UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| | |

| Investment Company Act file number: | | 811-23324 |

| |

| Exact name of registrant as specified in charter: | | PGIM ETF Trust |

| |

| Address of principal executive offices: | | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Name and address of agent for service: | | Andrew R. French |

| | 655 Broad Street, 6th Floor |

| | Newark, New Jersey 07102 |

| |

| Registrant’s telephone number, including area code: | | 800-225-1852 |

| |

| Date of fiscal year end: | | 08/31/2022 |

| |

| Date of reporting period: | | 08/31/2022 |

Item 1 – Reports to Stockholders

PGIM FIXED INCOME ETFs

PGIM Ultra Short Bond ETF (PULS)

PGIM Active High Yield Bond ETF (PHYL)

PGIM Active Aggregate Bond ETF (PAB)

PGIM Total Return Bond ETF (PTRB)

PGIM Floating Rate Income ETF (PFRL)

ANNUAL REPORT

AUGUST 31, 2022

To enroll in e-delivery, go to pgim.com/investments/resource/edelivery

Table of Contents

This report is not authorized for distribution to prospective investors unless preceded or accompanied by a current prospectus.

The views expressed in this report and information about the Funds’ portfolio holdings are for the period covered by this report and are subject to change thereafter.

Exchange-traded funds are distributed by Prudential Investment Management Services LLC (PIMS), member SIPC. PGIM Fixed Income is a unit of PGIM, Inc. (PGIM), a registered investment adviser. PIMS and PGIM are Prudential Financial companies. © 2022 Prudential Financial, Inc. and its related entities. PGIM and the PGIM logo are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.

2 Visit our website at pgim.com/investments

Letter from the President

| | |

| | Dear Shareholder: We hope you find the annual report for the PGIM Fixed Income ETFs informative and useful. The report covers performance for the 12-month period that ended August 31, 2022. The attention of the global economy and financial markets pivoted during the period from the COVID-19 pandemic to the challenge of rapidly rising inflation. While job growth and corporate profits remained strong, prices for a wide range of goods and services rose in response to economic re-openings, supply-chain disruptions, governmental stimulus, and Russia’s invasion of Ukraine. With inflation surging to a 40-year high, the US Federal Reserve and other central banks |

aggressively hiked interest rates, prompting recession concerns.

After rising to record levels at the end of 2021, stocks have fallen sharply in 2022 as investors worried about higher prices, slowing economic growth, geopolitical uncertainty, and new COVID-19 outbreaks. Equities rallied for a time during the summer but began falling again in late August on fears that the Fed would keep raising rates to tame inflation. For the entire 12-month period, equities suffered a broad-based global decline, although large-cap US stocks outperformed their small-cap counterparts by a significant margin. International developed and emerging markets trailed the US market during this time.

Rising rates and economic uncertainty drove fixed income prices broadly lower as well. US and global investment-grade bonds, along with US high yield corporate bonds and emerging market debt, all posted negative returns during the period.

Regarding your investments with PGIM, we believe it is important to maintain a diversified portfolio of funds consistent with your tolerance for risk, time horizon, and financial goals. Your financial advisor can help you create a diversified investment plan that may include funds covering all the basic asset classes and that reflects your personal investor profile and risk tolerance. However, diversification and asset allocation strategies do not assure a profit or protect against loss in declining markets.

At PGIM Investments, we provide access to active investment strategies across the global markets in the pursuit of consistent outperformance for investors. PGIM is the world’s 11th-largest investment manager with more than $1.5 trillion in assets under management. Our scale and investment expertise allow us to deliver a diversified suite of actively managed solutions across a broad spectrum of asset classes and investment styles.

Thank you for choosing our family of funds.

Sincerely,

Stuart S. Parker, President

PGIM Fixed Income ETFs

October 14, 2022

PGIM Fixed Income ETFs 3

PGIM Ultra Short Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | |

| |

| | | Average Annual Total Returns as of 8/31/22 |

| | |

| | | One Year (%) | | Since Inception (%) |

| | |

Net Asset Value (NAV) | | 0.21 | | 1.60 (04/05/2018) |

| | |

Market Price* | | 0.23 | | 1.60 (04/05/2018) |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

The ICE BofA US 3-Month Treasury Bill Index was adopted as the Fund’s primary benchmark in March 2022 due to the pending discontinuation of LIBOR.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

4 Visit our website at pgim.com/investments

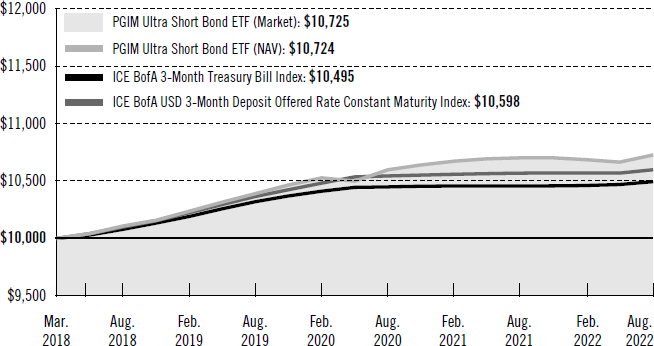

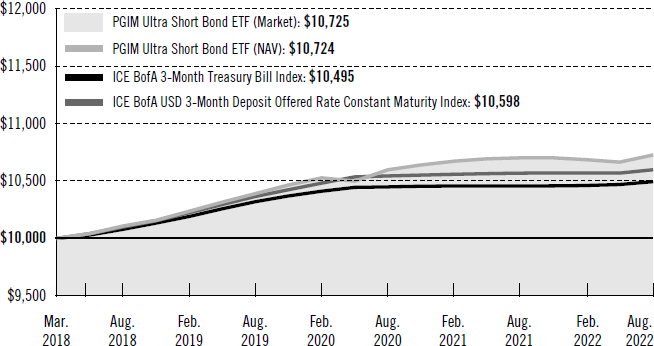

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the ICE BofA 3-Month Treasury Bill Index and the ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index by portraying the initial account values at the commencement of operations (April 5, 2018) and the account values at the end of the current fiscal year (August 31, 2022), as measured on a quarterly basis. The Fund assumes an initial investment on April 5, 2018, while the benchmark and the Index assume that the initial investment occurred on March 31, 2018. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Fixed Income ETFs 5

PGIM Ultra Short Bond ETF

Your Fund’s Performance (continued)

Benchmark Definitions

ICE BofA US 3-Month Treasury Bill Index—The ICE BofA US 3-Month Treasury Bill Index is an unmanaged index which is comprised of a single issue purchased at the beginning of the month and held for a full month. At the end of the month that issue is sold and rolled into a newly selected issue. The issue selected at each month-end rebalancing is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. To qualify for selection, an issue must have settled on or before the month-end rebalancing date.

ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index—The ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index is an unmanaged index which tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument.

ICE BOFA IS LICENSING THE BOFA INDICES “AS IS,” MAKES NO WARRANTIES REGARDING THE SAME, DOES NOT GUARANTEE THE SUITABILITY, QUALITY, ACCURACY, TIMELINESS, AND/OR COMPLETENESS OF THE ICE BOFA INDICES OR ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM, ASSUMES NO LIABILITY IN CONNECTION WITH THEIR USE, AND DOES NOT SPONSOR, ENDORSE, OR RECOMMEND THE FUND, OR ANY OF ITS PRODUCTS OR SERVICES.

Investors cannot invest directly in an index. The returns for the Indexes would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

6 Visit our website at pgim.com/investments

| | | | |

| |

Credit Quality expressed as a percentage of total investments as of 8/31/22 (%) | | | | |

| |

AAA | | | 32.2 | |

| |

AA | | | 24.3 | |

| |

A | | | 21.3 | |

| |

BBB | | | 17.6 | |

| |

Not Rated | | | 1.0 | |

| |

Cash/Cash Equivalents | | | 3.6 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | | | | | | | |

|

| Distributions and Yields as of 8/31/22 | |

| | | |

| | | | | | | SEC 30-Day | | | | SEC 30-Day | |

| | | Total Dividends Paid | | | | Subsidized | | | | Unsubsidized | |

| | | |

| | | for One Year ($) | | | | Yield* (%) | | | | Yield** (%) | |

| | | |

| | | 0.64 | | | | 3.18 | | | | 3.18 | |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Fixed Income ETFs 7

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Ultra Short Bond ETF (the Fund) returned 0.21% based on net asset value in the 12-month reporting period that ended August 31, 2022, underperforming the 0.30% return of the ICE BofA USD 3-Month Deposit Offered Rate Constant Maturity Index (the Index).

What were the market conditions?

| ● | | From a starting point of low yields and tight spreads, the shift in fundamentals—most notably, high inflation—drove a wholesale repricing of markets during the period. Concerns about central bank tightening, hard economic landings (i.e., a significant slowdown after a period of rapid growth), and the war in Ukraine led credit spreads notably wider, while rate volatility increased as markets first began pricing in more aggressive Federal Open Market Committee policy tightening and then later began to price in a hard economic landing. |

| ● | | Against the backdrop of historic lows in unemployment and generational highs in inflation, central banks signaled an increased willingness to accept more economic and market volatility than they had been over the prior decade of low inflation. A succession of rate hikes over the first half of 2022—including outsized hikes of 75 basis points (bps) by the Federal Reserve in both June and July—confirmed to markets that the Fed is fully focused on tackling inflation. (One basis point equals 0.01%.) |

| ● | | At the August 2022 Jackson Hole symposium, Fed Chairman Jerome Powell’s speech was successful in lifting investors’ expectations for rate hikes in 2022 and removing the prospects for rate cuts in 2023. While long-run inflation expectations remained relatively subdued through the end of the period, Powell expressed the need to exercise vigilance about the trajectory of expectations to avoid a self-fulfilling inflation spiral. Underpinning his escalation in rhetoric was the reality that Fed officials don’t know how high they will ultimately take the federal funds rate in order to tame inflation. |

| ● | | As a result, significant volatility continued to be priced into US Treasuries, with sharply higher front-end rates and lower long-dated yields forming a substantially flatter US Treasury yield curve before the curve finally inverted the last two months of the period. From 1.10% on August 31, 2021, the 10-year/2-year Treasury spread declined to -0.28% by the end of the period. |

| ● | | After rising to nearly 3.5% in June 2022, US 10-year Treasury yields ended the period at 3.20%. Meanwhile, the yield on the 2-year Treasury note ended the period at 3.48%, a rise of 327 bps over the period. |

| ● | | Just as longer-term Treasuries saw substantial volatility throughout the period, yields on short-term securities, which influence money market yields, also rose substantially. |

8 Visit our website at pgim.com/investments

| | The 3-month Treasury bill rose from 0.05% to 2.93% during the period, while the 3-month London Interbank Offered Rate (LIBOR) rose from 0.12% to 3.10%. Meanwhile, the Secured Overnight Financing Rate (SOFR) rose from 0.05% to 2.29%. |

| ● | | In the short-term credit markets, investment-grade credit spreads widened during the period. The Bloomberg 1-3 Year Credit Index, a proxy for the short-term spread market, underperformed similar short-duration Treasuries by -0.31% during the period. |

What worked?

The Fund emphasized spread assets—including short-term, investment-grade debt of financial, consumer cyclical and non-cyclical, and utility companies—ranging across the rating spectrum from AAA to BBB. Other spread sector assets included commercial mortgage-backed securities (CMBS) and collateralized loan obligations (CLOs). Overall positioning in CMBS contributed to performance during the period.

What didn’t work?

| ● | | The duration of the Fund was tactically managed during the period. Overall, duration positioning detracted from performance. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

| ● | | Overall positioning in CLOs and investment-grade corporates detracted from performance during the period. |

Did the Fund use derivatives?

During the period, the Fund used interest rate swaps and futures to help manage duration positioning and yield curve exposure. These instruments allowed the Fund to capture higher yields available farther out on the short-term portion of the yield curve and in spread-sector assets versus Treasuries, while mitigating interest rate risk. Overall, the positions added to performance during the period.

Current outlook

| ● | | Against the backdrop of historic lows in unemployment and generational highs in inflation, the Fed is signaling an increased willingness to accept more economic and market pain than it had been over the last decade of low inflation. If the Fed can avoid a recession, it will; but more than anything else, Fed officials want to get inflation under control. |

| ● | | Tighter financial conditions are expected to continue working their way through the economy with lagged effects in coming quarters. For now, the Fed is focused on currently high monthly inflation readings, vowing to keep up the pressure until readings show convincing signs of softening toward the Fed’s target. At some point, though, PGIM Fixed Income expects the Fed will likely pivot back toward a focus on the projected lagged effects of its tightening and—should material signs of softening accumulate—adopt a more measured pace of policy normalization. |

PGIM Fixed Income ETFs 9

Strategy and Performance Overview* (continued)

| ● | | PGIM Fixed Income continues to emphasize well-researched, short-term credit sectors, with the expectation that these assets offer the most value from a total return perspective, and it continues to seek out investments with the best total return potential in light of the more challenging market environment. |

| ● | | PGIM Fixed Income continues to find value within investment-grade corporates and structured products (CLOs, CMBS), which represent attractive value in relation to Treasuries and agency mortgage-backed securities, and it will remain selective as the front end of the market continues to adjust to the new rate-and-spread environment. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

10 Visit our website at pgim.com/investments

PGIM Active High Yield Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | |

| |

| | | Average Annual Total Returns as of 8/31/22 |

| | |

| | | One Year (%) | | Since Inception (%) |

| | |

Net Asset Value (NAV) | | -11.01 | | 3.03 (09/24/2018) |

| | |

Market Price* | | -11.14 | | 2.96 (09/24/2018) |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

PGIM Fixed Income ETFs 11

PGIM Active High Yield Bond ETF

Your Fund’s Performance (continued)

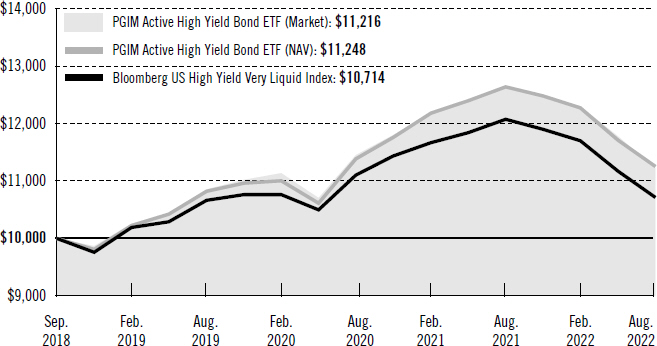

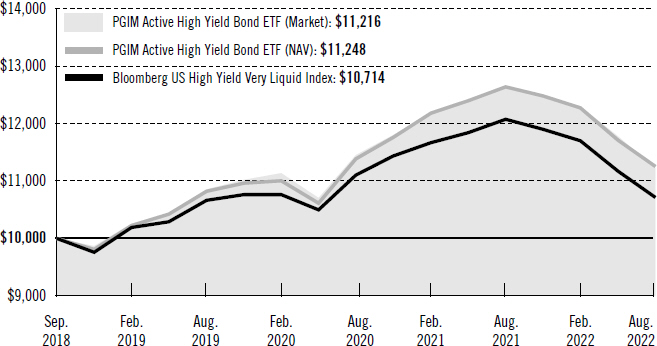

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the Bloomberg US High Yield Very Liquid Index by portraying the initial account values at the commencement of operations (September 24, 2018) and the account values at the end of the current fiscal year (August 31, 2022), as measured on a quarterly basis. The Fund assumes an initial investment on September 24, 2018, while the benchmark and the Index assume that the initial investment occurred on September 30, 2018. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

12 Visit our website at pgim.com/investments

Benchmark Definition

Bloomberg US High Yield Very Liquid Index (VLI)—The Bloomberg US High Yield Very Liquid Index is a component of the US Corporate High Yield Index that is designed to track a more liquid component of the USD-denominated, high yield, fixed rate corporate bond market. The Index uses the same eligibility criteria as the US Corporate High Yield Index, but includes only the three largest bonds from each issuer that have a minimum amount outstanding of USD500mn and less than five years from issue date. The Index also limits the exposure of each issuer to 2% of the total market value and redistributes any excess market value index-wide on a pro rata basis.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

PGIM Fixed Income ETFs 13

PGIM Active High Yield Bond ETF

Your Fund’s Performance (continued)

| | | | |

| |

Credit Quality expressed as a percentage of total investments as of 8/31/22 (%) | | | | |

| |

AAA | | | 12.0 | |

| |

BBB | | | 2.8 | |

| |

BB | | | 47.1 | |

| |

B | | | 24.0 | |

| |

CCC | | | 8.7 | |

| |

CC | | | 0.2 | |

| |

C | | | 0.1 | |

| |

Not Rated | | | 2.7 | |

| |

Cash/Cash Equivalents | | | 2.4 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | |

|

| Distributions and Yields as of 8/31/22 |

| | | |

| | Total Dividends | | SEC 30-Day | | SEC 30-Day |

| | Paid for | | Subsidized | | Unsubsidized |

| | | |

| | One Year ($) | | Yield* (%) | | Yield** (%) |

| | | |

| | | 2.40 | | 7.22 | | 7.22 |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

14 Visit our website at pgim.com/investments

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Active High Yield Bond ETF (the Fund) returned –11.01% based on net asset value (NAV) in the 12-month reporting period that ended August 31, 2022, outperforming the –11.28% return of the Bloomberg US High Yield Very Liquid Index (the Index).

What were the market conditions?

| ● | | After posting gains during the latter part of 2021, US high yield bonds posted significant declines over the first eight months of 2022—including, in the second quarter, their worst quarterly performance since the first quarter of 2020—as rate hike concerns, high and persistent inflation, and recession fears overshadowed the strength of earnings and credit fundamentals. |

| ● | | Retail demand for high yield remained negative throughout much of the period as a combination of slowing global growth and higher-than-expected inflation leading to an increasingly hawkish Federal Reserve (Fed) drove outflows from high yield bond mutual funds. However, subdued primary market activity combined with a high volume of calls, tenders, and coupon payments provided for a relatively solid technical backdrop. |

| ● | | After posting outflows of $14 billion during 2021, high yield bond mutual funds saw nearly $41 billion of outflows during the first eight months of 2022. For the period, spreads on the Bloomberg US Corporate High Yield Bond Index widened 196 basis points (bps) to 484 bps as of August 31, 2022. (One basis point equals 0.01%). By quality, higher-quality (BB-rated and B-rated) credits outperformed their lower-quality (CCC-rated) peers during the period as investors sought out the relative safety of higher-rated credits. |

| ● | | After seeing record gross issuance in 2021, the high yield primary market slowed considerably during the first part of 2022 as issuers sat out the volatility, helping to offset some of the technical headwinds from negative fund flows. After issuing $484 billion in high yield bonds during 2021, companies issued a mere $81 billion through the first eight months of 2022. |

| ● | | The par-weighted US high yield default rate, including distressed exchanges, ended the period at 1.20%, up from 1.13% the year before, and below the long-term historical average of 3.20%, according to J.P. Morgan. |

What worked?

| ● | | Overall security selection and sector allocation both contributed to performance during the period. Within security selection, positions in the upstream energy, telecom, and technology industries contributed the most. Within sector allocation, relative to the Index, overweights to upstream energy and electric utilities—along with an underweight to media & entertainment—contributed. |

| ● | | In individual security selection, positions in Chesapeake Energy Corp. (upstream energy), Veon Ltd. (telecom), and Civitas Resources Inc. (upstream energy) were the largest contributors to performance. |

PGIM Fixed Income ETFs 15

Strategy and Performance Overview* (continued)

| ● | | Having slightly more beta, on average, in the Fund relative to the Index over the period had a negligible impact on returns. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) |

What didn’t work?

| ● | | While overall security selection contributed to returns over the period, selection in media & entertainment, cable & satellite, and automotive detracted. |

| ● | | While overall sector allocation was positive, relative to the Index, underweights to the healthcare & pharmaceuticals and downstream energy industries—along with an overweight to building materials & home construction—detracted. |

| ● | | In individual security selection, overweights to Bausch Health Americas Inc. (healthcare & pharmaceuticals), Diamond Sports Group LLC (media & entertainment), and Intelsat SA (cable & satellite) relative to the Index, detracted from results. |

Did the Fund use derivatives?

The Fund used credit index derivatives and interest rate futures to manage its overall risk profile during the reporting period—the aggregate impact of which was negative.

Current outlook

| ● | | While strong credit fundamentals continue to sustain low US high yield default rates, PGIM Fixed Income has grown more cautious in light of increased geopolitical, inflation, and recession risks. In PGIM Fixed Income’s view, most US high yield issuers should be able to withstand the impacts of higher rates, slower growth, and inflation, aided in large part by a lack of near-term maturities. However, PGIM Fixed Income now anticipates higher default rates of 3% and 7% over the next two years, should the economy follow its base-case scenario of a shallow recession— induced by aggressive rate hikes and persistent inflation—occurring in that time. |

| ● | | Although PGIM Fixed Income remains defensive and is prepared for further spread widening, it does not expect defaults to be as severe as in previous downturns due to the favorable position most issuers find themselves in today, with strong debt serviceability, favorable maturity profiles, and strong cash flows. Notably, if inflation subsides sooner than expected, and/or the Fed engineers a soft landing, there is meaningful upside potential in the market given current wider-than-average spreads and significant price discounts. As such, PGIM Fixed Income believes the market is reasonably close to fair value, with only modest spread widening needed to balance the risks and rewards. |

| ● | | In terms of positioning, PGIM Fixed Income is reducing its allocation to lower-quality issuers in favor of higher-quality BB-rated bonds and maintaining an overweight to independent power producers and housing. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for

16 Visit our website at pgim.com/investments

performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

PGIM Fixed Income ETFs 17

PGIM Active Aggregate Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | | | |

| |

| | | Average Annual Total Returns as of 8/31/22 |

| | |

| | | One Year (%) | | Since Inception (%) |

| | |

Net Asset Value (NAV) | | -12.62 | | -7.57 (04/12/2021) |

| | |

Market Price* | | -12.64 | | -7.55 (04/12/2021) |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

18 Visit our website at pgim.com/investments

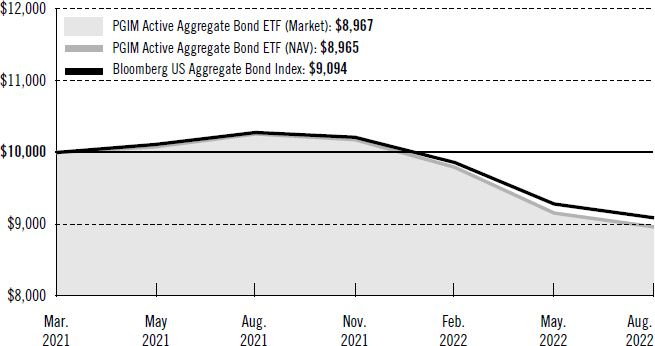

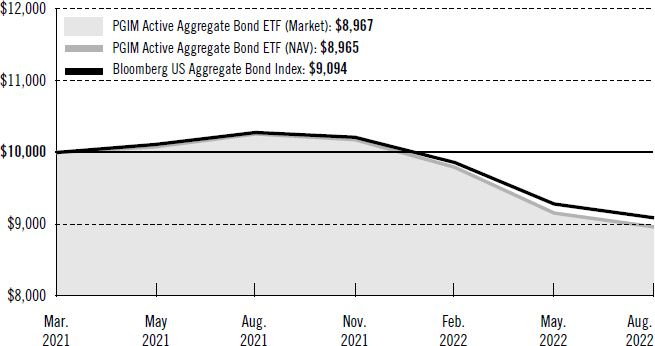

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Fund with a similar investment in the Bloomberg US Aggregate Bond Index by portraying the initial account values at the commencement of operations (April 12, 2021) and the account values at the end of the current fiscal year (August 31, 2022), as measured on a quarterly basis. The Fund assumes an initial investment on April 15, 2021, while the benchmark and the Index assume that the initial investment occurred on March 31, 2021. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Fixed Income ETFs 19

PGIM Active Aggregate Bond ETF

Your Fund’s Performance (continued)

Benchmark Definition

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and US dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

| | | | |

| |

Credit Quality expressed as a percentage of total investments as of 8/31/22 (%) | | | | |

| |

AAA | | | 68.6 | |

| |

AA | | | 5.7 | |

| |

A | | | 8.5 | |

| |

BBB | | | 16.7 | |

| |

Cash/Cash Equivalents | | | 0.5 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | | | | | | | |

|

| Distributions and Yields as of 8/31/22 | |

| | | |

| | | | | | | SEC 30-Day | | | | SEC 30-Day | |

| | | Total Dividends Paid | | | | Subsidized | | | | Unsubsidized | |

| | | |

| | | for One Year ($) | | | | Yield* (%) | | | | Yield** (%) | |

| | | |

| | | 1.56 | | | | 3.51 | | | | 3.51 | |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

20 Visit our website at pgim.com/investments

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Active Aggregate Bond ETF (the Fund) returned –12.62% based on net asset value in the 12-month reporting period that ended August 31, 2022, underperforming the –11.52% return of the Bloomberg US Aggregate Bond Index (the Index).

What were the market conditions?

| ● | | From a starting point of low yields, tight spreads, and high equity multiples, the shift in fundamentals—most notably, high inflation—drove a wholesale repricing of markets during the period. Concerns about central bank tightening, hard economic landings (i.e., a significant slowdown after a period of rapid growth), and the war in Ukraine led global credit spreads notably wider, while rate volatility increased as markets first began pricing in more aggressive Federal Open Market Committee policy tightening and then later began to price in a hard economic landing. |

| ● | | Against the backdrop of historic lows in unemployment and generational highs in inflation, central banks signaled an increased willingness to accept more economic and market volatility than they had been over the prior decade of low inflation. A succession of hikes during the second quarter of 2022— including outsized hikes of 75 basis points (bps) by the Federal Reserve in both June and July—confirmed to markets that the Fed is fully focused on tackling inflation. (One basis point equals 0.01%.) |

| ● | | At the August 2022 Jackson Hole symposium, Fed Chairman Jerome Powell’s speech was successful in lifting investors’ expectations for rate hikes in 2022 and removing the prospects for rate cuts in 2023. While long-run inflation expectations remained relatively subdued through the end of the period, Powell expressed the need to exercise vigilance about the trajectory of expectations to avoid a self-fulfilling inflation spiral. Underpinning this escalation in rhetoric was the reality that Fed officials don’t know how high they will ultimately take the federal funds rate in order to tame inflation. |

| ● | | As a result, significant volatility continued to be priced into US Treasuries, with sharply higher front-end rates and lower long-dated yields forming a substantially flatter US Treasury yield curve before the curve finally inverted during the last two months of the period. From 1.10% on August 31, 2021, the 10-year/2-year Treasury spread declined to –0.28% by the end of the period. |

| ● | | After rising to nearly 3.5% in June 2022, US 10-year Treasury yields ended the period at 3.20%. Meanwhile, the yield on the 2-year Treasury note ended the period at 3.48%, a rise of 327 bps over the period. |

| ● | | US investment-grade corporate spreads widened significantly as corporates were challenged by elevated inflationary pressures, a slower growth outlook, and increased event and geopolitical risk. US high yield bonds posted significant declines through much of 2022 as rate hike concerns, high and persistent inflation, and recession fears overshadowed the strength of earnings and credit fundamentals. Securitized credit spreads widened, with collateralized loan obligation (CLO) and commercial |

PGIM Fixed Income ETFs 21

Strategy and Performance Overview* (continued)

| | mortgage-backed securities (CMBS) spreads trading well above their recent tights by the end of the period. The emerging-markets sector posted negative total returns, and spreads widened as markets were pressured by tightening financial conditions and slowing growth in China and Europe. Meanwhile, agency mortgage-backed securities (MBS) underperformed Treasuries on concerns that the Fed may begin selling MBS if officials need to step up their inflation fight. |

What worked?

| ● | | Security selections in CMBS, municipal bonds, emerging markets, and CLOs contributed to performance. |

| ● | | In terms of sector allocation, underweights, relative to the Index, to MBS and agencies contributed. |

| ● | | Within credit, positioning in upstream energy, telecom, and gaming/lodging/leisure contributed to results. |

| ● | | In individual security selection, the Fund benefited, relative to the Index, from an underweight to Oracle Corp. (technology), along with overweights to Cenovus Energy Inc. (upstream energy) and the Republic of Indonesia. |

| ● | | The Fund’s yield curve positioning was modestly positive over the period. |

What didn’t work?

| ● | | Overall security selection detracted, with selections in Treasuries, investment-grade corporates, and MBS detracting the most. |

| ● | | Overall sector allocation detracted, with overweights, relative to the Index, to CMBS, CLOs, and investment-grade corporates detracting the most. |

| ● | | Within credit, positioning in banking, healthcare & pharmaceuticals, and media & entertainment detracted during the period. |

| ● | | In individual security selection, the Fund’s overweight positioning, relative to the Index, in Viatris Inc. (healthcare & pharmaceuticals), Bank of America Corp. (banking), and Charter Communications Inc. (cable & satellite) detracted from performance. |

| ● | | The Fund’s duration positioning detracted from performance during the period. |

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the period, the Fund used interest rate futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance.

Current outlook

| ● | | Tighter financial conditions are expected to continue working their way through the economy with lagged effects in coming quarters. For now, the Fed is focused on currently high monthly inflation readings, vowing to keep up the pressure until readings show convincing signs of softening toward the Fed’s target. At some point, |

22 Visit our website at pgim.com/investments

| | though, PGIM Fixed Income expects the Fed will likely pivot back toward a focus on the projected lagged effects of its tightening and—should material signs of softening accumulate—adopt a more measured pace of policy normalization. |

| ● | | Even though fundamentals and issuer liquidity are arguably well braced for recession and spread widening has already generated value in a number of sectors, PGIM Fixed Income believes spreads may remain soft until most of the current bad news (e.g., the cutoff of Russian gas supplies, cooling of the housing market) has largely played out. However, over the intermediate and longer term, the sell-off in rates and spreads could turn out to be a positive as the overarching trends of aging demographics, high debt burdens, and other factors that conspired for decades to push equilibrium interest rates down are more likely hibernating than reversing. It is anticipated that once the reopening enthusiasm and supply-chain problems have passed, inflation will likely be back at, or below, targets, and bonds are expected to post solid returns for an extended period. In the meantime, PGIM Fixed Income believes the best course will be to focus on the micro-alpha opportunities within and across sectors. |

| ● | | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term. Relative to the Index, the Fund is overweight structured products (CLOs, CMBS), with a more modest overweight to investment-grade corporates. The Fund is underweight MBS in favor of more attractive opportunities across spread sectors. |

| ● | | In terms of calling the cycle top in long-term rates, given the economic strength and level of inflation, PGIM Fixed income believes it’s too early to preclude the possibility of higher interest rates. Yet, from a long-term perspective, exposure to developed-market duration is becoming more compelling after the broad repricing and with the looming moderation in global growth. While acknowledging the immediate trajectory of inflation is going to dictate market volatility and the path of the US Treasury 10-year yield, PGIM Fixed Income’s base case is that implied volatility will ultimately decline, and the 10-year yield will stay below the federal funds terminal rate when it is eventually reached. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

PGIM Fixed Income ETFs 23

PGIM Total Return Bond ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | |

| |

| | | Total Returns as of 8/31/22 |

| |

| | | Since Inception (%) |

| |

Net Asset Value (NAV) | | -12.81 (12/02/2021) |

| |

Market Price* | | -12.69 (12/02/2021) |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

24 Visit our website at pgim.com/investments

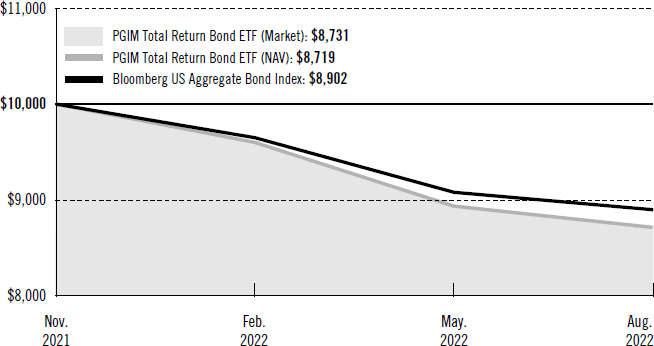

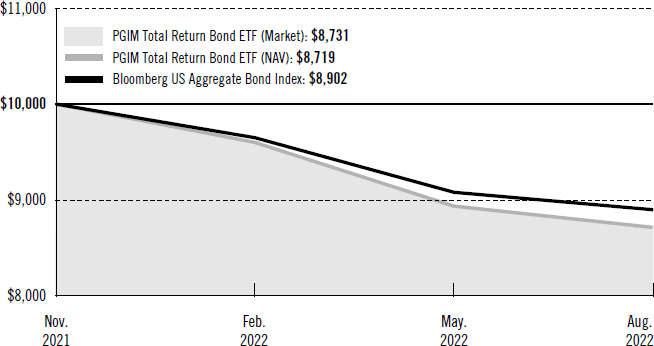

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Bloomberg US Aggregate Bond Index by portraying the initial account values at the commencement of operations (December 2, 2021) and the account values at the end of the current fiscal year (August 31, 2022), as measured on a quarterly basis. The Fund assumes an initial investment on December 8, 2021, while the benchmark and the Index assume that the initial investment occurred on November 30, 2021. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

PGIM Fixed Income ETFs 25

PGIM Total Return Bond ETF

Your Fund’s Performance (continued)

Benchmark Definition

Bloomberg US Aggregate Bond Index—The Bloomberg US Aggregate Bond Index is unmanaged and represents securities that are taxable and US dollar denominated. It covers the US investment-grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

26 Visit our website at pgim.com/investments

| | | | |

| |

Credit Quality expressed as a percentage of total investments as of 8/31/22 (%) | | | | |

| |

AAA | | | 55.2 | |

| |

AA | | | 7.3 | |

| |

A | | | 7.8 | |

| |

BBB | | | 18.6 | |

| |

BB | | | 8.1 | |

| |

B | | | 2.3 | |

| |

CCC | | | 0.4 | |

| |

Not Rated | | | 0.1 | |

| |

Cash/Cash Equivalents | | | 0.2 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | | | | | | | |

|

| Distributions and Yields as of 8/31/22 | |

| | | |

| | | | | | | SEC 30-Day | | | | SEC 30-Day | |

| | | Total Dividends Paid | | | | Subsidized | | | | Unsubsidized | |

| | | |

| | | for One Year ($) | | | | Yield* (%) | | | | Yield** (%) | |

| | | |

| | | 0.69 | | | | 3.83 | | | | 3.83 | |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Fixed Income ETFs 27

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Total Return Bond ETF (the Fund) returned –12.81% based on net asset value in the nine-month reporting period from the Fund’s inception on December 2, 2021, through August 31, 2022, underperforming the –10.98% return of the Bloomberg US Aggregate Bond Index (the Index) during that same time.

What were the market conditions?

| ● | | From a starting point of low yields, tight spreads, and high equity multiples, the shift in fundamentals—most notably, high inflation—drove a wholesale repricing of markets during the period. Concerns about central bank tightening, hard economic landings (i.e., a significant slowdown after a period of rapid growth), and the war in Ukraine led global credit spreads notably wider, while rate volatility increased as markets first began pricing in more aggressive Federal Open Market Committee policy tightening and then later began to price in a hard economic landing. |

| ● | | Against the backdrop of historic lows in unemployment and generational highs in inflation, central banks signaled an increased willingness to accept more economic and market volatility than they had been over the prior decade of low inflation. A succession of hikes during the second quarter of 2022—including outsized hikes of 75 basis points (bps) by the Federal Reserve in both June and July—confirmed to markets that the Fed is fully focused on tackling inflation. (One basis point equals 0.01%.) |

| ● | | At the August 2022 Jackson Hole symposium, Fed Chairman Jerome Powell’s speech was successful in lifting investors’ expectations for rate hikes in 2022 and removing the prospects for rate cuts in 2023. While long-run inflation expectations remained relatively subdued through the end of the period, Powell expressed the need to exercise vigilance about the trajectory of expectations to avoid a self-fulfilling inflation spiral. Underpinning this escalation in rhetoric was the reality that Fed officials don’t know how high they will ultimately take the federal funds rate in order to tame inflation. |

| ● | | As a result, significant volatility continued to be priced into US Treasuries, with sharply higher front-end rates and lower long-dated yields forming a substantially flatter US Treasury yield curve before the curve finally inverted during the last two months of the period. From 0.81% on December 2, 2021, the 10-year/2-year Treasury spread declined to –0.28% by the end of the period. |

| ● | | After rising to nearly 3.5% in June 2022, US 10-year Treasury yields ended the period at 3.20%. Meanwhile, the yield on the 2-year Treasury note ended the period at 3.48%, a rise of 286 bps since the Fund’s inception. |

| ● | | US investment-grade corporate spreads widened significantly as corporates were challenged by elevated inflationary pressures, a slower growth outlook, and increased event and geopolitical risk. US high yield bonds posted significant declines through much of 2022 as rate hike concerns, high and persistent inflation, and recession fears overshadowed the strength of earnings and credit fundamentals. Securitized |

28 Visit our website at pgim.com/investments

| | credit spreads widened, with collateralized loan obligation (CLO) and commercial mortgage-backed securities (CMBS) spreads trading well above their recent tights by the end of the period. The emerging-markets sector posted negative total returns, and spreads widened as markets were pressured by tightening financial conditions and slowing growth in China and Europe. Meanwhile, agency mortgage-backed securities (MBS) underperformed Treasuries on concerns that the Fed may begin selling MBS if officials need to step up their inflation fight. |

What worked?

| ● | | Security selections in CLOs, municipal bonds, and MBS contributed to returns. |

| ● | | In terms of sector allocation, underweights, relative to the Index, to MBS and municipal bonds contributed. |

| ● | | Within credit, positioning in upstream energy, telecom, and gaming/lodging/leisure contributed to results. |

| ● | | In individual security selection, the Fund benefited from overweights, relative to the Index, to Bellis Holdco Ltd. (consumer non-cyclical), Sasol Ltd. (chemicals), and Merck & Co. Inc. (healthcare & pharmaceuticals). |

| ● | | The Fund’s yield curve positioning, particularly in US rates, contributed to returns. |

What didn’t work?

| ● | | Overall security selection detracted, with selections in investment-grade corporates, emerging markets, and CMBS detracting the most. |

| ● | | Within sector allocation, overweights, relative to the Index, to high yield, CLOs, and CMBS detracted from performance. |

| ● | | Within credit, positioning in foreign non-corporates, banking, and healthcare & pharmaceuticals detracted from performance during the period. |

| ● | | In individual security selection, the Fund’s overweight positioning in the Republic of Ukraine, Bank of America Corp. (banking), and Viatris Inc. (healthcare & pharmaceuticals) detracted from performance. |

| ● | | The Fund’s duration positioning detracted from returns during the period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) |

Did the Fund use derivatives?

The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the period, the Fund used interest rate futures and swaps to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance.

Current outlook

| ● | | Tighter financial conditions are expected to continue working their way through the economy with lagged effects in coming quarters. For now, the Fed is focused on |

PGIM Fixed Income ETFs 29

Strategy and Performance Overview* (continued)

| | currently high monthly inflation readings, vowing to keep up the pressure until readings show convincing signs of softening toward the Fed’s target. At some point, though, PGIM Fixed Income expects the Fed will likely pivot back toward a focus on the projected lagged effects of its tightening and—should material signs of softening accumulate—adopt a more measured pace of policy normalization. |

| ● | | Even though fundamentals and issuer liquidity are arguably well braced for recession, and spread widening has already generated value in a number of sectors, PGIM Fixed Income believes spreads may remain soft until most of the current bad news (e.g., the cutoff of Russian gas supplies, cooling of the housing market) has largely played out. However, over the intermediate and longer term, the sell-off in rates and spreads could turn out to be a positive as the overarching trends of aging demographics, high debt burdens, and other factors that conspired for decades to push equilibrium interest rates down are more likely hibernating than reversing. It is anticipated that once the reopening enthusiasm and supply-chain problems have passed, inflation will likely be back at, or below, targets, and bonds are expected to post solid returns for an extended period. In the meantime, PGIM Fixed Income believes the best course will be to focus on identifying alpha opportunities within and across sectors. |

| ● | | PGIM Fixed Income maintains its positive view of the spread sectors over the medium to long term. Relative to the Index, the Fund is overweight to structured products (CLOs, CMBS), with more modest overweights to investment-grade corporates, high yield, and emerging markets. The Fund is underweight to MBS in favor of more attractive opportunities across spread sectors. |

| ● | | In terms of calling the cycle top in long-term rates, given the economic strength and level of inflation, PGIM Fixed income believes it’s too early to preclude the possibility of higher interest rates. Yet, from a long-term perspective, exposure to developed-market duration is becoming more compelling after the broad repricing and with the looming moderation in global growth. While acknowledging the immediate trajectory of inflation is going to dictate market volatility and the path of the US Treasury 10-year yield, PGIM Fixed Income’s base case is that implied volatility will ultimately decline, and the 10-year yield will stay below the federal funds terminal rate when it is eventually reached. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

30 Visit our website at pgim.com/investments

PGIM Floating Rate Income ETF

Your Fund’s Performance (unaudited)

Performance data quoted represent past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the past performance data quoted. An investor may obtain performance data as of the most recent month-end by visiting our website at pgim.com/investments or by calling (800) 225-1852.

| | |

| | | Total Returns as of 8/31/22 Since Inception (%) |

| |

Net Asset Value (NAV) | | 0.89 (05/17/2022) |

| |

Market Price* | | 0.87 (05/17/2022) |

| |

Credit Suisse Leveraged Loan Index | | |

| | | 1.30 |

*The market price is determined using the midpoint between the highest bid and the lowest offer on the listing exchange, as of the time that the Fund’s NAV is calculated. The first day of secondary market trading is typically several days after the date on which the Fund commenced investment operations; therefore, the NAV of the Fund is used as a proxy for the period from inception of investment operations to the first day of secondary market trading to calculate the market price returns.

The returns in the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or following the redemption or sale of Fund shares.

Market returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market returns would be lower. Market and NAV returns assume that dividends and capital gain distributions, if any, have been reinvested in the Fund at market price and NAV, respectively.

PGIM Fixed Income ETFs 31

PGIM Floating Rate Income ETF

Your Fund’s Performance (continued)

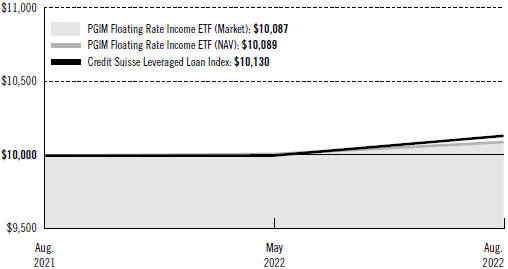

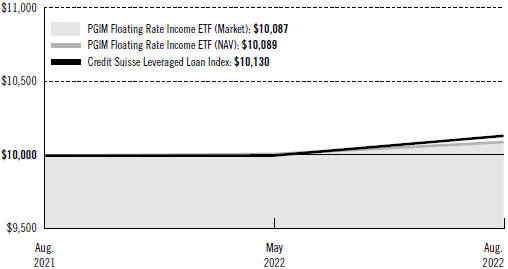

Growth of a $10,000 Investment (unaudited)

The graph compares a $10,000 investment in the Credit Suisse Leveraged Loan Index by portraying the initial account values at the commencement of operations (May 17, 2022) and the account values at the end of the current fiscal year (August 31, 2022), as measured on a quarterly basis. The Fund assumes an initial investment on May 17, 2022, while the benchmark and the Index assume that the initial investment occurred on May 31, 2022. For purposes of the graph, and unless otherwise indicated, it has been assumed that (a) all recurring fees (including management fees) were deducted and (b) all dividends and distributions were reinvested. Without waiver of fees and/or expense reimbursements, if any, the returns would have been lower.

Past performance does not predict future performance. Total returns and the ending account values in the graphs include changes in share price and reinvestment of dividends and capital gains distributions in a hypothetical investment for the periods shown. The Fund’s total returns do not reflect the deduction of income taxes on an individual’s investment. Taxes may reduce your actual investment returns on income or gains paid by the Fund or any gains you may realize if you sell your shares.

32 Visit our website at pgim.com/investments

Benchmark Definition

Credit Suisse Leveraged Loan Index—The Credit Suisse Leveraged Loan Index is an unmanaged index that represents the investable universe of the US dollar-denominated leveraged loan market.

Investors cannot invest directly in an index. The returns for the Index would be lower if they included the effects of operating expenses or taxes that may be paid by an investor.

| | | | |

| |

Credit Quality expressed as a percentage of total investments as of 8/31/22 (%) | | | |

| |

AAA | | | 1.7 | |

| |

AA | | | 0.7 | |

| |

BBB | | | 8.6 | |

| |

BB | | | 28.2 | |

| |

B | | | 57.2 | |

| |

CCC | | | 1.3 | |

| |

Cash/Cash Equivalents | | | 2.3 | |

| | |

Total | | | 100.0 | |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. These rating agencies are independent and are widely used. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change.

| | | | | | | | | | | | |

| | | |

Distributions and Yields as of 8/31/22 | | | | | | | | | |

| | | |

| | | Total Dividends Paid for One Year ($) | | | SEC 30-Day Subsidized Yield* (%) | | | SEC 30-Day

Unsubsidized

Yield** (%) | |

| | | |

| | | 0.33 | | | | 5.66 | | | | 5.66 | |

*SEC 30-Day Subsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s net expenses (net of any expense waivers or reimbursements). The investor experience is represented by the SEC 30-Day Subsidized Yield.

**SEC 30-Day Unsubsidized Yield (%)—A standardized yield calculation created by the Securities and Exchange Commission, it reflects the income earned during a 30-day period, after the deduction of the Fund’s gross expenses. The investor experience is represented by the SEC 30-Day Subsidized Yield.

PGIM Fixed Income ETFs 33

Strategy and Performance Overview*

(unaudited)

How did the Fund perform?

The PGIM Floating Rate Income ETF (the Fund) returned 0.89% based on net asset value in the three-month reporting period from the Fund’s inception on May 17, 2022 through August 31, 2022, underperforming the 1.30% return of the Credit Suisse Leveraged Loan Index (the Index) during that same time.

What were the market conditions?

| ● | | US leveraged loan performance was mixed during the period, declining in the second quarter of 2022, as economic growth concerns and broad market volatility weighed on risk sentiment before rebounding in July and August amid lighter new supply and more hawkish rhetoric from the Federal Reserve. |

| ● | | Shifting monetary policy expectations, combined with a broader risk-off tone, resulted in sizeable outflows from bank loan mutual funds over the period. Following 17 straight months of inflows totaling $71.8 billon, loan funds saw a fourth consecutive month of outflows in August. Though significant, August’s $1.4 billion outflow was a sharp deceleration from the combined $14.8 billion in outflows seen over the prior three months. Meanwhile, collateralized loan obligation (CLO) formation continued to slow from 2021’s record-setting pace, with new US CLO volume declining to a year-to-date low in August. |

| ● | | Loan issuance slowed throughout 2022 amid heightened volatility, with gross issuance through the first eight months of 2022 totaling $197 billion, down 67% from the same period in the prior year. |

| ● | | Heightened geopolitical-related volatility drove a decline in prices in June and July before recouping most of the declines in August. Beginning the period at approximately $95, the average price of all loans in the Index ended the period at $94.19. Meanwhile, average spreads ended the period at approximately 564 basis points (bps), relatively flat from where they stood at the Fund’s inception. (One basis point equals 0.01%.) By quality, BB-rated loans outperformed in May, June, and July before underperforming B-rated loans in August. |

| ● | | Despite broad market volatility, solid credit fundamentals and a lack of near-term maturities continued to keep default rates below the long-term average of 3.1%. The par-weighted loan default rate, including distressed exchanges, ended August 2022 at 1.36%, up 29 bps from August 2021. |

What worked?

| ● | | Overall security selection was the largest contributor to performance during the period, with selections in banking, capital goods, and transportation & environmental services contributing the most. |

| ● | | Relative to the Index, having less beta, on average, during the period was also a strong contributor to performance. (Beta is a measure of the volatility or risk of a security or portfolio compared to the market or index.) |

34 Visit our website at pgim.com/investments

| ● | | While overall sector allocation detracted, underweights, relative to the Index, to healthcare & pharmaceuticals, technology, and consumer non-cyclicals contributed to performance. |

| ● | | From a single-name credit perspective, positioning in Avaya Inc. (technology), Adtalem Global Education Inc. (other industrial), and Envision Healthcare Corp. (paper & packaging) added value. |

What didn’t work?

| ● | | Overall sector allocation detracted from performance during the period, with, relative to the Index, an overweight to the banking industry—along with underweights to chemicals and upstream energy—the largest detractors. |

| ● | | While overall security selection contributed, selections in media & entertainment, telecom, and cable & satellite detracted. |

| ● | | Diamond Sports Group LLC (media & entertainment), Allen Media Group LLC (media & entertainment), and ConvergeOne Holdings Corp. (technology) were the largest single-name detractors from performance. |

Did the Fund use derivatives?

The Fund held interest rate futures and swaps to help manage its duration and yield curve exposure and to reduce its sensitivity to changes in the levels of interest rates. Overall, this strategy had a positive impact on performance during the period. (Duration measures the sensitivity of the price—the value of principal—of a bond to a change in interest rates.) The Fund also participated in credit default swaps to increase or reduce credit risk to specific issuers. This strategy also had a positive impact on performance.

Current outlook

| ● | | Looking forward, PGIM Fixed Income expects loan performance to be largely driven by technicals over the next three to six months. While CLO formation has started to pick up again after evaporating in the last part of the second quarter of 2022, it is highly dependent on AAA-tranche buyers, which have yet to meaningfully return to the market. Meanwhile, PGIM Fixed Income expects flows into loan mutual funds to remain dependent on broader risk sentiment, as well as shifting monetary policy expectations. |

| ● | | While the short-term outlook is tempered by expected price volatility, PGIM Fixed Income’s long-term outlook is more constructive given the anticipated rise in base rates, which could make all-in loan coupons and yields increasingly attractive as 2022 progresses. Ultimately, actively managed credit selection is expected to be a differentiating factor between managers in volatile markets. |

*This strategy and performance overview, which discusses what strategies or holdings (including derivatives, if applicable) affected the Fund’s performance, is compiled based on how the Fund performed relative to the Fund’s benchmark index and is viewed for performance attribution purposes at the aggregate Fund level, which in most instances

PGIM Fixed Income ETFs 35

Strategy and Performance Overview* (continued)

will not directly correlate to the amounts disclosed in the Statement of Operations which conform to U.S. generally accepted accounting principles.

36 Visit our website at pgim.com/investments

Fees and Expenses (unaudited)

As a shareholder of the Fund, you incur ongoing costs, including investment management fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds.

The example is based on an investment of $1,000 held through the six-month period ended August 31, 2022. The example is for illustrative purposes only.

Actual Expenses

The first line in the tables on the following page provides information about actual account values and actual expenses. You may use the information on this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During the Six-Month Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the tables on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, brokerage commissions paid on purchases and sales of Fund shares. Therefore, the ending account values and expenses paid for the period are useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

PGIM Fixed Income ETFs 37

Fees and Expenses (continued)

| | | | | | | | |

| | | | | |

PGIM Ultra Short Bond

ETF | | Beginning

Account Value

March 1, 2022 | | Ending

Account Value

August 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

| Actual | | $1,000.00 | | $1,003.90 | | 0.15% | | $0.76 |

| | | | | |

| Hypothetical | | $1,000.00 | | $1,024.45 | | 0.15% | | $0.77 |

| | | | | | | | |

| | | | | |

PGIM Active High Yield Bond ETF | | Beginning Account Value March 1, 2022 | | Ending

Account Value

August 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

| Actual | | $1,000.00 | | $ 916.70 | | 0.53% | | $2.56 |

| | | | | |

| Hypothetical | | $1,000.00 | | $1,022.53 | | 0.53% | | $2.70 |

| | | | | | | | |

| | | | | |

PGIM Active Aggregate Bond ETF | | Beginning Account Value March 1, 2022 | | Ending

Account Value

August 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

| Actual | | $1,000.00 | | $ 915.40 | | 0.19% | | $0.92 |

| | | | | |

| Hypothetical | | $1,000.00 | | $1,024.25 | | 0.19% | | $0.97 |

| | | | | | | | |

| | | | | |

PGIM Total Return Bond ETF | | Beginning Account Value March 1, 2022 | | Ending

Account Value

August 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

| Actual | | $1,000.00 | | $ 908.30 | | 0.49% | | $2.36 |

| | | | | |

| Hypothetical | | $1,000.00 | | $1,022.74 | | 0.49% | | $2.50 |

| | | | | | | | |

| | | | | |

PGIM Floating Rate Income ETF | | Beginning Account Value March 1, 2022 | | Ending

Account Value

August 31, 2022 | | Annualized Expense

Ratio Based on the

Six-Month Period | | Expenses Paid

During the

Six-Month Period* |

| | | | | |

| Actual** | | $1,000.00 | | $1,008.90 | | 0.74% | | $2.16 |

| | | | | |

| Hypothetical | | $1,000.00 | | $1,021.48 | | 0.74% | | $3.77 |

*Fund expenses (net of fee waivers or subsidies, if any) are equal to the annualized expense ratio (provided in the table), multiplied by the average account value over the period, multiplied by the 184 days in the six-month period ended August 31, 2022, and divided by the 365 days in the Fund’s fiscal year ended August 31, 2022 (to reflect the six-month period). Expenses presented in the table include the expenses of any underlying portfolios in which the Fund may invest.

**“Actual” expenses are calculated using 106-day period ended August 31, 2022 due to the Fund’s inception date on May 17, 2022.

38 Visit our website at pgim.com/investments

Glossary

The following abbreviations are used in the Funds’ descriptions:

EUR—Euro

GBP—British Pound

USD—US Dollar

144A—Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and, pursuant to the requirements of Rule 144A, may not be resold except to qualified institutional buyers.

A—Annual payment frequency for swaps

BABs—Build America Bonds

BSBY—Bloomberg Short-Term Bank Yield Index

CDX—Credit Derivative Index