| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-22 |

| | | |

Free Writing Prospectus

Collateral Term Sheet

$1,287,148,920

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

BANK 2018-BNK10

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Morgan Stanley Mortgage Capital Holdings LLC

Wells Fargo Bank, National Association

Bank of America, National Association

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2018-BNK10

January 18, 2018

WELLS FARGO

SECURITIES | BofA MERRILL LYNCH | MORGAN STANLEY |

| | | |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

| | | |

| | Academy Securities Co-Manager | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 2 |

| BANK 2018-BNK10 | Summary of the Whole Loans |

Summary of the Whole Loans

| Property Name | Mortgage

Loan Seller in BANK

2018-BNK10 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer

for Whole Loan | Master Servicer Under

Lead Securitization

Servicing Agreement | Special Servicer Under

Lead Securitization

Servicing Agreement |

| Apple Campus 3 | WFB | A-1 | $94,000,000 | BANK 2018-BNK10 | Yes | Wells Fargo Bank, National Association | Torchlight Loan Services, LLC |

| A-2 | $30,000,000 | WFB | No |

| A-3 | $80,000,000 | WFB | No |

| A-4 | $68,000,000 | Deutsche Bank | No |

| A-5 | $68,000,000 | Goldman Sachs | No |

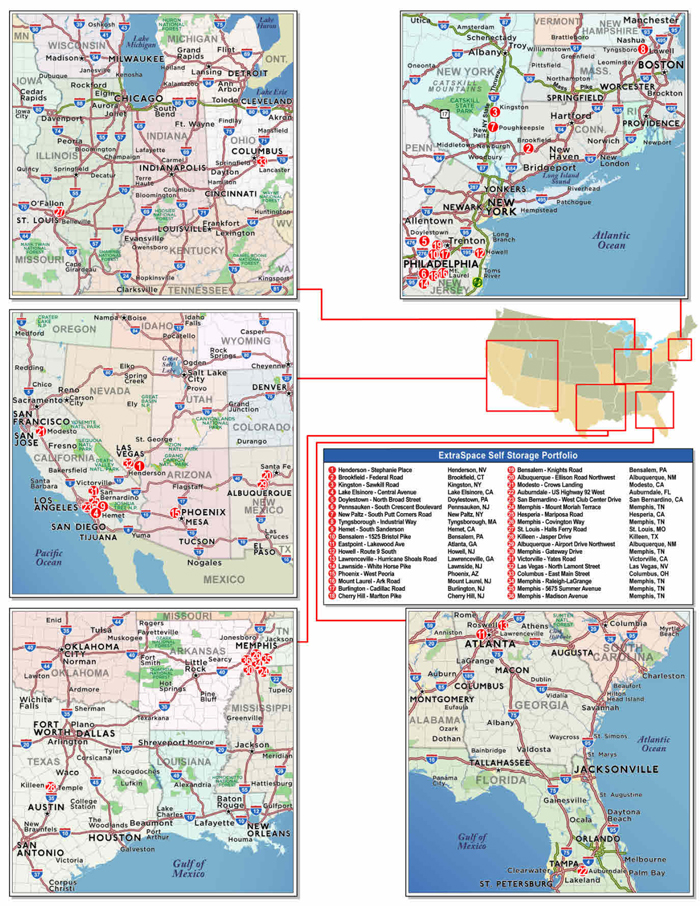

| Extra Space Self Storage Portfolio | MSMCH | A-1 | $92,000,000 | MSC 2017-HR2 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $60,000,000 | BANK 2018-BNK10 | No |

| A-3 | $42,400,000 | MSBNA | No |

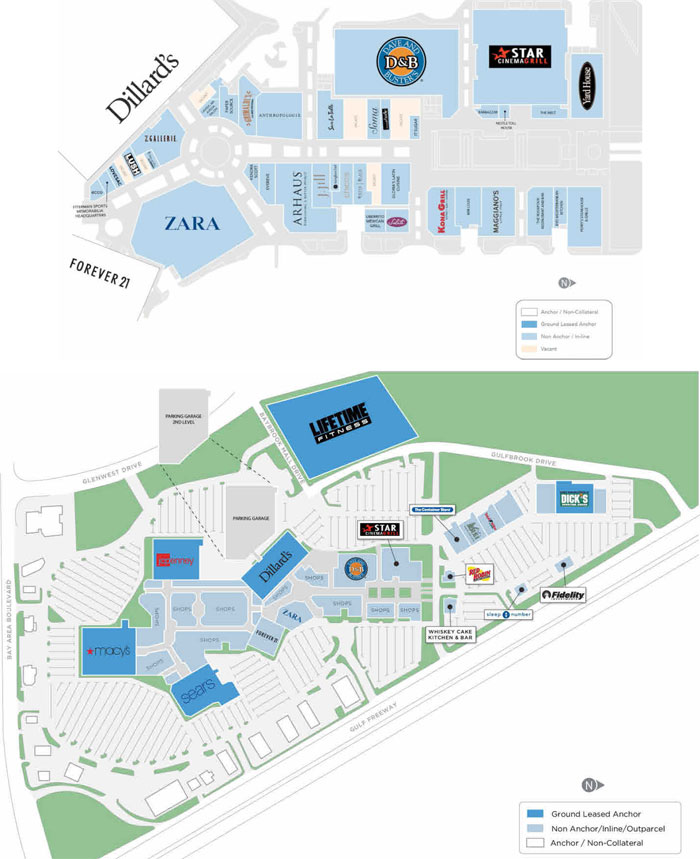

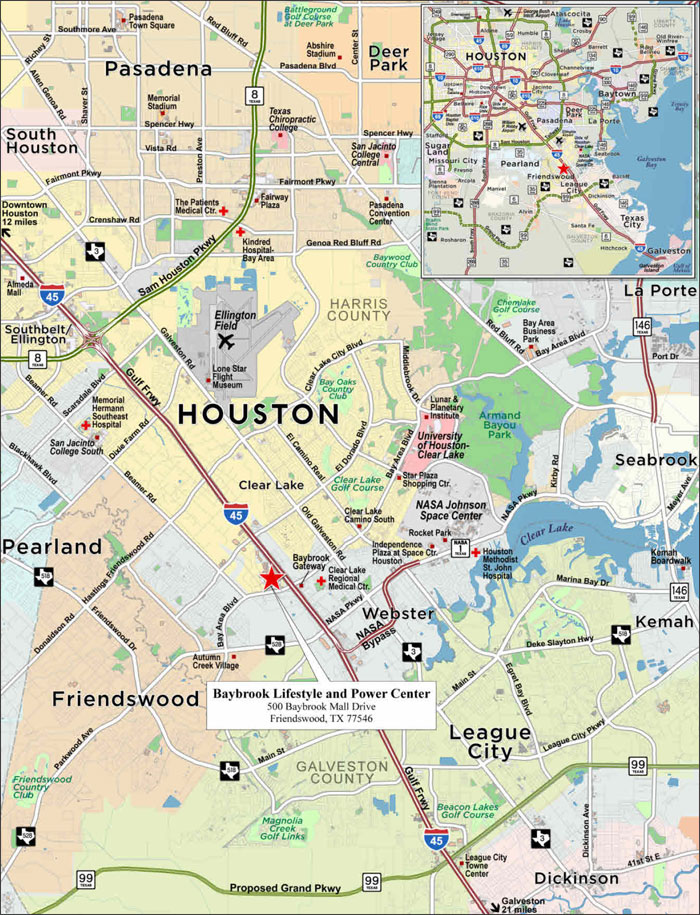

| Baybrook Lifestyle and Power Center | MSMCH | A-1 | $50,000,000 | MSC 2017-HR2 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $40,000,000 | BANK 2018-BNK10 | No |

| A-3 | $30,000,000 | MSC 2017-HR2 | No |

| A-4 | $20,000,000 | BANK 2018-BNK10 | No |

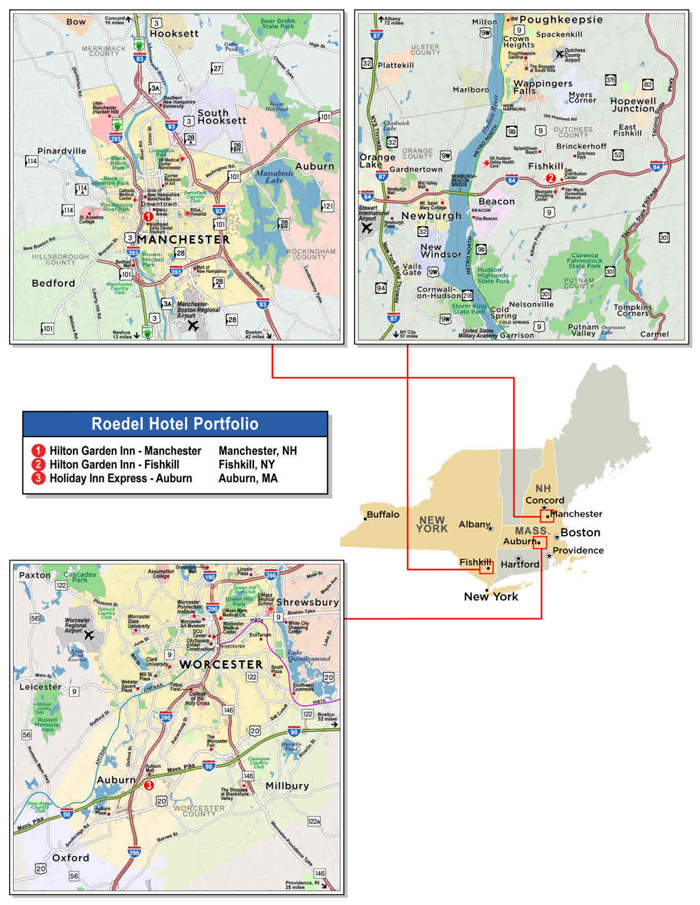

| Moffett Towers II - Building 2 | MSMCH | A-1 | $43,000,000 | Barclays Bank PLC(2) | Yes(2) | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $40,750,000 | Barclays Bank PLC | No |

| A-3 | $40,000,000 | WFCM 2017-C42 | No |

| A-4 | $41,250,000 | BANK 2018-BNK10 | No |

| One Newark Center | MSMCH | A-1 | $32,000,000 | MSBNA | No | Wells Fargo Bank, National Association | Torchlight Loan Services, LLC |

| A-2 | $20,000,000 | BANK 2018-BNK10 | Yes |

| A-3 | $14,580,000 | BANK 2018-BNK10 | No |

| Courtyard Los Angeles Sherman Oaks | WFB | A-1 | $28,000,000 | BANK 2018-BNK10 | Yes | Wells Fargo Bank, National Association | Torchlight Loan Services, LLC |

| A-2 | $27,000,000 | WFCM 2017-C42 | No |

| Warwick Mall | BANA | A-1 | $30,000,000 | BANK 2017-BNK9 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $27,500,000 | BANK 2018-BNK10 | No |

| A-3 | $17,500,000 | BANA | No |

| Kirkwood Plaza | MSMCH | A-1 | $23,790,000 | BANK 2018-BNK10 | Yes | Wells Fargo Bank, National Association | Torchlight Loan Services, LLC |

| A-2 | $15,000,000 | MSC 2017-HR2 | No |

| | | | | | | | | |

| (1) | No assurance can be provided that any unsecuritized note will not be split further. |

| (2) | The related whole loan is serviced under the WFCM 2017-C42 pooling and servicing agreement until the securitization of the related control note, after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related control note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the BANK 2018-BNK10 certificates after the closing of such securitization |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 3 |

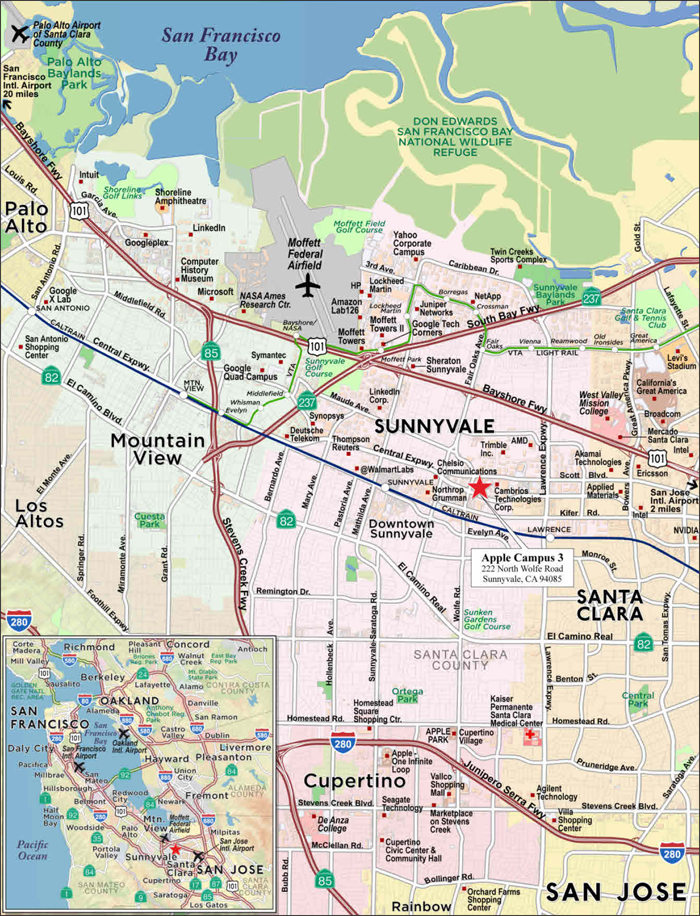

The pictures below are artist’s renderings of the Apple Campus 3 Property as it is generally proposed to be completed, and are not actual photographs or depictions of the current construction status of the related improvements. Furthermore, such renderings may differ in material aspects from the final design or the final, as-built condition of the completed improvements. Apple has taken possession of the Apple Campus 3 Property and is currently constructing its interior improvements.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 4 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 5 |

| No. 1 – Apple Campus 3 |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

| Credit Assessment (DBRS/Fitch/Moody’s): | [AA(high)]/[BBB-sf]/[Baa3] | | Property Type: | Office |

| Original Principal Balance(1): | $94,000,000 | | Specific Property Type: | Suburban |

| Cut-off Date Balance(1): | $94,000,000 | | Location: | Sunnyvale, CA |

| % of Initial Pool Balance: | 7.3% | | Size: | 882,657 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $385.20 |

| Borrower Name: | CW SPE LLC | | Year Built/Renovated: | 2017/NAP |

| Sponsors: | Paul Guarantor LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 3.365% | | Property Manager: | Self-managed |

| Note Date: | December 14, 2017 | | 4thMost Recent Occupancy(4): | NAP |

| Anticipated Repayment Date: | January 6, 2028 | | 3rdMost Recent Occupancy(4): | NAP |

| Maturity Date: | April 6, 2031 | | 2ndMost Recent Occupancy(4): | NAP |

| IO Period: | 120 months | | Most Recent Occupancy(4): | NAP |

| Loan Term (Original): | 120 months | | Current Occupancy(5): | 100.0% (2/1/2018) |

| Seasoning: | 1 month | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, ARD | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI(4): | NAP |

| Call Protection: | L(25),D(88),O(7) | | 3rdMost Recent NOI(4): | NAP |

| Lockbox Type: | Hard/Upfront Cash Management | | 2ndMost Recent NOI(4): | NAP |

| Additional Debt(1)(2): | Yes | | Most Recent NOI(4): | NAP |

| Additional Debt Type(1)(2): | Pari Passu;Mezzanine | | |

| | | | U/W Revenues: | $46,190,545 |

| | | | U/W Expenses: | $4,804,932 |

| Escrows and Reserves(3): | | | U/W NOI: | $41,385,613 |

| | | | | | U/W NCF: | $41,209,082 |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NOI DSCR(1): | 3.57x |

| Taxes | $0 | $249,368 | NAP | | U/W NCF DSCR(1)(2): | 3.55x |

| Insurance | $0 | Springing | NAP | | U/W NOI Debt Yield(1)(2): | 12.2% |

| Replacement Reserves | $0 | Springing | NAP | �� | U/W NCF Debt Yield(1): | 12.1% |

| TI/LC Reserves | $2,979,839 | $0 | NAP | | Stabilized Appraised Value(6): | $773,600,000 |

| Rent Concession Reserve | $42,706,326 | $0 | NAP | | Stabilized Appraisal Valuation Date(6): | June 1, 2019 |

| Punchlist Reserve | $93,750 | Springing | NAP | | Cut-off Date LTV Ratio(1)(2)(6): | 44.0% |

| | | | | | LTV Ratio at ARD(1)(2)(6): | 44.0% |

| | | | | | | |

| (1) | See “The Mortgage Loan” section. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the Apple Campus 3 Whole Loan (as defined below). |

| (2) | See “Subordinate and Mezzanine Indebtedness” section. The equity interest in the borrower has been pledged to secure senior mezzanine indebtedness with an original principal balance of $117,500,000 and junior mezzanine indebtedness with an original principal balance of $117,500,000. All statistical information related to the balance per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based solely on the Apple Campus 3 Whole Loan. As of the Cut-off Date, the U/W NCF DSCR, U/W NOI Debt Yield, Cut-off Date LTV Ratio and LTV Ratio at ARD based on the Apple Campus 3 Total Debt (as defined below) are 1.70x, 7.2%, 74.3% and 74.3%, respectively. |

| (3) | See “Escrows” section. |

| (4) | Historical occupancy and financial information is not applicable as the Apple Campus 3 Property (as defined below) was built in 2017. |

| (5) | Apple has taken possession of its space, is currently constructing its interior improvements and is expected to begin taking occupancy in September 2018. |

| (6) | See “Appraisal” section. The stabilized appraised value shown assumes that contractual tenant improvement and leasing commission (“TI/LC”) obligations have been fulfilled and there is no outstanding free rent. The borrower deposited upfront reserves totalling $45,779,915 for such contractual TI/LC obligations and free rent (see “Escrows” section). The As-Is Appraised Value is $624,600,000 as of November 7, 2017, equating to a Cut-off Date LTV Ratio and LTV Ratio at ARD of 54.4%. |

The Mortgage Loan. The mortgage loan (the “Apple Campus 3 Mortgage Loan”) is part of a whole loan (the “Apple Campus 3 Whole Loan”) evidenced by fivepari passu notes secured by a first mortgage encumbering the fee interest in a 882,657 square foot, four-story, class A, single-tenant office building located in Sunnyvale, California (the “Apple Campus 3 Property”). The Apple Campus 3 Whole Loan was co-originated on December 14, 2017 by Wells Fargo Bank, National Association; Deutsche Bank AG, New York Branch; and Goldman Sachs Mortgage Company. The Apple Campus 3 Whole Loan had an original principal balance of $340,000,000, has an outstanding principal balance as of the Cut-off Date of $340,000,000 and accrues interest at an interest rate of 3.365%per annum (the “Initial Interest Rate”) through the anticipated repayment date (“ARD”); provided, however, that upon the occurrence and continuance of an event of default, the Apple Campus 3 Whole Loan accrues interest at an interest rate equal to the Initial Interest Rate plus 5.000%. The Apple Campus 3 Whole Loan had an initial term of 120 months, has a remaining term to the ARD of 119 months as of the Cut-off Date and requires payments of interest-only through the ARD. The ARD is January 6, 2028 and the final maturity date is April 6, 2031. In the event the Apple Campus 3 Whole Loan is not paid off in full on or before the ARD,

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 6 |

the borrower will be required to make (a) interest payments based on an interest rate equal to the greater of (i) the Initial Interest Rate plus 1.500%per annum, and (ii) the swap rate plus 1.500%per annum; provided, however, that upon the occurrence and continuance of an event of default, the interest rate will be equal to (1) the greater of (i) and (ii), plus (2) 5.000%; and (b) principal payments based on a 30-year amortization assuming the Initial Interest Rate. The ARD automatically triggers a Cash Trap Event Period (see “Lockbox and Cash Management” section) whereby all excess cash flow will be used to pay down the principal balance of the Apple Campus 3 Whole Loan. See “Description of the Mortgage Pool—ARD Loan” and“—Whole Loans—Apple Campus 3 Whole Loan” in the Preliminary Prospectus.

Note A-1, which will be contributed to the BANK 2018-BNK10 Trust, had an original principal balance of $80,000,000, has an outstanding principal balance as of the Cut-off Date of $94,000,000 and represents the controlling interest in the Apple Campus 3 Whole Loan. The non-controlling Notes A-2, A-3, A-4 and A-5, which have an aggregate original principal balance of $246,000,000, are currently held by Wells Fargo Bank, National Association (Notes A-2 and A-3), Deutsche Bank AG, New York Branch (Note A-4) and Goldman Sachs Mortgage Company (Note A-5) and are expected to be contributed to future securitization trusts. The mortgage loans evidenced by Note A-2, A-3, A-4 and A-5 are collectively referred to herein as the “Apple Campus 3 Companion Loans”. The lender provides no assurances that any non-securitizedpari passu notes will not be split further. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

Note Summary

| Notes | Original Balance | | Note Holder | Controlling Interest |

| A-1 | $94,000,000 | | BANK 2018-BNK10 | Yes |

| A-2 | $30,000,000 | | Wells Fargo Bank, NA | No |

| A-3 | $80,000,000 | | Wells Fargo Bank, NA | No |

| A-4 | $68,000,000 | | Deutsche Bank AG | No |

| A-5 | $68,000,000 | | Goldman Sachs Mortgage Company | No |

| Total | $340,000,000 | | | |

Following the lockout period, on any date before July 6, 2027, the borrower has the right to defease the Apple Campus 3 Whole Loan in whole, but not in part. In addition, the Apple Campus 3 Whole Loan is prepayable without penalty on or after July 6, 2027. The lockout period will expire on the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) December 14, 2021.

Sources and Uses

| Sources | | | | | Uses | | | |

| Original loan amount | $340,000,000 | | 59.1% | | Loan payoff | $385,679,999 | | 67.1% |

| Mezzanine debt | 235,000,000 | | 40.9 | | Reserves | 45,779,915 | | 8.0 |

| | | | | | Closing costs | 2,636,016 | | 0.5 |

| | | | | | Return of equity | 140,904,070 | | 24.5 |

| Total Sources | $575,000,000 | 100.0% | | Total Uses | $575,000,000 | | 100.0% |

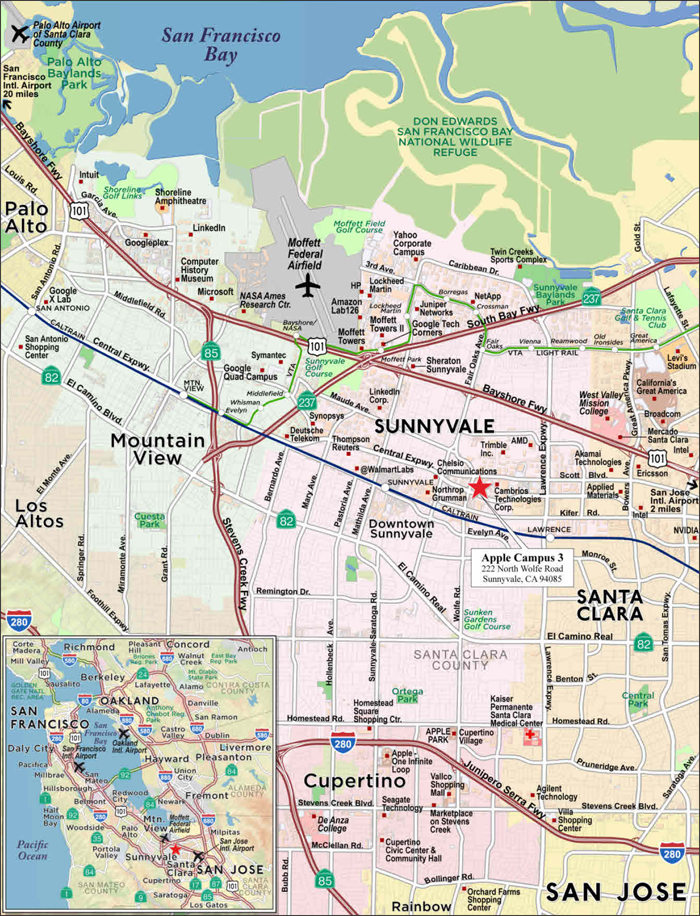

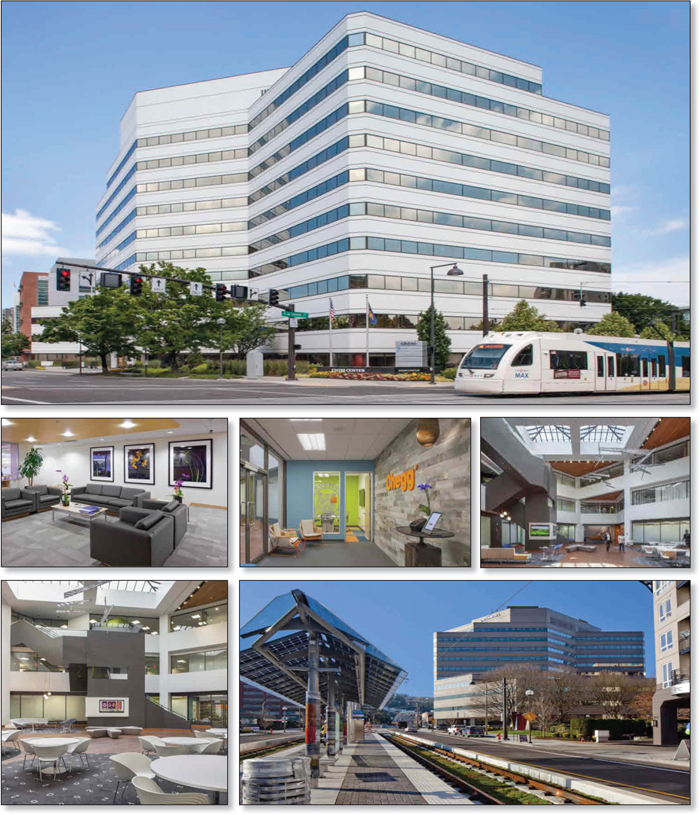

The Property. The Apple Campus 3 Property is a class A LEED Platinum office campus totaling 882,657 square feet and located in Sunnyvale, California. Built in 2017 and situated on a 17.8-acre site, the Apple Campus 3 Property comprises three interconnected, four-story office buildings totaling approximately 849,000 square feet, an amenities facility, outdoor common area and a seven-story parking structure. The Apple Campus 3 Property is 100.0% leased to Apple Inc. (“Apple”; NYSE: AAPL) through February 2031, with two, seven-year extension options and no termination options. Apple took possession of the Apple Campus 3 Property on December 1, 2017 and is currently constructing its interior improvements. As of January 2018, Apple is expected to begin taking occupancy of its space at the Apple Campus 3 Property in September 2018.

The interconnected office buildings within the Apple Campus 3 Property comprise Building A (308,659 square feet), Building B (269,997 square feet) and Building C (270,002 square feet), and the combined office floorplates average approximately 180,000 square feet. The amenities facility at the Apple Campus 3 Property totals approximately 34,000 square feet and is expected to serve as a cafeteria for Apple employees. Building A, Building B, the parking structure and the amenities building are collectively known as “Phase I” of the Apple Campus 3 Property; and Building C is known as “Phase 2”. Amenities at the Apple Campus 3 Property include a fitness/wellness center, coffee bar, general store, barber shop, bike repair shop, dry cleaning/laundry service and a conference center. Additional outdoor amenities at the Apple Campus 3 Property include a mini amphitheater situated in the center courtyard, outdoor seating, sport courts and athletic fields, bus/shuttle stops and green roof accessibility on the third floor of the office buildings.

According to the appraisal, as of 2016, Apple was the second largest employer in Sunnyvale, California, and the second largest space user in Silicon Valley. The Apple Campus 3 Property is situated approximately 3.5 miles north of both Apple Park and One Infinite Loop. Apple Park is Apple’s new 175-acre corporate headquarters campus, which comprises the 2.8 million square foot “spaceship” structure in addition to several associated research and development buildings. One Infinite Loop was originally developed as Apple’s headquarters in 1993 and totals approximately 850,000 square feet.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 7 |

The following table presents certain information relating to the tenancy at the Apple Campus 3 Property:

Major Tenant

| Tenant Name | Credit Rating

(Fitch/

Moody’s/

S&P)(1) | Tenant NRSF | % of

NRSF | Annual

U/W Base

Rent PSF(2) | Annual

U/W Base

Rent(2) | % of Total Annual

U/W Base

Rent | Lease

Expiration

Date |

| | | | | | | |

| Major Tenant | | | | | |

| Apple(3) | NR/Aa1/AA+ | 882,657 | 100.0% | $48.35 | $42,675,300 | 100.0% | 2/28/2031(4) |

| Total Major Tenant | 882,657 | 100.0% | $48.35 | $42,675,300 | 100.0% | |

| | | | | | | | |

| Vacant Space | | 0 | 0.0% | | | | |

| | | | | | | | |

| Collateral Total | 882,657 | 100.0% | | | | |

| | | | | | | | |

| (1) | The entity on the lease is Apple Inc., which is the rated entity. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent reflect the average rent over the remaining lease term. Apple is currently in a free rent period, as outlined in the footnote below, and will begin paying rent of $41.28 per square foot on Phase I in February 2019 and Phase II in June 2019. |

| (3) | Apple has taken possession of its space and is currently constructing its interior improvements. Apple is currently in a free rent period for (i) Phase 1 (approximately 69.4% of its space) through and including December 2018 and (ii) Phase 2 (approximately 30.6% of its space) through and including May 2019. In January 2019, Apple will pay reduced rent of approximately $6.93 per square foot on Phase I only. Through and including February 2018, Apple is required to pay reimbursements for utilities only, and commencing March 2018, the tenant will be required to pay reimbursements for utilities, operating expenses, taxes and insurance. All future rent credits and abatements under the Apple lease were reserved at the origination of the Apple Campus 3 Whole Loan (see “Escrows” section). |

| (4) | Apple has two, 7-year renewal options at 95% of fair market value with 360 days’ written notice. |

The following table presents certain information relating to the lease rollover schedule at the Apple Campus 3 Property:

Lease Expiration Schedule(1)

Year Ending

December 31, | No. of Leases Expiring | Expiring

NRSF | % of

Total

NRSF | Cumulative Expiring

NRSF | Cumulative % of Total

NRSF | Annual

U/W

Base Rent | % of Total Annual

U/W Base

Rent | Annual

U/W

Base

Rent

PSF |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2018 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2019 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2021 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2022 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2023 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2026 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2027 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2028 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| Thereafter | 1 | 882,657 | 100.0% | 882,657 | 100.0% | $42,675,300 | 100.0% | $48.35 |

| Vacant | 0 | 0 | 0.0% | 882,657 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 1 | 882,657 | 100.0% | | | $42,675,300 | 100.0% | $48.35 |

| (1) | Information obtained from the underwritten rent roll. |

The following table presents historical occupancy percentages at the Apple Campus 3 Property:

Historical Occupancy

12/31/2013(1) | 12/31/2014(1) | 12/31/2015(1) | 12/31/2016(1) | 2/1/2018(2)(3) |

| NAP | NAP | NAP | NAP | 100.0% |

| (1) | The Apple Campus 3 Property was built in 2017. |

| (2) | Apple has taken possession of its space at the Apple Campus 3 Property and is currently constructing its interior improvements. As of January 2018, Apple is expected to begin taking occupancy of its space at the Apple Campus 3 Property in September 2018. |

| (3) | Information obtained from the underwrittenrent roll. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 8 |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the Apple Campus 3 Property:

Cash Flow Analysis(1)

| | U/W | | % of U/W Effective Gross Income | | U/W $ per SF | |

| Base Rent | $42,675,300(2) | | 92.4% | | $48.35 | |

| Grossed Up Vacant Space | 0 | | 0.0 | | 0.00 | |

| Total Reimbursables | 3,981,816 | | 8.6 | | 4.51 | |

| Other Income | 0 | | 0.0 | | 0.00 | |

| Less Vacancy & Credit Loss | (466,571)(3) | | (1.0) | | (0.53) | |

| Effective Gross Income | $46,190,545 | | 100.0% | | $52.33 | |

| | | | | | | |

| Total Operating Expenses | $4,804,932 | | 10.4% | | $5.44 | |

| | | | | | | |

| Net Operating Income | $41,385,613 | | 89.6% | | $46.89 | |

| TI/LC | 0 | | 0.0 | | 0.00 | |

| Capital Expenditures | 176,531 | | 0.4 | | 0.20 | |

| Net Cash Flow | $41,209,082 | | 89.2% | | $46.69 | |

| | | | | | | |

| NOI DSCR(4) | 3.57x | | | | | |

| NCF DSCR(4) | 3.55x | | | | | |

| NOI DY(4) | 12.2% | | | | | |

| NCF DY(4) | 12.1% | | | | | |

| (1) | Historical operating statements are not applicable, as the Apple Campus 3 Property was built in 2017. |

| (2) | Base Rent reflects the average rent over the lease term (see “Major Tenant” section). |

| (3) | The underwritten economic vacancy is 1.0%. The Apple Campus 3 Property was 100.0% leased as of February 1, 2018. |

| (4) | The debt service coverage ratios and debt yields are based on the Apple Campus 3 Whole Loan. |

Appraisal.The appraiser concluded to an “as-stabilized” appraised value of $773,600,000 with a valuation date of June 1, 2019, which assumes that contractual TI/LC obligations have been fulfilled and there is no outstanding free rent. The borrower deposited upfront reserves totaling $45,779,915 for such TI/LC obligations and free rent periods (see “Escrows” section). As of the appraisal valuation date of November 7, 2017 the Apple Campus 3 Property had an “as-is” appraised value of $624,600,000. The appraiser also concluded to a “Go Dark” value of $566,750,000 as of November 7, 2017.

Environmental Matters. According to the Phase I Environmental Assessment dated November 20, 2017, there are recognized environmental conditions at the Apple Campus 3 Property related to (i) potential soil, gas and groundwater contamination and (ii) residual soil impacts and possible vapor intrusion concerns. The Phase I assessment recommended no further action aside from continued implementation of a site management plan and vapor-intrusion mitigation system. In regard to the groundwater contamination, the responsible parties are Advanced Micro Devices, Inc., Northrop Grumman and Locus Technologies (a subsidiary of the Philips Electronics Company). The RECs are further described under “Description of the Mortgage Pool—Mortgage Pool Characteristics–Environmental Considerations” in the Preliminary Prospectus.

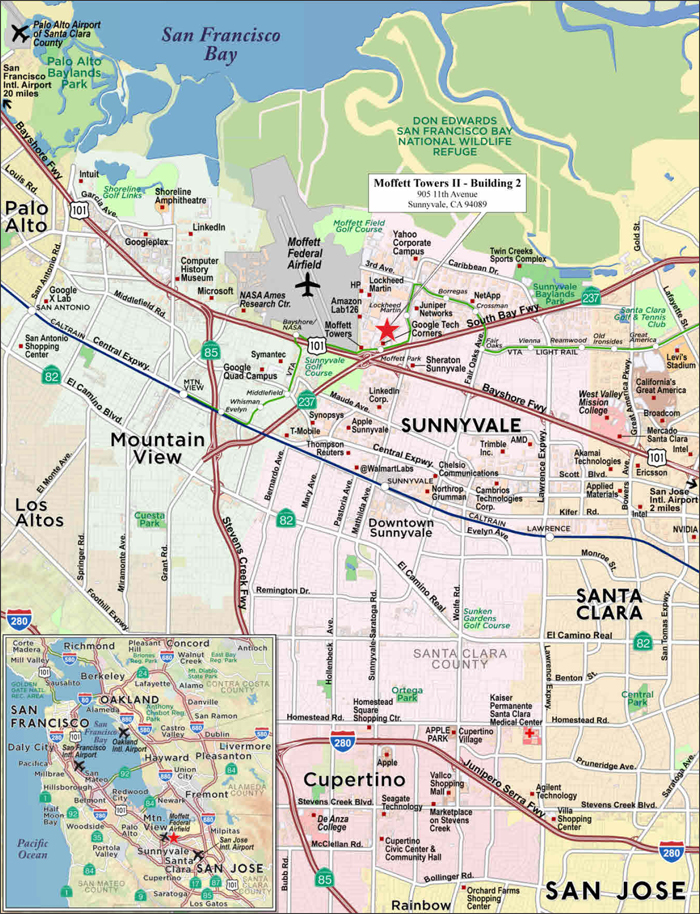

Market Overview and Competition. The Apple Campus 3 Property is located in Sunnyvale, California near the intersection of Central Expressway and Wolfe Road. Sunnyvale is the seventh most populous city in the San Francisco Bay Area and one of the major cities comprising Silicon Valley. According to a third party market research report, as of the third quarter of 2017, the San Jose/Sunnyvale/Santa Clara metropolitan statistical area had an unemployment rate of 3.2% and reported an 8.9% GDP growth rate over the past five years, compared to an overall 2.4% growth rate for the United States.

The Apple Campus 3 Property is centrally located within 1.4 miles of two Santa Clara Valley Transportation Authority Light Rail stations (the Sunnyvale station in the Heritage District Downtown and the Lawrence Station in eastern Sunnyvale), 3.9 miles from the Downtown Mountain View Caltrain Station, and within close proximity to highways 101, 280, 237 and 85. According to a third-party market research report, the 2017 estimated population within a one-, three- and five-mile radius of the Apple Campus 3 Property was 26,490, 193,228, and 466,901, respectively; while the 2017 estimated average household income within the same radii was $121,630, $133,362, and $141,198, respectively.

According to a third-party market research report, as of the third quarter of 2017, the Sunnyvale submarket contained approximately 10.9 million square feet of office space exhibiting a vacancy rate of approximately 3.1% and an average asking rental rate of $64.44 per square foot, gross. The appraiser identified 15 comparable class A office properties totaling approximately 2.4 million square feet, which reported a 99.7% occupancy rate and average asking rents of $50.58 per square foot, triple net.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 9 |

The following table presents certain information relating to comparable office leases for the Apple Campus 3:

Comparable Leases(1)

| Property Name/Location | Year Built/ Renovated | Total GLA

(SF) | Distance

from

Subject | Tenant Name | Lease Date/Term | Lease

Area

(SF) | Annual

Base Rent PSF | Lease Type |

Moffett Towers II 905 11th Avenue Sunnyvale, CA | 2016/NAV | 350,663 | 3.0 mile | Lab 126 | March 2017/ 10.0 Yrs | 350,663 | $47.40 | NNN |

Moffett Gateway 1225 Crossman Avenue Sunnyvale, CA | 2016/NAV | 298,924 | 2.3 miles | Google, Inc. | November 2016/ 11.0 Yrs | 298,924 | $44.40 | NNN |

10900 Tantau Avenue Cupertino, CA | 2008/NAV | 102,540 | 3.5 miles | Panasonic | May 2017/

5.0 Yrs | 43,034 | $51.00 | NNN |

Tree Farm 4440 El Camino Real Los Altos, CA | 1999/NAV | 96,562 | 6.8 mile | Toyota | March 2017/ 5.5 Yrs | 96,562 | $63.00 | NNN |

Moffett Tower II Bldg. 2 905 11th Avenue Sunnyvale, CA | 2017/NAV | 362,600 | 3.0 miles | Amazon | December 2016/ 10.0 Yrs | 362,600 | $48.00 | NNN |

| (1) | Information obtained from third party market report |

The Borrower.The borrower is CW SPE LLC, a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Apple Campus 3 Whole Loan. Paul Guarantor LLC is the guarantor of certain nonrecourse carveouts under the Apple Campus 3 Whole Loan.

The Borrower Sponsor.The borrower sponsor is Paul Guarantor LLC, which is 100% directly owned by Jay Paul Company, a privately held real estate firm based in San Francisco, California. Founded in 1975, Jay Paul Company concentrates on the acquisition, development, and management of commercial properties throughout California. Jay Paul Company has developed over 11.0 million square feet of institutional quality space, and since 2000, has closed on more than $12.0 billion in debt and equity financings.

Escrows.The Apple Campus 3 Whole Loan documents provide for upfront escrows in the amount of $42,706,326 for rent abatement periods, $2,979,839 for outstanding TI/LCs, and $93,750 for the estimated cost to complete outstanding punchlist items. The Apple Campus 3 Whole Loan documents provide for ongoing monthly escrows of $249,368 for real estate taxes. The Apple Campus 3 Whole Loan documents provide for additional reserves in the amount of 125% of any additional punchlist items received from Apple (following origination, an additional $506,100 was deposited due to additional punchlist items identified by Apple).

The Apple Campus 3 Whole Loan documents do not require ongoing monthly escrows for insurance premiums as long as (i) no event of default has occurred and is continuing; (ii) the borrower provides the lender with evidence that the Apple Campus 3 Property’s insurance coverage is included in a blanket policy and such policy is in full force and effect; and (iii) the borrower pays all applicable insurance premiums and provides the lender with evidence of renewals. The Apple Campus 3 Whole Loan documents do not require ongoing monthly escrows for replacement reserves as long as no “Cash Trap Event Period” (as defined in the “Lockbox and Cash Management” section) has occurred and is continuing.

Lockbox and Cash Management.The Apple Campus 3 Whole Loan requires a lender-controlled lockbox account, which is already in-place, and that the borrower direct the tenant to pay its rent directly into such lockbox account. The loan documents also require that all rents received by the borrower or the property manager be deposited into the lockbox account. Prior to the occurrence of a Cash Trap Event Period (as defined below), all excess funds are required to be distributed to the borrower. During a Cash Trap Event Period, all excess funds are required to be swept to a lender-controlled cash management account. During a Lease Sweep Period (as defined below), the borrower is required to make minimum monthly deposits of $1,838,869 into a leasing reserve (regardless of the amount of available excess cash flow).

A “Cash Trap Event Period” will commence upon the earlier of the following:

| (i) | the occurrence of an event of default under the Apple Campus 3 Whole Loan, the Apple Campus 3 Senior Mezzanine Loan or the Apple Campus 3 Junior Mezzanine Loan (see “Subordinate and Mezzanine Indebtedness” section); |

| (ii) | the occurrence of a Lease Sweep Period (as defined below); |

| (iii) | the debt service coverage ratio based on the Apple Campus 3 Whole Loan falling below 1.85x (based on a hypothetical 30-year amortization period), or the debt service coverage ratio based on the Apple Campus 3 Total Debt (see “Subordinate and Mezzanine Indebtedness” section) falling below 1.10x (based on a hypothetical 30-year amortization period) at the end of any calendar quarter; or |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 10 |

A Cash Trap Event Period will end upon the occurrence of the following:

| ● | with regard to clause (i), upon the cure of such event of default; |

| ● | with regard to clause (ii), upon a Lease Sweep Period Cure Event (as defined below); |

| ● | with regard to clause (iii), upon the debt service coverage ratio based on the Apple Campus 3 Whole Loan (based on a hypothetical 30-year amortization schedule) being equal to 1.85x or greater, and the debt service coverage ratio based on the Apple Campus 3 Total Debt (based on a hypothetical 30-year amortization schedule) being equal to 1.10x or greater for two consecutive calculation dates; or |

| ● | with regard to clause (iv), the Apple Campus 3 Whole Loan being repaid in full. |

A “Lease Sweep Period” will commence upon the earlier of the following (for clauses (i), (iii), (iv) and (v) below, the term ‘Apple’ includes any replacement tenant that occupies at least 75% of the space currently occupied by Apple):

| (i) | Apple cancels, terminates or gives notice of its intent to cancel or terminate its lease on at least 40,000 square feet; |

| (ii) | Apple is no longer an Investment Grade Entity (as defined below); |

| (iii) | Apple goes dark in 20% or more of its space; provided, however, that a Lease Sweep Period will not commence as long as Apple remains an Investment Grade Entity; |

| (iv) | Apple defaults under its lease beyond any applicable notice and cure period; or |

| (v) | Apple becomes insolvent or files for bankruptcy. |

A “Lease Sweep Cure Event” will occur upon the following:

| ● | with regard to clause (i), upon (a) a Qualified Re-Leasing Event (as defined below), or (b) total swept funds equating to $35.00 per square foot of such applicable space (or borrower delivering to the lender an acceptable letter of credit in such amount); |

| ● | with regard to clauses (ii) or (iii), upon (a) a Qualified Re-Leasing Event, (b) Apple restores its status as an Investment Grade Entity; (c) the applicable space being subleased to an Investment Grade Entity who has accepted delivery of the space and is paying unabated rent in an amount no less than the contract rate of the primary lease; or (d) total swept funds equating to $50.00 per square foot of (x) the Apple lease space with respect to clause (ii) and (y) the applicable space with respect to clause (iii) (or borrower delivering to the lender an acceptable letter of credit in such amount); provided, however, that once total swept funds in the leasing reserve equate to $35.00 per square foot of the applicable space, additional funds will be deposited into a debt service reserve account until such $50.00 per square foot cap is met; |

| ● | with regard to clause (iv), upon (a) the cure of such event of default and no other default occurs for a period of three consecutive months, or (b) total swept funds equating to $35.00 per square foot (or borrower delivering to the lender an acceptable letter of credit in such amount); |

| ● | with regard to clause (v), upon the bankruptcy or insolvency proceedings having terminated and the lease having been affirmed or assigned in a manner satisfactory to the lender. |

An “Investment Grade Entity” means an entity that is rated ‘BBB-’, or equivalent, or higher by at least two of Fitch, Moody’s and S&P.

A “Qualified Re-Leasing Event” will occur upon one or more replacement tenants acceptable to lender executing leases covering at least 75% of the space currently occupied by Apple with (i) terms extending at least three years beyond the Maturity Date of the Apple Campus 3 Whole Loan; (ii) economic terms at least as favorable as those in the lease being replaced; (iii) such replacement tenants having taken possession of such space and paying full unabated rent or such abatement has been reserved; (iv) and all tenant improvements and leasing commissions having been paid or reserved.

Property Management.The Apple Campus 3 Property is managed by an affiliate of the borrower.

Assumption.The Apple Campus 3 borrower has the right to transfer the Apple Campus 3 Property, provided that certain other conditions are satisfied, including, but not limited to: (i) no event of default has occurred and is continuing; (ii) the lender’s reasonable determination that the proposed transferee and guarantor satisfy the lender’s credit review and underwriting standards, taking into consideration transferee experience, financial strength and general business standing; and (iii) if requested by the lender, rating agency confirmation from DBRS, Fitch, and Moody’s that the transfer will not result in a downgrade, withdrawal or qualification of the respective ratings assigned to the Series 2018-BNK10 Certificates and similar confirmations from each rating agency rating any securities backed by any of the Apple Campus 3 Companion Loans with respect to the ratings of such securities.

Rights of First Offer. Apple has a right of first offer to purchase the Apple Campus 3 Property if the borrower markets the property for sale (the “Apple ROFO”). The Apple ROFO is not extinguished by foreclosure; however, the Apple ROFO does not apply to foreclosure or deed-in-lieu thereof.

Partial Release.Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Wells Fargo Bank, National Association; Deutsche Bank AG, New York Branch; and Goldman Sachs Mortgage Company (collectively, the “Mezzanine Co-Lenders”) funded a $117,500,000 senior mezzanine loan to CW Mezz LLC (the “Apple Campus 3 Senior Mezzanine Loan”) and a $117,500,000 junior mezzanine loan to Central Wolfe LLC (the “Apple Campus 3 Junior Mezzanine Loan”)(collectively, the Apple Campus 3 Whole Loan, Apple Campus 3 Senior Mezzanine Loan and Apple Campus 3 Junior Mezzanine Loan are referred to herein as the “Apple Campus 3 Total Debt”). The Apple Campus 3 Senior Mezzanine Loan and the Apple Campus 3 Junior Mezzanine Loan are coterminous with the Apple Campus 3 Whole Loan and require interest-only payments. The Apple Campus 3 Senior Mezzanine Loan accrues interest at a fixed interest rate equal to 4.620% per annum (the “Senior Mezzanine Initial Interest Rate”), and the Apple Campus 3 Junior Mezzanine Loan accrues interest at a fixed interest rate equal to 6.000% per annum (the “Junior Mezzanine Initial Interest Rate”). In the event the Apple Campus 3 Senior

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 11 |

Mezzanine Loan and/or the Apple Campus 3 Junior Mezzanine Loan are not paid off in full on or before the ARD, the borrower will be required to make interest payments based on an interest rate equal to the greater of (i) the Senior Mezzanine Initial Interest Rate or the Junior Mezzanine Initial Interest Rate, as applicable, plus 1.500% per annum, and (ii) the swap rate plus 1.500% per annum; provided, however, that upon the occurrence and continuance of an event of default, the interest rate will be equal to (1) the greater of (i) and (ii), plus (2) 5.000%. An intercreditor agreement is in place with respect to the Apple Campus 3 Whole Loan, the Apple Campus 3 Senior Mezzanine Loan and the Apple Campus 3 Junior Mezzanine Loan.

Ground Lease.None.

Terrorism Insurance.The Apple Campus 3 Whole Loan documents require that the “all risk” insurance policy required to be maintained by the borrower provide coverage for terrorism in an amount equal to the full replacement cost of the Apple Campus 3 Property, as well as business interruption insurance covering no less than the 24-month period following the occurrence of a casualty event, together with a 12-month extended period of indemnity.

Earthquake Insurance.The loan documents require earthquake insurance. At the time of closing, earthquake insurance coverage is in-place for the Apple Campus 3 Property. The seismic report indicated a probable maximum loss of 10.0% for the Apple Campus 3 Property.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 12 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 13 |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 14 |

| No. 2 – LARP I Portfolio |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Morgan Stanley Mortgage Capital Holdings LLC | | Single Asset/Portfolio: | Portfolio |

| Credit Assessment (DBRS/Fitch/Moody’s): | NR/NR/NR | | Property Type(3): | Multifamily |

| Original Principal Balance: | $90,000,000 | | Specific Property Type: | Various |

| Cut-off Date Balance: | $90,000,000 | | Location: | Various |

| % of Initial Pool Balance: | 7.0% | | Size: | 979 Units |

| Loan Purpose: | Recapitalization | | Cut-off Date Balance Per Unit(2): | $91,931 |

| Borrower Name: | Various | | Year Built/Renovated: | Various/Various |

| Borrower Sponsors: | Antheus Capital | | Title Vesting: | Fee |

| Mortgage Rate: | 5.004% | | Property Manager: | MAC Property Management, LLC (borrower-related) |

| Note Date: | December 22, 2017 | | 4thMost Recent Occupancy (As of): | 93.3% (12/31/2013) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of): | 93.8% (12/31/2014) |

| Maturity Date: | January 1, 2028 | | 2ndMost Recent Occupancy (As of): | 95.7% (12/31/2015) |

| IO Period: | 120 months | | Most Recent Occupancy (As of): | 95.0% (12/31/2016) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of): | 93.3% (11/11/2017) |

| Seasoning: | 1 month | | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | 4thMost Recent NOI (As of): | $6,147,939 (12/31/2014) |

| Interest Accrual Method: | Actual/360 | | 3rdMost Recent NOI (As of): | $6,659,855 (12/31/2015) |

| Call Protection: | L(25),D(88),O(7) | | 2ndMost Recent NOI (As of): | $7,235,799 (12/31/2016) |

| Lockbox Type: | Springing | | Most Recent NOI (As of): | $7,658,099 (TTM 9/30/2017) |

| Additional Debt: | Yes | | | |

| Additional Debt Type(1): | Mezzanine | | U/W Revenues(3): | $13,044,379 |

| | | | U/W Expenses: | $5,394,782 |

| | | | U/W NOI: | $7,649,597 |

| | | | U/W NCF: | $7,386,342 |

| Escrows and Reserves(2): | | | U/W NOI DSCR: | 1.68x |

| | | | | | U/W NCF DSCR: | 1.62x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NOI Debt Yield : | 8.5% |

| Taxes | $413,520 | $68,920 | NAP | | U/W NCF Debt Yield: | 8.2% |

| Insurance | $147,650 | $0 | NAP | | As-Is Appraised Value: | $140,530,000 |

| Residential Replacement Reserves | $0 | $20,999 | NAP | | As-Is Appraisal Valuation Date: | Various |

| Commercial Replacement Reserves | $0 | $403 | NAP | | Cut-off Date LTV Ratio: | 64.0% |

| Commercial Tenant TI/LC Reserves | $0 | $940 | $33,840 | | LTV Ratio at Maturity or ARD: | 64.0% |

| Required Repairs | $47,439 | NAP | NAP | | | |

| | | | | | | |

| | | | | | | |

| (1) | The equity interest in the borrowers has been pledged to secure mezzanine indebtedness with an original principal balance of $18,000,000 (the “LARP I Portfolio Mezzanine Loan”). All statistical information related to the balance per unit, loan-to-value ratios, debt service coverage ratios and debt yields are based solely on the LARP I Portfolio Mortgage Loan. As of the Cut-off Date, the combined U/W NOI DSCR, U/W NCF DSCR, U/W NOI Debt Yield, U/W NCF Debt Yield, Cut-off Date LTV Ratio and LTV Ratio at Maturity or ARD including the LARP I Portfolio Mezzanine Loan were 1.29x, 1.24x, 7.1%, 6.8%, 76.9% and 76.9%, respectively. |

| (2) | See “Escrows” section. |

| (3) | Four properties contain ground floor retail that accounts for approximately 8.3% of the aggregate underwritten gross potential rent for the LARP I Portfolio Properties. |

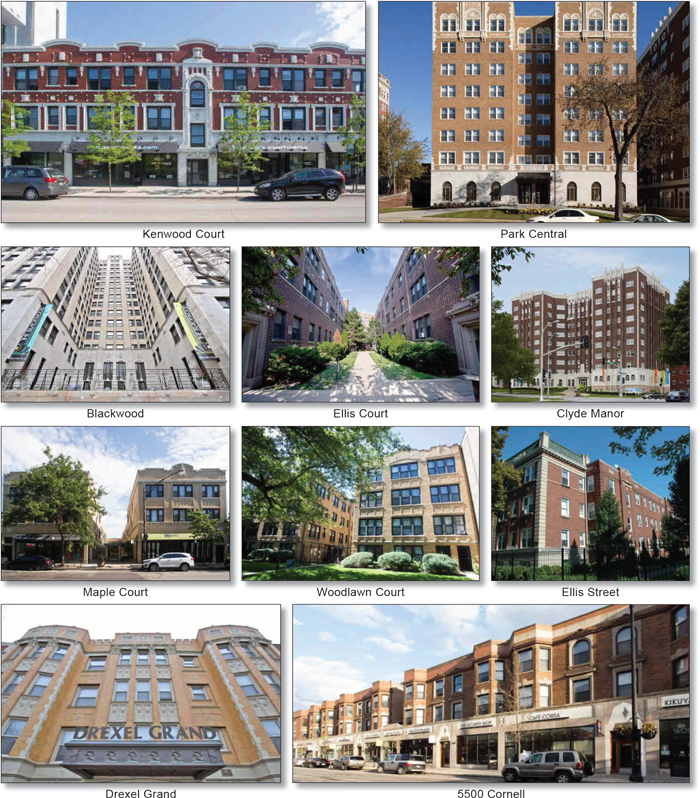

The Mortgage Loan. The mortgage loan (the “LARP I Portfolio Mortgage Loan”) is evidenced by a single promissory note secured by a first mortgage encumbering the fee interest in a portfolio of 18 multifamily properties totaling 979 units and 32,207 square feet of ground floor retail located in Chicago, Illinois and Kansas City, Missouri (the “LARP I Portfolio Properties”). The LARP I Portfolio Mortgage Loan had an original principal balance of $90,000,000, has an outstanding principal balance as of the Cut-off Date of $90,000,000 and accrues interest at an interest rate of 5.004% per annum. The LARP I Portfolio Mortgage Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires payments of interest-only through the term of the LARP I Portfolio Mortgage Loan. The LARP I Portfolio Mortgage Loan matures on January 1, 2028.

Following the lockout period, the borrower has the right to defease the LARP I Portfolio Mortgage Loan in whole, or in part as described below under “Partial Defeasance,” on any date before September 1, 2027. In addition, the LARP I Portfolio Mortgage Loan is prepayable without penalty on or after June 1, 2027, in whole, or in part as described below under “Partial Release”. The lockout period will expire on February 1, 2020.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 15 |

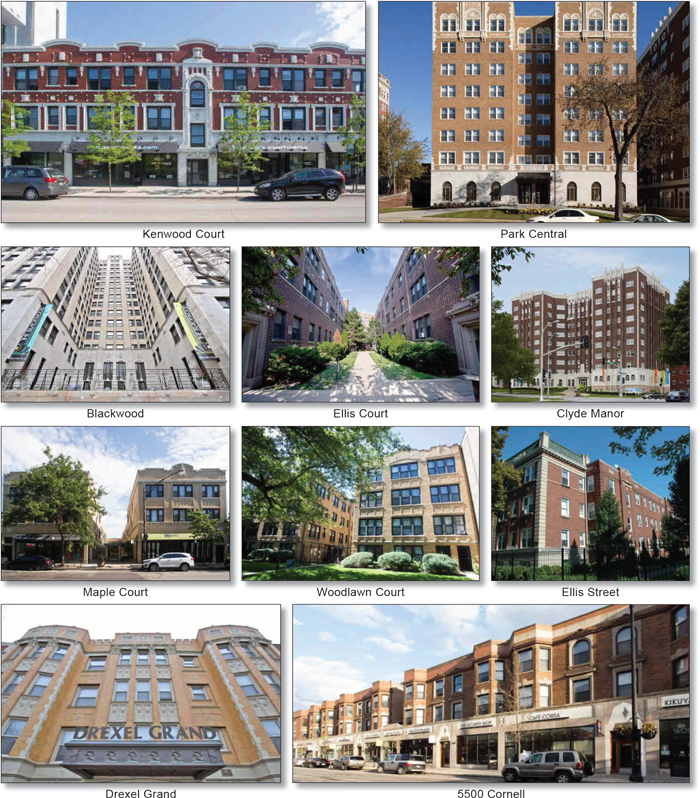

The following table presents certain information relating to the LARP I Portfolio Properties:

| Property Name | City / State | Year Built/Renovated | Units | Retail SF | Allocated Cut-off Date Balance(2) | % of ALA | Appraised Value(3) | % of Appraised Value | UW NOI | % of UW NOI |

| Blackwood | Chicago, IL | 1965/2009 | 145 | N/A | 17,000,000 | 18.9% | 26,200,000 | 18.6% | $1,419,614 | 18.6% |

| 5500 Cornell | Chicago, IL | 1903/NAP | 65 | 19,527 | 12,333,333 | 13.7% | 19,000,000 | 13.5% | $997,112 | 13.0% |

| Clyde Manor | Kansas City, MO | 1920/2010 | 115 | N/A | 8,333,333 | 9.3% | 12,930,000 | 9.2% | $667,127 | 8.7% |

| Woodlawn Terrace | Chicago, IL | 1926/NAP | 104 | N/A | 6,875,000 | 7.6% | 10,600,000 | 7.5% | $601,625 | 7.9% |

| Park Central | Kansas City, MO | 1930/2011 | 106 | N/A | 6,416,667 | 7.1% | 9,880,000 | 7.0% | $615,622 | 8.0% |

| Maple Court | Chicago, IL | 1913/NAP | 68 | 2,560 | 5,416,667 | 6.0% | 8,760,000 | 6.2% | $443,842 | 5.8% |

| Ellis Street | Chicago, IL | 1920/2015 | 80 | N/A | 5,416,667 | 6.0% | 8,350,000 | 5.9% | $468,740 | 6.1% |

| Drexel Grand | Chicago, IL | 1929/2005 | 74 | N/A | 5,041,667 | 5.6% | 7,800,000 | 5.6% | $476,882 | 6.2% |

| Ellis Court | Chicago, IL | 1924/2009 | 43 | 6,000 | 4,562,500 | 5.1% | 7,040,000 | 5.0% | $383,766 | 5.0% |

| Kenwood Court | Chicago, IL | 1911/2008 | 25 | 4,100 | 4,541,667 | 5.0% | 7,000,000 | 5.0% | $387,998 | 5.1% |

| Woodlawn Court | Chicago, IL | 1923/2005 | 30 | N/A | 4,000,000 | 4.4% | 6,200,000 | 4.4% | $320,203 | 4.2% |

| Harper Court | Chicago, IL | 1910/NAP | 18 | N/A | 2,020,833 | 2.2% | 3,380,000 | 2.4% | $163,909 | 2.1% |

| 925 E 46th Street | Chicago, IL | 1930/2016 | 24 | N/A | 1,791,667 | 2.0% | 2,760,000 | 2.0% | $163,485 | 2.1% |

| Yankee Hill | Kansas City, MO | 1913/2008 | 16 | N/A | 1,583,333 | 1.8% | 2,420,000 | 1.7% | $128,680 | 1.7% |

| Drexel Terrace | Chicago, IL | 1913/NAP | 25 | N/A | 1,416,667 | 1.6% | 2,810,000 | 2.0% | $117,315 | 1.5% |

| Gillham House | Kansas City, MO | 1910/2008 | 24 | N/A | 1,395,833 | 1.6% | 2,200,000 | 1.6% | $143,185 | 1.9% |

| Cornell Terrace | Chicago, IL | 1924/NAP | 14 | N/A | 1,229,167 | 1.4% | 2,000,000 | 1.4% | $100,269 | 1.3% |

| 5508 Cornell | Chicago, IL | 1920/2002 | 3 | N/A | 624,999 | 0.7% | 1,200,000 | 0.9% | $50,224 | 0.7% |

| Total/Weighted Average | | 979 | 32,187 | $90,000,000 | 100.0% | $140,530,000 | 100.0% | $7,649,597 | 100.0% |

Sources and Uses

| Sources | | | | | Uses | | | |

| Original loan amount | $[90,000,000] | | [76.0]% | | Loan Payoff | $[114,550,784] | | [96.7]% |

| Mezzanine loan | [18,000,000] | | [15.2] | | Closing costs | [3,275,767] | | [2.8] |

| Equity | [10,435,410] | | [8.8] | | Reserves | [608,859] | | [0.5] |

| Total Sources | [$118,435,410] | | 100.0% | | Total Uses | [$118,435,410] | | 100.0% |

The Properties.The LARP I Portfolio Properties comprise a mix of low-rise, garden, mid-rise and high-rise multifamily buildings totaling 979 multifamily units (comprising 91.7% of underwritten gross potential rent) and 32,187 square feet of ground floor retail space (comprising 8.3% of underwritten gross potential rent) located in Chicago, Illinois and Kansas City, Missouri. The multifamily units were 93.3% occupied and the retail space was 98.2% occupied as of the November 11, 2017 rent rolls. There are 14 multifamily properties totaling 718 units located in the Hyde Park and Kenwood neighborhoods of Chicago, Illinois, ranging in size from 3 to 145 units, accounting for 78.7% of total multifamily base rent. Four of the Chicago properties contain a total of 32,187 square feet of ground-level retail space, which accounts for 8.3% of total underwritten base rent. There are four multifamily properties totaling 261 units located in Kansas City, Missouri, ranging in size from 16 to 115 units, accounting for 21.3% of total multifamily gross potential rent. The largest property, Blackwood, has 145 units and comprises 19.5% of total gross potential rent, with no other property accounting for more than 10% of total gross potential rent. Only two properties individually account for more than 10% of underwritten net cash flow and include Blackwood (18.7% of underwritten NCF) and 5500 Cornell (13.1% of underwritten NCF).

The LARP I Portfolio Properties were constructed between 1903 and 1965 and acquired by the borrower between 2003 and 2006. Approximately $63.3 million was subsequently spent on renovations and capital improvements. The majority of the properties located in Chicago were substantially renovated at an aggregate cost of $27.4 million ($38,155 per unit) and the properties located in Kansas City underwent full historic rehabilitations at an aggregate cost of $36.0 million ($137,752 per unit). The Chicago Properties are located within approximately 2 miles of the University of Chicago and the Kansas City Properties are located within approximately 2.5 miles from the University of Missouri-Kansas City. Approximately 27.9% of the Chicago units and approximately 23.8% of the Kansas City units are leased to students.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 16 |

The following table presents certain information relating to the multifamily unit mix of the LARP I Portfolio Properties:

Multifamily Unit Mix Summary(1)

| Property Name | Neighborhood | Specific Property Type | Units | SF(2) | Average Unit Size(3) | Studio | 1 BR | 2 BR | 3 BR | 4 BR | Occupancy | |

| |

| Blackwood | Hyde Park | High Rise | 145 | 90,485 | 624 | 0 | 48 | 97 | 0 | 0 | 91.0% | |

| 5500 Cornell | Hyde Park | Garden | 65 | 53,387 | 521 | 41 | 2 | 9 | 7 | 6 | 96.9% | |

| Clyde Manor | Kansas City | Mid Rise | 115 | 61,111 | 532 | 17 | 63 | 35 | 0 | 0 | 90.0% | |

| Woodlawn Terrace | Kenwood | Garden | 104 | 47,322 | 455 | 78 | 12 | 14 | 0 | 0 | 97.0% | |

| Park Central | Kansas City | Mid Rise | 106 | 46,708 | 441 | 60 | 46 | 0 | 0 | 0 | 88.0% | |

| Maple Court | Kenwood | Garden | 68 | 41,151 | 568 | 2 | 62 | 4 | 0 | 0 | 97.0% | |

| Ellis Street | Kenwood | Garden | 80 | 36,666 | 458 | 36 | 21 | 23 | 0 | 0 | 95.0% | |

| Drexel Grand | Hyde Park | Garden | 74 | 30,970 | 419 | 42 | 30 | 2 | 0 | 0 | 97.3% | |

| Ellis Court | Hyde Park | Garden | 43 | 27,050 | 490 | 23 | 19 | 1 | 0 | 0 | 95.0% | |

| Kenwood Court | Hyde Park | Garden | 25 | 21,585 | 699 | 0 | 4 | 21 | 0 | 0 | 88.0% | |

| Woodlawn Court | Hyde Park | Garden | 30 | 24,030 | 801 | 0 | 0 | 24 | 6 | 0 | 87.0% | |

| Harper Court | Hyde Park | Garden | 18 | 14,955 | 831 | 1 | 10 | 7 | 0 | 0 | 100.0% | |

| 925 E 46th Street | North Kenwood | Garden | 24 | 22,918 | 955 | 0 | 5 | 12 | 7 | 0 | 100.0% | |

| Yankee Hill | Kansas City | Mid Rise | 16 | 15,021 | 939 | 0 | 0 | 16 | 0 | 0 | 87.5% | |

| Drexel Terrace | Kenwood | Garden | 25 | 17,825 | 713 | 0 | 12 | 12 | 1 | 0 | 96.0% | |

| Gillham House | Kansas City | Mid Rise | 24 | 10,056 | 419 | 12 | 12 | 0 | 0 | 0 | 92.0% | |

| Cornell Terrace | Hyde Park | Garden | 14 | 9,619 | 687 | 3 | 4 | 5 | 1 | 1 | 100.0% | |

| 5508 Cornell | Hyde Park | Garden | 3 | 5,760 | 1,920 | 0 | 0 | 0 | 0 | 3 | 66.7% | |

| Total/Weighted Average | | 979 | 576,619(2) | | 315 | 350 | 282 | 22 | 10 | 93.3% | |

| (1) | Information obtained from the appraisal and underwritten rent roll. |

| (2) | SF includes 32,187 square feet of retail space located at the 5500 Cornell, Maple Court, Ellis Court and Kenwood Court properties. |

| (3) | Average Unit Size reflects average square feet per multifamily unit only. |

The following table presents historical occupancy percentages at the LARP I Portfolio Properties:

Historical Occupancy(1)

12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 11/11/2017(2) |

| 93.3% | 93.8% | 95.7% | 95.0% | 93.3% |

| | | | | |

| (1) | Information obtained from the borrower. |

| (2) | Information obtained from the underwritten rent roll. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 17 |

Operating History and Underwritten Net Cash Flow.The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the LARP I Portfolio Properties:

Cash Flow Analysis

| | 2014 | 2015 | 2016 | TTM 9/30/2017 | U/W | % of U/W Effective Gross Income | U/W $ per Bed |

| Gross Potential Rent | $12,000,426 | $12,312,956 | $13,046,371 | $13,433,958 | $13,656,676(1) | 104.7% | $13,950 |

| Discounts/Concessions | (266,594) | (276,269) | (502,635) | (351,836) | (345,136) | (2.6) | (353) |

| Other Income(2) | 688,570 | 717,621 | 846,823 | 804,026 | 804,026 | 6.2 | 821 |

| Less Vacancy & Credit Loss | (826,638) | (710,245) | (952,861) | (1,011,726) | (1,071,187)(3) | (7.8) | (1,094) |

| | | | | | | | |

| Effective Gross Income | $11,595,763 | $12,044,063 | $12,437,698 | $12,874,422 | $13,044,379 | 100.0% | $13,324 |

| | | | | | | | |

| Total Operating Expenses(4) | $5,447,825 | $5,384,208 | $5,201,898 | $5,216,323 | $5,394,782 | 41.4% | $5,511 |

| | | | | | | | |

| Net Operating Income | $6,147,939 | $6,659,855 | $7,235,799 | $7,658,099 | $7,649,597 | 58.6% | $7,814 |

| Capital Expenditures | 0 | 0 | 0 | 0 | 251,983 | 1.9 | 257 |

| Other | 0 | 0 | 0 | 0 | 11,272 | 0.1 | 12 |

| Net Cash Flow | $6,147,939 | $6,659,855 | $7,235,799 | $7,658,099 | $7,386,342 | 56.6% | $7,545 |

| | | | | | | | |

| NOI DSCR | 1.35xx | 1.46x | 1.58x | 1.68x | 1.68x | | |

| NCF DSCR | 1.35xx | 1.46x | 1.58x | 1.68x | 1.62x | | |

| NOI DY | 6.8% | 7.4% | 8.0% | 8.5% | 8.5% | | |

| NCF DY | 6.8% | 7.4% | 8.0% | 8.5% | 8.2% | | |

| (1) | U/W Gross Potential Rent is comprised of $12,526,188 of residential income (91.7% of U/W Base Rent) and $1,130,488 of retail income (8.3% of U/W Gross Potential Rent). |

| (2) | Other income includes move-in and application fees, late fees, laundry income, lease termination fees, parking income and pet fees. |

| (3) | The underwritten economic vacancy is 7.8%. The LARP I Portfolio Properties were 93.3% physically occupied as of November 11, 2017. Underwritten Vacancy reflects an 8.1% vacancy rate on the multifamily component of Base Rent and a 5% vacancy rate on the commercial component of Base Rent. |

| (4) | The four LARP I Portfolio Properties located in Kansas City, Missouri are subject to a tax abatement under Chapter 353 of the Missouri Urban Redevelopment Corporations law that provides for a tax abatement in connection with the redevelopment of real property that has been found to be a “blighted area” by the city in which they are located. The tax abatement is in place until 2028. Underwritten taxes for such four LARP I Portfolio Properties are based on the abatement and total $2,988. The appraiser’s estimated stabilized taxes for such LARP I Portfolio Properties assuming no abatement are $128,834. |

Appraisal.As of the appraisal valuation dates of November 3, 2017 and November 10, 2017 the LARP I Portfolio Properties had an aggregate “as-is” appraised value of $140,530,000.

Environmental Matters.According to the Phase I environmental assessments dated November 13, 2017 and November 16th, 2017 there was no evidence of any recognized environmental conditions at the LARP I Portfolio Properties.

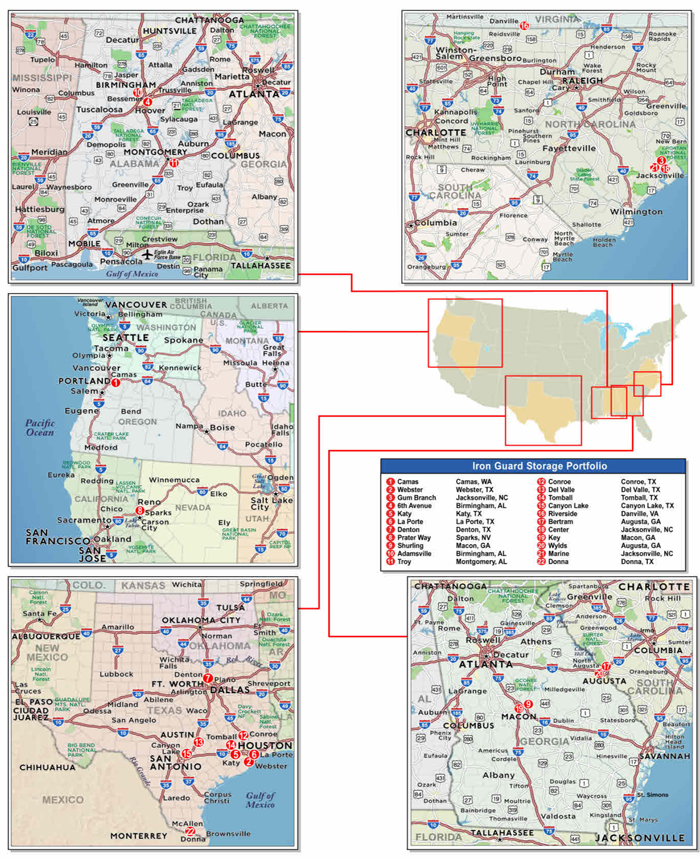

Market Overview and Competition.The LARP I Portfolio Properties are concentrated in the Bronzeville/Hyde Park/South Shore submarket of Chicago, Illinois and the Central Kansas City submarket of Kansas City, Missouri. There are 14 properties (718 units, 79.8% of underwritten net cash flow) located in the Chicago apartment market, which are concentrated in the Bronzeville/Hyde Park/South Shore submarket. According to the appraisal, the Chicago apartment market contained 708,408 apartment units with an occupancy rate of 95.3% as of the third quarter of 2017, a decline of 5 basis points over the previous quarter, and an average occupancy rate of 95.3% since 2012. The Bronzeville/Hyde Park/South Shore submarket contained 58,916 apartment units with an occupancy rate of 94.3% as of the third quarter of 2017, an increase of 9 basis points over the prior quarter, and an average occupancy rate of 94.3% since 2012. According to the appraisals, there are currently five multifamily properties under construction in the Bronzeville/Hyde Park/South Shore submarket expected to comprise of 501 units. Four of the LARP I Portfolio Properties located in Chicago contain ground-floor retail space. The Chicago retail market had a vacancy rate of 6.7% as of the third quarter of 2017, remaining unchanged over the previous quarter. As of the third quarter of 2017, the South Chicago retail submarket had a total inventory of 45,989,385 square feet with a vacancy rate of 6.1%. The LARP I Portfolio Properties located in Chicago are generally located within approximately 2 miles of the University of Chicago. Approximately 27.9% of the units at the Chicago properties are leased to students.

There are four properties (261 units, 20.2% of underwritten net cash flow) located in the Kansas City apartment market, which are concentrated in the Central Kansas City submarket. According to the appraisals, the Kansas City apartment market contained 152,182 apartment units with an occupancy rate of 94.5% as of the third quarter of 2017, a decline of 3 basis points over the previous quarter, and an average occupancy rate of 94.4% since 2012. The Central Kansas City submarket contained 23,018 apartment units with an occupancy rate of 93.3% as of the third quarter of 2017, a decline of 4 basis points over the prior quarter, and an average occupancy rate of 94.3% since 2012. According to the appraisals, there are 26 properties that have been completed or are under construction in the submarket comprising 3,734 units, of which three properties comprised of 517 units currently under construction in the midtown Kansas City are expected to be competitive with LARP I Portfolio properties located in Kansas City. The LARP I Portfolio Properties located in Kansas City are generally located within 2.5 miles of the University of Missouri-Kansas City. Approximately 23.8% of the units at the Kansas City properties are leased to students.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 18 |

The following table presents certain information relating to some comparable multifamily properties for the LARP I Portfolio Properties:

Competitive Set(1)

| Property Name | City/State | Market | Building Type | Units | Appraised Value | Appraised Value/Unit | Sales Comparables Value/Unit Range (Unadjusted) | |

| |

| Blackwood | Chicago, IL | Chicago | High Rise | 145 | $26,200,000 | $180,690 | $118,145 - $197,500 | |

| 5500 Cornell | Chicago, IL | Chicago | Garden | 65 | $19,000,000 | $292,308 | $174,074 - $303,960 | |

| Clyde Manor | Kansas City, MO | Kansas City | Mid Rise | 115 | $12,930,000 | $112,435 | $86,806 - $132,692 | |

| Woodlawn Terrace | Chicago, IL | Chicago | Garden | 104 | $10,600,000 | $101,923 | $79,592 - $150,926 | |

| Park Central | Kansas City, MO | Kansas City | Mid Rise | 106 | $9,880,000 | $93,208 | $86,806 - $132,692 | |

| Maple Court | Chicago, IL | Chicago | Garden | 68 | $8,760,000 | $128,824 | $116,692 - $174,074 | |

| Ellis Street | Chicago, IL | Chicago | Garden | 80 | $8,350,000 | $104,375 | $83,824 - $118,145 | |

| Drexel Grand | Chicago, IL | Chicago | Garden | 74 | $7,800,000 | $105,405 | $79,592 - $118,145 | |

| Ellis Court | Chicago, IL | Chicago | Garden | 43 | $7,040,000 | $163,721 | $118,145 - $258,333 | |

| Kenwood Court | Chicago, IL | Chicago | Garden | 25 | $7,000,000 | $280,000 | $208,333 - $320,000 | |

| Woodlawn Court | Chicago, IL | Chicago | Garden | 30 | $6,200,000 | $206,667 | $150,926 - $281,250 | |

| Harper Court | Chicago, IL | Chicago | Garden | 18 | $3,380,000 | $187,778 | $118,145 - $197,500 | |

| 925 E 46th Street | Chicago, IL | Chicago | Garden | 24 | $2,760,000 | $115,000 | $79,592 - $150,926 | |

| Yankee Hill | Kansas City, MO | Kansas City | Mid Rise | 16 | $2,420,000 | $151,250 | $84,167 - $132,692 | |

| Drexel Terrace | Chicago, IL | Chicago | Garden | 25 | $2,810,000 | $112,400 | $79,592 - $118,145 | |

| Gillham House | Kansas City, MO | Kansas City | Mid Rise | 24 | $2,200,000 | $91,667 | $84,167 - $132,692 | |

| Cornell Terrace | Chicago, IL | Chicago | Garden | 14 | $2,000,000 | $142,857 | $86,667 - $197,500 | |

| 5508 Cornell | Chicago, IL | Chicago | Garden | 3 | $1,200,000 | $400,000 | $330,000 - $460,000 | |

| (1) | Information obtained from the appraisal and underwritten rent roll. |

The following table presents certain information relating to the units and rent at the LARP I Portfolio Properties located in Chicago:

| Unit Type | # of Units | Avg SF per Unit | Monthly Market Rent per Unit(2) | Monthly Actual Rent per Unit(2) | Underwritten Monthly Rent per Unit(2) | |

| |

| Studio | 226 | 355 | $861 | $858 | $858 | |

| 1 Bedroom | 229 | 524 | $1,089 | $1,094 | $1,094 | |

| 2 Bedroom | 231 | 763 | $1,342 | $1,381 | $1,381 | |

| 3 Bedroom | 22 | 970 | $1,548 | $1,458 | $1,458 | |

| 4 Bedroom | 10 | 1,383 | $2,369 | $2,444 | $2,444 | |

| Commercial(2) | 26 | 1,238 | $16.54 | $35.22 | $35.22 | |

| Total/Weighted Average(3) | 718 | 3,994 | $1,130 | $1,221 | $1,221 | |

| (1) | Information obtained from the appraisal and underwritten rent roll. |

| (2) | Commercial Monthly Market Rent per Unit is based on square footage (SF). |

| (3) | Total/Weighted Averages only reflect multifamily units and excludes the Commercial Units. |

The following table presents certain information relating to the units and rent at the LARP I Portfolio Properties located in Kansas City:

| Unit Type | # of Units | Avg SF per Unit | Monthly Market Rent per Unit | Monthly Actual Rent per Unit | Underwritten Monthly Rent per Unit | |

| |

| Studio | 89 | 396 | $734 | $722 | $722 | |

| 1 Bedroom | 121 | 489 | $862 | $850 | $850 | |

| 2 Bedroom | 51 | 754 | $1,090 | $1,081 | $1,081 | |

| Total/Weighted Average | 261 | 1,639 | $863 | $854 | $854 | |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| |

| 19 |

The Borrower.The borrowers are 18 separate Delaware limited liability companies, which are single purpose entities with two independent directors. Legal counsel to the borrower provided a non-consolidation opinion in connection with the origination of the LARP I Portfolio Mortgage Loan. LARP Holdings, LLC, a Delaware limited liability company, is 100% owner of the borrowers. David Gefsky, Eli Ungar (together, the “Individual LARP I Portfolio Guarantors”) and LARP Holdings, LLC are the guarantors of certain nonrecourse carveouts under the LARP I Portfolio Mortgage Loan; however, only LARP Holdings, LLC (and not the Individual LARP I Portfolio Guarantors) is liable under the environmental indemnity. The Individual LARP I Portfolio Guarantors are liable under the non-recourse carveout guaranty only for certain voluntary and collusive bankruptcy events, failure to comply with single purpose entity covenants (which is loss recourse only, unless substantive consolidation of the LARP I Portfolio Borrowers with another entity results) and prohibited transfers of the LARP I Portfolio Properties and are not liable for other non-recourse carveouts, such as intentional misrepresentation, misappropriation of rents, casualty and condemnation proceeds and security deposits, waste, breaches of environmental provisions in the loan documents and prohibited transfers of interest in the borrowers. Further, at such time as LARP Holdings, LLC’s financial statements evidence a net worth of not less than $50,000,000 and liquidity of not less than $2,000,000 (in each case excluding the LARP I Portfolio Properties), the Individual LARP I Portfolio Guarantors will be released from all obligations and liabilities under the non-recourse carveout guaranty for events occurring after such date.

The Borrower Sponsors.The borrower sponsor is Antheus Capital, a Delaware limited partnership, which serves as the managing member of LARP Holdings Manager, LLC, the manager of LARP Holdings, LLC. Antheus Capital (“Antheus”) is a private real estate company focused on the acquisition, development and redevelopment of apartment properties located in submarkets throughout the United States. Antheus was founded in 2002 by Eli Ungar and David Gefsky. Today the portfolio consists of approximately 7,200 multifamily units and 400,000 square feet of commercial space with 4,851 units owned/managed in Chicago, 1,481 units owned/managed in Kansas City and 867 units owned/managed in St. Louis.

Escrows.The loan documents provide for upfront reserves of $413,520 for taxes, $147,650 for insurance premiums and $47,439 for required repairs. The loan documents also provide for ongoing monthly reserves of 1/12 of annual real estate taxes (currently $68,920) for taxes, 1/12 of annual insurance premiums (currently $14,765) (provided that such insurance reserve deposits will be waived so long as acceptable blanket insurance policies are in place) for insurance reserves (provided that such insurance reserve deposits will be waived so long as acceptable blanket insurance policies are in place), $20,999 for replacement reserves for residential units, $403 for replacement reserves for commercial units and $940 for rollover reserves for commercial units, subject to a cap of 36 times the then-current monthly deposit..

Lockbox and Cash Management.