UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23382

Sprott Funds Trust

(Exact name of registrant as specified in charter)

200 Bay Street, Suite 2600

Toronto, Ontario, Canada M5J2J1

(Address of principal executive offices) (Zip code)

John Ciampaglia

200 Bay Street, Suite 2600

Toronto, Ontario, Canada M5J2J1

(Name and address of agent for service)

(416)943-8099

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2021

Date of reporting period: June 30, 2021

Item 1. Reports to Stockholders.

Semi-Annual Report

June 30, 2021

Sprott Gold Equity Fund Investor Class (Nasdaq: SGDLX)

Sprott Gold Equity Fund Institutional Class (Nasdaq: SGDIX)

Sprott Gold Equity Fund

Shareholder LetterJune 30, 2021

Dear Fellow Shareholders,

We report to you on Sprott Gold Equity Fund’s (the “Fund”) semi-annual fiscal period ended June 30, 2021. For the six-month period, the Fund declined 9.09%. This compares to a decline of 1.25% for the PHLX Gold/Silver Sector Total Return Index (XXAU),1 the Fund’s prospectus benchmark, over the same period. Given the XXAU’s much larger-capitalization bias than the Fund, we are not surprised by the performance gap, which we discuss in more detail. A more apt performance comparison, the NYSE Arca Gold Miners Index (GDM)2 lost 5.39% during the six-month period; although the GDM is a better measure of medium-capitalization gold mining stocks, it (like XXAU) does not reflect the small-capitalization holdings held by the Fund.

Precious Metals Market Review

During the six months ended June 30, 2021, gold prices posted an overall decline of 6.76%. Gold prices began the year at $1,898 per ounce and rose to a first-half high of $1,950 per ounce shortly afterward, supported by spiking COVID-19 cases, U.S. political uncertainty and talk of tougher lockdown restrictions as the U.S. dollar (DXY)3 weakened. However, after trending upward initially in January, gold bullion and gold-related investments sold off for the remainder of January and into February. Gold finished February at $1,734 per ounce, posting one of the worst months in four years for gold prices. Gold and gold equities had to share the limelight with other commodity markets as investors began anticipating a post-COVID global economic recovery, on the back of rising energy prices, the U.S. government spending bolstering the reflation trade and a rally in broader equity markets.

During March, gold prices continued to come under pressure with the roll-out of COVID vaccines in the U.S. encouraging market optimism that was reflected in rising U.S. 10-Year Treasury yields and a stronger U.S. dollar. Towards the end of the first quarter, the accumulation of gold mining equities was apparent in the market even as gold prices fell, with notable rebounds in precious metals equities after gold prices corrected. After gold prices traded to a low for the period in early March at $1,684 per ounce, they found double-bottom support at around $1,685 per ounce during late March.

Gold prices made a steady move upward during April and May as yields on U.S. 10-Year Treasuries, which were rising since the beginning of the year, peaked in late March and then edged downward, a move that coincided with U.S. dollar weakness during those months. Gold ETF sales, which have been consistent since the start of the year, eased and began to reverse at the end of April. Investors began to acknowledge more broadly that a robust U.S. economic recovery was likely to incorporate inflationary pressures. This sentiment helped push the gold price back above $1,800 in early May and to close the month at $1,907.

The U.S. dollar regained some strength in June and gold initially pulled back from the $1,900 per ounce level. Gold prices came under pressure during June as markets began to anticipate that the U.S. Federal Reserve may one day tighten monetary policy. Markets then decided that this day may be further out, given a series of new COVID variants and waves of infections spreading worldwide and slowing the global economic recovery. Bond markets took note with U.S. 10-Year Treasury yields sliding back to levels seen earlier in the year, concluding that a move to a higher interest rate environment is not conducive to a solid economic recovery, especially if COVID persists. Gold took a cue from that and put in another double-bottom at around $1,760 per ounce in late June, higher than the double-bottom support seen during late March, and suggests from a technical perspective, mid-term support for gold prices has been established.

Gold mining equities followed a slightly different but more volatile pattern than the gold bullion price during April and May, with a relatively steady rise during those months. Even though June’s pullback in gold stocks in the second half of the month partially offset the April/May recovery, gold stocks ended with a positive move for the second quarter of 2021. As markets head into the second half of the year, the recent positive performance and stronger market activity have begun to offset the January and February correction.

Despite the volatile first half for precious metals investors, a comparison to 2020 reveals that much ground has been gained. The gold price finished the first half of this year at $1,770 per ounce and averaged $1,806 during the first six months. That compares to the first half of the 2020 calendar year when gold finished at $1,781 per ounce and averaged $1,648. Silver often trades in sync with gold and is considered a monetary metal but tends to be more sensitive to manufacturing activity as it is also a production input. Silver prices landed at $26.13 per ounce as of June 30, 2021, and averaged $26.47 for the first half. This compares to a finish of $18.21 per ounce and an average of $16.64 for the same calendar period last year.

Fund Positioning & Activity

Here we offer a deeper analysis of the Fund’s performance relative to its prospectus benchmark. The Sprott Gold Equity Fund’s allocation process has emphasized greater exposure to small- and mid-capitalization precious metals mining stocks because their valuations offer greater long-term appreciation potential compared to the PHLX Gold/Silver Sector Total Return Index (XXAU). The XXAU is a capital-weighted index which means that the larger companies in the Index account for the greater percentage of the Index’s value and performance. Unlike the Fund, the XXAU is heavily weighted to larger precious metals producers, and in particular, to Freeport-McMoRan Inc., which represents one of the largest components of the XXAU and was not a holding of the Fund during the six months. While Freeport produces gold as a byproduct of copper production, it is primarily valued as a copper mining company by market participants. Freeport’s performance can have a significant impact on the performance of XXAU. This was certainly the case in the first half of 2021, as copper prices surged during February and May (reaching an all-time high in Q2) while gold corrected during the first half of 2021. Copper prices gained a whopping 23.92% from January 1 to June 30, 2021. Another major difference between the Fund and the XXAU benchmark is that physical gold is not included in the Index; the decline in gold prices of 6.76%, as mentioned earlier, was certainly a drag on the Fund’s results in the first half of the year.

Sprott Gold Equity Fund

Shareholder LetterJune 30, 2021

The Fund’s largest position as of June 30, 2021, was physical gold (measuring 74,526 gross ounces) which is vaulted in a secure location outside the financial system and audited regularly. This gold bullion position represented 12.10% of the Fund’s value as of June 30, 2021. The exposure to physical gold reduces the Fund’s volatility and offsets the more volatile moves in gold and silver mining equities. Precious metals equity valuations are greatly influenced by moves in gold and silver prices.

Precious metals equities accounted for 85.91% of the Fund’s holdings5 as of June 30, 2021, and included 69 securities, with about 76.90% allocated to the gold industry and approximately 12.59% in the silver and silver mining industries.

Asset Allocation5 (% of Net Assets)

| | | |

Top 10 Positions5 (% of Net Assets) | | Asset Allocation5 (% of Net Assets) |

Gold Bullion | 12.10 | | |

MAG Silver Corp. | 5.78 |

Corvus Gold Inc. | 5.40 |

Osisko Gold Royalties Ltd | 3.97 |

Kirkland Lake Gold Ltd. | 3.56 |

Osisko Mining Inc. | 3.52 |

Sibanye-Stillwater Limited | 3.45 |

SilverCrest Metals Inc. | 3.26 |

Newmont Corporation | 2.98 |

Kinross Gold Corporation | 2.91 |

Top 10 Total | 46.93 |

Holdings may vary, and this list is not a recommendation to buy or sell any security.

| | | | |

Portfolio Details and Diagnostics | | | 5-Year Risk Measures & Statistics | |

Total Number of Holdings | 69 | | Volatility (Standard Deviation) | 29.53 |

Weighted Median Market Cap | $2.3 Billion | | Sharpe Ratio | 0.06 |

Weighted Avg. Market Cap | $6.7 Billion | | Alpha vs. PHLX Gold/Silver Sector Index (XAU) | -0.35 |

Turnover Ratio | 8.00% | | Beta vs. PHLX Gold/Silver Sector Index (XAU) | 0.82 |

Source: FactSet.

Top Performance Contributors and Detractors

The precious metals stocks that contributed the most to the Fund’s performance during the period included Corvus Gold, Inc., Osisko Gold Royalties Ltd, Sibanye-Stillwater Ltd., Newmont Corporation, and Gatos Silver, Inc. (representing 5.40%, 3.97% 3.45%, 2.98% and 1.45%, respectively, of the Fund’s net assets5 as of June 30, 2021). Corvus Gold, Inc. has had drilling success at its Motherlode and North Bullfrog properties in southern Nevada. This has recently resulted in a proposal by AngloGold Ashanti Ltd., the largest Corvus Gold, Inc. shareholder, to buy the entire company. The Fund is the second-largest owner, holding about 17% of Corvus Gold, Inc. shares and would receive cash under the AngloGold Ashanti Ltd. proposal. Sibanye-Stillwater Ltd. has demonstrated its cash flow generating ability from its various precious metals mines, which produce platinum group metals in addition to gold, while its exploration projects include copper, gold and platinum group metals projects. The company’s balance sheet is in a net cash position relative to its debt, providing flexibility to develop additional assets and return shareholder value. After Gatos Silver, Inc. self-financed the build of its mine and initiated metal production, its successful IPO (initial public offering) allowed it to reduce debt quickly and renew regional exploration around its Los Gatos Joint Venture, where numerous exploration targets have not been tested since the company began its mine building project several years ago. Osisko Gold Royalties Ltd. has re-rated and received a better valuation after some restructuring and the market’s recognition of its compelling royalty and streaming portfolio. Newmont Corporation continues to establish itself as a reliable environmental, sustainability and governance (ESG) gold mining company. In addition to its growing ESG recognition, Newmont Corporation has added considerable balance sheet strength with its robust cash flows.

Sprott Gold Equity Fund

Shareholder LetterJune 30, 2021

Positions that negatively impacted the Fund’s performance during the period included: the physical gold position, SilverCrest Metals Inc., International Tower Hill Mines Ltd., Torex Gold Resources Inc, and Jaguar Mining Inc. (representing 12.10%, 3.26%, 2.59%, 2.57% and 2.38%, respectively, of the Fund’s net assets5 as of June 30, 2021). Jaguar Mining Inc. and SilverCrest Metals Inc. had been outperformers over the past year and a half; while the physical gold bullion position corrected with the gold prices during the period. Torex Gold Resources Inc. is initiating mine construction while International Tower Hill Mines Ltd. continues to work on improving plans and design for processing ore at its project in Alaska in preparation for making a construction decision to build its mine.

Investment Outlook

Despite a challenging first half for the precious metals complex, we believe the investment rationale for precious metals exposure remains strong. Gold bullion and gold mining stocks are compelling buys. The vast majority of producing miners are generating free cash flow. Current strong earnings are geared to advance at a steep slope should our positive expectation for future gold prices prevail. Valuations, both relative and absolute, are the most attractive they have been in two decades. Although gold experienced a sell-off in June 2021, this was mostly driven by algorithmic, robotic macro funds. The accumulation and investment in physical gold continue. On June 18, 2021, investors bought $630 million of 100% gold-backed GLD shares (SPDR Gold Shares ETF),4 the largest one-day inflow since January 15, 2021. Central banks bought $6.3 billion of gold during the second quarter.

We remain skeptical about the health of this post-COVID global economic recovery. The current level of economic activity is highly dependent on continued fiscal and monetary stimulus. As COVID pandemic-related support begins to decline, disappointing housing, retail sales and employment data show the economy is losing steam. There is ample reason to think that a slowdown could become a downturn in the absence of renewed fiscal support. Without continued stimulus amid rising food and energy costs, consumer spending could come under pressure. Our view is that a significant slowdown lies ahead and that inflation is likely here to stay.

Faith in the Fed’s omniscience and ability to control inflation is convenient to the investment consensus because it underpins the current extraordinary overvaluation of financial assets. Let’s face it, despite pious subservience to the goals of full employment and price stability, the Fed’s real mandate is to keep financial markets from coming unglued. The relationship between overvalued financial assets and belief in an all-knowing Fed is symbiotic. Loss of that faith for heavily sedated markets would lead to losses of trillions of dollars in the world of financial assets. That very real possibility is sufficient rationale for investment in gold and the expectation of much higher gold prices.

| |

With best wishes, | |

| |

John C. Hathaway

Senior Portfolio Manager | Douglas B. Groh

Senior Portfolio Manager |

July 17, 2021

1The PHLX Gold/Silver Sector Total Return Index (XXAU) is a capitalization-weighted index composed of companies involved in the gold or silver mining industry.

2The NYSE Arca Gold Miners Index (GDM) is a modified market capitalization-weighted index comprised of publicly traded companies primarily involved in mining gold and silver in locations worldwide.

3The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies.

4SPDR® Gold Shares (GLD) is the largest physically backed gold exchange traded fund (ETF) in the world.

5Net assets exclude cash equivalents, other assets & receivables.

Sprott Gold Equity Fund

Performance OverviewJune 30, 2021 (Unaudited)

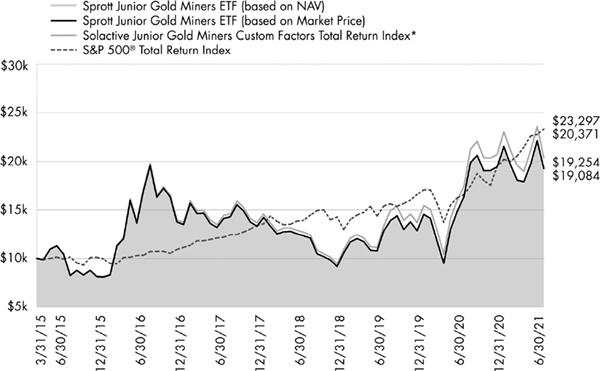

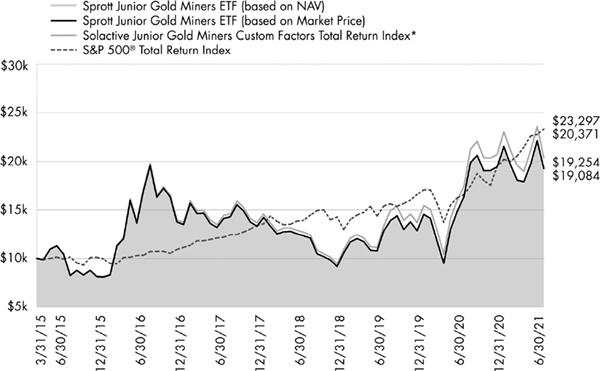

Growth of $10,000 (as of June 30, 2021)

Comparison of Change in Value of $10,000 Investment in the Fund and the Underlying Indexes

Sprott Gold Equity Fund (Investor Class)

(Unaudited)

This chart assumes an initial gross investment of $10,000 made on 6/30/2011. On January 21, 2020, the Sprott Gold Equity Fund assumed the net asset value and performance history of the Tocqueville Gold Fund (the “Predecessor Fund”). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2019 and 2020 the performance of the Sprott Gold Equity Fund (Investor Class) was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The Philadelphia (PHLX) Stock Exchange Gold and Silver Sector Total Return Index (XXAU) is an indicator of the performance of the common stock of companies in the gold and silver mining industry and reflects the reinvestment of any dividends. The Index performance quoted reflects the following indices and dates: the XAU from September 29, 1998 to October 31, 2011, and the XXAU onwards. These Indices do not incur fees and expenses. You cannot invest directly in an index.

The Standard & Poor’s 500 Total Return Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends. You cannot invest directly in an index.

AVERAGE ANNUAL RATE OF RETURN

FOR PERIODS ENDED JUNE 30, 2021

| | | | |

| 1 Year | 3 Year | 5 Year | 10 Year |

Sprott Gold Equity Fund (Investor Class) | -2.06% | 13.35% | 3.02% | -4.41% |

Philadelphia Gold/Silver Sector Total Return Index (XXAU) | 10.72% | 21.26% | 8.59% | -2.39% |

Standard & Poor’s 500 Total Return Index | 40.79% | 18.67% | 17.65% | 14.84% |

Sprott Gold Equity Fund

Performance OverviewJune 30, 2021 (Unaudited)

Growth of $1,000,000 (as of June 30, 2021)

Comparison of Change in Value of $1,000,000 Investment in the Fund and the Underlying Indexes

Sprott Gold Equity Fund (Institutional Class)

(Unaudited)

This chart assumes an initial gross investment of $1,000,000 made on 4/8/2019 (commencement of operations for Institutional Class). Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all dividends and other distributions. Past performance is not predictive of future performance. Investment return and principal value will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. The Fund imposes a 2% redemption fee on shares held 90 days or less.

In 2019 and 2020 the performance of the Sprott Gold Equity Fund (Institutional Class) was achieved during a period of unusually favorable market conditions. Such performance may not be sustainable.

The PHLX Gold/Silver Sector Index (XXAU) is an unmanaged capitalization-weighted index which includes the leading companies involved in the mining of gold and silver. Returns include the reinvestment of all dividends. You cannot invest directly in an index.

The Standard & Poor’s 500 Total Return Index (S&P 500) is a capital-weighted index, representing the aggregate market value of the common equity of 500 stocks primarily traded on the New York Stock Exchange. Returns include the reinvestment of all dividends. You cannot invest directly in an index.

AVERAGE ANNUAL RATE OF RETURN

FOR PERIODS ENDED JUNE 30, 2021

| | |

| 1 Year | Since Inception

(April 8, 2019) |

Sprott Gold Equity Fund (Institutional Class) | -1.80% | 21.08% |

Philadelphia Gold/Silver Sector Total Return Index (XXAU) | 10.72% | 31.99% |

Standard & Poor’s 500 Total Return Index | 40.79% | 21.53% |

Sprott Gold Equity Fund

Expense ExampleJune 30, 2021 (Unaudited)

As a shareholder of the Sprott Gold Equity Fund (the “Fund”), you incur two types of costs: transaction costs, including redemptions fees; and ongoing costs, including management fees; distribution fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (Jan 1, 2021 - June 30, 2021).

Actual Expenses: The first line of each table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes: The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | |

| Beginning Account

Value

Jan. 1, 2021 | Ending Account

Value

June 30, 2021 | Expenses Paid

During Period*

Jan. 1, 2021 -

June 30, 2021 |

Sprott Gold Equity Fund (Investor Class) | | | |

Actual | $1,000 | $ 909.10 | $6.48 |

Hypothetical (5% returns Before expenses) | $1,000 | $1,018.00 | $6.85 |

*The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio (1.37%) multiplied by the average account value during the period, multiplied by the number of days (181) in the most recent six-month period and divided by the number of the days in the most recent twelve month period (365).

| | | |

| Beginning Account

Value

Jan. 1, 2021 | Ending Account

Value

June 30, 2021 | Expenses Paid

During Period*

Jan. 1, 2021 -

June 30, 2021 |

Sprott Gold Equity Fund (Institutional Class) | | | |

Actual | $1,000 | $ 910.30 | $5.12 |

Hypothetical (5% returns Before expenses) | $1,000 | $1,019.44 | $5.41 |

*The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio (1.08%) multiplied by the average account value during the period, multiplied by the number of days (181) in the most recent six-month period and divided by the number of the days in the most recent twelve month period (365).

Sprott Gold Equity Fund

Schedule of Investmentsas of June 30, 2021 (Unaudited)

| | | | | |

| Shares | | Value | |

Common Stocks (86.7%) | | | | |

Gold Related Securities (73.6%) | | | | |

Australia (5.5%) | | | | |

Bellevue Gold Ltd.(a) | 6,023,000 | | $4,291,109

| |

Northern Star Resources Ltd. | 2,964,500 | | 21,743,194 | |

Perseus Mining Ltd.(a) | 12,000,000 | | 13,139,146 | |

West African Resources Ltd.(a)(b) | 27,400,000 | | 20,445,921 | |

| | | 59,619,370 | |

Canada (58.8%) | | | | |

Agnico Eagle Mines Ltd. | 303,186 | | 18,333,997 | |

Alamos Gold, Inc.- Class A | 3,799,600 | | 29,066,940 | |

B2Gold Corp.(c) | 1,499,900 | | 6,314,579 | |

Barrick Gold Corp. | 999,200 | | 20,663,456 | |

Baru Gold Corp.(a)(b) | 13,290,993 | | 857,760 | |

Corvus Gold, Inc.(a)(b)(c) | 3,226,901 | | 8,841,709 | |

Corvus Gold, Inc.(a)(b)(c)(d) | 6,954,100 | | 19,129,946 | |

Corvus Gold, Inc.(a)(b)(e) | 1,739,130 | | 4,784,151 | |

Corvus Gold, Inc.(a)(b)(d)(e) | 9,500,000 | | 26,133,430 | |

Equinox Gold Corp.(a) | 2,605,595 | | 18,097,913 | |

Falco Resources Ltd.(a)(b) | 16,222,300 | | 5,365,556 | |

Gold Standard Ventures Corp.(a)(c) | 3,000,000 | | 1,718,296 | |

I-80 Gold Corp.(a)(b)(c) | 10,415,264 | | 21,089,313 | |

International Tower Hill Mines Ltd.(a)(b) | 6,750,222 | | 7,087,733 | |

International Tower Hill Mines Ltd.(a)(b)(d) | 1,666,667 | | 1,734,431 | |

International Tower Hill Mines Ltd.(a)(b)(e) | 18,664,631 | | 19,423,503 | |

Jaguar Mining, Inc.(b) | 6,006,559 | | 25,923,758 | |

Kinross Gold Corp.(c) | 4,989,967 | | 31,686,290 | |

Kirkland Lake Gold Ltd. | 1,007,513 | | 38,826,151 | |

Maverix Metals, Inc.(c) | 1,615,000 | | 8,704,850 | |

Maverix Metals, Inc.(c)(d) | 2,650,000 | | 14,323,169 | |

Novagold Resources, Inc.(a) | 2,030,800 | | 16,266,708 | |

NuLegacy Gold Corp.(a)(b) | 37,852,485 | | 4,122,366 | |

Osisko Development Corp.(a) | 1,333,400 | | 7,529,687 | |

Osisko Gold Royalties Ltd. | 24,340 | | 333,458 | |

Osisko Gold Royalties Ltd.(d) | 3,130,127 | | 42,901,628 | |

Osisko Mining, Inc.(a)(b) | 15,384,239 | | 38,348,902 | |

Pan American Silver Corp. | 1,088,445 | | 31,096,874 | |

Pretium Resources, Inc.(a) | 2,923,485 | | 27,970,742 | |

Seabridge Gold, Inc.(a)(c) | 400,000 | | 7,020,000 | |

Silvercrest Metals, Inc.(a) | 4,056,600 | | 35,539,429 | |

SSR Mining, Inc. | 897,300 | | 14,013,979 | |

Strategic Metals Ltd.(a)(b)(e) | 9,886,500 | | 3,110,467 | |

Torex Gold Resources, Inc.(a) | 2,433,900 | | 28,038,151 | |

Trifecta Gold Ltd.(a) | 2,325,199 | | 187,576 | |

Wesdome Gold Mines Ltd.(a) | 3,115,200 | | 29,553,688 | |

Wheaton Precious Metals Corp. | 586,175 | | 25,832,732 | |

| | | 639,973,318 | |

South Africa (3.3%) | | | | |

AngloGold Ashanti Ltd.- ADR(c) | 544,000 | | 10,107,520 | |

Gold Fields Ltd.- ADR (c) | 2,681,000 | | 23,860,900 | |

Gold Fields Ltd.(d) | 200,000 | | 1,798,319 | |

| | | 35,766,739 | |

United Kingdom (2.5%) | | | | |

Endeavour Mining PLC | 1,297,500 | | 27,844,341 | |

| | | | | |

| Shares | | Value | |

| | | | | |

United States (3.5%) | | | | |

Contango ORE, Inc.(a) | 263,200 | | $5,570,628

| |

Electrum Ltd.(a)(f) (Originally acquired 12/21/07, Cost $13,065,361) | 2,127,287 | | 42,546 | |

Newmont Corporation | 511,990 | | 32,449,926 | |

| | | | 38,063,100 | |

Total Gold Related Securities | | | 801,266,868 | |

| | | | | |

Other Precious Metals Related Securities (12.4%) | | | |

Canada (6.6%) | | | | |

Bear Creek Mining Corp.(a)(b) | 5,982,800 | | 7,818,761 | |

MAG Silver Corp.(a)(b)(c) | 1,581,135 | | 33,077,344 | |

MAG Silver Corp.(a)(b)(d)(e) | 1,432,665 | | 29,956,983 | |

Nickel Creek Platinum Corp.(a)(b) | 14,037,494 | | 1,132,421 | |

| | | 71,985,509 | |

South Africa (3.5%) | | | | |

Sibanye Stillwater Ltd.- ADR(c) | 2,250,000 | | 37,642,500 | |

| | | | | |

United Kingdom (0.7%) | | | | |

Hochschild Mining PLC | 3,818,200 | | 8,102,141 | |

| | | | | |

United States (1.6%) | | | | |

Gatos Silver, Inc.(a) | 906,416 | | 15,853,210 | |

Silver Opportunity Partners Corp.(a)(f)

(Originally acquired 3/15/11,

Cost $4,525,333) | 243,690 | | 1,413,404 | |

| | | | 17,266,614 | |

Total Other Precious Metals Related Securities | | 134,996,764 | |

| | | | | |

Other Securities (0.7%) | | | | |

United States (0.7%) | | | | |

Gold Bullion International LLC(a)(b)(f)

(Originally acquired 5/12/10,

Cost $5,000,000) | 5,000,000 | | 6,900,000 | |

I-Pulse, Inc.(a)(f) (Originally acquired 3/25/2010, Cost $175,524) | 74,532 | | 596,256 | |

Total Other Securities | | | 7,496,256 | |

Total Common Stocks

(Cost $855,840,068) | | 943,759,888 | |

| | | | | |

Private Fund (1.2%) | | | | |

Gold Related Security (1.2%) | | | | |

Tocqueville Bullion Reserve LP -

Glass G(a)(b)(f) (Originally acquired 11/28/11, Cost $13,795,735) | 7,619 | | 12,692,002 | |

Total Private Fund

(Cost $13,795,735) | | | 12,692,002 | |

| | Ounces | | | |

Gold Bullion (12.1%) | | | | |

Gold Bullion(a) | 74,526 | | 131,918,421 | |

Total Gold Bullion

(Cost $32,073,279) | | | 131,918,421 | |

Sprott Gold Equity Fund

Schedule of Investmentsas of June 30, 2021 (Unaudited)

| | | | | |

| Shares | | Value | |

Warrants (0.1%) | | | | |

Gold Related Securities (0.1%) | | | | |

Canada (0.1%) | | | | |

Baru Gold Corp. | | | | |

Expiration: 3/8/2022,

Exercise Price: CAD $0.50(a)(b)(e)(f)

(Originally acquired 3/3/17, Cost $0) | 3,321,250 | | $—

| |

I-80 Gold Corp. | | | | |

Expiration: 9/18/2022,

Exercise Price: CAD $3.64(a)(b)(d)(f)

(Originally acquired 3/2/21, Cost $0) | 1,330,000 | | 161,583 | |

Maverix Metals, Inc. | | | | |

Expiration: 12/23/2021,

Exercise Price: CAD $2.41(a)(d)(f)

(Originally acquired 5/9/19, Cost $0) | 437,500 | | 1,219,289 | |

NuLegacy Gold Corp. | | | | |

Expiration: 10/8/2022,

Exercise Price: CAD $0.12(a)(b)(f)

(Originally acquired 10/7/19, Cost $0) | 4,648,198 | | 118,117 | |

Osisko Gold Royalties Ltd. | | | | |

Expiration: 2/18/2022,

Exercise Price: CAD $36.50(a)(d) | 274,000 | | 31,498 | |

Osisko Mining, Inc. | | | | |

Expiration: 12/23/2021,

Exercise Price: CAD $5.25(a)(b)(f)

(Originally acquired 6/17/20, Cost $0) | 932,500 | | 9,178 | |

Total Gold Related Securities | | | 1,539,665 | |

| | | |

Other Precious Metals Related Securities (0.0%) | | | |

Canada (0.0%) | | | | |

Nickel Creek Platinum Ltd. | | | | |

Expiration: 8/8/2022,

Exercise Price: CAD $0.35(a)(b)(e)(f)

(Originally acquired 8/4/17, Cost $0) | 6,189,601 | | — | |

Nickel Creek Platinum Ltd. | | | | |

Expiration: 7/1/2024,

Exercise Price: CAD $0.08(a)(b)(f)

(Originally acquired 07/01/2019

Cost $0) | 1,658,293 | | 49,364 | |

Total Other Precious Metals Related Securities | | 49,364 | |

Total Warrants

(Cost $0) | | | 1,589,029 | |

| | | | | |

Right (0.0%) | | | | |

Gold Related Securities (0.0%) | | | | |

Osisko Development Rights | | | | |

Expiration: 5/25/2022,

Exercise Price: CAD $10.00(a)(d)(f)

(Originally acquired 10/28/2020, Cost $0) | 666,700 | | 44,210 | |

Total Right

(Cost $0) | | | 44,210 | |

| | | | | |

| | | | | |

| Shares | | Value | |

Short -Term Investments (2.9%) | | | | |

Money Market Fund (0.0%) | | | | |

Invesco Treasury Portfolio | | | | |

Institutional Class, 0.010%(g) | 81,211 | | $81,211

| |

| | | | |

Investments Purchased with Collateral

from Securities Loaned (2.9%) | | | |

Mount Vernon Liquid Assets, 0.10% | 31,538,625 | | 31,538,625 | |

| | | | |

Total Short-Term Investments

(Cost $31,539,094) | | | 31,619,836 | |

| | | | | |

Total Investments

(Cost $933,248,176) (103.0%) | | | 1,121,623,386 | |

Liabilities in Excess of Other Assets ((3.0)%) | | (33,038,912 | ) |

| | | | |

Total Net Assets (100.0%) | | | $1,088,584,474

| |

ADR American Depository Receipt

(a)Non-income producing security.

(b)Affiliated company. See Footnote 7.

(c)This security or a partial position of this security is on loan at June 30, 2021. The total market value of securities on loan at June 30, 2021 was $29,051,168. The loaned securities were secured with cash collateral of $31,538,625. The cash collateral received consists of common stocks and is held for the benefit of the Fund at the Fund’s custodian. The Fund cannot repledge or resell this collateral. Collateral is calculated based on prior day’s prices. See Footnote 11.

(d)Denotes an issue that is traded on a foreign exchange when a company is listed more than once.

(e)Denotes a security that is either fully or partially restricted to resale. The value of restricted securities as of June 30, 2021 was $83,408,534, which represented 7.66% of net assets.

(f)Security is fair valued using procedures approved by the Board of Trustees which includes significant unobservable inputs and is deemed a Level 2 or 3 security. See Footnote 2. The aggregate value of fair valued securities as of June 30, 2021 was $23,245,949, which represented 2.14% of net assets.

(g)Variable rate security. Rate listed is the 7-day effective yield as of June 30, 2021.

The Accompanying Footnotes are an Integral Part of these Financial

Statements.

Sprott Gold Equity Fund

Schedule of InvestmentsJune 30, 2021 (Unaudited)

Percent of Total Investments

Allocation of Portfolio Holdings

As of June 30, 2021

*Category is less than 0.1% of total investments.

See Notes to Financial Statements.

Sprott Gold Equity Fund

Schedule of Assets & LiabilitiesJune 30, 2021 (Unaudited)

| | |

| Sprott Gold

Equity Fund | |

Assets: | | |

Investments, at value(1) | | |

Unaffiliated issuers | $823,308,687

| |

Affiliated issuers | 298,314,699 | |

Foreign currencies, at value(2) | 32 | |

Cash | 50,997 | |

Prepaid to Trustees | 26,721 | |

Prepaid to CCO | 52,215 | |

Receivable for investments sold | 1,504,028 | |

Receivable for Fund shares sold | 535,080 | |

Securities lending income receivable | 22,718 | |

Dividends, interest and other receivables | 411,713 | |

Return of capital receivable | 1 | |

Other assets | 59,910 | |

Total Assets | 1,124,286,801 | |

| | |

Liabilities: | | |

Payable for loans outstanding | 486,000 | |

Payable for Fund shares redeemed | 2,307,794 | |

Payable to Adviser (see Note 3) | 811,679 | |

Payable for collateral upon return of securities loaned | 31,538,625 | |

Payable to Administrator | 168,277 | |

Accrued distribution fee | 100,383 | |

Accrued expenses and other liabilities | 289,569 | |

Total Liabilities | 35,702,327 | |

Net Assets | $1,088,584,474

| |

| | |

NET ASSETS CONSIST OF: | | |

Paid in capital | $1,159,212,169

| |

Total distributable earnings | (70,627,695) | |

NET ASSETS | $1,088,584,474

| |

| | |

INVESTOR CLASS | | |

Net assets | $822,976,421

| |

Shares of beneficial interest outstanding (unlimited shares of $0.01 par value authorized) | 16,515,332 | |

Net asset value, offering and redemption price per share | $49.83

| |

| | |

INSTITUTIONAL CLASS | | |

Net assets | $265,608,053

| |

Shares of beneficial interest outstanding (unlimited shares of $0.01 par value authorized) | 5,296,887 | |

Net asset value, offering and redemption price per share | $50.14

| |

(1) Cost of investments | | |

Unaffiliated issuers | $641,635,407

| |

Affiliated issuers | $291,466,976

| |

(2) Cost of foreign currencies | $32

| |

Sprott Gold Equity Fund

Statements of OperationsJune 30, 2021

See Notes to Financial Statements.

| | |

| For the Period Ended

June 30, 2021

(Unaudited) | |

Investment Income: | | |

Dividends* | | |

Unaffiliated issuers | $6,061,448

| |

Affiliated issuers | 1,012,260 | |

Interest | 306 | |

Income from securities lending (See Note 11) | 87,799 | |

Total investment income | 7,161,813 | |

| | |

Expenses: | | |

Investment Adviser’s fee (See Note 3) | 4,815,962 | |

Distribution (12b-1) fees - Investor Class Only (See Note 3) | 1,092,481 | |

Administration fees (See Note 3) | 771,717 | |

Transfer agent and shareholder services fees - Investor Class | 228,569 | |

Custody fees | 103,865 | |

Fund accounting fees | 90,902 | |

Legal fees | 87,577 | |

Other expenses | 46,618 | |

Printing and mailing expense | 43,748 | |

Blue sky fees | 41,662 | |

Audit fees | 30,007 | |

Trustee fees and expenses | 26,265 | |

Transfer agent and shareholder services fees - Institutional Class | 17,867 | |

Miscellaneous expense | 16,616 | |

Insurance expense | 4,893 | |

Interest expense | 1,355 | |

Registration fees | 1,340 | |

Net expenses | 7,421,444 | |

Net Investment Loss | (259,631 | ) |

| | |

Realized and Unrealized Gain (Loss): | | |

Net realized gain (loss) on: | | |

Investments | | |

Unaffiliated issuers | 24,497,943 | |

Affiliated issuers | 3,629,067 | |

Foreign currency translation | (29,389 | ) |

| 28,097,621 | |

Net change in unrealized appreciation (depreciation) on: | | |

Investments | | |

Unaffiliated issuers | (117,390,950 | ) |

Affiliated issuers | (33,901,962 | ) |

Foreign currency translation | 12,092,196 | |

| (139,200,716 | ) |

Net gain on investments and foreign currency | (111,103,095 | ) |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $(111,362,726

| ) |

* Net of foreign taxes withheld of: | $864,157

| |

Sprott Gold Equity Fund

Statements of Changes in Net AssetsJune 30, 2021

See Notes to Financial Statements.

| | | | |

| Sprott Gold Equity Fund(1) |

| For the

Period Ended

June 30,

2021

(Unaudited) | | For the

Period Ended

December 31,

2020 | |

Operations: | | | | |

Net investment loss | $(259,631

| ) | $(1,021,375

| ) |

Net realized gain on sale of investments and foreign currency | 28,097,621 | | 2,862,848 | |

Net change in unrealized appreciation (depreciation) | (139,200,716 | ) | 21,724,396 | |

Net increase (decrease) in net assets resulting from operations | (111,362,726 | ) | 23,565,869 | |

| | | | |

Distributions to shareholders: | | | | |

Net dividends and distributions to shareholders - Investor Class | — | | — | |

Net dividends and distributions to shareholders - Institutional Class | — | | — | |

Total dividends and distributions | — | | — | |

| | | | |

Fund share transactions: | | | | |

Shares sold - Investor Class | 64,574,665 | | 24,862,917 | |

Shares sold - Institutional Class | 48,847,078 | | 18,623,769 | |

Shares issued to holders in reinvestment of dividends - Investor Class | — | | — | |

Shares issued to holders in reinvestment of dividends - Institutional Class | — | | — | |

Shares redeemed - Investor Class* | (117,830,532 | ) | (44,984,274 | ) |

Shares redeemed - Institutional Class* | (22,093,012 | ) | (10,268,787 | ) |

Net decrease | (26,501,801 | ) | (11,766,375 | ) |

Net increase (decrease) in net assets | (137,864,527 | ) | 11,799,494 | |

| | | | |

Net Assets: | | | | |

Beginning of period | 1,226,449,001 | | 1,214,649,507 | |

End of period | $1,088,584,474

| | $1,226,449,001

| |

*Net of redemption fees of: | $70,488

| | $30,676

| |

(1)The Fund was reorganized on January 17, 2020 and became a series within the Sprott Funds Trust thereafter.

Sprott Gold Equity Fund (Investor Class)

Financial HighlightsFor a Share Outstanding Throughout the Period

See Notes to Financial Statements.

| | | | | | | | | | | | | | | |

| | Sprott Gold Equity Fund |

Per share operating performance

(For a share outstanding throughout the period) | Six Months Ended

June 30,2021

(Unaudited) | | Period Ended

December 31

2020 | | Years Ended October 31, |

| 2020 | | 2019 | | 2018 | | 2017 | | 2016 | |

Net asset value, beginning

of period | | $54.81

| | $53.75

| | $38.74

| | $29.01

| | $35.64

| | $39.32

| | $26.04

| |

| | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | |

Net investment loss(1)(2) | | (0.03 | ) | (0.05 | ) | (0.42 | ) | (0.43 | ) | (0.38 | ) | (0.39 | ) | (0.33 | ) |

Net realized and unrealized gain (loss) | | (4.95 | ) | 1.11 | | 15.43 | | 10.16 | | (6.25 | ) | (3.29 | ) | 13.61 | |

Total from investment operations* | | (4.98 | ) | 1.06 | | 15.01 | | 9.73 | | (6.63 | ) | (3.68 | ) | 13.28 | |

| | | | | | | | | | | | | | | |

Distributions to shareholders: | | | | | | | | | | — | | — | | — | |

Dividends from net investment income | | — | | — | | — | | — | | — | | — | | — | |

Distributions from net realized gains | | — | | — | | — | | — | | — | | — | | — | |

Total distributions | | — | | — | | — | | — | | — | | — | | — | |

| | | | | | | | | | | | | | | |

Change in net asset value for the period | | (4.98 | ) | 1.06 | | 15.01 | | 9.73 | | (6.63 | ) | (3.68 | ) | 13.28 | |

Net asset value, end of period | | $49.83

| | $54.81

| | $53.75

| | $38.74

| | $29.01

| | $35.64

| | $39.32

| |

* Includes redemption fees per share of | | 0.00 | (3) | 0.00 | (3) | 0.01 | | 0.02 | | 0.00 | (3) | 0.01 | | 0.01 | |

Total Return | | (9.1)% | (4) | 2.0% | (4) | 38.7% | | 33.5% | | (18.6)% | | (9.4)% | | 51.0% | |

| | | | | | | | | | | | | | | |

Ratios/supplemental data | | | | | | | | | | | | | | | |

Net assets, end of period (000) | | $822,976

| | $964,071

| | $965,963

| | $998,076

| | $859,394

| | $1,153,287

| | $1,365,282

| |

| | | | | | | | | | | | | | | |

Ratio to average net assets: | | | | | | | | | | | | | | | |

Expense | | 1.37% | (5) | 1.37% | (5) | 1.39% | | 1.47% | | 1.42% | | 1.38% | | 1.39% | |

Net investment loss | | (0.12)% | (5) | (0.57)% | (5) | (0.93)% | | (0.94)% | | (0.88)% | | (0.95)% | | (0.91)% | |

Portfolio turnover rate | | 8% | (4) | 1% | (4) | 34% | | 12% | | 9% | | 14% | | 15% | |

(1)Net investment loss per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences for the four years ended 2019, 2018, 2017 and 2016.

(2)Net investment loss per share is calculated using the average shares outstanding method for the period ended June 30, 2021, the period ended December 31, 2020 and the year ended October 31, 2020.

(3)Represents less than $0.01.

(4)Not Annualized.

(5)Annualized.

Sprott Gold Equity Fund (Institutional Class)

Financial HighlightsFor a Share Outstanding Throughout the Period

See Notes to Financial Statements.

| | | | | | | | | |

| | Sprott Gold Equity Fund |

Per share operating performance

(For a share outstanding throughout the period) | | Six Months Ended

June 30, 2021

(Unaudited) | | Period Ended

December 31,

2020 | | Year Ended

October 31,

2020 | | April 8, 2019(1)

through

October 31,

2019 |

Net asset value, beginning of period | | $55.08

| | $53.98

| | $38.81

| | $32.73

| |

| | | | | | | | | |

Operations: | | | | | | | | | |

Net investment income (loss)(2)(3) | | 0.05 | | (0.03 | ) | (0.30 | ) | (0.10 | ) |

Net realized and unrealized gain (loss) | | (4.99 | ) | 1.13 | | 15.47 | | 6.18 | |

Total from investment operations* | | (4.94 | ) | 1.10 | | 15.17 | | 6.08 | |

| | | | | | | | | |

Distributions to shareholders: | | | | | | | | | |

Dividends from net investment income | | — | | — | | — | | — | |

Distributions from net realized gains | | — | | — | | — | | — | |

Total distributions | | — | | — | | — | | — | |

| | | | | | | | | |

Change in net asset value for the period | | (4.94 | ) | 1.10 | | 15.17 | | 6.08 | |

Net asset value, end of period | | $50.14

| | $55.08

| | $53.98

| | $38.81

| |

* Includes redemption fees per share of | | 0.00 | (6) | 0.00 | (6) | 0.02 | | — | |

Total Return | | (9.0)% | (4) | 2.0% | (4) | 39.1% | | 18.6% | (4) |

| | | | | | | | | |

Ratios/supplemental data | | | | | | | | | |

Net assets, end of period (000) | | $265,608

| | $262,378

| | $248,686

| | $39,732

| |

| | | | | | | | | |

Ratio to average net assets: | | | | | | | | | |

Expense | | 1.08% | (5) | 1.09% | (5) | 1.11% | | 1.28% | (5) |

Net investment income (loss) | | 0.19% | (5) | (0.29)% | (5) | (0.63)% | | (0.93)% | (5) |

Portfolio turnover rate | | 8% | (4) | 1% | (4) | 34% | | 12% | (4) |

(1)Institutional Class shares commenced operations on April 8, 2019.

(2)Net investment loss per share is calculated using the ending accumulated net investment income balances prior to consideration or adjustments for permanent book-to-tax differences for the period ended October 31, 2019.

(3)Net investment income (loss) per share is calculated using the average shares outstanding method for the period ended June 30, 2021, the period ended December 31, 2020 and the year ended October 31, 2020.

(4)Not Annualized.

(5)Annualized.

(6)Represents less than $0.01.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

1. ORGANIZATION

The Sprott Funds Trust (the “Trust”) was organized as a Delaware statutory trust on January 3, 2018. As of June 30, 2021, the Trust consisted of three separate portfolios that each represent a separate series of the Trust. This report pertains to the Sprott Gold Equity Fund (the “Fund”). The Fund is a non-diversified, open-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation. The Fund seeks to achieve its objective by investing at least 80% of its net assets, plus borrowings for investment purposes, in securities of companies located throughout the world, in both developed and emerging markets that are primarily engaged in mining or processing gold.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of financial statements in conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the year. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 and Accounting Standards Update 2013-08.

A. Portfolio Valuation

The Fund’s net asset value (“NAV”) is determined daily, as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time, on each day the NYSE is open for trading. The NAV is computed by dividing the value of all assets of the Fund (including accrued interest and dividends), less all liabilities (including accrued expenses and dividends declared but unpaid), by the total number of shares outstanding.

Portfolio securities are valued at the most recent sale price or official closing price reported on the exchange (U.S. or foreign) or over-the-counter market on which they trade. Portfolio securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined at the close of the exchange representing the principal market for such securities. Securities for which no sales are reported are valued at the calculated mean between the most recent bid and asked quotations on the relevant market or, if a mean cannot be determined, at the most recent bid quotation. Investments in open-end mutual funds such as money market funds are valued at the closing NAV.

The Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Trust’s Board of Trustees (the “Board”). When market quotations are not readily available or when events occur that make established valuation methods unreliable, securities of the Fund may be valued in good faith by or under the direction of the Board. These securities generally include, but are not limited to, restricted securities (securities which may not be publicly sold without registration under the Securities Act of 1933) for which a pricing service is unable to provide a market price; securities whose trading has been formally suspended; a security whose market price is not available from a pre-established primary pricing source or the pricing source is not willing to provide a price; a security with respect to which an event has occurred that is most likely to materially affect the value of the security after the market has closed but before the calculation of the Fund’s NAV or make it difficult or impossible to obtain a reliable market quotation; or a security whose price, as provided by the pricing service, does not reflect the security’s “fair value” due to the security being de-listed from a national exchange or the security’s primary trading market is temporarily closed at a time when, under normal conditions, it would be open. As a general principle, the current “fair value” of a security would be the amount which the owner might reasonably expect to receive from the sale on the applicable exchange or principal market. A variety of factors may be considered in determining the fair value of such securities.

B. Restricted and illiquid securities

The Fund may invest in securities that are subject to legal or contractual restrictions on resale or are illiquid. A security may be considered illiquid if it lacks a readily available market or if its valuation has not changed for a certain period of time. Disposal of these securities may involve time consuming negotiations and expense, and a prompt sale at the current valuation may be difficult.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

C. Fair Value Measurements

The Fund has adopted authoritative fair valuation accounting standards which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the year. These inputs are summarized in the three broad levels listed below.

Level 1 – Quoted prices in active markets for identical securities.

Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 – Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

When using the market quotations or closing price provided by the pricing service for equity investments, including common stocks, preferred stocks, foreign issued common stocks, exchange-traded funds, closed end funds and real estate investment trusts, which are traded on an exchange are valued at the last sale price reported by the exchange on which the securities are primarily traded on the day of valuation and when the market is considered active, the security will be classified as a Level 1 security. When using the mean between the latest bid and ask price, the security will be classified as Level 2. Gold bullion is valued using the latest available price on the valuation day, the security is classified as Level 1.

Investment in mutual funds, including money market funds, are generally priced at the ending NAV provided by the service agent of the funds and will be classified as Level 1 securities.

Debt securities, such as corporate bonds, convertible bonds, commercial paper, money market deposit accounts and U.S. government agency issues for which market quotations are not readily available may be valued based on information supplied by independent pricing services using matrix pricing formulas and/or independent broker bid quotations and are classified as Level 2. Warrants and rights for which the underlying security is registered and equities which are subject to a required holding period, but have a comparable public issue, are valued in good faith by the adviser pursuant to procedures established under the general supervision and responsibility of the Board. These securities will generally be classified as Level 2 securities. If the warrant or right is exchange traded and the official closing price of the exchange is used, these instruments are classified as Level 1 securities. Options can diverge from the prices of their underlying instruments. These are valued at the composite last price reported by the exchange on which the options are primarily traded on the day of the valuation and are classified as Level 1. If there is no composite last price on a given day the mean between the latest bid and ask price will be used. These contracts are classified as Level 2.

Any securities or other assets for which market quotations are not readily available are valued at fair value as determined in good faith by the adviser pursuant to procedures established under the general supervision and responsibility of the Board and will be classified as Level 3 securities. In determining fair value, the Fund will seek to assign a value to the security which it believes represents the amount that the Fund could reasonably expect to receive upon its current sale. With respect to securities that are actively traded on U.S. exchanges, the Fund expects that market quotations will generally be available and that fair value might be used only in limited circumstances, such as when trading for a security is halted during the trading day.

For securities traded principally on foreign exchanges, the Fund may use fair value pricing if an event occurs after the close of trading of the principal foreign exchange on which a security is traded, but before calculation of the Fund’s NAV, which the Fund believes affects the value of the security since its last market quotation. Such events may involve situations relating to a single issuer (such as news related to the issuer announced after the close of the principal foreign exchange), or situations relating to sectors of the market or the markets in general (such as significant fluctuations in the U.S. or foreign markets or significant changes in exchange rates, natural disasters, armed conflicts, or governmental actions).

In determining whether a significant event has occurred with respect to securities traded principally in foreign markets, the Fund may engage a third party fair value service provider to systematically recommend the adjustment of closing market prices of non-U.S. securities based upon changes in a designated U.S. securities market index occurring from the time of close of the relevant foreign market and the close of the NYSE. Fair value pricing may also be used to value restricted securities held by the Fund or securities with little or no trading activity for extended periods of time. Fair value pricing involves judgments that are inherently subjective and inexact and it is not possible to determine with certainty when, and to what extent, an event will affect a market price. As a result, there can be no assurance that fair value pricing will reflect actual market value and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

The following is a summary of the inputs used to value the Fund’s investments at June 30, 2021.

Sprott Gold Equity Fund*

| | | | | | | | | | | | |

Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total |

Common Stocks | | | | | | | | | | | | |

Gold Related | | $ | 795,653,694 | | $ | 5,570,628 | | $ | 42,546 | | $ | 801,266,868 |

Other Precious Metals Related | | | 133,583,360 | | | — | | | 1,413,404 | | | 134,996,764 |

Other | | | — | | | — | | | 7,496,256 | | | 7,496,256 |

Total Common Stocks | | | 929,237,055 | | | 5,570,628 | | | 8,952,206 | | | 943,759,888 |

Private Fund**^ | | | — | | | — | | | — | | | 12,692,002 |

Gold Bullion | | | 131,918,421 | | | — | | | — | | | 131,918,421 |

Warrants | | | | | | | | | | | | |

Gold Related | | | 31,498 | | | 1,508,167 | | | — | | | 1,539,665 |

Other Precious Metals Related | | | — | | | 49,364 | | | — | | | 49,364 |

Total Warrants | | | 31,498 | | | 1,557,531 | | | — | | | 1,589,029 |

Right | | | — | | | 44,210 | | | — | | | 44,210 |

Short Term Investments | | | 31,619,836 | | | — | | | — | | | 31,619,836 |

Total Investments | | $ | 1,092,806,809 | | $ | 7,172,369 | | $ | 8,952,206 | | $ | 1,121,623,386 |

*For a detailed sector breakdown, please see the accompanying Schedule of Investments.

**Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the Schedule of Investments.

^As of June 30, 2021, the Fund currently invests in a private fund that primarily invests in physical gold and is subject to redemption restrictions. This private fund investment can only be disposed of with notice given 24 hours in advance of redemption. Due to the elapsed time, the investment of the Fund is not subject to any redemption fees going forward.

Below is a reconciliation that details the activity of securities in Level 3 during the current fiscal period:

| | | | |

| | Sprott Gold Equity

Fund | |

Beginning Balance - December 31, 2020 | | $ | 8,513,563 | |

Purchases | | | — | |

Sales | | | — | |

Realized gains | | | — | |

Realized losses | | | — | |

Change in unrealized appreciation | | | 438,643 | |

Transfers in/(out) of Level 3 | | | — | |

Ending Balance - June 30, 2021 | | $ | 8,952,206 | |

As of June 30, 2021 the change in unrealized appreciation on positions still held for securities that were considered Level 3 was $438,643.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

The following table summarizes quantitative information about significant unobservable valuation inputs for Level 3 fair value measurement as of June 30, 2021.

| | | | | | | | | | | | |

Fund | | Type of Security | | Industry | | Fair Value at

6/30/2021 | | Valuation

Techniques | | Unobservable Inputs | | Range |

Sprott Gold

Equity Fund | | Common Stock | | Gold

Related | | $42,546

| | Professional analysis of latest company valuation or financing | | Financing prices | | $0.02

|

| | | | Other

Precious

Metals

Related | | $1,413,404

| | Professional analysis of latest company valuation or financing | | Financing prices | | $5.80

|

| | | | Other | | $7,496,256

| | Professional analysis of latest company valuation or financing | | Financing prices | | $1.38 - $8.00 |

The significant unobservable inputs used in the fair value measurement of the Fund’s common stocks are the most recent financing prices of the portfolio company, which approximate the companies’ value in the marketplace. The significant unobservable inputs used for the private fund is the latest price change of an Adviser deemed comparable proxy investment.

Significant changes in a companies’ ability to receive financing for new projects in the future would be an indication of the companies’ financial position and market value. Significant changes in the latest price change of the comparable proxy investment or a change in the adviser deemed comparable proxy investment could impact the value of the security.

The Trust’s valuation procedures have been adopted by the Board, which has established a Valuation Committee to oversee the valuation process. The Valuation Committee meets on an as needed basis to evaluate changes in the valuation of portfolio securities. The full findings and valuations are then reviewed quarterly by the Board including the Independent Trustees.

Portfolio management and the trading department monitor fair valued positions for new financing or corporate actions that could lead to a change in valuation.

D. Gold and Precious Metals Mining Industry Risk

The Fund is sensitive to changes in, and its performance will depend to a greater extent on, the overall condition of the gold and precious metals mining industry. In times of stable economic growth, traditional equity and debt investments could offer greater appreciation potential and the value of gold, silver and other precious metals may be adversely affected, which could in turn affect the Fund’s returns. The gold and precious metals industry can be significantly affected by competitive pressures, central bank operations, events relating to international political developments, the success of exploration projects, commodity prices, adverse environmental developments and tax and government regulations.

E. Foreign Investment Risk

The Fund’s investments in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. Adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Countries with emerging markets may present heightened risks of nationalization of businesses, restrictions on foreign ownership and prohibitions on the repatriation of assets. The economies of emerging markets countries also may be based on only a few industries, making them more vulnerable to changes in local or global trade conditions and more sensitive to debt burdens, inflation rates or adverse news and events. Where all or a portion of the Fund’s underlying securities trade in a market that is closed when the market in which the Fund’s shares are listed and trading in that market is open, there may be changes between the last quote from its closed foreign market and the value of such security during the Fund’s domestic trading day.

F. Foreign Currency Translation

The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

G. Gold Risk

Gold is subject to the special risks associated with investing in gold and other precious metals, including: (1) the price of gold or other precious metals may be subject to wide fluctuation; (2) the market for gold or other precious metals is relatively limited; (3) the sources of gold or other precious metals are concentrated in countries that have the potential for instability; and (4) the market for gold and other precious metals is unregulated.

H. Securities Transactions and Investment Income

Securities transactions are recorded as of the trade date. Realized gains and losses from securities transactions are recorded with a specific identification cost method. Dividend income and capital gains distributions, if any, are recorded on the ex-dividend date. Interest income, if any, is recorded on the accrual basis.

I. Dividends and Distributions to Shareholders

Dividends from net investment income for the Fund, if any, are declared and paid annually or as the Board may determine from time to time. Distributions of net realized capital gains earned by the Fund, if any, are distributed at least annually.

J. Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year. Actual results could differ from those estimates.

K. Indemnification

In the normal course of business the Fund enters into contracts that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote.

L. Federal Tax and Tax Basis Information

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations.

For the period ended December 31, 2020, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect permanent tax differences:

| | | | | | | | |

| | Distributable

Earnings | | | Paid in Capital | |

Sprott Gold Equity Fund | | $ | 9,510,695 | | | $ | (9,510,695 | ) |

| | | | | | | | |

The permanent differences primarily relate to net operating losses. | | | | | | | | |

| | | | | | | | |

As of December 31, 2020, the components of accumulated losses for income tax purposes were as follows: |

| | | | | | | | |

Tax cost of Investments | | | | | | $ | 964,941,261 | |

Unrealized appreciation | | | | | | | 480,780,646 | |

Unrealized depreciation | | | | | | | (164,012,988 | ) |

Net unrealized appreciation | | | | | | | 316,767,658 | |

Undistributed operating income | | | | | | | — | |

Undistributed long-term gains | | | | | | | — | |

Distributable earnings | | | | | | | — | |

Other accumulated loss | | | | | | | (276,032,627 | ) |

Total accumulated gain | | | | | | $ | 40,735,031 | |

For the fiscal period ended December 31, 2020 the Sprott Gold Equity Fund had no late year losses.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

At December 31, 2020 the Fund had tax basis capital losses which may be carried forward to offset future capital gains as shown below:

| | | |

| Capital Losses Expiring

Indefinite Short-Term | | Capital Losses Expiring

Indefinite Long Term |

Sprott Gold Equity Fund | $– | | $276,024,734 |

To the extent that the Fund may realize future net capital gains, those gains will be offset by any of their unused respective capital loss carryforwards.

M. COVID-19

The global outbreak of coronavirus disease 2019 (“COVID-19”) has disrupted global economic markets and adversely affected individual companies and investment products. The prolonged economic impact of COVID-19 is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments.

N. Subsequent Events Evaluation

In preparing these financial statements, the Fund has evaluated events and transactions for potential recognition or disclosure resulting from subsequent events after the Statements of Assets and Liabilities date of June 30, 2021 through the date the financial statements were available for issue. This evaluation did not result in any subsequent events that necessitated disclosure and/or adjustments.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

Sprott Asset Management L.P. (the “Adviser”) serves as the Fund’s investment adviser pursuant to an Investment Advisory Agreement with the Trust on behalf of the Fund (the “Advisory Agreement”). Pursuant to the Advisory Agreement, the Adviser receives fees from the Fund, calculated daily and payable monthly, at an annual fee rate of 1.00% on the first $500 million of the average daily net assets of the Fund, 0.75% of the average daily net assets in excess of $500 million but not exceeding $1 billion, and 0.65% of the average daily net assets in excess of $1 billion. Prior to the Reorganization, the Adviser of the Predecessor Fund received the same tiered fee structure.

The Adviser, on behalf of the Fund, has entered into a Sub-Advisory Agreement with Sprott Asset Management USA Inc. (the “Sub-Adviser”), an affiliate of the Adviser. The Sub-Adviser does not receive a separate sub-advisory fee under the Sub-Advisory Agreement.

Pursuant to an Administrative Services Agreement, the Fund pays the Adviser a fee computed and paid monthly at an annual rate of 0.15% on the first $400 million of the average daily net assets of the Fund; 0.13% on the next $600 million of the average daily net assets of the Fund; and 0.12% on all the average daily net assets of the Fund over $1 billion.

The Adviser has entered into a sub-administration agreement with U.S. Bank Global Fund Services (the “Sub-Administrator”), under which the Adviser pays the Sub-Administrator a fee based on the assets of the Fund. The fee payable to the Sub-Administrator by the Adviser is calculated daily and payable monthly, at an annual rate of: (i) 0.05% on the first $400 million of the average daily net assets; (ii) 0.03% on the next $600 million of the average daily net assets; and (iii) 0.02% of the average daily net assets in excess of $1 billion, subject to a minimum annual fee for the Fund of $60,000. For the period ended June 30, 2021 the Adviser has made payments of $212,277 to the Sub-Administrator for services provided under a sub-administration agreement for the Fund.

Sprott Global Resource Investments Ltd. (the “Distributor”), an affiliate of the Adviser, acts as distributor for shares of the Fund. The Investor Class adopted a distribution and services plan pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the plan, the Investor Class pays to the Distributor distribution and service fees of 0.25% per annum of its average daily net assets.

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

4. CAPITAL SHARE TRANSACTIONS

Transactions in capital shares for the Fund was as follows:

| | | | | | | | | | | | |

Sprott Gold Equity Fund (Investor Class) | | For the Period ended

June 30, 2021 | | For the Period ended

December 31, 2020 | | For the Year ended

October 31, 2020 |

Shares sold | | | 1,237,876 | | | | 463,845 | | | | 4,220,917 | |

Shares issues to holders in reinvestment dividends | | | — | | | | — | | | | — | |

Shares redeemed | | | (2,311,809 | ) | | | (847,599 | ) | | | (12,006,462 | ) |

Net decrease | | | (1,073,933 | ) | | | (383,754 | ) | | | (7,785,545 | ) |

| | | | | | | | | | | | |

Sprott Gold Equity Fund (Institutional Class) | | For the Period ended

June 30, 2021 | | For the Period ended

December 31, 2020 | | For the Year ended

October 31, 2020 |

Shares sold | | | 959,993 | | | | 347,676 | | | | 5,357,533 | |

Shares issues to holders in reinvestment dividends | | | — | | | | — | | | | — | |

Shares redeemed | | | (426,793 | ) | | | (190,717 | ) | | | (1,774,399 | ) |

Net increase | | | 533,200 | | | | 156,959 | | | | 3,583,134 | |

5. FUND SHARE TRANSACTIONS

The Fund currently offers two classes of shares of beneficial interest. A redemption fee of 2.00% is imposed on redemptions of shares held 90 days or fewer for the Fund. This fee is retained by the Fund and is credited to paid in capital. For a more detailed description of when the redemption fee does not apply, please see the Fund’s Prospectus.

6. INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding short-term instruments) for the period ended June 30, 2021 are summarized below.

| |

| Sprott Gold Equity Fund |

Purchases: | $ 87,363,655 |

Sales: | 107,464,125 |

7. Transactions with Affiliates*

The following issuers are affiliated with the Funds; that is, the Adviser had control of 5% or more of the outstanding voting securities during the period from January 1, 2021 through June 30, 2021. As defined in Section 2(a)(3) of the 1940 Act; such issues are:

| | | | | | | | | | | | | | | | | | | | | | | | |

| January 1, 2021 | | Additions | | Reductions | | June 30,

2021 | | Interest

Income | Dividend

Income | | Realized

Gain/(Loss) | | Change in

Gross

Unrealized

Appreciation/

(Depreciation) | | June 30, 2021 |

Issuer Name | Share Balance | | Cost | | Share Balance | | Cost | | Share Balance | | Cost | | Share Balance | | | Value | | Cost |

Sprott Gold Equity Fund | | | | | | | | | | | | | | | | | | | | | | | | |

Baru Gold Corp. | 194,440 | | 3,148,570 | | 13,096,553 | | 19,647,429 | | — | | — | | 13,290,993 | | — | — | | — | | (18,814,873 | ) | 857,760 | | 22,795,999 |

Baru Gold Corp. | 13,096,553 | | 19,647,429 | | | | | | (13,096,553 | ) | (19,647,429 | ) | — | | — | — | | — | | 17,949,785 | | — | | — |

Baru Gold Corp. Warrant | 3,321,250 | | — | | | | — | | — | | — | | 3,321,250 | | — | — | | — | | (261 | ) | — | | — |

Bear Creek Mining Corp. | 7,413,200 | | 28,761,181 | | — | | — | | (1,430,400 | ) | (6,361,161 | ) | 5,982,800 | | — | — | | (4,022,355 | ) | (4,048,781 | ) | 7,818,761 | | 22,400,020 |

Corvus Gold, Inc. | 3,226,901 | | 2,212,904 | | — | | — | | — | | — | | 3,226,901 | | — | — | | — | | 1,161,684 | | 8,841,709 | | 2,212,904 |

Corvus Gold, Inc. | 9,500,000 | | 7,163,141 | | — | | — | | | | | | 9,500,000 | | — | — | | — | | 3,594,346 | | 26,133,430 | | 7,163,141 |

Corvus Gold, Inc. | 6,954,100 | | 8,503,013 | | | | | | | | | | 6,954,100 | | — | — | | | | 2,631,099 | | 19,129,946 | | 8,503,013 |

Corvus Gold, Inc. | 1,739,130 | | 1,561,600 | | | | | | — | | — | | 1,739,130 | | — | — | | — | | 658,004 | | 4,784,151 | | 1,561,600 |

Falco Resources Ltd. | 16,222,300 | | 11,973,054 | | — | | — | | — | | — | | 16,222,300 | | — | — | | — | | 140,367 | | 5,365,556 | | 11,973,054 |

Gold Bullion International LLC | 5,000,000 | | 5,000,000 | | — | | — | | — | | — | | 5,000,000 | | — | 256,600 | | — | | — | | 6,900,000 | | 5,000,000 |

I-80 Gold Corp. | — | | — | | 10,415,264 | | 18,348,947 | | | | | | 10,415,264 | | | | | | | 2,740,366 | | 21,089,313 | | 18,348,947 |

I-80 Gold Corp. Warrant | — | | — | | 1,330,000 | | | | — | | — | | 1,330,000 | | | | | | | 161,583 | | 161,583 | | — |

Sprott Gold Equity Fund

Notes to Financial Statements (Unaudited)June 30, 2021

| | | | | | | | | | | | | | | | | | | | | | | | |

| January 1, 2021 | | Additions | | Reductions | | June 30,

2021 | | Interest

Income | Dividend

Income | | Realized

Gain/(Loss) | | Change in

Gross

Unrealized

Appreciation/

(Depreciation) | | June 30, 2021 |

Issuer Name | Share Balance | | Cost | | Share Balance | | Cost | | Share Balance | | Cost | | Share Balance | | | Value | | Cost |

International Tower Hill Mines Ltd. | 6,850,222 | | 22,509,061 | | | | | | (100,000 | ) | (125,703 | ) | 6,750,222 | | — | — | | (3,741 | ) | (2,239,871 | ) | 7,087,733 | | 22,383,358 |

International Tower Hill Mines Ltd. | 18,664,631 | | 35,619,856 | | — | | — | | | | | | 18,664,631 | | — | — | | — | | (6,676,775 | ) | 19,423,503 | | 35,619,856 |

International Tower Hill Mines Ltd. | 1,666,667 | | 8,833,502 | | | | | | — | | — | | 1,666,667 | | — | — | | — | | (596,206 | ) | 1,734,431 | | 8,833,502 |

Jaguar Mining, Inc. | 7,647,959 | | 5,832,118 | | | | | | (1,641,400 | ) | (2,021,987 | ) | 6,006,559 | | — | 755,660 | | 7,655,163 | | (22,163,437 | ) | 25,923,758 | | 3,810,131 |

MAG Silver Corp. | 1,581,135 | | 18,561,846 | | | | | | | | | | 1,581,135 | | — | — | | | | 632,454 | | 33,077,344 | | 18,561,846 |

MAG Silver Corp. | 1,432,665 | | 15,000,003 | | — | | — | | — | | — | | 1,432,665 | | — | — | | — | | 626,125 | | 29,956,983 | | 15,000,003 |

Nickel Creek Platinum Ltd. | 12,379,201 | | 2,544,342 | | — | | — | | (12,379,201 | ) | (2,544,342 | ) | — | | — | — | | — | | 941,909 | | — | | — |

Nickel Creek Platinum Ltd. | 1,658,293 | | 51,762 | | 12,379,201 | | 2,544,342 | | — | | — | | 14,037,494 | | — | — | | — | | (1,463,683 | ) | 1,132,421 | | 2,596,104 |

Nickel Creek Platinum Ltd. Warrant | 6,189,601 | | — | | — | | — | | — | | — | | 6,189,601 | | — | — | | — | | (11,184 | ) | — | | — |