICP CLO I Ltd. (Cayman Islands), Series 2015-1A, Class AR, 144A, 3 Month LIBOR + 0.800% | | | 3.148 | (c) | | | 07/20/27 | | | | 500 | | | | 498,146 | |

West CLO Ltd. (Cayman Islands), Series 2014-1A, Class A1R, 144A, 3 Month LIBOR + 0.920% | | | 3.253 | (c) | | | 07/18/26 | | | | 300 | | | | 300,014 | |

| | | | | | | | | | | | | | | | |

TOTAL ASSET-BACKED SECURITIES

(cost $4,297,834) | | | | | | | | 4,296,070 | |

| | | | | | | | | |

| |

COMMERCIAL MORTGAGE-BACKED SECURITIES 9.7% | | | | | |

BANK, Series 2017-BNK5, Class A1 | | | 1.909 | | | | 06/15/60 | | | | 131 | | | | 128,016 | |

CD Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-CD1, Class A1 | | | 1.443 | | | | 08/10/49 | | | | 32 | | | | 31,232 | |

Series 2017-CD3, Class A1 | | | 1.965 | | | | 02/10/50 | | | | 75 | | | | 74,047 | |

CFCRE Commercial Mortgage Trust, Series 2016-C4, Class A1 | | | 1.501 | | | | 05/10/58 | | | | 187 | | | | 183,793 | |

Citigroup Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2016-P5, Class A1 | | | 1.410 | | | | 10/10/49 | | | | 103 | | | | 100,937 | |

Series 2017-P8, Class A1 | | | 2.065 | | | | 09/15/50 | | | | 220 | | | | 214,773 | |

COMM Mortgage Trust, Series 2017-COR2, Class A1 | | | 2.111 | | | | 09/10/50 | | | | 227 | | | | 222,304 | |

CSAIL Commercial Mortgage Trust, Series 2015-C3, Class A1 | | | 1.717 | | | | 08/15/48 | | | | 377 | | | | 372,650 | |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 13 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | |

DBJPM Mortgage Trust, Series 2016-C3, Class A1 | | | 1.502 | % | | | 08/10/49 | | | | 106 | | | $ | 103,860 | |

GS Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2013-GC14, Class A3 | | | 3.526 | | | | 08/10/46 | | | | 150 | | | | 150,836 | |

Series 2014-GC24, Class A1 | | | 1.509 | | | | 07/10/19 | | | | 92 | | | | 91,503 | |

JP Morgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2012-CBX, Class A3 | | | 3.139 | | | | 06/15/45 | | | | 131 | | | | 130,957 | |

Series 2016-JP2, Class A1 | | | 1.324 | | | | 08/15/49 | | | | 70 | | | | 68,599 | |

JPMBB Commercial Mortgage Securities Trust, | | | | | | | | | | | | | | | | |

Series 2015-C31, Class A1 | | | 1.666 | | | | 08/15/48 | | | | 244 | | | | 241,037 | |

Series 2016-C1, Class A1 | | | 1.695 | | | | 03/15/49 | | | | 237 | | | | 234,842 | |

Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | | | | | | | | | |

Series 2014-C14, Class A3 | | | 3.669 | | | | 02/15/47 | | | | 80 | | | | 80,695 | |

Series 2015-C21, Class A1 | | | 1.548 | | | | 03/15/48 | | | | 69 | | | | 68,139 | |

Morgan Stanley Capital I Trust, | | | | | | | | | | | | | | | | |

Series 2015-MS1, Class A1 | | | 1.638 | | | | 05/15/48 | | | | 530 | | | | 524,067 | |

Series 2016-BNK2, Class A1 | | | 1.424 | | | | 11/15/49 | | | | 140 | | | | 136,060 | |

Series 2016-UBS9, Class A1 | | | 1.711 | | | | 03/15/49 | | | | 157 | | | | 154,357 | |

UBS Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2017-C5, Class A1 | | | 2.139 | | | | 11/15/50 | | | | 373 | | | | 365,472 | |

Series 2018-C11, Class A1 | | | 3.211 | | | | 06/15/51 | | | | 100 | | | | 100,018 | |

Wells Fargo Commercial Mortgage Trust, | | | | | | | | | | | | | | | | |

Series 2015-LC22, Class A1 | | | 1.639 | | | | 09/15/58 | | | | 289 | | | | 286,132 | |

Series 2015-NXS4, Class A1 | | | 1.889 | | | | 12/15/48 | | | | 129 | | | | 128,213 | |

Series 2016-BNK1, Class A1 | | | 1.321 | | | | 08/15/49 | | | | 151 | | | | 147,426 | |

Series 2016-C32, Class A1 | | | 1.577 | | | | 01/15/59 | | | | 442 | | | | 436,270 | |

Series 2016-LC24, Class A1 | | | 1.441 | | | | 10/15/49 | | | | 134 | | | | 133,021 | |

Series 2016-NXS6, Class A1 | | | 1.417 | | | | 11/15/49 | | | | 99 | | | | 97,004 | |

Series 2017-RB1, Class A1 | | | 2.056 | | | | 03/15/50 | | | | 101 | | | | 98,935 | |

| | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(cost $5,098,940) | | | | 5,105,195 | |

| | | | | | | | | | | | | | | | |

| |

CORPORATE BONDS 58.8% | | | | | |

| |

Aerospace & Defense 0.7% | | | | | |

General Dynamics Corp., Gtd. Notes, 3-Month

LIBOR + 0.290% | | | 2.628 | (c) | | | 05/11/20 | | | | 350 | | | | 351,381 | |

| |

Auto Manufacturers 5.7% | | | | | |

BMW US Capital LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.370% | | | 2.689 | (c) | | | 08/14/20 | | | | 250 | | | | 250,455 | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.410% | | | 2.747 | (c) | | | 04/12/21 | | | | 375 | | | | 375,859 | |

Daimler Finance North America LLC, | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.390% | | | 2.731 | (c) | | | 05/04/20 | | | | 150 | | | | 150,364 | |

Gtd. Notes, 144A, 3 Month LIBOR + 0.530% | | | 2.871 | (c) | | | 05/05/20 | | | | 360 | | | | 361,193 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | | | | | | | | | | | | |

| |

Auto Manufacturers (cont’d.) | | | | | |

Ford Motor Credit Co. LLC, Sr. Unsec’d. Notes, 3 Month LIBOR + 0.830% | | | 3.156 | %(c) | | | 03/12/19 | | | | 350 | | | $ | 350,436 | |

Harley-Davidson Financial Services, Inc., | | | | | | | | | | | | | | | | |

Gtd. Notes, 144A | | | 2.250 | | | | 01/15/19 | | | | 250 | | | | 249,542 | |

Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.500% | | | 2.812 | (c) | | | 05/21/20 | | | | 350 | | | | 351,105 | |

Nissan Motor Acceptance Corp., Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.390% | | | 2.727 | (c) | | | 07/13/20 | | | | 410 | | | | 410,382 | |

Toyota Motor Finance Netherlands BV (Netherlands), Sr. Unsec’d. Notes, EMTN, 3 Month LIBOR + 0.250% | | | 2.576 | (c) | | | 12/12/19 | | | | 500 | | | | 500,540 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,999,876 | |

| | | | |

Banks 17.7% | | | | | | | | | | | | | | | | |

ABN AMRO Bank NV (Netherlands), Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.570% | | | 2.881 | (c) | | | 08/27/21 | | | | 500 | | | | 501,149 | |

Australia & New Zealand Banking Group Ltd. (Australia), Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.320% | | | 2.661 | (c) | | | 11/09/20 | | | | 450 | | | | 450,950 | |

Bank of America Corp., Sr. Unsec’d. Notes, 3 Month LIBOR + 1.040% | | | 3.379 | (c) | | | 01/15/19 | | | | 435 | | | | 436,705 | |

Bank of Montreal (Canada), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.340%, | | | 2.677 | (c) | | | 07/13/20 | | | | 250 | | | | 251,016 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.460% | | | 2.797 | (c) | | | 04/13/21 | | | | 275 | | | | 276,313 | |

BB&T Corp., | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.570% | | | 2.911 | (c) | | | 06/15/20 | | | | 200 | | | | 201,395 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.715% | | | 3.054 | (c) | | | 01/15/20 | | | | 160 | | | | 161,111 | |

Capital One NA, Sr. Unsec’d. Notes, 3 Month LIBOR + 0.765% | | | 3.098 | (c) | | | 09/13/19 | | | | 250 | | | | 251,406 | |

Citibank NA, Sr. Unsec’d. Notes, 3 Month LIBOR + 0.260% | | | 2.595 | (c) | | | 09/18/19 | | | | 350 | | | | 350,531 | |

Commonwealth Bank of Australia (Australia), Sr. Unsec’d. Notes, GMTN | | | 2.050 | | | | 03/15/19 | | | | 400 | | | | 398,687 | |

Fifth Third Bank, Sr. Unsec’d. Notes, BKNT | | | 2.375 | | | | 04/25/19 | | | | 400 | | | | 399,606 | |

Goldman Sachs Group, Inc. (The), Sr. Unsec’d. Notes, 3 Month LIBOR + 1.020% | | | 3.367 | (c) | | | 10/23/19 | | | | 400 | | | | 403,673 | |

Industrial & Commercial Bank of China Ltd. (China), Sr. Unsec’d. Notes, MTN | | | 2.905 | | | | 11/13/20 | | | | 250 | | | | 245,969 | |

Industrial Bank of Korea (South Korea), Sr. Unsec’d. Notes, 144A | | | 2.000 | | | | 04/23/20 | | | | 350 | | | | 342,381 | |

JPMorgan Chase & Co., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.630% | | | 2.969 | (c) | | | 01/28/19 | | | | 650 | | | | 651,552 | |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 15 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | |

| | | | |

Banks (cont’d.) | | | | | | | | | | | | | | | | |

Morgan Stanley, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.850% | | | 3.192 | %(c) | | | 01/24/19 | | | | 149 | | | $ | 149,467 | |

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.740%, | | | 3.087 | (c) | | | 07/23/19 | | | | 350 | | | | 351,767 | |

PNC Bank NA, | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.250% | | | 2.597 | (c) | | | 01/22/21 | | | | 500 | | | | 500,354 | |

Sr. Unsec’d. Notes, BKNT | | | 1.950 | | | | 03/04/19 | | | | 400 | | | | 398,930 | |

Royal Bank of Canada (Canada), Sr. Unsec’d. Notes, GMTN, 3 Month LIBOR + 0.480% | | | 2.819 | (c) | | | 07/29/19 | | | | 368 | | | | 369,485 | |

State Street Corp., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.900% | | | 3.222 | (c) | | | 08/18/20 | | | | 127 | | | | 128,724 | |

Sumitomo Mitsui Banking Corp. (Japan), Gtd. Notes, 3 Month LIBOR + 0.670% | | | 3.012 | (c) | | | 10/19/18 | | | | 465 | | | | 465,440 | |

Toronto-Dominion Bank (The) (Canada), Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.280% | | | 2.606 | (c) | | | 06/11/20 | | | | 500 | | | | 501,336 | |

US Bank NA, Sr. Unsec’d. Notes, BKNT | | | 1.400 | | | | 04/26/19 | | | | 400 | | | | 397,199 | |

Wells Fargo Bank NA, Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.650% | | | 2.964 | (c) | | | 12/06/19 | | | | 404 | | | | 406,580 | |

Westpac Banking Corp. (Australia), | | | | | | | | | | | | | | | | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.560% | | | 2.882 | (c) | | | 08/19/19 | | | | 105 | | | | 105,490 | |

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.710% | | | 3.048 | (c) | | | 05/13/19 | | | | 250 | | | | 251,030 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 9,348,246 | |

| | | | |

Biotechnology 1.7% | | | | | | | | | | | | | | | | |

Amgen, Inc., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.600% | | | 2.910 | (c) | | | 05/22/19 | | | | 415 | | | | 416,582 | |

Biogen, Inc., Sr. Unsec’d. Notes | | | 2.900 | | | | 09/15/20 | | | | 500 | | | | 498,317 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 914,899 | |

| |

Building Materials 1.0% | | | | | |

Johnson Controls International PLC (Ireland), Sr. Unsec’d. Notes | | | 5.000 | | | | 03/30/20 | | | | 500 | | | | 513,800 | |

| |

Chemicals 1.0% | | | | | |

EI du Pont de Nemours & Co., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.530% | | | 2.873 | (c) | | | 05/01/20 | | | | 500 | | | | 503,195 | |

| |

Commercial Services 0.4% | | | | | |

Western Union Co. (The), Sr. Unsec’d. Notes, 3 Month LIBOR + 0.800% | | | 3.110 | (c) | | | 05/22/19 | | | | 205 | | | | 205,479 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | |

| |

Computers 1.1% | | | | | |

HP, Inc., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.940% | | | 3.279 | %(c) | | | 01/14/19 | | | | 600 | | | $ | 601,564 | |

| |

Diversified Financial Services 2.0% | | | | | |

American Express Credit Corp., Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.730% | | | 3.041 | (c) | | | 05/26/20 | | | | 415 | | | | 418,604 | |

BOC Aviation Ltd. (Singapore), Sr. Unsec’d. Notes, 144A | | | 3.000 | | | | 03/30/20 | | | | 250 | | | | 247,613 | |

Charles Schwab Corp. (The), Sr. Unsec’d. Notes, 3 Month LIBOR + 0.320% | | | 2.632 | (c) | | | 05/21/21 | | | | 350 | | | | 351,286 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,017,503 | |

| |

Electric 1.9% | | | | | |

Abu Dhabi National Energy Co. PJSC (United Arab Emirates), Sr. Unsec’d. Notes, 144A | | | 6.250 | | | | 09/16/19 | | | | 360 | | | | 371,552 | |

Black Hills Corp., Sr. Unsec’d. Notes | | | 2.500 | | | | 01/11/19 | | | | 400 | | | | 399,504 | |

Israel Electric Corp. Ltd. (Israel), Sr. Sec’d. Notes, 144A | | | 9.375 | | | | 01/28/20 | | | | 200 | | | | 215,254 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 986,310 | |

| |

Electronics 1.7% | | | | | |

Amphenol Corp., Sr. Unsec’d. Notes | | | 2.550 | | | | 01/30/19 | | | | 350 | | | | 349,855 | |

Honeywell International, Inc., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.040% | | | 2.379 | (c) | | | 10/30/19 | | | | 530 | | | | 530,090 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 879,945 | |

| |

Food 4.7% | | | | | |

Campbell Soup Co., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.500% | | | 2.835 | (c) | | | 03/16/20 | | | | 400 | | | | 399,559 | |

General Mills, Inc., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.540% | | | 2.879 | (c) | | | 04/16/21 | | | | 400 | | | | 401,782 | |

JM Smucker Co. (The), Sr. Unsec’d. Notes | | | 2.200 | | | | 12/06/19 | | | | 287 | | | | 284,144 | |

Kellogg Co., Sr. Unsec’d. Notes | | | 3.250 | | | | 05/14/21 | | | | 350 | | | | 350,054 | |

Sysco Corp., Gtd. Notes | | | 1.900 | | | | 04/01/19 | | | | 500 | | | | 497,832 | |

Wm Wrigley Jr Co., Sr. Unsec’d. Notes, 144A | | | 2.900 | | | | 10/21/19 | | | | 555 | | | | 555,084 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 2,488,455 | |

| |

Healthcare-Products 0.8% | | | | | |

Stryker Corp., Sr. Unsec’d. Notes | | | 2.000 | | | | 03/08/19 | | | | 440 | | | | 438,665 | |

| |

Healthcare-Services 1.8% | | | | | |

Aetna, Inc., Sr. Unsec’d. Notes | | | 2.200 | | | | 03/15/19 | | | | 500 | | | | 499,049 | |

UnitedHealth Group, Inc., Sr. Unsec’d. Notes | | | 1.700 | | | | 02/15/19 | | | | 491 | | | | 489,071 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 988,120 | |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 17 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | |

| |

Household Products/Wares 0.9% | | | | | |

Church & Dwight Co., Inc., Sr. Unsec’d. Notes | | | 2.450 | % | | | 12/15/19 | | | | 500 | | | $ | 497,117 | |

| |

Insurance 2.6% | | | | | |

New York Life Global Funding, 144A, 3 Month LIBOR + 0.320% | | | 2.661 | (c) | | | 08/06/21 | | | | 500 | | | | 501,035 | |

Principal Life Global Funding II, 144A, 3 Month LIBOR + 0.300% | | | 2.637 | (c) | | | 06/26/20 | | | | 400 | | | | 401,450 | |

Protective Life Global Funding, 144A | | | 2.262 | | | | 04/08/20 | | | | 500 | | | | 493,565 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,396,050 | |

| |

Machinery-Construction & Mining 0.8% | | | | | |

Caterpillar Financial Services Corp., Sr. Unsec���d. Notes, MTN, 3 Month LIBOR + 0.450% | | | 2.780 | (c) | | | 12/21/18 | | | | 402 | | | | 402,599 | |

| |

Machinery-Diversified 0.2% | | | | | |

John Deere Capital Corp., Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.270% | | | 2.609 | (c) | | | 10/15/18 | | | | 125 | | | | 125,052 | |

| |

Media 1.7% | | | | | |

Comcast Corp., Gtd. Notes | | | 5.700 | | | | 07/01/19 | | | | 400 | | | | 409,552 | |

Walt Disney Co. (The), Sr. Unsec’d. Notes, GMTN, 3 Month LIBOR + 0.310% | | | 2.625 | (c) | | | 05/30/19 | | | | 500 | | | | 501,124 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 910,676 | |

| |

Mining 0.7% | | | | | |

Glencore Funding LLC, Gtd. Notes, 144A | | | 3.125 | | | | 04/29/19 | | | | 350 | | | | 347,994 | |

| |

Oil & Gas 3.4% | | | | | |

BP Capital Markets PLC (United Kingdom), Gtd. Notes | | | 1.768 | | | | 09/19/19 | | | | 327 | | | | 323,819 | |

EOG Resources, Inc., Sr. Unsec’d. Notes | | | 5.625 | | | | 06/01/19 | | | | 450 | | | | 459,359 | |

Lukoil International Finance BV (Netherlands), Gtd. Notes, 144A | | | 7.250 | | | | 11/05/19 | | | | 200 | | | | 207,322 | |

Occidental Petroleum Corp., Sr. Unsec’d. Notes | | | 4.100 | | | | 02/01/21 | | | | 262 | | | | 267,874 | |

Petroleos Mexicanos (Mexico), Gtd. Notes | | | 6.000 | | | | 03/05/20 | | | | 175 | | | | 180,906 | |

Sinopec Group Overseas Development 2015 Ltd. (British Virgin Islands), Gtd. Notes, 144A | | | 2.500 | | | | 04/28/20 | | | | 375 | | | | 369,898 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,809,178 | |

| |

Pharmaceuticals 2.5% | | | | | |

AstraZeneca PLC (United Kingdom), Sr. Unsec’d. Notes | | | 1.950 | | | | 09/18/19 | | | | 500 | | | | 495,932 | |

Bayer US Finance II LLC, Gtd. Notes, 144A | | | 2.125 | | | | 07/15/19 | | | | 405 | | | | 402,497 | |

CVS Health Corp., Sr. Unsec’d. Notes | | | 2.250 | | | | 08/12/19 | | | | 350 | | | | 348,171 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 1,246,600 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal Amount (000)# | | | Value | |

CORPORATE BONDS (Continued) | | | | | |

| |

Pipelines 0.8% | | | | | |

Enterprise Products Operating LLC, Gtd. Notes | | | 6.500 | % | | | 01/31/19 | | | | 400 | | | $ | 406,010 | |

| |

Retail 0.9% | | | | | |

Walmart, Inc., Sr. Unsec’d. Notes | | | 3.125 | | | | 06/23/21 | | | | 500 | | | | 502,571 | |

| |

Telecommunications 1.4% | | | | | |

AT&T, Inc., Sr. Unsec’d. Notes | | | 2.300 | | | | 03/11/19 | | | | 350 | | | | 349,333 | |

Verizon Communications, Inc., Sr. Unsec’d. Notes, 3 Month LIBOR + 0.550% | | | 2.860 | (c) | | | 05/22/20 | | | | 351 | | | | 353,391 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 702,724 | |

| |

Transportation 0.7% | | | | | |

Ryder System, Inc., Sr. Unsec’d. Notes, MTN | | | 2.500 | | | | 05/11/20 | | | | 382 | | | | 377,318 | |

| | | | | | | | | | | | | | | | |

TOTAL CORPORATE BONDS

(cost $30,941,164) | | | | | | | | 30,961,327 | |

| | | | | | | | | | | | | | | | |

| |

CERTIFICATE OF DEPOSIT 2.2% | | | | | |

| |

Banks 2.2% | | | | | |

Bank of Nova Scotia (Canada),

3 Month LIBOR + 0.220% | | | 2.554 | (c) | | | 12/30/19 | | | | 325 | | | | 325,293 | |

Canadian Imperial Bank of Commerce (Canada), 3 Month LIBOR + 0.320% | | | 2.659 | (c) | | | 07/08/19 | | | | 350 | | | | 350,614 | |

Nordea Bank AB (Sweden), 3 Month LIBOR + 0.300% | | | 2.621 | (c) | | | 06/05/20 | | | | 500 | | | | 500,598 | |

| | | | | | | | | | | | | | | | |

TOTAL CERTIFICATE OF DEPOSIT

(cost $1,174,905) | | | | | | | | 1,176,505 | |

| | | | | | | | | | | | | | | | |

| |

SOVEREIGN BONDS 1.0% | | | | | |

Lithuania Government International Bond (Lithuania), Sr. Unsec’d. Notes, | | | 6.125 | | | | 03/09/21 | | | | 300 | | | | 320,808 | |

Qatar Government International Bond (Qatar),

Sr. Unsec’d. Notes, 144A | | | 5.250 | | | | 01/20/20 | | | | 200 | | | | 205,500 | |

| | | | | | | | | | | | | | | | |

TOTAL SOVEREIGN BONDS

(cost $525,729) | | | | | | | | 526,308 | |

| | | | | | | | | | | | | | | | |

TOTAL LONG-TERM INVESTMENTS

(cost $42,038,572) | | | | | | | | 42,065,405 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 19 | |

Schedule of Investments (continued)

as of August 31, 2018

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Shares | | | Value | |

SHORT-TERM INVESTMENTS 18.4% | | | | | |

| |

AFFILIATED MUTUAL FUND 0.1% | | | | | |

PGIM Institutional Money Market Fund(w) | | | | 37,010 | | | $ | 37,013 | |

| | | | | | | | | | | | | | | | |

TOTAL AFFILIATED MUTUAL FUND

(cost $37,013) | | | | 37,013 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | Principal

Amount (000)# | | | | |

TIME DEPOSITS 0.0%* | | | | | | | | | | | | | | | | |

Brown Brothers Harriman & Co. (Cayman Islands) | | | 1.280 | % | | | 09/04/18 | | | | 4 | | | | 3,885 | |

| | | | | | | | | | | | | | | | |

TOTAL TIME DEPOSITS

(cost $3,885) | | | | | | | | | | | | | | | 3,885 | |

| | | | | | | | | | | | | | | | |

| | | | |

CERTIFICATE OF DEPOSIT 4.2% | | | | | | | | | | | | | | | | |

| | | | |

Banks 4.2% | | | | | | | | | | | | | | | | |

Credit Suisse AG (Switzerland),

3 Month LIBOR + 0.320% | | | 2.659 | (c) | | | 04/09/19 | | | | 350 | | | | 350,196 | |

Mizuho Bank Ltd. (Japan), 3 Month LIBOR + 0.040% | | | 2.381 | (c) | | | 02/11/19 | | | | 500 | | | | 500,095 | |

Natixis SA (France), 1 Month LIBOR + 0.350% | | | 2.454 | (c) | | | 03/05/19 | | | | 500 | | | | 500,517 | |

Sumitomo Mitsui Trust Bank Ltd. (Japan),

3 Month LIBOR + 0.110% | | | 2.443 | (c) | | | 10/11/18 | | | | 500 | | | | 500,055 | |

Svenska Handelsbanken (Sweden),

3 Month LIBOR + 0.210% | | | 2.553 | (c) | | | 02/01/19 | | | | 350 | | | | 350,240 | |

| | | | | | | | | | | | | | | | |

TOTAL CERTIFICATE OF DEPOSIT

(cost $2,199,875) | | | | | | | | | | | | | | | 2,201,103 | |

| | | | | | | | | | | | | | | | |

| | | | |

COMMERCIAL PAPER 13.4% | | | | | | | | | | | | | | | | |

BAT International Finance PLC | | | 2.718 | (s) | | | 09/10/18 | | | | 250 | | | | 249,846 | |

Cabot Corp. | | | 2.252 | (s) | | | 09/06/18 | | | | 500 | | | | 499,819 | |

DENTSPLY SIRONA, Inc. | | | 2.232 | (s) | | | 09/14/18 | | | | 500 | | | | 499,565 | |

Dominion Energy, Inc. | | | 2.357 | (s) | | | 09/13/18 | | | | 500 | | | | 499,597 | |

Enterprise Products Operating LLC | | | 2.254 | (s) | | | 09/20/18 | | | | 250 | | | | 249,688 | |

FMC Technologies, Inc. | | | 2.325 | (s) | | | 09/17/18 | | | | 400 | | | | 399,577 | |

FMC Technologies, Inc. | | | 2.719 | (s) | | | 09/13/18 | | | | 150 | | | | 149,879 | |

Ford Motor Credit Co. LLC | | | 3.156 | (s) | | | 04/08/19 | | | | 150 | | | | 147,147 | |

Glencore Funding LLC | | | 2.262 | (s) | | | 09/06/18 | | | | 250 | | | | 249,906 | |

KCP&L Greater Missouri Operations Co. | | | 2.201 | (s) | | | 09/04/18 | | | | 600 | | | | 599,854 | |

Marriott International, Inc. (MD) | | | 2.489 | (s) | | | 09/21/18 | | | | 400 | | | | 399,475 | |

Nutrien Ltd. | | | 2.409 | (s) | | | 09/28/18 | | | | 500 | | | | 499,018 | |

Spectra Energy Partners LP | | | 2.201 | (s) | | | 09/05/18 | | | | 500 | | | | 499,848 | |

Spectra Energy Partners LP | | | 2.385 | (s) | | | 09/10/18 | | | | 500 | | | | 499,692 | |

See Notes to Financial Statements.

| | | | | | | | | | | | | | | | |

| Description | | Interest Rate | | | Maturity Date | | | Principal

Amount (000)# | | | Value | |

COMMERCIAL PAPER (Continued) | | | | | | | | | | | | | | | | |

SunCor Energy, Inc. | | | 2.647 | %(s) | | | 10/01/18 | | | | 500 | | | $ | 499,017 | |

UBS AG (London), (United Kingdom)144A,

3 Month LIBOR + 0.330% | | | 2.667 | (c) | | | 04/04/19 | | | | 400 | | | | 400,481 | |

UDR, Inc. | | | 2.304 | (s) | | | 09/28/18 | | | | 300 | | | | 299,470 | |

Vodafone Group PLC | | | 2.685 | (s) | | | 10/04/18 | | | | 400 | | | | 399,134 | |

| | | | | | | | | | | | | | | | |

TOTAL COMMERCIAL PAPER

(cost $7,040,600) | | | | | | | | | | | | | | | 7,041,013 | |

| | | | | | | | | | | | | | | | |

| | | | |

CORPORATE NOTES 0.7% | | | | | | | | | | | | | | | | |

| | | | |

Electric 0.7% | | | | | | | | | | | | | | | | |

Pacific Gas & Electric Co., Sr. Unsec’d. Notes,

3 Month LIBOR + 0.230% | | | 2.541 | (c) | | | 11/28/18 | | | | 400 | | | | 399,402 | |

| | | | | | | | | | | | | | | | |

TOTAL CORPORATE NOTES

(cost $399,816) | | | | | | | | | | | | | | | 399,402 | |

| | | | | | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(cost $9,681,189) | | | | | | | | | | | | | | | 9,682,416 | |

| | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS 98.3%

(cost $51,719,761) | | | | | | | | | | | | | | | 51,747,821 | |

Other Assets in Excess of Liabilities 1.7% | | | | | | | | | | | | | | | 878,912 | |

| | | | | | | | | | | | | | | | |

NET ASSETS 100.0% | | | | | | | | | | | | | | $ | 52,626,733 | |

| | | | | | | | | | | | | | | | |

The following abbreviations are used in the annual report:

(Q)—Quarterly payment frequency for swaps

(S)—Semiannual payment frequency for swaps

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may not be resold subject to that rule except to qualified institutional buyers. Unless otherwise noted, 144A securities are deemed to be liquid.

BKNT—Bank Note

CLO—Collateralized Loan Obligation

EMTN—Euro Medium Term Note

GMTN—Global Medium Term Note

LIBOR—London Interbank Offered Rate

MTN—Medium Term Note

| # | Principal or notional amount is shown in U.S. dollars unless otherwise stated. |

| (c) | Variable rate instrument. The interest rate shown reflects the rate in effect at August 31, 2018. |

| (s) | Rate represents yield to maturity at purchase date. |

| (w) | PGIM Investments LLC, the manager of the Fund, also serves as manager of the PGIM Institutional Money Market Fund. |

| * | A zero balance may reflect actual amounts rounding to less than 0.05%. |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 21 | |

Schedule of Investments (continued)

as of August 31, 2018

Interest rate swap agreements outstanding at August 31, 2018:

| | | | | | | | | | | | | | | | | | | | | | | | |

Notional

Amount

(000)# | | | Termination

Date | | | Fixed

Rate | | | Floating Rate | | Value at

Trade

Date | | | Value at

August 31,

2018 | | | Unrealized

Appreciation

(Depreciation) | |

| | Centrally cleared swap agreements: | |

| | 3,050 | | | | 10/09/2019 | | | | 2.545%(S) | | | 3 Month LIBOR(1)(Q) | | $ | 1,288 | | | $ | (15,139 | ) | | $ | (16,427 | ) |

| | 2,550 | | | | 04/10/2020 | | | | 2.587%(S) | | | 3 Month LIBOR(1)(Q) | | | 5,017 | | | | (9,134 | ) | | | (14,151 | ) |

| | 2,000 | | | | 04/10/2019 | | | | 2.434%(S) | | | 3 Month LIBOR(1)(Q) | | | 152 | | | | (11,105 | ) | | | (11,257 | ) |

| | 1,050 | | | | 07/18/2020 | | | | 2.711%(S) | | | 3 Month LIBOR(1)(Q) | | | 1,600 | | | | 1,619 | | | | 19 | |

| | 650 | | | | 11/02/2020 | | | | 2.806%(S) | | | 3 Month LIBOR(1)(Q) | | | 666 | | | | (4,274 | ) | | | (4,940 | ) |

| | 350 | | | | 05/09/2021 | | | | 2.855%(S) | | | 3 Month LIBOR(1)(Q) | | | 151 | | | | (2,546 | ) | | | (2,697 | ) |

| | 900 | | | | 11/24/2019 | | | | 2.714%(S) | | | 3 Month LIBOR(1)(Q) | | | 510 | | | | (6,120 | ) | | | (6,630 | ) |

| | 500 | | | | 03/11/2021 | | | | 2.850%(S) | | | 3 Month LIBOR(1)(Q) | | | 496 | | | | (513 | ) | | | (1,009 | ) |

| | 700 | | | | 07/27/2021 | | | | 2.929%(S) | | | 3 Month LIBOR(1)(Q) | | | 152 | | | | (1,554 | ) | | | (1,706 | ) |

| | 640 | | | | 02/28/2020 | | | | 2.742%(S) | | | 3 Month LIBOR(1)(Q) | | | 416 | | | | 250 | | | | (166 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 10,448 | | | $ | (48,516 | ) | | $ | (58,964 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The Fund pays the fixed rate and receives the floating rate. |

| (2) | The Fund pays the floating rate and receives the fixed rate. |

Cash with a value of $177,000 has been segregated with Citigroup Global Markets to cover requirements for open centrally cleared swap contracts at August 31, 2018.

Fair Value Measurements:

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1—unadjusted quoted prices generally in active markets for identical securities.

Level 2—quoted prices for similar securities, interest rates and yield curves, prepayment speeds, foreign currency exchange rates and other observable inputs.

Level 3—unobservable inputs for securities valued in accordance with Board approved fair valuation procedures.

See Notes to Financial Statements.

The following is a summary of the inputs used as of August 31, 2018 in valuing such portfolio securities:

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Investments in Securities | | | | | | | | | | | | |

Asset-Backed Securities | | | | | | | | | | | | |

Collateralized Loan Obligations | | $ | — | | | $ | 4,296,070 | | | $ | — | |

Commercial Mortgage-Backed Securities | | | — | | | | 5,105,195 | | | | — | |

Corporate Bonds | | | — | | | | 30,961,327 | | | | — | |

Certificate of Deposit | | | — | | | | 3,377,608 | | | | — | |

Sovereign Bonds | | | — | | | | 526,308 | | | | — | |

Affiliated Mutual Fund | | | 37,013 | | | | — | | | | — | |

Time Deposits | | | — | | | | 3,885 | | | | — | |

Commercial Paper | | | — | | | | 7,041,013 | | | | — | |

Corporate Notes | | | — | | | | 399,402 | | | | — | |

Other Financial Instruments* | | | | | | | | | | | | |

Centrally Cleared Interest Rate Swap Agreements | | | — | | | | (58,964 | ) | | | — | |

| | | | | | | | | | | | |

Total | | $ | 37,013 | | | $ | 51,651,844 | | | $ | — | |

| | | | | | | | | | | | |

| * | Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and centrally cleared swap contracts, which are recorded at the unrealized appreciation (depreciation) on the instrument, and OTC swap contracts which are recorded at fair value. |

Industry Classification:

The industry classification of investments and other assets in excess of liabilities shown as a percentage of net assets as of August 31, 2018 were as follows (unaudited):

| | | | |

Banks | | | 24.1 | % |

Comercial Papers | | | 13.4 | |

Commercial Mortage-Backed Securities | | | 9.7 | |

Collateralized Loan Obligations | | | 8.2 | |

Auto Manufacturers | | | 5.7 | |

Food | | | 4.7 | |

Oil & Gas | | | 3.4 | |

Insurance | | | 2.6 | |

Electric | | | 2.6 | |

Pharmaceuticals | | | 2.5 | |

Diversified Financial Services | | | 2.0 | |

Healthcare-Services | | | 1.8 | |

Biotechnology | | | 1.7 | |

Media | | | 1.7 | |

Electronics | | | 1.7 | |

Telecommunications | | | 1.4 | |

Computers | | | 1.1 | |

Sovereign bonds | | | 1.0 | |

Building Materials | | | 1.0 | % |

Chemicals | | | 1.0 | |

Retail | | | 0.9 | |

Household Products/Wares | | | 0.9 | |

Healthcare-Products | | | 0.8 | |

Pipelines | | | 0.8 | |

Machinery-Construction & Mining | | | 0.8 | |

Transportation | | | 0.7 | |

Aerospace & Defense | | | 0.7 | |

Mining | | | 0.7 | |

Commercial Services | | | 0.4 | |

Machinery-Diversified | | | 0.2 | |

Affiliated Mutual Fund | | | 0.1 | |

| | | | |

| | | 98.3 | |

Other Assets in Excess of Liabilities | | | 1.7 | |

| | | | |

| | | 100.0 | % |

| | | | |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 23 | |

Schedule of Investments (continued)

as of August 31, 2018

Effects of Derivative Instruments on the Financial Statements and Primary Underlying Risk Exposure:

The Fund invested in derivative instruments during the reporting period. The primary type of risk associated with these derivative instruments is interest rate contracts risk. The effect of such derivative instruments on the Fund’s financial position and financial performance as reflected in the Statement of Assets and Liabilities and Statement of Operations is presented in the summary below.

Fair values of derivative instruments as of August 31, 2018 as presented in the Statement of Assets and Liabilities:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Statement of Assets and

Liabilities Location | | Fair

Value | | | Statement of Assets and

Liabilities Location | | Fair

Value | |

| Interest rate contracts | | Due from/to broker—variation margin swaps* | | $ | 19 | | | Due from/to broker—variation margin swaps* | | $ | 58,983 | |

| | | | | | | | | | | | |

Total | | | | $ | 19 | | | | | $ | 58,983 | |

| | | | | | | | | | | | |

| * | Includes cumulative appreciation (depreciation) as reported in the schedule of centrally cleared swap contracts. Only unsettled variation margin receivable (payable) is reported within the Statement of Assets and Liabilities. |

The effects of derivative instruments on the Statement of Operations for the period ended August 31, 2018 are as follows:

| | | | |

Amount of Realized Gain (Loss) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Swaps | |

Interest rate contracts | | $ | 58,292 | |

| | | | |

Total | | $ | 58,292 | |

| | | | |

|

Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | |

Derivatives not accounted for as hedging instruments, carried at fair value | | Swaps | |

Interest rate contracts | | $ | (58,964 | ) |

| | | | |

Total | | $ | (58,964 | ) |

| | | | |

See Notes to Financial Statements.

For the period ended August 31, 2018 the Fund’s average volume of derivative activities is as follows:

|

Interest Rate Swap

Agreements(1) |

| $ 9,820,000 |

| (1) | Notional Amount in USD. |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 25 | |

Statement of Assets & Liabilities

as of August 31, 2018

| | | | |

Assets | | | | |

Investments at value: | | | | |

Unaffiliated investments (cost $51,682,748) | | $ | 51,710,808 | |

Affiliated investments (cost $37,013) | | | 37,013 | |

Cash | | | 66 | |

Receivable for Fund shares sold | | | 1,253,017 | |

Interest and dividends receivable | | | 236,264 | |

Deposit with broker for centrally cleared swaps | | | 177,000 | |

Receivable for investments sold | | | 3,149 | |

| | | | |

Total assets | | | 53,417,317 | |

| | | | |

| |

Liabilities | | | | |

Payable for investments purchased | | | 780,915 | |

Management fee payable | | | 5,457 | |

Due to broker—variation margin swaps | | | 4,212 | |

| | | | |

Total Liabilities | | | 790,584 | |

| | | | |

| |

Net Assets | | $ | 52,626,733 | |

| | | | |

| | | | | |

Net assets were comprised of: | | | | |

Common stock, at par | | $ | 1,050 | |

Paid-in capital in excess of par | | | 52,535,840 | |

| | | | |

| | | 52,536,890 | |

Undistributed net investment income | | | 78,236 | |

Accumulated net realized gain on investment transactions | | | 42,511 | |

Net unrealized depreciation on investments | | | (30,904 | ) |

| | | | |

Net assets, August 31, 2018 | | $ | 52,626,733 | |

| | | | |

| |

Net asset value, offering price and redemption price per share,

($ 52,626,733 / 1,050,000 shares of common stock issued and outstanding) | | $ | 50.12 | |

| | | | |

See Notes to Financial Statements.

Statement of Operations

Period Ended August 31, 2018*

| | | | |

Net Investment Income (Loss) | | | | |

Income | | | | |

Interest income | | $ | 361,434 | |

Affiliated dividend income | | | 8,235 | |

| | | | |

Total income | | | 369,669 | |

| | | | |

| |

Expenses | | | | |

Management fee | | | 20,334 | |

| | | | |

Total expenses | | | 20,334 | |

Less: Management fee waiver and/or expense reimbursement | | | (314 | ) |

| | | | |

Net expenses | | | 20,020 | |

| | | | |

Net investment income (loss) | | | 349,649 | |

| | | | |

| |

Realized And Unrealized Gain (Loss) On Investments | | | | |

Net realized gain (loss) on: | | | | |

Investment transactions (including affiliated of $(20)) | | | (9,960 | ) |

Swap agreement transactions | | | 58,292 | |

| | | | |

| | | 48,332 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments (including affiliated of $(4)) | | | 28,060 | |

Swap agreements | | | (58,964 | ) |

| | | | |

| | | (30,904 | ) |

| | | | |

Net gain (loss) on investment transactions | | | 17,428 | |

| | | | |

Net Increase (Decrease) In Net Assets Resulting From Operations | | $ | 367,077 | |

| | | | |

| * | For the period from April 5, 2018 (commencement of operations) through August 31, 2018. |

See Notes to Financial Statements.

| | | | |

| PGIM Ultra Short Bond ETF | | | 27 | |

Statement of Changes in Net Assets

| | | | |

| | | Period Ended August 31, | |

| | | 2018* | |

Increase (Decrease) in Net Assets | | | | |

Operations | | | | |

Net investment income (loss) | | $ | 349,649 | |

Net realized gain (loss) on investments | | | 48,332 | |

Net change in unrealized appreciation (depreciation) on investments | | | (30,904 | ) |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 367,077 | |

| | | | |

| |

Dividends and Distributions | | | | |

Dividends from net investment income | | | (277,234 | ) |

| | | | |

| |

Fund share transactions (Net of share conversions) | | | | |

Net proceeds from shares sold | | | 52,536,890 | |

Cost of shares reacquired | | | (100,000 | ) |

| | | | |

Net increase (decrease) in net assets from Fund share transactions | | | 52,436,890 | |

| | | | |

Total increase (decrease) | | | 52,526,733 | |

| |

Net Assets: | | | | |

Beginning of period | | | 100,000 | |

| | | | |

End of period(a) | | $ | 52,626,733 | |

| | | | |

(a) Includes undistributed net investment income of: | | $ | 78,236 | |

| | | | |

| * | For the period from April 5, 2018 (commencement of operations) through August 31, 2018. |

See Notes to Financial Statements.

Notes to Financial Statements

PGIM ETF Trust (the “Trust”) is a diversified, open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and operated as an exchange traded fund. The Trust was organized as a Delaware statutory trust on October 23, 2017 and consists of six separate series: PGIM Ultra Short Bond ETF (the “Fund”), PGIM Active High Yield Bond ETF, PGIM QMA Strategic Alpha Large-Cap Core ETF, PGIM QMA Strategic Alpha Small-Cap Growth ETF, PGIM QMA Strategic Alpha Small-Cap Value ETF and PGIM QMA Strategic Alpha International Equity ETF.

These financial statements relate only to the Fund which commenced investment operations on April 5, 2018.

The investment objective of the Fund is to seek total return through a combination of current income and capital appreciation, consistent with preservation of capital.

1. Accounting Policies

The Fund follows investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 Financial Services—Investment Companies. The following accounting policies conform to U.S. generally accepted accounting principles. The Fund consistently follows such policies in the preparation of its financial statements.

Securities Valuation: The Fund holds securities and other assets and liabilities that are fair valued at the close of each day (generally, 4:00 PM Eastern time) the New York Stock Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Trustees (the “Board”) has adopted valuation procedures for security valuation under which fair valuation responsibilities have been delegated to PGIM Investments LLC (“PGIM Investments” or “the Manager”). Pursuant to the Board’s delegation, a Valuation Committee has been hereby established as two persons, being one or more officers of the Trust, including: the Trust’s Treasurer (or the Treasurer’s direct reports); and the Trust’s Chief or Deputy Chief Compliance Officer (or Vice-President-level direct reports of the Chief or Deputy Chief Compliance Officer). Under the current valuation procedures, the Valuation Committee of the Board is responsible for supervising the valuation of portfolio securities and other assets and liabilities. The valuation procedures permit the Fund to utilize independent pricing vendor services, quotations from market makers, and alternative valuation methods when market quotations are either not readily available or not deemed representative of fair value. A record of the Valuation Committee’s actions is subject to the Board’s review, approval, and ratification at its next regularly scheduled quarterly meeting.

| | | | |

| PGIM Ultra Short Bond ETF | | | 29 | |

Notes to Financial Statements (continued)

For the fiscal reporting period-end, securities and other assets and liabilities were fair valued at the close of the last U.S. business day. Trading in certain foreign securities may occur when the NYSE is closed (including weekends and holidays). Because such foreign securities trade in markets that are open on weekends and U.S. holidays, the values of some of the Fund’s foreign investments may change on days when investors cannot purchase or redeem Fund shares.

Various inputs determine how the Fund’s investments are valued, all of which are categorized according to the three broad levels (Level 1, 2, or 3) detailed in the Schedule of Investments.

Investments in open-end, non-exchange-traded mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 in the fair value hierarchy since they may be purchased or sold at their net asset values on the date of valuation.

Fixed income securities traded in the OTC market are generally classified as Level 2 in the fair value hierarchy. Such fixed income securities are typically valued using the market approach which generally involves obtaining data from an approved independent third-party vendor source. The Fund utilizes the market approach as the primary method to value securities when market prices of identical or comparable instruments are available. The third-party vendors’ valuation techniques used to derive the evaluated bid price are based on evaluating observable inputs, including but not limited to, yield curves, yield spreads, credit ratings, deal terms, tranche level attributes, default rates, cash flows, prepayment speeds, broker/dealer quotations and reported trades. Certain Level 3 securities are also valued using the market approach when obtaining a single broker quote or when utilizing transaction prices for identical securities that have been used in excess of five business days.

During the reporting period, there were no changes to report with respect to the valuation approach and/or valuation techniques discussed above.

Centrally cleared swaps listed or traded on a multilateral or trade facility platform, such as a registered exchange, are generally valued at the daily settlement price determined by the respective exchange. These securities are classified as Level 2 in the fair value hierarchy, as the daily settlement price is not public.

Securities and other assets that cannot be priced according to the methods described above are valued based on pricing methodologies approved by the Board. In the event that unobservable inputs are used when determining such valuations, the securities will be classified as Level 3 in the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include: the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the Manager regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other unaffiliated mutual funds to calculate their net asset values.

Restricted and Illiquid Securities: Subject to guidelines adopted by the Board, the Fund may invest up to 15% of its net assets in illiquid securities, including those which are restricted as to disposition under securities law (“restricted securities”). Restricted securities are valued pursuant to the valuation procedures noted above. Illiquid securities are those that, because of the absence of a readily available market or due to legal or contractual restrictions on resale, cannot be sold within seven days in the ordinary course of business at approximately the amount at which the Fund has valued the investment. Therefore, the Fund may find it difficult to sell illiquid securities at the time considered most advantageous by its Subadviser and may incur transaction costs that would not be incurred in the sale of securities that were freely marketable. Certain securities that would otherwise be considered illiquid because of legal restrictions on resale to the general public may be traded among qualified institutional buyers under Rule 144A of the Securities Act of 1933. These Rule 144A securities, as well as commercial paper that is sold in private placements under Section 4(a)(2) of the Securities Act, may be deemed liquid by the Fund’s Subadviser under the guidelines adopted by the Trustees of the Trust. However, the liquidity of the Fund’s investments in Rule 144A securities could be impaired if trading does not develop or declines.

Swap Agreements: The Fund may enter into credit default, interest rate and other types of swap agreements. A swap agreement is an agreement to exchange the return generated by one instrument for the return generated by another instrument. Swap agreements are negotiated in the OTC market and may be executed either directly with counterparty (“OTC-traded”) or through a central clearing facility, such as a registered exchange. Swap agreements are valued daily at current market value and any change in value is included in the net unrealized appreciation (depreciation) on swap agreements. Centrally cleared swaps pay or receive an amount known as “variation margin”, based on daily changes in the valuation of the swap contract. Any upfront premiums paid and received are shown as swap premiums paid and swap premiums received in the Statement of Assets and Liabilities. Risk of loss may exceed amounts recognized on the Statement of Assets and Liabilities. Swap agreements outstanding at period end, if any, are listed on the Schedule of Investments.

Interest Rate Swaps: Interest rate swaps represent an agreement between counterparties to exchange cash flows based on the difference between two interest rates, applied to a

| | | | |

| PGIM Ultra Short Bond ETF | | | 31 | |

Notes to Financial Statements (continued)

notional principal amount for a specified period. The Fund is subject to interest rate risk exposure in the normal course of pursuing its investment objectives. The Fund used interest rate swaps to maintain its ability to generate steady cash flow by receiving a stream of fixed-rate payments and to increase exposure to prevailing market rates by receiving floating rate payments. The Fund’s maximum risk of loss from counterparty credit risk is the discounted net present value of the cash flows to be received from the counterparty over the contract’s remaining life.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains (losses) from investment and currency transactions are calculated on the specific identification method. Dividend income is recorded on the ex-date. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis. Expenses are recorded on an accrual basis, which may require the use of certain estimates by management that may differ from actual.

Taxes: It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable net investment income and capital gains, if any, to its shareholders. Therefore, no federal income tax provision is required. Withholding taxes on foreign dividends, interest and capital gains, if any, are recorded, net of reclaimable amounts, at the time the related income is earned.

Dividends and Distributions: The Fund expects to pay dividends from net investment income monthly and distributions from net realized capital gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-date. Permanent book/tax differences relating to income and gain (loss) are reclassified amongst undistributed net investment income, accumulated net realized gain (loss) and paid-in capital in excess of par, as appropriate.

Estimates: The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

2. Agreements

Pursuant to a management agreement with the Trust on behalf of the Fund (the Management Agreement), PGIM Investments LLC (“PGIM Investments”), subject to the supervision of the Board and in conformity with the stated policies of the Fund, manages

both the investment operations of the Fund and the composition of the Fund’s portfolio, including the purchase, retention and disposition of assets. In connection therewith, the Manager is obligated to keep certain books and records of the Fund. The Manager is authorized to enter into subadvisory agreements for investment advisory services in connection with the management of the Fund. The Manager will continue to have responsibility for all investment advisory services performed pursuant to any such subadvisory agreements. PGIM Investments will review the performance of the investment subadviser(s) and make recommendations to the Board with respect to the retention of investment subadvisers and the renewal of contracts. The Manager also administers the Fund’s business affairs and, in connection therewith, furnishes the Fund with office facilities, together with those ordinary clerical and bookkeeping services which are not being furnished by the Fund’s custodian (the Custodian). The management services of PGIM Investments to the Fund are not exclusive under the terms of the Management Agreement and PGIM Investments is free to, and does, render management services to others.

The Board of Trustees of the Trust has approved a unitary management fee structure for the Fund. Under the unitary fee structure, the Manager is responsible for paying substantially all the expenses of the Fund, excluding payments under the Fund’s 12b-1 plan (if any), costs of borrowing money (including interest expenses and any loan commitment or other associated fees), taxes, acquired fund fees and expenses, brokerage fees, costs of holding shareholder meetings, litigation, indemnification and extraordinary expenses.

The unitary fee paid to PGIM Investments is accrued daily and payable monthly, at an annual rate of 0.15% of the Fund’s average daily net assets. The Manager has agreed to waive a portion of its annual fee equal to the amount of the management fee received by the subadvisor due to the Fund’s investment in the PGIM Institutional Money Market Fund.

The Manager has entered into a subadvisory agreement (Subadvisory Agreement) with PGIM, Inc, the Fund’s investment subadviser (the “subadviser”). The Subadvisory Agreement provides that the subadviser will furnish investment advisory services in connection with the management of the Fund. In connection therewith, the subadviser is obligated to keep certain books and records of the Fund. Under the Subadvisory Agreement, the subadviser, subject to the supervision of PGIM Investments, is responsible for managing the assets of the Fund in accordance with the Fund’s investment objectives, policies and restrictions. The subadviser determines what securities and other instruments are purchased and sold for the Fund and is responsible for obtaining and evaluating financial data relevant to the Fund. PGIM Investments continues to have responsibility for all investment advisory services pursuant to the Management Agreement and supervises the subadviser’s performance of such services.

Brown Brothers Harriman & Co. (“BBH”) serves as the Custodian, Transfer Agent and Administrative Agent for the Trust. Pursuant to an Administrative and Transfer Agency Agreement, BBH maintains certain books and records and provides transfer agency, administrative, legal, tax support and accounting and financial reporting services for the maintenance and operations of the Trust. Pursuant to a Custodian Agreement, BBH

| | | | |

| PGIM Ultra Short Bond ETF | | | 33 | |

Notes to Financial Statements (continued)

maintains certain financial accounting books and records pursuant to an agreement with the Trust. Subcustodians provide custodial services for any non-US assets held outside the United States. As the transfer and dividend disbursing agent of the Trust, BBH provides customary transfer agency services to the Trust, including the handling of shareholder communications, the processing of shareholder transactions, the maintenance of shareholder account records, the payment of dividends and distributions, and related functions. For these services, BBH receives compensation from the Manager and is reimbursed for expenses, including custodian and administration fees and certain out-of-pocket expenses including, but not limited to, postage, stationery, printing, allocable communication expenses and other costs. The Manager is responsible for compensating BBH under the Custodian and Administrative and Transfer Agency Agreements.

3. Other Transactions with Affiliates