UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-K

________________________________

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to ________

Commission File Number 001-38427

___________________________________________________________

Piedmont Lithium Inc.

(Exact name of Registrant as specified in its Charter)

_________________________________________________________________________________________

| | | | | |

| Delaware | 36-4996461 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

42 E Catawba Street Belmont, North Carolina | 28012 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (704) 461-8000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.0001 par value per share | | PLL | | The Nasdaq Capital Market |

| | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | ☐ | No | ☒ |

| | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ☐ | No | ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| | | | | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | | |

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Exchange Act.

☐ Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☐ If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐ Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act).

As of June 30, 2024, the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant (based on the closing price of the registrant's common shares on the Nasdaq Stock Market for June 30, 2024) was approximately $190,429,937. For the purposes of the foregoing calculation only, all directors and executive officers of the registrant have been deemed affiliates.

As of February 18, 2025, there were 21,943,521 shares of the registrant’s common stock outstanding.

Table of Contents

| | | | | | | | | | | |

| | | Page |

| |

| PART I | |

| Item 1. | | |

| | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| | | |

| |

| | | |

| |

GLOSSARY OF TERMS AND DEFINITIONS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | |

| 2024 Cost Savings Plan | Board approved action in response to the decline in the lithium market to reduce cash operating costs, defer capital spending, and limit cash investments in and advances to affiliates in 2024 |

| 401(k) Plan | Piedmont Lithium 401(k) Plan |

| |

| |

| Annual Report | Annual Report on Form 10-K |

| ASC | Accounting Standards Codification |

| ASX | Australian Securities Exchange |

| Atlantic Lithium | Atlantic Lithium Limited |

| Atlantic Lithium Ghana | Atlantic Lithium’s Ghanaian-based lithium portfolio companies |

| ATM Program | at-the-market issuance sales agreement |

| ATVM | Advanced Technology Vehicles Manufacturing |

| Authier | Authier Lithium project |

| BAPE | Bureau d’Audiences Publiques Sur l’Environnement |

| Board | Piedmont Lithium’s Board of Directors |

| Carolina Lithium | Carolina Lithium project |

| CD&A | Compensation Discussion and Analysis |

| CDI | CHESS Depository Interest |

| CERCLA | Comprehensive Environmental Response, Compensation, and Liability Act |

| |

| CODM | Chief Operating Decision Maker |

| COSO | Committee of Sponsoring Organizations of the Treadway Commission |

| CWA | Clean Water Act |

| |

| Credit Facility | $25.0 million working capital financing arrangement with a trading company partner based on committed volumes of spodumene concentrate |

| Deloitte | Deloitte & Touche LLP |

| DEMLR | Department of Energy, Mineral and Land Resources |

| DFS | definitive feasibility study |

| dmt | dry metric ton(s) |

| DOE | U.S. Department of Energy |

| DPA | Defense Production Act of 1950, as amended |

| EPA | U.S. Environmental Protection Agency |

| |

| ESG | environmental, social and governance |

| Ewoyaa | Ewoyaa Lithium project |

| Exchange Act | Securities Exchange Act of 1934 |

| |

| FASB | Financial Accounting Standards Board |

| FCPA | U.S. Foreign Corrupt Practices Act |

| FDIC | Federal Deposit Insurance Corporation |

| |

| FOB | free on board |

| IRA | Inflation Reduction Act of 2022 |

| JORC Code | 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves |

| Killick Lithium | Killick Lithium Inc. |

| |

| LCE | lithium carbonate equivalent |

| LG Chem | LG Chem, Ltd. |

| Tennessee Lithium | Tennessee Lithium project |

Li2O | lithium oxide |

LiOH·H2O | lithium hydroxide monohydrate |

| LiOH | lithium hydroxide |

| Merger | The merger, pursuant to the Merger Agreement, of Shock MergerCo Inc. with and into Piedmont, with Piedmont continuing as the surviving company |

| | | | | |

| Merger Agreement | Agreement and Plan of Merger, dated as of November 18, 2024, by and among Piedmont Lithium, Sayona Mining, and Shock MergerCo Inc., a Delaware corporation and a wholly owned subsidiary of Sayona Mining |

| Metso | Metso Corporation |

| MIIF | Minerals Income Investment Fund of Ghana |

| Milestone PRAs | PRAs that could be earned based upon achievement of certain specified milestones |

| |

| |

| |

| MT | million metric tons |

| NAL | North American Lithium Inc. |

| Nasdaq | Nasdaq Capital Market |

| NCDEQ | North Carolina Department of Environmental Quality |

| NCDOT | North Carolina Department of Transportation |

| NEO | named executive officer |

| NEPA | National Environmental Protection Act |

| |

| Piedmont Australia | Piedmont Lithium Pty Ltd (formerly named Piedmont Lithium Limited) |

| |

| PRAs | performance rights awards |

| |

| PwC | PricewaterhouseCoopers LLP |

| QP | Qualified Person, as defined in Regulation S-K, Subpart 1300, under the Securities Act of 1933 |

| RCRA | Resource Conservation and Recovery Act |

| Redomiciliation | Redomiciliation of the Company from Australia to Delaware, effective May 17, 2021 |

| Ricca | Ricca Resources Limited |

| ROU | right-of-use |

| RSUs | restricted stock units |

| Sayona Mining | Sayona Mining Limited |

| Sayona Quebec | Sayona Quebec Inc. |

| SEC | U.S. Securities and Exchange Commission |

| Securities Act | Securities Act of 1933, as amended |

| SEH | safety, environment and health |

| S-K 1300 | Regulation S-K, Subpart 1300, under the Securities Act of 1933 |

| SOFR | secured overnight financing rate |

| spodumene concentrate | spodumene concentrate or SC[X] where “X” represents the lithium content of the concentrate on an Li2O% basis |

| Stock Incentive Plan | Piedmont Lithium Inc. Stock Incentive Plan adopted by our Board on March 31, 2021 |

| Tansim | Tansim Lithium project |

| |

| Title V Permit | Title V Prevention of Significant Deterioration Air Permit |

| TSR | total shareholder return |

| TSR PRAs | PRAs related to market goals based on a comparison of Piedmont Lithium’s total shareholder return relative to the total shareholder return of a pre-determined set of peer group companies for the performance periods |

| U.S. | United States of America |

| U.S. GAAP | U.S. generally accepted accounting principles |

| Vallée | Vallée Lithium project |

| Vinland Lithium | Vinland Lithium Inc. |

Item 1. BUSINESS

Overview

Piedmont Lithium Inc. (“Piedmont Lithium,” “Piedmont”, “we,” “us,” “our,” or “Company”) is a U.S.-based, development-stage company advancing a multi-asset, integrated lithium business in support of a clean energy economy and U.S. and global energy security. We plan to supply lithium hydroxide to the electric vehicle and battery manufacturing supply chains in North America by processing spodumene concentrate produced from assets we own or in which we have an economic interest.

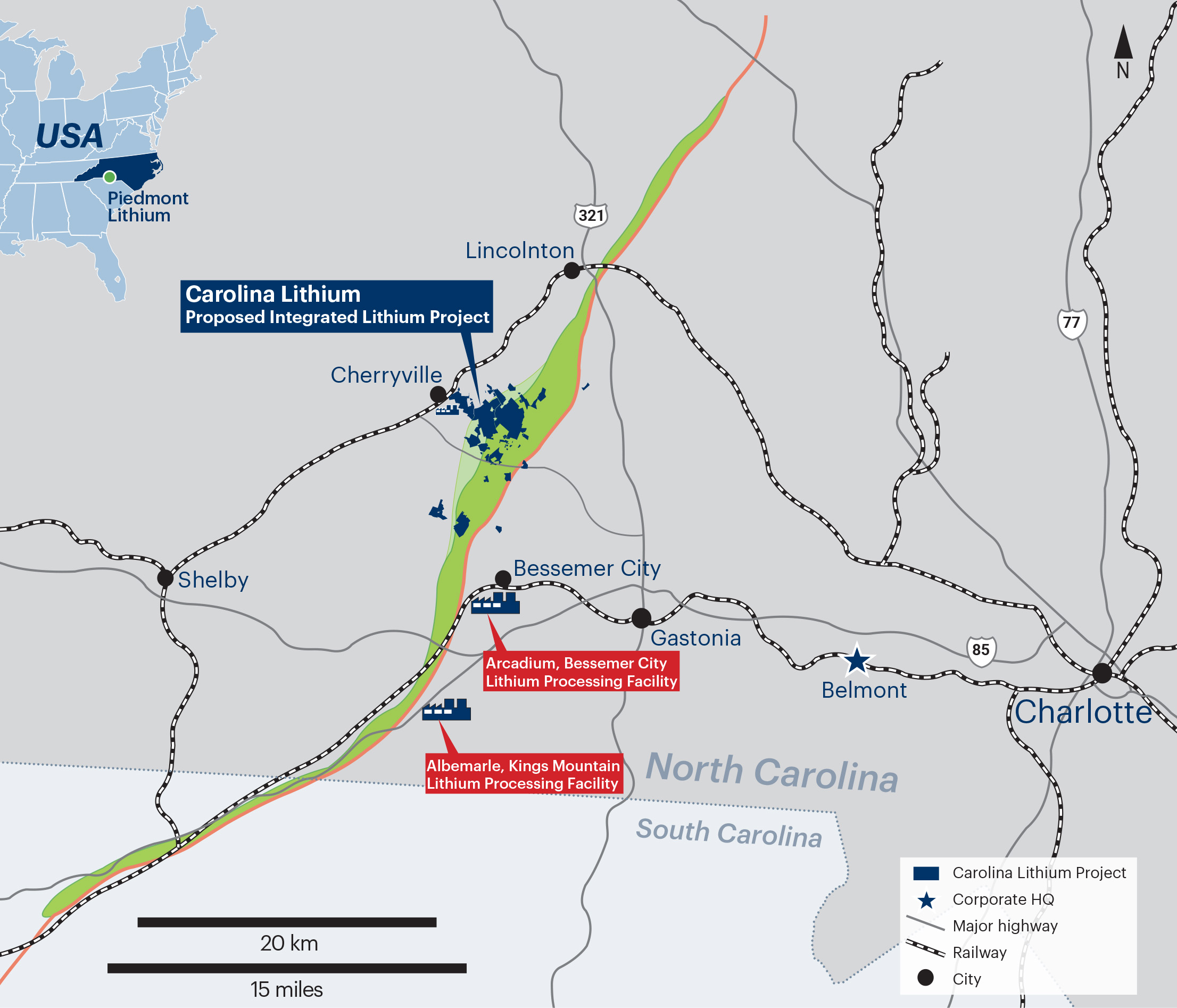

Our portfolio includes our wholly-owned Carolina Lithium, a proposed fully integrated spodumene ore-to-lithium hydroxide project in Gaston County, North Carolina. The balance of our project portfolio includes strategic investments in lithium assets in Quebec, Canada, including the operational NAL mine; in Ghana, West Africa with Atlantic Lithium, including the Ewoyaa project; and in Newfoundland, Canada with Vinland Lithium, including the Killick Lithium project.

Piedmont Lithium incorporated in the State of Delaware on December 3, 2020. We maintain executive offices at 42 E Catawba Street, Belmont, NC, 28012, and our telephone number is (704) 461-8000. Our website address is www.piedmontlithium.com. Shares of our common stock, par value $0.0001 per share, are traded on the Nasdaq under the symbol “PLL” and our CDIs, each representing 1/100th of a share of our common stock, are traded on the ASX, also under the symbol “PLL.”

Proposed Merger with Sayona Mining

On November 18, 2024, we entered into the Merger Agreement with Sayona Mining, whereby Piedmont and Sayona Mining will be combined on a stock-for-stock basis where each share of Piedmont common stock, par value US$0.0001 per share, issued and outstanding immediately prior to the consummation of the Merger, subject to certain exclusions, shall be converted into the right to receive from Sayona Mining 527 Sayona Mining ordinary shares.

Consummation of the Merger, which is expected to occur mid-2025, is subject to certain closing conditions, including requisite approvals of Piedmont’s stockholders and Sayona Mining’s shareholders of the Merger Agreement. The Merger Agreement contains certain termination rights in favor of Sayona Mining and Piedmont, including if the Merger is not consummated on or before September 30, 2025 or if the requisite approvals of Sayona Mining shareholders and Piedmont stockholders are not obtained.

The foregoing summary of the Merger Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its entirety by reference to the terms and conditions of the Merger Agreement, a copy of which is attached as Exhibit 2.1 to this Annual Report.

See Part I, Item 1A -“Risk Factors-Risks Related to the Merger Agreement” in this Annual Report for additional information about the Merger.

Foreign Currencies

Our consolidated financial statements have been presented in our reporting currency, U.S. dollars.

Gains and losses arising from translations or settlements of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency translation adjustments resulting from the change in functional currency are included in “Other comprehensive (loss) income, net of tax,” and gains and losses resulting from foreign currency transactions are presented in “Other loss” in the consolidated financial statements.

Unless otherwise indicated, all references to “$” are to U.S. dollars, all references to “AUD” are to Australian dollars, and all references to “CAD” are to Canadian dollars.

Our Segment

We have one operating segment, which is also our reportable segment. Our CODM, who is also our CEO, manages our operations on a consolidated basis for purposes of allocating resources.

Strategy

Our strategic goal is to become a leading producer of lithium products in North America, supplied by geographically diverse and sustainable spodumene assets. North American demand for lithium continues to grow as a cornerstone material for the global energy transition, including the manufacturing of electric vehicles and development of energy storage systems. We believe our global portfolio of hard rock lithium assets should support a level of estimated lithium hydroxide production that will dramatically increase current production of lithium hydroxide in the United States.

Our plan is to produce battery-grade lithium hydroxide from spodumene concentrate. We believe spodumene concentrate represents the lowest-risk and most commercially scalable raw material source for the production of lithium hydroxide. Within our production process, we expect to use Metso’s pressure leach technology as well as a number of manufacturing processes commonly used in the lithium industry today. We plan, as part of our sustainability goals within our overall ESG strategy, to develop our greenfield operation in North Carolina as one of the most sustainable lithium hydroxide production operations in the world.

Our portfolio, which includes Carolina Lithium and strategic equity investments, are being developed on a measured timeline to optimize both near-term cash flow and long-term value maximization. At production, we expect to have an estimated lithium hydroxide manufacturing capacity of 60,000 metric tons per year, as compared to the current total estimated U.S. lithium hydroxide production capacity of approximately 20,000 metric tons per year. In support of our strategy, we continue to evaluate opportunities to further expand our resource base and production capacity.

Developing an Integrated Lithium Production Business—Key Projects

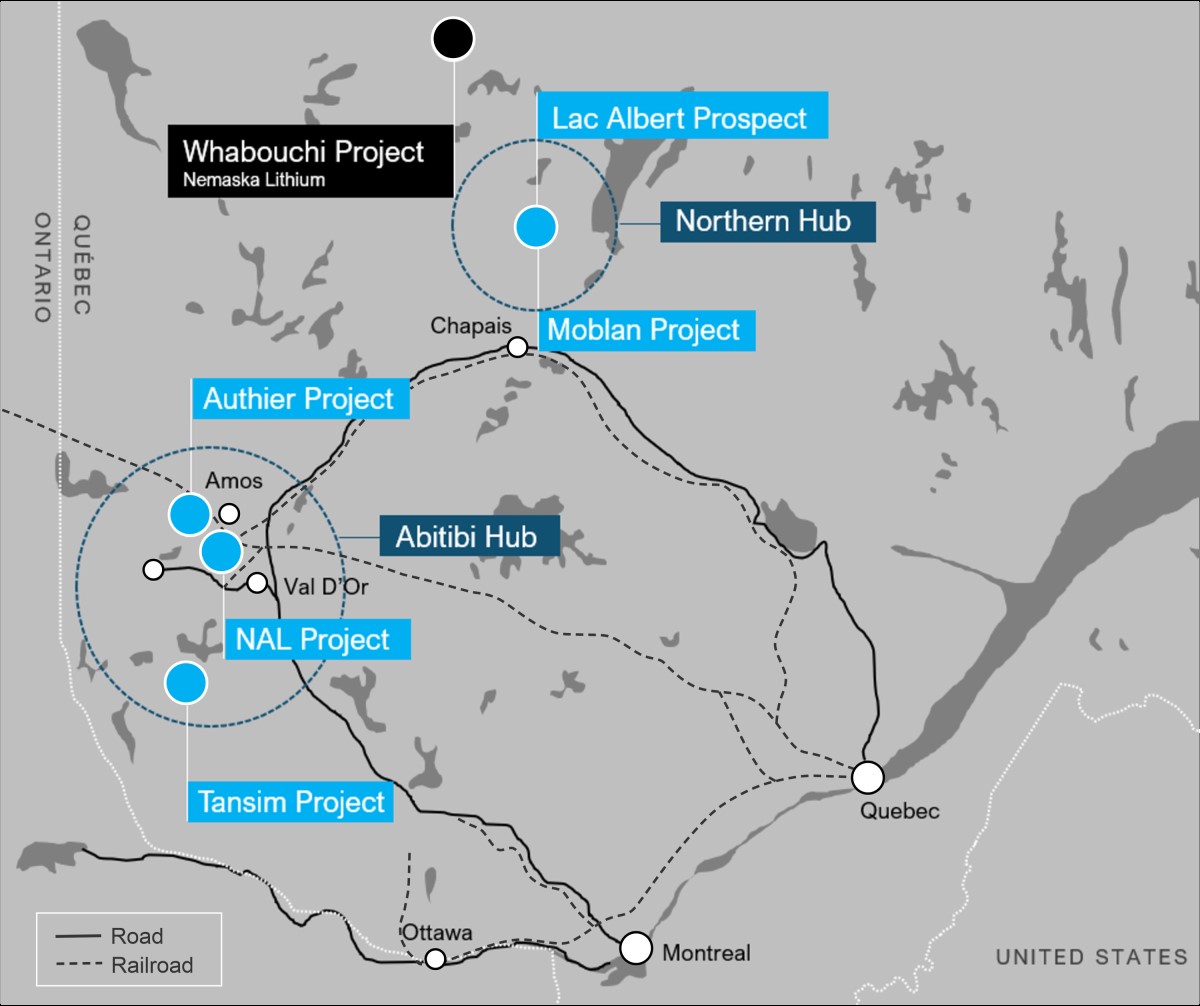

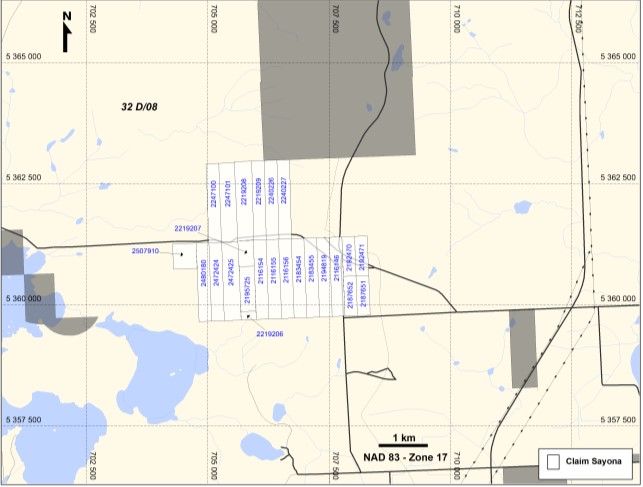

Quebec

Piedmont Lithium owns an equity interest of 25% in Sayona Quebec, which owns full equity interests in the NAL, Authier, Tansim, and Vallée properties. These projects are located in the Abitibi region of Quebec, Canada. We also hold an offtake agreement with Sayona Quebec for the greater of 113,000 dmt per year or 50% of annual spodumene concentrate production at market prices, subject to a price floor of $500 per dmt and a price ceiling of $900 per dmt for SC6, on a life-of-mine basis.

In February 2024, we sold approximately 1,250 million shares of Sayona Mining for an average of $0.03 per share. The shares sold represented approximately 12% of Sayona Mining’s outstanding shares and resulted in $41.4 million in net proceeds. The sale of these shares has no impact on Piedmont Lithium’s joint venture or offtake rights with Sayona Quebec.

NAL restarted production of spodumene concentrate in March 2023 and achieved steady-state production in June 2024. NAL progressively set record quarterly production levels of 40,439 dmt, 49,660 dmt, and 52,141 dmt, in the first quarter, second quarter, and third quarter, respectively, followed by 50,922 dmt in the fourth quarter, with significant increases in ore mined, mill utilization, and global recovery rates during 2024.

Sayona Mining achieved record production for the one-year period ended December 31, 2024, producing 193,162 dmt, of which 116,700 dmt were delivered to Piedmont Lithium in accordance with our offtake agreement. We, in turn, sold 116,700 dmt to our customers to whom we supply through offtake and purchase agreements, all of which contain market-based pricing mechanisms. We utilized an updated commercial strategy in the second half of 2024 to take advantage of lithium futures markets, resulting in an industry-leading realized spodumene concentrate price in the third and fourth quarters of 2024. Improved profitability was also the result of consolidation of shipments with Sayona Quebec, which reduced transportation costs. NAL completed construction of its tailings storage facility in the first quarter of 2024 and a crushed-ore dome in the second quarter of 2024. The completion of the dome contributed to the achievement of steady-state production in the second quarter of 2024 and is expected to be key in achieving full run-rate production throughput at NAL, thereby allowing for improved overall availability in the operation and resulting in meaningfully lower unit production costs. Increased blasting efficiencies and dilution management were utilized to deliver higher grades of ore to the plant in the second half of 2024. Continuing improvement of operating costs will be a key focus for NAL in 2025.

In addition to spodumene mining and concentrate production, NAL’s facilities also include a partially completed lithium carbonate plant, which was developed by a prior operator of NAL. In the event both we and Sayona Mining decide to jointly construct and operate a lithium conversion plant through our jointly-owned entity, Sayona Quebec, then spodumene concentrate produced from NAL would be preferentially delivered to that conversion plant upon commencement of conversion operations. Any remaining spodumene concentrate not delivered to a jointly owned conversion plant would first be delivered to Piedmont Lithium up to our offtake right and then to third parties.

In the third quarter of 2024, Sayona Mining announced an increase to the mineral resource estimate at NAL, including an increase to the mineral resources in the measured and indicated categories in accordance with JORC Code requirements.

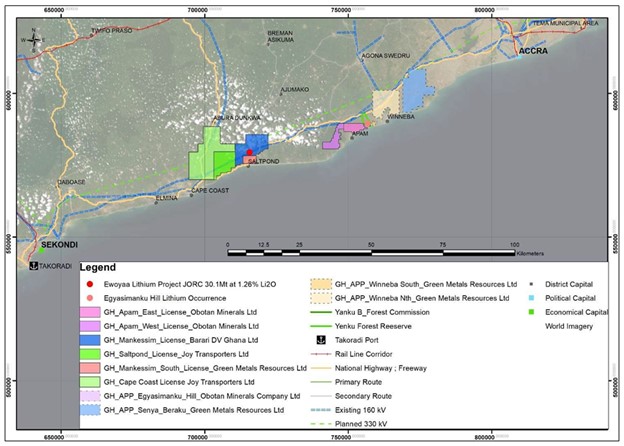

Ghana

As of December 31, 2024, we have the ability to earn a 50% equity interest in Atlantic Lithium Ghana, which includes Ewoyaa. In August 2023, we exercised our option, to acquire an initial 22.5% equity interest, and expect to earn an additional 27.5% equity interest, subject to funding the first $70 million of development costs for Ewoyaa. Once our equity interests are acquired, and if both the mining lease is ratified and the agreement with MIIF is executed, Piedmont Lithium and Atlantic Lithium expect to each own a 40.5% equity interest in Ewoyaa. MIIF is expected to own a 6% equity interest in Ewoyaa, with the Government of Ghana expected to obtain a 13% free-carried interest in accordance with the mining lease. As of December 31, 2024, we have not received any shares in Atlantic Lithium Ghana.

Additionally, we hold an offtake agreement for 50% of annual production of spodumene concentrate from Ewoyaa at market prices on a life-of-mine basis, subject to our satisfaction of certain development cost funding requirements. Ewoyaa is Atlantic Lithium’s flagship project in the Cape Coast region of Ghana and located approximately 70 miles from the Port of Takoradi, a major port via a national highway. We anticipate the development of the Ewoyaa project to be key for delivering spodumene concentrate to the market.

In January 2024, MIIF commenced its investment in Atlantic Lithium through its purchase of Atlantic Lithium’s common stock totaling $5 million. In September 2023, Atlantic Lithium had announced that MIIF plans to invest (i) $27.9 million to acquire a 6% stake in Ewoyaa and (ii) $5 million in Atlantic Lithium’s common stock to help further, in part, the development of Ewoyaa. As part of these investments, it is our understanding that MIIF intends to fund 6% of all future exploration and development costs within Atlantic Lithium Ghana. These funds are expected to equally reduce Piedmont Lithium’s and Atlantic Lithium’s capital expenditure contributions for Ewoyaa.

In January 2024, we sold 24.5 million shares of Atlantic Lithium, for an average price of $0.32 per share, after which we retained shares representing approximately a 5% ownership interest. The shares sold resulted in net proceeds of $7.7 million.

In July 2024, the application to grant the Ewoyaa mining lease was submitted to the Ghanaian parliament to undergo the ratification process. The mining lease remains subject to parliamentary ratification as of the date of this Annual Report. Ewoyaa made key strides on the regulatory front in the second half of 2024 with the receipt of the environmental permit granted by Ghana’s Environmental Protection Agency in September 2024 and the Mine Operating Permit issued by the Minerals Commission of Ghana in October 2024.

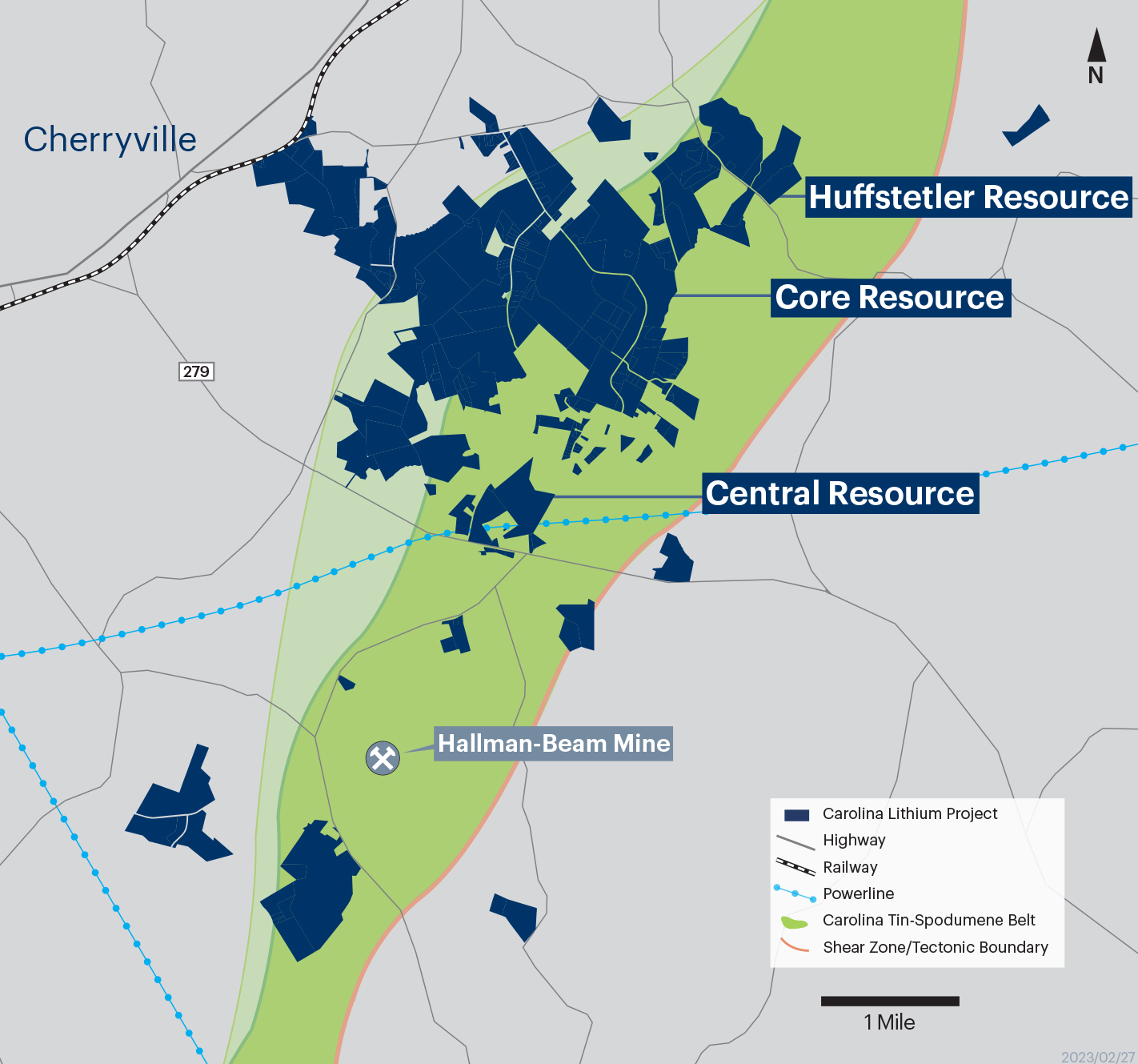

Carolina Lithium

Carolina Lithium is a development stage, hard rock lithium project located within the renowned Carolina Tin-Spodumene Belt of North Carolina and in close proximity to lithium markets. Carolina Lithium is expected to consist of a mining operation, a concentrator, and a lithium hydroxide conversion plant. The conversion plant is expected to be developed in phases and produce 60,000 metric tons of lithium hydroxide per year at full capacity. Due to the expected quality of this hard rock lithium asset, integration of the operation, existing infrastructure, and proximity to lithium and byproduct markets, we believe Carolina Lithium will be one of the lowest cost lithium hydroxide manufacturing operations in the world.

We received the mining permit for Carolina Lithium in 2024 and continue to engage in permitting activities with state and local agencies. In August 2021, we submitted a mining permit application to the NCDEQ’s DEMLR. Following our submission, we responded to a series of additional information requests made by DEMLR. In April 2024, DEMLR approved the mining permit application and issued the finalized permit in May 2024 following our posting of the required reclamation bond. A Prevention of Significant Deterioration – Title V Air Permit application was submitted to the NCDEQ Division of Air Quality and deemed complete in February 2023, and remains under review. We previously worked with the NCDEQ Division of Water Resources on a National Pollutant Discharge Elimination System permit for the site; however, we recently pivoted toward pursuit of North Carolina General Stormwater permits instead. As a result, we have withdrawn our National Pollutant Discharge Elimination System permit applications and submitted applications required to obtain North Carolina General Stormwater permits for both the conversion plant as well as the mine and concentrator operations.

Our goal in 2025 is to obtain the remaining material state permits for Carolina Lithium and assess the timeline for rezoning activities. The timeline for project development will take into consideration strategic partnerships and project financing activities, as well as market conditions.

Tennessee Lithium

Following the receipt of our Carolina Lithium state mining permit in the second quarter of 2024, and in response to changing market conditions, we consolidated our U.S. project development strategy by shifting the proposed Tennessee Lithium conversion capacity to Carolina Lithium. The updated strategy is designed to deploy capital and technical resources more efficiently and leverage our foundational North Carolina project with the potential for up to 60,000 metric tons of lithium hydroxide production per year .

The conversion capacity is expected to include two lithium hydroxide trains constructed in a phased approach. The bulk of previously completed front-end engineering work for Tennessee Lithium will be transferred to Carolina Lithium.

In 2024, we exited both our option agreement to purchase the proposed site for Tennessee Lithium and our purchase agreement to acquire an existing industrial facility in close proximity to our proposed Tennessee project site. We currently maintain in care and maintenance a 132-acre disposal facility adjacent to the former proposed Tennessee Lithium site, with the intention to sell the property in due time.

Strengths

We believe that we are well-positioned to successfully execute our business strategies primarily due to our following competitive strengths:

•Revenue generation from NAL—NAL, the largest producing lithium mine in North America, achieved run rate and multiple quarterly production records in 2024. We hold an offtake agreement with Sayona Quebec for the greater of 113,000 dmt per year or 50% of spodumene concentrate production from NAL at market prices, subject to a price floor of $500 per dmt and a price ceiling of $900 per dmt for SC6, on a life-of-mine basis. We, in turn, sell spodumene concentrate procured under our NAL offtake to Piedmont Lithium’s customers at market-based prices.

•Scale and diversification of resources—We own or hold interests in three significant spodumene resources located in Quebec, Ghana, and North Carolina. Beginning in January 2021, we have made investments in key spodumene resources and have established strategic partnerships with Sayona Mining and Atlantic Lithium. We continue to pursue opportunities to complement our business through additional acquisitions, joint ventures, strategic alliances, and investments.

•Advantageous locations and infrastructure—NAL is located in a well-established mining district within the Abitibi region of Quebec, Canada. The region provides access to infrastructure and is geopolitically advantageous. NAL is near the major mining town of Val-d’Or, Quebec, with access to rail, hydropower, and a skilled labor workforce. NAL has a partially completed lithium carbonate facility on site, which was developed by a previous operator. Ewoyaa is located in the Cape Coast region of Ghana with available power infrastructure nearby and direct highway access to Accra, which is approximately 60 miles from Ewoyaa. Ewoyaa also is approximately 70 miles from the deep-water Port of Takoradi, providing reasonable transport of spodumene concentrate. Carolina Lithium is well situated in a historical lithium region within the developing “Battery Belt.” The area features access to road and rail infrastructure, a highly skilled labor workforce, low-cost and low-carbon sources of baseload grid power, and research and development centers for lithium manufacturing.

•U.S.-based company—As a U.S.-domiciled and listed company with a U.S.-based proposed lithium project, Piedmont Lithium should benefit from policies aimed at supporting growth in the domestic battery supply chain and reducing reliance on foreign nations. These policies include the IRA’s Advanced Manufacturing Production Credit (Section 45X), which is available only to U.S. taxpayers and provides certain tax incentives for the production of applicable critical minerals. This credit is in addition to the opportunities available through the DOE’s ATVM loan program and DPA Title III loans or grants.

•Strategic funding—We are evaluating a variety of funding options to support development objectives aimed at maintaining shareholder value in the capital markets. ATVM, DPA loan(s) or grants, if awarded, are expected to cover a significant share of the capital required to develop Carolina Lithium, thereby strengthening the opportunity for strategic parties. Strategic partnerships, offtake prepayments, mineral royalties, and other opportunities are being considered to support the development of our projects and equity investments.

•Greenfield opportunities—Carolina Lithium is being designed as a new operation, which offers the opportunity to leverage modern technologies, systems, and procedures. We expect to utilize the innovative Metso pressure leach technology to convert spodumene concentrate to lithium hydroxide at this U.S. project. This technology is expected to provide a relative advantage in capital and operating costs and supports our ESG strategy to create a more sustainable operating profile as compared to other hard rock lithium conversion methods.

•Highly experienced management team—The Company is led by a highly experienced management team and has strong execution capabilities across all key functions.

Marketing, Sales, and Principal Markets

We continue to explore potential strategic partnerships and sales, offtake, and marketing agreements that will benefit the development of our assets as well as the U.S. electric vehicle supply chain.

Customers

On August 30, 2024, we entered into an amended offtake agreement with Tesla, Inc. to supply 125,000 dmt of spodumene concentrate from NAL. The term of the agreement runs through September 2026. Pricing is determined by a market-based mechanism. The initial term can be extended for an additional three years upon mutual agreement.

On February 16, 2023, we entered into a spodumene concentrate offtake agreement with LG Chem to sell 200,000 dmt of spodumene concentrate from our NAL offtake agreement. The term of the agreement expires four years from the date of first shipment or upon the delivery of 200,000 dmt. Pricing is determined by a market-based mechanism.

In addition to our offtake customers, we have entered into a series of purchase agreements with major international trading companies to facilitate individual sales. These purchase agreements provided for the delivery of spodumene concentrate primarily on an FOB vessel basis (Incoterms 2020) and included a partial prepayment convention.

Competition and Market Barriers

We compete with other mineral and chemical processing companies in connection with the acquisition of suitable exploration properties and the engagement of qualified personnel. Many of our competitors possess greater financial resources and technical capabilities than Piedmont Lithium. Although we aspire to be a leading lithium hydroxide producer in North America, the lithium mining and chemical industries are fragmented. We are one of many participants in these sectors. Many of our competitors, as compared to us, have been in business longer, have established more strategic partnerships and relationships, and have greater financial accessibility.

While we compete with other exploration companies in acquiring suitable properties, we believe there will be readily available purchasers of lithium chemical products or other industrial minerals if they are produced from any of our owned or leased properties. The price of our planned products may be affected by factors beyond our control, including fluctuations in the market prices for lithium, supplies of lithium, demand for lithium, and mining activities of others.

If we identify lithium mineralization that is determined to be of economic grade and in sufficient quantity to justify production, additional capital would be required to develop, mine, process, and sell such production. Our strategic partners, in which we have equity investments, face similar challenges as discussed above.

Government Regulations

Overview

Exploration and development activities for our projects are subject to extensive laws and regulations, which are overseen and enforced by multiple U.S. federal, state, and local authorities as well as foreign jurisdictions. These applicable laws govern exploration, development, production, exports, various taxes, labor standards, occupational and mine health and safety, waste disposal, protection and remediation of the environment, protection of endangered and protected species, and other matters. Various permits from government bodies are required for drilling, mining, or manufacturing operations to be undertaken, and we cannot be assured such permits will be received. Environmental laws and regulations may also, in addition to other requirements;

•require notice to stakeholders of proposed and ongoing exploration, drilling, environmental studies, mining, or production activities;

•require the installation of pollution control equipment;

•restrict the types, quantities and concentrations of various substances that can be released into the environment in connection with exploration, drilling, mining, lithium hydroxide manufacturing, or other production activities;

•limit or prohibit drilling, mining, lithium manufacturing or other production activities on lands located within wetlands, areas inhabited by endangered species and other protected areas, or otherwise restrict or prohibit activities that could impact the environment, including water resources;

•impose substantial liabilities for pollution resulting from current or former operations on or for any preexisting environmental impacts from our projects;

•require significant reclamation obligations in the future as a result of our mining and chemical operations; and

•require preparation of an environmental assessment or an environmental impact statement.

Compliance with environmental laws and regulations may impose substantial costs on us, subject us to significant potential liabilities, and have an adverse effect on our capital expenditures, results of operations, and competitive position. Violations and liabilities with respect to these laws and regulations could result in significant administrative, civil, and criminal penalties, remedial clean-ups, natural resource damages, permit modifications and/or revocations, operational interruptions and/or shutdowns, and other liabilities, as well as reputational harm, including damage to our relationships with customers, suppliers, investors, governments and other stakeholders. The costs of remedying such conditions may be significant, and remediation obligations could adversely affect our business, results of operations, and financial condition. Federal, state, and local legislative bodies and agencies frequently revise environmental laws and regulations, and any changes in these regulations, or the interpretations thereof, could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations. As of the date of this Annual Report, other than with respect to the permitting activities of Carolina Lithium, we have not been required to spend material amounts on compliance regarding environmental regulations.

Permits

Obtaining and renewing governmental permits are complex and time-consuming processes and involves numerous jurisdictions, public hearings, and possibly costly undertakings. The timeliness and success of permitting efforts are contingent upon many variables not within our control, including the interpretation of permit approval requirements administered by the applicable permitting authority. We may not be able to obtain or renew permits that are necessary for our planned operations, or the cost and time required to obtain or renew such permits may exceed our expectations. Any unexpected delays or costs associated with the permitting process could delay the exploration, development and/or operation of our projects. For additional information, see Part I, Item 1A, “Risk Factors—We will be required to obtain governmental permits and approvals in order to conduct development and mining operations, a process that is often costly and time-consuming. There is no certainty that all necessary permits and approvals for our planned operations will be granted.”

Carolina Lithium

In November 2019, we were granted a CWA Section 404 Standard Individual Permit from the U.S. Army Corps of Engineers for our integrated Carolina Lithium project. We received an updated preliminary jurisdictional determination in March 2022 based on an updated footprint of the integrated site.

In July 2022, we received an updated CWA Section 401 Individual Water Quality Certificate from the NCDEQ Division of Water Resources for our Carolina Lithium project.

In August 2021, we submitted a mining permit application to the NCDEQ’s DEMLR. Since our submission, we have responded to a series of additional information requests made by DEMLR. In March 2024, we responded to the last round of DEMLR additional information requests which resulted in Piedmont’s application being approved with the final permit received in May 2024.

In September 2021, the Gaston County Board of Commissioners updated its Unified Development Ordinance which, in part, defines operational requirements for new mines and quarries in the county and provides the parameters for the requisite conditional district zoning.

We hold a Synthetic Minor Construction and Operation Permit issued by the NCDEQ’s Division of Air Quality for our property in Kings Mountain, North Carolina. In June 2022, we submitted an application to modify the active air permit to incorporate the use of Metso’s pressure leach technology; however, in March 2024, we withdrew the modification application and continue to hold the air permit in its original form. We currently intend to sell this property since it is not strategic for the development of the Carolina Lithium project.

In January 2022, we submitted a determination request to NCDEQ’s Division of Air Quality in connection with Carolina Lithium. In March 2022, we received a response to this request informing us that Carolina Lithium would require a Title V Permit. In August 2022, we submitted our Title V Permit application, which was deemed complete in February 2023 and is subject to ongoing review.

We previously worked with the NCDEQ Division of Water Resources on a National Pollutant Discharge Elimination System permit for the site; however, we recently pivoted toward pursuit of North Carolina General Stormwater permits instead. As a result, we have withdrawn our National Pollutant Discharge Elimination System permit applications and submitted applications required to obtain North Carolina General Stormwater permits for both the conversion plant as well as the mine and concentrator operations.

Exploration and evaluation activities for our Carolina Lithium project included drilling, which was authorized under a general stormwater permit initially approved in 2017 by the NCDEQ and updated in April 2019, October 2019, and June 2021. We have reclamation obligations under this permit requiring us to reclaim all disturbed drill pads and temporary roads to the approximate original contours, including the seeding of grass and straw to stabilize any disturbances. Generally, we are required to affect such reclamation within 14 days following drilling. We have concluded that this cost of reclamation obligations is immaterial.

We may be required to obtain additional permits and approvals for Carolina Lithium, including but not limited to, a municipal wastewater permit by the City of Gastonia Wastewater Treatment, a road abandonment approved by the NCDOT and Gaston County under North Carolina General Statute 136-63, an encroachment permit for an at-grade rail crossing issued by the NCDOT, various driveway permits issued by the NCDOT, a Gaston County Watershed Permit approved by the Gaston County Planning Department, various building permits approved by the Gaston County Planning Department, explosives permits approved by the U.S. Bureau of Alcohol, Tobacco, and Firearms, and hazardous chemical permits issued by Gaston County Fire Officials.

U.S. Federal Legal Framework

Carolina Lithium will be required to comply with applicable environmental protection laws and regulations and licensing and permitting requirements. The material environmental, health, and safety laws and regulations that we must comply with include, among others, the following U.S. federal laws and regulations:

•NEPA, which requires careful evaluation of the environmental impacts of mining and lithium manufacturing operations that require federal approvals;

•Clean Air Act and its amendments, which govern air emissions;

•CWA, which governs discharges to and excavations within the waters of the U.S.;

•RCRA, which governs the management of solid waste;

•CERCLA, which imposes liability where hazardous substances have been released into the environment (commonly known as Superfund); and

•Federal Mine Safety and Health Act, which established the primary safety and health standards regarding working conditions of employees engaged in mining, related operations, and preparation and milling of the minerals extracted, as well as the Occupation Safety and Health Act, which regulates the protection of the health and safety of workers in lithium manufacturing operations.

Our operations will also be subject to state environmental laws and regulations, including but not limited to, laws and regulations related to the reclamation of mined lands, which may require reclamation bonds to be acquired prior to the commencement of mining operations and may require substantial financial guarantees to cover the cost of future reclamation activities.

Solid and Hazardous Waste

RCRA, and comparable state statutes, affect our operations by imposing regulations on the generation, transportation, treatment, storage, disposal, and cleanup of hazardous wastes and on the disposal of non-hazardous wastes. Under the auspices of the EPA, individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements.

In addition, CERCLA can impose joint and several liability without regard to fault or legality of conduct on classes of persons who are statutorily responsible for the release of a hazardous substance into the environment. These persons can include the current and former owners, lessees, or operators of a site where a release occurs, and anyone who disposes or arranges for the disposal of a hazardous substance. Under CERCLA, such persons may be subject to strict, joint, and several liability for the entire cost of cleaning up hazardous substances that have been released into the environment and for other costs, including response costs, alternative water supplies, damage to natural resources and for the costs of certain health studies. Moreover, it is not uncommon for neighboring landowners, workers, and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the indoor or outdoor environment. Each state also has environmental cleanup laws analogous to CERCLA. Hazardous wastes may have been previously handled, disposed of, or released on or under properties currently or formerly owned or leased by us or on or under other locations to which we sent waste for disposal. These properties and any materials disposed or released on them may subject us to liability under CERCLA, RCRA, and analogous state laws. Under such laws, we could be required to remove or remediate disposed wastes or property contamination, contribute to remediation costs, and perform remedial activities to prevent future environmental harm.

Air Emissions

The federal Clean Air Act and comparable state laws restrict the emission of air pollutants from numerous sources through the issuance of permits and the imposition of other requirements. Major sources of air pollutants are subject to more stringent, federally imposed permitting requirements. Air pollution regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain air permits, and comply with stringent permit requirements or utilize specific equipment or technologies to control emissions of certain pollutants. The need to obtain permits has the potential to delay our operations, and we may be required to incur capital expenditures for air pollution control equipment or other air emissions related obligations. Administrative enforcement actions for failure to strictly comply with air pollution regulations or permits are generally resolved by payment of monetary fines and correction of any identified deficiencies. Alternatively, regulatory agencies could require us to forego construction, modification, or operation of certain air emission sources.

Clean Water Act

The CWA imposes restrictions and strict controls regarding the pollution of protected waters, including mineral processing wastes, into waters of the U.S., a term broadly defined to include, among other things, certain wetlands. Permits must be obtained to discharge pollutants into federal waters. The CWA provides for civil, criminal, and administrative penalties for unauthorized discharges, both routine and accidental, of pollutants. It imposes substantial potential liability for the costs of removal or remediation associated with discharges of oil or hazardous substances. State laws governing discharges to water also provide varying civil, criminal, and administrative penalties, and impose liabilities in the case of a discharge of petroleum or its derivatives, or other hazardous substances, into state waters. In addition, the EPA has promulgated regulations that require permits to discharge storm water runoff, including discharges associated with construction activities. In the event of an unauthorized discharge of waste, we may be liable for penalties and costs.

Pursuant to these laws and regulations, we may also be required to develop and implement spill prevention, control, and countermeasure plans in connection with on-site storage of significant quantities of oil. Some states also maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater conditions. The CWA also prohibits the discharge of fill materials to regulated waters, including wetlands, without a permit from the U.S. Army Corps of Engineers.

In May 2015, the EPA issued a final rule that attempted to clarify the federal jurisdictional reach over waters of the U.S. The EPA repealed this rule in September 2019 and replaced it in April 2020 with the Navigable Water Protection Rule, which narrowed federal jurisdictional reach relative to the 2015 rule. The repeal and replacement of the 2015 rule is currently subject to litigation, and the scope of the jurisdictional reach of the CWA may, therefore, remain uncertain for several years, with a patchwork of legal guidelines applicable to various states potentially developing. We could incur increased costs and delays with respect to obtaining permits for dredge and fill activities in wetland areas to the extent they are required.

NEPA

NEPA requires federal agencies to evaluate major agency actions having the potential to significantly impact the environment. The NEPA process involves public input through comments, which can alter the nature of a proposed project either by limiting the scope of the project or requiring resource-specific mitigation. NEPA decisions can be appealed through the court system by process participants. This process may result in delaying the permitting and development of projects or increase the costs of permitting and developing some facilities.

Endangered Species Act

The federal Endangered Species Act restricts activities that may affect endangered and threatened species or their habitats. Some of our operations may be located in areas that are designated as habitats for endangered or threatened species. A critical habitat designation could result in further material restrictions to federal and private land use and could delay or prohibit land access or development. The U.S. Fish and Wildlife Service continues its effort to make listing decisions and critical habitat designations where necessary. To date, the Endangered Species Act has not had a significant impact on our operations. However, the designation of previously unprotected species as being endangered or threatened could cause us to incur additional costs or become subject to operating restrictions in areas where the species are known to exist.

Foreign Legal Framework

Our projects with Sayona Mining, Atlantic Lithium, and Vinland Lithium are required to comply with all environmental laws and regulations in Quebec, Canada, Ghana, West Africa, and Newfoundland, Canada, respectively.

U.S. Foreign Corrupt Practices Act

The U.S. FCPA generally prohibits U.S. companies and their intermediaries from making corrupt payments to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment and requires companies to maintain appropriate record-keeping and internal accounting practices to accurately reflect the transactions of the company. The FCPA applies to companies, individual directors, officers, employees and agents. Under the FCPA, U.S. companies may be held liable for actions taken by agents or local partners or representatives. If we or our intermediaries fail to comply with the requirements of the FCPA or the anti-corruption laws of other countries, governmental authorities in the U.S. or other countries could seek to impose civil and criminal penalties, which could have a material adverse effect on our business.

Human Capital Management

Our employees are driven by our core values:

•Teamwork. We work collaboratively in a transparent manner with all stakeholders, and value different backgrounds, opinions, and ideas.

•Optimism. We believe in a better future and see opportunities to improve our communities and the world.

•Pride. We are proud of our people, our mission, our commitment to safety, environment, health, and the delivery of our products, and our support of the clean energy economy.

•Innovation. We continuously look for creative ways to improve our business and the solutions we offer customers.

•Care. We understand the inherent worth and dignity of all people and care deeply about our team members, our neighbors, and our impact on the environment.

By living our core values every day, we are working to create a culture of excellence that inspires our employees to achieve their full potential and drive the success of our organization. Our Business Code of Conduct and Ethics commits us to fair treatment and non-discrimination. Our policy is to treat each employee and job applicant without regard to race, color, age, sex, religion, national origin, citizenship, sexual orientation, gender identity, ancestry, veteran status, or any other category protected by law. We believe in allocating resources and establishing, in an equitable manner, policies and procedures that are fair, impartial, and just.

Employees

As of December 31, 2024, we had 23 employees, all of whom were located in the U.S. None of our employees are subject to any union or collective bargaining agreement. We believe that we have a good relationship with our employees.

Contractors

We rely on specialized skills and knowledge to be able to gather, interpret, and process geological and geophysical data; successfully permit, design, build, and operate production facilities; and engage in additional activities required as part of the mine-to-lithium hydroxide process. We have employed, and expect to continue to employ, a strategy of contracting consultants and other service providers who have specialized skills and knowledge to supplement the skills and knowledge of our permanent workforce to undertake our lithium operations effectively.

Safety, Environment, and Health

SEH is a cornerstone of Piedmont Lithium. Our commitment to the health and welfare of every person involved in our projects is built into every aspect of our organization and is engrained in our company’s culture. We endeavor to implement safety programs and develop risk management processes covering our project activities to promote a behavior-based safety culture, ensure compliance with applicable environmental regulations and international standards, and raise environmental awareness among our employees and partners. Our SEH vision is to conduct operations with safety and the environment as a top priority. We work to promote the “Piedmont Promise,” which recognizes our obligation to our employees, neighbors, stakeholders, and the communities in which we live, work, and play.

Compensation and Benefits

Our compensation and benefits program is designed to attract and retain talented employees in the industry by offering competitive compensation and benefits. We use a combination of fixed and variable compensation, which includes base salary, incentive bonuses with pay for performance elements, and merit increases. As part of our long-term incentive plan for executive management and certain key employees, we provide long-term equity awards tied to the value of our stock price, some of which are performance based and time based. Additionally, all employees are eligible for an annual discretionary cash bonus and a long-term equity grant. We are focused on the health and wellness of our employees. As such, we offer eligible employees comprehensive medical plans, dental and vision coverage, short-term and long-term disability insurance, term life insurance, flexible work schedules, an employee assistance program, remote and hybrid work options, paid time off, new parent leave, and a 401(k) plan with employer-matching contributions.

Commitment to Values and Ethics

In connection with our core values, we act in accordance with our Code of Business Conduct and Ethics, which requires a commitment from employees, officers, and directors of Piedmont Lithium to conduct business honestly and ethically. This code discusses the responsibility that team members have to each other, the Company, stakeholders, our customers, and communities in which we operate. We have an anonymous hotline for employees to call in the event of ethical concerns or suspected instances of misconduct.

Protecting the Rights of Workers

We are an Equal Opportunity Employer committed to providing our employees with a safe, non-discriminatory work environment that promotes open and honest communication and embraces dignity, respect, and diversity in all aspects of its business operations. We expect our partners, suppliers, and contractors to uphold these same commitments. We maintain policies designed to support the elimination of all forms of forced labor including prison labor, forcibly indentured labor, bonded labor, slavery, and servitude. We condemn all forms of child exploitation. We do not recruit child labor, and we support the standard covering the prohibition on child labor in accordance with the International Labor Organization Minimum Age Convention. We support laws enacted to prevent and punish the crime of sexual exploitation of children, and we will cooperate fully with law enforcement authorities in these matters. We will work with our partners at Atlantic Lithium, Sayona Mining, and Vinland Lithium to ensure appropriate policies are in place within the businesses and projects in which we have invested.

Anti-Human Trafficking

We are committed to a work environment that is free from human trafficking and slavery, which includes forced labor and unlawful child labor. We will not tolerate or condone human trafficking or slavery in any part of our global organization.

Human Rights and Relationships with Indigenous People

We are committed to respecting human rights and providing a positive contribution in the communities where we operate and plan to operate. We expect our partners, suppliers, and contractors to uphold the same commitment. We respect the cultures, customs, and values of people in the communities where we operate and plan to operate and take into account their needs, concerns, and aspirations.

Equal Opportunity and Zero Discrimination

We recognize, respect, and embrace the cultural differences found in the worldwide marketplace. Our goal is to attract, develop, promote, and retain the best people from all cultures and segments of the population, based on ability. We maintain a policy of zero tolerance for discrimination or harassment of any kind. We have implemented policies regarding the reporting and investigation of discrimination, harassment, sexual harassment, retaliation, and abusive behavior and provide our employees training to foster full compliance with our policies.

Community Involvement

We are committed to making a measurable impact in the communities in which we operate and have project investments through our charitable giving. For three years, Piedmont Lithium Foundation – Power for Life, Inc., has provided scholarships to science, technology, engineering and mathematics students and financial support to our schools and communities. We have devoted tremendous time and effort to engaging community stakeholders regarding Carolina Lithium.

Through in-person meetings, phone calls, social media, and information shared with the media via press releases and interviews, we work to keep the community residents and local businesses informed of our plans and activities. Our goal is to develop and maintain relationships with residents near the site of Carolina Lithium and communicate our commitment to responsibly developing one of the world’s most sustainable lithium hydroxide operations. Further, we are committed to working with our investment partners, Sayona Mining, Atlantic Lithium, and Vinland Lithium, all of whom have several mechanisms in place for engaging with local communities regarding their projects, including addressing concerns and sharing information about employment opportunities.

Sustainability

We are committed to contributing to the transition to a net zero carbon world and the creation of a clean energy economy in North America through the products we sell and the way we produce products, operate our business, and work with our customers, vendors, and stakeholders. We are evaluating our emission profiles in a pre-operational state while establishing systems and tools to allow us to manage data easily and efficiently as we continue to grow.

We released our inaugural sustainability report in June 2023, followed by our second sustainability report in 2024, affirming our commitment to being a responsible, respectful steward of the planet, people, and the communities where we plan to operate our wholly-owned project, Carolina Lithium. Copies of our sustainability reports can be found under the “Sustainability” tab of our website: www.piedmontlithium.com. The information on our website, including, without limitation, the information in our sustainability reports, should not be deemed incorporated by reference into this Annual Report or otherwise “filed” for purposes of Section 18 of the Exchange Act, as amended, or otherwise subject to the liabilities of that section.

Governance

Audit Committee

The primary responsibilities of our Audit Committee are to monitor the integrity of our consolidated financial statements, the independence and qualifications of our independent auditors, the performance of our accounting staff and independent auditors, our compliance with legal and regulatory requirements, supervising our cybersecurity policies, and the effectiveness of our internal controls. The Audit Committee is responsible for selecting, retaining (subject to stockholder approval), evaluating, setting the compensation of, and if appropriate, recommending the termination of our independent auditors.

Leadership and Compensation Committee

The primary purpose of our Leadership and Compensation Committee is to assist our Board in discharging its responsibilities related to the compensation of our executive officers and directors and overseeing the Company’s overall compensation philosophy, policies, and programs.

Nominating and Corporate Governance Committee

The primary purpose of our Nominating and Corporate Governance Committee is to identify individuals qualified to become members of the Company’s Board, make recommendations on candidates for election at the annual meeting of stockholders, and perform a leadership role in shaping the Company’s corporate governance, including the implementation of our ESG principles.

Transaction Committee

Our Transaction Committee was formed in 2024 to assist our Board in its consideration, review, evaluation, and negotiation of the Merger Agreement and to take any other actions necessary or desirable in connection with the Merger.

Corporate Information

Our principal executive offices are located at 42 E Catawba Street, Belmont, NC, 28012, and our telephone number is (704) 461-8000. We file electronically with the SEC our Annual Reports and any amendments thereto, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. We make available on our website at www.piedmontlithium.com, under “Investors,” free of charge, copies of these reports as soon as reasonably practicable after filing or furnishing these reports to the SEC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that involve risks and uncertainties and includes statistical data, market data and other industry data and forecasts, which we obtained from market research, publicly available information and independent industry publications and reports that we believe to be reliable sources.

Certain information included or incorporated by reference in this Annual Report may be deemed to be “forward-looking statements” within the meaning of applicable securities laws. Such forward-looking statements concern our anticipated results and progress of our operations in future periods, planned exploration and development of our properties, and plans related to our business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable, and assumptions of management. All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “expect,” “estimate,” “may,” “might,” “will,” “could,” “can,” “shall,” “should,” “would,” “leading,” “objective,” “intend,” “contemplate,” “design,” “predict,” “potential,” “plan,” “target” and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements. Forward-looking statements in this Annual Report include, but are not limited to, statements with respect to risks related to:

•our limited operating history in the lithium industry;

•our status as a development stage issuer, including our ability to identify lithium mineralization and achieve commercial lithium production;

•the proposed Merger with Sayona Mining;

•our reliance on the management teams of our equity method investments;

•mining, exploration and mine construction, if warranted, on our properties, including timing and uncertainties related to acquiring and maintaining mining, exploration, environmental and other licenses, permits, zoning, rezoning, access rights or approvals in Gaston County, North Carolina (including the Carolina Lithium project), the Provinces of Quebec and Newfoundland and Labrador, Canada and Ghana, West Africa as well as properties that we may acquire or obtain an equity interest in the future;

•our ability to achieve and maintain profitability and to develop positive cash flows from our mining and processing activities;

•our exposure to cybersecurity threats and attacks;

•our estimates of mineral resources and whether mineral resources will ever be developed into mineral reserves;

•investment risk and operational costs associated with our exploration and development activities;

•our ability to develop and achieve production on our properties;

•our ability to enter into and deliver products under offtake agreements;

•the pace of adoption and cost of developing electric transportation and storage technologies dependent upon lithium batteries;

•our ability to access capital and the financial markets;

•recruiting, training, developing, and retaining employees, including our senior management team;

•possible defects in title of our properties;

•compliance with government regulations;

•environmental liabilities and reclamation costs;

•estimates of and volatility in lithium prices or demand for lithium;

•our common stock price and trading volume volatility; and

•our failure to successfully execute our growth strategy, including any delays in our planned future growth.

All forward-looking statements reflect our beliefs and assumptions based on information available at the time the assumption was made. These forward-looking statements are not based on historical facts but rather on management’s expectations regarding future activities, results of operations, performance, future capital and other expenditures, including the amount, nature and sources of funding thereof, competitive advantages, business prospects, and opportunities. By its nature, forward-looking information involves numerous assumptions, inherent risks and uncertainties, both general and specific, known and unknown, that contribute to the possibility that the predictions, forecasts, projections, or other forward-looking statements will not occur. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, or intended. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak

only as of the date made. Except as otherwise required by the securities laws of the U.S., we disclaim any obligation to subsequently revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

CAUTIONARY NOTE REGARDING DISCLOSURE OF MINERAL PROPERTIES

We are subject to the periodic reporting requirements of both U.S. and Australian securities laws with respect to mining matters. In the U.S., we are governed by the Exchange Act, including S-K 1300 thereunder. In Australia, we are governed by the JORC Code. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported but may at times embody different approaches or definitions.

On October 21, 2021, we announced an inaugural mineral resources estimate for our Carolina Lithium project. On December 14, 2021, we announced the completion of a DFS for our Carolina Lithium project, which included an initial estimation of mineral reserves. These estimates of mineral resources and mineral reserves are compatible with both S-K 1300 and JORC Code. A technical report summary with respect to our estimated mineral reserves was filed as an exhibit to our Transition Report on Form 10-KT for the period ending December 31, 2021. This technical report summary was amended to include certain information as required by S-K 1300. The amended technical report summary dated April 20, 2023, is included as Exhibit 96.1 and incorporated by reference to Exhibit 96.3 to our Annual Report on Form 10-K/A for the year ended December 31, 2022. Additionally, S-K 1300-compliant technical report summaries with respect to our estimated mineral resources and mineral reserves at NAL, and Authier, are attached as Exhibits 96.3 and 96.2 , respectively, of this Annual Report.

Item 1A. RISK FACTORS.

You should carefully consider the risks, as described below, together with all the other information in this Annual Report. If any of the following risks occur, our business, financial condition, and results of operations could be seriously harmed, and you could lose all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of our common stock could decline. We operate in a competitive environment that involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer, and the price of our stock could decline. We caution you that the risks, uncertainties and other factors referred to below and elsewhere in this Annual Report may not contain all the risks, uncertainties, and other factors that may affect our future results and operations. Our future results and operations could also be affected by factors, events, or uncertainties that are not presently known to us or that we currently do not consider to present a material risk. It is not possible for our management to predict all risks.

Business Risks

Our future performance is difficult to evaluate because we have a limited operating history in the lithium industry.

We began to implement our current business strategy in the lithium industry in 2016. Until the third quarter of 2023, we had yet to realize any revenues from the sale of lithium, and our operating cash flow needs have been financed primarily through issuances of common stock and not through cash flows derived from our operations. As a result, we have limited historical financial and operating information available to help you evaluate our performance.

There is no guarantee that our development will result in the commercial extraction of mineral deposits.

We are engaged in the business of exploring and developing mineral properties with the intention of locating economic deposits of minerals. We have declared mineral reserves on our development stage properties; however, we have yet to begin commercial extraction of minerals on these properties. Accordingly, we cannot assure you that we will realize profits in the medium to long term. Further, we cannot assure you that any of our property interests can be commercially mined or that our ongoing exploration programs will result in profitable commercial mining operations. The exploration and development of mineral deposits involve a high degree of financial risk over a significant period of time, which may or may not be reduced or eliminated through a combination of careful evaluation, experience, and skilled management. While discovery of additional ore-bearing deposits may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to construct mining and processing facilities and to establish additional reserves. The profitability of our operations will be, in part, directly related to the cost and success of our exploration and development programs, which may be affected by a number of factors. Additional expenditures are required to construct, complete, and install mining and processing facilities in those properties that are actually mined and developed.

Our exploration and development projects have no operating history upon which to base estimates of future operating costs and capital requirements. Exploration project items, such as any future estimates of reserves, metal recoveries, or cash operating costs will, to a large extent, be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques as well as future feasibility studies. Actual operating costs and economic returns of any and all exploration projects may materially differ from the costs and returns estimated, and accordingly, our financial condition, results of operations, and cash flows may be negatively affected.

We do not control our equity method investments.

We apply the equity method of accounting to investments when we have the ability to exercise significant influence over the operational decision-making authority and financial policies of the investee but we do not exercise control. Our equity method investees are governed by their own board of directors, whose members have fiduciary duties to the investees’ shareholders. While we have certain rights to appoint representatives to the investees’ boards of directors, the interests of the investees’ shareholders may not align with our interests or the interests of our shareholders and strategic and contractual disputes may arise.

We are generally dependent on the management team of our investees to operate and control such projects or businesses. While we may exert influence pursuant to our positions, as applicable, on the boards of directors and through certain limited governance or oversight roles, such influence may be limited. The management teams of our investees may not have the level of experience, technical expertise, human resources, management, and other attributes necessary to operate their projects or businesses optimally, and they may not share our business priorities, including, but not limited to, those priorities that relate to desired production levels. This could have a material adverse effect on the value of such investments as well as our growth, business, financial condition, results of operations, and prospects.

Some of our current or future properties may not contain any reserves, and any funds spent on exploration and evaluation may be lost.

We are a development stage mining company. We cannot assure you that our exploration programs will identify economically extractable mineralization, nor can we assure you about the quantity or grade of any mineralization we seek to extract. Our exploration prospects may not contain any reserves and any funds spent on evaluation and exploration may be lost. Even for the mineral reserves we have reported for our properties, any quantity or grade of reserves we indicate must be considered as estimates only until such reserves are actually mined. We do not know with certainty that economically recoverable lithium exists on our properties. In addition, the quantity of any reserves may vary depending on commodity prices. Any material change in the quantity or grade of reserves may affect the economic viability of our properties.

We face risks related to mining, exploration, mine construction, and plant construction, if warranted, on our properties.