UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to § 240.14a-12 | |

Tilray, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1. | Amount Previously Paid:

| |||

| 2. | Form, Schedule or Registration Statement No.:

| |||

| 3. | Filing Party:

| |||

| 4. | Date Filed:

| |||

This Schedule 14A filing consists of the following communications relating to the proposed business combination of Tilray, Inc. (the “Company”), a Delaware corporation, and Aphria Inc., a corporation existing under the laws of the Province of Ontario (“Aphria”), pursuant to the terms of an Arrangement Agreement, dated December 15, 2020, as amended, by and among the Company and Aphria:

| (i) | Press Release, dated February 23, 2021 |

| (ii) | Microsite (https://www.aphriatilraytogether.com/) |

Each item above was first used or made available on February 23, 2021.

(i)

Aphria and Tilray Announce Launch of www.aphriatilraytogether.com

Shareholders Encouraged to Visit Joint Company Website for

Information About the Proposed Aphria-Tilray Combination

Anti-Trust Clearances Received and Transaction Remains On-Track

to Close in the Second Quarter of 2021

LEAMINGTON, ON and NANAIMO, BC, Feb. 23, 2021 /PRNewswire/ – Aphria Inc. (“Aphria”) (TSX: APHA and NASDAQ: APHA), a leading global cannabis-lifestyle consumer packaged goods company inspiring and empowering the worldwide community to live their very best life, and Tilray, Inc. (“Tilray”) (NASDAQ: TLRY), a global pioneer in cannabis research, cultivation, production and distribution, are pleased to announce the launch of the website: www.aphriatilraytogether.com. This new, dedicated resource seeks to provide shareholders of both companies with pertinent information, news and updates leading up to the special meetings of shareholders at which Aphria’s and Tilray’s respective shareholders will vote on the resolutions necessary to implement the proposed business combination of the two companies (the “Transaction”). The website will also allow shareholders and other interested parties to register for Transaction updates that are made publicly available, so they receive information directly to their e-mail addresses.

As disclosed in the preliminary joint proxy statement and management information circular filed with regulators on February 19, 2021, both companies are pleased that the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired in relation to the Transaction (the “HSR Clearance”). In addition, the companies have received a no-action letter from the Competition Bureau of Canada in respect of the Transaction (the “Competition Act Approval”), which confirms that the Competition Bureau does not intend to challenge the Transaction under the Competition Act (Canada). The receipt of the HSR Clearance and the Competition Act Approval are two of the required regulatory clearances that need to be obtained to satisfy the conditions to closing of the Transaction. The closing of the Transaction is currently expected to occur in the second quarter of calendar year 2021.

Irwin D. Simon, Aphria’s Chairman and Chief Executive Officer commented, “The receipt of HSR Clearance and Competition Act Approval represent a significant step forward in bringing together these two companies, and we are incredibly pleased that we remain on track to complete our business combination in the second quarter of calendar year 2021. Together, Aphria and Tilray expect to have a robust strategic footprint in Canada and internationally with the operational scale necessary to compete more effectively in today’s consolidating cannabis market. We believe our strong, flexible balance sheet, cash position and access to capital will provide us with the ability to accelerate long-term sustainable growth and deliver attractive returns for shareholders.”

Benefits of the Transaction to Aphria Shareholders and Tilray Stockholders

The Boards of Directors of both companies believe that, at this stage of development and expansion of the global cannabis market, those companies with financial strength and leading geographic scale, product range and brand expertise are most likely to succeed in the long-term. Further, the Boards of Directors of both companies believe that the combination of Aphria and Tilray is expected to unlock significant shareholder value as follows:

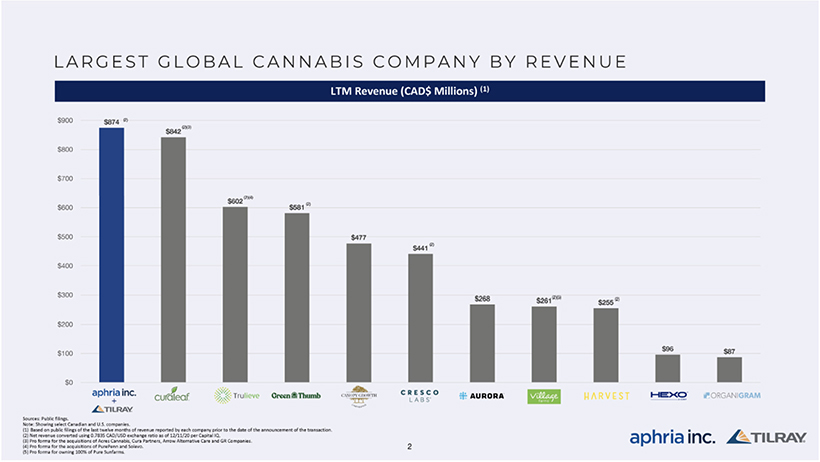

| • | The combination of Aphria and Tilray will create the world’s largest global cannabis company with pro forma revenue of US$685 million (C$874 million) for the last 12 months as reported by each company prior to the date of the announcement of the Transaction on December 16, 2020, the highest in the global cannabis industry. |

| • | To meet demand, the combined company will have state-of-the-art cultivation, processing and manufacturing facilities, as well as a complete portfolio of branded cannabis 2.0 products to strengthen its leadership position in Canada. |

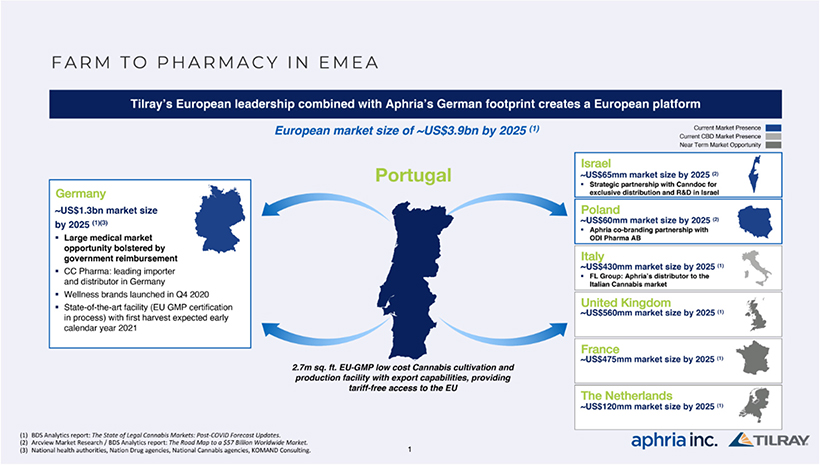

| • | Internationally, the combined company will be well-positioned to pursue growth opportunities with its strong medical cannabis brands, distribution network in Germany and end-to-end European Union Good Manufacturing Practices supply chain, which includes its production facilities in Portugal and Germany. |

| • | In the United States, the combined company will have a strong consumer packaged goods presence and infrastructure with two strategic pillars, including SweetWater Brewing Company, LLC, a leading cannabis lifestyle branded craft brewer, and Manitoba Harvest USA, LLC, a pioneer in branded hemp, CBD and wellness products with access to 17,000 stores in North America. In the event of federal permissibility in the United States, the combined company expects to be well-positioned to compete in the U.S. cannabis market given its existing strong brands and distribution system in addition to its track record of growth in consumer-packaged goods and cannabis products. |

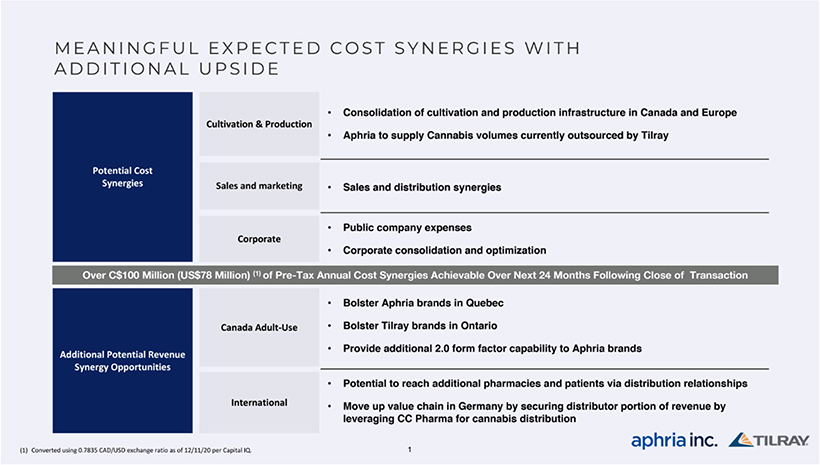

| • | The combination of Aphria and Tilray is expected to deliver approximately US$78 million (C$100 million) of annual pre-tax cost synergies within 24 months of the completion of the Transaction. The combined company expects to achieve cost synergies in the key areas of cultivation and production, cannabis and product purchasing, sales and marketing, and corporate expenses. |

Shareholder Questions

If you are an Aphria shareholder and have any questions, please contact Laurel Hill Advisory Group, Aphria’s proxy solicitation agent, by telephone at 1-877-452-7184 toll-free in North America or at 416-304-0211 for collect calls outside of North America or by email at assistance@laurelhill.com.

If you are a Tilray shareholder and have any questions, please contact MacKenzie Partners, Tilray’s proxy solicitation agent, by telephone at 1-800-322-2885 toll-free in North America or at 1-212-929-5500 for collect calls outside of North America or by email at proxy@mackenziepartners.com.

We Have A Good Thing Growing

About Aphria Inc.

Aphria Inc. is a leading global cannabis-lifestyle consumer packaged goods company with operations in Canada, United States, Europe and Latin America, that is changing people’s lives for the better – one person at a time – by inspiring and empowering the worldwide community to live their very best life by providing them with products that meet the needs of their mind, body and soul and invoke a sense of wellbeing. Aphria’s mission is to be the trusted partner for its patients and consumers by providing them with a cultivated experience and health and wellbeing through high-quality, differentiated brands and innovative products. Headquartered in Leamington, Ontario, Aphria cultivates, processes, markets and sells medical and adult-use cannabis, cannabis-derived extracts and derivative cannabis products in Canada under the provisions of the Cannabis Act and globally pursuant to applicable international regulations. Aphria also manufactures, markets and sells alcoholic beverages in the United States.

About Tilray®

Tilray (Nasdaq: TLRY) is a global pioneer in the research, cultivation, production, and distribution of cannabis and cannabinoids currently serving tens of thousands of patients and consumers in 17 countries spanning five continents.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information in this news release constitutes forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements are expressly qualified by this cautionary statement. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. Any information or statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this news release with regards to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected timing and closing of the Transaction including, receipt of required shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the combined company, including in respect of expected revenues and production of cannabis; (iii) the expected strategic and financial benefits of the business combination, including estimates of future cost reductions, synergies, including expected pre-tax synergies, savings and efficiencies; (iv) statements that the combined company anticipates having scalable medical and adult-use cannabis platforms expected to strengthen the leadership position in Canada, internationally and, eventually in the United States; (v) statements that the combined company is expected to offer a diversified and branded product offering and distribution footprint, state-of-the-art cultivation, processing and manufacturing facilities; (vi) statements in respect of operational efficiencies expected to be generated as a result of the Transaction in the amount of approximately C$100 million of pre-tax annual cost synergies; and (vii) statements regarding the value and returns to shareholders expected to be generated by the business combination and (viii) expectations of future balance sheet strength and future equity. Aphria and Tilray use words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Certain material factors or assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this news release, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary shareholder and court approvals for the Transaction, the ability of the parties to satisfy, in a timely manner, the conditions to closing of the Transaction and other expectations and assumptions concerning the Transaction. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management team including the reasonable assumptions, estimates, analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, risks assumptions and expectations described in Aphria’s and Tilray’s critical accounting policies and estimates; the adoption and impact of certain accounting pronouncements; Aphria’s and Tilray’s future financial and operating performance; the competitive and business strategies of Aphria and Tilray; the intention to grow the business, operations and potential activities of Aphria and Tilray; the ability of Aphria and Tilray to complete the Transaction; Aphria’s and Tilray’s ability to provide a return on investment; Aphria’s and Tilray’s ability to maintain a strong financial position and manage costs, the ability of Aphria and Tilray to maximize the utilization of their existing assets and investments and that the completion of the Transaction is subject to the satisfaction or waiver of a number of conditions as set forth in the Arrangement Agreement. There can be no assurance as to when these conditions will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the Transaction. There is a risk that some or all the expected benefits of the Transaction may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the combined company following the Transaction difficult. Material risks that could cause actual results to differ from forward-looking statements also include the inherent uncertainty associated with the financial and other projections a well as market changes arising from governmental actions or market conditions in response to the COVID-19 public health crisis; the prompt and effective integration of the combined company; the ability to achieve the anticipated synergies and value-creation contemplated by the Transaction; the risk associated with Aphria’s and Tilray’s ability to obtain the approval of the proposed transaction by their shareholders required to consummate the Transaction and the timing of the closing of the Transaction, including the risk that the conditions to the Transaction are not satisfied on a timely basis or at all; the risk that a consent or authorization that may be required for the Transaction is not obtained or is obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related to the Arrangement Agreement; unanticipated difficulties or expenditures relating to the Transaction, the response of business partners and retention as a result of the announcement and pendency of the Transaction; risks relating to the value of Tilray’s common stock to be issued in connection with the transaction; the impact of competitive responses to the announcement of the Transaction; and the diversion of management time on transaction-related issues. Readers are cautioned that the foregoing list of factors is not exhaustive. Other risks and uncertainties not presently known to Aphria and Tilray or that Aphria and Tilray presently believe are not material could also cause actual results or events to differ materially from those expressed in the forward-looking statements contained herein. For a more detailed discussion of risks and other factors, see the most recently filed annual information form of Aphria and the annual report filed on form 10-K of Tilray made with applicable securities regulatory authorities and available on SEDAR and EDGAR. The forward-looking statements included in this news release are made as of the date of this news release and neither Aphria nor Tilray undertake any obligation to publicly update such forward-looking statements to reflect new information, subsequent events or otherwise unless required by applicable securities laws.

Additional Information About the Transaction and Where to Find It

This news release is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. This release is being made in respect of the proposed transaction involving Aphria and Tilray pursuant to the terms of an arrangement agreement by and among Aphria and Tilray and may be deemed to be soliciting material relating to the proposed transaction.

In connection with the Transaction, Tilray has filed a preliminary proxy statement on Schedule 14A (which is subject to completion and may be amended) containing important information about the Transaction and related matters. Such preliminary proxy statement is subject to review by the SEC before finalization. Such preliminary proxy statement has also been made available by Aphria and Tilray on their respective SEDAR profiles. Tilray will file a definitive proxy statement and Aphria will file a management information circular upon the completion of the SEC review process. Additionally, Aphria and Tilray will file other relevant materials in connection with the Transaction with the applicable securities regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and definitive proxy statement (including any amendments or supplements to such documents), respectively, before making any voting decision with respect to the Transaction because they contain important information about the Transaction and the parties to the Transaction. The Aphria management information circular and the Tilray definitive proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray can obtain a free copy of the preliminary proxy statement, and when available, the definitive proxy statement, as well as other relevant filings containing information about Tilray and the Transaction, including materials incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Investors and security holders of Aphria will be able to obtain a free copy of the management information circular, as well as other relevant filings containing information about Aphria and the Transaction, including materials incorporated by reference into the information circular, without charge, on SEDAR at www.sedar.com or from Aphria by contacting Aphria’s investor relations at investors@aphria.com.

(ii)

Creating the largest global cannabis company by revenue

| • | Aphria/Tilray |

| • | Transaction |

| • | Timeline |

| • | Investors |

| • | Latest News |

| • | FAQs |

| • | Contact |

| • | Important Information |

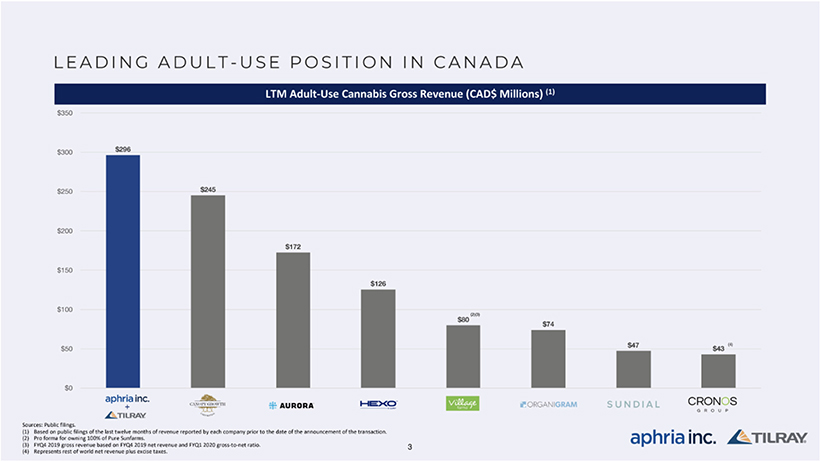

Aphria and Tilray’s complementary, scalable medical and adult-use cannabis businesses are expected to strengthen the combined company’s leadership position in Canada.

The business combination is expected to expand Aphria and Tilray’s U.S. and international reach through state-of-the-art cultivation and manufacturing facilities, a diversified product portfolio and its distribution footprint and robust supply chain.

The business combination is expected to provide operational efficiencies that are anticipated to generate approximately C$100 million (US$78 million) of annual pre-tax annual cost synergies within 24 months of the completion of the business combination.

APHRIA INC.

TILRAY, INC.

Sign up to receive updates about the transaction

This form collects your name and email so that we can add you to our distribution list for updates from Aphria Inc. and Tilray, Inc. Check out our privacy policies (https://aphriainc.com/general-privacy-policy/) for the full story on how we protect and manage your submitted data.

By clicking sign up, I consent to having Aphria Inc. and Tilray, Inc. to collect my name and email.

Aphria + Tilray

A Message from the CEOs

“This is an exciting day for both companies, for the cannabis industry, and for patients and consumers around the world. We are bringing together two world-class companies that share a culture of innovation, brand development and cultivation to enhance our Canadian, U.S., and international scale as we pursue opportunities for accelerated growth with the strength and flexibility of our balance sheet and access to capital. Our highly complementary businesses create a combined company with a leading branded product portfolio, including the most comprehensive Cannabis 2.0 product offerings for patients and consumers, along with significant synergies across our operations in Canada, Europe and the United States. Our combination with Tilray aligns with our strategic focus and emphasis on our highest return priorities as we strive to generate value for all stakeholders. I am honoured to work with Brendan Kennedy, a pioneer in the cannabis industry, and the Tilray team as they join forces with our talented employees at Aphria. I look forward to leading the talented teams of both Aphria and Tilray as we seek to create a leading global cannabis and consumer packaged goods company with a portfolio of medical, wellness and adult-use brands consumers love.”

| • | Irwin D. Simon, Chairman & CEO, Aphria Inc. |

“We are thrilled to bring together two cannabis industry leaders. At this nascent stage of development and expansion of the global cannabis market, we believe companies with leading geographic scale, product range and brand expertise are most likely to benefit long-term. By leveraging our combined strengths and capabilities, we expect to be able to meet the needs of consumers more effectively all over the world and advance patient care. With a strong financial profile, low-cost production, leading brands, distribution network and unique partnerships, we believe the combined company will be well-positioned to deliver sustainable, attractive returns for stockholders. I look forward to working with Irwin and the combined company’s management team to make our consumer products more accessible around the world.”

| • | Brendan Kennedy, CEO, Tilray, Inc. |

INVESTORS

Learn more about the transaction and its benefits

| • | Transaction Announcement |

| • | Investor Presentation | December 16, 2020 |

TRANSACTION OVERVIEW

Additional Information and Where to Find It

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray has filed a proxy statement on Schedule 14A (which is subject to completion and may be amended) containing important information about the proposed transaction and related matters. Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities’ regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents), respectively, before making any voting decision with respect to the proposed transaction because they contain important information about the proposed transaction and the parties to the transaction. The Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray can obtain a free copy of the proxy statement, as well as other relevant filings containing information about Tilray and the proposed transaction, including materials incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Investors and security holders of Aphria will be able to obtain a free copy of the information circular, as well as other relevant filings containing information about Aphria and the proposed transaction, including materials incorporated by reference into the information circular, without charge, on SEDAR at www.sedar.com or from Aphria by contacting Aphria’s investor relations at investors@aphria.com.

PARTICIPANTS IN THE SOLICITATION

Tilray and Aphria and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of Tilray and Aphria proxies in respect of the proposed transaction. Information regarding the persons who may, under applicable securities laws, be deemed participants in the solicitation of proxies of Tilray stockholders and Aphria shareholders in connection with the proposed transaction, and other information regarding the solicitation of proxies by Tilray and Aphria are set forth in the Tilray proxy statement for the proposed transaction and will be described in the information circular of Aphria. Copies of these documents may be obtained, free of charge, from the SEC, on SEDAR or from Tilray or Aphria as described in the preceding paragraph.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This website contains forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements on this website are expressly qualified by this cautionary statement. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. Any information or statements that are contained in this website that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this website with regards to and not limited to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected timing and closing of the transaction including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the combined company, including in respect of expected revenues, production of cannabis, adjusted EBITDA, pro-forma capitalization and pro-forma key financials; (iii) estimates of future cost reductions, synergies, including expected pre-tax synergies in an amount of more than US$78 million (C$100 million), savings and efficiencies; (iv) statements that the combined company anticipates having a scalable medical and adult-use cannabis platform expected to strengthen the leadership position in Canada internationally and, eventually in the United States; (v) statements that the combined company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities, (vi) the number of Tilray shares issuable to Aphria shareholders and the expected ownership percentages of Tilray and Aphria shareholders after the closing of the transaction and (vii) statements in respect of other strategic and financial benefits in connection with the business combination. This website uses words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Certain material factors or assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this website, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary shareholder, regulatory and court approvals for the business combination, the ability of the parties to satisfy, in a timely manner, the conditions to closing of the business combination and other expectations and assumptions concerning the arrangement. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management team including the assumptions, estimates, analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward- looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, the inherent uncertainty associated with financial or other projections or outlooks, Aphria and Tilray’s future financial and operating performance, the commercial and business plans of Aphria and Tilray and the other risks assumptions and expectations described in the joint proxy circular to be mailed to shareholders in respect of the transaction. There can be no assurance as to when conditions in respect of the transaction will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the transaction. There is also a risk that some or all of the expected benefits of the transaction may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the combined company following the transaction difficult. Readers are cautioned that the foregoing list of factors is not exhaustive. Other risks and uncertainties not presently known to Aphria and Tilray or that Aphria and Tilray presently believe are not material could also cause actual results or events to differ materially from those expressed in the forward-looking statements contained herein. Aphria and Tilray disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

STRUCTURE

| • | Share-for-share combination, which takes the form of a reverse acquisition of Tilray executed by way of a Plan of Arrangement under the Business Corporations Act (Ontario) |

| • | Aphria shareholders to receive 0.8381 shares of a Tilray share for each Aphria share they own — Tilray stockholders to continue to hold their shares |

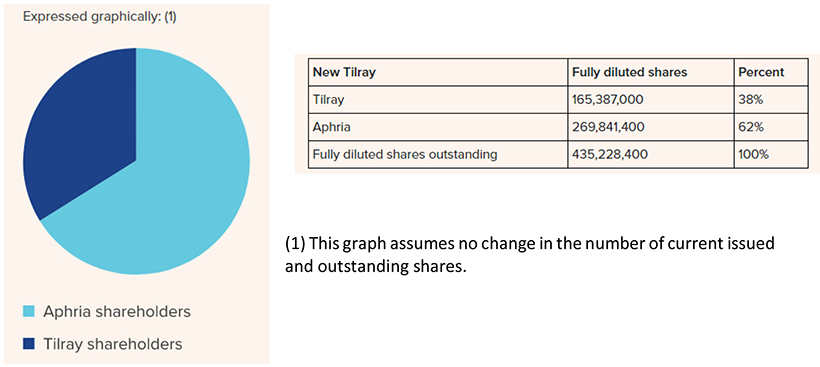

| • | Assuming no change in the issued and outstanding share numbers of Tilray and Aphria, expected pro forma ownership of approximately 62% for Aphria shareholders and 38% for Tilray stockholders, on a fully diluted basis, at closing |

BOARD OF DIRECTORS

| • | Irwin D. Simon: Chairman & CEO |

| • | The board of directors will consist of 9 members: |

| • | 7 current Aphria directors, including Mr. Simon |

| • | 2 current Tilray directors, including Brendan Kennedy with 1 additional director to be designated by the Tilray board |

MANAGEMENT

| • | Irwin D. Simon: Chairman and Chief Executive Officer |

NAME / TICKER / LOCATION

| • | Name: Tilray, Inc. | Ticker: Nasdaq: TLRY |

| • | Principal offices in United States (New York and Seattle), Canada (Toronto, Leamington and Vancouver Island), Portugal and Germany |

DOMICILE

| • | The combined company will operate under Tilray, Inc., a Delaware corporation |

CONDITIONS / TIMING

| • | Subject to customary closing conditions, including regulatory and shareholders’ approvals, as well as court approval of the Plan of Arrangement |

| • | Expected to close as soon as practicable following the satisfaction of the conditions to closing set out in the Arrangement Agreement |

A GLOBAL CANNABIS LEADER

| • | Combines two complementary businesses to create a leading cannabis-focused CPG company, and the largest globally by revenue |

| • | Expected to strengthen leadership position in Canada, with complete portfolio of branded cannabis 2.0 product offerings and carefully curated brands |

| • | Bolsters scale and capabilities of leading international medical cannabis business, with end-to-end GMP supply chain |

| • | Builds multi-pronged U.S. consumer packaged goods platform to be leveraged for cannabis products when regulations allow |

| • | Creates financial flexibility with a strong balance sheet and a best-in-class management team and board, highlighted by consumer-packaged goods and cannabis operating experience |

THE COMBINED COMPANY IN NUMBERS

FAQs

GENERAL QUESTIONS AND ANSWERS

This Q&A below highlights certain key aspects of the business combination transaction and the matters to be considered at the Aphria meeting and the Tilray meeting, but does not contain all of the information that is important to you. For a more complete understanding of the matters discussed here, you should carefully read the entire preliminary joint proxy statement and management information circular (the “Preliminary Circular”) filed with the SEC available here (https://www.sec.gov/Archives/edgar/data/1731348/000114036121005532/nt10018953x1_prem14.htm).

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray will file a proxy statement on Schedule 14A containing important information about the proposed transaction and related matters (the “Circular”). Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities regulatory authorities. On February 19, 2021, Tilray and Aphria, each filed the Preliminary Circular on SEDAR and EDGAR. The Preliminary Circular is subject to final changes to be reflected in the definitive Circular, which will be accessible on the SEDAR and EDGAR profiles of the respective companies. Additionally, the final Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders. Investors and security holders of Aphria and Tilray are urged to carefully read the entire Circular (including any amendments or supplements to such documents), when such documents become available before making any voting decision with respect to the proposed transaction because they will contain important information about the proposed transaction and the parties to the transaction.

All defined terms used below have the meanings ascribed to such terms in the Circular. All items indicated by brackets below will be updated when such information is finalized in connection with the final Circular.

Q: What are Aphria and Tilray proposing?

A: Aphria and Tilray are proposing to combine their businesses pursuant to an arrangement under the Business Corporations Act (Ontario). Under the terms of the arrangement, Aphria shareholders will receive 0.8381 of a Tilray Share for each Aphria Share. Tilray shareholders will continue to hold Tilray Shares. The transaction will, among other things, include the following:

| • | All outstanding Aphria Shares will be exchanged for Tilray Shares as described under “What will I receive for my shares under the arrangement?” below; |

| • | Tilray Stockholders will retain their Tilray Shares; |

| • | Aphria will become a wholly-owned subsidiary of Tilray; and |

| • | Tilray will make an amendment to its certificate of incorporation to implement the arrangement, all as described in the circular and if approved at the Tilray meeting. The arrangement will be carried out in accordance with the Arrangement Agreement dated December 15, 2020, as amended on February 19, 2021, between Aphria and Tilray, and the documents referred to in the Arrangement Agreement. Upon the completion of the arrangement, it is expected that the exchange ratio will result in Aphria shareholders will own approximately 62% of the outstanding Tilray shares on a fully diluted basis, and Tilray shareholders will own approximately 38% of the outstanding Tilray shares on a fully diluted basis, resulting in the reverse acquisition of Tilray |

Q: Why are Aphria and Tilray proposing to combine?

A: The Aphria Board and the Tilray Board each believe that, at this stage of development and expansion of the global cannabis market, companies with financial strength, a strategic footprint and scale, a diverse product range, brand expertise and strong leadership are most likely to succeed in the long-term. The following are the key benefits of the combination:

| • | World’s Largest Global Cannabis Company. The combination of Aphria and Tilray will create the world’s largest global cannabis company with pro forma revenue of US$685 million (C$874 million) for the last 12 months as reported by each company prior to the date of the announcement of the transaction on December 16, 2020, the highest in the global cannabis industry. |

| • | Strategic footprint and operational scale. The combined company is expected to have the strategic footprint and operational scale necessary to compete more effectively in today’s consolidating cannabis market with a strong, flexible balance sheet, strong cash balance and access to capital, which Aphria and Tilray believe will give it the ability to accelerate growth and deliver long-term sustainable value for stockholders. |

| • | Low-cost state-of-the-art production & the leading canadian adult-use cannabis producer. The demand of the combined company will be supported by low-cost state-of-the-art cultivation, processing, and manufacturing facilities and it will have a complete portfolio of branded cannabis 2.0 products in order to strengthen its leadership position in Canada. |

| • | Positioned to pursue international growth. Internationally, the combined company will be well-positioned to pursue growth opportunities with its strong medical cannabis brands, distribution network in Germany and end-to-end European Union Good Manufacturing Practices (“EU-GMP”) supply chain, which includes its production facilities in Portugal and Germany. |

| • | Enhanced consumer packaged goods presence and Infrastructure in the U.S. In the United States, the combined company will have a strong consumer packaged goods presence and infrastructure with two strategic pillars, including SweetWater, a leading cannabis lifestyle branded craft brewer, and Manitoba Harvest, a pioneer in branded hemp, CBD and wellness products with access to 17,000 stores in North America. In the event of federal permissibility, the Combined Company expects to be well-positioned to compete in the U.S. cannabis market given its existing strong brands and distribution system in addition to its track record of growth in consumer-packaged goods and cannabis products. |

| • | Substantial synergies. The combination of Aphria and Tilray is expected to deliver approximately US$78 million (C$100 million) of annual pre-tax cost synergies within 24 months of the completion of the Transaction. The combined company expects to achieve cost synergies in the key areas of cultivation and production, cannabis and product purchasing, sales and marketing and corporate expenses. |

Q: What will I receive for my Aphria Shares under the arrangement?

A: Aphria Shareholders. Under the arrangement and subject to the terms of the plan of arrangement, each Aphria shareholder will receive, for each Aphria Share held, 0.8381 of a Tilray Share. You will no longer own any Aphria shares, but instead will own Tilray shares. As an example, if you owned 1,000 Aphria shares on the closing day of the transaction, after the closing, you will own 838 Tilray Shares (since no fractional Tilray Shares are issued).

Tilray Stockholders. Under the arrangement, Tilray shareholders will retain their Tilray shares

Q: Why am I receiving 0.8381 of a Tilray Share for each of my Aphria shares?

A: The agreed exchange Ratio is 0.8381. This means that on closing, each holder of Aphria shares will receive 0.08381 of a Tilray Share for each Aphria Share. Since Tilray currently has approximately 165,387,000 shares outstanding and Aphria has approximately 321,953,000 outstanding, each on a fully diluted basis, on the closing of the Transaction, it is expected that the Exchange Ratio will result in Aphria shareholders owning approximately 62% of the outstanding shares of Tilray, and existing Tilray shareholders owning approximately 38% of the outstanding shares of Tilray. If there is no change in the issued and outstanding share numbers prior to closing, Tilray is expected to issue approximately 269,841,400 new shares to Aphria shareholders (269,841,400 / (165,387,000 + 269,841,400) = 62%) in exchange for their Aphria shares.

Q: How do I calculate the value of the Tilray Shares that I receive?

A: The value of the Tilray Shares that you will receive on closing of the transaction in exchange for your Aphria Shares will depend on the trading price of Tilray Shares on the day the Transaction is completed. To help you value what you will receive under the Transaction for your Aphria shares, see the example below:

If you bought your Aphria Shares on the TSX, then:

Step 1: Calculate the number of Tilray Shares that you will receive

Calculate the number of Tilray shares that you will receive on closing by multiplying the number of Aphria Shares that you own by 0.8381 (which is the Exchange Ratio).

Step 2: Calculate the value of the Tilray Shares that you will receive in US$

Multiply the answer from Step 1 by the current value of each Tilray Share.

Step 3: Calculate the value of the Tilray Shares that you will receive in C$

Multiply the answer from Step 2 by the US$ to C$ foreign exchange rate since the Tilray Shares currently trade in US$. This will give you the value of the Tilray Shares to be received in C$.

As an example, assume that:

| • | The value of each Tilray Share is US$20.00. |

| • | 1 US dollar = 1.2756 Canadian dollar |

| • | You own 1,000 Aphria Shares |

1,000 Aphria Shares X 0.8381 = 838 Tilray Shares

838 Tilray Shares X US$20.00 per Tilray Share =US$16,760.00

US$16,760.00 X 1.2756 = C$21,379.06 (or C$21.38 per Aphria Share that you own)

If you bought your Aphria Shares on the Nasdaq, then:

Step 1: Calculate the number of Tilray Shares that you will receive

Calculate the number of Tilray Shares that you will receive on closing by multiplying the number of Aphria Shares that you own by 0.8381 (which is the Exchange Ratio).

Step 2: Calculate the value of the Tilray Shares that you will receive in US$

Multiply the answer from Step 1 by the current value per Tilray Share

1,000 Aphria Shares X 0.8381 = 838 Tilray Shares

838 Tilray Shares X the current value per Tilray Share

Current and recent share price and trading data, and US$/C$ exchange rates, can be found at your preferred market data sources, or the following:

APHA trading on TSX: https://money.tmx.com/en/quote/APHA

APHA trading on Nasdaq: https://www.nasdaq.com/market-activity/stocks/apha

TLRY trading on Nasdaq: https://www.nasdaq.com/market-activity/stocks/tlry

US$:C$ exchange rate:https://www.oanda.com/us-en/trading/instruments/usd-cad/

Q: Will I receive fractional Tilray Shares?

A: No. If the total number of Tilray Shares that you will be entitled would result in a fraction of a Tilray Share being issuable, the number of Tilray Shares you will receive will be rounded down to the nearest whole Tilray Share.

Q: What approvals are required for the arrangement to be implemented?

A: The completion of the arrangement requires the approval from the Aphria Shareholders and the Tilray Stockholders, receipt of the Final Order from the Court, and receipt of the Required Regulatory Approvals.

Q: What will happen to Aphria if the arrangement is completed?

A: If the arrangement is completed, Tilray will acquire all outstanding Aphria Shares and Aphria will become a wholly-owned subsidiary of Tilray. Tilray intends to have the Aphria Shares delisted from the TSX.

Q: Are the Tilray Shares listed on a stock exchange?

A: Tilray Shares are currently listed on the Nasdaq under the symbol “TLRY” and trade in U.S. dollars. In addition, Tilray currently expects to list the Tilray Shares on the TSX at, or as soon as practicable following, the Effective Time, which will trade in Canadian dollars. Consequently, following the closing, Aphria Shareholders are expected to be able to trade their Tilray Shares on either exchange, in either currency.

Q: What are the Canadian federal income tax consequences of the arrangement?

A: Aphria Shareholders who are residents of Canada for purposes of the Tax Act should be aware that the exchange of Aphria Shares for Tilray Shares under the arrangement will be a taxable transaction for Canadian federal income tax purposes. Aphria Shareholders who are non-residents of Canada for purposes of the Tax Act and that do not hold their Aphria Shares as “taxable Canadian property” will generally not be subject to tax under the Tax Act on the exchange of their Aphria Shares for Tilray Shares under the arrangement.

For a summary of certain of the principal Canadian federal income tax consequences of the arrangement applicable to Aphria Shareholders, please refer to the section titled “Certain Canadian Federal Income Tax Considerations” in the Preliminary Circular. Such summary is not intended to be legal, business or tax advice. Aphria Shareholders should consult their own tax advisors as to the tax consequences of the arrangement to them with respect to their particular circumstances.

Q: What are the U.S. federal income tax consequences of the arrangement?

A: Aphria Shareholders should not recognize gain or loss as a result of the arrangement for U.S. tax purposes. Each holder’s aggregate tax basis in Tilray Shares received should equal the aggregate tax basis of the holder’s Aphria Shares surrendered in the arrangement, as applicable. Each holder’s holding period for Tilray Shares received in the arrangement should include such holder’s holding period for the Aphria Shares surrendered in the arrangement.

Holders who acquired different blocks of Aphria Shares with different holding periods and tax bases must generally apply the foregoing rules separately to each identifiable block of Aphria Shares. Any such holder should consult its tax advisor with regard to identifying the bases or holding periods of the particular shares of Tilray Shares received in the arrangement.

However, since your tax circumstances may be unique, you should consult your tax advisor to determine the tax consequences of the arrangement on you.

Please refer to the section titled “Certain U.S. Federal Income Tax Considerations” in the Preliminary Circular for a more detailed discussion of the U.S. federal income tax treatment of the arrangement.

Q: What will happen if the Aphria Resolution is not approved or the Tilray Resolutions are not approved or the Arrangement Agreement is terminated?

A: If the Aphria Resolution is not approved, the Arrangement Agreement may be terminated by either Aphria or Tilray, and in the event it is terminated by Tilray, Aphria will be required to pay to Tilray its Transaction Expenses (up to a maximum of C$10 million) provided that the Tilray Resolutions have been approved. If the Tilray Resolutions have not been approved, the Arrangement Agreement may be terminated by either Aphria or Tilray, and in the event it is terminated by Aphria, Tilray will be required to pay to Aphria its Transaction Expenses (up to a maximum of C$10 million), provided that the Aphria Resolution has been approved. A Party may be required to pay the other Party a Termination Amount of C$65 million if the Arrangement Agreement is terminated in certain circumstances as described in the Circular. If the Arrangement Agreement is terminated and the arrangement is not completed, the market price of Aphria Shares and the Tilray Shares may be materially adversely affected.

APHRIA INC. SHAREHOLDER QUESTIONS AND ANSWERS

Q: What am I voting on?

A: You are being asked to consider and, if thought advisable, approve the arrangement involving, among other things, the acquisition by Tilray of all of the outstanding Aphria Shares pursuant to the Arrangement Agreement.

Q: Does the Aphria Board support the arrangement?

A: Yes. The Aphria Board has unanimously determined that the arrangement is in the best interests of Aphria and recommends that Aphria Shareholders vote FOR the Aphria Resolution.

In making its recommendation, the Aphria Board considered a number of factors as described in the preliminary Circular, including the opinion from Jefferies to the effect that, as of the date of such opinion, based upon and subject to the limitations and assumptions set out therein and such other matters as Jefferies considered relevant, the Exchange Ratio is fair, from a financial point of view, to Aphria Shareholders.

Q: What approvals are required by Aphria Shareholders at the Aphria Meeting?

A: To be effective, the Aphria Resolution must be approved, with or without variation, by the affirmative vote of at least two-thirds of the votes cast on the Aphria Resolution by Aphria Shareholders, virtually present or represented by proxy at the Aphria Meeting.

Q: Are Aphria Shareholders entitled to Dissent Rights?

A: Yes. Registered holders of Aphria Shares are entitled to Dissent Rights only if they follow the procedures specified in the Business Corporations Act (Ontario), as modified by the Interim Order and the Plan of arrangement. Persons who are beneficial owners of Aphria Shares registered in the name of an Intermediary who wish to dissent should be aware that only registered Aphria Shareholders are entitled to Dissent Rights. If you wish to exercise Dissent Rights, you should review the requirements summarized in the preliminary Circular carefully and consult with your legal advisor.

Q: What happens if I hold my Aphria Shares in an RESP, TFSA or RRSP account?

A: For Canadian resident shareholders that hold Aphria Shares in an RESP, TFSA, RRSP or other registered account, no immediate Canadian tax will arise as a result of the arrangement, whether or not any gain is realized on the disposition of Aphria Shares. Further, Tilray Shares will remain qualified investments for an RESP, TFSA and RRSP or other registered accounts.

For a summary of certain of the principal Canadian federal income tax consequences of the arrangement applicable to Aphria Shareholders, please refer to the section titled “Certain Canadian Federal Income Tax Considerations” in the Preliminary Circular. Such summary is not intended to be legal, business or tax advice. Aphria Shareholders should consult their own tax advisors as to the tax consequences of the arrangement to them with respect to their particular circumstances.

Q: When will I receive the Consideration payable to me under the arrangement for my Aphria Shares?

A: You will receive the Consideration due to you under the arrangement as soon as practicable after the arrangement becomes effective and your Letter of Transmittal and Aphria Share certificate(s) or DRS Advice(s) and all other required documents are properly completed and received by the Depositary. It is anticipated that the arrangement will be completed in Q2, 2021, assuming the Aphria Resolution is approved, all Court and all other approvals have been obtained, and all other conditions of closing have been satisfied or waived.

Q: What happens if I send in my Aphria share certificate(s) or DRS Advice(s) and the Aphria Resolution is not approved or the arrangement is not completed?

A: If the Aphria Resolution is not approved or if the arrangement is not otherwise completed, your Aphria share certificate(s) or DRS Advice(s) will be returned promptly to you by the Depositary.

Q: Who can help answer my questions?

A: If you have any questions about the Preliminary Circular or the matters described in the Preliminary Circular, please contact your professional advisor. Aphria Shareholders who would like additional copies, without charge, of the Preliminary Circular or have additional questions about the procedures for voting Aphria Shares or making an election, should contact their Intermediary or Laurel Hill by email, or at one of the numbers below.

North American Toll-Free Number: 1-877-452-7184

Outside of North America Collect Calls Number: 416-304-0211

By Email: assistance@laurelhill.com

TILRAY, INC. SHAREHOLDER QUESTIONS AND ANSWERS

Q: What am I voting on?

A: You are being asked to consider and vote on the following proposals:

| • | To consider and vote on a proposal to increase the authorized capital stock of Tilray from 743,333,333 shares to 900,000,000 shares of capital stock, consisting of 890,000,000 shares of Class 2 common stock and 10,000,000 shares of preferred stock, as reflected in the amendment to the second amended and restated certificate of Tilray attached as Appendix “F” to the Circular (the “Tilray Charter Amendment”), which is further described in the Circular, including in the section entitled “Amendments to Tilray’s Organizational Documents” (the “Tilray Charter Amendment Proposal”). |

| • | To consider and vote on a proposal to issue Tilray Class 2 common stock (the “Tilray Shares”) to Aphria Shareholders pursuant to the Arrangement Agreement which is further described in the Circular, including in the section entitled “The Arrangement Agreement and Related Agreements” (the “Tilray Share Issuance Proposal”); |

| • | To consider and approve, on an advisory (non-binding) basis, the compensation that may be paid to Tilray’s named executive officers that is based on or otherwise relates to the transactions contemplated by the Arrangement Agreement, which is further described in the Circular, including in the section entitled “Interests of Tilray’s Directors and Management in the arrangement” (the “Tilray Advisory Compensation Proposal”); |

| • | To approve the adjournment of the Tilray Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies in the event there are not sufficient votes at the time of the Tilray Meeting to approve the Tilray Charter Amendment Proposal or the Tilray Share Issuance Proposal (the “Tilray Adjournment Proposal”). |

The Tilray Charter Amendment Proposal, the Tilray Share Issuance Proposal, the Tilray Advisory Compensation Proposal and the Tilray Adjournment Proposals are together referred to as the “Tilray Proposals”.

Please note that the approval of Tilray Stockholders to each of the Tilray Charter Amendment Proposal and the Tilray Share Issuance Proposal is required in order to complete the arrangement.

Q: Does the Tilray Board support the Tilray Proposals?

A: Yes. The Tilray Board has unanimously determined that the Tilray Proposals are in the best interests of Tilray and recommends that the Tilray Stockholders vote FOR the Tilray Proposals.

In making its recommendation regarding the Tilray Proposals, the Tilray Board considered a number of factors as described in the Preliminary Circular under “Description of the arrangement – Our Reasons for the arrangement” and “Description of the arrangement – Recommendation of the Tilray Board”, and “Description of the arrangement – Factors Considered by the Tilray Board”, including the opinions from Cowen and Imperial to the effect that, as of the date of such opinions, subject to the various assumptions, qualifications and limitations set forth therein, the Exchange Ratio of 0.8381 of a Tilray Share in exchange for each Aphria Share that is issued and outstanding, was fair, from a financial point of view, to Tilray. See “Description of the arrangement – Opinion of Tilray’s Financial Advisors” and Appendix “H” and Appendix “I” to the Preliminary Circular.

In making its recommendation regarding the Tilray Charter Amendment Proposal, the Tilray Board considered the benefits of the amendment to the Tilray Stockholders contained in the Tilray Charter Amendment Proposal.

Q: What approvals are required by Tilray Stockholders at the Tilray Meeting?

A: Except for the Tilray Adjournment Proposal, the vote required to approve all of the proposals listed herein assumes the presence of a quorum.

No. | Proposal | Votes Necessary | ||

| 1. | Tilray Charter Amendment Proposal | Approval requires the affirmative vote of the holders of a majority of the Tilray Shares outstanding and entitled to vote on the Tilray Charter Amendment Proposal.

A failure to vote, a broker non-vote or an abstention will have the same effect as a vote AGAINST the Tilray Charter Amendment Proposal. | ||

| 2. | Tilray Share Issuance Proposal | Approval requires the affirmative vote of a majority of votes cast at the Tilray Meeting on the Tilray Share Issuance Proposal.

An abstention will have the same effect as a vote AGAINST the Tilray Share Issuance Proposal, while a broker non-vote or other failure to vote will have no effect on the outcome of the Tilray Share Issuance Proposal, so long as a quorum is present. | ||

| 3. | Tilray Advisory Compensation Proposal | Approval requires the affirmative vote of the holders of a majority of the outstanding Tilray Shares, present or represented by proxy at the Tilray Meeting, and entitled to vote on the Tilray Advisory Compensation Proposal.

A failure to vote, a broker non-vote or an abstention will have the same effect as a vote AGAINST the Tilray Advisory Compensation Proposal. | ||

| 4. | Tilray Adjournment Proposal | Approval requires the affirmative vote of the holders of a majority of the voting power of the shares of Tilray Shares present or represented by proxy at the Tilray Meeting and entitled to vote on such proposal.

An abstention will have the same effect as a vote AGAINST the Tilray Adjournment Proposal, while a broker non-vote or other failure to vote will have no effect on the outcome of the Tilray Adjournment Proposal. | ||

Q: Who can help answer my questions?

A: If you have any questions about the preliminary Circular or the matters described in the preliminary Circular, please contact your professional advisor. Tilray Stockholders who would like additional copies, without charge, of the preliminary Circular or have additional questions about the procedures for voting Tilray Shares or making an election, should contact their broker or Mackenzie Partners by email, or at the numbers below.

Toll-Free Number: 1-800-322-2885

Call Collect: 1-212-929-5500

By Email: proxy@mackenziepartners.com

CONTACT

If you have questions or need more information about the proposed transaction, please contact:

Aphria Inc.

Aphria contacts:

Investors

Investor Relations

investors@aphria.com

Aphria’s shareholder communications advisor and proxy solicitation agent:

LAUREL HILL ADVISORY GROUP

North American Toll-Free Number: 1-877-452-7184

Collect Calls Outside North America: 416-304-0211

Email: assistance@laurelhill.com

Tilray contacts:

Investors

Raphael Gross

Raphael.Gross@icrinc.com

203-682-8253

Tilray’s shareholder communications advisor and proxy solicitation agent:

MACKENZIE PARTNERS, INC.

North American Toll-Free Number: 1-800-322-2885

Collect Calls Outside North America: 1-212-929-5500

Email: proxy@mackenziepartners.com

IMPORTANT INFORMATION

Additional Information and Where to Find It

In connection with the proposed transaction, Aphria will file a management information circular, and Tilray has filed a proxy statement on Schedule 14A (which is subject to completion and may be amended) containing important information about the proposed transaction and related matters. Additionally, Aphria and Tilray will file other relevant materials in connection with the proposed transaction with the applicable securities regulatory authorities. Investors and security holders of Aphria and Tilray are urged to carefully read the entire management information circular and proxy statement (including any amendments or supplements to such documents), respectively, before making any voting decision with respect to the proposed transaction because they contain important information about the proposed transaction and the parties to the transaction. The Aphria management information circular and the Tilray proxy statement will be mailed to the Aphria and Tilray shareholders, respectively, as well as be accessible on the SEDAR and EDGAR profiles of the respective companies.

Investors and security holders of Tilray can obtain a free copy of the proxy statement, as well as other relevant filings containing information about Tilray and the proposed transaction, including materials incorporated by reference into the proxy statement, without charge, at the SEC’s website (www.sec.gov) or from Tilray by contacting Tilray’s Investor Relations at (203) 682-8253, by email at Raphael.Gross@icrinc.com, or by going to Tilray’s Investor Relations page on its website at https://ir.tilray.com/investor-relations and clicking on the link titled “Financials.”

Investors and security holders of Aphria will be able to obtain a free copy of the information circular, as well as other relevant filings containing information about Aphria and the proposed transaction, including materials incorporated by reference into the information circular, without charge, on SEDAR at www.sedar.com or from Aphria by contacting Aphria’s investor relations at investors@aphria.com.

PARTICIPANTS IN THE SOLICITATION

Tilray and Aphria and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of Tilray and Aphria proxies in respect of the proposed transaction. Information regarding the persons who may, under applicable securities laws, be deemed participants in the solicitation of proxies of Tilray stockholders and Aphria shareholders in connection with the proposed transaction, and other information regarding the solicitation of proxies by Tilray and Aphria are set forth in the Tilray proxy statement for the proposed transaction and will be described in the information circular of Aphria. Copies of these documents may be obtained, free of charge, from the SEC, on SEDAR or from Tilray or Aphria as described in the preceding paragraph.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS:

This website contains forward-looking information or forward-looking statements (together, “forward-looking statements”) under Canadian securities laws and within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. The forward-looking statements on this website are expressly qualified by this cautionary statement. Forward-looking statements are provided for the purpose of presenting information about management’s current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. Any information or statements that are contained in this website that are not statements of historical fact may be deemed to be forward-looking statements, including, but not limited to, statements in this website with regards to and not limited to: (i) statements relating to Aphria’s and Tilray’s strategic business combination and the expected timing and closing of the transaction including, receipt of required regulatory approvals, shareholder approvals, court approvals and satisfaction of other closing customary conditions; (ii) estimates of pro-forma financial information of the combined company, including in respect of expected revenues, production of cannabis, adjusted EBITDA, pro-forma capitalization and pro-forma key financials; (iii) estimates of future cost reductions, synergies, including expected pre-tax synergies in an amount of more than US$78 million (C$100 million), savings and efficiencies; (iv) statements that the combined company anticipates having a scalable medical and adult-use cannabis platform expected to strengthen the leadership position in Canada internationally and, eventually in the United States; (v) statements that the combined company is expected to offer a diversified and branded product offering and distribution footprint, world-class cultivation, processing and manufacturing facilities, (vi) the number of Tilray shares issuable to Aphria shareholders and the expected ownership percentages of Tilray and Aphria shareholders after the closing of the transaction and (vii) statements in respect of other strategic and financial benefits in connection with the business combination. This website uses words such as “forecast”, “future”, “should”, “could”, “enable”, “potential”, “contemplate”, “believe”, “anticipate”, “estimate”, “plan”, “expect”, “intend”, “may”, “project”, “will”, “would” and the negative of these terms or similar expressions to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Certain material factors or assumptions were used in drawing the conclusions contained in the forward-looking statements throughout this website, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary shareholder, regulatory and court approvals for the business combination, the ability of the parties to satisfy, in a timely manner, the conditions to closing of the business combination and other expectations and assumptions concerning the arrangement. Forward-looking statements reflect current beliefs of management of Aphria and Tilray with respect to future events and are based on information currently available to each respective management team including the assumptions, estimates, analysis and opinions of management of Aphria and Tilray considering their experience, perception of trends, current conditions and expected developments as well as other factors that each respective management believes to be relevant as at the date such statements are made. Forward-looking statements involve significant known and unknown risks and uncertainties. Many factors could cause actual results, performance or achievement to be materially different from any future forward-looking statements. Factors that may cause such differences include, but are not limited to, the inherent uncertainty associated with financial or other projections or outlooks, Aphria and Tilray’s future financial and operating performance, the commercial and business plans of Aphria and Tilray and the other risks assumptions and expectations described in the joint proxy circular to be mailed to shareholders in respect of the transaction. There can be no assurance as to when conditions in respect of the transaction will be satisfied or waived, if at all, or that other events will not intervene to delay or result in the failure to complete the transaction. There is also a risk that some or all of the expected benefits of the transaction may fail to materialize or may not occur within the time periods anticipated by Aphria and Tilray. The challenge of coordinating previously independent businesses makes evaluating the business and future financial prospects of the combined company following the transaction difficult. Readers are cautioned that the foregoing list of factors is not exhaustive. Other risks and uncertainties not presently known to Aphria and Tilray or that Aphria and Tilray presently believe are not material could also cause actual results or events to differ materially from those expressed in the forward-looking statements contained herein. Aphria and Tilray disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.