NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

(All amount in thousands, except share and per share data, unless otherwise stated)

| 23. | Subsequent events (continued) |

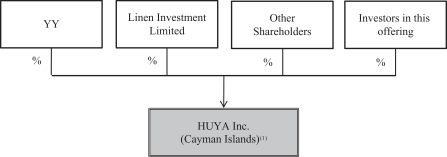

e) (Unaudited) On March 20, 2018 and March 22, 2018, YY sold its 1,397,059 Class B ordinary shares to one of the holders of the Series A-1 preferred shares and 6,985,294 Class B ordinary shares to one third party investor, at a price of US$7.16 per share. Such Class B ordinary shares were automatically converted into an equal number of Class A ordinary shares.

f) (Unaudited) On March 15, 2018, the Company granted 6,102,353 share options with an exercise price of $2.55 to the Company’s chairman and certain employees with the same terms as those of share options granted in 2017, which have been disclosed in Note 18(b). The Company is in the process of assessing the fair value of these share options.

(g) (Unaudited) On March 31, 2018, the Company granted 3,655,084 restricted shares units to certain employees. The grant date fair value was estimated to be approximately US$7.16 per share.

h) (Unaudited) On March 31, 2018, the Board of Directors approved the amended and restated 2017 Share Incentive Plan. The maximum number of shares that may be issued has been increased from 17,647,058 shares to 28,394,117 shares.

i) (Unaudited) On March 31, 2018, the Company has set up Solo Star—Light Eagle Trust as equity incentive trust for the purpose of holding share awards granted to certain employees and underlying shares before they are exercised as instructed by the employees.

Relevant PRC laws and regulations permit payments of dividends by the Group’s entities incorporated in the PRC only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. In addition, the Company’s entities in the PRC are required to annually appropriate 10% of their netafter-tax income to the statutory general reserve fund prior to payment of any dividends, unless such reserve funds have reached 50% of their respective registered capital. As a result of these and other restrictions under PRC laws and regulations, the Company’s entities incorporated in the PRC are restricted in their ability to transfer a portion of their net assets to the Company either in the form of dividends, loans or advances, which restricted portion as calculated under U.S. GAAP amounted to RMB75,627 and RMB166,267 as of December 31, 2016 and 2017. There are no differences between U.S. GAAP and PRC accounting standards in connection with the reported net assets of the legally owned subsidiaries in the PRC and the VIE. Even though the Company currently does not require any such dividends, loans or advances from the PRC entities for working capital and other funding purposes, the Company may in the future require additional cash resources from them due to changes in business conditions, to fund future acquisitions and development, or merely to declare and pay dividends or distributions to its shareholders. Except for the above, there is no other restriction on use of proceeds generated by the Group’s subsidiaries and VIE to satisfy any obligations of the Company.

For the year ended December 31, 2016, it was not applicable for the Group to disclose the condensed financial information for the parent company as the Company had not been incorporated as of December 31, 2016.

For the year ended December 31, 2017, the Company performed a test on the restricted net assets of subsidiaries and VIE in accordance with Securities and Exchange Commission RegulationS-X Rule4-08 (e) (3), “General Notes to Financial Statements” and concluded that the restricted net assets exceeded 25% of the consolidated net assets of the Company as of December 31, 2017 and the condensed financial information of the Company are required to be presented (Note 25).

| 25. | Additional information—condensed financial statements |

The condensed financial statements of the Company have been prepared in accordance with SEC RegulationS-X Rule5-04 and Rule12-04.

F-55

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China.

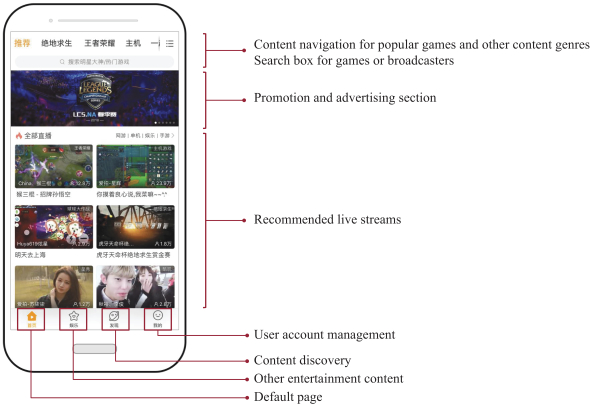

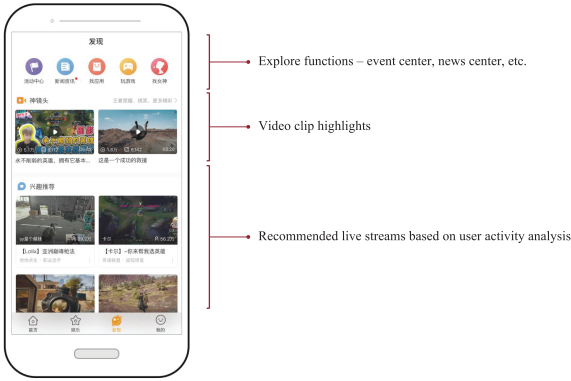

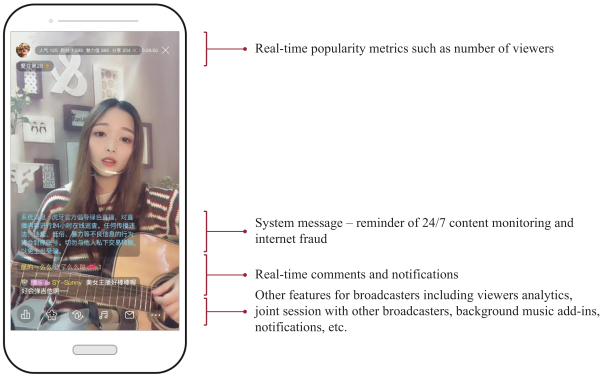

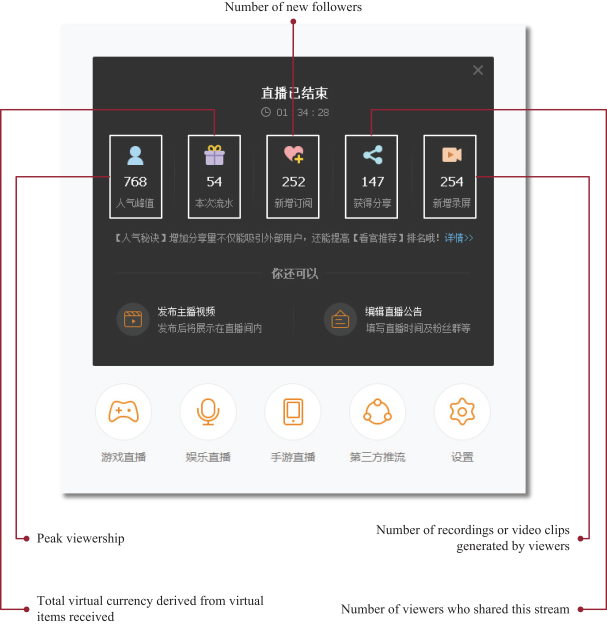

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China. )” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant (

)” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant ( )” and “Huya Mobile Game (

)” and “Huya Mobile Game ( )” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

)” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

,” and “

,” and “ ” trademarks, and are in the process to register additional 445 trademarks. We have obtained a royalty-free and exclusive license from YY to use 11 patents and technologies that are the subjects of 28 patent applications. relating to our business.

” trademarks, and are in the process to register additional 445 trademarks. We have obtained a royalty-free and exclusive license from YY to use 11 patents and technologies that are the subjects of 28 patent applications. relating to our business.