UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to § 240.14a-12 | |

Tilray, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

This Schedule 14A filing consists of the following communications relating to the proposed business combination of Tilray, Inc. (the “Company”), a Delaware corporation, and Aphria Inc., a corporation existing under the laws of the Province of Ontario (“Aphria”), pursuant to the terms of an Arrangement Agreement, dated December 15, 2020, by and among the Company and Aphira:

| (i) | Joint Press Release |

| (ii) | All Employee Communication |

| (iii) | Investor Presentation |

| (iv) | Investor Call Transcript |

Each item above was first used or made available on December 16, 2020.

(i)

|  |

APHRIA AND TILRAY COMBINE TO CREATE

LARGEST GLOBAL CANNABIS COMPANY WITH PRO FORMA REVENUE OF

C$874 MILLION (US$685 MILLION)

Complementary, Scalable Medical and Adult-Use Cannabis Businesses Strengthen Leadership Position in Canada; Expands U.S. and International Reach through World-Class Cultivation, Manufacturing, Diversified Product Portfolio and Distribution Footprint

Robust Supply Chain and Operational Efficiencies Expected to Generate Approximately C$100 Million of Pre-Tax Annual Cost Synergies

Aphria and Tilray to Host a Conference Call and Webcast at 8:30 a.m. Eastern Time

Leamington, Ontario and Nanaimo, British Columbia – December 16, 2020 – Aphria Inc. (“Aphria”) (TSX: APHA and Nasdaq: APHA), a leading global cannabis company inspiring and empowering the worldwide community to live their very best life, and Tilray, Inc. (“Tilray”) (Nasdaq: TLRY), a global pioneer in cannabis research, cultivation, production and distribution, today announced that they have entered into a definitive agreement (the “Agreement”) to combine their businesses and create the world’s largest global cannabis company (the “Combined Company”) based on pro forma revenue1. The deal is pursuant to a plan of arrangement (the “Arrangement”) under the Business Corporations Act (Ontario), and the implied pro forma equity value of the Combined Company is approximately C$5.0 billion (US$3.9 billion), based on the share price of Aphria and Tilray at the close of market on December 15, 2020. Following the completion of the Arrangement, the Combined Company will have principal offices in the United States (New York and Seattle), Canada (Toronto, Leamington and Vancouver Island), Portugal and Germany, and it will operate under the Tilray corporate name with shares trading on NASDAQ under ticker symbol “TLRY”.

The Combined Company, supported by low-cost, state-of-the-art cultivation, processing, and manufacturing facilities, will have a complete portfolio of branded Cannabis 2.0 products in Canada. Internationally, the Combined Company will be well-positioned to pursue growth opportunities with Aphria’s medical cannabis and distribution footprint in Germany, and Tilray’s European Union Good Manufacturing Practices (“EU-GMP”) low-cost cannabis production facility in Portugal, which has export capabilities and tariff-free access to the European Union (“EU”) to meet increasing global demand for medical cannabis. In the United States, the Combined Company will have a strong consumer packaged goods presence and infrastructure with two

strategic pillars, including SweetWater Brewing Company (“SweetWater”), a cannabis lifestyle branded craft brewer, and Manitoba Harvest, a leading hemp food manufacturer and a pioneer in branded CBD and wellness products. The Combined Company is expected to have a strong, flexible balance sheet, cash balance and access to capital giving it the ability to accelerate growth and deliver attractive returns for stockholders.

Under the terms of the Arrangement, the shareholders of Aphria (the “Aphria Shareholders”) will receive 0.8381 shares (the “Exchange Ratio”) of Tilray for each Aphria common share (each, an “Aphria Share”), while holders of Tilray shares (the “Tilray Stockholders”) will continue to hold their Tilray shares (the “Tilray Shares”) with no adjustment to their holdings. Upon the completion of the Arrangement, Aphria Shareholders will own approximately 62 percent of the outstanding Tilray Shares on a fully diluted basis, resulting in a reverse acquisition of Tilray, representing a premium of 23 percent based on the share price at market close on December 15, 2020 to Tilray shareholders. On a pro forma basis for the last twelve months reported by each company, the Combined Company would have had revenue of C$874 million (US$685 million).

| 1 | Based on the most recently reported quarterly financial statements for Aphria and Tilray. |

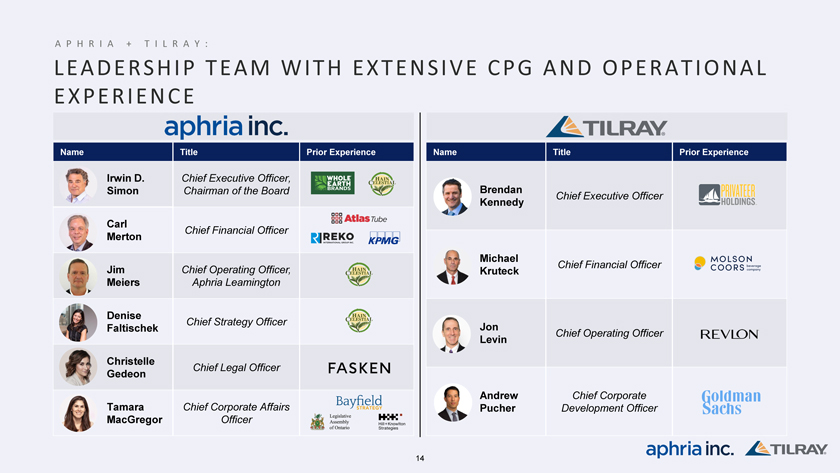

Proven Leadership Team

The Combined Company will be led by a best-in-class management team and board of directors, with strong track records in consumer-packaged goods and cannabis experience internationally. Upon completion of the Arrangement, Aphria’s current Chairman and Chief Executive Officer, Irwin D. Simon, will lead the Combined Company as Chairman and Chief Executive Officer. The board of directors will consist of nine members, seven of which, including Mr. Simon, are current Aphria directors and two of which will be from Tilray, including Brendan Kennedy, and one of which is to be designated. Aphria and Tilray are confident that the leadership team and proposed board of directors of the Combined Company provides a strong foundation for the Combined Company to accelerate growth. Additional senior leadership positions at the Combined Company will be named at a later date.

“This is an exciting day for both companies including our 2,500 employees, for the cannabis industry, and for patients and consumers around the world. We are bringing together two world-class companies that share a culture of innovation, brand development and cultivation to enhance our Canadian, U.S., and international scale as we pursue opportunities for accelerated growth with the strength and flexibility of our balance sheet and access to capital,” said Mr. Simon. “Our highly complementary businesses create a combined company with a leading branded product portfolio, including the most comprehensive Cannabis 2.0 product offerings for patients and consumers, along with significant synergies across our operations in Canada, Europe and the United States. Our business combination with Tilray aligns with our strategic focus and emphasis on our highest return priorities as we strive to generate value for all stakeholders.”

“I am honored to work with Brendan Kennedy, a pioneer in the cannabis industry, and the Tilray team as they join forces with our talented employees at Aphria,” continued Mr. Simon. “I look forward to leading the talented teams of both Aphria and Tilray as we seek to create a leading global cannabis and consumer packaged goods company with a portfolio of medical, wellness and adult-use brands consumers love.”

Mr. Kennedy, Tilray’s Chief Executive Officer, commented, “We are thrilled to bring together two cannabis industry leaders. At this nascent stage of development and expansion of the global cannabis market, we believe companies with leading geographic scale, product range and brand expertise are most likely to benefit long-term. By leveraging our combined strengths and capabilities, we expect to be able to meet the needs of consumers more effectively all over the world and advance patient care. With a strong financial profile, low-cost production, leading brands, distribution network and unique partnerships, we believe the Combined Company will be well-positioned to deliver sustainable, attractive returns for stockholders. I look forward to working with Irwin and the Combined Company’s management team to make our consumer products more accessible around the world.”

Strategic and Financial Benefits

The Combined Company will be the largest global cannabis company based on pro forma revenue for the last twelve months reported by each company with scale and breadth across major geographies and a complete portfolio of market leading brands in the major Cannabis 2.0 product categories. Aphria and Tilray each believe the business combination pursuant to the Arrangement will provide the following financial and strategic benefits, among others:

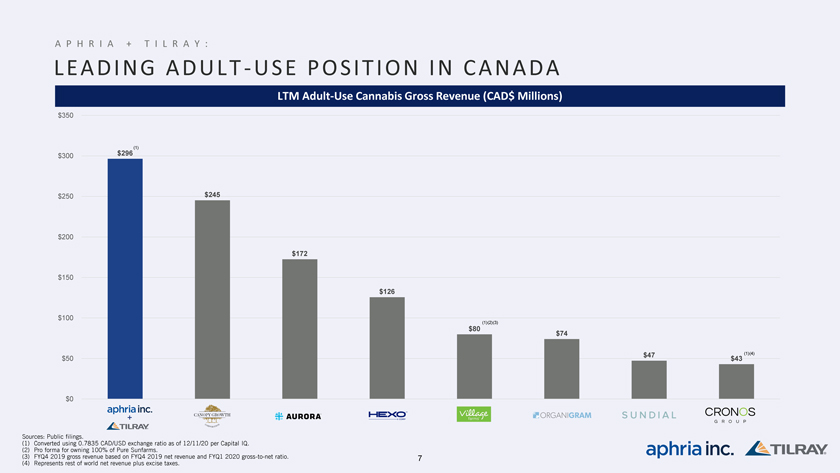

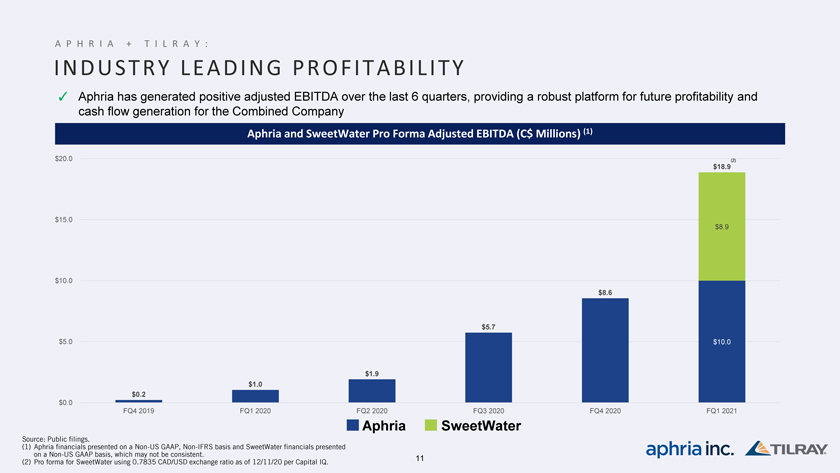

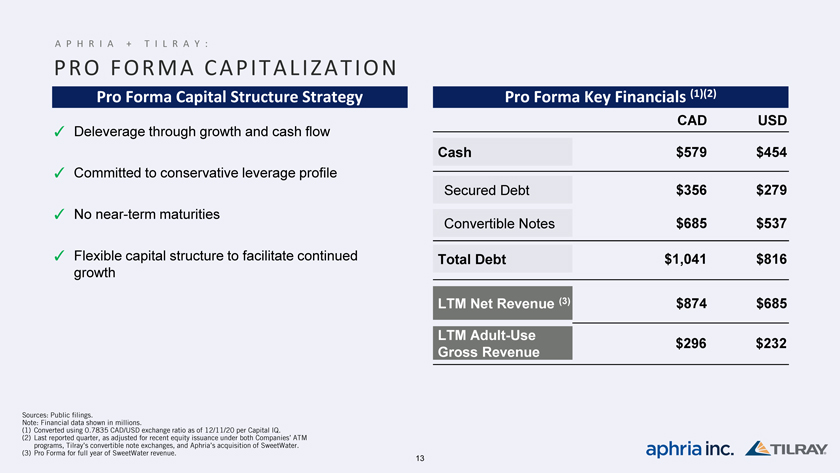

Financial Strength and Flexibility: The Combined Company will enjoy an attractive financial profile with pro forma revenue of C$874 million (US$685 million) for the last twelve months reported by each company, the highest in the global cannabis industry. In Canada, the combination of Aphria and Tilray will create the leading adult-use cannabis company with gross revenue of C$296 million (US$232 million) in the adult-use market for the twelve months reported by each company. Aphria has generated positive adjusted EBITDA over the last six quarters2, which in combination with the synergies to be realized, provides a robust platform for future profitability and cash flow generation for the Combined Company. This, collectively with the strength of the Combined Company’s balance sheet and access to capital, is expected to help accelerate global growth and value for the Combined Company’s stakeholders.

| 2 | Non-GAAP measure which may not be consistent between companies in our industry. See definition in Aphria’s Q1 2021 Management Discussion & Analysis. |

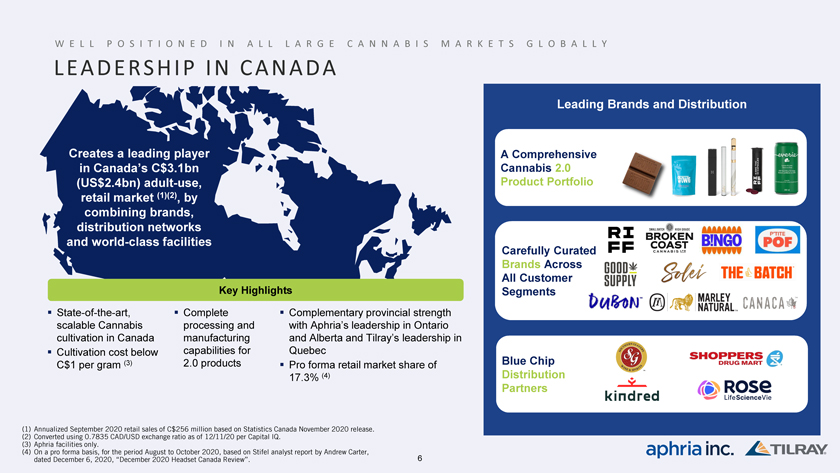

Creates the Leading Canadian Adult-Use Cannabis Licensed Producer: Together, Aphria and Tilray will be the leading adult-use cannabis Canadian Licensed Producer based on revenue for the last twelve months by combining their respective brands, distribution networks and world-class facilities. In Canada’s C$3.1 billion adult-use, retail market3, the Combined Company will have one of the lowest cost production operations with its state-of-the-art facilities. In addition, the Combined Company will have a portfolio of carefully curated brands across all consumer segments that are sold through its distribution partners. On a pro forma basis, for the period August to October 2020, the Combined Company would have held a 17.3% retail market share4, the largest share held by any single Licensed Producer in Canada and 700 basis points higher than the next closest competitor.

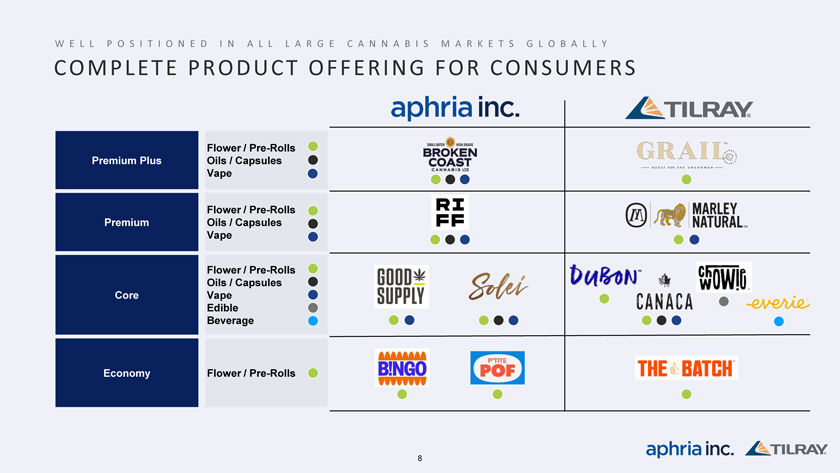

Increases Product Breadth and Commitment to Innovation: Leveraging both Aphria and Tilray’s commitment and culture of innovation and brand building, the Combined Company will serve clients with a complete portfolio of Cannabis 2.0 products and sales and service infrastructure supported by leading distribution partners. Aphria and Tilray’s complementary brands will be available across economy, value, core, premium and premium plus product offerings. In addition, the Combined Company will have a complete breadth of products in every major cannabis category, including flower, pre-roll, oils, capsules, vapes, edibles and beverages.

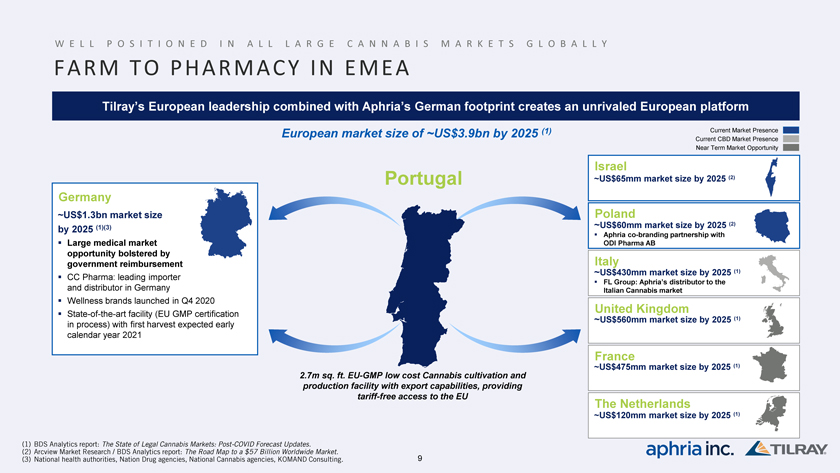

Establishes an Unrivaled European Platform: The Combined Company will be well-positioned to pursue growth opportunities with its end-to-end EU-GMP supply chain and distribution, which includes Aphria’s German medical cannabis distribution footprint and Tilray’s 2.7 million square foot European EU-GMP low-cost cannabis cultivation and production facility in Portugal. In Germany, Aphria’s wholly-owned subsidiary, CC Pharma GmbH, will provide the Combined Company with distribution capabilities for the Aphria and Tilray medical cannabis brands to more than 13,000 pharmacies. In Portugal, Tilray’s EU-GMP cultivation and production facility will provide the Combined Company with the capacity to cultivate and produce medical cannabis products in order to meet international demand and has export capabilities, which provides tariff-free access to the EU.

Enhances Consumer Packaged Goods Presence and Infrastructure in the U.S.: In the United States, the Combined Company will have a strong consumer packaged goods presence and infrastructure with two strategic pillars, including SweetWater, a cannabis lifestyle branded craft brewer, and Manitoba Harvest, a pioneer in branded hemp, CBD and wellness products with access to 17,000 stores in North America. The Combined Company is expected to leverage SweetWater’s craft beer manufacturing and distribution network to build brand awareness for the Combined Company’s leading brands via craft beers, hard seltzers, and other beverages as it seeks to take advantage of opportunities for both the adult-use and health and wellbeing beverage trends. The Combined Company also expects to pursue the opportunity to expand with new or existing CBD or other cannabinoid brands leveraging Manitoba Harvest’s strong hemp and wellness product platform. When U.S. regulations allow, the Combined Company expects to be well-positioned to compete in the U.S. cannabis market given its existing strong brands and distribution system in addition to its track record of growth in consumer-packaged goods and cannabis.

| 3 | Annualized September 2020 retail sales of C$256 million based on Statistics Canada November 2020 release |

| 4 | Based on Stifel analyst report by Andrew Carter, dated December 6, 2020, “December 2020 Headset Canada Review”. |

Positions Combined Company to Continue to Grow in the Beverage Segment: The Combined Company believes it will be well-positioned to pursue an accelerated rate of growth in the Canadian and the U.S. beverage industries by leveraging SweetWater’s innovation, knowledge, and expertise to introduce adult-use cannabis brands via craft beers and other beverages. This includes leveraging Aphria and Tilray’s proven distribution networks in Canada to sell SweetWater’s 420 cannabis lifestyle brand in Canada.

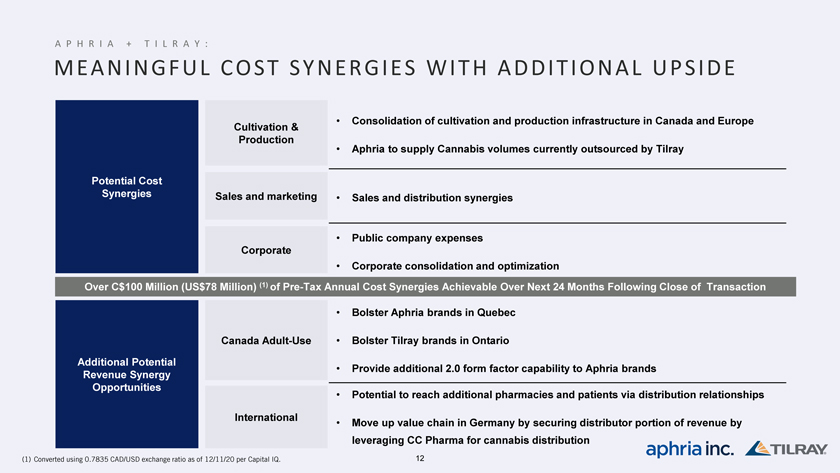

Substantial Synergies: The combination of Aphria and Tilray is expected to deliver approximately C$100 million of annual pre-tax cost synergies within 24 months of the completion of the transaction. The Combined Company expects to achieve cost synergies in the key areas of cultivation and production, cannabis and product purchasing, sales and marketing and corporate expenses. This is expected to include the opportunity for Aphria’s Leamington, Ontario operations to provide additional volume for Tilray’s brands and to replace the need for Tilray to use wholesale cannabis purchases from other licensed producers. Tilray’s London, Ontario facility will also provide Aphria with excess capacity to increase production of additional form factors including their branded edibles and beverages. The Combined Company is considering utilizing Tilray’s existing Nanaimo, British Columbia facility for Aphria’s premium Broken Coast brand to increasingly meet consumer demand for its products. The Combined Company plans to capitalize on opportunities for growth through a broadened product offering and additional form factors, with the aim of increasing adult-use cannabis brand availability across certain Canadian provinces to an expanded customer base with the Combined Company’s scalable infrastructure. Internationally, the Combined Company will have the opportunity to reach additional pharmacies and patients via distribution relationships. The combination is expected to unlock significant shareholder value.

Agreement Details

Under the terms of the Agreement, the Arrangement will be carried out by way of a court approved plan of arrangement under the Business Corporations Act (Ontario) and will require the approval of at least two-thirds of the votes cast by the Aphria Shareholders at a special meeting. Approval of a majority of the votes cast by Tilray stockholders will be required to, among other things contemplated by the Agreement, authorize the issuance of Tilray shares to Aphria shareholders pursuant to the Arrangement. Following completion of the Arrangement, Aphria will become a wholly-owned subsidiary of Tilray, with Aphria shareholders owning approximately 62 percent of Tilray.

Completion of the Arrangement is subject to regulatory and court approvals and other customary closing conditions. Regulatory approvals expected to be required include Competition Bureau (Canada), U.S. HSR and Germany FDI. The Agreement includes certain reciprocal customary provisions, including covenants in respect of the non-solicitation of alternative transactions, a right to match superior proposals and C$65 million (US$50 million) reciprocal termination fee payable under certain circumstances. The Arrangement is expected to close in the second quarter of calendar year 2021 following the receipt of such regulatory approvals, as well as court approval of the Arrangement.

Each of Aphria’s and Tilray’s respective directors and officers and certain principal Tilray Stockholders have entered into voting support agreements agreeing to vote their Aphria Shares or Tilray Shares, as applicable, in favor of the resolutions put before them pursuant to the Agreement.

For further information on the terms and conditions of the Arrangement, please refer to the Agreement in its entirety, which will be available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. Full details of the Arrangement will be included in a management information circular of Aphria and in a proxy statement of Tilray to be delivered to Aphria Shareholders and the Tilray Stockholders, respectively, in the coming weeks.

Board of Directors’ Approval

Each of Aphria’s and Tilray’s respective board of directors has unanimously approved the Agreement and the Arrangement. Jefferies LLC provided a fairness opinion to the Board of Directors of Aphria on December 15, 2020, stating that, as of the date of such opinion and based upon the scope of review and subject to the assumptions, limitations and qualifications stated in such opinion, the Exchange Ratio is fair, from a financial point of view, to the Aphria Shareholders. Cowen provided a fairness opinion dated December 15, 2020 to the board of directors of Tilray stating that, as of the date of such opinion and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the Exchange Ratio is fair, from a financial point of view, to Tilray.

Advisors

Jefferies LLC is serving as financial advisor and DLA Piper LLP (US), DLA Piper (Canada) LLP and Fasken Martineau Dumoulin LLP are acting as legal counsel to Aphria. Cowen is serving as financial advisor and Cooley LLP and Blake, Cassels and Graydon LLP are acting as legal counsel to Tilray.

Conference Call & Webcast Presentation

Aphria and Tilray executives will host a conference call and webcast with a supplemental presentation to discuss the strategic business combination today, December 16, 2020 at 8:30 a.m. Eastern Time.

To listen to the live call, dial (647) 427-7450 from Canada and the U.S. or (888) 231-8191 from international locations and use the passcode 4334816. A telephone replay will be available approximately two hours after the call concludes through January 13, 2021. To access the recording dial (855) 859-2056 and use the passcode 4334816.

There will also be a simultaneous, live webcast and supplemental presentation available on the Investors section of Aphria’s and Tilray’s website at aphriainc.com and Tilray.com. The webcast will be archived for 30 days.

We Have A Good Thing Growing

About Aphria Inc.

Aphria Inc. is a leading global cannabis company inspiring and empowering the worldwide community to live their very best life. Headquartered in Leamington, Ontario – the greenhouse capital of Canada – Aphria Inc. has been setting the standard for the low-cost production of high-quality cannabis at scale, grown in the most natural conditions possible. Focusing on untapped opportunities and backed by the latest technologies, Aphria Inc. is committed to bringing breakthrough innovation to the global cannabis market. The Company’s portfolio of brands is grounded in expertly researched consumer insights designed to meet the needs of every consumer segment. Rooted in our founders’ multi-generational expertise in commercial agriculture, Aphria Inc. drives sustainable long-term shareholder value through a diversified approach to innovation, strategic partnerships, and global expansion.

For more information, visit: aphriainc.com

About Tilray®

Tilray (Nasdaq: TLRY) is a global pioneer in the research, cultivation, production and distribution of cannabis and cannabinoids currently serving tens of thousands of patients and consumers in 15 countries spanning five continents.

###

Aphria contacts:

Media

Tamara Macgregor

Chief Corporate Affairs Officer

tamara.macgregor@aphria.com

437-343-4000

Investors

Investor Relations

investors@aphria.com

Tilray contacts:

Media

Amy Bonwick, 647-515-3748

amy@pomppr.com

Investors

Raphael Gross

203-682-8253

Raphael.Gross@icrinc.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information in this news release constitutes forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements are expressly qualified by this cautionary statement. Any information or statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this news release with regards to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected terms, timing and closing of the Arrangement including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the Combined Company, including in respect of expected revenues and production of cannabis; (iii) estimates of future costs applicable to sales; (iv) estimates of future capital expenditures; (v) estimates of future cost reductions, synergies including pre-tax synergies, savings and efficiencies; (vi) statements that the Combined Company anticipates to have scalable medical and adult-use cannabis platforms expected to strengthen the leadership position in Canada, United States and internationally; (vii) statements that the Combined Company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities; (viii) statements in respect of operational efficiencies expected to be generated as a result of the Arrangement in the amount of more than C$100 million of pre-tax annual cost synergies; (ix) expectations of future balance sheet strength and future equity; (x) that the Combined Company is expected to unlock significant shareholder value; and (xi) statements under the heading “Strategic and Financial Benefits” of this news release. Aphria and Tilray use words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Various assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this news release. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, risks assumptions and expectations described in Aphria’s and Tilray’s critical accounting policies and estimates; the adoption and impact of certain accounting pronouncements; Aphria’s and Tilray’s future financial and operating performance; the competitive and business strategies of Aphria and Tilray ; the intention to grow the business, operations and potential activities of Aphria and Tilray; the ability of Aphria and Tilray to complete the Arrangement; Aphria’s and Tilray’s ability to provide a return on investment; Aphria’s and Tilray’s ability to maintain a strong financial position and manage costs, the ability of Aphria and Tilray to maximize the utilization of their existing assets and investments and that the completion of the Arrangement is subject to the satisfaction or waiver of a number of conditions as set forth in the Arrangement Agreement. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Arrangement. There is a risk that some or all the expected benefits of the Arrangement may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the Combined Company following the Arrangement difficult. Material risks that could cause actual results to differ from forward-looking statements also include the inherent uncertainty associated with the financial and other projections; the prompt and effective integration of the Combined Company; the ability to achieve the anticipated synergies and value-creation contemplated by the proposed transaction; the risk associated with Aphria’s and Tilray’s ability to obtain the approval of the proposed transaction by their shareholders required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied on a timely basis or at all; the risk that a consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related to the Arrangement Agreement; unanticipated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transaction; risks relating to the value of Tilray’s common stock to be issued in connection with the transaction; the impact of competitive responses to the announcement of the transaction; and the diversion of management time on transaction-related issues. For a more detailed discussion of risks and other factors, see the most recently filed annual information form of Aphria and the annual report filed on form 10-K of Tilray made with applicable securities regulatory authorities and available on SEDAR and EDGAR. The forward-looking statements included in this news release are made as of the date of this news release and neither Aphria nor Tilray undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

Additional Information About Tilray and Where to Find It

This news release is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. This release is being made in respect of the proposed transaction involving Aphria and Tilray pursuant to the terms of an arrangement agreement by and among Aphria and Tilray and may be deemed to be soliciting material relating to the proposed transaction.

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray will file a proxy statement on Schedule 14A containing important information about the proposed transaction and related matters. Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents), respectively, when such documents become available before making any voting decision with respect to the proposed transaction because they will contain important information about the proposed transaction and the parties to the transaction. The Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray will be able to obtain a free copy of the proxy statement, as well as other relevant filings containing information about Tilray and the proposed transaction, including materials that will be incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Participants in the Tilray Solicitation

Tilray and Aphria and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of Tilray proxies in respect of the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Tilray stockholders in connection with the proposed transaction will be set forth in the Tilray proxy statement for the proposed transaction when available. Other information regarding the participants in the Tilray proxy solicitation and a description of their direct and indirect interests in the proposed transaction, by security holdings or otherwise, will be contained in such proxy statement and other relevant materials to be filed with the SEC in connection with the proposed transaction. Copies of these documents may be obtained, free of charge, from the SEC or Tilray as described in the preceding paragraph.

(ii)

To: All Tilray Global Staff

From: Brendan Kennedy

Subject: EXCITING NEWS: Tilray and Aphria Combination

Dear Tilray Team,

I’m proud to share some exciting news. We just announced that Tilray has entered into a definitive agreement to join forces with Aphria Inc., combining two leading Canadian cannabis companies to create the clear global leader with a strengthened global footprint and greatly-enhanced prospects for future growth. The combined company will utilize the Tilray name and will be led by Aphria CEO Irwin D. Simon. I will remain involved and engaged as a member of the “new” Tilray’s the board of directors.

The cultural alignment between the two organizations was a significant driver in the decision to pursue a merger – and it should be a strong, reassuring sign to all of us. Similar to Tilray, Aphria was founded on a mission to improve lives and inspire and empower the worldwide community to live their very best life. Together, with our combined teams, brands, and international footprint, we will deepen our brand portfolio across CPG, retail, and further meet increasing demand for medical cannabis around the globe.

This transaction provides great opportunities for you, our employees, as part of the largest cannabis company in Canada and – not insignificantly – the largest cannabis company in the world measured by revenue.

At the same time, I know that change of any kind can be challenging. Certainly, the last year has brought significant change for Tilray with tough decisions made to optimize our structure for long-term health and sustainability amid market volatility. In doing so, I committed to look for new partners in areas that bring new expertise to our business to ensure Tilray emerges as one of the leading and long-standing cannabis companies. And I truly believe this transaction is a winning combination of Tilray’s global pioneering roots and Aphria’s culture for innovation.

The transaction is expected to close in the second quarter of 2021, subject to the completion of standard closing conditions and approvals. Until then, it’s business as usual on both your near and long-term projects. We have put together an energetic and committed internal team, to oversee the integration process.

We founded Tilray over six years ago to pioneer the future of global cannabis. Two years ago, we made history by becoming the first cannabis company to complete our initial public offering (IPO) on a major U.S. stock exchange. Today marks yet another milestone and the beginning of an important step in the Tilray journey.

I invite you all to join me in a town hall later today, where I will share more insight to what this means for all of us at Tilray and to answer any questions I am able to.

I am honored and proud to be a part of this momentous junction in Tilray’s history, and I am looking forward to the future and the transformative opportunities that this combination will bring.

Thank you all for your continued support and dedication.

Best,

Brendan

Additional Information and Where to Find It

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray will file a proxy statement on Schedule 14A containing important information about the proposed transaction and related matters. Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents), respectively, when such documents become available before making any voting decision with respect to the proposed transaction because they will contain important information about the proposed transaction and the parties to the transaction. The Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray will be able to obtain a free copy of the proxy statement, as well as other relevant filings containing information about Tilray and the proposed transaction, including materials that will be incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Participants in the Solicitation

Tilray and Aphria and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of Tilray proxies in respect of the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Tilray stockholders in connection with the proposed transaction will be set forth in the Tilray proxy statement for the proposed transaction when available. Other information regarding the participants in the Tilray proxy solicitation and a description of their direct and indirect interests in the proposed transaction, by security holdings or otherwise, will be contained in such proxy statement and other relevant materials to be filed with the SEC in connection with the proposed transaction. Copies of these documents may be obtained, free of charge, from the SEC or Tilray as described in the preceding paragraph.

Notice Regarding Forward-Looking Statements

Certain information in this news release constitutes forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements are expressly qualified by this cautionary statement. Any information or statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this news release with regards to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected terms, timing and closing of the Arrangement including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the Combined Company, including in respect of expected revenues and production of cannabis; (iii) estimates of future costs applicable to sales; (iv) estimates of future capital expenditures; (v) estimates of future cost reductions, synergies including pre-tax synergies, savings and efficiencies; (vi) statements that the Combined Company anticipates to have scalable medical and adult-use cannabis platforms expected to strengthen the leadership position in Canada, United States and internationally; (vii) statements that the Combined Company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities; (viii) statements in respect of operational efficiencies expected to be generated as a result of the Arrangement in the amount of more than C$100 million of pre-tax annual cost synergies; (ix) expectations of future balance sheet strength and future equity; (x) that the Combined Company is expected to unlock significant shareholder value; and (xi) statements under the heading “Strategic and Financial Benefits” of this news release. Aphria and Tilray use words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Various assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this news release. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, risks assumptions and expectations described in Aphria’s and Tilray’s critical accounting policies and estimates; the adoption and impact of certain accounting pronouncements; Aphria’s and Tilray’s future financial and operating performance; the competitive and business strategies of Aphria and Tilray ; the intention to grow the business, operations and potential activities of Aphria and Tilray; the ability of Aphria and Tilray to complete the Arrangement; Aphria’s and Tilray’s ability to provide a return on investment; Aphria’s and Tilray’s ability to maintain a strong financial position and manage costs, the ability of Aphria and Tilray to maximize the utilization of their existing assets and investments and that the completion of the Arrangement is subject to the satisfaction or waiver of a number of conditions as set forth in the Arrangement Agreement. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Arrangement. There is a risk that some or all the expected benefits of the Arrangement may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the Combined Company following the Arrangement difficult. Material risks that could cause actual results to differ from forward-looking statements also include the inherent uncertainty associated with the financial and other projections; the prompt and effective integration of the Combined Company; the ability to achieve the anticipated synergies and value-creation contemplated by the proposed transaction; the risk associated with Aphria’s and Tilray’s ability to obtain the approval of the proposed transaction by their shareholders required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied on a timely basis or at all; the risk that a consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related to the Arrangement Agreement; unanticipated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transaction; risks relating to the value of Tilray’s common stock to be issued in connection with the transaction; the impact of competitive responses to the announcement of the transaction; and the diversion of management time on transaction-related issues.

For a more detailed discussion of risks and other factors, see the most recently filed annual information form of Aphria and the annual report filed on form 10-K of Tilray made with applicable securities regulatory authorities and available on SEDAR and EDGAR. The forward-looking statements included in this news release are made as of the date of this news release and neither Aphria nor Tilray undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

(iii)

LRAY COMBINE GLOBAL CANNABIS COMPANY | | | | | | | |

DISCLAIMER CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS: Certain information in this news release constitutes forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements are expressly qualified by this cautionary statement. Any information or statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this news release with regards to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected terms, timing and closing of the Arrangement including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the Combined Company, including in respect of expected revenues and production of cannabis; (iii) estimates of future costs applicable to sales; (iv) estimates of future capital expenditures; (v) estimates of future cost reductions, synergies including pre-tax synergies, savings and efficiencies; (vi) statements that the Combined Company anticipates to have scalable medical and adult-use cannabis platforms expected to strengthen the leadership position in Canada, United States and internationally; (vii) statements that the Combined Company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities; (viii) statements in respect of operational efficiencies expected to be generated as a result of the Arrangement in the amount of more than C$100 million of pre-tax annual cost synergies; (ix) expectations of future balance sheet strength and future equity; (x) that the Combined Company is expected to unlock significant shareholder value; and (xi) statements under the heading “Strategic and Financial Benefits” of this news release. Aphria and Tilray use words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Various assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this news release. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, risks assumptions and expectations described in Aphria’s and Tilray’s critical accounting policies and estimates; the adoption and impact of certain accounting pronouncements; Aphria’s and Tilray’s future financial and operating performance; the competitive and business strategies of Aphria and Tilray ; the intention to grow the business, operations and potential activities of Aphria and Tilray; the ability of Aphria and Tilray to complete the Arrangement; Aphria’s and Tilray’s ability to provide a return on investment; Aphria’s and Tilray’s ability to maintain a strong financial position and manage costs, the ability of Aphria and Tilray to maximize the utilization of their existing assets and investments and that the completion of the Arrangement is subject to the satisfaction or waiver of a number of conditions as set forth in the Arrangement Agreement. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Arrangement. There is a risk that some or all the expected benefits of the Arrangement may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the Combined Company following the Arrangement difficult. Material risks that could cause actual results to differ from forward-looking statements also include the inherent uncertainty associated with the financial and other projections; the prompt and effective integration of the Combined Company; the ability to achieve the anticipated synergies and value-creation contemplated by the proposed transaction; the risk associated with Aphria’s and Tilray’s ability to obtain the approval of the proposed transaction by their shareholders required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied on a timely basis or at all; the risk that a consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related to the Arrangement Agreement; unanticipated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transaction; risks relating to the value of Tilray’s common stock to be issued in connection with the transaction; the impact of competitive responses to the announcement of the transaction; and the diversion of management time on transaction-related issues. For a more detailed discussion of risks and other factors, see the most recently filed annual information form of Aphria and the annual report filed on form 10-K of Tilray made with applicable securities regulatory authorities and available on SEDAR and EDGAR. The forward-looking statements included in this news release are made as of the date of this news release and neither Aphria nor Tilray undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws. NON-IFRS MEASURES: In this Presentation, reference is made to adjusted EBITDA, which is not a measure of financial performance under International Financial Reporting Standards (IFRS). This metric and measure is not a recognized measure under IFRS does not have meanings prescribed under IFRS and is as a result unlikely to be comparable to similar measures presented by other companies. This measure is provided as information complimentary to those IFRS measures by providing a further understanding of our operating results from the perspective of management. As such, this measure should not be considered in isolation or in lieu of review of our financial information reported under IFRS. Definitions and reconciliations such measure can be found in Aphria’s annual Management’s Discussion and Analysis for the year ended August 31, 2020, filed on SEDAR and EDGAR. This Presentation may not be reproduced, further distributed or published in whole or in part by any other person. Neither this Presentation nor any copy of it may be taken or transmitted into or distributed in any other jurisdiction which prohibits the same except in compliance with applicable laws. Any failure to comply with this restriction may constitute a violation of applicable securities law. Recipients are required to inform themselves of, and comply with, all such restrictions or prohibitions and Aphria does not accept liability to any person in relation thereto. 2

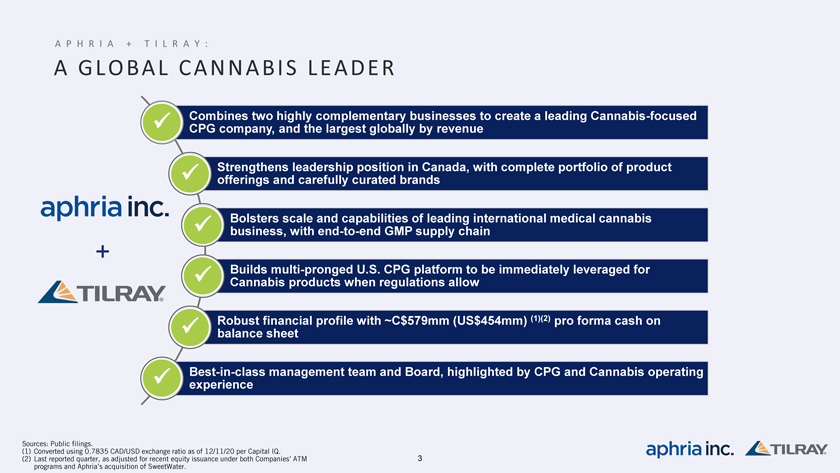

A P H R I A + T I L R A Y : A GLOBAL CANNABIS LEADER ✓ Combines two highly complementary businesses to create a leading Cannabis-focused CPG company, and the largest globally by revenue ✓ Strengthens leadership position in Canada, with complete portfolio of product offerings and carefully curated brands ✓ Bolsters scale and capabilities of leading international medical cannabis business, with end-to-end GMP supply chain + ✓ Builds multi-pronged U.S. CPG platform to be immediately leveraged for Cannabis products when regulations allow ✓ Robust financial profile with ~C$579mm (US$454mm) (1)(2) pro forma cash on balance sheet ✓ Best-in-class management team and Board, highlighted by CPG and Cannabis operating experience Sources: Public filings. (1) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. (2) Last reported quarter, as adjusted for recent equity issuance under both Companies’ ATM 3 programs and Aphria’s acquisition of SweetWater.

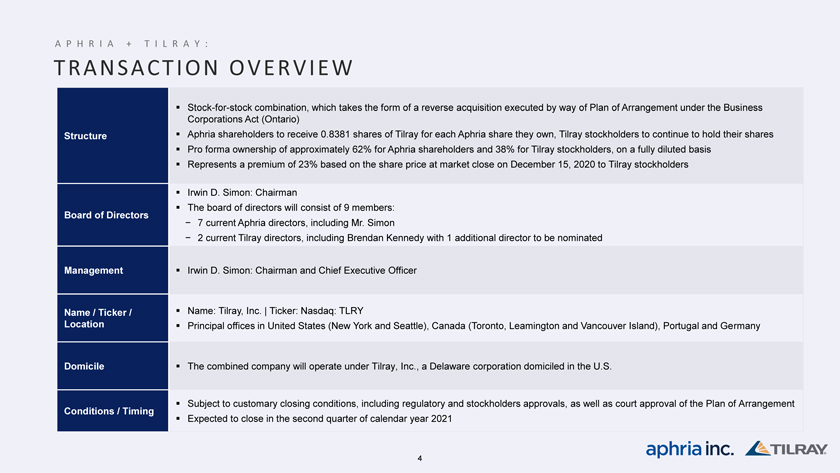

A P H R I A + T I L R A Y : TRANSACTION OVERVIEW â–ª Stock-for-stock combination, which takes the form of a reverse acquisition executed by way of Plan of Arrangement under the Business Corporations Act (Ontario) Structure â–ª Aphria shareholders to receive 0.8381 shares of Tilray for each Aphria share they own, Tilray stockholders to continue to hold their shares â–ª Pro forma ownership of approximately 62% for Aphria shareholders and 38% for Tilray stockholders, on a fully diluted basis â–ª Represents a premium of 23% based on the share price at market close on December 15, 2020 to Tilray stockholders â–ª Irwin D. Simon: Chairman â–ª The board of directors will consist of 9 members: Board of Directors - 7 current Aphria directors, including Mr. Simon—2 current Tilray directors, including Brendan Kennedy with 1 additional director to be nominated Management â–ª Irwin D. Simon: Chairman and Chief Executive Officer Name / Ticker / â–ª Name: Tilray, Inc. | Ticker: Nasdaq: TLRY Location â–ª Principal offices in United States (New York and Seattle), Canada (Toronto, Leamington and Vancouver Island), Portugal and Germany Domicile â–ª The combined company will operate under Tilray, Inc., a Delaware corporation domiciled in the U.S. â–ª Subject to customary closing conditions, including regulatory and stockholders approvals, as well as court approval of the Plan of Arrangement Conditions / Timing â–ª Expected to close in the second quarter of calendar year 2021 4

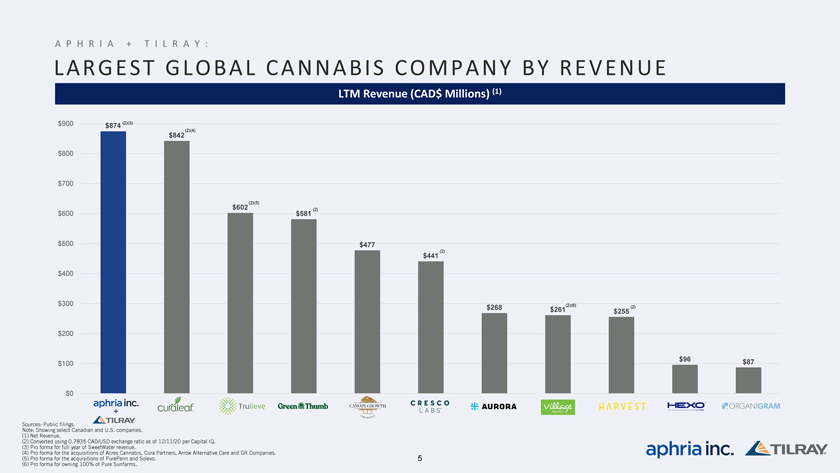

A P H R I A + T I L R A Y : LARGEST GLOBAL CANNABIS COMPANY BY REVENUE LTM Revenue (CAD$ Millions) (1) $900 $874 (2)(3) (2)(4) $842 $800 $700 (2)(5) $600 $602 $581 (2) $500 $477 (2) $441 $400 $300 (2)(6) $268 $261 (2) $255 $200 $96 $87 $100 $0 + Sources: Public filings. Note: Showing select Canadian and U.S. companies. (1) Net Revenue. (2) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. (3) Pro forma for full year of SweetWater revenue. (4) Pro forma for the acquisitions of Acres Cannabis, Cura Partners, Arrow Alternative Care and GR Companies. (5) Pro forma for the acquisitions of PurePenn and Solevo. 5 (6) Pro forma for owning 100% of Pure Sunfarms.

W E L L P O S I T I O N E D I N A L L L A R G E C A N N A B I S M A R K E T S G L O B A L L Y LEADERSHIP IN CANADA Leading Brands and Distribution Creates a leading player A Comprehensive in Canada’s C$3.1bn Cannabis 2.0 (US$2.4bn) adult-use, Product Portfolio retail market (1)(2), by combining brands, distribution networks and world-class facilities Carefully Curated Brands Across All Customer Key Highlights Segments â–ª State-of-the-art, â–ª Complete â–ª Complementary provincial strength scalable Cannabis processing and with Aphria’s leadership in Ontario cultivation in Canada manufacturing and Alberta and Tilray’s leadership in â–ª Cultivation cost below capabilities for Quebec C$1 per gram (3) 2.0 products â–ª Pro forma retail market share of Blue Chip 17.3% (4) Distribution Partners (1) Annualized September 2020 retail sales of C$256 million based on Statistics Canada November 2020 release. (2) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. (3) Aphria facilities only. (4) On a pro forma basis, for the period August to October 2020, based on Stifel analyst report by Andrew Carter, dated December 6, 2020, “December 2020 Headset Canada Review”. 6

A P H R I A + T I L R A Y : LEADING ADULT-USE POSITION IN CANADA LTM Adult-Use Cannabis Gross Revenue (CAD$ Millions) $350 $296 (1) $300 $250 $245 $200 $172 $150 $126 $100 (1)(2)(3) $80 $74 $47 (1)(4) $50 $43 $0 + Sources: Public filings. (1) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. (2) Pro forma for owning 100% of Pure Sunfarms. (3) FYQ4 2019 gross revenue based on FYQ4 2019 net revenue and FYQ1 2020 gross-to-net ratio. 7 (4) Represents rest of world net revenue plus excise taxes.

W E L L P O S I T I O N E D I N A L L L A R G E C A N N A B I S M A R K E T S G L O B A L L Y COMPLETE PRODUCT OFFERING FOR CONSUMERS Flower / Pre-Rolls Premium Plus Oils / Capsules Vape Flower / Pre-Rolls Premium Oils / Capsules Vape Flower / Pre-Rolls Oils / Capsules Core Vape Edible Beverage Economy Flower / Pre-Rolls 8

W E L L P O S I T I O N E D I N A L L L A R G E C A N N A B I S M A R K E T S G L O B A L L Y FARM TO PHARMACY IN EMEA Tilray’s European leadership combined with Aphria’s German footprint creates an unrivaled European platform European market size of ~US$3.9bn by 2025 (1) Current Market Presence Current CBD Market Presence Near Term Market Opportunity Israel Portugal ~US$65mm market size by 2025 (2) Germany ~US$1.3bn market size Poland ~US$60mm market size by 2025 (2) by 2025 (1)(3) â–ª Aphria co-branding partnership with â–ª Large medical market ODI Pharma AB opportunity bolstered by government reimbursement Italy ~US$430mm market size by 2025 (1) â–ª CC Pharma: leading importer â–ª FL Group: Aphria’s distributor to the and distributor in Germany Italian Cannabis market â–ª Wellness brands launched in Q4 2020 United Kingdom â–ª State-of-the-art facility (EU GMP certification ~US$560mm market size by 2025 (1) in process) with first harvest expected early calendar year 2021 France ~US$475mm market size by 2025 (1) 2.7m sq. ft. EU-GMP low cost Cannabis cultivation and production facility with export capabilities, providing tariff-free access to the EU The Netherlands ~US$120mm market size by 2025 (1) (1) BDS Analytics report: The State of Legal Cannabis Markets: Post-COVID Forecast Updates. (2) Arcview Market Research / BDS Analytics report: The Road Map to a $57 Billion Worldwide Market. 9 (3) National health authorities, Nation Drug agencies, National Cannabis agencies, KOMAND Consulting.

W E L L P O S I T I O N E D I N A L L L A R G E C A N N A B I S M A R K E T S G L O B A L L Y STRONG CPG PRESENCE AND INFRASTRUCTURE IN THE U.S. U.S. EXPANSION BASED ON TWO STRATEGIC PILLARS: Branded Cannabis Lifestyle Company U.S. Hemp and Wellness Platform ✓ Pioneer in branded hemp and CBD products with proven track ✓ Craft beer manufacturing and distribution infrastructure record in the U.S. to build brand awareness 420 Curated to the ✓ Cannabis lifestyle ✓ Access to 17,000 stores in North America ~40,000 on-premise and off-premise points of sale across 27 states ✓ Opportunity to leverage platform with new or existing brands for ✓ further U.S. expansion in CBD and other cannabinoids 420 Fest is one of the largest music festivals in the U.S. ✓ Introduce Aphria and Tilray’s leading brands via craft beers and other beverages to build brand awareness in the U.S. Selected Products Selected Retailers Well positioned to compete in the U.S. Cannabis market when regulations allow, given infrastructure and well-developed distribution network, track record and CPG and Cannabis expertise 10

A P H R I A + T I L R A Y : INDUSTRY LEADING PROFITABILITY ✓ Aphria has generated positive adjusted EBITDA over the last 6 quarters, providing a robust platform for future profitability and cash flow generation for the Combined Company Aphria and SweetWater Pro Forma Adjusted EBITDA (C$ Millions) (1) $20.0 (2) $18.9 $15.0 $8.9 $10.0 $8.6 $5.7 $5.0 $10.0 $1.9 $1.0 $0.2 $0.0 FQ4 2019 FQ1 2020 FQ2 2020 FQ3 2020 FQ4 2020 FQ1 2021 Aphria SweetWater Source: Public filings. (1) Aphria financials presented on a Non-US GAAP, Non-IFRS basis and SweetWater financials presented on a Non-US GAAP basis, which may not be consistent. (2) Pro forma for SweetWater using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. 11

A P H R I A + T I L R A Y : MEANINGFUL COST SYNERGIES WITH ADDITIONAL UPSIDE • Consolidation of cultivation and production infrastructure in Canada and Europe Cultivation & Production • Aphria to supply Cannabis volumes currently outsourced by Tilray Potential Cost Synergies Sales and marketing • Sales and distribution synergies • Public company expenses Corporate • Corporate consolidation and optimization Over C$100 Million (US$78 Million) (1) of Pre-Tax Annual Cost Synergies Achievable Over Next 24 Months Following Close of Transaction • Bolster Aphria brands in Quebec Canada Adult-Use • Bolster Tilray brands in Ontario Additional Potential • Provide additional 2.0 form factor capability to Aphria brands Revenue Synergy Opportunities • Potential to reach additional pharmacies and patients via distribution relationships International • Move up value chain in Germany by securing distributor portion of revenue by leveraging CC Pharma for cannabis distribution (1) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. 12

A P H R I A + T I L R A Y : PRO FORMA CAPITALIZATION Pro Forma Capital Structure Strategy Pro Forma Key Financials (1)(2) CAD USD ✓ Deleverage through growth and cash flow Cash $579 $454 ✓ Committed to conservative leverage profile Secured Debt $356 $279 ✓ No near-term maturities Convertible Notes $685 $537 ✓ Flexible capital structure to facilitate continued Total Debt $1,041 $816 growth LTM Net Revenue (3) $874 $685 LTM Adult-Use $296 $232 Gross Revenue Sources: Public filings. Note: Financial data shown in millions. (1) Converted using 0.7835 CAD/USD exchange ratio as of 12/11/20 per Capital IQ. (2) Last reported quarter, as adjusted for recent equity issuance under both Companies’ ATM programs, Tilray’s convertible note exchanges, and Aphria’s acquisition of SweetWater. (3) Pro Forma for full year of SweetWater revenue. 13

A P H R I A + T I L R A Y : LEADERSHIP TEAM WITH EXTENSIVE CPG AND OPERATIONAL EXPERIENCE Name Title Prior Experience Name Title Prior Experience Irwin D. Chief Executive Officer, Simon Chairman of the Board Brendan Chief Executive Officer Kennedy Carl Chief Financial Officer Merton Michael Chief Financial Officer Jim Chief Operating Officer, Kruteck Meiers Aphria Leamington Denise Chief Strategy Officer Faltischek Jon Chief Operating Officer Levin Christelle Chief Legal Officer Gedeon Andrew Chief Corporate Tamara Chief Corporate Affairs Pucher Development Officer MacGregor Officer 14

A P H R I A + T I L R A Y : THE RIGHT COMBINATION TO LEAD GLOBAL CANNABIS Leadership in Adult-Use throughout Canada Industry leading capabilities in beverage Adult-Use leadership in Canada with highly recognizable brands and edibles Lowest cost production across State-of-the-art GMP certified Portugal Low cost, state-of-the-art facilities the industry production facility Multi-faceted German strategy with Low cost EU GMP production facility Medical leadership in Europe domestic cultivation, import license and in Europe large distribution infrastructure SweetWater provides robust infrastructure Strong retail network in the U.S. through Well positioned for U.S. legalization and accelerates brand building in the U.S. Manitoba Harvest 15

Additional Information and Where to Find It

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray will file a proxy statement on Schedule 14A containing important information about the proposed transaction and related matters. Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents), respectively, when such documents become available before making any voting decision with respect to the proposed transaction because they will contain important information about the proposed transaction and the parties to the transaction. The Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray will be able to obtain a free copy of the proxy statement, as well as other relevant filings containing information about Tilray and the proposed transaction, including materials that will be incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Participants in the Solicitation

Tilray and Aphria and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of Tilray proxies in respect of the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Tilray stockholders in connection with the proposed transaction will be set forth in the Tilray proxy statement for the proposed transaction when available. Other information regarding the participants in the Tilray proxy solicitation and a description of their direct and indirect interests in the proposed transaction, by security holdings or otherwise, will be contained in such proxy statement and other relevant materials to be filed with the SEC in connection with the proposed transaction. Copies of these documents may be obtained, free of charge, from the SEC or Tilray as described in the preceding paragraph.

Notice Regarding Forward-Looking Statements

Certain information in this news release constitutes forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements are expressly qualified by this cautionary statement. Any information or statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this news release with regards to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected terms, timing and closing of the Arrangement including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the Combined Company, including in respect of expected revenues and production of cannabis; (iii) estimates of future costs applicable to sales; (iv) estimates of future capital expenditures; (v) estimates of future cost reductions, synergies including pre-tax synergies, savings and efficiencies; (vi) statements that the Combined Company anticipates to have scalable medical and adult-use cannabis platforms expected to strengthen the leadership position in Canada, United States and internationally; (vii) statements that the Combined Company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities; (viii) statements in respect of operational efficiencies expected to be generated as a result of the Arrangement in the amount of more than C$100 million of pre-tax annual cost synergies; (ix) expectations of future balance sheet strength and future equity; (x) that the Combined Company is expected to unlock significant shareholder value; and (xi) statements under the heading “Strategic and Financial Benefits” of this news release. Aphria

and Tilray use words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Various assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this news release. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management including based on reasonable assumptions, estimates, internal and external analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, risks assumptions and expectations described in Aphria’s and Tilray’s critical accounting policies and estimates; the adoption and impact of certain accounting pronouncements; Aphria’s and Tilray’s future financial and operating performance; the competitive and business strategies of Aphria and Tilray ; the intention to grow the business, operations and potential activities of Aphria and Tilray; the ability of Aphria and Tilray to complete the Arrangement; Aphria’s and Tilray’s ability to provide a return on investment; Aphria’s and Tilray’s ability to maintain a strong financial position and manage costs, the ability of Aphria and Tilray to maximize the utilization of their existing assets and investments and that the completion of the Arrangement is subject to the satisfaction or waiver of a number of conditions as set forth in the Arrangement Agreement. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Arrangement. There is a risk that some or all the expected benefits of the Arrangement may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the Combined Company following the Arrangement difficult. Material risks that could cause actual results to differ from forward-looking statements also include the inherent uncertainty associated with the financial and other projections; the prompt and effective integration of the Combined Company; the ability to achieve the anticipated synergies and value-creation contemplated by the proposed transaction; the risk associated with Aphria’s and Tilray’s ability to obtain the approval of the proposed transaction by their shareholders required to consummate the proposed transaction and the timing of the closing of the proposed transaction, including the risk that the conditions to the transaction are not satisfied on a timely basis or at all; the risk that a consent or authorization that may be required for the proposed transaction is not obtained or is obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related to the Arrangement Agreement; unanticipated difficulties or expenditures relating to the transaction, the response of business partners and retention as a result of the announcement and pendency of the transaction; risks relating to the value of Tilray’s common stock to be issued in connection with the transaction; the impact of competitive responses to the announcement of the transaction; and the diversion of management time on transaction-related issues.

For a more detailed discussion of risks and other factors, see the most recently filed annual information form of Aphria and the annual report filed on form 10-K of Tilray made with applicable securities regulatory authorities and available on SEDAR and EDGAR. The forward-looking statements included in this news release are made as of the date of this news release and neither Aphria nor Tilray undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

(iv)

Aphria, Inc. (APHA.CA) Aphria and Tilray Merger Call |  |

CORPORATE PARTICIPANTS

| Carl A. Merton | Brendan Kennedy | |

| Chief Financial Officer, Aphria, Inc. | Chief Executive Officer & Director, Tilray, Inc. | |

| Irwin David Simon | ||

| Chairman & Chief Executive Officer, Aphria, Inc. | ||

OTHER PARTICIPANTS

| Vivien Azer | Tamy Chen | |

| Analyst, Cowen and Company | Analyst, BMO Capital Markets Corp. (Canada) | |

| W. Andrew Carter | Matt Bottomley | |

| Analyst, Stifel, Nicolaus & Co., Inc. | Analyst, Canaccord Genuity Corp. | |

| Rupesh Parikh | Michael S. Lavery | |

| Analyst, Oppenheimer & Co., Inc. | Analyst, Piper Sandler & Co. | |

| Aaron Grey | Graeme Kreindler | |

| Analyst, Alliance Global Partners Corp. | Analyst, Eight Capital | |

| John Zamparo | ||

| Analyst, CIBC World Markets, Inc. | ||

MANAGEMENT DISCUSSION SECTION

Operator: Good morning and welcome to today’s conference to discuss the Strategic Business Combination of Aphria and Tilray. At this time, all participants are currently in a listen-only mode. The call will be open for your questions following the management’s remarks and instructions will be given at that time.

I would now like to turn the conference over to Carl Merton, Aphria Chief Financial Officer. Mr. Merton, please go ahead.

Carl A. Merton

Chief Financial Officer, Aphria, Inc.

Thank you. Good morning, everyone. And thank you for joining us to discuss Aphria and Tilray’s announcement to strategically enter into a business combination, creating a leading global cannabis company. By now, everyone should have access to the business combination press release we issued jointly this morning. The press release and supplemental presentation are available on the Investor section of Aphria’s website at www.aphriainc.com and Tilray’s website at www.tilray.com. For further information on the terms and conditions of Aphria and Tilray’s definitive arrangement agreement, pursuant to a plan of arrangement, please refer to the agreement in its entirety, which will be available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov.

Joining me on today’s call from Aphria are Irwin, our Chairman and CEO. From Tilray, their CEO, Brendan Kennedy; and CFO, Michael Kruteck.

| 2 Copyright © 2001-2020 FactSet CallStreet, LLC |

Aphria, Inc. (APHA.CA) Aphria and Tilray Merger Call |  |

Before we begin, please remember that during the course of this call, management may make forward-looking statements. These statements are based on management’s current expectations and beliefs and involve known and unknown risks and uncertainties which may prove to be incorrect, and actual results could differ materially from those described in these forward-looking statements. Please note the text of Aphria and Tilray’s press release issued today for a discussion on risks and uncertainties associated with such forward-looking statements.

And now, I’d like to turn the call over to Irwin.

Irwin David Simon

Chairman & Chief Executive Officer, Aphria, Inc.