NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(All amount in thousands, except share and per share data, unless otherwise stated)

| 23. | Subsequent events (continued) |

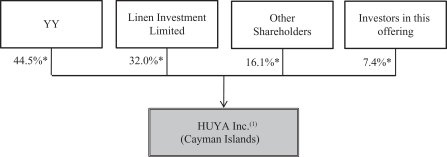

A-2 preferred shares or Series B-2 preferred shares, shall convert into an equal number of Low Vote Shares, which are Class A ordinary shares, Series A-1 preferred shares or Series B-1 preferred shares. Upon the closing of a qualified IPO, each Series A-2 and Series B-2 preferred share would automatically be converted into a Class B ordinary share, while each Series A-1 and Series B-1 preferred share would automatically be converted into a Class A ordinary share. After a qualified IPO, upon any sale, transfer, assignment or disposition of any Class B ordinary share by a shareholder to any person who is not an affiliate of such shareholder, or upon a change of ultimate beneficial ownership of any Class B ordinary share to any person who is not an affiliate of the registered shareholder of such share, such Class B ordinary share shall be automatically and immediately converted into one Class A ordinary share. Except for conversion rights and voting rights, holders of Class A and Class B ordinary shares have the same rights, Series A-1 and Series A-2 preferred shares have the same rights, and Series B-1 and Series B-2 have the same rights, respectively. High Vote Shares are held by YY, the CEO of Huya and Tencent, respectively, representing 58.0%, 2.9% and 38.0% voting interest in the Company on an as-converted basis, as of the closing of the Transaction.

Upon the completion of the Transaction, the Company’s Board of Directors consists three directors, in which YY appointed two directors and Tencent appointed one director. As YY has the majority of voting power, YY remains control over the Company.

b) On February 5, 2018, Tencent and the Company, through their respective PRC affiliated entities, entered into a business cooperation agreement, which became effective on March 8, 2018. Pursuant to the agreement, both parties agreed to establish strategic cooperation relationship in various areas, including game publishing and operation, live game streaming content provision and broadcaster management. Detail cooperation terms will be negotiated on a case by case basis in the normal course of business. This agreement has a term of three years, which will be renewed subject to both parties’ negotiation.

c) On March 8, 2018, YY and the Company, through their respective PRC affiliated entities, entered into a non-compete agreement. Pursuant to the agreement, YY agree not to compete with the Company in those areas relating to the Company’s core business, for a term of four years from the date of this non-compete agreement.

d) On March 8, 2018, YY and the Company, through their respective PRC affiliated entities, entered into a business cooperation agreement, which sets out terms of the cooperation in following areas:

i) YY provides payment handling support service to the Company with the charge at the lower of market price and cost;

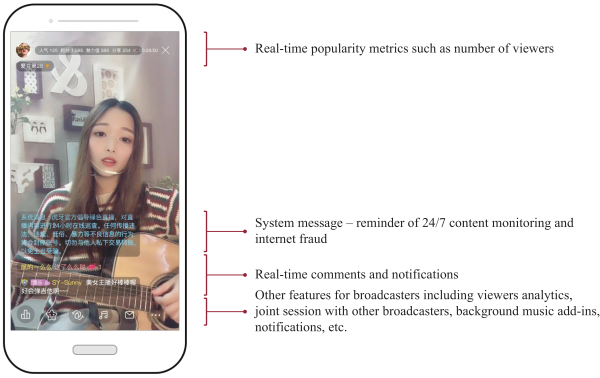

ii) The Company can use the content monitoring system provided by YY free of charge; and

iii) YY and the Company will not recruit broadcasters, who have entered into exclusive agreements, from the counter parties.

The business cooperation agreement has an initial term of five years from January 1, 2018 to December 31, 2022 and will be automatically renewed for one year unless any party refuses to renew.

e) (Unaudited) On March 20, 2018 and March 22, 2018, YY sold its 1,397,059 Class B ordinary shares to one of the holders of the Series A-1 preferred shares and 6,985,294 Class B ordinary shares to one third party investor, respectively, at a price of US$7.16 per share. Such Class B ordinary shares were automatically converted into an equal number of Class A ordinary shares.

f) (Unaudited) On March 15, 2018, the Company granted 6,102,353 share options with an exercise price of US$2.55 to the Company’s chairman and certain consultants with the same terms as those of share options granted in 2017, which have been disclosed in Note 18(b). The grant date fair value of the option was

F-52

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China.

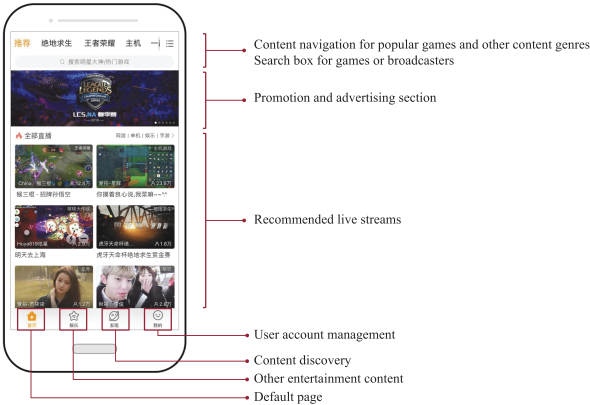

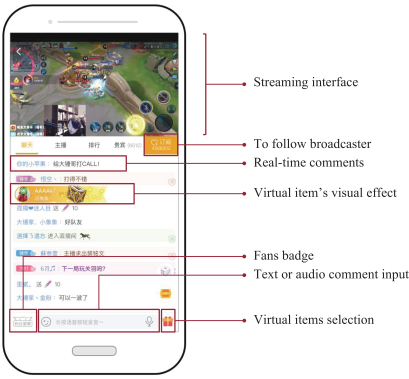

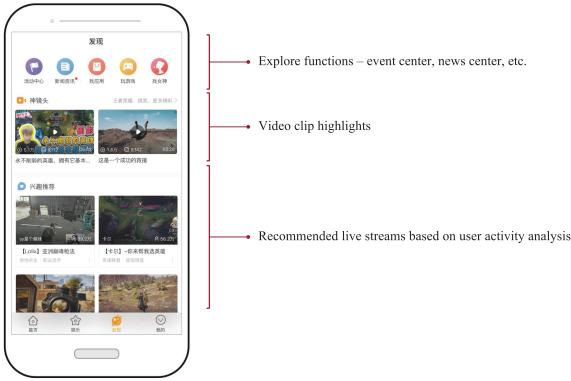

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China. )” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant (

)” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant ( )” and “Huya Mobile Game (

)” and “Huya Mobile Game ( )” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

)” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

,” and “

,” and “ ” trademarks, and are in the process to register additional 561 trademarks. We have obtained a royalty-free and exclusive license from Guangzhou Huaduo to use 39 patents, 18 of which are under application.

” trademarks, and are in the process to register additional 561 trademarks. We have obtained a royalty-free and exclusive license from Guangzhou Huaduo to use 39 patents, 18 of which are under application.