46Atlantic Lithium Limited Annual Report 2023 FINANCIAL STATEMENTS CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 47 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 48 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 49 CONSOLIDATED STATEMENT OF CASH FLOWS 50 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 51 Exhibit 99.3 47 Atlantic Lithium Limited Annual Report 2023 Notes 2023 $ 2022 $ Expenses Administration and consulting expenses (1,649,869) (1,081,132) Broker and investor relations (422,264) (393,782) Depreciation 3.3 (26,201) (16,827) Employee benefits expenses 5.1 (4,258,212) (2,124,940) Exploration costs written off 3.4 (39,533) (25,934) Interest expense (2) (1,644) Legal expenses (437,208) (1,039,711) Marketing and conferences (825,440) (564,473) Regulatory and compliance (291,345) (285,992) Share based payments 5.1 (3,544,028) (12,020,442) Unrealised foreign exchange gains (losses) (30,172) (927,941) Write down on demerger 6.3 - (16,228,010) Loss before income tax (11,524,274) (34,710,828) Income tax (expense) / benefit 2.3 (663,343) 63,282 Loss for the year (12,187,617) (34,647,546) Other comprehensive income Items that may be reclassified to profit or loss Exchange differences on translation of foreign operations 1,132,716 (5,774,884) Items that will not be reclassified to profit or loss Change in fair value of financial assets (467,512) 298,520 Income tax relating to change in fair value of financial assets 2.3 140,249 (90,750) Total comprehensive loss for the year attributable to the owners of Atlantic Lithium Limited (11,382,164) (40,214,660) Cents / share Cents / share Loss per share Basic loss per share 2.1 (2.0) (6.1) Diluted loss per share 2.1 (2.0) (6.1) The above consolidated statement of profit or loss and other comprehensive income should be read in conjunction with the accompanying notes. CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the year ended 30 June 2023

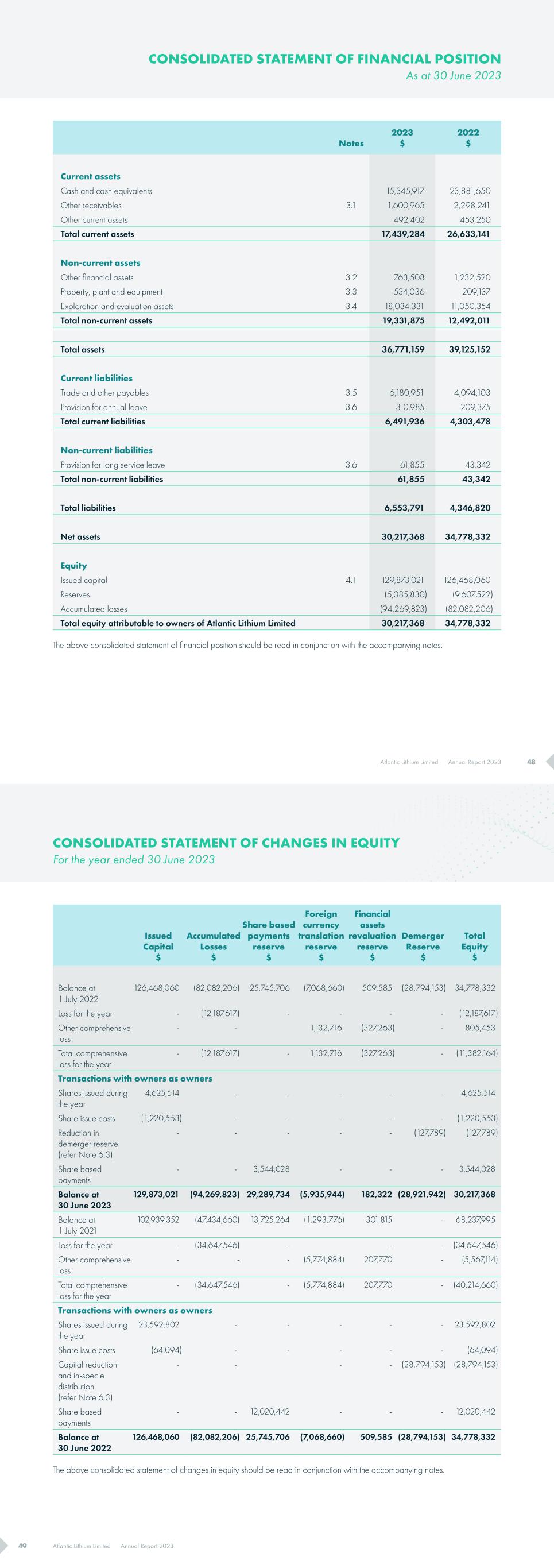

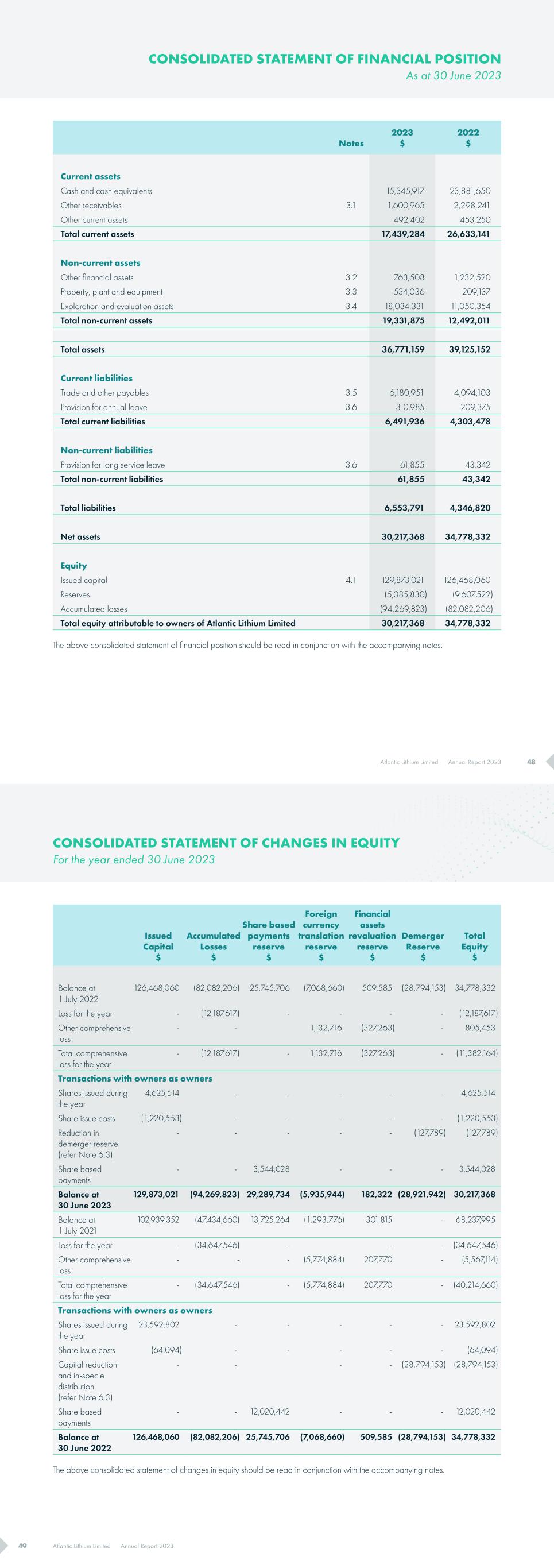

48Atlantic Lithium Limited Annual Report 2023 Notes 2023 $ 2022 $ Current assets Cash and cash equivalents 15,345,917 23,881,650 Other receivables 3.1 1,600,965 2,298,241 Other current assets 492,402 453,250 Total current assets 17,439,284 26,633,141 Non-current assets Other financial assets 3.2 763,508 1,232,520 Property, plant and equipment 3.3 534,036 209,137 Exploration and evaluation assets 3.4 18,034,331 11,050,354 Total non-current assets 19,331,875 12,492,011 Total assets 36,771,159 39,125,152 Current liabilities Trade and other payables 3.5 6,180,951 4,094,103 Provision for annual leave 3.6 310,985 209,375 Total current liabilities 6,491,936 4,303,478 Non-current liabilities Provision for long service leave 3.6 61,855 43,342 Total non-current liabilities 61,855 43,342 Total liabilities 6,553,791 4,346,820 Net assets 30,217,368 34,778,332 Equity Issued capital 4.1 129,873,021 126,468,060 Reserves (5,385,830) (9,607,522) Accumulated losses (94,269,823) (82,082,206) Total equity attributable to owners of Atlantic Lithium Limited 30,217,368 34,778,332 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at 30 June 2023 49 Atlantic Lithium Limited Annual Report 2023 Issued Capital $ Accumulated Losses $ Share based payments reserve $ Foreign currency translation reserve $ Financial assets revaluation reserve $ Demerger Reserve $ Total Equity $ Balance at 1 July 2022 126,468,060 (82,082,206) 25,745,706 (7,068,660) 509,585 (28,794,153) 34,778,332 Loss for the year - (12,187,617) - - - - (12,187,617) Other comprehensive loss - - 1,132,716 (327,263) - 805,453 Total comprehensive loss for the year - (12,187,617) - 1,132,716 (327,263) - (11,382,164) Transactions with owners as owners Shares issued during the year 4,625,514 - - - - - 4,625,514 Share issue costs (1,220,553) - - - - - (1,220,553) Reduction in demerger reserve (refer Note 6.3) - - - - - (127,789) (127,789) Share based payments - - 3,544,028 - - - 3,544,028 Balance at 30 June 2023 129,873,021 (94,269,823) 29,289,734 (5,935,944) 182,322 (28,921,942) 30,217,368 Balance at 1 July 2021 102,939,352 (47,434,660) 13,725,264 (1,293,776) 301,815 - 68,237,995 Loss for the year - (34,647,546) - - - (34,647,546) Other comprehensive loss - - - (5,774,884) 207,770 - (5,567,114) Total comprehensive loss for the year - (34,647,546) - (5,774,884) 207,770 - (40,214,660) Transactions with owners as owners Shares issued during the year 23,592,802 - - - - - 23,592,802 Share issue costs (64,094) - - - - - (64,094) Capital reduction and in-specie distribution (refer Note 6.3) - - - - (28,794,153) (28,794,153) Share based payments - - 12,020,442 - - - 12,020,442 Balance at 30 June 2022 126,468,060 (82,082,206) 25,745,706 (7,068,660) 509,585 (28,794,153) 34,778,332 The above consolidated statement of changes in equity should be read in conjunction with the accompanying notes. CONSOLIDATED STATEMENT OF CHANGES IN EQUITY For the year ended 30 June 2023

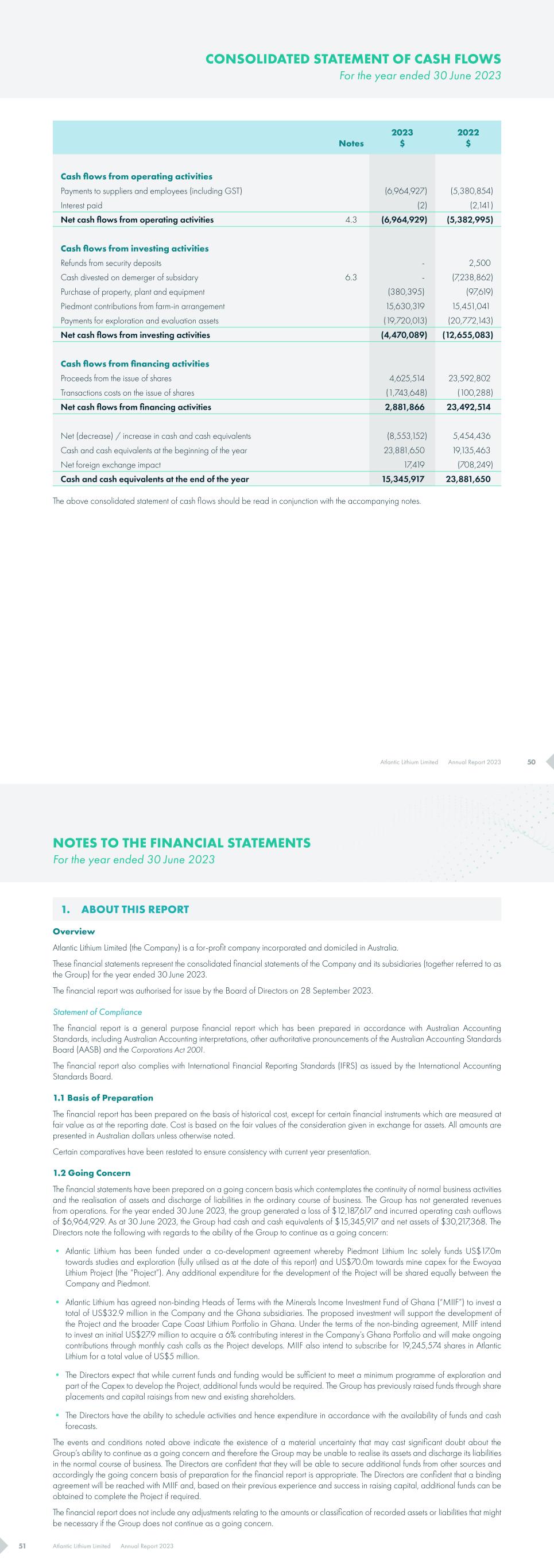

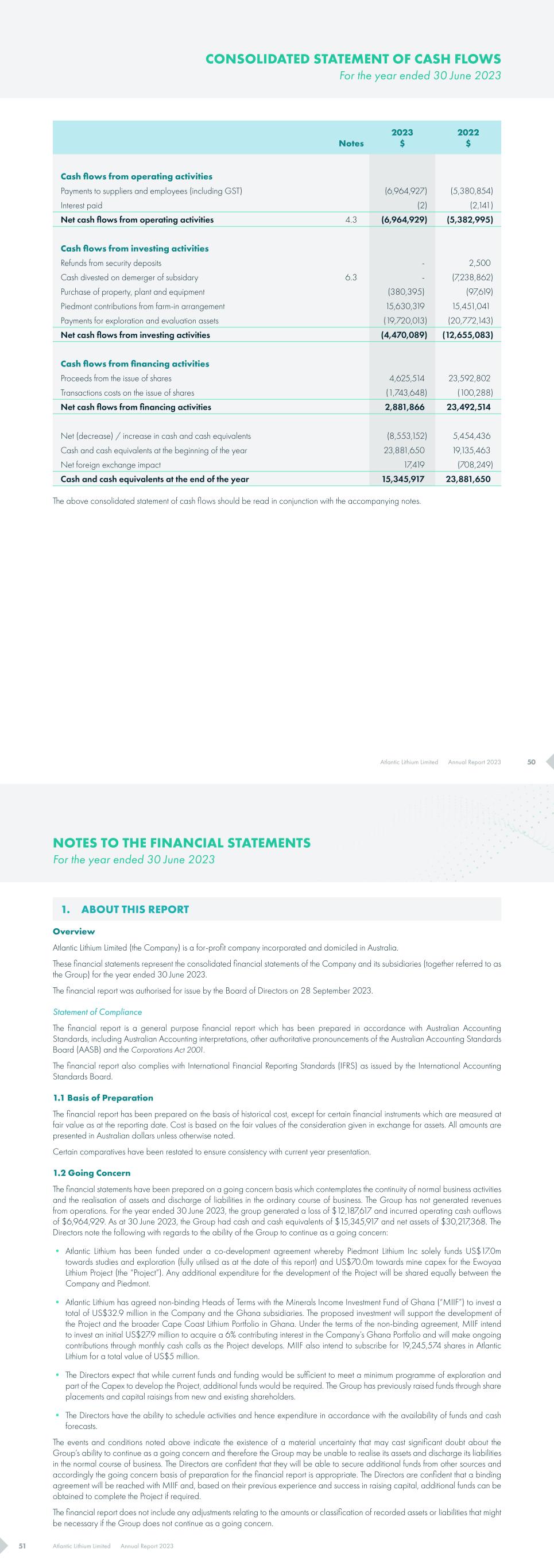

50Atlantic Lithium Limited Annual Report 2023 Notes 2023 $ 2022 $ Cash flows from operating activities Payments to suppliers and employees (including GST) (6,964,927) (5,380,854) Interest paid (2) (2,141) Net cash flows from operating activities 4.3 (6,964,929) (5,382,995) Cash flows from investing activities Refunds from security deposits - 2,500 Cash divested on demerger of subsidary 6.3 - (7,238,862) Purchase of property, plant and equipment (380,395) (97,619) Piedmont contributions from farm-in arrangement 15,630,319 15,451,041 Payments for exploration and evaluation assets (19,720,013) (20,772,143) Net cash flows from investing activities (4,470,089) (12,655,083) Cash flows from financing activities Proceeds from the issue of shares 4,625,514 23,592,802 Transactions costs on the issue of shares (1,743,648) (100,288) Net cash flows from financing activities 2,881,866 23,492,514 Net (decrease) / increase in cash and cash equivalents (8,553,152) 5,454,436 Cash and cash equivalents at the beginning of the year 23,881,650 19,135,463 Net foreign exchange impact 17,419 (708,249) Cash and cash equivalents at the end of the year 15,345,917 23,881,650 The above consolidated statement of cash flows should be read in conjunction with the accompanying notes. CONSOLIDATED STATEMENT OF CASH FLOWS For the year ended 30 June 2023 51 Atlantic Lithium Limited Annual Report 2023 1. ABOUT THIS REPORT Overview Atlantic Lithium Limited (the Company) is a for-profit company incorporated and domiciled in Australia. These financial statements represent the consolidated financial statements of the Company and its subsidiaries (together referred to as the Group) for the year ended 30 June 2023. The financial report was authorised for issue by the Board of Directors on 28 September 2023. Statement of Compliance The financial report is a general purpose financial report which has been prepared in accordance with Australian Accounting Standards, including Australian Accounting interpretations, other authoritative pronouncements of the Australian Accounting Standards Board (AASB) and the Corporations Act 2001. The financial report also complies with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. 1.1 Basis of Preparation The financial report has been prepared on the basis of historical cost, except for certain financial instruments which are measured at fair value as at the reporting date. Cost is based on the fair values of the consideration given in exchange for assets. All amounts are presented in Australian dollars unless otherwise noted. Certain comparatives have been restated to ensure consistency with current year presentation. 1.2 Going Concern The financial statements have been prepared on a going concern basis which contemplates the continuity of normal business activities and the realisation of assets and discharge of liabilities in the ordinary course of business. The Group has not generated revenues from operations. For the year ended 30 June 2023, the group generated a loss of $12,187,617 and incurred operating cash outflows of $6,964,929. As at 30 June 2023, the Group had cash and cash equivalents of $15,345,917 and net assets of $30,217,368. The Directors note the following with regards to the ability of the Group to continue as a going concern: • Atlantic Lithium has been funded under a co-development agreement whereby Piedmont Lithium Inc solely funds US$17.0m towards studies and exploration (fully utilised as at the date of this report) and US$70.0m towards mine capex for the Ewoyaa Lithium Project (the “Project”). Any additional expenditure for the development of the Project will be shared equally between the Company and Piedmont. • Atlantic Lithium has agreed non-binding Heads of Terms with the Minerals Income Investment Fund of Ghana (“MIIF”) to invest a total of US$32.9 million in the Company and the Ghana subsidiaries. The proposed investment will support the development of the Project and the broader Cape Coast Lithium Portfolio in Ghana. Under the terms of the non-binding agreement, MIIF intend to invest an initial US$27.9 million to acquire a 6% contributing interest in the Company’s Ghana Portfolio and will make ongoing contributions through monthly cash calls as the Project develops. MIIF also intend to subscribe for 19,245,574 shares in Atlantic Lithium for a total value of US$5 million. • The Directors expect that while current funds and funding would be sufficient to meet a minimum programme of exploration and part of the Capex to develop the Project, additional funds would be required. The Group has previously raised funds through share placements and capital raisings from new and existing shareholders. • The Directors have the ability to schedule activities and hence expenditure in accordance with the availability of funds and cash forecasts. The events and conditions noted above indicate the existence of a material uncertainty that may cast significant doubt about the Group’s ability to continue as a going concern and therefore the Group may be unable to realise its assets and discharge its liabilities in the normal course of business. The Directors are confident that they will be able to secure additional funds from other sources and accordingly the going concern basis of preparation for the financial report is appropriate. The Directors are confident that a binding agreement will be reached with MIIF and, based on their previous experience and success in raising capital, additional funds can be obtained to complete the Project if required. The financial report does not include any adjustments relating to the amounts or classification of recorded assets or liabilities that might be necessary if the Group does not continue as a going concern. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

52Atlantic Lithium Limited Annual Report 2023 1.3 Significant Accounting Policies Accounting policies have been consistently applied for all years presented in the financial report. Accounting policies are selected and applied in a manner which ensures that the resulting financial information satisfies the concepts of relevance and reliability, thereby ensuring that the substance of the underlying transactions or other events is reported. Where a significant accounting policy is specific to a note to the consolidated financial statements, the policy is described within that note. New Accounting Standards and Interpretations The Group has adopted all new or amended Accounting Standards and Interpretations issued by the AASB that are mandatory for the current reporting period. The adoption of these new or amended standards and interpretations did not have a significant impact on the Group’s consolidated financial statements. Any new or amended Accounting Standards or Interpretations that are not yet mandatory have not been early adopted, however the estimated impact on adoption is not expected to have a significant impact on the Group’s consolidated financial statements. Basis of Consolidation The consolidated financial statements comprise the financial statements of the Company and entities controlled by the Group. The Group controls an entity when it is exposed to, or has rights to, variable returns from its involvement with the entity and can affect those returns through its power to direct the activities of the entity. The financial statements include the information and results of each subsidiary from the date on which the Company obtains control and until such time as the Company ceases to control an entity. In preparing the consolidated financial statements, all intercompany balances, transactions, and unrealised gains and losses resulting from intra-group transactions have been eliminated in full. A change in the ownership interest of a subsidiary that does not result in a loss of control, is accounted for as an equity transaction. Investments in subsidiaries are carried at their cost of acquisition in the separate financial statements of the Company. Foreign Currency Items included in the financial statements of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity operates (the functional currency). The consolidated financial statements are presented in Australian dollars which is also the functional currency of the Company. The functional currency of all overseas entities is United States Dollars (US dollars). In the prior financial year, the functional currency of the entities incorporated in Ghana was the Ghanaian Cedi. Management have determined that on 1 July 2022 the functional currency of the Ghana entities changed from the Ghanaian Cedi to US dollars. As the exploration and DFS phase of the Ewoyaa project was completed during the current financial year and the Project moves towards development, management believe that US dollars better reflect the currency of the primary economic environment in which these entities operate given that the majority of expenditure and funding is in US dollars. The change in functional currency has been accounted for on a prospective basis. i. Foreign currency transactions Transactions in foreign currencies are translated into the respective functional currencies of Group companies at the exchange rate at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rate at the reporting date. Non-monetary items that are measured based on historical cost in a foreign currency are translated at the exchange rate at the date of the transaction. Foreign currency differences are recognised in profit or loss. ii. Foreign operations On consolidation, the assets and liabilities of foreign operations are translated into Australian dollars at the exchange rate at the reporting date and their income and expenses are translated to Australian dollars at the exchange rate at the dates of the transactions. Foreign exchange differences resulting from translation are initially recognised in other comprehensive income and are accumulated in the foreign currency translation reserve. When a foreign operation is disposed of any accumulated amount in the reserve is transferred to profit or loss. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 53 Atlantic Lithium Limited Annual Report 2023 Goods and Services Tax (GST) Revenues, expenses and assets are recognised net of GST except where GST incurred on a purchase of goods and services is not recoverable from the taxation authority, in which case the GST is recognised as part of the cost of acquisition of the asset or as part of the expense item. Receivables and payables are stated with the amount of GST included. The net amount of GST recoverable from, or payable to, the taxation authority is included as part of receivables or payables in the Consolidated Statement of Financial Position. Cash flows are included in the Consolidated Statement of Cash Flows on a gross basis and the GST component of cash flows arising from investing and financing activities, which is recoverable from, or payable to, the taxation authority, are classified as operating cash flows. Commitments and contingencies are disclosed net of the amount of GST recoverable from, or payable to, the taxation authority. 1.4 Critical Accounting Estimates and Judgements The application of the Group’s accounting policies requires management to make judgements, estimates and assumptions that affect the amounts reported in this financial report, and the accompanying disclosures. The estimates, judgements and assumptions incorporated into this financial report are based on historical experience, adjusted for current market conditions and economic data, obtained both internally and externally and are reviewed on a regular basis. Actual results may differ from these estimates. As noted above, the functional currency of the Ghana entities changed from Ghanaian Cedi to US dollars on 1 July 2022. Management have exercised judgement in determining that the primary economic environment in which these entities operate has changed and the effective date of the change. Further details on other key judgements and sources of estimation uncertainty can be found in the following notes: • Note 1.2 – Going concern • Note 3.4 – Exploration and evaluation assets • Note 5.2 – Determining the fair value of share-based payments 2. GROUP PERFORMANCE 2.1 Loss Per Share 2023 $ 2022 $ Loss Loss attributable to the owners of Atlantic Lithium Limited, used in the calculation of basic and diluted loss per share (12,187,617) (34,647,546) 2023 Number of Shares 2022 Number of Shares Weighted average number of shares Weighted average number of ordinary shares outstanding during the year, used in the calculation of basic and diluted loss per share 601,215,012 565,084,093 2023 Cents per share 2022 Cents per share Basic and diluted loss per share (2.0) (6.1) The options and performance rights are considered to be non-dilutive as the Group is loss making and are therefore excluded from the weighted average number of shares used in the calculation of diluted loss per share. These options and performance rights may become dilutive in the future periods. Refer to Note 4.1 for details of the options and performance rights on issue as at year end. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

54Atlantic Lithium Limited Annual Report 2023 2.2 Operating Segments The Group has identified its operating segment based on the internal reports that are reviewed and used by the Chief Executive Officer and Board of Directors (the chief operating decision makers) in assessing performance and determining the allocation of resources. The Group has one operating segment, being exploration for base and precious metals. The financial results contained in this consolidated financial report are consistent with the basis on which the chief operating decision makers assess the performance of the sole operating segment. Geographic Information The table below provides information on the geographic locations of non-current assets. Assets are allocated based on the location of the operation to which they relate. 2023 $ 2022 $ Australia 54,452 26,363 Ivory Coast 73,747 68,370 Ghana 18,440,168 11,164,758 18,568,367 11,259,491 2.3 Income Tax 2023 $ 2022 $ Income tax recognised outside of profit or loss Deferred tax credited directly to equity (523,094) (27,468) Deferred tax (credited)/debited to financial assets revaluation reserve (140,249) 90,750 (663,343) 63,282 Reconciliation between loss before income tax and income tax expense/ (benefit) Loss before income tax (11,524,274) (34,710,828) Prima facie tax on loss before income tax at 30% (2022: 30%) (3,457,282) (10,413,248) Tax effect of: Share based payments 1,063,208 3,606,132 Tax losses derecognised 2,206,064 9,203,885 Temporary differences derecognised 849,837 508,933 Other 1,516 16,889 Reversal of DTL on exploration and evaluation costs from acquisition of Tekton investment (part of Demerger with Ricca Resources) - (2,985,873) Income tax expense/(benefit) 663,343 (63,282) NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 55 Atlantic Lithium Limited Annual Report 2023 2.3 Income Tax (continued) Movement in Deferred Tax Balances Opening Balance $ Recognised in Profit or Loss $ Recognised in Equity $ Recognised in Other Comprehensive Income $ Closing Balance $ Year ended 30 June 2023 Accruals 111,780 518,539 - - 630,319 Provisions 76,230 40,439 - - 116,669 Share issue costs 676,666 (296,347) 523,094 - 903,413 Less: Deferred tax asset derecognised (508,933) (849,837) - - (1,358,770) Total deferred tax assets recognised 355,743 (587,206) 523,094 - 291,631 Other financial assets (161,724) - - 140,249 (21,475) Unrealised foreign exchange gains (190,472) (76,137) - - (266,609) Other (3,547) - - - (3,547) Total deferred tax liabilities (355,743) (76,137) - 140,249 (291,631) Net deferred tax asset/(liability) recognised - (663,343) 523,094 140,249 - Year ended 30 June 2022 Accruals 62,233 49,547 - - 111,780 Provisions 41,722 34,508 - - 76,230 Share issue costs 565,644 83,554 27,468 - 676,666 Tax losses 1,651,859 (1,651,859) - - - Less: Deferred tax asset derecognised - (508,933) - - (508,933) Total deferred tax assets recognised 2,321,458 (1,993,183) 27,468 - 355,743 Exploration and expenditure (1,858,674) 1,858,674 Other financial assets (22,131) (48,843) - (90,750) (161,724) Unrealised foreign exchange gains (417,993) 227,521 - - (190,472) Other (22,660) 19,113 - - (3,547) Total deferred tax liabilities (2,321,458) 2,056,465 - (90,750) (355,743) Net deferred tax asset/(liability) recognised - 63,282 27,468 (90,750) - 2023 $ 2022 $ Unrecognised deferred tax assets (@30%) Unrecognised temporary differences 1,358,770 508,933 Unrecognised tax losses Unused tax losses carried forward 58,122,083 50,768,530 Unused capital losses carried forward 12,402,110 12,402,110 In order to recoup carried forward losses in future periods, either the Continuity of Ownership Test (COT) or Same Business Test must be passed. The majority of losses are carried forward at 30 June 2023 under COT. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

56Atlantic Lithium Limited Annual Report 2023 2.3 Income Tax (continued) Deferred tax assets which have not been recognised as an asset, will only be obtained if: i. the Company derives future assessable income of a nature and of an amount sufficient to enable the losses to be realised; ii. the Company continues to comply with the conditions for deductibility imposed by the law; and iii. no changes in tax legislation adversely affect the Company in realising the losses. Measurement and Recognition The income tax expense for the period is the tax payable/recoverable on the current period’s taxable income/loss for each jurisdiction, adjusted for changes in deferred tax assets and liabilities and unused tax losses. Current and deferred tax is recognised as an expense or income in the consolidated statement of profit or loss, except where it relates to items credited or debited directly to equity, in which case the deferred tax is also recognised directly in equity. Deferred tax is accounted for in respect of temporary differences between the tax base of assets and liabilities and their carrying amount in the financial statements. Deferred tax liabilities are recognised for all taxable temporary differences. Deferred tax assets are recognised for all deductible temporary differences, unused income tax and capital losses and tax offsets, to the extent that it is probable that sufficient taxable profits will be available to utilise them. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply in the year when the asset is utilised or the liability is settled, based on tax rates and tax laws that have been enacted or substantively enacted at the reporting date. Deferred tax assets and liabilities are not recognised for temporary differences relating to investments in subsidiaries to the extent that the Group is able to control the timing of the reversal of the temporary differences and it is probable that they will not reverse in the foreseeable future. Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Group intends to settle its current tax assets and liabilities on a net basis. 3. ASSETS AND LIABILITIES 3.1 Other Receivables 2023 $ 2022 $ Piedmont farm in contributions receivable (refer Note 3.4) 1,141,881 1,987,164 Other receivables 459,084 311,077 1,600,965 2,298,241 Other receivables are recognised initially at fair value and are subsequently measured at amortised cost using the effective interest method, less a loss allowance. Receivables are non-interest bearing and are generally on 30-60 day terms. No allowance for credit loss has been recognised in either the current or previous year as all amounts are expected to be recovered in full. Due to the short-term nature of these receivables, their carrying value approximates their fair value. The maximum exposure to credit risk is the carrying value of the receivables. Collateral is not held as security. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 57 Atlantic Lithium Limited Annual Report 2023 3.2 Other Financial Assets 2023 $ 2022 $ Security deposits 6,000 7,500 Investment in shares at fair value through other comprehensive income Australasian Metals Limited 632,500 1,100,000 Auburn Resources Limited 125,000 125,000 Other 8 20 763,508 1,232,520 Australasian Metals Limited is listed on the Australian Stock Exchange. Auburn Resources Limited is an unlisted public company incorporated in Australia. Fair value has been determined for the investment in Auburn Resources based on the latest share capital placement in July 2021 at 12.5 cents per share. Refer to Note 7.2 for details of contingent liabilities relating to these investments. No dividends have been received nor shares disposed in relation to these investments in either the current or prior financial period. Measurement and Recognition The investment in shares are investments in equity instruments which are not held for trading. In accordance with AASB 9 Financial Instruments the Group made an irrevocable election on initial recognition to designate these equity instruments at fair value through other comprehensive income. Any changes in fair value since original recognition are recognised in other comprehensive income and are never reclassified to profit or loss. 3.3 Property, Plant and Equipment Motor Vehicle $ Plant & Equipment $ Office Equipment $ Total $ Year ended 30 June 2023 Balance as at 1 July 2022 182,773 5,683 20,681 209,137 Effect of movements in foreign exchange rates (9,620) - - (9,620) Additions 389,484 - 54,288 443,772 Depreciation capitalised to exploration and evaluation assets (83,052) - - (83,052) Depreciation expense - (3,221) (22,980) (26,201) Balance as at 30 June 2023 479,585 2,462 51,989 534,036 Cost 704,309 75,555 95,968 875,832 Accumulated depreciation (224,724) (73,093) (43,979) (341,796) Balance as at 30 June 2023 479,585 2,462 51,989 534,036 Year ended 30 June 2022 Balance as at 1 July 2021 278,411 16,059 40,784 335,254 Effect of movements in foreign exchange rates (41,218) 21 105 (41,092) Additions 88,669 - 9,279 97,948 Assets distributed to owners (refer Note 6.3) (39,078) - (15,837) (54,915) Depreciation capitalised to exploration and evaluation assets (104,011) (3,980) (3,240) (111,231) Depreciation expense - (6,417) (10,410) (16,827) Balance as at 30 June 2022 182,773 5,683 20,681 209,137 Cost 303,729 75,555 41,680 420,964 Accumulated depreciation (120,956) (69,872) (20,999) (211,827) Balance as at 30 June 2022 182,773 5,683 20,681 209,137 NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

58Atlantic Lithium Limited Annual Report 2023 3.3 Property, Plant and Equipment (continued) Measurement and Recognition Property, plant and equipment is measured at cost less accumulated depreciation and impairment losses. The cost of property, plant and equipment constructed by the Group includes the cost of materials, direct labour, borrowing costs and an appropriate portion of fixed and variable costs. Subsequent costs are included in the asset’s carrying amount or are recognised as a separate asset, as appropriate, only when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the item can be measured reliably. All other repairs and maintenance costs are recognised in the profit or loss as incurred. Depreciation commences once an asset is available for use and is calculated on a straight-line basis so as to write off the net cost of each asset to its estimated residual value over its expected useful life. The useful lives are as follows: Motor vehicles 5 years Plant & equipment 3.3-10 years Office equipment 3 years Impairment of Non-Financial Assets At each reporting date, the Group reviews the carrying value of its assets to determine whether there is any indication that those assets may be impaired. If such an indication exists, the recoverable amount of the asset, being the higher of the asset’s fair value less costs of disposal and value in use, is compared to the asset’s carrying value. Any excess of the asset’s carrying value over its recoverable amount is expensed to the profit or loss. When it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs. 3.4 Exploration and Evaluation Assets 2023 $ 2022 $ Exploration and evaluation assets 18,295,581 11,050,354 Movements in carrying amounts Balance as at 1 July 11,050,354 51,449,462 Effect of movement in foreign exchange rates 995,967 (3,272,244) Additions 20,844,027 18,247,469 Piedmont receipts from farm-in arrangements (refer below) (14,816,484) (17,438,205) Assets distributed to owners (refer to Note 6.3) - (37,910,194) Written-off during the year (39,533) (25,934) Balance as at 30 June 18,034,331 11,050,354 The recoverability of the carrying amount of exploration and evaluation assets is dependent on the successful development and commercial exploitation of the relevant area of interest or alternatively on the sale of that area of interest. Piedmont Funding Agreement On 31 August 2021, the Company entered into a binding agreement with Piedmont to provide US$103 million of funding for the Ewoyaa Lithium Project as it moves towards production. Piedmont is an US integrated supplier of raw materials and minerals supporting the electric vehicles and industrial markets. Piedmont is to earn-in up to 50% of the Company’s Cape Coast Lithium Portfolio in Ghana,(CCLP) including Ewoyaa, in the following stages (the “farm-in arrangement”): NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 59 Atlantic Lithium Limited Annual Report 2023 3.4 Exploration and Evaluation Assets (continued) Stage 1: Investment into Atlantic Lithium Limited (circa US$16 million) • On 31 August 2021, Piedmont subscribed for 54 million new ordinary shares in the Company at a price of 20 pence per share (£10.8 million), with a further £0.72 million committed via placing 2,880,000 shares at 25 pence per share. After these transactions Piedmont held a 9.91% interest in the issued share capital of the Company. Stage 2: Regional Exploration and Definitive Feasibility Study (“DFS”) Funding (US$17 million) • Piedmont to earn up to an initial 22.5% of CCLP, via sole funding, of the following: • US$5 million towards an accelerated regional exploration programme to enhance the current Ewoyaa resource; and • US$12 million towards completing the DFS for Ewoyaa. • Any cost overruns or savings will be shared equally between the Company and Piedmont • As at 30 June 2023 Piedmont has provided US$17 million of funding for this stage and all ongoing expenditure is now being shared equally between the Company and Piedmont. Stage 3: Development Funding (US$70 million) • On achievement of the “DFS criteria” (refer below) Piedmont can elect to earn a further 27.5% of CCLP via sole funding of Development for the Ewoyaa Project of US$70 million. • Any additional spending or savings will be shared equally between the Company and Piedmont. • Subsequent to year end, Piedmont notified the Company of its intent to support the development of the Ewoyaa Project (refer Note 7.3) Other Key Terms • The minimum DFS criteria is to deliver a 1.5 million tonnes per annum (“mtpa”) to 2.0 mtpa run of mine operation (“LOM”) for an 8 to 10 year life of mine respectively. • If the DFS criteria of Stage 2 is achieved and Piedmont elects by mutual agreement not to proceed to Stage 3, Piedmont will forfeit its Stage 2 interest. • Piedmont is entitled to appoint one director to the Company Board on completion of Stage 1 and while maintaining an equity interest equal to or above 9% in the Company. • An offtake agreement for 50% of the annual LOM lithium spodumene concentrate (SC6%) production where offtake pricing will be determined via a formula which is linked to the prevailing market price of lithium products. Measurement and Recognition Exploration and evaluation expenditure incurred is accumulated in respect of each identifiable area of interest. Such expenditure comprises net direct costs and an appropriate portion of related overhead expenditure but does not include overheads or administration expenditure which does not have a specific nexus with a particular area of interest. These assets are only carried forward to the extent that they are expected to be recouped through the successful development of the area or where activities in the area have not yet reached a stage which permits a reasonable assessment of the existence of economically recoverable reserves and active or significant operations in relation to the area of interest are continuing. A regular review is undertaken on each area of interest to determine the appropriateness of continuing to carry forward the exploration and evaluations assets for that area of interest. Exploration and expenditure assets are tested for impairment in accordance with the policy adopted for non-financial assets in Note 3.3. Once technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable and a final investment decision has been made, exploration and evaluation assets attributable to that area of interest are tested for impairment and then reclassified to mine property and development assets in property, plant and equipment. Accumulated costs in relation to an abandoned area are written off in full in the profit or loss in the year in which the decision to abandon the area is made. When production commences, the accumulated costs for the relevant area of interest are amortised over the life of the area according to the rate of depletion of the economically recoverable reserves. Costs of site restoration are provided over the life of the area of interest once exploration commences and are included in the costs of that stage. Site restoration costs include the dismantling and removal of mining plant, equipment and building structures, waste removal, and rehabilitation of the site in accordance with any requirements of mining permits. Such costs have been determined using estimates of future costs, current legal requirements and technology on an undiscounted basis. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

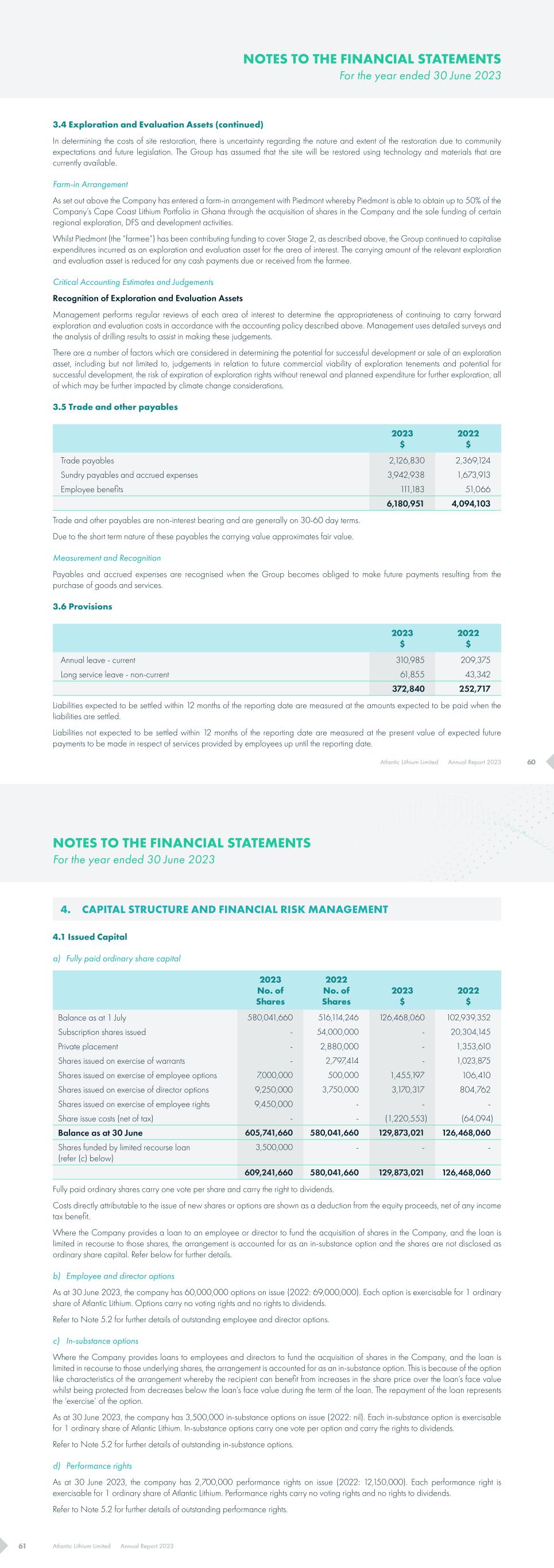

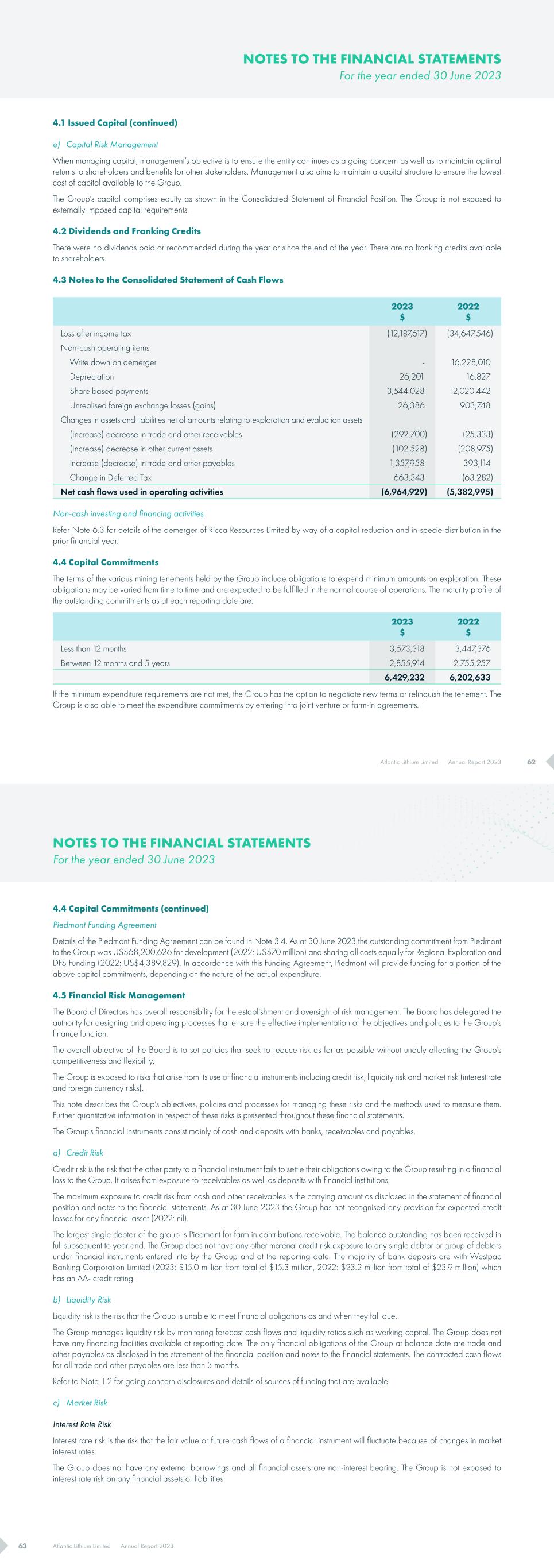

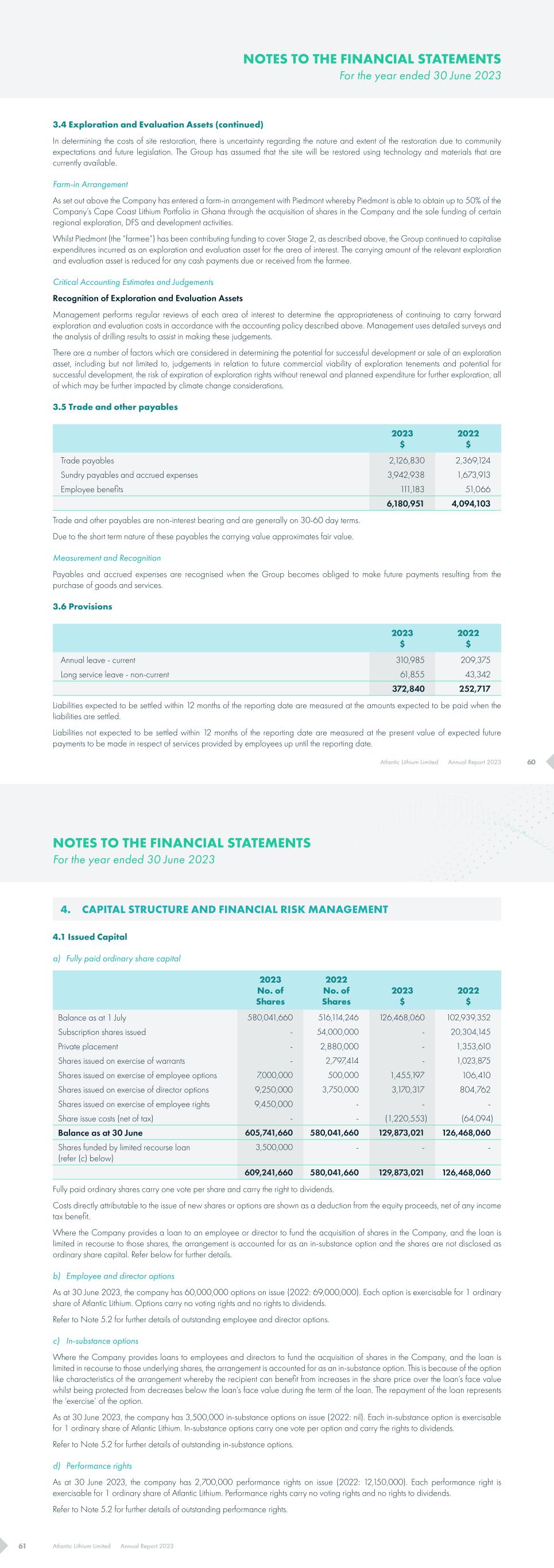

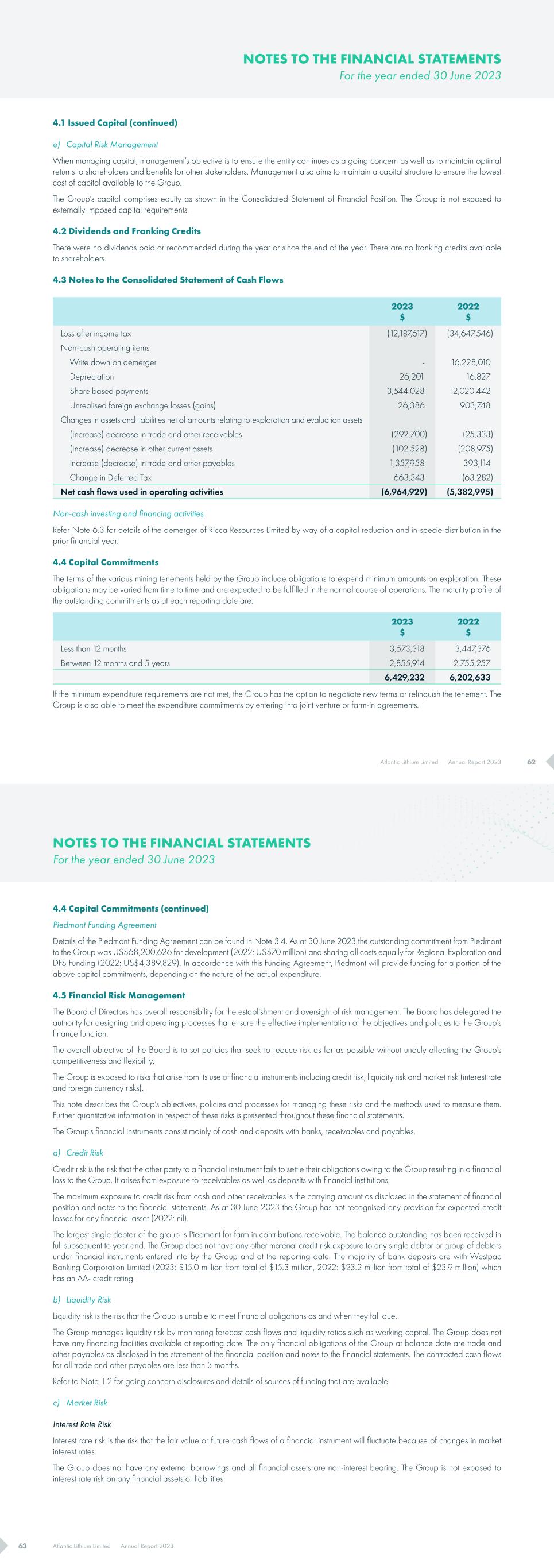

60Atlantic Lithium Limited Annual Report 2023 3.4 Exploration and Evaluation Assets (continued) In determining the costs of site restoration, there is uncertainty regarding the nature and extent of the restoration due to community expectations and future legislation. The Group has assumed that the site will be restored using technology and materials that are currently available. Farm-in Arrangement As set out above the Company has entered a farm-in arrangement with Piedmont whereby Piedmont is able to obtain up to 50% of the Company’s Cape Coast Lithium Portfolio in Ghana through the acquisition of shares in the Company and the sole funding of certain regional exploration, DFS and development activities. Whilst Piedmont (the “farmee”) has been contributing funding to cover Stage 2, as described above, the Group continued to capitalise expenditures incurred as an exploration and evaluation asset for the area of interest. The carrying amount of the relevant exploration and evaluation asset is reduced for any cash payments due or received from the farmee. Critical Accounting Estimates and Judgements Recognition of Exploration and Evaluation Assets Management performs regular reviews of each area of interest to determine the appropriateness of continuing to carry forward exploration and evaluation costs in accordance with the accounting policy described above. Management uses detailed surveys and the analysis of drilling results to assist in making these judgements. There are a number of factors which are considered in determining the potential for successful development or sale of an exploration asset, including but not limited to, judgements in relation to future commercial viability of exploration tenements and potential for successful development, the risk of expiration of exploration rights without renewal and planned expenditure for further exploration, all of which may be further impacted by climate change considerations. 3.5 Trade and other payables 2023 $ 2022 $ Trade payables 2,126,830 2,369,124 Sundry payables and accrued expenses 3,942,938 1,673,913 Employee benefits 111,183 51,066 6,180,951 4,094,103 Trade and other payables are non-interest bearing and are generally on 30-60 day terms. Due to the short term nature of these payables the carrying value approximates fair value. Measurement and Recognition Payables and accrued expenses are recognised when the Group becomes obliged to make future payments resulting from the purchase of goods and services. 3.6 Provisions 2023 $ 2022 $ Annual leave - current 310,985 209,375 Long service leave - non-current 61,855 43,342 372,840 252,717 Liabilities expected to be settled within 12 months of the reporting date are measured at the amounts expected to be paid when the liabilities are settled. Liabilities not expected to be settled within 12 months of the reporting date are measured at the present value of expected future payments to be made in respect of services provided by employees up until the reporting date. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 61 Atlantic Lithium Limited Annual Report 2023 4. CAPITAL STRUCTURE AND FINANCIAL RISK MANAGEMENT 4.1 Issued Capital a) Fully paid ordinary share capital 2023 No. of Shares 2022 No. of Shares 2023 $ 2022 $ Balance as at 1 July 580,041,660 516,114,246 126,468,060 102,939,352 Subscription shares issued - 54,000,000 - 20,304,145 Private placement - 2,880,000 - 1,353,610 Shares issued on exercise of warrants - 2,797,414 - 1,023,875 Shares issued on exercise of employee options 7,000,000 500,000 1,455,197 106,410 Shares issued on exercise of director options 9,250,000 3,750,000 3,170,317 804,762 Shares issued on exercise of employee rights 9,450,000 - - - Share issue costs (net of tax) - - (1,220,553) (64,094) Balance as at 30 June 605,741,660 580,041,660 129,873,021 126,468,060 Shares funded by limited recourse loan (refer (c) below) 3,500,000 - - - 609,241,660 580,041,660 129,873,021 126,468,060 Fully paid ordinary shares carry one vote per share and carry the right to dividends. Costs directly attributable to the issue of new shares or options are shown as a deduction from the equity proceeds, net of any income tax benefit. Where the Company provides a loan to an employee or director to fund the acquisition of shares in the Company, and the loan is limited in recourse to those shares, the arrangement is accounted for as an in-substance option and the shares are not disclosed as ordinary share capital. Refer below for further details. b) Employee and director options As at 30 June 2023, the company has 60,000,000 options on issue (2022: 69,000,000). Each option is exercisable for 1 ordinary share of Atlantic Lithium. Options carry no voting rights and no rights to dividends. Refer to Note 5.2 for further details of outstanding employee and director options. c) In-substance options Where the Company provides loans to employees and directors to fund the acquisition of shares in the Company, and the loan is limited in recourse to those underlying shares, the arrangement is accounted for as an in-substance option. This is because of the option like characteristics of the arrangement whereby the recipient can benefit from increases in the share price over the loan’s face value whilst being protected from decreases below the loan’s face value during the term of the loan. The repayment of the loan represents the ‘exercise’ of the option. As at 30 June 2023, the company has 3,500,000 in-substance options on issue (2022: nil). Each in-substance option is exercisable for 1 ordinary share of Atlantic Lithium. In-substance options carry one vote per option and carry the rights to dividends. Refer to Note 5.2 for further details of outstanding in-substance options. d) Performance rights As at 30 June 2023, the company has 2,700,000 performance rights on issue (2022: 12,150,000). Each performance right is exercisable for 1 ordinary share of Atlantic Lithium. Performance rights carry no voting rights and no rights to dividends. Refer to Note 5.2 for further details of outstanding performance rights. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

62Atlantic Lithium Limited Annual Report 2023 4.1 Issued Capital (continued) e) Capital Risk Management When managing capital, management’s objective is to ensure the entity continues as a going concern as well as to maintain optimal returns to shareholders and benefits for other stakeholders. Management also aims to maintain a capital structure to ensure the lowest cost of capital available to the Group. The Group’s capital comprises equity as shown in the Consolidated Statement of Financial Position. The Group is not exposed to externally imposed capital requirements. 4.2 Dividends and Franking Credits There were no dividends paid or recommended during the year or since the end of the year. There are no franking credits available to shareholders. 4.3 Notes to the Consolidated Statement of Cash Flows 2023 $ 2022 $ Loss after income tax (12,187,617) (34,647,546) Non-cash operating items Write down on demerger - 16,228,010 Depreciation 26,201 16,827 Share based payments 3,544,028 12,020,442 Unrealised foreign exchange losses (gains) 26,386 903,748 Changes in assets and liabilities net of amounts relating to exploration and evaluation assets (Increase) decrease in trade and other receivables (292,700) (25,333) (Increase) decrease in other current assets (102,528) (208,975) Increase (decrease) in trade and other payables 1,357,958 393,114 Change in Deferred Tax 663,343 (63,282) Net cash flows used in operating activities (6,964,929) (5,382,995) Non-cash investing and financing activities Refer Note 6.3 for details of the demerger of Ricca Resources Limited by way of a capital reduction and in-specie distribution in the prior financial year. 4.4 Capital Commitments The terms of the various mining tenements held by the Group include obligations to expend minimum amounts on exploration. These obligations may be varied from time to time and are expected to be fulfilled in the normal course of operations. The maturity profile of the outstanding commitments as at each reporting date are: 2023 $ 2022 $ Less than 12 months 3,573,318 3,447,376 Between 12 months and 5 years 2,855,914 2,755,257 6,429,232 6,202,633 If the minimum expenditure requirements are not met, the Group has the option to negotiate new terms or relinquish the tenement. The Group is also able to meet the expenditure commitments by entering into joint venture or farm-in agreements. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 63 Atlantic Lithium Limited Annual Report 2023 4.4 Capital Commitments (continued) Piedmont Funding Agreement Details of the Piedmont Funding Agreement can be found in Note 3.4. As at 30 June 2023 the outstanding commitment from Piedmont to the Group was US$68,200,626 for development (2022: US$70 million) and sharing all costs equally for Regional Exploration and DFS Funding (2022: US$4,389,829). In accordance with this Funding Agreement, Piedmont will provide funding for a portion of the above capital commitments, depending on the nature of the actual expenditure. 4.5 Financial Risk Management The Board of Directors has overall responsibility for the establishment and oversight of risk management. The Board has delegated the authority for designing and operating processes that ensure the effective implementation of the objectives and policies to the Group’s finance function. The overall objective of the Board is to set policies that seek to reduce risk as far as possible without unduly affecting the Group’s competitiveness and flexibility. The Group is exposed to risks that arise from its use of financial instruments including credit risk, liquidity risk and market risk (interest rate and foreign currency risks). This note describes the Group’s objectives, policies and processes for managing these risks and the methods used to measure them. Further quantitative information in respect of these risks is presented throughout these financial statements. The Group’s financial instruments consist mainly of cash and deposits with banks, receivables and payables. a) Credit Risk Credit risk is the risk that the other party to a financial instrument fails to settle their obligations owing to the Group resulting in a financial loss to the Group. It arises from exposure to receivables as well as deposits with financial institutions. The maximum exposure to credit risk from cash and other receivables is the carrying amount as disclosed in the statement of financial position and notes to the financial statements. As at 30 June 2023 the Group has not recognised any provision for expected credit losses for any financial asset (2022: nil). The largest single debtor of the group is Piedmont for farm in contributions receivable. The balance outstanding has been received in full subsequent to year end. The Group does not have any other material credit risk exposure to any single debtor or group of debtors under financial instruments entered into by the Group and at the reporting date. The majority of bank deposits are with Westpac Banking Corporation Limited (2023: $15.0 million from total of $15.3 million, 2022: $23.2 million from total of $23.9 million) which has an AA- credit rating. b) Liquidity Risk Liquidity risk is the risk that the Group is unable to meet financial obligations as and when they fall due. The Group manages liquidity risk by monitoring forecast cash flows and liquidity ratios such as working capital. The Group does not have any financing facilities available at reporting date. The only financial obligations of the Group at balance date are trade and other payables as disclosed in the statement of the financial position and notes to the financial statements. The contracted cash flows for all trade and other payables are less than 3 months. Refer to Note 1.2 for going concern disclosures and details of sources of funding that are available. c) Market Risk Interest Rate Risk Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Group does not have any external borrowings and all financial assets are non-interest bearing. The Group is not exposed to interest rate risk on any financial assets or liabilities. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

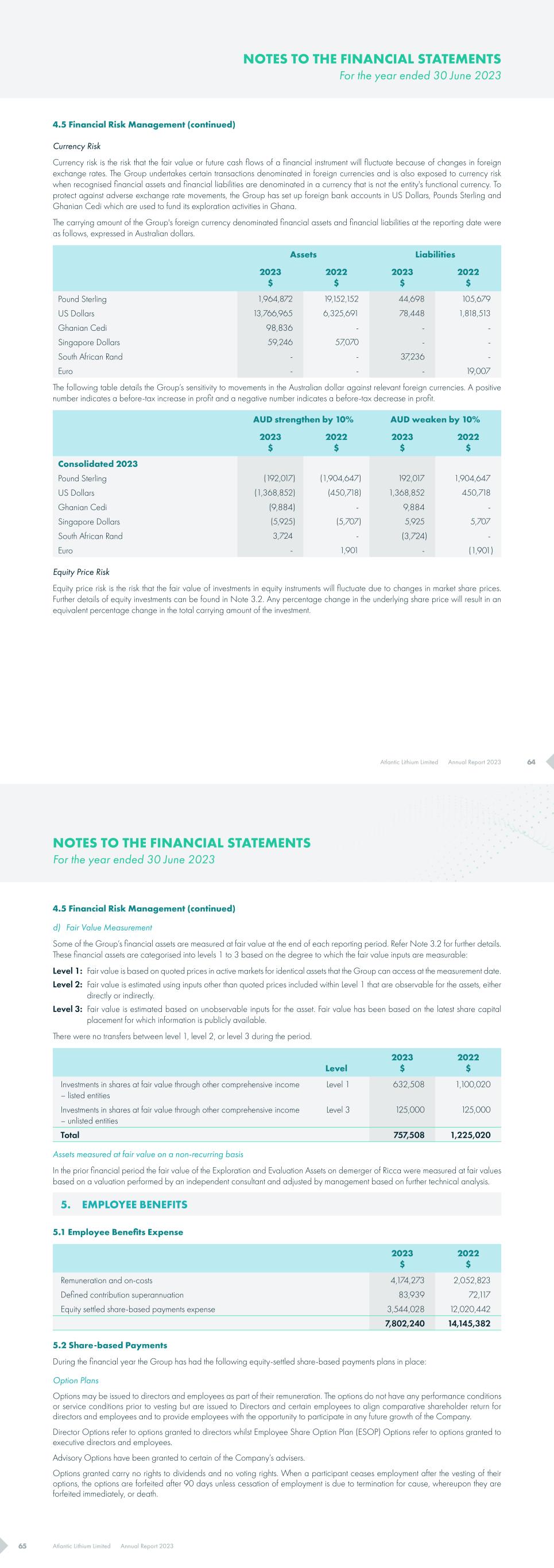

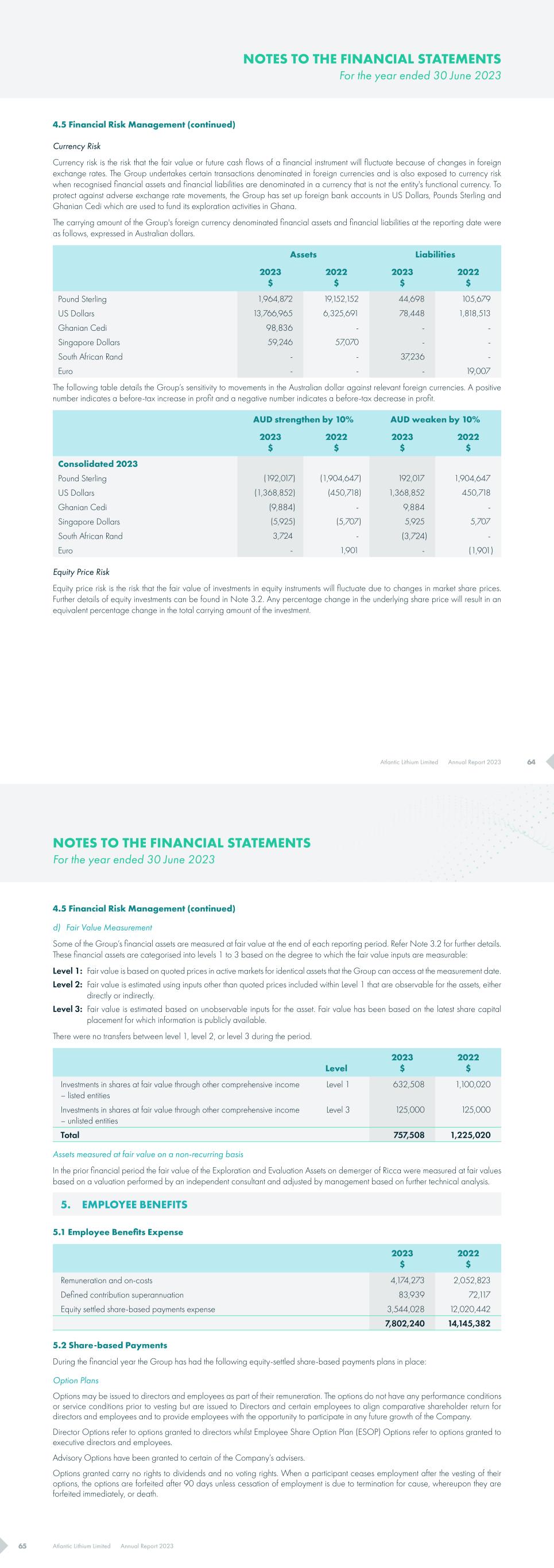

64Atlantic Lithium Limited Annual Report 2023 4.5 Financial Risk Management (continued) Currency Risk Currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Group undertakes certain transactions denominated in foreign currencies and is also exposed to currency risk when recognised financial assets and financial liabilities are denominated in a currency that is not the entity's functional currency. To protect against adverse exchange rate movements, the Group has set up foreign bank accounts in US Dollars, Pounds Sterling and Ghanian Cedi which are used to fund its exploration activities in Ghana. The carrying amount of the Group's foreign currency denominated financial assets and financial liabilities at the reporting date were as follows, expressed in Australian dollars. Assets Liabilities 2023 $ 2022 $ 2023 $ 2022 $ Pound Sterling 1,964,872 19,152,152 44,698 105,679 US Dollars 13,766,965 6,325,691 78,448 1,818,513 Ghanian Cedi 98,836 - - - Singapore Dollars 59,246 57,070 - - South African Rand - - 37,236 - Euro - - - 19,007 The following table details the Group’s sensitivity to movements in the Australian dollar against relevant foreign currencies. A positive number indicates a before-tax increase in profit and a negative number indicates a before-tax decrease in profit. AUD strengthen by 10% AUD weaken by 10% 2023 $ 2022 $ 2023 $ 2022 $ Consolidated 2023 Pound Sterling (192,017) (1,904,647) 192,017 1,904,647 US Dollars (1,368,852) (450,718) 1,368,852 450,718 Ghanian Cedi (9,884) - 9,884 - Singapore Dollars (5,925) (5,707) 5,925 5,707 South African Rand 3,724 - (3,724) - Euro - 1,901 - (1,901) Equity Price Risk Equity price risk is the risk that the fair value of investments in equity instruments will fluctuate due to changes in market share prices. Further details of equity investments can be found in Note 3.2. Any percentage change in the underlying share price will result in an equivalent percentage change in the total carrying amount of the investment. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 65 Atlantic Lithium Limited Annual Report 2023 4.5 Financial Risk Management (continued) d) Fair Value Measurement Some of the Group’s financial assets are measured at fair value at the end of each reporting period. Refer Note 3.2 for further details. These financial assets are categorised into levels 1 to 3 based on the degree to which the fair value inputs are measurable: Level 1: Fair value is based on quoted prices in active markets for identical assets that the Group can access at the measurement date. Level 2: Fair value is estimated using inputs other than quoted prices included within Level 1 that are observable for the assets, either directly or indirectly. Level 3: Fair value is estimated based on unobservable inputs for the asset. Fair value has been based on the latest share capital placement for which information is publicly available. There were no transfers between level 1, level 2, or level 3 during the period. Level 2023 $ 2022 $ Investments in shares at fair value through other comprehensive income – listed entities Level 1 632,508 1,100,020 Investments in shares at fair value through other comprehensive income – unlisted entities Level 3 125,000 125,000 Total 757,508 1,225,020 Assets measured at fair value on a non-recurring basis In the prior financial period the fair value of the Exploration and Evaluation Assets on demerger of Ricca were measured at fair values based on a valuation performed by an independent consultant and adjusted by management based on further technical analysis. 5. EMPLOYEE BENEFITS 5.1 Employee Benefits Expense 2023 $ 2022 $ Remuneration and on-costs 4,174,273 2,052,823 Defined contribution superannuation 83,939 72,117 Equity settled share-based payments expense 3,544,028 12,020,442 7,802,240 14,145,382 5.2 Share-based Payments During the financial year the Group has had the following equity-settled share-based payments plans in place: Option Plans Options may be issued to directors and employees as part of their remuneration. The options do not have any performance conditions or service conditions prior to vesting but are issued to Directors and certain employees to align comparative shareholder return for directors and employees and to provide employees with the opportunity to participate in any future growth of the Company. Director Options refer to options granted to directors whilst Employee Share Option Plan (ESOP) Options refer to options granted to executive directors and employees. Advisory Options have been granted to certain of the Company’s advisers. Options granted carry no rights to dividends and no voting rights. When a participant ceases employment after the vesting of their options, the options are forfeited after 90 days unless cessation of employment is due to termination for cause, whereupon they are forfeited immediately, or death. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

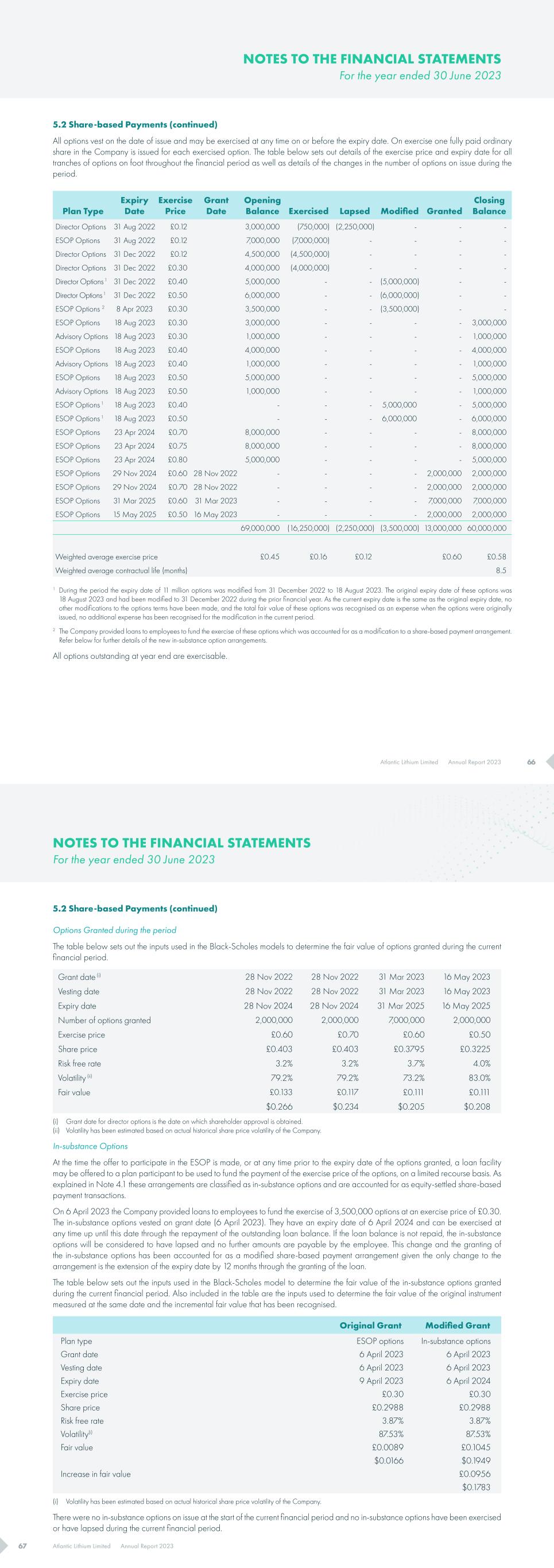

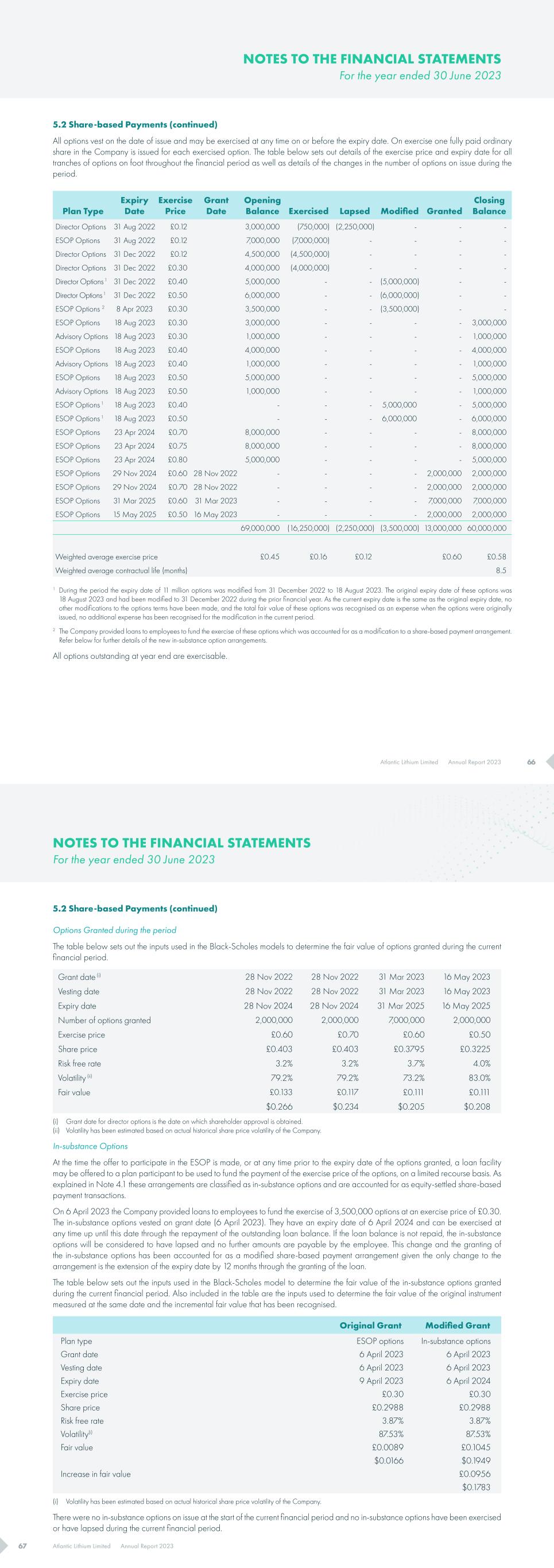

66Atlantic Lithium Limited Annual Report 2023 5.2 Share-based Payments (continued) All options vest on the date of issue and may be exercised at any time on or before the expiry date. On exercise one fully paid ordinary share in the Company is issued for each exercised option. The table below sets out details of the exercise price and expiry date for all tranches of options on foot throughout the financial period as well as details of the changes in the number of options on issue during the period. Plan Type Expiry Date Exercise Price Grant Date Opening Balance Exercised Lapsed Modified Granted Closing Balance Director Options 31 Aug 2022 £0.12 3,000,000 (750,000) (2,250,000) - - - ESOP Options 31 Aug 2022 £0.12 7,000,000 (7,000,000) - - - - Director Options 31 Dec 2022 £0.12 4,500,000 (4,500,000) - - - - Director Options 31 Dec 2022 £0.30 4,000,000 (4,000,000) - - - - Director Options 1 31 Dec 2022 £0.40 5,000,000 - - (5,000,000) - - Director Options 1 31 Dec 2022 £0.50 6,000,000 - - (6,000,000) - - ESOP Options 2 8 Apr 2023 £0.30 3,500,000 - - (3,500,000) - - ESOP Options 18 Aug 2023 £0.30 3,000,000 - - - - 3,000,000 Advisory Options 18 Aug 2023 £0.30 1,000,000 - - - - 1,000,000 ESOP Options 18 Aug 2023 £0.40 4,000,000 - - - - 4,000,000 Advisory Options 18 Aug 2023 £0.40 1,000,000 - - - - 1,000,000 ESOP Options 18 Aug 2023 £0.50 5,000,000 - - - - 5,000,000 Advisory Options 18 Aug 2023 £0.50 1,000,000 - - - - 1,000,000 ESOP Options 1 18 Aug 2023 £0.40 - - - 5,000,000 - 5,000,000 ESOP Options 1 18 Aug 2023 £0.50 - - - 6,000,000 - 6,000,000 ESOP Options 23 Apr 2024 £0.70 8,000,000 - - - - 8,000,000 ESOP Options 23 Apr 2024 £0.75 8,000,000 - - - - 8,000,000 ESOP Options 23 Apr 2024 £0.80 5,000,000 - - - - 5,000,000 ESOP Options 29 Nov 2024 £0.60 28 Nov 2022 - - - - 2,000,000 2,000,000 ESOP Options 29 Nov 2024 £0.70 28 Nov 2022 - - - - 2,000,000 2,000,000 ESOP Options 31 Mar 2025 £0.60 31 Mar 2023 - - - - 7,000,000 7,000,000 ESOP Options 15 May 2025 £0.50 16 May 2023 - - - - 2,000,000 2,000,000 69,000,000 (16,250,000) (2,250,000) (3,500,000) 13,000,000 60,000,000 Weighted average exercise price £0.45 £0.16 £0.12 £0.60 £0.58 Weighted average contractual life (months) 8.5 1 During the period the expiry date of 11 million options was modified from 31 December 2022 to 18 August 2023. The original expiry date of these options was 18 August 2023 and had been modified to 31 December 2022 during the prior financial year. As the current expiry date is the same as the original expiry date, no other modifications to the options terms have been made, and the total fair value of these options was recognised as an expense when the options were originally issued, no additional expense has been recognised for the modification in the current period. 2 The Company provided loans to employees to fund the exercise of these options which was accounted for as a modification to a share-based payment arrangement. Refer below for further details of the new in-substance option arrangements. All options outstanding at year end are exercisable. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 67 Atlantic Lithium Limited Annual Report 2023 5.2 Share-based Payments (continued) Options Granted during the period The table below sets out the inputs used in the Black-Scholes models to determine the fair value of options granted during the current financial period. Grant date (i) 28 Nov 2022 28 Nov 2022 31 Mar 2023 16 May 2023 Vesting date 28 Nov 2022 28 Nov 2022 31 Mar 2023 16 May 2023 Expiry date 28 Nov 2024 28 Nov 2024 31 Mar 2025 16 May 2025 Number of options granted 2,000,000 2,000,000 7,000,000 2,000,000 Exercise price £0.60 £0.70 £0.60 £0.50 Share price £0.403 £0.403 £0.3795 £0.3225 Risk free rate 3.2% 3.2% 3.7% 4.0% Volatility (ii) 79.2% 79.2% 73.2% 83.0% Fair value £0.133 £0.117 £0.111 £0.111 $0.266 $0.234 $0.205 $0.208 (i) Grant date for director options is the date on which shareholder approval is obtained. (ii) Volatility has been estimated based on actual historical share price volatility of the Company. In-substance Options At the time the offer to participate in the ESOP is made, or at any time prior to the expiry date of the options granted, a loan facility may be offered to a plan participant to be used to fund the payment of the exercise price of the options, on a limited recourse basis. As explained in Note 4.1 these arrangements are classified as in-substance options and are accounted for as equity-settled share-based payment transactions. On 6 April 2023 the Company provided loans to employees to fund the exercise of 3,500,000 options at an exercise price of £0.30. The in-substance options vested on grant date (6 April 2023). They have an expiry date of 6 April 2024 and can be exercised at any time up until this date through the repayment of the outstanding loan balance. If the loan balance is not repaid, the in-substance options will be considered to have lapsed and no further amounts are payable by the employee. This change and the granting of the in-substance options has been accounted for as a modified share-based payment arrangement given the only change to the arrangement is the extension of the expiry date by 12 months through the granting of the loan. The table below sets out the inputs used in the Black-Scholes model to determine the fair value of the in-substance options granted during the current financial period. Also included in the table are the inputs used to determine the fair value of the original instrument measured at the same date and the incremental fair value that has been recognised. Original Grant Modified Grant Plan type ESOP options In-substance options Grant date 6 April 2023 6 April 2023 Vesting date 6 April 2023 6 April 2023 Expiry date 9 April 2023 6 April 2024 Exercise price £0.30 £0.30 Share price £0.2988 £0.2988 Risk free rate 3.87% 3.87% Volatility(i) 87.53% 87.53% Fair value £0.0089 £0.1045 $0.0166 $0.1949 Increase in fair value £0.0956 $0.1783 (i) Volatility has been estimated based on actual historical share price volatility of the Company. There were no in-substance options on issue at the start of the current financial period and no in-substance options have been exercised or have lapsed during the current financial period. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

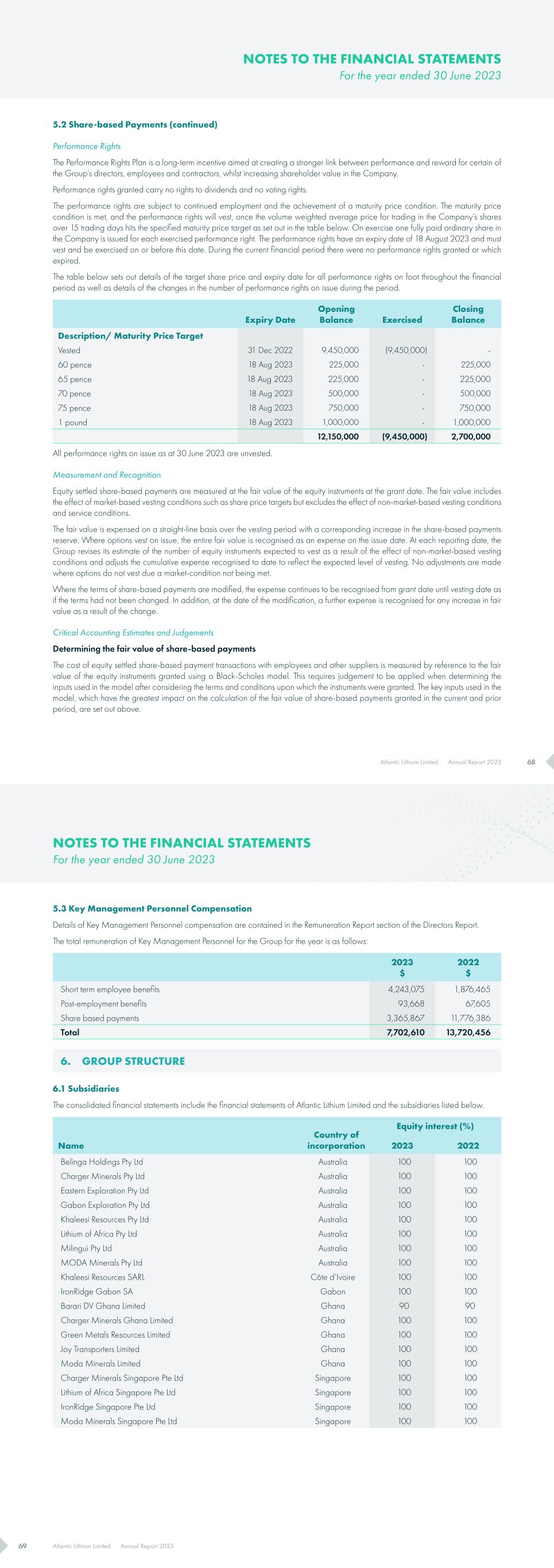

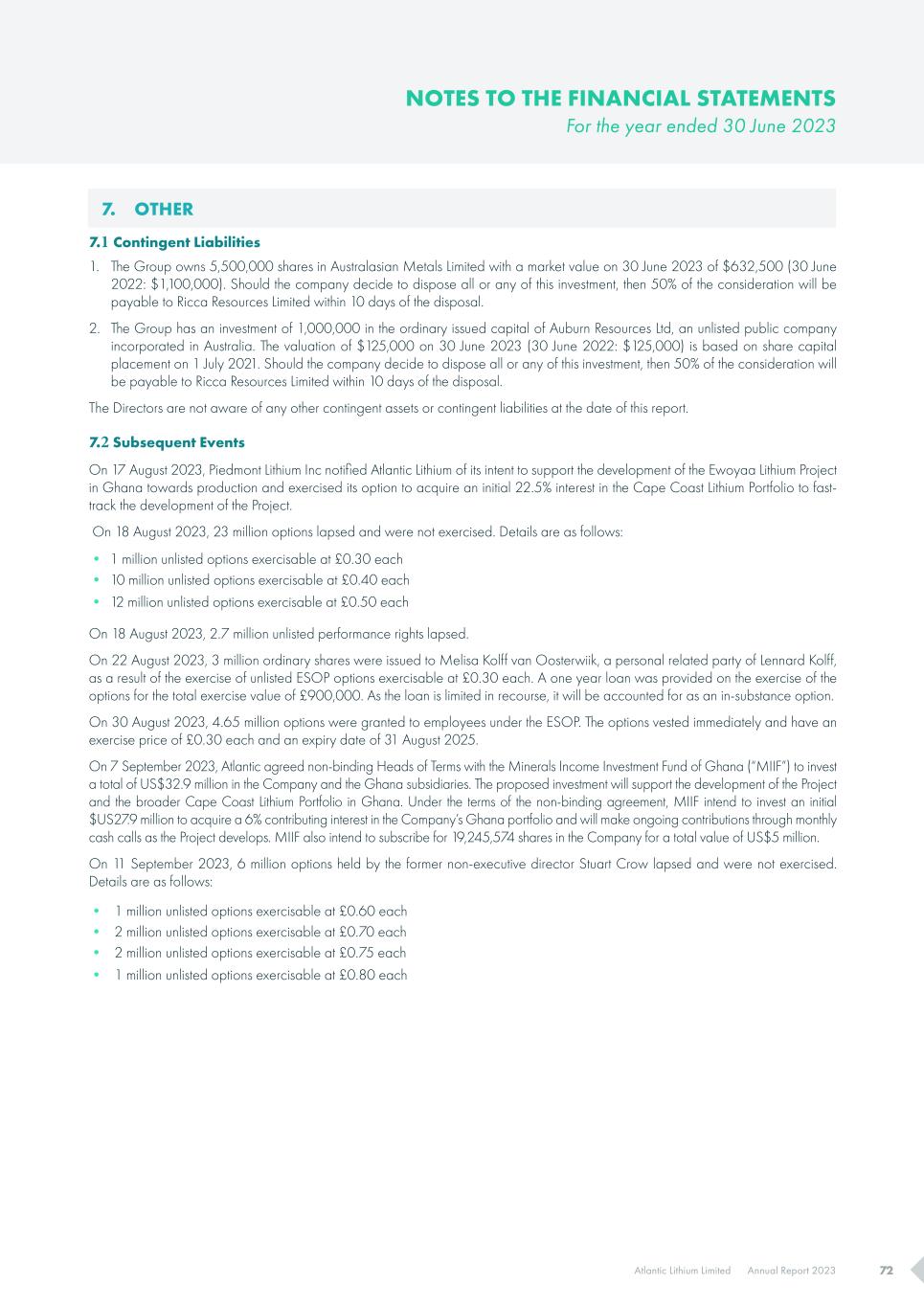

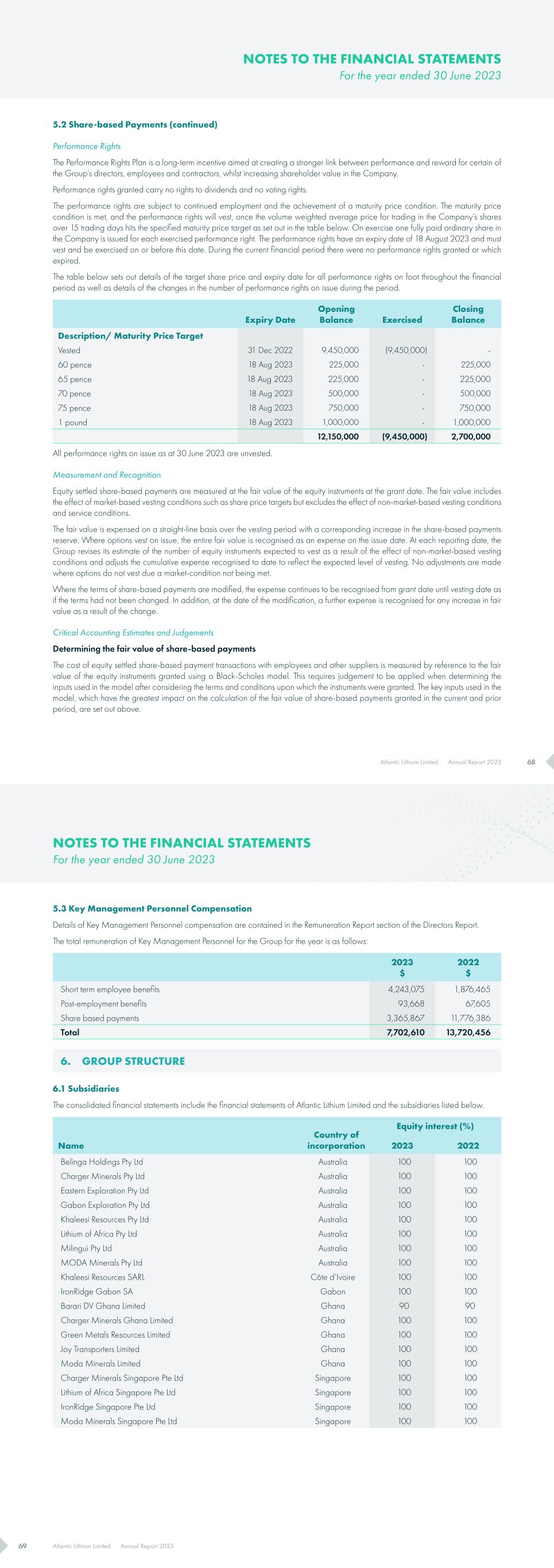

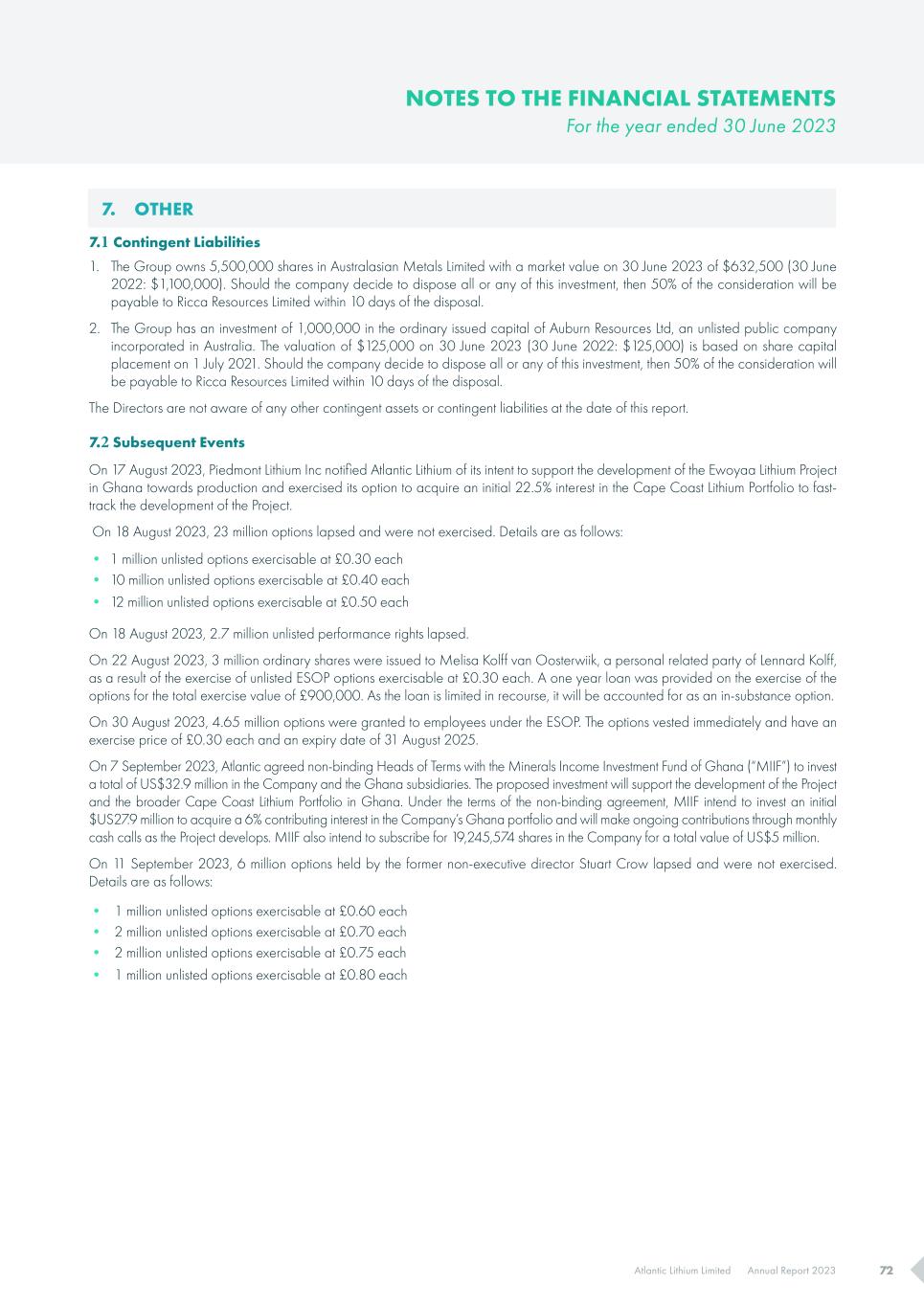

68Atlantic Lithium Limited Annual Report 2023 5.2 Share-based Payments (continued) Performance Rights The Performance Rights Plan is a long-term incentive aimed at creating a stronger link between performance and reward for certain of the Group’s directors, employees and contractors, whilst increasing shareholder value in the Company. Performance rights granted carry no rights to dividends and no voting rights. The performance rights are subject to continued employment and the achievement of a maturity price condition. The maturity price condition is met, and the performance rights will vest, once the volume weighted average price for trading in the Company’s shares over 15 trading days hits the specified maturity price target as set out in the table below. On exercise one fully paid ordinary share in the Company is issued for each exercised performance right. The performance rights have an expiry date of 18 August 2023 and must vest and be exercised on or before this date. During the current financial period there were no performance rights granted or which expired. The table below sets out details of the target share price and expiry date for all performance rights on foot throughout the financial period as well as details of the changes in the number of performance rights on issue during the period. Expiry Date Opening Balance Exercised Closing Balance Description/ Maturity Price Target Vested 31 Dec 2022 9,450,000 (9,450,000) - 60 pence 18 Aug 2023 225,000 - 225,000 65 pence 18 Aug 2023 225,000 - 225,000 70 pence 18 Aug 2023 500,000 - 500,000 75 pence 18 Aug 2023 750,000 - 750,000 1 pound 18 Aug 2023 1,000,000 - 1,000,000 12,150,000 (9,450,000) 2,700,000 All performance rights on issue as at 30 June 2023 are unvested. Measurement and Recognition Equity settled share-based payments are measured at the fair value of the equity instruments at the grant date. The fair value includes the effect of market-based vesting conditions such as share price targets but excludes the effect of non-market-based vesting conditions and service conditions. The fair value is expensed on a straight-line basis over the vesting period with a corresponding increase in the share-based payments reserve. Where options vest on issue, the entire fair value is recognised as an expense on the issue date. At each reporting date, the Group revises its estimate of the number of equity instruments expected to vest as a result of the effect of non-market-based vesting conditions and adjusts the cumulative expense recognised to date to reflect the expected level of vesting. No adjustments are made where options do not vest due a market-condition not being met. Where the terms of share-based payments are modified, the expense continues to be recognised from grant date until vesting date as if the terms had not been changed. In addition, at the date of the modification, a further expense is recognised for any increase in fair value as a result of the change. Critical Accounting Estimates and Judgements Determining the fair value of share-based payments The cost of equity settled share-based payment transactions with employees and other suppliers is measured by reference to the fair value of the equity instruments granted using a Black-Scholes model. This requires judgement to be applied when determining the inputs used in the model after considering the terms and conditions upon which the instruments were granted. The key inputs used in the model, which have the greatest impact on the calculation of the fair value of share-based payments granted in the current and prior period, are set out above. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 69 Atlantic Lithium Limited Annual Report 2023 5.3 Key Management Personnel Compensation Details of Key Management Personnel compensation are contained in the Remuneration Report section of the Directors Report. The total remuneration of Key Management Personnel for the Group for the year is as follows: 2023 $ 2022 $ Short term employee benefits 4,243,075 1,876,465 Post-employment benefits 93,668 67,605 Share based payments 3,365,867 11,776,386 Total 7,702,610 13,720,456 6. GROUP STRUCTURE 6.1 Subsidiaries The consolidated financial statements include the financial statements of Atlantic Lithium Limited and the subsidiaries listed below. Name Country of incorporation Equity interest (%) 2023 2022 Belinga Holdings Pty Ltd Australia 100 100 Charger Minerals Pty Ltd Australia 100 100 Eastern Exploration Pty Ltd Australia 100 100 Gabon Exploration Pty Ltd Australia 100 100 Khaleesi Resources Pty Ltd Australia 100 100 Lithium of Africa Pty Ltd Australia 100 100 Milingui Pty Ltd Australia 100 100 MODA Minerals Pty Ltd Australia 100 100 Khaleesi Resources SARL Côte d’Ivoire 100 100 IronRidge Gabon SA Gabon 100 100 Barari DV Ghana Limited Ghana 90 90 Charger Minerals Ghana Limited Ghana 100 100 Green Metals Resources Limited Ghana 100 100 Joy Transporters Limited Ghana 100 100 Moda Minerals Limited Ghana 100 100 Charger Minerals Singapore Pte Ltd Singapore 100 100 Lithium of Africa Singapore Pte Ltd Singapore 100 100 IronRidge Singapore Pte Ltd Singapore 100 100 Moda Minerals Singapore Pte Ltd Singapore 100 100 NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

70Atlantic Lithium Limited Annual Report 2023 6.2 Parent Information a) Statement of Financial Performance 2023 $ 2022 $ Assets Current assets 16,953,176 25,652,089 Non-current assets 16,179,648 10,954,232 Total assets 33,132,824 36,606,321 Liabilities Current liabilities 4,119,725 2,394,873 Non-current liabilities 61,856 43,341 Total liabilities 4,181,581 2,438,214 Net Assets 28,951,243 34,168,107 Issued capital 129,873,021 126,468,060 Share based payment reserve 29,289,734 25,745,706 Financial assets revaluation reserve 184,319 511,575 Demerger Reserve (28,921,942) (28,794,153) Accumulated losses (101,473,889) (89,763,081) Total equity 28,951,243 34,168,107 b) Statement of Profit of Loss and Comprehensive Income 2023 $ 2022 $ Loss for the year (11,710,808) (36,259,124) Other comprehensive income (327,256) 209,760 Total comprehensive loss (12,038,064) (36,049,364) c) Guarantees, contingent liabilities and capital commitments The parent entity has not guaranteed any debts of subsidiaries in the current or prior financial year. The parent entity has no capital commitments as at 30 June 2023 (2022: nil). The contingent liabilities of the parent entity are the same as those of the group as disclosed in Note 7.2. 6.3 Demerger of Ricca Resources Limited (Ricca) On 24 December 2021, the Group completed the demerger of Ricca (and accordingly the Gold Business in Ivory Coast and Chad), by way of a capital reduction and in-specie distribution to eligible Atlantic Lithium shareholders. Eligible shareholders received an in- specie distribution of 1 Ricca share for every 8 Atlantic shares. The demerger distribution is accounted for as a reduction in equity by the recognition of a demerger reserve of ($28,921,942). NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023 Atlantic Lithium Limited Annual Report 202371 6.3 Demerger of Ricca Resources Limited (Ricca) (continued) The fair values of assets and liabilities distributed to shareholders were: $ Cash and Equivalents 7,238,862 Other Current Assets 21,132 Property Plant and Equipment 54,916 Exploration and Evaluation Assets 37,910,194 Total Assets 45,225,104 Trade and Other Payables (75,152) Carrying value of net assets distributed 45,149,952 Write down on Demerger (16,228,010) Demerger Reserve 28,921,942 NOTE: The Fair value of net assets distributed increased by $127,789 compared to what was reported in the 2022 financial statements. This was due to an adjustment of Loans owing by Ivory Coast and Chad (on demerger date) written off in 2023 financial statements. 6.4 Related Party Transactions As disclosed in Note 3.4, the Company has a Funding Agreement with a major shareholder, Piedmont Lithium Inc. Amounts received from Piedmont during the year are disclosed in Note 3.4 and the amount receivable as at year end is disclosed in Note 3.1. The following table provides details of transactions with related parties during the current and prior financial year: Related party Services provided and reimbursed $ Services received and expensed $ Directors fees expensed $ Assore Limited (i) 2023 - - 120,000 2022 - - 120,000 Sumitomo Corporation (i) 2023 - - - 2022 - - 49,450 Ricca Resources Limited (ii) 2023 206,585 60,101 - 2022 94,330 - - (i) The Company has commercial agreements in place with major shareholders for the services of Non-Executive Directors (NEDs). Assore Limited has provided two NEDs in the current and prior financial year (Kieran Daly and Christelle Van der Merwe) and Sumitomo Corporation provided one NED until 27 April 2022 (Tetsunosuke Miyawaki). The Group pays a monthly fee for these services and the fees have been included in the directors remuneration report under the individual representatives of each shareholder (ii) During the prior financial year the Group completed the demerger of Ricca. Further details of the demerger are contained in Note 6.3. The Company recharges Ricca for certain services provided by the Company including exploration staff, premises, IT and insurance. Ricca recharges the Company for marketing staff. The following amounts were outstanding with related parties at the reporting date. Amounts Owed to Related Parties (i) Amounts Owed by Related Parties (ii) 2023 $ 2022 $ 2023 $ 2022 $ Assore Limited 60,000 885,714 - - Sumitomo Corporation - 4,451 - - Ricca Resources - - 167,406 152,227 (i) Disclosed within trade and other payables in Note 3.5. (ii) Disclosed within other receivables in Note 3.1. All outstanding balances are unsecured, interest free and will be settled in cash. NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023

Atlantic Lithium Limited Annual Report 2023 72 7. OTHER 7.1 Contingent Liabilities 1. The Group owns 5,500,000 shares in Australasian Metals Limited with a market value on 30 June 2023 of $632,500 (30 June 2022: $1,100,000). Should the company decide to dispose all or any of this investment, then 50% of the consideration will be payable to Ricca Resources Limited within 10 days of the disposal. 2. The Group has an investment of 1,000,000 in the ordinary issued capital of Auburn Resources Ltd, an unlisted public company incorporated in Australia. The valuation of $125,000 on 30 June 2023 (30 June 2022: $125,000) is based on share capital placement on 1 July 2021. Should the company decide to dispose all or any of this investment, then 50% of the consideration will be payable to Ricca Resources Limited within 10 days of the disposal. The Directors are not aware of any other contingent assets or contingent liabilities at the date of this report. 7.2 Subsequent Events On 17 August 2023, Piedmont Lithium Inc notified Atlantic Lithium of its intent to support the development of the Ewoyaa Lithium Project in Ghana towards production and exercised its option to acquire an initial 22.5% interest in the Cape Coast Lithium Portfolio to fast- track the development of the Project. On 18 August 2023, 23 million options lapsed and were not exercised. Details are as follows: • 1 million unlisted options exercisable at £0.30 each • 10 million unlisted options exercisable at £0.40 each • 12 million unlisted options exercisable at £0.50 each On 18 August 2023, 2.7 million unlisted performance rights lapsed. On 22 August 2023, 3 million ordinary shares were issued to Melisa Kolff van Oosterwiik, a personal related party of Lennard Kolff, as a result of the exercise of unlisted ESOP options exercisable at £0.30 each. A one year loan was provided on the exercise of the options for the total exercise value of £900,000. As the loan is limited in recourse, it will be accounted for as an in-substance option. On 30 August 2023, 4.65 million options were granted to employees under the ESOP. The options vested immediately and have an exercise price of £0.30 each and an expiry date of 31 August 2025. On 7 September 2023, Atlantic agreed non-binding Heads of Terms with the Minerals Income Investment Fund of Ghana (“MIIF”) to invest a total of US$32.9 million in the Company and the Ghana subsidiaries. The proposed investment will support the development of the Project and the broader Cape Coast Lithium Portfolio in Ghana. Under the terms of the non-binding agreement, MIIF intend to invest an initial $US27.9 million to acquire a 6% contributing interest in the Company’s Ghana portfolio and will make ongoing contributions through monthly cash calls as the Project develops. MIIF also intend to subscribe for 19,245,574 shares in the Company for a total value of US$5 million. On 11 September 2023, 6 million options held by the former non-executive director Stuart Crow lapsed and were not exercised. Details are as follows: • 1 million unlisted options exercisable at £0.60 each • 2 million unlisted options exercisable at £0.70 each • 2 million unlisted options exercisable at £0.75 each • 1 million unlisted options exercisable at £0.80 each NOTES TO THE FINANCIAL STATEMENTS For the year ended 30 June 2023