UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-23324 | |

| Exact name of registrant as specified in charter: | PGIM ETF Trust | |

| Address of principal executive offices: | 655 Broad Street, 17th Floor Newark, New Jersey 07102 | |

| Name and address of agent for service: | Andrew R. French 655 Broad Street, 17th Floor Newark, New Jersey 07102 | |

| Registrant’s telephone number, including area code: | 800-225-1852 | |

| Date of fiscal year end: | 8/31/2021 | |

| Date of reporting period: | 8/31/2021 | |

Item 1 – Reports to Stockholders

PGIM FIXED INCOME ETFS

PGIM Ultra Short Bond ETF (PULS)

PGIM Active High Yield Bond ETF (PHYL)

PGIM Active Aggregate Bond ETF (PAB)

ANNUAL REPORT

AUGUST 31, 2021

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery |

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 19 | ||||

| 22 | ||||

Holdings and Financial Statements | 25 | |||

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Exchange-traded funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2021 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

| 2 | Visit our website at pgim.com/investments |

| Dear Shareholder: | |

| We hope you find the annual report for the PGIM Fixed Income ETFs informative and useful. The report covers performance for the period that ended August 31, 2021. | ||

| The COVID-19 pandemic had a significant impact on the global economy and markets early in 2020, but a dramatic recovery was underway as the summer began. The Federal Reserve slashed interest rates to encourage borrowing. Congress passed stimulus bills worth several trillion dollars to help consumers and businesses. And several effective COVID-19 vaccines received regulatory approval later in the year. |

At the start of the period, stocks had recovered most of the steep losses they had suffered at the onset of the pandemic. Equities rallied as states reopened their economies but became more volatile in the fall as investors worried that a surge in COVID-19 infections would stall the recovery. However, rising corporate profits and economic growth, the resolution of the US presidential election, and the global rollout of approved vaccines lifted equity markets to record levels, helping stocks around the globe post gains for the full period.

Much of the bond market performed well during the period as investors sought safety in fixed income. Investment-grade bonds in the US declined slightly as the economy recovered, but global bonds and emerging market debt rose. While the 10-year US Treasury yield hovered near record lows early in the period after a significant rally in interest rates, rates moved higher later on as investors began to focus on stronger economic growth and the prospects of higher inflation. The Fed also took several aggressive actions to keep the bond markets running smoothly, restarting many of the relief programs that proved to be successful in helping end the global financial crisis in 2008-09.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we consider it a great privilege and responsibility to help investors participate in opportunities across global markets while meeting their toughest investment challenges. PGIM is a top-10 global investment manager with more than $1 trillion in assets under management. This scale and investment expertise allow us to deliver actively managed funds and strategies to meet the needs of investors around the globe.

Thank you for choosing our family of funds.

Sincerely,

| Stuart S. Parker, President |

| PGIM Fixed Income ETFs |

| October 15, 2021 |

| PGIM Fixed Income ETFs | 3 |

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 8/31/21 | ||||

| One Year (%) | Since Inception (%) | |||

Net Asset Value (NAV) | 0.98 | 2.01 (04/05/2018) | ||

Market Price* | 0.95 | 2.01 (04/05/2018) | ||

ICE BofA 3-Month T-Bill Index | 0.08 | 1.31 | ||

ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index | 0.22 | 1.63 | ||

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

Since inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

| 4 | Visit our website at pgim.com/investments |

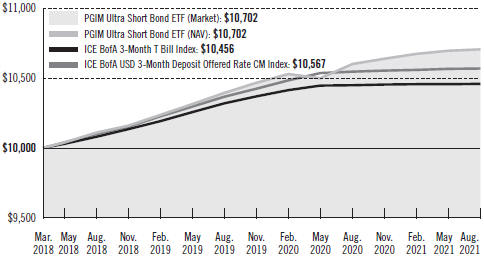

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the ICE BofA 3-Month T Bill Index and the ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index by portraying the initial account values at the commencement of operations (April 5, 2018) and the account values at the end of the current fiscal year (August 31, 2021), as measured on a quarterly basis.The Fund assumes an initial investment on April 5, 2018, while the benchmark and the Index assume that the initial investment occurred on March 31, 2018. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| PGIM Fixed Income ETFs | 5 |

PGIM Ultra Short Bond ETF

Your Fund’s Performance (continued)

Benchmark Definitions

ICE BofA 3-Month T Bill Index—The ICE BofA 3-Month US Treasury Bill Index tracks the performance of US dollar-denominated US Treasury bills publicly issued in the US domestic market with a remaining term to final maturity of 3 months.

ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index—The ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index is an unmanaged index which tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

ICE BOFA IS LICENSING THE BOFA INDICES “AS IS,” MAKES NO WARRANTIES REGARDING THE SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BOFA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND THE FUND, OR ANY OF ITS PRODUCTS OR SERVICES.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

| Credit Quality expressed as a percentage of total investments as of 8/31/21 (%) | ||||

AAA | 31.7 | |||

AA | 14.2 | |||

A | 27.4 | |||

BBB | 18.5 | |||

Cash/Cash Equivalents | 8.2 | |||

Total | 100.0 | |||

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| 6 | Visit our website at pgim.com/investments |

| Distributions and Yields as of 8/31/21 | ||||||||||||

| | Total Dividends Paid for 12 Months ($) | | | SEC 30-Day Subsidized Yield* (%) | | | SEC 30-Day Unsubsidized Yield** (%) | | ||||

| 0.71 | 0.55 | 0.55 | ||||||||||

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| PGIM Fixed Income ETFs | 7 |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Ultra Short Bond ETF (the Fund) returned 0.98% based on net asset value in the 12-month reporting period that ended August 31, 2021, outperforming the 0.22% return of the ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index (the Index).

What were the market conditions?

| ● | The strong global rebound from the depths of the COVID-19 pandemic continued throughout the reporting period, as economies responded to the unprecedented monetary and fiscal stimulus programs. The rollout of vaccines, President Biden’s $1.9 trillion stimulus package, a $900 billion aid bill, and anticipation of the Biden administration’s infrastructure bill fueled growth expectations in late 2020 and early 2021. Shifts in the prospects for growth and inflation kicked off a massive “reflation trade” in bond markets, which propelled yields higher during the first quarter of 2021. |

| ● | Although yields for short-term Treasuries remained well anchored by the Federal Reserve’s (the Fed’s) commitment to maintain its low-rate policy, longer-term Treasuries sold off sharply in the first quarter of 2021, with the yield on the benchmark US 10-year Treasury note rising from 0.92% on December 31, 2020, to 1.74% on March 31, 2021. Similarly, the yield on the 30-year Treasury bond rose from 1.65% to 2.41% over the same period. |

| ● | Market volatility for rates then eased in the second quarter of 2021, escaping the sell-offs observed earlier in the year, with lower long-dated yields and higher front-end rates forming a substantially flatter Treasury yield curve. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) Instead of pushing up the yield curve, the Fed’s turn toward tapering near the end of the second quarter led to a decline in long-term Treasury yields, as investors assumed a more hawkish Fed would simply mean a lower path for rates over the long run. |

| ● | Following the volatility of the first quarter of 2021, the US 10-year and 30-year Treasury yields ended the period at 1.31% and 1.93%, respectively. Meanwhile, the yield on the 2-year Treasury note ended the period at 0.21%, a rise of eight basis points over the period. (One basis point equals 0.01%.) |

| ● | While longer-term Treasuries saw substantial volatility throughout the period, yields on short-term securities, which influence money market yields, remained near zero. The 3-month Treasury bill declined from 0.107% to 0.043% during the period, while the 6-month Treasury bill declined from 0.122% to 0.058%. Meanwhile, the 3-month London Interbank Offered Rate (LIBOR) fell from 0.24% on August 31, 2020, to 0.12% by August 31, 2021. |

What worked?

| ● | The Fund emphasized spread assets—including short-term investment-grade debt of financial, consumer cyclical and non-cyclical, and utility companies—ranging across |

| 8 | Visit our website at pgim.com/investments |

the rating spectrum from AAA to BBB. Other spread-sector assets included commercial mortgage-backed securities (CMBS) and collateralized loan obligations (CLOs). |

| ● | Overall, positioning in CLOs, investment grade corporates, and CMBS all contributed to performance during the reporting period. Yield curve positioning also contributed to performance. |

What didn’t work?

The duration of the Fund was tactically managed during the period. Overall, duration positioning detracted from performance. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.)

Did the Fund use derivatives?

During the reporting period, the Fund used interest rate swaps and futures to help manage duration positioning and yield curve exposure. These instruments allowed the Fund to capture higher yields available farther out on the short-term portion of the yield curve and in spread-sector assets versus Treasuries, while mitigating interest rate risk. Overall, the positions added to performance during the period.

Current outlook

| ● | In considering the composition of the Treasury curve, PGIM Fixed Income believes the repricing of forward rates and inflation expectations in various parts of the curve will likely continue. Even when accounting for the recent change in policy messaging, the hurdle for the Fed to raise rates remains high, and officials will likely wait to observe whether the inflation pressure is transitory. |

| ● | The US has seen a marked acceleration in inflation in recent months. Part of this increase comes from “base effects,” but the lion’s share of the gains reflects surprisingly vigorous price increases. (Base effect is the distortion in a monthly inflation figure that results from abnormally high or low levels of inflation a year earlier. In this case, inflation was low a year ago.) Recent developments suggest that inflation will likely continue to run somewhat hot through the months ahead. However, PGIM Fixed Income expects inflation to slowly abate toward the end of the year and early next year, as many of the structural factors that drove soft inflation during much of the past decade remain firmly in place. |

| ● | To date, the Fed has felt comfortable looking through these recent price pressures and has kept rates on hold. That said, the Fed seems to have recently shifted to more of a “risk management” approach. While maintaining a baseline view that the current bout of inflation will be “transitory,” the Fed at its June 2021 meeting recognized that the upside risks to inflation have increased. Even so, PGIM Fixed Income expects monetary policy to remain highly stimulative through at least this year and much of next year. |

| PGIM Fixed Income ETFs | 9 |

PGIM Active High Yield Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| Average Annual Total Returns as of 8/31/21 | ||||||||

| One Year (%) | Since Inception (%) | |||||||

Net Asset Value (NAV) | 11.00 | 8.30 (09/24/2018) | ||||||

Market Price* | 10.22 | 8.25 (09/24/2018) | ||||||

Bloomberg US High Yield Very Liquid Index | ||||||||

| 8.77 | 6.68 | |||||||

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

Since inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

| 10 | Visit our website at pgim.com/investments |

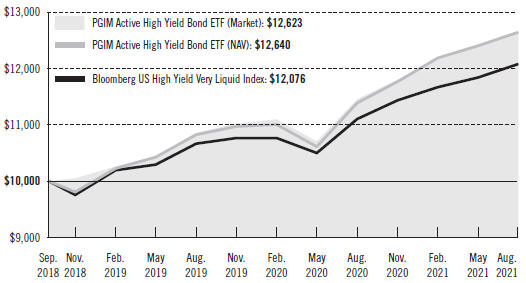

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the Bloomberg US High Yield Very Liquid Index by portraying the initial account values at the commencement of operations (September 24, 2018) and the account values at the end of the current fiscal year (August 31, 2021), as measured on a quarterly basis. The Fund assumes an initial investment on September 24, 2018, while the benchmark and the Index assume that the initial investment occurred on September 30, 2018. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| PGIM Fixed Income ETFs | 11 |

PGIM Active High Yield Bond ETF

Your Fund’s Performance (continued)

Benchmark Definitions

Bloomberg US High Yield Very Liquid Index (VLI)—The Bloomberg US High Yield Very Liquid Index is a component of the US Corporate High Yield Index that is designed to track a more liquid component of the USD-denominated, high yield, fixed rate corporate bond market. The Index uses the same eligibility criteria as the US Corporate High Yield Index, but includes only the three largest bonds from each issuer that have a minimum amount outstanding of USD500mn and less than five years from issue date. The Index also limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro rata basis.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

| Credit Quality expressed as a percentage of total investments as of 8/31/21 (%) | ||||

BBB | 4.3 | |||

BB | 47.6 | |||

B | 32.3 | |||

CCC | 9.3 | |||

CC | 0.4 | |||

NR | 2.1 | |||

Cash/Cash Equivalents | 4.0 | |||

Total | 100.0 | |||

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| 12 | Visit our website at pgim.com/investments |

| Distributions and Yields as of 8/31/21 | ||||||

| Total Dividends Paid for 12 Months ($) | SEC 30-Day Subsidized Yield* (%) | SEC 30-Day Unsubsidized Yield** (%) | ||||

| 2.82 | 3.69 | 3.69 | ||||

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| PGIM Fixed Income ETFs | 13 |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Active High Yield Bond ETF (the Fund) returned 11.00% based on net asset value in the 12-month reporting period that ended August 31, 2021, outperforming the 8.77% return of the Bloomberg US High Yield Very Liquid Index (the Index).

What were the market conditions?

| ● | US high yield bonds posted strong gains during the reporting period, driven by positive COVID-19 vaccine news, an accelerated economic recovery, higher-than-expected corporate earnings, ongoing monetary and fiscal stimulus programs, and declining default rates. Low and range-bound nominal interest rates continued to support risk sentiment and an ongoing search for yield. |

| ● | While flows into high yield bond mutual funds turned negative during the last eight months of the period, strong demand from institutional accounts and a new-issue calendar consisting mostly of refinancing activity provided a strong technical backdrop for the asset class. Meanwhile, fundamentals improved markedly from their pandemic lows as default rates declined, credit quality improved, and earnings continued to surprise to the upside. |

| ● | After posting inflows of $45 billion during 2020, high yield bond mutual funds saw $14 billion of outflows during the first eight months of 2021. For the period, spreads on the Bloomberg US High Yield 1% Issuer Constrained Bond Index tightened 194 basis points (bps) to 293 bps as of August 31, 2021. (One basis point equals 0.01%.) For perspective, spreads ended the period 48 bps tighter than at the start of 2020 after widening to a pandemic high of 1,100 bps in March 2020. |

| ● | By quality, lower-quality (CCC-rated) credits significantly outperformed their higher-quality (BB-rated and B-rated) peers during the period, as many of the higher-beta and COVID-19-impacted sectors that should benefit from strong growth and a further reopening of the economy outperformed. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) Airlines, energy, retail, aerospace, and metals & mining saw strong performance, while more defensive sectors lagged. |

| ● | The high yield primary market remained active, as issuers continued to take advantage of the low yield environment to push out maturities and lower their cost of capital. After issuing a record $450 billion in high yield bonds during 2020, US companies issued another $364 billion through the first eight months of 2021. |

| ● | The par-weighted US high yield default rate, including distressed exchanges, ended August 2021 at a 29-month low of 1.06%, down 470 bps year over year, according to JP Morgan. |

What worked?

| ● | Overall security selection was the largest contributor to the Fund’s returns during the reporting period, with selection in the upstream and midstream energy, telecom, aerospace & defense, gaming/lodging/leisure, and automotive industries the largest contributors. |

| 14 | Visit our website at pgim.com/investments |

| · | While overall industry selection was a modest detractor from performance, an overweight relative to the Index to the upstream energy and aerospace & defense industries—along with an underweight to downstream energy—contributed. |

| · | In individual security selection, overweights relative to the index to Chesapeake Energy Corp. (upstream energy), Digicel International (telecom), and Nabors Industries (upstream energy) were the largest contributors to performance. |

| ● | Having more beta on average in the Fund relative to the Index over the period was a strong contributor to returns. |

What didn’t work?

| ● | Overall industry selection modestly detracted from performance, with an overweight relative to the Index to building materials & home construction and electric utilities—along with an underweight to transportation & environmental services—the largest detractors. |

| ● | While overall security selection was positive, selection within the healthcare & pharmaceuticals, media & entertainment, and cable & satellite industries detracted. |

| ● | In individual security selection, overweights relative to the Index to Bausch Health Americas (healthcare & pharmaceuticals), Intelsat (cable & satellite), and Diamond Sports Group (media & entertainment) detracted from results. |

Did the Fund use derivatives?

The Fund used credit index derivatives, interest rate futures, and swaps to manage its overall risk profile, which had a positive aggregate impact on performance.

Current outlook

| ● | PGIM Fixed Income remains constructive on high yield bonds, given the enormous monetary and fiscal responses seen to date, and continues to expect spreads to tighten over the medium term. Optimism around the COVID-19 vaccines, an ongoing search for yield, a decline in defaults, and a market that is of higher quality than before the pandemic are among the factors that PGIM Fixed Income expects to drive spread compression going forward. |

| ● | PGIM Fixed Income has reduced its base-case default expectations to 0.9% over the next 12 months and to 1.0% for the following 12 months. This optimism is tempered modestly by COVID-19 mutations and the rapidly expanding delta variant, which are likely to cause growth to slow in regions around the globe that are not well vaccinated, as well as higher-than-expected inflation leading to an increasingly hawkish Federal Reserve, slowing growth in China and/or a materially higher US tax regime on corporations and higher-income individuals. |

| ● | In terms of positioning, PGIM Fixed Income believes BB-rated bonds relative to the Index are attractive on a relative-value basis. The Fund is currently underweight BB-rated bonds, but PGIM Fixed Income is selectively adding exposure. Overweights include independent power producers, housing, gaming, chemicals, and autos. |

| PGIM Fixed Income ETFs | 15 |

PGIM Active Aggregate Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

Average Annual Total Returns as of 8/31/21 Since Inception (%) | ||

Net Asset Value (NAV) | 2.59 (04/12/2021) | |

Market Price* | 2.64 (04/12/2021) | |

Bloomberg US Aggregate Bond Index

| 2.77

| |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

Since inception returns for the Index are measured from the closest month-end to the Fund’s inception date.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

| 16 | Visit our website at pgim.com/investments |

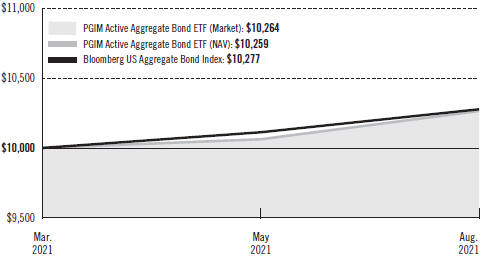

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the Bloomberg US Aggregate Bond Index by portraying the initial account values at the commencement of operations (April 12, 2021) and the account values at the end of the current fiscal year (August 31, 2021), as measured on a quarterly basis.The Fund assumes an initial investment on April 15, 2021, while the benchmark and the Index assume that the initial investment occurred on March 31, 2021. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

| PGIM Fixed Income ETFs | 17 |

PGIM Active Aggregate Bond ETF

Your Fund’s Performance (continued)

Benchmark Definitions

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

| Credit Quality expressed as a percentage of total investments as of 8/31/21 (%) | ||||

AAA | 67.1 | |||

AA | 6.6 | |||

A | 9.6 | |||

BBB | 16.5 | |||

Cash/Cash Equivalents | 0.2 | |||

Total | 100.0 | |||

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| Distributions and Yields as of 8/31/21 | ||||||||||||

|

Total Dividends Paid for the Reporting Period ($) |

| | SEC 30-Day Subsidized Yield* (%) |

| | SEC 30-Day Unsubsidized Yield** (%) |

| ||||

| 0.23 | 1.24 | 1.24 | ||||||||||

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

| 18 | Visit our website at pgim.com/investments |

Strategy and Performance Overview (unaudited)

How did the Fund perform?

The PGIM Active Aggregate Bond ETF (the Fund) returned 2.59% based on net asset value in the four-month reporting period from the Fund’s inception on April 12, 2021, through August 31, 2021, underperforming the 2.77% return of the Bloomberg US Aggregate Bond Index (the Index) during that same time.

What were the market conditions?

| ● | The strong global rebound continued throughout the reporting period, as economies responded to the unprecedented monetary and fiscal stimulus programs. Although yields for short-term Treasuries remained well anchored by the Federal Reserve’s (the Fed’s) commitment to maintain its low-rate policy, longer-term Treasuries sold off sharply in the first quarter of 2021, with the yield on the benchmark US 10-year Treasury note rising from 0.92% on December 31, 2020, to 1.74% on March 31, 2021. Similarly, the yield on the 30-year Treasury bond rose from 1.65% to 2.41% over the same period. |

| ● | Market volatility for rates then eased in the second quarter of 2021, escaping the sell-offs observed earlier in the year, with lower long-dated yields and higher front-end rates forming a substantially flatter Treasury yield curve by the end of the period. (A yield curve is a line graph that illustrates the relationship between the yields and maturities of fixed income securities. It is created by plotting the yields of different maturities for the same type of bonds.) Instead of pushing up the yield curve, the Fed’s turn toward tapering near the end of the second quarter led to a decline in long-term Treasury yields, as investors assumed a more hawkish Fed would simply mean a lower path for rates over the long run. |

| ● | Following the volatility of the first quarter of 2021, the US 10-year and 30-year Treasury yields ended the period at 1.31% and 1.93%, respectively. Meanwhile, the yield on the 2-year Treasury note ended the period at 0.21%. |

| ● | Spread markets continued to tighten, supported by the Fed’s monetary responses, fiscal stimulus, the rollout of COVID-19 vaccines, better-than-expected corporate earnings, and surging growth in the US, Europe, and some emerging market economies. |

| ● | The US investment-grade corporate bond market performed well, with spreads tightening to near-historic levels by the end of the period, supported by better-than-expected corporate earnings, positive vaccination progress, and a favorable technical backdrop. Strengthening fundamentals generally kept securitized credit on a tightening trajectory as well, with commercial mortgage-backed securities (CMBS) spreads trading well below their pre-pandemic tights by the end of the period. Meanwhile, agency mortgage-backed securities (MBS) spreads tightened on the back of ongoing Fed buying and bank purchases. |

| PGIM Fixed Income ETFs | 19 |

Strategy and Performance Overview (continued)

What worked?

| ● | Overall security selection and sector allocation both contributed to the Fund’s performance during the reporting period. Within security selection, positions in MBS, investment-grade corporates, and emerging markets were the largest contributors. |

| ● | Within sector allocation, an allocation to collateralized loan obligations (CLOs) and overweights to CMBS and investment-grade corporates contributed to returns. |

| ● | Within credit, positioning in banking, midstream energy, telecom, and retailers & restaurants contributed to results. |

| ● | In individual security selection, the Fund benefited from overweights to banking credits JP Morgan, Bank of America, and Goldman Sachs. |

| ● | The Fund’s duration and yield curve positioning both contributed to returns. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

What didn’t work?

| ● | While overall security selection was positive, selection in CLOs was a modest detractor from Fund performance. |

| ● | The Fund’s positioning in the electric utilities, healthcare insurance, and finance companies modestly detracted during the period. |

| ● | In individual security selection relative to the Index, the Fund’s overweight positioning in Edison International (electric utilities), along with underweights to General Electric (capital goods) and Mexico, detracted from performance. |

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used interest rate futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance.

Current outlook

| ● | In considering the composition of the Treasury curve, PGIM Fixed Income believes the repricing of forward rates and inflation expectations in various parts of the curve will likely continue. Even when accounting for the recent change in policy messaging, the hurdle for the Fed to raise rates remains high, and officials will likely wait to observe whether the inflation pressure is transitory. |

| ● | The US saw a marked acceleration in inflation through the first half of 2021. Part of the increase came from “base effects,” but the lion’s share of the gains reflected surprisingly vigorous price increases. (Base effect is the distortion in a monthly inflation figure that results from abnormally high or low levels of inflation a year earlier. In this case, inflation was low a year ago.) Recent developments suggest that inflation will likely continue to run somewhat hot through the months ahead. However, PGIM |

| 20 | Visit our website at pgim.com/investments |

Fixed Income believes inflation could slowly abate toward the end of the year and early next year, as many of the structural factors that drove soft inflation during much of the past decade remain firmly in place. |

| ● | To date, developed markets central banks have felt comfortable looking through recent price pressures and have kept rates on hold. While maintaining a baseline view that the current bout of inflation will be “transitory,” the Fed at its June 2021 meeting recognized that the upside risks to inflation have increased. Even so, PGIM Fixed Income expects monetary policy to remain highly stimulative through at least this year and much of next year. |

| ● | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term, and the Fund is overweight structured products (CMBS), investment-grade corporates (from a duration contribution perspective), and municipal bonds. The Fund is underweight MBS in favor of more attractive opportunities across spread sectors. |

| ● | While valuations are now a bit full, with spreads in many sectors tighter than historical norms, PGIM Fixed Income generally expects ongoing spread-sector outperformance. The combination of high cash balances and low money market rates is likely to continue pushing investors out on the risk spectrum in a search for yield. However, this outlook is not without caveats. First, the relatively narrow level of spreads diminishes the pace and magnitude of further outperformance. Additionally, narrower spreads leave little room for error, and the uncertain course of the long-term economic recovery warrants a discerning approach to credit selection. |

| ● | Within structured products, PGIM Fixed Income is biased to own the top of the capital structure, as near-zero policy rates and ongoing Fed purchases support a spread tightening environment. In investment-grade corporates, PGIM Fixed Income is looking to take advantage of spread compression in select higher-yielding BBB-rated bonds, solid credits in stressed industries, and cyclicals. While agency CMBS have benefited from strong bank demand and Fed support, a change in that dynamic—particularly from the Fed—could contribute some widening pressure on spreads. |

| PGIM Fixed Income ETFs | 21 |

As a shareholder of the Fund, you incur ongoing costs, including investment management fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 held through the six-month period ended August 31, 2021. The example is for illustrative purposes only.

Actual Expenses

The first line in the tables below provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the tables below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, brokerage commissions paid on purchases and sales of Fund shares. Therefore, the ending account values and expenses paid for the period are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

PGIM Ultra Short Bond ETF | Beginning Account Value March 1, 2021 | Ending Account Value | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | ||||

Actual | $1,000.00 | $1,002.90 | 0.15% | $0.76 | ||||

Hypothetical | $1,000.00 | $1,024.45 | 0.15% | $0.77 | ||||

| 22 | Visit our website at pgim.com/investments |

PGIM Active High Yield Bond ETF | Beginning Account Value March 1, 2021 | Ending Account Value | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | ||||

Actual | $1,000.00 | $1,037.40 | 0.53% | $2.72 | ||||

Hypothetical | $1,000.00 | $1,022.53 | 0.53% | $2.70 | ||||

PGIM Active Aggregate Bond ETF | Beginning Account Value March 1, 2021 | Ending Account Value | Annualized Expense Ratio Based on the Six-Month Period | Expenses Paid During the Six-Month Period* | ||||

Actual** | $1,000.00 | $1,025.90 | 0.19% | $0.74 | ||||

Hypothetical | $1,000.00 | $1,024.25 | 0.19% | $0.97 | ||||

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2021, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2021 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**“Actual” expenses are calculated using 141-day period ended August 31, 2021 due to the Fund’s inception date on April 12, 2021.

| PGIM Fixed Income ETFs | 23 |

PGIM Ultra Short Bond ETF

Schedule of Investments

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| LONG-TERM INVESTMENTS 79.4% | ||||||||||||||||

| ASSET-BACKED SECURITIES 19.1% | ||||||||||||||||

| Automobile ABS 1.0% | ||||||||||||||||

Donlen Fleet Lease Funding 2 LLC, Series 2021-2, Class A2, 144A | 0.560 | % | 12/11/34 | 6,000 | $ | 6,009,606 | ||||||||||

Enterprise Fleet Financing LLC, Series 2021-2, Class A2, 144A | 0.480 | 05/20/27 | 6,210 | 6,208,867 | ||||||||||||

Honda Auto Receivables Owner Trust, Series 2020-1, Class A3 | 1.610 | 04/22/24 | 5,500 | 5,567,109 | ||||||||||||

|

| |||||||||||||||

| 17,785,582 | ||||||||||||||||

| Collateralized Loan Obligations 18.1% | ||||||||||||||||

Adams Mill CLO Ltd. (Cayman Islands), Series 2014-1A, Class A1R, 144A, 3 Month LIBOR + 1.100% | 1.226 | (c) | 07/15/26 | 80 | 80,133 | |||||||||||

Allegro CLO IV Ltd. (Cayman Islands), Series 2016-1A, Class AR2, 144A, 3 Month LIBOR + 0.950% | 1.076 | (c) | 01/15/30 | 9,108 | 9,105,428 | |||||||||||

Anchorage Capital CLO 7 Ltd. (Cayman Islands), Series 2015-7A, Class AR2, 144A, 3 Month LIBOR + 1.090% | 1.222 | (c) | 01/28/31 | 5,000 | 5,002,500 | |||||||||||

Anchorage Capital CLO 8 Ltd. (Cayman Islands), Series 2016-8A, Class AR, 144A, 3 Month LIBOR + 1.000% | 1.132 | (c) | 07/28/28 | 1,076 | 1,076,112 | |||||||||||

Atlas Senior Loan Fund III Ltd. (Cayman Islands), Series 2013-1A, Class AR, 144A, 3 Month LIBOR + 0.830% | 0.954 | (c) | 11/17/27 | 3,874 | 3,874,609 | |||||||||||

Atrium XII (Cayman Islands), Series 12A, Class AR, 144A, 3 Month LIBOR + 0.830% | 0.968 | (c) | 04/22/27 | 7,449 | 7,449,169 | |||||||||||

Bain Capital Credit CLO (Cayman Islands), Series 2018-1A, Class A1, 144A, 3 Month LIBOR + 0.960% | 1.098 | (c) | 04/23/31 | 4,000 | 3,996,408 | |||||||||||

Battalion CLO VII Ltd. (Cayman Islands), Series 2014-7A, Class A1RR, 144A, 3 Month LIBOR + 1.040% | 1.174 | (c) | 07/17/28 | 1,684 | 1,684,295 | |||||||||||

Benefit Street Partners CLO II Ltd. (Cayman Islands), Series 2013-IIA, Class A1R2, 144A, 3 Month LIBOR + 0.870% | 0.996 | (c) | 07/15/29 | 5,000 | 4,995,934 | |||||||||||

Benefit Street Partners CLO III Ltd. (Cayman Islands), Series 2013-IIIA, Class A1R2, 144A, 3 Month LIBOR + 1.000% | 1.134 | (c) | 07/20/29 | 10,000 | 9,996,795 | |||||||||||

See Notes to Financial Statements.

PGIM Fixed Income ETFs | 25 |

PGIM Ultra Short Bond ETF

Schedule of Investments (continued)

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||||||||||

| Collateralized Loan Obligations (cont'd.) | ||||||||||||||||

BlueMountain CLO XXII Ltd. (Cayman Islands), Series 2018-22A, Class A1, 144A, 3 Month LIBOR + 1.080% | 1.206 | %(c) | 07/15/31 | 4,500 | $ | 4,500,000 | ||||||||||

Brookside Mill CLO Ltd. (Cayman Islands), Series 2013-1A, Class AR, 144A, 3 Month LIBOR + 0.820% | 0.954 | (c) | 01/17/28 | 2,728 | 2,727,780 | |||||||||||

Canyon Capital CLO Ltd. (Cayman Islands), Series 2017-1A, Class AR, 144A, 3 Month LIBOR + 1.000% | 1.112 | (c) | 07/15/30 | 15,000 | 14,996,274 | |||||||||||

Carlyle US CLO Ltd. (Cayman Islands), Series 2017-1A, Class A1R, 144A, 3 Month LIBOR + 1.000% | 1.134 | (c) | 04/20/31 | 13,000 | 12,999,973 | |||||||||||

Catamaran CLO Ltd. (Cayman Islands), Series 2013-1A, Class AR, 144A, 3 Month LIBOR + 0.850% | 0.979 | (c) | 01/27/28 | 159 | 158,470 | |||||||||||

CIFC Funding Ltd. (Cayman Islands), | ||||||||||||||||

Series 2013-3RA, Class A1, 144A, 3 Month LIBOR + 0.980% | 1.105 | (c) | 04/24/31 | 2,000 | 2,000,332 | |||||||||||

Series 2017-1A, Class AR, 144A, 3 Month LIBOR + 1.010% | 1.144 | (c) | 04/23/29 | 4,997 | 4,996,998 | |||||||||||

Series 2017-2A, Class AR, 144A, 3 Month LIBOR + 0.950% | 1.084 | (c) | 04/20/30 | 15,000 | 14,983,082 | |||||||||||

Elevation CLO Ltd. (Cayman Islands), | ||||||||||||||||

Series 2014-2A, Class A1R, 144A, 3 Month LIBOR + 1.230% | 1.356 | (c) | 10/15/29 | 1,500 | 1,500,040 | |||||||||||

Series 2017-7A, Class A, 144A, 3 Month LIBOR + 1.220% | 1.346 | (c) | 07/15/30 | 1,708 | 1,708,077 | |||||||||||

Ellington CLO IV Ltd. (Cayman Islands), Series 2019-4A, Class AR, 144A, 3 Month LIBOR + 1.580% | 1.706 | (c) | 04/15/29 | 12,000 | 11,992,628 | |||||||||||

HPS Loan Management Ltd. (Cayman Islands), Series 11A-17, Class AR, 144A, 3 Month LIBOR + 1.020% | 1.142 | (c) | 05/06/30 | 3,500 | 3,501,741 | |||||||||||

ICG US CLO Ltd. (Cayman Islands), Series 2014-3A, Class A1RR, 144A, 3 Month LIBOR + 1.030% | 1.155 | (c) | 04/25/31 | 7,083 | 7,078,471 | |||||||||||

JMP Credit Advisors CLO IV Ltd. (Cayman Islands), Series 2017-1A, Class AR, 144A, 3 Month LIBOR + 1.280% | 1.414 | (c) | 07/17/29 | 12,068 | 12,064,728 | |||||||||||

KKR CLO Ltd. (Cayman Islands), Series 11, Class AR, 144A, 3 Month LIBOR + 1.180% | 1.306 | (c) | 01/15/31 | 1,000 | 999,707 | |||||||||||

See Notes to Financial Statements.

| 26 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||||||||||

| Collateralized Loan Obligations (cont'd.) | ||||||||||||||||

KVK CLO Ltd. (Cayman Islands), Series 2018-1A, Class A, 144A, 3 Month LIBOR + 0.930% | 1.061 | %(c) | 05/20/29 | 1,931 | $ | 1,928,889 | ||||||||||

Madison Park Funding XXX Ltd. (Cayman Islands), Series 2018-30A, Class A, 144A, 3 Month LIBOR + 0.750% | 0.876 | (c) | 04/15/29 | 13,366 | 13,367,926 | |||||||||||

Madison Park Funding XXXVIII Ltd. (Cayman Islands), Series 2021-38A, Class X, 144A, 3 Month LIBOR + 0.950% | 1.084 | (c) | 07/17/34 | 3,500 | 3,499,918 | |||||||||||

Magnetite XVI Ltd. (Cayman Islands), Series 2015-16A, Class AR, 144A, 3 Month LIBOR + 0.800% | 0.934 | (c) | 01/18/28 | 2,404 | 2,402,943 | |||||||||||

Man GLG US CLO Ltd. (Cayman Islands), Series 2018-2A, Class A1R, 144A, 3 Month LIBOR + 1.240% | 1.366 | (c) | 10/15/28 | 1,875 | 1,875,458 | |||||||||||

Midocean Credit CLO IX (Cayman Islands), Series 2018-9A, Class A1, 144A, 3 Month LIBOR + 1.150% | 1.284 | (c) | 07/20/31 | 5,250 | 5,249,991 | |||||||||||

Midocean Credit CLO V (Cayman Islands), Series 2016-5A, Class AR, 144A, 3 Month LIBOR + 1.120% | 1.254 | (c) | 07/19/28 | 6,007 | 6,007,349 | |||||||||||

Mountain View CLO Ltd. (Cayman Islands), Series 2013-1A, Class ARR, 144A, 3 Month LIBOR + 1.000% | 1.138 | (c) | 10/12/30 | 13,500 | 13,500,432 | |||||||||||

Oaktree CLO Ltd. (Cayman Islands), Series 2015-1A, Class A1R, 144A, 3 Month LIBOR + 0.870% | 1.004 | (c) | 10/20/27 | 1,583 | 1,583,145 | |||||||||||

Ocean Trails CLO VII (Cayman Islands), Series 2019-7A, Class AR, 144A, 3 Month LIBOR + 1.010% | 1.144 | (c) | 04/17/30 | 5,000 | 4,999,503 | |||||||||||

OCP CLO Ltd. (Cayman Islands), Series 2017-13A, Class A1A, 144A, 3 Month LIBOR + 1.260% | 1.386 | (c) | 07/15/30 | 4,400 | 4,400,000 | |||||||||||

Octagon Investment Partners 31 LLC (Cayman Islands), Series 2017-1A, Class AR, 144A, 3 Month LIBOR + 1.050% | 1.184 | (c) | 07/20/30 | 8,000 | 7,990,799 | |||||||||||

OZLM VI Ltd. (Cayman Islands), Series 2014-6A, Class A1S, 144A, 3 Month LIBOR + 1.080% | 1.214 | (c) | 04/17/31 | 8,867 | 8,863,978 | |||||||||||

OZLM XII Ltd. (Cayman Islands), Series 2015-12A, Class A1R, 144A, 3 Month LIBOR + 1.050% | 1.179 | (c) | 04/30/27 | 91 | 91,292 | |||||||||||

OZLM XIII Ltd. (Cayman Islands), Series 2015-13A, Class A1R, 144A, 3 Month LIBOR + 1.080% | 1.209 | (c) | 07/30/27 | 125 | 125,337 | |||||||||||

See Notes to Financial Statements.

PGIM Fixed Income ETFs | 27 |

PGIM Ultra Short Bond ETF

Schedule of Investments (continued)

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||||||||||

| Collateralized Loan Obligations (cont'd.) | ||||||||||||||||

| Palmer Square CLO Ltd. (Cayman Islands), | ||||||||||||||||

Series 2014-1A, Class A1R2, 144A, 3 Month LIBOR + 1.130% | 1.264 | %(c) | 01/17/31 | 1,250 | $ | 1,249,645 | ||||||||||

Series 2015-2A, Class A1R2, 144A, 3 Month LIBOR + 1.100% | 1.234 | (c) | 07/20/30 | 1,400 | 1,399,293 | |||||||||||

Park Avenue Institutional Advisers CLO Ltd. (Cayman Islands), Series 2018-1A, Class A1AR, 144A, 3 Month LIBOR + 1.000% | 1.134 | (c) | 10/20/31 | 10,000 | 10,005,001 | |||||||||||

Race Point VIII CLO Ltd. (Cayman Islands), Series 2013-8A, Class AR2, 144A, 3 Month LIBOR + 1.040% | 1.171 | (c) | 02/20/30 | 9,873 | 9,876,034 | |||||||||||

Sound Point CLO VII-R Ltd. (Cayman Islands), Series 2014-3RA, Class A1R, 144A, 3 Month LIBOR + 1.070% | 1.208 | (c) | 10/23/31 | 10,000 | 9,996,496 | |||||||||||

Sound Point CLO XVII Ltd. (Cayman Islands), Series 2017-3A, Class A1R, 144A, 3 Month LIBOR + 0.980% | 1.114 | (c) | 10/20/30 | 10,000 | 9,986,639 | |||||||||||

Sound Point CLO XXII Ltd. (Cayman Islands), Series 2019-1A, Class AR, 144A, 3 Month LIBOR + 1.080% | 1.193 | (c) | 01/20/32 | 13,000 | 12,971,128 | |||||||||||

TCW CLO Ltd. (Cayman Islands), Series 2017-1A, Class AR, 144A, 3 Month LIBOR + 1.030% | 1.160 | (c) | 07/29/29 | 5,500 | 5,497,838 | |||||||||||

TICP CLO III-2 Ltd. (Cayman Islands), Series 2018-3R, Class A, 144A, 3 Month LIBOR + 0.840% | 0.974 | (c) | 04/20/28 | 1,612 | 1,611,693 | |||||||||||

Trinitas CLO IV Ltd. (Cayman Islands), Series 2016-4A, Class A1L2, 144A, 3 Month LIBOR + 1.100% | 1.234 | (c) | 10/18/31 | 12,000 | 12,000,737 | |||||||||||

Trinitas CLO V Ltd. (Cayman Islands), Series 2016-5A, Class ARR, 144A, 3 Month LIBOR + 1.030% | 1.155 | (c) | 10/25/28 | 6,480 | 6,478,119 | |||||||||||

Venture XXI CLO Ltd. (Cayman Islands), Series 2015-21A, Class AR, 144A, 3 Month LIBOR + 0.880% | 1.006 | (c) | 07/15/27 | 453 | 452,900 | |||||||||||

Venture XXIV CLO Ltd. (Cayman Islands), Series 2016-24A, Class ARR, 144A, 3 Month LIBOR + 0.900% | 1.034 | (c) | 10/20/28 | 9,599 | 9,596,015 | |||||||||||

| Voya CLO Ltd. (Cayman Islands), | ||||||||||||||||

Series 2014-1A, Class AAR2, 144A, 3 Month LIBOR + 0.990% | 1.124 | (c) | 04/18/31 | 1,864 | 1,864,473 | |||||||||||

See Notes to Financial Statements.

| 28 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| ASSET-BACKED SECURITIES (Continued) | ||||||||||||||||

| Collateralized Loan Obligations (cont'd.) | ||||||||||||||||

| Voya CLO Ltd. (Cayman Islands), (cont'd.) | ||||||||||||||||

Series 2014-2A, Class A1RR, 144A, 3 Month LIBOR + 1.020% | 1.154 | %(c) | 04/17/30 | 1,689 | $ | 1,689,444 | ||||||||||

| Wellfleet CLO Ltd. (Cayman Islands), | ||||||||||||||||

Series 2015-1A, Class AR3, 144A, 3 Month LIBOR + 1.280% | 1.414 | (c) | 07/20/29 | 7,945 | 7,945,129 | |||||||||||

Series 2016-2A, Class A1R, 144A, 3 Month LIBOR + 1.140% | 1.274 | (c) | 10/20/28 | 5,016 | 5,015,512 | |||||||||||

Series 2017-2A, Class A1R, 144A, 3 Month LIBOR + 1.060% | 1.194 | (c) | 10/20/29 | 1,750 | 1,749,917 | |||||||||||

York CLO-2 Ltd. (Cayman Islands), Series 2015-1A, Class AR, 144A, 3 Month LIBOR + 1.150% | 1.288 | (c) | 01/22/31 | 10,340 | 10,339,969 | |||||||||||

Zais CLO 7 Ltd. (Cayman Islands), Series 2017-2A, Class A, 144A, 3 Month LIBOR + 1.290% | 1.416 | (c) | 04/15/30 | 244 | 244,268 | |||||||||||

Zais CLO 8 Ltd. (Cayman Islands), Series 2018-1A, Class A, 144A, 3 Month LIBOR + 0.950% | 1.076 | (c) | 04/15/29 | 831 | 830,829 | |||||||||||

|

| |||||||||||||||

| 340,157,723 | ||||||||||||||||

|

| |||||||||||||||

TOTAL ASSET-BACKED SECURITIES |

| 357,943,305 | ||||||||||||||

|

| |||||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES 13.6% | ||||||||||||||||

| BANK, | ||||||||||||||||

Series 2017-BNK5, Class A1 | 1.909 | 06/15/60 | 256 | 256,524 | ||||||||||||

Series 2017-BNK7, Class A1 | 1.984 | 09/15/60 | 16 | 15,983 | ||||||||||||

Series 2017-BNK9, Class A1 | 2.322 | 11/15/54 | 395 | 397,138 | ||||||||||||

Series 2018-BN14, Class A1 | 3.277 | 09/15/60 | 384 | 393,444 | ||||||||||||

| Benchmark Mortgage Trust, | ||||||||||||||||

Series 2018-B1, Class A1 | 2.560 | 01/15/51 | 325 | 326,909 | ||||||||||||

Series 2018-B2, Class A2 | 3.662 | 02/15/51 | 975 | 1,006,019 | ||||||||||||

Series 2018-B3, Class A2 | 3.848 | 04/10/51 | 960 | 998,056 | ||||||||||||

Series 2018-B5, Class A2 | 4.077 | 07/15/51 | 800 | 840,661 | ||||||||||||

CCUBS Commercial Mortgage Trust, Series 2017-C1, Class A1 | 2.288 | (cc) | 11/15/50 | 2,130 | 2,141,570 | |||||||||||

CGMS Commercial Mortgage Trust, Series 2017-B1, Class A1 | 2.008 | 08/15/50 | 88 | 88,236 | ||||||||||||

| Citigroup Commercial Mortgage Trust, | ||||||||||||||||

Series 2014-GC21, Class AAB | 3.477 | 05/10/47 | 291 | 302,446 | ||||||||||||

Series 2014-GC23, Class AAB | 3.337 | 07/10/47 | 797 | 828,999 | ||||||||||||

Series 2014-GC25, Class A3 | 3.372 | 10/10/47 | 7,219 | 7,650,932 | ||||||||||||

Series 2016-P4, Class A2 | 2.450 | 07/10/49 | 4,422 | 4,436,939 | ||||||||||||

Series 2017-P8, Class A1 | 2.065 | 09/15/50 | 320 | 321,828 | ||||||||||||

See Notes to Financial Statements.

PGIM Fixed Income ETFs | 29 |

PGIM Ultra Short Bond ETF

Schedule of Investments (continued)

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | ||||||||||||||||

| COMM Mortgage Trust, | ||||||||||||||||

Series 2012-CR4, Class A3 | 2.853 | % | 10/15/45 | 2,704 | $ | 2,760,391 | ||||||||||

Series 2012-CR5, Class A4 | 2.771 | 12/10/45 | 4,750 | 4,864,879 | ||||||||||||

Series 2013-CR11, Class ASB | 3.660 | 08/10/50 | 498 | 512,216 | ||||||||||||

Series 2013-CR7, Class ASB | 2.739 | 03/10/46 | 228 | 230,876 | ||||||||||||

Series 2013-CR8, Class A4 | 3.334 | 06/10/46 | 454 | 463,254 | ||||||||||||

Series 2013-CR8, Class A5 | 3.612 | (cc) | 06/10/46 | 5,081 | 5,322,412 | |||||||||||

Series 2014-CR17, Class ASB | 3.598 | 05/10/47 | 402 | 416,472 | ||||||||||||

Series 2014-UBS2, Class ASB | 3.472 | 03/10/47 | 852 | 882,450 | ||||||||||||

Series 2014-UBS5, Class A4 | 3.838 | 09/10/47 | 10,000 | 10,847,008 | ||||||||||||

Series 2015-CR22, Class A3 | 3.207 | 03/10/48 | 2,000 | 2,012,910 | ||||||||||||

Series 2015-CR23, Class ASB | 3.257 | 05/10/48 | 1,568 | 1,634,786 | ||||||||||||

Series 2015-CR24, Class ASB | 3.445 | 08/10/48 | 2,901 | 3,044,175 | ||||||||||||

Series 2015-DC1, Class A2 | 2.870 | 02/10/48 | 194 | 194,184 | ||||||||||||

Series 2015-LC23, Class A2 | 3.221 | 10/10/48 | 683 | 688,658 | ||||||||||||

Series 2017-COR2, Class A1 | 2.111 | 09/10/50 | 85 | 85,986 | ||||||||||||

| CSAIL Commercial Mortgage Trust, | ||||||||||||||||

Series 2015-C3, Class A4 | 3.718 | 08/15/48 | 8,000 | 8,730,810 | ||||||||||||

Series 2016-C5, Class ASB | 3.533 | 11/15/48 | 3,540 | 3,738,589 | ||||||||||||

| DBJPM Mortgage Trust, | ||||||||||||||||

Series 2016-C3, Class A2 | 1.886 | 08/10/49 | 97 | 97,372 | ||||||||||||

Series 2017-C6, Class A3 | 3.269 | 06/10/50 | 5,400 | 5,651,252 | ||||||||||||

Freddie Mac STACR REMIC Trust, Series 2021-DNA5, Class M1, 144A, SOFR30A + 0.650% | 0.700 | (c) | 01/25/34 | 1,628 | 1,628,011 | |||||||||||

GS Mortgage Securities Corp. Trust, Series 2021-RENT, Class A, 144A, 1 Month LIBOR + 0.700% | 0.788 | (c) | 11/21/35 | 5,425 | 5,432,271 | |||||||||||

| GS Mortgage Securities Trust, | ||||||||||||||||

Series 2014-GC22, Class AAB | 3.467 | 06/10/47 | 500 | 518,116 | ||||||||||||

Series 2017-GS7, Class A1 | 1.950 | 08/10/50 | 605 | 607,561 | ||||||||||||

| JP Morgan Chase Commercial Mortgage Securities Trust, | ||||||||||||||||

Series 2012-C6, Class ASB | 3.144 | 05/15/45 | 542 | 544,971 | ||||||||||||

Series 2012-C8, Class A3 | 2.829 | 10/15/45 | 3,024 | 3,070,610 | ||||||||||||

Series 2013-LC11, Class A5 | 2.960 | 04/15/46 | 7,287 | 7,510,172 | ||||||||||||

Series 2016-JP2, Class ASB | 2.713 | 08/15/49 | 8,284 | 8,643,802 | ||||||||||||

| JPMBB Commercial Mortgage Securities Trust, | ||||||||||||||||

Series 2013-C12, Class A4 | 3.363 | 07/15/45 | 2,904 | 2,994,307 | ||||||||||||

Series 2013-C12, Class ASB | 3.157 | 07/15/45 | 316 | 318,678 | ||||||||||||

Series 2013-C14, Class ASB | 3.761 | (cc) | 08/15/46 | 7,300 | 7,547,243 | |||||||||||

Series 2014-C18, Class A4A2, 144A | 3.794 | 02/15/47 | 4,170 | 4,402,032 | ||||||||||||

Series 2014-C25, Class ASB | 3.407 | 11/15/47 | 3,863 | 4,036,413 | ||||||||||||

JPMCC Commercial Mortgage Securities Trust, | 1.969 | 09/15/50 | 219 | 219,639 | ||||||||||||

See Notes to Financial Statements.

| 30 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | ||||||||||||||||

| Morgan Stanley Bank of America Merrill Lynch Trust, | ||||||||||||||||

Series 2012-C6, Class A4 | 2.858 | % | 11/15/45 | 1,413 | $ | 1,434,719 | ||||||||||

Series 2013-C12, Class ASB | 3.824 | 10/15/46 | 5,195 | 5,343,515 | ||||||||||||

Series 2013-C8, Class A4 | 3.134 | 12/15/48 | 4,750 | 4,874,513 | ||||||||||||

Series 2013-C9, Class AAB | 2.657 | 05/15/46 | 434 | 440,440 | ||||||||||||

Series 2014-C19, Class ASB | 3.326 | 12/15/47 | 5,757 | 5,992,443 | ||||||||||||

Series 2015-C23, Class ASB | 3.398 | 07/15/50 | 1,963 | 2,053,388 | ||||||||||||

Series 2017-C34, Class A1 | 2.109 | 11/15/52 | 15 | 15,072 | ||||||||||||

| Morgan Stanley Capital I Trust, | ||||||||||||||||

Series 2016-UB12, Class A2 | 2.932 | 12/15/49 | 5,029 | 5,036,983 | ||||||||||||

Series 2018-H3, Class A2 | 3.997 | 07/15/51 | 1,000 | 1,051,548 | ||||||||||||

| MSG III Securitization Trust, | ||||||||||||||||

Series 2021-1, Class A, 144A, 1 Month LIBOR + 0.750% | 0.841 | (c) | 06/25/54 | 4,480 | 4,474,428 | |||||||||||

Series 2021-1, Class B, 144A, 1 Month LIBOR + 0.900% | 0.991 | (c) | 06/25/54 | 650 | 648,198 | |||||||||||

Series 2021-1, Class C, 144A, 1 Month LIBOR + 1.100% | 1.191 | (c) | 06/25/54 | 530 | 528,533 | |||||||||||

Series 2021-1, Class D, 144A, 1 Month LIBOR + 1.300% | 1.391 | (c) | 06/25/54 | 200 | 199,448 | |||||||||||

One New York Plaza Trust, Series 2020-1NYP, Class A, 144A, 1 Month LIBOR + 0.950% | 1.046 | (c) | 01/15/26 | 4,925 | 4,948,365 | |||||||||||

| Station Place Securitization Trust, | ||||||||||||||||

Series 2021-4, Class A, 144A, 1 Month LIBOR + 0.900% | 0.986 | (c) | 04/11/22 | 6,500 | 6,493,722 | |||||||||||

Series 2021-8, Class A, 144A, 1 Month LIBOR + 0.800% | 0.886 | (c) | 06/20/22 | 9,450 | 9,457,352 | |||||||||||

| UBS Commercial Mortgage Trust, | ||||||||||||||||

Series 2012-C1, Class A3 | 3.400 | 05/10/45 | 1,177 | 1,181,913 | ||||||||||||

Series 2017-C4, Class A1 | 2.129 | 10/15/50 | 8 | 8,088 | ||||||||||||

Series 2017-C5, Class A1 | 2.139 | 11/15/50 | 277 | 278,212 | ||||||||||||

Series 2017-C6, Class A1 | 2.344 | 12/15/50 | 2,849 | 2,870,747 | ||||||||||||

Series 2018-C11, Class A1 | 3.211 | 06/15/51 | 5 | 4,707 | ||||||||||||

Series 2018-C8, Class A1 | 2.659 | 02/15/51 | 1,106 | 1,115,937 | ||||||||||||

Series 2018-C8, Class A2 | 3.713 | 02/15/51 | 1,950 | 2,015,449 | ||||||||||||

| UBS-Barclays Commercial Mortgage Trust, | ||||||||||||||||

Series 2012-C3, Class A4 | 3.091 | 08/10/49 | 8,769 | 8,929,894 | ||||||||||||

Series 2012-C4, Class A5 | 2.850 | 12/10/45 | 11,500 | 11,740,416 | ||||||||||||

Series 2013-C5, Class A4 | 3.185 | 03/10/46 | 8,311 | 8,541,540 | ||||||||||||

Series 2013-C6, Class A4 | 3.244 | 04/10/46 | 16,009 | 16,542,075 | ||||||||||||

| Wells Fargo Commercial Mortgage Trust, | ||||||||||||||||

Series 2013-LC12, Class A4 | 4.218 | (cc) | 07/15/46 | 17,500 | 18,445,430 | |||||||||||

Series 2013-LC12, Class ASB | 3.928 | (cc) | 07/15/46 | 4,783 | 4,946,788 | |||||||||||

See Notes to Financial Statements.

PGIM Fixed Income ETFs | 31 |

PGIM Ultra Short Bond ETF

Schedule of Investments (continued)

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| COMMERCIAL MORTGAGE-BACKED SECURITIES (Continued) | ||||||||||||||||

| Wells Fargo Commercial Mortgage Trust, (cont'd.) | ||||||||||||||||

Series 2015-NXS2, Class A2 | 3.020 | % | 07/15/58 | 210 | $ | 214,538 | ||||||||||

Series 2016-C34, Class ASB | 2.911 | 06/15/49 | 4,754 | 4,983,208 | ||||||||||||

Series 2017-C42, Class A1 | 2.338 | 12/15/50 | 657 | 661,510 | ||||||||||||

|

| |||||||||||||||

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES |

| 255,131,309 | ||||||||||||||

|

| |||||||||||||||

| CORPORATE BONDS 45.9% | ||||||||||||||||

| Advertising 0.4% | ||||||||||||||||

Interpublic Group of Cos, Inc. (The), Sr. Unsec’d. Notes | 3.750 | 10/01/21 | 8,496 | 8,519,733 | ||||||||||||

| Aerospace & Defense 0.1% | ||||||||||||||||

Lockheed Martin Corp., Sr. Unsec’d. Notes | 3.350 | 09/15/21 | 1,556 | 1,557,752 | ||||||||||||

| Agriculture 0.2% | ||||||||||||||||

Cargill, Inc., Sr. Unsec’d. Notes, 144A | 1.375 | 07/23/23 | 1,000 | 1,019,943 | ||||||||||||

Philip Morris International, Inc., Sr. Unsec’d. Notes | 1.125 | 05/01/23 | 3,000 | 3,039,304 | ||||||||||||

|

| |||||||||||||||

| 4,059,247 | ||||||||||||||||

| Airlines 0.4% | ||||||||||||||||

Southwest Airlines Co., Sr. Unsec’d. Notes(a) | 4.750 | 05/04/23 | 7,500 | 8,010,529 | ||||||||||||

| Apparel 0.4% | ||||||||||||||||

VF Corp., Sr. Unsec’d. Notes | 2.050 | 04/23/22 | 8,000 | 8,086,286 | ||||||||||||

| Auto Manufacturers 1.8% | ||||||||||||||||

American Honda Finance Corp., Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 0.290% | 0.418 | (c) | 12/10/21 | 750 | 750,384 | |||||||||||

| BMW US Capital LLC, | ||||||||||||||||

Gtd. Notes, 144A | 1.850 | 09/15/21 | 1,668 | 1,668,956 | ||||||||||||

Gtd. Notes, 144A | 3.800 | 04/06/23 | 4,000 | 4,209,992 | ||||||||||||

Gtd. Notes, 144A, SOFR + 0.530% | 0.580 | (c) | 04/01/24 | 4,000 | 4,040,055 | |||||||||||

Daimler Finance North America LLC, Gtd. Notes, 144A | 0.750 | 03/01/24 | 13,500 | 13,518,589 | ||||||||||||

Toyota Motor Credit Corp., Sr. Unsec’d. Notes, MTN, SOFR + 0.300% | 0.350 | (c) | 06/13/22 | 10,000 | 10,011,989 | |||||||||||

|

| |||||||||||||||

| 34,199,965 | ||||||||||||||||

| Banks 13.7% | ||||||||||||||||

Banco del Estado de Chile (Chile), Sr. Unsec’d. Notes, 144A | 3.875 | 02/08/22 | 4,045 | 4,102,297 | ||||||||||||

See Notes to Financial Statements.

| 32 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| CORPORATE BONDS (Continued) | ||||||||||||||||

| Banks (cont'd.) | ||||||||||||||||

Banco Santander SA (Spain), Sr. Unsec’d. Notes | 3.500 | % | 04/11/22 | 10,400 | $ | 10,601,186 | ||||||||||

Bank of America Corp., Sr. Unsec’d. Notes, MTN, 3 Month BSBY + 0.430% | 0.529 | (c) | 05/28/24 | 15,000 | 15,026,312 | |||||||||||

Bank of Nova Scotia (The) (Canada), Sr. Unsec’d. Notes | 1.625 | 05/01/23 | 6,000 | 6,132,710 | ||||||||||||

Banque Federative du Credit Mutuel SA (France), Sr. Unsec’d. Notes, 144A | 0.650 | 02/27/24 | 7,250 | 7,253,807 | ||||||||||||

Barclays Bank PLC (United Kingdom), Sr. Unsec’d. Notes | 1.700 | 05/12/22 | 10,000 | 10,090,486 | ||||||||||||

Canadian Imperial Bank of Commerce (Canada), Sr. Unsec’d. Notes, SOFR + 0.800% | 0.850 | (c) | 03/17/23 | 6,000 | 6,057,155 | |||||||||||

Citizens Bank NA, Sr. Unsec’d. Notes, BKNT, 3 Month LIBOR + 0.810% | 0.932 | (c) | 05/26/22 | 8,500 | 8,542,359 | |||||||||||

Commonwealth Bank of Australia (Australia), Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 0.700% | 0.828 | (c) | 03/10/22 | 5,000 | 5,017,270 | |||||||||||

Cooperatieve Rabobank UA (Netherlands), Sr. Unsec’d. Notes, SOFR + 0.300% | 0.350 | (c) | 01/12/24 | 5,500 | 5,508,213 | |||||||||||

Credit Agricole Corporate & Investment Bank SA (France), MTN | 0.400 | 01/15/23 | 11,600 | 11,604,098 | ||||||||||||

| Credit Suisse AG (Switzerland), | ||||||||||||||||

Sr. Unsec’d. Notes, SOFR + 0.390% | 0.440 | (c) | 02/02/24 | 3,750 | 3,749,895 | |||||||||||

Sr. Unsec’d. Notes, SOFR + 0.450% | 0.500 | (c) | 02/04/22 | 5,000 | 5,006,428 | |||||||||||

DIB Sukuk Ltd. (Cayman Islands), Sr. Unsec’d. Notes | 3.664 | 02/14/22 | 2,400 | 2,428,364 | ||||||||||||

Fifth Third Bank NA, Sr. Unsec’d. Notes, BKNT | 1.800 | 01/30/23 | 5,000 | 5,104,354 | ||||||||||||

| Goldman Sachs Group, Inc. (The), | ||||||||||||||||

Sr. Unsec’d. Notes | 5.750 | 01/24/22 | 3,000 | 3,065,177 | ||||||||||||

Sr. Unsec’d. Notes, 3 Month LIBOR + 1.053% | 2.908 | (cc) | 06/05/23 | 7,314 | 7,451,290 | |||||||||||

Sr. Unsec’d. Notes, SOFR + 0.538% | 0.627 | (cc) | 11/17/23 | 5,000 | 5,007,020 | |||||||||||

Huntington National Bank (The), Sr. Unsec’d. Notes | 1.800 | 02/03/23 | 6,000 | 6,121,508 | ||||||||||||

Industrial & Commercial Bank of China Ltd. (China), Sr. Unsec’d. Notes | 2.452 | 10/20/21 | 1,864 | 1,868,318 | ||||||||||||

ING Groep NV (Netherlands), Sr. Unsec’d. Notes, 3 Month LIBOR + 1.150% | 1.296 | (c) | 03/29/22 | 10,500 | 10,564,002 | |||||||||||

JPMorgan Chase & Co., Sr. Unsec’d. Notes, SOFR + 0.490% | 0.768 | (cc) | 08/09/25 | 15,000 | 14,970,449 | |||||||||||

| Mitsubishi UFJ Financial Group, Inc. (Japan), | ||||||||||||||||

Sr. Unsec’d. Notes | 2.623 | 07/18/22 | 3,500 | 3,572,408 | ||||||||||||

Sr. Unsec’d. Notes | 2.665 | 07/25/22 | 3,044 | 3,109,167 | ||||||||||||

| Morgan Stanley, | ||||||||||||||||

Sr. Unsec’d. Notes | 2.750 | 05/19/22 | 3,000 | 3,054,265 | ||||||||||||

Sr. Unsec’d. Notes, MTN | 2.625 | 11/17/21 | 3,000 | 3,015,198 | ||||||||||||

Sr. Unsec’d. Notes, MTN, 3 Month LIBOR + 1.400% | 1.525 | (c) | 10/24/23 | 4,750 | 4,815,946 | |||||||||||

See Notes to Financial Statements.

PGIM Fixed Income ETFs | 33 |

PGIM Ultra Short Bond ETF

Schedule of Investments (continued)

as of August 31, 2021

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||||

| CORPORATE BONDS (Continued) | ||||||||||||||||

| Banks (cont'd.) | ||||||||||||||||

| National Securities Clearing Corp., | ||||||||||||||||

Sr. Unsec’d. Notes, 144A | 0.400 | % | 12/07/23 | 3,750 | $ | 3,757,982 | ||||||||||

Sr. Unsec’d. Notes, 144A | 1.200 | 04/23/23 | 3,000 | 3,042,739 | ||||||||||||

Nordea Bank Abp (Finland), Sr. Unsec’d. Notes, 144A | 0.625 | 05/24/24 | 9,500 | 9,521,088 | ||||||||||||

PNC Bank NA, Sr. Unsec’d. Notes, BKNT, 3 Month LIBOR + 0.325% | 0.453 | (c) | 02/24/23 | 3,000 | 3,003,688 | |||||||||||

RHB Bank Bhd (Malaysia), Sr. Unsec’d. Notes, EMTN | 2.503 | 10/06/21 | 1,300 | 1,302,342 | ||||||||||||

Royal Bank of Canada (Canada), Sr. Unsec’d. Notes, GMTN, 3 Month LIBOR + 0.730% | 0.848 | (c) | 02/01/22 | 5,050 | 5,064,987 | |||||||||||

Santander UK PLC (United Kingdom), Sr. Unsec’d. Notes, 3 Month LIBOR + 0.660% | 0.785 | (c) | 11/15/21 | 1,000 | 1,001,173 | |||||||||||

Skandinaviska Enskilda Banken AB (Sweden), 144A | 0.650 | 09/09/24 | 11,250 | 11,234,025 | ||||||||||||

Skysea International Capital Management Ltd. (British Virgin Islands), Gtd. Notes, EMTN | 4.875 | 12/07/21 | 4,300 | 4,348,479 | ||||||||||||

Standard Chartered PLC (United Kingdom), Sr. Unsec’d. Notes, 144A, 3 Month LIBOR + 1.200% | 1.328 | (c) | 09/10/22 | 10,000 | 10,002,022 | |||||||||||

Toronto-Dominion Bank (The) (Canada), Sr. Unsec’d. Notes, MTN, SOFR + 0.480% | 0.530 | (c) | 01/27/23 | 7,138 | 7,172,388 | |||||||||||

| Truist Bank, | ||||||||||||||||

Sr. Unsec’d. Notes, BKNT, 3 Month LIBOR + 0.590% | 0.714 | (c) | 05/17/22 | 3,000 | 3,011,057 | |||||||||||

Sr. Unsec’d. Notes, BKNT, SOFR + 0.730% | 0.776 | (c) | 03/09/23 | 2,000 | 2,014,247 | |||||||||||

| UBS AG (Switzerland), | ||||||||||||||||

Sr. Unsec’d. Notes, 144A | 0.450 | 02/09/24 | 3,000 | 2,988,644 | ||||||||||||

Sr. Unsec’d. Notes, 144A, SOFR + 0.360% | 0.410 | (c) | 02/09/24 | 4,500 | 4,524,103 | |||||||||||

US Bank NA, Sr. Unsec’d. Notes, BKNT, 3 Month LIBOR + 0.440% | 0.571 | (c) | 05/23/22 | 3,700 | 3,709,759 | |||||||||||

Wells Fargo Bank NA, Sr. Unsec’d. Notes, BKNT, 3 Month LIBOR + 0.650% | 2.082 | (cc) | 09/09/22 | 8,000 | 8,002,960 | |||||||||||

|

| |||||||||||||||

| 256,541,365 | ||||||||||||||||

| Beverages 0.7% | ||||||||||||||||

Coca-Cola Europacific Partners PLC (United Kingdom), | ||||||||||||||||

Sr. Unsec’d. Notes, 144A | 0.500 | 05/05/23 | 5,600 | 5,594,732 | ||||||||||||

Sr. Unsec’d. Notes, 144A | 0.800 | 05/03/24 | 3,000 | 2,996,413 | ||||||||||||

PepsiCo, Inc., Sr. Unsec’d. Notes | 0.400 | 10/07/23 | 5,500 | 5,518,168 | ||||||||||||

|

| |||||||||||||||

| 14,109,313 | ||||||||||||||||

See Notes to Financial Statements.

| 34 |

| Description | Interest Rate | Maturity Date | Principal Amount (000)# | Value | ||||||||||

| CORPORATE BONDS (Continued) | ||||||||||||||

| Biotechnology 0.3% | ||||||||||||||

Gilead Sciences, Inc., | ||||||||||||||

Sr. Unsec’d. Notes | 0.750% | 09/29/23 | 3,000 | $ | 3,000,761 | |||||||||

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.520% | 0.666(c) | 09/29/23 | 3,000 | 3,000,763 | ||||||||||

|

| |||||||||||||

| 6,001,524 | ||||||||||||||

| Building Materials 0.1% | ||||||||||||||

Martin Marietta Materials, Inc., Sr. Unsec’d. Notes | 0.650 | 07/15/23 | 2,250 | 2,255,585 | ||||||||||

| Chemicals 0.4% | ||||||||||||||

Air Liquide Finance SA (France), Gtd. Notes, 144A | 2.250 | 09/27/23 | 1,000 | 1,035,249 | ||||||||||

Nutrien Ltd. (Canada), Sr. Unsec’d. Notes | 1.900 | 05/13/23 | 3,000 | 3,069,492 | ||||||||||

Westlake Chemical Corp., Sr. Unsec’d. Notes | 0.875 | 08/15/24 | 2,750 | 2,752,057 | ||||||||||

|

| |||||||||||||

| 6,856,798 | ||||||||||||||

| Coal 0.2% | ||||||||||||||

Korea Resources Corp. (South Korea), Sr. Unsec’d. Notes | 3.000 | 04/24/22 | 3,200 | 3,250,452 | ||||||||||

| Commercial Services 0.3% | ||||||||||||||

PayPal Holdings, Inc., Sr. Unsec’d. Notes | 1.350 | 06/01/23 | 5,000 | 5,088,555 | ||||||||||

| Computers 0.4% | ||||||||||||||

Apple, Inc., | ||||||||||||||

Sr. Unsec’d. Notes | 1.700 | 09/11/22 | 5,000 | 5,077,218 | ||||||||||

Sr. Unsec’d. Notes, 3 Month LIBOR + 0.500% | 0.625(c) | 02/09/22 | 2,163 | 2,167,689 | ||||||||||

|

| |||||||||||||

| 7,244,907 | ||||||||||||||