DESCRIPTION OF SHARE CAPITAL

We are a Cayman Islands exempted company with limited liability and our corporate affairs are governed by our memorandum and articles of association, as amended from time to time and the Companies Law (2018 Revision) of the Cayman Islands, which we refer to as the Companies Law below, and the common law of the Cayman Islands.

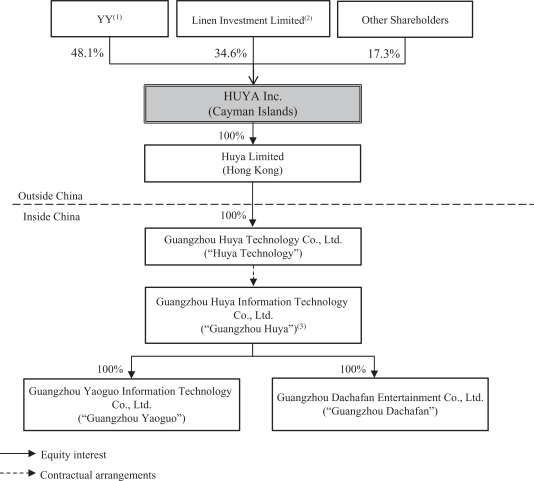

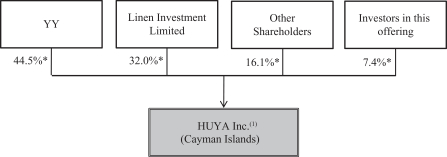

As of the date of this prospectus, the authorized share capital of our company is US$50,000 divided into 500,000,000 shares with a par value of US$0.0001 each, and (i) 249,957,163 shares are designated as Class A ordinary shares, (ii) 99,007,544 shares are designated as Class B ordinary shares, (iii) 17,647,058 shares are designated as series A-1 preferred shares, (iv) 4,411,765 shares are designated as series A-2 preferred shares, (v) 64,488,235 shares are designated as series B-1 preferred shares, and (vi) 64,488,235 shares are designated as series B-2 preferred shares. As of the date of this prospectus, 9,742,679 Class A ordinary shares, 90,257,321 Class B ordinary shares, 17,647,058 series A-1 preferred shares, 4,411,765 series A-2 preferred shares, and 64,488,235 series B-2 preferred shares are issued and outstanding.

Immediately prior to the completion of this offering, all series A-1 preferred shares, series A-2 preferred shares, series B-1 preferred shares and series B-2 preferred shares will be redesignated and converted. Immediately upon the completion of this offering, our authorized share capital will be US$100,000 divided into 1,000,000,000 shares comprising (i) 750,000,000 Class A ordinary shares of par value US$0.0001 each, (ii) 200,000,000 Class B ordinary shares of par value US$0.0001 each and (iii) 50,000,000 shares of par value US$0.0001 each of such class or classes (however designated) as our board of directors may determine in accordance with our post-offering amended and restated memorandum and articles of association. We will have 42,389,737 Class A ordinary shares issued and outstanding, and 159,157,321 Class B ordinary shares issued and outstanding, assuming the underwriters do not exercise the over-allotment option.

Our Post-Offering Amended and Restated Memorandum and Articles of Association

We plan to adopt, subject to the approval of our shareholders, a third amended and restated memorandum and articles of association, which will become effective and replace our current memorandum and articles of association in its entirety immediately prior to the completion of this offering. The following are summaries of material provisions of our post-offering amended and restated memorandum and articles of association that we expect will become effective immediately prior to the closing of this offering and of the Companies Law, insofar as they relate to the material terms of our ordinary shares.

Objects of our company

Under our post-offering amended and restated memorandum and articles of association, the objects of our company are unrestricted and we have the full power and authority to carry out any object not prohibited by the laws of the Cayman Islands.

Ordinary shares

Our ordinary shares are divided into Class A ordinary shares and Class B ordinary shares. Holders of our Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. Our ordinary shares are issued in registered form and are issued when registered in our register of members. Our shareholders who arenon-residents of the Cayman Islands may freely hold and vote their shares.

Conversion

Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Upon any sale,

165

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China.

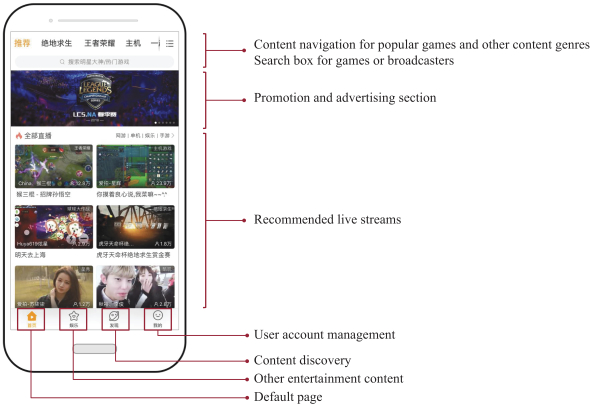

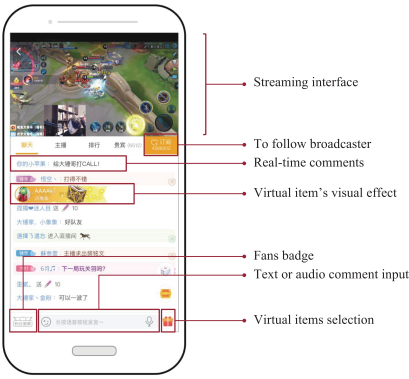

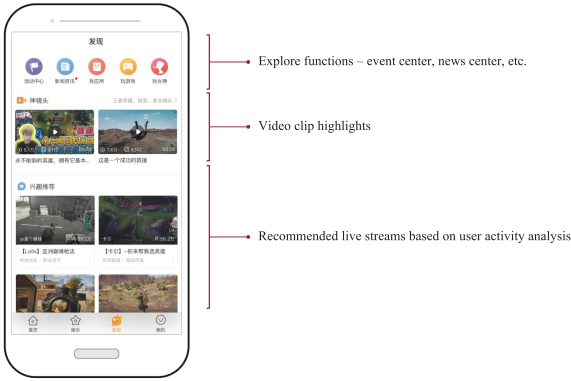

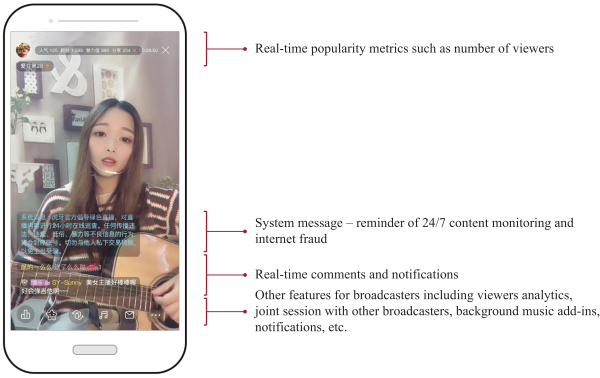

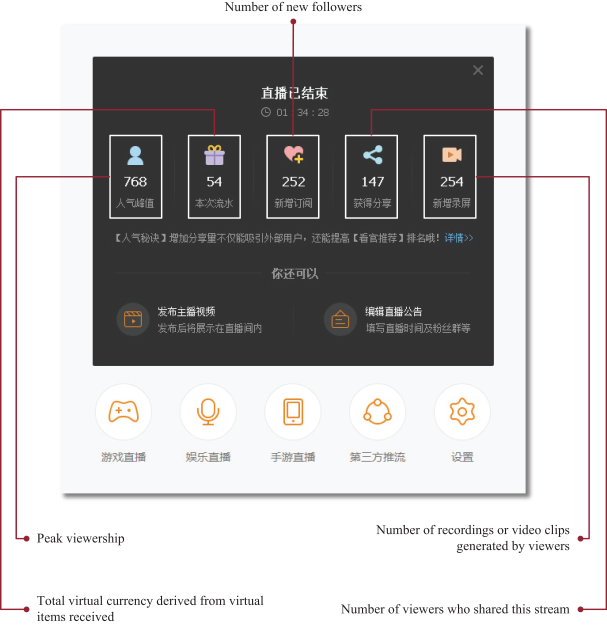

). This effective cooperation contributed to the subsequent rapid growth of the popularity of this game among the wider audience in China. )” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant (

)” mobile app or through the mobile-device-friendly website “m.huya.com.” Broadcasters may also conveniently live stream through our “Huya Assistant ( )” and “Huya Mobile Game (

)” and “Huya Mobile Game ( )” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

)” mobile apps. Our mobile apps are available for download from Apple App Store and various Android app stores. We also provide live streaming services through our PC website at www.huya.com and PC clients to both users and broadcasters.

,” and “

,” and “ ” trademarks, and are in the process to register additional 561 trademarks. We have obtained a royalty-free and exclusive license from Guangzhou Huaduo to use 39 patents, 18 of which are under application.

” trademarks, and are in the process to register additional 561 trademarks. We have obtained a royalty-free and exclusive license from Guangzhou Huaduo to use 39 patents, 18 of which are under application.